Abstract

The excess levels of investor participation coupled with irrational behaviour in the South African bond market causes excess volatility, which in turn exposes investors to losses. Consequently, the study aims to examine the effect of market-wide investor sentiment on government bond index returns of varying maturities under changing market conditions. This study constructs a new market-wide investor sentiment index for South Africa and uses the two-state Markov regime-switching model for the sample period 2007/03 to 2024/01. The findings illustrate that the effect investor sentiment has on government bond indices returns of varying maturities is regime-specific and time-varying. For instance, the 1–3-year government index return and the over-12-year government bond index were negatively affected by investor sentiment in a bull market condition and not in a bear market condition. Moreover, the bullish market condition prevailed among the returns of selected government bond indices of varying maturities. The findings suggest that the government bond market is adaptive, as proposed by AMH, and contains alternating efficiencies. The study contributes to the emerging market literature, which is limited. That being said, it uses market-wide investor sentiment as a tool to make pronunciations on asset selection, portfolio formulation, and portfolio diversification, which assists in limiting investor losses. Moreover, the findings of the study contribute to settling the debate surrounding the efficiency of bond markets and the effect between market-wide sentiment and bond index returns in South Africa. That being said, it is nonlinear, which is a better modelled using nonlinear models and alternates with market conditions, making the government bond market adaptive.

JEL Classification:

G41; G11; G14

1. Introduction

The development of the South African bond market can be traced back to the 1970s and early 1980s, when the trading of bonds occurred informally. In the mid-1980s, trading became formalised, and the Bond Market Association (BSA) was formed (Radier et al. 2016). This was later changed to the Bond Exchange of South Africa (BESA), which is a subsidiary of the Johannesburg Stock Exchange (JSE) (JSE 2013). The growing prominence of the South African bond market, coupled with limited regulation of investor participation, has, over the years, made it one of the leading bond markets in Africa. It is considered the largest debt market in Africa according to market capitalisation and liquidity, with a value of outstanding bonds in 2022 at R1.8 trillion (JSE 2024b). For example, the trading that takes place on the BESA accounts for 90 percent of turnover in Africa (Capital Markets Authority 2012), with the average daily trading valued at R25 billion (JSE 2024b). Moreover, the South African bond market is the most diversified in Africa, with government bonds accounting for the most issues (55 percent) of all bond classes, and it includes indices of varying maturities (1–3-, 3–7-, 7–12-, and over-12-year).

Despite the attractive characteristics of the South African bond market, it is also prone to increased market uncertainty. The added uncertainty can be attributed to the limited financial market regulation on foreign investor participation, which means that investor participation is at elevated levels (Radier et al. 2016). At face value, this may seem beneficial to the liquidity of BESA, which enhances economic growth, but it also has limitations. Amplified market participation is found to not only increase the liquidity of the bond market but also increase volatility (Beirne et al. 2024). This is due to the bond market comprising different types of market participants that include rational and irrational investors. Rational investors base their investment decisions on fundamental information, but irrational investors make use of non-fundamental information in their decision-making (Muhammad and Ismail 2008). The difference between the two types of investors causes bond prices to deviate from their fundamental values. Given that the bond market is highly competitive due to an increase in the number of investors, the mispricing does not reach fundamental value (Lewis et al. 2021). As such, irrational investors identify the mispricing and switch their investments from one bond security to another, causing an increase in bond market volatility. The added market volatility causes bond securities prices to fluctuate, which in turn influences return perspective and portfolio diversification, leaving investors with increased losses.

Consequently, academics have attempted to understand how investor irrationality influences bond security returns by introducing investor sentiment measures to capture irrational investor behaviour. These measures include surveys, lexicons, and proxies. However, many studies have argued against using surveys and lexicons as a measure of investor sentiment. For example, Baker and Wurgler (2007) argue that surveys are centred around a specific group of individuals and, as such, they do not capture market-wide investor sentiment. Bormann (2013) argues that surveys are subjected to many influences such that there are significant gaps between how individuals respond to surveys and how they behave in reality. Beer and Zouaoui (2013) argue that surveys do not illustrate current sentiment; rather, they contain past and current opinions, which distort the true measure of sentiment for the sample period. On the other hand, Baker and Wurgler (2006) argued that sophisticated automated programmes are required for lexicons, and there is a need for news agencies and financial journals to have a large following such that the tone from the articles can be gleaned. Against this backdrop, Baker and Wurgler (2007) introduced the principal component analysis (PCA) to combine proxies of investor sentiment in a composite index. The advantage lies in the ability of composite indices to capture market-wide sentiment at different angles as they consider different sources of information, which filters out the idiosyncratic noise to reflect changes in sentiment, whereas surveys and lexicons do not.

Despite having a robust measure for market-wide investor sentiment, the literature is still inconclusive in emerging markets like South Africa, as some studies find that investor sentiment has a positive effect on bond returns (Zaremba and Szczygielski 2019; Soja and Paykovic 2022), while some studies find it negative (Li 2021; Beirne et al. 2024). However, the new body of literature produced by Lo (2004) suggests that investor sentiment should have a nonlinear effect on bond market returns. According to Lo (2004), the effect investor sentiment has on government bond returns is dependent on the state of the bond market, such that the effect will alternate between a bull and bear market condition. Studies by Nayak (2010) and Pineiro-Chousa et al. (2022) have embraced the concept of the adaptive market hypothesis, but these studies are isolated to developed markets with little emphasis placed on emerging bond markets.

On this basis, the study objective is to examine the effect of investor sentiment on government bond indices returns of varying maturities under bull and bear market conditions. In achieving the study’s objective, the following research questions will be answered: 1—How do different government bond indices of varying maturities respond to changes in investor sentiment in a bull and bear market condition? 2—How does investor sentiment influence the overall government bond returns in changing market conditions? 3—How do market conditions vary across the government bond indices of varying maturities? In answering the following research questions, the study contributes to the literature in many ways. This study is the first to develop a market-wide investor sentiment index in South Africa that captures foreign investor sentiment and general consumers, which is an essential determinant of a robust market-wide investor sentiment index. The findings of the South African bond market is in reference to market sentiment, this allows investors to use the findings of the study as a tool for asset selection, portfolio rebalancing and portfolio diversification. Furthermore, the study contributes to the limited literature in emerging markets, such as South Africa, by introducing the nonlinear effect between investor sentiment and bond market returns. Therefore, the study introduces bond indices of varying maturities with a new methodology (Markov regime-switching model) to analyse the nonlinear relationship in South Africa. The study focuses on the efficiency of the South African government bond market by introducing AMH. Therefore, the South African Reserve Bank (SARB) can use the findings of the study to develop financial market regulations that align with the South African government bond market being adaptive, such that bull and bear market conditions make the South African government bond market efficient or inefficient at different periods.

The remaining order of the study is as follows: the Literature Review section is presented in Section 2, and thereafter, Section 3 presents the methodology, which includes data and empirical model descriptions. Section 4 presents the preliminary and empirical results, which are followed by the discussion of results in Section 5. Section 6 presents the conclusion, which includes the implications and recommendations of the study.

2. Literature Review

2.1. Market Behaviour Conceptualisation

The prospect theory was developed by Kahneman and Tversky (1979) and is one of the foundational theories of behavioural finance. The theory postulates that in the presence of risk, investors’ decisions on final asset positions are based on the value attained to gains and losses. Investors are more sensitive to losses than proportional gains, which is known as loss aversion. The foundation of the prospect theory is based on three principals. First, this includes the reference point, which is determined by the value of the prospect. Second, the assumption is that investors do not have the same risk tolerance, which makes the value function concave for gains and convex for losses. Lastly, losses are greater than gains, as proposed by the concept of loss aversion. In addition, it is noted that investors consider their risks and prospects in isolation. Therefore, investors require a higher return for the higher risk they take because they are averse to losses. If investors are more prone to losses, this will cause negative sentiment in the market, while if investors are more prone to gains, this will cause positive sentiment as investors’ behavioural biases, emotions, beliefs, and levels of risk tolerance contribute to overall sentiment in the bond market.

Despite the prospect theory being the fundamental theory for behavioural finance, it ignores the possibility of irrational investors earning excess returns, which makes markets inefficient. Consequently, Shefrin and Statman (1994) developed the behavioural capital asset pricing theory. The theory served as an alternative to asset pricing models such as the capital asset pricing model (CAPM) and arbitrage pricing theory (APT). The authors suggest that the bond market is not efficient as proposed by the efficient market hypothesis owing to noise traders, which cause bond pricing to deviate from its fundamental value. The theory considers that excess returns can be earned because of the irrational behaviour of investors (Nanayakkara et al. 2019). Hence, the risk associated with bond pricing is not the only factor to consider but also psychological factors and cognitive errors that influence bond prices and returns. Therefore, Shefrin and Statman (1994) suggested that noise traders should be considered when pricing bonds and determining their yield. The price and demand for bonds will increase when investors’ psychological and cognitive errors enhance the selection of securities in the bond market; the opposite is also true. This means that when investors perceive the outlook of the bond market to be positive, then market sentiment will be positive, thereby increasing the demand and price of the bond security, whereas if the investor’s outlook of the market is pessimistic, then market sentiment will be negative, thereby decreasing the demand and price of the bond market security. Despite the ability of the behavioural capital asset pricing theory to explain the inefficiency of the bond market, many academics criticised the theory for not being able to explain alternating efficiencies. In an attempt to rectify this, Lo (2004) developed the adaptive market hypothesis (AMH).

The basis of AMH incorporates key evolutionary concepts such as natural selection, competition, and adaption, which influence investors’ cognitive thinking. Hence, investors’ decisions in the bond market are based on past experiences, whereby the negative and positive outcomes of investor decisions cause them to adapt to outcomes in the bond market. These experiences bring about heuristics that cause investors to behave differently and ultimately give rise to market conditions such as bull and bear regimes (Lo 2005). As a result, this causes different levels of sentiment in the market, and, as such, investor sentiment should have an alternating effect on bond market returns in a bull or bear regime, making the effect nonlinear. Moreover, the presence of economic conditions causes the bond market to contain alternating efficiency. The bond market may be efficient for a period of time, but it could change to be inefficient given the type of economic condition and investors’ heuristics in the bond market.

2.2. Review of Empirical Literature

The growing prominence of the bond market as an alternative to risk-free investments has caused scholars to examine the determinants of bond market returns both internationally and locally. Many studies have highlighted factors such as country risk and macroeconomy as determinants of bond market returns. However, the focus has shifted towards investor sentiment. For example, Lee and Kim (2019) examined the effect of investor sentiment on zero-coupon bond risk premia of China for the period 2006 to 2016. The study constructed a monthly market-wide investor sentiment index using proxies as proposed by Baker and Wurgler (2006). The methodology of Cochrane and Piazzesi (2005) indicated that investor sentiment can be used to predict the risk premia of zero-coupon treasury bonds, where the predictability power is much higher during the 2008 financial crisis. The findings demonstrate that market sentiment is an important determinant of bond risk premia in China. Islam (2021) also used a market-wide investor sentiment index, but the aim was to examine the effect of investor sentiment on the United States (U.S.) corporate bond returns. The capital asset pricing model (CAPM) for the sample period January 1989 to December 2018 demonstrated that low-equity market sentiment causes investors to switch their investments to the bond market, whereas high-equity market sentiment does the opposite. Moreover, bond returns with low investor sentiment exposure outperform high-sentiment-exposed funds across the sample period.

In a similar study, Soja and Paykovic (2022) examined the effect of investor sentiment on German bond market indices of varying maturities. The dependent variable consisted of monthly 2-, 5-, and 10-year bond indices returns, whereas the independent variables consisted of the Sentix confidence index for the period 2014 to 2021. The results of the linear autoregressive model demonstrated that investor sentiment has a significant positive effect on government bond indices returns of varying maturities. The sentiment in the market must be continuously monitored to limit excess volatility in the returns of bonds. Similarly, Cornaggia et al. (2022) used the vector autoregressive (VAR) model and Granger causality test to examine the effect of investor attention on U.S. municipal bond returns. The study findings show that investor attention, as measured by the Muni insurance index, has a short- and long-term effect on municipal bond returns for the period 2006 to 2016. Moreover, investor attention at a retail and institutional level Granger causes municipal returns. The findings highlight the importance of considering investor sentiment in the bond market.

In a more recent study, Shen et al. (2023) examined the ability of investor sentiment to predict U.S. bond returns for the sample period 1988–2014. The Thomson Reuters MarketPsych monthly investor sentiment index was used to determine the different levels of emotions in the bond market. The findings of the VAR and Granger causality test suggest that when investors are optimistic and joyful, it has a positive effect on treasury bond returns in the short run and long run. However, when investors are pessimistic, it has a negative effect. Furthermore, investors’ emotions in the U.S. bond market can predict treasury bond returns in the short term but not in the long term. Beirne et al. (2024) also looked at investor sentiment and bond returns, but they focused on Asian countries. The VAR model and Granger causality test demonstrated that the international investor sentiment index has a significant negative effect on ten Asian countries (Vietnam, Thailand, Singapore, Philippines, Malaysia, Republic of Korea, Indonesia, India, China, Hong Kong, and People’s Republic of China) currency bond returns during the period 1999 to 2020. The findings demonstrate that foreign investor sentiment is an important determinant of current bond returns and should be considered when examining market-wide sentiment.

The shortcomings of the above studies are such that they are isolated according to the linear observation between investor sentiment and bond returns. However, the body of literature has since shifted from the linear to nonlinear effect. For instance, Nayak (2010) used a market-wide investor sentiment index to examine the time-varying effect of sentiment on corporate bond yields. The study used monthly data for the period 1996 to 2008 to estimate the Markov regime-switching vector autoregressive model (MS-VAR). The findings of the study demonstrated that corporate bond yields of varying maturities co-vary with market-wide investor sentiment. Moreover, investor sentiment has a positive effect on corporate bond yields in a pessimistic period, whereas a negative effect is observed for optimistic periods. Similarly, Spyrou (2013) used the VAR model to investigate the effect of investor sentiment on European government bond yield spread during a stable and crisis regime. The findings suggest that investor sentiment is an important determinant of bond yields during the global financial crises. The findings of the study are in line with a study conducted by Aristei and Martelli (2014), as the same measures for investor sentiment were used. However, they include more European countries, and the sample period is extended to December 2012.

In a more recent study, Li (2021) used the ordinary least squared (OLS) method to examine the effect of investor sentiment on European sovereign bond yields. The finding shows that investor sentiment has a negative effect on sovereign bond yields and that investors treat emerging market sovereign bonds as risky assets and not safe haven assets. The findings are supported by Pineiro-Chousa et al. (2022) since the threshold model indicated that the Twitter sentiment index has a positive effect on bond yields, whereas in a bear regime, its effect is negative. The findings of the study are important, as they demonstrate the nonlinear relationship that exists between investor sentiment and bond yields, as proposed by AMH.

The review of the empirical literature has highlighted significant research gaps. Firstly, it is evident that the majority of the literature is centred around the linear effect of investor sentiment on bond returns as opposed to the nonlinear effect proposed by Lo (2004) in AMH. Secondly, where there exist studies that have examined the effect of investor sentiment on bond market returns, these studies are predominantly populated in the international setting and focused on aggregated bond indices with no emphasis placed on emerging markets like South Africa and aggregated bond indices. Third, there is no consensus on the type of effect that investor sentiment has on bond returns, as the empirical literature demonstrates that it should be linear, whereas others find it to be nonlinear. Fourthly, it is impossible to find a study in South Africa that examines either the linear or nonlinear effect of investor sentiment on the bond market. Where the bond market determinants were examined, it focused primarily on the macroeconomy and country risk (see Obalade et al. 2023; Moodley 2024; Muzindutsi and Obalade 2024). Accordingly, this study contributes to the above research gaps, as it is the first study in South Africa to consider the effect of investor sentiment on the South African bond market under the bull and bear regimes by specifically examining disaggregated bond indices. Therefore, this study introduces the nonlinear effect, as proposed by AMH, in emerging markets like South Africa, which contributes to the unresolved debate surrounding the effect between investor sentiment and bond indices returns.

3. Methodology

3.1. Data

The study uses monthly time series data for the period of March 2007 to January 2024 to capture important historical events such as the contagion effect of the U.S. dot-com bubble, the U.S. housing bubble in the early 2000s, the 2008 global financial crises, European debt crises, and the COVID-19 pandemic. More specifically, the study incorporates government bond indices of varying maturities, as provided in Appendix A. The study selects government bond indices of varying maturities as they are the most traded bond instruments in the South African bond market, accounting for 90 percent of liquidity on the JSE debt board (JSE 2024a). Moreover, investors incorporate government bond indices of varying maturity in their portfolios, as they provide riskless returns. Therefore, it minimises portfolio volatility by enhancing diversification (Hatemi-J et al. 2023). Thus, it is vital to understand how investor sentiment influences government bond indices returns of varying maturity, especially under changing market conditions. As investor perception deviates from rational behaviour due to stable or volatile market conditions, which either increase or decrease bond indices returns and alter the diversification of a portfolio (Chen et al. 2021). The data were obtained from the Bloomberg database. The investor sentiment measure and how it was computed are discussed next.

Investor Sentiment

Given that there is no direct measure for investor sentiment and the shortcomings of surveys and lexicons, the study incorporates the most popular used investor sentiment measure in the literature, known as the investor sentiment composite index, as proposed by Baker and Wurgler (2006). Pan (2018), in his study, found contagion across different asset markets such as the equity, bond, property, commodity, and foreign exchange markets. The author argued that it is important to formulate a market-wide index that captures the entire market sentiment. Therefore, this study develops a new market-wide investor sentiment index for South Africa by augmenting and updating the Muguto et al. (2019) index for the sample period from March 2007 to January 2024. The proxy used in the newly constructed market-wide investor sentiment index includes the share turnover ratio, equity issue ratio, advance/decline ratio, rand/dollar bid–ask spread, South African volatility index (SAVI), CNN fear and greed index, and the South African consumer confidence index (CCI). The uniqueness of the newly constructed sentiment index lies in the index’s ability to capture foreign investor sentiment and general consumers in the South African financial market, which is yet to be done in South Africa. Refer to Appendix B for a detailed explanation of each proxy.

The study uses the principal component analysis (PCA) method as proposed by Baker and Wurgler (2006) to develop the market-wide investor sentiment index. First, the proxies are standardised so that they have the same unit of measurement. Secondly, the study orthogonalises the proxies against four macroeconomic variables (inflation, short-term interest rate, long-term interest rate, and gross domestic product growth rate) to ensure that they reflect sentiment and not risk factors. Third, the residuals are captured, and the PCA is rotated as certain proxies take longer to reflect sentiment than others. The newly constructed market-wide investor sentiment index is given as follows:

where is share turnover, is the equity issue ratio, is the advance/decline index, is the rand/dollar bid–ask spread, SAVI is the South African volatility index, CNN is the CNN fear and greed index, and is the consumer confidence index.

3.2. Empirical Model

The study used the Markov regime-switching model to examine the effect of investor sentiment on government bond index returns of varying maturities under changing market conditions. It was evident in the literature that the Markov regime-switching model was the most used nonlinear model when considering varying economic conditions. This was owing to the bull or bear regime being based on the unobservable state-dependent factor, which considers the initial-order Markov chain (Hamilton 1989). The various market conditions are not required as input in the model; rather, the model isolates the market condition based on the sample period. Thus, the model allows regime changes under different market conditions, whereas other nonlinear models only consider market conditions under fixed periods. The Markov regime-switching model that contains a switching intercept, error variance, and regressors is given as follows:

where , are government bond index returns of varying maturities. is the state-dependent intercept (mean). is the regime-dependent variance of the returns, and YK = 0, 1 illustrates two regimes, namely bull (0) and bear (1) regime, where the investor sentiment index contains state-dependent coefficients. is the change in the market-wide investor sentiment index and the primary independent variable. is the state-dependent error term.

The study implements control variables as Moodley (2024) found that some macroeconomic variables influence bond index returns of varying maturities under changing market conditions. Hence, the study controls for these macroeconomic variables to isolate the effect of investor sentiment. The model with state-dependent control variables is given as follows:

where is the South African inflation rate growth rate. is the South African short-term interest growth rate. is the South African long-term interest growth rate. is the South African gross domestic product growth rate.

The bull and bear regime follows the first-order Markov process, which is given by the constant transition probability. The possibility of being in a bull or bear regime is contagion upon the current state, given as follows:

where is the probability (P) of switching from a bull regime (0) in a period denoted to a bear regime (1) in a specific period (K). The probability of switching is constant for all periods. The matrix for a two-state regime model is given as follows:

where is the probability that the bond index return of varying maturity is at a bullish regime at and remained there at time . is the probability that the returns are at a bullish regime at and moved to a bearish regime at time . is the probability that the returns are at a bearish regime at time and remained there at time . is the probability that the returns are at a bearish regime at and moved to a bullish regime at time

3.3. Preliminary and Diagnostic Tests

A requirement of the Markov regime-switching model is that the dependent and independent variables should be nonlinear, have no multicollinearity, and be stationary in levels and structural breaks. This paper implements the Brock, Dechert, and Scheinkman (BDS) test for nonlinearity, the variance inflation factor (VIF) test for multicollinearity, augmented Dicky–Fuller (ADF) unit root test, Kwiatkowski–Phillips–Schmidt–Shin (KPSS) stationarity test, and ADF breakpoint unit root test. Moreover, the Wald coefficient diagnostic test is implemented for the PCA to determine if the investor sentiment proxies are significantly different from each other. Moreover, the Breusch–Godfrey LM and Durbin–Watson autocorrelation test is implemented to determine the presence of autocorrelation in the residuals of the Markov regime-switching model.

4. Empirical Results

4.1. Preliminary Tests

In Table 1, Panel A, descriptive statistics are presented for the JSE government bond indices of varying maturities, the investor sentiment index, and the macroeconomic control variables. It can be inferred that the 3–7-year government bond index achieves the highest average return, but the all-bond government index has the lowest average return. It is further evident that the 3–7-year government bond index also attains the highest return for the sample period, but the all-bond government index attained the lowest return. The all-bond government index return is the most volatile as it depicts the highest standard deviation; this is supported by the values of the maximum and minimum values as the range is very wide, suggesting that the returns fluctuate frequently. Moreover, the variation in the analysis suggests that the government bond indices of varying maturities behave differently when faced with alternating market conditions; thus, market cycles influence the variation in returns. The 1–7-year government bond index, 3–7-year government bond index, and over-12-year government bond index are positively skewed, but the all-bond government index and the 7–12-year government bond index are negatively skewed. The former suggests that the returns lie to the left of the mean, whereas the latter suggests that the returns lie to the right of the mean. It is also evident that the kurtosis associated with the returns of the government bond indices of varying maturities are positive, suggesting that the returns are leptokurtic distributed. The findings are supported by the Jarque–Bera test of normality as the study rejects the null hypothesis that the government bond indices returns are normally distributed, as supported by the significant p-values.

Table 1.

Descriptive statistics, preliminary and correlation results.

The investor sentiment index has a positive maximum value and a negative minimum value. This demonstrates that the index captures both positive and negative market-wide investor sentiment, which is an important determinant of the robustness of the developed index. Moreover, the mean of the investor sentiment index is negative, and the findings are in line with the literature as the sample period considers many historical financial market events like the contagion effect of the U.S. dot-com bubble, the U.S. housing bubble in the early 2000s, the 2008 global financial crises, European debt crises, and the COVID-19 pandemic. The standard deviation of the investor sentiment index is positive and close to two; this demonstrates that there are adequate variations of sentiment for the sample period as captured by the maximum and minimum values. The market-wide investor sentiment index is positively skewed, whereas the kurtosis is below three. The former suggests that the observation of sentiment is above the mean sentiment level, whereas the latter suggests that the distribution has thin tails and flat means. This is confirmed by the Jarque–Bera test of normality, as the market-wide investor sentiment index is not normally distributed.

Control variables such as the gross domestic product had the highest average growth rate, followed by short-term interest growth rate, long-term interest growth rate, and inflation growth rate. Short-term interest has the highest growth rate, and inflation has the lowest growth rate. The inflation growth rate attained the highest standard deviation, as it fluctuated much. The inflation growth rate and the long-term interest growth rate are negatively skewed, but the short-term interest rate and the gross domestic product growth rate are positively skewed. All macroeconomic variables, except the inflation growth rate, have a kurtosis of greater than 3. Thus, only the inflation growth rate is mesokurtic distributed, but the rest is leptokurtic distributed, which is confirmed by the Jarque–Bera normality test.

In Table 1, Panel B, the BDS and VIF tests are provided. It is seen that the BDS test statistic is greater than the associated critical values at all levels of significance. The null hypothesis that the data are independently and identically distributed is rejected in favour of the alternative hypothesis that the data are non-linearly dependent. Hence, it can be concluded that there exists nonlinear dependency among the time series data, and as such, a nonlinear model is required. Furthermore, the VIF test confirms that the independent variables (investor sentiment and macroeconomic variables) are not multicollinear since the VIF figures are between 1 and 2. Hence, the findings allow the independent variables to be incorporated into the analysis.

Table 1, Panel C, provides the unconditional correlational analysis of the given variables. Investor sentiment has a positive significant effect on the all-bond government index returns and over-12-year government bond index but a negative significant effect on the 3–7-year government and over-12-year government bond index returns. The control variables are also found to have a significant effect on the government bond indices returns of varying maturities, as inflation growth rate and long-term interest growth rate had a positive significant effect on the all-bond government index returns but a negative significant effect on the over-12-year government bond index returns. The short-term interest growth rate had a positive significant effect on the 1–3-year government bond index return and the over-12-year government bond index returns, but the long-term interest growth rate had a negative significant effect on the 1–3-year government bond index return. The gross domestic product growth rate had a positive significant effect on the 3–7-year government bond index return and the over-12-year government bond index return. The findings of the analysis suggest that investor sentiment and macroeconomic factors affect government bond index returns of varying maturities. However, it does not provide evidence of the nonlinear effect. As such, the analysis has to be further extended to cater to the nonlinear dependencies as provided for by the BDS test. Furthermore, the inclusion of control variables in the form of the macroeconomic variables provided is supported by the findings of the unconditional correlation analysis.

Unit Root and Stationarity Tests

The findings of the unit root and stationarity tests are provided in Table 2. It is evident that the ADF test statistics are more negative than the associated critical levels at a 1 percent, 5 percent, and 10 percent significance level. The null hypothesis of the government bond indices returns of varying maturities, investor sentiment index, and macroeconomic variables containing a unit root can be rejected in favour of the alternative hypothesis that the variables are stationary in levels. The findings are further collaborated by the KPSS test as the test statistic is less than the critical values. Hence, we do not reject the null hypothesis that the variables are stationary. Moreover, the ADF breakpoint test confirms that the variables are stationary in the presence of structural breaks, as the ADF test statistic is more negative than the associated critical values. Thus, the study finds that the government bond indices return of varying maturities, investor sentiment index, and macroeconomic variables are integrated of order I(0). Having found the existence of nonlinearities in the given variables, no multicollinearity and stationarity in levels, and the presence of structural breaks, the Markov regime-switching model can be estimated.

Table 2.

Unit root and stationarity results.

4.2. Empirical Model Results

4.2.1. Principal Component Analysis

Table 3 below presents the PCA output for the newly constructed investor sentiment index and the Wald coefficient diagnostic test. The results of the Wald test confirm that there is a significant difference between the coefficients of the parameters of the sentiment index as the null hypothesis (C(1)=C(2)=C(3)=C(4)=C(5)=C(6)=C(7)) is rejected at the 5 percent level of significance. Thus, the interpretation of the PCA is permitted as it provides robust and unbiased output. The sentiment index accounts for 51.04 percent of the total variance as compared to Reis and Pinho (2020) of 47 percent and Muguto (2022) of 43.71 percent. Furthermore, it is seen that the first four principal components explain 89 percent of the variation in the data. The eigenvalue of the first principal component is positive and greater than 1, as found by Baker and Wurgler (2006), which further justifies the PCA robustness. The variables that exhibit a high correlation with the first principal component include the rand/dollar bid–ask spread (0.5125), SAVI (0.5128), and the consumer confidence index (0.4915). The first principal component index () with the current values is given by:

Table 3.

Principal component analysis results.

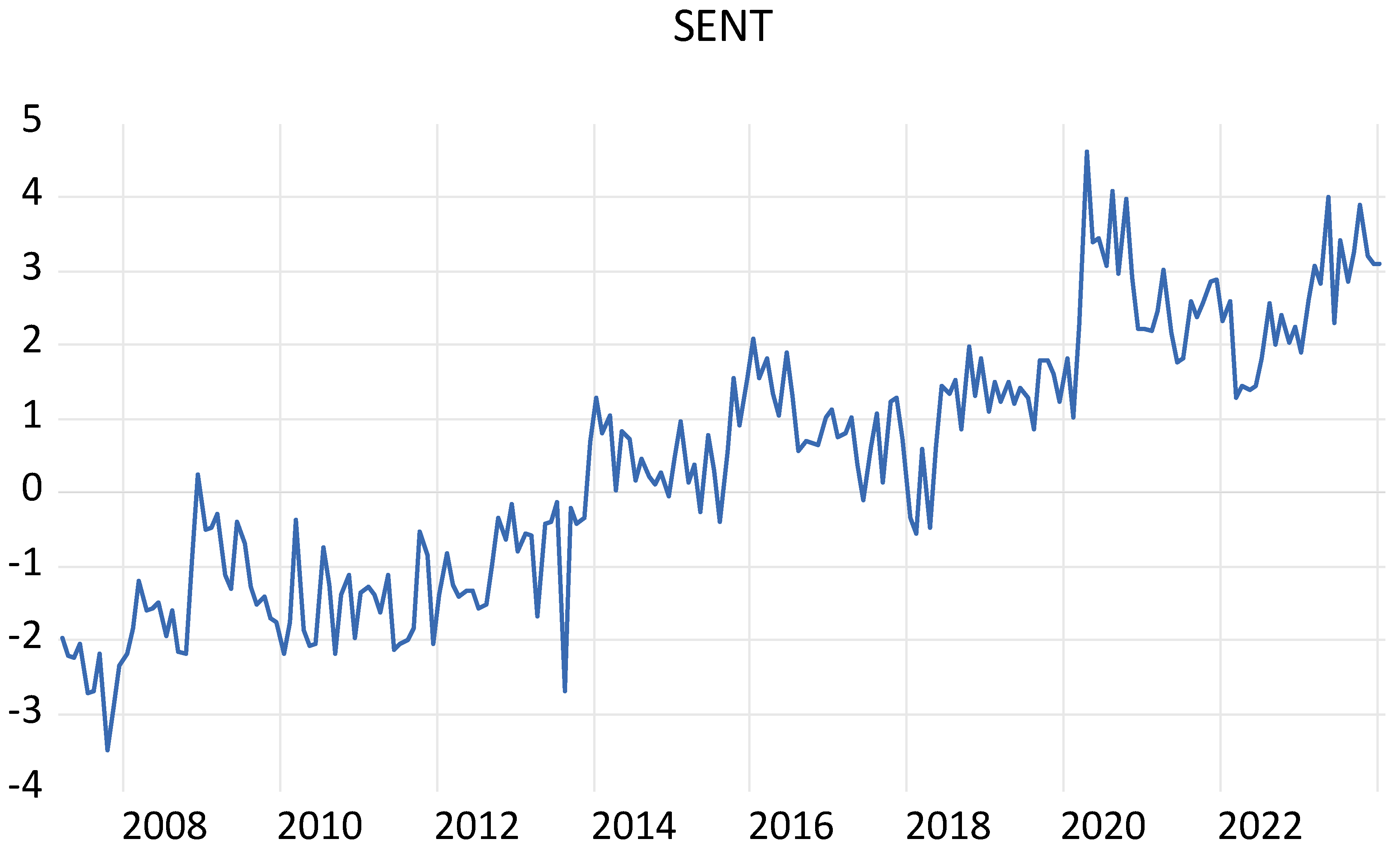

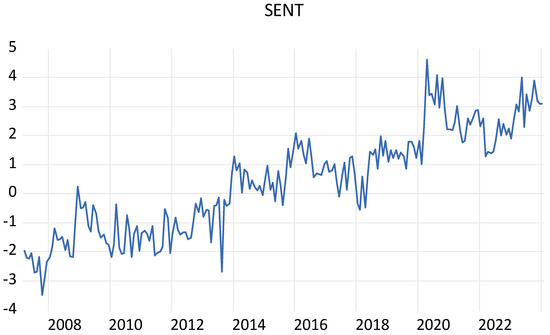

Figure 1 below provides the graphical plot of the newly constructed market-wide investor sentiment index as derived from the above first principal component. The sentiment index contains large amounts of volatility clustering, as seen in the spikes and changes in the sentiment index. The sentiment index is aligned to the historical accounts of bubbles and crashes as found in the Muguto et al. (2019), Rupande et al. (2019), and Muzindutsi et al. (2023) South African sentiment index. The visualisation of these economic events includes the contagion effects of the 2007/2008 financial crises, which originated in the United States housing market (Helleiner 2011), the 2015/2016 Chinese market turbulence (Han 2019), and the 2020 decline due to the COVID-19 pandemic (Ashraf 2020). It is further seen that for the period 2007–2013, the sentiment index attributed negative figures, which suggest that there was negative sentiment in the market. However, for the period 2014–2023, the sentiment index attributed positive figures, indicative of positive sentiment in the market. However, the sentiment levels did flatten throughout the periods, as seen by the spikes. It is therefore evident that the sentiment index is robust as it captures both positive and negative sentiment, which is significant when analysing market-wide investor sentiment.

Figure 1.

Investor sentiment index, SENT. Notes: 1. Source: Authors’ own estimations (2024).

4.2.2. Markov Regime-Switching Model

In Table 4, the Markov regime-switching model results are presented. In Panel A, it is evident that the returns (C) are positive for all government bond indices of varying maturities, but only the all-bond government index returns, and the 1–3-year government bond index returns, 7–12-year government bond index returns, and over-12-year government bond index return are significant. Moreover, it can be seen that the volatility () of the returns in a bull market condition is positive and significant for all government bond index returns of varying maturities, with the exception of the 3–7-year government bond index returns. These findings are in line with the theoretical literature that returns in a bull market condition increase over time and, as such, are less volatile (Davies 2013). Furthermore, investor sentiment has a positive significant effect on the 3–7-year government bond index return in a bull regime but a negative significant effect on the 1–3-year government bond index return, 7–12-year government bond index return, and over-12-year government bond index return.

Table 4.

Markov regime-switching results.

In Panel B, the returns of all the government bond index returns of varying maturities are negative in a bear market condition. Only the all-bond government index returns and the 7–12-year government bond index returns are significant. However, the volatility of all government bond index returns of varying maturities, except the over-12-year government bond index return, is negative (positive) and significant in a bear market condition for all. The findings are corroborated by the theoretical literature, as returns in a bear market condition decrease over time and attain high volatility as compared to the bull market condition. Investor sentiment has a positive significant effect on the 7–12-year government and over-12-year government bond index return bond index returns in a bear market condition but a negative significant effect on the all-bond government index return and 3–7-year government bond index return. It is also evident that all macroeconomic variables have a significant effect on the returns of selected government bond indices of varying maturities under a bull and bear market condition. Therefore, controlling for these effects is further substantiated by the findings, which increases the robustness of the estimation.

In Panel C, the diagnostic tests are presented. The Breusch–Godfrey LM test statistic is insignificant at all levels of significance. The study fails to reject the null hypothesis that there is no autocorrelation in the residuals of the model. The Durbin–Watson test further corroborates the findings as the test statistics is 2, which suggests there exists no autocorrelation in the residuals of the model and further increases the robustness of the model.

4.2.3. Transition Probabilities and Duration

Table 5 presents the constant transition probabilities and expected duration of the Markov regime-switching model. A key advantage of the model lies in its ability to automatically characterise the bull and bear periods that reflect the returns of the government indices of varying maturities. This implies that subsampling and indicating the periods of bull and bear conditions is not required. Accordingly, the Markov regime-switching model is the most used model in the literature when considering bull and bear regimes due to its advantage of capturing the transition probabilities and the expected duration of staying in either regime (see, among others, Moodley et al. 2022, 2024; Muzindutsi et al. 2023; Obalade et al. 2023; Lawrence et al. 2024; Muzindutsi and Obalade 2024). The transition probabilities for the all-bond government index returns, 1–3-year government bond index return, 3–7-year government bond index return, and the over-12-year government bond index return are close to 1 in the bull market conditions. However, in a bear market condition, the transition probabilities of the 7–12-year government bond index return is close to 1. The former suggests that the switching from a bull to bear regime is persistent, and the returns do not stay in a bull condition for long periods of time. However, the latter suggests that the switching from a bear to a bull regime is persistent, and the returns do not stay in a bear market condition for long periods of time. Furthermore, from the expected duration in Table 4, it is evident that the all-bond government index returns (159 months), 1–3-year government bond index return (11 months), 3–7-year government bond index return (13 months), and over-12-year government bond index return (9 months) stayed the longest in a bull regime, but the 7–12-year government bond index return (10 months) stayed the longest in a bear regime. The findings are further supported by the constant transition probabilities in Table 4, as it is larger in a bull market condition for the former and higher in a bear market condition for the latter.

Table 5.

Regime probabilities and expected duration.

4.2.4. Smooth Regime-Switching Graphs

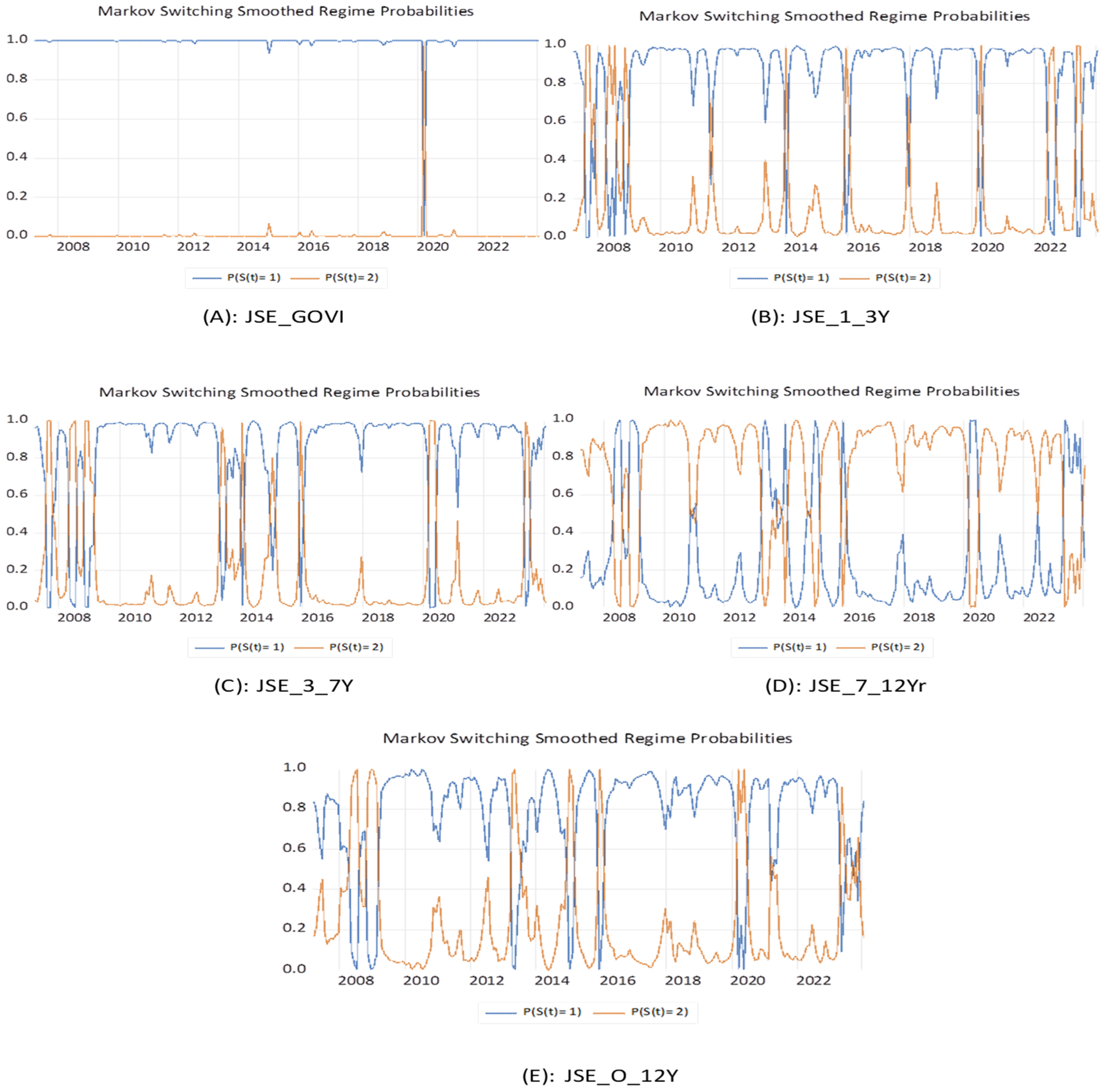

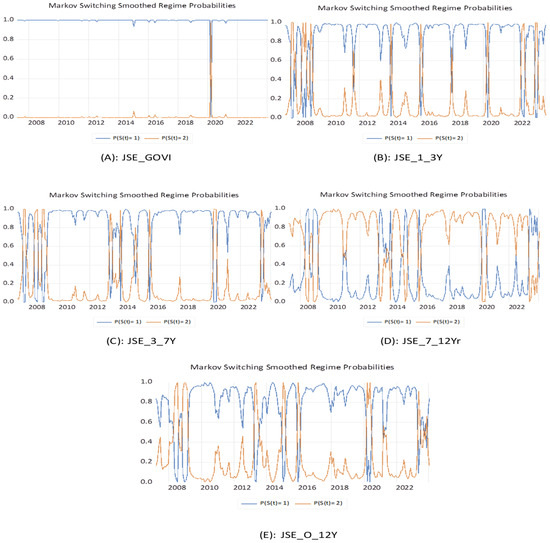

Figure 2 provides the smooth transition probabilities for the sample period associated with each government bond index of varying maturities. The all-bond government index returns stayed for long periods in a bull regime before switching into a bear regime. The 1–3-year government bond index returns, 3–7-year government bond index returns, and over-12-year government bond index returns did not stay in a bull or bear regime for prolonged periods of time; this is supported by the immediate spikes in a bull regime and bear regime. Moreover, the spikes in a bull regime are greater than that of a bear regime, which suggests that the three indices return stayed longer in a bear regime than in a bull regime. The findings are further supported by the evaluation in Section 4.2.3, as it is evident that the bull market condition was more persistent, with the expected duration being longer in a bull market condition. On the contrary, the 7–12-year government bond index return did not stay in a bear regime for prolonged periods of time; rather, it switched from a bear regime to a bull regime frequently. However, the spikes in a bear regime are greater than that of a bull regime, which suggests that the index return stayed longer in a bear regime than in a bull regime. The findings are further corroborated by the observations in Section 4.2.3, as the bear regime is more persistent among the 7–12-year government bond index return.

Figure 2.

Smooth regime probabilities. Note: 1. Source: Authors’ own estimations (2024).

It can be visualised in Figure 2 that for the period 2007–2008, the returns of the government bond indices of varying maturities were in a bearish state and moved from a bearish to a bullish state frequently. These findings align with the 2007/2008 global financial crises as it was seen that the bond market returns, especially the government bond index returns, were significantly affected such that the returns dropped drastically. However, not all government bond index returns responded the same way to the global financial crises, as some saw stable returns and some experienced volatile returns; this is further supported by the findings of the all-bond government index returns. However, after the 2007/2008 financial crises, the 1–3-year government bond index returns, the 3–7-year government bond index, and the over-12-year government bond index returns recovered from the crises as the returns were bullish and increased over time. On the contrary, it is seen that the 7–12-year government bond index returns stayed in a bearish state for the periods after the 2007/2008 financial crises. This suggests that the returns did not recover, as the 2007/2008 global financial crises had a contagion effect on the returns of these indices. Regarding the COVID-19 period, it is evident that all the government bond indices returns of varying maturities were bearish; this can be attributed to the start of the COVID-19 period, which harmed the South African bond market. However, the 1–3-year government bond index return, 3–7-year government bond index return, and the over-12-year government bond index recovered from the COVID-19 pandemic such that the return after the period is bullish. This was not seen for the 7–12-year government bond index return, as the returns remained in a bearish period.

5. Discussion of Results

It must be noted before the commencement of this section that there exists no study in South Africa or internationally that has examined the effect of investor sentiment on government bond indices of varying maturities under changing market conditions. It is almost impossible to compare the findings of this study with those in the existing literature. Despite this, it is evident that investor sentiment has an alternating effect on government bond indices of varying maturities under bull and bear regimes. According to He (2020), a financial market comprises optimistic and pessimistic investors that have a positive and negative effect on security prices, respectively. Moreover, the AMH argues that not all investors behave in the same manner, such that their past experiences and current cognitive biases influence their current decisions (Lo 2004). This implies that in a bull regime, investors may be optimistic about future outcomes because of their past experiences and cognitive biases, which cause investors to enter the market and drive security prices up. Similarly, there also exist investors who are pessimistic about the market in a bull regime because their past experiences and cognitive biases cause them to perceive the future outcomes of the market to be negative. Thus, they sell and leave the market, which drives securities prices down, causing a negative effect in a bull market condition; the opposite is also seen in a bear market condition. Consequently, it is not uncommon to see alternating effects in bull or bear regimes that do not align with the classical financial theory but do align with behavioural financial theories.

Despite the limited literature, one can compare the findings of the transition probabilities and expected duration with other studies as there exist three studies, namely Obalade et al. (2023), Moodley (2024), and Muzindutsi and Obalade (2024). It is evident that investor sentiment has an alternating effect on each government bond index return of varying maturities under bullish and bearish market conditions. Under certain instances, investor sentiment has a significant effect on government bond index returns of varying maturities in a bull regime but an insignificant effect in a bear regime, and vice versa. The findings show that the effect of investor sentiment on government bond indices of varying maturities is regime-specific and time-varying. Obalade et al. (2023), Moodley (2024), Muzindutsi and Obalade (2024) also found the bond market to contain alternating efficiencies and inefficiencies such that the expected effect investor sentiment on government bond indices of varying maturities is dependent on the state of the bond market. The findings therefore suggest that the bond market is not as efficient as proposed by EMH; rather, it is adaptive, as advocated by AMH.

Obalade et al. (2023) and Muzindutsi and Obalade (2024) found that the all-bond government index returns stayed the longest in a bull regime; this is in line with the findings of this study. The findings are further supported by Moodley (2024), who found that the 3–7-year government bond index return (7–12-year government bond index return) stayed longer in a bullish state (bearish state). On the contrary, the findings regarding the 1–3-year government bond index return and over-12-year government bond index are not in line with Moodley (2024), as the scholar found that the indices returns were bearish for the sample period and not bullish as found by this study. The conflicting findings can be attributed to the different sample periods in both studies. It is seen in Moodley (2024) that the sample size was restricted to 2022, but this study expanded the sample period to 2024. Accordingly, during 2023 and the first month in 2024, as seen by the smooth transition probabilities graph, the 1–3-year government bond index return and over-12-year government bond index returns were bullish. Consequently, the indices return stayed an additional 1 year and 1 month in a bull market condition, thereby contradicting the findings of Moodley (2024). However, the overall persistence of the bullish market among the government bond index returns of varying maturities is supported by studies by Maheu et al. (2012), Guidolin (2016), and Muzindutsi and Obalade (2024) but not by Obalade et al. (2023) and Moodley (2024). Hence, the South African bond market behaves differently, where such behaviour is solely dependent on the state of the bond market. This can be attributed to emerging bond markets such as South Africa, which are more prone to fluctuating market conditions and instability.

The implication of the findings is three-fold. First, investors should conduct asset selection in line with the findings of the study so that if the financial market is in a bullish market state, investors should consider only the 3–7-year government bond index in their portfolio. Moreover, if the financial market is in a bearish market state, only the 7–12-year government bond index returns should be considered in their portfolio, as both alternatives will yield higher returns in the presence of a sentiment-induced market and changing market conditions. Furthermore, if investors have the 1–3-year, 7–12-year, and over-12-year government bond index returns (3–7-year government bond index returns) in their portfolio and the financial market is in a bullish market condition (bearish market condition), then investors should consider portfolio rebalancing as it will yield negative returns in a sentiment-induced market. Second, the study contributes to the theoretical debate surrounding the efficiency of the government bond market; that is, it is adaptive, as proposed by AMH. Third, the study contributes to the empirical debate surrounding the effect investor sentiment has on bond indices, such that the findings suggest that the effect is nonlinear and better modelled by nonlinear models.

6. Conclusions

At the commencement of this research article, the aim was to examine the effect of investor sentiment on government bond indices of varying maturities under changing market conditions. The dependent variables of the study consisted of the returns of the all-bond government index return, 1–3-year government bond index, 3–7-year government bond index, 7–12-year government bond index, and over-12-year government bond index. Similarly, the independent variable comprised a newly constructed market-wide investor sentiment index using the PCA analysis. Macroeconomic variables in the form of inflation growth rate, short-term interest growth rate, long-term interest growth rate, gross domestic product growth rate, and real effective exchange growth rate were implemented as control variables.

The two-state Markov regime-switching model for the sample period 2007/03 to 2024/01 illustrated that the effect investor sentiment has on government bond indices return of varying maturities are regime-specific and time-varying. The findings can be isolated according to the research questions of the study. Research question 1 (How do different government bond indices of varying maturities respond to changes in investor sentiment in a bull and bear market condition?): the 1–3-year government index return and over-12-year government bond index were negatively affected by investor sentiment in a bull market condition. Moreover, the 3–7-year government bond index return (7–12-year government bond index returns and the over-12-year government bond index) was positively (negatively) affected by investor sentiment in a bull market condition but negatively (positively) affected in a bear market condition. Research question 2 (How does investor sentiment influence the overall government bond returns in changing market conditions?): investor sentiment has a negative significant effect on the all-bond government index (a proxy for the government bond market in South Africa) returns in a bear market condition and not in a bull market condition. Research question 3 (How do market conditions vary across the government bond indices of varying maturities?): the bullish market condition prevailed among the selected government bond index returns of varying maturities. The findings suggest that the government bond market is adaptive, as proposed by AMH, and contains alternating efficiencies. The implications are that investors should align their asset selection strategy with the findings of the study, and portfolio rebalancing should be conducted by investors if they incorporate any of the government bond indices of varying maturities in their portfolios. Moreover, the South African Reserve Bank (SARB) should revisit financial market policies to cater to the adaptive behaviour of the bond market.

A possible limitation is that the study does not use any formal efficiency tests to confirm the finding of the South African government bond market being adaptive. Thus, future research can incorporate formal efficiency tests to confirm that the South African government bond market is adaptive. Moreover, future studies could extend the sample period by considering different proxies for investor sentiment and testing it on various bonds, such as corporate bonds, municipal bonds, mortgage bonds, and emerging market bonds.

Author Contributions

It is important to note that the research article was written in its entirety by F.M., a Doctor of Philosophy candidate in Risk Management at Northwest University. The additional authors, S.F.-S. and K.M., are the doctoral candidate’s supervisors who assumed advisory roles and provided comments to improve the manuscript. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data are available on request from the corresponding author.

Acknowledgments

We are grateful to the anonymous reviewers whose thorough reviews have helped to improve the published paper.

Conflicts of Interest

No potential conflicts of interest were reported by the authors.

Appendix A

Table A1.

Bond market dependent variables.

Table A1.

Bond market dependent variables.

| Variable Name | Abbreviation |

|---|---|

| JSE all-government bond index | JSE_GOVI |

| 1–3-year government bond yield | JSE_1_3Y |

| 3–7-year government bond yield | JSE_3_7Y |

| 7–12-year government bond yield | JSE_7_12Y |

| Over-12-year government bond yield | JSE_O_12Y |

Note: 1. Source: Authors’ own depiction (2024).

Appendix B

Table A2.

Investor sentiment proxies.

Table A2.

Investor sentiment proxies.

| Investor Sentiment Proxy | Explanation |

|---|---|

| Share turnover ratio | The share turnover proxy is retained in this study’s investor sentiment index, as found in the index of Muguto et al. (2019). The proxy is calculated by taking the total volume of shares traded and dividing it by the number of average shares listed in the South African stock market. The variable selection follows that of Baker and Stein (2004), as the academic argues that noise traders are high when there are short-sale characteristics in the market because the arbitrate of rational investors 21 does not drive noise traders out of the market. This causes stock prices to be overvalued. Studies such as Rupande et al. (2019), Muguto et al. (2022), and Muzindutsi et al. (2023) used the proxy for investor sentiment. |

| Equity issue ratio | The equity issue ratio is retained in this study’s investor sentiment index, as found in the index of Muguto et al. (2019). The calculation of the proxy entails taking the number of issued shares of total equity and dividing it by the total issue of debt in South Africa. Baker and Wurgler (2006, 2007) argue that elevated share issues predict low market returns. That being said, companies wanting to expand will issue shares when sentiment in the market is high, making equity overvalued. Thus, overvaluation is associated with high sentiment periods because sentiment-induced investors underestimate risk and overestimate returns. (Baker and Wurgler 2006). Studies by Muguto et al. (2019) and Muzindutsi et al. (2023) use the proxy to measure market sentiment. |

| Advance/decline ratio index | The advance/decline ratio index is retained in this study’s investor sentiment index, as found in the index of Muguto et al. (2019). It is measured by the number of advancing and declining shares, adjusted for their volume (Brown and Cliff 2004). Positive sentiment is indicated by positive market breadth, whereas negative sentiment is indicated by negative market breadth. Consequently, many studies have used it as a measure of market sentiment; these include Muguto et al. (2019), Reis and Pinho (2020), and Gong et al. (2022). |

| Rand/dollar bid–ask spread | The bid–ask spreads remain within this study’s investor sentiment index, as found in the index of Muguto et al. (2019). It is determined by the demand for domestic securities, where negative sentiment attributed to poor economic performance shows a decline in capital inflows. This causes the bid–ask spread to increase as foreign investors omit rand-denominated securities (Hengelbrock et al. 2011). Studies by Muguto et al. (2019), Rupande et al. (2019), and Muguto et al. (2022) used it as a proxy for market sentiment. |

| South African volatility index (SAVI) | The South African volatility index (SAVI) will replace the rand/pound bid–ask spread in the Muguto et al. (2019) investor sentiment index. This is done by including both the rand/dollar bid–ask spread and rand/pound bid–ask spread, as done by Muguto et al. (2019), which will enhance high correlation levels. Consequently, adding the SAVI proxy will remove the correlation bias, which contributes significantly to the robustness of the constructed market-wide sentiment index. The SAVI provides the 90-day future level of volatility associated with the entire financial market of South Africa. High levels of volatility indicate fear among investors in the market. Rupande et al. (2019) used the index as a proxy for market sentiment. |

| CNN fear and greed index | The CNN fear and greed index will replace the term structure of interest proxy proposed in the Muguto et al. (2019) index. This is done to increase the robustness of the constructed investor sentiment index as investors participating in the South African financial market are not isolated to domestic investors but also foreign investors (Liu et al. 2020). Therefore, to account for foreign investors in the South African financial market, the CNN fear and greed index is used as a proxy in this study. The fear and greed index is a global index that comprises seven different proxies that CNN uses to formulate a market sentiment index for the United States (U.S.) financial market. Against the backdrop of there being no direct proxy for foreign investor sentiment in South Africa, the CNN fear and greed index is selected as the U.S. is the focal point of the global financial market. Hence, it constitutes investors from different geographical regions, which provides a better gauge of foreign investors’ participation in South Africa. The proxy is unique to this study as previous South African studies (Muguto et al. 2019; Rupande et al. 2019; Muzindutsi et al. 2023) have not captured the sentiment of foreign investors in the South African financial market. Moreover, Beirne et al. (2024) argues that in any market-wide investor sentiment index, it is essential for foreign market participation to be captured as financial markets are not isolated to domestic investors but also foreign investors. Consequently, studies by Liutvinavicius et al. (2017), Halliday (2018), and Chen et al. (2021) used the index as a measure of market sentiment. |

| South African consumer confidence index | The consumer confidence index (CCI) is added additionally to the study’s constructed investor sentiment index. This is done because financial markets consist of investors with different financial statuses, high-end individuals, and lower-end individuals (Junaeni 2020). Consequently, it is important that the market-wide investor sentiment captures both types of investors and is not isolated to high-end individuals, which distorts the level of sentiment. The CCI provides household consumption and savings prospects based on their financial status (OECD 2022). Although stock prices do not affect consumers’ opinions, the index is highly correlated with sentiment in the financial market (Rahman and Shamsuddin 2019). This is because market participants’ financial status dictates their ability to participate in financial markets; if they do not have income, they will not participate, but the opposite holds if they do have income. Hence, high-value signs reflect increased consumer confidence in future economic conditions, allowing investors to participate in financial markets. Koy and Akkaya (2017) demonstrate that CCI has evolved as a critical measure for sentiment following the financial crises. Hamurcu (2021) found that the index as a proxy for sentiment influences the Turkish stock market. Therefore, the proxy will contribute to the South African context as previous studies in South Africa (Muguto et al. 2019; Rupande et al. 2019; Muzindutsi et al. 2023) did not capture consumer sentiment in their sentiment index, which is a vital flaw given that these domestic consumers also participate in the South African financial market. |

Note: 1. Authors’ own depiction (2024).

References

- Aristei, David, and Duccio Martelli. 2014. Sovereign bond yield spreads and market sentiment and expectations: Empirical evidence from Euro area countries. Journal of Economics and Business 76: 55–84. [Google Scholar] [CrossRef]

- Ashraf, Badar Nadeem. 2020. Stock markets’ reaction to COVID-19: Cases or fatalities? Research in International Business and Finance 54: 101249. [Google Scholar] [CrossRef] [PubMed]

- Baker, Malcom, and Jeffrey Wurgler. 2006. Investor sentiment and the cross-section of stock returns. The Journal of Finance 61: 1645–80. [Google Scholar] [CrossRef]

- Baker, Malcom, and Jeffrey Wurgler. 2007. Investor Sentiment in The Stock Market. Journal of Economic Perspectives 21: 129–52. [Google Scholar] [CrossRef]

- Baker, Malcom, and Jeremy C. Stein. 2004. Market Liquidity as A Sentiment Indicator. Journal of Financial Markets 7: 271–99. [Google Scholar] [CrossRef]

- Beer, Francisa, and Mohammed Zouaoui. 2013. Measuring stock market investor sentiment. Journal of Applied Business Research 29: 51–67. [Google Scholar] [CrossRef]

- Beirne, John, Nuobu Renzhi, and Ulrich Volz. 2024. Local currency bond markets, foreign investor participation and capital flow volatility in emerging Asia. The Singapore Economic Review 69: 517–41. [Google Scholar] [CrossRef]

- Bormann, Seven-Kristjan. 2013. Sentiment Indices on Financial Markets: What do They Measure? (No. 2013-58). Economics Discussion Papers. Kiel: Kiel Institute for the World Economy (IfW). [Google Scholar]

- Brown, Gregory W., and Michael T. Cliff. 2004. Investor sentiment and the near-term stock market. Journal of Empirical Finance 11: 19–27. [Google Scholar] [CrossRef]

- Capital Markets Authority. 2012. Comparative Study on African Equity Marketsin 2011. Available online: http://www.cma.or.ke/index.php?view=download&alias=402-issue-no-13-published-betweenoctober-a-december-2012&category_slug=newsletter&option=com_docman&Itemid=583 (accessed on 9 July 2024).

- Chen, Han, Liang Shan, and Chenhui Wang. 2021. Investment Sentiment in Finance Market. In 2021 3rd International Conference on Economic Management and Cultural Industry (ICEMCI 2021). Amsterdam: Atlantis Press, pp. 3325–32. [Google Scholar]

- Cochrane, John H., and Monika Piazzesi. 2005. Bond risk premia. American Economic Review 95: 138–60. [Google Scholar] [CrossRef]

- Cornaggia, Kimberly, John Hund, and Giang Nguyen. 2022. Investor attention and municipal bond returns. Journal of Financial Markets 60: 100738. [Google Scholar] [CrossRef]

- Davies, Jerome Edward. 2013. Predicting the Bull Run: Scientific Evidence for Turning Points of Markets. Ph.D. thesis, University of Cape Town, Cape Town, South Africa. [Google Scholar]

- Gong, Xue, Weiguo Zhang, Junbo Wang, and Chao Wang. 2022. Investor sentiment and stock volatility: New evidence. International Review of Financial Analysis 80: e102028. [Google Scholar] [CrossRef]

- Guidolin, Massimo. 2016. Modeling, Estimating and Forecasting Financialdata under the Regime (Markov) Switching. Available online: http://didattica.unibocconi.it/mypage/dwload.php (accessed on 20 March 2024).

- Halliday, Alexander Essu. 2018. Assessing the Relationship of Investor Sentiment and Herding and the Closed-End Fund Discount Cycle. Angeles: Holy Angel University (The Philippines). [Google Scholar]

- Hamilton, James Desmon. 1989. A new approach to the economic analysis of nonstationary time series and the business cycle. Econometrica: Journal of the Econometric Society 4: 357–84. [Google Scholar] [CrossRef]

- Hamurcu, Çağrı. 2021. How consumer confidence index affects foreign investors’ portfolio and equity security investments: A research on Turkey. Manisa Celal Bayar Üniversitesi Sosyal Bilimler Dergisi 19: 191–204. [Google Scholar] [CrossRef]

- Han, Dong. 2019. Network analysis of the Chinese stock market during the turbulence of 2015–2016 using log-returns, volumes and mutual information. Physica A: Statistical Mechanics and Its Applications 523: 1091–109. [Google Scholar]

- Hatemi-J, Abdulnasser, Eduardo Roca, and Alan Mustafa. 2023. Portfolio diversification impact of oil and asymmetric interaction between oil, equity and bonds in the global market: Fresh evidence from alternative approaches. Journal of Economic Studies 50: 790–805. [Google Scholar] [CrossRef]

- He, Zhifang. 2020. Dynamic impacts of crude oil price on Chinese investor sentiment: Nonlinear causality and time-varying effect. International Review of Economics & Finance 66: 131–53. [Google Scholar]

- Helleiner, Eric. 2011. Understanding the 2007–2008 global financial crisis: Lessons for scholars of international political economy. Annual Review of Political Science 14: 67–87. [Google Scholar] [CrossRef]

- Hengelbrock, Jordis, Erik Theissen, and Christian Westheide. 2011. Market Response to Investor Sentiment. Working Paper. Cambridge: Centre for Financial Research, pp. 1–34. [Google Scholar]

- Islam, Mohd Anisul. 2021. Investor sentiment in the equity market and investments in corporate-bond funds. International Review of Financial Analysis 78: 01898. [Google Scholar] [CrossRef]

- JSE. 2013. Debt Market, South Africa. Available online: https://www.jse.co.za/trade/debt-market (accessed on 7 July 2024).

- JSE. 2024a. Government Bonds. Available online: https://www.jse.co.za/trade/debt-market/bonds/government-bonds (accessed on 25 July 2024).

- JSE. 2024b. Interest Rate Market. Available online: https://www.jse.co.za/raise-capital/interest-rate-market#:~:text=At%20the%20end%20of%202022,debt%20listed%20on%20the%20JSE (accessed on 4 May 2024).

- Junaeni, Irawati. 2020. Analysis of Factors ‘That Influence Decision Making Invest in Capital Markets in Millennial Generations’. International Journal of Accounting & Finance in Asia Pasific (IJAFAP) 3: 78–87. [Google Scholar]

- Kahneman, Daniel, and Amos Tversky. 1979. Prospect theory: An analysis of decision under risk. Econometrica 47: 263–92. [Google Scholar] [CrossRef]

- Koy, Ayben, and Murat Akkaya. 2017. The role of consumer confidence as a leading indicator on stock returns: A Markov switching approach. Social Science Research Network. [Google Scholar] [CrossRef]

- Lawrence, Babatunde, Fabian Moodley, and Sune Ferreira-Schenk. 2024. Macroeconomic determinants of the JSE size-base industries connectedness: Evidence from changing market conditions. Cogent Economics & Finance 12: 2397454. [Google Scholar]

- Lee, Kiryoung, and Minki Kim. 2019. Investor sentiment and bond risk premia: Evidence from China. Emerging Markets Finance and Trade 55: 915–33. [Google Scholar] [CrossRef]

- Lewis, Kurt F., Francis A. Longstaff, and Lubomir Petrasek. 2021. Asset mispricing. Journal of Financial Economics 141: 981–1006. [Google Scholar] [CrossRef]

- Li, Yulin. 2021. Investor sentiment and sovereign bonds. Journal of International Money and Finance 115: e102388. [Google Scholar] [CrossRef]

- Liu, Yu-Hong, Syuan-Rong Dai, Fu-Min Chang, Yih-Bey Lin, and Nicholas Rueilin Lee. 2020. Does the investor sentiment affect the stock returns in Taiwan’s stock market under different market states? Journal of Applied Finance and Banking 10: 41–59. [Google Scholar]

- Liutvinavicius, Marius, Jelena Zubova, and Virgilijus Sakalauskas. 2017. Behavioural economics approach: Using investors sentiment indicator for financial markets forecasting. Baltic Journal of Modern Computing 5: 275–92. [Google Scholar] [CrossRef]

- Lo, Andrew W. 2004. The adaptive markets hypothesis: Market efficiency from an evolutionary perspective. Journal of Portfolio Management, Forthcoming. [Google Scholar]

- Lo, Andrew W. 2005. Reconciling efficient markets with behavioral finance: The adaptive markets hypothesis. Journal of Investment Consulting 7: 21–44. [Google Scholar]

- Maheu, John M., Thomas H. McCurdy, and Yong Song. 2012. Components of bull and bear markets: Bull corrections and bear rallies. Journal of Business & Economic Statistics 30: 391–403. [Google Scholar]

- Moodley, Fabian. 2024. Bond Indices Maturities and Changing Macroeconomic Conditions: Evidence from South Africa. Journal of Economics and Financial Analysis 8: 57–73. [Google Scholar]

- Moodley, Fabian, Babatunde Lawrence, and Damien Kunjal. 2024. Macroeconomic determinants of responsible investments’ performance under different market conditions: Evidence from South Africa. Journal of Accounting and Investment 25: 826–39. [Google Scholar]

- Moodley, Fabian, Ntokozo Nzimande, and Paul-Francois Muzindutsi. 2022. Stock Returns Indices and Changing Macroeconomic Conditions: Evidence from the Johannesburg Securities Exchange. The Journal of Accounting and Management 12: 110–21. [Google Scholar]

- Muguto, Hilary Tinotenda, Lorraine Muguto, Azra Bhayat, Hawaa Ncalane, Kara Jasmine Jack, Saadia Abdullah, Thabile Siphesihle Nkosi, and Paul-Francois Muzindutsi. 2022. The impact of investor sentiment on sectoral returns and volatility: Evidence from the Johannesburg stock exchange. Cogent Economics & Finance 10: e2158007. [Google Scholar]

- Muguto, Hilary Tinotenda, Lorraine Rupande, and Paul-Francois Muzindutsi. 2019. Investors entiment and foreign financial flows: Evidence from South Africa. Zbornik Radova Ekonomskog Fakulteta u Rijeci 37: 473–98. [Google Scholar]

- Muguto, L. 2022. Analysis of Stock Return Volatility and Its Response to Investor Sentiment: An Examination of Emerging and Developed Markets. Ph.D. thesis, University of KwaZulu-Natal, Durban, South Africa. [Google Scholar]

- Muhammad, Nik Maheran Nik, and Nurazleena Ismail. 2008. December. Investment decision behavior: Are investors rational or irrational? In Proceeding of East Coast Economic Region Development Conference. Kuala Lumpur: University Publication Centre (UPENA), pp. 15–17. [Google Scholar]

- Muzindutsi, Paul Francois, and Adefemi A. Obalade. 2024. Effects of country risk shocks on the South African bond market performance under changing regimes. Global Business Review 25: 137–49. [Google Scholar] [CrossRef]

- Muzindutsi, Paul Francois, Richard Apau, Lorraine Muguto, and Hillary Tinotenda Muguto. 2023. The impact of investor sentiment on housing prices and the property stock index volatility in South Africa. Real Estate Management and Valuation 31: 1–17. [Google Scholar] [CrossRef]

- Nanayakkara, N., P. D. Nimal, and Y. K. Weerakoo. 2019. Behavioural asset pricing: A review. International Journal of Economics and Financial Issues 9: 101–8. [Google Scholar] [CrossRef]

- Nayak, Subhankar. 2010. Investor sentiment and corporate bond yield spreads. Review of Behavioural Finance 2: 59–80. [Google Scholar] [CrossRef]

- Obalade, Adefemi A., Z. Khumalo, S. Maistry, M. Naidoo, N. Thwala, and Paul-Fancois Muzindutsi. 2023. The Macroeconomic Determinants of the South African Bond Performance under Different Regimes. Review of Integrative Business and Economics Research 12: 92–110. [Google Scholar]

- OECD. 2022. Consumer Confidence Index (BCI) [Online]. Available online: https://data.oecd.org/leadind/consumer-confidence-index-cci.htm (accessed on 2 March 2024).

- Pan, Wei Fong. 2018. Evidence of Investor Sentiment Contagion Across Asset Markets. MPRA Paper No. 88561. Available online: https://mpra.ub.uni-muenchen.de/88561/ (accessed on 2 March 2024).

- Pineiro-Chousa, Juan, M. Ángeles López-Cabarcos, and Aleksandar Šević. 2022. Green bond market and Sentiment: Is there a switching Behaviour? Journal of Business Research 141: 520–27. [Google Scholar] [CrossRef]

- Radier, Geoffrey, Akios Majoni, Kosmas Njanike, and Marko Kwaramba. 2016. Determinants of bond yield spread changes in South Africa. African Review of Economics and Finance 8: 50–81. [Google Scholar] [CrossRef]

- Rahman, Md. Lutfur, and Abul Shamsuddin. 2019. Investor sentiment and the price-earnings ratio in the G7 stock markets. Pacific-Basin Finance Journal 55: 46–62. [Google Scholar] [CrossRef]

- Reis, Pedro Manuel Nogueira, and Carlos Pinho. 2020. A new European investor sentiment index (EURsent) and its return and volatility predictability. Journal of Behavioral and Experimental Finance 27: 100373. [Google Scholar] [CrossRef]

- Rupande, Lorraine, Hilary Tinotenda Muguto, and Paul-Francois Muzindutsi. 2019. Investor sentiment and stock return volatility: Evidence from the Johannesburg Stock Exchange. Cogent Economics and Finance 7: 1600233. [Google Scholar] [CrossRef]

- Shefrin, Hersh, and Meir Statman. 1994. Behavioral capital asset pricing theory. Journal of Financial and Quantitative Analysis 29: 323–49. [Google Scholar] [CrossRef]

- Shen, Jiancheng, John Griffith, Mohammed Najand, and Licheng Sun. 2023. Predicting stock and bond market returns with emotions: Evidence from futures markets. Journal of Behavioral Finance 24: 333–44. [Google Scholar] [CrossRef]

- Soja, Tijana, and Topic Pavkovic. 2022. What Moves Sovereign Bond Markets? The Effect of Macroeconomic Indicators and Business Sentiment on Germany Bond Yields. International Journal of Economics & Law 34: 235–53. [Google Scholar]

- Spyrou, Spyros. 2013. Investor sentiment and yield spread determinants: Evidence from European markets. Journal of Economic Studies 40: 739–62. [Google Scholar] [CrossRef]

- Zaremba, Adam, and Jan Jakub Szczygielski. 2019. Limits to arbitrage, investor sentiment, and factor returns in international government bond markets. Economic Research-Ekonomska istraživanja 32: 1727–43. [Google Scholar] [CrossRef]