Sectoral Performance Trends and Differences in the Balkan and Eastern European Region

Abstract

:1. Introduction

2. Literature Review

2.1. COVID-19-Related Publications in the Research Field

2.2. Financial Performance-Related Publications in the Field

2.3. Novel Research Trends and Dissemination of Non-Financial Ratios

2.4. Summary of the Literature Review and Hypothesis Formulation

3. Materials and Methods

3.1. Data Collection and Analysis

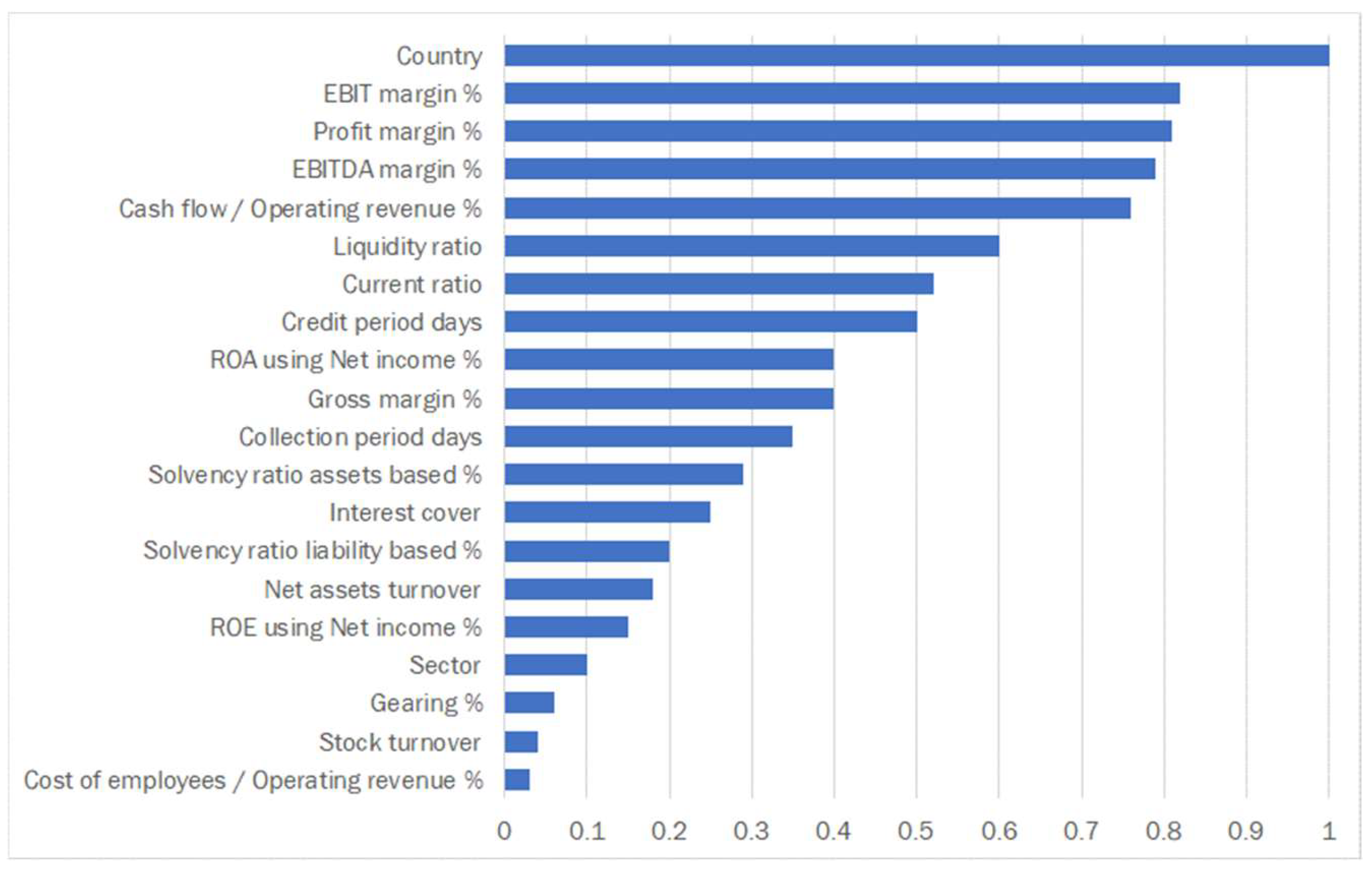

3.2. Variable Specification

3.3. Data Preparation and Aggregation

3.4. Applied Multivariate Cluster Analysis Method

4. Results and Discussion

4.1. Results of Sectoral Performance Trend Analysis

4.2. Results of Sectoral Performance Difference Analysis

5. Conclusions

5.1. Results of Examining H1

5.2. Results of Examining H2

5.3. Results of Examining H3

5.4. Implications

5.5. Limitations and Future Research Directions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

References

- Abdel-Basset, Mohamed, Weiping Ding, Rehab Mohamed, and Noura Metawa. 2020. An integrated plithogenic MCDM approach for financial performance evaluation of manufacturing industries. Risk Management 22: 192–218. [Google Scholar] [CrossRef]

- Alter, Adrian, and Selim A. Elekdag. 2020. Emerging market corporate leverage and global financial conditions. Journal of Corporate Finance 62: 101590. [Google Scholar] [CrossRef]

- Amoa-Gyarteng, Karikari. 2021. Corporate financial distress: The impact of profitability, liquidity, asset productivity, activity and solvency. Journal of Accounting, Business and Management 28: 104–15. [Google Scholar] [CrossRef]

- Anqi, Chen, and Ong Tze San. 2022. Environmental performance, corporate governance and financial performance of Chinese heavy polluted industries. International Journal of Energy Economics and Policy 12: 460–69. [Google Scholar] [CrossRef]

- Ataman, Başak, Gürbüz Gökçen, and Kezban Şimşek. 2022. The impacts of the COVID-19 pandemic on sectoral performance: A review on the BIST sectors in Turkey. Finans Ekonomi ve Sosyal Araştırmalar Dergisi 7: 253–69. [Google Scholar] [CrossRef]

- Bekaert, Geert, and Campbell R. Harvey. 2002. Research in emerging markets finance: Looking to the future. Emerging Markets Review 3: 429–48. [Google Scholar] [CrossRef]

- Bhaskar, Ratikant, and Shashank Bansal. 2022. Nineteen years of emerging markets finance and trade: A bibliometric analysis. Emerging Markets Finance and Trade 58: 4120–35. [Google Scholar] [CrossRef]

- Cumming, Douglas, Vincenzo Verdoliva, and Feng Zhan. 2021. New and future research in corporate finance and governance in China and emerging markets. Emerging Markets Review 46: 100792. [Google Scholar] [CrossRef]

- Dao, Binh Thi Thanh, and Hoang Anh Ngo. 2020. Impact of corporate governance on firm performance and earnings management a study on Vietnamese non-financial companies. Asian Economic and Financial Review 10: 480–501. [Google Scholar] [CrossRef]

- Demirkan, Irem, Qin Yang, and Crystal X. Jiang. 2019. Corporate entrepreneurship of emerging market firms: Current research and future directions. New England Journal of Entrepreneurship 22: 5–30. [Google Scholar] [CrossRef]

- Harantová, Veronika, Jaroslav Mazanec, Vladimíra Štefancová, Jaroslav Mašek, and Hana Brůhová Foltýnová. 2023. Two-step cluster analysis of passenger mobility segmentation during the COVID-19 pandemic. Mathematics 11: 583. [Google Scholar] [CrossRef]

- Huynh, Nhan, Dat Nguyen, and Ahn Dao. 2021. Sectoral performance and the government interventions during COVID-19 pandemic: Australian evidence. Journal of Risk and Financial Management 14: 178. [Google Scholar] [CrossRef]

- Ipsmiller, Edith, and Desislava Dikova. 2021. Internationalization from Central and Eastern Europe: A systematic literature review. Journal of International Management 27: 100862. [Google Scholar] [CrossRef]

- Kliestik, Tomas, Katarina Valaskova, George Lazaroiu, Maria Kovacova, and Jaromir Vrbka. 2020. Remaining financially healthy and competitive: The role of financial predictors. Journal of Competitiveness 12: 74–92. [Google Scholar] [CrossRef]

- Konar, Hanife Gül, and Metin Atmaca. 2020. Sectoral applications intended for business performance measurement with the financial ratios method. Journal of Applied and Theoretical Social Sciences 2: 49–71. [Google Scholar] [CrossRef]

- Kovacova, Maria, Tomas Kliestik, Katarina Valaskova, Pavol Durana, and Zuzana Juhaszova. 2019. Systematic review of variables applied in bankruptcy prediction models of Visegrad group countries. Oeconomia Copernicana 10: 743–72. [Google Scholar] [CrossRef]

- Kristóf, Tamás, and Miklós Virág. 2022. What drives financial competitiveness of industrial sectors in Visegrad Four countries? Evidence by use of machine learning techniques. Journal of Competitiveness 14: 117–36. [Google Scholar] [CrossRef]

- Kuchiki, Akifumi. 2021. ‘Sequencing Economics’ on the ICT industry agglomeration for economic integration. Economies 9: 2. [Google Scholar] [CrossRef]

- Kurniawandi, Kevin Adhiya. 2021. Analysis of financial performance of ceramic, porcelain, and glass sub-sector industries. Journal of Accounting, Entrepreneurship and Financial Technology 3: 73–86. [Google Scholar] [CrossRef]

- Li, Hui, and Jie Sun. 2011. Mining business failure predictive knowledge using two-step clustering. African Journal of Business Management 5: 4107–20. [Google Scholar] [CrossRef]

- Manimannan, Ganesan, and Priya R. Lakshmi. 2020. Indian industrial performance based on financial ratios using data mining. International Journal of Data Mining and Emerging Technologies 10: 29–37. [Google Scholar] [CrossRef]

- Muthu, Kugin, and Nicolene Wesson. 2023. The impact of COVID-19 on company performance per industry sector: Evidence from South Africa. Journal of Economic and Financial Sciences 16: a801. [Google Scholar] [CrossRef]

- Omotola, Akinbolajo, and Rebecca Bank-Ola. 2022. Financial development and economic performance in Nigeria: Evidence from sectoral analysis. International Journal of Scientific and Management Research 5: 15–32. [Google Scholar] [CrossRef]

- Oppusunggu, Lis Sintha, Lela Nurlaela Wati, and Heri Ispriyahadi. 2023. The Covid-19 pandemic’s impact on financial performance and market performance in nine Indonesian business sectors. Journal of Economics, Finance and Management Studies 6: 385–94. [Google Scholar] [CrossRef]

- Popa, Dorina Nicoleta, Victoria Bogdan, Claudia Diana Sabau Popa, Marioara Belenesi, and Alina Badulescu. 2022. Performance mapping in two-step cluster analysis through ESEG disclosures and EPS. Kybernetes 51: 98–118. [Google Scholar] [CrossRef]

- Priya, Prigati, and Chandan Sharma. 2023. COVID-19 related stringencies and financial market volatility: Sectoral evidence from India. Journal of Financial Economic Policy 15: 16–34. [Google Scholar] [CrossRef]

- Rahman, Abdul, and Raj Bahadur Sharma. 2020. Cash flows and financial performance in the industrial sector of Saudi Arabia: With special reference to insurance and manufacturing sectors. Investment Management and Financial Innovations 17: 76–84. [Google Scholar] [CrossRef]

- Rundle-Thiele, Sharyn, Krzysztof Kubacki, Aaron Tkaczynski, and Joy Parkinson. 2015. Using two-step cluster analysis to identify homogeneous physical activity groups. Marketing Intelligence & Planning 33: 522–37. [Google Scholar] [CrossRef]

- Shabbir, Malik Shahzad, Ejaz Aslam, Adil Irshad, Kanwal Bilal, Shabab Aziz, Bilal Ahmed Abbasi, and Sayma Zia. 2020. Nexus between corporate social responsibility and financial and non-financial sectors’ performance: A non-linear and disaggregated approach. Environmental Science and Pollution Research 27: 39164–79. [Google Scholar] [CrossRef]

- Shamsuddin, Amanuddin Bin, and Ghazi Mohammed Alshahri. 2022. The effect of audit committee characteristics on firm performance: Evidence from non-financial sectors in Oman. Asian Economic and Financial Review 12: 816–36. [Google Scholar] [CrossRef]

- Singh, Nitya, and Paul Hong. 2023. CSR, risk management practices, and performance outcomes: An empirical investigation of firms in different industries. Journal of Risk and Financial Management 16: 69. [Google Scholar] [CrossRef]

- Skoczylas, Wanda, and Barbara Batóg. 2019. A dynamic approach to a comparative evaluation of financial performance of sections and sectors of the Polish economy. Acta Universitatis Lodziensis. Folia Oeconomica 4: 39–52. [Google Scholar] [CrossRef]

- Suman, Smriti, Vaibhav Jaiswal, and Ravi Veeraraghavan. 2022. An analysis of financial performance of select Indian industry sectors before and after COVID-19. EPRA International Journal of Multidisciplinary Research 8: 247–52. [Google Scholar] [CrossRef]

- Tabash, Mosab I., Babatunde Afolabi, Johnson Adelakun, and Ruth Astuwa. 2022. Financial deepening and sectoral performance in emerging markets: Evidence from the Nigerian agricultural and manufacturing sectors. Agricultural and Resource Economics: International Scientific E-Journal 8: 171–86. [Google Scholar] [CrossRef]

- VanderPal, Geoffrey. 2019. Exploring the nexus between research and development expenditures and corporate financial performance: A sectoral analysis. American Journal of Management 19: 133–54. [Google Scholar] [CrossRef]

- Vidal-Llana, Xenxo, Jorge M. Uribe, and Montserrat Guillén. 2023. European stock market volatility connectedness: The role of country and sector membership. Journal of International Financial Markets, Institutions and Money 82: 101696. [Google Scholar] [CrossRef]

- Vijayakumaran, Ratnam, and Sunitha Vijayakumaran. 2019. Leverage, debt maturity and corporate performance: Evidence from Chinese listed companies. Asian Economic and Financial Review 9: 491–506. [Google Scholar] [CrossRef]

- Wijayanto, Andi, and Agus Hermani D. Seno. 2021. Comparative analysis of company financial performance between sub sectors in the consumer goods industry in Indonesia before and during the Covid-19 pandemic. Journal of Economics, Finance and Management Studies 4: 2427–32. [Google Scholar] [CrossRef]

- Wira, Variyetmi. 2021. The effects of financial performance toward firm value on tourism, hotel and restaurant, and transportation sectors listed on Indonesia Stock Exchange. Inovbiz: Jurnal Inovasi Bisnis 9: 141–49. [Google Scholar] [CrossRef]

| Country | Available Corporate Financial Data | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | Total | |

| AL | 90 | 257 | 251 | 218 | 196 | 1147 | 6866 | 7517 | 5504 | 22,046 |

| BA | 19,954 | 20,264 | 21,072 | 20,475 | 18,744 | 18,102 | 17,410 | 18,730 | 18,013 | 172,764 |

| BG | 225,422 | 241,147 | 257,229 | 270,427 | 285,723 | 298,340 | 304,499 | 308,263 | 313,644 | 2,504,694 |

| BY | 1523 | 1621 | 1646 | 1511 | 1552 | 1687 | 2568 | 1384 | 12,587 | 26,079 |

| CZ | 118,531 | 119,317 | 129,230 | 141,541 | 143,282 | 139,564 | 127,664 | 115,469 | 126,650 | 1,161,248 |

| EE | 75,504 | 83,748 | 97,735 | 108,780 | 118,461 | 129,165 | 137,215 | 145,158 | 141,839 | 1,037,605 |

| GR | 25,868 | 28,177 | 29,175 | 30,857 | 33,840 | 35,900 | 36,184 | 34,363 | 8258 | 262,622 |

| HR | 55,273 | 65,189 | 74,910 | 80,867 | 88,984 | 97,351 | 101,988 | 111,117 | 108,438 | 784,117 |

| HU | 219,342 | 234,312 | 251,101 | 264,049 | 276,913 | 289,914 | 289,871 | 318,273 | 329,863 | 2,473,638 |

| KV | 153 | 231 | 263 | 299 | 332 | 317 | 171 | 281 | 269 | 2316 |

| LT | 9052 | 9658 | 9514 | 10,861 | 12,519 | 19,202 | 63,977 | 69,629 | 71,463 | 275,875 |

| LV | 49,042 | 53,532 | 59,000 | 63,606 | 67,786 | 70,968 | 74,132 | 78,124 | 37,343 | 553,533 |

| MD | 438 | 392 | 338 | 270 | 4886 | 4957 | 4895 | 5287 | 5540 | 27,003 |

| ME | 1262 | 8977 | 10,525 | 10,633 | 10,148 | 10,273 | 10,651 | 10,760 | 10,253 | 83,482 |

| MK | 30,756 | 34,558 | 38,871 | 40,005 | 42,200 | 43,986 | 44,317 | 46,977 | 47,034 | 368,704 |

| PL | 81,129 | 90,544 | 101,433 | 97,168 | 184,337 | 204,845 | 213,586 | 222,910 | 221,814 | 1,417,766 |

| RO | 360,312 | 378,707 | 425,768 | 455,789 | 496,722 | 530,944 | 559,552 | 619,823 | 656,423 | 4,484,040 |

| RS | 59,285 | 51,248 | 51,866 | 68,705 | 87,843 | 91,913 | 162,493 | 173,950 | 167,288 | 914,591 |

| SI | 63,202 | 69,690 | 73,397 | 74,408 | 78,988 | 83,276 | 83,608 | 91,462 | 93,410 | 711,441 |

| SK | 119,801 | 135,486 | 147,006 | 158,714 | 169,692 | 178,089 | 182,432 | 196,483 | 203,881 | 1,491,584 |

| UA | 235,244 | 218,279 | 232,361 | 240,523 | 255,308 | 269,072 | 263,251 | 322,866 | 20,773 | 2,057,677 |

| Total | 1,753,196 | 1,847,348 | 2,014,706 | 2,141,722 | 2,380,473 | 2,521,030 | 2,689,349 | 2,900,846 | 2,602,308 | 20,832,825 |

| Sector | Available Corporate Financial Data | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | Total | |

| Agriculture, Horticulture & Livestock | 91,339 | 95,882 | 102,326 | 106,116 | 115,249 | 119,302 | 117,827 | 125,402 | 87,882 | 961,325 |

| Biotechnology and Life Sciences | 5533 | 5686 | 6136 | 6462 | 7342 | 7726 | 7968 | 8723 | 7211 | 62,787 |

| Business Services | 342,224 | 365,080 | 398,559 | 429,240 | 483,108 | 514,154 | 553,554 | 612,371 | 557,676 | 4,255,966 |

| Chemicals, Petroleum, Rubber & Plastic | 18,678 | 19,295 | 20,584 | 21,357 | 23,480 | 24,384 | 25,160 | 26,900 | 22,327 | 202,165 |

| Construction | 163,661 | 172,015 | 190,127 | 205,395 | 233,639 | 252,895 | 271,890 | 298,650 | 282,747 | 2,071,019 |

| Food & Tobacco Manufacturing | 31,672 | 33,710 | 36,595 | 39,002 | 44,243 | 46,942 | 51,855 | 55,534 | 48,441 | 387,994 |

| Industrial, Electric & Electronic Machinery | 26,145 | 27,267 | 28,767 | 30,215 | 32,891 | 34,224 | 34,885 | 36,761 | 32,023 | 283,178 |

| Information Technology and Communications | 47,182 | 51,198 | 56,901 | 62,649 | 73,543 | 80,740 | 87,481 | 97,582 | 93,959 | 651,235 |

| Leather, Stone, Clay & Glass products | 10,539 | 10,882 | 11,558 | 11,910 | 13,062 | 13,603 | 14,389 | 15,373 | 12,377 | 113,693 |

| Media & Broadcasting | 13,886 | 14,895 | 16,459 | 17,902 | 21,039 | 22,842 | 24,387 | 26,254 | 24,186 | 181,850 |

| Metals & Metal Products | 33,693 | 35,515 | 37,841 | 40,163 | 44,168 | 46,765 | 48,758 | 51,934 | 47,661 | 386,498 |

| Mining & Extraction | 4690 | 4726 | 5076 | 5233 | 5760 | 5984 | 6076 | 6505 | 4884 | 48,934 |

| Miscellaneous Manufacturing | 4764 | 4973 | 5491 | 5931 | 6840 | 7382 | 8615 | 9259 | 8749 | 62,004 |

| Printing & Publishing | 18,556 | 19,199 | 20,218 | 20,849 | 22,675 | 23,335 | 23,981 | 25,095 | 20,889 | 194,797 |

| Property Services | 134,334 | 136,468 | 153,545 | 158,439 | 175,570 | 185,620 | 191,145 | 203,781 | 177,470 | 1,516,372 |

| Retail | 224,560 | 234,493 | 251,052 | 262,142 | 280,845 | 287,918 | 311,458 | 325,214 | 307,022 | 2,484,704 |

| Textiles & Clothing Manufacturing | 19,112 | 20,108 | 21,564 | 22,644 | 25,156 | 26,574 | 28,743 | 30,067 | 26,785 | 220,753 |

| Transport Manufacturing | 4442 | 4719 | 5153 | 5421 | 6052 | 6478 | 6705 | 7134 | 6270 | 52,374 |

| Transport, Freight & Storage | 96,688 | 104,458 | 114,924 | 125,216 | 140,654 | 150,899 | 163,496 | 178,428 | 167,056 | 1,241,819 |

| Travel, Personal & Leisure | 143,297 | 156,146 | 175,511 | 190,824 | 216,499 | 236,006 | 269,727 | 282,691 | 267,548 | 1,938,249 |

| Utilities | 14,712 | 15,408 | 16,942 | 17,446 | 20,281 | 21,454 | 22,893 | 26,627 | 22,840 | 178,603 |

| Waste Management & Treatment | 7350 | 7723 | 8427 | 8810 | 9985 | 10,439 | 10,613 | 11,341 | 9863 | 84,551 |

| Wholesale | 261,907 | 271,494 | 292,790 | 308,495 | 334,729 | 349,308 | 358,551 | 386,223 | 318,898 | 2,882,395 |

| Wood, Furniture & Paper Manufacturing | 32,219 | 33,994 | 36,145 | 37,845 | 41,646 | 44,038 | 47,173 | 50,977 | 45,523 | 369,560 |

| Total | 1,751,183 | 1,845,334 | 2,012,691 | 2,139,706 | 2,378,456 | 2,519,012 | 2,687,330 | 2,898,826 | 2,600,287 | 20,832,825 |

| Financial Ratio | Calculation Formula | References |

|---|---|---|

| ROA using Net income % | (Net income/Total assets) × 100 | Kurniawandi (2021) |

| ROE using Net income % | (Net income/Shareholders’ funds) × 100 | Manimannan and Lakshmi (2020) |

| Profit margin % | (Profit (loss) before tax/Turnover) × 100 | Wira (2021) |

| Gross margin % | (Gross profit/Turnover) × 100 | Kristóf and Virág (2022) |

| EBIT margin % | (Operating profit/Turnover) × 100 | Vijayakumaran and Vijayakumaran (2019) |

| EBITDA margin % | ((Operating profit + Depreciation + Total amortization and impairment)/Turnover) × 100 | Kristóf and Virág (2022) |

| Cash flow/Operating revenue % | ((Net income + Depreciation + Total amortization and impairment)/Turnover) × 100 | Muthu and Wesson (2023) |

| Net assets turnover | Turnover/Total assets less Current liabilities | Wira (2021) |

| Interest cover | Profit (loss) before interest/Interest paid | Kliestik et al. (2020) |

| Stock turnover | Turnover/Stock and work in progress | Kovacova et al. (2019) |

| Collection period days | (Trade debtors/Turnover) × 365 | Wira (2021) |

| Credit period days | (Trade creditors/Turnover) × 365 | Kristóf and Virág (2022) |

| Current ratio | Current assets/Current liabilities | Kurniawandi (2021) |

| Liquidity ratio | (Current assets − Stock and work in progress)/Current liabilities | Muthu and Wesson (2023) |

| Shareholders liquidity ratio | Shareholders’ funds/Long-term liabilities | Kliestik et al. (2020) |

| Solvency ratio assets based % | (Shareholders’ funds/Total assets) × 100 | Manimannan and Lakshmi (2020) |

| Solvency ratio liability based % | (Shareholders’ funds/Liabilities) × 100 | Rahman and Sharma (2020) |

| Gearing % | ((Short-term loans and overdrafts + Long-term liabilities)/Shareholders’ funds) × 100 | Kristóf and Virág (2022) |

| Cost of employees/Operating revenue % | (Remuneration/Turnover) × 100 | Kristóf and Virág (2022) |

| Financial Ratio | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|---|---|---|---|

| ROA using Net income % | 3.967 | 4.618 | 6.264 | 7.715 | 7.972 | 8.555 | 9.416 | 7.778 | 9.822 |

| ROE using Net income % | 10.813 | 11.851 | 15.766 | 19.032 | 21.008 | 21.588 | 22.737 | 21.839 | 24.442 |

| Profit margin % | 6.886 | 8.445 | 8.875 | 9.980 | 10.081 | 10.725 | 11.794 | 10.727 | 12.999 |

| Gross margin % | 34.163 | 38.395 | 40.797 | 42.786 | 43.965 | 44.559 | 46.465 | 43.051 | 47.136 |

| EBIT margin % | 6.444 | 8.013 | 9.592 | 10.590 | 10.707 | 11.253 | 11.598 | 11.348 | 12.195 |

| EBITDA margin % | 11.647 | 12.554 | 13.935 | 14.613 | 14.389 | 14.966 | 15.389 | 15.129 | 16.790 |

| Cash flow/Operating revenue % | 8.258 | 9.193 | 10.640 | 11.456 | 11.564 | 12.313 | 12.663 | 12.239 | 13.824 |

| Net assets turnover | 9.364 | 9.497 | 8.909 | 8.834 | 8.888 | 8.819 | 9.148 | 8.862 | 9.299 |

| Interest cover | 36.635 | 33.131 | 36.807 | 41.070 | 41.050 | 41.977 | 43.122 | 44.135 | 47.828 |

| Stock turnover | 38.727 | 38.932 | 47.390 | 41.687 | 42.041 | 43.587 | 45.542 | 44.317 | 42.349 |

| Collection period days | 72.588 | 75.877 | 67.996 | 65.305 | 66.555 | 65.827 | 64.977 | 67.554 | 67.308 |

| Credit period days | 51.889 | 49.105 | 45.874 | 44.500 | 45.221 | 43.914 | 44.247 | 47.884 | 46.365 |

| Current ratio | 4.797 | 4.906 | 5.168 | 5.460 | 5.481 | 5.776 | 6.054 | 6.136 | 6.303 |

| Liquidity ratio | 3.782 | 3.898 | 4.135 | 4.276 | 4.375 | 4.565 | 4.838 | 5.029 | 5.276 |

| Shareholders liquidity ratio | 25.048 | 23.483 | 26.287 | 24.858 | 24.860 | 25.009 | 24.411 | 22.303 | 23.570 |

| Solvency ratio assets based % | 43.633 | 44.447 | 45.917 | 46.781 | 47.820 | 51.401 | 52.181 | 49.615 | 51.961 |

| Solvency ratio liability based % | 36.427 | 36.975 | 37.307 | 37.293 | 37.389 | 37.561 | 37.789 | 36.599 | 37.671 |

| Gearing % | 44.444 | 42.725 | 42.372 | 41.029 | 42.036 | 42.169 | 42.031 | 41.739 | 41.944 |

| Cost of employees/Operating revenue % | 22.176 | 22.224 | 22.213 | 22.889 | 23.439 | 23.778 | 24.395 | 25.605 | 24.704 |

| Cluster | Number of Records | Share of Cluster (Percent) | Cluster Cohesion * |

|---|---|---|---|

| Cluster-1 | 1822 | 0.40 | 0.73 |

| Cluster-2 | 1240 | 0.27 | 0.52 |

| Cluster-3 | 1474 | 0.33 | 1.00 |

| Financial Ratio | Cluster-1 | Cluster-2 | Cluster-3 |

|---|---|---|---|

| ROA using Net income % | 3.707 | 4.804 | 8.800 |

| ROE using Net income % | 12.939 | 16.978 | 21.664 |

| Profit margin % | 3.928 | 4.633 | 12.621 |

| Gross margin % | 39.090 | 34.343 | 55.858 |

| EBIT margin % | 4.087 | 4.808 | 13.085 |

| EBITDA margin % | 7.799 | 8.031 | 19.535 |

| Cash flow/Operating revenue % | 6.818 | 6.316 | 16.957 |

| Net assets turnover | 5.077 | 8.242 | 5.292 |

| Interest cover | 27.495 | 38.252 | 44.525 |

| Stock turnover | 39.438 | 50.398 | 57.633 |

| Collection period days | 119.145 | 60.740 | 71.583 |

| Credit period days | 99.315 | 54.886 | 49.894 |

| Current ratio | 2.987 | 4.286 | 6.358 |

| Liquidity ratio | 2.196 | 3.237 | 5.358 |

| Solvency ratio assets based % | 43.660 | 45.640 | 55.004 |

| Solvency ratio liability based % | 41.266 | 39.307 | 40.046 |

| Gearing % | 64.889 | 54.511 | 50.549 |

| Cost of employees/Operating revenue % | 26.718 | 22.777 | 25.849 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kristóf, T.; Virág, A.; Virág, M. Sectoral Performance Trends and Differences in the Balkan and Eastern European Region. Economies 2024, 12, 87. https://doi.org/10.3390/economies12040087

Kristóf T, Virág A, Virág M. Sectoral Performance Trends and Differences in the Balkan and Eastern European Region. Economies. 2024; 12(4):87. https://doi.org/10.3390/economies12040087

Chicago/Turabian StyleKristóf, Tamás, Attila Virág, and Miklós Virág. 2024. "Sectoral Performance Trends and Differences in the Balkan and Eastern European Region" Economies 12, no. 4: 87. https://doi.org/10.3390/economies12040087