3.1. Data Collection and Sampling

A non-probabilistic sampling method was employed to select participants for the study. Questionnaires as shown in (

Appendix A) were aimed at the funding departments of banks during the time period from January and April 2023. The sample consisted of three Islamic banks and five commercial banks in Palestine that were selected to take part in the research. A total of 122 questionnaires were distributed to participants, of which 104 were returned. The collected data from the questionnaires was analyzed to determine the impact of GF on the sustainability performance of banks in Palestine.

The following model presented in

Figure 2. depicts both the structural and measurement equations. This model can be regarded as a combination of reflective and formative elements, with the structural equation being formative and the measurement equations being reflective.

To investigate the moderation role of female presence at the managerial level on the relationship between the social, economic, and environmental drivers of green finance on a bank’s sustainable performance, the following regression model has been used:

where,

SP: is the sustainability performance proxied by : the short-term financial sustainability, long-term financial sustainability, and environmental sustainability.

: Stands for the green finance drivers : Social, Economic, and Environmental drivers.

: Is a binary variable that equals 0 for males and 1 for females.

: the error terms.

The study employs a robust analytical framework, combining descriptive statistics and structural equation modeling (SEM), to assess the influence of social, economic, and environmental factors on the sustainability of Palestinian banks within the context of green finance. This investigation relies on survey data collected from the target population that gauges attitudes and perceptions regarding the issue in question Furthermore, the study examines the moderating role of female presence using multiple regression analysis.

In this study, the assessment of the banks’ sustainability relies on performance measurements derived from credit managers’ attitudes and perceptions gathered through surveys as the primary data collection instrument. The banks’ performance as dependent variables have been divided into three parts; short-term financial sustainability measured through a collection of items adapted from (

Zheng et al. 2021;

Khan and Quaddus 2015), long-term financial sustainability measured by four attributes adapted from (

Malsha et al. 2020;

Raihan 2019), and sustainability performance measured by four attributes adapted from (

Khan and Quaddus 2015;

Zheng et al. 2021). Furthermore, the social dimension of green finance was measured using five attributes, the economic dimension with four attributes adapted from (

Zheng et al. 2021), and the environmental dimension of green finance using five attributes adapted from (

Zheng et al. 2021;

Khan and Quaddus 2015). Each dimension in the proposed models is a latent variable that has been captured by a set of observed variables, with each observed variable being represented by one single question. Each term, treated as an item scale, was measured through a five-point Likert scale (5 = strongly agree to 1 = strongly disagree).

The SEM differs fundamentally from regression. There is an obvious distinction between dependent and independent variables in a regression model (

McDonald and Ho 2002). Such fundamentals, however, only apply in relative terms in SEM since a dependent variable in one model equation might become an independent variable in other components of the SEM system (

Hancock and Schoonen 2015).

According to the data,

Table 1 shows a gender imbalance in the sample with 71.15% of the participants being male. The majority of the participants fall within the age range of 41–50 years, which might reflect the age structure commonly found in the banking industry. The largest group of workers in terms of work experience consists of individuals with 4–7 years of experience followed by those with more than 11 years of experience. This may have implications for career advancement and employee retention. Overall, the data suggests that the banking workforce is experienced.

The descriptive statistics presented in

Table 2 provide valuable insights into the main dimensions being examined, which include social drivers, economic drivers, environmental drivers, short-term financial sustainability, long-term financial sustainability, and sustainability performance. These statistics offer a comprehensive overview of the central tendencies and dispersion of data within each of these dimensions.

When considering the mean scores, it becomes evident that each of these dimensions is rated quite highly by the participants, as reflected by the mean values ranging from 3.88 to 4.375 on a scale of 1 to 5. This suggests a strong inclination toward these dimensions, with the respondents consistently attributing substantial importance to them. Furthermore, the narrow range of standard deviations, spanning from 0.56 to 0.701, indicates that the data points within each dimension are tightly clustered around their respective means. This implies a remarkable level of agreement among the participants regarding their assessments of these dimensions. The small standard deviations signify a limited degree of variability, suggesting that the participants’ viewpoints align closely with the average perceptions for each dimension. In detail, the statistics reveal that social drivers hold an average significance of 4.177, economic drivers are rated at 3.88, and environmental drivers are notably high at 4.31. Meanwhile, both short-term and long-term financial sustainability dimensions receive considerable attention, with mean scores of 4.12 and 4.161, respectively. Additionally, the dimension of sustainability performance garners a substantial mean score of 4.375.

In summary, the results from

Table 2 underscore the prominence of these dimensions within the scope of the study. The consistently high mean scores across all dimensions point to their perceived importance, while the compact dispersion of data around the means highlights the consensus among participants. This alignment in responses suggests a shared understanding and agreement regarding the central role of these dimensions in the context being examined.

The correlation matrix in

Table 3 displays the correlations between the variables examined in the study. Here are some observations based on the matrix:

All variables are positively correlated with each other, indicating that higher values of one variable are associated with higher values of the other variables.

The strongest correlations are between the three drivers (SD, ED, and EnD) and the sustainability performance variables (STFSP, LTFSP, and SP). This suggests that there is a relationship between the drivers and the sustainability performance of the bank.

The strongest correlation is between LTFSP and SP (0.743), followed by the correlation between STFSP and SP (0.492). This suggests that environmental sustainability is strongly related to the long-term financial sustainability of the bank, while there is also a moderate relationship between environmental sustainability and short-term financial sustainability.

The weakest correlation is between ED and EnD (0.223). This suggests that there is less overlap between the economic and environmental drivers of green finance.

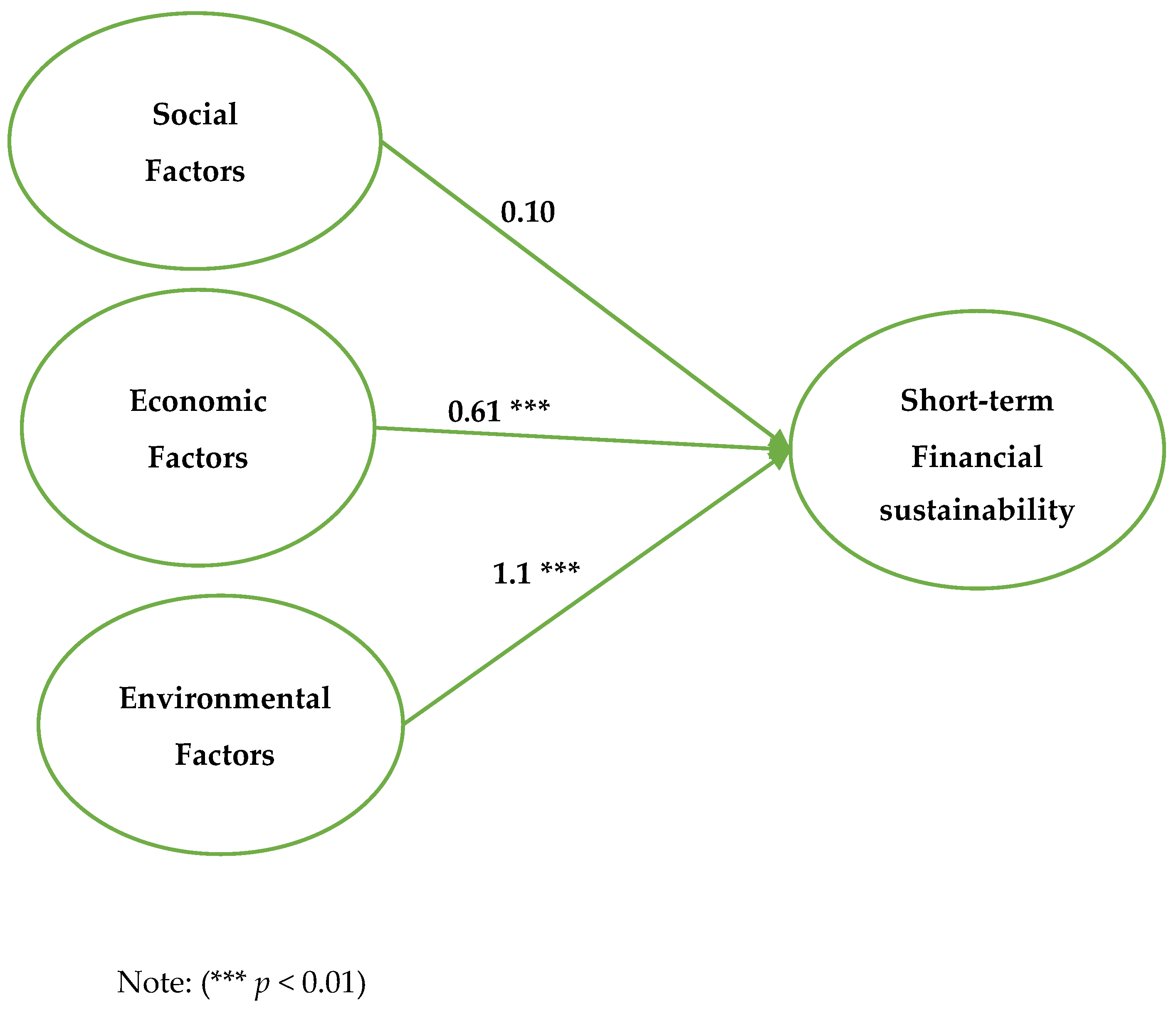

3.1.1. Model 1: Short-Term Financial Sustainability

Figure 3 shows the e impact of the social, economic, and environmental drivers of green finance on the Palestinian banks’ short-term financial sustainability. Based on the data, the model does not indicate a significant impact of social factors on short-term financial sustainability.

However, the model demonstrates a significant and positive impact of the economic and environmental drivers of green finance on short-term financial performance.

Based on the outcomes of the model, it appears that the economic and environmental drivers of green finance have a significant positive influence on short-term financial sustainability in Palestinian banks, whereas social factors do not demonstrate a significant impact.

These results are consistent with Numerous studies conducted in the past. For instance,

Rehman and Nasrullah (

2019) discovered that environmental sustainability positively affects the financial performance of banks in Pakistan, while social factors do not have a significant impact. Likewise,

Chiu and Ho (

2014) found that environmental and economic factors positively influence the financial performance of banks in Taiwan, while social factors do not demonstrate a significant effect.

On the other hand, there are studies that have reported diverse results. For example,

Saha and Bhattacharya (

2018) demonstrated that social factors, such as corporate social responsibility and stakeholder engagement have a significant positive impact on the financial performance of Indian banks. Another study by

Leong and Othman (

2017) initiated that social factors, such as employee satisfaction and customer loyalty have a significant positive impact on the financial performance of Malaysian Islamic banks.

3.1.2. Model 2: Long-Term Financial Sustainability (LTFSP)

Figure 4 shows the impact of the social, economic, and environmental drivers of green finance on the Palestinian banks’ long-term financial sustainability. The model does not indicate a significant impact of social factors on long-term financial sustainability.

Similarly, the model concludes a significant and positive impact of the economic and environmental drivers of green finance on the long-term financial performance.

Based on Model (2), the social factors of green finance do not demonstrate a significant impact on the long-term financial sustainability of Palestinian banks, while the economic and environmental drivers show a significant and positive impact.

These findings are corroborated by existing research. As an illustration,

Rehman and Nasrullah’s (

2019) research demonstrated that environmental sustainability has a positive influence on the financial performance of banks in Pakistan, while social factors did not show a significant impact. Likewise, research conducted by,

Chiu and Ho (

2014) revealed that economic and environmental factors had a notably positive effect on the financial performance of banks in Taiwan, where areas social factors exhibited no significant impact.

Conversely, there is research that opposes these conclusions. For instance, a study by

Gao and Lin (

2020) revealed that social factors, including corporate social responsibility, exert a significant positive impact on the financial performance of Chinese banks. Another study by

Uddin et al. (

2019) found that environmental and social performance have a significant positive influence on the financial performance of Indonesian banks.

Overall, it is important to note that the impact of green finance drivers on financial performance may vary depending on the specific context and methodology of the study. Therefore, it is recommended to conduct further research to fully comprehend the relationship between green finance and financial performance in the Palestinian banking sector.

3.1.3. Model 3: Environmental Sustainability

Figure 5 shows the impact of the social, economic, and environmental drivers of green finance on the Palestinian banks’ environmental sustainability performance.

The model concludes with a significant and positive impact of the social, economic, and environmental drivers of green finance on environmental sustainability performance.

Green finance and its effects on banks’ environmental sustainability performance are attracting increasing attention. Model 3 examines how Palestinian banks’ performance in terms of environmental sustainability is influenced by social, economic, and environmental green finance factors. According to the model, these determinants significantly and favorably affect how well the banks perform in terms of environmental sustainability.

Numerous studies have investigated the relationship between green finance drivers and the financial and environmental sustainability performance of banks, providing insights that either support or contradict the findings of Model (3). Studies that support the model’s findings include the works of

Elshandidy and Hassanein (

2020),

Shahbaz et al. (

2019), and

Kuo et al. (

2019), all of which conclude a positive impact of green finance on both bank performance and environmental sustainability.

3.1.4. The Moderating Role of Gender

Table 4 represents data indicating that the presence of females at the managerial level of Palestinian banks has a moderating role in the relationship between environmental drivers and short-term financial sustainable performance. The impact of environmental drivers and short-term financial sustainable performance indicates a difference between the two groups: 0.423 for males and an increased impact of 0.772 when females are present.

However,

Table 5 demonstrates that the presence of females at the managerial level of the Palestinian banks has a moderating role, which negatively affects the relationship between economic drivers and long-term financial sustainable performance. When examining the impact of the economic drivers and long-term financial sustainable performance, it is evident that for males, the impact is (0.256), where areas the impact turns negative (−0.061) with the presence of females.

Table 6 shows that the presence of females at the managerial level of the Palestinian banks plays a moderating role in the relationship between environmental drivers and environmentally sustainable performance. For instance, when considering the influence of environmental drivers and environmentally sustainable performance, it is observed that for males, the impact is (0.189), but in the presence of females, this impact increases to (0.620).

While

Table 4 shows that female presence moderates the relationship between green finance drivers and short-term financial sustainable performance positively, increasing the impact from 0.423 for males to 0.772 for females,

Table 5, on the contrary, indicates that female presence moderates the relationship between green finance drivers and long-term financial sustainable performance negatively, with the impact decreasing from 0.256 for males to −0.061 when females are present.

Table 6 illustrates that female presence moderates the relationship between green finance drivers and environmentally sustainable performance positively, with the impact increasing from 0.189 for males to 0.358 when females are present.

In summary, female presence at the managerial level of Palestinian banks moderates the relationship between green finance drivers and financial and environmentally sustainable performance in contrary ways, with a positive moderating effect on short-term financial and environmentally sustainable performance, but a negative moderating effect on long-term financial sustainable performance.

The existing literature on the moderating role of gender in the relationship between green finance drivers and financial sustainable performance contains some degree of conflict. While Some studies have demonstrated a positive moderating effect of female presence on financial sustainable performance, others have indicated mixed or inconclusive results. In their research,

Wu et al. (

2022) concluded that female presence at the managerial level positively moderated the relationship between green finance drivers and financial sustainable performance. Furthermore,

Provasi and Harasheh (

2021) concluded that female executives positively influenced the moderating effect on the relationship between green innovation and financial performance in Chinese manufacturing firms. Therefore, despite some conflicting results, there is a general consensus in the literature that gender can indeed play a significant moderating role in this relationship.