Stock Price Forecasting for Jordan Insurance Companies Amid the COVID-19 Pandemic Utilizing Off-the-Shelf Technical Analysis Methods

Abstract

:1. Introduction

2. Related Literature

3. Materials and Methods

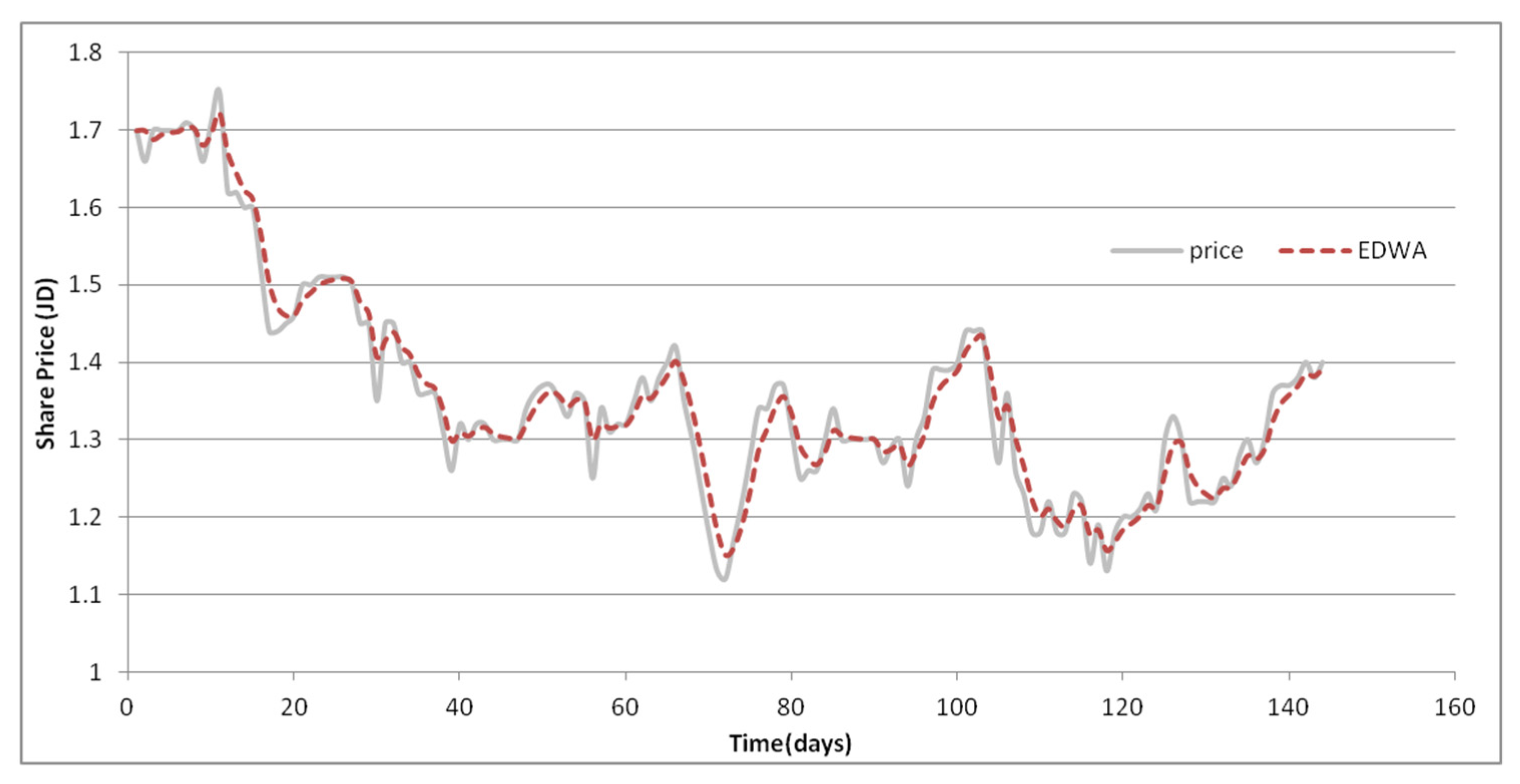

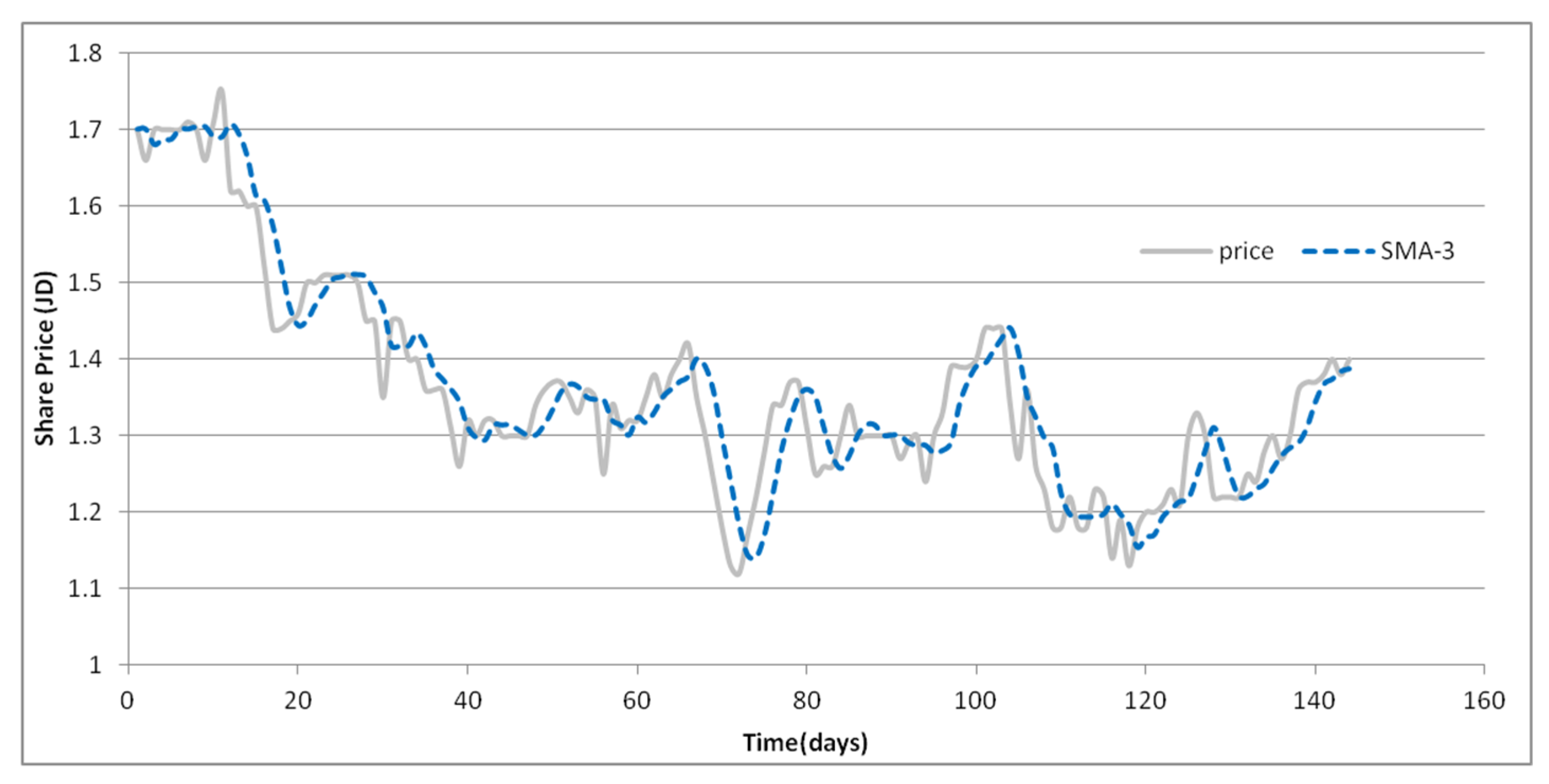

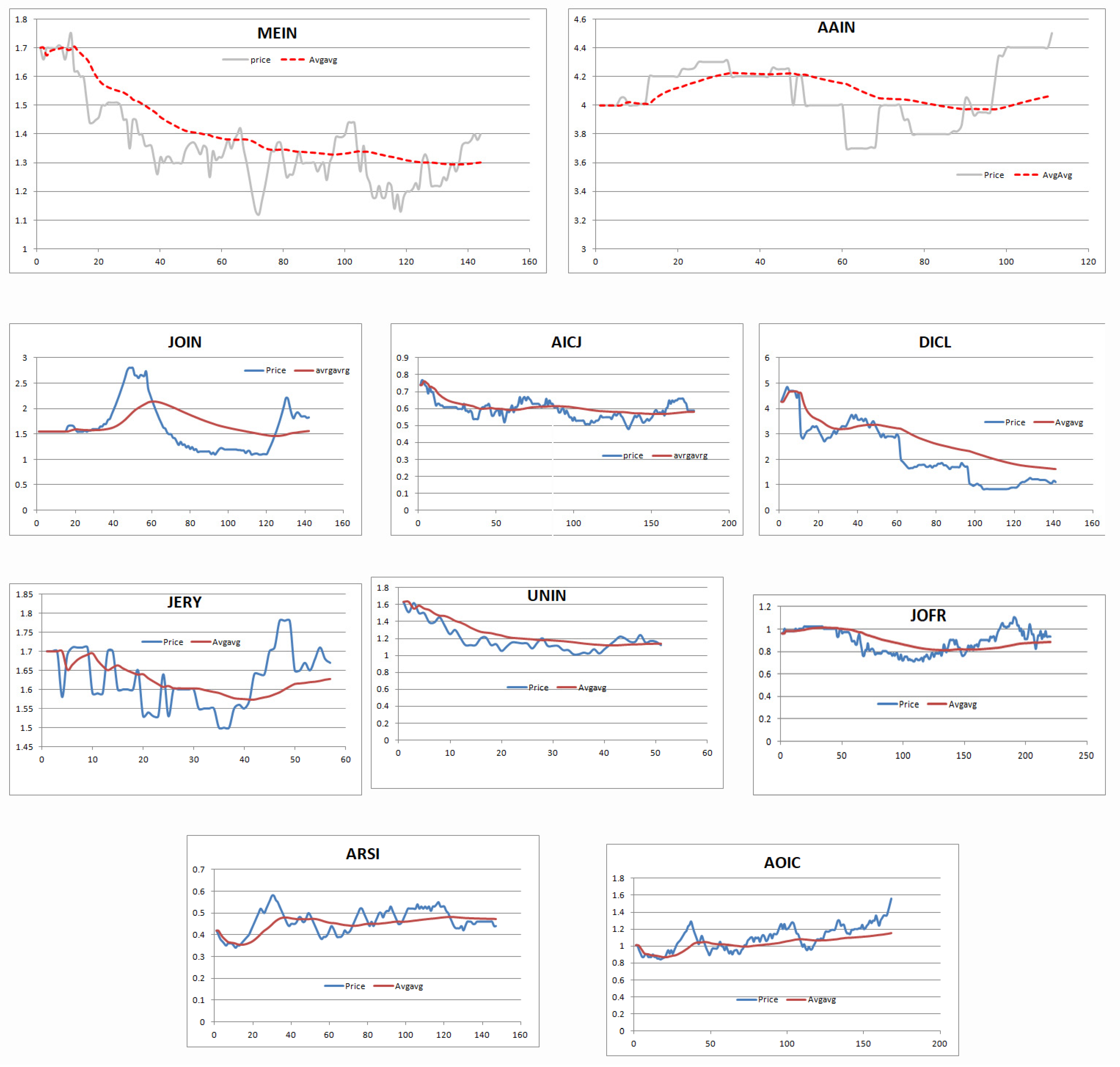

4. Results and Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abadleh, Ahmad, Bassam M. Al-Mahadeen, Rami M. AlNaimat, and Omar Lasassmeh. 2021. Noise segmentation for step detection and distance estimation using smartphone sensor data. Wireless Networks 27: 2337–46. [Google Scholar] [CrossRef]

- Abadleh, Ahmad, Eshraaq Al-Hawari, Esra’a Alkafaween, and Hamad Al-Sawalqah. 2017. Step detection algorithm for accurate distance estimation using dynamic step length. Paper presented at the 2017 18th IEEE International Conference on Mobile Data Management (MDM), Daejeon, Korea, May 29–June 1. [Google Scholar]

- Abadleh, Ahmad, Sangyup Han, Soon Joo Hyun, Ben Lee, and Myungchul Kim. 2016. Construction of indoor floor plan and localization. Wireless Networks 22: 175–91. [Google Scholar] [CrossRef]

- Abarbanell, Jeffrey, and Brian J. Bushee. 1997. Fundamental Analysis, Future Earnings, and Stock Prices. Journal of Accounting Research 35: 1–24. [Google Scholar] [CrossRef]

- Abdallah, Wajih, Sami Mnasri, and Thierry Val. 2020a. Genetic-Voronoi algorithm for coverage of IoT data collection networks. Paper presented at the 30th International Conference on Computer Theory and Applications, ICCTA 2020, Alexandria, Egypt, December 2–14. [Google Scholar]

- Abdallah, Wajih, Sami Mnasri, Nejah Nasri, and Thierry Val. 2020b. Emergent IoT Wireless Technologies beyond the year 2020: A Comprehensive Comparative Analysis. Paper presented at the 2020 International Conference on Computing and Information Technology (ICCIT-1441), Tabuk, Saudi Arabia, September 9–10. [Google Scholar]

- Abuzuraiq, AlMaha, Mouhammd Alkasassbeh, and Muhammad Almseidin. 2020. Intelligent Methods for Accurately Detecting Phishing Websites. Paper presented at the 2020 11th International Conference on Information and Communication Systems, ICICS 2020, Irbid, Jordan, April 7–9. [Google Scholar]

- Agrawal, J. G., V. S. Chourasia, and A. K. Mittra. 2013. State-of-the-Art in Stock Prediction Techniques. International Journal of Advanced Research in Electrical, Electronics and Instrumentation Engineering 2: 1360–66. [Google Scholar]

- Alabadleh, Ahmad, Saqer Aljaafreh, Ahmad Aljaafreh, and Khaled Alawasa. 2018. A RSS-based localization method using HMM-based error correction. Journal of Location Based Services 12: 273–85. [Google Scholar] [CrossRef]

- Al-Btoush, Audi I., Mohammad A. Abbadi, Ahmad B. Hassanat, Ahmad S. Tarawneh, Asad Hasanat, and V. B. Surya Prasath. 2019. New Features for Eye-Tracking Systems: Preliminary Results. Paper presented at the 2019 10th International Conference on Information and Communication Systems (ICICS), Irbid, Jordan, June 11–13. [Google Scholar]

- Alghamdi, Mansoor, and William Teahan. 2017. Experimental evaluation of Arabic OCR systems. PSU Research Review 1: 229–41. [Google Scholar] [CrossRef] [Green Version]

- Aljaafreh, Ahmad, Khaled Alawasa, Saqer Alja’afreh, and Ahmad Abadleh. 2017. Fuzzy inference system for speed bumps detection using smart phone accelerometer sensor. Journal of Telecommunication, Electronic and Computer Engineering 9: 133–36. [Google Scholar]

- Al-kasassbeh, Mouhammd, and Tarek Khairallah. 2019. Winning tactics with DNS tunneling. Network Security 2019: 12–19. [Google Scholar] [CrossRef]

- Al-Kasassbeh, Mouhammd, Safaa Mohammed, Mohammad Alauthman, and Ammar Almomani. 2019. Feature selection using a machine learning to classify a malware. In Handbook of Computer Networks and Cyber Security. Cham: Springer, pp. 889–904. [Google Scholar]

- Alkasassbeh, Mouhammd. 2018. A novel hybrid method for network anomaly detection based on traffic prediction and change point detection. Journal of Computer Science 14: 1–11. [Google Scholar] [CrossRef] [Green Version]

- Almseidin, Mohammad, Imre Piller, Mouhammd Al-Kasassbeh, and Szilveszter Kovacs. 2019a. Fuzzy automaton as a detection mechanism for the multi-step attack. International Journal on Advanced Science, Engineering and Information Technology 9: 575–86. [Google Scholar] [CrossRef]

- Almseidin, Muhammad, AlMaha Abu Zuraiq, Mouhammd Al-kasassbeh, and Nidal Alnidami. 2019b. Phishing detection based on machine learning and feature selection methods. International Journal of Interactive Mobile Technologies 13: 171–83. [Google Scholar] [CrossRef] [Green Version]

- Almseidin, Muhammad, Mouhammd Al-Kasassbeh, and Szilveszter Kovacs. 2019c. Detecting Slow Port Scan Using Fuzzy Rule Interpolation. Paper presented at the 2019 2nd International Conference on New Trends in Computing Sciences, ICTCS 2019, Amman, Jordan, October 9–11. [Google Scholar]

- Al-Naymat, Ghazi, Mouhammd Al-Kasassbeh, and Eshraq Al-Hawari. 2018. Using machine learning methods for detecting network anomalies within SNMP-MIB dataset. International Journal of Wireless and Mobile Computing 15: 67–76. [Google Scholar] [CrossRef]

- Alothman, Zainab, Mouhammd Alkasassbeh, and Sherenaz Al-Haj Baddar. 2020. An efficient approach to detect IoT botnet attacks using machine learning. Journal of High Speed Networks 26: 1–14. [Google Scholar] [CrossRef]

- Alqatawneh, Alaa, Rania Alhalaseh, Ahmad Hassanat, and Mohammad Abbadi. 2019. Statistical-Hypothesis-Aided Tests for Epilepsy Classification. Computers 8: 84. [Google Scholar] [CrossRef] [Green Version]

- Al-Shamaileh, Mohammad Z., Ahmad B. Hassanat, Ahmad. S. Tarawneh, MD Sohel Rahman, Ceyhun Celik, and Moohanad Jawthari. 2019. New Online/Offline text-dependent Arabic Handwriting dataset for Writer Authentication and Identification. Paper presented at the 2019 10th International Conference on Information and Communication Systems (ICICS), Irbid, Jordan, June 11–13; pp. 116–21. [Google Scholar]

- Altarawneh, Ghada. 2019. Prediction of Stock Price Using A Hybrid Technical Analysis Method. Science International Lahore 31: 391–96. [Google Scholar]

- AlTarawneh, Ragaad, Manal AlKhoshrman, Yousef Nabeel, Shah Rukh Humayoun, and Ahmad Hassanat. 2017. The Story of Designing an Educational Mobile Application for Children in South of Jordan. Paper presented at the 31st International BCS Human Computer Interaction Conference (HCI 2017), London, UK, July 3–6. [Google Scholar]

- Ausloos, Maecel, and Katrin Ivanova. 2002. Mechanistic approach to generalized technical analysis of share prices and stock market indices. The European Physical Journal B-Condensed Matter and Complex Systems 27: 177–87. [Google Scholar] [CrossRef] [Green Version]

- Bollen, Johan, Huina Mao, and Xiaojun Zeng. 2011. Twitter mood predicts the stock market. Journal of Computational Science 2: 1–8. [Google Scholar] [CrossRef] [Green Version]

- Brock, William, Josef Lakonishok, and Blake LeBaron. 1992. Simple technical trading rules and the stochastic properties of stock returns. The Journal of Finance 47: 1731–64. [Google Scholar] [CrossRef]

- Chen, Yuh-Jen, and Yuh-Min Chen. 2013. A fundamental analysis-based method for stock market forecasting. Paper presented at the 2013 International Conference on Intelligent Control and Information Processing, ICICIP 2013, Dali, China, June 9–11. [Google Scholar]

- Chen, Yuh-Jen, Yuh-Min Chen, and Chang Lin Lu. 2017. Enhancement of stock market forecasting using an improved fundamental analysis-based approach. Soft Computing 21: 3735–57. [Google Scholar] [CrossRef]

- Chi, Wan Le. 2018. Stock price forecasting based on time series analysis. In AIP Conference Proceedings. New York: AIP Publishing LLC. [Google Scholar]

- Chopra, Sunil, and Peter Meindl. 2013. Supply Chain Management: Strategy, Planning, and Operation, 5th ed. Hoboken: Prentice Hall, p. 195. [Google Scholar]

- Chourmouziadis, Konstandinos, and Prodromos D. Chatzoglou. 2016. An intelligent short term stock trading fuzzy system for assisting investors in portfolio management. Expert Systems with Applications 43: 298–311. [Google Scholar] [CrossRef]

- Chowdhury, Reaz, M. R. Mahdy, Tanisha N. Alam, Golam D. Al Quaderi, and M. Arifur Rahman. 2020. Predicting the stock price of frontier markets using machine learning and modified Black–Scholes Option pricing model. Physica A: Statistical Mechanics and Its Applications 555: 124444. [Google Scholar] [CrossRef] [Green Version]

- De Voogt, Alex, Ahmad Hassanat, and Mahmoud Alhasanat. 2017. The history and distribution of tab: A survey of Petra’s gaming boards. Journal of Near Eastern Studies 76: 93–101. [Google Scholar] [CrossRef]

- Drakopoulou, Veliota. 2016. A Review of Fundamental and Technical Stock Analysis Techniques. Journal of Stock & Forex Trading 5: 1–8. [Google Scholar]

- Edwards, Robert, John Magee, and W. H. Bassetti. 2012. Technical Analysis of Stock Trends. Boca Raton: CRC Press. [Google Scholar]

- Eyal Salman, Hamzeh, Abdelhak-Djamel Seriai, and Christophe Dony. 2015. Feature-level change impact analysis using formal concept analysis. International Journal of Software Engineering and Knowledge Engineering 25: 69–92. [Google Scholar] [CrossRef] [Green Version]

- Eyal Salman, Hamzeh. 2017. Identification multi-level frequent usage patterns from APIs. Journal of Systems and Software 130: 42–56. [Google Scholar] [CrossRef]

- Fama, Eugene, Lawrence Fisher, Michael Jensen, and Richard Roll. 1969. The adjustment of stock prices to new information. Nternational Economic Review 10: 1–21. [Google Scholar] [CrossRef]

- Fama, Eugene. 1965. The behavior of stock-market prices. The Journal of Business 38: 34–105. [Google Scholar] [CrossRef]

- Fama, Eugene. 1995. Random walks in stock market prices. Financial Analysts Journal 51: 75–80. [Google Scholar] [CrossRef] [Green Version]

- Fikru, Mahelet. 2019. Estimated electricity bill savings for residential solar photovoltaic system owners: Are they accurate enough? Applied Energy 253: 113501. [Google Scholar] [CrossRef]

- Ghatasheh, Nazeeh, Hossam Faris, Ruba Abukhurma, Pedro Castillo, Nailah Al-Madi, Antonio Mora, Ala Al-Zoubi, and Ahmad Hassanat. 2020. Cost-sensitive ensemble methods for bankruptcy prediction in a highly imbalanced data distribution: A real case from the Spanish market. Progress in Artificial Intelligence 9: 361–75. [Google Scholar] [CrossRef]

- Haji Rahimi, Zahra, and Mehdi Khashei. 2018. A least squares-based parallel hybridization of statistical and intelligent models for time series forecasting. Computers & Industrial Engineering 118: 44–53. [Google Scholar]

- Hamadaqa, Emad, Ahmad Abadleh, Ayoub Mars, and Wael Adi. 2019. Highly Secured Implantable Medical Devices. Paper presented at the International Conference on Innovations in Information Technology (IIT), Al Ain, United Arab Emiratespp, November 7–12. [Google Scholar]

- Hassanat, Aahmad B., and Ahmad Tarawneh. 2016. Fusion of color and statistic features for enhancing content-based image retrieval systems. Journal of Theoretical and Applied Information Technology 88: 644–55. [Google Scholar]

- Hassanat, Ahmad B. 2018a. Furthest-Pair-Based Binary Search Tree for Speeding Big Data Classification Using K-Nearest Neighbors. Big Data 6: 225–35. [Google Scholar] [CrossRef]

- Hassanat, Ahmad B. 2018b. Furthest-Pair-Based Decision Trees: Experimental Results on Big Data Classification. Information 9: 284. [Google Scholar] [CrossRef] [Green Version]

- Hassanat, Ahmad B. 2018c. Norm-Based Binary Search Trees for Speeding Up KNN Big Data Classification. Computers 7: 54. [Google Scholar] [CrossRef] [Green Version]

- Hassanat, Ahmad B. 2018d. Two-point-based binary search trees for accelerating big data classification using KNN. PLoS ONE 13: e0207772. [Google Scholar] [CrossRef] [Green Version]

- Hassanat, Ahmad B. 2018e. On Identifying Terrorists Using Their Victory Signs. Data Science Journal 17: 27. [Google Scholar] [CrossRef] [Green Version]

- Hassanat, Ahmad B., Ahmad S. Tarawneh, Samer Subhi Abed, Ghada Awad Altarawneh, Malek Alrashidi, and Mansoor Alghamdi. 2022. RDPVR: Random Data Partitioning with Voting Rule for Machine Learning from Class-Imbalanced Datasets. Electronics 11: 228. [Google Scholar] [CrossRef]

- Hassanat, Ahmad B., and Ghada Altarawneh. 2014. Rule-and dictionary-based solution for variations in written Arabic names in social networks, big data, accounting systems and large databases. Research Journal of Applied Sciences, Engineering and Technology 8: 1630–38. [Google Scholar] [CrossRef]

- Hassanat, Ahmad B., and Sabah Jassim. 2010. Visual words for lip-reading. In Proceedings of SPIE. Bellingham: The International Society for Optical Engineering, vol. 7708. [Google Scholar]

- Hassanat, Ahmad B., Ghada Altarawneh, Ahmad S. Tarawneh, Hossam Faris, Mahmoud B. Alhasanat, Alex de Voogt, Bakir Al-Rawashdeh, Muhammad Alshamaileh, and Surya V. B. Prasath. 2018a. On Computerizing the Ancient Game of Ṭāb. International Journal of Gaming and Computer-Mediated Simulations 10: 20–40. [Google Scholar] [CrossRef] [Green Version]

- Hassanat, Ahmad B., Mouhammd Alkasassbeh, Mouhammd Al-awadi, and Esra’a Alhasanat. 2015a. Color-based object segmentation method using artificial neural network. Simulation Modelling Practice and Theory 64: 3–17. [Google Scholar] [CrossRef]

- Hassanat, Ahmad B., Mouhammd Alkasassbeh, Mouhammd Al-Awadi, and Esra’a Alhasanat. 2015b. Colour-based lips segmentation method using artificial neural networks. Paper presented at the 2015 6th International Conference on Information and Communication Systems (ICICS), Irbid, Jordan, April 7–9. [Google Scholar]

- Hassanat, Ahmad B., Muhammad Al-Awadi, Eman Btoush, Amani Al-Btoush, Esraa Alhasanat, and Ghada Altarawneh. 2015c. New mobile phone and webcam hand images databases for personal authentication and identification. Procedia Manufacturing 3: 4060–67. [Google Scholar] [CrossRef] [Green Version]

- Hassanat, Ahmad B., Sami Mnasri, Mohammed Aseeri, Khaled Alhazmi, Omar Cheikhrouhou, Ghada Altarawneh, Malek Alrashidi, Ahmad S. Tarawneh, Khalid Almohammadi, and Hani Almoamari. 2021. A simulation model for forecasting covid-19 pandemic spread: Analytical results based on the current Saudi covid-19 data. Sustainability 13: 4888. [Google Scholar] [CrossRef]

- Hassanat, Ahmad B., V. S. Prasath, Bassam M. A. Mahadeen, and Samaher M. M. Alhasanat. 2017a. Classification and gender recognition from veiled-faces. International Journal of Biometrics 9: 347. [Google Scholar] [CrossRef]

- Hassanat, Ahmad B., V. S. Prasath, Khalil Mseidein, Muhammad Al-Awadi, and Awni Hammouri. 2017b. A hybrid wavelet-shearlet approach to robust digital image watermarking. Informatica 41: 1–13. [Google Scholar]

- Hassanat, Ahmad B., V. S. Prasath, Mouhammd Al-kasassbeh, Ahmad Tarawneh, and Ahmad Al-shamailh. 2018b. Magnetic energy-based feature extraction for low-quality fingerprint images. Signal, Image and Video Processing 12: 1471–78. [Google Scholar] [CrossRef]

- Sunny, Md Arif Istiake, Mirza Maswood, and Abdullah Alharbi. 2020. Deep Learning-Based Stock Price Prediction Using LSTM and Bi-Directional LSTM Model. Paper presented at the 2nd Novel Intelligent and Leading Emerging Sciences Conference, NILES 2020, Giza, Egypt, October 24–26. [Google Scholar]

- Khan, Ayaz. 2014. How does stock prices respond to various macroeconomic factors? A case study of Pakistan. Journal of Management Info 4: 75–95. [Google Scholar] [CrossRef]

- Khan, Wasiat, Usman Malik, Mustansar A. Ghazanfar, Muhammad Azam, Khaled Alyoubi, and Ahmed S. Alfakeeh. 2020. Predicting stock market trends using machine learning algorithms via public sentiment and political situation analysis. Soft Computing 24: 11019–43. [Google Scholar] [CrossRef]

- Khashei, Mehdi, and Zahra Hajirahimi. 2018. A comparative study of series arima/mlp hybrid models for stock price forecasting. Communications in Statistics-Simulation and Computation 48: 2625–40. [Google Scholar] [CrossRef]

- Kimoto, Takashi, Kazuo Asakawa, Morio Yoda, and Masakazu Takeoka. 1990. Stock market prediction system with modular neural networks. Paper presented at the 1990 IJCNN International Joint Conference on Neural Networks, San Diego, CA, USA, June 17–21; pp. 1–6. [Google Scholar]

- Lei, L. 2017. Wavelet Neural Network Prediction Method of Stock Price Trend Based on Rough Set Attribute Reduction. Applied Soft Computing Journal 62: 923–32. [Google Scholar] [CrossRef]

- Lin, Yu-Fei, Tzu-Ming Huang, Wei-Ho Chung, and Yeong-Luh Ueng. 2020. Forecasting Fluctuations in the Financial Index Using a Recurrent Neural Network Based on Price Features. IEEE Transactions on Emerging Topics in Computational Intelligence 5: 780–91. [Google Scholar] [CrossRef]

- Lo, Andrew, and A. Craig MacKinlay. 1988. Stock market prices do not follow random walks: Evidence from a simple specification test. The Review of Financial Studies 1: 41–66. [Google Scholar] [CrossRef]

- Ma, Alfred. 2022. Profitability of technical trading strategies under market manipulation. Financial Innovation 8: 1–9. [Google Scholar] [CrossRef]

- Malkiel, Burton. 2003. The efficient market hypothesis and its critics. Journal of Economic Perspectives 17: 59–82. [Google Scholar] [CrossRef] [Green Version]

- Mars, Ayoub, Ahmad Abadleh, and Wael Adi. 2019. Operator and Manufacturer Independent D2D Private Link for Future 5G Networks. Paper presented at the INFOCOM 2019—IEEE Conference on Computer Communications Workshops, INFOCOM WKSHPS 2019, Paris, France, April 29–May 2. [Google Scholar]

- Mehta, Pooja, Sharnil Pandya, and Ketan Kotecha. 2021. Harvesting social media sentiment analysis to enhance stock market prediction using deep learning. PeerJ Computer Science 7: e476. [Google Scholar] [CrossRef] [PubMed]

- Mitra, Subrata Kumar. 2011. How rewarding is technical analysis in the Indian stock market? Quantitative Finance 11: 287–97. [Google Scholar] [CrossRef]

- Mnasri, Sami, Adrien Van Den Bossche, Nejah Narsi, and Thierry Val. 2015. The 3D Deployment Multi-objective Problem in Mobile WSN: Optimizing Coverage and Localization. International Research Journal of Innovative Engineering—IRJIE 1: 1–15. [Google Scholar]

- Mnasri, Sami, Fatma Abbes, Kamel Zidi, and Khaled Ghedira. 2014. A multi-objective hybrid BCRC-NSGAII algorithm to solve the VRPTW. Paper presented at the 13th International Conference on Hybrid Intelligent Systems, HIS 2013, Gammarth, Tunisia, December 4–6. [Google Scholar]

- Mnasri, Sami, Adrien Van Den Bossche, Nejah Nasri, and Thierry Val. 2017a. The 3D Redeployment of Nodes in Wireless Sensor Networks with Real Testbed Prototyping. In Lecture Notes in Computer Science (including subseries Lecture Notes in Artificial Intelligence and Lecture Notes in Bioinformatics). Cham: Springer, vol. 10517 LNCS. [Google Scholar]

- Mnasri, Sami, Nejah Nasri, Adrien Van Den Bossche, and Thierry Val. 2017b. A hybrid ant-genetic algorithm to solve a real deployment problem: A case study with experimental validation. In Lecture Notes in Computer Science (including subseries Lecture Notes in Artificial Intelligence and Lecture Notes in Bioinformatics). Cham: Springer, vol. 10517 LNCS. [Google Scholar]

- Mnasri, Sami, Nejah Nasri, Adrien Van Den Bossche, and Thierry Val. 2018a. A comparative analysis with validation of NSGA-III and MOEA/D in resolving the 3D indoor redeployment problem in DL-IoT. Paper presented at the 2017 International Conference on Internet of Things, Embedded Systems and Communications, IINTEC 2017, Gafsa, Tunisia, October 20–22. [Google Scholar]

- Mnasri, Sami, Nejah Nasri, Adrien van den Bossche, and Thierry Val. 2019. A new multi-agent particle swarm algorithm based on birds accents for the 3D indoor deployment problem. ISA Transactions 91: 262–80. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Mnasri, Sami, Nejah Nasri, and Thierry Val. 2018b. The 3D indoor deployment in DL-IoT with experimental validation using a particle swarm algorithm based on the dialects of songs. Paper presented at the 2018 14th International Wireless Communications and Mobile Computing Conference, IWCMC 2018, Limassol, Cyprus, June 25–29. [Google Scholar]

- Mnasri, Sami, Nejah Nasri, Malek Alrashidi, Adrien van den Bossche, and Thierry Val. 2020. IoT networks 3D deployment using hybrid many-objective optimization algorithms. Journal of Heuristics 26: 663–709. [Google Scholar] [CrossRef]

- Muhammad, Shakeel. 2018. The Relationship Between Fundamental Analysis and Stock Returns Based on the Panel Data Analysis; Evidence from Karachi Stock exchange (KSE). Research Journal of Finance and Accounting 9: 84–96. [Google Scholar]

- Mulhem, Saleh, Ahmad Abadleh, and Wael Adi. 2019. Accelerometer-Based Joint User-Device Clone-Resistant Identity. Paper presented at the Second World Conference on Smart Trends in Systems, Security and Sustainability (WorldS4), London, UK, October 30–31; pp. 230–37. [Google Scholar]

- Nabipour, Mojtaba, Pooyan Nayyeri, Hamed Jabani, S. Shahab, and Amir Mosavi. 2020. Predicting Stock Market Trends Using Machine Learning and Deep Learning Algorithms Via Continuous and Binary Data; A Comparative Analysis. IEEE Access 8: 150199–212. [Google Scholar] [CrossRef]

- Narloch, Piotr, Ahmad Hassanat, Ahmad S. Tarawneh, Hubert Anysz, Jakub Kotowski, and Khalid Almohammadi. 2019. Predicting Compressive Strength of Cement-Stabilized Rammed Earth Based on SEM Images Using Computer Vision and Deep Learning. Applied Sciences 9: 5131. [Google Scholar] [CrossRef] [Green Version]

- Nevasalmi, Lauri. 2020. Forecasting multinomial stock returns using machine learning methods. Journal of Finance and Data Science 6: 86–106. [Google Scholar] [CrossRef]

- Nti, Isaac Kofi, Adebayo Felix Adekoya, and Benjamin Asubam Weyori. 2020. A systematic review of fundamental and technical analysis of stock market predictions. Artificial Intelligence Review 53: 3007–57. [Google Scholar] [CrossRef]

- Oxford Business Group. 2017. Egypt’s Insurance Sector Posts Strong Growth in Tough Economic Context. Available online: https://oxfordbusinessgroup.com/overview/catching-sector-posts-strong-growth-tough-economic-context (accessed on 1 November 2021).

- Oxford Business Group. 2020. Increased Competition and New Regulations Transform the Sector. Available online: https://oxfordbusinessgroup.com/overview/increased-competition-and-new-regulations-transform-sector (accessed on 1 November 2021).

- Park, Cheol-Ho, and Scott Irwin. 2007. What do we know about the profitability of technical analysis? Journal of Economic Surveys 21: 786–826. [Google Scholar] [CrossRef]

- Patel, Jigar, Sahil Shah, Priyank Thakkar, and Ketan Kotecha. 2015. Predicting stock market index using fusion of machine learning techniques. Expert Systems with Applications 42: 2162–72. [Google Scholar] [CrossRef]

- Paul, Sanjoy Kumar. 2011. Determination of Exponential Smoothing Constant to Minimize Mean Square Error and Mean Absolute Deviation. Global Journal of Research in Engineering 11: 20–31. [Google Scholar]

- Prechter, Robert R., Jr., and Wayne D. Parker. 2007. The financial/economic dichotomy in social behavioral dynamics: The socionomic perspective. The Journal of Behavioral Finance 8: 84–108. [Google Scholar] [CrossRef]

- Qian, Bo, and Khaled Rasheed. 2007. Stock market prediction with multiple classifiers. Applied Intelligence 26: 25–33. [Google Scholar] [CrossRef]

- Qiu, Mingyue, and Song Yu. 2016. Predicting the Direction of Stock Market Index Movement Using an Optimized Artificial Neural Network Model. PLoS ONE 11: e0155133. [Google Scholar] [CrossRef] [Green Version]

- Rawashdeh, Adnan, Mouhammd Alkasassbeh, and Muna Al-Hawawreh. 2018. An anomaly-based approach for DDoS attack detection in cloud environment. International Journal of Computer Applications in Technology 57: 312–24. [Google Scholar]

- Salman, Hamzeh E., Mustafa Hammad, Abdelhak-Djamel Seriai, and Ahed Al-Sbou. 2018. Semantic clustering of functional requirements using agglomerative hierarchical clustering. Information 9: 222. [Google Scholar] [CrossRef] [Green Version]

- Samer, A., M. Rawan, and L. Omar. 2018. The Role of Corporate Social Responsibility in Local Community Development: A study of the Jordan Ahli Bank. International Journal of Academic Research in Business and Social Sciences 8: 199–214. [Google Scholar] [CrossRef]

- Santos, B. M. 2011. Selecting the right nutrient rate: Basis for managing fertilization programs. HortTechnology 21: 683–85. [Google Scholar] [CrossRef]

- Shynkevich, Yauheniya, T. Martin McGinnity, Sonya Coleman, Ammar Belatreche, and Yuhua Li. 2017. Forecasting price movements using technical indicators: Investigating the impact of varying input window length. Neurocomputing 264: 71–88. [Google Scholar] [CrossRef] [Green Version]

- Singh, Aishwarya. 2018. Predicting the Stock Market Using Machine Learning and Deep Learning. Electronic Research Journal of Engineering, Computer and Applied Sciences 2: 1–10. [Google Scholar]

- Singh, Aryendra, Priyanshi Gupta, and Narina Thakur. 2021. An empirical research and comprehensive analysis of stock market prediction using machine learning and deep learning techniques. IOP Conference Series: Materials Science and Engineering 1022: 012098. [Google Scholar] [CrossRef]

- Singh, Shashank, Maaz Ahmad, Aditya Bhattacharya, and M. Azhagiri. 2019. Predicting stock market trends using hybrid SVM model and LSTM with sentiment determination using natural language processing. International Journal of Engineering and Advanced Technology 9: 2870–75. [Google Scholar] [CrossRef]

- Tarawneh, Ahmad S., Ahmad B. Hassanat, Ceyhun Celik, Dmitry Chetverikov, MD S. Rahman, and Chaman Verma. 2019a. Deep Face Image Retrieval: A Comparative Study with Dictionary Learning. Paper presented at the 2019 10th International Conference on Information and Communication Systems (ICICS), Irbid, Jordan, June 11–13. [Google Scholar]

- Tarawneh, Ahmad S., Ahmad B. Hassanat, Dmitry Chetverikov, I. Lendak, and Chaman Verma. 2019b. Invoice Classification Using Deep Features and Machine Learning Techniques. Paper presented at the 2019 IEEE Jordan International Joint Conference on Electrical Engineering and Information Technology (JEEIT), Irbid, Jordan, April 9–11. [Google Scholar]

- Tarawneh, Ahmad S., Ahmad B. Hassanat, I. Elkhadiri, Dmitry Chetverikov, and Khaled Almohammadi. 2020a. Automatic Gamma Correction Based on Root-Mean-Square-Error Maximization. Paper presented at the 2020 International Conference on Computing and Information Technology (ICCIT-1441), Tabuk, Saudi Arabia, September 9–10. [Google Scholar]

- Tarawneh, Ahmad S., Ceyhun Celik, Ahmad B. Hassanat, and Dmitry Chetverikov. 2020b. Detailed investigation of deep features with sparse representation and dimensionality reduction in CBIR: A comparative study. Intelligent Data Analysis 24: 47–68. [Google Scholar] [CrossRef] [Green Version]

- Tarawneh, Ahmad S., Dmitry Chetverikov, Chaman Verma, and Ahmad Hassanat. 2018. Stability and reduction of statistical features for image classification and retrieval: Preliminary results. Paper presented at the 2018 9th International Conference on Information and Communication Systems (ICICS), Irbid, Jordan, April 3–5. [Google Scholar]

- Taylor, Mark P., and Helen Allen. 1992. The use of technical analysis in the foreign exchange market. Journal of international Money and Finance 11: 304–14. [Google Scholar] [CrossRef]

- Tlili, Sihem, Sami Mnasri, and Thierry Val. 2021. A multi-objective Gray Wolf algorithm for routing in IoT Collection Networks with real experiments. Paper presented at the 2021 IEEE 4th National Computing Colleges Conference, NCCC 2021, Taif, Saudi Arabia, March 27–28. [Google Scholar]

- Turner, Toni. 2007. A Beginner’s Guide to Day Trading Online, 2nd ed. Avon: Adams Media. [Google Scholar]

- Valencia, Franco, Alfonso Gómez-Espinosa, and Benjamín Valdés-Aguirre. 2019. Price movement prediction of cryptocurrencies using sentiment analysis and machine learning. Entropy 21: 589. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Vasiliou, Dimitrios, Nikolaos Eriotis, and Spyros Papathanasiou. 2006. How rewarding is technical analysis? Evidence from Athens Stock Exchange. Operational Research 6: 85–102. [Google Scholar] [CrossRef]

- Wong, Wing-Keung, Meher Manzur, and Boon-Kiat Chew. 2010. How rewarding is technical analysis? Evidence from Singapore stock. Applied Financial Economics 13: 543–51. [Google Scholar] [CrossRef]

- Zhong, Xiao, and David Enke. 2019. Predicting the daily return direction of the stock market using hybrid machine learning algorithms. Financial Innovation 5: 1–20. [Google Scholar] [CrossRef]

- Zhuo, Jinwu, Xinmiao Li, and Changrui Yu. 2021. Parameter behavioral finance model of investor groups based on statistical approaches. Quarterly Review of Economics and Finance 80: 74–79. [Google Scholar] [CrossRef]

- Zulkarnain, Iskandar. 2014. Research on The Simple Moving Average (SMAs)Technical Analysis Effectiveness: A Test of Conformity with the Earning Per Share of Top Gainers at IDX. Paper presented at the ICE-ISM, Palembang, Indonesia, October 17–18. [Google Scholar]

- Zuraiq, AlMaha A., and Mouhammd Alkasassbeh. 2019. Review: Phishing Detection Approaches. Paper presented at the 2019 2nd International Conference on New Trends in Computing Sciences, ICTCS 2019, Amman, Jordan, October 9–11. [Google Scholar]

| Method | Period (Days) | MAE | MAPE | MPE | MSE | TS |

|---|---|---|---|---|---|---|

| SMA | 5 | 0.0463 | 0.0361 | 0.0068 | 0.0040 | 0.1509 |

| 10 | 0.0498 | 0.0389 | 0.0105 | 0.0048 | 0.2234 | |

| 15 | 0.0476 | 0.0373 | 0.0124 | 0.0041 | 0.2895 | |

| 20 | 0.0480 | 0.0378 | 0.0147 | 0.0042 | 0.3471 | |

| STD | 0.0015 | 0.0012 | 0.0033 | 0.0003 | 0.0846 | |

| WMA | 5 | 0.1078 | 0.0805 | −0.0469 | 0.0988 | −0.6131 |

| 10 | 0.2188 | 0.1653 | −0.1325 | 0.2450 | −0.8179 | |

| 15 | 0.3284 | 0.2492 | −0.2172 | 0.3899 | −0.8830 | |

| 20 | 0.4395 | 0.3317 | −0.2995 | 0.5437 | −0.9124 | |

| STD | 0.1426 | 0.1082 | 0.1088 | 0.1911 | 0.1349 |

| Company’s Name | Symbol | Average Value Traded | Average No. of Trans | Listed Shares | Available Data (Days) |

|---|---|---|---|---|---|

| Middle East Insurance | MEIN | 37,853.6 | 3.1 | 22,050,000 | 144 |

| Al-Nisr Al-Arabi Insurance | AAIN | 2355.4 | 1.6 | 10,000,000 | 111 |

| Jordan Insurance | JOIN | 8144.8 | 3.7 | 30,000,000 | 143 |

| Arabia Insurance Company-Jordan | AICJ | 2425.5 | 2.5 | 8,000,000 | 178 |

| Delta Insurance | DICL | 3931.5 | 2.2 | 8,000,000 | 142 |

| Jerusalem Insurance | JERY | 1780.1 | 1.8 | 8,000,000 | 57 |

| The United Insurance | UNIN | 10,320.0 | 1.9 | 8,000,000 | 51 |

| Jordan French Insurance | JOFR | 3165.5 | 2.1 | 9,100,000 | 220 |

| Al-Manara Insurance Plc.Co. | ARSI | 30,751.92 | 2.95 | 5,600,000 | 147 |

| Arab Orient Insurance Company | AOIC | 1748.47 | 2.75 | 21,438,252 | 168 |

| Company | Market Capitalization | High Price | Low Price | Closing Price | Average Price | Value Traded | Turnover Ratio | Dividend | EPS |

|---|---|---|---|---|---|---|---|---|---|

| MEIN | 22,050,000 | 1.45 | 1.13 | 1.28 | 1 | 6,795,941 | 24 | 0.050 | 0.046 |

| AAIN | 10,000,000 | 5 | 4 | 4 | 4 | 246,972 | 1 | 0.300 | 0.306 |

| JOIN | 30,000,000 | 2.33 | 1.1 | 1.42 | 1.44 | 478,096 | 1.11 | 0.000 | 0.100 |

| AICJ | 8,000,000 | 1 | 1 | 1 | 1 | 1,425,692 | 20 | 0.000 | 0.078 |

| DICL | 8,000,000 | 1 | 1 | 1 | 1 | 30,124 | 0 | 0.050 | 0.076 |

| JERY | 8,000,000 | 2 | 2 | 2 | 2 | 19,067 | 0 | 0.070 | 0.156 |

| UNIN | 8,000,000 | 1 | 1 | 1 | 1 | 282,431 | 3 | 0.100 | 0.188 |

| JOFR | 9,100,000 | 1 | 1 | 1 | 1 | 59,437 | 1 | 0.000 | 0.100 |

| ARSI | 5,600,000 | 1 | 0 | 0 | 0 | 194,495 | 8 | 0.000 | 0.317 |

| AOIC | 25,438,252 | 1.63 | 1.14 | 1.55 | 1 | 66,046 | 0 | 0.000 | 0.265 |

| CN | Method | MAE | MAPE | MPE | MSE | TS | CN | Method | MAE | MAPE | MPE | MSE | TS |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| MEIN | EDWMA | 0.018 | 0.014 | 0.002 | 0.001 | 0.125 | AAIN | EDWMA | 0.021 | 0.005 | −0.001 | 0.002 | −0.189 |

| SMA-3 | 0.038 | 0.029 | 0.004 | 0.003 | 0.11 | SMA-3 | 0.044 | 0.011 | −0.002 | 0.007 | −0.184 | ||

| WMA-3 | 0.047 | 0.033 | −0.004 | 0.022 | −0.174 | WMA-3 | 0.074 | 0.018 | −0.01 | 0.15 | −0.577 | ||

| ES-0.1 | 0.062 | 0.047 | 0.021 | 0.006 | 0.423 | ES-0.1 | 0.114 | 0.028 | −0.005 | 0.023 | −0.235 | ||

| ES-0.5 | 0.036 | 0.027 | 0.004 | 0.002 | 0.119 | ES-0.5 | 0.043 | 0.011 | −0.002 | 0.006 | −0.189 | ||

| ES-0.9 | 0.03 | 0.023 | 0.002 | 0.002 | 0.077 | ES-0.9 | 0.028 | 0.007 | −0.001 | 0.005 | −0.172 | ||

| SMA-10 | 0.056 | 0.042 | 0.01 | 0.006 | 0.216 | SMA-10 | 0.097 | 0.024 | −0.004 | 0.017 | −0.212 | ||

| WMA-10 | 0.142 | 0.091 | −0.048 | 0.164 | −0.602 | WMA-10 | 0.362 | 0.09 | −0.075 | 1.172 | −0.839 | ||

| SMA-20 | 0.071 | 0.053 | 0.021 | 0.008 | 0.37 | SMA-20 | 0.762 | 0.186 | −0.165 | 2.74 | −0.893 | ||

| WMA-20 | 0.252 | 0.164 | −0.116 | 0.332 | −0.761 | WMA-20 | 0.762 | 0.186 | −0.165 | 2.74 | −0.893 | ||

| JOIN | EDWMA | 0.034 | 0.019 | 0 | 0.003 | −0.059 | AICJ | EDWMA | 0.008 | 0.013 | 0.002 | 0 | 0.096 |

| SMA-3 | 0.071 | 0.04 | 0 | 0.012 | −0.055 | SMA-3 | 0.016 | 0.028 | 0.003 | 0 | 0.106 | ||

| WMA-3 | 0.072 | 0.041 | −0.007 | 0.026 | −0.197 | WMA-3 | 0.019 | 0.031 | −0.003 | 0.004 | −0.148 | ||

| ES-0.1 | 0.207 | 0.121 | 0.016 | 0.086 | −0.079 | ES-0.1 | 0.03 | 0.051 | 0.014 | 0.001 | 0.243 | ||

| ES-0.5 | 0.068 | 0.038 | 0 | 0.011 | −0.059 | ES-0.5 | 0.016 | 0.027 | 0.003 | 0 | 0.107 | ||

| ES-0.9 | 0.045 | 0.026 | −0.001 | 0.005 | −0.048 | ES-0.9 | 0.014 | 0.023 | 0.002 | 0 | 0.069 | ||

| SMA-10 | 0.154 | 0.086 | 0.004 | 0.057 | −0.076 | SMA-10 | 0.027 | 0.045 | 0.009 | 0.001 | 0.163 | ||

| WMA-10 | 0.205 | 0.122 | −0.055 | 0.168 | −0.466 | WMA-10 | 0.053 | 0.081 | −0.04 | 0.024 | −0.565 | ||

| SMA-20 | 0.25 | 0.143 | 0.013 | 0.135 | −0.1 | SMA-20 | 0.034 | 0.058 | 0.013 | 0.002 | 0.191 | ||

| WMA-20 | 0.383 | 0.23 | −0.118 | 0.394 | −0.56 | WMA-20 | 0.091 | 0.143 | −0.099 | 0.045 | −0.734 |

| CN | Method | MAE | MAPE | MPE | MSE | TS | CN | Method | MAE | MAPE | MPE | MSE | TS |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| DICL | EDWMA | 0.057 | 0.028 | 0.013 | 0.013 | 0.393 | JOFR | EDWMA | 0.01 | 0.012 | 0.001 | 0 | 0.015 |

| SMA-3 | 0.124 | 0.06 | 0.026 | 0.059 | 0.364 | SMA-3 | 0.022 | 0.026 | 0.001 | 0.001 | 0.012 | ||

| WMA-3 | 0.141 | 0.059 | 0.015 | 0.202 | 0.046 | WMA-3 | 0.025 | 0.028 | −0.003 | 0.005 | −0.166 | ||

| ES-0.1 | 0.326 | 0.183 | 0.14 | 0.198 | 0.688 | ES-0.1 | 0.037 | 0.042 | 0.004 | 0.002 | 0.023 | ||

| ES-0.5 | 0.114 | 0.056 | 0.026 | 0.05 | 0.396 | ES-0.5 | 0.02 | 0.023 | 0.001 | 0.001 | 0.013 | ||

| ES-0.9 | 0.091 | 0.042 | 0.014 | 0.036 | 0.276 | ES-0.9 | 0.018 | 0.021 | 0.001 | 0.001 | 0.008 | ||

| SMA-10 | 0.241 | 0.127 | 0.076 | 0.147 | 0.538 | SMA-10 | 0.029 | 0.033 | 0.002 | 0.002 | 0.026 | ||

| WMA-10 | 0.443 | 0.152 | −0.001 | 1.334 | −0.376 | WMA-10 | 0.061 | 0.065 | −0.034 | 0.036 | −0.571 | ||

| SMA-20 | 0.39 | 0.217 | 0.147 | 0.277 | 0.626 | SMA-20 | 0.041 | 0.047 | 0.005 | 0.003 | 0.045 | ||

| WMA-20 | 0.705 | 0.263 | −0.045 | 2.028 | −0.526 | WMA-20 | 0.113 | 0.118 | −0.077 | 0.083 | −0.699 | ||

| JERY | EDWMA | 0.019 | 0.012 | 0.001 | 0.001 | 0.015 | UNIN | EDWMA | 0.026 | 0.022 | 0.008 | 0.001 | 0.391 |

| SMA-3 | 0.042 | 0.026 | 0.001 | 0.003 | 0.017 | SMA-3 | 0.054 | 0.045 | 0.016 | 0.004 | 0.35 | ||

| WMA-3 | 0.067 | 0.041 | −0.016 | 0.053 | −0.432 | WMA-3 | 0.08 | 0.06 | −0.006 | 0.055 | −0.182 | ||

| ES-0.1 | 0.049 | 0.031 | 0.005 | 0.005 | 0.127 | ES-0.1 | 0.117 | 0.1 | 0.082 | 0.02 | 0.816 | ||

| ES-0.5 | 0.039 | 0.024 | 0.001 | 0.003 | 0.02 | ES-0.5 | 0.051 | 0.042 | 0.016 | 0.004 | 0.376 | ||

| ES-0.9 | 0.031 | 0.019 | 0.001 | 0.003 | 0.018 | ES-0.9 | 0.046 | 0.038 | 0.009 | 0.003 | 0.24 | ||

| SMA-10 | 0.053 | 0.032 | 0.002 | 0.004 | 0.021 | SMA-10 | 0.082 | 0.069 | 0.038 | 0.011 | 0.543 | ||

| WMA-10 | 0.278 | 0.167 | −0.14 | 0.397 | −0.848 | WMA-10 | 0.276 | 0.202 | −0.139 | 0.328 | −0.744 | ||

| SMA-20 | 0.057 | 0.035 | 0.002 | 0.006 | 0.002 | SMA-20 | 0.112 | 0.096 | 0.068 | 0.018 | 0.703 | ||

| WMA-20 | 0.551 | 0.336 | −0.32 | 0.856 | −0.956 | WMA-20 | 0.489 | 0.386 | −0.347 | 0.59 | −0.912 |

| CN | Method | MAE | MAPE | MPE | MSE | TS | CN | Method | MAE | MAPE | MPE | MSE | TS |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ARSI | EDWMA | 0.009 | 0.019 | 0 | 0 | −0.019 | AOIC | EDWMA | 0.019 | 0.017 | −0.002 | 0.001 | −0.161 |

| SMA-3 | 0.019 | 0.041 | 0.001 | 0.001 | −0.018 | SMA-3 | 0.039 | 0.036 | −0.004 | 0.002 | −0.152 | ||

| WMA-3 | 0.019 | 0.042 | −0.007 | 0.001 | −0.161 | WMA-3 | 0.041 | 0.039 | −0.009 | 0.007 | −0.268 | ||

| ES-0.1 | 0.033 | 0.071 | 0.002 | 0.002 | −0.078 | ES-0.1 | 0.071 | 0.065 | −0.011 | 0.008 | −0.28 | ||

| ES-0.5 | 0.017 | 0.037 | 0.001 | 0 | −0.02 | ES-0.5 | 0.037 | 0.034 | −0.003 | 0.002 | −0.157 | ||

| ES-0.9 | 0.013 | 0.028 | 0 | 0 | −0.012 | ES-0.9 | 0.031 | 0.028 | −0.002 | 0.001 | −0.117 | ||

| SMA-10 | 0.031 | 0.068 | 0.001 | 0.002 | −0.061 | SMA-10 | 0.066 | 0.06 | −0.008 | 0.006 | −0.217 | ||

| WMA-10 | 0.044 | 0.108 | −0.057 | 0.008 | −0.497 | WMA-10 | 0.093 | 0.093 | −0.057 | 0.042 | −0.602 | ||

| SMA-20 | 0.039 | 0.083 | −0.002 | 0.003 | −0.12 | SMA-20 | 0.084 | 0.077 | −0.015 | 0.011 | −0.303 | ||

| WMA-20 | 0.074 | 0.183 | −0.124 | 0.019 | −0.658 | WMA-20 | 0.159 | 0.166 | −0.123 | 0.09 | −0.733 |

| CN | Method | MAE | MAPE | MPE | MSE | TS | CN | Method | MAE | MAPE | MPE | MSE | TS |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| MEIN | EDWMA | 0.018 | 0.014 | 0.002 | 0.001 | 0.125 | AAIN | EDWMA | 0.017 | 0.004 | 0.001 | 0.001 | 0.247 |

| ES-0.9 | 0.007 | 0.027 | 0.019 | 0.005 | 0.002 | ES-0.9 | 0.024 | 0.006 | 0.001 | 0.004 | 0.196 | ||

| JOIN | EDWMA | 0.029 | 0.013 | −0.009 | 0.002 | −0.696 | AICJ | EDWMA | 0.009 | 0.015 | 0.003 | 0.000 | 0.153 |

| ES-0.9 | 0.036 | 0.017 | −0.011 | 0.003 | −0.630 | SMA-3 | 0.016 | 0.025 | 0.003 | 0.000 | 0.116 | ||

| DICL | EDWMA | 0.013 | 0.015 | 0.007 | 0.000 | 0.447 | JOFR | EDWMA | 0.007 | 0.009 | 0.002 | 0.000 | 0.200 |

| ES-0.9 | 0.018 | 0.020 | 0.007 | 0.001 | 0.302 | SMA-3 | 0.013 | 0.016 | 0.002 | 0.000 | 0.120 | ||

| JERY | EDWMA | 0.020 | 0.013 | 0.003 | 0.001 | 0.192 | UNIN | EDWMA | 0.032 | 0.025 | 0.016 | 0.002 | 0.629 |

| ES-0.9 | 0.036 | 0.022 | 0.004 | 0.003 | 0.144 | SMA-3 | 0.054 | 0.043 | 0.016 | 0.005 | 0.370 | ||

| ARSI | EDWMA | 0.010 | 0.022 | 0.000 | 0.000 | −0.041 | AOIC | EDWMA | 0.018 | 0.018 | −0.001 | 0.000 | −0.080 |

| ES-0.9 | 0.014 | 0.032 | 0.000 | 0.000 | −0.035 | SMA-3 | 0.031 | 0.030 | −0.001 | 0.001 | −0.051 |

| CN | Method | MAE | MAPE | MPE | MSE | TS | CN | Method | MAE | MAPE | MPE | MSE | TS |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| MEIN | EDWMA | 0.019 | 0.015 | 0.001 | 0.001 | 0.052 | AAIN | EDWMA | 0.022 | 0.005 | −0.002 | 0.002 | −0.509 |

| ES-0.9 | 0.001 | 0.032 | 0.025 | 0.001 | 0.002 | ES-0.9 | 0.028 | 0.007 | −0.003 | 0.004 | −0.467 | ||

| JOIN | EDWMA | 0.034 | 0.021 | 0.004 | 0.003 | 0.195 | AICJ | EDWMA | 0.007 | 0.012 | 0.001 | 0.000 | 0.048 |

| ES-0.9 | 0.047 | 0.030 | 0.004 | 0.005 | 0.158 | SMA-3 | 0.012 | 0.021 | 0.001 | 0.000 | 0.028 | ||

| DICL | EDWMA | 0.022 | 0.020 | −0.007 | 0.001 | −0.384 | JOFR | EDWMA | 0.015 | 0.016 | −0.001 | 0.000 | −0.083 |

| ES-0.9 | 0.035 | 0.031 | −0.007 | 0.002 | −0.245 | SMA-3 | 0.026 | 0.029 | −0.001 | 0.001 | −0.061 | ||

| JERY | EDWMA | 0.017 | 0.010 | −0.003 | 0.001 | −0.292 | UNIN | EDWMA | 0.021 | 0.019 | 0.004 | 0.001 | 0.154 |

| ES-0.9 | 0.026 | 0.015 | −0.003 | 0.002 | −0.203 | SMA-3 | 0.034 | 0.031 | 0.004 | 0.002 | 0.102 | ||

| ARSI | EDWMA | 0.007 | 0.014 | 0.001 | 0.000 | 0.069 | AOIC | EDWMA | 0.019 | 0.016 | −0.003 | 0.001 | −0.248 |

| ES-0.9 | 0.010 | 0.021 | 0.002 | 0.000 | 0.068 | SMA-3 | 0.030 | 0.025 | −0.004 | 0.001 | −0.198 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Altarawneh, G.A.; Hassanat, A.B.; Tarawneh, A.S.; Abadleh, A.; Alrashidi, M.; Alghamdi, M. Stock Price Forecasting for Jordan Insurance Companies Amid the COVID-19 Pandemic Utilizing Off-the-Shelf Technical Analysis Methods. Economies 2022, 10, 43. https://doi.org/10.3390/economies10020043

Altarawneh GA, Hassanat AB, Tarawneh AS, Abadleh A, Alrashidi M, Alghamdi M. Stock Price Forecasting for Jordan Insurance Companies Amid the COVID-19 Pandemic Utilizing Off-the-Shelf Technical Analysis Methods. Economies. 2022; 10(2):43. https://doi.org/10.3390/economies10020043

Chicago/Turabian StyleAltarawneh, Ghada A., Ahmad B. Hassanat, Ahmad S. Tarawneh, Ahmad Abadleh, Malek Alrashidi, and Mansoor Alghamdi. 2022. "Stock Price Forecasting for Jordan Insurance Companies Amid the COVID-19 Pandemic Utilizing Off-the-Shelf Technical Analysis Methods" Economies 10, no. 2: 43. https://doi.org/10.3390/economies10020043