The Influence of Airbnb Announcements on North American Capital Markets: Insights for Stakeholders

Abstract

:1. Introduction

1.1. Exploring Airbnb’s Expansion: A Focus on North America

1.2. Airbnb’s Dual Impact: Bridging Tourism, Real Estate, and Global Markets

2. Literature Review

2.1. Analyzing the Impact of Tourism on Financial Markets

2.2. Airbnb’s Economic Impact in North America

2.3. Real Estate Dynamics: Unraveling Interconnections with Financial Markets

2.4. Housing Market Fluctuations

2.5. Interest Rates and Housing Demand

2.6. Real Estate Debt and Financial Stability

2.7. Real Estate Dynamics: Interplay between Registered and Direct Ownership

2.8. Financial Market Sentiment and Real Estate Investment

2.9. Investment and Portfolio Diversification

2.10. Analyzing Dynamics in the Hospitality Sector via Event Studies

2.10.1. The Methodology of Event Studies

2.10.2. Dissecting Hospitality Market Trends: Insights from Event Studies

2.11. Event Studies on Airbnb’s Impact

3. Hypotheses and Theoretical Framework

3.1. Rationale for Hypothesis 1

3.2. Rationale for Hypothesis 2

4. Data and Empirical Methodology

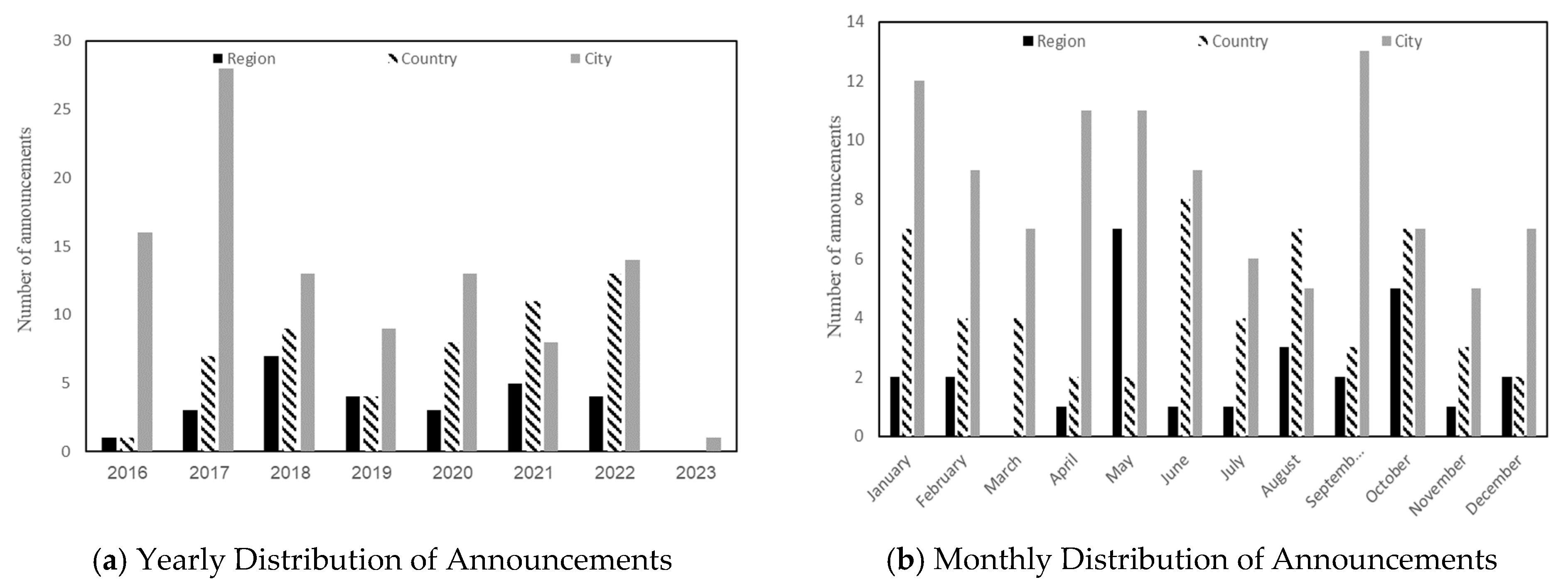

4.1. Data

4.2. Empirical Strategy

4.2.1. Event Study Methodology

4.2.2. Regression Methodology

5. Empirical Results

5.1. Descriptive Statistics

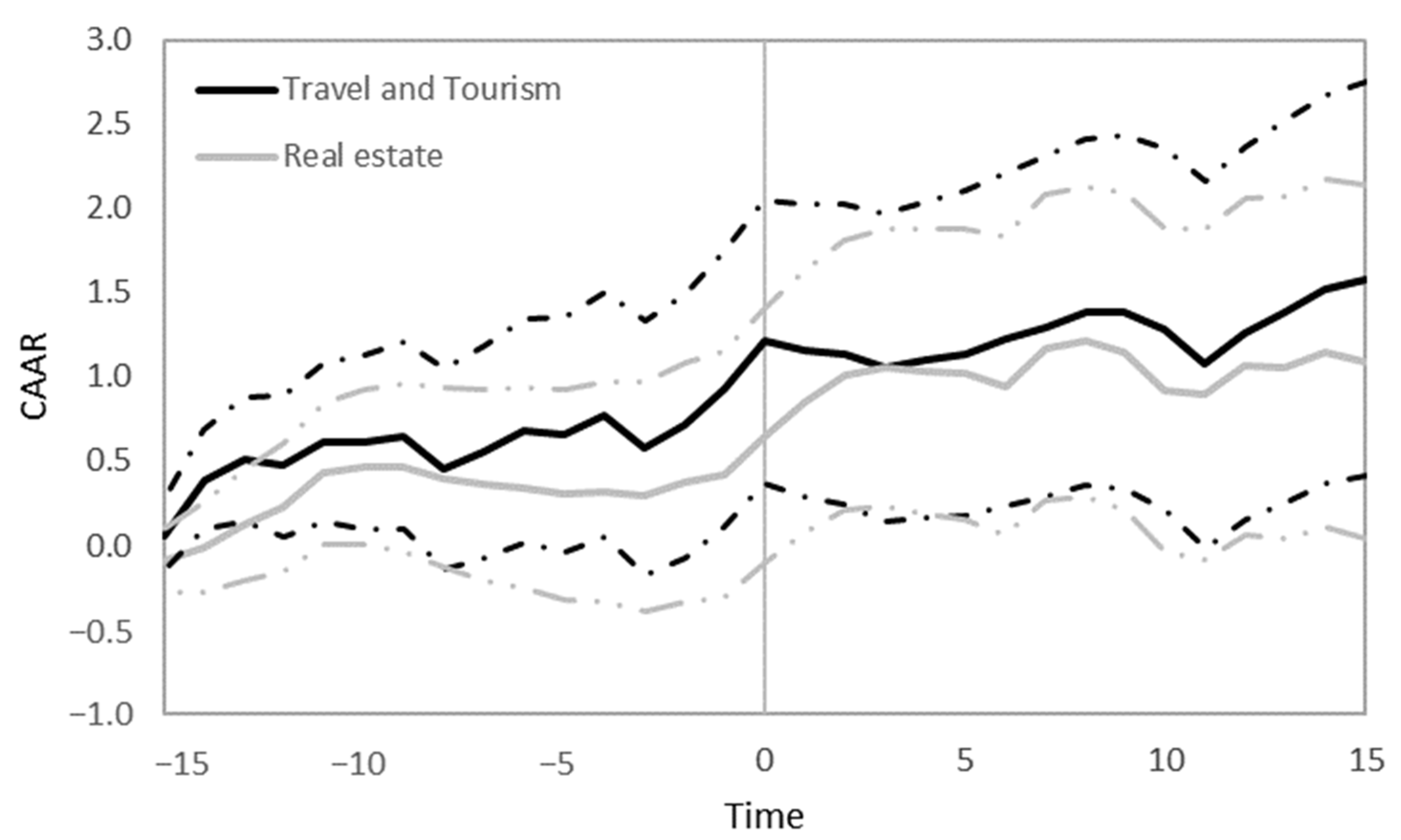

5.2. Impact of Announcements on North American Stock Indices Performance

5.3. Robustness Check

5.4. Regression Results

6. Conclusions and Policy Implications

6.1. Conclusions

6.2. Policy Implications

Funding

Data Availability Statement

Conflicts of Interest

| 1 | The Mean Absolute Value Test (MAVT) is the absolute value of the mean of all statistical test results within a specified time window. |

References

- Akbari, Amir, and Karolina Krystyniak. 2021. Government real estate interventions and the stock market. International Review of Financial Analysis 75: 101742. [Google Scholar] [CrossRef]

- Akimov, Alexey, Chyi Lin Lee, and Simon Stevenson. 2020. Interest rate sensitivity in european public real estate markets. Journal of Real Estate Portfolio Management 25: 138–50. [Google Scholar] [CrossRef]

- Baker, Malcolm, and Jeffrey Wurgler. 2006. Investor sentiment and the cross-section of stock returns. The Journal of Finance 61: 1645–80. [Google Scholar] [CrossRef]

- Ball, Ray, and Philip Brown. 1968. An empirical evaluation of accounting income numbers. Journal of Accounting Research 6: 159–78. [Google Scholar] [CrossRef]

- Bardhan, Ashok, Jaclene Begley, Cynthia A. Kroll, and Nathan George. 2008. Global Tourism and Real Estate. 2008 Industry Studies Conference Paper. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1126837 (accessed on 30 April 2008).

- Barron, Kyle, Edward Kung, and Davide Proserpio. 2021. The effect of home-sharing on house prices and rents: Evidence from Airbnb. Marketing Science 40: 23–47. [Google Scholar] [CrossRef]

- Benitez-Aurioles, Beatriz, and Iis Tussyadiah. 2020. What Airbnb does to the housing market. Annals of Tourism Research 90: 103108. [Google Scholar] [CrossRef]

- Bianco, Simone, Florian J. Zach, and Anyu Liu. 2022a. Early and late-stage startup funding in hospitality: Effects on incumbents’ market value. Annals of Tourism Research 95: 103436. [Google Scholar] [CrossRef]

- Bianco, Simone, Florian J. Zach, and Manisha Singal. 2022b. Disruptor recognition and market value of incumbent firms: Airbnb and the lodging industry. Journal of Hospitality & Tourism Research 48: 84–104. [Google Scholar] [CrossRef]

- Bibler, Andrew, Keith Teltser, and Mark J. Tremblay. 2022. Short-term rentals, home prices, and housing affordability: Evidence from Airbnb registration enforcement. Andrew Young School of Policy Studies Research Paper Series. forthcoming. [Google Scholar]

- Bloom, Barry A.N., and Leonard A. Jackson. 2016. Abnormal stock returns and volume activity surrounding lodging firms’ CEO transition announcements. Tourism Economics 22: 141–61. [Google Scholar] [CrossRef]

- Boehmer, Ekkehart, Jim Masumeci, and Annette B. Poulsen. 1991. Event-study methodology under conditions of event-induced variance. Journal of Financial Economics 30: 253–72. [Google Scholar] [CrossRef]

- Borrego-Domínguez, Susana, Fernando Isla-Castillo, and Mercedes Rodríguez-Fernández. 2022. Determinants of Tourism Demand in Spain: A European Perspective from 2000–2020. Economies 10: 276. [Google Scholar] [CrossRef]

- Braun, Julia, Hans-Peter Burghof, Julius Langer, and Dag Einar Sommervoll. 2022. The volatility of housing prices: Do different types of financial intermediaries affect housing market cycles differently? The Journal of Real Estate Finance and Economics, 1–32. [Google Scholar] [CrossRef]

- Brida, Juan Gabriel, Bibiana Lanzilotta, Leonardo Moreno, and Florencia Santiñaque. 2018. A non-linear approximation to the distribution of total expenditure distribution of cruise tourists in Uruguay. Tourism Management 69: 62–68. [Google Scholar] [CrossRef]

- Cameron, Anna, Mukesh Khanal, and Lindsay M. Tedds. 2023. Managing Airbnb: A Cross-Jurisdictional Review of Approaches for Regulating the Short-Term Rental Market. Available online: https://ssrn.com/abstract=4009268 (accessed on 25 October 2023).

- Candelon, Bertrand, Franz Fuerst, and Jean-Baptiste Hasse. 2021. Diversification potential in real estate portfolios. International Economics 166: 126–39. [Google Scholar] [CrossRef]

- Caporin, Massimiliano, Rangan Gupta, and Francesco Ravazzolo. 2021. Contagion between real estate and financial markets: A Bayesian quantile-on-quantile approach. The North American Journal of Economics and Finance 55: 101347. [Google Scholar] [CrossRef]

- Che Ahmat, Nur Hidayah, Jewoo Kim, and Susan W. Arendt. 2023. Examining the impact of minimum wage policy on hospitality financial performance using event study method. International Journal of Hospitality & Tourism Administration 24: 98–122. [Google Scholar]

- Chen, Ming-Hsiang, Chao-Ning Liao, and Shi-Shen Huang. 2010. Effects of shifts in monetary policy on hospitality stock performance. The Service Industries Journal 30: 171–84. [Google Scholar] [CrossRef]

- Chen, Chang, Haoyu Zhai, Zhiruo Wang, Shen Ma, Jie Sun, Chengliang Wu, and Yang Zhang. 2022. Experimental Research on the Impact of Interest Rate on Real Estate Market Transactions. Discrete Dynamics in Nature and Society 2022: 9946703. [Google Scholar] [CrossRef]

- Cowan, Arnold Richard. 1992. Nonparametric event study tests. Review of Quantitative Finance and Accounting 2: 343–58. [Google Scholar] [CrossRef]

- Dogru, Tarik. 2017. Under- vs over-investment: Hotel firms’ value around acquisitions. International Journal of Contemporary Hospitality Management 29: 2050–69. [Google Scholar] [CrossRef]

- Dogru, Tarik, Makarand Mody, Nathan Line, Courtney Suess, Lydia Hanks, and Mark Bonn. 2020. Investigating the whole picture: Comparing the effects of Airbnb supply and hotel supply on hotel performance across the United States. Tourism Management 79: 104094. [Google Scholar] [CrossRef]

- Etebari, Ahmad. 2016. Real estate as a portfolio risk diversifier. Investment Management and Financial Innovations 13: 45–52. [Google Scholar] [CrossRef] [PubMed]

- Fama, Eugene F., and Richard Roll. 1968. Some properties of symmetric stable distributions. Journal of the American Statistical Association 63: 817–36. [Google Scholar]

- Fama, Eugene F., Lawrence Fisher, Michael C. Jensen, and Richard Roll. 1969. The adjustment of stock prices to new information. International Economic Review 10: 1–21. [Google Scholar] [CrossRef]

- Freybote, Julia, and Philip A. Seagraves. 2017. Heterogeneous investor sentiment and institutional real estate investments. Real Estate Economics 45: 154–76. [Google Scholar] [CrossRef]

- Garcia-López, Miquel-Àngel, Jordi Jofre-Monseny, Rodrigo Martínez-Mazza, and Mariona Segú. 2020. Do short-term rental platforms affect housing markets? Evidence from Airbnb in Barcelona. Journal of Urban Economics 119: 103278. [Google Scholar] [CrossRef]

- Ghosh, Chinmoy, Randall S. Guttery, and C. F. Sirmans. 1997. The effects of the real estate crisis on institutional stock prices. Real Estate Economics 25: 591–614. [Google Scholar] [CrossRef]

- Gompers, Paul, Joy Ishii, and Andrew Metrick. 2003. Corporate governance and equity prices. The Quarterly Journal of Economics 118: 107–56. [Google Scholar] [CrossRef]

- Goyette, Kiley. 2021. ‘Making ends meet’ by renting homes to strangers: Historicizing Airbnb through women’s supplemental income. City 25: 332–54. [Google Scholar] [CrossRef]

- Griffiths, Sarah Lynn. 2017. Where Home Meets Hotel: Regulating Tourist Accommodations in the Age of Airbnb. Burnaby: Simon Fraser University. [Google Scholar]

- Gupta, Manjul, Pouyan Esmaeilzadeh, Irem Uz, and Vanesa M. Tennant. 2019. The effects of national cultural values on individuals’ intention to participate in peer-to-peer sharing economy. Journal of Business Research 97: 20–29. [Google Scholar] [CrossRef]

- Guttentag, Daniel. 2015. Airbnb: Disruptive innovation and the rise of an informal tourism accommodation sector. Current Issues in Tourism 18: 1192–217. [Google Scholar] [CrossRef]

- Hampshire, Robert C., and Craig Gaites. 2011. Peer-to-peer carsharing: Market analysis and potential growth. Transportation Research Record 2217: 119–26. [Google Scholar] [CrossRef]

- He, Xin, Zhenguo Len Lin, and Yingchun Liu. 2018. Volatility and liquidity in the real estate market. Journal of Real Estate Research 40: 523–50. [Google Scholar] [CrossRef]

- Hu, Yang, Chunlin Lang, Shaen Corbet, and Junchuan Wang. 2024. The Impact of COVID-19 on the Volatility Connectedness of the Chinese Tourism Sector. Research in International Business and Finance 68: 102192. [Google Scholar] [CrossRef]

- Ismail, Eman, Yasser Tawfik Halim, and Mohamed Samy EL-Deeb. 2023. Corporate reputation and shareholder investment: A study of Egypt’s tourism listed companies. Future Business Journal 9: 1–15. [Google Scholar]

- Ivanov, Stanislav Hristov, and Craig Webster. 2012. Tourism’s impact on growth: The role of globalisation. Annals of Tourism Research 41: 231–36. [Google Scholar] [CrossRef]

- Jang, Hanwool, Yena Song, Sungbin Sohn, and Kwangwon Ahn. 2018. Real estate soars and financial crises: Recent stories. Sustainability 10: 4559. [Google Scholar] [CrossRef]

- Januário, João Fragoso, and Carlos Oliveira Cruz. 2023. The Impact of the 2008 Financial Crisis on Lisbon’s Housing Prices. Journal of Risk and Financial Management 16: 46. [Google Scholar] [CrossRef]

- Jayaraman, Krishnaswamy, Soh Keng Lin, Hasnah Haron, and Wooi Leng Ong. 2011. Macroeconomic factors influencing Malaysian tourism revenue, 2002–2008. Tourism Economics 17: 1347–63. [Google Scholar] [CrossRef]

- Jensen, Michael C. 1978. Some anomalous evidence regarding market efficiency. Journal of Financial Economics 6: 95–101. [Google Scholar] [CrossRef]

- Jiang, Yonghong, Gengyu Tian, Yiqi Wu, and Bin Mo. 2022. Impacts of geopolitical risks and economic policy uncertainty on Chinese tourism-listed company stock. International Journal of Finance & Economics 27: 320–33. [Google Scholar]

- Jiménez, Juan Luis, Armando Ortuño, and Jorge V. Pérez-Rodríguez. 2022. How does AirBnb affect local Spanish tourism markets? Empirical Economics 62: 2515–45. [Google Scholar] [CrossRef]

- Kolari, James W., and Seppo Pynnönen. 2010. Event study testing with cross-sectional correlation of abnormal returns. The Review of Financial Studies 23: 3996–4025. [Google Scholar] [CrossRef]

- Kolari, James W., and Seppo Pynnönen. 2011. Nonparametric rank tests for event studies. Journal of Empirical Finance 18: 953–71. [Google Scholar] [CrossRef]

- Lee, Yong-Jin Alex, Seongsoo Jang, and Jinwon Kim. 2020. Tourism clusters and peer-to-peer accommodation. Annals of Tourism Research 83: 102960. [Google Scholar] [CrossRef]

- Lee, Chyi Lin, Simon Stevenson, and Hyunbum Cho. 2022. Listed real estate futures trading, market efficiency, and direct real estate linkages: International evidence. Journal of International Money and Finance 127: 102693. [Google Scholar] [CrossRef]

- Ling, David C., and Andy Naranjo. 2015. Returns and information transmission dynamics in public and private real estate markets. Real Estate Economics 43: 163–208. [Google Scholar] [CrossRef]

- Liu, Yikui, Lei Wu, and Jie Li. 2019. Peer-to-peer (P2P) electricity trading in distribution systems of the future. The Electricity Journal 32: 2–6. [Google Scholar] [CrossRef]

- Liu, Han, Peng Yang, Haiyan Song, and Doris Chenguang Wu. 2023. Global and domestic economic policy uncertainties and tourism stock market: Evidence from China. Tourism Economics. [Google Scholar] [CrossRef]

- McGough, Tony, and Jim Berry. 2022. Real estate risk, yield modelling and market sentiment: The impact on pricing in European office markets. Journal of European Real Estate Research 15: 179–91. [Google Scholar] [CrossRef]

- Mladina, Peter. 2018. Real Estate Betas and the Implications for Asset Allocation. The Journal of Investing 27: 109–20. [Google Scholar] [CrossRef]

- Newey, Whitney K., and Kenneth D. West. 1987. A Simple, Positive Semi-Definite, Heteroskedasticity and Autocorrelation Consistent Covariance Matrix. Econometrica 55: 703–8. [Google Scholar] [CrossRef]

- Nguyen, My-Linh Thi, and Toan Ngoc Bui. 2020. The real estate market and financial stability. International Journal of Mathematical, Engineering and Management Sciences 5: 1270. [Google Scholar] [CrossRef]

- Olszewski, Krzysztof. 2012. The Impact of Commercial Real Estate on the Financial Sector, Its Tracking by Central Banks and Some Recommendations for the Macro-Financial Stability Policy of Central Banks. National Bank of Poland Working Paper, No. 132. Amsterdam: Elsevier. [Google Scholar]

- Oxford Analytica. 2022. Higher Interest Rates Will Stress Real Estate Activity. Bingley: Emerald Expert Briefings. [Google Scholar]

- Palatnik, Ruslana Rachel, Tchai Tavor, and Liran Voldman. 2019. The Symptoms of Illness: Does Israel Suffer from “Dutch Disease”? Energies 12: 2752. [Google Scholar] [CrossRef]

- Papathanasiou, Spyros, Dimitris Kenourgios, Drosos Koutsokostas, and Georgios Pergeris. 2023. Can treasury inflation-protected securities safeguard investors from outward risk spillovers? A portfolio hedging strategy through the prism of COVID-19. Journal of Asset Management 24: 198–211. [Google Scholar]

- Park, Jun-hyoung. 2013. Calendar effect: Do investors overreact to the seasonality of the US hotel Industry? International Journal of Tourism Sciences 13: 80–102. [Google Scholar] [CrossRef]

- Patell, James M. 1976. Corporate forecasts of earnings per share and stock price behavior: Empirical test. Journal of Accounting Research 14: 246–76. [Google Scholar] [CrossRef]

- Peng, Kang-Lin, Chih-Hung Wu, Pearl M. C. Lin, and IokTeng Esther Kou. 2023. Investor sentiment in the tourism stock market. Journal of Behavioral and Experimental Finance 37: 100732. [Google Scholar] [CrossRef]

- Qin, Feng-Ming, and Zhong-Nan Zhang. 2007. The influence of real estate price expansion on financial situation. Journal of Shandong University (Philosophy and Social Sciences) 4: 33–36. [Google Scholar]

- Rabiei-Dastjerdi, Hamidreza, Gavin McArdle, and William Hynes. 2022. Which came first, the gentrification or the Airbnb? Identifying spatial patterns of neighbourhood change using Airbnb data. Habitat International 125: 102582. [Google Scholar] [CrossRef]

- Roll, Richard. 1984. A simple implicit measure of the effective bid-ask spread in an efficient market. The Journal of Finance 39: 1127–39. [Google Scholar]

- Sanford, Douglas M., Jr., and Huiping Dong. 2000. Investment in familiar territory: Tourism and new foreign direct investment. Tourism Economics 6: 205–19. [Google Scholar] [CrossRef]

- Shabrina, Zahratu, Elsa Arcaute, and Michael Batty. 2022. Airbnb and its potential impact on the London housing market. Urban Studies 59: 197–221. [Google Scholar] [CrossRef]

- Shirkhani, Setareh, Sami Fethi, and Andrew Adewale Alola. 2021. Tourism-related loans as a driver of a small island economy: A case of northern Cyprus. Sustainability 13: 9508. [Google Scholar] [CrossRef]

- Śmietana, Katarzyna. 2014. Diversification principles of real estate portfolios. Real Estate Management and Valuation 22: 51–57. [Google Scholar] [CrossRef]

- Snedecor, George W., and William G. Cochran. 1989. Statistical Methods, 8th ed. Ames: Iowa State University Press. [Google Scholar]

- Sternik, S. G., and N. B. Safronova. 2021. Financialization of Real Estate Markets as a Macroeconomic Trend of the Digital Economy. Studies on Russian Economic Development 32: 676–82. [Google Scholar] [CrossRef]

- Sternik, Sergey Gennadievich, and Grigory Teleshev. 2018. Impact of banking real estate as an asset class on financial system stability: Monitoring, forecasting, management. Journal of Reviews on Global Economics 7: 851–64. [Google Scholar] [CrossRef]

- Tavor, Tchai. 2023. The effect of natural gas discoveries in Israel on the strength of its currency. Australian Economic Papers 62: 236–56. [Google Scholar] [CrossRef]

- Teitler-Regev, Sharon, and Tchai Tavor. 2023. The effect of Airbnb announcements on hotel stock prices. Australian Economic Papers 62: 78–100. [Google Scholar] [CrossRef]

- Thackway, William Thomas, Matthew Kok Ming Ng, Chyi-Lin Lee, Vivien Shi, and Christopher James Pettit. 2022. Spatial variability of the ‘Airbnb effect’: A spatially explicit analysis of Airbnb’s impact on housing prices in Sydney. ISPRS International Journal of Geo-Information 11: 65. [Google Scholar] [CrossRef]

- The World Bank. 2023. Available online: https://data.worldbank.org/country (accessed on 7 February 2023).

- Urquhart, Andrew, and Hanxiong Zhang. 2019. Is Bitcoin a hedge or safe haven for currencies? An intraday analysis. International Review of Financial Analysis 63: 49–57. [Google Scholar] [CrossRef]

- Wachsmuth, David, and Alexander Weisler. 2018. Airbnb and the rent gap: Gentrification through the sharing economy. Environment and Planning A: Economy and Space 50: 1147–70. [Google Scholar] [CrossRef]

- Wang, Chuhan Renee, and Miyoung Jeong. 2018. Whatmakes you choose Airbnb again? An examination ofusers’ perceptions toward the website andtheir stay. International Journal of Hospitality Management 74: 162–70. [Google Scholar] [CrossRef]

- Wang, Jinsong, Luoqiu Tang, and Yueqiao Li. 2022. Real estate assets, heterogeneous firms, and debt stability. Journal of Post Keynesian Economics 45: 1–34. [Google Scholar] [CrossRef]

- Wilson, Patrick, and John Okunev. 1999. Spectral analysis of real estate and financial assets markets. Journal of Property Investment & Finance 17: 61–74. [Google Scholar]

- Zervas, Georgios, Davide Proserpio, and John W. Byers. 2017. The rise of the sharing economy: Estimating the impact of Airbnb on the hotel industry. Journal of Marketing Research 54: 687–705. [Google Scholar] [CrossRef]

- Zurek, Maximilian. 2022. Real Estate Markets and Lending: Does Local Growth Fuel Risk? Journal of Financial Services Research 62: 27–59. [Google Scholar] [CrossRef]

| Date | Event | Description |

|---|---|---|

| North American region | ||

| 9 October 2018 | 22 | Look Snow Further: 10 of the Most Popular Ski Destinations in North America |

| 3 September 2021 | 26 | The return of big events in North America |

| Countries in the North American region | ||

| 13 October 2022 | 61 | Canada’s coziest cottages and trending Canadian cities for fall |

| 12 August 2021 | 76 | Costa Rica by Land, an initiative to promote responsible tourism recovery |

| Cities in the North American region | ||

| 20 December 2022 | 138 | Report finds new rules would impact New York City’s local tourism industry. |

| 31 January 2018 | 158 | Mexico City hosts launch five Home Sharing Clubs |

| Panel A: Market Model | ||||||

| Variables | N | Mean | Std. Dev | Min | Median | Max |

| Stock indices | ||||||

| NATT | 1820 | 0.031 | 1.468 | −13.580 | 0.050 | 14.780 |

| NARE | 1821 | 0.025 | 1.344 | −16.720 | 0.060 | 8.770 |

| Market indices | ||||||

| DJTT | 1783 | 0.034 | 1.570 | −14.340 | 0.080 | 15.400 |

| DJRE | 1783 | 0.021 | 1.367 | −17.430 | 0.070 | 8.530 |

| MSCINA | 1843 | 0.044 | 1.192 | −12.020 | 0.040 | 9.560 |

| FTSENA | 1841 | 0.045 | 1.191 | −11.990 | 0.040 | 9.550 |

| Panel B: Regression | ||||||

| Variables | N | Mean | Std. Dev | Min | Median | Max |

| Year | 182 | 2019 | 2 | 2016 | 2019 | 2023 |

| Location | 182 | 2.412 | 0.736 | 1 | 3 | 3 |

| Tourism | 182 | 70.120 | 59.690 | 1.100 | 42.659 | 175.261 |

| GDPC | 182 | 45.891 | 22.832 | 1.494 | 55.085 | 77.272 |

| GDP growth | 182 | 1.610 | 3.849 | −23.823 | 2.242 | 7.580 |

| HDI | 182 | 0.872 | 0.081 | 0.535 | 0.921 | 0.936 |

| Population | 182 | 186.057 | 138.371 | 0.407 | 126.700 | 331.900 |

| Panel A: Travel and Tourism | ||||||||

| Parametric Tests | Non-Parametric Tests | |||||||

| Daily Time | CAR(%) | ORDIN | Adj-PATELL | Adj-BMP | FEV | SIGN | G-SIGN | GRANK-T |

| Event window surrounding the event day | ||||||||

| CAR[−1,+1] | 0.447 | 2.408 ** | 1.248 | 1.309 | 5.772 *** | 1.038 | 0.738 | −1.370 |

| CAR[−2,+2] | 0.556 | 2.321 ** | 0.527 | 0.450 | 4.481 *** | 1.038 | 0.738 | −1.311 |

| CAR[−3,+3] | 0.281 | 0.791 | −0.556 | −0.490 | 3.979 *** | 0.445 | 0.145 | −0.102 |

| Pre-event and post-event window | ||||||||

| CAR[−3,0] | 0.440 | 1.551 | 1.128 | 1.020 | 4.886 *** | 2.075 ** | 1.776 * | −1.489 |

| CAR[−2,0] | 0.635 | 2.649 *** | 2.448 ** | 2.070 ** | 5.299 *** | 2.965 *** | 2.665 *** | −2.620 *** |

| CAR[−1,0] | 0.502 | 2.705 *** | 2.976 *** | 3.308 *** | 7.299 *** | 3.410 *** | 3.110 *** | −3.376 *** |

| CAR[0,0] | 0.287 | 2.676 *** | 2.420 ** | 3.111 *** | 2.372 ** | 2.072 ** | −2.842 *** | |

| CAR[+1,+2] | −0.079 | −0.520 | −2.165 ** | −1.951 * | 7.708 *** | −0.148 | −0.449 | 1.038 |

| CAR[+1,+3] | −0.159 | −0.740 | −2.152 ** | −1.907 * | 7.129 *** | −1.482 | −1.783 * | 1.962 ** |

| Panel B: Real Estate | ||||||||

| Parametric Tests | Non-Parametric Tests | |||||||

| Daily Time | CAR(%) | ORDIN | Adj-PATELL | Adj-BMP | FEV | SIGN | G-SIGN | GRANK-T |

| Event window surrounding the event day | ||||||||

| CAR[−1,+1] | 0.475 | 2.847 *** | 2.313 ** | 2.118 ** | 6.387 *** | 2.668 *** | 2.366 ** | −2.248 ** |

| CAR[−2,+2] | 0.719 | 3.339 *** | 2.254 ** | 1.733 * | 4.987 *** | 2.817 *** | 2.514 ** | −2.180 ** |

| CAR[−3,+3] | 0.743 | 2.916 *** | 2.325 ** | 1.957 * | 4.139 *** | 3.261 *** | 2.959 *** | −2.353 ** |

| Pre-event and post-event window | ||||||||

| CAR[−3,0] | 0.336 | 1.747 * | 0.736 | 0.523 | 4.585 *** | 2.224 ** | 1.921 * | −1.127 |

| CAR[−2,0] | 0.358 | 2.146 ** | 0.991 | 0.670 | 5.512 *** | 2.668 *** | 2.366 ** | −1.148 |

| CAR[−1,0] | 0.275 | 2.023 ** | 1.526 | 1.261 | 7.271 *** | 3.113 *** | 2.811 *** | −1.662 * |

| CAR[0,0] | 0.234 | 2.433 ** | 2.562 ** | 2.710 *** | 1.927 * | 1.624 | −2.111 ** | |

| CAR[+1,+2] | 0.361 | 2.651 *** | 2.351 ** | 2.477 ** | 8.116 *** | 4.447 *** | 4.145 *** | −2.933 *** |

| CAR[+1,+3] | 0.406 | 2.437 ** | 2.702 *** | 2.735 *** | 7.324 *** | 3.113 *** | 2.811 *** | −3.276 *** |

| Panel A: Travel and Tourism | ||||||

| MSCINA | FTSENA | |||||

| Daily Time | CAR(%) | Positive (%) | ORDIN | CAR(%) | Positive (%) | ORDIN |

| Event window surrounding the event day | ||||||

| CAR[−1,+1] | 0.330 | 0.555 | 1.851 * | 0.324 | 0.549 | 1.820 * |

| CAR[−2,+2] | 0.327 | 0.571 | 1.421 | 0.339 | 0.571 | 1.475 |

| CAR[−3,+3] | 0.115 | 0.566 | 0.337 | 0.126 | 0.566 | 0.370 |

| Pre-event and post-event window | ||||||

| CAR[−3,0] | 0.370 | 0.577 | 1.357 | 0.371 | 0.599 | 1.364 |

| CAR[−2,0] | 0.523 | 0.659 | 2.274 ** | 0.524 | 0.659 | 2.281 ** |

| CAR[−1,0] | 0.453 | 0.654 | 2.538 ** | 0.446 | 0.648 | 2.503 ** |

| CAR[0,0] | 0.269 | 0.560 | 2.610 *** | 0.266 | 0.577 | 2.589 *** |

| CAR[+1,+2] | −0.196 | 0.467 | −1.348 | −0.185 | 0.467 | −1.275 |

| CAR[+1,+3] | −0.254 | 0.451 | −1.235 | −0.245 | 0.456 | −1.191 |

| Panel B: Real Estate | ||||||

| MSCINA | FTSENA | |||||

| Daily Time | CAR(%) | Positive (%) | ORDIN | CAR(%) | Positive (%) | ORDIN |

| Event window surrounding the event day | ||||||

| CAR[−1,+1] | 0.386 | 0.571 | 2.326 ** | 0.381 | 0.571 | 2.286 ** |

| CAR[−2,+2] | 0.561 | 0.582 | 2.613 *** | 0.566 | 0.582 | 2.630 *** |

| CAR[−3,+3] | 0.674 | 0.588 | 2.655 *** | 0.676 | 0.599 | 2.120 ** |

| Pre-event and post-event window | ||||||

| CAR[−3,0] | 0.272 | 0.549 | 1.420 | 0.272 | 0.549 | 1.070 |

| CAR[−2,0] | 0.258 | 0.566 | 1.550 | 0.256 | 0.582 | 1.189 |

| CAR[−1,0] | 0.241 | 0.615 | 1.776 * | 0.235 | 0.615 | 1.409 |

| CAR[0,0] | 0.220 | 0.544 | 2.292 ** | 0.215 | 0.527 | 2.231 ** |

| CAR[+1,+2] | 0.303 | 0.676 | 2.234 ** | 0.310 | 0.670 | 2.279 ** |

| CAR[+1,+3] | 0.402 | 0.643 | 2.417 ** | 0.404 | 0.632 | 2.099 ** |

| Panel A: Travel and Tourism | ||||||||||||

| Event Window | ||||||||||||

| CAR[−2,+2] | CAR[−1,+1] | CAR[−3,0] | CAR[−2,0] | CAR[0,0] | CAR[+1,+2] | |||||||

| Variables | Coefficient | t-Statistic | Coefficient | t-Statistic | Coefficient | t-Statistic | Coefficient | t-Statistic | Coefficient | t-Statistic | Coefficient | t-Statistic |

| Constant | −36.714 | −1.651 * | −15.928 | −0.898 | −31.018 | −1.623 | −35.17 | −1.815 * | −18.347 | −2.735 *** | −1.541 | −0.166 |

| CAR[−15,−4] | 0.036 | 0.534 | 0.096 | 1.744 * | 0.049 | 0.621 | −0.001 | −0.013 | 0.033 | 1.766 * | 0.037 | 1.213 |

| Year | 4.816 | 1.648 * | 2.086 | 0.895 | 4.076 | 1.623 | 4.622 | 1.815 * | 2.411 | 2.735 *** | 0.194 | 0.159 |

| Location | −0.015 | −2.090 ** | −0.001 | −0.189 | −0.016 | −3.104 *** | −0.012 | −2.396 ** | −0.003 | −1.149 | −0.003 | −0.674 |

| Tourism | −0.003 | −0.833 | −0.003 | −1.435 | −0.001 | −0.210 | −0.003 | −1.252 | 0.001 | 0.580 | 0.000 | 0.262 |

| GDPC | −0.012 | −1.440 | −0.002 | −0.288 | −0.018 | −2.831 *** | −0.017 | −2.772 *** | −0.004 | −1.097 | 0.004 | 0.763 |

| GDP growth | −0.09 | −1.743 * | −0.095 | −2.968 *** | −0.045 | −1.301 | −0.051 | −1.637 | −0.024 | −1.275 | −0.038 | −1.185 |

| HDI | 0.216 | 2.449 ** | 0.075 | 1.113 | 0.212 | 3.262 *** | 0.194 | 3.063 *** | 0.039 | 1.145 | 0.021 | 0.378 |

| Population | 0.007 | 2.532 ** | 0.005 | 2.870 *** | 0.005 | 2.472 ** | 0.006 | 3.225 *** | 0.001 | 1.050 | 0.001 | 0.489 |

| Panel B: Real Estate | ||||||||||||

| Event Window | ||||||||||||

| CAR[−2,+2] | CAR[−1,+1] | CAR[−3,0] | CAR[−2,0] | CAR[0,0] | CAR[+1,+2] | |||||||

| Variables | Coefficient | t-Statistic | Coefficient | t-Statistic | Coefficient | t-Statistic | Coefficient | t-Statistic | Coefficient | t-Statistic | Coefficient | t-Statistic |

| Constant | −21.207 | −1.137 | −14.161 | −0.907 | −17.075 | −0.934 | −13.693 | −0.833 | −16.379 | −1.829 * | −7.523 | −0.809 |

| CAR[−15,−4] | 0.009 | 0.127 | 0.036 | 0.835 | 0.078 | 0.744 | 0.068 | 0.747 | −0.022 | −1.440 | −0.06 | −1.405 |

| Year | 2.788 | 1.137 | 1.861 | 0.907 | 2.245 | 0.934 | 1.801 | 0.834 | 2.155 | 1.830 * | 0.988 | 0.808 |

| Location | −0.003 | −0.509 | −0.003 | −0.797 | −0.012 | −2.167 ** | −0.011 | −2.394 ** | −0.003 | −1.262 | 0.008 | 1.793 * |

| Tourism | −0.004 | −1.505 | −0.001 | −0.382 | −0.003 | −0.837 | −0.003 | −0.967 | 0.001 | 1.246 | −0.002 | −1.057 |

| GDPC | −0.005 | −0.615 | −0.001 | −0.316 | −0.007 | −1.104 | −0.008 | −1.378 | −0.006 | −2.077 ** | 0.003 | 0.547 |

| GDP growth | −0.079 | −2.020 ** | −0.069 | −2.810 *** | −0.022 | −0.583 | −0.041 | −1.308 | −0.006 | −0.511 | −0.038 | −1.416 |

| HDI | 0.049 | 0.622 | 0.01 | 0.173 | 0.077 | 1.272 | 0.083 | 1.544 | 0.045 | 1.585 | −0.034 | −0.636 |

| Population | 0.006 | 2.273 ** | 0.003 | 2.180 ** | 0.002 | 1.434 | 0.004 | 1.945 * | 0.001 | 1.308 | 0.002 | 1.060 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tavor, T. The Influence of Airbnb Announcements on North American Capital Markets: Insights for Stakeholders. Int. J. Financial Stud. 2024, 12, 6. https://doi.org/10.3390/ijfs12010006

Tavor T. The Influence of Airbnb Announcements on North American Capital Markets: Insights for Stakeholders. International Journal of Financial Studies. 2024; 12(1):6. https://doi.org/10.3390/ijfs12010006

Chicago/Turabian StyleTavor, Tchai. 2024. "The Influence of Airbnb Announcements on North American Capital Markets: Insights for Stakeholders" International Journal of Financial Studies 12, no. 1: 6. https://doi.org/10.3390/ijfs12010006

APA StyleTavor, T. (2024). The Influence of Airbnb Announcements on North American Capital Markets: Insights for Stakeholders. International Journal of Financial Studies, 12(1), 6. https://doi.org/10.3390/ijfs12010006