Cryptocurrency Taxation: A Bibliometric Analysis and Emerging Trends

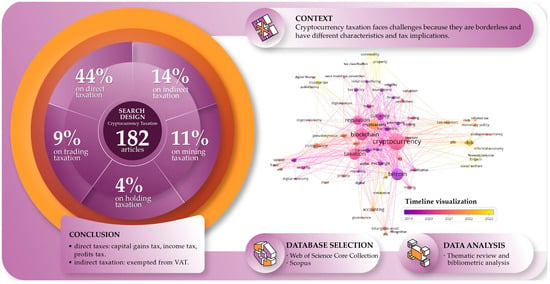

Abstract

:1. Introduction

2. Research Technique

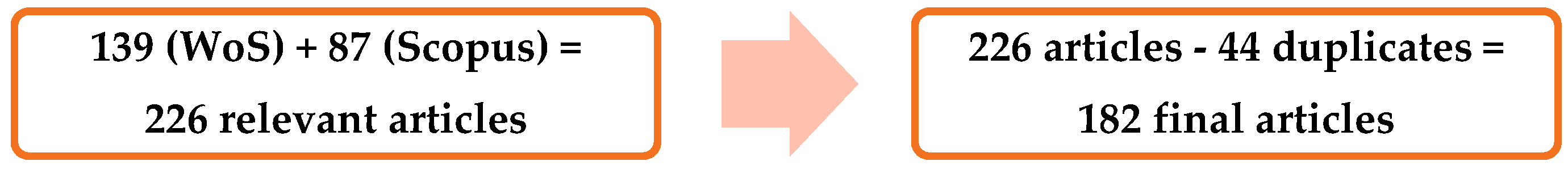

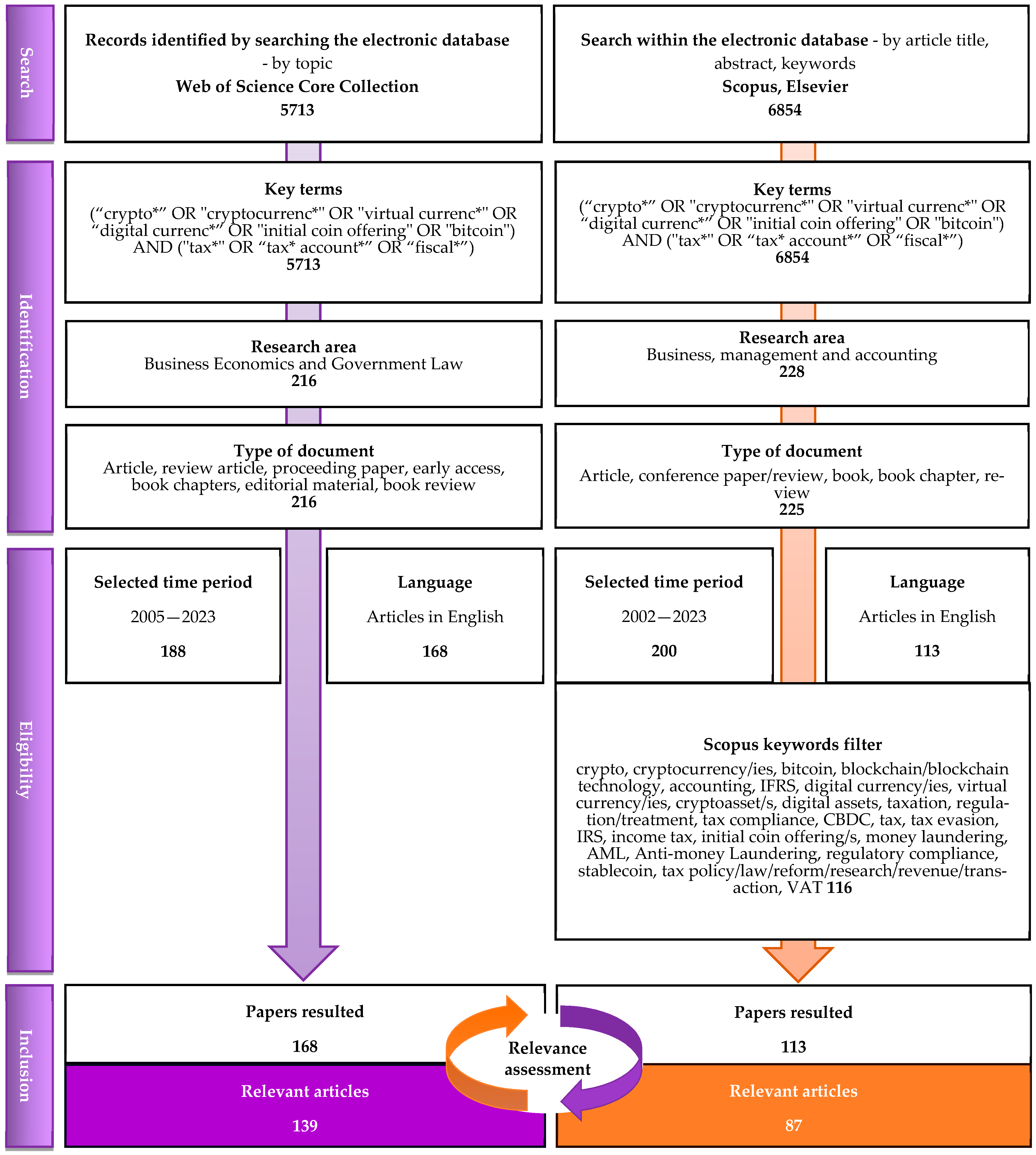

2.1. Keywords and Selection of Data

2.2. Procedure of Data Refinement and Relevance Assessment

3. Exploratory Bibliographic Study

3.1. Yearly Scientific Output and Citations

3.2. Publications’ Sources

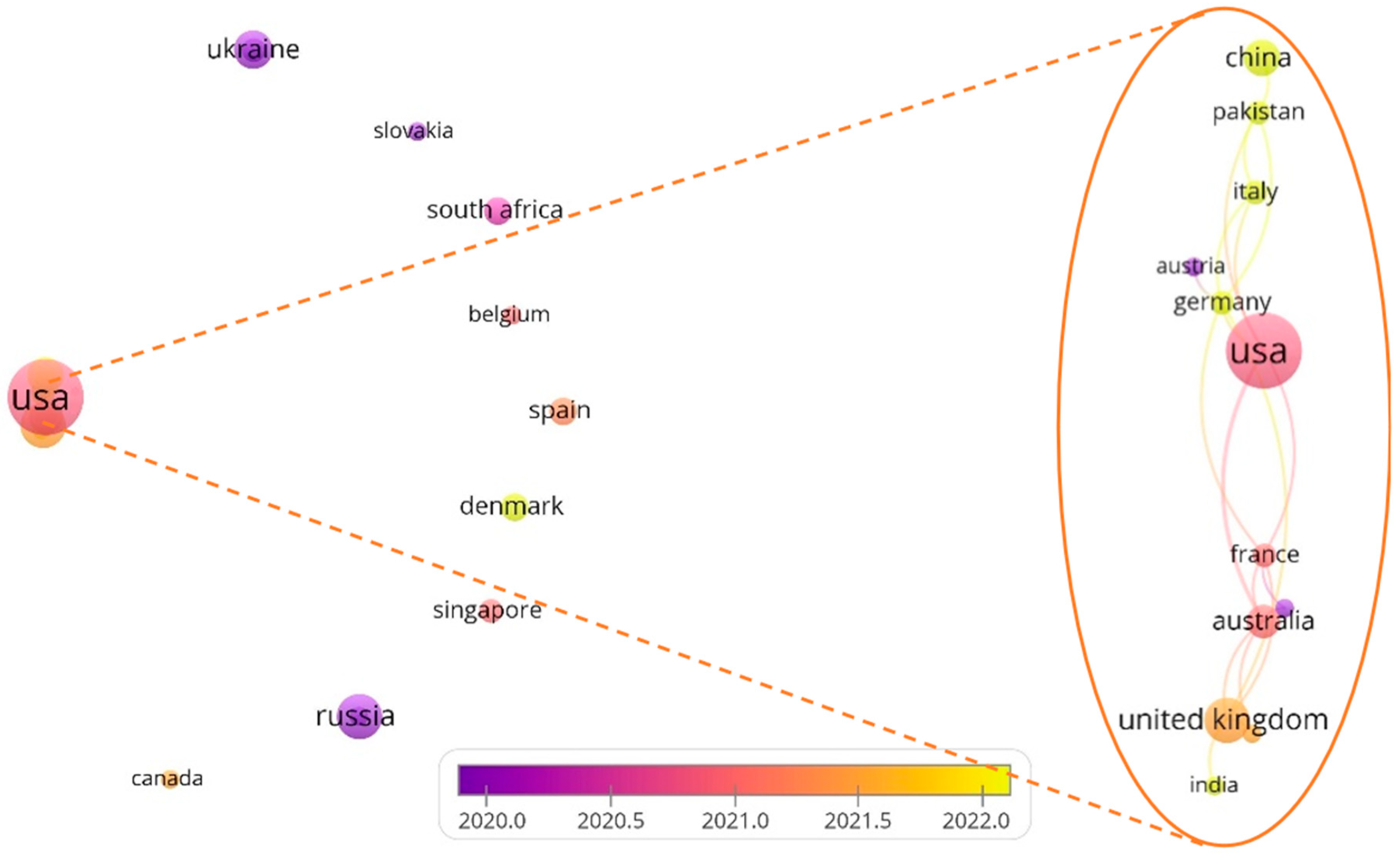

3.3. Countries’ Co-Authorship Analysis

3.4. Author Citation Network

3.5. Citations at the Institutional Level

4. Bibliometric Analyses of the Investigated Topics

4.1. Keyword Co-Occurrence Examination

4.2. Results and Discussions on the Taxation of Cryptocurrencies

- Direct taxation

- Indirect taxation

5. Conclusions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Adams, M. T., & Bailey, W. A. (2021). Emerging cryptocurrencies and irs summons power: Striking the proper balance between irs audit authority and taxpayer privacy. ATA Journal of Legal Tax Research, 19(1), 61–81. [Google Scholar] [CrossRef]

- Adevarul. (2024). Câștigurile uriașe din criptomonede, scutite temporar de impozitul pe venit. Care este motivul. adevarul. Available online: https://adevarul.ro/economie/castigurile-uriase-din-criptomonede-scutite-2401009.html (accessed on 14 December 2024).

- Ainsworth, R. T., Alwohaibi, M., & Cheetham, M. (2016). VATCoin: The GCC’s cryptotaxcurrency. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Alexander, G. (2022). Blocking the gap: The potential for blockchain technology to secure VAT compliance. EC Tax Review, 31(3), 140–155. [Google Scholar] [CrossRef]

- Alhasana, K. A. H., & Alrowwad, A. M. M. (2022). National standards of accounting and reporting in the era of digitalization of the economy. Financial and Credit Activity: Problems of Theory and Practice, 1(42), 154–161. [Google Scholar] [CrossRef]

- Alonso, M. A. G., Vega, T. D. J. V., Garcia, M. L. S., & Gonzalez, E. V. (2023). Virtual assets (cryptocurrencies) taxation according to the income tax law. In Revista de derecho privado (pp. 111–127). Univ Externado Colombia. [Google Scholar] [CrossRef]

- Alsalmi, N., Ullah, S., & Rafique, M. (2023). Accounting for digital currencies. Research in International Business and Finance, 64, 101897. [Google Scholar] [CrossRef]

- Andreevich, M. D., Petrovich, M. N., & Khoteevich, H. G. (2022). Regulatory regulation of the issue and circulation of digital currencies in the countries of the modern world. Springer proceedings in business and economics. In A. Rumyantseva, V. Plotnikov, A. Minin, & H. Anyigba (Eds.), Challenges and solutions in the digital economy and finance. Springer Nature. [Google Scholar] [CrossRef]

- Angeline, Y. K. H., Chin, W. S., Teoh Teng Tenk, M., & Saleh, Z. (2021). Accounting treatments for cryptocurrencies in Malaysia: The hierarchical component model approach. Asian Journal of Business and Accounting, 14(2), 137–171. [Google Scholar] [CrossRef]

- Aria, M., & Cuccurullo, C. (2017). bibliometrix: An R-tool for comprehensive science mapping analysis. Journal of Informetrics, 11(4), 959–975. [Google Scholar] [CrossRef]

- Arslanian, H., & Fischer, F. (2019). The future of finance: The impact of FinTech, AI, and Crypto on financial services. Springer International Publishing. [Google Scholar] [CrossRef]

- Artemenko, D., Novoselov, K., Efremenko, I., Nazarenko, G., & Palant, A. (2019). Trends and directions of supranational cryptocurrency operations regulations in the world economy. In K. Soliman (Ed.), Vision 2025: Education excellence and management of innovations through sustainable economic competitive advantage (pp. 7469–7475). International Business Information Management Association-IBIMA. [Google Scholar]

- Avi-Yonah, R. (2023). Comment on Cong et al., “Tax loss harvesting with cryptocurrencies”. Journal of Accounting & Economics, 76(2–3), 101612. [Google Scholar] [CrossRef]

- Baer, K., De Mooij, R., Hebous, S., & Keen, M. (2023). Taxing cryptocurrencies. Oxford Review of Economic Policy, 39(3), 478–497. [Google Scholar] [CrossRef]

- Bagus, P., & de la Horra, L. P. (2021). An ethical defense of cryptocurrencies. Business Ethics the Environment & Responsibility, 30(3), 423–431. [Google Scholar] [CrossRef]

- Bal, A. (2015). How to tax bitcoin? In Handbook of digital currency: Bitcoin, innovation, financial instruments, and big data. Elsevier Inc. [Google Scholar] [CrossRef]

- Bal, A. (2019). Developing a regulatory framework for the taxation of virtual currencies. Intertax, 47(2), 219–233. [Google Scholar] [CrossRef]

- Baltgailis, J., Simakhova, A., & Buka, S. (2023). Digital currencies and fintech innovation technologies for economic growth. Marketing and Management of Innovations, 14(3), 202–214. [Google Scholar] [CrossRef]

- Barrdear, J., & Kumhof, M. (2022). The macroeconomics of central bank digital currencies. Journal of Economic Dynamics & Control, 142(SI), 104148. [Google Scholar] [CrossRef]

- Belda, I. (2023). Metaverse and NFTs: New technological challenges in direct and international introduction. In Idp-internet law and politics. Universitat Oberta de Catalunya. [Google Scholar] [CrossRef]

- Bellucci, M., Cesa Bianchi, D., & Manetti, G. (2022). Blockchain in accounting practice and research: Systematic literature review. Meditari Accountancy Research, 30(7), 121–146. [Google Scholar] [CrossRef]

- Bibi, S. (2023). Money in the time of crypto. In Research in international business and finance (Vol. 65). Elsevier. [Google Scholar] [CrossRef]

- Binance. (2024). Binance news. Available online: https://www.binance.com/en/square/profile/binance_news (accessed on 14 December 2024).

- Blahušiaková, M. (2022). Accounting for holdings of cryptocurrencies in the Slovak Republic: Comparative analysis. In Contemporary Economics (Vol. 16, pp. 16–31). University of Economics and Human Sciences in Warsaw. [Google Scholar] [CrossRef]

- Bozdoğanoğlu, B. (2019). Cryptocurrencies’ low risk for money laundering and high risk for cybercrime: Desperation of tax administration or new future of taxation. In Current perspectives in public finance. Peter Lang AG. Available online: https://www.scopus.com/inward/record.uri?eid=2-s2.0-85112708817&partnerID=40&md5=b470161216d1b4edf5bd07396996e614 (accessed on 14 December 2024).

- Bozdoğanoğlu, B. (2022). Evaluation of the effects of technology literacy and digital financial literacy on the investment and taxation process in crypto assets. In Current issues and empirical studies in public finance. Peter Lang AG. Available online: https://www.scopus.com/inward/record.uri?eid=2-s2.0-85138957012&partnerID=40&md5=5eaf96405cfa6b1f821d82dae2bc58e5 (accessed on 14 December 2024).

- Bubnova, Y. B. (2020). Financial markets security: Tax aspect. In D. Solovev (Ed.), Proceedings of the international scientific conference—Far east con (ISCFEC 2020) (Vol. 128, pp. 882–891). Atlantis Press. [Google Scholar]

- Budak, T., & Yilmaz, G. (2022). Taxation of virtual/crypto assets/currencies. Sosyoekonomi, 30(52), 37–54. [Google Scholar] [CrossRef]

- Bunget, O. C., & Trifa, G. I. (2023). Cryptoassets—Perspectives of accountancy recognition in the technological era. Audit Financiar, 21(171), 526–551. [Google Scholar] [CrossRef]

- Caliskan, K. (2022). The elephant in the dark: A new framework for cryptocurrency taxation and exchange platform regulation in the US. Journal of Risk and Financial Management, 15(3), 118. [Google Scholar] [CrossRef]

- Canadian Tax Amnesty. (2020, October 13). CRA audits cryptocurrency revised. Available online: https://www.canadiantaxamnesty.ca/article/irs-crypto/ (accessed on 3 October 2024).

- Canadian Tax Amnesty. (2024, October 1). Israel’s anticipated, pilot voluntary disclosures program gets a rocky start--and lessons from Canada’s voluntary disclosure program (VDP). Available online: https://www.canadiantaxamnesty.ca/article/israels-anticipated-pilot-voluntary-disclosures-program-gets-a-rocky-start-and-lessons-from-canadas-voluntary-disclosure-program-vdp/ (accessed on 3 October 2024).

- Cassidy, J., Cheng, M. H. A., Le, T., & Huang, E. (2020). A toss of a (bit)coin: The uncertain nature of the legal status of cryptocurrencies. eJournal of Tax Research, 17(2), 168–192. [Google Scholar]

- Caton, J. L. (2020). Cryptoliquidity: The Blockchain and Monetary Stability. Journal of Entrepreneurship and Public Policy, 9(2), 227–252. [Google Scholar] [CrossRef]

- Chornous, Y., Denysenko, S., Hrudnytskyi, V., Turkot, O., & Sikorskyi, O. (2019). Legal regulation of cryptocurrency turnover in ukraine and the EU. journal of legal, ethical and regulatory issues. Available online: https://www.scopus.com/inward/record.uri?eid=2-s2.0-85071435386&partnerID=40&md5=36d6da0b0c7d53b97ef44cb936f7d6d9 (accessed on 14 December 2024).

- Chudinovskikh, M., & Sevryugin, V. (2019). Cryptocurrency regulation in the brics countries and the eurasian economic union. BRICS Law Journal, 6(1), 63–81. [Google Scholar] [CrossRef]

- Chutipat, V., Kasemrat, R., Kraiwanit, T., & Phaksipaeng, I. (2023). Selection of cryptocurrency exchange platforms in a developing economy. Corporate and Business Strategy Review, 4(2), 344–350. [Google Scholar] [CrossRef]

- Chyzhmar, K., Yunin, O., Paterylo, I., Alieksieienko, I., & Shevchenko, S. (2019). Problem of protection against cyber crimes in the field of cryptocurrency circulation. Journal of Legal, Ethical and Regulatory Issues, 22(2), 1. Available online: https://www.scopus.com/inward/record.uri?eid=2-s2.0-85071454037&partnerID=40&md5=63d292718f005150d66d5929142784ed (accessed on 14 December 2024).

- Cong, L. W., Landsman, W., Maydew, E., & Rabetti, D. (2023). Tax-loss harvesting with cryptocurrencies. Journal of Accounting and Economics, 76(2–3), 101607. [Google Scholar] [CrossRef]

- Corbet, S., Urquhart, A., & Yarovaya, L. (2020). Cryptocurrency and blockchain technology. In Cryptocurrency and blockchain technology. De Gruyter. [Google Scholar] [CrossRef]

- Cotler, B. (2023). Tokenized and non-tokenized assets: Legal considerations. In The emerald handbook on cryptoassets: Investment opportunities and challenges. Emerald Group Publishing Ltd. [Google Scholar] [CrossRef]

- Cui, J. (2010, August 24–26). The issue of internet virtual currency should be uniformly issued by the monetary authorities—The topic raised and finished by levying tax on internet virtual transaction. 2010 International Conference on Management and Service Science, MASS 2010, Wuhan, China. [Google Scholar] [CrossRef]

- Cyrus, R. (2023). Custody, provenance, and reporting of blockchain and cryptoassets. In The emerald handbook on cryptoassets: Investment opportunities and challenges. Emerald Group Publishing Ltd. [Google Scholar] [CrossRef]

- DAC 8. (2024). Tax transparency rules for crypto-asset transactions (DAC8). European Parliamentary Research Service. Available online: https://www.europarl.europa.eu/RegData/etudes/BRIE/2023/739310/EPRS_BRI(2023)739310_EN.pdf (accessed on 14 December 2024).

- Davenport, S. A., & Usrey, S. C. (2023a). Crypto assets: Examining possible tax classifications. Journal of Emerging Technologies in Accounting, 20(2), 55–70. [Google Scholar] [CrossRef]

- Davenport, S. A., & Usrey, S. C. (2023b). Does notice 2014-21 need an update? An analysis of potential tax classifications for cryptocurrency. ATA Journal of Legal Tax Research, 21(1), 22–44. [Google Scholar] [CrossRef]

- Davis, A. E. E. (2023). Genealogy of finance: Long-term history and alternatives. Review of Radical Political Economics, 55(4), 660–669. [Google Scholar] [CrossRef]

- Didenko, A. N., & Buckley, R. P. (2022). Central bank digital currencies as a potential response to some particularly Pacific problems. Asia Pacific Law Review, 30(1), 44–69. [Google Scholar] [CrossRef]

- Drozd, O., Basai, O., & Churpita, H. (2018). The specificities of using cryptocurrency in purchase and sale contracts. Baltic Journal of Economic Studies, 4(2), 274–281. [Google Scholar] [CrossRef]

- Egorova, M. A., Grib, V. V., Efimova, L. G., Kozhevina, O. V., & Slepak, V. Y. (2023). Research of the effectiveness of the system of legal regulation of tax relations for operations with cryptocurrency currently in force. In Vestnik of Saint Petersburg university-law-vestnik sankt-peterburgskogo universiteta-pravo (Vol. 14, pp. 564–579). St Petersburg University Press. [Google Scholar] [CrossRef]

- Ehrke-Rabel, T., & Zechner, L. (2020). VAT treatment of cryptocurrency intermediation services. Intertax, 48(5), 498–514. [Google Scholar] [CrossRef]

- Emery, J., & Stewart, M. (2017). The taxing challenge of digital currency. Journal of Banking and Finance Law and Practice, 28(3), 236–269. [Google Scholar]

- Enajero, S. (2021). Cryptocurrency, money demand and the mundell-fleming model of international capital mobility. Atlantic Economic Journal, 49(1), 57–69. [Google Scholar] [CrossRef]

- Essaghoolian, N. (2019). Initial coin offerings: Emerging technology’s fundraising innovation. UCLA Law Review, 66(1), 294–343. [Google Scholar]

- Ferniss, J. (2023). Taxation of bitcoins and similar cryptoassets in Scandinavia with special focus on Danish law. Intertax, 51(1), 63–83. [Google Scholar] [CrossRef]

- FLATICON. (2024). Access 18.0M+ vector icons & stickers. Available online: https://www.flaticon.com/ (accessed on 14 December 2024).

- Frias, A. E. C., & Freire, E. J. S. (2019). Financial shielding that Bitcoin grants to capitals in the world. Investment Management and Financial Innovations, 16(3), 49–61. [Google Scholar] [CrossRef]

- Gao, X. (2023). Digital transformation in finance and its role in promoting financial transparency. Global Finance Journal, 58, 100903. [Google Scholar] [CrossRef]

- Gheorghiu, L. (2023). Policy forum: Non-fungible tokens and their income tax treatment. Canadian Tax Journal, 71(1), 83–99. [Google Scholar] [CrossRef]

- Goel, R. K., & Mazhar, U. (2024). Are the informal economy and cryptocurrency substitutes or complements? Applied Economics, 56(20), 2470–2481. [Google Scholar] [CrossRef]

- Gomaa, A. A., Gomaa, M. I., & Stampone, A. (2019). A transaction on the blockchain: An AIS perspective, intro case to explain transactions on the ERP and the role of the internal and external auditor. Journal of Emerging Technologies in Accounting, 16(1), 47–64. [Google Scholar] [CrossRef]

- Greeff, C. (2019). An investigation into the output tax consequences of bitcoin transactions for a South African value-added tax vendor. South African Journal of Economic and Management Sciences, 22(1), 1–9. [Google Scholar] [CrossRef]

- Hendrickson, J. R., & Luther, W. J. (2022). Cash, crime, and cryptocurrencies. Quarterly Review of Economics and Finance, 85, 200–207. [Google Scholar] [CrossRef]

- Holden, R., & Malani, A. (2022). The law and economics of blockchain. Annual Review of Law and Social Science, 18, 297–313. [Google Scholar] [CrossRef]

- Hougan, M., Lawant, D., & Choudhury, G. (2023). Tax-loss harvesting in Crypto: A significant and underexplored opportunity for financial advisors. Journal of Investing, 32(3), 74–87. [Google Scholar] [CrossRef]

- Hsieh, A. (2019). The faceless coin: Achieving a modern tax policy in the changing landscape of cryptocurrency. In University of Illinois Law Review (pp. 1079–1116). Univ Illinois. [Google Scholar]

- Huang, R. H., Deng, H., & Chan, A. F. L. (2023). The legal nature of cryptocurrency as property: Accounting and taxation implications. Computer Law and Security Review, 51, 105860. [Google Scholar] [CrossRef]

- IFRS Foundation. (2024). Available online: https://www.ifrs.org/issued-standards/list-of-standards (accessed on 14 December 2024).

- Ilham, R. N., Erlina, Fachrudin, K. A., Silalahi, A. S., Saputra, J., & Albra, W. (2019). Investigation of the bitcoin effects on the country revenues via virtual tax transactions for purchasing management. International Journal of Supply Chain Management, 8(6), 737–740. [Google Scholar]

- Inger, K. K., & Mathis, M. (2021). Taxes: Taking a bite out of bitcoin. Issues in Accounting Education, 36(1), 57–64. [Google Scholar] [CrossRef]

- Inshyn, M., Mohilevskyi, L., & Drozd, O. (2018). The issue of cryptocurrency legal regulation in ukraine and all over the world: A comparative analysis. Baltic Journal of Economic Studies, 4(1), 169–174. [Google Scholar] [CrossRef]

- Jalal, R. N.-U.-D., Sargiacomo, M., & Sahar, N. U. (2020). Commodity prices, tax purpose recognition and bitcoin volatility: Using ARCH/GARCH modeling. Journal of Asian Finance, Economics and Business, 7(11), 251–257. [Google Scholar] [CrossRef]

- Jayasuriya, D. D., & Sims, A. (2023). From the abacus to enterprise resource planning: Is blockchain the next big accounting tool? Accounting. Auditing and Accountability Journal, 36(1), 24–62. [Google Scholar] [CrossRef]

- Jozipović, Š., Perkušić, M., & Gadžo, S. (2022). Tax compliance in the era of cryptocurrencies and CBDCs: The end of the right to privacy or no reason for concern? EC Tax Review, 31(1), 16–29. [Google Scholar] [CrossRef]

- Katrencik, I., & Zatrochova, M. (2018). 2017-Year of the cryptocurrency. In L. Slahor, & P. Czarnecki (Eds.), Proceedings of the 11th international conference European entrepreneurship forum 2017: Eurozone: Evolution or revolution? (pp. 64–72) Newton Academy. [Google Scholar]

- Katuk, N., Abd Wahab, N., & Kamis, N. S. (2023). Cryptocurrency estate planning: The challenges, suggested solutions and Malaysia’s future directions. In Digital Policy, Regulation and Governance (Vol. 25, pp. 325–350). Emerald Publishing. [Google Scholar] [CrossRef]

- Kaygin, E., Topcuoglu, E., & Ozkes, S. (2019). Investigating the bitcoin system and its properties within the scope of business ethics. Turkish Journal of Business Ethics, 11(2), 186–192. [Google Scholar] [CrossRef]

- Kimani, D., Adams, K., Attah-Boakye, R., Ullah, S., Frecknall-Hughes, J., & Kim, J. (2020). Blockchain, business and the fourth industrial revolution: Whence. whither, wherefore and how? Technological Forecasting and Social Change, 161, 120254. [Google Scholar] [CrossRef]

- Kjaersgaard, L. F., & Arfwidsson, A. (2019). Taxation of cryptocurrencies from the Danish and Swedish perspectives. Intertax, 47(6–7), 620–634. [Google Scholar]

- Koinly. (2024). Cryptocurrency tax guides. Available online: https://koinly.io/blog/tags/guides/ (accessed on 14 December 2024).

- Kolková, A. (2018). The use of cryptocurrency in enterprises in Czech Republic. In O. Dvoulety, M. Lukes, & A. J. Misar (Eds.), Proceedings of the 6th international conference innovation management, entrepreneurship and sustainability (IMES 2018). Oeconomica Publishing House. [Google Scholar]

- Kollmann, J. (2019). The VAT treatment of cryptocurrencies. EC Tax Review, 28(3), 164–170. [Google Scholar] [CrossRef]

- Kowalski, P. (2015). Taxing bitcoin transactions under polish tax law. Comparative Economic Research-Central and Eastern Europe, 18(3), 139–152. [Google Scholar] [CrossRef]

- Kreklewetz, R. G., & Burlock, L. J. (2023). Policy forum: Canada’s proposed cryptoasset legislation. Canadian Tax Journal, 71(1), 73–81. [Google Scholar] [CrossRef]

- Kreminskyi, O., Kuzmenko, O., Antoniuk, A., & Smahlo, O. (2021). International cooperation in the investigation of economic crimes related to cryptocurrency circulation. Estudios de Economia Aplicada, 39(6). [Google Scholar] [CrossRef]

- Kshetri, N. (2023). The nature and sources of international variation in formal institutions related to initial coin offerings: Preliminary findings and a research agenda. Financial Innovation, 9(1), 9. [Google Scholar] [CrossRef] [PubMed]

- Kucherov, I. I., & Khavanova, I. A. (2017). Tax consequences of using alternative means of payment (theoretical and legal aspects). In Vestnik permskogo universiteta-juridicheskie nauki (pp. 66–72). Perm State National Research University. [Google Scholar] [CrossRef]

- Kucheryavenko, M. P., Dmytryk, O. O., & Golovashevych, O. O. (2019). Cryptocurrencies: Development, features and classification. In Financial and credit activity-problems of theory and practice (Vol. 3, pp. 371–378). University of Banking of the National Bank of Ukraine, Kharkiv Institute of Banking. [Google Scholar] [CrossRef]

- Kwon, O., Lee, S., & Park, J. (2022). Central bank digital currency, tax evasion, and inflation tax. Economic Inquiry, 60(4), 1497–1519. [Google Scholar] [CrossRef]

- Lazea, G.-I., Bunget, O.-C., & Lungu, C. (2024). Cryptocurrencies’ impact on accounting: Bibliometric review. Risks, 12(6), 94. [Google Scholar] [CrossRef]

- Lee, D. K. C., Shih, C. M., & Zheng, J. (2023). Asian CBDCs on the rise: An in-depth analysis of developments and implications. Quantitative Finance and Economics, 7(4), 665–696. [Google Scholar] [CrossRef]

- Legge, M. (2022). Ghid despre impozitarea veniturilor din criptomonede în România 2023. Koinly. Available online: https://koinly.io/guides/taxe-crypto-romania/ (accessed on 14 December 2024).

- Lim, W. (2021). Taxation of non-fungible Tokens. Australian Tax Review, 50(4), 270–279. [Google Scholar]

- Liu, E., Cowling, B., & Cartoon, S. (2021). Donating digital money to deductible gift recipients: Decrypting the australian tax implications. Australian Tax Review, 50(4), 249–259. [Google Scholar]

- Loginov, M., Tatyannikov, V., & Sobina, N. (2019). Concept of the cryptoruble market formation in Russia. In Y. Silin, Y. Animitsa, E. Dvoryadkina, & V. Blaginin (Eds.), Proceedings of the 2nd international scientific conference on new industrialization: Global, national, regional dimension (SICNI 2018), Ekaterinburg, Russia, 4–5 December 2018 (Vol. 240, pp. 124–128). Atlantis press. [Google Scholar]

- Longo, A., & Tomassini, A. (2023, August 11). Voluntary disclosure for crypto-assets and related income is now available. DLA PIPER. Available online: https://www.dlapiper.com/en-pr/insights/publications/2023/08/voluntary-disclosure-for-cryptoassets-and-related-income-is-now-available (accessed on 14 December 2024).

- Makarov, I., & Schoar, A. (2022). Cryptocurrencies and decentralized finance (DeFi). In Brookings papers on economic activity (pp. 141–196). Johns Hopkins University Press. [Google Scholar]

- Makurin, A. (2023). Technological aspects and environmental consequences of mining encryption. Economics Ecology Socium, 7(1), 61–70. [Google Scholar] [CrossRef]

- Makurin, A., Maliienko, A., Tryfonova, O., & Masina, L. (2023). Management of cryptocurrency transactions from accounting aspects. Economics Ecology Socium, 7(3), 26–35. [Google Scholar] [CrossRef]

- Maniatis, A. (2019). Blockchain with emphasis on tax law. In D. Vrontis, Y. Weber, & E. Tsoukatos (Eds.), Business management theories and practices in a dynamic competitive environment (pp. 679–684). Euromed Press. [Google Scholar]

- Marchiori, L. (2021). Monetary theory reversed: Virtual currency issuance and the inflation tax. Journal of International Money and Finance, 117, 102441. [Google Scholar] [CrossRef]

- Matkovskyy, R., Jalan, A., & Dowling, M. (2020). Effects of economic policy uncertainty shocks on the interdependence between Bitcoin and traditional financial markets. Quarterly Review of Economics and Finance, 77, 150–155. [Google Scholar] [CrossRef]

- McKeon, S., & Schloss, D. E. (2021). Law and Blockchains. In The palgrave handbook of technological finance. Springer International Publishing. [Google Scholar] [CrossRef]

- Mgadmi, N., Bejaoui, A., Moussa, W., & Sadraoui, T. (2022). The impact of the COVID-19 pandemic on the cryptocurrency market. Scientific Annals of Economics And Business, 69(3), 343–359. [Google Scholar] [CrossRef]

- Miglietti, C. (2014). Bitcoin: Speculative bubble or future world currency? In D. Stavarek, & P. Vodova (Eds.), Proceedings of the 14th international conference on finance and banking (pp. 277–281). Silesian University in Opava, School Business Administration Karvina. [Google Scholar]

- Mohsin, M., Naseem, S., Zia-ur-Rehman, M., Baig, S. A., & Salamat, S. (2023). The crypto-trade volume, GDP, energy use, and environmental degradation sustainability: An analysis of the top 20 crypto-trader countries. International Journal of Finance & Economics, 28(1), 651–667. [Google Scholar] [CrossRef]

- Morgan, P. J. (2022). Assessing the risks associated with green digital finance and policies for coping with them. In Economics, law, and institutions in Asia pacific (pp. 51–68). Springer. [Google Scholar] [CrossRef]

- Morozova, T., Akhmadeev, R., Lehoux, L., Yumashev, A., Meshkova, G., & Lukiyanova, M. (2020). Crypto asset assessment models in financial reporting content typologies. Entrepreneurship and Sustainability Issues, 7(3), 2196–2212. [Google Scholar] [CrossRef]

- Morse, E. A. (2018). From rai stones to blockchains: The transformation of payments. Computer Law and Security Review, 34(4), 946–953. [Google Scholar] [CrossRef]

- Morton, E., & Curran, M. (2023). Exemplifying the opportunities and limitations of blockchain technology through corporate tax losses. In Handbook of big data and analytics in accounting and auditing. Springer Nature. [Google Scholar] [CrossRef]

- Morton, E., Devos, K., Vesty, G., & Nguyen, L. (2023). The crypto-economy and tax practitioner competencies: An Australian exploratory study. eJournal of Tax Research, 21(2), 203–252. [Google Scholar]

- Nazarov, M. A., Mikhaleva, O. L., & Fomin, E. P. (2019). Digital economy: Russian taxation issues. In V. Mantulenko (Ed.), Proceedings of the GCPMED 2018—International scientific conference global challenges and prospects of the modern economic development (Vol. 57, pp. 1269–1276). Future Academy. [Google Scholar] [CrossRef]

- Niftaliyev, S. G. (2023). Problems arising in the accounting of cryptocurrencies. Financial and Credit Activity: Problems of Theory and Practice, 3(50), 76–86. [Google Scholar] [CrossRef]

- Novak, M. (2020). Crypto-friendliness: Understanding blockchain public policy. Journal of Entrepreneurship and Public Policy, 9(2), 165–184. [Google Scholar] [CrossRef]

- Novak, M., & Pochesneva, A. (2019). Toward a crypto-friendly index for the APEC Region. Journal of the British Blockchain Association, 2(1), 39–45. [Google Scholar] [CrossRef] [PubMed]

- Nylen, P. C., & Huels, B. W. (2022). Using unrelated IRS guidance as a framework for taxing crypto transactions: Revenue procedure 2019-18. ATA Journal of Legal Tax Research, 20(1), 30–46. [Google Scholar] [CrossRef]

- Obrist, T., & Pfister, R. A. (2019). Tax treatment of cryptocurrency holders and miners in the era of virtual currencies from a multijurisdictional and Swiss perspective. In D. Kraus, T. Obrist, & O. Hari (Eds.), Blockchains, smart contracts, decentralised autonomous organisations and the law (pp. 299–347). Edward Elgar Publishing Ltd. [Google Scholar]

- Obu, O. C., & Ukpere, W. I. (2022). The Implications of the Incursion of Cryptocurrency on the Effectiveness of Fiscal Policy. Review of Applied Socio-Economic Research, 23(1), 134–150. [Google Scholar] [CrossRef]

- OECD. (2023). International standards on automatic exchange of information in tax matters: Crypto-asset reporting framework and 2023 update to the common reporting standard. OECD. [Google Scholar] [CrossRef]

- Oh, E. Y., & Zhang, S. (2022). Informal economy and central bank digital currency. Economic Inquiry, 60(4), 1520–1539. [Google Scholar] [CrossRef]

- Pandey, D., & Gilmour, P. (2024). Accounting meets metaverse: Navigating the intersection between the real and virtual worlds. Journal of Financial Reporting and Accounting, 22(2), 211–226. [Google Scholar] [CrossRef]

- Parlaktuna, I., & Gungul, M. (2019). Taxation problem of bitcoin: Regulations in Turkey and other countries. In Cryptocurrency in all aspects. Peter Lang AG. Available online: https://www.scopus.com/inward/record.uri?eid=2-s2.0-85112617650&partnerID=40&md5=73e8e4694116e09d1daa13ca45152e29 (accessed on 14 December 2024).

- Parrondo, L. (2023). Cryptoassets: Definitions and accounting treatment under the current international financial reporting standards framework. Intelligent Systems in Accounting, Finance and Management, 30(4), 208–227. [Google Scholar] [CrossRef]

- Parsons, S. (2022). What’s in a name?: The classification of ‘interest’ on crypto-assets in South Africa and beyond. Intertax, 50(6–7), 499–511. [Google Scholar] [CrossRef]

- Păunescu, M. (2018, June 13–14). The accountant’s headache: Accounting for virtual currencies transactions. Proceedings of the 13th International Conference Accounting and Management Information Systems (AMIS 2018), Bucharest, Romania. [Google Scholar]

- Peláez-Repiso, A., Sánchez-Núñez, P., & García Calvente, Y. (2021). Tax regulation on blockchain and cryptocurrency: The implications for open innovation. Journal of Open Innovation: Technology, Market, and Complexity, 7(1), 98. [Google Scholar] [CrossRef]

- Pelucio-Grecco, M. C., dos Santos Neto, J. P., & Constancio, D. (2020). Accounting for bitcoins in light of IFRS and tax aspects. Revista Contabilidade e Financas, 31(83), 275–282. [Google Scholar] [CrossRef]

- Perkins, A. J. (2022). Regulating virtual asset service providers in the offshore world: The cayman islands example. Law and Financial Markets Review, 16(3), 266–283. [Google Scholar] [CrossRef]

- Pimentel, E., & Boulianne, E. (2020). Blockchain in accounting research and practice: Current trends and future opportunities*. Accounting Perspectives, 19(4), 325–361. [Google Scholar] [CrossRef]

- Podhorsky, A. (2023). Taxing bitcoin: Incentivizing the difficulty adjustment mechanism to reduce electricity usage. International Review of Financial Analysis, 86, 102493. [Google Scholar] [CrossRef]

- Porter, R. D., & Rousse, W. (2016). Reinventing money and lending for the digital age. In P. Tasca, T. Aste, L. Pelizzon, & N. Perony (Eds.), Banking beyond banks and money: A guide to banking services in the twenty-first century (pp. 145–180). Springer. [Google Scholar] [CrossRef]

- Powell, K., & Hope, M. (2019). Shifting digital currency definitions: Current considerations in Australian and US tax law. eJournal of Tax Research, 16(3), 594–619. [Google Scholar]

- Protos Staff. (2024). How bitcoin and crypto are taxed in the EU. Protos. Available online: https://protos.com/chart-how-bitcoin-and-crypto-are-taxed-in-the-eu/ (accessed on 14 December 2024).

- Ram, A. J. (2018). Taxation of the bitcoin: Initial insights through a correspondence analysis. Meditari Accountancy Research, 26(2), 214–240. [Google Scholar] [CrossRef]

- Rehman, M. H. U., Salah, K., Damiani, E., & Svetinovic, D. (2020). Trust in blockchain cryptocurrency ecosystem. IEEE Transactions on Engineering Management, 67(4), 1196–1212. [Google Scholar] [CrossRef]

- Ren, D., Guo, H., & Jiang, T. (2023). Managed anonymity of CBDC, social welfare and taxation: A new monetarist perspective. Applied Economics, 55(42), 4990–5011. [Google Scholar] [CrossRef]

- Riley, J. (2021). The Current Status of Cryptocurrency Regulation in China and Its Effect around the World. China and WTO Review, 7(1), 135–152. [Google Scholar] [CrossRef]

- Robertson, D. D., & Ing, S. (2023). Policy forum: Digital asset mining and GST—Tax policy versus public policy. Canadian Tax Journal, 71(1), 59–71. [Google Scholar] [CrossRef]

- Rosa, M. P. D. O., & Caminha, L. (2023). Finance reflected by funhouse mirrors: A proposal of indirect regulation (GATEKEEPERS) to crypto centralized exchanges (CEX). Revista Estudos Institucionais-Journal of Institutional Studies, 9(2), 369–397. [Google Scholar] [CrossRef]

- Ryabova, T., & Henderson, S. A. (2019). Integrating cryptocurrency into intermediate financial accounting curriculum: A case study. Journal of Accounting and Finance, 19(6). [Google Scholar] [CrossRef]

- Ryznar, M. (2019). Regulating bitcoin: A tax case study. In Contributions to Management Science (pp. 69–75). Springer. [Google Scholar] [CrossRef]

- Salawu, M. K., & Moloi, T. (2018). Benefits of legislating cryptocurrencies: Perception of Nigerian professional accountants. Academy of Accounting and Financial Studies Journal, 22(6), 1–17. Available online: https://www.scopus.com/inward/record.uri?eid=2-s2.0-85061856468&partnerID=40&md5=c82546d028992b4ce7a1f44284df2182 (accessed on 14 December 2024).

- Scarcella, L. (2021a). “Catch Me If I Chain”: Latest Developments on Extending Reporting Obligations and Automatic Exchange of Information to Cryptocurrency and Crypto-Asset Transactions. Australian Tax Review-Blockchain Special Issue, 50(4), 234–241. [Google Scholar] [CrossRef]

- Scarcella, L. (2021b). The Implications of Adopting a European Central Bank Digital Currency: A Tax Policy Perspective. EC Tax Review, 30(4), 177–188. [Google Scholar] [CrossRef]

- Schilling, L., & Uhlig, H. (2019). Some simple bitcoin economics. Journal of Monetary Economics, 106(SI), 16–26. [Google Scholar] [CrossRef]

- Senarathne, C. W., & Jianguo, W. (2020, March 12–14). Volatility spillovers between US banking industry and bitcoin market: Risk implications for banking industry. 2020 2nd International Conference on Blockchain Technology (ICBCT 2020) (pp. 75–79), Hilo, HI, USA. [Google Scholar] [CrossRef]

- Shahid, M. N., Sattar, A., Aftab, F., Saeed, A., & Abbas, A. (2019). Month of Ramadan Effect Swings and Market Becomes Adaptive a Firm Level Evidence through Islamic Calendar. Journal of Islamic Marketing, 11(3), 661–685. [Google Scholar] [CrossRef]

- Shovkhalov, S., & Idrisov, H. (2021). Economic and legal analysis of cryptocurrency: Scientific views from Russia and the Muslim world. Laws, 10(2), 32. [Google Scholar] [CrossRef]

- Shvayko, M. L., & Grebeniuk, N. O. (2020). Current crediting instruments influencing investment climate in Ukraine. Financial and Credit Activity-Problems of Theory and Practice, 1(32), 414–423. [Google Scholar]

- Smith, S. S., Petkov, R., & Lahijani, R. (2019). Blockchain and cryptocurrencies—Considerations for treatment and reporting for financial services professionals. International Journal of Digital Accounting Research, 19, 59–78. [Google Scholar] [CrossRef] [PubMed]

- Sokolenko, L., Ostapenko, T., Kubetska, O., Portna, O., & Tran, T. (2019). Cryptocurrency: Economic essence and features of accounting. Academy of Accounting and Financial Studies Journal, 23(2), 1–6. Available online: https://www.scopus.com/inward/record.uri?eid=2-s2.0-85071699405&partnerID=40&md5=aae414a62836e6bbf8b4416444e8d6be (accessed on 14 December 2024).

- Sotiri, E. (2024). Analysis of crypto-taxation: France, Belgium, and Luxembourg. Jurisconsul Publications. Available online: https://www.lexology.com/library/detail.aspx?g=b70e8017-6c1b-4157-9e03-6d2ef1e2f58f (accessed on 14 December 2024).

- Stiegler, T., Singer, K., & Wiesener, A. U. (2018). Investment trend in digital currencies—The current state of fiscal treatment of bitcoin investments in Germany. In R. Pamfilie, V. Dinu, L. Tachiciu, D. Plesea, & C. Vasiliu (Eds.), Proceedings of the Basiq international conference: New trends in sustainable business and consumption 2018 (pp. 90–96). Editura ASE. [Google Scholar]

- Strauss, H., Fawcett, T., & Schutte, D. (2020). Tax risk assessment and assurance reform in response to the digitalised economy. Journal of Telecommunications and the Digital Economy, 8(4), 96–126. [Google Scholar] [CrossRef]

- Strauss, H., Schutte, D., & Fawcett, T. (2021). An evaluation of the legislative and policy response of tax authorities to the digitalisation of the economy. South African Journal of Accounting Research, 35(3), 239–262. [Google Scholar] [CrossRef]

- Tan, B. S., & Low, K. Y. (2017). Bitcoin—Its economics for financial reporting. Australian Accounting Review, 27(2), 220–227. [Google Scholar] [CrossRef]

- Terando, W. D., Cataldi, B., & Mennecke, B. E. (2017). Impact of the IRC section 475 mark-to-market election on bitcoin taxation. ATA Journal of Legal Tax Research, 15(1), 66–76. [Google Scholar] [CrossRef]

- Tipanov, V., Drachov, A., Tkalenko, S., Mirzodaieva, T., & Syerova, L. (2021). Financial and legal regulation of blockchane technology: Status and prospects of cryptovolute use. Financial and Credit Activity-Problems of Theory and Practice, 2(37), 72–83. [Google Scholar]

- Tut, D. (2022). ‘Bitcoin: Future or fad?’ Big data in finance: Opportunities and challenges of financial digitalization. Springer International Publishing. [Google Scholar] [CrossRef]

- Tyc, A., & Siucinski, R. (2020). Cryptocurrencies: Some remarks from the perspective of polish employment and tax law. TalTech Journal of European Studies, 10(1), 22–39. [Google Scholar] [CrossRef]

- van Eck, N. J., & Waltman, L. (2023). VOSviewer manual. Available online: https://www.vosviewer.com/documentation/Manual_VOSviewer_1.6.20.pdf (accessed on 26 September 2024).

- Veuger, J. (2021). Digitization and blockchain in finance, The Netherlands in 2020 and 2021. International Journal of Applied Economics, Finance and Accounting, 11(1), 1–22. [Google Scholar] [CrossRef]

- Vishnevsky, V. P., & Chekina, V. D. (2018). Robot vs. Tax inspector or how the fourth industrial revolution will change the tax system: A review of problems and solutions. Journal of Tax Reform, 4(1), 6–26. [Google Scholar] [CrossRef]

- Volosovych, S., & Baraniuk, Y. (2018). Tax control of cryptocurrency transactions in Ukraine. Banks and Bank Systems, 13(2), 89–106. [Google Scholar] [CrossRef] [PubMed]

- Vumazonke, N., & Parsons, S. (2023). An analysis of South Africa’s guidance on the income tax consequences of crypto assets. South African Journal of Economic and Management Sciences, 26(1), 4832. [Google Scholar] [CrossRef]

- Wang, G., & Hausken, K. (2021). Governmental Taxation of Households Choosing between a National Currency and a Cryptocurrency. Games, 12(2), 34. [Google Scholar] [CrossRef]

- Wang, Q., Huang, Q., Wu, X., Tan, J., & Sun, P. (2023). Categorical uncertainty in policy and bitcoin volatility. Finance Research Letters, 58(C), 104664. [Google Scholar] [CrossRef]

- Yayman, D. (2023). Taxation in virtual worlds: Analysis under United States of America and Turkish tax regulations. Sosyoekonomi, 31(55), 211–231. [Google Scholar] [CrossRef]

- Ylonen, M., Raudla, R., & Babic, M. (2024). From tax havens to cryptocurrencies: Secrecy-seeking capital in the global economy. Review of International Political Economy, 31(2), 563–588. [Google Scholar] [CrossRef]

- Zatsepin, A. M., Filippova, O. V., & Permyakov, M. V. (2020). Mining is a Legal Category. In N. Anton (Ed.), Proceedings of the XVII international research-to-practice conference dedicated to the memory of M.I. Kovalyov (ICK 2020) (Vol. 420, pp. 192–196). Atlantis Press. [Google Scholar]

| First Author | Paper | Journal | Year | Total Citations |

|---|---|---|---|---|

| Andreevich MD | “Regulatory Regulation of the Issue and Circulation of Digital Currencies in the Countries of the Modern World” | Springer Proceedings in Business and Economics | 2022 | 219 |

| Adams MT | “Emerging Cryptocurrencies and IRS Summons Power: Striking the Proper Balance between IRS Audit Authority and Taxpayer Privacy” | The ATA Journal of Legal Tax Research | 2021 | 57 |

| Ryle PM | “Book Reviews” | Journal of the American Taxation Association | 2019 | 57 |

| Terando WD | “Impact of the IRC Section 475 Mark-to-Market Election on Bitcoin Taxation” | The ATA Journal of Legal Tax Research | 2017 | 57 |

| Enajero S | “Cryptocurrency, Money Demand and the Mundell-Fleming Model of International Capital Mobility” | Atlantic Economic Journal | 2021 | 46 |

| Holden R | “The Law and Economics of Blockchain” | Annual Review of Law and Social Science | 2022 | 41 |

| Makarov I | “Cryptocurrencies and Decentralized Finance (DEFI)” | Brookings Papers on Economic Activity | 2022 | 27 |

| Lee DKC | “Asian CBDCs on the rise: An in-depth analysis of developments and implications” | Quantitative Finance and Economics | 2023 | 26 |

| Maniatis A | “Blockchain with Emphasis on Tax Law” | Euromed Academy of Business Conference Book of Proceedings | 2019 | 25 |

| Stiegler T | “Investment Trend in Digital Currencies—The Current State of Fiscal Treatment of Bitcoin Investments in Germany” | BASIQ International Conference: New Trends in Sustainable Business and Consumption 2018 | 2018 | 24 |

| Clusters | Most Relevant Key Terms | Occurrences | Total Link Strength | Main Topic |

|---|---|---|---|---|

|

Cluster 1 red (13 items) | AML | 6 | 37 | Financial regulations |

| currency | 18 | 101 | ||

| DEFI | 6 | 33 | ||

| digital | 2 | 11 | ||

| exchange | 8 | 54 | ||

| framework | 7 | 56 | ||

| income | 9 | 53 | ||

| pseudonymous | 2 | 11 | ||

| regulation | 27 | 139 | ||

| reporting | 2 | 18 | ||

| transaction | 8 | 57 | ||

| virtual | 3 | 24 | ||

| wallet | 2 | 18 | ||

|

Cluster 2 green (13 items) | cash | 2 | 9 | Economic ecosystem and monetary policies |

| CBDC | 14 | 32 | ||

| cryptocurrency | 80 | 278 | ||

| endogenous money | 2 | 5 | ||

| financial inclusion | 2 | 3 | ||

| fintech | 4 | 8 | ||

| GDP | 3 | 3 | ||

| inflation tax | 2 | 5 | ||

| informal economy | 2 | 2 | ||

| monetary policy | 4 | 6 | ||

| money demand | 2 | 4 | ||

| social welfare | 2 | 5 | ||

| tax evasion | 6 | 31 | ||

|

Cluster 3 blue (11 items) | commodity | 2 | 9 | Fiscal policies and tax regulations |

| cryptoassets | 26 | 90 | ||

| digital finance | 2 | 2 | ||

| income tax | 5 | 11 | ||

| initial coin offering | 3 | 21 | ||

| OECD model tax convention | 2 | 8 | ||

| property | 2 | 9 | ||

| public policy | 2 | 4 | ||

| securities | 2 | 9 | ||

| tax classification | 2 | 10 | ||

| tax policy | 5 | 19 | ||

|

Cluster 4 yellow (10 items) | blockchain | 44 | 167 | Law compliance and security |

| compliance | 10 | 58 | ||

| digital economy | 2 | 6 | ||

| fraud | 2 | 16 | ||

| MTF | 2 | 16 | ||

| privacy | 4 | 15 | ||

| security | 5 | 29 | ||

| trust | 2 | 6 | ||

| VAT | 6 | 30 | ||

| VATcoin | 2 | 16 | ||

|

Cluster 5 purple (8 items) | holding | 3 | 17 | Fiscal system |

| IRS | 6 | 32 | ||

| metaverse | 3 | 7 | ||

| NFT | 4 | 15 | ||

| taxation | 38 | 163 | ||

| taxpayer | 8 | 47 | ||

| trading | 3 | 19 | ||

| valuation | 2 | 12 | ||

|

Cluster 6 light blue (6 items) | accounting | 8 | 27 | Cryptocurrency financial reporting |

| bitcoin | 42 | 141 | ||

| governance | 2 | 5 | ||

| IFRS | 3 | 10 | ||

| intangible asset | 4 | 14 | ||

| recognition | 2 | 5 | ||

|

Cluster 7 orange (6 items) | digitalisation | 2 | 5 | Investment and hedging |

| financial | 3 | 14 | ||

| investment | 4 | 26 | ||

| jurisdictions | 3 | 17 | ||

| token | 6 | 33 | ||

| volatility | 2 | 10 | ||

|

Cluster 8 brown (3 items) | classification | 4 | 24 | Taxation on the nature of activity |

| government | 4 | 32 | ||

| mining | 5 | 23 |

| Country | Tax Percentage | Tax Base Type | Tax Rate Type | |

|---|---|---|---|---|

| Austria | 27.50% | Capital gains tax | FTR | |

| Belgium | 0% *–33% | Capital gains tax (*for long-term investors) | PTS | |

| Bulgaria | 10% | Personal income | FTR | |

| Croatia | 0% */18% | Capital gains tax (*if asset is held for over two years) | PTS | |

| Cyprus | 0–35% | Personal income (based on profit and frequency) | PTS | |

| Czech Republic | 15%/23% * | Capital gains tax (*23% over €70K) | PTS | |

| Denmark | 37–52% | Personal income tax | PTS | |

| Estonia | 20% | Personal income tax | FTR | |

| Finland | 30–34% | Capital gains tax (30% under €30K, 34% over €30K) | PTS | |

| France | 30% | Capital gain tax | FTR | |

| Germany | 0–45% | Personal income tax (based on income) | PTS | |

| Greece | 15% | Capital gains tax (beginning in 2025) | FTR | |

| Hungary | 15% | Personal income | FTR | |

| Ireland | 33% | Capital gains tax | FTR | |

| Italy | 26% | Capital gains tax (over €2K, may increase to 42%) | FTR | |

| Latvia | 25.50% | Personal income tax | FTR | |

| Lithuania | 15% | Capital gains tax | FTR | |

| Luxembourg | 0% */22–25% | Personal income tax (*holding more than six months) | PTS | |

| Malta | 0% | Capital gains tax exemption | FTR | |

| The Netherlands | 36% | Personal income tax (presumed return on total value) | FTR | |

| Poland | 19% | Capital gains tax | FTR | |

| Portugal | 0% */28% | Capital gains tax (*assets held for over one year) | PTS | |

| Romania | 10% | Capital gains tax (if over €120) | FTR | |

| Slovakia | 7% | Crypto-specific tax (on profits from over one year) | FTR | |

| Slovenia | 0% | Capital gains tax exemption | PTS | |

| Spain | 19–28% | Capital gains tax (based on income) | PTS | |

| Sweden | 30% | Capital gains tax | FTR | |

| Colour code | 0–19% | 20–29% | >30% | |

| Operation | Tax Percentage | Tax Base |

|---|---|---|

| Conversion of cryptocurrencies into fiat money | 10% | Profit/capital gain |

| Exchanges between cryptocurrencies | 10% | Profit/capital gain |

| Payments with cryptocurrencies | 10% | Gain from the difference between purchase price and market price at the time of the transaction |

| Compensation received from cryptocurrency mining (via PoW mechanism) | 10% | Accounting value of the gain at the time of entry/receipt |

| Compensation received from cryptocurrency staking (via PoS/DPoS mechanism) | 10% | Accounting value of the gain at the time of entry/receipt |

| Earning new tokens | 10% | Accounting value of the gain at the time of entry/generation |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lazea, G.-I.; Balea-Stanciu, M.-R.; Bunget, O.-C.; Sumănaru, A.-D.; Coraș, A.-M.G. Cryptocurrency Taxation: A Bibliometric Analysis and Emerging Trends. Int. J. Financial Stud. 2025, 13, 37. https://doi.org/10.3390/ijfs13010037

Lazea G-I, Balea-Stanciu M-R, Bunget O-C, Sumănaru A-D, Coraș A-MG. Cryptocurrency Taxation: A Bibliometric Analysis and Emerging Trends. International Journal of Financial Studies. 2025; 13(1):37. https://doi.org/10.3390/ijfs13010037

Chicago/Turabian StyleLazea, Georgiana-Iulia, Maria-Roxana Balea-Stanciu, Ovidiu-Constantin Bunget, Anca-Diana Sumănaru, and Ana-Maria Georgiana Coraș. 2025. "Cryptocurrency Taxation: A Bibliometric Analysis and Emerging Trends" International Journal of Financial Studies 13, no. 1: 37. https://doi.org/10.3390/ijfs13010037

APA StyleLazea, G.-I., Balea-Stanciu, M.-R., Bunget, O.-C., Sumănaru, A.-D., & Coraș, A.-M. G. (2025). Cryptocurrency Taxation: A Bibliometric Analysis and Emerging Trends. International Journal of Financial Studies, 13(1), 37. https://doi.org/10.3390/ijfs13010037