Abstract

This paper principally aims at examining the impact of capital requirements regulation on bank operating efficiency in Tanzania. The study employs bank level data for the period between 2009 and 2015. The findings show a positive and significant relationship between capital ratio and bank operating efficiency. This shows that commercial banks in Tanzania with more stringent capital regulations are more operationally efficient. This relationship proposes that capital adequacy does not only strengthen financial stability by providing a larger capital cushion but also improves bank operating efficiency by preventing a moral hazard problem between shareholders and debt-holders. This result may also imply that the increased regulations on capital requirements influence the bank’s decision to revisit their internal operations strategy in terms of strong corporate governance, risk assessment methods, credit evaluation procedures, employment of more qualified staffs, and enhanced internal control procedures. Another key finding is an inverse relationship between non-performing Loans (credit risk) and bank operating efficiency. The implication of this relationship may simply mean that the bank’s total loan and advances in combination with total deposit either due from customers or from other banks are of little importance in determining the operational efficiency of banks. This probably implies that the amount of money banks loan out is too excessive, which would attract a greater chance of default. The paper lays down some recommendations: first, banks in Tanzania are advised to invest in more advanced technological innovations to reduce the staff costs and other operating expenses to increase their operational efficiency; and, second, bank management is also advised to be more careful in the loan screening process to reduce the incidence of non-performing loans.

JEL Classification:

G21; G28

1. Introduction

Traditionally, the core function of any commercial bank is the extension of loans and the larger proportion of banks’ assets is formed by loans (Fungacova et al. 2014). This function is well executed only when banks operate in a more efficient manner. The financial crisis of 2007/2008 was a wake-up call for banks globally, and particularly in Africa. The lesson learned from the recent financial crisis remind banks that bank performance and efficiency is a pre-requisite for some aspect of global economic development and financial stability such as credit supply (Fungacova et al. 2014). According to Fungacova et al. (2014), to promote a sound financial system, regulators require banks to hold sufficient amount of capital to absorb losses and limit moral hazard behavior.

Recently, bank supervisors, throughout Africa, and particularly Bank of Tanzania, called for banks to hold as buffer a specified level of capital to cushion for the portion of risk they take, and advise banks to sustain minimum regulatory capital levels to prevent the possibility of insolvency and stability of the banking system, as advocated by Berger et al. (1995) and Aggarwal and Jacques (2001). This regulatory pressure brings discipline to bank managers. Capital adequacy as an essential mechanism to protect banks’ solvency and profitability is among the riskiest businesses in the financial market. The reason for this is due to the presence of potential information asymmetry between banks and borrowers which may result in loan default. This consequently leads to bank losses and, therefore, banks are obliged to have adequate capital, not only to remain solvent, but also to avoid the failure of the financial system and remain efficient in their operations (Aggarwal and Jacques 2001).

Banks are said to be operational if they can provide quality banking services at the lowest possible cost of operation (Allen and Rai 1996). More specifically, operational efficiency might be achieved when banks use the right combination input while ensuring limiting cost of operation to the desired level (Athanasoglou et al. 2008). According to Athanasoglou et al. (2008), banks operate efficiently by issuing loans to the portfolio of its customers who are well vetted and approved to have the highest credit worthiness. Careful monitoring of borrowers after lending the money improves the banks operating efficiency because it reduces the possibility of default. Technical efficiency of banks, according to Athanasoglou et al. (2008), involve the following activities: the ability of banks to design innovative products such as loans to Small and Medium Enterprises to support economic development, ATMs fund transfer systems, etc.; participating in the insurance business through network of bank branches to expand through self-designed insurance products; avoiding too many bank branches and coming up with other innovative ways of boosting revenues to improve productivity; and strengthening corporate governance to bring financial stability and operational transparency in the banking system, which will improve public confidence and faith in banks.

Commercial banks are subjected to thorough supervision and regulation by an independent authority because the level of risks they incur is too high compared to other institutions, and they are the engine of financial stability and economic prosperity of any country (Llewellyn 1999). According to Llewellyn (1999), bank rules and guidelines help protect customers from exploitative prices and safeguard the banking industry against systemic risk. A proven method for creating bank financial stability is bank capital regulation. A fundamental influence of a capital adequacy requirement is the contribution of this prudential regulation on bank efficiency, as previously advocated by Fiordelisi and Marques-Ibanez (2013). Such prudential regulations are also thought to have downsides, raising concern on its implementation. For example, higher capital ratios might inflict trade-offs in terms of bank liquidity creation (Berger and Bouwman 2009), lending, and output growth (BCBS 2010).

The level of capital adequacy in Tanzania is determined by the Bank of Tanzania. To reinforce the banking sector and extend the financial sector. Bank of Tanzania set a higher minimum regulatory capital ratio than the one stated in Basel (I–III), which is 8% for total capital and 4.5% for tier-1 capital, and 6% for tier-2 capital. The Bank of Tanzania (BOT) issued Banking and Financial Institutions Act (BOT 2014) in August 2014, in replacement of Banking and Financial Institutions Act (BOT 2008) to develop and enforce the regulations governing the capital adequacy of Tanzanian banks. The objective of these efforts to prepare the bank regulations on capital adequacy, as prescribed in Banking and Financial Institutions Act (2014) Section 5, are: ensuring that banks and all other financial institutions maintain an adequate capital level which act as buffer against the operational risk they face as a result of their business; making sure that banks and other financial institutions comply with accepted international bank best practices; and encouraging and promoting public confidence in the banking sector in Tanzania.

There is debate on the effectiveness of capital regulatory pressure on bank efficiency worldwide. Theory offers contradicting views on the effect of capital ratios on bank performance and efficiency. Some scholars say that capital regulation has a positive impact on bank performance, while others say the regulation of bank capital negatively affects bank performance and efficiency. The scholars who advocate the positive relationship between bank capital regulation and performance include: Holmstrom and Tirole (1997), and Mehran and Thakor (2011). The believers of this view argue that, due to bank shareholders’ limited liability, reducing the capital ratio required of them increases their incentives to take on excessive risk and this behavior is strengthened by explicit or implicit government guarantees of deposits. Alternatively, a higher capital ratio reduces risk-shifting and increases shareholders’ incentive to control risk.

Another contrasting view is that of another group of scholars who advocate a negative relationship between bank capital regulation and performance. This group relies on agency theory, and argues that agency costs between managers and shareholders have a propensity to increase when capital ratios are higher due to the discipline imposed on manager behavior by debt repayment requirements (Calomiris and Kahn 1991). In their influential paper on impact of capital adequacy on bank efficiency, Berger and Bonaccorsi di Patti (2006), using the sample of US banking industry, found that lower capital ratios are linked with higher bank efficiency, while, using European banking industry sample, Fiordelisi and Marques-Ibanez (2013) found the opposite results. Establishing which effect is relevant in Tanzanian banks remains an empirical question that this study tries to answer.

This study contributes to the literature by analyzing the effect of bank regulatory pressure on operating efficiency in Tanzania. The Tanzanian case provides a unique framework to measure this relationship because the country has recently focused on transforming the way banks are regulated. This living example is the changes in the bank capital regulations which occurred in 1998, 2008 and 2014, when the Bank of Tanzania (BOT) issued Banking and Financial Institutions Act (BOT 2014), which parallel the requirements of Basel III. The study examines whether such an improvement in bank capital regulation is related to bank efficiency or it is just for compliance purpose.

This study is built on the Regulatory and Efficient Market-Monitoring Hypothesis first introduced by Fama (1980). This hypothesis postulates that bank regulators, e.g., Bank of Tanzania, promote banks to raise the level of their capital to counter the amount of risk they take, and this might be achieved via efficient market monitoring mechanisms that scale-up capital levels when the levels tend to come down. The hypothesis calls for a positive relationship between capital adequacy and bank operating efficiency, and the crucial factor tht influences this relationship has a direct link with the behaviors of bank regulators and supervisors. This paper adds value to the available literature in this area, as few papers are available in Tanzania regarding capital regulation in relations to bank operating efficiency. The results of the paper are also very useful to banks, especially during the recent period where the incidence of bad loans has been so extensive, in such a way that several banks have collapsed due to capital problem and Non-Performing Loans problem.

2. Related Literature

2.1. Theoretical Underpinnings

Studies on efficiency are guided by at least three theories: theory of economic efficiency, trade-off theory and the buffer theory. Among these theories, the buffer theory can best back up the foundation of this study. The theory of economic efficiency is the basic theory which can give light to our present study on bank efficiency, and the basis of this theory is the requirement that banks must render their banking services at the lowest possible cost (Aly et al. 1990). A bank is said to be technically efficient if it uses the same input quantity to get more output in comparison to other banks. This may be reflected in the annual profits they earn, as stipulated by Isik and Kabir (2002).

Another theory is the trade-off theory of capital structure which explains the level of leverage of the bank, that is whether the bank is financed by equity or debt. This theory insists that banks should do a cost–benefit analysis before deciding whether to use debt or equity in their capital structure. According to Niu (2008), the benefit of using debt in the capital structure is the tax-advantage it has over equity, and. therefore, the cost of debt is lower than cost of equity. When the cost of debt is low and the corporate tax rate is at the high enough that a firm benefits considerably from debt financing, it will employ additional debt as long as the marginal tax-rate on debt is lower than the corporate tax rate. Consequently, a firm needs to balance the tax benefits of debt and the cost related to leverage (Niu 2008).

The most related theory to this study is the buffer theory which postulates that banks with their capital marginally above the regulatory minimum ratios should always increase the capital ratio and cut risk to avoid compliance penalty by the regulator (Milne and Whiley 2001). According to Milne and Whalley (2001), buffer is a term used to show the excess capital held by the bank beyond the minimum requirement. This implies that banks are forced to raise the level of their capital ratio when coming close to the required minimum level. The view of Berger et al. (1995) is that banks may hold large capital to explore future unforeseen investment opportunities. According to Berger et al. (1995), banks can opt to have a capital buffer to reduce the likelihood of their capital dropping below the statutory requirement, mainly if the ratio is very unsteady.

Another possible reason for holding buffer capital is related to the level of risk of the bank’s total assets. According to Milne and Whalley (2001), compared to banks with lower portfolio risk, banks with a highly risky portfolio hold a higher level of buffer capital because their capital is likely to fall below the statutory minimum requirement. During financial crises, banks with small amount of capital may escalate systemic risk and hence hamper financial stability. Conversely, if banks have already complied with the regulatory minimum capital as well as have buffer capital, then any changes in capital requirements will have less impact on bank behavior.

Recently, the Bank of Tanzania had to increase the bank capital level to provide a buffer to commercial banks in Tanzania for them to absorb any unforeseen financial crises that might hit the banks and withstand any real shocks to improve the financial stability of the banking sector. On the other hand, higher capital levels help commercial banks protect themselves against the array of risks considering the requirements of International Financial Reporting Standard (IFRS), International Accounting Standards (IASs) and the International Standards of Auditing (ISAs), BOT (2016).

2.2. Empirical Review

Recently, particularly in the last decade, studies that scrutinize the relevance of bank capital regulations have increased exponentially. Some writers examined the effect of capita regulation on bank performance and found a positive relationship (Holmstrom and Tirole 1997; Mehran and Thakor 2011), while others such as Calomiris and Kahn (1991) found a negative relationship.

Other researchers examined the impact of capital regulations on productivity and linked the capital requirement ratios with productivity in several ways. Firstly, they argue that capital regulation may affect bank productivity through lending function. For example, Kopecky and VanHoose (2006) linked the influence of capital regulation with the quality and quantity of loan offered by banks. The authors further argued that, when a bank has regulatory capital requirements imposed for the first time, it faces the notable reduction of the loan book. However, afterwards, the quality of the loan book may either improve or worsen.

Thakor (1996) argued that, in the presence of severe competition in the banking industry, increasing in the minimum capital requirement ratios increases lending rates, and, therefore, diminishes bank profitability. In this situation, banks will always prefer to invest in government securities to avoid their capital to being held up.

According to Thakor (1996), the increased regulations on capital requirements force banks to revisit their internal operation strategies in terms of strong corporate governance, risk assessment methods, credit evaluation procedures, employment of more qualified staff, and enhanced internal control procedures. According to Thakor (1996), it is obvious that banks with more capital are financially able to explore profitable projects, expand operations and take on well estimated levels of risks, while those banks with limited capital refrain from investing large sums of money in lending activities, which is risky, and instead invest much of their money in less risky government securities. Therefore, capital adequacy is deemed to have a positive relationship with bank efficiency.

Supporting the rationale of increasing capital requirements, Das and Ghosh (2006) argued that banks with sufficient capital will be financially healthier and safer, and therefore credible credit risk management standards lead to improved efficiency. In their study on the impact of capital regulation on bank operating efficiency, Das and Ghosh (2006) found a positive significant relationship between bank capital ratio and operating efficiency.

Similarly, Pasiouras et al. (2009) in their study on the effect of bank capital regulation on bank stability found that an increase in the bank minimum capital requirement decreased bank financial stability. However, Pasiouras et al. (2009), using standard supervisory procedures used by the World Bank conducted research on the relationship between bank technical efficiency and capital requirement. The study found a positive relationship between technical efficiency and bank capital requirement.

Using USA bank sample and the Generalized Methods of Moments (GMM) estimation technique, Berger and Bonaccorsi di Patti (2006) studied the effect of bank regulations on profitability, and found that lower capital ratios increase the operating efficiency of banks. This result supports the notion that banks fear taking additional risks when they go beyond the minimum regulatory capital ratios.

Applying the capital regulatory index to examine the influence of capital requirements on commercial bank operating efficiency in 22 EU countries, Chortareas et al. (2012) found that increasing capital requirements improves operating efficiency of banks. Similarly, Färe et al. (2004) found a positive impact of capital regulations on bank operating efficiency. Closely related is the study by Altunbas et al. (2007) that examined the cross section of European banks, and found a negative relationship between bank capital requirements and bank operating efficiency.

In their global study of 72 countries on the influence of bank supervision, regulation and monitoring on operating efficiency, Barth et al. (2013) found that banks from countries with more strict capital requirements are more operationally efficient compared to those banks from countries with flexible bank capital regulations.

Using Kenyan commercial banks sample, Odunga (2016) studied the determinants of bank operating efficiency, and found bank capital adequacy as one of the most significant factors which affect bank operating efficiency. According to Odunga (2016), for banks to manage their operating cost, they need to increase their capital. Another study by Odunga (2016) on determinant of bank liquidity also found capital adequacy as the important determinant of liquidity, which means that banks with more capital are more operationally stable and can easily survive financial down turns.

3. Data and Methodology

3.1. Data Collection

The data for this study are collected by hand from the annual accounts of large commercial banks operating in Tanzania for the period between 2009 and 2015. These banks are sampled because they comprise the large part of the Tanzanian banking sector market share (about 80%). On the other hand, 2009–2015 is a period during which significant changes in bank capital regulations have taken place in Tanzania. The study employs panel data analysis where behaviors of all banks are analyzed across the entire period. Panel data allow us to control for variables that cannot be easily measured, e.g., different business practices across banks.

3.2. Model Specification

When a model is properly specified, it is believed that explanatory variables can explain a large part of what differentiate each observation in the dataset. However, even if the model is properly specified, there is some unobserved heterogeneity, which is usually left unmodeled and is often part of the error term (e1it). The actual problem transpires when some banks (or, less commonly, time periods) share some unmodeled heterogeneity. Usually, one would wish to set a model in such a way as to explain everything that makes each bank unique or different, but, in most cases, this is difficult, so some econometrics techniques have to be applied to reduce or remove the shared systematic heterogeneity from the error term. Since this study employs panel data, to solve the potential problem of heterogeneity, either a fixed effect or random effect regression model should be used.

Choosing between fixed or random effects, a Hausman test is employed. In Hausman test, the null hypothesis is that “the preferred model is random effects”, while its corresponding hypothesis is that the preferred model is fixed effects, as advocated by Greene (2008). The Hausman test shows whether the unique errors are correlated with the regressors; the null hypothesis is that they are not correlated. If the probability of chi squared in the Hausman test output is less than 0.05, fixed effects is preferred; otherwise, random effect is preferable. When this test was run, the probability for Chi-squared is found to be 0.0001, which is less than 0.05, as shown in Table 1, thus this study applies fixed-effect regression model.

Table 1.

Hausman Test Results.

The model:

where

OEFFit = b0 + b1* BSZit + b2* CARit + b3* NPLit + b4* LOANDEPt + b5* ROAit + e1it

OEFF is the operating expense over operating income. It refers to what occurs when the right combination of inputs such as staff, technology and process are used in production, while ensuring that costs are maintained at the desired level to improve productivity (Shawk 2008).

CAR is the capital adequacy ratio, which is measured as the ratio of quotient of total bank capital with total assets. This shows the strength of banks against the vagaries of economic and financial environment. The variable is adapted from Shawk (2008), Lotto (2016), and Berger and Bonaccorsi di Patti (2006).

BSZ is the size of the bank, which is measured as the natural logarithm of total assets of the bank. Size can show the economies of scale.

ROA is the profitability. It is the returns on assets of the bank measured by the ratio of the bank’s profits over the bank’s total assets. It generally shows the effectiveness of management in the utilization of the funds contributed by shareholders. The variable was also used by Lotto (2016).

NPL is non-performing loans. This is the ratio of the bad loans over bank total assets. This is an indicator of credit risk management. It shows how banks manage their credit risk, as it defines the proportion of loan losses amount in relation to total loan amount. This variable was also previously used by Lotto and Mwemezi (2016).

LOANDEP is the ratio of loans to deposits. The loan-to-deposit ratio is a measure of liquidity. Higher figures denote lower liquidity (Fiordelisi and Marques-Ibanez 2013).

e1it is the error term.

4. Empirical Results

4.1. Descriptive Statistics

Capital adequacy is an essential mechanism to protect bank solvency and profitability because banking is among the riskier businesses in the financial market. This might be due to the presence of potential information asymmetry between banks and borrowers that might result in loan default. This consequently leads to bank losses and, therefore, banks are obliged to have adequate capital, not only to remain solvent, but also to avoid the failure of the financial system. The level of capital adequacy in Tanzania is determined by the Bank of Tanzania. The Banking and Financial Institutions Act (2014) requires a bank or any financial institution, at any time, to maintain core capital of not less than 12.5% of its total risk-weighted assets and off-balance sheet exposure as well as total capital of not less than 14.5% of its total risk weighted assets and off-balance sheet exposure.

This section summarizes the descriptive statistics of the variables used in this paper. Descriptive statistics results in Table 2 show that, on average, all sampled banks have operating efficiency of 12%, measured as the ratio of bank expenses to bank revenues. Likewise, Table 2 shows that the minimum operating efficiency for the sample banks is 4.1%, while the maximum is 20.4%. The interpretation of bank operating efficiency of 12% is that, on average, the operating expenses of any bank in the sample of this study comprises only 12% of the total income of the bank. The operating efficiency measures the output of a bank in relation to its utilized input. The smaller is this ratio, the more profitable is the bank. If the ratio increases, it implies that bank’s expenses are increasing, which consequently decreases the bank’s profit. The ratio shows a clear view of how efficient the bank is operating.

Table 2.

Descriptive Statistics.

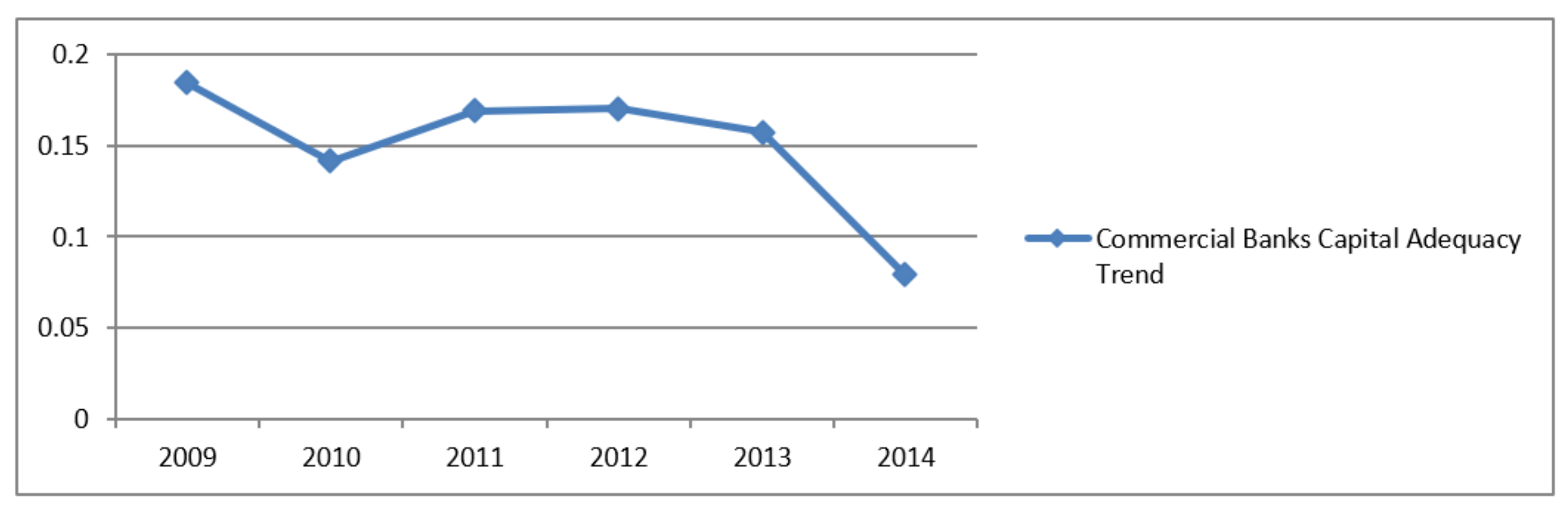

Table 2 shows that, on average, every bank in Tanzania holds a capital requirement of about 12.6%, a level well above the stipulated capital adequacy requirement in the Banking and Financial Institution Act (2014). The maximum level of capital adequacy reported in Table 2 is about 24%, while the minimum is 9%. Although Tanzanian commercial banks, on average, have a capital ratio above the requirement, most are financed by roughly 13% equity, showing that they rely more on long-term liabilities to finance their assets. The interesting finding is that even banks that do not comply with the minimum capital requirement set by BOT comply with the standard set by Basel (I–III), i.e., a minimum total capital ratio of 8%. The average capital adequacy ratio of Tanzanian commercial banks has had a decreasing trend since 2009: from around 18% in 2009 to around 7.5% in 2014 (Figure 1).

Figure 1.

Commercial Banks Capital Adequacy Trend.

Table 2 shows that bank non-performing loans ratio is between a minimum of 0% and a maximum of about 25%, with an average (mean) of around 7%. Large commercial banks in Tanzania have a reported average return on equity of about 2% with maximum of 5% and minimum of −2%, as shown in Table 2. Likewise, Table 2 shows that capital adequacy is an essential mechanism to protect bank solvency and profitability because banking is among the riskiest businesses in the financial market. Table 2 reports an average liquidity of about 48% with a minimum of roughly 18% and a maximum of 71%.

4.2. Regression Results

The fixed effect regression results presented in Table 3 show that bank capital regulation positively impacts the operating performance of Tanzanian banks. The results show that, for every increase in one unit of bank capital ratio, banks operating efficiency increases by 0.78. The results of the fixed effect regression also show a statistically significant positive relationship at 1% significant level. This shows that increased regulations on capital requirements influence a bank’s decision to change their internal operations strategy in terms of strong corporate governance, risk assessment methods, credit evaluation procedures, employment of more qualified staff, and enhanced internal control procedures, as previously suggested by Thakor (1996). It is also a common understanding that heavily capitalized banks are financially able to explore profitable projects, expand operations and take on well estimated levels of risks, while undercapitalized banks will always avoid investing large sums of money in lending activities that are risky, and instead invest much of their money into less risky government securities. Therefore, it follows that capital adequacy has a positive relationship with bank operating efficiency.

Table 3.

Fixed effect regression Results.

This study has similar results with that of Das and Ghosh (2006) who report a positive relationship between capital regulation and bank efficiency. They argued that banks that have sufficient capital will be financially healthier and safer regarding credit risk management standards. This ultimately improves the bank operating efficiency. Another study with similar results is that by Pasiouras et al. (2009) who studied the effect of bank capital regulation on bank stability. They found that an increase in the bank minimum capital requirement results decreased bank financial stability. However, another study Pasiouras et al. (2009), which used standard supervisory procedures adopted from the World Bank, found a positive relationship between bank technical efficiency and capital requirement.

Results in Table 3 show an inverse relationship between bank operating efficiency and credit risk (measured by total loans to total deposits ratio and by non-performing loans). The relationship between bank operating efficiency and total loan to total deposit is statistically significant at 5% significant level. Similarly, the same statistical significant level is also reported between bank operating efficiency and non-performing loans. The implication of the negative relationship between bank operating efficiency and total loans to total deposits might simply mean that a bank’s total loans and advances in combination with total deposits either from customers or from other banks are of little importance in determining the operational efficiency of banks. This probably implies that the amount of money banks loan out is excessive, thus attracts a greater chance of default. Another implication of this finding is that that the money taken by banks as demand deposits, saving deposits and time deposits is not well utilized to broaden the asset base of the banks, which ultimately hurts the operating efficiency of the banks. It is also understandable that deposits constitute a substantial proportion of banks resource and capital, hence the more deposits a bank can mobilize, the more capital they have to make available. The results are inconsistent with the findings of Karimzadeh (2012) who found a positive relationship.

5. Concluding Remarks and Recommendations

This study aims at examining the impact of capital requirements regulation on bank operating efficiency in Tanzania for the period between 2009 and 2015. The results show a positive and significant relationship between capital ratio and bank operating efficiency, implying that, the more stringent bank capital regulations are, the more operationally efficient commercial banks in Tanzania become. This positive relationship proposes that capital adequacy not only reinforces financial stability by providing a larger capital cushion but also improves bank operating efficiency by lowering moral hazard between shareholders and debt-holders. This study might also show that the increased regulations on capital requirements influence a bank’s decision to change their internal operations strategy in terms of strong corporate governance, risk assessment methods, credit evaluation procedures, employment of more qualified staff, and enhancing internal control procedures

Another finding is an inverse relationship between bank operating efficiency and credit risk (measured by total loans to total deposits ratio and by non-performing loans). The implication of the negative relationship between bank operating efficiency and total loans to total deposits ratio might mean that the bank’s total loan and advances and total deposits either from customers or from other banks are of little importance in determining the operational efficiency of banks. This probably implies that the amount of money banks loan out is excessive, thus attracting a greater chance of default. The banks are, therefore, advised to formulate a policy of scrutinizing a borrowers’ businesses extensively, and an evaluation process before issuing loans should be done seriously with senior loan officers. Bank management should also be more careful to work in close proximity with loan officers in the loan screening process to reduce the incidence of bad loans and consequent adverse effect total loans on operating efficiency as specified by Sealey and Lindley (1977).

While Tanzania banking sector has notable technological advancements such as electronic banking and other cashless services, it should invest in other advanced technological innovations to reduce staff costs and other operating expenses to increase their operational efficiency.

Conflicts of Interest

The author declares no conflict of interest.

References

- Aggarwal, Raj, and Kevin T. Jacques. 2001. The impact of FDICIA and prompt corrective action on bank capital and risk: Estimates using a simultaneous equations model. Journal of Banking and Finance 25: 1139–60. [Google Scholar] [CrossRef]

- Allen, Linda, and Anoop Rai. 1996. Operational Efficiency in Banking: An International Comparison. Journal of Banking & Finance 20: 655–72. [Google Scholar]

- Altunbas, Yener, Santiago Carbo, Edward P.M. Gardener, and Philip Molyneux. 2007. Examining the relationship between capital, risk and efficiency in European Banking. European Financial Management 13: 49–70. [Google Scholar] [CrossRef]

- Aly, Hassan Y., Richard Grabowski, Carl Pasurka, and Nanda Rangan. 1990. Technical, scale, and allocative efficiencies in US banking: An empirical investigation. The Review of Economics and Statistics 72: 211–18. [Google Scholar] [CrossRef]

- Athanasoglou, Panayiotis P., Sophocles N. Brissimis, and Matthaios D. Delis. 2008. Bank-specific, industry-specific and macroeconomic determinants of bank profitability. Journal of International Financial Markets, Institutions and Money 6: 1833–3850. [Google Scholar] [CrossRef]

- Barth, James R., Chen Lin, Yue Ma, Jesús Seade, and Frank M. Song. 2013. Do Bank Regulation, Supervision and Monitoring Enhance or Impede Bank Efficiency? Journal of Banking and Finance 37: 2879–92. [Google Scholar] [CrossRef]

- Guidance for National Authorities Operating the Countercyclical Capital Buffer. 2010. Basel: Bank for International Settlements Communications.

- Berger, Allen N., and Emilia Bo-naccorsi di Patti. 2006. Capital structure and performance in the US banking industry. European Financial Management 4: 49–70. [Google Scholar]

- Berger, Allen N., and Christa H.S. Bouwman. 2009. How does capital affect bank performance during financial crises? Journal of Financial Economics 109: 146–76. [Google Scholar] [CrossRef]

- Berger, Allen N., Richard J. Herring, and Giorgio P. Szegö. 1995. The role of capital in financial institutions. Wharton 19: 50–90. [Google Scholar] [CrossRef]

- Directorate of Banking Supervision. 2008, In The Banking and Financial Institutions (Licensing) Regulations. G.N. No. 150. Dar es Salaam: The Bank of Tanzania.

- Directorate of Banking Supervision. 2014, In The Banking and Financial Institutions (Licensing) Regulations. G.N. No. 297. Dar es Salaam: The Bank of Tanzania.

- Directorate of Banking Supervision. 2016, In Bank of Tanzania Annual Report. Dar es Salaam: The Bank of Tanzania.

- Calomiris, Charles W., and Charles M. Kahn. 1991. The role of demandable debt in structuring optimal banking arrangements. American Economic Review 81: 497–513. [Google Scholar]

- Chortareas Georgios E., Claudia Girardone, and Alexia Ventouri. 2012. Bank supervision, regulation, and efficiency: Evidence from the European Union. Journal of Financial Stability 8: 292–302. [Google Scholar] [CrossRef]

- Das, Abhimaan, and Saibal Ghosh. 2006. Financial deregulation and efficiency: An empirical analysis of Indian banks during the post reform period. Review of Financial Economics 15: 193–221. [Google Scholar] [CrossRef]

- Fama, Eugene F. 1980. Agency Problems and the Theory of the Firm. Journal of Political Economy 88: 288–307. [Google Scholar] [CrossRef]

- Färe, R., S. Grosskopf, and F. Hernandez-Sancho. 2004. Environmental Performance: An Index Number Approach. Resource and Energy Economics 26: 343–52. [Google Scholar] [CrossRef]

- Fiordelisi, Franco, and David Marques-Ibanez. 2013. Is bank default risk systematic? Journal of Banking and Finance 37: 2000–10. [Google Scholar] [CrossRef]

- Fungacova, Zuzana, Laura Solanko, and Laurent Weill. 2014. Does competition influence the bank lending channel in the Euro area? Journal of Banking and Finance 49: 356–66. [Google Scholar] [CrossRef]

- Greene, William H. 2008. Econometric Analysis, 6th ed. Upper Saddle River: Prentice Hall. [Google Scholar]

- Holmstrom, Bengt, and Jean Tirole. 1997. Financial intermediation, loan-able funds, and the real sector. Quantitative Journal of Economics 112: 663–91. [Google Scholar] [CrossRef]

- Isik, Ihsan, and M. Kabir Hassan. 2002. Technical, scale and allocative efficiencies of Turkish banking industry. Banking and Finance 26: 719–66. [Google Scholar] [CrossRef]

- Karimzadeh, Majid. 2012. Efficiency analysis by using Data Envelop Analysis Model: Evidence from Indian Banks. International Journal of Finance, Economics and Science 2: 228–37. [Google Scholar]

- Kopecky, Kenneth J., and David VanHoose. 2006. Capital regulation, heterogeneous monitoring costs and aggregate loan quality. Banking and Finance 6: 2235–55. [Google Scholar] [CrossRef]

- Llewellyn, David. 1999. The technical efficiency of large bank production. Journal of Banking and Finance 4: 495–509. [Google Scholar]

- Lotto, Josephat. 2016. Efficiency of Capital Adequacy Requirements in Reducing Risk-Taking Behavior of Tanzanian Commercial Banks. Research Journal of Finance and Accounting 7: 21. [Google Scholar]

- Lotto, Josephat, and Justus Mwemezi. 2016. Assessing the Determinants of Bank Liquidity with an Experience from Tanzanian Banks. The African Journal of Finance and Management 23: 76–88. [Google Scholar]

- Mehran, Hamid, and Anjan Thakor. 2011. Bank capital and value in the cross-section. Review of Financial Studies 24: 1019–67. [Google Scholar] [CrossRef]

- Milne, Alistair, and A. Elizabeth Wiley. 2001. Bank Capital Regulation and Incentives for Risk—Taking (December 2001). Cass Business School Research Paper. Available at SSRN: https://ssrn.com/abstract=299319 or http://dx.doi.org/10.2139/ssrn.299319.

- Niu, Xiaoyan. 2008. Theoretical and practical review of capital structure and its determinants. International Journal of Business and Management 13: 801–60. [Google Scholar] [CrossRef][Green Version]

- Odunga, Robert M. 2016. Specific performance indicators, market share and operating efficiency for commercial banks in Kenya. International Journal of Finance and Accounting 8: 135–45. [Google Scholar]

- Pasiouras, Fotios, Sailesh Tanna, and Constantin Zopounidis. 2009. The impact of banking regulation on banks cost and profit efficiency: Cross-country evidence. International Review of Financial Analysis 6: 294–302. [Google Scholar] [CrossRef]

- Sealey, Calvin W., and James T. Lindley. 1977. Inputs, Outputs, and Theory of Production Cost at Depository Financial Institutions. Journal of Finance 32: 1251–66. [Google Scholar] [CrossRef]

- Operational Efficiency a Brand Point Management Perspective. 2008. Available online: http://www.schawk.com (accessed on 23 May 2017).

- Thakor, Anjan V. 1996. Capital requirements monetary policy and aggregate bank lending: Theory and empirical evidence. The journal of American Finance Association 51: 279–324. [Google Scholar] [CrossRef]

© 2018 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).