What Factors Are Limiting Financial Inclusion and Development in Peru? Empirical Evidence

Abstract

:1. Introduction

2. Literature Review

3. Materials and Methodology

3.1. Materials

3.2. Methodology

4. Results

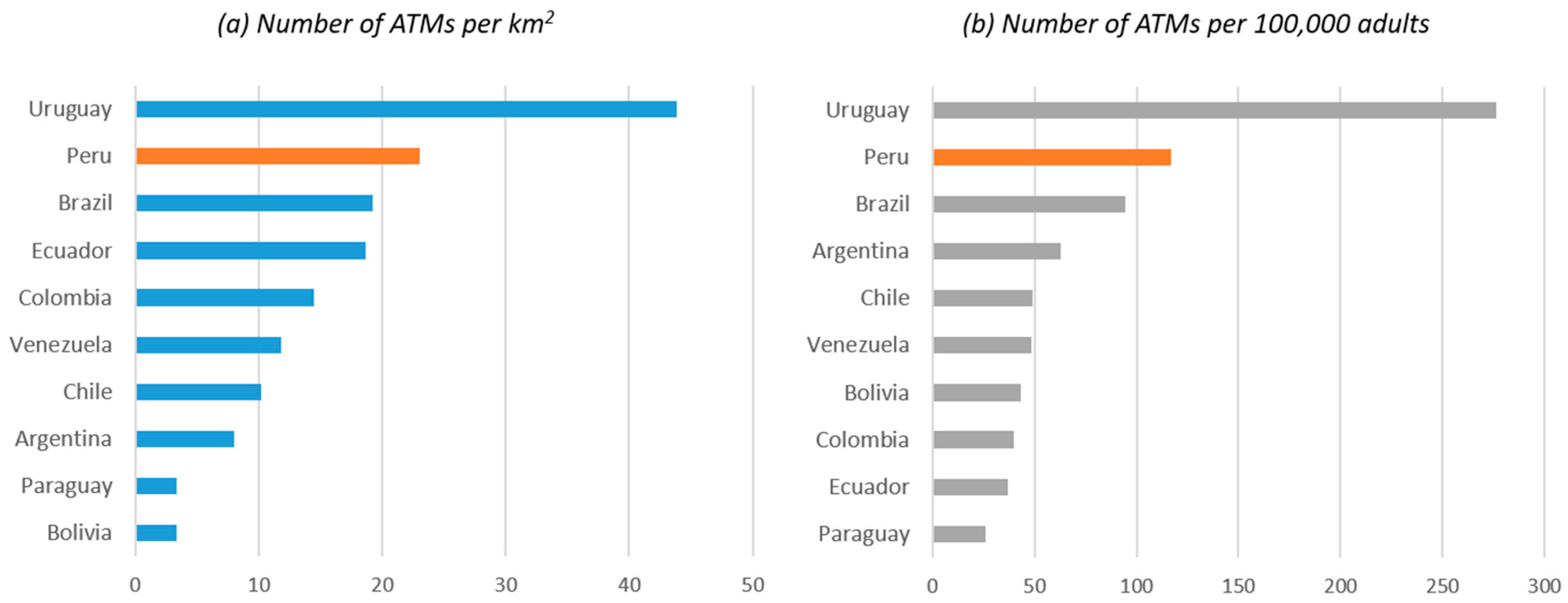

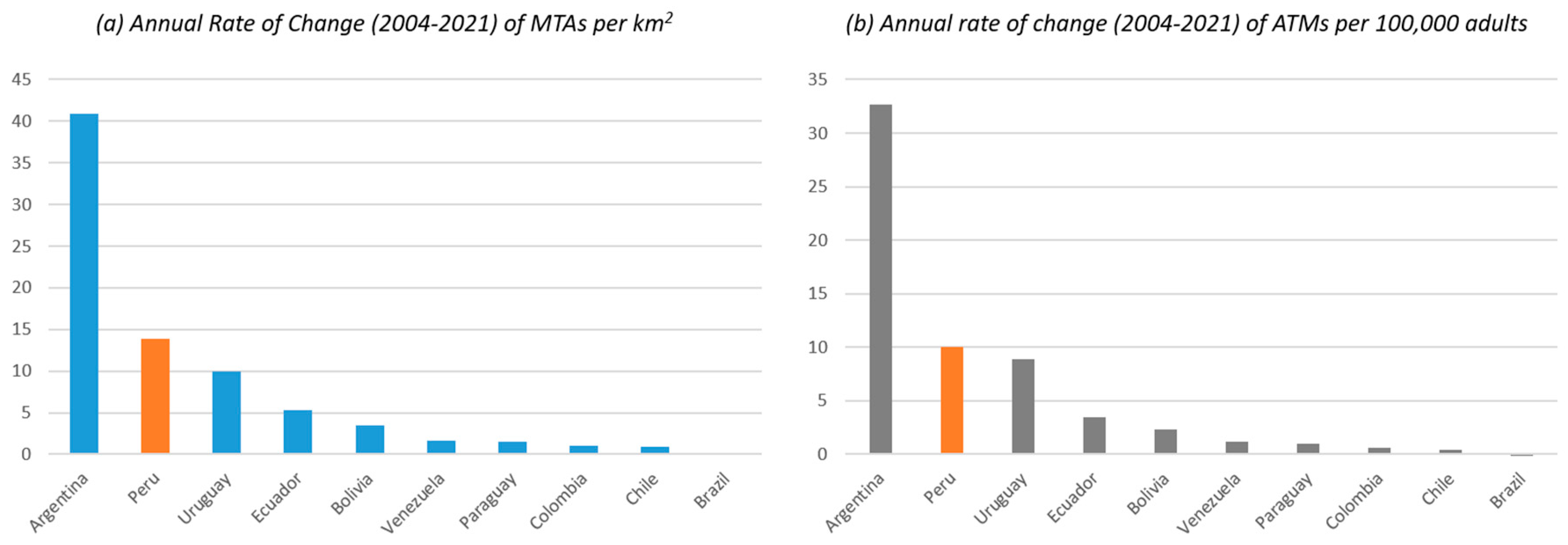

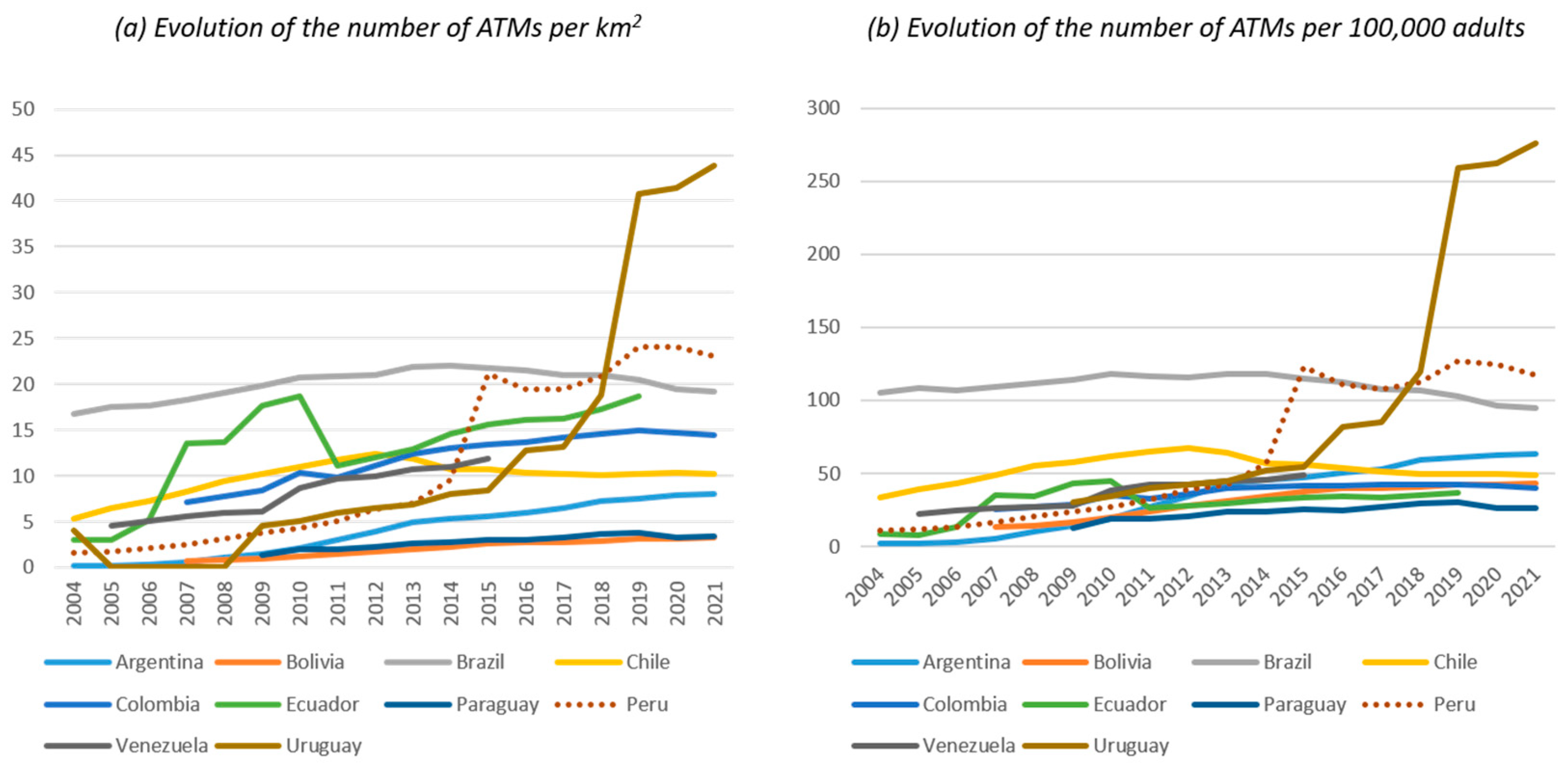

4.1. Results Derived from the Application of FAS Metrics in Peru and South America Comparison

4.2. Results Derived from the Application of FAS Metrics at the Department Level in Peru

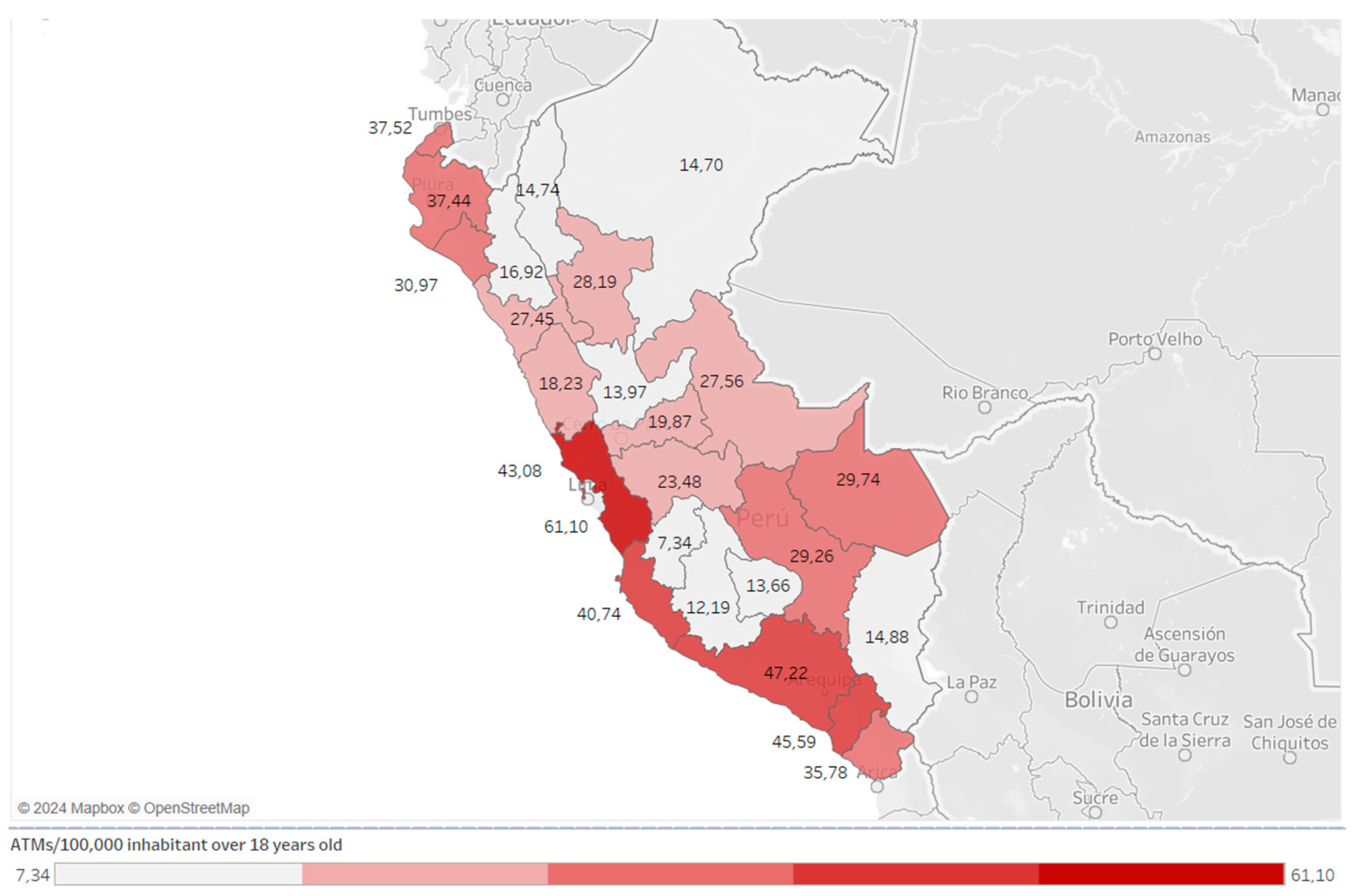

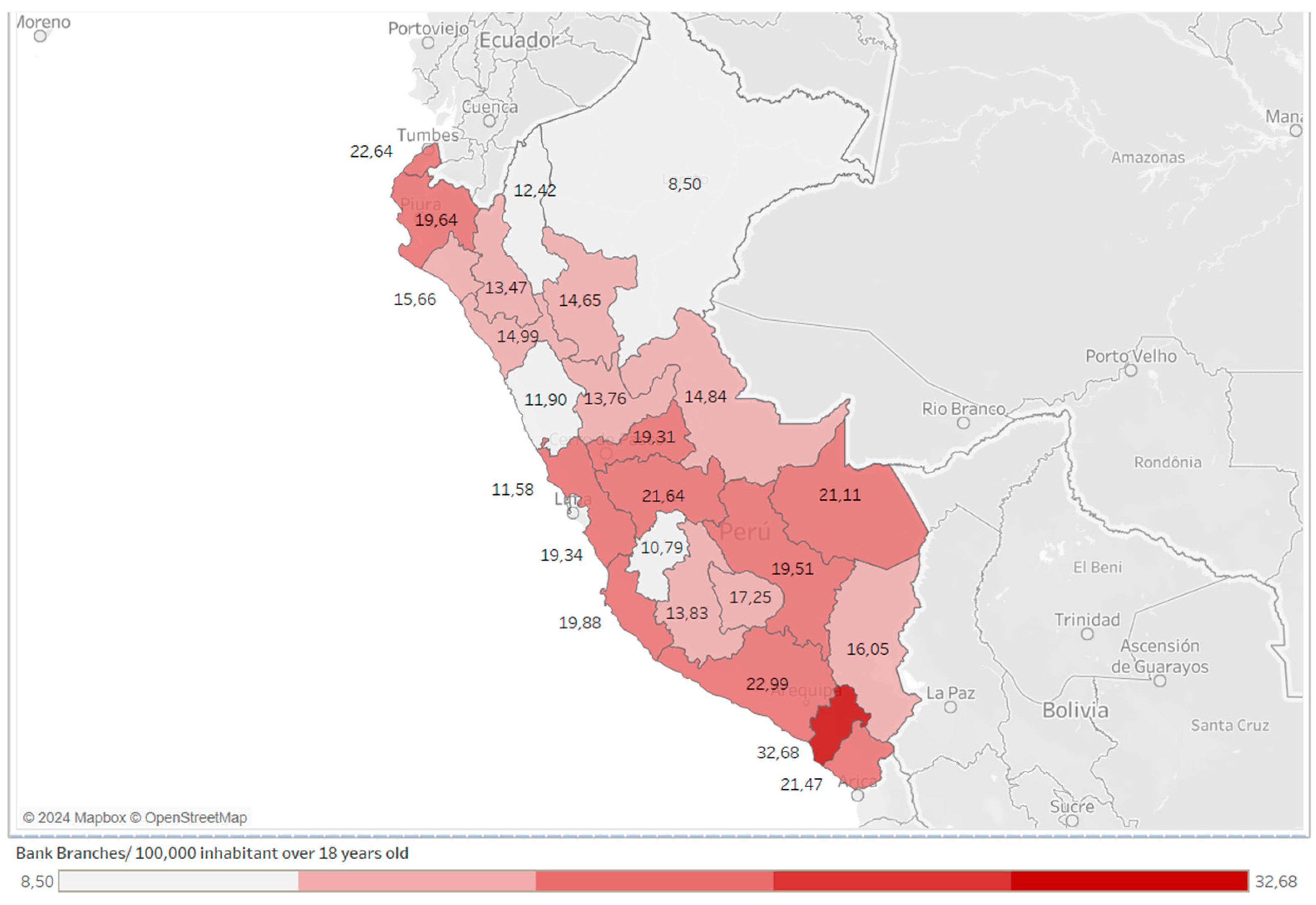

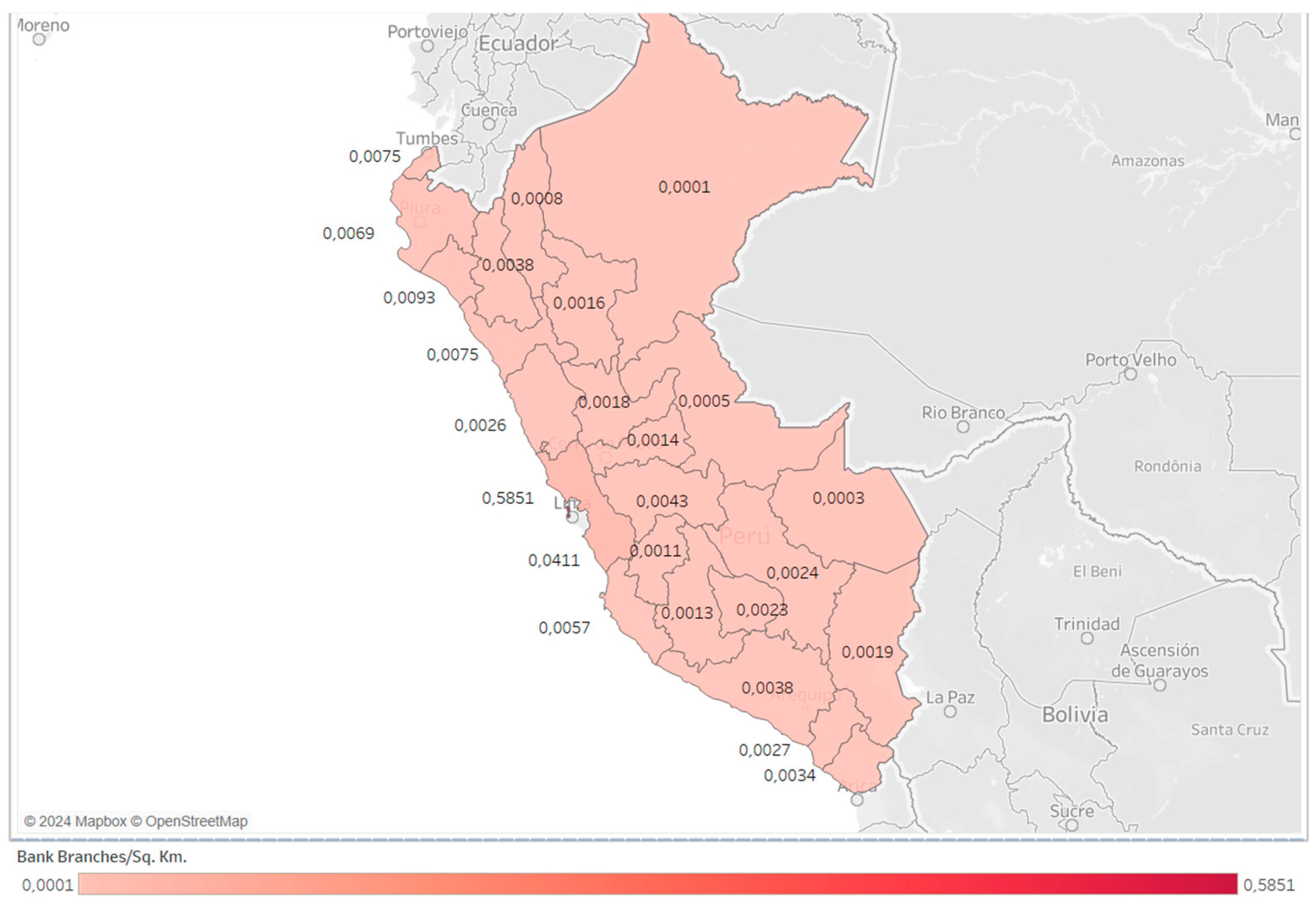

4.3. Geographic Distribution Analysis Results

4.4. Results of ACI Methodology Application

4.5. Results from the Econometric Analysis

5. Discussion of Results and Conclusions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Correction Statement

Appendix A

| Departments | % of Adults with Bank Account | GDP per Capita per Department (USD) | Unemployment Rate | DHI | Mobile Internet | Population Sq. Km | Poverty | Bank Offices 100,000 Inhab | ATMs 100,000 Inhab | Bank Offices Sq. Km. | ATMS Sq. Km. | Bank Offices Department |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Amazonas | 57.1 | 3694 | 2.3 | 0.418 | 262,809 | 39,249 | 28.6 | 7.7 | 9.1 | 0.0008 | 0.0010 | 32 |

| Ancash | 46.06 | 8756 | 3.1 | 0.516 | 868,469 | 35,915 | 18.6 | 8.1 | 12.4 | 0.0026 | 0.0039 | 92 |

| Apurímac | 40.98 | 7918 | 1.8 | 0.411 | 341,537 | 20,896 | 9.3 | 11.3 | 9.0 | 0.0023 | 0.0018 | 48 |

| Arequipa | 55.18 | 10,065 | 5.5 | 0.643 | 1,391,106 | 63,345 | 9.7 | 16.5 | 33.9 | 0.0038 | 0.0078 | 241 |

| Ayacucho | 43.12 | 4627 | 3.3 | 0.433 | 518,034 | 43,815 | 18.5 | 9.1 | 8.0 | 0.0013 | 0.0012 | 59 |

| Cajamarca | 36.93 | 4268 | 2.3 | 0.425 | 988,361 | 33,318 | 17.6 | 8.8 | 11.0 | 0.0038 | 0.0047 | 125 |

| Callao | 63.62 | 11,664 | 7.8 | 0.64 | 892,720 | 147 | 7.3 | 8.2 | 30.6 | 0.5851 | 2.1772 | 86 |

| Cusco | 45.11 | 7020 | 2.8 | 0.512 | 1,067,065 | 71,987 | 11.7 | 13.1 | 19.6 | 0.0024 | 0.0036 | 172 |

| Huancavelica | 48.84 | 5511 | 2.2 | 0.384 | 248,976 | 22,131 | 20.2 | 6.8 | 4.6 | 0.0011 | 0.0008 | 25 |

| Huánuco | 40.97 | 4339 | 2.8 | 0.454 | 553,776 | 36,849 | 28.4 | 8.8 | 8.9 | 0.0018 | 0.0018 | 67 |

| Ica | 54.27 | 11,092 | 3.8 | 0.6 | 787,322 | 21,328 | 12.0 | 13.5 | 27.8 | 0.0057 | 0.0116 | 121 |

| Junín | 45.24 | 5547 | 3.6 | 0.511 | 1,020,149 | 44,197 | 22.0 | 14.4 | 15.6 | 0.0043 | 0.0046 | 189 |

| La Libertad | 48.65 | 5770 | 3.2 | 0.548 | 1,569,536 | 25,500 | 11.0 | 10.1 | 18.4 | 0.0075 | 0.0136 | 190 |

| Lambayeque | 50.1 | 4827 | 4.8 | 0.534 | 959,523 | 14,231 | 7.8 | 10.6 | 21.0 | 0.0093 | 0.0183 | 132 |

| Loreto | 47.55 | 3819 | 3.1 | 0.483 | 535,361 | 368,852 | 52.5 | 4.9 | 8.5 | 0.0001 | 0.0002 | 1432 |

| Madre de Dios | 29.44 | 4723 | 2.7 | 0.614 | 236,780 | 85,301 | 27.2 | 13.6 | 19.2 | 0.0003 | 0.0004 | 48 |

| Moquegua | 59.52 | 22,290 | 7.5 | 0.659 | 185,485 | 15,734 | 8.9 | 23.6 | 33.0 | 0.0027 | 0.0038 | 22 |

| Pasco | 52.97 | 9734 | 2.7 | 0.478 | 195,424 | 25,320 | 23.8 | 12.9 | 13.2 | 0.0014 | 0.0014 | 43 |

| Piura | 48.36 | 4914 | 3.6 | 0.513 | 1,340,897 | 35,892 | 21.3 | 12.7 | 24.3 | 0.0069 | 0.0131 | 35 |

| Puno | 31.62 | 4507 | 3.3 | 0.466 | 1,016,897 | 71,999 | 18.6 | 11.2 | 10.4 | 0.0019 | 0.0018 | 246 |

| San Martín | 44.28 | 3186 | 2.2 | 0.483 | 600,692 | 51,253 | 32.8 | 9.3 | 17.9 | 0.0016 | 0.0030 | 137 |

| Tacna | 49.14 | 9010 | 3.6 | 0.59 | 313,084 | 16,076 | 7.0 | 15.5 | 25.8 | 0.0034 | 0.0056 | 80 |

| Tumbes | 45.03 | 5474 | 4.0 | 0.555 | 193,190 | 4669 | 21.5 | 14.9 | 24.7 | 0.0075 | 0.0124 | 54 |

| Ucayali | 37.77 | 3739 | 2.0 | 0.484 | 366,076 | 102,411 | 42.9 | 8.9 | 16.6 | 0.0005 | 0.0009 | 35 |

| Lima | 61.27 | 10,114 | 3.4 | 0.707 | 9,385,230 | 34,802 | 9.2 | 14.1 | 44.6 | 0.0411 | 0.1300 | 49 |

| Non-Standardized Coefficients | Standardized Coefficients | t | Sig. | 95.0% Confidence Interval for B | Colinearity Statistics | ||||

|---|---|---|---|---|---|---|---|---|---|

| B | Error | Beta | Lower Limit | Upper Limit | Tolerance | VIF | |||

| (Constant) | 69.268 | 13.695 | 5.058 | 0.000 | 40.700 | 97.836 | |||

| GDP per capita per department (USD) | 0.002 | 0.000 | 0.810 | 4.243 | 0.000 | 0.001 | 0.003 | 0.442 | 2.261 |

| DHI | −68.852 | 35.964 | −0.691 | −1.914 | 0.007 | −143.872 | 6.168 | 0.124 | 8.089 |

| Bank Offices 100,000 inhab | −1.469 | 0.434 | −0.673 | −3.388 | 0.003 | −2.373 | −0.565 | 0.409 | 2.444 |

| ATMs 100,000 inhab | 1.017 | 0.311 | 1.182 | 3.274 | 0.004 | 0.369 | 1.664 | 0.124 | 8.087 |

References

- Albert, Juan Francisco, Nerea Gómez Fernández, and Sergio Luis Náñez Alonso. 2024. Monedas sociales en la era digital: Retos y oportunidades. CIRIEC-España, Revista de Economía Pública, Social y Cooperativa 110: 163. [Google Scholar] [CrossRef]

- Amidžic, Goran, Alexander Massara, and Andre Mialou. 2014. Assessing Countries’ Financial Inclusion Standing: A New Composite Index. Washington, DC: IMF. [Google Scholar]

- Aparicio, Carlos, and Miguel Jaramillo. 2012. Determinantes de la inclusión al sistema financiero: ¿Cómo hacer para que el Perú alcance los menores estándares a nivel internacional? (Documento de trabajo); Lima: SBS. Available online: https://www.sbs.gob.pe/Portals/0/jer/ddt_ano2012/DT-4-2012_Aparicio_Jaramillo.pdf (accessed on 22 December 2023).

- Aurazo, Jose, and Farid Gasmi. 2022. Labor Informality and Financial Inclusion Transitions: Evidence from Peru. Available online: https://www.bcrp.gob.pe/docs/Publicaciones/Documentos-de-Trabajo/2023/documento-de-trabajo-007-2023.pdf (accessed on 15 November 2023).

- Banco Central de Reserva del Perú [BCR]. 2014. Evolución de los cajeros corresponsables en el Perú. Available online: https://www.bcrp.gob.pe/docs/Publicaciones/Reporte-Estabilidad-Financiera/2014/Mayo/ref-mayo-2014-recuadro-6.pdf (accessed on 11 September 2023).

- Banque de France. 2022. Report on Public Access to Cash in Metropolitan France. Paris: Banque de France, December 15, Available online: https://www.banque-france.fr/sites/default/files/medias/documents/464ta22_2022_07_12_cp-rapport_accessibilite_cp.pdf (accessed on 14 October 2023).

- Barbieri, Larua, Mariarosa Borroni, Andrea Lippi, Mariacristina Piva, and Simone Rossi. 2021. Determinants of Bank Branch Presence in Local Areas: A Comparison Between North and South of Italy. International Journal of Economics and Finance 13: 1–15. [Google Scholar] [CrossRef]

- Bermeo, Elizabeth. 2019. Determinants of Financial Inclusion: Results of Multilevel Analyses. Ph.D. thesis, University of Bristol, Bristol, UK. Archivo Digital. Available online: https://research-information.bris.ac.uk/ws/portalfiles/portal/213422942/Final_Copy_2019_10_19_Bermeo_E_PhD.pdf (accessed on 10 August 2023).

- Boitano, Guillermo, and Deyvi Franco Abanto. 2020. Desafíos de las políticas de inclusión financiera en el Perú. Revista Finanzas y Política 12: 89–117. [Google Scholar] [CrossRef]

- Bramley, Glen, and Kirsten Besemer. 2017. Poverty and Social Exclusion in the UK: Vol. 2: The Dimensions of Disadvantage. Bristol: Policy Press. [Google Scholar]

- Caddy, James, and Zhan Zhang. 2021. How Far Do Australians Need to Travel to Access Cash? Reserve Bank of Australia, June 17. Available online: https://www.rba.gov.au/publications/bulletin/2021/jun/how-far-do-australians-need-to-travel-to-access-cash.html (accessed on 22 July 2023).

- Cadete de Matos, João, and Luis D’Aguiar. 2018. Assessing financial inclusion in Portugal from the central bank’s perspective. In The Role of Data in Supporting Financial Inclusion Policy. Basel: Bank for International Settlements. Available online: https://econpapers.repec.org/bookchap/bisbisifc/47-03.htm (accessed on 21 August 2023).

- Caplan, Mary A., Julie Birkenmaier, and Junghee Bae. 2020. Financial exclusion in OECD countries: A scoping review*. International Journal of Social Welfare 30: 58–71. [Google Scholar] [CrossRef]

- Carballo, Ignacio Esteban, and Facundo Dalle-Nogare. 2019. Fintech e inclusión financiera: Los casos de México, Chile y Perú. Revista CEA 5: 11–34. [Google Scholar] [CrossRef]

- Carbó, Santiago, Edward P. M. Gardener, and Philip Molyneux. 2005. Financial Exclusion in the UK. In Financial Exclusion. London: Palgrave Macmillan, pp. 14–44. [Google Scholar]

- Carlson, Stacy, Era Dabla-Norris, Mika Saito, and Yu Shi. 2015. Household financial access and risk sharing in Nigeria. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Cejudo, Guillermo, Cynthia Michel, and Pablo de los Cobos. 2020. Respuestas para enfrentar la pandemia en América Latina y el Caribe: El uso de programas de transferencias monetarias y de sistemas de información de protección social. New York: Programa de las Naciones Unidas para el Desarrollo (PNUD). Available online: https://www.undp.org/sites/g/files/zskgke326/files/migration/latinamerica/undp-rblac-CD19-PDS-Number24-transferencias-ES.pdf (accessed on 22 July 2023).

- Chen, Heng, and Matthew Strathearn. 2020. A Spatial Model of Bank Branches in Canada. Staff Working Paper 2020-4. Ottawa: Bank of Canada. [Google Scholar]

- Comisión Multisectorial de Inclusión Financiera [CMIF]. 2021. Política Nacional de Inclusión Financiera; Superintendencia de Banca, Seguros y Administradoras Privadas de Fondos de Pensiones-Ministerio de Economía y Finanzas. Available online: https://www.sbs.gob.pe/Portals/4/jer/EST-MONITOREO-ENIF/Documento%20Resumen_PNIF.PDF (accessed on 15 September 2023).

- Daher, Marianne, Antonia Rosati, and Andrea Jaramillo. 2021. Saving as a path for female empowerment and entrepreneurship in rural Peru. Progress in Development Studies 22: 32–55. [Google Scholar] [CrossRef]

- Delaney, Luc, Aidan O’Hara, and Richard Finlay. 2019. Cash Withdrawal Symptoms, Bulletin–June 2019 Payments; Sydney: Reserve Bank of Australia. Available online: https://www.rba.gov.au/publications/bulletin/2019/jun/cash-withdrawal-symptoms.html (accessed on 16 September 2023).

- Demir, Ayse, Vanesa Pesqué-Cela, Yener Altunbas, and Víctor Murinde. 2020. Fintech, financial inclusion and income inequality: A quantile regression approach. The European Journal of Finance 28: 86–107. [Google Scholar] [CrossRef]

- Elouaourti, Zakaria, and Elhadj Ezzahid. 2022. Factors of regional financial inclusion in Morocco. Regional Science Policy & Practice 16: 12516. [Google Scholar] [CrossRef]

- Estrategia Nacional de Inclusión Financiera. [ENIF]. 2015. Estrategia Nacional de Inclusión Financiera. Available online: https://www.sbs.gob.pe/inclusion-financiera-principal/politica-nacional-de-inclusion-financiera/antecedentes (accessed on 23 October 2023).

- Evans, Jamie C. N., Daniel Tischer, and Sarah V. Davies. 2020. Geographies of access to Cash–Identifying Vulnerable Communities in a Case Study of South Wales. Bristol: University of Bristol. Available online: https://research-information.bris.ac.uk/en/publications/geographies-of-access-to-cash-identifying-vulnerable-communities (accessed on 23 October 2023).

- Garcia Bianchi, Antonella, Rubi Santillan Leiba, and Narda Sotomayor Valenzuela. 2020. Determinantes del Ahorro Voluntario en el Perú: Evidencia de una Encuesta de Demanda (Documento de trabajo); Lima: Superintendencia de Banca, Seguros y Administradoras Privadas de Fondos de Pensiones (SBS). Available online: https://www.sbs.gob.pe/Portals/4/jer/PUB-ESTUDIOS-INVESTIGACIONES/Determinantes%20del%20ahorro%20voluntario%20en%20el%20Peru_DT-001-2020_2.pdf (accessed on 15 October 2023).

- Grados-Smith, Pedro Luis. 2021. Implications of Financial Inclusion and Informal Employment on Monetary Poverty of Peru Departments. Revista Finanzas y Política Económica 13: 545–69. [Google Scholar]

- He, Canfey, and Godfrey Yeung. 2011. The locational distribution of foreign banks in China: A disaggregated analysis. Regional Studies 45: 733–54. [Google Scholar] [CrossRef]

- Henry, Nick, Jane Pollard, Paul Sissons, Jennifer Ferreira, and Mike Coombes. 2017. Banking on exclusion: Data disclosure and geographies of UK personal lending markets. Environment and Planning A 49: 2046–64. [Google Scholar] [CrossRef]

- Higgs, Gary, Andrew Price, and Mitchel Langford. 2022. Investigating the impact of bank branch closures on access to financial services in the early stages of the COVID-19 pandemic. Journal of Rural Studies 95: 1–14. [Google Scholar] [CrossRef] [PubMed]

- Inoue, Takeshi, and Shigeyuki Hamori. 2016. Financial access and economic growth: Evidence from sub-saharan Africa. Emerging Markets Finance and Trade 52: 743–53. [Google Scholar] [CrossRef]

- Instituto Nacional de Estadística e Informática [INEI]. 2022. Pobreza Monetaria 2021. Available online: https://www.inei.gob.pe/media/MenuRecursivo/publicaciones_digitales/Est/pobreza2021/Pobreza2021.pdf (accessed on 12 November 2023).

- International Monetary Fund [IMF]. 2022. Financial Access Survey (FAS). IMF Data. International Monetary Fund: Available online: https://data.imf.org/?sk=E5DCAB7E-A5CA-4892-A6EA-598B5463A34C (accessed on 2 October 2023).

- Izquierdo, Noelia Cámara, and David Tuesta. 2015. Factors that matter for financial inclusion: Evidence from Peru. Aestimatio: The IEB International Journal of Finance 10: 10–31. [Google Scholar]

- Jorge-Vázquez, Javier, Sergio Luis Náñez Alonso, Konrad Kolegowicz, and Jarosław Kaczmarek. 2022. Technological entrepreneurship and rural development: A binomial to combat depopulation in Spain. Journal of Public Governance 59: 41–52. [Google Scholar] [CrossRef]

- Koku, Paul Sergius. 2015. Financial exclusion of the poor: A literature review. International Journal of Bank Marketing 33: 654–68. [Google Scholar] [CrossRef]

- Korczak, Dieter. 2019. Financial education and financial literacy in Germany. An Overview. In Financial Literacy and Financial Education. Berlin: De Gruyter, pp. 53–64. [Google Scholar] [CrossRef]

- Kumar, Anjali, and Thorsten Beck. 2005. Assessing Financial Access in Brazil. Washington, DC: The World Bank. [Google Scholar] [CrossRef]

- León-Ramírez, Segundo Víctor. 2022. Social programs and their contribution to financial inclusion in Peru. Journal of Positive School Psychology 6: 1665–71. Available online: https://journalppw.com/index.php/jpsp/article/view/1709 (accessed on 12 September 2023).

- Leyshon, Andrew, and Nigel Thrift. 1995. Geographies of Financial Exclusion: Financial Abandonment in Britain and the United States. Transactions of the Institute of British Geographers 20: 312. [Google Scholar] [CrossRef]

- Marr, Ana, Janina León, and Fátima Ponce. 2014. Financial inclusion of the poor in Peru: Explanatory factors and determinants. Applied Econometrics and International Development 14: 101–22. [Google Scholar]

- Mylonidis, Nikolaos, Michael Chletsos, and Vanessa Barbagianni. 2019. Financial exclusion in the USA: Looking beyond demographics. Journal of Financial Stability 40: 144–58. [Google Scholar] [CrossRef]

- Náñez Alonso, Sergio Luis. 2018. Análisis del beneficio fiscal a favor de la familia en los tributos cedidos en la España de las autonomías: Periodo 2000–15. Derecho PUCP 80: 461–95. [Google Scholar] [CrossRef]

- Náñez Alonso, Sergio Luis, Javier Jorge-Vazquez, Miguel Ángel Echarte Fernández, Konrad Kolegowicz, and Wojciech Szymla. 2022a. Financial exclusion in rural and urban contexts in Poland: A threat to achieving SDG eight? Land 11: 539. [Google Scholar] [CrossRef]

- Náñez Alonso, Sergio Luis, Javier Jorge-Vazquez, Ricardo Francisco Reier Forradellas, and Elena Ahijado Dochado. 2022b. Solutions to Financial Exclusion in Rural and Depopulated Areas: Evidence Based in Castilla y León (Spain). Land 11: 74. [Google Scholar] [CrossRef]

- Náñez Alonso, Sergio Luis, Javier Jorge-Vázquez, Beatriz Sastre-Hernández, and Bernard Ziębicki. 2023. Do credit unions contribute to financial inclusion and local economic development? Empirical evidence from Poland. Economics & Sociology 16: 110–29. [Google Scholar] [CrossRef]

- Nizam, Rosmah, Zulkefly Abdul Karim, Tamat Sarmidi, and Aisyah Abdul Rahman. 2020. Financial inclusion and firms growth in manufacturing sector: A threshold regression analysis in selected Asean countries. Economies 8: 80. [Google Scholar] [CrossRef]

- Nizam, Rosmah, Zulkefly Abdul Karim, Tamat Sarmidi, and Aisyah Abdul Rahman. 2021. Financial inclusion and firm growth in Asean-5 countries: A new evidence using threshold regression. Finance Research Letters 41: 101861. [Google Scholar] [CrossRef]

- Nowacka, Anna, Mariola Szewczyk-Jarocka, and Izabela Zawiślińska. 2021. Socio-demographic determinants of financial exclusion of the unemployed on the local labour market: A case study. Ekonomia i Prawo 20: 155. [Google Scholar] [CrossRef]

- Omar, Abdullah, and Kazuo Inaba. 2020. Does financial inclusion reduce poverty and income inequality in developing countries? A panel data analysis. Journal of Economic Structures 9: 37. [Google Scholar] [CrossRef]

- Orazi, Sofía, Lisana B. Martinez, and Hernán P. Vigier. 2023. Determinants and evolution of financial inclusion in Latin America: A demand side analysis. Quantitative Finance and Economics 7: 187–206. [Google Scholar] [CrossRef]

- Ozili, Peterson K. 2022. Financial inclusion and sustainable development: An empirical association. Journal of Money and Business 2: 186–98. [Google Scholar] [CrossRef]

- Ozili, Peterson K. 2023. The acceptable r-square in empirical modelling for social science research. In Social Research Methodology and Publishing Results. Hershey: IGI Global, pp. 134–43. [Google Scholar] [CrossRef]

- Park, Cyn-Young, and Rogelio Mercado. 2015. Financial Inclusion, Poverty, and Income Inequality in Developing Asia. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Polloni-Silva, Eduardo, Naijela da Costa, Herick Fernando Moralles, and Mario Sacomano Neto. 2021. Does financial inclusion diminish poverty and inequality? A panel data analysis for Latin American countries. Social Indicators Research 158: 889–925. [Google Scholar] [CrossRef] [PubMed]

- Rajamohan, Selam, and K. Subha. 2011. Financial inclusion in India: An overview. Indian Journal of Applied Research 4: 299–300. [Google Scholar] [CrossRef]

- Sain, Mohamed, Rosli Mohamed, Mohammad M. Rahman, and Rasheda Khanam. 2018. Financial Exclusion and the Role of Islamic Finance in Australia: A Case Study in Queensland. Australasian Accounting, Business and Finance Journal 12: 23–42. [Google Scholar] [CrossRef]

- Salah Uddin, K. M., and Tahmina Begum. 2023. Financial inclusion: Factors influencing on customer adoption of mobile banking services in Bangladesh. International Journal of Business and Management 18: 1. [Google Scholar] [CrossRef]

- Schmied, Julian, and Marr Ana. 2016. Financial inclusion and poverty: The case of Peru. Regional and Sectoral Economic Studies 16: 29–40. [Google Scholar]

- Sinclair, Stephen. 2013. Financial Exclusion: An Introductory Survey. Edimburgh: CRSIS, Edinburgh College of Art/Heriot Watt University. [Google Scholar]

- Sotomayor, Narda, and Jacqueline Talledo. 2018. Determinantes de la inclusión financiera en el Perú: Evidencia reciente; (Documento de trabajo). Lima: Superintendencia de Banca, Seguros y Administradoras Privadas de Fondos de Pensiones (SBS). Available online: https://www.sbs.gob.pe/Portals/0/jer/DDT_ANO2018/DT-001-2018%20(esp).pdf (accessed on 15 October 2023).

- Stix, Helmut. 2020a. A spatial analysis of access to ATMs in Austria. Monetary Policy & the Economy 20: 39–59. [Google Scholar]

- Stix, Helmut. 2020b. The Austrian bank branch network from 2000 to 2019 from a spatial perspective. Financial Stability Report 40: 87–101. [Google Scholar]

- Superintendencia de Banca, Seguros y Administradoras Privadas de Fondos de Pensiones–SBS. 2022. Gobierno Del Perú. Lima. Available online: https://www.gob.pe/sbs (accessed on 10 August 2023).

- Świecka, Beata Ś., and Olga Wyszkowska-Kaniewska. 2019. Financial literacy and financial education in Poland. An overview. In Financial Literacy and Financial Education. Berlin: De Gruyter, pp. 30–52. [Google Scholar] [CrossRef]

- Tischer, Daniel, Jamie Evans, and Sara Davies. 2019. Mapping the Availability of Cash—A Case Study of Bristol’s Financial Infrastructure. Bristol: University of Bristol. Available online: https://research-information.bris.ac.uk/en/publications/mapping-the-availability-of-cash-a-case-study-of-bristols-financi (accessed on 2 September 2023).

- Trütsch, Tobias. 2022. Swiss Money Map 2022: A spatial analysis of cash access points in Switzerland. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Vargas, Jorge. 2022. Brechas de la inclusión financiera digital en Perú, en un contexto de crisis económica y sanitaria por el COVID-19, usando el análisis de componentes principales; Lima: Instituto Nacional de Estadística e Informática. Available online: https://www.inei.gob.pe/media/MenuRecursivo/investigaciones/brecha.pdf (accessed on 5 September 2023).

- Velazquez, Patricia Vilcanqui, Vito Bobek, Romana Korez Vide, and Tatjana Horvat. 2022. Lessons from remarkable fintech companies for the financial inclusion in Peru. Journal of Risk and Financial Management 15: 62. [Google Scholar] [CrossRef]

- World Bank. 2023a. The World Bank Financial Inclusion: Overview. Washington, DC: World Bank. Available online: https://www.worldbank.org/en/topic/financialinclusion/overview#1 (accessed on 12 August 2023).

- World Bank. 2023b. The Global Findex 2021. Washington, DC: World Bank Group. Available online: https://www.worldbank.org/en/publication/globalfindex/Data. (accessed on 12 August 2023).

- Yadav, Priyanka, and Anil Kumar Sharma. 2016. Financial inclusion in India: An application of TOPSIS. Humanomics 32: 328–51. [Google Scholar] [CrossRef]

- Zamalloa, Juan Carlos, Ena Cecilia Obando Peralta, and Vladimir Cairo. 2016. Inclusión financiera en distritos de Perú: Enfoque multidimensional y factores determinantes. Quipukamayoc 24: 111–26. Available online: https://pdfs.semanticscholar.org/8a92/d95a395664df9a563b39b8dfdbbab182780a.pdf (accessed on 15 September 2023). [CrossRef]

| 1 | No. of ATMs per 100,000 adult population |

| 2 | No. of bank branches per 100,000 adult population |

| 3 | No. of ATMs per 1000 sq. mt. |

| 4 | No. of bank branches per 1000 sq. meters |

| Model | R | R2 | Standard Estimation Error | Selection Criteria | |||

|---|---|---|---|---|---|---|---|

| Akaike Information Criteria | Amemiya Prediction Criteria | Mallows Prediction Criteria | Schwarz Bayesian Criterion | ||||

| 1 | 0.823 a | 0.678 | 5.31 | 87.94 | 0.48 | 5.00 | 94.04 |

| Model | Sum of Squares | gl | Root Mean Squared | F | Sig. | |

|---|---|---|---|---|---|---|

| 1 | Regression | 1186.87 | 4 | 296.71 | 10.50 | <0.001 b |

| Residual | 564.94 | 20 | 28.24 | |||

| Total | 1751.82 | 24 | ||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Náñez Alonso, S.L.; Jorge-Vazquez, J.; Arias, L.G.; del Nogal, N.M. What Factors Are Limiting Financial Inclusion and Development in Peru? Empirical Evidence. Economies 2024, 12, 93. https://doi.org/10.3390/economies12040093

Náñez Alonso SL, Jorge-Vazquez J, Arias LG, del Nogal NM. What Factors Are Limiting Financial Inclusion and Development in Peru? Empirical Evidence. Economies. 2024; 12(4):93. https://doi.org/10.3390/economies12040093

Chicago/Turabian StyleNáñez Alonso, Sergio Luis, Javier Jorge-Vazquez, Lieslie Gallegos Arias, and Noelia Muñoz del Nogal. 2024. "What Factors Are Limiting Financial Inclusion and Development in Peru? Empirical Evidence" Economies 12, no. 4: 93. https://doi.org/10.3390/economies12040093

APA StyleNáñez Alonso, S. L., Jorge-Vazquez, J., Arias, L. G., & del Nogal, N. M. (2024). What Factors Are Limiting Financial Inclusion and Development in Peru? Empirical Evidence. Economies, 12(4), 93. https://doi.org/10.3390/economies12040093