Investor Sentiment and Herding Behavior in the Korean Stock Market

Abstract

:1. Introduction

2. Literature Review

3. Data and Methodology

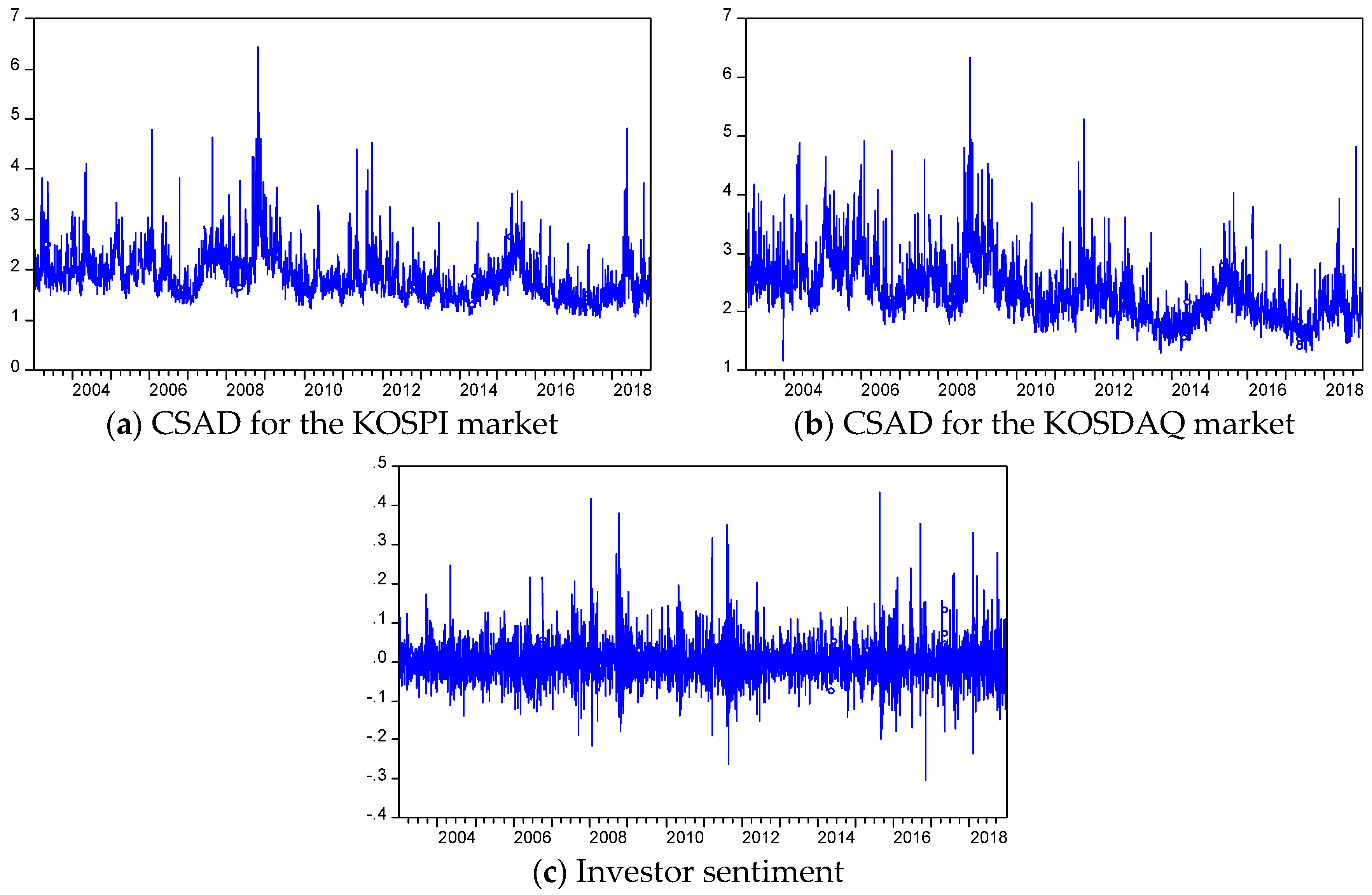

3.1. Data

3.2. Methodology

3.2.1. Herding Behavior

3.2.2. Quantile Regression of Herding Behavior

3.2.3. Herding Behavior and Investor Sentiment

4. Empirical Results

4.1. Empirical Results Regarding Herding Behaviour

4.2. Empirical Results of Herding Behaviour and Investor Sentiment

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Admati, Anat R., and Paul Pfleiderer. 1997. Does it all add up? Benchmarks and the compensation of active portfolio managers. Journal of Business 70: 323–50. [Google Scholar] [CrossRef] [Green Version]

- Banerjee, Abhijit V. 1992. A simple model of herd behavior. Quarterly Journal of Economics 107: 797–817. [Google Scholar] [CrossRef] [Green Version]

- Barnes, Michelle L., and Anthony W. Hughes. 2002. A Quantile Regression Analysis of the cross Section of Stock Market Returns. Working Paper. Federal Reserve Bank of Boston. Available online: https://ssrn.com/abstract=458522 (accessed on 18 December 2019).

- Bikhchandani, Sushil, and Sunil Sharma. 2001. Herd behavior in financial markets. IMF Staff Papers 47: 279–310. [Google Scholar]

- Bikhchandani, Sushil, David Hirshleifer, and Ivo Welch. 1992. A theory of fads, fashion, custom, and cultural change as informational cascades. Journal of Political Economy 100: 992–1026. [Google Scholar] [CrossRef]

- Blasco, Natividad, Pilar Corredor, and Sandra Ferreruela. 2012. Market sentiment: A key factor of investors’ imitative behavior. Accounting & Finance 52: 663–89. [Google Scholar]

- Buchinsky, Moshe. 1998. Recent advances in quantile regression models: A practical guideline for empirical research. Journal of Human Resources 33: 88–126. [Google Scholar] [CrossRef]

- Chang, Eric C., Joseph. W. Cheng, and Ajay Khorana. 2000. An examination of herd behavior in equity markets: An international perspective. Journal of Banking & Finance 24: 1651–79. [Google Scholar]

- Chiang, Thomas C., and Dazhi Zheng. 2010. An empirical analysis of herd behavior in global stock markets. Journal of Banking & Finance 34: 1911–21. [Google Scholar]

- Chiang, Thomas C., Jiandong Li, and Lim Tan. 2010. Empirical investigation of herding behavior in Chinese stock markets: Evidence from quantile regression analysis. Global Finance Journal 21: 111–24. [Google Scholar] [CrossRef]

- Christie, William G., and Roger D. Huang. 1995. Following the pied piper: Do individual returns herd around the market? Financial Analysts Journal 51: 31–37. [Google Scholar] [CrossRef]

- Clements, Adam, Stan Hurn, and Shuping Shi. 2017. An empirical investigation of herding in the US stock market. Economic Modelling 67: 184–92. [Google Scholar] [CrossRef] [Green Version]

- De Long, Bradford J., Andrei Shleifer, Lawrence H. Summers, and Robert J. Waldmann. 1990. Positive feedback investment strategies and destabilizing rational speculation. Journal of Finance 45: 374–97. [Google Scholar] [CrossRef] [Green Version]

- Economou, Fotini, Christis Hassapis, and Nikolaos Philippas. 2018. Investors’ fear and herding in the stock market. Applied Economics 50: 3654–63. [Google Scholar] [CrossRef]

- Economou, Fotini, Konstantinos Gavriilidis, Abhinav Goyal, and Vasileios Kallinterakis. 2015. Herding dynamics in exchange groups: Evidence from Euronext. Journal of International Financial Markets, Institutions and Money 34: 228–44. [Google Scholar] [CrossRef]

- Froot, Kenneth A., David S. Scharfstein, and Jeremy C. Stein. 1992. Herd on the street: Informational inefficiencies in a market with short-term speculation. Journal of Finance 47: 1461–84. [Google Scholar] [CrossRef]

- Galariotis, Emilios C., Wu Rong, and Spyros I. Spyrou. 2015. Herding on fundamental information: A comparative study. Journal of Banking & Finance 50: 589–98. [Google Scholar]

- Gavriilidis, Konstantinos, Vasileios Kallinterakis, and Ioannis Tsalavoutas. 2016. Investor mood, herding and the Ramadan effect. Journal of Economic Behavior & Organization 132: 23–38. [Google Scholar]

- Gębka, Bartosz, and Mark E. Wohar. 2013. International herding: Does it differ across sectors? Journal of International Financial Markets, Institutions and Money 23: 55–84. [Google Scholar] [CrossRef]

- Grinblatt, Mark, Sheridan Titman, and Russ Wermers. 1995. Momentum investment strategies, portfolio performance, and herding: A study of mutual fund behavior. The American Economic Review 85: 1088–105. [Google Scholar]

- Hwang, Soosung, and Mark Salmon. 2004. Market stress and herding. Journal of Empirical Finance 11: 585–616. [Google Scholar] [CrossRef] [Green Version]

- Hwang, Soosung, and Mark Salmon. 2009. Sentiment and Beta Herding; Working Paper. SSRN. Available online: http://ssrn.com/abstract,299919 (accessed on 20 December 2019).

- Koenker, Roger, and Gilbert Bassett Jr. 1978. Regression quantiles. Econometrica 46: 33–50. [Google Scholar] [CrossRef]

- Laih, Yih-Wenn, and Yung-Shi Liau. 2013. Herding behavior during the subprime mortgage crisis: Evidence from six Asia-Pacific stock markets. International Journal of Economics and Finance 5: 71–84. [Google Scholar] [CrossRef] [Green Version]

- Lakonishok, Josef, Andrei Shleifer, and Robert W. Vishny. 1992. The impact of institutional trading on stock prices. Journal of Financial Economics 32: 23–43. [Google Scholar] [CrossRef] [Green Version]

- Lam, Keith. S. K., and Zhuo Qiao. 2015. Herding and fundamental factors: The Hong Kong experience. Pacific-Basin Finance Journal 32: 160–88. [Google Scholar] [CrossRef]

- Lao, Paulo, and Harminder Singh. 2011. Herding behaviour in the Chinese and Indian stock markets. Journal of Asian Economics 22: 495–506. [Google Scholar] [CrossRef]

- Liao, Tsai-Ling, Chih-Jen Huang, and Chieh-Yuan Wu. 2011. Do fund managers herd to counter investor sentiment? Journal of Business Research 64: 207–12. [Google Scholar] [CrossRef]

- Pochea, Maria-Miruna, Angela-Maria Filip, and Andreea-Maria Pece. 2017. Herding behavior in CEE stock markets under asymmetric conditions: A quantile regression analysis. Journal of Behavioral Finance 18: 400–16. [Google Scholar] [CrossRef]

- Prendergast, Canice, and Lars Stole. 1996. Impetuous Youngsters and Jaded Old-Timers: Acquiring a reputation for learning. Journal of Political Economy 104: 1105–34. [Google Scholar] [CrossRef]

- Roll, Richard. 1992. A mean/variance analysis of tracking error. Journal of Portfolio Management 18: 13–23. [Google Scholar] [CrossRef]

- Scharfstein, David. S., and Jeremy. C. Stein. 1990. Herd behavior and investment. American Economic Review 80: 465–79. [Google Scholar]

- Smales, Lee A. 2017. The importance of fear: Investor sentiment and stock market returns. Applied Economics 49: 3395–421. [Google Scholar] [CrossRef]

- Tan, Lin, Thomas C. Chiang, Joseph R. Mason, and Edward Nelling. 2008. Herding behavior in Chinese stock markets: An examination of A and B shares. Pacific-Basin Finance Journal 16: 61–77. [Google Scholar] [CrossRef]

- Trueman, Brett. 1994. Analyst forecasts and herding behavior. Review of Financial Studies 7: 97–124. [Google Scholar] [CrossRef]

- Vieira, Elisabete F. Simoes, and Marcia S. Valente Pereira. 2015. Herding behaviour and sentiment: Evidence in a small European market. Revista de Contabilidad 18: 78–86. [Google Scholar] [CrossRef] [Green Version]

- Yao, Juan, Chuanchan Ma, and William Peng He. 2014. Investor herding behaviour of Chinese stock market. International Review of Economics & Finance 29: 12–29. [Google Scholar]

- Yousaf, Imran, Shoaib Ali, and Syed Zulfiqar Ali Shah. 2018. Herding behavior in Ramadan and financial crises: The case of the Pakistani stock market. Financial Innovation 4: 1–16. [Google Scholar] [CrossRef]

| Panel A: Descriptive Statistics | ||||||||

| Mean | Max | Min | Std. D. | Ske. | Kur. | J-B | N | |

| KOSPI | 1.8688 | 6.4392 | 1.0418 | 0.4817 | 2.0591 | 11.7608 | 15454.6 *** | 3958 |

| KOSDAQ | 2.3479 | 6.3245 | 1.1678 | 0.5364 | 1.3677 | 6.8118 | 3630.1 *** | 3958 |

| Sent | −0.0002 | 0.4344 | −0.3027 | 0.0536 | 1.1027 | 9.7720 | 8239.4 *** | 3958 |

| Panel B: Unit Root Test | ||||||||

| ADF (1) | ADF (2) | PP (1) | PP (2) | |||||

| KOSPI | −7.3493 *** | −9.6390 *** | −43.8588 *** | −47.0165 *** | ||||

| KOSDAQ | −7.0294 *** | −8.9427 *** | −38.7360 *** | −45.5168 *** | ||||

| Sent | −30.4317 *** | −30.4316 *** | −71.8796 *** | −71.9138 *** | ||||

| KOSPI | KOSDAQ | |

|---|---|---|

| 1.5864 (0.0090) *** | 2.0744 (0.0112) *** | |

| 0.3960 (0.0126) *** | 0.3155 (0.0134) *** | |

| −0.0028 (0.0021) | −0.0017 (0.0020) | |

| 0.4404 | 0.3357 |

| KOSPI | KOSDAQ | |

|---|---|---|

| 0.1598 (0.0091) *** | 2.0811 (0.0113) *** | |

| 0.4160 (0.0142) *** | 0.3585 (0.0150) *** | |

| 0.3702 (0.0164) *** | 0.2665 (0.0184) *** | |

| −0.0053 (0.0024) ** | −0.0065 (0.0022) *** | |

| −0.0009 (0.0039) | 0.0001 (0.0044) | |

| 0.4417 | 0.3424 |

| KOSPI | KOSDAQ | |

|---|---|---|

| 1.5962 (0.0092) *** | 2.0756 (0.0111) *** | |

| 0.3060 (0.0186) *** | 0.2451 (0.0157) *** | |

| 0.4497 (0.0143) *** | 0.3884 (0.0159) *** | |

| 0.0147 (0.0054) *** | 0.0080 (0.0026) *** | |

| −0.0100 (0.0023) *** | −0.0124 (0.0026) *** | |

| 0.4501 | 0.3478 |

| KOSPI | KOSDAQ | |

|---|---|---|

| 1.5741 (0.0097) *** | 2.0647 (0.0139) *** | |

| 0.4343 (0.0210) *** | 0.3185 (0.0356) *** | |

| 0.3544 (0.0128) *** | 0.2837 (0.0141) *** | |

| 0.0327 (0.0065) *** | 0.0494 (0.0166) *** | |

| 0.0003 (0.0022) | 0.0022 (0.0021) | |

| 0.4633 | 0.3461 |

| Panel A: Returns up and down | ||||||

| Quantile () | 1.2322 *** (0.0131) | 0.3494 *** (0.0205) | 0.3000 *** (0.0268) | −0.0028* (0.0016) | −0.0039 (0.0024) | 0.1465 |

| Quantile () | 1.4071 *** (0.0198) | 0.3668 *** (0.0198) | 0.3344 *** (0.0268) | 0.0009 (0.0037) | −0.0001 (0.0090) | 0.1735 |

| Quantile () | 1.5587 *** (0.0144) | 0.3776 *** (0.0256) | 0.3337 *** (0.0483) | 0.0013 (0.0049) | 0.0120 (0.0207) | 0.1987 |

| Quantile () | 1.7406 *** (0.0255) | 0.4158 *** (0.0335) | 0.2937 ** (0.1225) | −0.0049 (0.0048) | 0.0273 (0.0699) | 0.2300 |

| Quantile () | 2.0347 *** (0.0239) | 0.4827 *** (0.0411) | 0.2035 *** (0.0787) | −0.0105* (0.0061) | 0.1110 *** (0.0337) | 0.2999 |

| Panel B: Trading volume high and low | ||||||

| Quantile () | 1.2400 *** (0.0116) | 0.2575 *** (0.0218) | 0.3456 *** (0.0187) | 0.0246 *** (0.0030) | −0.0084 *** (0.0018) | 0.1485 |

| Quantile () | 1.4115 *** (0.0095) | 0.2821 *** (0.0167) | 0.3896 *** (0.0201) | 0.0183 *** (0.0027) | −0.0051* (0.0029) | 0.1775 |

| Quantile () | 1.5637 *** (0.0116) | 0.2835 *** (0.0272) | 0.4148 *** (0.0242) | 0.0232 ** (0.0094) | −0.0059 (0.0048) | 0.2036 |

| Quantile () | 1.7345 *** (0.0135) | 0.2841 *** (0.0325) | 0.4618 *** (0.0270) | 0.0218* (0.0124) | −0.0106 ** (0.0053) | 0.2348 |

| Quantile () | 2.0150 *** (0.0185) | 0.3031 *** (0.0434) | 0.5523 *** (0.0408) | 0.0275 ** (0.0128) | −0.0192 *** (0.0063) | 0.3006 |

| Panel C: Volatility high and low | ||||||

| Quantile () | 1.2254 *** (0.0127) | 0.3388 *** (0.0257) | 0.3111 *** (0.0191) | 0.0230 *** (0.0038) | 0.0004 (0.0015) | 0.1496 |

| Quantile () | 1.3990 *** (0.0151) | 0.3660 *** (0.0313) | 0.3146 *** (0.0541) | 0.0479 *** (0.0044) | 0.0059 (0.0203) | 0.1839 |

| Quantile () | 1.5342 *** (0.0110) | 0.4317 *** (0.0230) | 0.3237 *** (0.0176) | 0.0360 *** (0.0038) | 0.0093 *** (0.0034) | 0.2150 |

| Quantile () | 1.7190 *** (0.0196) | 0.3919 *** (0.0550) | 0.3062 *** (0.0582) | 0.0683 *** (0.0234) | 0.0135 (0.0194) | 0.2465 |

| Quantile () | 2.0095 *** (0.0392) | 0.4319 * (0.2284) | 0.3173 *** (0.0638) | 0.0641 (0.1510) | 0.0154 (0.0145) | 0.3090 |

| Panel A: Returns up and down | ||||||

| Quantile () | 1.5987 *** (0.0149) | 0.3178 *** (0.0198) | 0.2234 *** (0.0232) | −0.0040 ** (0.0020) | −0.0032 (0.0020) | 0.1142 |

| Quantile () | 1.8756 *** (0.0413) | 0.3137 *** (0.0171) | 0.1662 *** (0.0267) | −0.0027* (0.0016) | 0.0203 *** (0.0064) | 0.1273 |

| Quantile () | 2.0527 *** (0.0136) | 0.3629 *** (0.0217) | 0.2323 *** (0.0287) | −0.0086 *** (0.0020) | 0.0076 *** (0.0078) | 0.1542 |

| Quantile () | 2.2577 *** (0.0284) | 0.3829 *** (0.0336) | 0.2401 ** (0.1200) | −0.0079 (0.0052) | 0.0131 (0.0624) | 0.1828 |

| Quantile () | 2.6006 *** (0.0318) | 0.4184 *** (0.0349) | 0.2664 ** (0.1200) | −0.0137 *** (0.0047) | 0.0317 (0.0541) | 0.2475 |

| Panel B: Volume high and low | ||||||

| Quantile () | 1.5890 *** (0.0197) | 0.2224 *** (0.0247) | 0.3319 *** (0.0574) | 0.0073 *** (0.0020) | −0.0114 (0.0207) | 0.1126 |

| Quantile () | 1.8657 *** (0.0133) | 0.2078 *** (0.0196) | 0.3085 *** (0.0183) | 0.0105 *** (0.0027) | −0.0021 (0.0027) | 0.1229 |

| Quantile () | 2.0434 *** (0.0210) | 0.2535 *** (0.0711) | 0.3612 *** (0.0303) | 0.0060 (0.0249) | −0.0091 ** (0.0037) | 0.1516 |

| Quantile () | 2.2470 *** (0.0193) | 0.2554 *** (0.0514) | 0.4032 *** (0.0281) | 0.0089 (0.0184) | −0.0102 ** (0.0041) | 0.1858 |

| Quantile () | 2.5931 *** (0.0221) | 0.2330 *** (0.0578) | 0.4910 *** (0.0317) | 0.0190 (0.0173) | −0.0245 *** (0.0047) | 0.2584 |

| Panel C: Market volatility high and low | ||||||

| Quantile () | 1.5887 *** (0.0192) | 0.2481 *** (0.0520) | 0.2330 *** (0.0202) | 0.0366 (0.0247) | 0.0060 *** (0.0016) | 0.1090 |

| Quantile () | 1.8575 *** (0.0200) | 0.2695 *** (0.0621) | 0.2502 *** (0.0230) | 0.0256 (0.0344) | 0.0054 (0.0039) | 0.1201 |

| Quantile () | 2.0383 *** (0.0169) | 0.2931 *** (0.0468) | 0.2758 *** (0.0296) | 0.0402 (0.0254) | 0.0031 (0.0073) | 0.1503 |

| Quantile () | 2.2214 *** (0.0218) | 0.3734 *** (0.0748) | 0.3069 *** (0.0240) | 0.0418 (0.0459) | 0.0022 (0.0035) | 0.1844 |

| Quantile () | 2.5680 *** (0.0294) | 0.3862 *** (0.0717) | 0.2956 *** (0.0866) | 0.1060 *** (0.0179) | 0.0119 (0.0248) | 0.2571 |

| KOSPI | KOSDAQ | |

|---|---|---|

| 1.5866 (0.0193) *** | 2.0766 (0.0212) *** | |

| 0.3958 (0.0308) *** | 0.3147 (0.0226) *** | |

| −0.0029 (0.0045) | −0.0025 (0.0029) | |

| 0.0255 (0.1246) | 0.4568 (0.1333) *** | |

| 0.4404 | 0.3377 |

| Panel A: KOSPI | |||||

| Quantile () | 1.2338 *** (0.0119) | 0.3221 *** (0.0183) | -0.0007 (0.0014) | 0.2520 ** (0.1170) | 0.1443 |

| Quantile () | 1.4063 *** (0.0102) | 0.3479 *** (0.0179) | 0.0023 (0.0040) | 0.1534 (0.1329) | 0.1729 |

| Quantile () | 1.5557 *** (0.0107) | 0.3596 *** (0.0187) | 0.0039 (0.0041) | -0.0393 (0.1638) | 0.1982 |

| Quantile () | 1.7286 *** (0.0225) | 0.3740 *** (0.0624) | 0.0040 (0.0236) | 0.3318* (0.1846) | 0.2279 |

| Quantile () | 2.0105 *** (0.0296) | 0.4302 *** (0.0900) | 0.0025 (0.0327) | -0.3558 (0.3888) | 0.2910 |

| Panel B: KOSDAQ | |||||

| Quantile () | 1.5906 *** (0.0141) | 0.2633 *** (0.0177) | 0.0029* (0.0015) | 0.5309 *** (0.1443) | 0.1081 |

| Quantile () | 1.8640 *** (0.0129) | 0.2612 *** (0.0148) | 0.0011 (0.0014) | 0.7259 *** (0.1376) | 0.1221 |

| Quantile () | 2.0463 *** (0.0116) | 0.3036 *** (0.0136) | -0.0035 ** (0.0016) | 0.4598 *** (0.1684) | 0.1488 |

| Quantile () | 2.2449 *** (0.0165) | 0.3362 *** (0.0259) | -0.0021 (0.0051) | 0.5547 ** (0.2641) | 0.1794 |

| Quantile () | 2.5863 *** (0.0295) | 0.3736 *** (0.0655) | -0.0051 (0.0181) | 0.3007 (0.2607) | 0.2453 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Choi, K.-H.; Yoon, S.-M. Investor Sentiment and Herding Behavior in the Korean Stock Market. Int. J. Financial Stud. 2020, 8, 34. https://doi.org/10.3390/ijfs8020034

Choi K-H, Yoon S-M. Investor Sentiment and Herding Behavior in the Korean Stock Market. International Journal of Financial Studies. 2020; 8(2):34. https://doi.org/10.3390/ijfs8020034

Chicago/Turabian StyleChoi, Ki-Hong, and Seong-Min Yoon. 2020. "Investor Sentiment and Herding Behavior in the Korean Stock Market" International Journal of Financial Studies 8, no. 2: 34. https://doi.org/10.3390/ijfs8020034

APA StyleChoi, K.-H., & Yoon, S.-M. (2020). Investor Sentiment and Herding Behavior in the Korean Stock Market. International Journal of Financial Studies, 8(2), 34. https://doi.org/10.3390/ijfs8020034