Persistent and Long-Term Co-Movements between Gender Equality and Global Prices

Abstract

1. Introduction

2. Literature Review

3. Methodology

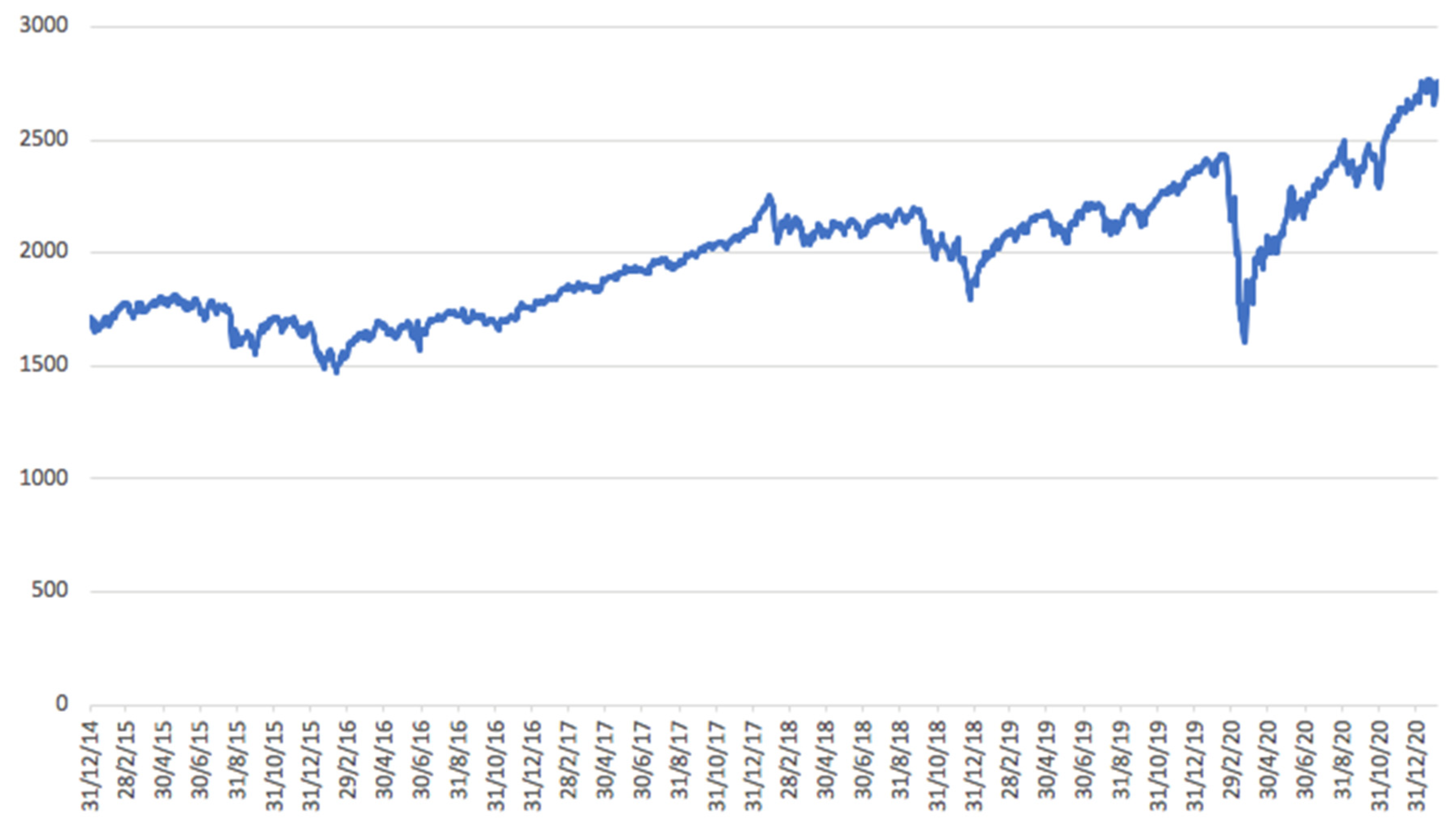

4. Data

5. Empirical Results

6. Concluding Comments

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Adekoya, Oluwasegun B. 2021. Persistence and efficiency of OECD stock markets: Linear and nonlinear fractional integration approaches. Empirical Economics 61: 1415–33. [Google Scholar] [CrossRef]

- Afzal, Alia, and Philipp Sibbertsen. 2021. Modelling fractional cointegration between high and low stock prices in Asian countries. Empirical Economics 60: 661–81. [Google Scholar] [CrossRef]

- Albuquerque, Rul, Yrjo Koskinen, and Chendi Zhang. 2018. Corporate Social Responsibility and Firm Risk: Theory and Empirical Evidence. European Corporate Governance Institute (ECGI)—Finance Working Paper No. 359/2013. January 15. Available online: https://ssrn.com/abstract=1961971 (accessed on 15 January 2018).

- Allemand, Isabelle, Daniela Borodak, and Xavier Hollandts. 2024. Board Gender Diversity and ESG: The Influence of the Varieties of Capitalism 1. Finance 45: 43–89. [Google Scholar] [CrossRef]

- Aloy, Marcel, Mohamed Boutahar, Karine Gente, and Anne Péguin-Feissolle. 2010. Fractional integration and cointegration in stock prices and exchange rates. Economics Bulletin 30: 115–29. [Google Scholar]

- Ayadi, O. Felix, and Chong Soo Pyun. 1994. An application of variance ratio test to the Korean securities market. Journal of Banking and Finance 18: 643–58. [Google Scholar] [CrossRef]

- Azar, Alexandre, and Heying Zhou. 2017. Do Good and Do Well: An Empirical Study of the MSCI World. Master’s thesis, Lund University School of Economics and Management, Lund, Sweden, June. [Google Scholar]

- Badea, Leonardo, Daniel Ştefan Armeanu, Dan Costin Nițescu, Valentin Murgu, Iulian Panait, and Boris Kuzman. 2020. A study of the relative stock market performance of companies recognized for supporting gender equality policies and practices. Sustainability 12: 3558. [Google Scholar] [CrossRef]

- Barberá, Esther, and Amparo Ramos. 2004. Liderazgo y discriminación de género. Revista de Psicología General y Aplicada 57: 147–60. [Google Scholar]

- Baur, DIrk, and Niels Schulze. 2005. Coexceedances in financial markets—A quantile regression analysis of contagion. Emerging Markets Review 6: 21–43. [Google Scholar] [CrossRef]

- Beltratti, Andrea, and Claudio Morana. 2006. Breaks and persistency: Macroeconomic causes of stock market volatility. Journal of Econometrics 131: 151–77. [Google Scholar] [CrossRef]

- BenSaïda, Ahmed, Sabri Boubaker, Du Khuong Nguyen, and Skander Slim. 2018. Value-at-risk under market shifts through highly flexible models. Journal of Forecasting 37: 790–804. [Google Scholar] [CrossRef]

- Bernardi, Richard A., Susan M. Bosco, and Veronica L. Columb. 2009. Does Female Representation on Boards of Directors Associate with the ‘Most Ethical Companies’ List? Corporate Reputation Review 12: 270–80. [Google Scholar] [CrossRef]

- BlackRock. 2023. Lifting Financial Performance by Investing in Women. Available online: https://www.blackrock.com/corporate/literature/whitepaper/lifting-financial-performance-by-investing-in-women.pdf (accessed on 30 November 2023).

- Bloomberg. 2022. Bloomberg Gender-Equality Index Methodology. Available online: https://assets.bbhub.io/company/sites/46/2022/01/Bloomberg-Gender-Equality-Index-Methodology.pdf (accessed on 31 January 2022).

- Bloomfield, Peter. 1973. An exponential model in the spectrum of a scalar time series. Biometrika 60: 217–26. [Google Scholar] [CrossRef]

- Bonciani, Dario, and Martino Ricci. 2020. The international effects of global financial uncertainty shocks. Journal of International Money and Finance 109: 102236. [Google Scholar] [CrossRef]

- Campbell, John Y., and Pierre Perron. 1991. Pitfalls and opportunities. What macroeconomists should know about unit roots. NBER Macroeconomic Annual 6: 1141–201. [Google Scholar] [CrossRef]

- Campbell, Kevi, and Antonio Mínguez-Vera. 2008. Gender diversity in the boardroom and firm financial performance. Journal of Business Ethics 83: 435–51. [Google Scholar] [CrossRef]

- Caporale, Guglielmo Maria, and Luis Alberiko Gil-Alana. 2002. Fractional integration and mean reversion in stock prices. The Quarterly Review of Economics and Finance 42: 599–609. [Google Scholar] [CrossRef]

- Caporale, Guglielmo Maria, Luis Alberiko Gil-Alana, and Carlos Poza. 2020. Persistence, non-linearities and structural breaks in European stock market indices. The Quarterly Review of Economics and Finance 77: 50–61. [Google Scholar] [CrossRef]

- Caporale, Guglielmo Maria, Luis Alberiko Gil-Alana, and James C. Orlando. 2016. Linkages between the US and European stock markets: A fractional cointegration approach. International Journal of Finance & Economics 21: 143–53. [Google Scholar] [CrossRef]

- Cascella, Clelia, J. Williams, and Maria Pampaka. 2022. An extended regional gender gaps index (eRGGI): Comparative measurement of gender equality at different levels of Regionality. Social Indicators Research 159: 757–800. [Google Scholar] [CrossRef]

- Chapple, Larelle, and Jacquelyn E. Humphrey. 2014. Does board gender diversity have a financial impact? Evidence using stock portfolio performance. Journal of Business Ethics 122: 709–23. [Google Scholar] [CrossRef]

- Cheung, Ying-Wong, and Kon S. Lai. 1993. A fractional cointegration analysis of purchasing power parity. Journal of Business and Economic Statistics 11: 103–12. [Google Scholar] [CrossRef]

- Clark, Gordon L., Andreas Feiner, and Michael Viehs. 2015. From the Stockholder to the Stakeholder: How Sustainability Can Drive Financial Outperformance. Available online: https://ssrn.com/abstract=2508281 (accessed on 15 January 2018).

- Cochrane, John H. 1991. A critique of the application of unit root tests. Journal of Economic Dynamics and Control 15: 275–84. [Google Scholar] [CrossRef]

- Conrad, Christian, and Karin Loch. 2014. Anticipating Long-Term Stock Market Volatility. Journal of Applied Econometrics 30: 1090–114. [Google Scholar] [CrossRef]

- DeJong, David, John Nankervis, N. E. Savin, and Charles H. Whiteman. 1992. Integration versus trend stationarity in time series. Econometrica 60: 423–33. [Google Scholar] [CrossRef]

- DePenya, Javier R., and Luis Alberiko Gil-Alana. 2004. Do Spanish stock market prices follow a random walk. European Review of Economics and Finance 3: 3–13. [Google Scholar]

- Dickey, David A., and Wayne A. Fuller. 1979. Distributions of the Estimators for Autoregressive Time Series with a Unit Root. Journal of American Statistical Association 74: 427–81. [Google Scholar]

- Diebold, Francis X., and Glenn D. Rudebusch. 1991. On the Power of Dickey-Fuller Test against Fractional Alternative. Washington: Board of Governors of the Federal Reserve System, p. 258. [Google Scholar]

- Díaz-García, Cristina, Angela González-Moreno, and Francisco Jose Sáez-Martínez. 2013. Gender diversity within R&D teams: Its impact on radicalness of innovation. Innovation 15: 149–60. [Google Scholar]

- Ehouman, Yoo Axel. 2020. Volatility transmission between oil prices and banks’ stock prices as a new source of instability: Lessons from the United States experience. Economic Modelling 91: 198–217. [Google Scholar] [CrossRef]

- Elliot, Graham, Thomas J. Rothenberg, and James H. Stock. 1996. Efficient Tests for an Autoregressive Unit Root. Econometrica 64: 813–36. [Google Scholar] [CrossRef]

- Engle, Robert, and Clive W. J. Granger. 1987. Cointegration and error correction. Representation, estimation and testing. Econometrica 55: 251–76. [Google Scholar] [CrossRef]

- Fama, Eugene. 1970. Efficient Capital Markets: A Review of Theory and Empirical Work. The Journal of Finance 25: 383–417. [Google Scholar] [CrossRef]

- Fekete, Thomas Glede, and Erik Hagen. 2021. Do Investors Reward Gender Diversity? An Event Study of the MSCI World Women’s Leadership Index. Master’s thesis, Norwegian School of Economics, Bergen, Norway, December. [Google Scholar]

- Gagnon, Marie Helene, Gabriel J. Power, and Dominique Toupin. 2016. International stock market cointegration under the risk-neutral measure. International Review of Financial Analysis 47: 243–55. [Google Scholar] [CrossRef]

- Galbreath, Jeremy. 2018. Is board gender diversity linked to financial performance? The mediating mechanism of CSR. Business & Society 57: 863–89. [Google Scholar]

- García-Sánchez, Isabel Maria, Valentina Minutiello, and Patrizia Tettamanzi. 2022. Gender disclosure: The impact of peer behavior and the firm’s equality policies. Corporate Social Responsibility and Environmental Management 29: 385–405. [Google Scholar] [CrossRef]

- Gil-Alana, Luis Alberiko. 2003. Testing of fractional cointegration in macroeconomic time series. Oxford Bulletin of Economics and Statistics 65: 517–29. [Google Scholar] [CrossRef]

- Gil-Alana, Luis Alberiko, Olanrewaju I. Shittu, and OlaOluwa S. Yaya. 2014. On the persistence and volatility in European, American and Asian stocks bull and bear markets. Journal of International Money and Finance 40: 149–62. [Google Scholar] [CrossRef]

- Gozbasi, Onur, Ilhan Kucukkaplan, and Saban Nazlioglu. 2014. Re-examining the Turikish stock market efficiency. Evidence from nonlinear unit root tests. Economic Modelling 38: 381–84. [Google Scholar] [CrossRef]

- Groenewold, Nicolaas, and Kuay Chin Kang. 1993. The semi-strong efficiency of the Australian share market. Economic Record 69: 405–10. [Google Scholar] [CrossRef]

- Guesmi, Khaled, Heni Boubaker, and Van Son Lai. 2016. From Oil to Stock Markets. Journal of Economic Integration 31: 103–33. [Google Scholar] [CrossRef][Green Version]

- Gülsoy, Tanses, and Ayfer Ustabaş. 2019. Corporate sustainability initiatives in gender equality: Organizational practices fostering inclusiveness at work in an emerging-market context. International Journal of Innovation and Technology Management 16: 1940005. [Google Scholar] [CrossRef]

- Hamdam, Reem Khamls, and Allam M. Hamdam. 2019. Linear and nonlinear sectoral response of stock markets to oil price movements: The case of Saudi Arabia. International Journal of Finance and Economics 25: 336–48. [Google Scholar] [CrossRef]

- Hammond, Allam, and World Resources Institute. 1995. Environmental Indicators: A Systematic Approach to Measuring and Reporting on Environmental Policy Performance in the Context of Sustainable Development. Washington: World Resources Institute, vol. 36. [Google Scholar]

- Hasanov, Mübariz. 2009. Is South Korea’s sotck market efficient? Evidence from a nonlinear unit root test. Applied Economics Letters 16: 163–67. [Google Scholar] [CrossRef]

- Hassler, Uwe, and Jürgen Wolters. 1994. On the power of unit root tests against fractional alternatives. Economic Letters 45: 1–5. [Google Scholar] [CrossRef]

- Hill, John. 2020. Environmental, Social, and Governance (ESG) Investing: A Balanced Analysis of the Theory and Practice of a Sustainable Portfolio. Cambridge: Academic Press. [Google Scholar]

- Hou, Yang, Steven Li, and Fenghua Wen. 2019. Time-varying volatility spillover between Chinese fuel oil and stock index futures markets based on a DCC-GARCH model with a semi-nonparametric approach. Energy Economics 83: 119–43. [Google Scholar] [CrossRef]

- Ionascu, Michaela, Ion Ionascu, Marian Sacarin, and Michaela Minu. 2018. Women on boards and financial performance: Evidence from a European emerging market. Sustainability 10: 1644. [Google Scholar] [CrossRef]

- Jankelová, Nadezda, Zuzana Joniaková, and Katarina Procházková. 2022. The way to business competitiveness: The importance of diversity management and teamwork climate in stabilizing of employees. Journal of Business economics and Management 23: 606–25. [Google Scholar] [CrossRef]

- Jin, Xing, Meng Wang, Qingyun Wang, Juan Yang, and Yi Guo. 2024. Gender diversity of senior management teams and corporate innovation efficiency: Evidence from China. Finance Research Letters 60: 104897. [Google Scholar] [CrossRef]

- Johansen, Soren, and Morten Orregaard Nielsen. 2010. Likelihood inference for a nonstationary fractional autoregressive model. Journal of Econometrics 158: 51–66. [Google Scholar] [CrossRef]

- Johansen, Soren, and Morten Orregaard Nielsen. 2012. Likelihood inference for a fractionally cointegrated vector autoregressive model. Econometrica 80: 2667–732. [Google Scholar] [CrossRef][Green Version]

- Kahreh, Mohammad Safari, Asghar Babania, Mohammad Tive, and Seyed Mehdi Mirmehdi. 2014. An examination to effects of Gender Differences on the Corporate Social Responsibility (CSR). Procedia-Social and Behavioral Sciences 109: 664–68. [Google Scholar] [CrossRef]

- Keefe, Joseph F. 2011. Gender Equality as an Investment Concept. Portsmouth: Pax World Investments. [Google Scholar]

- Kocmanova, Alena, Petr Nemecek, and Marie Docekalova. 2012. Environmental, social and governance (ESG) key performance indicators for sustainable reporting. Paper presented at the 7th International Scientific Conference, Vilnius, Lithuania, May 10–11; pp. 655–63. [Google Scholar]

- Kwiatkowski, Denis, Peter C. D. Phillips, Peter Schmidt, and Yongcheol Shin. 1992. Testing the null hypothesis of stationarity against the alternative of a unit root: How sure are we that economic time series have a unit root? Journal of Econometrics 54: 159–78. [Google Scholar] [CrossRef]

- Lagoarde-Segot, Thomas. 2011. Corporate social responsibility as a bolster for economic performance: Evidence from emerging markets. Global Business and Organizational Excellence 31: 38–53. [Google Scholar] [CrossRef]

- Lee, Dongin, and Peter Schmidt. 1996. On the power of the KPSS test of stationary against fractionally integrated alternatives. Journal of Econometrics 73: 285–302. [Google Scholar] [CrossRef]

- Leventi, Lydia. 2022. The Growing Role of Environmental, Social and Governance (ESG) Criteria in Investments. Available online: https://repository.ihu.edu.gr/xmlui/handle/11544/30045 (accessed on 7 October 2022).

- Martínez, Maria del Carmen Valls, Pedro Antonio Martín-Cervantes, and del Maria del Mar Miralles-Quirós. 2022. Sustainable development and the limits of gender policies on corporate boards in Europe. A comparative analysis between developed and emerging markets. European Research on Management and Business Economics 28: 100168. [Google Scholar] [CrossRef]

- Mehrotra, Vikas, Lukas Roth, Yusuke Tsujimoto, and Yupana Wiwattanakantang. 2024. Index Inclusion and Corporate Social Performance: Evidence from the MSCI Empowering Women Index. Available online: https://ssrn.com/abstract=4800375 (accessed on 19 April 2024).

- Mokni, Khaled, and Manel Youssef. 2019. Measuring persistence of dependence between crude oil prices and GCC stock markets: A copula approach. The Quarterly Review of Economics and Finance 72: 14–33. [Google Scholar] [CrossRef]

- Monge, Manuel, and Luis Alberiko Gil-Alana. 2021. Lithium industry and the U.S. crude oil prices. A fractional cointegration VAR and a Continuous Wavelet Transform análisis. Resources Policy 72: 102040. [Google Scholar] [CrossRef]

- MSCI Inc. 2023. Workforce Gender Diversity Data Methodology. Available online: https://www.msci.com/documents/1296102/3556282/Workforce%2BGender%2BDiversity%2BData%2BMethodology.pdf (accessed on 31 May 2023).

- MSCI. 2024. MSCI ACWI IMI Index. Available online: https://www.msci.com/documents/10199/178e6643-6ae6-47b9-82be-e1fc565ededb (accessed on 31 May 2024).

- Narayan, Paresh Kumar. 2008. Do shocks to G7 stock prices have a permanent effect? Evidence from panel unit root tests with structural change. Mathematics and Computers in Simulation 77: 369–73. [Google Scholar] [CrossRef]

- Nelson, Charles R., Jeremy Piger, and Eric Zivot. 2001. Markov regime switching and unit root tests. Journal of Business and Economic Statistics 19: 404–15. [Google Scholar] [CrossRef]

- Ng, Serena, and Pierre Perron. 2001. Lag length selection and the construction of unit root tests with good size and power. Econometrica 69: 519–1554. [Google Scholar] [CrossRef]

- Omay, Tolga. 2015. Fractional Frequency Flexible Fourier Form to approximate smooth breaks in unit root testing. Economics Letters 134: 123–26. [Google Scholar] [CrossRef]

- Omay, Tolga, and Dumitru Baleanu. 2021. Fractional unit-root tests allowing for a fractional frequency flexible Fourier form trend: Predictability of COVID-19. Advances in Differences Equations 2021: 167. [Google Scholar] [CrossRef] [PubMed]

- Otieno, Donald A., Rose W. Ngugi, and Peter W. Muriu. 2019. The impact of inflation rate on stock market returns: Evidence from Kenya. Journal of Economics and Finance 43: 73–90. [Google Scholar] [CrossRef]

- Pagano, Michael S., Graham Sinclair, and Tina Yang. 2018. Understanding ESG ratings and ESG indexes. In Research Handbook of Finance and Sustainability. Cheltenham: Edward Elgar Publishing, pp. 339–71. [Google Scholar]

- Peillex, Jonathan, Sabri Boubaker, and Breeda Comyns. 2021. Does it pay to invest in Japanese women? Evidence from the MSCI Japan empowering women index. Journal of Business Ethics 170: 595–613. [Google Scholar] [CrossRef]

- Perron, Pierre. 1989. The great crash, the oil price shock and the unit root hypothesis. Econometrica 57: 1361–401. [Google Scholar] [CrossRef]

- Phillips, Peter C., and Pierre Perron. 1988. Testing for a unit root in time series regression. Biometrika 75: 335–46. [Google Scholar] [CrossRef]

- Quinlan, Joseph, and Jackie VanderBrug. 2016. Gender Lens Investing: Uncovering Opportunities for Growth, Returns, and Impact. New York: John Wiley & Sons. [Google Scholar]

- Robinson, Peter M. 1994. Efficient tests of nonstationary hypotheses. Journal of the American Statistical Association 89: 1420–37. [Google Scholar] [CrossRef]

- Robinson, Peter M., and Javier Hualde. 2003. Cointegration in fractional, systems with unknown integration orders. Econometrica 71: 1727–66. [Google Scholar] [CrossRef]

- Rutskiy, Vladislav, Irina Yarygina, Shaida Hamoud Alshahrani, Sergei Elkin, Andrei Plotnikov, Alla Plotnikova, Oleg Ikonnikov, Valentina Everstova, Alexey Mishchenko, Ivan Seleznyov, and et al. 2022. The relationship between gender inequality and the performance of large corporations. In Proceedings of the Computational Methods in Systems and Software. Cham: Springer International Publishing, pp. 576–86. [Google Scholar]

- Sahu, Tarak Nath, Kalpataru Bandopadhyay, and Debasish Mondal. 2014. An empirical study on the dynamic relationship between oil prices and Indian stock market. Managerial Finance 40: 200–15. [Google Scholar] [CrossRef]

- Salisu, Afees A., and Rangan Gupta. 2021. Oil shocks and stock market volatility of the BRICS: A GARCH-MIDAS approach. Global Finance Journal 48: 100546. [Google Scholar] [CrossRef]

- Sarwar, Suleman, Aviral Kumar Tiwari, and Cao Tingqiu. 2020. Analyzing volatility spillovers between oil market and Asian stock markets. Resources Policy 66: 101608. [Google Scholar] [CrossRef]

- Susan, Enyan Besong, and Manases Mbengwor Natu. 2023. Re-imagining the Gender Gap in Economic Participation and Opportunities: Assessing the Link Between Sustainable Development and Gender Equality in Some African Countries. Social Indicators Research 169: 817–45. [Google Scholar] [CrossRef]

- Tabak, Benjamin M. 2007. Testing for unit root bilinearity in the Brazilian stock market. Physica A: Statistical Mechanics and Its Applications 385: 261–69. [Google Scholar] [CrossRef]

- Targa, Laya, Silvia Rueda, Jose Vicente Riera, Sergio Casas, and Cristina Portalés. 2023. Enhancing the Understanding of the EU Gender Equality Index through Spatiotemporal Visualizations. ISPRS International Journal of Geo-Information 12: 421. [Google Scholar] [CrossRef]

- Tiwari, Aviral Kumar, and Phouphet Kyophilavong. 2014. New evidence from the random walk hypothesis for BRICS stock indices. A wavelet unit root test approach. Economic Modelling 43: 38–41. [Google Scholar] [CrossRef]

- United Nations Environment Programme Finance Initiative. 2008. Making It Happen: Implementing the Principles for Responsible Investment. Available online: https://www.unepfi.org/industries/investment/making-it-happen-implementing-the-principles-for-responsible-investment/ (accessed on 31 October 2008).

- Wang, Juan, Dongxiang Zhang, and Jian Zhang. 2015. Mean reversion in stock prices of seven Asian stock markets: Unit root test and stationary test with Fourier functions. International Review of Economics & Finance 37: 157–64. [Google Scholar] [CrossRef]

- Williams, Robert J. 2003. Women on corporate boards of directors and their influence on corporate philanthropy. Journal of Business Ethics 42: 1–10. [Google Scholar] [CrossRef]

| Series | No Terms | An Intercept | An Intercept and a Linear Time Trend |

|---|---|---|---|

| (i) White noise errors | |||

| MXWO | 1.006 (0.975, 1.041) | 1.029 (1.000, 1.063) | 1.029 (1.000, 1.063) |

| BFGEI | 1.002 (0.971, 1.037) | 1.014 (0.984, 1.048) | 1.014 (0.984, 1.048) |

| (ii) Autocorrelated (Bloomfield) errors | |||

| MXWO | 1.011 (0.966, 1.093) | 1.103 (1.043, 1.162) | 1.103 (1.043, 1.162) |

| BFGEI | 1.029 (0.974, 1.074) | 1.118 (1.044, 1.184) | 1.120 (1.044, 1.185) |

| (iii) White noise errors | |||

| Log of MXWO | 0.997 (0.964, 1.032) | 1.013 (0.983, 1.046) | 1.013 (0.983, 1.046) |

| Log of BFGEI | 0.997 (0.966, 1.032) | 1.001 (0.971, 1.035) | 1.001 (0.971, 1.035) |

| (iv) Autocorrelated (Bloomfield) errors | |||

| Log of MXWO | 0.996 (0.941, 1.055) | 1.073 (1.019, 1.153) | 1.073 (1.019, 1.153) |

| Log of BFGEI | 0.997 (0.941, 1.053) | 1.101 (1.029, 1.171) | 1.101 (1.029, 1.171) |

| Series | No Terms | Intercept (t-Value) | Time Trend (t-Value=) |

|---|---|---|---|

| (i) White noise errors | |||

| 1.029 (1.000, 1.063) | 4.606 (334.70) | --- | |

| 1.014 (0.984, 1.048) | 7.444 (759.47) | --- | |

| (ii) Autocorrelated (Bloomfield) errors | |||

| 1.103 (1.043, 1.162) | 200.207 (72.57) | --- | |

| 1.118 (1.044, 1.184) | 1710.533 (91.01) | --- | |

| (iii) White noise errors | |||

| (iii) White noise errors | |||

| Log of | 1.013 (0.983, 1.046) | 1.527 (509.06) | --- |

| Log of | 1.001 (0.971, 1.035) | 2.007 (1547.09) | --- |

| (iv) Autocorrelated (Bloomfield) errors | |||

| Log of | 1.073 (1.019, 1.153) | 4.606 (336.57) | --- |

| Log of | 1.101 (1.029, 1.171) | 7.444 (767.77) | --- |

| Series: Residuals | No Terms | An Intercept | An Intercept and a Linear Time Trend |

|---|---|---|---|

| White noise | 0.973 (0.943, 1.018) | 0.973 (0.946, 1.011) | 0.973 (0.948, 1.012) |

| Bloomfield autocorr. | 0.994 (0.944, 1.067) | 1.002 (0.955, 1.052) | 1.001 (0.957, 1.051) |

| Seasonal MA(1) | 0.981 (0.943, 1.011) | 0.982 (0.943, 1.012) | 0.982 (0.943, 1.016) |

| Series: LOG RESIDUALS linear time trend | No terms | An intercept | An intercept and a linear time trend |

| White noise | 0.991 (0.968, 1.034) | 0.997 (0.960, 1.037) | 0.998 (0.968, 1.035) |

| Bloomfield autocorr. | 1.002 (0.942, 1.065) | 1.001 (0.959, 1.066) | 1.001 (0.959, 1.064) |

| Seasonal MA(1) | 0.992 (0.962, 1.031) | 0.997 (0.964, 1.034) | 0.995 (0.965, 1.032) |

| Series | (Standard Error) | (Standard Error) |

|---|---|---|

| Original series | 0.969 (0.036) | 0.969 (0.122) |

| Logged values | 0.975 (0.035) | 0.975 (0.127) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Infante, J.; del Rio, M.; Gil-Alana, L.A. Persistent and Long-Term Co-Movements between Gender Equality and Global Prices. Economies 2024, 12, 175. https://doi.org/10.3390/economies12070175

Infante J, del Rio M, Gil-Alana LA. Persistent and Long-Term Co-Movements between Gender Equality and Global Prices. Economies. 2024; 12(7):175. https://doi.org/10.3390/economies12070175

Chicago/Turabian StyleInfante, Juan, Marta del Rio, and Luis Alberiko Gil-Alana. 2024. "Persistent and Long-Term Co-Movements between Gender Equality and Global Prices" Economies 12, no. 7: 175. https://doi.org/10.3390/economies12070175

APA StyleInfante, J., del Rio, M., & Gil-Alana, L. A. (2024). Persistent and Long-Term Co-Movements between Gender Equality and Global Prices. Economies, 12(7), 175. https://doi.org/10.3390/economies12070175