Factors Affecting the Intention to Use Financial Technology among Vietnamese Youth: Research in the Time of COVID-19 and Beyond

Abstract

:1. Introduction

2. Background in Vietnam

Context

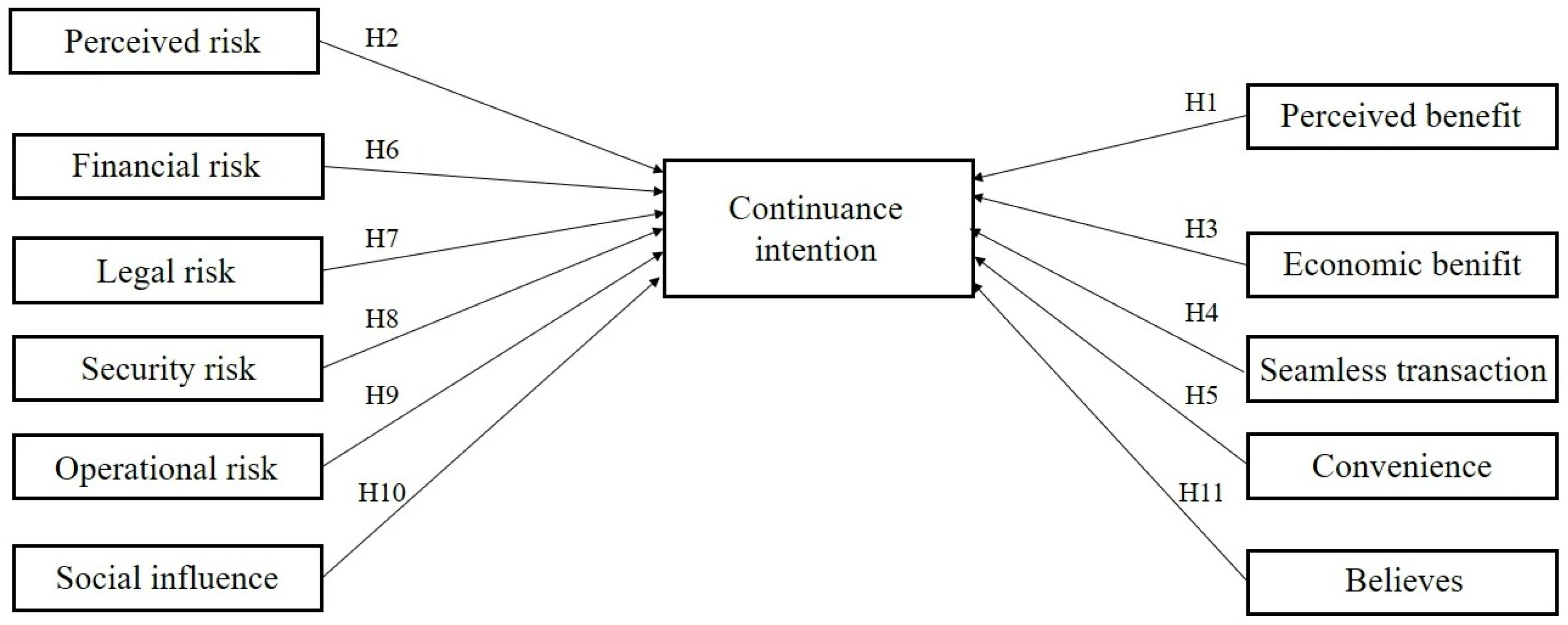

3. Theoretical Framework and Hypothesis Development

3.1. Theory of Reasoned Action (TRA)

3.2. Technology Acceptance Model (TAM)

Hypothesis Development

4. Research Design

4.1. Scale and Structure of the Questionnaire

4.2. Methodology

4.3. Samples and Ways of Collecting Samples

4.3.1. Overall Research

4.3.2. Sampling Method

5. Results and Discussion

5.1. Descriptive Statistics

5.1.1. Demographics

5.1.2. Check Measurement

Check the First Measurement Model

Check the Second Measurement Model

Conclusion

Discriminant Validity

5.1.3. Structural Model

Evaluate Collinearity Phenomenon

Assess the Suitability of Relationships

6. Discussion

7. Conclusions and Implications

7.1. Conclusions

7.2. Theorical Contribution

7.3. Practice Contribution

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abramova, Svetlana, and Rainer Böhme. 2016. Perceived Benefit and Risk as Multidimensional Determinants of Bitcoin Use: A Quantitative Exploratory Study. Paper presented at Thirty Seventh International Conference on Information Systems, Dublin, Ireland, December 11–14. [Google Scholar]

- Agarwal, Ritu, Manju Ahuja, Pamela E. Carter, and Mitch Gans. 1998. Early and late adopters of IT innovations: Extensions to innovation diffusion theory. Proceedings of the DIGIT Conference 1: 18. [Google Scholar]

- Ajzen, Icek. 1991. The theory of planned behavior. Organizational Behavior and Human Decision Processes 50: 179–211. [Google Scholar] [CrossRef]

- Ajzen, Icek, and Martin Fishbein. 1975. A Bayesian analysis of attribution processes. Psychological Bulletin 82: 261. [Google Scholar] [CrossRef]

- Al-Nawayseh, Mohammad K. 2020. Fintech in COVID-19 and beyond: What factors are affecting customers’ choice of FinTech applications? Journal of Open Innovation: Technology, Market, and Complexity 6: 153. [Google Scholar] [CrossRef]

- Barakat, Ahmed, and Khaled Hussainey. 2013. Bank governance, regulation, supervision, and risk reporting: Evidence from operational risk disclosures in European banks. International Review of Financial Analysis 30: 254–73. [Google Scholar] [CrossRef]

- Batara, Jame Bryan L., Joanna Paula R. Mariblanca, Karlo Mar D. Kinaadman, and Jandall Airon B. Go. 2018. The Effect of Consumer Innovativeness, Perceived Benefits, Perceived Risk, and Brand Image in the Decision to Buy Online. Recoletos Multidisciplinary Research Journal 6: 55–64. [Google Scholar] [CrossRef]

- Benlian, Alexander, and Thomas Hess. 2011. Opportunities and risks of software-as-a-service: Findings from a survey of IT executives. Decision Support Systems 52: 232–46. [Google Scholar] [CrossRef]

- Carlin, Bruce, Arna Olafsson, and Michaela Pagel. 2017. Fintech Adoption across Generations: Financial Fitness in the Information Age. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Chandio, Fida Hussain, Muhammad Sharif Abbasi, Hyder Ali Nizamani, and Qurat Ul Ain Nizamani. 2013. Online banking information systems acceptance: A structural equation modelling analysis. International Journal of Business Information Systems 12: 177–93. [Google Scholar] [CrossRef]

- Chatterjee, Sutirtha. 2008. Unethical Behavior Using Information Technology. Washington, DC: Washington State University. [Google Scholar]

- Chen, Jung-Fang, Jui-Fang Chang, Cheng-Wan Kao, and Yueh-Min Huang. 2016. Integrating ISSM into TAM to Enhance Digital Library Services: A Case Study of the Taiwan Digital Meta-Library. Taiwan: The Electronic Library. [Google Scholar]

- Cheng, T. C. Edwin, David Y. C. Lam, and Andy C. L. Yeung. 2006. Adoption of internet banking: An empirical study in Hong Kong. Decision Support Systems 42: 1558–72. [Google Scholar] [CrossRef] [Green Version]

- Chishti, Susanne. 2016. How peer to peer lending and crowdfunding drive the fintech revolution in the UK. In Banking beyond Banks and Money. Berlin/Heidelberg: Springer, pp. 55–68. [Google Scholar]

- Chuang, Yating, Xiaofei Xie, and Chang Liu. 2016. Interdependent orientations increase pro-environmental preferences when facing self-interest conflicts: The mediating role of self-control. Journal of Environmental Psychology 46: 96–105. [Google Scholar] [CrossRef]

- Csobanka, Zsuzsa Emese. 2016. The Z generation. Acta Technologica Dubnicae 6: 63–76. [Google Scholar] [CrossRef] [Green Version]

- Dang, Thi Ngoc Lan. Quá Trình Phát Triển Của Fintech Và Những Chuyển Động Trong Lĩnh Vực Tài Chính-Ngân Hàng. Available online: http://sob.ueh.edu.vn/wp-content/uploads/2018/11/19.-DANG-THI-NGOC-LAN.pdf (accessed on 12 October 2021).

- David, Paul A. 1989. Computer and Dynamo: The Modern Productivity Paradox in a Not-Too Distant Mirror. Coventry: University of Warwick. [Google Scholar]

- Davis, Fred D. 1985. A Technology Acceptance Model for Empirically Testing New End-User Information Systems: Theory and Results. Cambridge: Massachusetts Institute of Technology. [Google Scholar]

- Derbaix, Christian. 1983. Perceived risk and risk relievers: An empirical investigation. Journal of Economic Psychology 3: 19–38. [Google Scholar] [CrossRef]

- Estrin, Saul, Daniel Gozman, and Susanna Khavul. 2018. The evolution and adoption of equity crowdfunding: Entrepreneur and investor entry into a new market. Small Business Economics 51: 425–39. [Google Scholar] [CrossRef] [Green Version]

- Featherman, Mauricio S, and Paul A. Pavlou. 2003. Predicting e-services adoption: A perceived risk facets perspective. International Journal of Human-Computer Studies 59: 451–74. [Google Scholar] [CrossRef] [Green Version]

- Fintech and Digital Banking 2025 Asia Pacific. 2020. Boston: IDC Financial Insight and Backbase.

- Forsythe, Sandra, Chuanlan Liu, David Shannon, and Liu Chun Gardner. 2006. Development of a scale to measure the perceived benefits and risks of online shopping. Journal of Interactive Marketing 20: 55–75. [Google Scholar] [CrossRef]

- Gomber, Peter, Robert J. Kauffman, Chris Parker, and Bruce W. Weber. 2018. On the fintech revolution: Interpreting the forces of innovation, disruption, and transformation in financial services. Journal of Management Information Systems 35: 220–65. [Google Scholar] [CrossRef]

- Hair, Joseph F., Marko Sarstedt, Christian M Ringle, Kai O. Thiele, and Siegfried P. Gudergan. 2016. Estimation issues with PLS and CBSEM: Where the bias lies! Journal of Business Research 69: 3998–4010. [Google Scholar]

- Jacoby, Jacob, and Leon B. Kaplan. 1972. The Components of Perceived Risk. Chicago: ACR Special Volumes. [Google Scholar]

- Kaplan, Leon B., George J. Szybillo, and Jacob Jacoby. 1974. Components of perceived risk in product purchase: A cross-validation. Journal of Applied Psychology 59: 287. [Google Scholar] [CrossRef]

- Kim, Dan J., Donald L. Ferrin, and H. Raghav Rao. 2008. A trust-based consumer decision-making model in electronic commerce: The role of trust, perceived risk, and their antecedents. Decision Support Systems 44: 544–64. [Google Scholar] [CrossRef]

- Kuisma, Tuire, Tommi Laukkanen, and Mika Hiltunen. 2007. Mapping the reasons for resistance to Internet banking: A means-end approach. International Journal of Information Management 27: 75–85. [Google Scholar] [CrossRef]

- Lee, David Kuo Chuen, and Ernie G. S. Teo. 2015. Emergence of FinTech and the LASIC Principles. Journal of Financial Perspectives 3: 24–36. [Google Scholar] [CrossRef] [Green Version]

- Lee, Ming-Chi. 2009. Factors influencing the adoption of internet banking: An integration of TAM and TPB with perceived risk and perceived benefit. Electronic Commerce Research and Applications 8: 130–41. [Google Scholar] [CrossRef]

- Lehmann, Matthias. 2020. Global Rules for a Global Market Place?—Regulation and Supervision of Fintech Providers. BU Int’l LJ 38: 118. [Google Scholar] [CrossRef]

- Liébana-Cabanillas, Francisco, Francisco Muñoz-Leiva, and Juan Sánchez-Fernández. 2018. A global approach to the analysis of user behavior in mobile payment systems in the new electronic environment. Service Business 12: 25–64. [Google Scholar] [CrossRef]

- Liébana-Cabanillas, Francisco, Juan Sánchez-Fernández, and Francisco Muñoz-Leiva. 2014. Antecedents of the adoption of the new mobile payment systems: The moderating effect of age. Computers in Human Behavior 35: 464–78. [Google Scholar] [CrossRef]

- Lien, Nguyen Thi Kim, Thu-Trang Thi Doan, and Toan Ngoc Bui. 2020. Fintech and banking: Evidence from Vietnam. The Journal of Asian Finance, Economics, and Business 7: 419–26. [Google Scholar] [CrossRef]

- Littler, Dale, and Demetris Melanthiou. 2006. Consumer perceptions of risk and uncertainty and the implications for behaviour towards innovative retail services: The case of internet banking. Journal of Retailing and Consumer Services 13: 431–43. [Google Scholar] [CrossRef]

- Liu, SiLu, Yue Zhuo, Dilip Soman, and Min Zhao. 2012. The Consumer Implications of the Use of Electronic and Mobile Payment Systems. Toronto: Rotman School of Management, University of Toronto. [Google Scholar]

- Mackenzie, Annette. 2015. The fintech revolution. London Business School Review 26: 50–53. [Google Scholar] [CrossRef]

- Maignan, Isabelle, and Bryan A. Lukas. 1997. The nature and social uses of the Internet: A qualitative investigation. Journal of Consumer Affairs 31: 346–71. [Google Scholar] [CrossRef]

- Nguyen, Dang Tue. 2020. Nhân Tố Tác Động Tới Việc Tiếp Tục Sử Dụng Dịch Vụ Thanh Toán Bằng Fintech-Nghiên Cứu Đối Với Sinh Viên Các Trường Đại Học ở Việt Nam. Hanoi: Tạp chí Quản lý và Kinh tế quốc tế. [Google Scholar]

- Nguyễn, Đình Thọ. 2012. Phương Pháp Nghiên Cứu Khoa Học Trong Kinh Doanh. Hanoi: Lao động xã hội. [Google Scholar]

- Okazaki, Shintaro, and Felipe Mendez. 2013. Exploring convenience in mobile commerce: Moderating effects of gender. Computers in Human Behavior 29: 1234–42. [Google Scholar] [CrossRef] [Green Version]

- Oliveira, Tiago, Manoj Thomas, Goncalo Baptista, and Filipe Campos. 2016. Mobile payment: Understanding the determinants of customer adoption and intention to recommend the technology. Computers in Human Behavior 61: 404–14. [Google Scholar] [CrossRef]

- Omar Ali, Siti Rapidah, Wan Nur Khadijah Wan Marzuki, Nur Shafini Mohd Said, Suhaily Maizan Abdul Manaf, and Nur Dalila Adenan. 2020. Perceived ease of use and trust towards intention to use online banking in Malaysia. Jurnal Intelek 15: 107–14. [Google Scholar] [CrossRef]

- Patel, Kiran J., and Hiren J. Patel. 2018. Adoption of internet banking services in Gujarat: An extension of TAM with perceived security and social influence. International Journal of Bank Marketing 36: 47–169. [Google Scholar] [CrossRef]

- Peter, J. Paul, and Lawrence X. Tarpey Sr. 1975. A comparative analysis of three consumer decision strategies. Journal of Consumer Research 2: 29–37. [Google Scholar] [CrossRef]

- Rich, Stuart U., and Donald F. Cox. 2014. Perceived risk and consumer decision making: The case of telephone shopping. Journal of Marketing Research 1: 32–39. [Google Scholar]

- Rogers, Everett M. 1995. Diffusion of Innovations: Modifications of a model for telecommunications. In Die Diffusion von Innovationen in der Telekommunikation. Berlin/Heidelberg: Springer, pp. 25–38. [Google Scholar]

- Ryu, Hyun-Sun. 2018. Understanding benefit and risk framework of fintech adoption: Comparison of early adopters and late adopters. Paper presented at the 51st Hawaii International Conference on System Sciences, Hilton Waikoloa Village, HI, USA, January 3–6. [Google Scholar]

- Schierz, Paul Gerhardt, Oliver Schilke, and Bernd W. Wirtz. 2010. Understanding consumer acceptance of mobile payment services: An empirical analysis. Electronic Commerce Research and Applications 9: 209–16. [Google Scholar] [CrossRef]

- Tang, Kin Leong, Chee Keong Ooi, and Jia Bao Chong. 2020. Perceived Risk Factors Affect Intention To Use FinTech. Journal of Accounting and Finance in Emerging Economies 6: 453–63. [Google Scholar] [CrossRef]

- Van Loo, Rory. 2018. Making innovation more competitive: The case of fintech. UCLA Law Review 65: 232. [Google Scholar]

- Venkatesh, Viswanath, Michael G. Morris, Gordon B. Davis, and Fred D. Davis. 2003. User acceptance of information technology: Toward a unified view. MIS Quarterly 27: 425–78. [Google Scholar] [CrossRef] [Green Version]

- Vietnam Fintech Report 2020. 2020. Singapore: Fintech News Network.

- Zavolokina, Liudmila, Mateusz Dolata, and Gerhard Schwabe. 2016. FinTech transformation: How IT-enabled innovations shape the financial sector. In FinanceCom 2016. Berlin/Heidelberg: Springer. [Google Scholar]

| Living Area | ||

|---|---|---|

| Quantity | Percentage | |

| Ho Chi Minh City | 149 | 92.5% |

| Others | 12 | 7.5% |

| Total | 161 | 100% |

| Age | ||

| 18–24 | 158 | 98.1% |

| 25–34 | 2 | 1.2% |

| 35–39 | 0 | 0.0% |

| Over 39 | 1 | 0.6% |

| Total | 161 | 100% |

| Latent Variable | Observed Variables | Convergent Validity | Internal Stability | Discriminant Validity | |||

|---|---|---|---|---|---|---|---|

| Factor Loading | Outer Loadings | AVE | Composite Reliability | Cronbach’s Alpha | |||

| >0.7 | >0.5 | >0.5 | 0.6–0.95 | 0.6–0.95 | |||

| B | B1 | 0.836 | 0.699 | 0.656 | 0.919 | 0.896 | Yes |

| B2 | 0.858 | 0.735 | |||||

| B3 | 0.838 | 0.702 | |||||

| B4 | 0.789 | 0.623 | |||||

| B5 | 0.802 | 0.643 | |||||

| B7 | 0.731 | 0.534 | |||||

| CI | CI1 | 0.84 | 0.705 | 0.714 | 0.909 | 0.866 | Yes |

| CI2 | 0.871 | 0.758 | |||||

| CI3 | 0.839 | 0.703 | |||||

| CI4 | 0.829 | 0.688 | |||||

| CV | CV1 | 0.902 | 0.814 | 0.786 | 0.917 | 0.864 | Yes |

| CV2 | 0.856 | 0.733 | |||||

| CV3 | 0.900 | 0.810 | |||||

| EB | EB1 | 0.850 | 0.723 | 0.715 | 0.883 | 0.803 | Yes |

| EB2 | 0.826 | 0.682 | |||||

| EB3 | 0.860 | 0.740 | |||||

| FR | FR1 | 0.930 | 0.865 | 0.780 | 0.876 | 0.727 | Yes |

| FR3 | 0.833 | 0.694 | |||||

| LR | LR2 | 0.889 | 0.790 | 0.765 | 0.907 | 0.854 | Yes |

| LR3 | 0.793 | 0.629 | |||||

| LR4 | 0.935 | 0.875 | |||||

| OR | OR1 | 0.768 | 0.590 | 0.701 | 0.875 | 0.793 | Yes |

| OR2 | 0.824 | 0.679 | |||||

| OR3 | 0.913 | 0.834 | |||||

| PB | PB1 | 0.825 | 0.681 | 0.696 | 0.901 | 0.854 | Yes |

| PB2 | 0.858 | 0.736 | |||||

| PB3 | 0.860 | 0.740 | |||||

| PB4 | 0.791 | 0.626 | |||||

| PR | PR1 | 0.954 | 0.911 | 0.782 | 0.877 | 0.747 | Yes |

| PR2 | 0.808 | 0.653 | |||||

| SI | SI1 | 0.869 | 0.775 | 0.795 | 0.921 | 0.871 | Yes |

| SI2 | 0.918 | 0.843 | |||||

| SI3 | 0.887 | 0.788 | |||||

| SR | SR1 | 0.903 | 0.815 | 0.742 | 0.895 | 0.842 | Yes |

| SR2 | 0.716 | 0.513 | |||||

| SR3 | 0.948 | 0.899 | |||||

| ST | ST1 | 0.870 | 0.756 | 0.712 | 0.881 | 0.797 | Yes |

| ST2 | 0.813 | 0.661 | |||||

| ST3 | 0.847 | 0.717 | |||||

| B | CI | CV | EB | FR | LR | OR | PR | PR | SI | SR | ST | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| B | ||||||||||||

| CI | 0.534 | |||||||||||

| CV | 0.519 | 0.684 | ||||||||||

| EB | 0.359 | 0.512 | 0.544 | |||||||||

| FR | 0.245 | 0.090 | 0.209 | 0.090 | ||||||||

| LR | 0.161 | 0.142 | 0.079 | 0.074 | 0.584 | |||||||

| OR | 0.088 | 0.166 | 0.209 | 0.101 | 0.403 | 0.456 | ||||||

| PB | 0.430 | 0.777 | 0.766 | 0.549 | 0.175 | 0.164 | 0.178 | |||||

| PR | 0.200 | 0.084 | 0.131 | 0.116 | 0.700 | 0.406 | 0.377 | 0.135 | ||||

| SI | 0.656 | 0.486 | 0.379 | 0.405 | 0.125 | 0.118 | 0.116 | 0.363 | 0.064 | |||

| SR | 0.169 | 0.071 | 0.057 | 0.100 | 0.297 | 0.382 | 0.631 | 0.094 | 0.520 | 0.067 | ||

| ST | 0.507 | 0.564 | 0.715 | 0.586 | 0.270 | 0.238 | 0.069 | 0.691 | 0.285 | 0.346 | 0.056 |

| Constructs | CI | |

|---|---|---|

| B. | Beliefs | 1.927 |

| CI | Continuance intention | |

| CV | Convenience | 2.341 |

| EB | Economic benefit | 1.514 |

| FR | Financial risk | 1.621 |

| LR | Legal risk | 1.385 |

| OR | Operational risk | 1.571 |

| PB | Perceived benefit | 1.996 |

| PR | Perceived risk | 1.587 |

| SI | Social influence | 1.661 |

| SR | Security risk | 1.583 |

| ST | Seamless transaction | 1.860 |

| Original Sample (O) | Sample Mean (M) | Standard Deviation (STDEV) | T Statistic (|O/STDEV|) | p Value | |

|---|---|---|---|---|---|

| B → CI | 0.169 | 0.176 | 0.075 | 2.242 | 0.025 |

| CV → CI | 0.167 | 0.149 | 0.100 | 1.669 | 0.096 |

| EB → CI | 0.067 | 0.067 | 0.074 | 0.901 | 0.368 |

| FR → CI | 0.115 | 0.070 | 0.077 | 1.493 | 0.136 |

| LR → CI | −0.081 | −0.072 | 0.071 | 1.150 | 0.251 |

| OR → CI | 0.031 | 0.042 | 0.066 | 0.466 | 0.641 |

| PB → CI | 0.408 | 0.403 | 0.080 | 5.120 | 0.000 |

| PR → CI | −0.047 | −0.024 | 0.090 | 0.521 | 0.603 |

| SI → CI | 0.111 | 0.112 | 0.070 | 1.572 | 0.117 |

| SR → CI | 0.045 | 0.042 | 0.079 | 0.562 | 0.574 |

| ST → CI | 0.025 | 0.034 | 0.083 | 0.300 | 0.764 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Khuong, N.V.; Phuong, N.T.T.; Liem, N.T.; Thuy, C.T.M.; Son, T.H. Factors Affecting the Intention to Use Financial Technology among Vietnamese Youth: Research in the Time of COVID-19 and Beyond. Economies 2022, 10, 57. https://doi.org/10.3390/economies10030057

Khuong NV, Phuong NTT, Liem NT, Thuy CTM, Son TH. Factors Affecting the Intention to Use Financial Technology among Vietnamese Youth: Research in the Time of COVID-19 and Beyond. Economies. 2022; 10(3):57. https://doi.org/10.3390/economies10030057

Chicago/Turabian StyleKhuong, Nguyen Vinh, Nguyen Thi Thanh Phuong, Nguyen Thanh Liem, Cao Thi Mien Thuy, and Tran Hung Son. 2022. "Factors Affecting the Intention to Use Financial Technology among Vietnamese Youth: Research in the Time of COVID-19 and Beyond" Economies 10, no. 3: 57. https://doi.org/10.3390/economies10030057

APA StyleKhuong, N. V., Phuong, N. T. T., Liem, N. T., Thuy, C. T. M., & Son, T. H. (2022). Factors Affecting the Intention to Use Financial Technology among Vietnamese Youth: Research in the Time of COVID-19 and Beyond. Economies, 10(3), 57. https://doi.org/10.3390/economies10030057