Analyzing the Impact of Foreign Capital Inflows and Political Economy on Economic Growth: An Application of Regime Switching Model

Abstract

:1. Introduction

Economic Performance of Pakistan under Different Political Regimes

2. Some Snippets from Past Literature

3. Materials and Methods

3.1. Conceptual Framework

3.2. Data and Variables

3.3. Preliminary Integration

3.3.1. Test of Nonlinearity

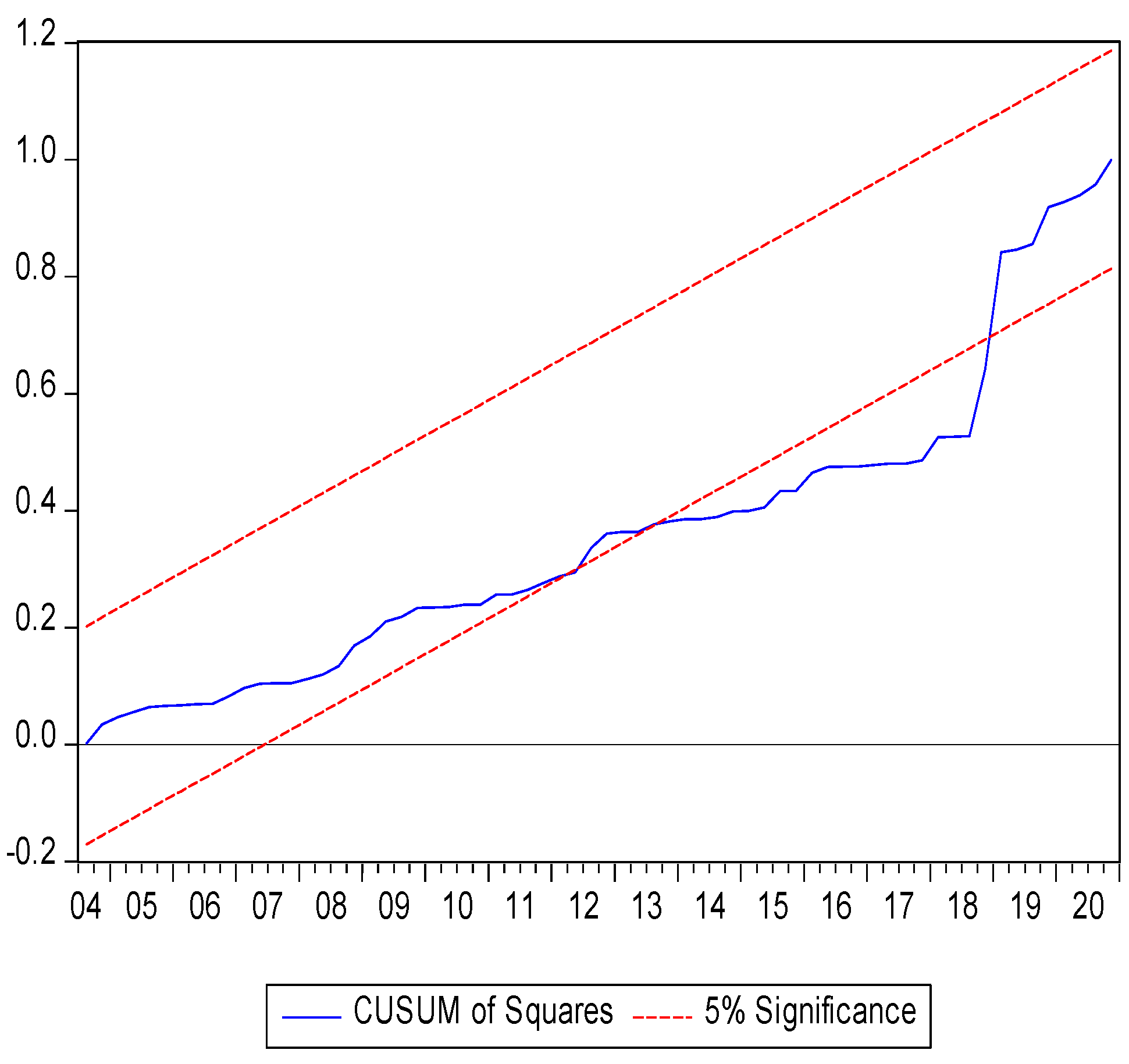

3.3.2. Structural Stability Tests

3.4. Markov Regime-Switching Technique

4. Results and Discussion

4.1. Markov Switching Model Results

4.2. Transition Probabilities

4.3. Markov Switching Smooth Regime Probabilities

5. Conclusions and Policy Recommendations

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Agenor, Pierre, and Peter Montiel. 1999. Macroeconomics Development. Princeton: Princeton University Press. [Google Scholar]

- Ahmad, Nawaz, Rizwan Ahmed, Imamuddin Khoso, Rana Palwishah, and Unaib Raza. 2014. Impact of exchange rate on balance of payment: An investigation from Pakistan. Research Journal of Finance and Accounting 5: 32–42. [Google Scholar]

- Akinlo, Anthony Enisan. 2020. Impact of External Debt on Economic Growth: A Markov Regime–Switching Approach. Journal of Applied Financial Econometrics 1: 123–43. [Google Scholar]

- Alesina, Alberto, and Roberto Perotti. 1996. Income distribution, political instability, and investment. European Economic Review 40: 1203–28. [Google Scholar] [CrossRef] [Green Version]

- Ali, Afshan, and Sabeen Saif. 2017. Determinants of economic growth in Pakistan: A time series analysis. European Online Journal of Natural and Social Sciences 6: 686. [Google Scholar]

- Almfraji, Mohammad Amin, and Mahmoud Khalid Almsafir. 2014. Foreign direct investment and economic growth literature review from 1994 to 2012. Procedia-Social and Behavioral Sciences 129: 206–13. [Google Scholar] [CrossRef] [Green Version]

- Anwar, M. Masood, Aftab Anwar, and Ghulam Yahya Khan. 2020. Inclusive Growth Measurement Under Different Political Regimes of Pakistan. Global Social Sciences Review 5: 42–49. [Google Scholar] [CrossRef]

- Asaad, Zeravan, and Hazheen Mustafa. 2020. The impact of FDI Inflows on GDP Growth in Iraq for the period (2004–2017): An applied study. Tanmiyat Al-Rafidain 39: 56–86. [Google Scholar] [CrossRef]

- Asghar, Ashfaq, and A. Ashfaq. 2004. Remittances not very productively employed. Daily Dawn, September 13. [Google Scholar]

- Asteriou, Dimitrios, and Simon Price. 2001. Political instability and economic growth: UK time series evidence. Scottish Journal of Political Economy 48: 383–99. [Google Scholar] [CrossRef]

- Barajas, Adolfo, Ralph Chami, Connel Fullenkamp, Michael Gapen, and Peter J. Montiel. 2009. Do Workers’ Remittances Promote Economic Growth? Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1442255 (accessed on 20 February 2022).

- Bilgili, Faik, Recep Ulucak, Emrah Koçak, and Salih Çağrı İlkay. 2020. Does globalization matter for environmental sustainability? Empirical investigation for Turkey by Markov regime switching models. Environmental Science and Pollution Research 27: 1087–100. [Google Scholar] [CrossRef]

- Bird, Graham, and Yongseok Choi. 2020. The effects of remittances, foreign direct investment, and foreign aid on economic growth: An empirical analysis. Review of Development Economics 24: 1–30. [Google Scholar] [CrossRef]

- Brock, William, Blake Lebaron, and Jose Scheinkman. 1995. A Test for Independence Based on the Correlation Dimension. Working Paper. Madison: University of Wisconsin at Madison, Department of Economics. [Google Scholar]

- Calvo, Guillermo A., Leonardo Leiderman, and Carmen M. Reinhart. 1996. Inflows of Capital to Developing Countries in the 1990s. Journal of Economic Perspectives 10: 123–39. [Google Scholar] [CrossRef] [Green Version]

- Chuhan, Punam, Stijn Claessens, and Nlandu Mamingi. 1998. Equity and bond flows to Latin America and Asia: The role of global and country factors. Journal of Development Economics 55: 439–63. [Google Scholar] [CrossRef]

- Davar, Ezra. 2013. Government Spending and Economic Growth. The Finance and Business 2: 4–19. [Google Scholar]

- Fiaz, Asma, Nabila Khurshid, Ahsan Satti, and Muhammad Shuaib Malik. 2021. Real exchange rate misalignment in Pakistan: An application of regime switching model. The Journal of Asian Finance, Economics and Business 8: 63–73. [Google Scholar]

- Fry, Maxwell J. 1997. In favour of financial liberalisation. The Economic Journal 107: 754–70. [Google Scholar] [CrossRef]

- Haddad, Mona, and Ann Harrison. 1993. Are there positive spillovers from direct foreign investment?: Evidence from panel data for Morocco. Journal of Development Economics 42: 51–74. [Google Scholar] [CrossRef]

- Hamilton, James D. 1989. A new approach to the economic analysis of nonstationary time series and the business cycle. Econometrica: Journal of the Econometric Society 57: 357–84. [Google Scholar] [CrossRef]

- Haq, Mirajul, and Muhammad Luqman. 2014. The contribution of international trade to economic growth through human capital accumulation: Evidence from nine Asian countries. Cogent Economics & Finance 2: 947000. [Google Scholar]

- Hassan, Adewale, and Daniel Meyer. 2021. Exploring the channels of transmission between external debt and economic growth: Evidence from Sub-Saharan African countries. Economies 9: 50. [Google Scholar] [CrossRef]

- Hayat, Arshad. 2019. Foreign direct investments, institutional quality, and economic growth. The Journal of International Trade & Economic Development 28: 561–79. [Google Scholar]

- Hussain, Karrar. 2019. Monetary Policy Channels of Pakistan and Their Impact on Real GDP and Inflation. CID Research Fellow and Graduate Student Working Paper Series; Cambridge, MA: Center for International Development at Harvard University. [Google Scholar]

- Hussain, Shahzad, and Shahnawaz Malik. 2011. Inflation and economic growth: Evidence from Pakistan. International Journal of Economics and Finance 3: 262–76. [Google Scholar] [CrossRef]

- Irshad, Hira. 2017. Relationship among political instability, stock market returns and stock market volatility. Studies in Business and Economics 12: 70–99. [Google Scholar] [CrossRef] [Green Version]

- James, Patrick, and John R. Oneal. 1991. The influence of domestic and international politics on the president’s use of force. Journal of Conflict Resolution 35: 307–32. [Google Scholar] [CrossRef]

- Javid, Muhammad, Umaima Arif, and Abdul Qayyum. 2012. Impact of remittances on economic growth and poverty. Academic Research International 2: 433. [Google Scholar]

- Jawaid, Syed Tehseen, and Shaikh Muhammad Saleem. 2017. Foreign capital inflows and economic growth of Pakistan. Journal of Transnational Management 22: 121–49. [Google Scholar] [CrossRef]

- Khan, Muhammad Arshad, and Ayaz Ahmed. 2007. Foreign aid—Blessing or curse: Evidence from Pakistan. The Pakistan Development Review 46: 215–40. [Google Scholar] [CrossRef] [Green Version]

- Khan, Muhammad Arshad, Atif Ali Jaffri, Faisal Abbas, and Azad Haider. 2017. Does Trade Liberalization Improve Trade Balance in Pakistan? South Asia Economic Journal 18: 158–83. [Google Scholar] [CrossRef]

- Kharusi, Sami Al, and Mbah Stella Ada. 2018. External debt and economic growth: The case of emerging economy. Journal of Economic Integration 33: 1141–57. [Google Scholar] [CrossRef]

- Koojaroenprasit, Sauwaluck. 2012. The impact of foreign direct investment on economic growth: A case study of South Korea. International Journal of Business and Social Science 3: 8–19. [Google Scholar]

- Kuan, Chung-Ming. 2002. Lecture on the Markov switching model. Institute of Economics Academia Sinica 8: 1–30. [Google Scholar]

- Kurzman, Charles, Regina Werum, and Ross E. Burkhart. 2002. Democracy’s effect on economic growth: A pooled time-series analysis 1951–80. Studies in Comparative International Development 37: 3–33. [Google Scholar] [CrossRef]

- Malik, Fahad Javed, and Mohammed Nishat. 2017. Real interest rate volatility in the Pakistani economy: A regime switching approach. IBA Business Review 12: 22–32. [Google Scholar] [CrossRef]

- Markusen, James, and Anthony Venable. 1999. Foreign direct investment as a catalyst for industrial development. European Economic Review 43: 335–56. [Google Scholar] [CrossRef] [Green Version]

- MengYun, Wu, Muhammad Imran, Muhammad Zakaria, Zhang Linrong, Muhammad Umer Farooq, and Shah Khalid Muhammad. 2018. Impact of terrorism and political instability on equity premium: Evidence from Pakistan. Physica A: Statistical Mechanics and its Applications 492: 1753–62. [Google Scholar] [CrossRef]

- Mishkin, Frederic S. 2000. Inflation targeting in emerging-market countries. American Economic Review 90: 105–9. [Google Scholar] [CrossRef] [Green Version]

- Mohey-ud-Din, Ghulam. 2007. Impact of Foreign Capital Inflows (FCI) on Economic Growth in Pakistan [1975–2004]. Journal of Independent Studies and Research (JISR) 5: 24–29. [Google Scholar]

- Muhammad, Faqeer, Tongsheng Xu, and Rehmat Karim. 2015. Impact of expenditure on economic growth in Pakistan. International Journal of Academic Research in Business and Social Sciences 5: 231–36. [Google Scholar] [CrossRef] [Green Version]

- Musa, Yakubu, and B. K. Asare. 2013. Long and short run relationship analysis of monetary and fiscal policy on economic growth in Nigeria: A VEC model approach. Research Journal of Applied Sciences, Engineering and Technology 5: 3044–51. [Google Scholar] [CrossRef]

- Orozco, Manuel. 2002. Globalization and migration: The impact of family remittances in Latin America. Latin American Politics and Society 44: 41–66. [Google Scholar] [CrossRef]

- Oshota, Sebil O., and Abdulazeez A. Badejo. 2015. Impact of remittances on economic growth in Nigeria: Further evidence. Economics Bulletin 35: 247–58. [Google Scholar]

- Payne, James L. 1991. Elections and government spending. Public Choice 70: 71–82. [Google Scholar] [CrossRef]

- Qadeer, Samia, and Zainab Jehan. 2021. Democracy and Human Development in Developing Countries: Role of Globalization. FJWU (Economics) Working Paper Series 1: 49. [Google Scholar]

- Qadir, Shakeel, Muhammad Tariq, and Muhammad Waqas. 2016. Democracy or military dictatorship: A choice of governance for the economic growth of Pakistan. IBT Journal of Business Studies (JBS) 12: 39–51. [Google Scholar] [CrossRef]

- Rahman, Abdul, Muhammad Arshad Khan, and Lanouar Charfeddine. 2020. Financial development–economic growth nexus in Pakistan: New evidence from the Markov switching model. Cogent Economics & Finance 8: 1716446. [Google Scholar]

- Reinhart, Carmen, and Guillermo Calvo. 2000. When capital inflows come to a sudden stop: Consequences and policy options. In Reforming the International Monetary and Financial System. Washington: International Monetary Fund, pp. 175–201. [Google Scholar]

- Sajjad, Irum, and Muhammad Azam Khan. 2018. Investigating the impact of external debt on economic growth: A case study of Pakistan. Journal of Business & Tourism 4: 41–51. [Google Scholar]

- Tabassam, Aftab Hussain, Shujahat Haider Hashmi, and Faiz Ur Rehman. 2016. Nexus between political instability and economic growth in Pakistan. Procedia-Social and Behavioral Sciences 230: 325–34. [Google Scholar] [CrossRef] [Green Version]

- Tahir, Muhammad, Ahmad Ali Jan, Syed Quaid Ali Shah, Md Badrul Alam, Muhammad Asim Afridi, Yasir Bin Tariq, and Malik Fahim Bashir. 2020. Foreign inflows and economic growth in Pakistan: Some new insights. Journal of Chinese Economic and Foreign Trade Studies 13: 97–113. [Google Scholar] [CrossRef]

- Tanoli, Junaid Roshan. 2016. Comparative Analysis of Gwadar and Chabahar: The Two Rival Ports. Islamabad: Center for Strategic and Contemporary Research. [Google Scholar]

- Taylor, Edward J. 1999. The new economics of labour migration and the role of remittances in the migration process. International Migration 37: 63–88. [Google Scholar] [CrossRef]

- Teräsvirta, Timo. 1995. Modelling nonlinearity in US gross national product 1889–987. Empirical Economics 20: 577–97. [Google Scholar] [CrossRef]

- Yang, Dean, and HwaJung Choi. 2007. Are remittances insurance? Evidence from rainfall shocks in the Philippines. The World Bank Economic Review 21: 219–48. [Google Scholar] [CrossRef]

- Yasmin, Bushra. 2005. Foreign capital inflows and growth in Pakistan: A simultaneous equation model. South Asia Economic Journal 6: 207–19. [Google Scholar] [CrossRef]

| Variables | Explanation | Data Source |

|---|---|---|

| Dependent Variable | ||

| Economic Growth (LNGDP) | Economic growth is GDP growth rate annual | Handbook of Statistics |

| Independent Variables | ||

| External Debt (DEBT) | External debt in USD million | Economic surveys (various issues) and Handbook of Statistics (2020). |

| Remittances (REM) | Worker remittances in USD million | State Bank of Pakistan |

| Foreign Direct Investment (FDI) | Foreign Direct Investment in USD million | State Bank of Pakistan |

| Govt. Expenditures(GEXP) | Govt. expenditure in USD million | Handbook of Statistics |

| Inflation (INF) | Inflation is CPI | Handbook of Statistics |

| Election Time (ELEC) | The election dummy is a proxy for measuring political instability and its impact on GDP. We give them value “1” when they occur and “0” | Election Commission of Pakistan |

| Democracy/dictatorship (DICT) | Political situation is measured as dummy variable that is categorized into democratic and non-democratic regimes. The code ‘0’ is used for democratic regime and ‘1’ is used for non-democratic regime (Javed et al. 2012). | Election Commission of Pakistan |

| Dimension | BDS Statistic | z-Statistic | Prob |

|---|---|---|---|

| 2 | 0.073 | 9.125 | 0.000 |

| 3 | 0.111 | 8.682 | 0.000 |

| 4 | 0.128 | 8.372 | 0.000 |

| 5 | 0.134 | 8.348 | 0.000 |

| 6 | 0.129 | 8.294 | 0.000 |

| Variables | Level | 1st Difference | Decision |

|---|---|---|---|

| LNGDP | −11.33 *** | - | I(0) |

| CMR | −1.95 | −11.05 *** | I(1) |

| DEBT | −1.86 | −8.79 *** | I(1) |

| FDI | −3.66 ** | - | 1(0) |

| GEXP | −0.10 | −8.05 *** | I(1) |

| REM | −2.32 | −11.91 *** | I(1) |

| INF | −2.37 | −5.47 *** | 1(1) |

| Regime 1 | |||

|---|---|---|---|

| Variables | Model 1 | Model 2 | Model 3 |

| ED | −0.12 *** (0.01) | −0.1116 *** (0.007) | −0.011 *** (0.014) |

| REMITT | 0.010 (0.009) | 0.0176 *** (0.003) | 0.0105 (0.0087) |

| FDI | 0.0002 (0.001) | 0.0001 (0.0003) | 0.002 ** (0.0008) |

| GEXP | 0.019 * (0.007) | _ | 0.019 *** (0.0035) |

| INF | 0.232 *** (0.03) | 0.0547 ** (0.024) | 0.019 (0.0287) |

| DICT | 1.33 (0.89) | _ | _ |

| ELEC | 0.398 ** (0.193) | _ | |

| C | 7.310 (1.40) | 7.02 (0.33) | 7.656 (0.582) |

| LOG(SIGMA) | −1.039 *** (0.12) | −0.79 *** (0.1599) | −0.922 *** (0.58) |

| Regime 2 | |||

| ED | −0.023 (0.02) | −0.0516 * (0.028) | −0.083 *** (0.01) |

| REMITT | 0.08 (0.009) | −0.0205 ** (0.010) | 0.04 ** (0.0085) |

| FDI | 0.004 (0.002) | −0.00319 ** (0.0015) | 0.002 ** (0.001) |

| DICT | 1.1946 (0.80) | _ | _ |

| ELEC | −0.5000 (0.669) | _ | |

| C | 5.758 (1.44) | 4.29 (0.800) | 6.0293 (0.548) |

| LOG(SIGMA) | −0.593 *** (0.14) | −1.122 (0.114) | −1.05 (0.1245) |

| Model 1 | Model 2 | Model 3 | |||

|---|---|---|---|---|---|

| Probabilities | Estimate | Probabilities | Estimate | Probabilities | Estimate |

| P11 | 0.98 | P11 | 0.90 | P11 | 0.90 |

| P12 | 0.01 | P12 | 0.09 | P12 | 0.09 |

| P21 | 0.01 | P21 | 0.05 | P21 | 0.06 |

| P22 | 0.98 | P22 | 0.94 | P22 | 0.93 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Khurshid, N.; Sharif, H.; Tabash, M.I.; Hamouri, B.; Fiaz, A.; Munir, F. Analyzing the Impact of Foreign Capital Inflows and Political Economy on Economic Growth: An Application of Regime Switching Model. Economies 2023, 11, 181. https://doi.org/10.3390/economies11070181

Khurshid N, Sharif H, Tabash MI, Hamouri B, Fiaz A, Munir F. Analyzing the Impact of Foreign Capital Inflows and Political Economy on Economic Growth: An Application of Regime Switching Model. Economies. 2023; 11(7):181. https://doi.org/10.3390/economies11070181

Chicago/Turabian StyleKhurshid, Nabila, Hamza Sharif, Mosab I. Tabash, Basem Hamouri, Asma Fiaz, and Fozia Munir. 2023. "Analyzing the Impact of Foreign Capital Inflows and Political Economy on Economic Growth: An Application of Regime Switching Model" Economies 11, no. 7: 181. https://doi.org/10.3390/economies11070181

APA StyleKhurshid, N., Sharif, H., Tabash, M. I., Hamouri, B., Fiaz, A., & Munir, F. (2023). Analyzing the Impact of Foreign Capital Inflows and Political Economy on Economic Growth: An Application of Regime Switching Model. Economies, 11(7), 181. https://doi.org/10.3390/economies11070181