Benefits of Advance Payments of Tax on Profit: Consideration within the Brusov–Filatova–Orekhova (BFO) Theory

Abstract

:1. Introduction

1.1. The Importance of Consideration of Upfront Payments

1.2. A Literature Review on the Evolution of the Theory of the Cost of Capital and the Capital Structure

- (1)

- The Modigliani–Miller (MM) theory, created by Nobel Prize winners in 1958 [1], was the first quantitative theory of capital structure. It was based on many restrictions, the main of which were the absence of taxes and the perpetual nature of all financial flows and companies. The first limitation was removed by the MMs themselves [2,3], and the following formulas were obtained:For tax shield, TS:TS = DT;For company value, V (financially independent company V0, leverage company, V:For weighted average cost of capital, WACC:For equity cost, ke:

- (2)

- In 1969, Hamada [4] derived the following formula for the leveraged company equity cost, accounting both financial and business risk of company, and united the Modigliani–Miller theory with the Capital Asset Pricing Model (CAPM):where bU is the β-coefficient of the company of the same group of business risk, that the considering company, but with L = 0.

- (3)

- Merton Miller in 1977 [5] took into account the corporate and individual taxes. He got for the capitalization of the financially independent company the following formula:Here, TC–the tax on corporate income rate, TS–the tax rate on income of an individual investor from his ownership by corporation stock, TD–tax rate on interest income from the provision of investor–individuals of credits to other investors and companies.

- (4)

- (5)

- The problem of tax pressure is actual in most countries. The article [11] was the first empirical study of the impact of tax pressure on the financial equilibrium of energy companies. The obtained results showed that tax pressure has stronger impacts on the equilibrium (both the short- and long-term) of oil and electricity companies than of gas companies. The research could be useful to energy companies managers underestimating the equilibrium state evolution of the company considering different possible financial crises.

- (6)

- Batrancea [12] used econometric models with two-stage least squares (2SLS) panel and panel generalized method of moments (GMM) to study how financial liquidity and financial solvency impact the performance of healthcare companies. It follows from an empirical evidence that such financial parameters as current liquidity ratio, quick liquidity ratio, and financial leverage significantly influenced company performance measured by return on assets, gross margin ratio, operating margin ratio, taxes, earnings before interest, amortization and depreciation. Based on liquidity and solvency insights, the strategies were also addressed with the intention to improve business performance.

- (7)

- In 2008, Brusov, Filatova, and Orekhova [13] lifted up the limitation concerning the perpetuity of flows and companies and created the modern theory of capital cost and capital structure—the BFO theory—which describes the companies of arbitrary age (and arbitrary lifetime). The generalization of the MM theory for the companies of arbitrary age (and arbitrary lifetime) required the modification of the valuation of the tax shield TS, as well as of the valuation of the company capitalization: financially independent, V0, as well as financially dependent, V.

- (8)

- Recently, we modified the Modigliani–Miller theory for the case of advanced payments of income tax [10] and have shown that obtained results are quite different from ones the in “classical” Modigliani–Miller theory.

2. Modification of the Brusov–Filatova–Orekhova (BFO) Theory for Companies with Advance Payments of Tax on Income

2.1. Calculation of the Tax Shield

2.2. Company Value

2.3. The Weighted Average Cost of Capital, WACC

2.4. Calculation of the Equity Cost

3. Results

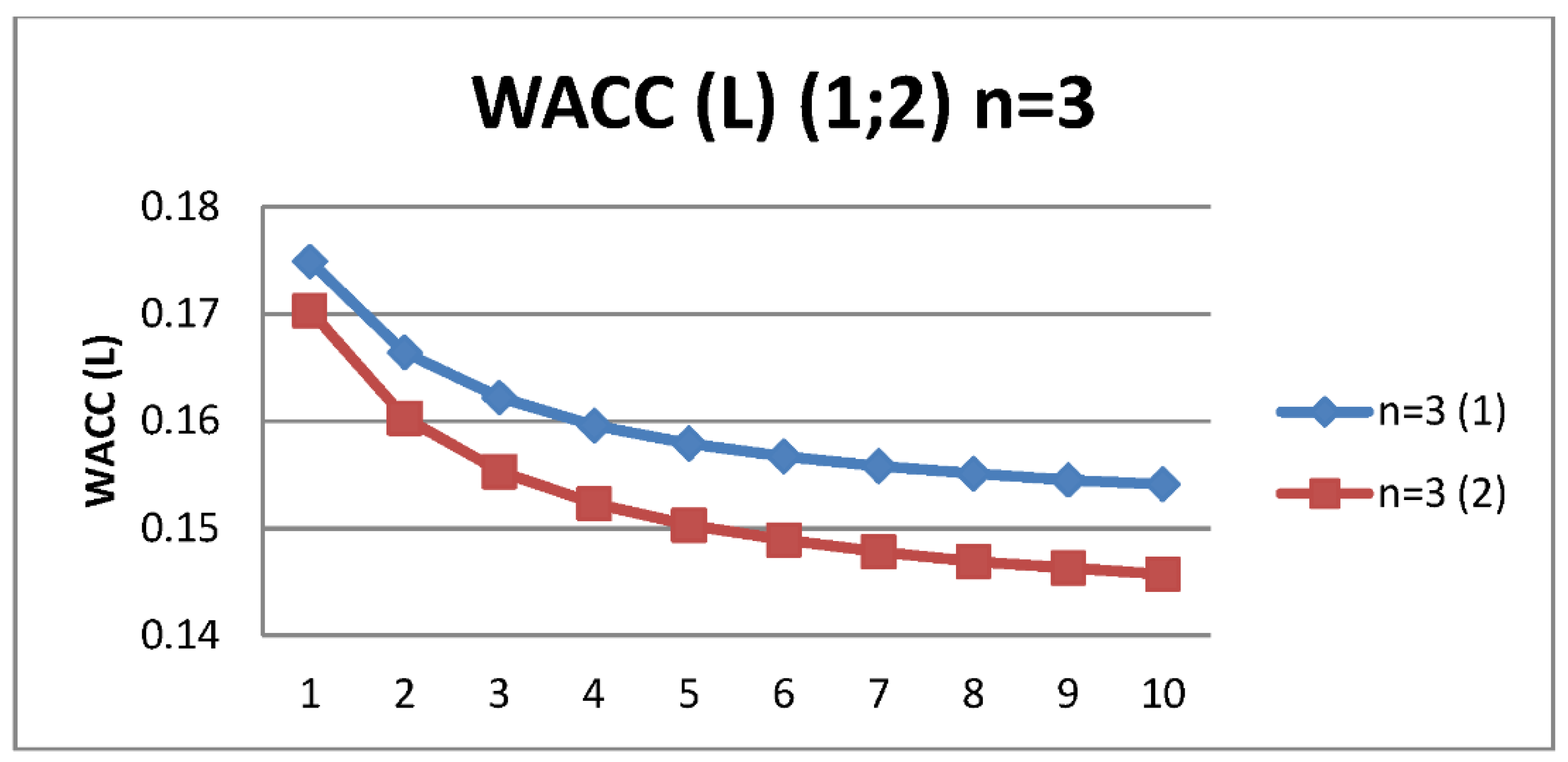

3.1. Dependence of the Weighted Average Cost of Capital, WACC, Capital Value, V, Equity Cost, ke, on Leverage Level L for Three-Year Company

3.2. Dependence of the Weighted Average Cost of Capital, WACC, Capital Value, V, Equity Cost, ke, on Leverage Level L for Six-Year Company

4. Comparison of Results for Three-Year and Six-Year Companies

5. Discussion and Conclusions

- WACC(L) decreases with L in both cases: advanced payments of income tax and payments at the ends of years. This means that debt financing is important and should be used by a company—it leads to a decrease of attracting capital cost with L.

- WACC turns out to be lower in the case of advanced payments of income tax; this tells about the importance of the use of advanced payments of income tax for companies.

- WACC decreases with company age: this is one of the important results of the classical BFO theory.

- Company value, V, increases with L in both cases; this follows from the decrease of attracting capital cost with L.

- Company value, V, turns out to be bigger in the case of advanced payments of income tax: this tells about the importance of the use of advanced payments of income tax for companies.

- Company value, V, increases with company age.

- Equity cost ke decreases with company age in both cases: this is one of the important results of the classical BFO theory.

- Equity cost ke increases with leverage level L in the case of payments of income tax at the end of the year.

- Equity cost ke decreases with leverage level L in the case of advanced payments of income tax. This means the discovery of a qualitatively new effect that can greatly change the company’s dividend policy, because the economically justified amount of dividends is equal to the equity cost.

- we consider for the first time the generalization of the BFO theory for the case of advance payments on income tax.

- we show that the impact of the transition to advance payments is much more significant than in the case of a perpetuity limit (the “classical” Modigliani–Miller theory)

- we discovered a qualitatively new effect in the dependence of equity cost on leverage: this is a pioneering result that radically changes the company’s dividend policy.

- we developed the recommendations to the regulator to expand the practice of advance payments on income tax, giving to it a clear understanding that such a practice is beneficial to both parties: companies and the state.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Modigliani, F.; Miller, M. The cost of capital, corporate finance, and the theory of investment. Am. Econ. Rev. 1958, 48, 261–297. [Google Scholar]

- Modigliani, F.; Miller, M. Corporate income taxes and the cost of capital: A correction. Am. Econ. Rev. 1963, 53, 147–175. [Google Scholar]

- Modigliani, F.; Miller, M. Some estimates of the cost of capital to the electric utility industry 1954–1957. Am. Econ. Rev. 1966, 56, 333–391. [Google Scholar]

- Hamada, R. Portfolio Analysis, Market Equilibrium, and Corporate Finance. J. Financ. 1969, 24, 13–31. [Google Scholar] [CrossRef]

- Miller, M. Debt and taxes. J. Financ. 1977, 32, 261–275. [Google Scholar] [CrossRef]

- Farber, A.; Gillet, R.; Szafarz, A.A. General Formula for the WACC. Int. J. Bus. 2006, 11, 211–218. [Google Scholar]

- Fernandez, P.A. General Formula for the WACC: A Comment. Int. J. Bus. 2006, 11, 219. [Google Scholar]

- Berk, J.; De Marzo, P. Corporate Finance; Pearson-Addison Wesley: Boston, MA, USA, 2007. [Google Scholar]

- Harris, R.; Pringle, J. Risk–Adjusted Discount Rates-Extension form the Average-Risk Case. J. Financ. Res. 1985, 8, 237–244. [Google Scholar] [CrossRef]

- Brusov, P.N.; Filatova, T.V.; Orekhova, N.P.; Kulik, V.L.; Chang, S.-I.; Lin, Y.C.G. Modification of the Modigliani-Miller Theory for the Case of Advance Payments of Tax on Profit. J. Rev. Glob. Econ. 2020, 9, 257–267. [Google Scholar] [CrossRef]

- Batrancea, L. An Econometric Approach Regarding the Impact of Fiscal Pressure on Equilibrium: Evidence from Electricity, Gas and Oil Companies Listed on the New York Stock Exchange. Mathematics 2021, 9, 630. [Google Scholar] [CrossRef]

- Batrancea, L. The Influence of Liquidity and Solvency on Performance within the Healthcare Industry: Evidence from Publicly Listed Companies. Mathematics 2021, 9, 2231. [Google Scholar] [CrossRef]

- Brusov, P.; Filatova, T.; Orehova, N.; Eskindarov, M. Modern Corporate Finance, Investments, Taxation and Ratings, 2nd ed.; Springer Nature Publishing: Cham, Switzerland, 2018; pp. 1–571. [Google Scholar]

- Myers, S. Capital structure. J. Econ. Perspect. 2001, 15, 81–102. [Google Scholar] [CrossRef]

- Dimitropoulos, P. Capital structure and corporate governance of soccer clubs: European evidence. Manag. Res. Rev. 2014, 37, 658–678. [Google Scholar] [CrossRef]

- Luiz, K.; Cruz, M. The relevance of capital structure on firm performance: A multivariate analysis of publicly traded Brazilian companies. REPeC Brasília 2015, 9, 384–401. [Google Scholar]

- Massimiliano, B. On the risk–neutral value of debt tax shields. Appl. Financ. Econ. 2011, 22, 251–258. [Google Scholar]

- Zhukov, P. The Impact of Cash Flows and Weighted Average Cost of Capital to Enterprise Value in the Oil and Gas Sector. J. Rev. Glob. Econ. 2018, 7, 138–145. [Google Scholar]

- Franc-Dąbrowska, J.; Mądra-Sawicka, M.; Milewska, A. Energy Sector Risk and Cost of Capital Assessment—Companies and Investors Perspective. Energies 2021, 14, 1613. [Google Scholar] [CrossRef]

- Angotti, M.; de Lacerda Moreira, R.; Hipólito Bernardes do Nascimento, J.; Neto de Almeida Bispo, O. Analysis of an equity investment strategy based on accounting and financial reports in Latin American markets. Reficont 2018, 5, 22–40. [Google Scholar]

- Vergara-Novoa, C.; Sepúlveda-Rojas, J.P.; Miguel, D.A.; Nicolás, R. Cost of Capital Estimation For Highway Concessionaires in Chile. J. Adv. Transp. 2018, 2153536. [Google Scholar] [CrossRef]

| n = 3 | WACC | ke | V | |||

|---|---|---|---|---|---|---|

| L | 1 | 2 | 1 | 2 | 1 | 2 |

| 1 | 0.1749 | 0.1703 | 0.2057 | 0.1966 | 219.2281 | 220.8472 |

| 2 | 0.1664 | 0.1603 | 0.2113 | 0.1930 | 222.2455 | 224.4700 |

| 3 | 0.1622 | 0.1553 | 0.2168 | 0.1892 | 223.7856 | 226.3263 |

| 4 | 0.1596 | 0.1523 | 0.2222 | 0.1855 | 224.7199 | 227.4549 |

| 5 | 0.1579 | 0.1503 | 0.2277 | 0.1817 | 225.3471 | 228.2136 |

| 6 | 0.1567 | 0.1489 | 0.2331 | 0.1780 | 225.7973 | 228.7586 |

| 7 | 0.1558 | 0.1478 | 0.2386 | 0.1742 | 226.1361 | 229.1691 |

| 8 | 0.1551 | 0.1469 | 0.2440 | 0.1704 | 226.4003 | 229.4893 |

| 9 | 0.1545 | 0.1463 | 0.2495 | 0.1666 | 226.6122 | 229.7462 |

| 10 | 0.1541 | 0.1457 | 0.2549 | 0.1628 | 226.7858 | 229.9568 |

| n = 6 | WACC | ke | V | |||

|---|---|---|---|---|---|---|

| L | 1 | 2 | 1 | 2 | 1 | 2 |

| 1 | 0.1743 | 0.1697 | 0.2047 | 0.1953 | 354.8940 | 359.2385 |

| 2 | 0.1657 | 0.1593 | 0.2090 | 0.1900 | 363.0242 | 369.1124 |

| 3 | 0.1613 | 0.1542 | 0.2131 | 0.1846 | 367.2305 | 374.2557 |

| 4 | 0.1586 | 0.1510 | 0.2172 | 0.1791 | 369.8015 | 377.4110 |

| 5 | 0.1569 | 0.1489 | 0.2213 | 0.1736 | 371.5355 | 379.5443 |

| 6 | 0.1556 | 0.1474 | 0.2254 | 0.1680 | 372.7841 | 381.0830 |

| 7 | 0.1547 | 0.1463 | 0.2294 | 0.1624 | 373.7261 | 382.2451 |

| 8 | 0.1539 | 0.1454 | 0.2335 | 0.1569 | 374.4620 | 383.1540 |

| 9 | 0.1534 | 0.1447 | 0.2376 | 0.1513 | 375.0529 | 383.8841 |

| 10 | 0.1529 | 0.1442 | 0.2416 | 0.1457 | 375.5377 | 384.4836 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Brusov, P.; Filatova, T.; Kulik, V. Benefits of Advance Payments of Tax on Profit: Consideration within the Brusov–Filatova–Orekhova (BFO) Theory. Mathematics 2022, 10, 2013. https://doi.org/10.3390/math10122013

Brusov P, Filatova T, Kulik V. Benefits of Advance Payments of Tax on Profit: Consideration within the Brusov–Filatova–Orekhova (BFO) Theory. Mathematics. 2022; 10(12):2013. https://doi.org/10.3390/math10122013

Chicago/Turabian StyleBrusov, Peter, Tatiana Filatova, and Veniamin Kulik. 2022. "Benefits of Advance Payments of Tax on Profit: Consideration within the Brusov–Filatova–Orekhova (BFO) Theory" Mathematics 10, no. 12: 2013. https://doi.org/10.3390/math10122013