Analytical Derivations of New Specifications for Stochastic Frontiers with Applications

Abstract

1. Introduction

2. Stochastic Frontiers: What Is New

2.1. A Special Case: Modeling Dependence with the Copula Function

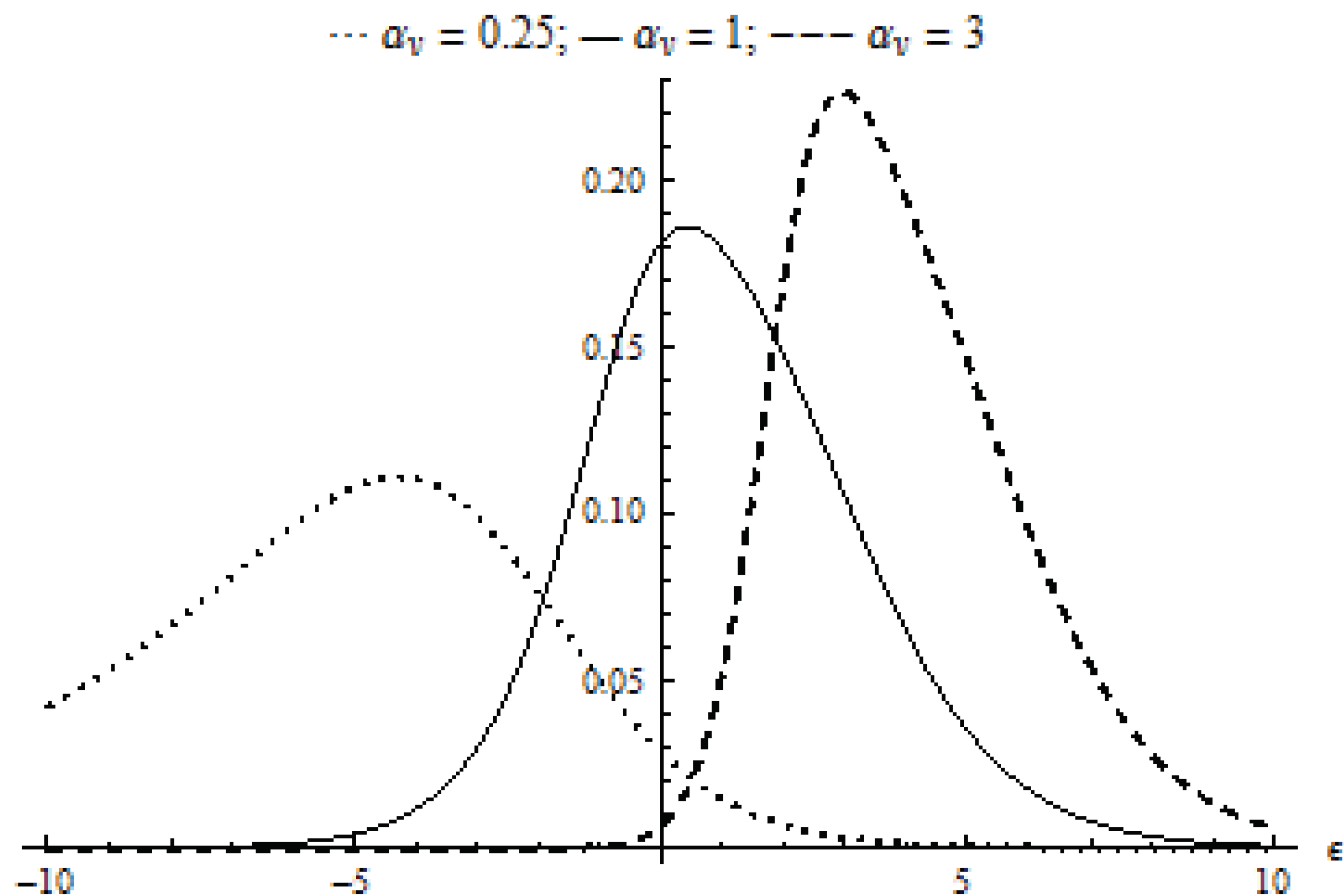

- for and , we get the model of independence (between inefficiency error, u, and random error, v) and symmetry of v, denoted by ;

- for and , we have the model of independence and asymmetry, denoted by ;

- for and , we obtain the model of dependence and symmetry, denoted by ;

- for and , we have the model of dependence and asymmetry, denoted by

2.2. Calculation of Efficiency Scores

2.3. Some Important Results

3. Empirical Applications of New SF Methodology

3.1. Production Frontiers and Airport Efficiency

3.2. The Cost Efficiency of the Banking System

4. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| SF | Stochastic Frontier/Stochastic Frontiers |

| probability density function | |

| Exp | Exponential |

| GL | Generalized Logistic |

| FGM | Farlie-Gumbel-Morgenstern |

| IS | Independence and Symmetry |

| IA | Independence and Asymmetry |

| DS | Dependence and Symmetry |

| DA | Dependence and Asymmetry |

| TE | Technical Efficiency |

| CE | Cost Efficiency |

| ENAC | National Civil Aviation Association |

| ICCSAI | International Center for Competitive Studies in the Aviation Industry |

| ABI | Italian Banking Association Banking Data |

Appendix A. Proof of Theorem 2

- 1.

- If the random variable U has an exponential distribution, with distribution function , denoted with then

- r-th moment is . Consequently, we have: , and . Moreover, after algebra, it is simple to verify that

- 2.

- If the random variable V has a generalized logistic distribution with a distribution function , denoted with , then, after algebra, we have

- ;

- ;

- where with , and , we indicated the functions digamma, trigamma and tetragamma, respectively.

- For what follows, it is useful to calculate . To this end, we observe thatLet , we can writewhere is the expectation with respect to the with parameters and , i.e., .

It is immediate to verify that - 3.

- if then

- 1.

- The pdf of composite error is where .Given that is a density copula of an FGM copula, we haveUsing (A1), we have , where , and , for are special cases of I.Now, in order to calculate the integral I, we observe thatwhere . After algebra, we can writeIf before we put and then , after algebra, we obtainBearing in mind that the following is true for hypergeometric functionsWe obtain

- 2.

- By the lemma, we can verify that

- given that , the covariance between U and V is given byAccordingly, the variance of the composite error is

- Moreover, recalling that for a generic random variable, Z, we have , after simple algebra, and . Moreover, by the lemma, we have:andby (5), after algebra, we obtain .

References

- Aigner, D.; Lovell, C.A.K.; Schmidt, P. Formulation and estimation of stochastic frontier production function models. J. Econom. 1977, 6, 21–37. [Google Scholar] [CrossRef]

- Meeusen, D.; van de Broek, J. Efficiency estimation from Cobb-Douglas production functions with composed error. Int. Econ. Rev. 1977, 18, 435–444. [Google Scholar] [CrossRef]

- Battese, G.E.; Corra, G.S. Estimation of a production frontier model: With application to the pastoral zone of eastern Australia. Aust. J. Agric. Econ. 1977, 21, 169–179. [Google Scholar] [CrossRef]

- Kumbhakar, S.C.; Lovell, C.A.K. Stochastic Frontier Analysis; Cambridge University Press: Cambridge, UK, 2000. [Google Scholar]

- Battese, G.E.; Coelli, T.J.; Rao, D.S.P.; ODonnell, C.J. An Introduction to Efficiency and Productivity Analysis; Springer: New York, NY, USA, 2005. [Google Scholar]

- Kumbhakar, S.C.; Parmeter, C.F.; Zelenyuk, V. Stochastic frontier analysis: Foundations and advances I. In Handbook of Production Economics; Springer: New York, NY, USA, 2020; pp. 1–40. [Google Scholar]

- Greene, W.H. A gamma-distributed stochastic frontier model. J. Econom. 1990, 46, 141–163. [Google Scholar] [CrossRef]

- Stead, A.D.; Wheat, P.; Greene, W.H. Distributional forms in stochastic frontier analysis. In The Palgrave Handbook of Economic Performance Analysis; Palgrave Macmillan: Cham, Switzerland, 2019; pp. 225–274. [Google Scholar]

- Green, A.; Mayes, D.G. Technical inefficiency in manufacturing industries. Econ. J. 1991, 101, 523–538. [Google Scholar] [CrossRef]

- Carree, M.A. Technological inefficiency and the skewness of the error component in stochastic frontier analysis. Econ. Lett. 2002, 77, 101–107. [Google Scholar] [CrossRef]

- Tsionas, E.G. Efficiency measurement with the Weibull stochastic frontier. Oxf. Bull. Econ. Stat. 2007, 69, 693–706. [Google Scholar] [CrossRef]

- Qian, J.; Sickles, R.C. Stochastic Frontiers with Bounded Inefficiency; Rice University: Houston, TX, USA, 2009. [Google Scholar]

- Almanidis, P.; Sickles, R.C. Skewness problem in Stochastic Frontier Models: Fact or Fiction? In Exploring Research Frontiers in Contemporary Statistics and Econometrics: A Festschrift in Honor of Leopold Simar; Springer: New York, NY, USA, 2011. [Google Scholar]

- Feng, Q.; Horrace, W.C.; Wu, G.L. Wrong Skewness and Finite Sample Correction in Parametric Stochastic Frontier Models; Center for Policy Research, Maxwell School, Syracuse University: Syracuse, NY, USA, 2013; Volume 154. [Google Scholar]

- Hafner, C.M.; Manner, H.; Simar, L. The “wrong skewness” problem in stochastic frontier model: A new approach. Econom. Rev. 2018, 37, 380–400. [Google Scholar] [CrossRef]

- Zhu, X.; Wei, Z.; Wang, T. Multivariate skew normal-based stochastic frontier models. J. Stat. Theory Pract. 2022, 16, 1387–1406. [Google Scholar] [CrossRef]

- Horrace, W.C.; Parmeter, C.F. A Laplace stochastic frontier model. Econom. Rev. 2018, 37, 260–280. [Google Scholar] [CrossRef]

- Bonanno, G.; De Giovanni, D.; Domma, F. The ‘wrong skewness’ problem: A re-specification of stochastic frontiers. J. Prod. Anal. 2017, 47, 49–64. [Google Scholar] [CrossRef]

- Badunenko, O.; Henderson, D.J. Production Analysis with Asymmetric Noise; Working Paper; MPRA: Fort Leonard Wood, MO, USA, 2021. [Google Scholar]

- Papadopoulos, A. The Nash bargaining two-tier stochastic frontier model. 2022; Unpublished Working Paper. [Google Scholar]

- Gómez-Déniz, E.; Pérez-Rodriguez, J.V. Closed-form solution for a bivariate distribution in stochastic frontier models with dependent errors. J. Prod. Anal. 2015, 43, 215–223. [Google Scholar] [CrossRef]

- Pal, M.; Sengupta, A. A model of FPF with correlated error components: An application to Indian agriculture. Indian J. Stat. Ser. B 1999, 61, 337–350. [Google Scholar]

- Smith, M.D. Stochastic frontier models with dependent error components. Econom. J. 2008, 11, 172–192. [Google Scholar] [CrossRef]

- Joe, H. Dependence Modeling with Copulas; CRC Press, Taylor and Francis Group: Boca Raton, FL, USA, 2014. [Google Scholar]

- Nelsen, R.N. An Introducton to Copulas; Springer Series in Statistics; Springer: New York, NY, USA, 2007. [Google Scholar]

- Cherubini, U.; Gobbi, F.; Mulinacci, S. Convolution Copula Econometrics; Springer Briefs in Statistics; Springer: New York, NY, USA, 2016. [Google Scholar]

- Trivedi, P.K.; Zimmer, D.M. Copula modeling: An introduction for Practitioners. In Foundations and Trends in Econometrics; Now the Essence of Knowledge: Boston, MA, USA, 2007. [Google Scholar]

- Amsler, C.; Schmidt, P.; Amsler, C.; Schmidt, P. A survey of the use of copulas in stochastic frontier models. In Advances in Efficiency and Productivity Analysis; Springer Proceedings in Business and Economics; Parmeter, C.F., Sickles, R.C., Eds.; Springer: New York, NY, USA, 2021. [Google Scholar]

- Mamonov, M.E.; Parmeter, C.F.; Prokhorov, A.B. Dependence modeling in stochastic frontier analysis. Depend. Model. 2022, 10, 123–144. [Google Scholar] [CrossRef]

- Andrews, G.E.; Askey, R.; Roy, R. Special Functons; Cambridge University Press: Cambridge, UK, 1999. [Google Scholar]

- Martin, J.C.; Roman, C.; Voltes-Dorta, A. A stochastic frontier analysis to estimate the relative efficiency of spanish airports. J. Prod. Anal. 2009, 31, 163–176. [Google Scholar] [CrossRef]

- ICCSAI. Air Transport in Europe, Volume Factbook; International Centre for Competitive Studies in the Aviation Industry; BookSurge Publishing: Charleston, SC, USA, 2017. [Google Scholar]

- Scotti, D.; Malighetti, P.; Martini, G.; Volta, N. The impact of airport competition on technical efficiency: A stochastic frontier analysis applied to italian airport. J. Air Transp. Manag. 2012, 22, 9–15. [Google Scholar] [CrossRef]

- Abrate, G.; Erbetta, F. Efficiency and patterns of service mix in airport companies: An input distance function approach. Transp. Res. Part E Logist. Transp. Rev. 2010, 46, 693–708. [Google Scholar] [CrossRef]

- Merkert, R.; Mangia, L. Efficiency of italian and norwegian airports: A matter of management or of the level of competition in remote regions? Transp. Res. Part A Policy Pract. 2014, 62, 30–38. [Google Scholar] [CrossRef]

- Burnham, K.P.; Anderson, D.R. Multimodel inference: Understanding AIC and BIC in model selection. Sociol. Methods Res. 2004, 33, 261–304. [Google Scholar] [CrossRef]

- Berger, A.N.; Humphrey, D.B. Efficiency of financial institutions: International survey and directions for future research. Eur. J. Oper. Res. 1997, 98, 175–212. [Google Scholar] [CrossRef]

- Sealey, C.W.; Lindley, J.T. Input, output and a theory of production and cost at depository financial institutions. J. Financ. 1977, 32, 1251–1266. [Google Scholar] [CrossRef]

- Aiello, F.; Bonanno, G. Looking at the determinants of efficiency in banking: Evidence from Italian mutual-cooperatives. Int. Rev. Appl. Econ. 2016, 30, 507–526. [Google Scholar] [CrossRef]

- Aiello, F.; Bonanno, G. Multilevel empirics for small banks in local markets. Pap. Reg. Sci. 2018, 97, 1017–1037. [Google Scholar] [CrossRef]

| Classic SF | IS Model | IA Model | DS Model | DA Model | |

|---|---|---|---|---|---|

| Constant | 1.549 *** | 1.073 *** | 1.148 *** | 1.136 *** | 1.271 *** |

| 1.176 *** | −0.006 | −0.023 | −0.107 | 0.100 | |

| −0.045 | 0.729 *** | 0.661 *** | 0.723 *** | 0.564 *** | |

| 1.429 *** | 1.074 *** | 1.186 *** | 1.143 *** | 1.308 *** | |

| 1.766 * | 1.721 ** | 0.990 | 2.044 ** | 0.846 | |

| 1.159 *** | −0.197 | 0.078 | 0.798 ** | 0.936 *** | |

| 0.172 | −0.312 | 0.030 | 0.388 | 0.168 | |

| −4.670 *** | 0.204 | 0.195 | −2.310 ** | −2.737 *** | |

| 2.507 *** | −0.602 | −0.111 | 1.656 ** | 3.000 *** | |

| −1.329 ** | −0.163 | −0.862 * | −1.808 *** | −1.963 *** | |

| 2.947 *** | |||||

| 0.984 *** | |||||

| 0.661 *** | 0.736 *** | 0.733 *** | 0.756 *** | ||

| 3.503 *** | 2.825 *** | ||||

| 0.268 *** | 0.284 *** | 0.288 *** | 0.315 *** | ||

| 0.929 *** | 0.673 * | ||||

| Mean efficiency | 0.4255 | 0.6211 | 0.6022 | 0.5858 | 0.5865 |

| Log-Lik | −512.1404 | −461.96 | −446.31 | −454.45 | −435.42 |

| Obs | 379 | 379 | 379 | 379 | 379 |

| k | 12 | 12 | 13 | 13 | 14 |

| AIC | 1048.28 | 947.93 | 918.62 | 934.90 | 898.84 |

| Classic SF | IS Model | IA Model | DS Model | DA Model | |

|---|---|---|---|---|---|

| Constant | −0.816 *** | −1.044 *** | −1.512 *** | −0.811 *** | −0.937 *** |

| 0.315 *** | 0.421 *** | 0.427 *** | 0.437 *** | 0.438 *** | |

| 0.488 *** | 0.424 *** | 0.421 *** | 0.404 *** | 0.410 *** | |

| 0.098 *** | 0.085 *** | 0.086 *** | 0.093 *** | 0.091 *** | |

| 0.720 *** | 0.672 *** | 0.721 *** | 0.625 *** | 0.633 *** | |

| 0.258 *** | 0.317 *** | 0.275 *** | 0.360 *** | 0.359 *** | |

| 0.158 *** | |||||

| 0.832 *** | |||||

| 0.193 *** | 0.204 *** | 0.206 *** | 0.223 *** | ||

| 0.295 *** | 0.224 ** | ||||

| 0.070 *** | 0.031 *** | 0.074 *** | 0.027 ** | ||

| −0.474 | −0.637 | ||||

| Mean efficiency | 0.7811 | 0.8477 | 0.7295 | 0.8388 | 0.6854 |

| Log-Lik | −52.88 | 59.64 | 77.94 | 66.42 | 91.40 |

| Obs | 621 | 621 | 621 | 621 | 621 |

| k | 8 | 8 | 9 | 9 | 10 |

| AIC | 121.76 | −103.29 | −137.89 | −114.84 | −162.79 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bonanno, G.; Domma, F. Analytical Derivations of New Specifications for Stochastic Frontiers with Applications. Mathematics 2022, 10, 3876. https://doi.org/10.3390/math10203876

Bonanno G, Domma F. Analytical Derivations of New Specifications for Stochastic Frontiers with Applications. Mathematics. 2022; 10(20):3876. https://doi.org/10.3390/math10203876

Chicago/Turabian StyleBonanno, Graziella, and Filippo Domma. 2022. "Analytical Derivations of New Specifications for Stochastic Frontiers with Applications" Mathematics 10, no. 20: 3876. https://doi.org/10.3390/math10203876

APA StyleBonanno, G., & Domma, F. (2022). Analytical Derivations of New Specifications for Stochastic Frontiers with Applications. Mathematics, 10(20), 3876. https://doi.org/10.3390/math10203876