Monte Carlo Simulations for Resolving Verifiability Paradoxes in Forecast Risk Management and Corporate Treasury Applications

Abstract

1. Introduction

2. Literature Review

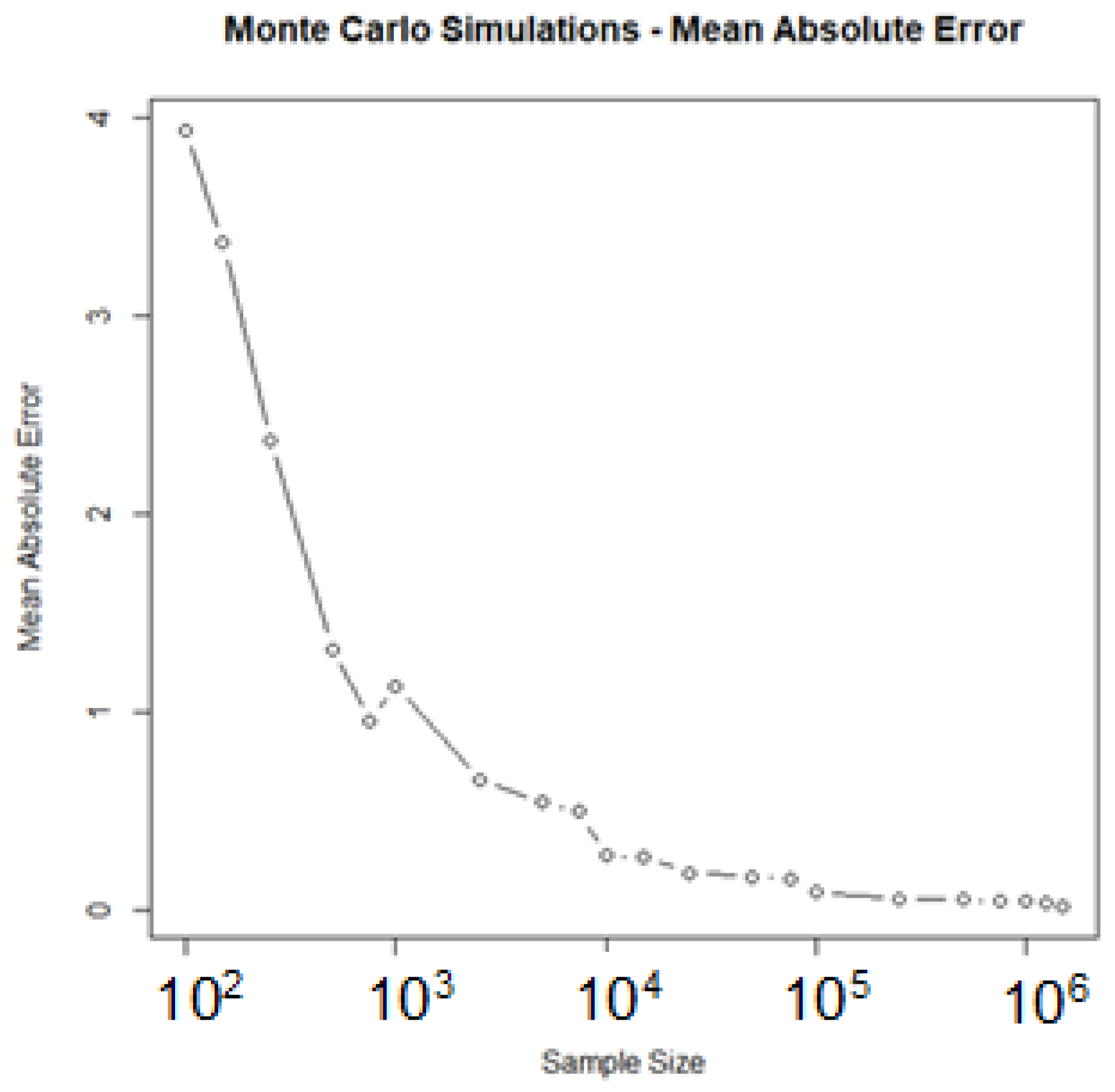

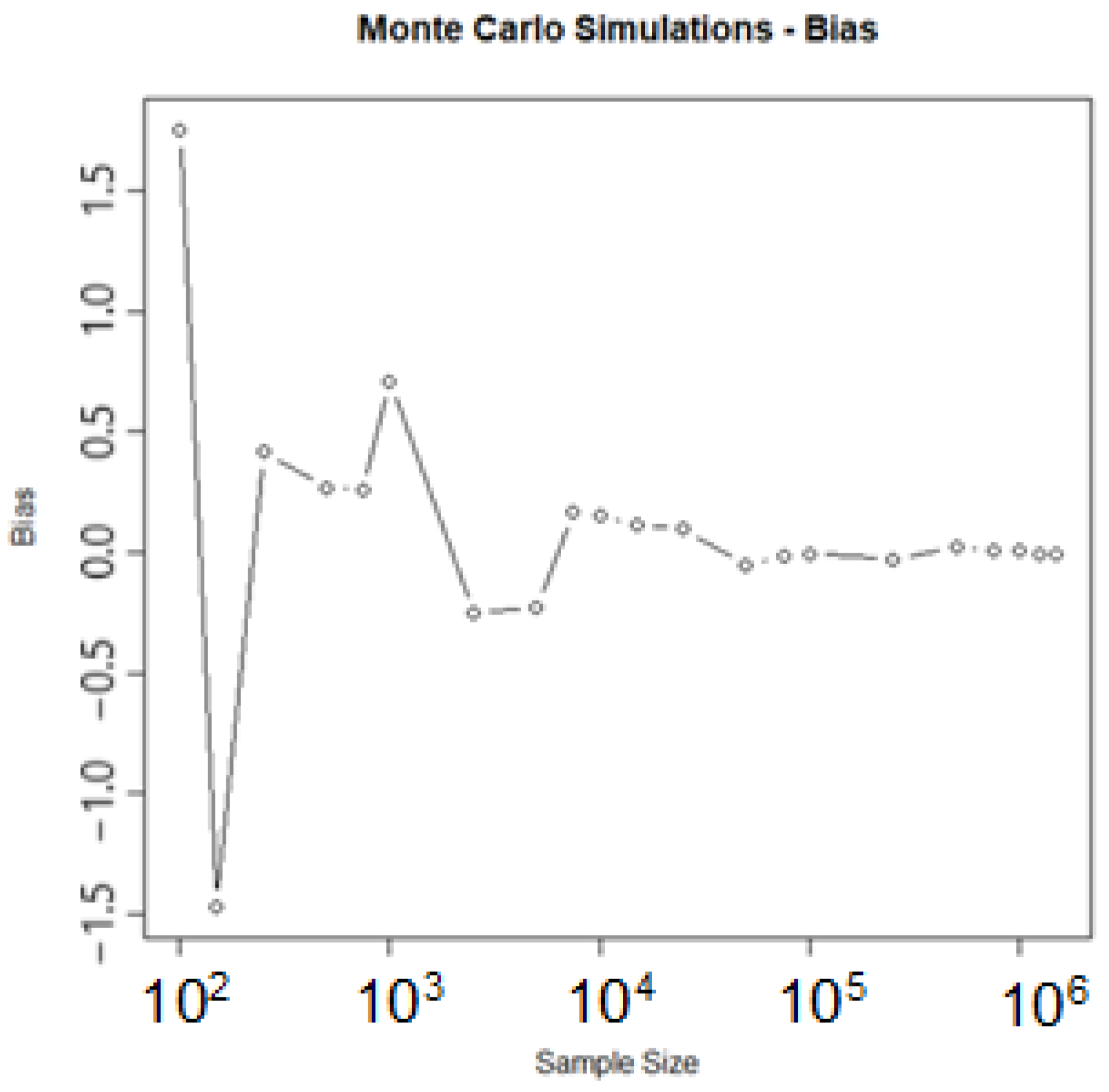

3. Methodology

4. Veridical-Type Paradoxes

4.1. Bertrand’s Box

- A box containing two gold coins;

- A box containing two silver coins;

- A box containing one gold coin and one silver coin.

- P(A)—the probability of choosing gold coin in the second toss;

- P(B)—the probability of choosing gold coin in the first toss.

- set.seed(100)

- samplesize<-1000000

- a<-sample(0:2,samplesize,replace=T)

- # 3 boxes: 0—gold, gold; 1—silver, silver; 2—gold, silver

- b<-sample(0:1,samplesize,replace=T) # 2 balls in each box

- data<-data.frame(a,b)

- data2<-subset(data,(a==0) | (a==2 & b==0),select=a)

- round(sum(a==0)/nrow(data2),4) # final probability

4.2. Three Prisoners Dilemma

- A, B and C correspond to prisoners;

- P(A), P(B) and P(C) are the probabilities that the governor pardoned the corresponding prisoners;

- A, B and C are events in which the warden mentions that the corresponding prisoners were pardoned.

- set.seed(100)

- samplesize<-1000000

- governor<-sample(0:2,samplesize,replace=T)

- fm<-function(a,j) {

- if (a[j]==0) {thisone<-sample(1:2,1,replace=T)}

- if (a[j]==1) {thisone<-2}

- if (a[j]==2) {thisone<-1}

- this one

- }

- warden<- sapply(1:samplesize, function(j) fm(governor,j))

- r<-data.frame(governor,warden)

- # Warden told B, given that the governor chose A.

- sum(r$warden==1 & r$governor==0)/sum(r$warden==1)

- # Warden told C, given governor choose A.

- sum(r$warden==2 & r$governor==0)/sum(r$warden==2)

- # Warden told B, giving the governor the choice of C.

- sum(r$warden==1 & r$governor==2)/sum(r$warden==1)

- # Warden told C, given governor choose B.

- sum(r$warden==2 & r$governor==1)/sum(r$warden==2)

4.3. Monty Hall Problem

- is the host opening door 3.

- Not switching decision;

- Switching decision;

- Flip-a-coin decision;

- Tic-toc decision;

- Opposite tic-toc decision.

5. Conclusions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

- samplesize<-100000 # sample size

- doors<-9 # doors count -1

- door<-vector(“numeric”,length=doors*(doors-1)/2)

- prize<-vector(“numeric”,length=doors*(doors-1)/2)

- changedp<-vector(“numeric”,length=doors*(doors-1)/2)

- nochangep<-vector(“numeric”,length=doors*(doors-1)/2)

- ttp<-vector(“numeric”,length=doors*(doors-1)/2)

- ottp<-vector(“numeric”,length=doors*(doors-1)/2)

- flipp<-vector(“numeric”,length=doors*(doors-1)/2)

- results <- data.frame(door, prize, changedp, ttp,flipp,

- ottp,nochangep)

- #tic-toc oppposite tic-toc function

- ttott<-function(ttott1,win1,win2,trigger){

- if (ttott1==0) {if (win2==0) {thisone<-0

- } else {thisone<-1 }}

- if (ttott1==1) {if (win1==0) {thisone<-1

- } else {thisone<-0 }}

- if (trigger==“ott”) {if (thisone==0) {thisone<-1

- } else {thisone<-0 }}

- thisone}

- for (i in 2:doors) {

- for (j in 1:(i-1)) {

- set.seed(100)

- initial<-replicate(samplesize,list(sample(0:i,1,replace=F)))

- priz<-replicate(samplesize,list(sample(0:i,j,replace=F)))

- # initial guess & prizes behind doors

- flip<-sample(0:1,samplesize, replace=T) # flip a coin

- tt<-sample(0,samplesize,replace=T) # tic toc

- ott<-sample(0,samplesize,replace=T) # opposite tic toc

- choices<-replicate(samplesize,list(c(0:i)))

- # WHICH GOAT WILL BE SHOWN

- goats<-mapply(setdiff,choices,priz)

- goats2<- lapply(1:ncol(goats), function(p) goats[,p])

- # goats are opposite prizes

- notinitial<-mapply(setdiff,choices,initial)

- notinitial2<-lapply(1:ncol(notinitial),

- function(p) notinitial[,p])

- # group of not initial decisions

- goats3<-mapply(intersect,goats2,notinitial2)

- goats4<-lapply(goats3, function(p) c(p,p))

- goat<-lapply(goats4, function(p) sample(p,1))

- # to show just one goat from intersect not initial & goats

- remove(goats,goats2,choices,notinitial,goats3,goats4)

- chmind<-mapply(setdiff,notinitial2,goat)#to change mind

- #to exclude goat which was shown from not initial group

- if (is.null(ncol(chmind))==FALSE) {

- chmind2<- lapply(1:ncol(chmind), function(p) chmind[,p])

- } else {chmind2<-chmind}

- chmind3<-lapply(chmind2, function(p) c(p,p))

- newmind<-lapply(chmind3, function(p) sample(p,1))

- # to choose 1 new decision from all the available

- remove(notinitial2, goat,chmind,chmind2,chmind3)

- win1<-mapply(intersect,newmind,priz)#win1 changed mind

- win2<-mapply(intersect,initial,priz)#win2 not changed mind

- win13<-as.numeric(lapply(win1,function(p) length(p)==0))

- win23<-as.numeric(lapply(win2, function(p) length(p)==0))

- # intersection—1 no intersection,0 intersection

- for(l in 1:(samplesize-1)) { # TIC-TOC, OPPOSITE TIC TOC

- tt[l+1]<-ttott(tt[l],win13[l],win23[l],‘tt’)

- ott[l+1]<-ttott(ott[l],win13[l],win23[l],‘ott’)}

- #PROBABILITIES

- win1p<-sum(win13==0)/samplesize #win1p changed mind

- win2p<-sum(win23==0)/samplesize #win2p not changed mind

- remove(newmind,priz,initial,win1,win2)

- flipfr<-data.frame(win13,win23,flip,tt,ott)

- flip1<-nrow(flipfr[flipfr$flip==1 & flipfr$win13==0,])

- flip2<-nrow(flipfr[flipfr$flip==0 & flipfr$win23==0,])

- # flip1—changed mind,flip2—initial decision

- tt1<-nrow(flipfr[flipfr$tt==1 & flipfr$win13==0,])

- tt2<-nrow(flipfr[flipfr$tt==0 & flipfr$win23==0,])

- ott1<-nrow(flipfr[flipfr$ott==1 & flipfr$win13==0,])

- ott2<-nrow(flipfr[flipfr$ott==0 & flipfr$win23==0,])

- flipp<-(flip1+flip2)/samplesize

- tictocp<-(tt1+tt2)/samplesize

- opptictocp<-(ott1+ott2)/samplesize

- results$door[i*(i-1)/2-i+1+j]<-i+1#RESULTS—WRITTING

- results$prize[i*(i-1)/2-i+1+j]<-j

- results$changedp[i*(i-1)/2-i+1+j]<-round(win1p*100,3)

- results$ttp[i*(i-1)/2-i+1+j]<-round(tictocp*100,3)

- results$flipp[i*(i-1)/2-i+1+j]<-round(flipp*100,3)

- results$ottp[i*(i-1)/2-i+1+j]<-round(opptictocp*100,3)

- results$nochangep[i*(i-1)/2-i+1+j]<-round(win2p*100,3)

- remove(win13,win23,flipfr,flip,tt,ott) } }

- nname<- paste(toString(samplesize),”r.txt”,sep=““)

- write.table(results,nname,append=FALSE)

References

- Adamolekun, G. (2024). Firm biodiversity risk, climate vulnerabilities, and bankruptcy risk. Journal of International Financial Markets, Institutions and Money, 97, 102075. [Google Scholar] [CrossRef]

- Adil, M. H., & Roy, A. (2024). Asymmetric effects of uncertainty on investment: Empirical evidence from India. Journal of Economic Asymmetries, 29, e00359. [Google Scholar] [CrossRef]

- Ajovalasit, S., Consiglio, A., & Provenzano, D. (2024). Debt sustainability in the context of population ageing: A risk management approach. Risks, 12(12), 188. [Google Scholar] [CrossRef]

- Akgün, A. İ., & Memiş Karataş, A. (2024). Do impact of cash flows and working capital ratios on performance of listed firms during the crisis? The cases of EU-28 and Western European countries. Journal of Economic and Administrative Sciences. [Google Scholar] [CrossRef]

- Akhtar, T. (2022). Corporate governance, excess-cash and firm value: Evidence from ASEAN-5. Economics and Business Review, 8(4), 39–67. [Google Scholar] [CrossRef]

- Akhtar, T. (2024). Are the motives of holding cash differing between developed and emerging financial markets? Kybernetes, 53(5), 1653–1681. [Google Scholar] [CrossRef]

- Akhtar, T., Chen, L., & Tareq, M. A. (2024). Blockchain technology enterprises’ ownership structure and cash holdings. Sustainable Futures, 8, 100229. [Google Scholar] [CrossRef]

- Akhtar, T., Tareq, M. A., Sakti, M. R. P., & Khan, A. A. (2018). Corporate governance and cash holdings: The way forward. Qualitative Research in Financial Markets, 10(2), 152–170. [Google Scholar] [CrossRef]

- Alam, M. S., Safiullah, M., & Islam, M. S. (2024). Cash-rich firms and carbon emissions. International Review of Financial Analysis, 81, 102106. [Google Scholar] [CrossRef]

- Alban, A., Darji, H. A., Imamura, A., & Nakayama, M. K. (2017). Efficient Monte Carlo methods for estimating failure probabilities. Reliability Engineering and System Safety, 165, 376–394. [Google Scholar] [CrossRef]

- Alexandrov, V. N., Martel, C. G., & Straßburg, J. (2011). Monte Carlo scalable algorithms for computational finance. Procedia Computer Science, 4, 1708–1715. [Google Scholar]

- Al-Hamshary, F. S. A. A., Mohamad Ariff, A., Kamarudin, K. A., & Abd Majid, N. (2025). Corporate risk-taking, financial constraints and cash holdings: Evidence from Saudi Arabia. International Journal of Islamic and Middle Eastern Finance and Management, 18(1), 166–183. [Google Scholar] [CrossRef]

- Alzoubi, M. (2021). Bank capital adequacy: The impact of fundamental and regulatory factors in a developing country. Journal of Applied Business Research, 37(6), 205–216. [Google Scholar]

- Arnold, U., & Yildiz, Ö. (2015). Economic risk analysis of decentralized renewable energy infrastructures—A Monte Carlo Simulation approach. Renewable Energy, 77(1), 227–239. [Google Scholar] [CrossRef]

- Athari, S. A., Cho Teneng, R., Çetinkaya, B., & Bahreini, M. (2024). Country risk, global uncertainty, and firms’ cash holdings: Do the role of law, culture, and financial market development matter? Heliyon, 10(5), e26266. [Google Scholar] [CrossRef] [PubMed]

- Austin, P. C. (2009a). Balance diagnostics for comparing the distribution of baseline covariates between treatment groups in propensity-score matched samples. Statistics in Medicine, 28(25), 3083–3107. [Google Scholar] [CrossRef] [PubMed]

- Austin, P. C. (2009b). Some methods of propensity-score matching had superior performance to others: Results of an empirical investigation and Monte Carlo simulations. Biometrical Journal, 51(1), 171–184. [Google Scholar] [CrossRef]

- Banu, J. R., Preethi, Kavitha, S., Gunasekaran, M., & Kumar, G. (2020). Microalgae based biorefinery promoting circular bioeconomy-techno economic and life-cycle analysis. Bioresource Technology, 302, 122822. [Google Scholar] [CrossRef]

- Batan, L. Y., Graff, G. D., & Bradley, T. H. (2016). Techno-economic and Monte Carlo probabilistic analysis of microalgae biofuel production system. Bioresource Technology, 219, 45–52. [Google Scholar] [CrossRef]

- Behera, M., & Mahakud, J. (2025). Geopolitical risk and cash holdings: Evidence from an emerging economy. Journal of Financial Economic Policy, 17(1), 132–156. [Google Scholar] [CrossRef]

- Belas, J., Dvorsky, J., Hlawiczka, R., Smrcka, L., & Khan, K. A. (2024a). SMEs sustainability: The role of human resource management, corporate social responsibility and financial management. Oeconomia Copernicana, 15(1), 307–342. [Google Scholar] [CrossRef]

- Belas, J., Gavurova, B., Kubak, M., & Novotna, A. (2023). Risk management level determinants in visegrad countries—Sectoral analysis. Technological and Economic Development of Economy, 29(1), 307–325. [Google Scholar] [CrossRef]

- Belas, J., Gavurova, B., Kubak, M., & Rowland, Z. (2024b). Quantifying export potential and barriers of SMEs in V4. Acta Polytechnica Hungarica, 21(2), 251–270. [Google Scholar] [CrossRef]

- Brandimarte, P. (2014). Handbook in Monte Carlo simulation: Applications in financial engineering, risk management, and economics (pp. 1–662). John Wiley & Sons. [Google Scholar] [CrossRef]

- Cao, D., Tahir, S. H., Rizvi, S. M. R., & Khan, K. B. (2024). Exploring the influence of women’s leadership and corporate governance on operational liquidity: The glass cliff effect. PLoS ONE, 19, e0302210. [Google Scholar] [CrossRef]

- Carrick, J. (2023). Navigating the path from innovation to commercialization: A review of technology-based academic entrepreneurship. Journal of Applied Business Research, 39(1), 1–14. [Google Scholar]

- Carsey, T., & Harden, J. (2014). Monte Carlo simulation and resampling methods for social science. SAGE Publications. [Google Scholar]

- Chen, S., Farooq, U., Aldawsari, S. H., Waked, S. S., & Badawi, M. (2025). Impact of environmental, social, and governance performance on cash holdings in BRICS: Mediating role of cost of capital. Corporate Social Responsibility and Environmental Management, 32(1), 1182–1197. [Google Scholar] [CrossRef]

- Chen, X., Yu, W., & Zhao, Y. (2020). Financial risk management and control based on marine economic forecast. Journal of Coastal Research, 112(sp1), 234–236. [Google Scholar] [CrossRef]

- Cheng, S.-R. (2008). Highly nonlinear model in finance and convergence of Monte Carlo simulations. Journal of Mathematical Analysis and Applications, 353(2), 531–543. [Google Scholar]

- Chung, H. J., Jhang, H., & Ryu, D. (2023). Impacts of COVID-19 pandemic on corporate cash holdings: Evidence from Korea. Emerging Markets Review, 56, 101055. [Google Scholar] [CrossRef]

- Crouhy, M., Galai, D., & Mark, R. (2000). A comparative analysis of current credit risk models. Journal of Banking and Finance, 24(1–2), 59–117. [Google Scholar] [CrossRef]

- Cui, F., Tan, Y., & Lu, B. (2024). How do macroeconomic cycles and government policies influence cash holdings? Evidence from listed firms in China. Sustainability, 16(18), 7961. [Google Scholar] [CrossRef]

- da Costa Moraes, M. B., Manoel, A. A. S., & Carneiro, J. (2025). Determinants of corporate cash holdings in private and public companies: Insights from Latin America. Review of Quantitative Finance and Accounting. [Google Scholar] [CrossRef]

- Dang, D.-M., Xu, Q., & Wu, S. (2015). Multilevel dimension reduction Monte-Carlo simulation for high-dimensional stochastic models in finance. Procedia Computer Science, 51, 1583–1592. [Google Scholar]

- Das, B. C., Hasan, F., & Sutradhar, S. R. (2024). The impact of economic policy uncertainty and inflation risk on corporate cash holdings. Review of Quantitative Finance and Accounting, 62(3), 865–887. [Google Scholar] [CrossRef]

- Demiraj, R., Labadze, L., Dsouza, S., Demiraj, E., & Grigolia, M. (2024). The quest for an optimal capital structure: An empirical analysis of European firms using GMM regression analysis. EuroMed Journal of Business. [Google Scholar] [CrossRef]

- Di, L., Jiang, W., Mao, J., & Zeng, Y. (2024). Managing liquidity along the supply chain: Supplier-base concentration and corporate cash policy. European Financial Management, 30(4), 2376–2421. [Google Scholar] [CrossRef]

- Diebold, F. X., Gunther, T. A., & Tay, A. S. (1998). Evaluating density forecasts with applications to financial risk management. International Economic Review, 39(4), 863–883. [Google Scholar] [CrossRef]

- Diebold, F. X., Hahn, J., & Tay, A. S. (1999). Multivariate density forecast evaluation and calibration in financial risk management: High-frequency returns on foreign exchange. Review of Economics and Statistics, 81(4), 661–673. [Google Scholar] [CrossRef]

- Ding, S., Wang, A., Cui, T., & Min Du, A. (2025). Renaissance of climate policy uncertainty: The effects of U.S. presidential election on energy markets volatility. International Review of Economics & Finance, 98, 103866. [Google Scholar] [CrossRef]

- Dsouza, S., Momin, M., Habibniya, H., & Tripathy, N. (2024). Optimizing performance through sustainability: The mediating influence of firm liquidity on ESG efficacy in African enterprises. Cogent Business and Management, 11(1), 2423273. [Google Scholar] [CrossRef]

- Elamer, A. A., & Utham, V. (2024). Cash is queen? Impact of gender-diverse boards on firms’ cash holdings during COVID-19. International Review of Financial Analysis, 95, 103490. [Google Scholar] [CrossRef]

- Elroukh, A. W. (2025). The asymmetric impact of economic policy uncertainty on the demand for money in the GCC countries. International Journal of Economics and Financial Issues, 15(1), 93–100. [Google Scholar] [CrossRef]

- Elyasiani, E., & Movaghari, H. (2024). Money demand function with time-varying coefficients. Quarterly Review of Economics and Finance, 98, 101914. [Google Scholar] [CrossRef]

- Fan, J., Wang, K., & Xu, M. (2024). Does digital finance development affect corporate cash holdings? Evidence from China. Technology Analysis and Strategic Management. [Google Scholar] [CrossRef]

- Fang, S., Deitch, M., Gebremicael, T., Angelini, C., & Ortals, C. (2024). Identifying critical source areas of non-point source pollution to enhance water quality: Integrated SWAT modeling and multi-variable statistical analysis to reveal key variables and thresholds. Water Research, 253, 121286. [Google Scholar] [CrossRef] [PubMed]

- Fantazzini, D. (2009). The effects of misspecified marginals and copulas on computing the value at risk: A Monte Carlo study. Computational Statistics and Data Analysis, 53(6), 2168–2188. [Google Scholar] [CrossRef]

- Farooq, U., Thavorn, J., & Tabash, M. I. (2024). Exploring the impact of environmental regulations and green innovation on corporate investment and cash management: Evidence from Asian economies. China Finance Review International. [Google Scholar] [CrossRef]

- Floros, C., Galariotis, E., Gkillas, K., Magerakis, E., & Zopounidis, C. (2024). Time-varying firm cash holding and economic policy uncertainty nexus: A quantile regression approach. Annals of Operations Research, 341(2–3), 859–895. [Google Scholar] [CrossRef]

- Gharaibeh, A. M. O. (2023). The determinants of capital adequacy in the Jordanian banking sector: An autoregressive distributed lag-bound testing approach. International Journal of Financial Studies, 11(2), 75. [Google Scholar] [CrossRef]

- Guo, H., & Polak, P. (2021). Artificial intelligence and financial technology fintech: How AI is being used under the pandemic in 2020. In Studies in computational intelligence (Vol. 935, pp. 169–186). Springer. [Google Scholar] [CrossRef]

- Hasan, M. M., Habib, A., & Zhao, R. (2022). Corporate reputation risk and cash holdings. Accounting and Finance, 62(1), 667–707. [Google Scholar] [CrossRef]

- Hasan, S. B., Alam, M. S., Paramati, S. R., & Islam, M. S. (2022). Does firm-level political risk affect cash holdings? Review of Quantitative Finance and Accounting, 59(1), 311–337. [Google Scholar] [CrossRef]

- Hong, L. J., Hu, Z., & Liu, G. (2014). Monte Carlo methods for value-at-risk and conditional value-at-risk: A review. ACM Transactions on Modeling and Computer Simulation, 24(4), 5. [Google Scholar] [CrossRef]

- Hung, N. T., & Su Dinh, T. (2022). Threshold effect of working capital management on firm profitability: Evidence from Vietnam. Cogent Business and Management, 9(1), 2141090. [Google Scholar] [CrossRef]

- Husmann, S., & Kollegen, M. (2022). Company classification using machine learning. Journal of Financial Data Science, 4(2), 45–67. [Google Scholar]

- Hwang, J.-T., & Wen, M. (2024). Electronic payments and money demand in China. Economic Analysis and Policy, 82, 47–64. [Google Scholar] [CrossRef]

- İnal, V. (2024). On the relationship between the money rate of interest and aggregate investment spending. Review of Radical Political Economics, 56(2), 300–318. [Google Scholar] [CrossRef]

- Jajuga, K. (2023). Data analysis for risk management—Economics, finance and business: New developments and challenges. Risks, 11(4), 70. [Google Scholar] [CrossRef]

- Jinkrawee, J., Lonkani, R., & Suwanaphan, S. (2023). A matter of others’ money: How cash holdings of other firms affect a firm’s cash holding? International Journal of Emerging Markets, 18(10), 3954–3972. [Google Scholar] [CrossRef]

- Kalash, I. (2024). How does excess cash affect corporate financial performance? Journal of Applied Accounting Research, 25(5), 1223–1243. [Google Scholar] [CrossRef]

- Kayani, U., Hasan, F., Choudhury, T., & Nawaz, F. (2025). Unveiling WCM and firm performance relationship: Evidence from Shariah compliance United Kingdom firms. International Journal of Islamic and Middle Eastern Finance and Management. [Google Scholar] [CrossRef]

- Kazak, H., Mensi, W., Akif Gunduz, M., & Kilicarslan, A. (2025). Connections between gold, main agricultural commodities, and Turkish stock markets. Borsa Istanbul Review, 25, 296–310. [Google Scholar] [CrossRef]

- Koller, D., & Friedman, N. (2009). Probabilistic graphical models principles and techniques. The MIT Press. [Google Scholar]

- Kumar, N., & Symss, J. (2024). Corporate cash holding and firm’s performance in times of Ukraine war: A literature review and way forward. Journal of Chinese Economic and Foreign Trade Studies. [Google Scholar] [CrossRef]

- Lara-Galera, A., Alcaraz-Carrillo de Albornoz, V., Molina-Millán, J., & Muñoz-Medina, B. (2025). Spread valuation and risk on transport infrastructure loans. Economics of Transportation, 41, 100392. [Google Scholar] [CrossRef]

- Lee, J. (2024). Corporate cash holdings and industry risk. Journal of Financial Research, 47(2), 435–470. [Google Scholar] [CrossRef]

- Le Maux, J., & Smaili, N. (2021). Annual report readability and corporate bankruptcy. Journal of Applied Business Research, 37(3), 73–80. [Google Scholar]

- Li, X., Pan, Z., Ho, K.-C., & Bo, Y. (2024). Epidemics, local institutional quality, and corporate cash holdings. International Review of Economics and Finance, 92, 193–210. [Google Scholar] [CrossRef]

- Li, X., & Shiu, Y.-M. (2024). The effect of risk management on direct and indirect capital structure deviations. Risks, 12(12), 186. [Google Scholar] [CrossRef]

- Liu, J., Cheng, Y., Li, X., & Sriboonchitta, S. (2022). The role of risk forecast and risk tolerance in portfolio management: A case study of the Chinese financial sector. Axioms, 11(3), 134. [Google Scholar] [CrossRef]

- Liu, L. (2024). Litigation risk and corporate cash holdings: The moderating effect of CEO tenure. Finance Research Letters, 69, 106211. [Google Scholar] [CrossRef]

- Liu, L., Cowan, L., Wang, F., & Onega, T. (2025). A multi-constraint Monte Carlo Simulation approach to downscaling cancer data. Health & Place, 91, 103411. [Google Scholar] [CrossRef]

- Liu, X., Zhang, Y., & Chen, L. (2024). Application of machine learning algorithms in the domain of financial engineering. Computational Economics, 63(1), 87–110. [Google Scholar] [CrossRef]

- Luo, P., & Liu, X. (2024). Dynamic investment in new technology and risk management. Review of Quantitative Finance and Accounting. [Google Scholar] [CrossRef]

- Mamani, J. C. M., Carrasco-Choque, F., Paredes-Calatayud, E. F., Cusilayme-Barrantes, H., & Cahuana-Lipa, R. (2024). Modeling uncertainty energy price based on interval optimization and energy management in the electrical grid. Operations Research Forum, 5(1), 4. [Google Scholar] [CrossRef]

- Mao, X., & Yuan, C. (2006). Stochastic differential equations with Markovian switching. Imperial College Press. [Google Scholar]

- Mertzanis, C., Hamill, P. A., Pavlopoulos, A., & Houcine, A. (2024). Sustainable investment conditions and corporate cash holdings in the MENA region: Market preparedness and Shari’ah-compliant funds. International Review of Economics and Finance, 93, 1043–1063. [Google Scholar] [CrossRef]

- Metwally, A. B. M., Aly, S. A. S., & Ali, M. A. S. (2024). The impact of corporate social responsibility on cash holdings: The moderating role of board gender diversity. International Journal of Financial Studies, 12(4), 104. [Google Scholar] [CrossRef]

- Michalski, G. (2007). Portfolio management approach in trade credit decision making. Romanian Journal of Economic Forecasting, 8(3), 42–53. [Google Scholar]

- Michalski, G. (2008). Corporate inventory management with value maximization in view. Agricultural Economics-Zemedelska Ekonomika, 54(5), 187–192. [Google Scholar] [CrossRef]

- Movaghari, H., & Sermpinis, G. (2025). Heterogeneous impact of cost of carry on corporate money demand. European Financial Management, 31(1), 400–426. [Google Scholar] [CrossRef]

- Nießner, T., Nießner, S., & Schumann, M. (2022, August 10–14). Influence of corporate industry affiliation in financial business forecasting: A Data analysis concerning competition. 28th Americas Conference on Information Systems, AMCIS 2022, Minneapolis, MN, USA. [Google Scholar]

- Nießner, T., Nießner, S., & Schumann, M. (2023). Is it worth the effort? Considerations on text mining in AI-based corporate failure prediction. Information, 14(4), 215. [Google Scholar] [CrossRef]

- Nishibe, T., Iwasa, T., Matsuda, S., & Kano, M. (2025). Prediction of aneurysm sac shrinkage after endovascular aortic repair using machine learning-based decision tree analysis. Journal of Surgical Research, 306, 197–202. [Google Scholar] [CrossRef]

- Nusair, S. A., Olson, D., & Al-Khasawneh, J. A. (2024). Asymmetric effects of economic policy uncertainty on demand for money in developed countries. Journal of Economic Asymmetries, 29, e00350. [Google Scholar] [CrossRef]

- Obaid, K., & Pukthuanthong, K. (2022). A picture is worth a thousand words: Measuring investor sentiment by combining machine learning and photos from news. Journal of Behavioral Finance, 23(3), 211–229. [Google Scholar]

- Oh, S., Lim, C., & Lee, B. (2025). Stochastic scaling of the time step length in a full-scale Monte Carlo Potts model. Computational Materials Science, 249, 113644. [Google Scholar] [CrossRef]

- Ortmann, A., & Spiliopoulos, L. (2023). Ecological rationality and economics: Where the Twain shall meet. Synthese, 201(4), 135. [Google Scholar] [CrossRef]

- Ökten, G., Tuffin, B., & Burago, V. (2006). A central limit theorem and improved error bounds for a hybrid-Monte Carlo sequence with applications in computational finance. Journal of Complexity, 22, 435–458. [Google Scholar] [CrossRef]

- Page, S. (2010). Diversity and complexity. Princeton University Press. [Google Scholar]

- Pang, J., Wang, K., & Zhao, L. (2024). Tax enforcement and corporate cash holdings. Journal of Business Finance and Accounting, 51(9–10), 2737–2762. [Google Scholar] [CrossRef]

- Park, J. (2022). Impact of informal communication on corporate creative performance. Journal of Applied Business Research, 38(1), 19–28. [Google Scholar] [CrossRef]

- Pereira, E. J. S., Pinho, J. T., Galhardo, M. A. B., & Macêdo, W. N. (2014). Methodology of risk analysis by Monte Carlo Method applied to power generation with renewable energy. Renewable Energy, 69, 347–355. [Google Scholar] [CrossRef]

- Polak, P., Masquelier, F., & Michalski, G. (2018). Towards treasury 4.0/the evolving role of corporate treasury management for 2020. Management, 23(2), 189–197. [Google Scholar] [CrossRef]

- Puri, I. (2025). Simplicity and risk. Journal of Finance. [Google Scholar] [CrossRef]

- Rehan, R. (2022). Investigating the capital structure determinants of energy firms. Edelweiss Applied Science and Technology, 6(1), 1–14. [Google Scholar] [CrossRef]

- Rehan, R., Khan, M. A., Fu, G. H., Sa’ad, A. A., & Irshad, A. (2024a). The determinants of Shariah banks’ capital structure. International Journal of Economics and Financial Issues, 14(5), 193–202. [Google Scholar] [CrossRef]

- Rehan, R., Sa’ad, A. A., Fu, G. H., & Khan, M. A. (2024b). The determinants of banks’ capital structure in SAARC economies. Edelweiss Applied Science and Technology, 8(4), 417–433. [Google Scholar] [CrossRef]

- Rehman, I. U., Shahzad, F., Hanif, M. A., Khalid, N., & Nawaz, F. (2024). From commitment to capital: Does environmental innovation reduce corporate cash holdings? Journal of Sustainable Finance and Investment, 15, 22–51. [Google Scholar] [CrossRef]

- Reyes, J. E. M., Pérez, J. J. C., & Aké, S. C. (2023). Credit risk management analysis: An application of fuzzy theory to forecast the probability of default in a financial institution [Análisis de la gestión del riesgo de crédito: Una aplicación de la teoría difusa para pronosticar la probabilidad de incumplimiento en una institución financiera]. Contaduria y Administracion, 69(1), 180–211. [Google Scholar] [CrossRef]

- Rijanto, A. (2022). Political connection status decisions and benefits for firms experiencing financial difficulties in emerging markets. Problems and Perspectives in Management, 20(3), 164–177. [Google Scholar] [CrossRef]

- Sabripoor, A., & Ghousi, R. (2024). Risk-based cooperative vehicle routing problem for cash-in-transit scenarios: A hybrid optimization approach. International Journal of Industrial Engineering Computations, 15(1), 127–148. [Google Scholar] [CrossRef]

- Salas, V., & Saurina, J. (2002). Credit risk in two institutional regimes: Spanish commercial and savings banks. Journal of Financial Services Research, 22(3), 203–224. [Google Scholar] [CrossRef]

- Schrand, C., & Unal, H. (1998). Hedging and coordinated risk management: Evidence from thrift conversions. Journal of Finance, 53(3), 979–1013. [Google Scholar] [CrossRef]

- Severino, J. S., Joy, C., Boyle, P. P., & Tan, K. S. (2004). Accelerating quasi-Monte Carlo approximations for pricing financial derivatives. Applied Mathematics and Computation, 148, 173–187. [Google Scholar] [CrossRef]

- Smith, J., & Patel, R. (2023). Systematic literature review: Quantum machine learning and its applications. Quantum Computing in Finance, 5(1), 55–79. [Google Scholar]

- Soltani, A. (2024). Exploring the interplay of foreign direct investment, digitalization, and green finance in renewable energy: Advanced analytical methods and machine learning insights. Energy Conversion and Management: X, 24, 100802. [Google Scholar]

- Song, K., & Lee, Y. (2012). Long-term effects of a financial crisis: Evidence from cash holdings of East Asian firms. Journal of Financial and Quantitative Analysis, 47(3), 617–641. [Google Scholar] [CrossRef]

- Steffen, B. (2018). The importance of project finance for renewable energy projects. Energy Economics, 69, 280–294. [Google Scholar] [CrossRef]

- Stewart, J. (2005). Fiscal incentives, corporate structure and financial aspects of treasury management operation. Accounting Forum, 29(3), 271–288. [Google Scholar] [CrossRef]

- Taylor, J. W., & Yu, K. (2016). Using auto-regressive logit models to forecast the exceedance probability for financial risk management. Journal of the Royal Statistical Society. Series A: Statistics in Society, 179(4), 1069–1092. [Google Scholar] [CrossRef]

- Tobisova, A., Senova, A., & Rozenberg, R. (2022). Model for Sustainable financial planning and investment financing using monte carlo method. Sustainability, 14(14), 8785. [Google Scholar] [CrossRef]

- Tripathi, V., & Madhavan, V. (2024). Firm value evidence from India. Economic and Political Weekly, 59(21), 83–90. [Google Scholar]

- Tsviliuk, O., Zhang, D., & Melnik, R. (2010). Complex systems in finance: Monte Carlo evaluation of first passage time density functions. Procedia Computer Science, 1, 2381–2389. [Google Scholar]

- Varela, A., Dopico, D., & Fernández, A. (2025). An analytical approach to the sensitivity analysis of semi-recursive ODE formulations for multibody dynamics. Computers & Structures, 308, 107642. [Google Scholar] [CrossRef]

- Vasquez, J. Z., Cruz, L. D. C. S. S., Navarro, L. R. R., Benavides, A. M. V., López, R. D. J. T., & Rodriguez, V. H. P. (2023). Relationship between internal control and treasury management in a Peruvian municipality. Journal of Law and Sustainable Development, 11(2), e0706. [Google Scholar] [CrossRef]

- Vega-Gutiérrez, P. L., López-Iturriaga, F. J., & Rodríguez-Sanz, J. A. (2025). Economic policy uncertainty and capital structure in Europe: An agency approach. European Journal of Finance, 31(1), 53–75. [Google Scholar] [CrossRef]

- Vithayasrichareon, P., & MacGill, I. F. (2012). A Monte Carlo based decision-support tool for assessing generation portfolios in future carbon constrained electricity industries. Energy Policy, 41, 374–392. [Google Scholar] [CrossRef]

- von Solms, J., & Langerman, J. (2022). Digital technology adoption in a bank treasury and performing a digital maturity assessment. African Journal of Science, Technology, Innovation and Development, 14(2), 302–315. [Google Scholar] [CrossRef]

- Wang, X., Li, L., & Bian, S. (2024). Irrelevant answers in customers’ earnings communication conferences and suppliers’ cash holdings. Journal of Financial Stability, 75, 101346. [Google Scholar] [CrossRef]

- Wang, Z., Zhang, C., Wu, R., & Sha, L. (2024). From ethics to efficiency: Understanding the interconnected dynamics of ESG performance, financial efficiency, and cash holdings in China. Finance Research Letters, 64, 105419. [Google Scholar] [CrossRef]

- Worku, Z. (2021). Business ethics and the repayment of loans in small enterprises. Journal of Applied Business Research, 37(2), 51–60. [Google Scholar]

- Wu, J., Al-Khateeb, F. B., Teng, J.-T., & Cárdenas-Barrón, L. E. (2016). Inventory models for deteriorating items with maximum lifetime under downstream partial trade credits to credit-risk customers by discounted cash-flow analysis. International Journal of Production Economics, 171, 105–115. [Google Scholar] [CrossRef]

- Yamamoto, T., & Sakamoto, H. (2025). Monte Carlo methods based on “virtual density” theory for calculation of k-eigenvalue sensitivity under nonuniform anisotropic deformation. Annals of Nuclear Energy, 213, 111181. [Google Scholar] [CrossRef]

- Yang, J., Bao, M., & Chen, S. (2025). A retreat to safety: Why COVID-19 make firms more risk-averse? International Review of Financial Analysis, 97, 103789. [Google Scholar] [CrossRef]

- Yang, S. H., & Jun, S.-G. (2022). Owners of Korean conglomerates and corporate investment. Journal of Applied Business Research, 38(1), 1–18. [Google Scholar] [CrossRef]

- Yang, Y., & Lei, J. (2025). Analysis of coupled distributed stochastic approximation for misspecified optimization. Neurocomputing, 622, 129310. [Google Scholar] [CrossRef]

- Yitzhaky, L., & Bahli, B. (2021). Target setting and firm performance: A review. Journal of Applied Business Research, 37(3), 81–94. [Google Scholar] [CrossRef]

- Yudaruddin, R., Lesmana, D., Yudaruddin, Y. A., Ekşi, İ. H., & Başar, B. D. (2024). Impact of the Israel–Hamas conflict on financial markets of MENA region—A study on investors’ reaction. Journal of Economic and Administrative Sciences. [Google Scholar] [CrossRef]

- Zhang, D., & Melnik, R. V. N. (2009). First passage time for multivariate jump-diffusion stochastic models with applications in finance. Applied Stochastic Models in Business and Industry, 25(5), 565–582. [Google Scholar] [CrossRef]

- Zhang, L., & Gao, J. (2024). Does climate policy uncertainty influence corporate cash holdings? Evidence from the U.S. tourism and hospitality sector. Tourism Economics, 30(7), 1704–1728. [Google Scholar] [CrossRef]

- Zvarikova, K., Dvorsky, J., Belas, J., Jr., & Metzker, Z. (2024). Model of sustainability of SMES in V4 countries. Journal of Business Economics and Management, 25(2), 226–245. [Google Scholar] [CrossRef]

| No | Door | Prize | Changep | Ttp | Flipp | Ottp | No Changep |

|---|---|---|---|---|---|---|---|

| 1 | 3 | 1 | 66.645 | 55.585 | 50.061 | 44.415 | 33.355 |

| 2 | 4 | 1 | 37.545 | 31.857 | 31.278 | 30.005 | 24.992 |

| 3 | 4 | 2 | 75 | 66.686 | 62.54 | 60.013 | 49.993 |

| 4 | 5 | 1 | 26.704 | 23.5 | 23.35 | 22.854 | 19.979 |

| 5 | 5 | 2 | 53.287 | 47.463 | 46.657 | 45.705 | 40.047 |

| 6 | 5 | 3 | 80.014 | 73.354 | 69.997 | 68.534 | 59.99 |

| 7 | 6 | 1 | 20.86 | 18.802 | 18.791 | 18.505 | 16.649 |

| 8 | 6 | 2 | 41.67 | 37.76 | 37.493 | 37.015 | 33.303 |

| 9 | 6 | 3 | 62.565 | 57.244 | 56.253 | 55.6 | 50.053 |

| 10 | 6 | 4 | 83.273 | 77.724 | 75.042 | 74.074 | 66.719 |

| 11 | 7 | 1 | 17.155 | 15.756 | 15.767 | 15.591 | 14.286 |

| 12 | 7 | 2 | 34.268 | 31.582 | 31.477 | 31.138 | 28.581 |

| 13 | 7 | 3 | 51.457 | 47.512 | 47.114 | 46.796 | 42.892 |

| 14 | 7 | 4 | 68.592 | 63.727 | 62.917 | 62.387 | 57.163 |

| 15 | 7 | 5 | 85.661 | 80.856 | 78.553 | 77.89 | 71.399 |

| 16 | 8 | 1 | 14.564 | 13.591 | 13.562 | 13.408 | 12.49 |

| 17 | 8 | 2 | 29.171 | 27.15 | 27.097 | 26.916 | 25.009 |

| 18 | 8 | 3 | 43.77 | 40.764 | 40.609 | 40.408 | 37.492 |

| 19 | 8 | 4 | 58.368 | 54.537 | 54.252 | 53.886 | 49.989 |

| 20 | 8 | 5 | 72.953 | 68.614 | 67.716 | 67.327 | 62.504 |

| 21 | 8 | 6 | 87.511 | 83.353 | 81.251 | 80.743 | 74.955 |

| 22 | 9 | 1 | 12.709 | 11.932 | 11.919 | 11.793 | 11.063 |

| 23 | 9 | 2 | 25.378 | 23.882 | 23.85 | 23.712 | 22.286 |

| 24 | 9 | 3 | 38.05 | 35.79 | 35.62 | 35.541 | 33.302 |

| 25 | 9 | 4 | 50.793 | 47.765 | 47.603 | 47.438 | 44.429 |

| 26 | 9 | 5 | 63.514 | 59.971 | 59.574 | 59.209 | 55.543 |

| 27 | 9 | 6 | 76.224 | 72.26 | 71.459 | 71.043 | 66.624 |

| 28 | 9 | 7 | 88.856 | 85.161 | 83.35 | 82.965 | 77.803 |

| 29 | 10 | 1 | 11.263 | 10.659 | 10.663 | 10.589 | 9.974 |

| 30 | 10 | 2 | 22.496 | 21.287 | 21.273 | 21.272 | 20.021 |

| 31 | 10 | 3 | 33.796 | 31.901 | 31.856 | 31.801 | 29.957 |

| 32 | 10 | 4 | 44.983 | 42.591 | 42.497 | 42.38 | 40.009 |

| 33 | 10 | 5 | 56.281 | 53.328 | 53.151 | 52.905 | 49.971 |

| 34 | 10 | 6 | 67.475 | 64.136 | 63.734 | 63.504 | 59.945 |

| 35 | 10 | 7 | 78.761 | 75.157 | 74.413 | 74.125 | 69.99 |

| 36 | 10 | 8 | 90.008 | 86.636 | 84.967 | 84.669 | 79.949 |

| No | Door | Prize | Changep | No Changep | No Changep | Flipp | Flipp |

|---|---|---|---|---|---|---|---|

| Monte Carlo | True | Combined | |||||

| 1 | 3 | 1 | 66.645 | 33.355 | 33.333 | 50.061 | 49.989 |

| 2 | 4 | 1 | 37.545 | 24.992 | 25 | 31.278 | 31.273 |

| 3 | 4 | 2 | 75 | 49.993 | 50 | 62.54 | 62.5 |

| 4 | 5 | 1 | 26.704 | 19.979 | 20 | 23.35 | 23.352 |

| 5 | 5 | 2 | 53.287 | 40.047 | 40 | 46.657 | 46.644 |

| 6 | 5 | 3 | 80.014 | 59.99 | 60 | 69.997 | 70.007 |

| 7 | 6 | 1 | 20.86 | 16.649 | 16.667 | 18.791 | 18.764 |

| 8 | 6 | 2 | 41.67 | 33.303 | 33.333 | 37.493 | 37.502 |

| 9 | 6 | 3 | 62.565 | 50.053 | 50 | 56.253 | 56.283 |

| 10 | 6 | 4 | 83.273 | 66.719 | 66.667 | 75.042 | 74.97 |

| 11 | 7 | 1 | 17.155 | 14.286 | 14.286 | 15.767 | 15.721 |

| 12 | 7 | 2 | 34.268 | 28.581 | 28.571 | 31.477 | 31.42 |

| 13 | 7 | 3 | 51.457 | 42.892 | 42.857 | 47.114 | 47.157 |

| 14 | 7 | 4 | 68.592 | 57.163 | 57.143 | 62.917 | 62.868 |

| 15 | 7 | 5 | 85.661 | 71.399 | 71.429 | 78.553 | 78.545 |

| 16 | 8 | 1 | 14.564 | 12.49 | 12.5 | 13.562 | 13.532 |

| 17 | 8 | 2 | 29.171 | 25.009 | 25 | 27.097 | 27.086 |

| 18 | 8 | 3 | 43.77 | 37.492 | 37.5 | 40.609 | 40.635 |

| 19 | 8 | 4 | 58.368 | 49.989 | 50 | 54.252 | 54.184 |

| 20 | 8 | 5 | 72.953 | 62.504 | 62.5 | 67.716 | 67.727 |

| 21 | 8 | 6 | 87.511 | 74.955 | 75 | 81.251 | 81.256 |

| 22 | 9 | 1 | 12.709 | 11.063 | 11.111 | 11.919 | 11.91 |

| 23 | 9 | 2 | 25.378 | 22.286 | 22.222 | 23.85 | 23.8 |

| 24 | 9 | 3 | 38.05 | 33.302 | 33.333 | 35.62 | 35.692 |

| 25 | 9 | 4 | 50.793 | 44.429 | 44.444 | 47.603 | 47.619 |

| 26 | 9 | 5 | 63.514 | 55.543 | 55.556 | 59.574 | 59.535 |

| 27 | 9 | 6 | 76.224 | 66.624 | 66.667 | 71.459 | 71.446 |

| 28 | 9 | 7 | 88.856 | 77.803 | 77.778 | 83.35 | 83.317 |

| 29 | 10 | 1 | 11.263 | 9.974 | 10 | 10.663 | 10.632 |

| 30 | 10 | 2 | 22.496 | 20.021 | 20 | 21.273 | 21.248 |

| 31 | 10 | 3 | 33.796 | 29.957 | 30 | 31.856 | 31.898 |

| 32 | 10 | 4 | 44.983 | 40.009 | 40 | 42.497 | 42.492 |

| 33 | 10 | 5 | 56.281 | 49.971 | 50 | 53.151 | 53.141 |

| 34 | 10 | 6 | 67.475 | 59.945 | 60 | 63.734 | 63.738 |

| 35 | 10 | 7 | 78.761 | 69.99 | 70 | 74.413 | 74.381 |

| 36 | 10 | 8 | 90.008 | 79.949 | 80 | 84.967 | 85.004 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pavlik, M.; Michalski, G. Monte Carlo Simulations for Resolving Verifiability Paradoxes in Forecast Risk Management and Corporate Treasury Applications. Int. J. Financial Stud. 2025, 13, 49. https://doi.org/10.3390/ijfs13020049

Pavlik M, Michalski G. Monte Carlo Simulations for Resolving Verifiability Paradoxes in Forecast Risk Management and Corporate Treasury Applications. International Journal of Financial Studies. 2025; 13(2):49. https://doi.org/10.3390/ijfs13020049

Chicago/Turabian StylePavlik, Martin, and Grzegorz Michalski. 2025. "Monte Carlo Simulations for Resolving Verifiability Paradoxes in Forecast Risk Management and Corporate Treasury Applications" International Journal of Financial Studies 13, no. 2: 49. https://doi.org/10.3390/ijfs13020049

APA StylePavlik, M., & Michalski, G. (2025). Monte Carlo Simulations for Resolving Verifiability Paradoxes in Forecast Risk Management and Corporate Treasury Applications. International Journal of Financial Studies, 13(2), 49. https://doi.org/10.3390/ijfs13020049