The Timing and Strength of Inequality Concerns in the UK Public Debate: Google Trends, Elections and the Macroeconomy

Abstract

1. Introduction

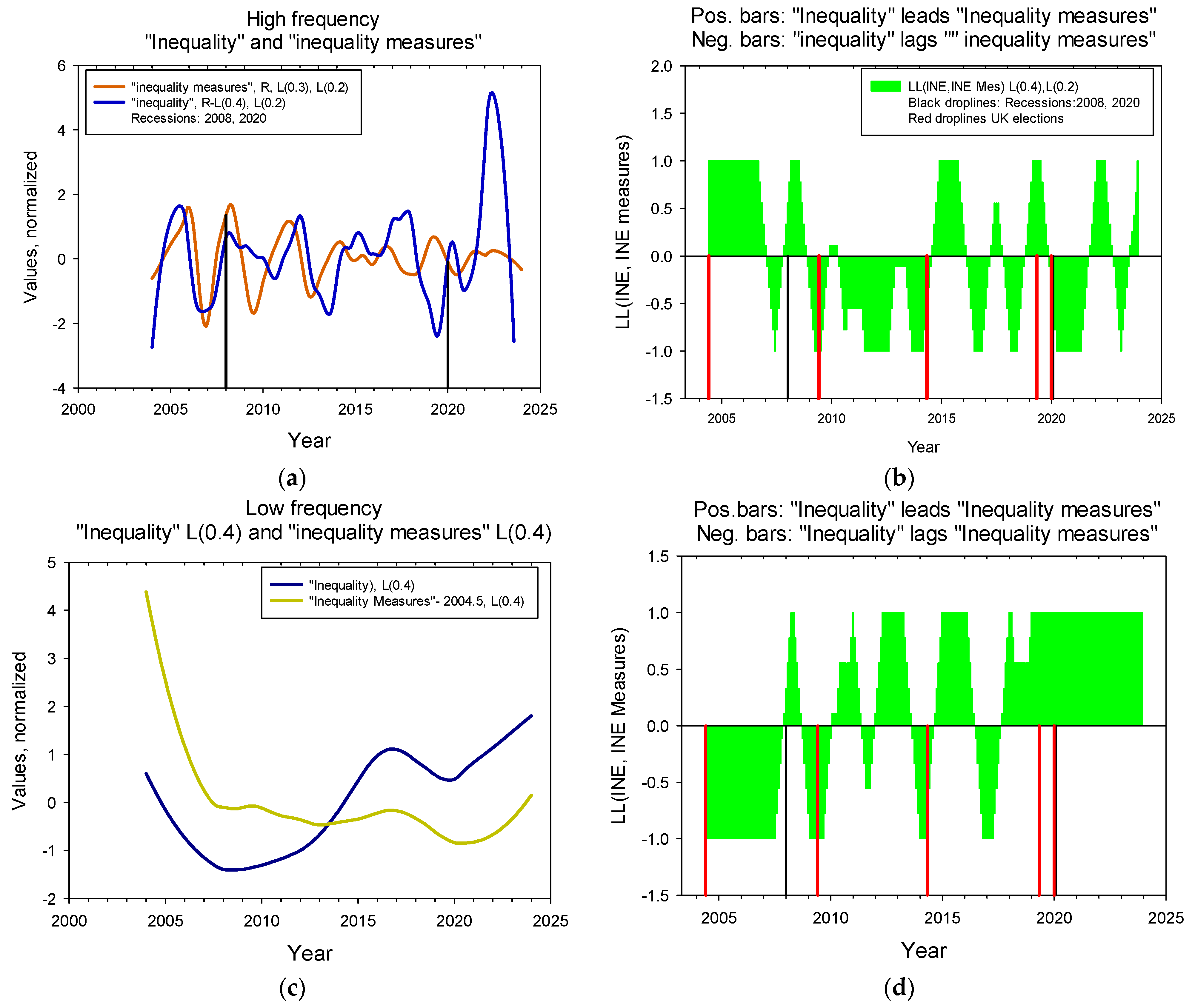

2. Data

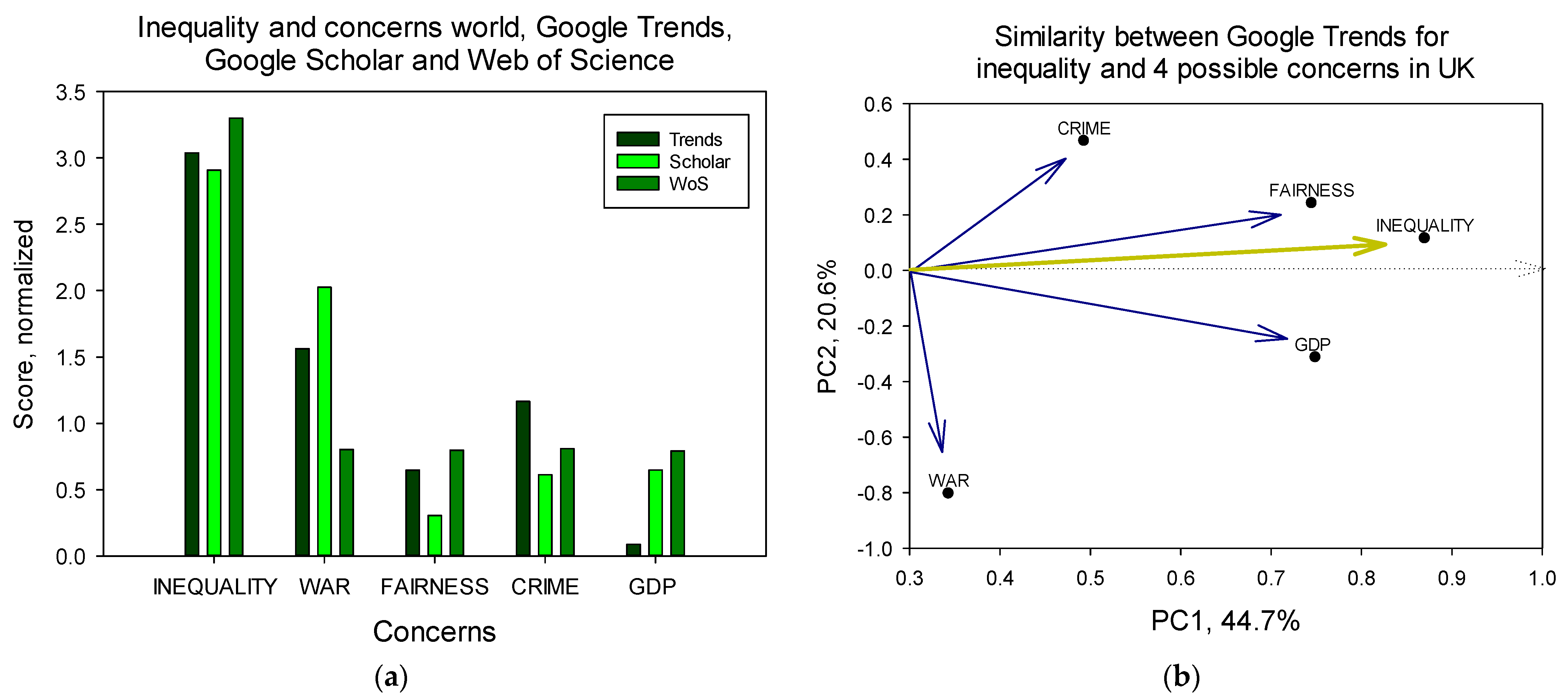

3. Methodology

3.1. Data Preprocessing

3.2. Scoring Time Series Events

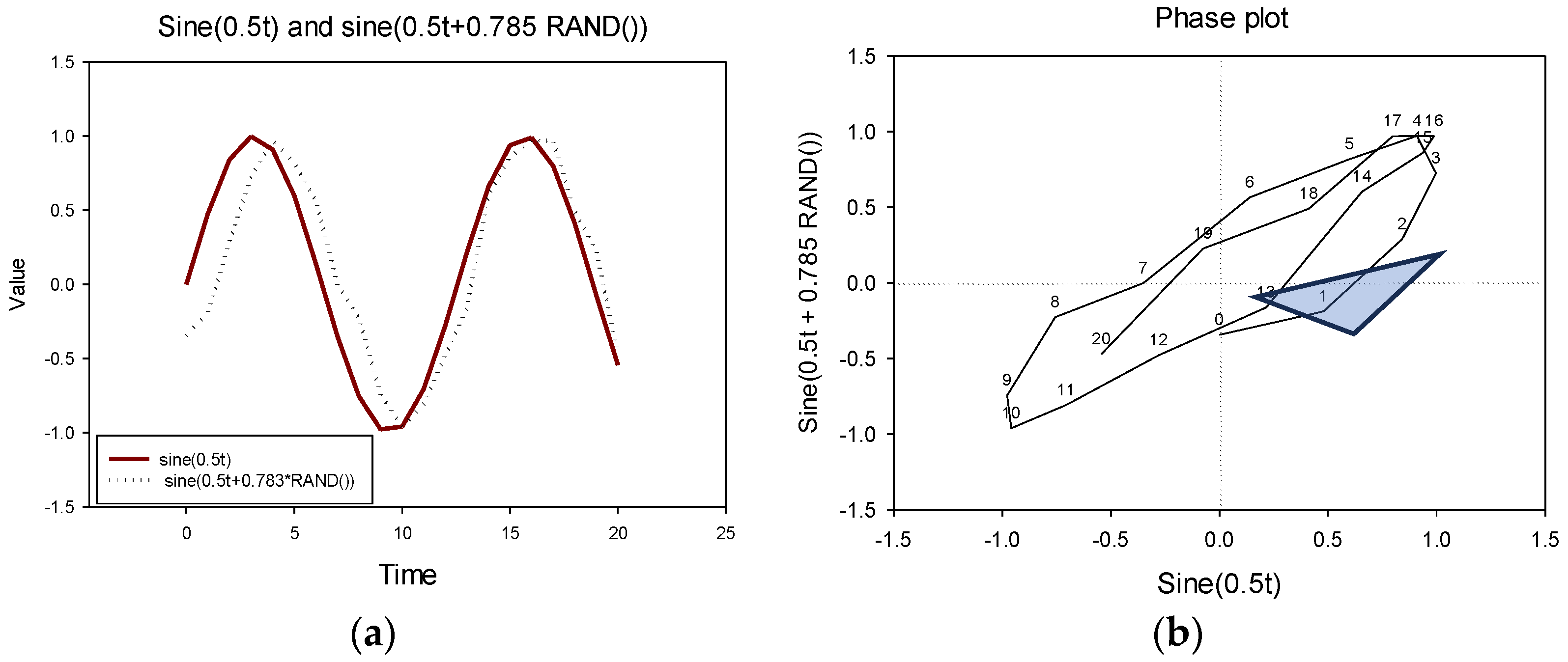

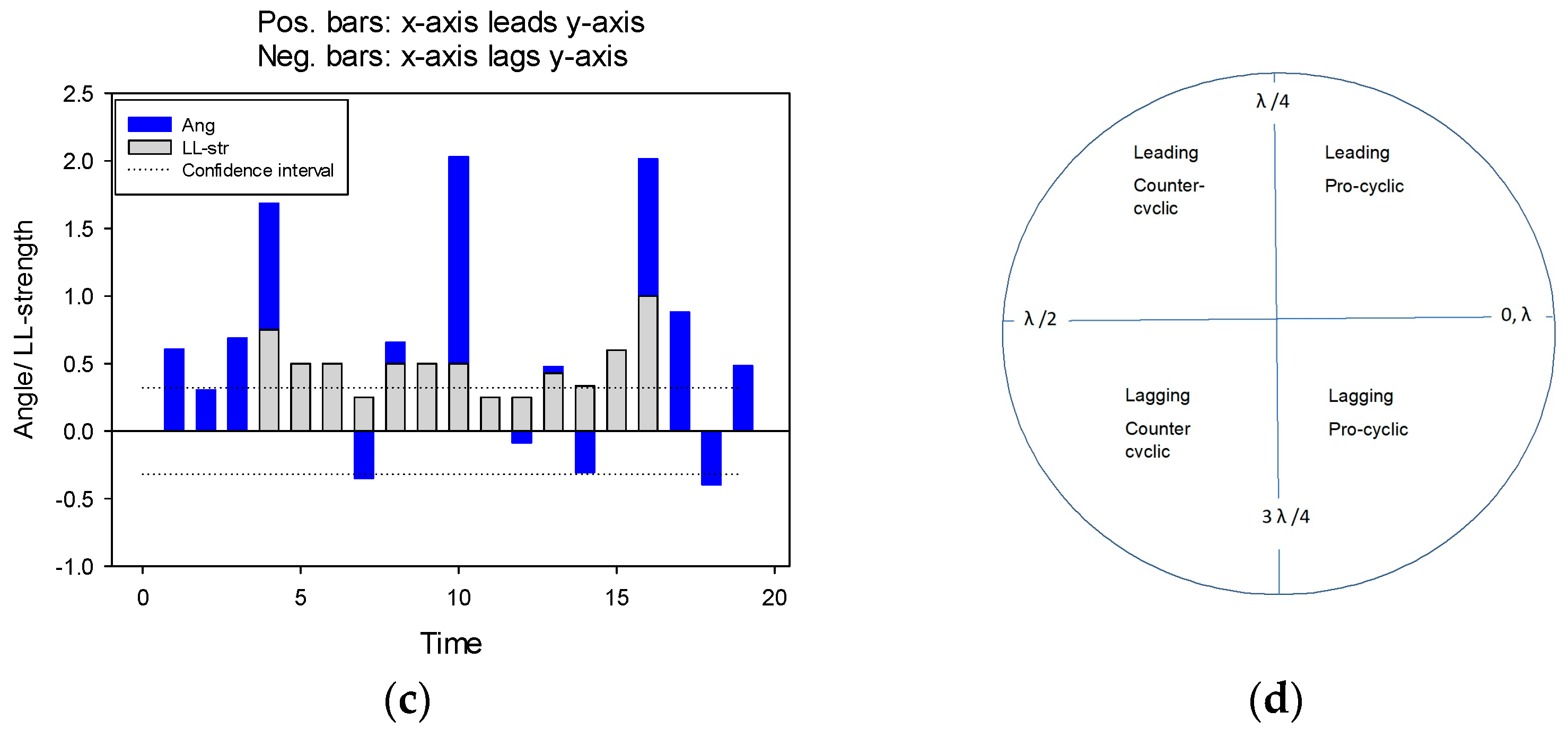

3.3. Lead-Lag Analysis

4. Results

4.1. “Inequality” and “Inequality Measures” during Recessions and Parliament Elections

4.2. The UK Economy

4.3. Inequality Concerns

5. Discussion

5.1. UK Economic History 2008–2023

5.2. High-Intensity Discussions of Inequality Issues

5.3. Lead-Lag Relations

5.4. Inequality Concerns and Inequality Abatement Measures

5.4.1. Inequality Concerns

5.4.2. Inequality Abatement Measures

5.5. How Economic Policies May Create Greater Inequality

5.6. The Method

5.7. Robustness

5.8. Further Work

6. Conclusions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Angelov, Nikolay, and Daniel Waldenström. 2023. COVID-19 and income inequality: Evidence from monthly population registers. The Journal of Economic Inequality 21: 351–79. [Google Scholar] [CrossRef]

- Azzollini, Leo, Richard Breen, and Brian Nolan. 2023. Demographic behaviour and earnings inequality across OECD countries. The Journal of Economic Inequality 21: 441–61. [Google Scholar] [CrossRef]

- Barth, Erling, Henning Finseraas, Anders Kjelsrud, and Kalle Moene. 2023. Openness and the welfare state: Risk and income effects in protection without protectionism. European Journal of Political Economy 79: 102405. [Google Scholar] [CrossRef]

- Berisha, Edmond, David Gabauer, Rangan Gupta, and Chi Keung Marco Lau. 2021. Time-varying influence of household debt on inequality in United Kingdom. Empirical Economics 61: 1917–33. [Google Scholar] [CrossRef]

- Bratanova, Boyka, Steve Loughnan, Olivier Klein, and Robert Wood. 2016. The rich get richer, the poor get even: Perceived socioeconomic position influences micro-social distributions of wealth. Scandinavian Journal of Psychology 57: 243–49. [Google Scholar] [CrossRef] [PubMed]

- Burns, G. W., and W. C. Mitchell. 1946. Measuring Business Cycles. Cambridge, MA: National Bureau of Economic Research. [Google Scholar]

- Cetin, Murat, Harun Demir, and Selin Saygin. 2021. Financial Development, Technological Innovation and Income Inequality: Time Series Evidence from Turkey. Social Indicators Research 156: 47–69. [Google Scholar] [CrossRef]

- Chroufa, Mohamed Ali, and Nouri Chtourou. 2022. Inequality and Growth in Tunisia: New Evidence from Threshold Regression. Social Indicators Research 163: 901–24. [Google Scholar] [CrossRef]

- Connor, Paul, Vasilis Sarafidis, Michael J. Zyphur, Dacher Keltner, and Serena Chen. 2019. Income Inequality and White-on-Black Racial Bias in the United States: Evidence from Project Implicit and Google Trends. Psychological Science 30: 205–22. [Google Scholar] [CrossRef] [PubMed]

- Davidescu, Adriana AnaMaria, Tamara Maria Nae, and Margareta-Stela Florescu. 2024. From Policy to Impact: Advancing Economic Development and Tackling Social Inequities in Central and Eastern Europe. Economies 12: 28. [Google Scholar] [CrossRef]

- Díaz, Guillermo Arenas, Andrés Barge-Gil, and Joost Heijs. 2020. The effect of innovation on skilled and unskilled workers during bad times. Structural Change and Economic Dynamics 52: 141–58. [Google Scholar] [CrossRef]

- Filippin, Antonio, and Luca Nunziata. 2019. Monetary effects of inequality: Lessons from the euro experiment. The Journal of Economic Inequality 17: 99–124. [Google Scholar] [CrossRef]

- Fisman, Raymond, Pamela Jakiela, and Shachar Kariv. 2017. Distributional preferences and political behavior. Journal of Public Economics 155: 1–10. [Google Scholar] [CrossRef]

- Gong, Yuhan, Tim Li, and Lin Chen. 2020. Interdecadal modulation of ENSO amplitude by the Atlantic multi-decadal oscillation (AMO). Climate Dynamics 55: 2689–702. [Google Scholar] [CrossRef]

- Granger, C. W. J. 1969. Investigating Causal Relations by Econometric Models and Cross-spectral Methods. Econometrica 37: 424. [Google Scholar] [CrossRef]

- Hoy, Christopher, Russell Toth, and Nurina Merdikawati. 2024. A false divide? Providing information about inequality aligns preferences for redistribution between right- and left-wing voters. The Journal of Economic Inequality 2024: 1–39. [Google Scholar] [CrossRef]

- Jaravel, Xavier. 2021. Inflation Inequality: Measurement, Causes, and Policy Implications. Annual Review of Economics 13: 599–629. [Google Scholar] [CrossRef]

- Kelly, Morgan. 2000. Inequality and Crime. The Review of Economics and Statistics 82: 530–39. [Google Scholar] [CrossRef]

- Kestin, Tahl S., David J. Karoly, Jun-Ichi Yano, and Nicola A. Rayner. 1998. Time–Frequency Variability of ENSO and Stochastic Simulations. Journal of Climate 11: 2258–72. [Google Scholar] [CrossRef]

- Lambert, Peter J., Daniel L. Millimet, and Daniel Slottje. 2003. Inequality aversion and the natural rate of subjective inequality. Journal of Public Economics 87: 1061–90. [Google Scholar] [CrossRef]

- Malla, Manwar Hossein, and Pairote Pathranarakul. 2022. Fiscal Policy and Income Inequality: The Critical Role of Institutional Capacity. Economies 10: 115. [Google Scholar] [CrossRef]

- Maza, Adolfo. 2022. Regional Differences in Okun’s Law and Explanatory Factors: Some Insights from Europe. International Regional Science Review 45: 555–80. [Google Scholar] [CrossRef]

- Michalek, Anton, and Jan Vybostok. 2019. Economic Growth, Inequality and Poverty in the EU. Social Indicators Research 141: 611–30. [Google Scholar] [CrossRef]

- Nafziger, E. Wayne, and Juha Auvinen. 2002. Economic Development, Inequality, War, and State Violence. World Development 30: 153–63. [Google Scholar] [CrossRef]

- Naguib, Costanza. 2015. The relationship between inequality and GDP growth: An empirical approach. In LIS Working Paper Series. Luxembourg: Luxembourg Income Study (LIS). [Google Scholar]

- Ogbeide, Evelyn Nwamaka Osaretin, and David Onyinyechi Agu. 2015. Poverty and Income Inequality in Nigeria: Any Causality? Asian Economic and Financial Review 5: 439–52. [Google Scholar] [CrossRef]

- Rajaguru, Gulasekaran, Sadhana Srivastava, Rahul Sen, and Pundarik Mukhopadhaya. 2023. Does globalization drive long-run inequality within OECD countries? A guide to policy making. Journal of Policy Modeling 45: 469–93. [Google Scholar] [CrossRef]

- Roe, Mark J., and Jordan I. Siegel. 2011. Political instability: Effects on financial development, roots in the severity of economic inequality. Journal of Comparative Economics 39: 279–309. [Google Scholar] [CrossRef]

- Rözer, Jesper, Bram Lancee, and Beate Volker. 2022. Keeping Up or Giving Up? Income Inequality and Materialism in Europe and the United States. Social Indicators Research 159: 647–66. [Google Scholar] [CrossRef]

- Sandnes, Frode Eika, Anders Örtenblad, and Einar Duengen Bøhn. 2023. For or Against Equal Pay? A Study of Common Perceptions. Compensation & Benefits Review 55: 87–110. [Google Scholar] [CrossRef]

- Seip, Knut L., Oyvind Gron, and Hui Wang. 2018. Carbon dioxide precedes temperature change during short-term pauses in multi-millennial palaeoclimate records. Palaeogeography, Palaeoclimatology, Palaeoecology 506: 101–11. [Google Scholar] [CrossRef]

- Seip, Knut Lehre, and Dan Zhang. 2022. A High-Resolution Lead-Lag Analysis of US GDP, Employment, and Unemployment 1977–2021: Okun’s Law and the Puzzle of Jobless Recovery. Economies 10: 260, Corrected in Economies 11: 75. [Google Scholar] [CrossRef]

- Seip, Knut Lehre, and Robert McNown. 2007. The timing and accuracy of leading and lagging business cycle indicators: A new approach. International Journal of Forecasting 23: 277–87. [Google Scholar] [CrossRef]

- Seip, Knut Lehre, Yunus Yilmaz, and Michael Schröder. 2019. Comparing Sentiment- and Behavioral-Based Leading Indexes for Industrial Production: When Does Each Fail? Economies 7: 104. [Google Scholar] [CrossRef]

- Timoneda, Joan C., and Erik Wibbels. 2022. Spikes and Variance: Using Google Trends to Detect and Forecast Protests. Political Analysis 30: 1–18. [Google Scholar] [CrossRef]

- Tosun, Onur Kemal, and Brian Lucey. 2023. Growth... What growth? Finance Research Letters 52: 103594. [Google Scholar] [CrossRef]

- Weber, Isabella M., and Evan Wasner. 2023. Sellers’ inflation, profits and conflict: Why can large firms hike prices in an emergency? Review of Keynesian Economics 11: 183–213. [Google Scholar] [CrossRef]

- Wilkinson, Richard, and Kate Pickett. 2010. The Spirit Level: Why Greater Equality Makes Societies Stronger. New York: Bloomsbury Press. [Google Scholar]

| Variables | Cycle Periods (months) | Phase Shift (months) |

|---|---|---|

| HF | 25 | 5–6 |

| LF | 190 ± 136 | 13–22 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Seip, K.L.; Sandnes, F.E. The Timing and Strength of Inequality Concerns in the UK Public Debate: Google Trends, Elections and the Macroeconomy. Economies 2024, 12, 135. https://doi.org/10.3390/economies12060135

Seip KL, Sandnes FE. The Timing and Strength of Inequality Concerns in the UK Public Debate: Google Trends, Elections and the Macroeconomy. Economies. 2024; 12(6):135. https://doi.org/10.3390/economies12060135

Chicago/Turabian StyleSeip, Knut Lehre, and Frode Eika Sandnes. 2024. "The Timing and Strength of Inequality Concerns in the UK Public Debate: Google Trends, Elections and the Macroeconomy" Economies 12, no. 6: 135. https://doi.org/10.3390/economies12060135

APA StyleSeip, K. L., & Sandnes, F. E. (2024). The Timing and Strength of Inequality Concerns in the UK Public Debate: Google Trends, Elections and the Macroeconomy. Economies, 12(6), 135. https://doi.org/10.3390/economies12060135