Abstract

Behavioral risk management is an increasingly important consideration in investment strategies, as research has shown that investor psychology can significantly impact portfolio performance. This study examines how psychological variables influence investing choices and the effects that these actions have on risk mitigation and overall investment performance. The primary respondents for this study were the employees of Takoradi Technical University. Partial Least Square Structural Modeling was adopted for the data processing, analysis, and testing of the study’s hypotheses. The study’s findings, which were based on a carefully chosen sample of 348 investors, showed that investigating behavioral risk management in investment strategies is an effective method for thoroughly comprehending and utilizing investors’ psychology to maximize risk management procedures and enhance investment results in dynamic financial markets. Seven hypotheses were deemed insignificant, and five were considered significant. This study is limited by its exclusive focus on only one technical university. This study augmented the growing corpus of research on risk management in investment strategies.

1. Introduction

A key element of successful investing strategies is behavioral risk management (BRM), which helps investors make better decisions, control risks more skillfully, and eventually produce better investment results. By integrating the BRM principle, investment professionals can gain a more thorough understanding of the psychological issues affecting financial decision-making and adapt strategies to lessen the negative effects of behavioral biases (Haidari, 2023). Research by Yapicioglu (2023) and Iriani et al. (2024) focused on creating more resilient and flexible investing strategies that can more effectively traverse intricate and unpredictable financial landscapes. To increase knowledge of behavioral biases and foster risk awareness within businesses, BRM highlights the significance of education and training initiatives (Kyung-Tae Lee et al., 2023; GBenga, 2024).

The impact of investor psychology on financial markets has long been recognized in the realm of investing techniques. The study of behavioral risk management in investment strategies looks at how investors’ decision-making is impacted by social influences, emotional reactions, and cognitive biases (Polychronakis, 2023; Mittal, 2022). There is increasing awareness that conventional financial theories, which frequently presume rational behavior, fall short of explaining the intricacies of human psychology (VanderPal & Brazie, 2022; Huck et al., 2020). Currently, no thorough frameworks incorporate psychological insights into workable risk management solutions; instead, behavioral finance and risk management have been mostly treated as distinct topics in the literature (Hochrainer-Stigler et al., 2024). This division restricts our knowledge of how to methodically handle emotional and cognitive biases in investment strategies. How psychological factors influence investing decisions and what effects these behaviors have on risk management and overall investment success are two urgent research questions raised by this gap. A thorough framework that integrates behavioral finance concepts into risk management procedures is proposed in this paper. The goal of this research is to investigate the techniques that reduce cognitive biases and improve investment outcomes by examining how these biases impact decision-making. Additionally, Xia and Madni (2024) and Malik et al. (2024) emphasized that investor psychology in decision-making processes greatly impacts how investors assess opportunities, perceive risk, and ultimately decide whether to purchase, hold, or sell assets.

Research suggests that investors commonly encounter myriads of challenges including overconfidence, loss aversion and herd behavior, which can result in less-than-ideal choices (Haidari, 2023; Bhanu, 2023). Significant financial repercussions, such as market volatility and asset mispricing, may arise from these psychological occurrences. For example, investors may irrationally panic during market downturns, causing mass sell-offs that worsen drops. According to Ul Abdin et al. (2022), overconfidence during bull markets can result in excessive risk-taking and significant losses. Therefore, comprehending these patterns of behavior is essential to creating risk management plans to address the psychological elements’ effect on investing performance (Elhussein & Abdelgadir, 2020; Almansour et al., 2023).

This research is significant not only for individual investors but also for financial institutions, policymakers, and the economy as a whole. Additionally, this research can guide the development of educational initiatives aimed at raising investor knowledge of psychological biases and encouraging more logical decision-making. The article’s structure consists of a literature review, a methodology, empirical analysis and findings, a discussion, a conclusion, and research implications.

2. Theoretical Foundation of the Study

One well-known behavioral finance theory that questions the conventional wisdom of rational decision-making in the face of uncertainty is Prospect Theory (Kahneman & Tversky, 2013). This theory has important ramifications for comprehending investor behavior and risk management tactics, as well as offering insightful information about how people make risk judgments. According to the theory, decision-making is systematically biased as a result of people weighing possible rewards and losses against a reference point. The theory helps comprehend behavioral risk management in investment strategies because of a number of its components. Understanding that investors assess risks about a reference point helps financial advisors better understand how their clients see risk. How risk is conveyed can be influenced by factors including an investor’s sensitivity to the possibility of loss concerning their initial investment against the possibility of gain.

The theory presents ideas like framing effects, which show how information presentation affects decision-making, and loss aversion, showing a contrast between the pain of losing and the joy of winning. In the context of behavioral risk management, the theory explains how investors’ risk choices are influenced by psychological variables rather than only logical evaluations of probability and outcomes. Studies that have used this theory include financial management and behavioral finance (Shrader et al., 2021; Bromiley & Rau, 2022). These studies show that behavioral biases affect how investors assess risk and make decisions. Other studies investigated the relationship between risk perception and investment decision-making (Bazley et al., 2021), and emphasized that cognitive biases frequently influence subjective assessments of risk. According to the study’s findings, greater investment outcomes may result from an awareness of these biases. Once more, Areiqat et al. (2019) looked into the connection between behavioral finance characteristics and investing choices and found loss aversion and overconfidence as major factors affecting how risk is perceived and, in turn, how decisions are made. Using Prospect Theory, Muermann et al. (2006) demonstrated how loss aversion affects people’s propensity to buy insurance policies. This study emphasizes Prospect Theory’s wider application outside of conventional investing scenarios. Because it aids in evaluating behavioral risk management to develop methods that accommodate investors’ risk preferences as impacted by prospect framing, the study thus supports the applicability of prospect theory in comprehending investor behavior. One drawback of the study’s premise is that, while it explains how investors make decisions, it offers no precise recommendations for the best course of action. Because there is no clear framework, people or investors may be unsure of what makes a “rational” decision in different circumstances. By employing Prospect Theory, the research has a solid theoretical foundation.

3. Literature Review and Hypotheses Development

3.1. Herd Behavior in Investment Decision

Herd behavior in investment decisions refers to the act of following others’ way of doing things, without consideration for their own personal information or logical reasoning, in the context of investment decisions (Bikhchandani et al., 2024). This can increase market fluctuations and contribute to market inefficiencies by causing excessive asset purchases or sales based on the behavior of others rather than on fundamental considerations. Social proof and FOMO are two examples of cognitive biases and information cascades that impact herd behavior (Khalil et al., 2023). This may affect the market reaction to fresh information, which would distort asset values and raise market volatility. Contrarian investors who are prepared to defy expectations and take advantage of market mispricing may find opportunities as a result of herd behavior (Dumiter et al., 2023). But it may also be dangerous for investors who mindlessly follow the herd, which can result in less-than-ideal investing outcomes and heightened susceptibility to market declines. In a study of the Saudi stock markets, Almansour et al. (2023) discovered that herding behavior had a big influence on how people perceive risk and make investment choices. The study used structural equation modeling to explore the role of herd behavior and other biases in the relationship between investors’ risk perceptions and decision-making. Chandrakala and Ch (2024) investigated how several behavioral finance ideas, including herd mentality, affected Bangalore investors’ choices of investments. According to their findings, investor attitudes and decision-making processes are significantly shaped by psychological factors, including social effects. Areiqat et al. (2019) emphasized the mediating role of perceived risk in the connection between investment choices and behavioral finance elements like herding. Their study highlighted how cognitive biases impact investors’ risk perceptions, which in turn impact their propensity to follow the herd. The impact of psychological elements, such as herd behavior, on investing decisions, was examined (Bazley et al., 2021). They discovered that during market booms, investors frequently overestimate the safety of following the herd, which encourages them to take on more risk. We postulate the following hypotheses:

H1a.

There is a favorable relationship between market efficiency and herd behavior.

H1b.

Portfolio performance is favorably correlated with herd behavior.

3.2. Overconfidence in Investment Decision

In behavioral finance, cognitive bias influences investment decisions, which frequently results in worse-than-ideal outcomes (Distor et al., 2023). This bias can take many different forms, such as overestimating one’s ability to beat the market, underestimating hazards, and overestimating how accurate one’s predictions are (Lu et al., 2023). Overconfidence and other behavioral biases’ effects on investment decisions in developing markets were investigated (Riaz & Iqbal, 2015). According to their findings, investors’ risk-taking behavior was greatly impacted by overconfidence, which resulted in less-than-ideal investment decisions. In their research on investor behavior in Bangalore, Chandrakala and Ch (2024) showed how overconfidence influences investment choices. According to their research, overconfident investors were more inclined to depend on their intuition and disregard fundamental analysis, which led to worse investment results. Almansour et al. (2023) examined the mediating role of the relationship between perceived financial risk and investment decisions. According to the study, overconfident investors frequently misjudge risk, which increases the possibility that they will make poor investment decisions. Coffie (2013) investigated how psychological elements, such as overconfidence, affect less knowledgeable investors’ financial methods. The study found that financial knowledge lessens the impacts of overconfidence, which can result in illogical decision-making. Thus, the following hypotheses are put forth:

H2a:

Market efficiency and overconfidence are positively correlated.

H2b:

Overfinance and portfolio returns are positively correlated.

3.3. Liquidity in Investment Decision

Liquidity refers to the ease with which an asset can be turned into cash without influencing its price. Low liquidity implies that selling an asset can need a reduction in its market value, whereas high liquidity means that an asset can be swiftly turned into cash with no effect on price. For investors, liquidity is essential because it influences their capacity to manage risk, enter and exit positions, and react to market movements. In investment decision-making, liquidity is critical because illiquid assets may have higher funding risks, price volatility, and transaction costs. Several variables, including market depth, bid-ask spreads, and trading volume, affect liquidity in investment decisions (Shleifer & Vishny, 1997). Numerous studies have looked at how investors’ perceptions and preferences with regards to liquidity are influenced by psychological variables, which in turn affect the investments they make. According to Rupande et al. (2019), when investor attitude is positive, the stock market is very liquid, and vice versa, indicating that psychological variables are important in determining market liquidity. The results shows how investor psychology and liquidity interact in financial markets. In a similar vein, Aljifri (2023) investigated how overconfidence affects firm valuation and found that overconfident investors frequently undervalue assets, which results in market inefficiencies. The study showed how psychological variables have a direct impact on market results and investing choices, with ramifications for liquidity. Finally, a study by Phan et al. (2023) focused on how liquidity influences investor behavior to comprehend how behavioral finance theories affect investment choices. Their study demonstrated how psychological elements affect investors’ perceptions of liquidity and the investments they make as a result. Thus, the following are the study hypotheses:

H3a.

Liquidity moderates the correlation between market efficiency and herd behavior.

H3b.

Liquidity moderates the portfolio outcomes–herd behavior relationship.

H3c.

The association between market efficiency and overconfidence is moderated by liquidity.

H3d.

Liquidity moderates the overconfidence–portfolio returns relationship.

3.4. Portfolio Returns in Investment Decision

The gains or losses produced by an investment portfolio over a given period are known as portfolio returns. Various psychological aspects influence investment decisions, which are a major component in deciding these returns. According to conventional finance theories, investors make logical choices to minimize risk and maximize returns.

The impact of psychological factors on loss aversion and overconfidence was examined (Bazley et al., 2021). They discovered that these biases affect risk assessment and procedures, which affect the performance of the portfolio. In another development, Almansour et al. (2023) studied the mediating effect of risk perception in the correlation of behavioral finance with investment decisions. According to their research, overconfident investors frequently misjudge risk, which results in poor investing decisions and negatively impacts portfolio performance. The effect of overconfidence bias on investing performance was also studied by Qureshi et al. (2022), who discovered that overconfident investors often take on excessive risk, which lowers portfolio returns. According to their research, overconfidence can skew risk assessment and decision-making processes, highlighting the mediating function of risk propensity. Additionally, Riaz and Iqbal (2015) found that loss aversion and overconfidence affected investors’ decisions in developing countries, and opined that these biases had a major impact on investors’ perceptions of risk and how they made decisions, which in turn affected the success of their portfolios. Once more, Sindhu (2014), who aimed to investigate risk perception concerning the investment–decision relationship, revealed that psychological elements, such as overconfidence, influence how investors view risk and choose investments. Their study showed that investors’ risk estimations are influenced by past performance, which further shapes portfolios (Ung et al., 2024). The study by Ah Mand et al. (2023) emphasized how information asymmetry and overconfidence interact to influence investing choices. They discovered that overconfident investors frequently overlook important information, which results in bad choices and less-than-ideal portfolio outcomes.

3.5. Market Efficiency in Investment Decision

Financial markets are efficient, according to the Efficient Market Hypothesis (EMH), which postulates that an efficient financial market represents all available information on asset prices at any given moment (Bihari et al., 2022; Abideen et al., 2023). Since asset prices swiftly incorporate new information, active management cannot continuously produce returns that are higher than the market as a whole, according to EMH. This idea has significant ramifications for investment strategies and decision-making since it implies that investors should use passive investment strategies instead of trying to “beat the market”. Behavioral finance research has focused on the connection between market efficiency, investor investment decisions, and investor psychology. To find out how behavioral finance theories affect investing choices, Coffie (2013) carried out a study. According to the research, investor behavior is greatly influenced by psychological variables, which can result in actions that are not in line with reasonable expectations and contribute to market inefficiencies. Also, Riaz and Iqbal (2015) examined the overconfidence–investment biases relationship in developing countries. According to their findings, these biases had a major impact on investors’ perceptions of risk and how they made decisions, which in turn affected market efficiency. An empirical investigation on the effect of overconfidence on firm valuation was carried out by Aljifri (2023), who found that overconfident investors frequently misprice assets, resulting in market inefficiencies. The study showed how psychological variables have a direct impact on market results and investing choices.

3.6. Risk-Taking Propensity in Investment Decisions

A person’s inclination to participate in risky actions, especially in financial situations, is referred to as their risk-taking propensity. It is an important psychological characteristic that affects financial choices because there is a high positive correlation between risk-taking and investment decisions (Bucciol & Miniaci, 2018). Recent empirical research has focused more on the moderating influence of risk-taking inclination on investor investing decisions and psychology. Mulyani et al. (2021) examined the influence of risk perception risk propensity on investment decisions among novice investors in West Sumatra. Their study results showed a positive correlation between risk inclination and investing decisions, indicating that even in the face of psychological biases, investors’ inclination to risk-taking affects their financial judgments. A study measuring the influence of risk-taking inclination on investing decision-making was carried out by (Lathief et al., 2024). According to the study, risk propensity mitigated the impact of behavioral biases on investment decisions, including loss aversion and overconfidence. These biases had less of an impact on investors who were more inclined to take risks, which resulted in more logical investing decisions. The connection between psychological biases and investment choices in developing markets was examined (Riaz & Iqbal, 2015). The researchers discovered that risk-taking propensity considerably mitigated overconfidence and loss aversion in investment decisions, suggesting that despite psychological pressures, investors with more risk tolerance were more inclined to make riskier investments. Coffie (2013) looked at how behavioral finance theories affected investment choices, highlighting the impact of risk-taking tendencies. According to the study, risk-taking investors ignore unfavorable information and psychological biases, which might result in more aggressive investing techniques. Thus, the following theories are put forth:

H4a.

The association between herd behavior and market efficiency is moderated by a risk-taking tendency.

H4b.

The association between herd behavior and portfolio returns is favorably moderated by risk-taking propensity.

H4c.

The association between overconfidence and market efficiency is positively moderated by risk-taking.

H4d.

Risk-taking propensity moderates the association between overconfidence and portfolio returns.

Based on the above literature review, the study therefore proposes the below conceptual framework (Figure 1).

Figure 1.

Proposed conceptual framework.

4. Results

4.1. The Measurement Model

Associations between latent variables were examined in this work. The link between latent variables was assessed using factor loadings, convergent validity, and discriminant validity. To ensure a good match, the initial factor loadings were thoroughly examined. We removed factors that fell below the permissible cutoff of 0.7 (Henseler et al., 2015). We calculated internal consistency and convergent reliability using Cronbach’s alpha and composite reliability (CR), as well as convergent validity (Hair et al., 2017). Each model construct met the suggested Cronbach’s alpha criteria (≥0.7), suggesting appropriate internal consistency, and showed good convergent validity (see Table 1). The Fornell and Larcker (1981) measurements were employed by the researchers to assess discriminant validity. This approach is commonly used in research to ensure that multiple constructs (variables or factors) assess distinct concepts rather than merely variations of the same underlying construct. The Fornell and Larcker (1981) criteria are used to compare the square root of each construct’s Average Variance Extracted (AVE) to its association with each other construct in the model. Every value that was derived for the AVE was above the 0.5 minimum criterion. All of the values on the diagonally arranged data, including 0.801, 0.827, 0.837, 0.763, 0.827, and 0.788, appropriately meet the required threshold specifications of above 0.5 as the initial point of assessment. Data in Table 2 below display the average variance that was retrieved. Table 1 illustrates the significant uniqueness among the constructs in the model, as each one has a bivariate correlation that is less than the square root of the AVE.

Table 1.

Construct, indicator, loading, VIF, CR, AVE, and CA.

Table 2.

Discriminant validity.

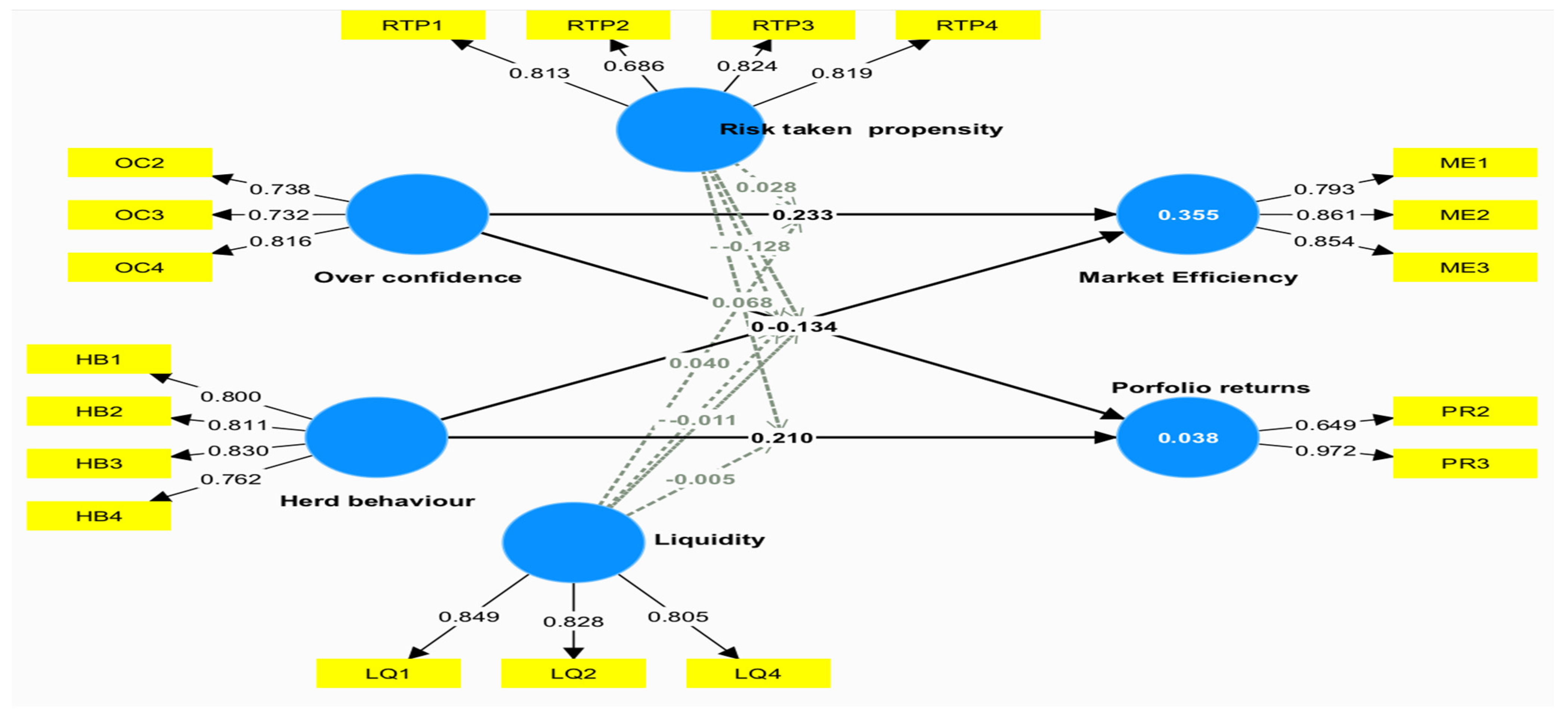

4.2. Assessment of the Structural Model and Hypothesis Testing

This section presents findings on hypothesis testing and the computation of the coefficient of determination (R2) (Hair et al., 2019). Cross-sectional survey data may be subject to common method bias, as suggested by some researchers (Amoah et al., 2022; Podsakoff et al., 2003). Following the suggestion of Scott and Bruce (1994), various measures were used to reduce the CMB effect. Using Harman’s one-factor test, the study revealed that three components with an eigenvalue greater than one accounted for 70% of the variance, while over half of the variance was not explained by any factor. Since some researchers have claimed that Harman’s one-factor test is insufficient to provide evidence of CMB, the researchers also employed the Partially General Factor proposed by Tehseen et al. (2017) in the PLS Model technique. The variance inflation factor (VIF) values showed unbiased path coefficients, which is consistent with the findings of Hair et al. (2017), with values falling between 1.45 and 4.31. Then, as shown in Table 2, R2 values representing the predictive ability and explanatory power were ascertained (Hair et al., 2019). Table 2 also presents findings from the hypothesis test, as well as from moderation analysis (risk-taking propensity and liquidity), which looks at how independent variables affect dependent variables. The results of the findings revealed that five of the hypotheses were accepted, while seven of them were rejected as seen in Table 3 and Figure 2 respectively.

Table 3.

Hypothesis testing.

Figure 2.

Estimated model.

5. Materials and Method

5.1. Data Collection and Sampling

To gather information for data processing and analysis, the researchers of this study created a questionnaire and distributed it to the teaching and non-teaching personnel at Takoradi Technical University in Ghana as part of the quantitative strategy to accomplish the study goal. This study used a structured questionnaire methodology based on Figure 1.

Four questions in total were created for section A and twenty-four questions were devised for section B. The pilot study employed a sample of 30 respondents in total. Some questions were removed, while others that did not meet the acceptable dependability criterion were changed (Hair et al., 2019). Following the revision of the pilot study’s questionnaire questions, the data collection procedure was underway. To choose respondents who were accessible and ready to complete the questionnaire, convenience sampling was used. This sampling technique is more cost-effective since it lowers participant recruitment and data-collecting expenses (Amoah et al., 2022; Haseeb et al., 2019). A major disadvantage of convenience sampling is that, because participants are chosen based on availability rather than by chance, there could be bias in representation, and the results may not be generalizable to the larger population. Before starting the data collection process, the current study received ethical approval from the various associations’ personnel in leadership positions. Participants and authorities were informed of the study’s goals and other relevant details.

Prior to the questionnaire being distributed, confidentiality was stressed and study participation was completely voluntary. The data collection method was open to respondents who were active investors. This was due to the possibility that individuals who are actively investing would give more accurate answers than those who had no prior investment experience. Following approval of consent, a Google link containing the questionnaire was sent to the emails of respondents (Bruce et al., 2022). Respondents provided a total of 348 valid responses. A sample size of 300 or more is necessary for quantitative analysis (Hair et al., 2017; Tabachnick & Fidell, 2007), and this study satisfies this criterion. Data were gathered from February to May of 2024. Each respondent took an average of eleven minutes to finish answering the questionnaire. The PLS-SEM software version 4.0 was used to process and assess the valid replies that were obtained. PLS-SEM was used for analysis due to its ability to make predictions and is frequently used in empirical research due to its versatility and suitability for explanatory studies, particularly in investigations where linkages may be intricate (Purwanto & Sudargini, 2021; Alabdali & Salam, 2022). This quantitative design’s explanatory approach enabled us to methodically investigate, measure, and elucidate the correlations between variables. In other to effectively test the hypotheses, and conduct statistical analyses, this strategy was beneficial (Egala et al., 2024). The demographics of the study participants are shown in Table 4 below.

Table 4.

Socio-demographic profile of study participants.

5.2. Data Collection Instrument

This study used a five-point Likert scale, with 1 denoting strongly agree and 5 denoting strongly disagree. Overconfidence (Cordell et al., 2011; Malmendier & Tate, 2005; Grežo, 2021), herd behavior (Cipriani & Guarino, 2014; Ahmad & Wu, 2022; Cont & Bouchaud, 2000), portfolio returns (Reilly, 2002; Kapoor, 2014; Drake & Fabozzi, 2010), market efficiency (Dimson & Mussavian, 2000; Kawakatsu & Morey, 1999), risk-taking propensity (Sekścińska et al., 2022; Saini & Martin, 2009; Harrison et al., 2019), and liquidity (Zimon et al., 2021; Hiadlovský et al., 2016) are some of the outcomes that we chose to include based on the aforementioned seminal studies.

6. Discussion

This study proposed twelve hypotheses in line with the underlying conceptual framework aimed at meeting the objectives of the study. First, from the respondents’ demographics, it was apparent that the majority of the respondents (63.22%) were males. This is not strange since males are generally more responsive and found of investment than females. This study sought to investigate how psychological factors shape investment decisions, and what implications these behaviors have for risk management and overall investment performance, particularly within a particular technical university. The first hypothesis (H1a) was to confirm the link between herd behavior and market efficiency. This hypothesis was supported. The current research validated the previous findings of Ahmad and Wu (2022) and Curto et al. (2017), which argued that her behavior positively influences the decision-making of individual investors. The hypothesis testing the relationship between herd behavior and market efficiency is supported by empirical evidence indicating that herding can lead to price deviations from intrinsic values, increase market volatility, and distort investor decision-making. These factors contribute to overall market inefficiency, demonstrating the critical role that psychological elements play in financial markets. Understanding this relationship is essential for investors and policymakers alike, as it can inform strategies to enhance market stability and efficiency.

Once more, the hypothesis (H1b) which holds that herd behavior and portfolio returns are positively correlated is supported by this study. Previous research has validated this claim (Chang et al., 2000; Ouarda et al., 2013). The acceptance of this hypothesis suggests that collective investor actions can result in enhanced price discovery, increased market momentum, and short-term speculative gains. Although market inefficiencies can be influenced by herd behavior, its immediate effects frequently yield positive returns for investors who follow the trend. Investors’ understanding of the dynamics of herd behavior can successfully navigate the complexities of financial markets.

Also, the findings supported the hypothesis (H2a) stating that overconfidence has a positive relationship with market efficiency. This means that overconfidence positively correlates with portfolio returns. Alsabban and Alarfaj (2020) contended that overconfidence positively influences market efficiency. It was discovered that overconfidence bias predominates loss aversion. The hypothesis stating that overconfidence has a positive relationship with market efficiency is supported by evidence suggesting that overconfident investors contribute to the price discovery process, enhance market liquidity, and facilitate the rapid incorporation of information into asset prices (Mungai, 2019). While overconfidence can lead to market inefficiencies, particularly during bubbles, the eventual corrections often result in a more efficient market environment. Understanding the dual role of overconfidence in financial markets is crucial for investors and policymakers alike.

Nevertheless, the hypothesis (H2b) stating that overconfidence has a positive relationship with portfolio returns was not supported, suggesting no positive correlation between overconfidence and portfolio returns. This contrasts the findings of (Khan et al., 2019; Tekçe & Yılmaz, 2015), which confirmed a positive relationship. The findings not supporting the hypothesis may suggest a negative relationship between overconfidence in trading behavior, risk assessment, and decision-making. Although overconfidence may result in short-term gains in certain market conditions, it frequently leads to excessive trading, poor risk management, and, ultimately, lower long-term portfolio returns. To develop effective investment strategies and improve financial decision-making, the complexity of overconfidence and its effect on investing behavior cannot be overemphasized (Galariotis et al., 2016; Yapicioglu, 2023).

With regards to the moderation effect (hypothesis 3), only hypothesis H3a had one; that is, liquidity positively moderates the relationship between herd behavior and market efficiency. The other three hypotheses (H3b, H3c, and H3d) had no moderation effect. The hypotheses stating that liquidity moderates the relationships between herd behavior and portfolio returns, overconfidence and market efficiency, and overconfidence and portfolio returns were not supported by the findings of this study. Studies such as those conducted by Ndlovu and Stampanoni (2024) confirm hypothesis H3b. Similarly, the findings for hypothesis (H3c) are in agreement with those from previous studies by (Wafula et al., 2023; Najafi Moghaddam & Ramsheh, 2018). Lastly, hypothesis (H3d) contradicts the findings of Gupta et al. (2018) showing that positive relationships were affirmed. The rejection of hypothesis H3b may stem from the complexity of the relationships between the aforementioned factors. For instance, while it is suggested that higher liquidity can facilitate herding by allowing investors to buy or sell assets quickly, others are of the view that increased liquidity can also exacerbate volatility, leading to negative impacts on returns during periods of extreme herding behavior. Also, the rejection of hypothesis H3c may have stemmed from the influence of various market mechanisms and external factors such as regulatory environments and macroeconomic conditions. These complexities can lead to unpredictable outcomes where increased liquidity does not translate into improved efficiency when overconfident behavior is prevalent. Hypothesis H3d was rejected since the dynamics of overconfidence are complex and often lead to behavioral biases that negatively affect decision-making. For instance, while overconfident decision-makers may engage in riskier trades, this behavior does not guarantee higher returns and can lead to losses instead. Simply put, the hypotheses were rejected, which may have stemmed from the complexities and nuances of financial markets and human behavior. Because financial markets are dynamic, shifts in their structure over time can influence the interaction of liquidity, herd behavior, and market efficiency (Komalasari et al., 2022; Shantha, 2019). While liquidity is an essential factor in financial markets, it cannot compensate for the negative effects of herd behavior and overconfidence in investment decisions and outcomes. Investor psychology, market conditions, and the interplay between liquidity and behavioral biases all contribute to the complex dynamics of portfolio returns and market efficiency.

Finally, hypothesis (H4a), which demonstrates risk-taking propensity’s moderation effect on the herd behavior–market efficiency relationship, was supported. This hypothesis was confirmed by the study’s findings, which are in line with those of (Apochi et al., 2024; Ranaweera & Kawshala, 2022). Furthermore, the remaining hypotheses, H4b, H4c and H4d, did not reveal any positive relationships. The hypotheses stating that risk-taking propensity moderates the relationships between herd behavior and portfolio returns, overconfidence and market efficiency, and overconfidence and portfolio returns were not supported by the findings of this study. Studies such as those by (Singh et al., 2023; Apochi et al., 2024; Ahmad & Wu, 2022) support the rejection of H4b. Also, the rejection of hypothesis H4c is in agreement with the findings of studies by (Vo et al., 2023; Ali & Tauni, 2021). Lastly, findings from the studies by Ali and Tauni (2021) and Benischke et al. (2019) corroborate the current study’s findings on the rejection of hypothesis H4d. There may be a more nuanced relationship than initially imagined between the tendency to take risks and these behavioral traits (herd mentality and overconfidence). The effect of overconfidence or herd behavior on portfolio returns and market efficiency may not be consistently exacerbated or diminished by a risk-taking tendency. Its moderating effect can be unpredictable or non-existent in certain situations due to the nature of risk-taking itself, which can differ amongst investors or situations. While risk-taking propensity may seem advantageous in certain situations, it cannot compensate for the negative effects of herd behavior and overconfidence on investment decisions and outcomes. Investor psychology, market conditions, and the interplay between risk-taking propensity and behavioral biases all contribute to the complex dynamics of portfolio returns and market efficiency. Effective risk management and diversification are crucial for investors seeking to optimize their returns while managing risk effectively.

7. Implications

To improve investment outcomes by taking into account psychological factors that influence decision-making, this study aimed to explore behavioral risk management in investment strategies. Because psychological biases in investors often lead them to deviate from rational behavior, it is crucial to understand these biases. Additionally, behavioral risk management techniques enhance risk assessment and further advance investor education and awareness.

The theoretical contribution of this study lies in its assessment of behavioral risk management in investment strategies by analyzing investors’ psychology. The integration of behavioral finance and psychology insights into conventional investment frameworks is a major theoretical contribution of this paper on behavioral risk management in investment strategies. By highlighting the psychological aspects that affect decision-making, this method adds to our understanding of investor behavior beyond the confines of conventional economic models. The recognition that emotional reactions and cognitive biases frequently impact investors’ decisions rather than just their logical calculations is a significant theoretical contribution. The aforementioned viewpoint casts doubt on the conventional notion of investor rationality and emphasizes the significance of integrating behavioral insights into risk mitigation tactics. Moreover, studies on behavioral finance have identified some cognitive biases that influence investing decisions, including loss aversion, herd behavior, and overconfidence. These discoveries aid in developing risk management frameworks that lessen the detrimental effects of these biases by fostering a more sophisticated understanding of investor behavior and market dynamics. Investment professionals can create strategies that better match the real behavior of investors by incorporating behavioral insights, which may enhance risk-adjusted returns and portfolio performance overall.

From a practical standpoint, this study offers a tangible strategy for optimizing behavioral risk management in investment strategies. This study makes several practical contributions. By offering frameworks and instruments that recognize and take into consideration the psychological elements influencing investor behavior, this paper on behavioral risk management in investment strategies makes a useful practical contribution. As a result, it improves risk management techniques, decision-making processes, and investment outcomes in volatile and dynamic market environments. Our research on behavioral risk management in investment strategies improves decision-making procedures and risk management techniques in investment practices by utilizing insights from behavioral finance and psychology. The ultimate aim of incorporating behavioral insights into investing procedures was to enhance long-term results. Through the alignment of strategies with investor behavior instead of what traditional models suggest should happen, practitioners may eventually achieve better risk-adjusted returns and higher levels of client satisfaction. Behavioral risk management promotes investor education and communication campaigns that are both successful. Practitioners can enable investors to make more logical decisions by increasing awareness of common biases and how they affect investment decisions. This may result in better long-term results and fewer hastily made decisions during volatile markets.

8. Conclusions and Limitations

Behavioral risk management in investment strategies requires a comprehensive understanding of investor psychology. By acknowledging the influences of risk propensity, herd behavior, and overconfidence, financial professionals can develop more effective strategies that align with the psychological realities of their clients, ultimately leading to improved investment outcomes and market efficiency. The analysis of behavioral risk management in investment strategies, particularly through the lens of investor psychology, reveals significant insights into how psychological factors influence investment decisions and outcomes. The examination of risk propensity, herd behavior, and overconfidence illustrates the complex interplay between these elements and their impact on portfolio returns and market efficiency. Prospect theory was used as a theoretical foundation to comprehend how people view risk and make decisions in the face of uncertainty. Partial least square structural equation modeling was adopted for the data analysis and processing. The study used respondents from Takoradi Technical University. In addition, a total sample size of 348 was used through the application of the convenience sampling technique. The findings of the study revealed that five of the proposed hypotheses were accepted while seven of them were not accepted.

The limitations of this study include our inability to generalize the findings due to the particular geographic area in which it was conducted, the need for future research to be conducted as an extension of the study, the need for comparative analysis with other contexts, our use of a cross-sectional survey despite research designs potentially yielding more insights, the inclusion of only the staff of Takoradi Technical University and exclusion of other technical university staff in Ghana, and the need for future studies to take into account a larger sample size than what was used in this study.

Author Contributions

Data curation, J.A.; formal analysis, Z.P.; investigation, J.C. and J.O.A.; methodology, J.C.; project administration, S.A.K.; resources, S.A.K., J.C. and Z.P.; software, J.A.; visualization, J.O.A.; Writing—original draft, S.A.K. and Z.P.; writing—review and editing, J.A. All authors have read and agreed to the published version of the manuscript.

Funding

The research received no external funding.

Institutional Review Board Statement

Based on the nature of this research project, which includes non-invasive, publicly available data, and comes with minimal risk, it is deemed to be exempt from the requirement of a full ethical review by the Ethics Review Committee of TTU. It does not necessitate formal ethical clearance for the following reason: The TAKORADI TECHNICAL UNIVERSITY REVIEW COMMITTEE, with reference number TTU/ERC/25/001, waived ethical approval for this study because our institution does not require ethics approval for reporting individual cases or case series.

Informed Consent Statement

Informed consent for participation was obtained from all subjects involved in the study.

Data Availability Statement

Data are available upon reasonable request. The authors will make the raw data supporting this article’s conclusions available upon request.

Acknowledgments

The paper is an outcome of the project NFP313011BWN6, “The implementation framework and business model of the Internet of Things, Industry 4.0 and smart transport”.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Abideen, Z. U. I., Ahmed, Z., Qiu, H., & Zhao, Y. (2023). Do behavioral biases affect investors’ investment decision making? Evidence from the pakistani equity market. Risks, 11, 109. [Google Scholar] [CrossRef]

- Ahmad, M., & Wu, Q. (2022). Does herding behavior matter in investment management and perceived market efficiency? Evidence from an emerging market. Management Decision, 60(8), 2148–2173. [Google Scholar] [CrossRef]

- Ah Mand, A., Janor, H., Abdul Rahim, R., & Sarmidi, T. (2023). Herding behavior and stock market conditions. PSU Research Review, 7(2), 105–116. [Google Scholar] [CrossRef]

- Alabdali, M. A., & Salam, M. A. (2022). The impact of digital transformation on supply chain procurement for creating competitive advantage: An empirical study. Sustainability, 14(19), 12269. [Google Scholar] [CrossRef]

- Ali, Z., & Tauni, M. Z. (2021). CEO overconfidence and future firm risk in China: The moderating role of institutional investors. Chinese Management Studies, 15(5), 1057–1084. [Google Scholar] [CrossRef]

- Aljifri, R. (2023). Investor psychology in the stock market: An empirical study of the impact of overconfidence on firm valuation. Borsa Istanbul Review, 23(1), 93–112. [Google Scholar] [CrossRef]

- Almansour, B. Y., Elkrghli, S., & Almansour, A. Y. (2023). Behavioral finance factors and investment decisions: A mediating role of risk perception. Cogent Economics & Finance, 11(2), 2239032. [Google Scholar]

- Alsabban, S., & Alarfaj, O. (2020). An empirical analysis of behavioral finance in the Saudi stock market: Evidence of overconfidence behavior. International Journal of Economics and Financial Issues, 10(1), 73. [Google Scholar] [CrossRef]

- Amoah, J., Jibril, A. B., Bankuoru Egala, S., & Keelson, S. A. (2022). Online brand community and consumer brand trust: Analysis from Czech millennials. Cogent Business & Management, 9(1), 2149152. [Google Scholar]

- Apochi, J. G., Ahmed, N. M., Okpanachi, J., & Agbi, S. E. (2024). Herding bias and financial risk tolerance on individual investment performance in Nigeria: Moderated by financial literacy. International Journal of Business and Management Review, 12(3), 1–17. [Google Scholar] [CrossRef]

- Areiqat, A. Y., Abu-Rumman, A., Al-Alani, Y. S., & Alhorani, A. (2019). Impact of behavioral finance on stock investment decisions applied study on a sample of investors at Amman stock exchange. Academy of Accounting and Financial Studies Journal, 23(2), 1–17. [Google Scholar]

- Bazley, W. J., Cronqvist, H., & Mormann, M. (2021). Visual Finance: The pervasive effects of red on investor behavior. Management Science, 67(9), 5616–5641. [Google Scholar] [CrossRef]

- Benischke, M. H., Martin, G. P., & Glaser, L. (2019). CEO equity risk bearing and strategic risk-taking: The moderating effect of CEO personality. Strategic Management Journal, 40(1), 153–177. [Google Scholar] [CrossRef]

- Bhanu, B. K. (2023). Behavioral finance and stock market anomalies: Exploring psychological factors influencing investment decisions. Commerce, Economics & Management, 23, 191–197. [Google Scholar]

- Bihari, A., Dash, M., Kar, S. K., Muduli, K., Kumar, A., & Luthra, S. (2022). Exploring behavioral bias affecting investment decision-making: A network cluster based conceptual analysis for future research. International Journal of Industrial Engineering and Operations Management, 4(1/2), 19–43. [Google Scholar] [CrossRef]

- Bikhchandani, S., Hirshleifer, D., Tamuz, O., & Welch, I. (2024). Information cascades and social learning. Journal of Economic Literature, 62(3), 1040–1093. [Google Scholar] [CrossRef]

- Bromiley, P., & Rau, D. (2022). Some problems in using prospect theory to explain strategic management issues. Academy of Management Perspectives, 36(1), 125–141. [Google Scholar] [CrossRef]

- Bruce, E., Shurong, Z., Egala, S. B., Amoah, J., Ying, D., Rui, H., & Lyu, T. (2022). Social media usage and SME firms’ sustainability: An introspective analysis from Ghana. Sustainability, 14(15), 9433. [Google Scholar] [CrossRef]

- Bucciol, A., & Miniaci, R. (2018). Financial risk propensity, business cycles, and perceived risk exposure. Oxford Bulletin of Economics and Statistics, 80(1), 160–183. [Google Scholar] [CrossRef]

- Chandrakala, M., & Ch, R. K. (2024). A study on behavioural finance investment decisions of investors in Bangalore. In Digital technology and changing roles in managerial and financial accounting: Theoretical knowledge and practical application (pp. 181–190). Emerald Publishing Limited. [Google Scholar]

- Chang, E. C., Cheng, J. W., & Khorana, A. (2000). An examination of herd behavior in equity markets: An international perspective. Journal of Banking & Finance, 24(10), 1651–1679. [Google Scholar]

- Cipriani, M., & Guarino, A. (2014). Estimating a structural model of herd behavior in financial markets. American Economic Review, 104(1), 224–251. [Google Scholar] [CrossRef]

- Coffie, M. R. (2013). The impact of social venture capital and social entrepreneurship on poverty reduction [Doctoral dissertation, Walden University]. [Google Scholar]

- Cont, R., & Bouchaud, J. P. (2000). Herd behavior and aggregate fluctuations in financial markets. Macroeconomic Dynamics, 4(2), 170–196. [Google Scholar] [CrossRef]

- Cordell, D. M., Smith, R., & Terry, A. (2011). Overconfidence in financial planners. Financial Services Review, 20(4). [Google Scholar]

- Curto, J. D., Falcão, P. F., & Braga, A. A. (2017). Herd behavior and market efficiency: Evidence from the Iberian stock exchanges. Journal of Advanced Studies in Finance, 8(2), 81–93. [Google Scholar]

- Dimson, E., & Mussavian, M. (2000). Market efficiency. The current state of business disciplines. Economics, 3(1), 959–970. [Google Scholar]

- Distor, J. M., Sanchez, A. M., Magturo, J., Corales, C., & Laxamana, J. J. (2023). Risk aversion and investment intentions of filipino investors: A moderation study. Diversitas Journal, 8(3), 2748–2761. [Google Scholar] [CrossRef]

- Drake, P. P., & Fabozzi, F. J. (2010). The basics of finance: An introduction to financial markets, business finance, and portfolio management (Vol. 192). John Wiley & Sons. [Google Scholar]

- Dumiter, F. C., Turcaș, F., Nicoară, Ș. A., Bențe, C., & Boiță, M. (2023). The impact of sentiment indices on the stock exchange—The connections between quantitative sentiment indicators, technical analysis, and stock market. Mathematics, 11(14), 3128. [Google Scholar] [CrossRef]

- Egala, S. B., Amoah, J., Bashiru Jibril, A., Opoku, R., & Bruce, E. (2024). Digital transformation in an emerging economy: Exploring organizational drivers. Cogent Social Sciences, 10(1), 2302217. [Google Scholar] [CrossRef]

- Elhussein, N. H. A., & Abdelgadir, J. N. A. (2020). Behavioral bias in individual investment decisions: Is it a common phenomenon in stock markets? International Journal of Financial Research, 11(6), 25. [Google Scholar] [CrossRef]

- Fornell, C., & Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18(1), 39–50. [Google Scholar] [CrossRef]

- Galariotis, E. C., Krokida, S. I., & Spyrou, S. I. (2016). The effect of liquidity on herding: A comparative study. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2720152 (accessed on 2 March 2025).

- GBenga, A. N. (2024). Business risk management ideology and entrepreneurial development of students in tertiary institutions in Southwestern, Nigeria. Journal of Technology Management and Business, 11(1), 32–48. [Google Scholar] [CrossRef]

- Grežo, M. (2021). Overconfidence and financial decision-making: A meta-analysis. Review of Behavioral Finance, 13(3), 276–296. [Google Scholar] [CrossRef]

- Gupta, S., Goyal, V., Kalakbandi, V. K., & Basu, S. (2018). Overconfidence, trading volume and liquidity effect in Asia’s Giants: Evidence from pre-, during-and post-global recession. Decision, 45(3), 235–257. [Google Scholar] [CrossRef]

- Haidari, M. N. (2023). Impact of decision-making on investment performance: A comprehensive analysis. Journal of Asian Development Studies, 12(4), 980–990. [Google Scholar] [CrossRef]

- Hair, J. F., Risher, J. J., Sarstedt, M., & Ringle, C. M. (2019). When to use and how to report the results of PLS-SEM. European Business Review, 31(1), 2–24. [Google Scholar] [CrossRef]

- Hair, J. F., Jr., Matthews, L. M., Matthews, R. L., & Sarstedt, M. (2017). PLS-SEM or CB-SEM: Updated guidelines on which method to use. International Journal of Multivariate Data Analysis, 1(2), 107–123. [Google Scholar] [CrossRef]

- Harrison, J. S., Thurgood, G. R., Boivie, S., & Pfarrer, M. D. (2019). Measuring CEO personality: Developing, validating, and testing a linguistic tool. Strategic Management Journal, 40(8), 1316–1330. [Google Scholar] [CrossRef]

- Haseeb, M., Hussain, H. I., Ślusarczyk, B., & Jermsittiparsert, K. (2019). Industry 4.0: A solution towards technology challenges of sustainable business performance. Social Sciences, 8(5), 154. [Google Scholar] [CrossRef]

- Henseler, J., Ringle, C. M., & Sarstedt, M. (2015). A new criterion for assessing discriminant validity in variance-based structural equation modeling. Journal of the Academy of Marketing Science, 43(1), 115–135. [Google Scholar] [CrossRef]

- Hiadlovský, V., Rybovičová, I., & Vinczeová, M. (2016). Importance of liquidity analysis in the process of financial management of companies operating in the tourism sector in Slovakia: An empirical study. International Journal for Quality Research, 10(4), 799–812. [Google Scholar]

- Hochrainer-Stigler, S., Bachner, G., Knittel, N., Poledna, S., Reiter, K., & Bosello, F. (2024). Risk management against indirect risks from disasters: A multi-model and participatory governance framework applied to flood risk in Austria. International Journal of Disaster Risk Reduction, 106, 104425. [Google Scholar] [CrossRef]

- Huck, N., Mavoori, H., & Mesly, O. (2020). The rationality of irrationality in times of financial crises. Economic Modelling, 89, 337–350. [Google Scholar] [CrossRef]

- Iriani, N., Agustianti, A., Sucianti, R., Rahman, A., & Putera, W. (2024). Understanding risk and uncertainty management: A qualitative inquiry into developing business strategies amidst global economic shifts, government policies, and market volatility. Golden Ratio of Finance Management, 4(2), 62–77. [Google Scholar] [CrossRef]

- Kahneman, D., & Tversky, A. (2013). Prospect theory: An analysis of decision under risk. In Handbook of the fundamentals of financial decision making: Part I (pp. 99–127). World Scientific. [Google Scholar]

- Kapoor, N. (2014). Financial portfolio management: Overview and decision making in the investment process. International Journal of Research (IJR), 1(10), 1362–1369. [Google Scholar]

- Kawakatsu, H., & Morey, M. R. (1999). Financial liberalization and stock market efficiency: An empirical examination of nine emerging market countries. Journal of Multinational Financial Management, 9(3–4), 353–371. [Google Scholar] [CrossRef]

- Khalil, N. B., Rabiai, S., Inariten, S., & Bakri, W. (2023). Herding behavior and investor’s sentiment: Evidence from the Chinese Stock Market. International Journal of Behavioural Accounting and Finance, 7(1), 55–85. [Google Scholar] [CrossRef]

- Khan, M. T. I., Tan, S. H., & Chong, L. L. (2019). Overconfidence mediates how perception of past portfolio returns affects investment behaviors. Journal of Asia-Pacific Business, 20(2), 140–161. [Google Scholar] [CrossRef]

- Komalasari, P. T., Asri, M., Purwanto, B. M., & Setiyono, B. (2022). Herding behavior in the capital market: What do we know and what is next? Management Review Quarterly, 72(3), 745–787. [Google Scholar]

- Lathief, J. T. A., Kumaravel, S. C., Velnadar, R., Vijayan, R. V., & Parayitam, S. (2024). Quantifying risk in investment decision-making. Journal of Risk and Financial Management, 17(2), 82. [Google Scholar]

- Lee, K.-T., Park, S.-J., & Kim, J.-H. (2023). Comparative analysis of managers’ perception in overseas construction project risks and cost overrun in actual cases: A perspective of the Republic of Korea. Journal of Asian Architecture and Building Engineering, 22(4), 2291–2308. [Google Scholar] [CrossRef]

- Lu, Y., Hu, J., & Gong, Y. (2023). Learning to be overconfident and underconfident. The Singapore Economic Review, 68(5), 1815–1827. [Google Scholar]

- Malik, L., Ullah, K., & Soomro, M. (2024). The impact of cognitive and emotional biases on individual investor’s investment decision: Mediating role of risk perception. Pakistan Journal of Humanities and Social Sciences, 12(3), 2651–2660. [Google Scholar] [CrossRef]

- Malmendier, U., & Tate, G. (2005). Does overconfidence affect corporate investment? CEO overconfidence measures revisited. European Financial Management, 11(5), 649–659. [Google Scholar] [CrossRef]

- Mittal, S. K. (2022). Behavior biases and investment decision: Theoretical and research framework. Qualitative Research in Financial Markets, 14(2), 213–228. [Google Scholar] [CrossRef]

- Muermann, A., Mitchell, O. S., & Volkman, J. M. (2006). Regret, portfolio choice, and guarantees in defined contribution schemes. Insurance: Mathematics and Economics, 39(2), 219–229. [Google Scholar] [CrossRef]

- Mulyani, E., Fitra, H., & Honesty, F. F. (2021). Investment decisions: The effect of risk perceptions and risk propensity for beginner investors in west sumatra. In Seventh padang international conference on economics education, economics, business and management, accounting and entrepreneurship (PICEEBA 2021) (pp. 49–55). Atlantis Press. [Google Scholar]

- Mungai, R. (2019). Using efficient market theory and behavioral finance theory to investigate the impact of investor confidence: Lessons from global financial crises. University of the Western Cape. [Google Scholar]

- Najafi Moghaddam, A., & Ramsheh, M. (2018). The moderating effect of firm value and liquidity on the relationship between managerial overconfidence and R and D. Petroleum Business Review, 2(3), 40–46. [Google Scholar]

- Ndlovu, G., & Stampanoni, M. (2024). Investigating the relationship between herding behaviour and liquidity in the johannesburg stock exchange. Preprint. [Google Scholar] [CrossRef]

- Ouarda, M., El Bouri, A., & Bernard, O. (2013). Herding behavior under markets condition: Empirical evidence on the European financial markets. International Journal of Economics and Financial Issues, 3(1), 214–228. [Google Scholar]

- Phan, T. N. T., Bertrand, P., Phan, H. H., & Vo, X. V. (2023). The role of investor behavior in emerging stock markets: Evidence from Vietnam. The Quarterly Review of Economics and Finance, 87, 367–376. [Google Scholar] [CrossRef]

- Podsakoff, P. M., MacKenzie, S. B., Lee, J. Y., & Podsakoff, N. P. (2003). Common method biases in behavioral research: A critical review of the literature and recommended remedies. Journal of Applied Psychology, 88(5), 879. [Google Scholar] [CrossRef]

- Polychronakis, N. (2023). Investment behavioural biases: Cognitive vs. emotional [Master’s thesis, Πανεπιστήμιο Πειραιώς]. [Google Scholar]

- Purwanto, A., & Sudargini, Y. (2021). Exploring factors affecting the purchase intention of halal food products: An empirical study on student consumers. International Journal of Social and Management Studies, 2(4), 13–21. [Google Scholar]

- Qureshi, F., Yusuf, M., Kamyab, H., Vo, D. V. N., Chelliapan, S., Joo, S. W., & Vasseghian, Y. (2022). Latest eco-friendly avenues on hydrogen production towards a circular bioeconomy: Currents challenges, innovative insights, and future perspectives. Renewable and Sustainable Energy Reviews, 168, 112916. [Google Scholar] [CrossRef]

- Ranaweera, S. S., & Kawshala, B. A. H. (2022). Influence of behavioral biases on investment decision making with moderating role of financial literacy and risk attitude: A study based on Colombo stock exchange. South Asian Journal of Finance, 2(1), 56–67. [Google Scholar] [CrossRef]

- Reilly, F. K. (2002). Investment analysis and portfolio management. 中信出版社. [Google Scholar]

- Riaz, T., & Iqbal, H. (2015). Impact of overconfidence, illusion of control, self-control and optimism bias on investors decision making; evidence from developing markets. Research Journal of Finance and Accounting, 6(11), 110–116. [Google Scholar]

- Rupande, L., Muguto, H. T., & Muzindutsi, P. F. (2019). Investor sentiment and stock return volatility: Evidence from the Johannesburg Stock Exchange. Cogent Economics & Finance, 7(1), 1600233. [Google Scholar]

- Saini, A., & Martin, K. D. (2009). Strategic risk-taking propensity: The role of ethical climate and marketing output control. Journal of Business Ethics, 90, 593–606. [Google Scholar] [CrossRef]

- Scott, S. G., & Bruce, R. A. (1994). Determinants of innovative behavior: A path model of individual innovation in the workplace. Academy of Management Journal, 37(3), 580–607. [Google Scholar] [CrossRef]

- Sekścińska, K., Rudzinska Wojciechowska, J., & Kusev, P. (2022). How decision-makers sense and state of power induce the propensity to take financial risks. Journal of Economic Psychology, 89, 1. [Google Scholar] [CrossRef]

- Shantha, K. V. A. (2019). The evolution of herd behavior: Will herding disappear over time? Studies in Economics and Finance, 36(4), 637–661. [Google Scholar] [CrossRef]

- Shleifer, A., & Vishny, R. W. (1997). The limits of arbitrage. Journal of Finance, 52(1), 35–55. [Google Scholar] [CrossRef]

- Shrader, R. C., Simon, M., & Stanton, S. (2021). Financial forecasting and risky decisions: An experimental study grounded in Prospect theory. International Entrepreneurship and Management Journal, 17, 1827–1841. [Google Scholar] [CrossRef]

- Sindhu, M. I. (2014). Relationship between free cash flow and dividend: Moderating role of firm size. Research Journal of Finance and Accounting, 5(5), 16–23. [Google Scholar]

- Singh, Y., Adil, M., & Haque, S. I. (2023). Personality traits and behaviour biases: The moderating role of risk-tolerance. Quality & Quantity, 57(4), 3549–3573. [Google Scholar]

- Tabachnick, B. G., & Fidell, L. S. (2007). Experimental designs using ANOVA (Vol. 724). Thomson/Brooks/Cole. [Google Scholar]

- Tehseen, S., Ramayah, T., & Sajilan, S. (2017). Testing and controlling for common method variance: A review of available methods. Journal of Management Sciences, 4(2), 142–168. [Google Scholar] [CrossRef]

- Tekçe, B., & Yılmaz, N. (2015). Are individual stock investors overconfident? Evidence from an emerging market. Journal of Behavioral and Experimental Finance, 5, 35–45. [Google Scholar] [CrossRef]

- Ul Abdin, S. Z., Qureshi, F., Iqbal, J., & Sultana, S. (2022). Overconfidence bias and investment performance: A mediating effect of risk propensity. Borsa Istanbul Review, 22(4), 780–793. [Google Scholar] [CrossRef]

- Ung, S. N., Gebka, B., & Anderson, D. J. (2024). An enhanced investor sentiment index. The European Journal of Finance, 30(8), 827–864. [Google Scholar] [CrossRef]

- VanderPal, G., & Brazie, R. (2022). Influence of basic human behaviors (influenced by brain architecture and function), and past traumatic events on investor behavior and financial bias. Journal of Accounting and Finance, 22(2), 33–53. [Google Scholar]

- Vo, L. T., Vo, N. V., Ngoc Pham, T., & Hien, N. N. (2023). The impact of historical performance and managerial risk-taking propensity on the behavior of choosing prospector strategy and using strategic management accounting information in Viet Nam manufacturer. SAGE Open, 13(4), 21582440231219360. [Google Scholar] [CrossRef]

- Wafula, D. S., Charles, Y. T., & Ondiek, A. B. (2023). The moderating role of fund size on the relationship between overconfidence and portfolio financial performance of mutual funds in Kenya. African Journal of Empirical Research, 4(1), 286–297. [Google Scholar] [CrossRef]

- Xia, Y., & Madni, G. R. (2024). Unleashing the behavioral factors affecting the decision-making of Chinese investors in stock markets. PLoS ONE, 19(2), e0298797. [Google Scholar] [CrossRef] [PubMed]

- Yapicioglu, B. (2023). Navigating turbulent environments: Exploring resilience in SMEs through complex adaptive systems perspective. Sugstainability, 15(11), 9118. [Google Scholar] [CrossRef]

- Zimon, G., Nakonieczny, J., Chudy-Laskowska, K., Wójcik-Jurkiewicz, M., & Kochański, K. (2021). An analysis of the financial liquidity management strategy in construction companies operating in the Podkarpackie Province. Risks, 10(1), 5. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).