Compensations of Top Executives and M&A Behaviors: An Empirical Study of Listed Companies

Abstract

:1. Introduction

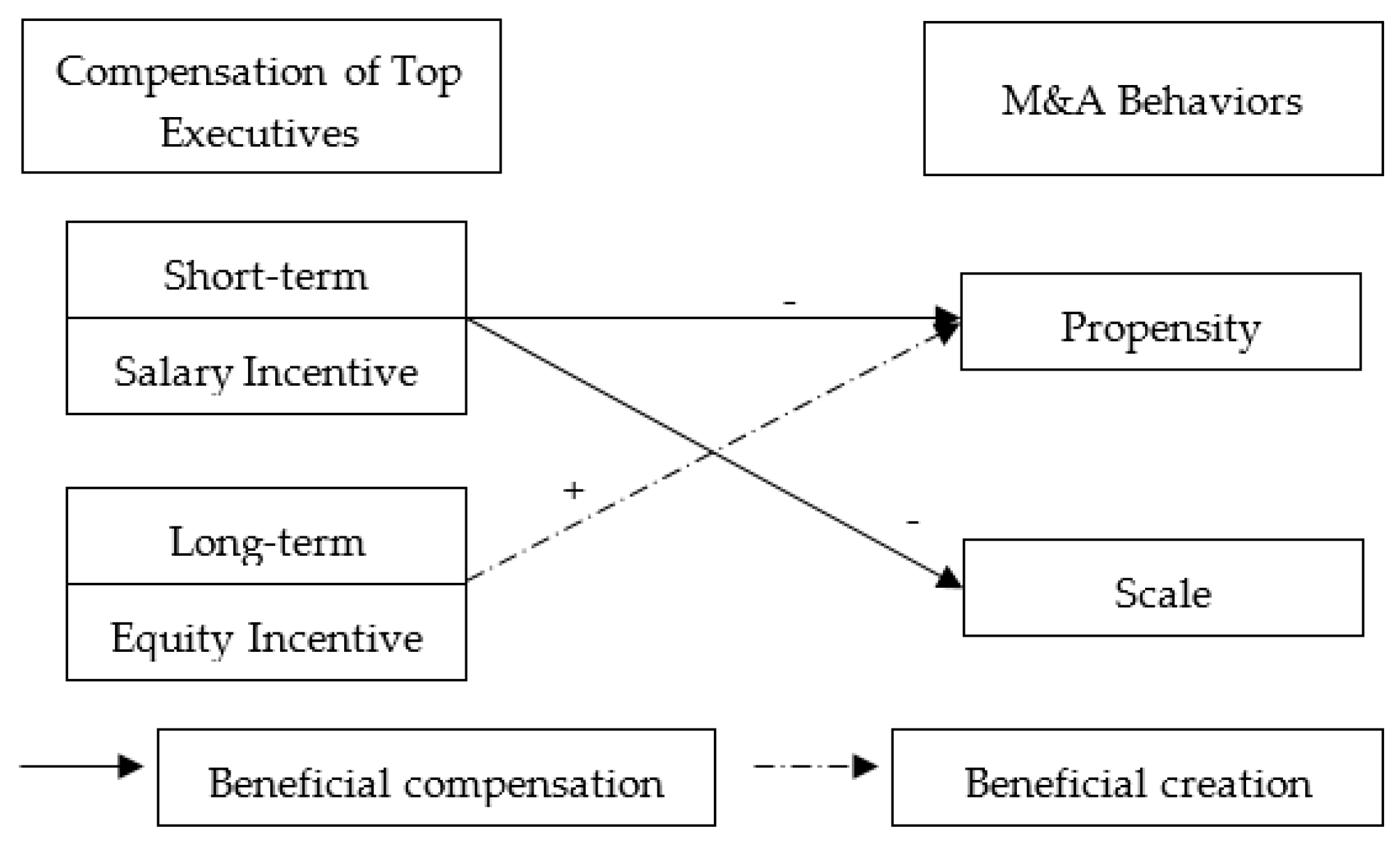

2. Theoretical Analysis and Hypothesis

2.1. Salary-Based Executive Incentives and Corporate M&A

2.2. Equity-Based Executive Incentives and Corporate M&A

3. Data and Summary Statistic

3.1. Sample Selection and Data Sources

3.2. Variable Selection and Definition

3.3. Econometric MODEL

4. Empirical Analysis and Results

4.1. Descriptive Statistics and Correlation Analysis Results for the Variables

4.2. The Influence of Executive Incentives on M&A Propensity

4.3. Influence of Executive Incentives on the Scale of M&A

4.4. Robustness Test

5. Discussion

5.1. Results Analysis

5.2. Implications

5.3. Limitations and Future Research

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Abudy, Menachem Meni, M. Dan Amiram, Odded Rozenbaum, and Efrat Shust. 2020. Do executive compensation contracts maximize firm value? Indications from a quasi-natural experiment. Journal of Banking & Finance 144: 105787. [Google Scholar]

- Agyei-Boapeah, Henry, Collins G. Ntim, and Samuel Fosu. 2019. Governance structures and the compensation of powerful corporate leaders in financial firms during M&As. Journal of International Accounting, Auditing and Taxation 37: 100285. [Google Scholar]

- Amewu, Godfred, and Paul Alagidede. 2019. Mergers and executive compensation changes: Evidence from African markets. Research in International Business and Finance 48: 397–419. [Google Scholar] [CrossRef]

- Brzozowski, Jan, Marco Cucculelli, and Valentina Peruzzi. 2018. Firms’ proactiveness during the crisis: Evidence from European data. Entrepreneurship Research Journal 9: 1–14. [Google Scholar] [CrossRef]

- Bizjak, John M., Michael L. Lemmom, and Lalitha Naveen. 2008. Does the use of peer groups contribution to higher pay and less effectient compensation? Journal of Financial Economics 90: 152–68. [Google Scholar] [CrossRef]

- Chapple, Larelle, Brandon Chen, Tahir Suleman, and Thu Phuong Truong. 2020. Stock trading behavior and firm performance: Do CEO equity-based compensation and block ownership matter? Pacific-Basin Finance Journal, 101129. [Google Scholar]

- Cael, R. Chen, Weiyu Guo, and Vivek Mande. 2003. Managerial ownership and firm valuation: Evidence from Japanese firms. Pacific-Basin Finance Journal 11: 267–83. [Google Scholar]

- Chu, Yongqiang, Ming Liu, Tao Ma, and Xinming Li. 2020. Executive compensation and corporate risk-taking: Evidence from private loan contracts. Journal of Corporate Finance 64: 201683. [Google Scholar] [CrossRef]

- Demsetz, Harold, and Belén Villalonga. 2001. Ownership structure and corporate performance. Journal of Corporate Finance 7: 209–33. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Michael C. Jensen. 1983. Separation of ownership and control. Journal of Law and Economics 26: 301–25. [Google Scholar] [CrossRef]

- Faulkender, Michael, and Jun Yang. 2010. Inside the black box: The role and composition of compensation peer groups. Journal of Financial Economics 96: 257–70. [Google Scholar] [CrossRef]

- Firth, Michael. 1980. Takeover, shareholder return, and the theory of the firm. The Quarterly Journal of Economics 94: 235–60. [Google Scholar] [CrossRef]

- Gabaix, Xavier, and Augustin Landier. 2008. Why has CEO pay increased so much? Quarterly Journal of Economics 123: 49–100. [Google Scholar] [CrossRef] [Green Version]

- Grinstein, Yaniv, and Paul Hribar. 2004. CEO compensation and incentives: Evidence from M&A bonuses. Journal of Financial Economics 73: 119–43. [Google Scholar]

- Harford, Jarrad, and Kai Li. 2007. Decoupling CEO wealth and firm performance: The case of acquiring CEOs. Journal of Finance 62: 917–49. [Google Scholar] [CrossRef]

- Heckman, James J. 1979. Sample selection bias as a specification error. Econometrica 47: 153–61. [Google Scholar] [CrossRef]

- Himmelberg, Charles P., R. Glenn Hubbard, and Darius Palia. 1999. Understanding the determinants of managerial ownership and the link between ownership and performance. Journal of Financial Economics, 353–84. [Google Scholar] [CrossRef] [Green Version]

- Jiang, Fu Xiu, Gregory R. Stone, Jian Fei Sun, and Min Zhang. 2011. Managerial hubris, firm expansion and firm performance: Evidence from China. Fuel & Energy Abstracts 48: 489–99. [Google Scholar]

- Jensen, Michael C., and William H. Meckling. 1976. Theory of the firm: Managerial behavior, agency costs, and ownership structure. Journal of Financial Economics 3: 305–60. [Google Scholar] [CrossRef]

- Jensen, Michael C., and Kevin J. Murphy. 1990. Performance pay and top-management incentives. The Journal of Political Economy 98: 225–64. [Google Scholar] [CrossRef]

- Jensen, Michael C. 1986. Agency costs of free cash flow, corporate finance, and takeovers. American Economic Review, 323–29. [Google Scholar]

- Kole, Stacey R. 1995. Measuring managerial equity ownership: A comparison of ownership data. Journal of Corporate Finance, 413–35. [Google Scholar]

- Meng, Xiao Hua, Sai Xing Zeng, Chi MingTam, and Xiao Dong Xu. 2013. Whether top executives’ turnover influences environmental responsibility: From the perspective of environmental information disclosure. Journal of Business Ethics 114: 341–53. [Google Scholar]

- Shleifer, Andrei, and Robert W. Vishny. 1990. The takeover wave of the 1980s. Journal of Applied Corporate Finance 249: 745–49. [Google Scholar]

- Shyam-Sunder, L. 1999. Testing Static Tradeoff against Pecking Order Models of Capital Structure. Journal of Financial Economics 51: 219–44. [Google Scholar]

- Tang, Chia-Hsien, Yen-Hsien Lee, Ming-Chih Lee, and Ya-Ling Huang. 2020. CEO Characteristics Enhancing the Impact of CEO Overconfidence on Firm Value After Mergers and Acquisitions—A Case Study in China. Review of Pacific Basin Financial Markets and Policies 23: 2050003. [Google Scholar]

- Wadhwa, Anu, and Suresh Kotha. 2006. Knowledge creation through external venturing: Evidence from the telecommunications equipment manufacturing industry. Academy of Management Journal 49: 819–35. [Google Scholar]

- Zhou, Bing, Shantanu Dutta, and Pengcheng Zhu. 2020. CEO tenure and mergers and acquisitions. Finance Research Letters 34: 101277. [Google Scholar]

| 1 | Per the regulations of the CSRC and individual stock exchanges, M&A of listed corporations are subject to a series of administrative or internal procedures from the disclosure of information to completion. The procedures can become even more complicated if the M&A involve major asset reorganization, stock issuance, asset purchase, or reorganization of state-owned assets. |

| Variable | Code | Measuring Method |

|---|---|---|

| Data year | YEAR | The year 2011is used as the base period for two dummy variables. |

| Industry | FIN | Per the Guidelines for the Industry Classification of Listed Companies (2012) issued by CSRC, the agricultural, forestry, husbandry, and fishery industries (type A) are used as the base period for 16 dummy variables. The financial (type J) and education (type P) industries are excluded. |

| Firm size | FS | The year-end total assets are used as the proxy variable, LN (unit: million RMB), for corporation size. |

| Firm age | FA | Ln (from time established to 2016). |

| Innovation performance | IPOR | Number of patent applications per million RMB. |

| Second offerings | SEOS | Number of follow-on offerings in the past 5 years, including public issuances and nonpublic issuances. |

| Refinancing demands | REFD | The cash-flow gap is used as the proxy variable for the standardization of total assets at the end of year (Shyam-Sunder and Myers 1999). Cash-flow gap = increase in long-term investment + increase in fixed asset investment + increase in working capital + dividends − cash flow from operating activities + financing expenses. |

| (a) Panel A Regional Distribution of Samples | |||||

| Region | No. | % | Region | No. | % |

| Anhui | 120 | 4.2 | Liaoning | 66 | 2.3 |

| Beijing | 262 | 9.2 | Inner Mongolia | 12 | 0.4 |

| Fujian | 102 | 3.6 | Ningxia | 6 | 0.2 |

| Gansu | 18 | 0.6 | Qinghai | 6 | 0.2 |

| Guangdong | 518 | 18.1 | Shandong | 198 | 6.9 |

| Guangxi | 15 | 0.5 | Shanxi | 30 | 1.1 |

| Guizhou | 15 | 0.5 | Shannxi | 42 | 1.5 |

| Hainan | 21 | 0.7 | Shanghai | 174 | 6.1 |

| Hebei | 42 | 1.5 | Sichuan | 102 | 3.6 |

| Henan | 114 | 4.0 | Tianjin | 27 | 0.9 |

| Heilongjiang | 12 | 0.4 | Tibet | 12 | 0.4 |

| Hubei | 93 | 3.3 | Xinjiang | 18 | 0.6 |

| Hunan | 89 | 3.1 | Yunnan | 30 | 1.1 |

| Jilin | 33 | 1.2 | Zhejiang | 297 | 10.4 |

| Jiangsu | 300 | 10.5 | Chongqing | 32 | 1.1 |

| Jiangxi | 48 | 1.7 | Total | 2856 | 100.0 |

| (b) Panel B Ownership Distribution of Samples | |||||

| Ownership | No. | % | |||

| State-owned | 827 | 28.86% | |||

| 97 | 3.38% | ||||

| Private | 1909 | 66.61% | |||

| others | 23 | 0.80% | |||

| total | 2866 | 1 | |||

| (c) Panel C Year and Industry Distribution of Samples | |||||

| Year | 2011 | 2012 | 2013 | ||

| Industry | No. (%) | No. (%) | No. (%) | ||

| farming, forestry, husbandry and fishing (A) | 17 (1.7) | 15 (1.6) | 15 (1.6) | ||

| Mining (B) | 23 (2.4) | 20 (2.1) | 21 (2.2) | ||

| Manufacturing (C) | 649 (68.2) | 663 (69.6) | 662 (69.5) | ||

| Electricity/heat/gas water production and supply (D) | 17 (1.7) | 18 (1.9) | 19 (2) | ||

| Construction (E) | 20 (2) | 25 (2.6) | 25 (2.6) | ||

| Wholesale and retail (F) | 40 (4.2) | 37 (3.9) | 38 (4) | ||

| Transportation, storage, and post (G) | 27 (2.8) | 26 (2.7) | 26 (2.7) | ||

| Accommodation and catering (H) | 5 (0.5) | 5 (0.5) | 5 (0.5) | ||

| Information transmission/software and information technology services (I) | 77 (8) | 68 (7) | 68 (7) | ||

| Real estate (K) | 36 (3.7) | 39 (4.1) | 35 (3.7) | ||

| Rental and business services (L) | 9 (0.9) | 6 (0.6) | 7 (0.7) | ||

| Scientific Research and Technology Services (M) | 6 (0.6) | 6 (0.6) | 6 (0.6) | ||

| water conservancy/environment and public facilities management (N) | 3(0.3) | 12 (1.3) | 12 (1.3) | ||

| Residential services, repairs and other services (O) | 7 (0.7) | 0 (0) | 0 (0) | ||

| Health and social affairs (Q) | 2 (0.2) | 2 (0.2) | 2 (0.2) | ||

| Culture, sports and entertainment (R) | 8 (0.8) | 8 (0.8) | 8 (0.8) | ||

| Others (S) | 6 (0.6) | 2 (0.2) | 3 (0.3) | ||

| MAE | CE | FS | FA | IPOR | REFD | SEOS | TMTST | TMTSA | |

|---|---|---|---|---|---|---|---|---|---|

| CE | 0.463 ** | 1 | |||||||

| FS | −0.018 | −0.017 | 1 | ||||||

| FA | −0.005 | −0.007 | .008 | 1 | |||||

| IPOR | −0.030 | −0.054 ** | −0.069 ** | −0.142 ** | 1 | ||||

| REFD | −0.018 | −0.078 ** | 0.097 ** | 0.076 ** | −0.102 ** | 1 | |||

| SEOS | 0.032 | 0.078 ** | 0.088 ** | 0.236 ** | −0.119 ** | 0.181 ** | 1 | ||

| TMTST | −0.016 | −0.008 | −0.136 ** | −0.311 ** | 0.214 ** | −0.214 ** | −0.273 ** | 1 | |

| TMTSA | −0.038 * | 0.004 | 0.222 ** | 0.108 ** | −0.089 ** | −0.144 ** | 0.166 ** | −0.221 ** | 1 |

| Mean | 0.025 | 0.080 | 11567 | 2.397 | 0.008 | 0.179 | 0.320 | 0.206 | 3.188 |

| S. D. | 0.143 | 0.279 | 57489 | 0.512 | 0.016 | 0.159 | 0.591 | 0.243 | 0.608 |

| Model 1 | Model 2 | Model 3 | Model 4 | |

|---|---|---|---|---|

| Control variables | ||||

| YEAR | Include | Include | Include | Include |

| IND | Include | Include | Include | Include |

| FS | 0.000 | 0.000 | 0.000 | 0.000 |

| FA | −0.248 ** | −0.227 *** | −0.232 ** | −0.221 *** |

| IPOR | −9.147 * | −8.446 * | −8.423 * | −8.487 * |

| REFD | −0.954 ** | −1.194 *** | −1.370 *** | −1.420 *** |

| SEOS | 0.314 *** | 0.280 *** | 0.259 *** | 0.284 *** |

| Predictor variables | ||||

| TMTSA | −0.189 * | −0.230 ** | ||

| TMTST | 0.388 + | 0.172 + | ||

| Model Indices | Wald = 79.17 *** | Wald = 87.19 *** | Wald = 80.31 *** | Wald = 101.72 *** |

| Obs | 2823 | 2823 | 2823 | 2823 |

| Model 5 | Model 6 | Model 7 | Model 8 | |

|---|---|---|---|---|

| Control variables | ||||

| YEAR | Include | Include | Include | Include |

| IND | Include | Include | Include | Include |

| FS | 0.000 | 0.000 | 0.000 | 0.000 |

| FA | −0.028 | −0.144 | −0.026 | −0.197 |

| IPOR | −1.650 * | −0.433 | −1.334 * | −0.203 |

| REFD | −0.077 | −0.068 | −0.070 | −0.040 * |

| SEOS | 0.055 | 0.074 | 0.057 | 0.008 |

| Predictor Variables | ||||

| TMTSA | −0.015 ** | −0.016 *** | ||

| TMTST | −0.011 | −0.014 | ||

| Model Indices | Wald = 61.80 *** | Wald = 67.86 *** | Wald = 57.33 *** | Wald = 55.38 *** |

| Obs | 2854 | 2854 | 2854 | 2854 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xue, J.; Fan, H.; Dong, Z. Compensations of Top Executives and M&A Behaviors: An Empirical Study of Listed Companies. Int. J. Financial Stud. 2020, 8, 64. https://doi.org/10.3390/ijfs8040064

Xue J, Fan H, Dong Z. Compensations of Top Executives and M&A Behaviors: An Empirical Study of Listed Companies. International Journal of Financial Studies. 2020; 8(4):64. https://doi.org/10.3390/ijfs8040064

Chicago/Turabian StyleXue, Jiao, Heng Fan, and Zhanxun Dong. 2020. "Compensations of Top Executives and M&A Behaviors: An Empirical Study of Listed Companies" International Journal of Financial Studies 8, no. 4: 64. https://doi.org/10.3390/ijfs8040064