In this context, the purpose of this research is to estimate the short- and long-term impacts of FDI on Peruvian economic growth, considering exports as a non-missing variable. Our variables present annual time series data for the period 1970–2020. We previously obtained the integration order of the series through the Dickey–Fuller unit root test. Additionally, the Granger causality test allowed us to find a feedback causality relationship and a unidirectional causality relationship between the series. In our ARDL (4,1,3) model, using the Pesaran–Shin–Smith cointegration test, we detected the presence of a long-term equilibrium relationship between the research variables that also define our error correction model (ECM).

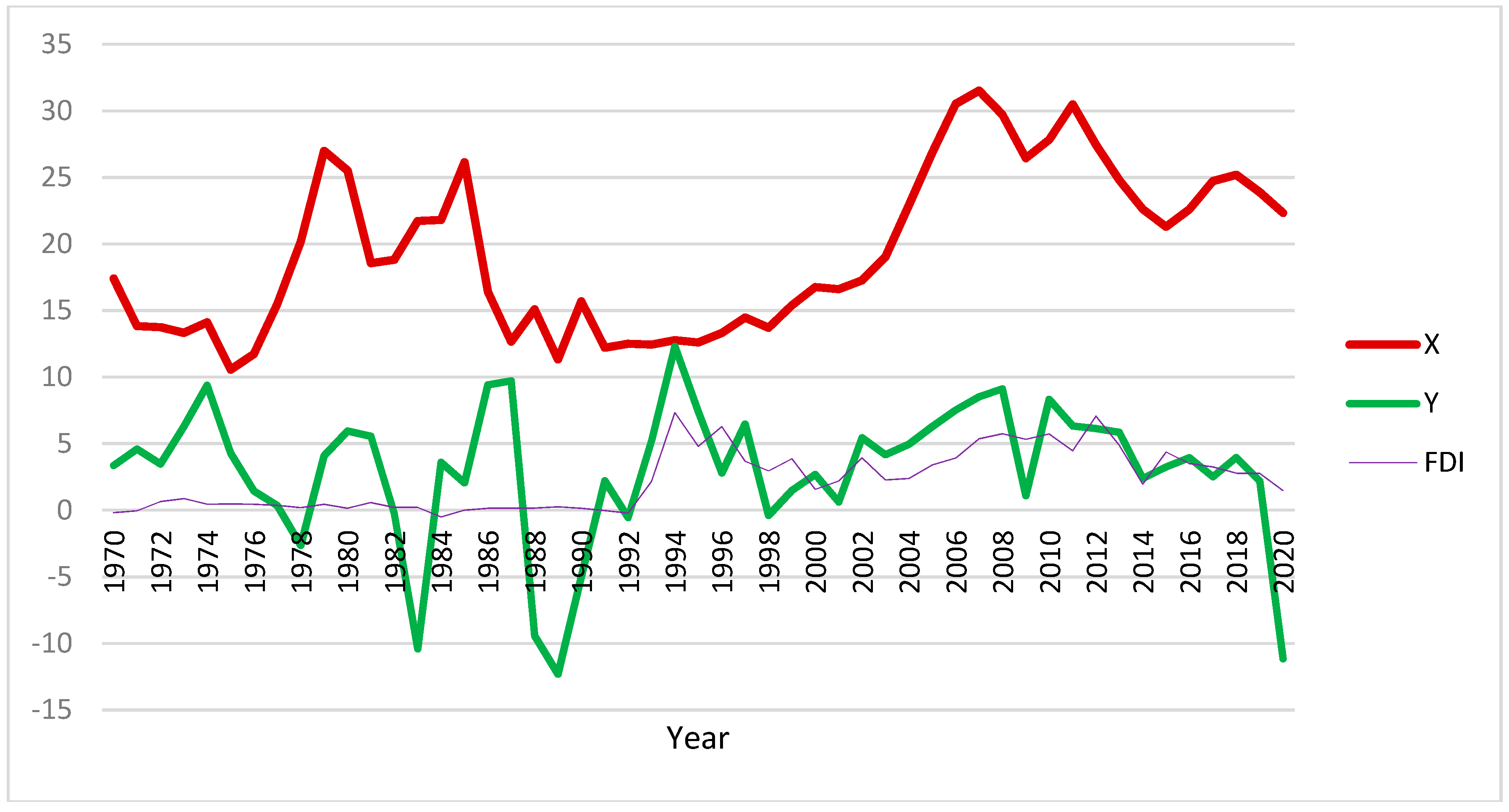

Table 1 shows the amazing evolution in the dynamics of economic growth in Peru. The percentage change of real GDP (thousands of millions, constant 2015 prices) between the average of the 1970s and 1980s was 22.02%, as the first effects produced by the agricultural reform of the 1980s were realized. The 1990s was 6.31%, manifested by economic and social problems such as hyperinflation, poverty, and terrorism. The 1990s and 2000s was 50.42% in response to countercyclical economic measures, such as currency denomination change, sale of public companies, and granting of concessions. The 2000s and 2010s, including 2020, was 70.68% as a result of the promotion of private investment, increasing commodities prices, and, as explained by

Bazán et al. (

2022), an increase in public expenditures. The most adverse percentage change in FDI net inflows (percentage of GDP) occurred between the average of the 1970s and 1980s, −62.26%, due to the interest in continuing with the nationalization of private companies, such as the banking system, causing the flight of foreign capital. Additionally, the delay of pending payments from the national oil company to private oil companies (

Central Reserve Bank of Peru 1990) caused a lower flow of fuel in the country, which was one of the factors causing inflation. The most notable percentage change occurred between the average of the 1980s and 1990s, with a value of 2123.23% as a result of foreign investment in public companies that attracted a greater amount of capital (

Central Reserve Bank of Peru 1995). Since the 2000s, the FDI has increased at decreasing rates due to political problems, causing a decrease in loans from parent companies to subsidiaries (

Central Reserve Bank of Peru 2015,

2020). The percentage change average of exports from 1970 to 1995 had the same trend as FDI, while the period 1996–2020 had the same trend as GDP.

1.1. Foreign Direct Investment and Economic Growth

From the perspective of the neoclassical economic growth theory (

Solow 1956), an exogenous increase in FDI would generate a temporary rise in the level of capital per capita and GDP without affecting the long-term growth rate. The impact of FDI on the long-term economic growth rate can only occur through technological developments or labor force growth (both considered exogenous variables in the neoclassical model) (

Belloumi 2014). According to

Tanaya and Suyanto (

2022), from the neoclassical growth perspective, FDI can only boost economic growth if it leads to technological progress over the long term. From the endogenous growth perspective (

Romer 1986,

1993;

Lucas 1988;

Barro 1990), it is deduced that FDI is a significant component of technology transfer and spill-over (

Yao 2006).

In the empirical literature, there are numerous papers analyzing the relationship between FDI and economic growth. Some of them have found evidence of positive impacts of FDI on economic growth, whereas others have found opposite results. As cited by

Zhang (

2001),

Abbes et al. (

2015), and

Sarker and Khan (

2020), the modeling results between FDI and GDP series propose the following hypotheses: FDI-LG (FDI-led growth), G-LFDI (growth-led FDI), feedback (FDI-led growth and growth-led FDI), and neutrality (absence of the effect on each variable caused by another variable).

Under the FDI-LG hypothesis, FDI could boost the economic growth of the recipient country by increasing its capital stock, thereby enabling technology transfer and creating new jobs (

de Mello 1997;

Borensztein et al. 1998). Alternatively, the G-LFDI hypothesis highlights the need to increase market size and improve human capital conditions and infrastructure to attract FDI (Zhang 2000, as cited in

Zhang 2001). The feedback hypothesis suggests that both FDI and economic growth are positively interdependent. It could occur in countries with high growth rates, as generating higher demand for FDI and providing better opportunities to earn profit would attract more FDI. Conversely, FDI inflows can foster economic growth in host countries through positive direct and indirect effects (

Zhang 2001). If there is no causal relationship between economic growth and FDI, then the neutrality hypothesis is validated (

Abbes et al. 2015).

Sarker and Khan (

2020) examined the causal nexus between FDI (net inflow, millions of USD) and real GDP (millions of USD at a constant price in 2000) in Bangladesh from 1972 to 2017. The variables that present annual data were transformed to the natural logarithm. The annual series constitutes a nonstationary series considered a first-order integrated process,

, according to the Dickey–Fuller unit root test results, and additional tests indicated similar results. The ARDL cointegration bound test indicated the presence of cointegration between the series logarithm of FDI and logarithm of real GDP—fulfilled even when the dependent variable is altered—as the F-statistic is higher than the bands at the 5% significance level. Real GDP has an elastic behavior with regard to FDI in the long-term equilibrium. Moreover, FDI presents a negative long-term equilibrium income-inelasticity. The ECM estimated using

Pesaran et al. (

2001) methodology is relevant only when the dependent variable is the first difference of the logarithm of FDI, as it confirms the long-term equilibrium effect of the logarithm of real GDP on the logarithm of FDI. The Akaike information criteria demonstrated that the prior estimation of the

model and short-term income elasticity for FDI is 0.09 at the 10% significance level while considering a maximum number of lags equal to 4. According to Harvey, Breusch–Godfrey, and Jarque–Bera tests, residuals of this ECM support homoscedasticity, nonautocorrelation, and normality assumptions, respectively. They assessed the model’s specification using the Ramsey RESET test, which indicated its appropriate functional form. The parametric stability was tested at the 5% significance level using the CUSUM and CUSUM of squares tests.

Tanaya and Suyanto (

2022) examined the relationship between the variables, namely, real GDP (USD at constant prices in 2010) and FDI inflows (millions of USD) in Indonesia for the period 1970–2018. The variables were transformed to natural logarithms. The annual series logarithm of real GDP is a nonstationary series

and the logarithm of FDI is a stationary series

, according to Dickey–Fuller and Phillips–Perron unit root tests. The order of integration of each series expressed in logarithms enables the application of the ARDL cointegration bound test in an

model with a dependent variable logarithm of FDI whose lag selection was considered by the Schwarz Bayesian information criterion. At the 5% significance level, the authors deduced a long-term equilibrium relationship between the logarithm of real GDP and FDI, and the test yielded an F-statistic equal to 477.26 that far exceeds the

and

bands. The results of the estimated ECM reveal an extremely significant and high short-term income elasticity of FDI equal to 76.74 and a significant income elasticity of FDI in the following period equal to 42.18. FDI has a significant negative and inelastic behavior with respect to its value in the previous period. Finally, this model confirms the cointegration between the series with a highly significant and negative coefficient of the error correction term.

1.2. Foreign Direct Investment and Economic Growth in Peru

Herzer et al. (

2008) conducted a study to determine the effects of FDI on economic growth in 28 countries during the period 1970–2003. In Latin America: Argentina, Brazil, Chile, Colombia, Costa Rica, Dominican Republic, Ecuador, Mexico, Peru, and Venezuela; in Asia: India, Indonesia, Korea, Malaysia, Pakistan, Philippines, Singapore, Sri Lanka, and Thailand; in Africa: Cameroon, Côte d’Ivoire, Egypt, Ghana, Kenya, Morocco, Nigeria, Tunisia, and Zambia. The annual time series researched is the logarithm of real GDP (USD at constant prices in 2000) and FDI-to-GDP ratio (they used net FDI); both series behave as nonstationary

in all countries according to Perron’s unit root test. The application of the Engle–Granger cointegration test indicates the existence of a long-term equilibrium relationship between the

series in all countries, except Ecuador, Mexico, Venezuela, and Sri Lanka, at the 5% significance level. The main finding of this research is that FDI does contribute to growth in the long term. In the case of Peru, according to the Engle–Granger cointegration test, a strong long-term equilibrium relationship was found between the logarithm of GDP and FDI-to-GDP ratio, even at the 1% significance level, and the first difference of the equilibrium error was not explained by its own lags.

Oladipo (

2013) conducted a study referring to 16 Latin American and Caribbean countries for the purpose of examining the causal relationship between FDI and economic growth for the period 1980Q1–2010Q4. The quarterly time series of the FDI and GDP growth rate variables show nonstationary behavior for Argentina, Brazil, Colombia, Costa Rica, Dominican Republic, El Salvador, Guatemala, Mexico, Peru, Venezuela, Trinidad and Tobago, Jamaica, and the Bahamas, except the FDI variable that is stationary for Bolivia, Chile, and Ecuador, according to the results of the Dickey–Fuller and Phillip–Perron unit root tests. The results of the Johansen cointegration test show the presence of a cointegrating vector between the two series for all countries, except for Argentina, Bolivia, and Guatemala, which have two cointegrating vectors. The Granger causality test results revealed that the unidirectional relationship FDI leads to GDP growth rate is validated in all countries with the exception of Jamaica, the Dominican Republic, and Trinidad and Tobago. It was also found that the GDP growth rate causes FDI unidirectional relationships in all countries except Bolivia, Colombia, Costa Rica, Dominican Republic, Ecuador, El Salvador, Guatemala, and Jamaica. Therefore, bidirectional Granger causality between the series FDI and GDP growth rate is evident for Argentina, Brazil, Mexico, Peru, and Venezuela.

Bustamante (

2017) conducted a study in Peru during the period 2009Q1–2016Q2, considering quarterly time series data for the following variables, FDI flow and GDP. Both series were nonstationary according to the results of the Dickey–Fuller unit root test. The application of the Johansen cointegration test indicated the presence of a cointegrating vector. The long-term equilibrium GDP elasticity with respect to FDI flow is statistically significant equal to 0.13 according to the estimated vector error correction model (VECM).

1.3. Foreign Direct Investment, Exports, and Economic Growth

Several empirical papers study the dynamic relationship between the three variables exclusively, analyzing, in general, stationarity, contrasting cointegration, and Granger causality between them and measuring the short and long-term impacts of dependent variables on the independent variable. Below, we outline some of these papers using ARDL and VECM time series models for the analysis.

Baliamoune-Lutz (

2004) conducted a study to estimate the effects of FDI increase (ratio of nominal FDI to nominal GDP, both expressed in USD) in Morocco, considering the following variables: GDP growth rate (annual percentage change in real GDP) and exports (ratio of nominal exports to nominal GDP) during the period 1973–1999. The Dickey–Fuller unit root test indicated that the three annual series are stationary

at the 5% significance level. The results of the Granger causality test present a feedback causality relationship between exports and FDI and also present two unidirectional causality relationships where each variable, FDI and exports, Granger causes GDP growth.

Andraz and Rodrigues (

2010) empirically analyzed the relationship and causality direction between FDI, exports, and economic growth in Portugal between 1977 and 2004. With annual time series data of real GDP, real exports, and real FDI inflows, and the Elliott–Rothenberg–Stock unit root test, it was determined that at log-levels, the variables were nonstationary time series constituting first-order integrated processes,

. Post this finding, using the Johansen–Juselius cointegration test, a VECM was estimated, and a cointegrating vector was found between the variables studied. Moreover, with the Granger causality test on the VECM, it was deduced that exports and FDI drive economic growth in the long term (evidence supporting the hypotheses [E-LG: exports-led growth] and FDI-LG) while in the short term, a bidirectional causality relationship was found between FDI and economic growth (evidence supporting the feedback hypothesis), in addition to a unidirectional causality relationship from FDI to economic growth (evidence supporting the FDI-LE: foreign direct investment-led exports hypotheses). Finally,

Andraz and Rodrigues (

2010) concluded that FDI is the main determinant of economic growth in Portugal, both directly and indirectly, through exports in the short and long terms.

Dritsaki and Stiakakis (

2014), applying annual time series data of the FDI variable (as a GDP percentage), the exports variable (as a percentage of GDP), and the GDP growth rate variable, examined the stationarity and cointegration of these variables in Croatia over the period 1994–2012. Unit root tests show that the series of the three study variables constitute

or

process. Thus, the authors estimate three ARDL models (model 1: FDI as dependent variable; model 2: exports as dependent variable, and model 3: GDP growth rate as dependent variable), and, by applying the Pesaran–Shin–Smith cointegration bound test in each of them, they find two cointegrating vectors confirming a long-term equilibrium relationship between the three variables only in Models 2 and 3. The results show that (i) exports have a significant and positive impact on economic growth in the short and long terms; (ii) the GDP growth rate also has a positive and significant economic impact on exports in the short and long terms, and (iii) FDI exerts a negative and significant impact on the GDP growth rate (evidence against the FDI-LG: foreign direct investment-led growth hypothesis). Finally,

Dritsaki and Stiakakis (

2014) concluded that domestic capital investments and exports are a catalyst for economic growth in Croatia.

Szkorupová (

2014) examined the effects of FDI (million EUR) and exports (million EUR, regular prices, seasonally adjusted) on GDP (million EUR, market prices, seasonally adjusted) for Slovakia during the period 2001Q2–2010Q4. The interest in reducing data dispersion required to log-transform the quarterly series before testing. The results of the Dickey–Fuller unit root test revealed that the three research variables expressed in logarithm constitute nonstationary

series. Through the Akaike information criterion, the optimal second-order lag was obtained for the unsteady VAR model. The Johansen cointegration test considered the presence—at the 5% significance level—of a unique long-term relationship between the variables expressed in logarithms, both in the results of the trace test and maximum eigenvalue test. The estimated VECM showed a significant and positive long-term equilibrium elasticity of GDP for exports equal to 0.731.

For the period 1960Q1–2009Q4,

Akoto (

2016) examined the linkage between real exports, real nonexport GDP, and FDI in South Africa; the quarterly time series were seasonally adjusted except FDI. The application of the Johansen cointegration test, through the trace and maximum eigenvalue tests, yielded the presence of a cointegrating vector. The estimated VECM demonstrated that FDI Granger causes exports and FDI Granger causes GDP and that the significant long-term equilibrium elasticity of exports with regard to FDI was equal to 0.19.

Nguyen (

2017) analyzed the short and long-term impacts of exports and FDI on economic growth in Vietnam for the period 1986–2015. The author estimated an ARDL model using annual series data on the GDP growth rate and the shares of FDI and exports to GDP and discovered cointegration between the examined variables. In the long term, the author found a negative and significant impact of exports on negative economic growth and a positive and significant impact of FDI on economic growth. In the short term, the estimation of an ARDL-ECM revealed that neither FDI nor exports exerted a significant impact on the economic growth in Vietnam.

Sultanuzzaman et al. (

2018) analyzed the role of FDI and exports on economic growth in Sri Lanka for the period 1980–2016. The authors used annual time series data of GDP growth rate (with aggregate GDP values measured in constant USD in 2010), net FDI inflows (BoP, current USD), and exports of goods and services (BoP, current USD). They analyzed stationarity using augmented Dickey–Fuller, Elliott–Rothenberg–Stock, and Phillips–Perron unit root tests and deduced that these series, transformed into natural logarithms, constitute

or

processes. By applying the Pesaran–Shin–Smith cointegration bound test to an ARDL model, they found that FDI, exports, and economic growth have a long-term equilibrium relationship. The results revealed that FDI has a significant and positive impact on economic growth in the short and long term and that exports have a negative and significant impact on economic growth in the long term and a significant and positive impact in the short term. Finally,

Sultanuzzaman et al. (

2018) concluded that FDI inflows and exports influence Sri Lanka’s economic progress.

Sharmiladevi (

2020) highlighted India’s openness toward FDI due to economic liberalization policies and attempted to relate it to export and economic growth variables over the period 1971–2014. The annual time series inward FDI (millions of USD at current prices and current exchanges rates), exports (billions of INR), and GDP (billions of INR at factor cost constant prices) reflected nonstationary behavior as

series. Moreover, the application of Johansen’s cointegration test demonstrated a long-term relationship between variables whose trace and maximum eigenvalues tests found the presence of two cointegrating vectors. The estimated VECM revealed results different from those of the Johansen cointegration test.

Hobbs et al. (

2021) highlighted that Albania continues to move toward the transition to a mixed economy, demonstrating the relationship between exports, FDI inflow, and economic growth between 1992 and 2016. The research variables present annual time series data with a sample size equal to 25, FDI expressed as a percentage of GDP, exports (as proxy of trade) expressed in USD at constant prices, and GDP—an indicator of economic growth—expressed in USD at constant prices. For the data analysis, the variables were transformed into natural logarithms behaving as nonstationary series

, according to the Dickey–Fuller unit root results. They applied the Granger causality test between the series—but did not consider stationary series as required by

Granger (

1969)—thus obtaining a unidirectional causality relationship: the logarithm of GDP causes the logarithm of FDI. They applied VECM to each pair of series owing to their small sample size. The results of Johansen’s cointegration test (trace and maximum eigenvalue tests) indicated the presence of a cointegration vector between the log GDP and log FDI series. The estimation of the VECM between the first difference of the FDI logarithm and the first difference of the GDP logarithm presents the long-term equilibrium income elasticity of FDI equal to 2.70. Further, the estimation presents a significant coefficient of the error correction term equal to −0.48 for the equation whose dependent variable is the first difference of the FDI logarithm and a significant short-term income elasticity of FDI equal to 3.58 for the next 2 years.

Sopta et al. (

2021) studied the nexus between GDP growth rate (percentage, GDP at current prices), FDI logarithm (as a percentage of GDP, both at current prices), and exports logarithm (as a percentage of GDP, both at current prices) for Croatia during the period 2000–2020. The Dickey–Fuller unit root results present the FDI logarithm as a stationary

series, and the GDP growth rate and logarithm of exports as nonstationary

series. They determined a long-term equilibrium relationship between the research variables using the cointegration bound test applied in an

model suggested by the Schwarz Bayesian information criteria.

1.4. Theoretical Model

The macroeconomic static model of Mundell and Fleming (

Fleming 1962;

Mundell 1963) with an exogenous financial account and other specific assumptions in the markets mentioned below served as the basis for analyzing the effects of FDI and exports on GDP; this model consists of an extension of the IS-LM model adding the broader sector from the foreign exchange market, the three markets—good and services, monetary, and foreign exchange—must be in equilibrium (

Gandolfo 2016;

Wang 2020).

The aggregate output—as called Gross Domestic Product (GDP) (

Blanchard 2021)—can be measured through the aggregate income

—income received by the factors due to their participation in the production process of good and services (

Parkin and Bade 2016)—. Given the following functions and variables: consumption

C, investment

, exogenously determined government expenditure

, exogenously determined exports

, imports

with unity normalized local and foreign prices (

Jiménez 2006), income

, interest rate

, and floating exchange rate

in the price quotation system (

Gandolfo 2016), we define aggregate demand

AD—demand for domestic goods—as the following identity (

Jiménez 2006;

Dornbusch et al. 2018;

Blanchard 2021):

where

(

Malaspina 1994;

Jiménez 2006).

In the equilibrium of the goods and services market, the aggregate income equals aggregate demand (

Dornbusch et al. 2018;

Blanchard 2021),

, is given by the following identity:

Additionally, the definition of income

in the Mundell–Fleming model, according to

Gandolfo (

2016), incorporates the following imports partial derivate

in Equation (2).

From Equation (2), we obtain the equilibrium equation

whose slope is

The demand for money

is represented by the following liquidity of money function

(

Wang 2020):

The supply of money

is represented exogenously by actual money balances

In the equilibrium of the money market, the demand for money equals supply of money,

, the equilibrium equation

is given by the following identity:

whose slope is

.

We assume that the payment balance

is equal to the sum of the current account balance

and financial account

. Under a system with a fluctuating exchange rate (with instant exchange rate adjustment),

will always be in equilibrium; i.e., it will always be equal to zero (

Wang 2020).

It is assumed that the current account balance

comprises only of the trade balance

, i.e.,

. Also, the trade balance

equals net exports shown in the following equation as follows:

Due to the perfect mobility of financial capital—no restrictions to capital flows (

Gandolfo 2016;

Wang 2020)─, it is reasonable to assume that the financial account

FA mainly comprises assets and liabilities of the private sector without considering investments in portfolios or long-term loans in liabilities.

where

represents the exogenously determined net FDI inflow variable (the difference between FDI in the resident country and direct investment abroad). A positive FDI value implies a net inflow of foreign financial capital, whereas a negative FDI value implies a net outflow of foreign financial capital.

From Equations (6)–(8), we obtain the following equilibrium equation of payment balance.

We assume that the payment balance

is equal to the sum of the trade balance and financial account. Under a system with a fluctuating exchange rate (with instant exchange rate adjustment), the payment balance will always be in equilibrium; i.e., it will always be equal to zero:

Equation (9) only is expressed in terms of , then effects of and cannot be calculated.

Based on the equilibrium equations of each market, we identified three endogenous variables

,

and

, and four exogenous variables

,

,

and

that allows us to build the following system of equations formed by the implicit functions

,

and

from the equilibrium of goods and services market, the equilibrium of monetary market, and the equilibrium of foreign exchange, respectively, to get each endogenous variable as a function of all exogenous variables:

where

is a vector of endogenous variables and

is a vector of exogenous variables.

According to

de la Fuente (

2000), to apply the theorem of the general implicit function, we must assume that the vector

is a composite function of implicit functions

,

and

, i.e.,

, has continuous partial derivatives regarding the endogenous variables vector

, and if the exogenous variables vector

and Jacobian determinant—defined as

—of the model evaluated at a point

satisfying Equation system (10) is not null, we obtain the following:

The Jacobian determinant

differs from zero in the following two cases depending on the comparison of the slopes of equilibrium equations

and

Thus,

Sydsæter and Hammond (

2008) express that a point

that complies with Equation system (10) would be the only equilibrium solution. According to the theorem of the implicit function, it is justified to write in a neighborhood of

the following system of new implicit functions:

In Equation system (14), we obtain the comparative static derivative of

with respect to

, as explained by

Takayama (

1994), indicating that an infinitesimal increase in

with ceteris paribus in the remaining exogenous variables can lead to a decline or a rise in

depending on whether Jacobian determinant

given by Equation (11) is negative or positive, respectively, or depending of the comparison of the slopes of equilibrium equations

and

shown below:

Additionally, in Equation (15), we obtain the comparative static derivative

with respect to

equal to zero, indicating that an infinitesimal increase in

with ceteris paribus in the rest of exogenous variables shows the neutrality of income. This finding is highlighted in the equilibrium of the proposed macroeconomic model along with assumptions.

In our analysis, we assume that variables

and

exhibit an autonomous behavior; then, the first equation of the system (13) is expressed as follows:

Equation (16) constitutes our theoretical research function.

The relationship of variables in Equation (16) is an approach to the theoretical results proposed by

Hsiao and Hsiao (

2006) in an equilibrium Keynesian aggregate demand model. In this model, the equilibrium between the monetary and government sectors and the autonomous behavior of all financial variables are assumed, thereby obtaining the following implicit function:

.