Optimal Pricing Policies with an Allowable Discount for Perishable Items under Time-Dependent Sales Price and Trade Credit

Abstract

:1. Introduction

1.1. Overview and Practical Motivations

1.2. Aim of This Study

- What would be the best pricing methods for perishable products which optimize the total profit?

- What would be the optimal sales price of a product when it depends on the time?

- What would be the optimal cycle time which optimizes the total profit?

- Under the dynamic demand with the assumption of time-varying holding cost, how much inventory should be supplied and in what quantities?

- If the retailer collects a trade credit period from the supplier, then what would be the effects on total profit?

- Which behavior is preferred by the retailer and how do the model’s key parameters influence this preference?

- What would be the managerial implications of implementing this model to use in reality?

1.3. Flow of the Paper

2. Literature Review

Research Gap and Contributions

- This study addresses a policy with non-instantaneous perishable units with a time-varying sales price and a permitted discount rate for items that deteriorate after a certain period.

- The model is used to evaluate variable holding cost, as they increase over time, as well as to manage perishable commodities to prevent spoilage.

- The rate of demand for an item is determined not only by the product’s sales price, but also by the cumulative demand or sale.

- In contrast to many situations, this model maximizes the overall profit under the trade credit policy.

- To determine the optimality of the total profit function, this model employs the traditional optimization approach.

- To demonstrate the theoretical outcomes, this article discusses the numerical illustrations for each situation under trade credit.

- This study analyzes the sensitivity analysis of the main parameters and managerial implications, which gives the best strategy to the retailer for maximizing total profit.

3. Problem Explanation, Notation, and Assumptions

3.1. Problem Explanation

3.2. Assumptions

- The current inventory system is limited to a single product.

- When the deterioration begins in the system, per unit time, throughout , the holding cost is presumed to be time varying and is defined by , where is the holding cost parameter and is the rate of increase over time (one can examine an article’s assumption [28]).

- The sales price of the product is assumed to be constant ; when there is no deterioration during and when the deterioration begin in the system, it is assumed to be exponential decreasing function of time with variable discount during (one can examine an article’s assumption [28]. Therefore, the time-dependent sales price is described as

- The dynamic demand rate is considered to be a function of the sales price and also cumulative demand, which can be defined as follows:

- When there is no deterioration, the rate of demand can be determined as

- When deterioration begins in the system, the rate of demand can be determined as

- Where represents a scaling demand, represents the sensitivity of the demand concerning price, and both of them are known and positive. The parameter is the reduced rate of sales, which indicates the saturation impact and includes the percentage of the market that will not buy the units at the specified period one can examine an article’s assumption [28].

- With a lead time of zero, the rate of replenishment is infinite.

- The retailer trades only a single kind of deteriorating item, and no replacement is admissible throughout the entire cycle time.

- Shortages are not permitted.

4. Mathematical Model

- Cost of ordering (per order):

- Cost of purchasing (per unit):

- Cost of holding (per unit time):

- Disposing cost (per unit):

5. Algorithm Rule for Optimality

6. Numerical Illustrations, Comparison Chart, Sensitivity Analysis, and Managerial Implications

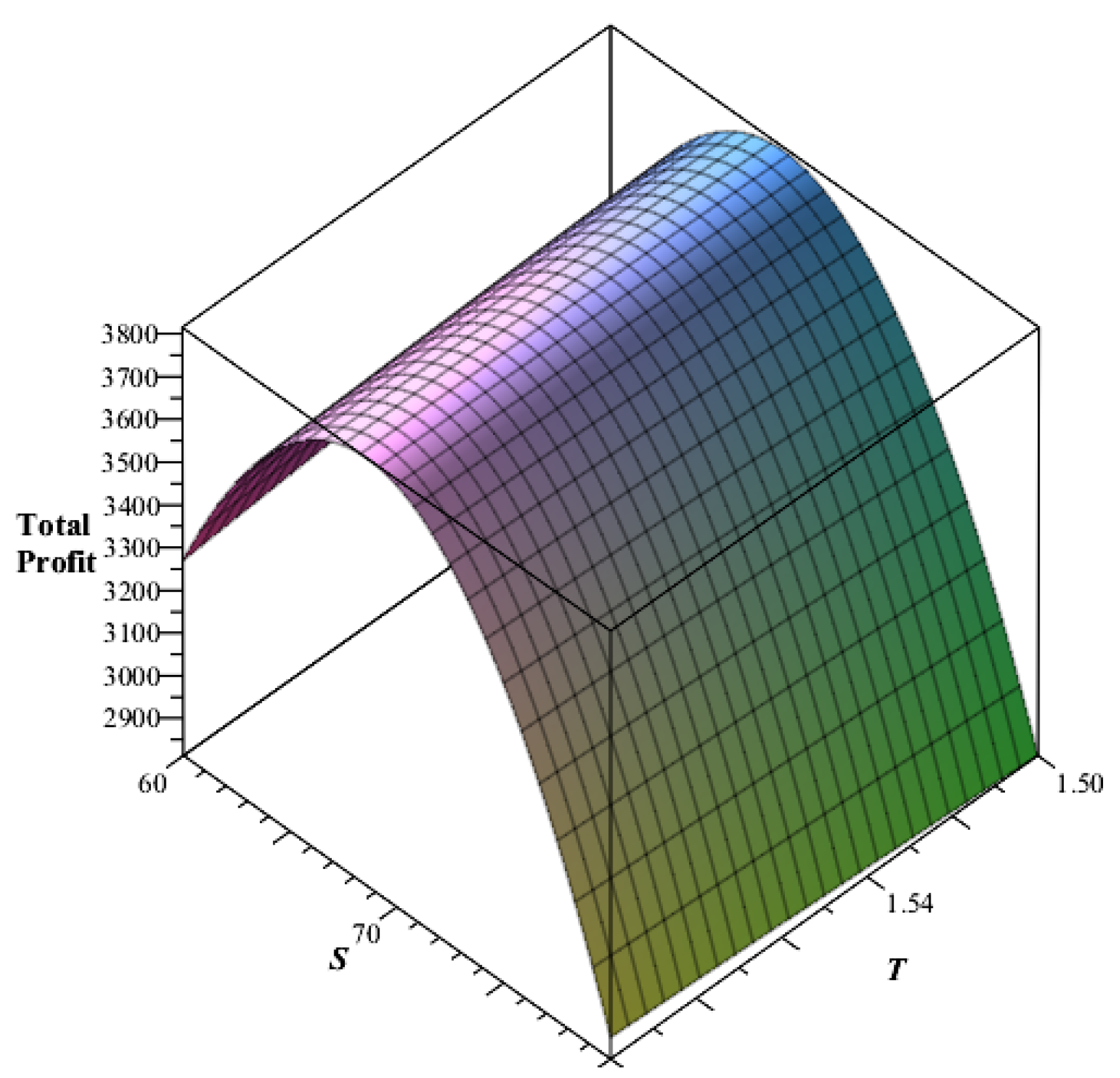

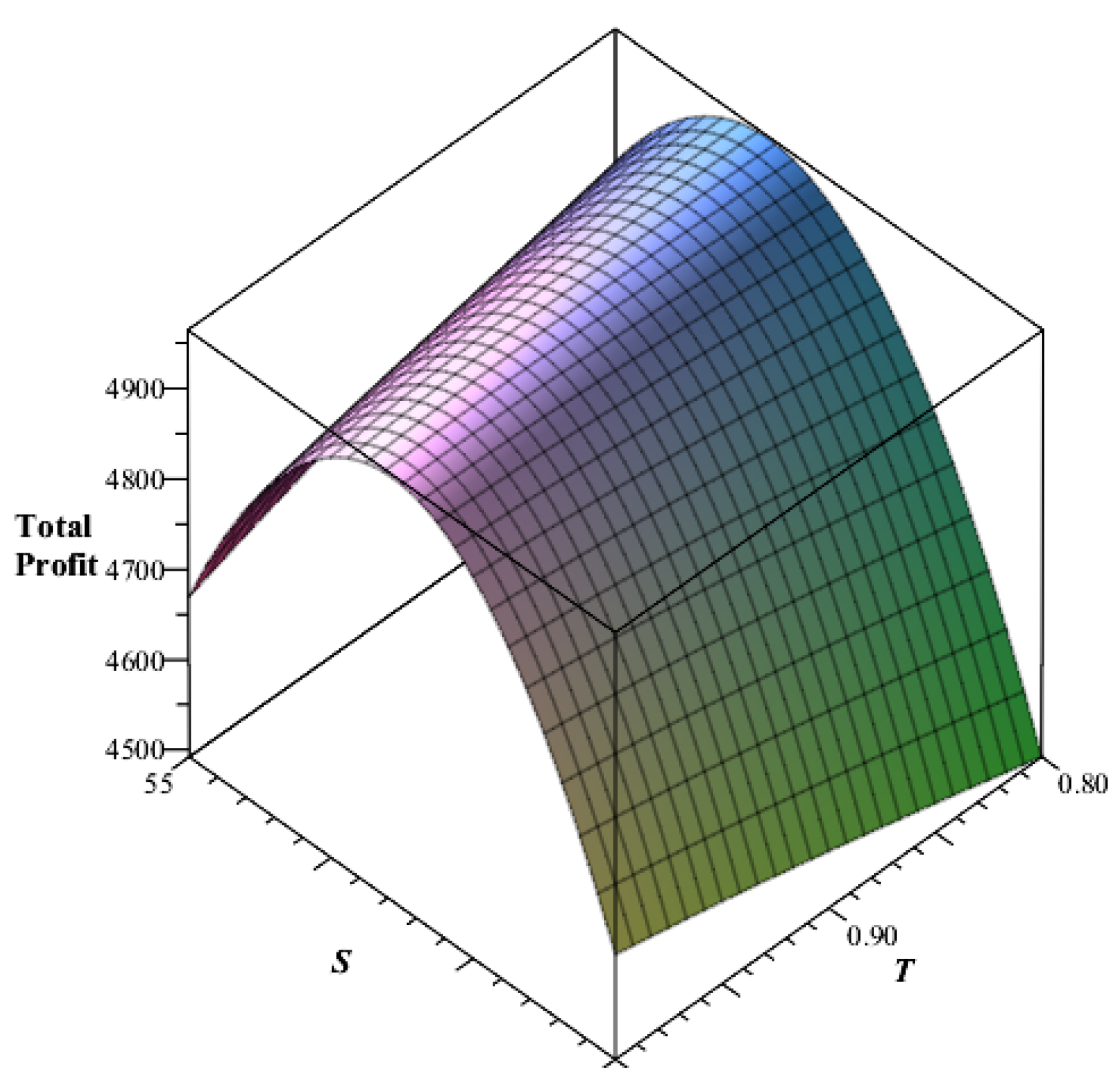

6.1. Numerical Illustrations

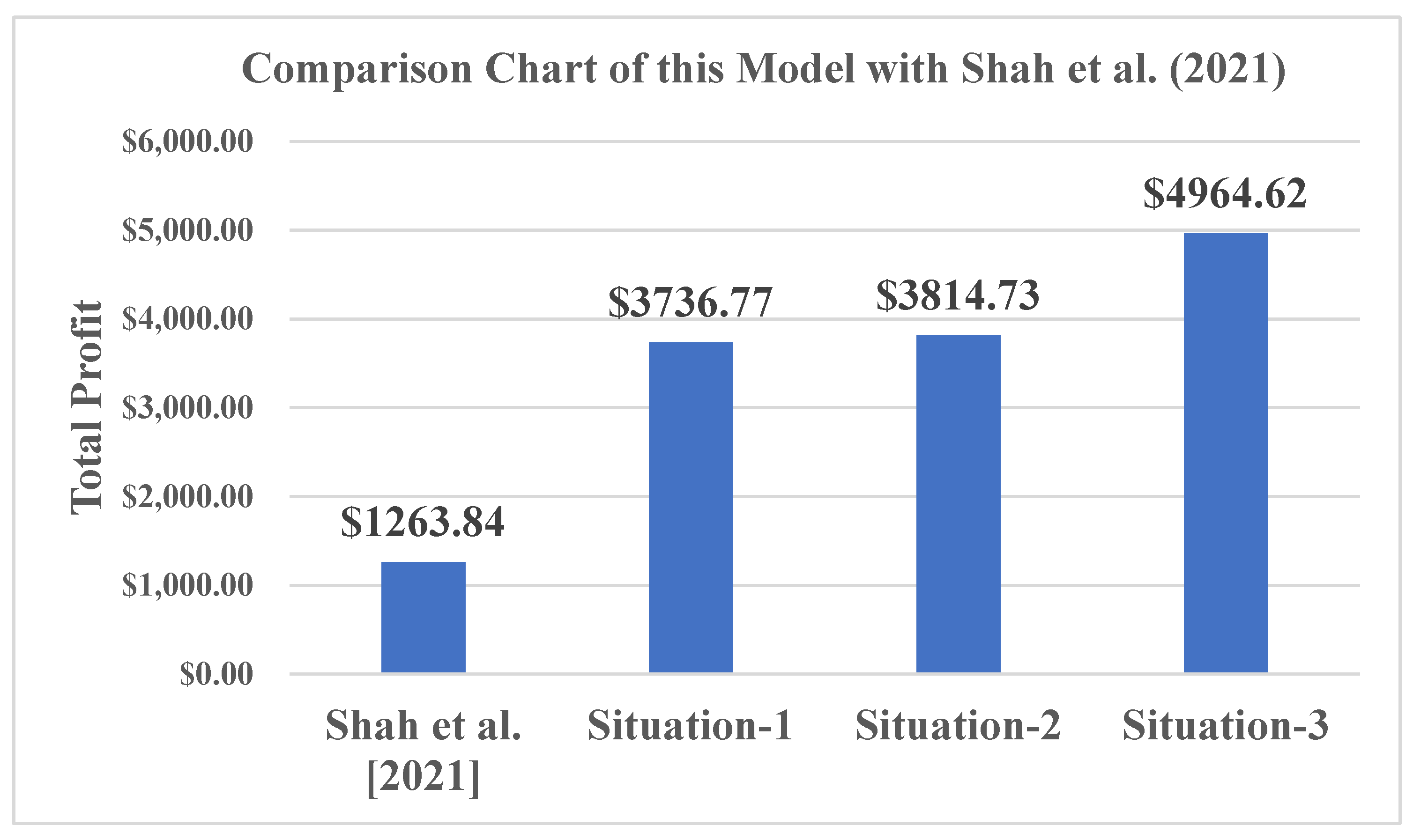

6.2. Comparison Chart

6.3. Sensitivity Analysis

6.4. Managerial Implications

- It is observed that the overall profit for the retailer under the proposed model is maximal when the initial rate of demand of a customer and the scaling demand of a product is high, which proposes to the retailer that if the initial customer’s demand for a product is high, then it would be better for the retailer to order a large number of units.

- The price-sensitive parameter and reduced rate of sales parameter affect negatively a retailer’s total profit as they decrease the sales price of a product. Therefore, the increase is not beneficial for the retailer.

- The increase in the purchasing cost of a unit rises the sales price, and it is noticeable that an increase in the sales price would have a direct impact on the demand rate. Thus, the total profit will decrease as demand decreases. Therefore, if the purchasing cost of a product is high, then the retailer should not place any order.

- The increase in holding cost and ordering cost of a product is not beneficial for the retailer, as it decreases the overall profit for a retailer. Hence, if the ordering cost and holding cost both are low, then the retailer should order more units so that the retailer can easily carry the inventory to achieve the maximum profit when the demand for a product is high.

- When the rate of deterioration is high, the retailer does not need to hold items for an extended period. It is not recommended because the increase decreases total profit.

- Since the trade credit period and interest gain increase the retailer’s overall profit, it suggests that if the retailer obtains a higher credit period from a supplier, then the retailer should accept the proposal of a supplier and order more units to achieve maximum profit.

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Notation

| Parameters | |

| Purchasing cost; (in $/unit) | |

| Ordering cost; (in $/order) | |

| Deterioration with the constant rate (in %) | |

| The discount variable; | |

| The reduced rate of sales; ψ > 0 | |

| Cost of holding per unit; (in $//unit time) | |

| The rate of increase in holding cost; | |

| Period of trade credit (in years) | |

| The retailer’s earned interest throughout the interval | |

| The retailers paid interest throughout the interval | |

| The initial order quantity (in units) | |

| The initial rate of demand at a time | |

| Decision variables | |

| The original sales price of a product (in $/unit) | |

| The replenishment time (in years) | |

| Functions | |

| ; the length of time for non-deteriorating units (in years) | |

| The time-dependent holding cost which increases over time | |

| The time-varying function of the sales price | |

| The dynamic demand rate throughout the time | |

| The dynamic demand rate throughout the time | |

| The inventory level for the non-deteriorating items (in units) | |

| The inventory level for the deteriorating items (in units) | |

| Retailer’s overall profit function per cycle time for each situation (in $) |

References

- Goyal, S.K. Economic ordering policy for deteriorating items over an infinite time horizon. Eur. J. Oper. Res. 1987, 28, 298–301. [Google Scholar] [CrossRef]

- Sarkar, B. An EOQ model with delay in payments and stock-dependent demand in the presence of imperfect production. Appl. Math. Comput. 2012, 218, 8295–8308. [Google Scholar] [CrossRef]

- Liu, G.; Zhang, J.; Tang, W. Joint dynamic pricing and investment strategy for perishable food with price-quality dependent demand. Ann. Oper. Res. 2015, 216, 397–416. [Google Scholar] [CrossRef]

- Dye, C.-Y.; Yang, C.-T. Optimal dynamic pricing and preservation technology investment for deteriorating products with reference price effects. Omega 2016, 62, 52–67. [Google Scholar] [CrossRef]

- Ghoreishi, M.; Weber, G.W.; Mirzazadeh, A. An inventory model for non-instantaneous deteriorating items with partial backlogging, permissible delay in payments, inflation, and selling price-dependent demand and customer returns. Ann. Oper. Res. 2018, 226, 221–238. [Google Scholar] [CrossRef]

- Tayal, S.; Singh, S.R.; Sharma, R.; Singh, A.P. An EPQ model for non-instantaneous deteriorating items with time-dependent holding cost and exponential demand rate. Int. J. Oper. Res. 2015, 23, 145–162. [Google Scholar] [CrossRef]

- Ai, X.Y.; Zhang, J.L.; Wang, L. Optimal joint replenishment policy for multiple non-instantaneous deteriorating items. Int. J. Prod. Res. 2017, 55, 4625–4642. [Google Scholar] [CrossRef]

- Tiwari, S.; Ahmed, W.; Sarkar, B. Sustainable ordering policies for non-instantaneous deteriorating items under carbon emission and multi-trade-credit-policies. J. Clean. Prod. 2019, 240, 118183. [Google Scholar] [CrossRef]

- Li, G.; He, X.; Zhou, J.; Wu, H. Pricing replenishment and preservation technology investment decisions for non-instantaneous deterioration items. Omega 2019, 84, 114–126. [Google Scholar] [CrossRef]

- Udayakumar, R.; Geetha, K.V.; Sana, S.S. Economic ordering policy for non-instantaneous deteriorating items with price and advertisement dependent demand and permissible delay in payment under inflation. Math. Methods Appl. Sci. 2021, 44, 7697–7721. [Google Scholar] [CrossRef]

- Zhao, W.; Zheng, Y.S. Optimal dynamic pricing for perishable assets with nonhomogeneous demand. Manag. Sci. 2000, 46, 375–388. [Google Scholar] [CrossRef]

- Dasu, S.; Tong, C. Dynamic pricing when consumers are strategic: Analysis of posted and contingent pricing schemes. Eur. J. Oper. Res. 2010, 204, 662–671. [Google Scholar] [CrossRef]

- Taleizadeh, A.A.; Niaki, S.T.A.; Seyedjavadi, S.M.H. Multi-product multi-chance-constraint stochastic inventory control problem with dynamic demand and partial back-ordering: A harmony search algorithm. J. Manuf. Syst. 2012, 31, 204–213. [Google Scholar] [CrossRef]

- Tan, B.; Karabati, S. Retail inventory management with stock-out-based dynamic demand substitution. Int. J. Prod. Econ. 2013, 145, 78–87. [Google Scholar] [CrossRef] [Green Version]

- Hu, X.; Wan, Z.; Murthy, N.N. Dynamic pricing of limited inventories with product returns. Manuf. Serv. Oper. Manag. 2019, 21, 501–518. [Google Scholar] [CrossRef]

- ABC News. Amazon Error May End “Dynamic Pricing”. 2000. Available online: http://abcnews.go.com/Technology/story?id=119399 (accessed on 20 May 2020).

- Saren, S.; Sarkar, B.; Bachar, R.K. Application of various price-discount policies for deteriorated products and delay in payments in an advanced inventory model. Inventions 2020, 5, 50. [Google Scholar] [CrossRef]

- Lin, M.; Sengupta, I. Analysis of Optimal Portfolio on Finite and Small-Time Horizons for a Stochastic Volatility Market Model. SIAM J. Financ. Math. 2021, 12, 1596–1624. [Google Scholar] [CrossRef]

- Ding, Y.; Jiang, Y.; Wu, L.; Zhou, Z. Two-echelon supply chain network design with trade credit. Comput. Oper. Res. 2021, 131, 105270. [Google Scholar] [CrossRef]

- Wu, K.S.; Ouyang, L.Y.; Yang, C.T. An optimal replenishment policy for non-instantaneous deteriorating items with stock dependent demand and partial backlogging. Int. J. Prod. Econ. 2006, 101, 369–384. [Google Scholar] [CrossRef]

- Bakker, M.; Riezebos, J.; Teunter, R.H. Review of inventory systems with a deterioration since 2001. Eur. J. Oper. Res. 2012, 221, 275–284. [Google Scholar] [CrossRef]

- Perez, F.; Torres, F. An integrated production-inventory model for deteriorating items to evaluate JIT purchasing alliances. Int. J. Ind. Eng. Comput. 2019, 10, 51–66. [Google Scholar] [CrossRef]

- Xu, W.; Zhao, K.; Shi, Y.; Bingzhen, S. The optimal pricing model for non-instantaneous deterioration items with price and freshness sensitive demand under the e-commerce environment in China. Kybernetes 2021, 51, 623–640. [Google Scholar] [CrossRef]

- Xue, M.; Tang, W.; Zhang, J. Optimal dynamic pricing for deteriorating items with reference price effects. Int. J. Syst. Sci. 2016, 47, 2022–2031. [Google Scholar] [CrossRef]

- Li, S.; Zhang, J.; Tang, W. Joint dynamic pricing and inventory control policy for a stochastic inventory system with perishable products. Int. J. Prod. Res. 2014, 53, 2937–2950. [Google Scholar] [CrossRef]

- Kumar, R.; Nasralah, H. Asymptotic Approximation of Optimal Portfolio for Small Time Horizons. SIAM J. Financ. Math. 2018, 9, 755–774. [Google Scholar] [CrossRef] [Green Version]

- Pathak, U.; Kant, R.; Shankar, R. Price and profit decisions in manufacturer-led dual-channel supply chain configurations. Int. J. Ind. Eng. Comput. 2020, 11, 377–400. [Google Scholar] [CrossRef]

- Shah, N.H.; Rabari, K.; Patel, E. Dynamic demand and pricing inventory model for non-instantaneous deteriorating items. Int. J. Math. Eng. Manag. Sci. 2021, 6, 510–521. [Google Scholar] [CrossRef]

- Pourmohammad-Zia, N.; Karimi, B.; Rezaei, J. Dynamic pricing and inventory control policies in a food supply chain of growing and deteriorating items. Ann. Oper. Res. 2021, 1–40. [Google Scholar] [CrossRef]

- Chiu, Y.; Chiu, T.; Pai, F.; Wu, H. A producer-retailer incorporated a multi-item EPQ problem with delayed differentiation, the expedited rate for common parts, multi-delivery, and scrap. Int. J. Ind. Eng. Comput. 2021, 12, 427–440. [Google Scholar]

| Author(s) | Demand Type | Non-Instantaneous Deterioration | Variable Holding Cost | Trade Credit | Nature of Sales Price |

|---|---|---|---|---|---|

| [8] | Fuzzy price-sensitive | Yes | No | Yes | Linear |

| [9] | Price-sensitive | Yes | No | No | Constant |

| [11] | Non-homogeneous | No | No | No | Dynamic price |

| [25] | Dynamic Pricing | No | No | No | Time dependent |

| [28] | Dynamic pricing | Yes | Yes | No | Constant and time dependent |

| In this paper | Dynamic pricing | Yes | Yes | Yes | Constant and time dependent |

| Situations | Interest Gained (Ig) | Interest Paid (Ip) |

|---|---|---|

| The retailer gains the interest during the time from 0 to and that can be evaluated as | The retailer must pay the interest to the supplier during the time from to , and that can be evaluated as | |

| The retailer gains the interest during the time from 0 to as well as from to and that can be evaluated as | Same as the above case, the retailer must charge the interest to the supplier during the time from to , and that can be evaluated as | |

| The retailer gains the maximum profit as the credit period occurs after the completion of the entire cycle time and earns the additional interest during the period from to , which can be evaluated as | The retailer has sold all the purchased goods from the supplier, hence the interest charged to the retailer will be zero. That is, |

| 800 | 1.211 | 57.38 | 126.13 | 1473.63 |

| 900 | 1.404 | 62.97 | 204.82 | 2476.34 |

| 1100 | 1.765 | 74.11 | 436.25 | 5524.50 |

| 1200 | 1.855 | 77.87 | 580.36 | 6728.10 |

| 8.8 | 1.989 | 81.65 | 529.05 | 6898.85 |

| 9.9 | 1.784 | 74.75 | 407.15 | 5174.67 |

| 12.1 | 1.421 | 63.45 | 234.11 | 2835.47 |

| 13.2 | 1.275 | 59.18 | 178.89 | 2117.52 |

| 24 | 1.847 | 66.15 | 456.39 | 5238.21 |

| 27 | 1.714 | 67.36 | 375.28 | 4480.38 |

| 33 | 1.472 | 69.73 | 251.62 | 3231.24 |

| 36 | 1.363 | 70.89 | 204.90 | 2721.35 |

| 0.16 | 1.593 | 68.55 | 309.11 | 3822.37 |

| 0.18 | 1.591 | 68.55 | 308.46 | 3818.66 |

| 0.22 | 1.587 | 68.55 | 307.09 | 3811.19 |

| 0.24 | 1.586 | 68.56 | 306.42 | 3807.33 |

| 40 | 1.587 | 68.54 | 307.21 | 3820.99 |

| 45 | 1.588 | 68.55 | 307.51 | 3818.02 |

| 55 | 1.590 | 68.56 | 308.60 | 3811.55 |

| 60 | 1.591 | 68.56 | 308.64 | 3808.65 |

| 0.16 | 1.845 | 68.37 | 401.13 | 4350.09 |

| 0.18 | 1.708 | 68.46 | 349.83 | 4065.43 |

| 0.22 | 1.486 | 68.63 | 272.76 | 3594.14 |

| 0.24 | 1.395 | 68.70 | 243.43 | 3397.45 |

| 0.28 | 1.611 | 68.74 | 325.11 | 3931.83 |

| 0.31 | 1.599 | 68.63 | 315.02 | 3864.32 |

| 0.38 | 1.580 | 68.48 | 300.78 | 3766.63 |

| 0.42 | 1.568 | 68.38 | 291.79 | 3704.49 |

| 4 | 1.591 | 68.51 | 307.76 | 3793.32 |

| 4.5 | 1.590 | 68.53 | 307.78 | 3803.52 |

| 5.5 | 1.588 | 68.57 | 307.80 | 3826.31 |

| 6 | 1.587 | 68.59 | 307.81 | 3837.27 |

| 0.24 | 1.574 | 68.82 | 298.42 | 3692.01 |

| 0.27 | 1.577 | 68.77 | 300.24 | 3714.38 |

| 0.33 | 1.589 | 68.72 | 308.51 | 3792.03 |

| 0.36 | 1.592 | 68.67 | 310.28 | 3815.69 |

| 0.08 | 1.591 | 68.57 | 308.16 | 3810.23 |

| 0.09 | 1.590 | 68.56 | 307.96 | 3812.64 |

| 0.11 | 1.588 | 68.54 | 307.57 | 3817.19 |

| 0.12 | 1.587 | 68.53 | 307.38 | 3819.59 |

| 0.096 | 1.643 | 68.59 | 327.74 | 3902.40 |

| 0.108 | 1.615 | 68.57 | 317.46 | 3857.67 |

| 0.132 | 1.564 | 68.53 | 298.57 | 3773.95 |

| 0.144 | 1.540 | 68.51 | 289.87 | 3734.09 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jani, M.Y.; Betheja, M.R.; Bhadoriya, A.; Chaudhari, U.; Abbas, M.; Alqahtani, M.S. Optimal Pricing Policies with an Allowable Discount for Perishable Items under Time-Dependent Sales Price and Trade Credit. Mathematics 2022, 10, 1948. https://doi.org/10.3390/math10111948

Jani MY, Betheja MR, Bhadoriya A, Chaudhari U, Abbas M, Alqahtani MS. Optimal Pricing Policies with an Allowable Discount for Perishable Items under Time-Dependent Sales Price and Trade Credit. Mathematics. 2022; 10(11):1948. https://doi.org/10.3390/math10111948

Chicago/Turabian StyleJani, Mrudul Y., Manish R. Betheja, Amrita Bhadoriya, Urmila Chaudhari, Mohamed Abbas, and Malak S. Alqahtani. 2022. "Optimal Pricing Policies with an Allowable Discount for Perishable Items under Time-Dependent Sales Price and Trade Credit" Mathematics 10, no. 11: 1948. https://doi.org/10.3390/math10111948

APA StyleJani, M. Y., Betheja, M. R., Bhadoriya, A., Chaudhari, U., Abbas, M., & Alqahtani, M. S. (2022). Optimal Pricing Policies with an Allowable Discount for Perishable Items under Time-Dependent Sales Price and Trade Credit. Mathematics, 10(11), 1948. https://doi.org/10.3390/math10111948