Stock Portfolio Optimization with Competitive Advantages (MOAT): A Machine Learning Approach

Abstract

1. Introduction

2. A Brief Review of Competitive Advantages and Economic Moat

Economic Moat

- Poor value-chain integration;

- Cyber-security challenges;

- Uncertainty about economic benefits;

- Lack of adequate skills in the workforce;

- High investment requirements;

- Lack of infrastructure;

- Work interruptions;

- Challenges in data management and data quality;

- Lack of security standards and norms.

3. Methodology, Moat Ratios and Evaluation

Moat Evaluation

4. Empirical Results from ML Modeling

5. Discussion of Results

- Long-Term Debt-to-Net Income close to zero and high pre-tax ROA.

- High EPV-to-reproduction value with a low Long-Term Debt-to-Net Income.

- High Gross Profit-to-Assets with a high EPS trend.

- High Gross Profit Margin with a high EPS Trend.

- Interest Expense-to-EBIT is closer to zero and has a high EPS trend.

- High SG&A expenses with a weak EPS trend.

- High D&A expenses with a high LT Debt.

- Low Current Ratio with a low pre-tax ROA.

- Lower ROIC-to-WACC with a lower Gross Profit-to-Assets.

- Low Net Margin.

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A. Dependence Plots

References

- Liu, W.-J.; Bai, Y.-T.; Jin, X.-B.; Su, T.-L.; Kong, J.-L. Adaptive Broad Echo State Network for Nonstationary Time Series Forecasting. Mathematics 2022, 10, 3188. [Google Scholar] [CrossRef]

- Khan, A.T.; Cao, X.; Liao, B.; Francis, A. Bio-Inspired Machine Learning for Distributed Confidential Multi-Portfolio Selection Problem. Biomimetics 2022, 7, 124. [Google Scholar] [CrossRef] [PubMed]

- Lombardo, G.; Pellegrino, M.; Adosoglou, G.; Cagnoni, S.; Pardalos, P.M.; Poggi, A. Machine Learning for Bankruptcy Prediction in the American Stock Market: Dataset and Benchmarks. Future Internet 2022, 14, 244. [Google Scholar] [CrossRef]

- Morningstar Wide Moat Focus. Available online: https://indexes.morningstar.com/our-indexes/equity/FOUSA06B9O (accessed on 14 December 2021).

- Porter, M.E. How competitive forces shape strategy. Harv. Bus. Rev. 1979, 57, 137–145. [Google Scholar]

- Ruiz-Moreno, F.; Mas-Ruiz, F.J.; Sancho-Esper, F.M. Strategic groups, and product differentiation: Evidence from the Spanish airline market deregulation. Res. Transp. Econ. 2021, 90, 101030. [Google Scholar] [CrossRef]

- Bet, G. Product specification under a threat of entry: Evidence from Airlines’ departure times. Int. J. Ind. Organ. 2021, 75, 102705. [Google Scholar] [CrossRef]

- Berendt, J.; Uhrich, S.; Thompson, S.A. Marketing, get ready to rumble—How rivalry promotes distinctiveness for brands and consumers. J. Bus. Res. 2018, 88, 161–172. [Google Scholar] [CrossRef]

- Covarrubias, M.; Gutiérrez, G.; Philippon, T. From Good to Bad Concentration? US Industries over the Past 30 Years. NBER Macroecon. Annu. 2020, 34, 1–46. [Google Scholar] [CrossRef]

- Guthrie, G. Investment flexibility as a barrier to entry. J. Econ. Dyn. Control 2020, 116, 103928. [Google Scholar] [CrossRef]

- Kumar, P.; Bhamu, J.; Singh Sangwan, K. Analysis of Barriers to Industry 4.0 adoption in Manufacturing Organizations: An ISM Approach. Procedia CIRP 2021, 98, 85–90. [Google Scholar] [CrossRef]

- Corrigan, J.R.; O’Connor, R.J.; Rousu, M.C. Which smokers adopt e-cigarettes and at what price? An experimental estimation of price elasticity of demand and factors. Addict. Behav. 2020, 105, 106324. [Google Scholar] [CrossRef] [PubMed]

- Casamatta, G.; Giannoni, S.; Brunstein, D.; Jouve, J. Host type and pricing on Airbnb: Seasonality and perceived market power. Tour. Manag. 2022, 88, 104433. [Google Scholar] [CrossRef]

- Tseng, F.-C.; Linh Pham, T.T.; Cheng, T.; Teng, C.-I. Enhancing customer loyalty to mobile instant messaging: Perspectives of network effect and self-determination theories. Telemat. Inform. 2018, 35, 1133–1143. [Google Scholar] [CrossRef]

- Alibeiki, H.; Li, S.; Vaidy, R. Market dominance or product cost advantage: Retail power impacts on assortment decisions. Int. J. Prod. Econ. 2020, 222, 107505. [Google Scholar] [CrossRef]

- Seo, Y.-J.; Park, J.S. The estimation of minimum efficient scale of the port industry. Transp. Policy 2016, 49, 168–175. [Google Scholar] [CrossRef]

- Lim, S.C.; Macias, A.J.; Moel, T. Intangible assets and capital structure. J. Bank. Finance 2020, 118, 105873. [Google Scholar] [CrossRef]

- Rizkiah, S.K.; Disli, M.; Salim, K.; Razak, L.A. Switching costs and bank competition: Evidence from dual banking economies. J. Int. Financ. Mark. Inst. Money 2021, 75, 101445. [Google Scholar] [CrossRef]

- Liu, Y.; Mantecon, T. Is sustainable competitive advantage an advantage for stock investors? Q. Rev. Econ. Financ. 2017, 63, 299–314. [Google Scholar] [CrossRef]

- Azeem, M.; Ahmed, M.; Haider, S.; Sajjad, M. Expanding competitive advantage through organizational culture, knowledge sharing and organizational innovation. Technol. Soc. 2021, 66, 101635. [Google Scholar] [CrossRef]

- Wan, M.; Wasiuzzaman, S. Environmental, Social and Governance (ESG) disclosure, competitive advantage and performance of firms in Malaysia. Clean. Environ. Syst. 2021, 2, 100015. [Google Scholar] [CrossRef]

- Waqas, M.; Honggang, X.; Ahmad, N.; Rehman Khan, S.A.; Iqbal, M. Big data analytics as a roadmap towards green innovation, competitive advantage and environmental performance. J. Clean. Prod. 2021, 323, 128998. [Google Scholar] [CrossRef]

- Raguseo, E.; Pigni, F.; Vitari, C. Streams of digital data and competitive advantage: The mediation effects of process efficiency and product effectiveness. Inf. Manag. J. 2021, 58, 103451. [Google Scholar] [CrossRef]

- Damodaran, A. Investment Valuation: Tools and Techniques for Determining the Value of Any Asset; Wiley Finance Series; Wiley: Hoboken, NJ, USA, 2012. [Google Scholar]

- Chawla, N.V.; Bowyer, K.W.; Hall, L.O.; Kegelmeyer, P.W. SMOTE: Synthetic Minority Over-sampling Technique. J. Artif. Intell. Res. 2002, 16, 321–357. [Google Scholar] [CrossRef]

- Breiman, L. Random Forests. Mach. Learn. 2001, 45, 5–32. [Google Scholar] [CrossRef]

- Hastie, T.; Tibshirani, R.; Friedman, J. Random Forests. In The Elements of Statistical Learning, 2nd ed.; Hastie, T., Tibshirani, R., Friedman, J., Eds.; Springer: New York, USA, 2009; pp. 587–604. [Google Scholar]

- Lundberg, S.; Lee, S.-I. A Unified Approach to Interpreting Model Predictions. In Advances in Neural Information Processing Systems, 1st ed.; Guyon, I., Von Luxburg, U., Bengio, Wallach, S., Fergus, R., Vishwanathan, S., Garnett, R., Eds.; Curran Associates, Inc: Long Beach, CA, USA, 2017; pp. 4768–4777. [Google Scholar]

- Python Software Foundation. Python Language Reference, version 3.9; Available online: http://www.python.org (accessed on 14 December 2021).

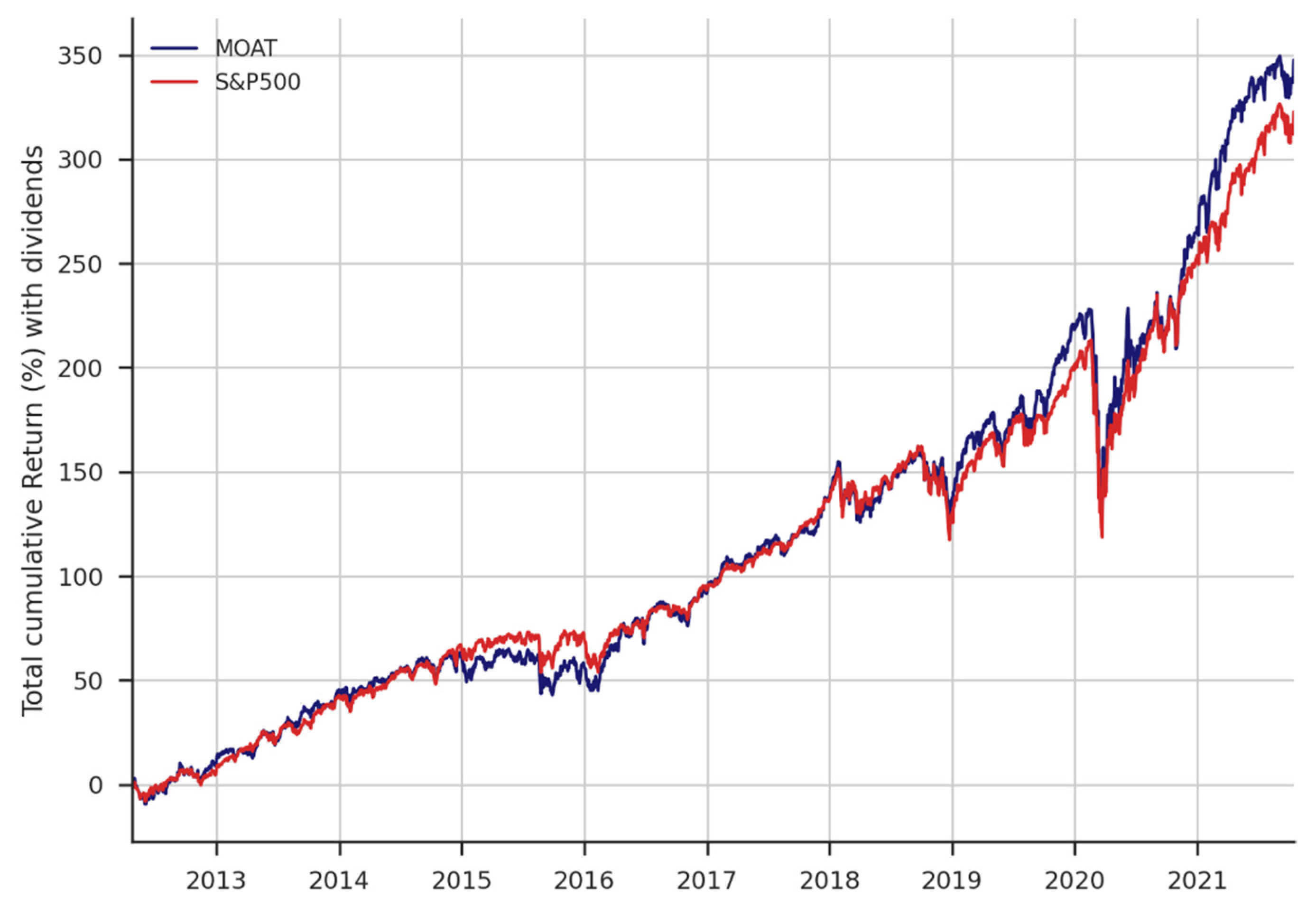

| Asset | Price-to-Earnings (PE) | Price to Book (PB) | PB Growth (%) | Dividend Yield (%) | Sales Growth (%) | Long-Term Earnings Growth (%) | Sharpe Ratio |

|---|---|---|---|---|---|---|---|

| MOAT | 17.62 | 3.77 | 3.77 | 1.79 | 3.3 | 10.36 | 0.84 |

| SPY | 20.19 | 3.86 | 4.83 | 1.48 | 2.86 | 14 | 0.77 |

| Ratio | Interpretation |

|---|---|

| Economies of scale emerge when the marginal cost is lower than the average cost. Companies with large production volumes are related to their moat, where higher revenues and lower costs positively impact the gross margin. | |

| Sales and administration expenses directly impact sales since advertising expenses, commissions and administrative wages are part of this ratio. Low operating costs imply that the good or service has high substitution costs or shows consumer loyalty. | |

| Depreciation represents the wear and tear on the company’s assets. When this cash outflow is low, it implies operating efficiency. Those industries that do not require reinvesting large capital can redistribute more significant quantities in dividends, acquire new businesses, or repurchase shares. | |

| Interest expense reflects an outflow of cash. Companies with low or no costs could have achieved good margins with low debt thanks to some competitive advantage and better margins. In this sense, they can provide a better return to the investor. | |

| Companies with economies of scale, operational efficiency and low cost of debt have better profit margins. In this sense, the net margin becomes a significant indicator representing the business’s operational efficiency. | |

| Companies with enduring competitive advantages overlook a consistent EPS trend. Earnings per share may improve for two reasons: first, improvement in business performance; and second, for-share repurchases that increase the value of the shareholders’ investment. | |

| For companies that use stocks, when inventories and profits trend strongly, it indicates that the company’s organic growth is in order; otherwise, both decrease strongly. | |

| Companies with low net accounts compared to their income indicate good sales management. Likewise, it could be an indication of negotiating power. | |

| Firms with high Return on Assets (ROA) regularly have little competition. Another interpretation is that companies that want to participate in a specific industry require concessions or biddings versus those with high ROAs, becoming a barrier to entry. | |

| Companies that present more cash than short-term debt reflect good financial management and the ability to use resources differently. | |

| Firms with a high level of liquidity indicate the company’s ability to meet their short-term obligations by improving their leeway. Removing inventories, cash, short-term investments and short-term debt, and holding a negative working capital could indicate trading power. | |

| Holding profit levels over time with low debt levels implies more efficient companies. This reduces the default probability. In this sense, companies with a better debt-to-utility ratio can express the presence of economic moats. | |

| High debt levels relative to equity can erode any moat since a debt-predominant capital structure increases the cost of financing, decreasing the company’s valuation. | |

| Companies with a positive trend in retained earnings imply good business performance and reasonable expectations for the future since these are used for reinvestment. On the other hand, firms with a negative or null trend could imply that the business is in a maturity phase or, in the worst case, declining. | |

| A high ROE indicates that a company has competitive advantages. For instance, share repurchase improves ROE. A vast difference between ROE and adjusted ROE suggests the presence of financial engineering, which needs to be accurate to be a competitive advantage. | |

| Companies with a network effect require smaller amounts of investment since the marginal cost of adding new users tends to be zero. In addition, firms that do not require high amounts of reinvestment to maintain the flow of income can distribute benefits in the repurchase of shares or distribution of dividends. | |

| On average, companies with a high CROIC can show several competitive advantages due to the company’s high Free Cash Flow (FCF) compared to the capital invested. | |

| This rate is used to estimate the expected growth in operating income. A company’s growth is determined by capital, which is reinvested, and the return on that investment. The expected operating income growth rate is based on the total reinvestment and invested capital return [24]. | |

| This indicator measures the efficiency of organic growth. In this ratio, revenue stability is prioritized over new business acquisitions. The company experiences economies of scale when gross profit is high relative to assets. | |

| Any company that obtains a return-on-capital more remarkable than its cost of capital is acquiring an excess return. It is the result of the competitive advantages of a company or the barriers to entering the industry. High returns over long periods imply that this company has a permanent competitive advantage [24]. |

| Sector | Total | None | Narrow | Wide | None (%) Total | Narrow (%) Total | Wide (%) Total |

|---|---|---|---|---|---|---|---|

| Information Technology | 76 | 8 | 41 | 27 | 10.5 | 53.9 | 35.5 |

| Industrials | 73 | 23 | 40 | 10 | 31.5 | 54.8 | 13.7 |

| Financials | 65 | 5 | 49 | 11 | 7.7 | 75.4 | 16.9 |

| Health Care | 64 | 12 | 31 | 21 | 18.8 | 48.4 | 32.8 |

| Consumer Discretionary | 63 | 20 | 28 | 15 | 31.7 | 44.4 | 23.8 |

| Consumer Staples | 32 | 13 | 16 | 3 | 40.6 | 50.0 | 9.4 |

| Real Estate | 29 | 18 | 11 | 0 | 62.1 | 37.9 | 0 |

| Utilities | 28 | 26 | 2 | 0 | 92.9 | 7.1 | 0 |

| Materials | 28 | 13 | 14 | 1 | 46.4 | 50.0 | 3.6 |

| Communication Services | 27 | 14 | 7 | 6 | 51.9 | 25.9 | 22.2 |

| Energy | 21 | 19 | 2 | 0 | 90.5 | 9.5 | 0 |

| Total | 506 | 171 | 241 | 94 | 33.8 | 47.6 | 18.6 |

| Model | Accuracy (%) | Standard Deviation |

|---|---|---|

| Logistic regression | 80.8 | 0.047 |

| Support Vector Machine (SVM) | 88.0 | 0.033 |

| Random forest | 91.2 | 0.022 |

| Gradient boosting | 89.2 | 0.032 |

| Artificial Neural Networks | 86.0 | 0.026 |

| Label | Precision | Recall | F1-Score | Support |

|---|---|---|---|---|

| 0 | 1 | 0.8 | 0.89 | 5 |

| 1 | 0.8 | 1 | 0.89 | 4 |

| 2 | 1 | 1 | 1 | 3 |

| Accuracy | 0.92 | 12 | ||

| Macro Avg | 0.93 | 0.93 | 0.93 | 12 |

| Weighted avg | 0.93 | 0.92 | 0.92 | 12 |

| Test | Statistic | p-Value | Result |

|---|---|---|---|

| Anderson–Darling Test | 44.014 | 0.0000 | Data do not follow the normal distribution |

| D’Agostino’s K2 Test | 111.512 | 0.0000 | Data do not follow the normal distribution |

| Shapiro–Wilk Test | 0.405 | 0.0000 | Data do not follow the normal distribution |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jiménez-Preciado, A.L.; Venegas-Martínez, F.; Ramírez-García, A. Stock Portfolio Optimization with Competitive Advantages (MOAT): A Machine Learning Approach. Mathematics 2022, 10, 4449. https://doi.org/10.3390/math10234449

Jiménez-Preciado AL, Venegas-Martínez F, Ramírez-García A. Stock Portfolio Optimization with Competitive Advantages (MOAT): A Machine Learning Approach. Mathematics. 2022; 10(23):4449. https://doi.org/10.3390/math10234449

Chicago/Turabian StyleJiménez-Preciado, Ana Lorena, Francisco Venegas-Martínez, and Abraham Ramírez-García. 2022. "Stock Portfolio Optimization with Competitive Advantages (MOAT): A Machine Learning Approach" Mathematics 10, no. 23: 4449. https://doi.org/10.3390/math10234449

APA StyleJiménez-Preciado, A. L., Venegas-Martínez, F., & Ramírez-García, A. (2022). Stock Portfolio Optimization with Competitive Advantages (MOAT): A Machine Learning Approach. Mathematics, 10(23), 4449. https://doi.org/10.3390/math10234449