1. Introduction

The increasing development in the field of information technology is changing work systems in order to keep pace with recent developments. All accounting systems operate electronically, to produce financial information of high quality, which is useful to the internal and external users for decision-making (

Al-Omair 2018). This development leads to great progress in the electronic operation of accounting systems and their development, which is reflected in the methods and procedures of the audit process used by the auditor (

Barbari and Bin Bo Ali 2017).

On the other side, cloud computing appeared, which is considered one of the latest trends in the world of information technology. This provided a new paradigm that reduces the complexity of information technology by promoting the effective assembly of a virtual self-organizing infrastructure on demand. Cloud computing uses the Internet to share computing resources such as data storage and processing, and provide access to applications, data, and services from anywhere and on any device. Cloud computing provides many features such as access to and process information from anywhere via the Internet, resource configuration, subscription options, and service features (

Bensaid et al. 2018). Additionally, cloud computing has allowed everyone to easily access information from anywhere in the world, and the cloud service provider is trying to preserve the rights of clients through policies and procedures that have been developed within international standards (

Alrabei et al. 2022;

Bensaid et al. 2018). Green electronic auditing is a prerequisite for improving the methods of doing business effectively and efficiently (

Alrabei et al. 2020;

Almomani et al. 2023). The adoption of electronic auditing of cloud computing provides many opportunities for all companies, regardless of their size or shape, and the application of cloud computing in developing accounting information systems will have a great impact on developing these systems and facilitating their use and benefits (

Alrabei 2021;

Bensaid et al. 2018).

Moumni and Farrag (

2020) and

Al-Zoubi and Al-Qadi (

2016) reached the conclusion that the green electronic audit improves the integrity of accounting information by enhancing its qualitative characteristics. In addition,

Thaer et al. (

2023) discovered that there is a link between electronic auditing and accounting information reliability via confidence, and that cloud computing had a moderating effect on e-auditing and accounting information reliability in Jordanian institutions.

In examining green electronic auditing, the dependability of accounting information, and cloud technology, this study is therefore of great importance. In an era characterized by the increasing significance of green auditing, this study examines the relationship between green electronic auditing and accounting information reliability, with cloud technology serving as a moderator. In addition, this study contributes significantly to the Jordanian Social Security Corporation’s sensible decision-making by enhancing the accuracy of accounting data, and integrating theoretical concepts with practical applications.

In addition, the purpose of this study is to examine the impact of green electronic auditing on accounting information reliability, and the function of cloud computing as a moderator in the Jordanian Social Security Corporation.

1.1. Cloud Computing

Communication and information technology have become an important part of every person’s daily life. This phenomenon has affected all human fields, and caused a huge revolution in today’s world. It has become one of the daily requirements of individuals and institutions (

Al-Omari and Al-Rahili 2014). Cloud computing is a modern technology that relies on transferring processors, operations, and storage of the computer to the so-called cloud, which is considered a server device that is accessed via the Internet, so that information technology programs turn into services (

Amara 2012;

Salim 2016;

Alshamrany 2019).

Cloud computing consists of cloud providers, which includes Internet service providers, telecommunications companies, business operations, data centers, systems, and various services provided to the consumer. Additionally, cloud service brokers, which includes technology consultants and professional services in organizations, that help the beneficiary to choose the best cloud computing solutions, and is the one who performs the negotiations between the service provider and the beneficiary. Finally, cloud resellers are included, and are considered the most important factor in cloud marketing, as the service provider chooses a consulting company or seller to display its products and services provided in the cloud (

Al-Eryani and Al-Areqi 2017;

Zerzar and Ben Ourida 2019).

1.2. Accounting Information Reliability

Accounting information systems reliability is defined as independent professional services that aim to verify the reliability and content of the information for decision-making purposes (

Thuneibat et al. 2022;

Shniekat et al. 2022;

Alrabei et al. 2020), which includes five principles: The system security principle is a good security level of the accounting information system, and is a tool to reduce threats related to illegal physical use, including theft and intentional damage to system elements (

FFIEC 2003). The confidentiality principle is known as procedures that participate in processing, which contribute to maintaining the confidentiality of the company’s information, whether in the process of collecting, processing, or storing it (

Wang 2021). The privacy principle is a set of steps that guarantees the privacy of the information of individuals dealing with the company’s systems by establishing a set of levels to protect the information of each of the company’s customers, as well as users of the system (

Al-Fatlawi et al. 2021;

Al-tarawneh et al. 2023;

Moshtaha et al. 2011). The processing integrity principle is the degree of accuracy, legitimacy, timeliness, and completeness of data processing operations in the AIS. The integrity of the AIS is often described as being good if it can implement the planned series of processing operations during the set time schedules, while ensuring that no illegal use or access of the processing resources occurs (

Shan et al. 2022;

Nawaiseh et al. 2022). The availability principle is the extent to which the end user is able, during the appropriate time, to use the system to implement the work requirements of the business organization. This concept implies the ability to carry out the data processing cycle of activities of input, processing, storage, and reporting as efficiently as possible (

Romney and Steinbart 2018).

1.3. Green Electronic Auditing

It has become necessary for the auditing profession to keep abreast of recent developments, and to use accounting information technology in the green auditing process (

Youssef and Najm 2018). Information technology has greatly affected financial and accounting systems in terms of developing and controlling internal control in establishments, which led to the obligatory entry and use of information technology in performing audit tasks, and keeping abreast of these developments (

Tyab 2021).

Many researchers defined the green electronic audit as the process of applying any type of system using information technology to assist the auditor in planning, controlling, and documenting audit work (

Thuneibat 2017).

Al-Tom (

2019) defined it as an organized and established process for obtaining paper and electronic evidence of the allegations and beliefs of the management, evaluating them objectively, and evaluating each of the internal control, data, and information security in all stages of the electronic accounting information system, including inputs, operation, and outputs.

Ser Al-Khatm (

2020),

Jumma (

2005), and

Mohammed (

1999) defined it as the process of collecting evidence and evaluating it to determine whether the use of a computer contributes to protecting the assets of the enterprise, and ensuring the integrity of its data and the accuracy of its financial statements, achieving its objectives and using its resources efficiently. Overall, to increase the reliability of the data that is relied upon in decision-making.

1.4. Jordanian Social Security Corporation

The economic development, the expansion of the labor market in Jordan, and the development of its economic and social conditions were favorable conditions at the end of the seventies for the issuance of comprehensive legislation for social security, which is the temporary Social Security Law No. (30) in the year 1978. This came into force in the early eighties and continued until 31 May 2001, where amendments were made to it, resulting in the Social Security Law No. (19) of 2001. To enhance social protection and expand the scope of insurance coverage, and address the gaps and imbalances that were revealed during implementation, as well as ensure the permanence of the system for the current and future generations, the temporary law No. (7) of 2010 was enacted, and came into effect on 1 May 2010. On 10 January 2019, the amendment to Social Security Law No. (1) of 2014 was approved.

Jordan is an integral part of the Middle East region. This region is considered one of the hottest regions in the world. Therefore, the researcher chose Jordan as a case study of the Jordanian Social Security Corporation. Social security is considered a general symbiotic insurance system that aims to protect people socially and economically. The law defines its benefits and funding sources. The benefits are funded from contributions borne by insured persons and employers. This system is concerned with achieving social sufficiency considerations (

ssc.gov.jo, accessed on 10 March 2023).

The Jordanian Social Security Corporation is a public institution that provides direct insurance services to companies and institutions in the public and private sectors, and is one of the leading government institutions in the use of information technology (cloud computing) and accounting information in its work. Therefore, as a result of economic and social development in Jordan, working groups that are not covered by other retirement systems and laws, such as civil retirement and military retirement, were targeted. This required a socioeconomic umbrella that adds protection to these productive groups, and gives them more sense of security and reassurance, and stability for present and future generations.

Social Security Corporation (

2023) (

ssc.gov.jo, accessed on 10 March 2023).

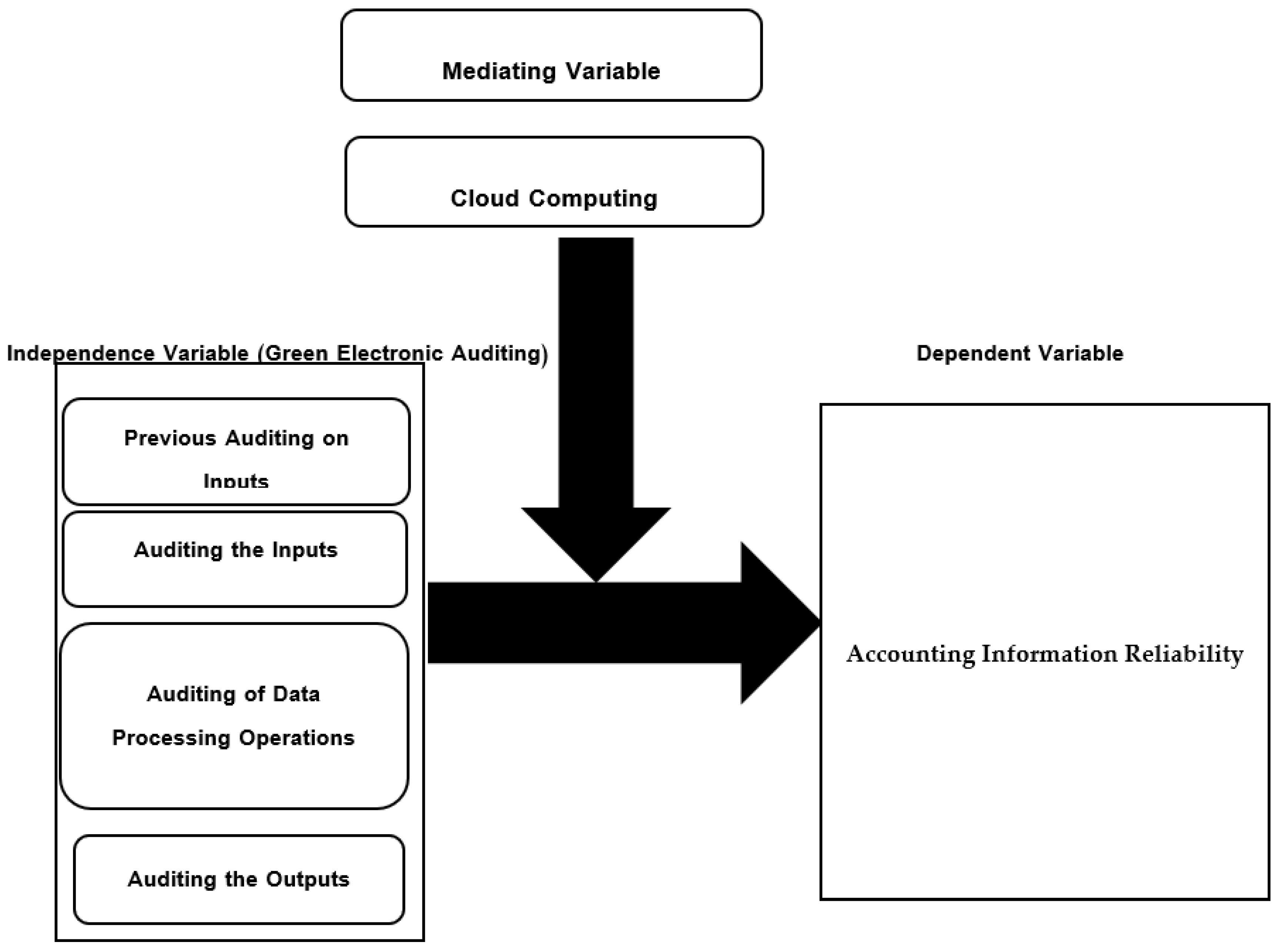

Most studies only investigate between two variables, but the current study investigates between three variables. Therefore, the purpose of this study is to examine the link between green electronic auditing procedures (previous green auditing on inputs, auditing green inputs, auditing green data processing operations, and auditing green outputs) and accounting information reliability, with a particular emphasis on the function of cloud computing as a mediating effect.

2. Literature Review and Hypotheses Development

Many researchers found that there is an essential effect of cloud computing on accounting information reliability, as (

Moudud-Ul-Huq et al. 2020;

Abdul Latif 2018;

Al-Zoubi 2017) and other researchers found, there is a nexus between information and communication technology (cloud computing) on e-auditing green and accounting information reliability (

Alshawabkeh et al. 2022;

Qutib and Qasimi 2016); the current study seeks to compare it with many studies through the following hypotheses:

H1. First major hypothesis: at the significance level (α ≥ 0.05), there is no statistically significant effect of green electronic auditing on accounting information reliability in the Jordanian Social Security Corporation.

Qutib and Qasimi (

2016) found a role for information and communication technology in the green auditing process, which positively affects the quality of accounting information. Thus, auditing of information technology plays a real role, which leads to improving the quality of accounting information.

Al-Zoubi and Al-Qadi (

2016) found that there is an impact to the e-auditing system in decreasing the e-environment complexity of accounting information systems. Additionally,

Antunes et al. (

2022) and

Abdul Latif (

2018) concluded that the use of information technology facilitated accounting practices, and helped provide accurate information that supports the decision-making process in a timely manner, and improved the financial performance of the institution.

The previous green audit of the inputs is through the documentary stage that precedes the internal audit process. By controlling and following-up the data, identifying the extent to which they meet the required conditions, and confirming that they are handled according to the systems, instructions, internal regulations, and procedure manuals, the audit department in the Social Security Corporation ensures the validity of the data entered into the accounting system (

Al-Jabr 2023). Thus, the following hypothesis is formulated as follows:

H1a. At the significance level (α ≥ 0.05), there is no statistically significant effect for previous green auditing of inputs on accounting information reliability in the Jordanian Social Security Corporation.

The data which constitutes the inputs of the system is related to the operations of the economic unit and the rest of the events must be collected and entered into the system for subsequent processing operations (

Haj 2013). Therefore,

Sayed (

2019) found that there is a significant effect of the effectiveness of accounting information systems on the risks of green electronic auditing in the Irbid Electricity Company. Additionally,

Nour Alddine and Lamin (

2015) found that the use of electronic operating systems for accounting data in the field of internal audits enables the auditor to accurately plan the process. Thus, the following hypothesis is formulated as follows:

H1b. At the significance level (α ≥ 0.05), there is no statistically significant effect of auditing green inputs on accounting information reliability in the Jordanian Social Security Corporation.

Processing is a set of accounting operations, logical comparison operations, summarization, classification, and sorting that is conducted on the entered data to convert it into information that is presented to the final beneficiary (

Haj 2013). The accounting information system and its subsystems deal with financial and nonfinancial transactions that directly affect the processing of financial transactions (

Hall 2011). Therefore, the use of electronic data processing systems led to a tangible change in accounting information through the reduction of time and routine work that was spent daily in the manual registration of accounting operations (

Moscov and Simken 2005). Some researchers found the automated processing environment for accounting data helped the internal auditor in implementing green audit programs and achieving goals in a better way (

Nour Alddine and Lamin 2015). Thus, the following hypothesis is formulated as follows:

H1c. At the significance level (α ≥ 0.05), there is no statistically significant effect of green auditing of data processing operations on accounting information reliability in the Jordanian Social Security Corporation.

Al-Jazrawi and Al-Janabi (

2009) found the output (information), which is delivered to the beneficiaries in various forms such as reports, tables, lists, and charts, is the main objective of any information system, which is to produce appropriate information for the beneficiaries.

Abdul Qadir (

2020) found that information technology contributes effectively to improving the performance of the accounting information system and its outputs, which is reflected in the performance of the economic institution as a whole. Thus, the following hypothesis is formulated as follows:

H1d. At the significance level (α ≥ 0.05), there is no statistically significant effect of green auditing of outputs on accounting information reliability in the Jordanian Social Security Corporation.

Many researchers have touched on cloud computing through information technology, such as

Thaer et al. (

2023), who found that there was a mediating impact of cloud computing on the nexus between the internal control system’s costs and increasing confidence in accounting information in Jordanian banks.

Hyba and Amen (

2017) showed that the use of information technology in auditing works to improve auditing procedures and methods, and also enhances the speed and accuracy of the auditing process, while reducing the effort and cost associated with it.

Alshamrany (

2019) concluded that cloud computing contributes to facilitating audit procedures and reducing costs, time, and effort.

Al-Zoubi (

2017) found that cloud computing leads to reducing the size of the enterprise in terms of the building and offices. Additionally,

Wat and Sherif (

2019) found the impact of information technology on the quality of accounting information and investment decision-making.

Sirhan (

2019) found the effect of success factors of computerized accounting information systems (information quality, service quality, and system quality) on the quality of electronic green auditing in auditors’ offices operating in Jordan.

Alshawabkeh et al. (

2022) found that cloud computing plays a significant moderating role in the nexus between accounting information reliability through availability, security, and integrity, with firm performance.

Al-Zoubi (

2017),

Abdulsalam and Hedabou (

2022), and

Al-Marsy et al. (

2021) concluded that cloud computing allows for the reliability of accounting information through companies and individuals using other programs and equipment, without the need to purchase them. Thus, the following hypothesis is formulated as follows:

H2. Second major hypothesis: there is no statistically significant mediating effect, at the significance level (0.05 ≥ α), for cloud computing on the nexus between green electronic auditing and accounting information reliability in the Jordanian Social Security Corporation.

3. Methodology

This study model consists of the independent variable of green electronic auditing (previous green auditing on inputs, auditing green inputs, auditing green data processing operations, and auditing green outputs), and the dependent variable of accounting information reliability. As for the mediating variable, it is represented by cloud computing. This study’s survey consists of a number of paragraphs: independent variables have 20 paragraphs for each variable have 5 paragraphs, the dependent variable has 8 paragraphs, and the mediating variable has 6 paragraphs. The purpose of which is identifying the mediating effect of the cloud computing on the nexus between green electronic auditing and accounting information reliability in the Jordanian Social Security Corporation. Therefore, the researcher will rely on the five-point Likert scale within the following weights: (5) degrees, strongly agree; (4) degrees, agree; (3) degrees, agree to some extent; (2) degrees, disagree; and (1) degree, strongly disagree.

In order to collect the required data, a questionnaire was sent out to all 500 of the Jordanian Social Security Corporation’s staff members. The use of an electronic form was used for the survey. A total of 157 employees participated in the study as part of the audit, internal control, information technology, and accountant staff samples, yielding a response rate of 31.4%. The investigation into the relationships between cloud computing, auditing on data processing processes, auditing the inputs, auditing the outputs, prior auditing of inputs, and accounting information reliability was carried out with the use of structural equation modeling. The researcher collected and analyzed the scientific and practical study data, depending on two types of elements. Secondary data are data obtained from library sources and from literary reviews of previous studies such as books, scientific research, statistics, official reports, master’s theses, doctoral dissertations, periodicals, and research published in peer-reviewed journals. The primary data are from the researcher, who designed a scientific survey to collect data on green electronic auditing and the reliability of accounting information and cloud computing.

Table 1 Shows the items used to measure the research. Which divided to the independent variables as (Previous Green Auditing of Inputs, Auditing Green Inputs, Auditing Green Data Processing Operations, and Auditing Green Outputs) and Accounting Information Reliability as a dependent variable and Cloud Computing as Mediating variable.

3.1. Descriptive Statistics

To ensure the data are subject to the normal distribution, the researchers measured both the coefficients of kurtosis and skewness for each domain and variable of the study, to ensure the appropriateness and validity of the data and to test the normal distribution. The tables below show the values of kurtosis and skewness for each domain and study variable.

Table 2 shows the coefficients of kurtosis and skewness in all ranges within the acceptable minimum and upper limits of the normal distribution. The value of skewness ranges between (±1.96), and the value of the kurtosis coefficient ranges between (±2.58), which indicates that the study data follow a normal distribution (

Hair et al. 2017).

3.2. Construct Reliability and Validity

According to

Table 3, Cronbach’s alpha, composite reliability, and average variance extracted (AVE) findings show that the assessment items in the research measure the desired construct’s reliably and validly. All of the variables in the research had a strong Cronbach’s alpha and composite reliability scores, indicating that the items on the scale are assessing the same underlying concept. Furthermore, all of the variables had AVE values greater than 0.5, suggesting that the construct being assessed explains a considerable amount of variation in the items.

These results are comparable with prior studies that employed Cronbach’s alpha, composite reliability, and AVE to assess assessment item internal consistency, reliability, and validity. According to one study, Cronbach’s alpha is commonly used and acknowledged as a measure of internal consistency, and a value of 0.7 or above is typically deemed appropriate for research purposes. Similarly,

Hair et al. (

2021) discovered that composite reliability is a widely used measure of internal consistency, with a value of 0.7 or above deemed acceptable. Finally,

Fornell and Larcker (

1981) discovered that AVE is a frequently used measure of convergent validity, with a value of 0.5 or above regarded as acceptable.

3.3. Measurement Model of the Study by Smart PLS

Figure 2 is a diagram of the SmartPLS measurement model. In structural equation modeling (SEM), the measurement model is used to assess the reliability and validity of the study’s measures (

Hair et al. 2017). The objective of the measurement model is to demonstrate that the observed variables (indicators) are accurate measures of the underlying constructs (latent variables) that they represent. Typically, in SmartPLS, the measurement model is represented as a path diagram that illustrates the relationships between observed variables and their respective constructs. Typically, the constructs are depicted as ovals or circles, whereas the observed variables are depicted as rectangles or squares. The strength and direction of the relationship between the observed variables and their respective constructs are indicated by the arrows connecting them. Previously discussed metrics of validity, as well as reliability, such as Cronbach’s alpha, composite reliability, and average variance extracted (AVE), are used to evaluate the measurement model. Typically, SmartPLS displays these measures as numeric values in a table or matrix, as well as in the diagram of paths itself. The measurement model serves as an important basis for the structural model, which is employed for evaluating the hypothesized relationships between the constructs. By demonstrating the reliability and validity of the study’s measures, the measurement model contributes to the accuracy and significance of the structural model’s results.

3.4. The Value of The Indicators in The Outer Loading

Indicators’ (observed variables) outer loadings on constructions (latent variables) are shown in

Table 4. In other words, it demonstrates the accuracy with which each indication evaluates the target construct. Accounting information reliability (AIR), auditing on data processing operations (ADPO), auditing the inputs (ATI), auditing the outputs (ATO), cloud computing (CC), and previous auditing on inputs are the structures in this specific table. Under each construct, there is a table with a list of indicators, and a table with the outer loadings for each indication. Values closer to one indicate a greater association between the indicator and the relevant construct, with outer loadings ranging from 0 to 1. If the outer loading is more than 0.7, the measurements are generally accepted in terms of their validity and reliability. According to the data in the table, except for CC5 and CC6, all of the indicators have outer loadings greater than 0.7. These numbers are still close to the minimum criteria of 0.7, and might be regarded as satisfactory for the research.

Table 3’s outer loadings provide evidence that the indicators are legitimate and trustworthy indicators of the constructs being measured. It is important to remember that the study’s context and the chosen measurement approach might affect how outer loadings are interpreted, and what levels are considered acceptable. To establish proper criteria for external loadings in specific research, it is necessary to reference the applicable literature and recommendations.

3.5. Discriminant Validity

The results of the discriminant validity test are shown in

Table 5. Discriminant validity determines if the model’s constructs are distinct from one another. The diagonal numbers are the square roots of each construct’s average variance extracted (AVE), while the off-diagonal values are the correlation coefficients between components. The diagonal values in this table are greater than the correlation coefficients between constructs, showing that discriminant validity is upheld. The AVE values are all greater than 0.5, showing that each construct describes more than 50% of the variation of its indicators. The correlation coefficients between constructs are all less than the square roots of their respective AVE values, indicating that the variance shared by the constructs is less than the variance accounted for by each construct. Furthermore, the correlations between constructs and their corresponding AVE values show that each construct has a larger connection with its indicators than with the indicators of other constructs, validating the constructs’ discriminant validity. As a result, we may infer that the discriminant validity of the measures utilized in this research is satisfactory.

3.6. Structural Model

The researchers built a route analysis model based on

Figure 2 to investigate the interactions between the variables. In the path analysis model, the dependent variable (accounting information reliability) was evaluated for the direct and indirect impacts of the independent variables (green auditing on data processing operations, auditing green inputs, auditing green outputs, cloud computing, and previous auditing on inputs).

Table 5 displays the path analysis model’s results, which include the standardized regression coefficients, t-values, and

p-values. The

p-values represent the statistical significance of the coefficients. With

p-values of 0.003, 0.000, 0.000, and 0.027, respectively, we can see that green auditing on data processing operations, auditing green outputs, cloud computing, and previous auditing on inputs all have statistically significant direct effects on accounting information reliability. This indicates that there is evidence that these factors have a substantial influence on accounting information reliability. The

p-values for auditing the inputs (0.042), cloud computing between ATI and AIR (0.113), CC between ATO and AIR (0.708), and CC between PAI and AIR (0.371) are greater than 0.05, indicating that there is insufficient evidence to support a significant direct effect of these variables on accounting information reliability.

In

Figure 3. Structural model, the path model of analysis shows that green auditing on data processing operations, auditing green outputs, cloud computing, and previous auditing on inputs have significant impacts on accounting information reliability, though auditing green inputs and some of the cloud computing variables (CC between ATI and AIR, CC between ATO and AIR, and CC between PAI and AIR) do not.

3.7. Path Coefficients and Level of Significance

Table 6 shows the

p-values for previous auditing on inputs, green auditing on data processing, auditing green inputs, and auditing green outputs are all less than 0.05, indicating that there is a strong relationship between these factors and accounting information reliability. The

p-value for (CC) is 0.023, which is less than 0.05, indicating that the relationship between CC and ADPO and AIR is statistically significant. The

p-value for (CC) is 0.113, which is more than 0.05, indicating that there is no significant relationship between CC and ATI and AIR. The

p-value for (CC) is 0.708, which is more than 0.05, indicating that there is no significant relationship between CC and ATO and AIR. The

p-value for (CC) is 0.371, which is more than 0.05, indicating that there is no significant relationship between CC and PAI and AIR. The

p-value for (CC) is 0.000, which is less than 0.05, indicating that there is a significant relationship between cloud computing and accounting information reliability. In summary, these results suggest that previous auditing on inputs, green auditing on data processing, auditing green inputs, and auditing green outputs have a strong positive impact on AIR, while the relationship between (CC) and AIR is statistically significant.

Hence, a notable correlation exists between cloud computing and the reliability of accounting information in the present study. Based on the analysis of previous findings, the present discourse posits that the reliability of accounting information is significantly influenced by various factors, namely: previous auditing on inputs, green auditing on data processing, auditing green inputs, auditing green outputs (commonly known as green electronic auditing), and the relationship between cloud computing and accounting information reliability. It is worth noting that the aforementioned factors exhibit a strong positive impact on the reliability of accounting information, with statistical significance observed in the relationship between cloud computing and accounting information reliability. Based on the findings of my study, it aligns with the research conducted by

Qutib and Qasimi (

2016),

Hyba and Amen (

2017), and

Abdul Qadir (

2020). These scholars have identified the significance of information and communication technology, specifically cloud computing, in the context of green auditing. Their research demonstrates that the integration of cloud computing positively influences the quality of accounting information. Therefore, the integration of information technology in auditing has a significant impact on enhancing the reliability and accuracy of accounting information.

Al-Zoubi and Al-Qadi (

2016),

Nour Alddine and Lamin (

2015), and

Moscov and Simken (

2005) have all identified that the implementation of the e-auditing system has a significant effect on reducing the complexity of the e-environment in accounting information systems.

Thaer et al. (

2023),

Alshawabkeh et al. (

2022),

Wat and Sherif (

2019), and

Al-Zoubi (

2017) have collectively determined that the quality of accounting information is influenced by the presence of information technology, specifically cloud computing.

Table 7. The model’s R square and R square adjusted values. The R square score of 0.850 suggests that the independent variables in the model can explain eighty-five percent of the variation in accounting information reliability. The adjusted R square result of 0.841 shows that the adjusted R square takes the number of independent variables in the model into account, and is a more accurate picture of the model’s capacity to explain the variation in the dependent variable. In general, the high R square and R square adjusted values indicate that the model fits well, and can explain a considerable portion of the variation in accounting information reliability.

4. Conclusions and Recommendation

The goal of this study was to investigate the relationship between auditing green procedures and accounting information reliability, with a focus on the function of cloud computing and previous auditing of green inputs. The results demonstrated a significant favorable relationship between green auditing data processing processes, auditing green outputs, cloud computing, and previously auditing green inputs and accounting information dependability. In contrast, there was no significant relationship between auditing green inputs and accounting information reliability. The findings provide important insights into the factors that may affect the dependability of accounting information, and highlight the importance of good auditing processes.

Based on the findings, we advise that enterprises emphasize good green auditing methodologies, particularly for data processing activities and outputs. Furthermore, cloud computing should be thoroughly monitored and reviewed to ensure that it does not have a negative impact on the trustworthiness of accounting data. Organizations can also investigate the utility of previously auditing green inputs as a way to improve the dependability of accounting data.

As a result, in my analysis, there is a significant association between cloud computing and accounting information reliability. According to the previous results, previous auditing on inputs, green auditing on data processing, auditing green inputs, and auditing green outputs (green electronic auditing) have a strong positive impact on accounting information reliability, while cloud computing and accounting information reliability have a statistically significant relationship. According to this, my study agrees with

Qutib and Qasimi (

2016),

Hyba and Amen (

2017), and

Abdul Qadir (

2020) because they identify the role of information and communication technology (cloud computing) in the green auditing process, which has a positive impact on the quality of accounting information. Thus, auditing in the context of information technology plays a significant role in increasing the quality of accounting information. Furthermore,

Al-Zoubi and Al-Qadi (

2016),

Nour Alddine and Lamin (

2015), and (

Moscov and Simken 2005) discovered that the e-auditing system has an impact on the e-environment complexity of the accounting information system.

Thaer et al. (

2023),

Alshawabkeh et al. (

2022),

Wat and Sherif (

2019), and

Al-Zoubi (

2017) discovered that information technology (cloud computing) has an impact on the quality of accounting information.

This study contributes to the body of knowledge on green auditing methodologies and accounting information reliability. First, it emphasizes the importance of suitable green auditing methodologies in ensuring the veracity of accounting information, particularly in the context of cloud computing. Second, it provides empirical evidence on the previously unexplored link between earlier auditing green inputs and accounting information reliability. Finally, this study demonstrates the value of employing a structural equation modeling technique to analyze the complex relationships between green auditing operations and the dependability of accounting information. These contributions have far-reaching implications for accounting and auditing practitioners and academics alike.

This study recommends more future studies and research in the field of green electronic auditing to keep pace with and exploit cloud computing (information technology) in order to improve the reliability of accounting information, and to raise the level of credibility of reports and financial statements used by decision makers.

5. Practical Implications

This study provides a clear insight to the decision makers in the Jordanian Social Security Corporation of the important role played by green electronic auditing in the reliability of accounting information and cloud computing. Employees in the auditing and accounting department, and information technology in the Jordanian Social Security Corporation in general, about the extent to which green electronic auditing is used in their work, also, employees have been given a clear perception of the importance of the role played by the green electronic auditing in the reliability of accounting information and cloud computing. This study clarifies the vital role that electronic auditing plays in maintaining the confidentiality, privacy, and operational integrity of accounting data, as well as the function that cloud computing plays in acting as a mediator between these factors.

The accuracy and efficiency of financial records are greatly improved when “green” techniques (those that do not harm the environment) are included in electronic audits. This method enhances data precision, lessens carbon emissions and resource use, increases openness, and cuts costs. Green electronic auditing improves the overall quality of financial reporting, and is in line with sustainability objectives by making use of digital technologies and optimized procedures.

6. Social Implications

Through this study, the researcher seeks to increase knowledge enrichment in green electronic auditing (previous auditing of inputs, auditing of inputs, auditing of data processing operations, and auditing of outputs), the outputs of the reliability of accounting information, the mediating role of cloud computing, and to provide some information related to these concepts. This study is one of the very few studies that links the subject of the independent, dependent, and mediating variables.