Impact of Carbon Tax and Environmental Regulation on Inbound Cross-Border Mergers and Acquisitions Volume: An Evidence from India

Abstract

1. Introduction

2. Review of Literature and Hypothesis Development

2.1. CBM&A Volume

2.2. Carbon Tax

2.3. Environmental Regulation Distance

2.4. Moderating the Role of Corruption

3. Data and Methodology

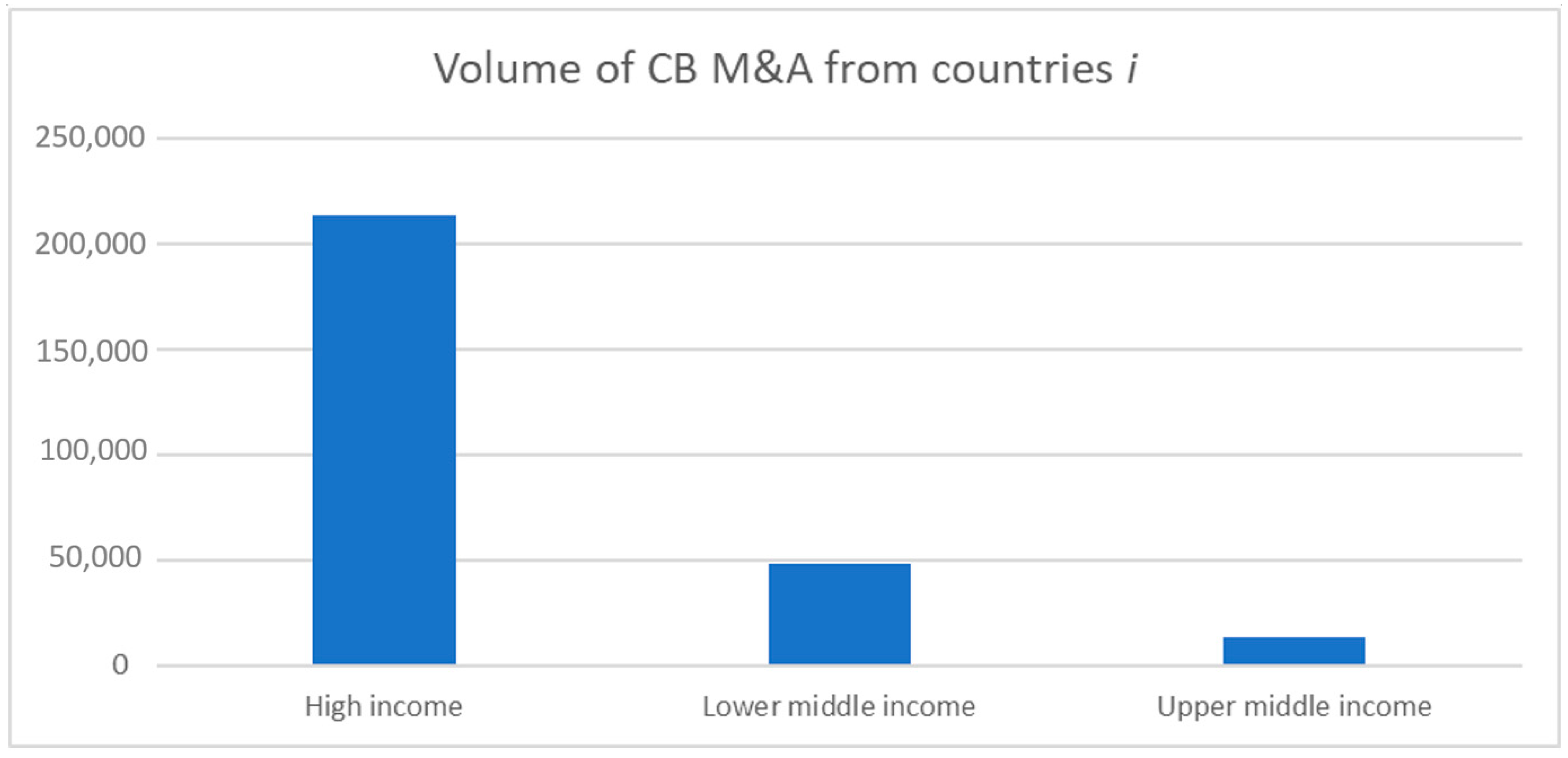

3.1. Sample and Data

3.2. Methodology

4. Results and Discussion

4.1. Summary Statistics

4.2. Impact of the Introduction of the Carbon Tax and Environmental Regulation Distance on CBM&A Volume

4.3. Moderation of Target Country’s Control of Corruption

5. Discussion

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Abbas, Hafiz Syed Mohsin, Xiaodong Xu, and Chunxia Sun. 2021. Role of foreign direct investment interaction to energy consumption and institutional governance in sustainable GHG emission reduction. Environmental Science and Pollution Research 28: 56808–21. [Google Scholar] [CrossRef] [PubMed]

- Abid, Mehdi. 2017. Does economic, financial and institutional developments matter for environmental quality? A comparative analysis of EU and MEA countries. Journal of Environmental Management 188: 183–94. [Google Scholar] [CrossRef] [PubMed]

- Ahern, Kenneth R., Daniele Daminelli, and Cesare Fracassi. 2012. Lost in translation? The effect of cultural values on mergers around the world. Journal of Financial Economics 117: 165–89. [Google Scholar] [CrossRef]

- Aller, Carlos, Lorenzo Ductor, and M. J. Herrerias. 2015. The world trade network and the environment. Energy Economics 52: 55–68. [Google Scholar] [CrossRef]

- Aller, Carlos, Lorenzo Ductor, and Daryna Grechyna. 2021. Robust determinants of CO2 emissions. Energy Economics 96: 105154. [Google Scholar] [CrossRef]

- Bae, Jeong Hwan, Dmitriy D. Li, and Meenakshi Rishi. 2017. Determinants of CO2 emission for post-Soviet Union independent countries. Climate Policy 17: 591–615. [Google Scholar] [CrossRef]

- Balogh, Jeremiás M., Sarma Aralas, Jain Yassin, Jeremiás Máté Balogh, and Attila Jámbor. 2017. Determinants of CO2 Emission: A Global Evidence. International Journal of Energy Economics and Policy 7: 217–26. Available online: http:www.econjournals.com (accessed on 25 February 2022).

- Barbopoulos, Leonidas, Krishna Paudyal, and Gioia Pescetto. 2012. Legal systems and gains from cross-border acquisitions. Journal of Business Research 65: 1301–12. [Google Scholar] [CrossRef]

- Basuil, Dynah A., and Deepak K. Datta. 2019. Effects of Firm-specific and Country-specific Advantages on Relative Acquisition Size in Service Sector Cross-Border Acquisitions: An Empirical Examination. Journal of International Management 25: 66–80. [Google Scholar] [CrossRef]

- Bhat, Aaqib Ahmad, and Prajna Paramita Mishra. 2020. Evaluating the performance of carbon tax on green technology: Evidence from India. Environmental Science and Pollution Research 27: 2226–37. [Google Scholar] [CrossRef]

- Boateng, A., M. Du, Y. Wang, C. Wang, and M. F. Ahammad. 2017. Explaining the surge in M&A as an entry mode: Home country and cultural influence. International Marketing Review 34: 87–108. [Google Scholar] [CrossRef]

- Bose, Sudipta, Kristina Minnick, and Syed Shams. 2021. Does carbon risk matter for corporate acquisition decisions? Journal of Corporate Finance 70: 102058. [Google Scholar] [CrossRef]

- Buch, Claudia M., and Gayle DeLong. 2004. Cross-border bank mergers: What lures the rare animal? Journal of Banking and Finance 28: 2077–102. [Google Scholar] [CrossRef]

- Buckley, Peter J., Pei Yu, Qing Liu, Surender Munjal, and Pan Tao. 2016. The Institutional Influence on the Location Strategies of Multinational Enterprises from Emerging Economies: Evidence from China’s Cross-border Mergers and Acquisitions. Management and Organization Review 12: 425–48. [Google Scholar] [CrossRef]

- Candau, Fabien, and Elisa Dienesch. 2017. Pollution Haven and Corruption Paradise. Journal of Environmental Economics and Management 85: 171–92. [Google Scholar] [CrossRef]

- Chari, Murali Dr, and Kiyoung Chang. 2009. Determinants of the share of equity sought in cross-border acquisitions. Journal of International Business Studies 40: 1277–97. [Google Scholar] [CrossRef]

- Choi, Jongmoo Jay, Sang Mook Lee, and Amir Shoham. 2016. The effects of institutional distance on FDI inflow: General environmental institutions (GEI) versus minority investor protection institutions (MIP). International Business Review 25: 114–23. [Google Scholar] [CrossRef]

- Contractor, Farok J., Somnath Lahiri, B. Elango, and Sumit K. Kundu. 2014. Institutional, cultural and industry-related determinants of ownership choices in emerging market FDI acquisitions. International Business Review 23: 931–41. [Google Scholar] [CrossRef]

- Cuypers, Ilya R. P., and Gokhan Ertug. 2015. The effects of linguistic distance and lingua franca proficiency on the stake taken by acquirers in cross-border acquisitions. Journal of International Business Studies 46: 429–42. [Google Scholar] [CrossRef]

- Damania, Richard, Per G. Fredriksson, and John A. List. 2003. Trade liberalization, corruption, and environmental policy formation: Theory and evidence. Journal of Environmental Economics and Management 46: 490–512. [Google Scholar] [CrossRef]

- Das, Sukanya, M. N. Murty, and Kavita Sardana. 2021. Using economic instruments to fix the liability of polluters in india: Assessment of the information required and identification of gaps. Ecology, Economy and Society 4: 45–64. [Google Scholar] [CrossRef]

- Dasgupta, Susmita, Benoit Laplante, Hua Wang, and David Wheeler. 2002. Confronting the Environmental Kuznets Curve. Journal of Economic Perspectives 16: 147–68. [Google Scholar] [CrossRef]

- Demirbag, Mehmet, Keith W. Glaister, and Ekrem Tatoglu. 2007. Institutional and transaction cost influences on MNEs’ ownership strategies of their affiliates: Evidence from an emerging market. Journal of World Business 42: 418–34. [Google Scholar] [CrossRef]

- Deng, Ping, and Monica Yang. 2015. Cross-border mergers and acquisitions by emerging market firms: A comparative investigation. International Business Review 24: 157–72. [Google Scholar] [CrossRef]

- di Giovanni, J. 2005. What drives capital flows? The case of cross-border M&A activity and financial deepening. Journal of International Economics 65: 127–49. [Google Scholar] [CrossRef]

- Dikova, Desislava, Andrei Panibratov, and Anna Veselova. 2019. Investment motives, ownership advantages and institutional distance: An examination of Russian cross-border acquisitions. International Business Review 28: 625–37. [Google Scholar] [CrossRef]

- Erel, Isil, Rose C. Liao, and Michael S. Weisbach. 2012. Determinants of Cross-Border Mergers and Acquisitions. The Journal of Finance 67: 1045–82. [Google Scholar] [CrossRef]

- Esty, Daniel C., and Michael E. Porter. 2002. Ranking National Environmental Regulation and Performance: A Leading Indicator of Future Competitiveness? Available online: https://www.hbs.edu/faculty/Pages/item.aspx?num=46902 (accessed on 3 March 2022).

- Ferreira, Miguel A., and Massimo Massa. 2010. Shareholders at the gate institutional investors and cross-border mergers and acquisitions. Review of Financial Studies 23: 601–44. [Google Scholar] [CrossRef]

- Francis, Jere R., Shawn X. Huang, and Inder K. Khurana. 2016. The Role of Similar Accounting Standards In Cross-Border Mergers and Acquisitions. Contemporary Accounting Research 33: 1298–330. [Google Scholar] [CrossRef]

- Fredriksson, Per G., and Jakob Svensson. 2003. Political instability, corruption and policy formation: The case of environmental policy. Journal of Public Economics 87: 1383–405. [Google Scholar] [CrossRef]

- Guardo, Maria Chiara di, Emanuela Marrocu, and Raffaele Paci. 2013. The Concurrent Impact of Cultural, Political, and Spatial Distances on International Mergers and Acquisitions. The World Economy 39: 824–52. [Google Scholar] [CrossRef]

- Gulamhussen, Mohamed Azzim, Jean François Hennart, and Carlos Manuel Pinheiro. 2016. What drives cross-border M&As in commercial banking? Journal of Banking and Finance 72: S6–S18. [Google Scholar] [CrossRef]

- Hasan, Munir, Mohd Nayyer Rahman, and Badar Alam Iqbal. 2017. Corruption and FDI Inflows: Evidence from India and China. Mediterranean Journal of Social Sciences 8: 2039–117. [Google Scholar] [CrossRef]

- Herger, Nils, Christos Kotsogiannis, and Steve McCorriston. 2008. Cross-border acquisitions in the global food sector. European Review of Agricultural Economics 35: 563–87. [Google Scholar] [CrossRef]

- Hu, Yichuan, Chang Li, and Cong Qin. 2020. The impact of regional financial depth on outbound cross-border mergers and acquisitions. Journal of International Money and Finance 104: 102–81. [Google Scholar] [CrossRef]

- Huynh, Cong Minh, and Hong Hiep Hoang. 2019. Foreign direct investment and air pollution in Asian countries: Does institutional quality matter? Applied Economics Letters 26: 1388–92. [Google Scholar] [CrossRef]

- Hyun, Hea-Jung, and Hyuk Hwang Kim. 2010. The Determinants of Cross-border M & As: The Role of Institutions and Financial Development in the Gravity Model. The World Economy 33: 292–310. [Google Scholar] [CrossRef]

- International Energy Agency. 2021. Review 2021 Assessing the Effects of Economic Recoveries on Global Energy Demand and CO2 Emissions in 2021 Global Energy. Available online: www.iea.org/t&c/ (accessed on 3 March 2022).

- Jongwanich, Juthathip, Douglas H. Brooks, and Archanun Kohpaiboon. 2013. Cross-border mergers and acquisitions and financial development: Evidence from emerging Asia. Asian Economic Journal 27: 265–84. [Google Scholar] [CrossRef]

- Kaufmann, Daniel, Aart Kraay, Massimo Mastruzzi The, and World Bank. 2010. The Worldwide Governance Indicators Methodology and Analytical Issues (No. 5430). Available online: www.govindicators.org (accessed on 3 March 2022).

- Kedia, Ben L., and Tsvetomira V. Bilgili. 2015. When history matters: The effect of historical ties on the relationship between institutional distance and shares acquired. International Business Review 24: 921–34. [Google Scholar] [CrossRef]

- Khan, Muhammad Azam, and Ilhan Ozturk. 2020. Examining foreign direct investment and environmental pollution linkage in Asia. Environmental Science and Pollution Research 27: 7244–55. [Google Scholar] [CrossRef]

- Kiymaz, Halil. 2004. Cross-border acquisitions of US financial institutions: Impact of macroeconomic factors. Journal of Banking and Finance 28: 1413–39. [Google Scholar] [CrossRef]

- Kogut, Bruce, and Harbir Singh. 1988. The Effect of National Culture on the Choice of Entry Mode. Journal of International Business Studies 19: 411–32. [Google Scholar] [CrossRef]

- Lahiri, Somnath, B Elango, and Sumit K. Kundu. 2013. Cross-border acquisition in services: Comparing ownership choice of developed and emerging economy MNEs in India. Journal of World Business 49: 409–20. [Google Scholar] [CrossRef]

- Lee, Jung Wan, and Tantatape Brahmasrene. 2013. Investigating the influence of tourism on economic growth and carbon emissions: Evidence from panel analysis of the European Union. Tourism Management 38: 69–76. [Google Scholar] [CrossRef]

- Li, Chang, and Lianxing Yang. 2020. Import to invest: Impact of cultural goods on cross-border mergers and acquisitions. Economic Modelling 93: 354–64. [Google Scholar] [CrossRef]

- Liang, Qin, Ningxu Li, and Jie Li. 2018. How Are the Determinants of Emerging Asia’s Cross-Border Mergers and Acquisitions Inflows Different from Outflows? Asian Economic Papers 17: 123–44. [Google Scholar] [CrossRef]

- Liou, Ru-shiun, Mike Chen-ho Chao, and Monica Yang. 2016. Emerging economies and institutional quality: Assessing the differential effects of institutional distances on ownership strategy. Journal of World Business 51: 600–11. [Google Scholar] [CrossRef]

- Liu, Kun, Shiyi Wu, Na Guo, and Qiaoling Fang. 2021. Host Country’s carbon emission and cross-border M&A performance: Evidence from listed enterprises in China. Journal of Cleaner Production 314: 127977. [Google Scholar] [CrossRef]

- Luu, Hiep Ngoc, Ngoc Minh Nguyen, Hai Hong Ho, and Vu Hoang Nam. 2019. The effect of corruption on FDI and its modes of entry. Journal of Financial Economic Policy 11: 232–50. [Google Scholar] [CrossRef]

- Maung, Min, Zhenyang Tang, Craig Wilson, and Xiaowei Xu. 2020. Religion, risk aversion, and cross border mergers and acquisitions. Journal of International Financial Markets, Institutions and Money 70: 101262. [Google Scholar] [CrossRef]

- McCann, M. 2001. Cross-border acquisitions: The UK experience. Applied Economics 33: 457–61. [Google Scholar] [CrossRef]

- Mert, Mehmet, and Abdullah Emre Caglar. 2020. Testing pollution haven and pollution halo hypotheses for Turkey: A new perspective. Environmental Science and Pollution Research 27: 32933–43. [Google Scholar] [CrossRef] [PubMed]

- Moeller, Sara B., and Frederik P. Schlingemann. 2005. Global diversification and bidder gains: A comparison between cross-border and domestic acquisitions. Journal of Banking & Finance 29: 533–64. [Google Scholar] [CrossRef]

- Muhammad, Sulaman, and Xingle Long. 2021. Rule of law and CO2 emissions: A comparative analysis across 65 belt and road initiative(BRI) countries. Journal of Cleaner Production 279: 123539. [Google Scholar] [CrossRef]

- OECD. 2021. Carbon Pricing in India. Available online: www.oecd.org/tax/tax-policy/carbon-pricing-background-notes.pdf (accessed on 20 April 2022).

- Olivier, J. G. J., and J. A. H. W. Peters. 2020. Trends in Global CO2 and Total Greenhouse Gas Emissions: 2020 Report. Available online: https://www.pbl.nl/en/publications/trends-in-global-co2-and-total-greenhouse-gas-emissions-2020-report (accessed on 15 February 2022).

- Owen, Sian, and Alfred Yawson. 2010. Human development and cross-border acquisitions. Journal of Empirical Finance 17: 689–701. [Google Scholar] [CrossRef]

- Portes, Richard, and Hélene Rey. 2002. Determinants of cross-border equity transaction flows. Journal of International Economics. [Google Scholar]

- Prasadh, R. Shyaam, and M. Thenmozhi. 2018. Does religion affect cross-border acquisitions? Tales from developed and emerging economies R. Finance Research Letters 31. [Google Scholar] [CrossRef]

- Raghavendra, Chandrika, Mahesh Rampilla, and Thripathy Naliniprava. 2022. Is India a pollution haven? Evidence from cross-border mergers and acquisitions. Journal of Cleaner Production 376: 134–355. [Google Scholar] [CrossRef]

- Rossi, Stefano, and Paolo F. Volpin. 2004. Cross-country determinants of mergers and acquisitions. Journal of Financial Economics 74: 277–304. [Google Scholar] [CrossRef]

- Shao, Yanmin. 2018. Does FDI affect carbon intensity? New evidence from dynamic panel analysis. International Journal of Climate Change Strategies and Management 10: 27–42. [Google Scholar] [CrossRef]

- Slangen, Arjen H. L. 2006. National cultural distance and initial foreign acquisition performance: The moderating effect of integration. Journal of World Business 41: 161–70. [Google Scholar] [CrossRef]

- Uddin, Moshfique, and Agyenim Boateng. 2011. Explaining the trends in the UK cross-border mergers & acquisitions: An analysis of macro-economic factors. International Business Review 20: 547–56. [Google Scholar] [CrossRef]

- UN. 2019. Public Servants Discuss Ways to Effectively Deliver on SDGs [Press Release]. Available online: https://sdg.iisd.org/news/publicservants-discuss-ways-to-effectively-deliver-on-sdgs/ (accessed on 15 March 2022).

- Wall, Ronald, Stelios Grafakos, Alberto Gianoli, and Spyridon Stavropoulos. 2019. Which policy instruments attract foreign direct investments in renewable energy? Climate Policy 19: 59–72. [Google Scholar] [CrossRef]

- Wang, Shi, Hua Wang, and Qian Sun. 2020. The impact of foreign direct investment on environmental pollution in China: Corruption matters. International Journal of Environmental Research and Public Health 17: 6477. [Google Scholar] [CrossRef] [PubMed]

- Yoon, Hyungseok David, Jonathan Peillex, and Peter J. Buckley. 2020. Friends or Foes? Bilateral Relationships and Ownership Choice in Cross-border Acquisitions by Emerging Market Firms. British Journal of Management 32: 852–71. [Google Scholar] [CrossRef]

| Variable | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| Volume_CBM&A | 979 | 1.751 | 2.554 | 0.000 | 8.760 |

| CT_T | 979 | 0.421 | 0.494 | 0.000 | 1.000 |

| ERR Distance | 979 | 1.160 | 0.817 | −0.177 | 3.062 |

| CoC_T | 979 | 42.589 | 4.251 | 35.545 | 49.519 |

| CO2_A | 979 | 0.485 | 0.365 | 0.070 | 1.525 |

| CO2_T | 979 | 1.081 | 0.074 | 0.940 | 1.232 |

| Taxburden_T | 979 | 75.533 | 3.657 | 46.800 | 79.400 |

| FinDepth_A | 979 | 80.274 | 44.116 | 13.331 | 190.674 |

| Ex. Rate_growth | 979 | −0.006 | 0.068 | −0.209 | 0.161 |

| Eco_Distance(GDPpc) | 979 | 2.834 | 1.221 | 0.000 | 4.793 |

| Inst_Distance | 979 | 0.003 | 0.002 | 0.000 | 0.009 |

| Cul_Distance | 979 | 0.002 | 0.001 | 0.000 | 0.004 |

| Geo_Distance | 979 | 8.362 | 1.377 | 0.000 | 9.594 |

| Eff_Distance | 979 | 60.346 | 15.846 | 23.470 | 81.790 |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Volume CBM&A (1) | 1 | |||||||||||||

| CO2_A (2) | −0.147 | 1 | ||||||||||||

| CT_T (3) | 0.094 | −0.110 | 1 | |||||||||||

| ERR Distance (4) | 0.327 | −0.576 | 0.000 | 1 | ||||||||||

| CoC_T (5) | −0.004 | 0.001 | −0.074 | −0.019 | 1 | |||||||||

| CO2_T (6) | −0.160 | 0.119 | −0.495 | −0.024 | −0.364 | 1 | ||||||||

| Taxburden_T (7) | 0.159 | −0.092 | 0.408 | 0.026 | 0.041 | −0.589 | 1 | |||||||

| FinDepth_A (8) | 0.205 | −0.376 | 0.117 | 0.442 | −0.045 | −0.134 | 0.109 | 1 | ||||||

| Ex. Rate_growth (9) | −0.018 | 0.043 | −0.050 | 0.008 | 0.076 | 0.025 | −0.029 | −0.024 | 1 | |||||

| Eco_Distance (10) | 0.148 | −0.585 | −0.139 | 0.714 | −0.062 | 0.086 | −0.048 | 0.428 | −0.046 | 1 | ||||

| Inst_Distance (11) | 0.004 | −0.054 | 0.089 | −0.140 | 0.055 | −0.204 | 0.144 | −0.146 | 0.034 | −0.283 | 1 | |||

| Cul_Distance (12) | 0.074 | −0.047 | −0.003 | 0.181 | 0.002 | 0.007 | −0.005 | 0.152 | −0.011 | −0.017 | 0.101 | 1 | ||

| Geo_Distance (13) | −0.213 | −0.353 | 0.004 | 0.309 | −0.008 | −0.016 | 0.013 | 0.180 | −0.020 | 0.414 | 0.229 | 0.254 | 1 | |

| Eff_Distance (14) | 0.114 | −0.315 | −0.033 | 0.546 | −0.060 | −0.012 | 0.020 | 0.200 | 0.009 | 0.818 | −0.266 | −0.089 | 0.356 | 1 |

| VIF | ||

|---|---|---|

| Variable | Model 1 | Model 2 |

| CT_T | 1.63 | |

| ERR Distance | 2.50 | |

| CoC_T | 1.26 | 1.37 |

| CO2_A | 2.01 | 2.22 |

| CO2_T | 2.05 | 2.45 |

| Taxburden_T | 1.62 | 1.64 |

| FinDepth_A | 1.51 | 1.55 |

| Ex. Rate_growth | 1.02 | 1.03 |

| Eco_Distance(GDPpc) | 4.50 | 7.93 |

| Inst_Distance | 1.38 | 1.45 |

| Cul_Distance | 1.14 | 1.23 |

| Geo_Distance | 1.56 | 1.60 |

| Eff_Distance | 3.65 | 4.34 |

| Mean VIF | 1.97 | 2.38 |

| Model 1 | Model 2 | Model 3 | ||||

|---|---|---|---|---|---|---|

| Coeff. | p-Value | Coeff. | p-Value | Coeff. | p-Value | |

| Independent variables | ||||||

| CT_T | −170.661 * | 0.066 | 1124.464 * | 0.080 | ||

| ERR Distance | −27.339 ** | 0.017 | −27.855 ** | 0.016 | ||

| Moderating variable | ||||||

| CoC_T | −3.968 * | 0.093 | −9.139 * | 0.074 | 20.914 * | 0.081 |

| Interaction effect | ||||||

| CT_T*CoC_T | −30.047 * | 0.078 | ||||

| ERR Distance*CoC_T | 0.048 | 0.242 | ||||

| Control Variables | ||||||

| CO2_T | −32.192 | 0.119 | −778.213 * | 0.060 | −766.747 * | 0.062 |

| CO2_A | −7.098 *** | 0.002 | −7.098 *** | 0.002 | −15.238 *** | 0.001 |

| Taxburden_T | 1.703 * | 0.076 | 1.689 * | 0.073 | 1.666 * | 0.074 |

| FinDepth_A | −0.0001 | 0.990 | −0.001 | 0.916 | −0.002 | 0.750 |

| Ex. Rate_growth | −1.662 | 0.421 | −2.280 | 0.270 | −2.072 | 0.317 |

| Eco_Distance(GDPpc) | 1.472 ** | 0.035 | 0.769 | 0.293 | 0.920 | 0.215 |

| Inst_Distance | −36.016 | 0.692 | −36.774 | 0.684 | −40.148 | 0.661 |

| Cul_Distance | −18,252.09 *** | 0.000 | −30,418.82 *** | 0.003 | −29,443.08 *** | 0.005 |

| Geo_Distance | 19.660 *** | 0.004 | 34.773 *** | 0.006 | 33.286 *** | 0.009 |

| Eff_Distance | 0.157 ** | 0.026 | 0.169 ** | 0.016 | 0.167 ** | 0.019 |

| Acquiring country FE | Yes | Yes | Yes | |||

| Year FE | Yes | Yes | Yes | |||

| No. Obs. | 979 | 979 | 979 | |||

| LR chi2 | 799.050 *** | 0.000 | 808.78 *** | 0.000 | 812.79 *** | 0.000 |

| Pseudo R2 | 0.251 | 0.254 | 0.256 | |||

| Log-likelihood | −1190.805 | −1185.940 | −1183.931 | |||

| Constant | −61.706 | 0.460 | 1007.932 | 0.133 | −288.887 ** | 0.021 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Raghavendra, C.; Rampilla, M.; Thanikella, V.R.; Gupta, I. Impact of Carbon Tax and Environmental Regulation on Inbound Cross-Border Mergers and Acquisitions Volume: An Evidence from India. Int. J. Financial Stud. 2022, 10, 106. https://doi.org/10.3390/ijfs10040106

Raghavendra C, Rampilla M, Thanikella VR, Gupta I. Impact of Carbon Tax and Environmental Regulation on Inbound Cross-Border Mergers and Acquisitions Volume: An Evidence from India. International Journal of Financial Studies. 2022; 10(4):106. https://doi.org/10.3390/ijfs10040106

Chicago/Turabian StyleRaghavendra, Chandrika, Mahesh Rampilla, Venkata Ramana Thanikella, and Isha Gupta. 2022. "Impact of Carbon Tax and Environmental Regulation on Inbound Cross-Border Mergers and Acquisitions Volume: An Evidence from India" International Journal of Financial Studies 10, no. 4: 106. https://doi.org/10.3390/ijfs10040106

APA StyleRaghavendra, C., Rampilla, M., Thanikella, V. R., & Gupta, I. (2022). Impact of Carbon Tax and Environmental Regulation on Inbound Cross-Border Mergers and Acquisitions Volume: An Evidence from India. International Journal of Financial Studies, 10(4), 106. https://doi.org/10.3390/ijfs10040106