Technology Spillovers among Innovation Agents from the Perspective of Network Connectedness

Abstract

:1. Introduction

2. Literature Review

2.1. Technology Spillovers among Innovation Agents

2.2. Technology Spillover Analysis from the Perspective of Network Connectedness

3. Conceptual Framework

3.1. Construction of Technology Spillover Connectedness Index and Connectedness Matrix

3.2. Data Source

4. Static Analysis of the Technology Spillover Connectedness among the Innovation Agents

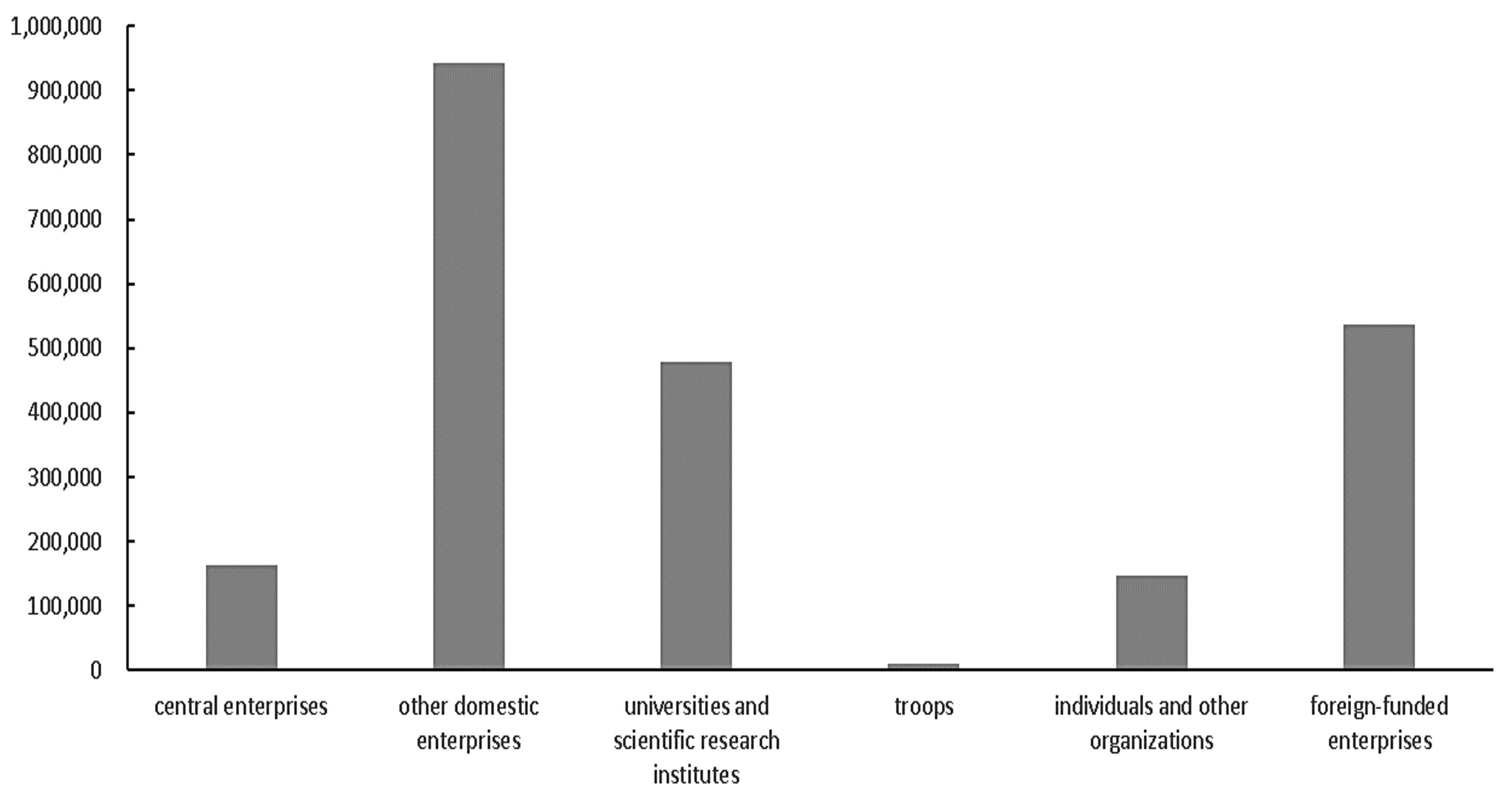

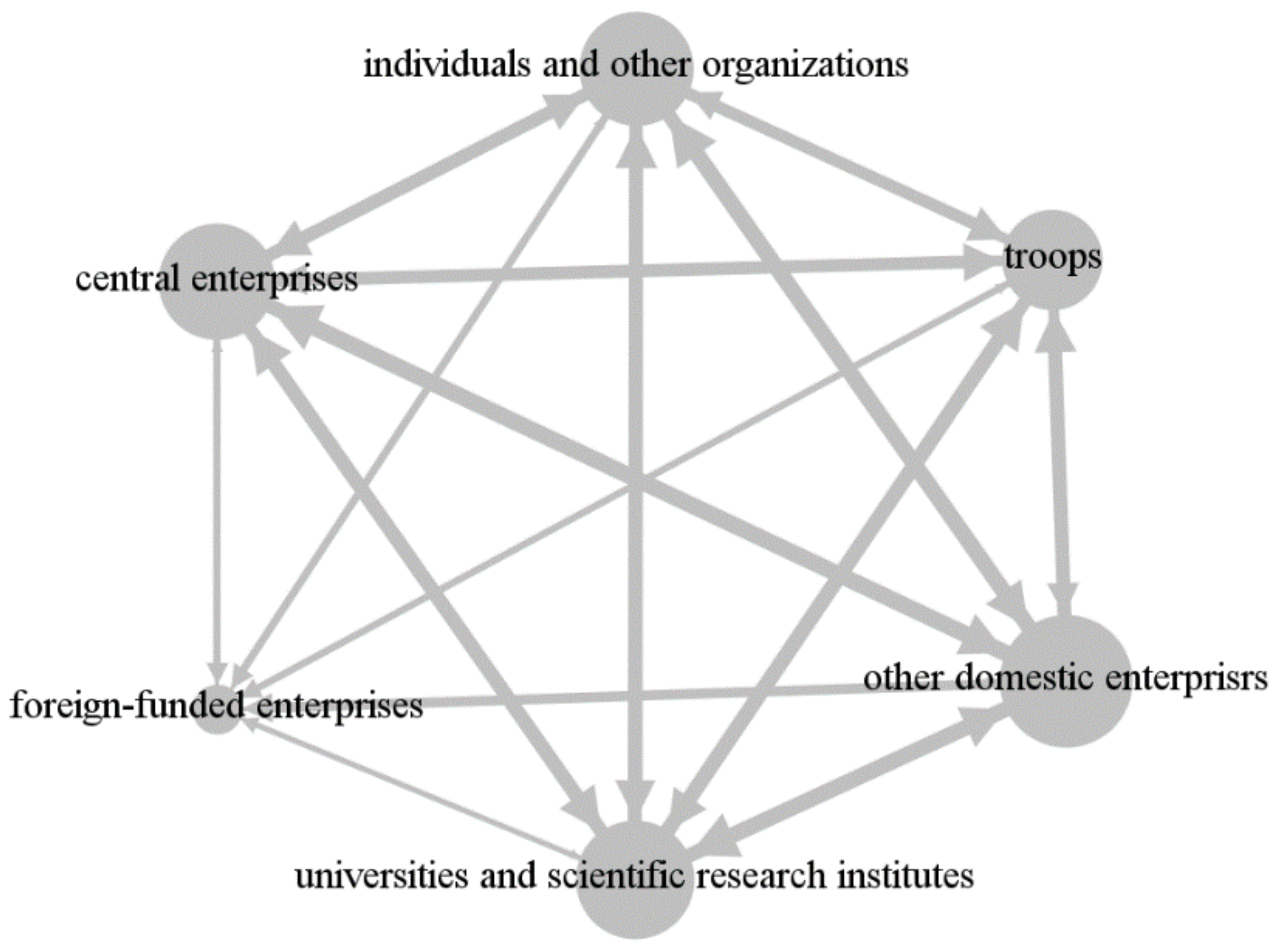

4.1. Analysis of Technology Spillover Connectedness among the Six Innovation Agents

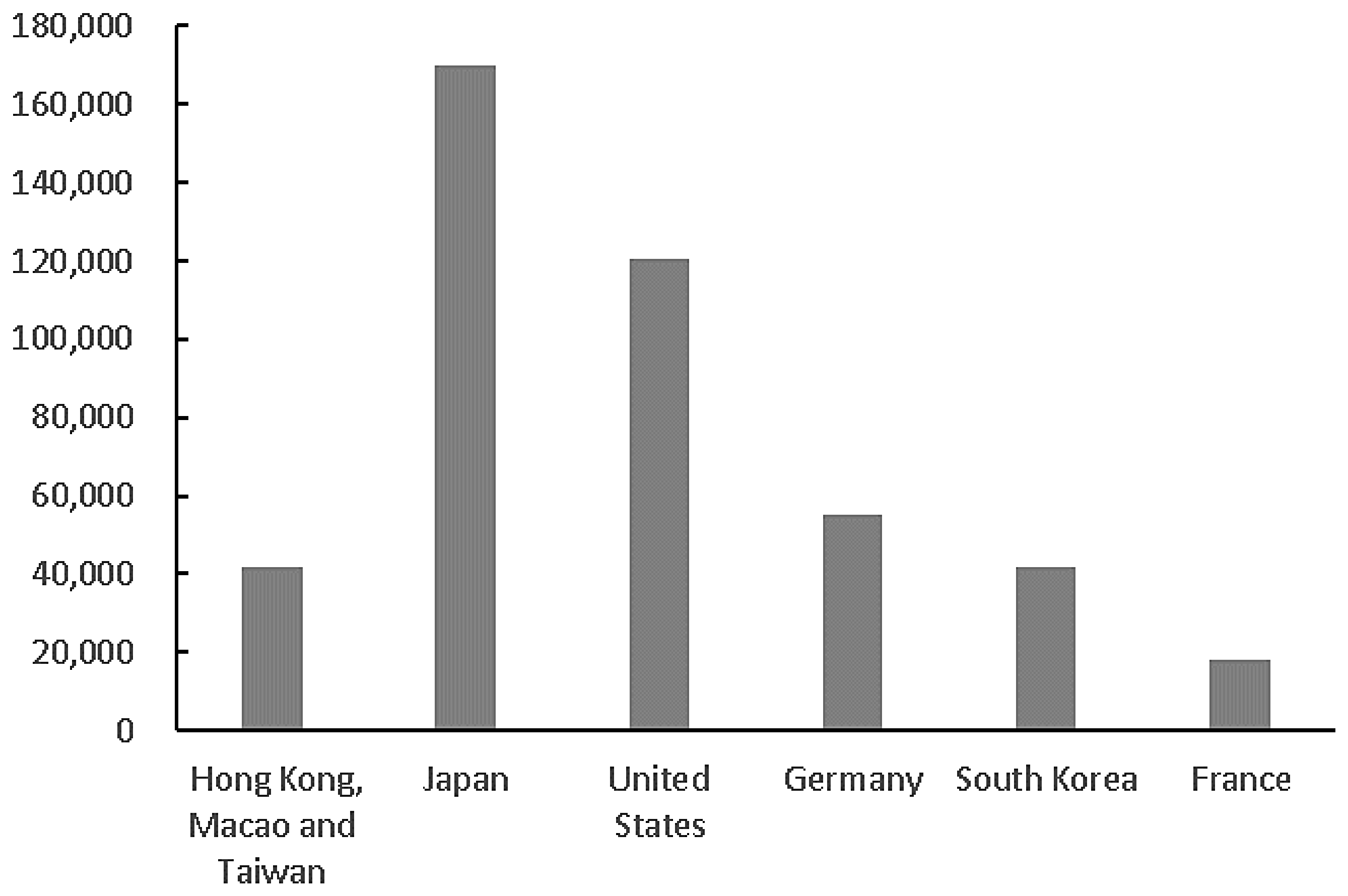

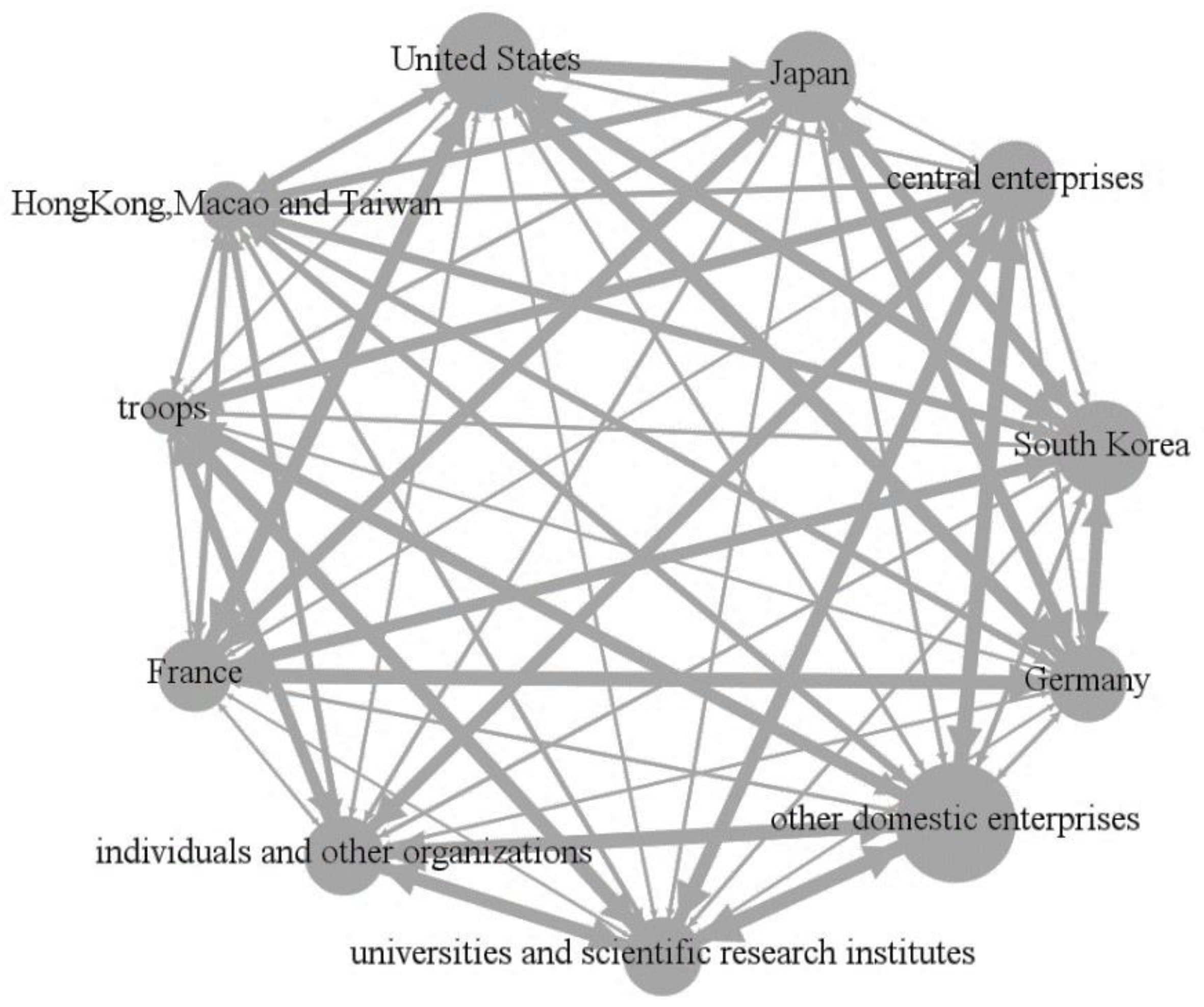

4.2. Analysis of Technology Spillover Connectedness among the Eleven Innovation Agents

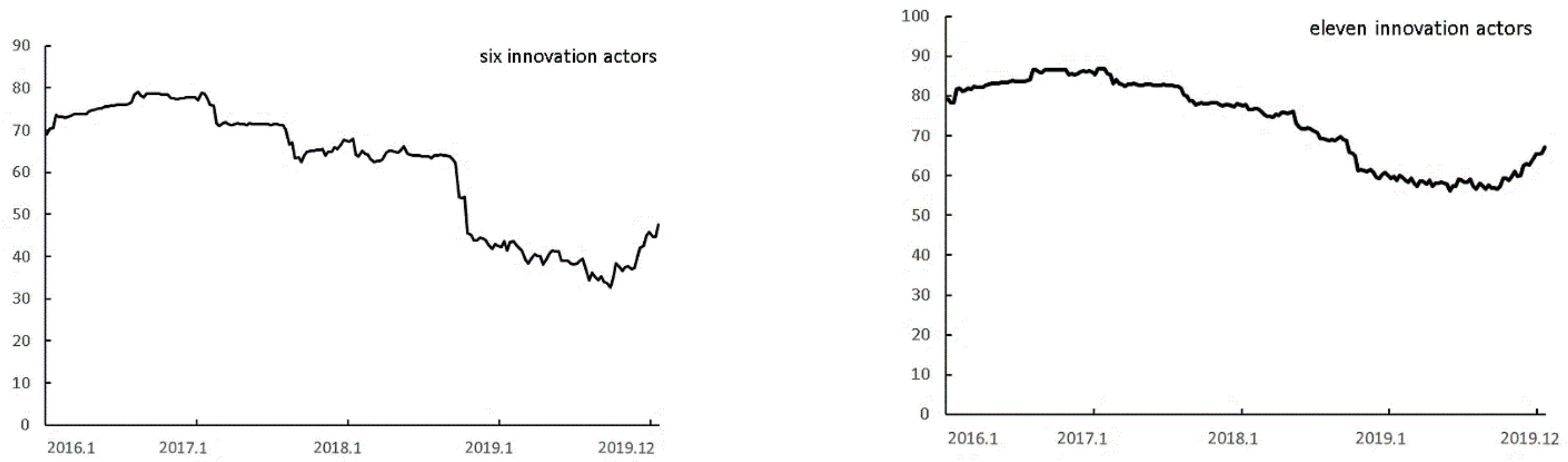

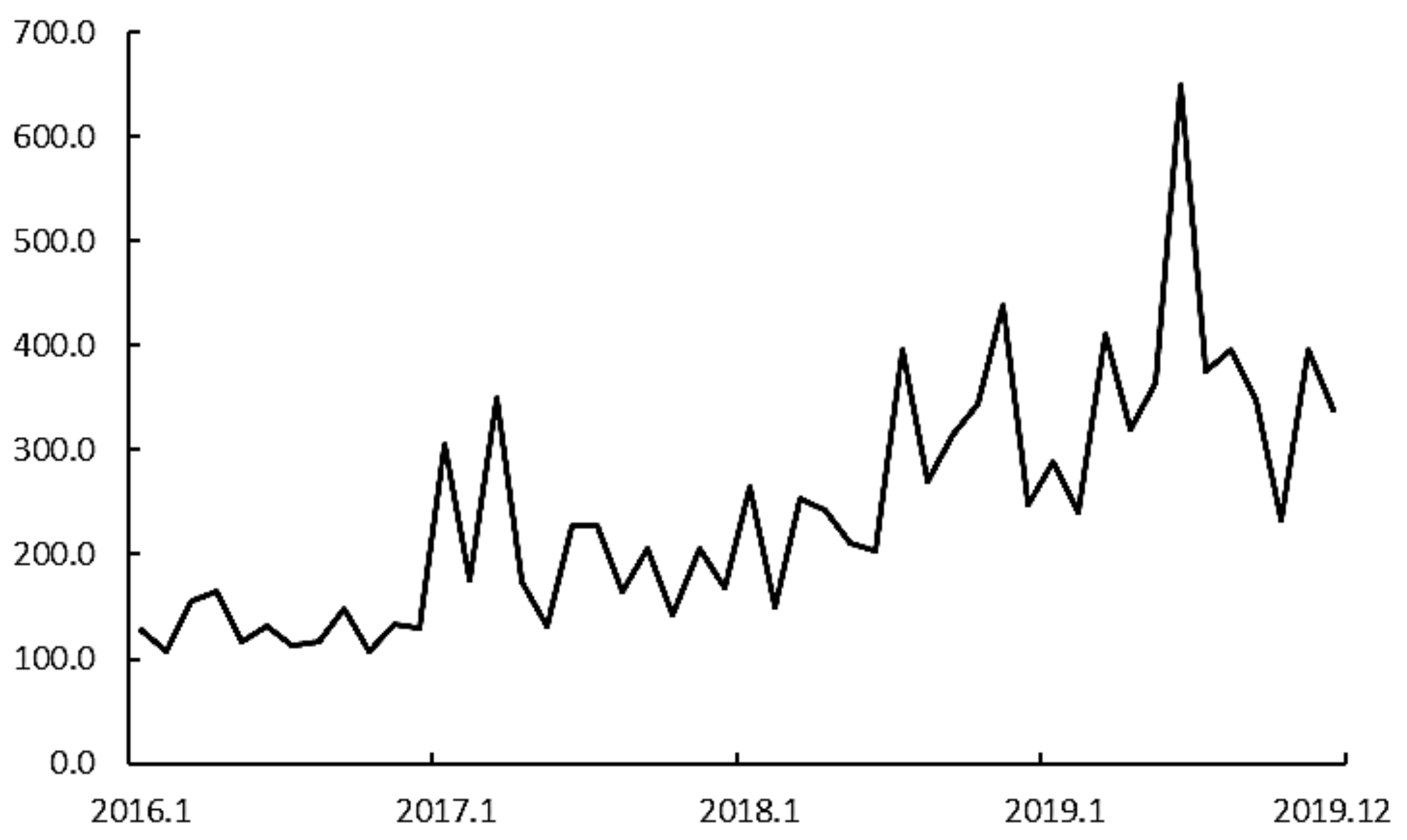

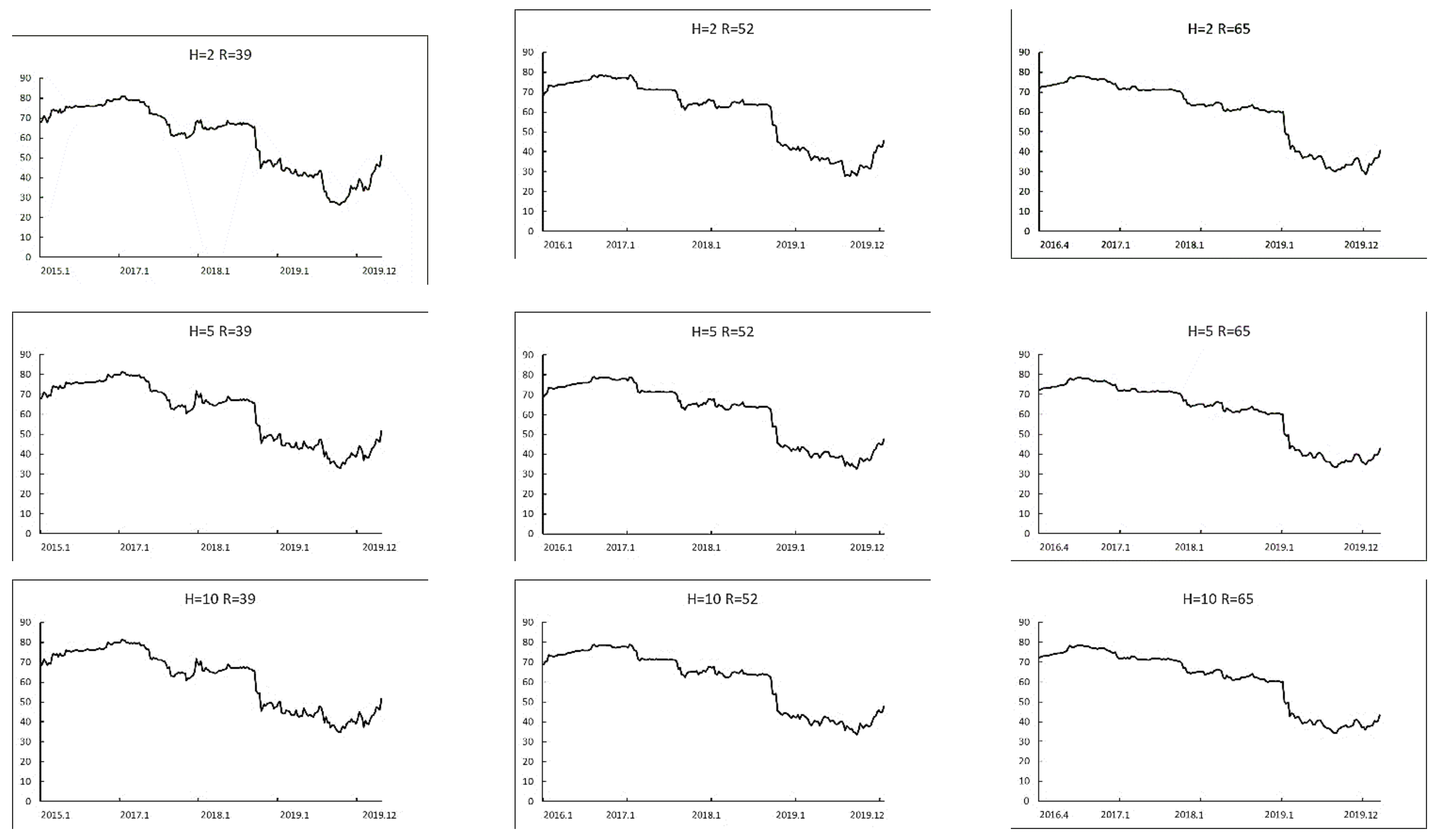

5. Dynamic Analysis of the Technology Spillover Connectedness among the Innovation Agents

6. Conclusions and Discussion

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Grossman, G.M.; Helpman, E. Endogenous innovation in the theory of growth. J. Econ. Perspect. 1994, 8, 23–44. [Google Scholar] [CrossRef] [Green Version]

- Hasan, I.; Tucci, C.L. The innovation–economic growth nexus: Global evidence. Res. Policy 2010, 39, 1264–1276. [Google Scholar] [CrossRef] [Green Version]

- Yglesias, E. Porter vs. Porter: Modeling the technological competitiveness of nations. Scientometrics 2003, 57, 281–293. [Google Scholar] [CrossRef]

- Maskus, K.E. Encouraging International Technology Transfer; International Centre for Trade and Sustainable Development (ICTSD): Geneva, Switzerland, 2004. [Google Scholar]

- Griliches, Z. Issues in assessing the contribution of research and development to productivity growth. Bell J. Econ. 1979, 10, 92–116. [Google Scholar] [CrossRef]

- Sun, Y.; Liu, F. Measuring international trade-related technology spillover: A composite approach of network analysis and information theory. Scientometrics 2013, 94, 963–979. [Google Scholar] [CrossRef]

- Chuang, Y.C.; Hsu, P.F. FDI, trade, and spillover efficiency: Evidence from China’s manufacturing sector. Appl. Econ. 2004, 36, 1103–1115. [Google Scholar] [CrossRef]

- Liu, X.; Buck, T. Innovation performance and channels for international technology spillovers: Evidence from Chinese high-tech industries. Res. Policy 2007, 36, 355–366. [Google Scholar] [CrossRef]

- Grossman, G.M.; Helpman, E. Trade, knowledge spillovers, and growth. Eur. Econ. Rev. 1991, 35, 517–526. [Google Scholar] [CrossRef] [Green Version]

- Das, G.G. Trade-induced technology spillover and adoption: A quantitative general equilibrium application. J. Econ. Dev. 2002, 27, 21–44. [Google Scholar]

- Madsen, J.B. Technology spillover through trade and TFP convergence: 135 years of evidence for the OECD countries. J. Int. Econ. 2007, 72, 464–480. [Google Scholar] [CrossRef] [Green Version]

- Cheung, K.Y.; Lin, P. Spillover effects of FDI on innovation in China: Evidence from the provincial data. China Econ. Rev. 2004, 15, 25–44. [Google Scholar] [CrossRef] [Green Version]

- Liu, Z. Foreign direct investment and technology spillover: Evidence from China. J. Comp. Econ. 2002, 30, 579–602. [Google Scholar] [CrossRef]

- Du, J.; Li, H.; Wu, X. Empirical analysis on the negative technology spillover effect of foreign direct investment in China. Asian J. Technol. Innov. 2008, 16, 133–151. [Google Scholar] [CrossRef]

- Lu, Y.; Tao, Z.; Zhu, L. Identifying FDI spillovers. J. Int. Econ. 2017, 107, 75–90. [Google Scholar] [CrossRef]

- Jaffe, A.B.; Trajtenberg, M.; Henderson, R. Geographic localization of knowledge spillovers as evidenced by patent citations. Q. J. Econ. 1993, 108, 577–598. [Google Scholar] [CrossRef]

- Criscuolo, P.; Narula, R.; Verspagen, B. Role of home and host country innovation systems in R&D internationalisation: A patent citation analysis. Econ. Innov. New Technol. 2005, 14, 417–433. [Google Scholar]

- Thompson, P.; Fox-Kean, M. Patent citations and the geography of knowledge spillovers: A reassessment. Am. Econ. Rev. 2005, 95, 450–460. [Google Scholar] [CrossRef] [Green Version]

- Chen, Z.; Guan, J. The impact of small world on innovation: An empirical study of 16 countries. J. Informetr. 2010, 4, 97–106. [Google Scholar] [CrossRef]

- Guan, J.; Chen, Z. Patent collaboration and international knowledge flow. Inf. Processing Manag. 2012, 48, 170–181. [Google Scholar] [CrossRef]

- Seibert, S.E.; Kacmar, K.M.; Kraimer, M.L.; Downes, P.E.; Noble, D. The role of research strategies and professional networks in management scholars’ productivity. J. Manag. 2017, 43, 1103–1130. [Google Scholar] [CrossRef]

- Yaşar, M.; Paul, C.J.M. Firm performance and knowledge spillovers from academic, industrial and foreign linkages: The case of China. J. Product. Anal. 2012, 38, 237–253. [Google Scholar] [CrossRef]

- Chen, S.H.; Lin, W.T. The dynamic role of universities in developing an emerging sector: A case study of the biotechnology sector. Technol. Forecast. Soc. Chang. 2017, 123, 283–297. [Google Scholar] [CrossRef]

- Rubin, T.H.; Aas, T.H.; Stead, A. Knowledge flow in technological business incubators: Evidence from Australia and Israel. Technovation 2015, 41, 11–24. [Google Scholar] [CrossRef]

- Chen, H.; Song, X.; Jin, Q.; Wang, X. Network dynamics in university-industry collaboration: A collaboration-knowledge dual-layer network perspective. Scientometrics 2022, 1–24. [Google Scholar] [CrossRef]

- Cao, X.; Li, C. Evolutionary game simulation of knowledge transfer in industry-university-research cooperative innovation network under different network scales. Sci. Rep. 2020, 10, 1–13. [Google Scholar] [CrossRef] [Green Version]

- Mao, C.; Yu, X.; Zhou, Q.; Harms, R.; Fang, G. Knowledge growth in university-industry innovation networks–Results from a simulation study. Technol. Forecast. Soc. Chang. 2020, 151, 119746. [Google Scholar] [CrossRef]

- Yu, S.; Yuizono, T. A Proximity Approach to Understanding University-Industry Collaborations for Innovation in Non-Local Context: Exploring the Catch-Up Role of Regional Absorptive Capacity. Sustainability 2021, 13, 3539. [Google Scholar] [CrossRef]

- Wu, Y.; Gu, X.; Tu, Z.; Zhang, Z. System dynamic analysis on industry-university-research institute synergetic innovation process based on knowledge flow. Scientometrics 2022, 127, 1317–1338. [Google Scholar] [CrossRef]

- Qiu, S.; Liu, X.; Gao, T. Do emerging countries prefer local knowledge or distant knowledge? Spillover effect of university collaborations on local firms. Res. Policy 2017, 46, 1299–1311. [Google Scholar] [CrossRef]

- Markusen, J.R.; Venables, A.J. Foreign direct investment as a catalyst for industrial development. Eur. Econ. Rev. 1999, 43, 335–356. [Google Scholar] [CrossRef] [Green Version]

- Lou, J.; Wang, S. Public Finance in China: Reform and Growth for A Harmonious Society; World Bank Publications: Washington, DC, USA, 2008. [Google Scholar]

- Motohashi, K.; Yuan, Y. Productivity impact of technology spillover from multinationals to local firms: Comparing China’s automobile and electronics industries. Res. Policy 2010, 39, 790–798. [Google Scholar] [CrossRef]

- Del Giudice, M.; Scuotto, V.; Garcia-Perez, A.; Petruzzelli, A.M. Shifting Wealth II in Chinese economy. The effect of the horizontal technology spillover for SMEs for international growth. Technol. Forecast. Soc. Chang. 2019, 145, 307–316. [Google Scholar] [CrossRef]

- Bin, G. Technological development, technology spillover and profitability: An industry level empirical analysis of Chinese manufacturing industries. Technol. Anal. Strateg. Manag. 2005, 17, 279–292. [Google Scholar] [CrossRef]

- Lasagni, A. How can external relationships enhance innovation in SMEs? New evidence for Europe. J. Small Bus. Manag. 2012, 50, 310–339. [Google Scholar] [CrossRef]

- Zeng, S.X.; Xie, X.M.; Tam, C.M. Relationship between cooperation networks and innovation performance of SMEs. Technovation 2010, 30, 181–194. [Google Scholar] [CrossRef]

- Gui, Q.; Liu, C.; Du, D.B. The structure and dynamic of scientific collaboration network among countries along the Belt and Road. Sustainability 2019, 11, 5187. [Google Scholar] [CrossRef] [Green Version]

- Singh, J. Collaborative networks as determinants of knowledge diffusion patterns. Manag. Sci. 2005, 51, 756–770. [Google Scholar] [CrossRef] [Green Version]

- Wei, L.T.; Goang, Y.W.; Sheng, H.T.; Kuei, L.K.; Lo, T.-W.; Yang, W.-G.; Hung, T.-S.; Lai, K.-K. Technological spillovers of transferred inventors from the perspective of Social Network Analysis (SNA). Afr. J. Bus. Manag. 2011, 5, 8192–8203. [Google Scholar] [CrossRef]

- Zacchia, P. Knowledge spillovers through networks of scientists. Rev. Econ. Stud. 2020, 87, 1989–2018. [Google Scholar] [CrossRef] [Green Version]

- Tajpour, M.; Hosseini, E.; Mohammadi, M.; Bahman-Zangi, B. The Effect of Knowledge Management on the Sustainability of Technology-Driven Businesses in Emerging Markets: The Mediating Role of Social Media. Sustainability 2022, 14, 8602. [Google Scholar] [CrossRef]

- Han, Y.; Park, Y. Patent network analysis of inter-industrial knowledge flows: The case of Korea between traditional and emerging industries. World Pat. Inf. 2006, 28, 235–247. [Google Scholar] [CrossRef]

- Bergé, L.R.; Wanzenböck, I.; Scherngell, T. Centrality of regions in R&D networks: A new measurement approach using the concept of bridging paths. Reg. Stud. 2017, 51, 1165–1178. [Google Scholar]

- De Noni, I.; Orsi, L.; Belussi, F. The role of collaborative networks in supporting the innovation performances of lagging-behind European regions. Res. Policy 2018, 47, 1–13. [Google Scholar] [CrossRef]

- Fleming, L.; King, C., III; Juda, A., I. Small worlds and regional innovation. Organ. Sci. 2007, 18, 938–954. [Google Scholar] [CrossRef] [Green Version]

- Maggioni, M.A.; Uberti, T.E.; Usai, S. Treating patents as relational data: Knowledge transfers and spillovers across Italian provinces. Ind. Innov. 2011, 18, 39–67. [Google Scholar] [CrossRef]

- Xiang, X.-Y.; Cai, H.; Lam, S.; Pei, Y.-L. International knowledge spillover through co-inventors: An empirical study using Chinese assignees’ patent data. Technol. Forecast. Soc. Chang. 2013, 80, 161–174. [Google Scholar] [CrossRef]

- Shih, H.Y.; Chang, T.L.S. International diffusion of embodied and disembodied technology: A network analysis approach. Technol. Forecast. Soc. Chang. 2009, 76, 821–834. [Google Scholar] [CrossRef]

- Yang, W.; Yu, X.; Zhang, B.; Huang, Z. Mapping the landscape of international technology diffusion (1994–2017): Network analysis of transnational patents. J. Technol. Transf. 2021, 46, 138–171. [Google Scholar] [CrossRef]

- Wanzenboeck, I.; Scherngell, T.; Brenner, T. Embeddedness of regions in European knowledge networks: A comparative analysis of inter-regional R&D collaborations, co-patents and co-publications. Ann. Reg. Sci. 2014, 53, 337–368. [Google Scholar]

- Diebold, F.X.; Yilmaz, K. Better to Give than to Receive: Predictive Directional Measurement of Volatility Spillovers. Int. J. Forecast. 2012, 28, 57–66. [Google Scholar] [CrossRef] [Green Version]

- Diebold, F.X.; Yilmaz, K. On the network topology of variance decompositions: Measuring the connectedness of financial firms. J. Econom. 2014, 182, 119–134. [Google Scholar] [CrossRef] [Green Version]

- Xu, W.; Ma, F.; Chen, W.; Zhang, B. Asymmetric volatility spillovers between oil and stock markets: Evidence from China and the United States. Energy Econ. 2019, 80, 310–320. [Google Scholar] [CrossRef]

- Yoon, S.-M.; Al Mamun, M.; Uddin, G.S.; Kang, S.H. Network connectedness and net spillover between financial and commodity markets. North Am. J. Econ. Financ. 2019, 48, 801–818. [Google Scholar] [CrossRef]

- Bouri, E.; Cepni, O.; Gabauer, D.; Gupta, R. Return connectedness across asset classes around the COVID-19 outbreak. Int. Rev. Financ. Anal. 2021, 73, 101646. [Google Scholar] [CrossRef]

- Bhattacharya, U.; Hsu, P.H.; Tian, X.; Xu, Y. What affects innovation more: Policy or policy uncertainty? J. Financ. Quant. Anal. 2017, 52, 1869–1901. [Google Scholar] [CrossRef] [Green Version]

| FROM | |||||

|---|---|---|---|---|---|

| TO |

| Innovation Agents | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|

| Central enterprises | 6.010 | 6.912 | 7.847 | 7.758 | 7.309 |

| Other domestic enterprises | 38.029 | 39.488 | 40.565 | 44.249 | 43.631 |

| Universities and scientific research institutes | 19.918 | 18.691 | 21.834 | 20.949 | 23.284 |

| Troops | 0.393 | 0.364 | 0.434 | 0.410 | 0.446 |

| Individuals and other organizations | 8.011 | 7.405 | 6.741 | 6.266 | 4.441 |

| Foreign-funded enterprises | 27.640 | 27.140 | 22.579 | 20.368 | 20.889 |

| Total | 100 | 100 | 100 | 100 | 100 |

| Central Enterprises | Other Domestic Enterprises | Universities and Scientific Research Institutes | Troops | Individuals and Other Organizations | Foreign-Funded Enterprises | FROM | |

|---|---|---|---|---|---|---|---|

| Central enterprises | 27.061 | 21.967 | 18.198 | 13.028 | 16.76 | 2.987 | 72.939 |

| Other domestic enterprises | 19.372 | 26.145 | 18.892 | 13.049 | 18.664 | 3.878 | 73.855 |

| Universities and scientific research institutes | 18.31 | 20.973 | 24.769 | 16.801 | 17.183 | 1.964 | 75.231 |

| Troops | 16.321 | 18.136 | 20.004 | 27.104 | 15.389 | 3.045 | 72.896 |

| Individuals and other organizations | 16.633 | 21.148 | 18.141 | 12.715 | 28.29 | 3.072 | 71.71 |

| Foreign-funded enterprises | 7.938 | 12.085 | 5.551 | 7.684 | 8.713 | 58.03 | 41.97 |

| TO | 78.573 | 94.309 | 80.787 | 63.276 | 76.709 | 14.946 | 68.1 |

| Order | Agents | NET | TO | FROM | GROSS |

|---|---|---|---|---|---|

| 1 | Other domestic enterprises | 20.454 | 94.309 | 73.855 | 168.164 |

| 2 | Central enterprises | 5.634 | 78.573 | 72.939 | 151.512 |

| 3 | Universities and scientific research institutes | 5.556 | 80.787 | 75.231 | 156.018 |

| 4 | Individuals and other organizations | 4.999 | 76.709 | 71.71 | 148.419 |

| 5 | Troops | −9.62 | 63.276 | 72.896 | 136.172 |

| 6 | Foreign-funded enterprises | −27.024 | 14.946 | 41.97 | 56.916 |

| Innovation Agents | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|

| Hong Kong, Macao and Taiwan | 2.183 | 2.131 | 1.794 | 1.577 | 1.559 |

| Japan | 9.729 | 8.647 | 6.921 | 6.093 | 6.430 |

| The United States | 5.915 | 6.010 | 5.099 | 4.827 | 4.735 |

| Germany | 2.656 | 2.940 | 2.421 | 2.047 | 2.063 |

| South Korea | 1.661 | 1.802 | 1.760 | 1.896 | 2.041 |

| France | 0.928 | 0.974 | 0.765 | 0.641 | 0.668 |

| Total | 23.071 | 22.504 | 18.760 | 17.082 | 17.497 |

| Central Enterprises | Other Domestic Enterprises | Universities and Scientific Research Institutes | Troops | Individuals and Other Organizations | Hong Kong, Macao and Taiwan | The United States | Japan | South Korea | Germany | France | FROM | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Central enterprises | 22.565 | 18.36 | 15.9 | 11.149 | 14.631 | 5.078 | 2.661 | 2.207 | 3.937 | 2.075 | 1.437 | 77.435 |

| Other domestic enterprises | 15.619 | 21.301 | 15.836 | 10.676 | 15.689 | 6.878 | 2.903 | 3.026 | 4.269 | 2.117 | 1.685 | 78.699 |

| Universities and scientific research institutes | 16.485 | 18.832 | 22.226 | 15.164 | 15.431 | 4.331 | 1.493 | 2.037 | 2.241 | 1.09 | 0.67 | 77.774 |

| Troops | 14.325 | 15.764 | 17.734 | 23.921 | 13.584 | 4.225 | 2.311 | 2.346 | 2.844 | 1.501 | 1.446 | 76.079 |

| Individuals and other organizations | 14.545 | 18.38 | 15.578 | 10.949 | 24.31 | 6.284 | 2.006 | 3.023 | 2.372 | 1.47 | 1.082 | 75.69 |

| Hong Kong, Macao and Taiwan | 5.042 | 8.983 | 4.279 | 3.599 | 7.384 | 22.679 | 9.841 | 11.404 | 11.446 | 8.182 | 7.162 | 77.321 |

| the United States | 2.742 | 3.498 | 1.593 | 2.113 | 2.261 | 7.392 | 18.566 | 14.543 | 15.119 | 16.072 | 16.102 | 81.434 |

| Japan | 2.238 | 3.657 | 1.96 | 2.154 | 3.021 | 8.774 | 15.389 | 19.68 | 14.095 | 14.544 | 14.488 | 80.32 |

| South Korea | 3.683 | 4.794 | 2.277 | 2.344 | 2.381 | 8.74 | 15.612 | 14.152 | 19.02 | 13.542 | 13.455 | 80.98 |

| Germany | 2.319 | 2.8 | 1.194 | 1.538 | 1.764 | 6.642 | 18.093 | 15.504 | 14.598 | 18.232 | 17.315 | 81.768 |

| France | 1.719 | 2.391 | 0.994 | 1.597 | 1.463 | 5.85 | 17.805 | 15.292 | 14.306 | 16.495 | 22.087 | 77.913 |

| TO | 78.717 | 97.458 | 77.345 | 61.283 | 77.609 | 64.194 | 88.114 | 83.535 | 85.227 | 77.088 | 74.842 | 78.674 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, C.; Feng, X.; Wang, Y. Technology Spillovers among Innovation Agents from the Perspective of Network Connectedness. Mathematics 2022, 10, 2854. https://doi.org/10.3390/math10162854

Zhang C, Feng X, Wang Y. Technology Spillovers among Innovation Agents from the Perspective of Network Connectedness. Mathematics. 2022; 10(16):2854. https://doi.org/10.3390/math10162854

Chicago/Turabian StyleZhang, Cui, Xiongjin Feng, and Yanzhen Wang. 2022. "Technology Spillovers among Innovation Agents from the Perspective of Network Connectedness" Mathematics 10, no. 16: 2854. https://doi.org/10.3390/math10162854

APA StyleZhang, C., Feng, X., & Wang, Y. (2022). Technology Spillovers among Innovation Agents from the Perspective of Network Connectedness. Mathematics, 10(16), 2854. https://doi.org/10.3390/math10162854