1. Introduction

It is notable that “efficiency” as a target criterion for the activities of the economic entities in relation to the public sector has been understudied. We require specific indicators and methods of assessment, new approaches to accounting, and analytical support for effective state (municipal) property use. The Russian practice of management activities needs the development of a modern concept for analyzing effective state (municipal) property use based on the experience of other countries and the requirements of international financial reporting standards in the public sector. The need for the effective management of public assets is emphasized in the documents of the

UN (

2009), the

International Federation of Accountants (

2014), the

European Commission (

2015), the

OECD (

2016), and the

World Bank Group (

2016).

Joseph M. Giglio et al. (

2018) noted the role of financing mechanisms and financial reporting in providing effective management decisions on state assets.

Mohammad Javad Mirzaei et al. (

2015) proposed a methodology for assessing the performance of public lighting systems to improve the efficiency of public spending.

Peter Adoko Obicci et al. (

2021) devoted their works to studying the factors of the successful disposal of state assets from the point of view of sustainable procurement. Thus, the issues of developing the methodology for analyzing the effective state (municipal) property use are quite relevant and discussed in the professional community (

Bulamu et al. 2020).

In the process of research, the authors concluded that the conceptual methodology should be based on solving problems arising from the main stages of analyzing the effective state property use: providing the information base for analysis; assessing the property which state bodies and state institutions need when they perform their functions and powers; and developing a system of performance indicators for state property.

The qualitative assessment of effective state property use is not possible without appropriate accounting and analytical support (

Stojanović 2018). Currently, such an information base is the federal state information and analytical system “Unified State Property Management System” (hereinafter—USPMS). The USPMS is the information system of the Federal Property Management Agency that ensures the processes of state property management, solves the problems of accounting, and provides information and analytical reporting on the state property in the Russian Federation. However, the current information system has several significant disadvantages, such as the following: (1) there is no single regulatory act on maintaining the register at all levels of government; (2) the duplicated information about the property; and (3) the lack of indicators and criteria in the register that would reflect effective property use, etc. The solving of these problems will form the basis for information and analytical support for assessing effective state property use at all levels.

Various approaches are used to assess property needs when a state body or a state institution performs its functions and powers. These approaches are based on standards for institutions in various sectors (healthcare, education, etc.) in relation to the property and specific equipment necessary for the provision of public services. The main disadvantage of these approaches is that it is impossible to use them to assess the impact of the property factor on the quality of public services provided (

Fedchenko 2017). The study identifies the lack of a unified approach for assessing the property which state bodies and state institutions need when they perform their functions and powers. The consequences of this problem are the insufficient development of methodological support for state property management in terms of the unity of requirements for property needs of state bodies and state institutions; and in the field of assessing effective property use, the different levels of quality of functions and powers performed by state bodies and state institutions due to differentiation in the property. The solution to this problem is to develop a unified approach for assessing the property which state bodies and state institutions need when they perform their functions and powers.

It has been established that to assess the activities of the federal executive bodies in the field of federal property management, several regulatory legal acts have been adopted. Therefore, the Federal Property Management Agency published indicators approved by the Decree of the Government of the Russian Federation No. 481-r “On approval of the reporting form for indicators characterizing the activities of the federal executive bodies in the sphere of the federal property management”. In 2020, the Order of the Government of the Russian Federation No. 2645-r established the methodology for determining the criteria for the optimal composition of the state and municipal property and indicators for the effective property management and disposal of it. However, the analytical indicators used by the Federal Property Management Agency characterize the activities of the federal executive authorities in the field of federal property management and they do not fully reflect a detailed analysis of state property disposal and use. These indicators are not aimed at analyzing the causes of inefficient property use and making informed management decisions.

In connection with the foregoing, the purpose of the study is to substantiate and resolve issues in improving accounting and analytical support and developing specific methods for analyzing and assessing state property management.

2. Results and Discussion

In the process of research, the authors concluded that the concept of analyzing the effective state (municipal) property use should be based on three components discussed below.

2.1. Development of the Unified Register of the State Property

After analyzing the legal framework for the creation, formation, and maintenance of the unified register of the state (municipal) property, it is possible to single out that there are no general provisions for accounting and maintaining the unified register of the property, and no information about the available property at all levels (about its condition, use, rights, or other information about the object). To solve the identified problems, it is necessary to develop a unified list of rules that ensure the transparency of accounting for state property, as well as the effectiveness of its management. The creation of a single information resource with data on the property accounting of public legal entities will increase the efficiency of their management.

Accounting and maintenance of registers and the information on the property disposal should be carried out separately by authorized bodies at the expense of the relevant budgets, with the transfer of the information to a single information resource. To improve the maintenance (formation) of the property register, we should develop the algorithm for setting property objects for accounting (budgetary) by economic entities based on the data of the property register, considering indicators characterizing the physical state and use of the property, which is confirmed by the Concept of increasing efficiency budget expenditures in 2019–2024. In addition, the GIS “Electronic Budget” should integrate the register into the form of property accounting with accounting data. The results of the transition to maintaining registers based on GIS data can be implemented at the level of the subjects of the Russian Federation and municipalities. This will create the prerequisites for the unified GIS to manage the state and municipal property based on property registers of the relevant public legal entities.

As part of the single system, the unification of criteria and indicators is established in relation to the optimal composition of the state property, considering the delimitation of powers between authorities. The following proposals have been made on indicators: the form of the property use; the form of the property disposition; the recognition of the asset; and the objective function of the asset.

The proposed indicators are correlated with the indicators of accounting (budget) reporting of economic entities. Indicators of the form of the property use include the property used based on ownership; the property received for reimbursable use (lease); the property received in trust management; the property received for gratuitous use; and the unused property. Property management indicators include the property transferred for paid use (lease), the property transferred for trust management, and the property transferred for free use. Asset recognition indicators reflect the object of the property subject to certain conditions. Objects of the state (municipal) property related to architectural monuments and historical heritage are proposed to be divided into the especially valuable movable property and immovable property. For real estate, the following indicators are proposed: the time of construction, the degree of defects in building structures, the class of defects in building structures, and the category of physical condition. For especially valuable movables, the time of creation, the degree of external defects, the class of external defects, and the category of physical condition are considered.

2.2. Assessment of the Property Which State Bodies and State Institutions Need When They Perform Their Functions and Powers

The analysis of effective state property use is not possible without assessing the property which state bodies and state institutions need when they perform their functions and powers, which is a calculated indicator of the volume of the movable and immovable property necessary for the performance of functions and powers, in accordance with legally established qualitative and quantitative standards. The study identified the minimum allowable level of ensuring the needs of the property are met, which is understood as the basic list of standards. If they are not compiled, the needs for the property of the state body or state institution are completely unsatisfactory to perform its functions and powers. This means that each of the state bodies and state institutions must meet the minimum acceptable level of security of the needs for the property, which is considered the acceptable level, that is, corresponding to the standards, to carry out activities (

Figure 1).

To determine the security of the equipment with the established standards, it is necessary to conduct a comparative analysis of the calculated value of the share of equipment per consumer of services (D

E) and legally established standards (P) (

Table 1).

Thus, the state institution’s needs for the property are proposed to be considered as a combination of two elements—shares of the main area and equipment for one consumer of services. Such an algorithm is proposed to be used to calculate the current satisfaction of the state institution’s needs for the property. The advantages of the approach are its visibility and accessibility, because the numerical values for analysis are open to both institutions and other interested persons. It is worth saying that the conclusion on the security of the property of the state institution should be formed based on both components. If at least one of the indicators does not meet the standards, then the security of the property is considered unacceptable. In this case, it is necessary to take measures to increase the security of the component, the level of which is unacceptable. In addition, the calculated values of the state institution in question can be compared not only with the established standards, but also with similar indicators of other institutions in this sector. Based on the comparative analysis, it is possible to form a rating of the most effective use of property to provide services by state institutions.

In relation to state bodies, it is advisable to assess the needs for the property based on indicators of the main area and material and technical equipment, which are calculated based on the structure of state civil servants. Having information about the number of state civil servants in each category and group, we formed the general property needs of the state body. Thus, at the legislative level, the standards of office space are regulated, considering the category of federal civil servants and groups of positions. The lowest standard established for providing junior specialists is 7.5 m2 per person.

The volume of the main area, which corresponds to the regulatory needs of the state body, is calculated as the sum of the standards of office space for state civil servants in each category and group of positions, and the volume of the area of technical premises. In addition to the volume of the main area, the standard regulates the minimum set of equipment for each state civil servant used in the design of buildings, which includes a desk, an office chair, a personal computer, a telephone, and a file cabinet (

Table 2). The requirements for the equipment of the official place in various federal state bodies are determined by relevant acts, considering the established minimum requirements.

The total number of state civil servants should be identical to the number of each of the five elements that make up the minimum requirements. For example, if the total number of civil servants in the state body is 50, the target demand value in the material and technical facilities will be 12,500, if there are no additional minimum requirements for equipment inside the state body (ESB = (50 × 50) + (50 × 50) + (50 × 50) + (50 × 50) + (50 × 50) + 0 = 125,000).

If the actual value does not correspond to the standard value, we determine for which elements there is a deviation to make managerial decisions and improve the property management of the state body. Comparing the standard values of the needs for the area, resources, and facilities with the actual values, we can come to a conclusion on the property provisions to the state body: if the actual value of at least one of the two indicators does not correspond to the normative one, then the security of the property is considered insufficient and it is necessary to take measures aimed at increasing the actual values (

Table 3).

If the basis for determining the amount of the main area and equipment that the state institution needs to perform its activities is the number of recipients of public services, which is a key indicator for assessing the need for the property of the state institution, then the number of federal civil servants and their place in the official structure is important for state bodies. When determining the need for the property of the state body, the following algorithm is proposed: at the initial stages, it is necessary to determine the basic parameters, including the organizational structure of the state body, which is represented by a certain set of structural divisions, and a list of their official powers to implement the tasks of the state body.

Based on the functions of the structural units, the staff is formed, which is necessary to implement the tasks of the structural unit. At the same time, it is required to provide a detailed description of the staff, including a list of categories and groups of positions. Next, we calculate the main area for each of the employees and the required equipment, considering the established standards. We consider not only the norms of the legislation of the Russian Federation established for all state bodies, but also specific requirements regulated by the documents of the state body. At the next stage, the standard is calculated for technical premises, the presence of which is necessary to ensure the activities of the state body, but these premises do not relate to the main official powers of state civil servants. At the final stage, the aggregate indicator of the main area and equipment required for the state body to perform its functions is formed. These indicators make up the needs for the property of the state body (

Figure 2).

The considered algorithm is relevant both when designing new buildings for state bodies and for existing ones. If the normative need for the property of the state body turns out to be less than the property available to it, then a decision may be made to use the state property exceeding the need for other purposes to improve the efficiency of its management. For example, the property can be rented out, which will become an additional source of income for the budget and reduce the cost of servicing the property beyond the need (

Bulamu et al. 2020). If the normative need for the property exceeds the size of the existing property, then a decision may be made to expand the main area. To make informed management decisions in the cases considered, it is necessary to regulate the permissible level of deviations at the legislative level. For example, if the actual existing property of the main area of the state body exceeds by more than 30%, it is necessary to consider options for the alternative property.

2.3. Methodology for Assessing the Effective State (Municipal) Property Use

For the purposes of the research, we propose a system and developed a methodology for calculating the performance indicators of the federal executive authorities in the field of federal property management, which includes the following groups of indicators:

Indicators of effective property disposal and use that make up the state treasury (

Figure 3);

Indicators of the effective property disposal and use of economic entities in the public sector (

Figure 4).

The proposed system of indicators for assessing effective state (municipal) property use can be a standard model of the unified approach to analyze the causes of the inefficiency of property and to make informed management decisions. Notably, the indicators used by the Federal Property Management Agency that characterize the effective activities of the federal executive authorities in the field of federal property management are aligned with the indicators proposed in the recommended methodology, but they provide significantly fewer opportunities for the detailed analysis of state property disposal and use, including due to their quantitative limitations. The indicators proposed in the study allow the analysis of the state property disposal and use of economic entities, which would facilitate more purposeful conclusions and informed decisions based on the analysis.

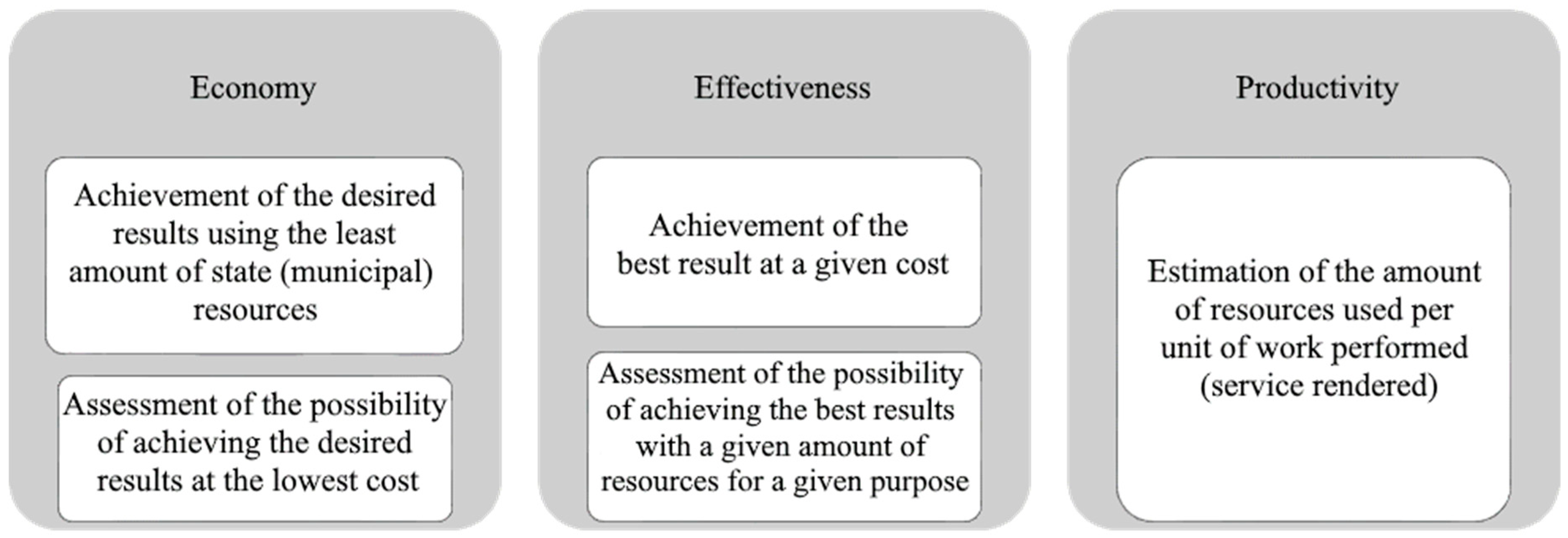

Effective state property use is determined by the ratio between the effect that is achieved and the costs of achieving this effect. The effect achieved in the process of property management is the achievement of the established target values and indicators in qualitative and quantitative aspects aimed at solving the socio-economic problems of public legal entities. The concept of efficiency includes the effectiveness and economy in property management, which is one of the subjects of the efficiency audit (

Figure 5).

Effective state (municipal) property management should be assessed through the effective use of accounting objects of economic entities and is aimed at obtaining a social and economic effect, using indicators for assessing effective state property management.

The system of indicators includes a set of calculated, summarized, and additional indicators for assessing property management. The calculation of summary indicators (indices) assumes a comparison of growth rates by interrelated calculated indicators and assesses the corresponding trend in changes in the assessment parameters, where a unit is taken as the base value (norm) of the indices.

Elements of the methodology for assessing effective state (municipal) property management should include substantive aspects of efficiency, principles, and procedures for assessing the system of indicators through efficiency. A grouping of indicators of the effective state (municipal) property management for information users was compiled to study the analytical provision of assets (

Table 4).

The methods for analyzing and assessing effective property management are based on the dialectical method of studying the relevant economic processes that determine the specifics of its implementation.

The results of the study are the continued scientific research in the field of increasing the efficiency of ownership and state property disposal, especially in the context of the financial crisis (

Gorecki et al. 2011;

Zhang and Marsh 2020), modeling and forecasting the return on assets (

Gribisch et al. 2020) and highlighting the significance of accounting information in the redistribution of state assets (

Chen et al. 2014). They can also be the basis for further research in the field of improving effective state property use.

3. Materials and Methods

To develop a unified register of state property, the authors studied the provisions of the Civil Code of the Russian Federation, which fixes the concept and composition of state-owned property. According to Articles 214 and 215 of the Civil Code of the Russian Federation, state property is “the property owned by the right of ownership of the Russian Federation (federal property), and the property owned by the right of ownership of the subjects of the Russian Federation”. State property includes land and other natural resources that are not owned by individuals or legal entities, and municipalities (

Ouyang et al. 2020). Based on the civil legislation, it can be concluded that the owner of the state property is the corresponding public legal entity, but the rights of the owner on his behalf are exercised by state authorities (state bodies) within their competence, or in cases and procedures defined by federal laws, Presidential decrees and government resolutions of the Russian Federation, regulatory acts of the subjects of the Russian Federation, state bodies, local self-government bodies, legal entities, and citizens.

It is notable that the differences in the interpretation of property rights in Russian practice and the practice of other countries are insignificant. Thus, economists from other countries consider the right of ownership as a set of rights to property use and benefits brought by it, the right to change this property, and the right to transfer it on a paid or gratuitous basis to other persons (

Parker 2018;

Vraciu 2019;

Lueck and Torrens 2020). In Russian practice, the right of ownership is the rights of ownership, actual possession, including reflection on its balance sheet, and property disposal and use, which in their essence are collectively similar to those in other countries (

Gavrilin and Azanova 2019). State property may be transferred for use on the rights of economic management or operational management. On the right of economic management, the property is assigned to three types of economic entities: a federal state unitary enterprise, a state unitary enterprise of the subject of the Russian Federation, and a municipal unitary enterprise. At the same time, in accordance with Article 195 of the Civil Code of the Russian Federation, the state, as the owner of the property, has the right to receive part of the profit from this property under the economic management of the enterprise.

The entities possessing the property under operational management, according to Article 296 of the Civil Code of the Russian Federation, are institutions and state-owned enterprises of the appropriate level. At the same time, the owner has the right to withdraw the unused or excessive property from the institution or the state-owned enterprise and, in the future, this owner can independently dispose of this property at his discretion. The property, which is not assigned to state enterprises and institutions, forms the state treasury of the Russian Federation, the treasury of the subject of the Russian Federation. The state treasury (property treasury) is defined as a temporary state of the property, and it is used only for providing state functions. Thus, the structure of the state property can be represented as follows (

Figure 6).

The subjects of the state property are not fixed at the legislative level, but they can be distinguished based on provisions of management regulation and accounting bodies. These may include state authorities and state bodies, state institutions (state-owned, budgetary, autonomous), state unitary enterprises, joint-stock companies, limited liability companies, and other organizations if they use the state property. It is necessary to single out the executive authority that implements the unified state policy in the field of property relations, which keeps records of the state property of the corresponding public legal entity. At present, 2,479,483 objects are registered in the register of the federal property. At the same time, the main share of the federal property in the register is occupied by the movable property, the initial value of which is equal to or exceeds 500,000 RUB, and especially valuable movable property—43%; buildings, structures, objects of unfinished construction—25%; land plots—19%; and residential and non-residential premises—12%. The remaining 11% includes stocks; shares (deposits) in the authorized (warehouse) capitals of business companies and partnerships; shares in the right of common shared ownership of the immovable and (or) movable property; and aircraft, sea vessels, and inland navigation vessels.

The analysis of the regulations for accounting and maintaining property registers showed that “there are no general provisions for property accounting and maintaining a single register, no information about the available property at all levels (about its condition, use, rights, other information about the object), which leads to the inefficient spending of budget funds, untimely resolution of issues in socio-economic and other spheres of activity”. Thus, according to the report on the results of the expert and analytical event carried out by the Accounting Chamber of the Russian Federation, it has been revealed that the information about the property of the state treasury of the Russian Federation in the register of the federal property and the information system “Kazna” (hereinafter—“Kazna” IS) is not completed and reliable: “the data of these subsystems are not fully synchronized; there is no unambiguous categorization of objects; the data on the type of use of state treasury objects in the “Kazna” IS are formed in relation to less than half of the objects (43%); a full inventory of the property of the state treasury is not carried out; there was a distortion of the information about the property of the state treasury; the information about the property of the state treasury disposal is not formed, etc.”

To assess the property which state bodies and state institutions need when they perform their functions and powers, the authors studied the regulatory documents of the Ministry of Construction, Housing and Communal Services of the Russian Federation. Using the example of premises of higher educational institutions, it has been established that the fundamental criterion is the number of students studying, which, in turn, is determined depending on the type of higher educational institution. For universities and polytechnic institutes, the accepted number of students is from 4 to 12 thousand; for engineering, pedagogical, economic, medical, and agricultural institutions—from 2 to 6 thousand; and for cultural institutions—from 0.5 to 2 thousand. The estimated number of students is taken within 90% of the total number of full-time and 10% of part-time students. The area of office, administrative, and utility premises is also calculated based on the established norms per student (

Table 5).

For example, the number of university students is 4.343 students (2.363 intramural students and 1.980 extramural students); therefore, the estimated number of students for the example under consideration is 2.127 intramural students (90% of the total number of intramural students) and 198 extramural students (10% of the total number of extramural students). If the university has 1 lecture hall with 500 seats, 2 lecture halls with 151–350 seats, 6 lecture halls with 101–150 seats, 15 lecture halls with 50–75 seats, and 20 classrooms, then based on the estimated number of students, the university should have a total main area of 4917.5 m

2 (

Table 6).

Thus, the norm for the example under consideration would be 4917.5 m2 (the total of the main area of classrooms and lecture halls, excluding domestic premises, a library, and a sports hall). Then, the share of the main area per consumer of services (student), according to the standards, would be 2.12 m2 ((DS) = = 2.12 m2). Similarly, the indicator of the provision of the state institution’s need for the property is calculated based on the share of resources per consumer of services. In relation to the state institution of higher education, this refers to providing a student with the necessary set of seats, tables, chalkboards, and other equipment to receive educational services in full and corresponding to educational quality standards.

In addition, depending on the specific activity of the state body or the state institution (health, education, etc.), different approaches are used to assess the need for the property. This is associated with the application of various standards for the necessary property to provide public services and to use specific equipment, which differs depending on their field of activity. The study considers the specific indicators of the area of classrooms, laboratories, and lecture halls, and examines the existing metrics for assessing the property needs of the state institution.

The actual number of facilities and resources is proposed to be determined using the inventory method: checking the actual availability of a minimum set of facilities and resources for each employee. The normative volume of facilities and resources is determined by summing the quantity values of each of the elements that make up the minimum requirements for facilities and resources, depending on the number of state civil servants and other items established in the state body.

where N

th—the total number of civil servants of the state body; T

th—the minimum required number of office tables; C

th—the minimum required number of office chairs; K

th—the minimum required number of personal computers; P

th—the minimum required number of phones; S

th—the minimum required number of file cabinets; and T—the minimum number of other objects of material equipment, according to the requirements of the specific state body.

The volume of the main area, which corresponds to the regulatory needs of the state body, is calculated as the sum of the standards of office space for state civil servants of each category and group of positions, and the volume of the area of technical premises.

where N

a, N

b, …, N

k—the number of civil servants in each category and group of posts (a specialist of a younger group, a specialist of a senior group, etc.); S

a, S

b, …, S

k—a standard cabinet area for civil servants to each category and group of posts; and S

t—the number of technical areas.

The normative volume of the main area of each state body is proposed to be compared with the factual one for making managerial decisions.

Recently, more and more attention has been paid to the need to assess effective state property use. Thus, the Order of the Government of the Russian Federation No. 2645-r approved the methodology determining the criteria for the optimal composition of the state (municipal) property and indicators for the effective property management and disposal of it (2020), which is used by the Federal Property Agency to assess the activities of the federal executive authorities in the field of the federal property management. Within the framework of this methodology, four sections with certain analytical support are allocated in the structure of indicators that characterize the activities of the federal executive bodies in the field of federal property management:

Indicators of the federal budget execution in terms of federal property management;

Management indicators of federal state unitary enterprises and joint-stock companies with state participation;

Indicators of privatization of the federal property;

Indicators of federal property use and safety.

However, the analytical indicators used by the Federal Property Management Agency that characterize the activities of the federal executive authorities in the field of federal property management do not fully reflect a detailed analysis of state property disposal and use. We believe that to assess the state property disposal and use, we should use a criteria-based approach. Based on the Standard of external state audit (control) of the

WTO 104 “Performance Audit” (

2016), the criteria for assessing the effective state property disposal and use can be defined as qualitative and quantitative characteristics of processes, results of state property disposal and use, and (or) the activities of efficiency audit objects concerning state property disposal and use. The criteria show what processes should be, what results are evidence of effective state property disposal and use, and how the activities of efficiency audit objects for state property disposal and use should be organized.

When determining these criteria, it is necessary to be guided by regulatory documents in the field of the object’s activity whose effectiveness is assessed, the statutory documents of the object, and other circumstances. There are no universal criteria, because the specifics of the objects being checked are different. For example, the Accounts Chamber of the Moscow region developed Order No. 40R-115 “On the approval of methodological recommendations for the audit of the effective state property use, including land plots” (2019). These recommendations establish the methodological framework, rules, and procedures during the audit of effective property use.

4. Conclusions

Management and analytical support of effective state (municipal) property use assume the existence of a single register of this kind of property, including information about the physical condition, rights of use, valuation, and other information. In this regard, based on the analyzed structural characteristics of the existing registers, the authors developed the unified register of the state (municipal) property, which includes additional indicators characterizing the physical condition, recognition in accounting, and forms of the property disposal and use, which considerably activates property management at all levels. Therewith, based on the state-integrated information system “Electronic Budget” and the developed register of the federal property, the creation of a single information space is proposed. It would allow for the systematizing and ordering of all information about state property available in various state information systems. The implementation of this proposal will require revision of these systems, which are currently used by the federal authorities. The recommended methodological approaches to the systematization of accounting and analytical support for the management of state treasury assets, including the formation of the treasury property, its movement, and disposal, can be used by financial authorities of public law entities to develop uniform rules to account non-produced assets, uniform budgetary requirements, and the treasury, including the property in concession.

The developed unified approach for assessing the property, based on the scope of the state body or state institution’s activity, as well as the introduction of the minimum allowable level of security for the property, can be used by management authorities for rating objects according to the quality of services provided depending on the property factor, and can identify institutions with insufficient efficiency in property management. In turn, government agencies can use this approach when planning financial and economic activities for the future.

The proposed system of performance indicators for state (municipal) property, consisting of indicators for property disposal and use—which makes up the state treasury—and indicators for the property disposal and use of economic entities in the public sector, can be used to develop a standard model of the unified approach to analyzing the causes of inefficient property use. Management bodies can use the recommended system of indicators to assess the achievement of target indicators for effective state property management. State organizations and institutions use this system to develop provisions to optimize state property management.

This methodology ensures the possibility of its application in various areas of the public sector and allows you to set key and target indicators for effective state (municipal) property use, because the forecasts are based on the implementation of these indicators.