Real Economy Effects on Consumption-Based CAPM

Abstract

:1. Introduction

2. Related Literature

3. Methodology and Data

- (a)

- The core idea of CCAPM is that consumption expenditure should be covered by the wealth increased in the future. In other words, the risk premium on an asset should equal to its consumption risk. The most important difference between CAPM and CCAPM is the definition of portfolio: in CCAPM, consumption tracking portfolio plays the role of market portfolio in CAPM;

- (b)

- The sensitivity of stock market to consumption market is described as β. Differing from CAPM, the value of β is not necessary. According to much empirical evidence, the value of β is usually greater than 1.

4. Baseline Results

4.1. Portfolios Sorted on Size and Book-to-Market Ratio

4.2. Portfolios Sorted on Size and Short-Term Reversal

5. Further Empirical Results

5.1. Effects of Real Economy Factors

5.2. Effects of Stock Market

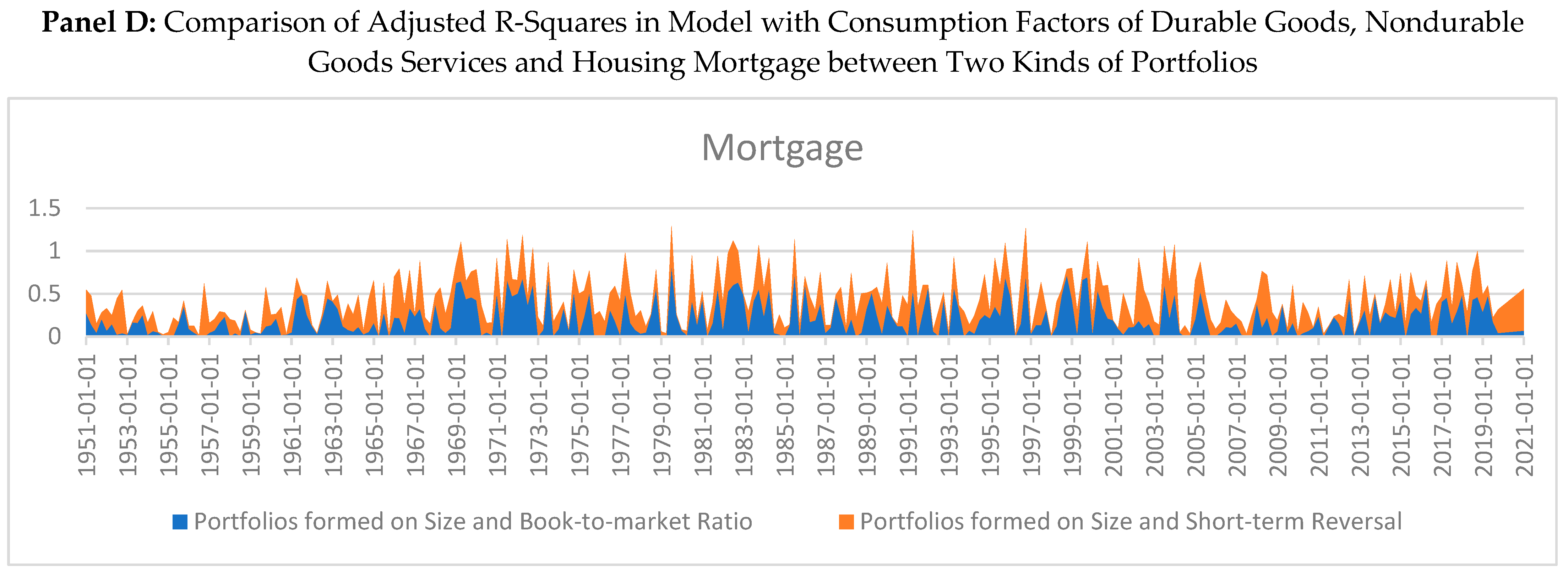

5.3. Portfolios Sorted on Size and Short-Term Reversal

6. Panel Data Analysis

6.1. Full Sample Regressions

6.2. Sub-Sample Regressions

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Sharpe, W. Capital Asset Prices: A Theory of Market Equilibrium under Conditions of Risk. J. Financ. 1964, 19, 425–444. [Google Scholar]

- Lintner, J. The valuation of risk assets and the selection of risky investments in stock portfolios and capital budgets. Rev. Econ. Stat. 1965, 47, 13–37. [Google Scholar] [CrossRef]

- Acharya, V.V.; Pedersen, L.H. Asset pricing with liquidity risk. J. Financ. Econ. 2005, 77, 375–410. [Google Scholar] [CrossRef] [Green Version]

- Bodie, Z.; Kane, A.; Marcus, A.J. Investment, 8th ed.; McGraw-Hill Education: New York, NY, USA, 2009. [Google Scholar]

- Fama, E.F.; French, K.R. The Capital pricing model: Theory and Evidence. J. Econ. Perspect. 2004, 18, 25–46. [Google Scholar] [CrossRef] [Green Version]

- Lucas, R.E. Asset prices in an exchange economy. Econometrica 1978, 46, 1429–1445. [Google Scholar] [CrossRef]

- Fama, E.F.; French, K.R. Common risk factors in the returns on stocks and bonds. J. Financ. Econ. 1993, 33, 3–56. [Google Scholar] [CrossRef]

- Aono, K.; Ivaisako, T. The consumption–wealth ratio, real estate wealth, and the Japanese stock market. Jpn. World Econ. 2013, 25, 39–51. [Google Scholar] [CrossRef] [Green Version]

- Chen, M.H. Risk and return: CAPM and CCAPM. Q. Rev. Econ. Financ. 2003, 43, 369–393. [Google Scholar] [CrossRef]

- Liu, W.; Luo, D.; Zhao, H. Transaction costs, liquidity risk and the CCAPM. J. Bank. Financ. 2015, 63, 126–145. [Google Scholar] [CrossRef] [Green Version]

- Campbell, J.Y. Asset Pricing at the Millennium. J. Financ. 2002, 55, 1515–1567. [Google Scholar] [CrossRef] [Green Version]

- Sonje, A.A.; Casni, A.C.; Vizek, M. The effect of housing and stock market wealth on consumption in emerging and developed countries. Econ. Syst. Res. 2014, 38, 433–450. [Google Scholar] [CrossRef]

- Yum, K.K.; Charles, L.; Dong, J. Comparing consumption-based asset pricing models: The case of an Asian City. J. Hous. Econ. 2014, 28, 1–52. [Google Scholar]

- Campbell, R.H.; Akhtar, S. Conditional skewness in asset pricing tests. J. Financ. 2000, 3, 1263–1295. [Google Scholar]

- Abhyankar, A.; Klinkowska, O.; Lee, S. Consumption risk and the cross-section of government bond returns. J. Empir. Financ. 2015, 32, 180–200. [Google Scholar] [CrossRef] [Green Version]

- Okunev, J.; Wilson, P.; Zurbruegg, R. The causal relationship between real estate and stock markets. J. Real Estate Financ. Econ. 2000, 21, 251–261. [Google Scholar] [CrossRef]

- Benjamin, J.D.; Chinloy, P.; Jud, G.D. Real estate versus financial wealth in consumption. J. Real Estate Financ. Econ. 2004, 29, 341–354. [Google Scholar] [CrossRef]

- Parker, J.A.; Julliard, C. Consumption risk and the cross section of expected returns. J. Political Econ. 2005, 113, 185–222. [Google Scholar] [CrossRef] [Green Version]

- Møller, S.V.; Rangvid, J. End-of-the-year economic growth and time-varying expected returns. J. Financ. Econ. 2015, 115, 136–154. [Google Scholar] [CrossRef] [Green Version]

- Li, H. Asset pricing with long-run durable expenditure risk. Financ. Res. Lett. 2020, 32, 101176. [Google Scholar] [CrossRef]

- Yogo, M. A consumption-based explanation of expected stock returns. J. Financ. 2006, 2, 539–580. [Google Scholar] [CrossRef] [Green Version]

- Piazzesi, M.; Schneider, M.; Tuzel, S. Housing, consumption and asset pricing. J. Financ. Econ. 2007, 83, 531–569. [Google Scholar] [CrossRef] [Green Version]

- Chen, G.; Hong, Z.; Ren, Y. Durable consumption and asset returns: Cointegration Analysis. Econ. Model. 2016, 53, 231–244. [Google Scholar] [CrossRef]

- Alizadeh, S.; Shahiki Tash, M.N.; Roshan, R. The study of an adjusted CCAPM model through the Bayesian estimation of trading costs. J. Econ. Policy 2021, 12, 273–308. [Google Scholar]

- Balcilar, M.; Demirer, R.; Bekun, F.V. Flexible time-varying betas in a novel mixture innovation factor model with latent threshold. Mathematics 2021, 9, 915. [Google Scholar] [CrossRef]

- Peng, C.; Chen, W.; Wei, A. Teaching CAPM for a pre-finance graduate program at the STEM undergraduate level: Linear algebra perspective. Mathematics 2021, 9, 1668. [Google Scholar] [CrossRef]

- Bostic, R.; Gabriel, S.; Painter, G. Housing wealth, financial wealth, and consumption: New evidence from micro data. Reg. Sci. Urban Econ. 2009, 39, 79–89. [Google Scholar] [CrossRef]

- Chen, J.; Hardin III, W.; Hu, M. Housing, wealth, income and consumption: China and homeownership heterogeneity. Real Estate Econ. 2020, 48, 373–405. [Google Scholar] [CrossRef]

- Azar, S.A. The CCAPM with varying preferences. Int. J. Bus. Manag. 2017, 12, 199–206. [Google Scholar] [CrossRef] [Green Version]

- Carmichael, B.; Coën, A. Real estate and consumption growth as common risk factors in asset pricing models. Real Estate Econ. 2016, 46, 936–970. [Google Scholar] [CrossRef]

- Dusha, E.; Janiak, A. On the dynamics of asset prices and liquidity: The role of search frictions and idiosyncratic shocks. In Society for Economic Dynamics 2018 Meeting Papers; Instituto Tecnológico Autónomo de México: Mexico City, Mexico, 2018. [Google Scholar]

- Breeden, D. An Intertemporal Asset Pricing Model with Stochastic Consumption and Investment Opportunities. J. Financ. Econ. 1979, 7, 265–296. [Google Scholar] [CrossRef]

- Jagannathan, R.; Wang, Y. Lazy investors, discretionary consumption, and the cross-section of stock return. J. Financ. 2007, 4, 1623–1661. [Google Scholar] [CrossRef] [Green Version]

- Huh, S.; Kim, I. Real estate and relative risk aversion with generalized recursive preferences. J. Macroecon. 2021, 68, 103310. [Google Scholar] [CrossRef]

- Eiling, E.; Giambona, E.; Aliouchkin, R.; Tuijp, P. The cross-section of expected housing returns. SSRN Electron. J. 2019. Available online: https://ssrn.com/abstract=331239 (accessed on 26 August 2021). [CrossRef]

- Liu, Z.; Wang, P.; Zha, T. Land-price dynamics and macroeconomic fluctuations. Econometrica 2013, 81, 1147–1184. [Google Scholar]

- Turid, S. Accountability and the debt crisis. Futures 1989, 21, 593–607. [Google Scholar]

- Samii, M.V. The Oil price crisis: Economic effects and policy responses. Energy Policy 1988, 16, 527–528. [Google Scholar] [CrossRef]

- Edwards, C. The debt crisis and development: A comparison of major economic theories. Geoforum 1988, 19, 3–28. [Google Scholar] [CrossRef]

- Deni, W.; Alexandr, A.; Eduardo, R. The impact of bond market development on economic growth before and after the global financial crisis: Evidence from developed and developing countries. Int. Rev. Financ. Anal. 2021, 77, 101865. [Google Scholar]

- António, A.M.; Blanco-Arana, C. Financial and economic development in the context of the global 2008-09 financial crisis. Int. Econ. 2022, 169, 30–42. [Google Scholar]

- Ellington, M.; Florackis, C.; Milas, C. Liquidity shocks and real GDP growth: Evidence from a Bayesian time-varying parameter VAR. J. Int. Money Financ. 2017, 72, 93–117. [Google Scholar] [CrossRef] [Green Version]

- Ellington, M.; Fu, X.; Zhu, Y. Real Estate Illiquidity and Returns: A Time-varying Regional Perspective. Int. J. Forecast. 2021. forthcoming. [Google Scholar] [CrossRef]

- Baker, S.R.; Bloom, N.; Davis, S.J. Measuring economic policy uncertainty. Q. J. Econ. 2016, 131, 1593–1636. [Google Scholar] [CrossRef]

- Guaita-Pradas, I.; Blasco-Ruiz, A. Analyzing profitability and discount rates for solar PV plants. A Spanish case. Sustainability 2020, 12, 3157. [Google Scholar] [CrossRef] [Green Version]

- Lin, Q. The q5 model and its consistency with the intertemporal CAPM. J. Bank. Financ. 2021, 127, 106096. [Google Scholar] [CrossRef]

- Ayub, U.; Kausar, S.; Noreen, U.; Zakaria, M.; Jadoon, I.A. Downside risk-based six-factor capital asset pricing model (CAPM): A new paradigm in asset pricing. Sustainability 2020, 12, 6756. [Google Scholar] [CrossRef]

- Nasir, M.A.; Shahbaz, M.; Mai, T.T.; Shubita, M. Development of Vietnamese stock market: Influence of domestic macroeconomic environment and regional markets. Int. J. Financ. Econ. 2021, 26, 1435–1458. [Google Scholar] [CrossRef]

| Low | Book-to-Market | High | |||

|---|---|---|---|---|---|

| Small | 4.83% | 10.38% | 9.84% | 12.38% | 13.68% |

| Size | 6.96% | 10.24% | 11.00% | 11.11% | 12.65% |

| 7.93% | 10.24% | 9.77% | 11.35% | 12.08% | |

| 8.65% | 8.67% | 9.61% | 10.52% | 10.61% | |

| Big | 7.77% | 7.33% | 8.48% | 6.99% | 8.91% |

| Panel A: Consumption Growth | ||||

| Mean | 0.0266 | 0.0250 | 0.0229 | 0.0252 |

| SD | 0.0162 | 0.0160 | 0.0128 | 0.0182 |

| Panel B: Consumption Beta | ||||

| Mean | 2.1783 | 3.8714 | 1.3410 | 3.4729 |

| SD | 0.6031 | 0.5890 | 0.4348 | 0.8292 |

| Low | Book-to-Market | High | |||

|---|---|---|---|---|---|

| Small | 1.6433 *** | 1.4597 * | 2.0740 ** | 2.1216 ** | 2.2142 *** |

| Size | (0.0090) | (0.0510) | (0.0130) | (0.0140) | (0.0040) |

| 1.5575 ** | 1.8114 ** | 2.2687 ** | 2.4092 *** | 2.9062 *** | |

| (0.0300) | (0.0330) | (0.0150) | (0.0100) | (0.0000) | |

| 1.5721 ** | 2.0218 ** | 2.3435 ** | 2.8423 *** | 2.8763 *** | |

| (0.0490) | (0.0340) | (0.0220) | (0.0040) | (0.0010) | |

| 1.3334 | 2.0732 ** | 2.8664 *** | 3.0756 *** | 2.8762 *** | |

| (0.1320) | (0.0420) | (0.0070) | (0.0020) | (0.0010) | |

| 0.6255 | 1.9048 | 2.3269 * | 3.0818 *** | 2.1716 ** | |

| Big | (0.5730) | (0.1240) | (0.0710) | (0.0050) | (0.0200) |

| Small | 2.6363 *** | 2.6560 *** | 3.6221 *** | 3.6785 *** | 3.7442 *** |

| Size | (0.0000) | (0.0010) | (0.0000) | (0.0000) | (0.0000) |

| 2.6324 *** | 3.2268 *** | 3.9527 *** | 4.5849 *** | 4.2967 *** | |

| (0.0010) | (0.0010) | (0.0000) | (0.0000) | (0.0000) | |

| 2.8490 *** | 3.8537 *** | 4.3420 *** | 4.7639 *** | 4.2210 *** | |

| (0.0010) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | |

| 2.7554 *** | 3.7569 *** | 4.8373 *** | 5.3526 *** | 4.3391 *** | |

| (0.0050) | (0.0010) | (0.0000) | (0.0000) | (0.0000) | |

| 2.8930 ** | 4.3105 *** | 4.5499 *** | 5.0528 *** | 3.8782 *** | |

| Big | (0.0180) | (0.0020) | (0.0010) | (0.0000) | (0.0000) |

| Small | 1.1042 ** | 1.0709 * | 1.4080 ** | 1.5741 ** | 1.6488 *** |

| Size | (0.0270) | (0.0710) | (0.0340) | (0.0210) | (0.0080) |

| 0.7889 | 1.0619 | 1.3411 * | 1.8202 ** | 1.8200 *** | |

| (0.1670) | (0.1160) | (0.0690) | (0.0150) | (0.0050) | |

| 0.8214 | 1.0013 | 1.3806 * | 1.4816 * | 1.8065 *** | |

| (0.1950) | (0.1860) | (0.0880) | (0.0570) | (0.0100) | |

| 0.5310 | 0.7796 | 1.5380 * | 1.7567 ** | 1.8166 *** | |

| (0.4500) | (0.3350) | (0.0670) | (0.0280) | (0.0080) | |

| 0.6625 | 0.9950 | 1.2684 | 2.1822 ** | 1.8669 ** | |

| Big | (0.4510) | (0.3110) | (0.2150) | (0.0120) | (0.0120) |

| Small | 2.1918 *** | 2.1554 *** | 3.1015 *** | 3.1704 *** | 3.3376 *** |

| Size | (0.0020) | (0.0100) | (0.0010) | (0.0010) | (0.0000) |

| 2.1510 *** | 2.7077 *** | 3.5758 *** | 4.0995 *** | 4.0058 *** | |

| (0.0070) | (0.0040) | (0.0010) | (0.0000) | (0.0000) | |

| 2.4571 *** | 3.3409 ** | 3.9366 *** | 4.3774 *** | 3.8885 *** | |

| (0.0060) | (0.0020) | (0.0010) | (0.0000) | (0.0000) | |

| 2.3657 ** | 3.1182 *** | 4.4607 *** | 4.9066 *** | 4.1415 *** | |

| (0.0170) | (0.0060) | (0.0000) | (0.0000) | (0.0000) | |

| 2.6322 ** | 3.7378 *** | 4.3739 *** | 4.8046 *** | 3.7834 *** | |

| Big | (0.0330) | (0.0070) | (0.0020) | (0.0000) | (0.0000) |

| Low | Short-Term Reverse | High | |||

|---|---|---|---|---|---|

| Small | 16.39% | 12.58% | 11.73% | 10.12% | 2.81% |

| Size | 15.41% | 14.93% | 12.12% | 10.10% | 6.18% |

| 14.34% | 13.34% | 11.84% | 9.39% | 6.37% | |

| 13.66% | 13.92% | 11.53% | 9.42% | 6.14% | |

| Big | 9.73% | 10.37% | 9.19% | 8.65% | 6.41% |

| Mean | 2.0842 | 0.3760 | 1.2459 | 3.3859 |

| SD | 0.3835 | 0.0491 | 0.2892 | 0.4818 |

| Low | Short-Term Reversal | High | |||

|---|---|---|---|---|---|

| Small | 2.1904 *** | 2.0562 *** | 1.7665 ** | 1.8950 ** | 1.1029 |

| Size | (0.0000) | (0.0070) | (0.0300) | (0.0230) | (0.1410) |

| 2.0597 *** | 2.1443 *** | 1.9706 ** | 1.9734 ** | 1.8604 *** | |

| (0.0020) | (0.0100) | (0.0250) | (0.0330) | (0.0240) | |

| 2.5047 *** | 2.4888 *** | 2.5651 *** | 2.3512 ** | 1.9416 *** | |

| (0.0000) | (0.0060) | (0.0080) | (0.0190) | (0.0350) | |

| 2.8191 *** | 2.2757 ** | 2.3503 ** | 2.1280 * | 2.3094 ** | |

| (0.0000) | (0.0180) | (0.0250) | (0.0510) | (0.0170) | |

| 2.5023 *** | 2.1604 ** | 1.3109 | 1.5630 | 1.8164 | |

| Big | (0.0050) | (0.0480) | (0.2880) | (0.2080) | (0.1220) |

| Small | 0.3114 *** | 0.3557 *** | 0.3320 *** | 0.3570 *** | 0.2433 *** |

| Size | (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0030) |

| 0.3094 *** | 0.3875 *** | 0.3875 *** | 0.3865 *** | 0.3217 *** | |

| (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | |

| 0.3578 *** | 0.4263 *** | 0.4483 *** | 0.4196 *** | 0.3492 *** | |

| (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0010) | |

| 0.3916 *** | 0.3904 *** | 0.4596 *** | 0.4024 *** | 0.3985 *** | |

| (0.0000) | (0.0000) | (0.0000) | (0.0010) | (0.0000) | |

| 0.3509 *** | 0.4193 *** | 0.4010 *** | 0.4444 *** | 0.3483 *** | |

| Big | (0.0000) | (0.0000) | (0.0030) | (0.0010) | (0.0070) |

| Small | 1.3313 *** | 1.4184 ** | 1.2289 * | 1.2442 * | 0.6842 |

| Size | (0.0080) | (0.0180) | (0.0570) | (0.0600) | (0.2490) |

| 1.3144 ** | 1.5432 ** | 1.2297 * | 1.3447 * | 1.0128 | |

| (0.0140) | (0.0190) | (0.0790) | (0.0660) | (0.1210) | |

| 1.4228 ** | 1.4688 ** | 1.5244 ** | 0.9976 | 0.9660 | |

| (0.0120) | (0.0420) | (0.0480) | (0.2100) | (0.1870) | |

| 1.6324 *** | 1.1048 | 1.2242 | 0.9612 | 0.9096 | |

| (0.0080) | (0.1480) | (0.1420) | (0.2680) | (0.2380) | |

| 1.7436 ** | 1.6078 * | 1.5803 | 1.0219 | 0.6310 | |

| Big | (0.0130) | (0.0630) | (0.1060) | (0.2990) | (0.4980) |

| Small | 2.6070 *** | 3.1598 *** | 2.8998 *** | 3.1335 *** | 2.1956 *** |

| Size | (0.0000) | (0.0000) | (0.0010) | (0.0010) | (0.0090) |

| 2.5538 *** | 3.3506 *** | 3.3318 *** | 3.5828 *** | 2.9986 *** | |

| (0.0010) | (0.0000) | (0.0010) | (0.0000) | (0.0010) | |

| 3.0700 *** | 3.8211 *** | 4.0304 *** | 3.7664 *** | 3.3286 *** | |

| (0.0000) | (0.0000) | (0.0000) | (0.0010) | (0.0010) | |

| 3.4973 *** | 3.4826 *** | 4.0439 *** | 3.6127 *** | 3.7160 *** | |

| (0.0000) | (0.0010) | (0.0010) | (0.0030) | (0.0010) | |

| 3.2110 *** | 4.0572 *** | 3.8213 *** | 4.0211 *** | 3.3547 *** | |

| Big | (0.0010) | (0.0010) | (0.0050) | (0.0040) | (0.0100) |

| Traditional CCAPM | 0.1011 ** | 0.0473 | −0.0644 | 0.0528 | 0.0701 | −0.0715 ** | −0.0164 | 0.0529 | 0.0337 | 0.0801 * |

| (0.1630) | (0.0470) | (0.0510) | (0.0570) | (0.0690) | (0.1630) | (0.0080) | (0.0210) | (0.0520) | (0.1470) | |

| Durable Goods | 0.1514 ** | 0.095 | −0.0627 | 0.1110 * | −0.0561 | 0.108 | −0.0247 | 0.0496 | 0.0663 | 0.0758 * |

| (0.2130) | (0.1100) | (0.0280) | (0.1480) | (0.0400) | (0.0960) | (0.0110) | (0.0420) | (0.0190) | (0.1530) | |

| Durable Goods and Real Estate | 0.0784 ** | 0.0276 | −0.0643 | 0.0498 | 0.0007 | 0.0662 * | −0.0791 *** | −0.0434 | 0.015 | 0.0243 |

| (0.1880) | (0.0310) | (0.0970) | (0.0980) | (0.0000) | (0.1180) | (0.3840) | (0.1060) | (0.0030) | (0.0520) | |

| Durable Goods and Mortgage | 0.1800 ** | 0.1133 * | −0.0855 | 0.1384 ** | −0.0783 | 0.1412 * | −0.0366 | 0.0503 | 0.0768 | 0.0829 ** |

| (0.2730) | (0.1410) | (0.0470) | (0.2080) | (0.0700) | (0.1480) | (0.0230) | (0.0390) | (0.0230) | (0.1660) | |

| Traditional CCAPM | −0.0101 | −0.0207 | 0.0308 | −0.0035 | 0.0728 ** | −0.04 | 0.0252 | 0.0267 | −0.029 | −0.1083 ** |

| (0.0020) | (0.0300) | (0.0370) | (0.0000) | (0.2820) | (0.0780) | (0.0330) | (0.0200) | (0.0100) | (0.3370) | |

| Durable Goods | −0.0213 | 0.0094 | −0.0374 | −0.1108 | 0.0625 * | −0.0887 ** | 0.0007 | 0.0363 | −0.0399 | −0.1300 ** |

| (0.0050) | (0.0040) | (0.0310) | (0.1060) | (0.1220) | (0.2230) | (0.0000) | (0.0220) | (0.0110) | (0.2830) | |

| Durable Goods and Real Estate | 0.0028 | −0.0443 ** | 0.0163 | 0.0397 | 0.0643 *** | −0.0264 | 0.0235 | 0.0237 | −0.0108 | −0.0742 ** |

| (0.0000) | (0.2620) | (0.0200) | (0.0450) | (0.4240) | (0.0650) | (0.0550) | (0.0310) | (0.0030) | (0.3040) | |

| Durable Goods and Mortgage | −0.0315 | 0.0023 | −0.046 | −0.0968 | 0.0762 ** | −0.0956 ** | −0.0084 | 0.0512 | −0.0376 | −0.1430 ** |

| (0.0100) | (0.0000) | (0.0430) | (0.0730) | (0.1640) | (0.2350) | (0.0020) | (0.0390) | (0.0090) | (0.3100) | |

| Traditional CCAPM | 0.1045 *** | 0.1134 ** | 0.1057 * | −0.1019 * | 0.0177 | 0.0046 | 0.0227 | 0.0101 | −0.0034 | 0 |

| (0.5110) | (0.1950) | (0.1370) | (0.1260) | (0.0130) | (0.0000) | (0.0110) | (0.0090) | (0.0010) | (0.0000) | |

| Durable Goods | 0.1244 *** | 0.1764 ** | 0.1238 | −0.0911 | −0.0415 | 0.1147 * | −0.0515 | −0.0326 | −0.0546 * | 0.04 |

| (0.4240) | (0.2750) | (0.1100) | (0.0590) | (0.0420) | (0.1170) | (0.0320) | (0.0530) | (0.1470) | (0.0150) | |

| Durable Goods and Real Estate | 0.0715 *** | 0.0814 ** | 0.0818 ** | −0.1202 ** | 0.0111 | 0.0071 | 0.0152 | 0.0183 | 0.0063 | −0.0146 |

| (0.4600) | (0.1930) | (0.1570) | (0.3370) | (0.0100) | (0.0010) | (0.0090) | (0.0550) | (0.0060) | (0.0070) | |

| Durable Goods and Mortgage | 0.1288 *** | 0.2012 ** | 0.1360 * | −0.112 | −0.0517 | 0.1193 * | −0.0507 | 0.0183 | −0.0604 ** | 0.0331 |

| (0.4110) | (0.3240) | (0.1200) | (0.0800) | (0.0590) | (0.1140) | (0.0280) | (0.0550) | (0.1620) | (0.0100) | |

| Traditional CCAPM | −0.0331 | 0.0459 ** | −0.0307 * | −0.0029 | −0.0638 | −0.0879 | −0.0471 ** | −0.0393 | 0.0546 ** | 0.0610 ** |

| (0.1070) | (0.1590) | (0.1220) | (0.0000) | (0.0770) | (0.0970) | (0.1930) | (0.0480) | (0.2610) | (0.1710) | |

| Durable Goods | −0.0828 *** | 0.1019 *** | −0.0701 ** | 0.0242 | −0.0814 | −0.0592 | −0.0985 *** | −0.0025 | 0.1074 *** | 0.1234 *** |

| (0.3900) | (0.4580) | (0.3710) | (0.0090) | (0.0730) | (0.0260) | (0.4930) | (0.0000) | (0.5890) | (0.4090) | |

| Durable Goods and Real Estate | −0.0225 | 0.0195 | −0.0161 | −0.0224 | −0.0374 | −0.0863 ** | −0.0163 | −0.0386 | 0.0328 ** | 0.0337 |

| (0.0950) | (0.0550) | (0.0640) | (0.0260) | (0.0500) | (0.1790) | (0.0450) | (0.0890) | (0.1810) | (0.1000) | |

| Durable Goods and Mortgage | −0.0922 *** | 0.1072 *** | −0.0789 *** | 0.0342 | −0.0716 | −0.0502 | −0.1049 *** | 0.0029 | 0.1197 *** | 0.1392 *** |

| (0.4380) | (0.4590) | (0.4250) | (0.0170) | (0.0510) | (0.0170) | (0.5060) | (0.0000) | (0.6620) | (0.4720) | |

| Traditional CCAPM | 0.0431 | 0.1266 ** | −0.0736 ** | −0.0106 | 0.0207 | −0.0656 ** | −0.0106 | −0.0234 | 0.0344 | 0.1177 ** |

| (0.1050) | (0.1920) | (0.1710) | (0.0030) | (0.0320) | (0.2030) | (0.0020) | (0.0160) | (0.0530) | (0.2530) | |

| Durable Goods | 0.0099 | 0.0595 | −0.1199 ** | −0.0919 * | −0.0179 | −0.1282 *** | −0.1049 * | 0.0584 | −0.0316 | 0.0842 |

| (0.0030) | (0.0250) | (0.2650) | (0.1390) | (0.0140) | (0.4540) | (0.1270) | (0.0580) | (0.0260) | (0.0760) | |

| Durable Goods and Real Estate | 0.0457 ** | 0.0814 * | −0.0480 * | 0.0063 | 0.0246 | −0.0313 | −0.0053 | −0.0252 | 0.0272 | 0.0606 * |

| (0.2270) | (0.1520) | (0.1400) | (0.0020) | (0.0860) | (0.0890) | (0.0010) | (0.0360) | (0.0640) | (0.1290) | |

| Durable Goods and Mortgage | 0.007 | 0.0443 | −0.1369 ** | −0.1110 ** | −0.0247 | −0.1418 *** | −0.1232 ** | 0.0698 | −0.0384 | 0.0698 |

| (0.0010) | (0.0120) | (0.3130) | (0.1840) | (0.0240) | (0.5030) | (0.1580) | (0.0750) | (0.0350) | (0.0470) | |

| Traditional CCAPM | 0.0733 *** | 0.1101 *** | 0.0805 *** | −0.0966 ** | 0.1120 ** | 0.0914 ** | −0.0457 | 0.1298 ** | 0.0531 | −0.0896 ** |

| (0.4960) | (0.4280) | (0.4430) | (0.2150) | (0.2890) | (0.3230) | (0.0250) | (0.3180) | (0.0470) | (0.1740) | |

| Durable Goods | 0.1016 *** | 0.1740 *** | 0.1037 *** | −0.064 | 0.1552 ** | 0.1526 *** | −0.1697 ** | 0.2153 *** | 0.0756 | −0.0495 |

| (0.5560) | (0.6240) | (0.4290) | (0.0550) | (0.3250) | (0.5270) | (0.2030) | (0.5110) | (0.0550) | (0.0310) | |

| Durable Goods and Real Estate | 0.0553 *** | 0.0763 *** | 0.0766 *** | −0.0667 ** | 0.0734 ** | 0.0502 ** | −0.022 | 0.0804 ** | 0.0367 | −0.0766 ** |

| (0.5420) | (0.3950) | (0.7720) | (0.1970) | (0.2390) | (0.1880) | (0.0110) | (0.2350) | (0.0430) | (0.2440) | |

| Durable Goods and Mortgage | 0.1113 *** | 0.1839 *** | 0.1165 *** | −0.0726 | 0.1848 *** | 0.1645 *** | −0.1948 ** | 0.2361 *** | 0.0672 | −0.0473 |

| (0.6040) | (0.6320) | (0.4910) | (0.0640) | (0.4160) | (0.5550) | (0.2420) | (0.5560) | (0.0400) | (0.0260) | |

| Traditional CCAPM | −0.1683 ** | −0.1335 *** | 0.015 | −0.0027 | −0.0276 | 0.0919 * | −0.043 | −0.0721 ** | 0.0260 * | 0.0443 ** |

| (0.3080) | (0.8050) | (0.0180) | (0.0010) | (0.0900) | (0.1280) | (0.0480) | (0.1860) | (0.1200) | (0.2820) | |

| Durable Goods | −0.1975 ** | −0.1406 *** | 0.0691 ** | 0.0284 | −0.0679 ** | 0.1634 ** | −0.0863 * | −0.0889 ** | 0.0105 | 0.0745 *** |

| (0.2470) | (0.5220) | (0.2220) | (0.0340) | (0.3180) | (0.2360) | (0.1130) | (0.1660) | (0.0110) | (0.4660) | |

| Durable Goods and Real Estate | −0.1141 ** | −0.0827 *** | 0.0068 | −0.0234 | −0.0132 | 0.0603 | −0.043 | −0.0551 ** | 0.0327 ** | 0.0291 ** |

| (0.2720) | (0.5950) | (0.0070) | (0.0760) | (0.0390) | (0.1060) | (0.0930) | (0.2090) | (0.3660) | (0.2350) | |

| Durable Goods and Mortgage | −0.2379 ** | −0.1469 *** | 0.0783 ** | 0.0319 | −0.0770 ** | 0.1677 ** | −0.0941 * | −0.0800 * | 0.0116 | 0.0844 *** |

| (0.3250) | (0.5160) | (0.2580) | (0.0390) | (0.3700) | (0.2250) | (0.1220) | (0.1210) | (0.0130) | (0.5420) | |

| Traditional CCAPM | 0.0493 | 0.0722 *** | 0.0591 ** | −0.063 | −0.0091 | 0.0572 ** | −0.0488 | 0.018 | 0.0027 | −0.0851 *** |

| (0.0640) | (0.3890) | (0.2860) | (0.0530) | (0.0030) | (0.3290) | (0.0380) | (0.0120) | (0.0010) | (0.4800) | |

| Durable Goods | 0.1228 ** | 0.1226 *** | 0.0970 *** | −0.032 | −0.0689 | 0.1054 *** | −0.0885 | 0.0665 | 0.0406 | −0.0938 ** |

| (0.2310) | (0.6570) | (0.4510) | (0.0080) | (0.1060) | (0.6530) | (0.0730) | (0.0970) | (0.0890) | (0.3410) | |

| Durable Goods and Real Estate | 0.0157 | 0.0546 *** | 0.0484 ** | −0.0546 | −0.0048 | 0.0425 ** | −0.0043 | 0.0376 | 0.0092 | −0.0669 *** |

| (0.0120) | (0.4290) | (0.3700) | (0.0770) | (0.0020) | (0.3490) | (0.0010) | (0.1020) | (0.0150) | (0.5720) | |

| Durable Goods and Mortgage | 0.1320 ** | 0.1324 *** | 0.1049 *** | −0.0305 | −0.0864 * | 0.1159 *** | −0.0637 | 0.0825 * | 0.0528 * | −0.0948 ** |

| (0.2420) | (0.6930) | (0.4770) | (0.0070) | (0.1510) | (0.7140) | (0.0340) | (0.1350) | (0.1360) | (0.3150) | |

| Traditional CCAPM | −0.0654 * | −0.0141 | 0.0025 | 0.1053 ** | 0.0853 * | −0.0076 | 0.1169 ** | −0.0216 | 0.0860 ** | 0.1714 ** |

| (0.1490) | (0.0150) | (0.0000) | (0.3170) | (0.1230) | (0.0010) | (0.3660) | (0.0080) | (0.2700) | (0.2360) | |

| Durable Goods | −0.059 | −0.0663 ** | −0.0433 | 0.1052 ** | 0.025 | 0.0188 | 0.1920 *** | −0.1353 ** | 0.1432 *** | 0.0994 |

| (0.0710) | (0.1920) | (0.0790) | (0.1850) | (0.0060) | (0.0030) | (0.5770) | (0.1930) | (0.4370) | (0.0460) | |

| Durable Goods and Real Estate | −0.0508 ** | 0.0028 | 0.0046 | 0.0673 ** | 0.0721 ** | −0.0025 | 0.0769 ** | −0.0179 | 0.0573 ** | 0.0983 * |

| (0.1730) | (0.0010) | (0.0030) | (0.2480) | (0.1690) | (0.0000) | (0.3040) | (0.0110) | (0.2300) | (0.1490) | |

| Durable Goods and Mortgage | −0.0781 | −0.0682 ** | −0.051 | 0.0993 * | 0.0383 | 0.0221 | 0.2079 *** | −0.1522 ** | 0.1613 *** | 0.1029 |

| (0.1130) | (0.1840) | (0.0990) | (0.1490) | (0.0130) | (0.0040) | (0.6120) | (0.2210) | (0.5020) | (0.0450) | |

| Traditional CCAPM | 0.0629 *** | 0.0011 | 0.0874 ** | −0.0909 ** | −0.0492 | −0.017 | 0.0264 | −0.1043 ** | −0.0088 | 0.0777 * |

| (0.4540) | (0.0000) | (0.2120) | (0.2700) | (0.0610) | (0.0060) | (0.0140) | (0.1690) | (0.0060) | (0.1550) | |

| Durable Goods | 0.0545 ** | 0.0325 | 0.0538 | −0.1236 ** | −0.0465 | −0.089 | 0.0334 | −0.065 | 0.0392 | 0.1027 ** |

| (0.1990) | (0.0230) | (0.0470) | (0.2910) | (0.0320) | (0.1020) | (0.0130) | (0.0380) | (0.0670) | (0.1580) | |

| Durable Goods and Real Estate | 0.0484 *** | −0.0399 * | 0.0634 ** | −0.0799 *** | −0.0869 ** | −0.0145 | −0.0366 | −0.1219 *** | −0.0066 | 0.0155 |

| (0.5170) | (0.1150) | (0.2150) | (0.4010) | (0.3670) | (0.0090) | (0.0530) | (0.4440) | (0.0060) | (0.0120) | |

| Durable Goods and Mortgage | 0.0610 ** | 0.0248 | 0.0657 | −0.1463 ** | −0.0594 | −0.1178 ** | 0.019 | −0.071 | 0.0406 | 0.0876 |

| (0.2250) | (0.0120) | (0.0630) | (0.3700) | (0.0470) | (0.1620) | (0.0040) | (0.0410) | (0.0650) | (0.1040) | |

| Traditional CCAPM | 0.0618 ** | 0.0309 | −0.0286 | 0.0581 *** | −0.1010 ** | −0.1415 *** | 0.032 | −0.0102 | −0.1797 ** | −0.0559 ** |

| (0.2530) | (0.0140) | (0.0440) | (0.4080) | (0.3680) | (0.5200) | (0.0050) | (0.0020) | (0.3690) | (0.1800) | |

| Durable Goods | −0.0920 ** | 0.0662 ** | −0.1119 ** | −0.1966 *** | 0.0356 | 0.0112 | −0.2465 *** | −0.1079 *** | −0.0980 ** | 0.0948 ** |

| (0.2640) | (0.3090) | (0.2640) | (0.5860) | (0.0040) | (0.0020) | (0.4060) | (0.3910) | (0.1720) | (0.2850) | |

| Durable Goods and Real Estate | 0.0224 | 0.0119 | −0.0038 | 0.0540 *** | −0.0867 *** | −0.0942 *** | 0.0822 | −0.0219 | −0.1230 ** | −0.0330 * |

| (0.0640) | (0.0040) | (0.0010) | (0.6760) | (0.5210) | (0.4430) | (0.0680) | (0.0190) | (0.3330) | (0.1210) | |

| Durable Goods and Mortgage | 0.1099 *** | 0.0092 | −0.0971 ** | 0.0728 ** | −0.1191 ** | −0.2111 *** | 0.0364 | 0.0301 | −0.2591 *** | −0.1225 *** |

| (0.4230) | (0.0010) | (0.2660) | (0.3380) | (0.2710) | (0.6110) | (0.0040) | (0.0100) | (0.4060) | (0.4560) | |

| Traditional CCAPM | 0.0719 ** | 0.0418 | −0.0113 | −0.0359 | −0.0068 | −0.0236 | −0.02 | 0.0919 * | 0.0933 * | −0.0095 |

| (0.3650) | (0.0690) | (0.0050) | (0.0340) | (0.0010) | (0.0120) | (0.0060) | (0.1400) | (0.1520) | (0.0010) | |

| Durable Goods | 0.1146 ** | 0.0682 ** | 0.031 | 0.0435 | −0.057 | 0.028 | 0.0151 | 0.0374 | 0.1433 ** | 0.1884 ** |

| (0.1760) | (0.1920) | (0.0220) | (0.0410) | (0.0510) | (0.0110) | (0.0030) | (0.0120) | (0.1990) | (0.3620) | |

| Durable Goods and Real Estate | 0.0603 ** | 0.0685 *** | 0.0474 ** | 0.0067 | −0.012 | −0.0265 | −0.008 | −0.0727 * | 0.0399 | 0.0346 |

| (0.1610) | (0.6360) | (0.1700) | (0.0030) | (0.0070) | (0.0330) | (0.0030) | (0.1450) | (0.0510) | (0.0400) | |

| Durable Goods and Mortgage | 0.1145 ** | 0.0824 ** | 0.0331 | 0.0571 | −0.0575 | 0.0252 | 0.0175 | 0.0315 | 0.1342 ** | 0.1962 ** |

| (0.1590) | (0.2530) | (0.0230) | (0.0650) | (0.0470) | (0.0080) | (0.0030) | (0.0080) | (0.1580) | (0.3550) | |

| Traditional CCAPM | −0.0283 | −0.051 | 0.0269 | 0.0033 | 0.0023 | 0.0892 * | −0.0201 | 0.0103 | 0.0868 ** | 0.0864 ** |

| (0.0370) | (0.1060) | (0.0250) | (0.0010) | (0.0000) | (0.1330) | (0.0130) | (0.0040) | (0.1830) | (0.3240) | |

| Durable Goods | −0.022 | −0.0424 | 0.0504 | 0.0629 | −0.0514 | 0.1466 ** | 0.0245 | 0.036 | 0.0625 | 0.1269 *** |

| (0.0130) | (0.0430) | (0.0510) | (0.1060) | (0.1010) | (0.2100) | (0.0120) | (0.0280) | (0.0550) | (0.4080) | |

| Durable Goods and Real Estate | −0.0381 * | −0.0526 ** | 0.0194 | −0.0187 | 0.0006 | 0.0662 * | −0.0255 | 0.0188 | 0.0846 ** | 0.0667 ** |

| (0.1300) | (0.2170) | (0.0250) | (0.0310) | (0.0000) | (0.1410) | (0.0410) | (0.0250) | (0.3340) | (0.3710) | |

| Durable Goods and Mortgage | −0.0316 | −0.0469 | 0.0434 | 0.0698 * | −0.0616 * | 0.1551 ** | 0.0334 | 0.0345 | 0.0624 | 0.1382 *** |

| (0.0250) | (0.0470) | (0.0340) | (0.1190) | (0.1320) | (0.2130) | (0.0190) | (0.0240) | (0.0500) | (0.4380) | |

| Traditional CCAPM | 0.0538 | −0.0204 | −0.013 | −0.0169 | 0.003 | −0.0462 * | 0.0810 ** | −0.0184 | 0.0841 ** | 0.0415 |

| (0.0670) | (0.0110) | (0.0260) | (0.0250) | (0.0010) | (0.1300) | (0.2150) | (0.0440) | (0.2570) | (0.0510) | |

| Durable Goods | 0.1360 ** | 0.0143 | −0.0473 ** | −0.0579 ** | −0.0339 | −0.0922 ** | 0.1097 ** | −0.0606 ** | 0.0603 | −0.0055 |

| (0.2480) | (0.0030) | (0.1970) | (0.1710) | (0.0420) | (0.3030) | (0.2310) | (0.2810) | (0.0770) | (0.0010) | |

| Durable Goods and Real Estate | 0.0296 | −0.0672 ** | 0.003 | −0.0053 | 0.0234 | −0.023 | 0.0703 ** | −0.0046 | 0.0788 *** | 0.0239 |

| (0.0390) | (0.2280) | (0.0030) | (0.0050) | (0.0660) | (0.0620) | (0.3120) | (0.0050) | (0.4350) | (0.0330) | |

| Durable Goods and Mortgage | 0.1523 ** | 0.011 | −0.0527 ** | −0.0685 ** | −0.0401 | −0.1021 ** | 0.1173 ** | −0.0689 ** | 0.0681 | −0.0153 |

| (0.2820) | (0.0020) | (0.2210) | (0.2160) | (0.0530) | (0.3360) | (0.2390) | (0.3280) | (0.0890) | (0.0040) | |

| Traditional CCAPM | 0.0364 ** | 0.0360 ** | −0.0217 | 0.0367 ** | 0.0208 | 0.0003 | 0.0854 *** | −0.0338 * | 0.0069 | −0.0573 ** |

| (0.1800) | (0.2230) | (0.0560) | (0.2820) | (0.0690) | (0.0000) | (0.7970) | (0.1390) | (0.0090) | (0.1630) | |

| Durable Goods | 0.0734 *** | 0.0791 *** | −0.0714 ** | 0.0648 *** | −0.0007 | 0.0465 | 0.1047 *** | −0.0147 | −0.0235 | −0.0945 ** |

| (0.4280) | (0.6300) | (0.3580) | (0.5140) | (0.0000) | (0.0390) | (0.7000) | (0.0150) | (0.0600) | (0.2590) | |

| Durable Goods and Real Estate | 0.0352 ** | 0.0260 ** | −0.0238 * | 0.0275 ** | 0.0238 ** | 0.0419 | 0.0525 *** | −0.0376 ** | 0.0083 | −0.0436 ** |

| (0.3240) | (0.2250) | (0.1310) | (0.3050) | (0.1720) | (0.1050) | (0.5800) | (0.3300) | (0.0250) | (0.1820) | |

| Durable Goods and Mortgage | 0.0836 *** | 0.0863 *** | −0.0769 ** | 0.0742 *** | −0.0055 | 0.0677 | 0.1085 *** | −0.0142 | −0.0299 | −0.1129 ** |

| (0.5020) | (0.6790) | (0.3760) | (0.6110) | (0.0030) | (0.0760) | (0.6810) | (0.0130) | (0.0870) | (0.3350) | |

| Traditional CCAPM | −0.0625 | −0.0838 ** | −0.0143 | 0.0558 | −0.0603 *** | −0.0719 ** | 0.0555 ** | 0.0599 ** | 0.0437 ** | −0.0890 * |

| (0.0480) | (0.3010) | (0.0100) | (0.0960) | (0.5430) | (0.3730) | (0.2530) | (0.1920) | (0.1720) | (0.1160) | |

| Durable Goods | −0.1779 ** | −0.1430 *** | 0.0067 | 0.0262 | −0.0934 *** | −0.0765 ** | 0.0418 | 0.0299 | 0.0825 ** | −0.1032 |

| (0.2290) | (0.5120) | (0.0010) | (0.0120) | (0.7600) | (0.2470) | (0.0840) | (0.0280) | (0.3580) | (0.0910) | |

| Durable Goods and Real Estate | −0.0528 | −0.0715 *** | 0.0045 | 0.0054 | −0.0420 *** | −0.0595 *** | 0.0456 ** | 0.0500 ** | 0.0386 ** | −0.0688 * |

| (0.0670) | (0.4210) | (0.0020) | (0.0020) | (0.5070) | (0.4920) | (0.3280) | (0.2580) | (0.2570) | (0.1330) | |

| Durable Goods and Mortgage | −0.1967 ** | −0.1582 *** | 0.0209 | 0.0093 | −0.1025 *** | −0.0816 ** | 0.0407 | 0.0248 | 0.0937 *** | −0.1351 * |

| (0.2540) | (0.5670) | (0.0110) | (0.0010) | (0.8290) | (0.2540) | (0.0720) | (0.0170) | (0.4180) | (0.1410) | |

| Traditional CCAPM | −0.0221 | −0.1430 ** | 0.0857 *** | −0.0116 | −0.1268 *** | 0.0282 | 0.0593 | 0.0470 * | 0.0197 | 0.1406 ** |

| (0.0050) | (0.2450) | (0.5870) | (0.0030) | (0.5330) | (0.0130) | (0.0440) | (0.1270) | (0.0270) | (0.2210) | |

| Durable Goods | 0.0359 | −0.1288 * | 0.1204 *** | 0.0323 | −0.1636 *** | 0.1122 * | 0.1506 ** | 0.1033 ** | −0.0279 | 0.1287 |

| (0.0070) | (0.1160) | (0.6760) | (0.0150) | (0.5190) | (0.1240) | (0.1660) | (0.3570) | (0.0320) | (0.1080) | |

| Durable Goods and Real Estate | −0.0659 | −0.0965 ** | 0.0631 *** | −0.0242 | −0.0914 *** | 0.0396 | 0.0096 | 0.0211 | 0.0181 | 0.0819 * |

| (0.0800) | (0.2150) | (0.6110) | (0.0270) | (0.5330) | (0.0510) | (0.0020) | (0.0490) | (0.0450) | (0.1440) | |

| Durable Goods and Mortgage | 0.0109 | −0.1464 * | 0.1316 *** | 0.0422 | −0.1868 *** | 0.1384 ** | 0.1694 ** | 0.1129 *** | −0.0359 | 0.1357 |

| (0.0010) | (0.1360) | (0.7320) | (0.0230) | (0.6120) | (0.1710) | (0.1900) | (0.3860) | (0.0480) | (0.1090) | |

| Traditional CCAPM | 0.0016 | −0.0305 | 0.0738 *** | 0.1176 ** | 0.0760 * | −0.1412 *** | 0.0343 | 0.0764 ** | −0.0827 ** | −0.0987 * |

| (0.0000) | (0.0420) | (0.5760) | (0.1650) | (0.1140) | (0.4230) | (0.0230) | (0.2420) | (0.1610) | (0.1520) | |

| Durable Goods | 0.0539 | −0.0975 ** | 0.0964 *** | 0.0323 | 0.0379 | −0.1792 *** | 0.0461 | 0.1478 *** | −0.1438 ** | −0.033 |

| (0.0500) | (0.2490) | (0.5750) | (0.0150) | (0.0170) | (0.3980) | (0.0240) | (0.5280) | (0.2840) | (0.0100) | |

| Durable Goods and Real Estate | −0.0344 | −0.0146 | 0.0540 *** | −0.0242 | 0.0441 | −0.0955 ** | 0.0179 | 0.0531 ** | −0.0768 ** | −0.0729 ** |

| (0.0670) | (0.0180) | (0.5940) | (0.0270) | (0.0740) | (0.3720) | (0.0120) | (0.2250) | (0.2670) | (0.1590) | |

| Durable Goods and Mortgage | 0.0374 | −0.1109 ** | 0.1018 *** | 0.0988 | 0.0247 | −0.1971 *** | 0.0267 | 0.1616 *** | −0.1589 ** | −0.0298 |

| (0.0220) | (0.2920) | (0.5800) | (0.0620) | (0.0060) | (0.4360) | (0.0070) | (0.5720) | (0.3150) | (0.0070) | |

| Traditional CCAPM | −0.0453 * | −0.0002 | −0.0650 ** | −0.0328 *** | −0.0273 ** | 0.0379 | 0.0549 *** | 0.0291 *** | 0.0300 ** | −0.0418 ** |

| (0.1470) | (0.0000) | (0.2610) | (0.5110) | (0.1700) | (0.0670) | (0.5210) | (0.5810) | (0.1700) | (0.1980) | |

| Durable Goods | −0.0224 | −0.0424 | −0.1071 *** | −0.0504 *** | −0.0529 ** | 0.0286 | 0.0796 *** | 0.0422 *** | 0.0215 | −0.0907 *** |

| (0.0210) | (0.0720) | (0.4140) | (0.7030) | (0.3730) | (0.0220) | (0.6390) | (0.7150) | (0.0510) | (0.5440) | |

| Durable Goods and Real Estate | −0.0268 | −0.0118 | −0.0449 ** | −0.0211 *** | −0.0136 | 0.0278 | 0.0365 *** | 0.0167 ** | 0.0300 ** | −0.0217 |

| (0.1000) | (0.0180) | (0.2400) | (0.4080) | (0.0810) | (0.0690) | (0.4430) | (0.3690) | (0.3250) | (0.1030) | |

| Durable Goods and Mortgage | −0.015 | −0.0593 * | −0.1218 *** | −0.0537 *** | −0.0600 *** | 0.0371 | 0.0852 *** | 0.0437 *** | 0.0216 | −0.0952 *** |

| (0.0090) | (0.1270) | (0.4850) | (0.7220) | (0.4350) | (0.0340) | (0.6630) | (0.6940) | (0.0460) | (0.5420) | |

| Traditional CCAPM | 0.0449 | −0.1115 | −0.0202 | 0.0974 ** | 0.0309 | 0.1638 * | 0.0157 | −0.0873 * | −0.0888 *** | −0.0898 ** |

| (0.0220) | (0.0710) | (0.0190) | (0.2810) | (0.0210) | (0.1430) | (0.0030) | (0.1310) | (0.3970) | (0.2650) | |

| Durable Goods | 0.0281 | −0.0867 | −0.0769 ** | 0.1581 *** | 0.1255 ** | 0.0413 | −0.0141 | −0.0728 | −0.0606 | −0.0704 |

| (0.0050) | (0.0250) | (0.1580) | (0.4330) | (0.2040) | (0.0050) | (0.0020) | (0.0530) | (0.1080) | (0.0950) | |

| Durable Goods and Real Estate | 0.0213 | −0.1109 * | −0.006 | 0.0769 ** | 0.0445 | 0.1412 ** | −0.0567 | −0.1052 ** | −0.0680 *** | −0.0721 ** |

| (0.0100) | (0.1340) | (0.0030) | (0.3380) | (0.0850) | (0.2040) | (0.0830) | (0.3660) | (0.4480) | (0.3290) | |

| Durable Goods and Mortgage | 0.0086 | −0.0824 | −0.0924 ** | 0.1835 *** | 0.1428 ** | 0.0408 | −0.0225 | −0.0757 | −0.0647 | −0.0775 |

| (0.0000) | (0.0200) | (0.2060) | (0.5280) | (0.2400) | (0.0050) | (0.0040) | (0.0520) | (0.1120) | (0.1040) | |

| Traditional CCAPM | −0.0787 ** | 0.0068 | 0.0862 | 0.0942 ** | 0.1850 ** | 0.0319 | −0.0814 ** | 0.0201 | 0.2079 ** | 0.0662 |

| (0.2390) | (0.0010) | (0.0540) | (0.2890) | (0.3520) | (0.0140) | (0.1840) | (0.0040) | (0.3150) | (0.0980) | |

| Durable Goods | −0.1188 ** | 0.0071 | 0.1465 | 0.1092 ** | 0.1586 * | −0.0263 | −0.1534 *** | 0.0209 | 0.1992 ** | 0.1472 ** |

| (0.3180) | (0.0010) | (0.0910) | (0.2270) | (0.1510) | (0.0050) | (0.3830) | (0.0020) | (0.1690) | (0.2840) | |

| Durable Goods and Real Estate | −0.0219 | 0.0052 | 0.0945 * | 0.0530 ** | 0.1019 ** | 0.0645 | −0.0562 ** | 0.0531 | 0.1199 ** | 0.0171 |

| (0.0360) | (0.0010) | (0.1240) | (0.1760) | (0.2050) | (0.1080) | (0.1690) | (0.0500) | (0.2020) | (0.0130) | |

| Durable Goods and Mortgage | −0.1081 ** | −0.0003 | 0.1754 * | 0.1160 ** | 0.1678 * | −0.0134 | −0.1757 *** | 0.0404 | 0.2078 ** | 0.1626 ** |

| (0.2380) | (0.0000) | (0.1180) | (0.2310) | (0.1530) | (0.0010) | (0.4540) | (0.0080) | (0.1670) | (0.3140) | |

| Traditional CCAPM | −0.1081 ** | 0.0305 | −0.1116 *** | −0.0464 | 0.0523 | −0.1098 ** | −0.0441 *** | −0.0318 ** | −0.0899 ** | 0.0151 |

| (0.3570) | (0.0500) | (0.4030) | (0.0390) | (0.0830) | (0.2910) | (0.6020) | (0.1930) | (0.3040) | (0.0290) | |

| Durable Goods | −0.1598 *** | −0.0464 | 0.1546 *** | −0.1864 *** | −0.0384 ** | −0.0657 *** | −0.0865 ** | −0.0231 | 0.0215 | −0.0907 *** |

| (0.4830) | (0.0390) | (0.4240) | (0.4900) | (0.2670) | (0.4820) | (0.1650) | (0.0400) | (0.0710) | (0.5440) | |

| Durable Goods and Real Estate | −0.0868 *** | 0.0056 | −0.0999 *** | −0.056 | 0.0276 | −0.0512 * | −0.0341 *** | −0.0221 ** | −0.0869 *** | 0.016 |

| (0.4440) | (0.0030) | (0.6220) | (0.1100) | (0.0440) | (0.1220) | (0.6940) | (0.1790) | (0.5470) | (0.0640) | |

| Durable Goods and Mortgage | −0.0984 * | 0.1024 ** | −0.1689 *** | −0.002 | 0.1634 *** | −0.1901 *** | −0.0421 ** | −0.0689 *** | −0.0932 ** | −0.0248 |

| (0.1570) | (0.3010) | (0.4880) | (0.0000) | (0.4290) | (0.4620) | (0.2910) | (0.4790) | (0.1730) | (0.0420) | |

| Traditional CCAPM | −0.1612 *** | 0.0441 | 0.0828 ** | 0.0508 | 0.0801 | 0.0689 ** | 0.0289 ** | −0.0975 ** | 0.0021 | 0.0377 ** |

| (0.4240) | (0.0730) | (0.2380) | (0.0700) | (0.0570) | (0.1910) | (0.2210) | (0.1650) | (0.0000) | (0.2820) | |

| Durable Goods | −0.2252 *** | 0.0944 ** | 0.0733 | 0.0292 | 0.1903 ** | 0.1327 *** | 0.0052 | −0.0945 | −0.0919 | 0.0722 *** |

| (0.4840) | (0.1970) | (0.1090) | (0.0130) | (0.1880) | (0.4130) | (0.0010) | (0.0720) | (0.0850) | (0.6030) | |

| Durable Goods and Real Estate | −0.1080 ** | 0.026 | 0.0850 *** | 0.0605 ** | 0.0733 | 0.0433 * | 0.0293 *** | −0.0151 | −0.0501 | 0.0260 ** |

| (0.3660) | (0.0490) | (0.4830) | (0.1900) | (0.0920) | (0.1450) | (0.4390) | (0.0060) | (0.0840) | (0.2580) | |

| Durable Goods and Mortgage | −0.2382 *** | 0.1115 ** | 0.0809 * | 0.0478 | 0.2166 ** | 0.1453 *** | 0.0221 | −0.1106 | −0.071 | 0.0784 *** |

| (0.4900) | (0.2490) | (0.1200) | (0.0330) | (0.2210) | (0.4490) | (0.0680) | (0.0890) | (0.0460) | (0.6450) | |

| Traditional CCAPM | 0.0592 | −0.0087 | −0.0639 ** | −0.0779 ** | 0.0893 *** | 0.0337 | 0.0798 ** | 0.0328 ** | 0.0679 | 0.1258 ** |

| (0.0920) | (0.0020) | (0.1750) | (0.2400) | (0.5780) | (0.0230) | (0.2390) | (0.2010) | (0.0850) | (0.2420) | |

| Durable Goods | 0.1391 ** | 0.0611 | −0.0408 | −0.0676 | 0.1173 *** | 0.0961 | 0.1487 *** | 0.0135 | 0.1372 ** | 0.2433 *** |

| (0.2950) | (0.0690) | (0.0420) | (0.1060) | (0.5830) | (0.1070) | (0.4850) | (0.0200) | (0.2030) | (0.5280) | |

| Durable Goods and Real Estate | 0.0554 * | −0.0095 | −0.0669 ** | −0.0817 *** | 0.0699 *** | 0.0307 | 0.0471 ** | 0.0315 ** | 0.0173 | 0.0615 |

| (0.1540) | (0.0050) | (0.3690) | (0.5080) | (0.6810) | (0.0360) | (0.1600) | (0.3560) | (0.0110) | (0.1110) | |

| Durable Goods and Mortgage | 0.1659 ** | 0.0775 | −0.0434 | −0.0694 | 0.1277 *** | 0.086 | 0.1625 *** | 0.0134 | 0.1553 ** | 0.2513 *** |

| (0.3810) | (0.1000) | (0.0430) | (0.1010) | (0.6250) | (0.0780) | (0.5240) | (0.0180) | (0.2350) | (0.5100) | |

| Traditional CCAPM | 0.0753 *** | 0.0476 | 0.0482 | −0.0579 ** | −0.0044 | 0.0826 ** | −0.0573 ** | 0.1279 ** | 0.0538 | 0.1112 * |

| (0.5140) | (0.0240) | (0.0510) | (0.1750) | (0.0010) | (0.1740) | (0.2250) | (0.3370) | (0.0520) | (0.1380) | |

| Durable Goods | 0.0867 *** | 0.0524 | 0.1126 ** | −0.1285 *** | −0.0426 | 0.0264 | −0.1071 *** | 0.1807 *** | 0.1479 ** | 0.0675 |

| (0.3980) | (0.0170) | (0.1620) | (0.5060) | (0.0610) | (0.0100) | (0.4580) | (0.3930) | (0.2290) | (0.0300) | |

| Durable Goods and Real Estate | 0.0673 *** | 0.0432 | 0.0115 | −0.0390 * | 0.0112 | 0.0479 | −0.0341 * | 0.1194 *** | 0.0332 | 0.0933 ** |

| (0.7900) | (0.0380) | (0.0060) | (0.1530) | (0.0140) | (0.1130) | (0.1530) | (0.5660) | (0.0380) | (0.1870) | |

| Durable Goods and Mortgage | 0.0953 *** | 0.0382 | 0.1172 ** | −0.1422 *** | −0.0542 | 0.0149 | −0.1209 *** | 0.2064 *** | 0.1619 ** | 0.0828 |

| (0.4350) | (0.0080) | (0.1590) | (0.5600) | (0.0890) | (0.0030) | (0.5280) | (0.4650) | (0.2480) | (0.0400) | |

| Traditional CCAPM | 0.0831 | −0.0747 | −0.0142 | 0.0189 | −0.0292 | −0.0622 | 0.0489 | −0.1391 * | −0.0752 ** | 0.024 |

| (0.1070) | (0.1100) | (0.0080) | (0.0060) | (0.0110) | (0.0560) | (0.0450) | (0.1420) | (0.1860) | (0.1100) | |

| Durable Goods | 0.1304 * | −0.0235 | 0.033 | 0.0639 | −0.0947 | −0.1650 ** | 0.1331 ** | −0.2218 ** | −0.1255 ** | 0.0531 ** |

| (0.1530) | (0.0060) | (0.0240) | (0.0380) | (0.0650) | (0.2310) | (0.1920) | (0.2110) | (0.3030) | (0.3140) | |

| Durable Goods and Real Estate | 0.0446 | −0.0679 ** | −0.0154 | 0.0249 | 0.0491 | 0.0139 | 0.0174 | −0.0781 | −0.0251 | 0.0227 ** |

| (0.0590) | (0.1750) | (0.0170) | (0.0190) | (0.0580) | (0.0050) | (0.0110) | (0.0860) | (0.0400) | (0.1890) | |

| Durable Goods and Mortgage | 0.1591 ** | −0.0152 | 0.0469 | 0.092 | −0.0737 | −0.1585 ** | 0.1611 ** | −0.2340 ** | −0.1421 ** | 0.0582 ** |

| (0.2070) | (0.0020) | (0.0450) | (0.0700) | (0.0360) | (0.1930) | (0.2550) | (0.2130) | (0.3520) | (0.3420) | |

| Traditional CCAPM | 0.044 | −0.0103 | 0.0361 ** | 0.0212 * | −0.0129 | −0.0438 | −0.0171 | 0.0177 | −0.0333 | −0.0650 *** |

| (0.0640) | (0.0150) | (0.2520) | (0.1180) | (0.0110) | (0.0630) | (0.0250) | (0.0430) | (0.1040) | (0.4840) | |

| Durable Goods | 0.0970 ** | −0.0435 ** | 0.0468 ** | 0.0306 * | 0.0229 | −0.0860 * | −0.0202 | 0.0063 | −0.0114 | −0.0737 ** |

| (0.1810) | (0.1620) | (0.2470) | (0.1440) | (0.0210) | (0.1410) | (0.0210) | (0.0030) | (0.0070) | (0.3640) | |

| Durable Goods and Real Estate | 0.0226 | −0.0158 | 0.0163 | 0.009 | −0.0068 | −0.0184 | −0.0294 * | 0.0314 ** | −0.0286 * | −0.0587 *** |

| (0.0320) | (0.0700) | (0.0990) | (0.0410) | (0.0060) | (0.0210) | (0.1460) | (0.2600) | (0.1470) | (0.7600) | |

| Durable Goods and Mortgage | 0.0945 * | −0.0523 ** | 0.0433 ** | 0.0258 | 0.0283 | −0.0792 | −0.0236 | 0.0077 | −0.0159 | −0.0803 *** |

| (0.1550) | (0.2120) | (0.1910) | (0.0930) | (0.0280) | (0.1080) | (0.0260) | (0.0040) | (0.0130) | (0.3910) | |

| Traditional CCAPM | −0.0354 | −0.0903 ** | −0.0680 * | −0.1504 ** | 0.0154 | −0.1606 *** | −0.004 | |||

| (0.0590) | (0.2750) | (0.1340) | (0.1850) | (0.0110) | (0.4010) | (0.0010) | ||||

| Durable Goods | 0.0111 | −0.1455 *** | −0.0827 * | −0.2579 ** | 0.0925 ** | −0.1608 ** | −0.0521 * | |||

| (0.0030) | (0.4170) | (0.1160) | (0.3180) | (0.2380) | (0.2350) | (0.1180) | ||||

| Durable Goods and Real Estate | −0.0246 | −0.0570 ** | −0.0835 *** | −0.0435 | −0.0003 | −0.0902 ** | 0.01 | |||

| (0.0550) | (0.2100) | (0.3890) | (0.0300) | (0.0000) | (0.2440) | (0.0140) | ||||

| Durable Goods and Mortgage | 0.0221 | −0.1637 *** | −0.1025 ** | −0.2569 ** | 0.0971 ** | −0.1640 ** | −0.0524 | |||

| (0.0120) | (0.4770) | (0.1610) | (0.2860) | (0.2380) | (0.2210) | (0.1080) |

| Traditional CCAPM | 0.0726 ** | 0.0721 * | 0.0484 | 0.0586 ** | −0.0024 | 0.0457 | 0.016 | 0.0302 | 0.0494 ** | 0.0674 ** |

| (0.2810) | (0.1270) | (0.0430) | (0.1900) | (0.0010) | (0.0220) | (0.0110) | (0.0750) | (0.1840) | (0.2060) | |

| Durable Goods | 0.0097 ** | 0.0148 ** | 0.0139 ** | 0.0048 | −0.0045 * | 0.0091 | 0.0118 ** | 0.0096 *** | 0.001 | 0.0024 |

| (0.3080) | (0.3300) | (0.2180) | (0.0800) | (0.1160) | (0.0530) | (0.3560) | (0.4620) | (0.0050) | (0.0160) | |

| Durable Goods and Real Estate | 0.0663 *** | 0.0927 ** | 0.0620 * | 0.0637 *** | 0.0113 | 0.0969 ** | 0.0291 | 0.0086 | 0.0365 ** | 0.0225 |

| (0.4110) | (0.3710) | (0.1240) | (0.3950) | (0.0210) | (0.1730) | (0.0620) | (0.0110) | (0.1760) | (0.0400) | |

| Durable Goods and Mortgage | 0.0898 ** | 0.1469 ** | 0.0935 | 0.0456 | −0.0662 ** | 0.122 | 0.1263 *** | 0.0983 *** | −0.0083 | 0.0166 |

| (0.2720) | (0.3350) | (0.1020) | (0.0730) | (0.2600) | (0.0990) | (0.4210) | (0.5070) | (0.0030) | (0.0080) | |

| Traditional CCAPM | −0.0644 * | 0.0039 | 0.0283 ** | 0.0014 | 0.0388 * | 0.0074 | −0.0007 | 0.0653 * | −0.0646 * | 0.045 |

| (0.1490) | (0.0030) | (0.2100) | (0.0000) | (0.1350) | (0.0030) | (0.0000) | (0.1320) | (0.1280) | (0.0880) | |

| Durable Goods | 0 | 0.0066 *** | −0.0012 | −0.0043 | −0.0026 | −0.001 | −0.0034 | 0.0088 * | 0.005 | 0.0003 |

| (0.0000) | (0.4690) | (0.0230) | (0.0550) | (0.0370) | (0.0040) | (0.0970) | (0.1470) | (0.0470) | (0.0000) | |

| Durable Goods and Real Estate | −0.0419 | −0.0085 | 0.0216 ** | 0.0263 | 0.0352 ** | 0.0402 ** | 0.01 | 0.0387 | 0.0049 | 0.0204 |

| (0.1100) | (0.0220) | (0.2140) | (0.0580) | (0.1950) | (0.1570) | (0.0240) | (0.0810) | (0.0010) | (0.0320) | |

| Durable Goods and Mortgage | 0.0088 | 0.0752 *** | −0.0262 * | −0.0657 * | −0.0475 * | −0.0362 | −0.0483 ** | 0.0859 * | 0.049 | −0.0037 |

| (0.0020) | (0.6210) | (0.1140) | (0.1310) | (0.1280) | (0.0460) | (0.1990) | (0.1450) | (0.0470) | (0.0000) | |

| Traditional CCAPM | 0.0055 | 0.1051 ** | 0.0426 | 0.0368 | 0.0208 | −0.0078 | 0.0703 ** | −0.0023 | −0.0092 | 0.0527 ** |

| (0.0010) | (0.2870) | (0.0370) | (0.0260) | (0.0520) | (0.0020) | (0.1990) | (0.0010) | (0.0150) | (0.2200) | |

| Durable Goods | 0.0014 | 0.0105 ** | −0.002 | 0.0171 ** | −0.003 | 0.0130 ** | −0.0032 | −0.0050 ** | −0.0060 *** | 0.0019 |

| (0.0040) | (0.1750) | (0.0050) | (0.3470) | (0.0680) | (0.3460) | (0.0240) | (0.2780) | (0.3850) | (0.0180) | |

| Durable Goods and Real Estate | 0.0193 | 0.0659 ** | 0.0487 | 0.0397 | 0.0183 | 0.0421 | 0.0067 | −0.0153 | −0.0149 | 0.0514 ** |

| (0.0230) | (0.1990) | (0.0860) | (0.0540) | (0.0710) | (0.1040) | (0.0030) | (0.0750) | (0.0690) | (0.3670) | |

| Durable Goods and Mortgage | −0.0029 | 0.0994 ** | −0.0671 | 0.1565 ** | −0.0509 ** | 0.1319 ** | −0.0408 | −0.0574 ** | −0.0668 *** | 0.0031 |

| (0.0000) | (0.1630) | (0.0590) | (0.3020) | (0.1970) | (0.3690) | (0.0420) | (0.3800) | (0.4960) | (0.0000) | |

| Traditional CCAPM | 0.0246 * | 0.0441 ** | 0.0018 | 0.0505 ** | 0.0857 *** | 0.0431 | −0.0069 | −0.0199 | 0.0094 | 0.0473 *** |

| (0.1480) | (0.2950) | (0.0010) | (0.1980) | (0.3950) | (0.0780) | (0.0060) | (0.0240) | (0.0140) | (0.4170) | |

| Durable Goods | −0.0026 | 0.0064 ** | −0.0028 ** | 0.0078 ** | 0.0075 ** | 0.0085 ** | −0.0061 ** | 0.0058 * | 0.0058 ** | 0.0043 ** |

| (0.0980) | (0.3770) | (0.1960) | (0.2860) | (0.1840) | (0.1870) | (0.3100) | (0.1250) | (0.3290) | (0.2100) | |

| Durable Goods and Real Estate | 0.014 | 0.0415 *** | 0.0038 | 0.0135 | 0.0690 *** | 0.0332 | 0.0025 | −0.0178 | 0.0137 | 0.0351 *** |

| (0.0840) | (0.4580) | (0.0100) | (0.0250) | (0.4510) | (0.0810) | (0.0010) | (0.0330) | (0.0540) | (0.4050) | |

| Durable Goods and Mortgage | −0.0368 ** | 0.0558 ** | −0.0376 ** | 0.0832 ** | 0.0558 | 0.0745 * | −0.0692 *** | 0.0812 ** | 0.0681 *** | 0.0408 ** |

| (0.2100) | (0.2980) | (0.3590) | (0.3400) | (0.1060) | (0.1480) | (0.4110) | (0.2520) | (0.4750) | (0.1970) | |

| Traditional CCAPM | −0.0041 | 0.0185 | −0.0225 | 0.0219 | −0.0059 | −0.0025 | 0.0232 | 0.0239 ** | 0.0266 * | 0.0617 * |

| (0.0040) | (0.0110) | (0.0220) | (0.0470) | (0.0090) | (0.0000) | (0.0470) | (0.1680) | (0.1390) | (0.1440) | |

| Durable Goods | −0.0034 * | −0.0065 | −0.0064 | −0.0063 ** | −0.0039 ** | −0.0099 ** | −0.0059 ** | 0.0029 * | −0.0033 * | −0.0022 |

| (0.1480) | (0.0820) | (0.1090) | (0.2420) | (0.2360) | (0.3670) | (0.1850) | (0.1540) | (0.1280) | (0.0110) | |

| Durable Goods and Real Estate | 0.0078 | −0.0094 | 0.0147 | 0.015 | 0.0059 | −0.0079 | 0.0245 | 0.0258 ** | 0.0185 * | 0.035 |

| (0.0230) | (0.0050) | (0.0170) | (0.0390) | (0.0150) | (0.0070) | (0.0920) | (0.3430) | (0.1170) | (0.0810) | |

| Durable Goods and Mortgage | −0.0464 ** | −0.0901 ** | −0.0840 ** | −0.0803 *** | −0.0498 *** | −0.1109 *** | −0.0795 ** | 0.0291 ** | −0.0467 ** | −0.0545 |

| (0.2940) | (0.1630) | (0.1980) | (0.4060) | (0.3900) | (0.4790) | (0.3520) | (0.1570) | (0.2710) | (0.0710) | |

| Traditional CCAPM | 0.0522 ** | 0.0566 ** | −0.0254 | 0.0632 * | 0.0441 ** | 0.0321 | 0.0155 | −0.0171 | 0.0396 | 0.0347 |

| (0.2010) | (0.2530) | (0.0300) | (0.1540) | (0.3390) | (0.0660) | (0.0170) | (0.0230) | (0.0550) | (0.0620) | |

| Durable Goods | 0.0108 *** | 0.0095 *** | 0.0012 | 0.0103 ** | 0.0045 ** | 0.0100 *** | −0.0059 * | 0.0073 ** | −0.0028 | 0.0092 ** |

| (0.5230) | (0.4310) | (0.0040) | (0.2520) | (0.2180) | (0.3910) | (0.1510) | (0.2510) | (0.0160) | (0.2630) | |

| Durable Goods and Real Estate | 0.0531 ** | 0.0505 ** | 0.0274 | 0.0712 ** | 0.0365 *** | 0.0048 | 0.0288 | −0.0246 | 0.0717 ** | 0.0407 * |

| (0.3670) | (0.3540) | (0.0610) | (0.3440) | (0.4080) | (0.0030) | (0.1050) | (0.0820) | (0.3150) | (0.1490) | |

| Durable Goods and Mortgage | 0.1049 *** | 0.0856 ** | 0.0189 | 0.0971 ** | 0.0355 * | 0.1127 *** | −0.0845 ** | 0.0864 ** | −0.0417 | 0.0842 ** |

| (0.5160) | (0.3660) | (0.0100) | (0.2310) | (0.1390) | (0.5110) | (0.3270) | (0.3660) | (0.0380) | (0.2300) | |

| Traditional CCAPM | −0.0133 | −0.0742 * | −0.0131 | 0.0303 ** | −0.0117 | 0.0617 ** | 0.0149 | 0.0564 * | −0.0126 | 0.0064 |

| (0.0050) | (0.1460) | (0.0520) | (0.2600) | (0.0430) | (0.2210) | (0.0070) | (0.1450) | (0.0440) | (0.0060) | |

| Durable Goods | −0.0103 ** | 0.0005 | 0.0030 ** | 0.0046 ** | −0.0041 ** | 0.0025 | −0.0021 | 0.0112 ** | −0.0038 ** | 0.0074 *** |

| (0.1770) | (0.0000) | (0.1650) | (0.3660) | (0.3250) | (0.0220) | (0.0090) | (0.3480) | (0.2370) | (0.4990) | |

| Durable Goods and Real Estate | 0.0025 | −0.0483 | −0.0171 * | 0.0041 | −0.0103 | 0.0418 ** | −0.0209 | 0.0132 | −0.0048 | −0.0009 |

| (0.0000) | (0.1080) | (0.1550) | (0.0090) | (0.0580) | (0.1780) | (0.0260) | (0.0140) | (0.0110) | (0.0000) | |

| Durable Goods and Mortgage | −0.1028 ** | 0.0308 | 0.0408 ** | 0.0442 ** | −0.0499 *** | 0.0081 | −0.0306 | 0.1116 ** | −0.0451 ** | 0.0857 *** |

| (0.1850) | (0.0160) | (0.3200) | (0.3510) | (0.4930) | (0.0020) | (0.0200) | (0.3590) | (0.3550) | (0.6990) | |

| Traditional CCAPM | 0.0503 * | 0.0234 | 0.0034 | 0.029 | 0.0136 | −0.0164 | 0.0409 ** | −0.0022 | −0.0034 | 0.0346 ** |

| (0.1190) | (0.0360) | (0.0020) | (0.1100) | (0.0290) | (0.0470) | (0.2020) | (0.0010) | (0.0040) | (0.2830) | |

| Durable Goods | 0.0108 ** | 0.0090 ** | 0.0040 ** | 0.0002 | −0.0055 ** | 0.0064 *** | −0.0003 | 0.0038 | 0.0049 *** | 0.001 |

| (0.3340) | (0.3280) | (0.1670) | (0.0000) | (0.2890) | (0.4380) | (0.0010) | (0.1040) | (0.4760) | (0.0140) | |

| Durable Goods and Real Estate | 0.0185 | 0.0244 | 0.0301 ** | 0.0377 ** | 0.0165 | −0.0113 | 0.0442 *** | 0.0205 | 0.0021 | 0.0236 ** |

| (0.0280) | (0.0700) | (0.2760) | (0.3280) | (0.0750) | (0.0390) | (0.4140) | (0.0880) | (0.0020) | (0.2320) | |

| Durable Goods and Mortgage | 0.1080 ** | 0.0973 *** | 0.0347 * | −0.0014 | −0.0704 *** | 0.0709 *** | −0.0076 | 0.0524 ** | 0.0490 *** | 0.0096 |

| (0.3470) | (0.4000) | (0.1320) | (0.0000) | (0.4920) | (0.5530) | (0.0040) | (0.2070) | (0.4990) | (0.0140) | |

| Traditional CCAPM | −0.0437 | −0.0084 | 0.0058 | 0.0329 | 0.0065 | 0.1101 ** | 0.0148 | 0.0181 | 0.0391 | 0.0332 |

| (0.0650) | (0.0200) | (0.0060) | (0.0480) | (0.0020) | (0.3080) | (0.0100) | (0.0300) | (0.0910) | (0.0230) | |

| Durable Goods | −0.0014 | −0.0062 *** | −0.0051 ** | −0.0083 ** | −0.0042 | 0.0097 * | 0.0121 *** | −0.0067 ** | 0.0120 *** | 0.0037 |

| (0.0040) | (0.6640) | (0.2980) | (0.1860) | (0.0600) | (0.1450) | (0.4020) | (0.2520) | (0.5200) | (0.0180) | |

| Durable Goods and Real Estate | −0.0014 | −0.0075 | 0.0099 | 0.0266 | 0.0055 | 0.0735 ** | 0.0184 | −0.0001 | −0.0111 | 0.0115 |

| (0.0000) | (0.0270) | (0.0330) | (0.0550) | (0.0030) | (0.2410) | (0.0270) | (0.0000) | (0.0130) | (0.0050) | |

| Durable Goods and Mortgage | −0.0156 | −0.0641 *** | −0.0612 *** | −0.0942 ** | −0.0671 ** | 0.0909 * | 0.1251 *** | −0.0847 *** | 0.1228 *** | −0.0079 |

| (0.0050) | (0.7290) | (0.4480) | (0.2460) | (0.1610) | (0.1330) | (0.4430) | (0.4160) | (0.5700) | (0.0010) | |

| Traditional CCAPM | 0.0167 | 0.0771 ** | 0.0517 ** | −0.0581 ** | 0.0551 *** | −0.0065 | 0.0365 | −0.0052 | −0.0330 ** | 0.0389 ** |

| (0.0310) | (0.3280) | (0.2680) | (0.2160) | (0.4200) | (0.0020) | (0.0750) | (0.0010) | (0.2690) | (0.2520) | |

| Durable Goods | −0.0069 ** | 0.0097 ** | −0.0021 | −0.0012 | 0.0034 | −0.0091 ** | 0.0047 | 0.0119 ** | 0.0028 * | 0.0015 |

| (0.3200) | (0.3160) | (0.0260) | (0.0060) | (0.0980) | (0.2860) | (0.0760) | (0.2670) | (0.1150) | (0.0230) | |

| Durable Goods and Real Estate | −0.0016 | 0.0551 ** | 0.0339 ** | −0.0598 *** | 0.0388 ** | −0.0144 | −0.0281 | −0.0488 * | −0.0261 ** | 0.0458 *** |

| (0.0010) | (0.2940) | (0.2020) | (0.4030) | (0.3670) | (0.0210) | (0.0780) | (0.1290) | (0.2970) | (0.6130) | |

| Durable Goods and Mortgage | −0.0838 *** | 0.0880 ** | −0.0446 * | −0.0152 | 0.0218 | −0.1117 *** | 0.0337 | 0.1359 ** | 0.0367 ** | 0.0026 |

| (0.4940) | (0.2700) | (0.1260) | (0.0090) | (0.0420) | (0.4430) | (0.0410) | (0.3600) | (0.2120) | (0.0010) | |

| Traditional CCAPM | 0.0459 | −0.0308 | −0.0052 | 0.0016 | 0.0096 | −0.1135 ** | 0.018 | 0.0285 | 0.0008 | −0.026 |

| (0.1070) | (0.0500) | (0.0030) | (0.0000) | (0.0040) | (0.3620) | (0.0100) | (0.0310) | (0.0000) | (0.0490) | |

| Durable Goods | 0.0103 ** | −0.0091 ** | −0.0075 *** | −0.004 | 0.0061 | 0.003 | −0.006 | 0.0105 ** | 0.0053 | −0.0090 ** |

| (0.3250) | (0.2700) | (0.3880) | (0.0820) | (0.0940) | (0.0150) | (0.0700) | (0.2600) | (0.0660) | (0.3600) | |

| Durable Goods and Real Estate | −0.0092 | −0.0341 | 0.0155 | 0.0108 | 0.01 | −0.0447 | 0.0454 * | −0.0029 | −0.0206 | −0.0019 |

| (0.0080) | (0.1080) | (0.0480) | (0.0170) | (0.0070) | (0.0990) | (0.1140) | (0.0010) | (0.0290) | (0.0000) | |

| Durable Goods and Mortgage | 0.0990 ** | −0.0694 ** | −0.0822 *** | −0.0505 * | 0.0750 * | 0.0529 | −0.0907 ** | 0.1232 ** | 0.0505 | −0.0972 *** |

| (0.3140) | (0.1610) | (0.4840) | (0.1360) | (0.1470) | (0.0500) | (0.1650) | (0.3700) | (0.0620) | (0.4320) | |

| Traditional CCAPM | 0.0099 | 0.012 | 0.0225 | −0.0049 | 0.0331 | 0.0027 | 0.0054 | 0.0104 ** | 0.0053 | 0.003 |

| (0.0070) | (0.0130) | (0.0330) | (0.0020) | (0.0550) | (0.0200) | (0.0600) | (0.2330) | (0.0590) | (0.0240) | |

| Durable Goods | −0.0037 | −0.0028 | −0.004 | 0.0058 * | −0.0015 | 0.0027 | 0.0054 | 0.0104 ** | 0.0053 | 0.003 |

| (0.0620) | (0.0450) | (0.0630) | (0.1480) | (0.0070) | (0.0200) | (0.0600) | (0.2330) | (0.0590) | (0.0240) | |

| Durable Goods and Real Estate | 0.0415 ** | 0.0041 | 0.0301 | 0.0192 | 0.0367 * | 0.0668 ** | 0.0716 ** | 0.0221 | −0.0125 | −0.007 |

| (0.2260) | (0.0030) | (0.1050) | (0.0470) | (0.1180) | (0.3480) | (0.3010) | (0.0300) | (0.0100) | (0.0040) | |

| Durable Goods and Mortgage | −0.0540 * | −0.0434 | −0.0580 * | 0.0704 ** | −0.015 | 0.0243 | 0.0466 | 0.0977 ** | 0.019 | 0.0476 |

| (0.1380) | (0.1090) | (0.1400) | (0.2290) | (0.0070) | (0.0170) | (0.0460) | (0.2120) | (0.0080) | (0.0640) | |

| Traditional CCAPM | 0.004 | 0.0018 | −0.0035 | 0.0312 | 0.0244 | 0.0308 | −0.0032 | −0.0165 | −0.0079 | −0.0449 |

| (0.0010) | (0.0000) | (0.0010) | (0.0680) | (0.1080) | (0.0980) | (0.0010) | (0.0130) | (0.0040) | (0.0770) | |

| Durable Goods | −0.0014 | −0.0014 | 0.0018 | 0.0092 ** | −0.0016 | −0.0009 | 0.0080 ** | 0.0008 | −0.0062 * | 0.0081 * |

| (0.0090) | (0.0100) | (0.0130) | (0.3630) | (0.0270) | (0.0060) | (0.2940) | (0.0020) | (0.1440) | (0.1520) | |

| Durable Goods and Real Estate | 0.0164 | −0.0329 ** | −0.005 | 0.0048 | 0.0152 | 0.0481 *** | 0.0089 | 0.0176 | 0.0207 | −0.0322 |

| (0.0390) | (0.1580) | (0.0030) | (0.0030) | (0.0740) | (0.4190) | (0.0110) | (0.0270) | (0.0460) | (0.0700) | |

| Durable Goods and Mortgage | −0.0315 | 0.0041 | 0.0016 | 0.1018 *** | −0.0326 * | −0.0279 | 0.0818 ** | 0.0063 | −0.0813 ** | 0.1013 ** |

| (0.0520) | (0.0010) | (0.0000) | (0.4610) | (0.1230) | (0.0510) | (0.3220) | (0.0010) | (0.2550) | (0.2490) | |

| Traditional CCAPM | 0.0324 | 0.0493 *** | 0.0025 | −0.0041 | −0.013 | −0.0223 | 0.0131 | −0.0048 | −0.018 | 0.0289 |

| (0.0540) | (0.4420) | (0.0030) | (0.0030) | (0.0270) | (0.0580) | (0.0130) | (0.0070) | (0.0150) | (0.1120) | |

| Durable Goods | 0.0089 ** | 0.0023 | −0.0033 ** | −0.0066 *** | −0.0046 ** | −0.0078 *** | −0.0005 | −0.0044 ** | −0.0062 | −0.0023 |

| (0.2530) | (0.0610) | (0.2980) | (0.4080) | (0.2090) | (0.4300) | (0.0010) | (0.3740) | (0.1130) | (0.0430) | |

| Durable Goods and Real Estate | 0.0480 ** | 0.0223 ** | 0.005 | 0.0003 | 0.001 | −0.0128 | 0.0478 ** | −0.0036 | −0.0138 | 0.0364 ** |

| (0.2100) | (0.1590) | (0.0190) | (0.0000) | (0.0000) | (0.0340) | (0.3030) | (0.0070) | (0.0160) | (0.3130) | |

| Durable Goods and Mortgage | 0.1025 ** | 0.0174 | −0.0415 *** | −0.0769 *** | −0.0553 ** | −0.0777 *** | −0.0186 | −0.0531 *** | −0.0661 * | −0.0413 * |

| (0.3450) | (0.0350) | (0.4790) | (0.5760) | (0.3130) | (0.4430) | (0.0170) | (0.5610) | (0.1320) | (0.1450) | |

| Traditional CCAPM | −0.0205 | −0.0006 | 0.0310 ** | 0.0051 | 0.0076 | −0.0319 | 0.0522 ** | 0.0232 ** | 0.0136 ** | 0.0538 ** |

| (0.0670) | (0.0000) | (0.3780) | (0.0050) | (0.0310) | (0.1100) | (0.2770) | (0.2110) | (0.1850) | (0.2240) | |

| Durable Goods | 0.0026 | 0.0050 ** | −0.0008 | 0.0047 ** | −0.0016 | 0.0015 | −0.0033 | 0.0026 ** | −0.001 | −0.0008 |

| (0.0670) | (0.3540) | (0.0170) | (0.2700) | (0.0820) | (0.0150) | (0.0690) | (0.1630) | (0.0650) | (0.0030) | |

| Durable Goods and Real Estate | −0.0007 | 0.0058 | 0.0116 | −0.0022 | 0.0131 ** | −0.0119 | 0.0155 | 0.0118 | 0.0106 ** | 0.0499 ** |

| (0.0000) | (0.0140) | (0.0920) | (0.0020) | (0.1600) | (0.0270) | (0.0430) | (0.0960) | (0.1970) | (0.3390) | |

| Durable Goods and Mortgage | 0.0395 ** | 0.0585 *** | −0.018 | 0.0585 *** | −0.0259 ** | 0.0259 | −0.0539 ** | 0.0256 ** | −0.0177 ** | −0.0368 |

| (0.1580) | (0.5080) | (0.0810) | (0.4290) | (0.2240) | (0.0460) | (0.1870) | (0.1620) | (0.1980) | (0.0670) | |

| Traditional CCAPM | 0.0554 * | −0.0073 | −0.0115 | 0.0557 *** | 0.0048 | −0.0589 ** | 0.0096 | 0.0106 | 0.0173 | 0.0490 ** |

| (0.1170) | (0.0020) | (0.0200) | (0.4590) | (0.0030) | (0.2570) | (0.0120) | (0.0080) | (0.0360) | (0.3050) | |

| Durable Goods | 0.0054 | −0.0088 ** | 0.0022 | −0.0003 | −0.0057 ** | −0.0011 | 0.0026 | −0.0007 | 0.0076 *** | −0.0011 |

| (0.0680) | (0.2170) | (0.0450) | (0.0010) | (0.2800) | (0.0060) | (0.0520) | (0.0030) | (0.4220) | (0.0090) | |

| Durable Goods and Real Estate | 0.0227 | −0.0481 ** | 0.0094 | 0.0227 * | 0.007 | −0.0468 ** | −0.0173 | 0.0009 | −0.0056 | 0.0430 *** |

| (0.0350) | (0.1880) | (0.0240) | (0.1340) | (0.0120) | (0.2850) | (0.0670) | (0.0000) | (0.0070) | (0.4140) | |

| Durable Goods and Mortgage | 0.0162 | −0.0867 ** | 0.0221 | −0.0199 | −0.0717 *** | 0.0098 | 0.0112 | −0.0324 | 0.0839 *** | −0.0231 |

| (0.0060) | (0.2200) | (0.0470) | (0.0370) | (0.4630) | (0.0050) | (0.0100) | (0.0500) | (0.5340) | (0.0430) | |

| Traditional CCAPM | −0.0218 | 0.0486 | 0.0217 | 0.0445 ** | −0.0089 | 0.0079 | 0.0788 ** | 0.0438 ** | 0.0232 ** | 0.0688 * |

| (0.0270) | (0.0300) | (0.0410) | (0.1730) | (0.0030) | (0.0030) | (0.3490) | (0.3130) | (0.1860) | (0.1320) | |

| Durable Goods | 0.0068 ** | 0.0063 | 0.0077 ** | 0.0045 | −0.0043 | 0.0087 ** | 0.0065 * | 0.0067 *** | −0.0007 | 0.0055 |

| (0.1620) | (0.0310) | (0.3150) | (0.1070) | (0.0480) | (0.2500) | (0.1470) | (0.4420) | (0.0110) | (0.0520) | |

| Durable Goods and Real Estate | −0.0139 | 0.0527 | −0.0216 | 0.0453 ** | 0.0194 | 0.0041 | 0.0512 ** | 0.0294 ** | 0.0194 ** | 0.0490 * |

| (0.0200) | (0.0620) | (0.0710) | (0.3150) | (0.0270) | (0.0020) | (0.2600) | (0.2480) | (0.2280) | (0.1180) | |

| Durable Goods and Mortgage | 0.053 | 0.0205 | 0.0861 *** | 0.0448 | −0.0584 | 0.0921 ** | 0.0584 * | 0.0597 ** | −0.0196 | 0.0378 |

| (0.1020) | (0.0030) | (0.4060) | (0.1110) | (0.0890) | (0.2890) | (0.1220) | (0.3680) | (0.0840) | (0.0250) | |

| Traditional CCAPM | 0.0191 | 0.0113 | −0.0286 | 0.0445 ** | −0.0239 | 0.0969 * | 0.0275 | 0.0076 | 0.0822 ** | −0.0098 |

| (0.0170) | (0.0140) | (0.0390) | (0.1730) | (0.0320) | (0.1410) | (0.0250) | (0.0030) | (0.2120) | (0.0040) | |

| Durable Goods | 0.0106 ** | −0.0054 ** | 0.003 | 0.0045 | −0.0077 ** | −0.0047 | −0.0021 | 0.0084 ** | −0.003 | 0.0092 ** |

| (0.3120) | (0.1990) | (0.0270) | (0.1070) | (0.2000) | (0.0200) | (0.0090) | (0.2290) | (0.0170) | (0.2060) | |

| Durable Goods and Real Estate | 0.0134 | −0.0156 | −0.0399 * | 0.0453 ** | −0.0249 | 0.0491 | 0.0354 | 0.0182 | 0.025 | 0.0133 |

| (0.0140) | (0.0490) | (0.1340) | (0.3150) | (0.0610) | (0.0630) | (0.0720) | (0.0310) | (0.0350) | (0.0120) | |

| Durable Goods and Mortgage | 0.1057 ** | −0.0658 ** | 0.0267 | −0.0453 | −0.0912 ** | −0.0905 | −0.0479 | 0.1039 ** | −0.0507 | 0.1063 ** |

| (0.3230) | (0.3110) | (0.0220) | (0.0220) | (0.2920) | (0.0780) | (0.0480) | (0.3610) | (0.0510) | (0.2840) | |

| Traditional CCAPM | −0.0021 | 0.016 | −0.0616 ** | −0.0138 * | −0.0114 | 0.0079 | 0.0473 ** | −0.0032 | 0.008 | 0.0145 |

| (0.0010) | (0.0680) | (0.2240) | (0.1250) | (0.0450) | (0.0140) | (0.3270) | (0.0130) | (0.0700) | (0.0900) | |

| Durable Goods | 0 | −0.0032 ** | −0.0067 ** | −0.0021 ** | −0.0042 ** | 0.0045 ** | 0.0035 | 0.0022 ** | −0.0012 | −0.0025 ** |

| (0.0000) | (0.1640) | (0.1590) | (0.1770) | (0.3670) | (0.2800) | (0.1080) | (0.3670) | (0.0910) | (0.1630) | |

| Durable Goods and Real Estate | 0.0021 | 0.0091 | −0.0611 *** | −0.0172 ** | −0.0118 | 0.0121 | 0.0455 *** | −0.0087 ** | 0.0109 ** | 0.0149 ** |

| (0.0010) | (0.0380) | (0.3870) | (0.3400) | (0.0840) | (0.0580) | (0.5310) | (0.1660) | (0.2240) | (0.1670) | |

| Durable Goods and Mortgage | 0.0097 | −0.0405 ** | −0.0422 | −0.0126 | −0.0408 ** | 0.0437 ** | 0.0261 | 0.0230 *** | −0.0178 ** | −0.0352 ** |

| (0.0100) | (0.2750) | (0.0660) | (0.0660) | (0.3640) | (0.2730) | (0.0630) | (0.4160) | (0.2170) | (0.3330) | |

| Traditional CCAPM | −0.0484 | 0.0525 | 0.0087 | −0.0084 | −0.0081 | 0.0358 | 0.0715 ** | 0.0067 | −0.0334 * | −0.0357 ** |

| (0.0990) | (0.0610) | (0.0100) | (0.0030) | (0.0030) | (0.0260) | (0.1760) | (0.0020) | (0.1190) | (0.1770) | |

| Durable Goods | −0.0077 * | −0.001 | −0.0064 ** | 0.0090 ** | 0.0089 ** | −0.008 | 0.0067 | 0.0043 | 0.0052 ** | 0.0037 * |

| (0.1540) | (0.0010) | (0.3140) | (0.2310) | (0.2360) | (0.0790) | (0.0940) | (0.0470) | (0.1730) | (0.1170) | |

| Durable Goods and Real Estate | −0.0770 *** | 0.0773 ** | 0.0103 | −0.0083 | 0.0434 ** | 0.0201 | −0.0146 | −0.0485 ** | −0.0229 | −0.0342 ** |

| (0.4420) | (0.2340) | (0.0240) | (0.0060) | (0.1630) | (0.0140) | (0.0130) | (0.1720) | (0.0980) | (0.2850) | |

| Durable Goods and Mortgage | −0.0689 * | −0.0246 | −0.0752 *** | 0.1078 ** | 0.0892 ** | −0.1241 ** | 0.062 | 0.0653 | 0.0686 ** | 0.0473 ** |

| (0.1280) | (0.0090) | (0.4540) | (0.3460) | (0.2480) | (0.1970) | (0.0840) | (0.1120) | (0.3170) | (0.1960) | |

| Traditional CCAPM | 0.0391 | −0.0723 ** | 0.0777 ** | 0.0789 ** | −0.0185 | −0.0179 | 0.0393 | −0.0318 | 0.0357 | −0.0006 |

| (0.0780) | (0.3430) | (0.2240) | (0.3500) | (0.0110) | (0.0120) | (0.0670) | (0.0150) | (0.0320) | (0.0000) | |

| Durable Goods | −0.0035 | 0.0014 | 0.003 | 0.0032 | 0.0074 | −0.0094 ** | −0.0068 * | −0.0011 | −0.0026 | 0.0084 ** |

| (0.0380) | (0.0080) | (0.0200) | (0.0340) | (0.1100) | (0.2030) | (0.1210) | (0.0010) | (0.0110) | (0.2850) | |

| Durable Goods and Real Estate | 0.0401 * | −0.0330 * | 0.0825 *** | 0.0253 | −0.0614 ** | 0.0506 ** | −0.0032 | 0.0678 * | 0.0319 | −0.015 |

| (0.1450) | (0.1260) | (0.4430) | (0.0630) | (0.2200) | (0.1690) | (0.0010) | (0.1230) | (0.0450) | (0.0260) | |

| Durable Goods and Mortgage | −0.0577 | 0.0285 | 0.0156 | 0.0077 | 0.0721 | −0.0964 ** | −0.0885 ** | −0.019 | −0.0327 | 0.0970 *** |

| (0.1080) | (0.0340) | (0.0060) | (0.0020) | (0.1090) | (0.2210) | (0.2150) | (0.0030) | (0.0170) | (0.3950) | |

| Traditional CCAPM | 0.0043 | 0.0117 | 0.0307 | 0.0553 ** | 0.0276 | −0.0468 * | −0.0256 ** | 0.0146 | −0.0057 | 0.0045 |

| (0.0010) | (0.0230) | (0.1010) | (0.2870) | (0.0580) | (0.1290) | (0.2600) | (0.1060) | (0.0040) | (0.0080) | |

| Durable Goods | 0.0073 ** | 0.0066 *** | −0.0027 | 0.0553 ** | 0.0084 ** | −0.0112 *** | 0.0017 | −0.0013 | 0.0012 | −0.0024 * |

| (0.2010) | (0.4470) | (0.0460) | (0.2870) | (0.3270) | (0.4490) | (0.0730) | (0.0480) | (0.0090) | (0.1400) | |

| Durable Goods and Real Estate | 0.0358 * | 0.0132 | 0.0374 ** | 0.0477 ** | 0.0387 ** | −0.031 | −0.0173 ** | 0.0067 | −0.0196 | −0.0011 |

| (0.1380) | (0.0510) | (0.2630) | (0.3760) | (0.2010) | (0.0990) | (0.2080) | (0.0390) | (0.0740) | (0.0010) | |

| Durable Goods and Mortgage | 0.0689 ** | 0.0735 *** | −0.0417 * | 0.0684 ** | 0.0829 ** | −0.1199 *** | 0.0278 ** | −0.0193 * | 0.0269 | −0.0326 ** |

| (0.1850) | (0.5680) | (0.1180) | (0.2790) | (0.3320) | (0.5370) | (0.1940) | (0.1170) | (0.0500) | (0.2740) | |

| Traditional CCAPM | 0.0004 | 0.0037 | 0.0547 ** | 0.0358 ** | 0.0439 ** | 0.1012 ** | 0.035 | 0.0213 | 0.0258 | 0.011 |

| (0.0010) | (0.0390) | (0.2050) | (0.2570) | (0.1840) | (0.2260) | (0.0410) | (0.0400) | (0.0540) | (0.0180) | |

| Durable Goods | 0.0004 | 0.0037 | 0.0041 | 0.0045 ** | 0.0004 | 0.0046 | 0.0037 | 0.0061 ** | 0.0047 | 0.0058 ** |

| (0.0010) | (0.0390) | (0.0710) | (0.2530) | (0.0010) | (0.0290) | (0.0290) | (0.1970) | (0.1100) | (0.2910) | |

| Durable Goods and Real Estate | 0.0346 * | −0.0124 | 0.0697 *** | 0.0272 ** | 0.0570 *** | 0.0565 * | 0.0686 ** | 0.0263 | 0.0478 ** | 0.0145 |

| (0.1500) | (0.0130) | (0.5860) | (0.2600) | (0.5440) | (0.1240) | (0.2790) | (0.1070) | (0.3290) | (0.0530) | |

| Durable Goods and Mortgage | −0.0286 | 0.0512 | 0.0176 | 0.0422 ** | −0.0147 | 0.0189 | 0.0452 | 0.0601 ** | 0.0458 | 0.0718 *** |

| (0.0370) | (0.0780) | (0.0140) | (0.2270) | (0.0130) | (0.0050) | (0.0440) | (0.2010) | (0.1090) | (0.4710) | |

| Traditional CCAPM | 0.0022 | 0.0610 ** | 0.0644 ** | 0.0082 | 0.0458 * | −0.0053 | 0.002 | 0.0927 ** | 0.0261 | 0.0391 ** |

| (0.0000) | (0.2070) | (0.3720) | (0.0040) | (0.1520) | (0.0100) | (0.0020) | (0.2760) | (0.0160) | (0.2040) | |

| Durable Goods | 0.0014 | 0.0091 ** | 0.0067 ** | 0.0092 ** | 0.0086 ** | 0.0035 ** | −0.0036 ** | 0.0127 ** | 0.0151 ** | −0.0033 |

| (0.0070) | (0.2820) | (0.2480) | (0.3020) | (0.3250) | (0.2760) | (0.3040) | (0.3190) | (0.3350) | (0.0880) | |

| Durable Goods and Real Estate | 0.0328 | 0.022 | 0.0242 | −0.0145 | 0.0342 * | −0.0095 | 0.0028 | 0.0281 | 0.0347 | 0.0147 |

| (0.1000) | (0.0470) | (0.0930) | (0.0220) | (0.1480) | (0.0580) | (0.0050) | (0.0450) | (0.0510) | (0.0510) | |

| Durable Goods and Mortgage | −0.0149 | 0.0856 ** | 0.0627 ** | 0.1042 *** | 0.0672 ** | 0.0443 *** | −0.0448 *** | 0.1214 ** | 0.1312 ** | −0.0540 ** |

| (0.0070) | (0.2580) | (0.2230) | (0.4030) | (0.2070) | (0.4600) | (0.4820) | (0.3010) | (0.2630) | (0.2480) | |

| Traditional CCAPM | −0.0398 * | 0.053 | 0.0607 ** | 0.0236 | 0.0018 | −0.0041 | 0.0099 | 0.0439 | 0.0691 | 0.0248 |

| (0.1450) | (0.0920) | (0.2460) | (0.0540) | (0.0010) | (0.0030) | (0.0030) | (0.0820) | (0.0660) | (0.0200) | |

| Durable Goods | 0.0034 | 0.0075 * | 0.0087 ** | −0.0059 ** | −0.0036 ** | −0.0056 ** | 0.0041 | 0.0110 ** | 0.0085 | 0.0166 *** |

| (0.0650) | (0.1130) | (0.3080) | (0.2060) | (0.1710) | (0.3050) | (0.0300) | (0.3120) | (0.0610) | (0.5330) | |

| Durable Goods and Real Estate | −0.0451 ** | 0.0933 *** | 0.0417 ** | 0.0093 | 0.0200 * | 0.003 | 0.04 | 0.0587 ** | 0.0832 ** | −0.0107 |

| (0.3270) | (0.4990) | (0.2040) | (0.0150) | (0.1500) | (0.0030) | (0.0810) | (0.2580) | (0.1680) | (0.0060) | |

| Durable Goods and Mortgage | 0.0398 | 0.0573 | 0.0729 ** | −0.0790 *** | −0.0485 ** | −0.0666 *** | 0.0336 | 0.1108 ** | 0.0882 | 0.1636 *** |

| (0.0920) | (0.0680) | (0.2240) | (0.3840) | (0.3180) | (0.4460) | (0.0210) | (0.3300) | (0.0680) | (0.5380) | |

| Traditional CCAPM | 0.0490 ** | −0.0319 | −0.0626 * | −0.005 | 0.0358 | −0.0203 | 0.0283 | −0.0424 | −0.0186 * | 0.0147 * |

| (0.1870) | (0.0380) | (0.1180) | (0.0030) | (0.0720) | (0.0730) | (0.0350) | (0.1100) | (0.1490) | (0.1180) | |

| Durable Goods | 0.0047 | −0.0107 ** | −0.0116 ** | 0.0069 ** | 0.0075 ** | 0.0055 ** | −0.0033 | −0.0118 *** | 0.0025 ** | −0.0025 ** |

| (0.1040) | (0.2580) | (0.2470) | (0.3060) | (0.1920) | (0.3200) | (0.0290) | (0.5210) | (0.1650) | (0.2180) | |

| Durable Goods and Real Estate | 0.0571 *** | 0.02 | −0.0729 ** | −0.0067 | 0.0521 ** | −0.0262 ** | 0.0544 ** | −0.0097 | −0.0085 | 0.0103 |

| (0.4460) | (0.0260) | (0.2820) | (0.0080) | (0.2670) | (0.2110) | (0.2280) | (0.0100) | (0.0540) | (0.1030) | |

| Durable Goods and Mortgage | 0.0372 | −0.0939 ** | −0.1101 ** | 0.0839 *** | 0.0794 ** | 0.0641 *** | −0.0523 | −0.1208 *** | 0.0303 ** | −0.0333 *** |

| (0.0680) | (0.2070) | (0.2310) | (0.4690) | (0.2240) | (0.4570) | (0.0760) | (0.5650) | (0.2500) | (0.3870) | |

| Traditional CCAPM | 0.0389 ** | −0.0048 | 0.0136 | −0.0221 * | 0.0093 | 0.0192 ** | −0.0137 | −0.0151 | −0.0011 | −0.0118 |

| (0.2780) | (0.0040) | (0.0300) | (0.1490) | (0.0100) | (0.1690) | (0.0760) | (0.0950) | (0.0000) | (0.0810) | |

| Durable Goods | 0.0036 * | 0.0027 | 0.0018 | 0.0008 | 0.0078 *** | −0.0019 | −0.0004 | 0.0023 * | 0.0028 | −0.0040 *** |

| (0.1410) | (0.0800) | (0.0310) | (0.0120) | (0.4380) | (0.1070) | (0.0040) | (0.1370) | (0.0310) | (0.5590) | |

| Durable Goods and Real Estate | 0.0431 *** | −0.0279 ** | 0.0246 ** | −0.0018 | 0.0193 | 0.0197 ** | 0.0104 | −0.0229 *** | −0.0296 | −0.0101 |

| (0.5990) | (0.2420) | (0.1710) | (0.0020) | (0.0770) | (0.3150) | (0.0770) | (0.3850) | (0.0970) | (0.1040) | |

| Durable Goods and Mortgage | 0.0255 | 0.0368 * | 0.0004 | 0.0044 | 0.0803 *** | −0.0261 ** | −0.0107 | 0.0294 ** | 0.0325 | −0.0424 *** |

| (0.0750) | (0.1510) | (0.0000) | (0.0040) | (0.4780) | (0.1990) | (0.0290) | (0.2270) | (0.0420) | (0.6560) | |

| Traditional CCAPM | 0.02 | −0.0247 ** | 0.0835 *** | 0.0489 | −0.0177 | −0.0367 | −0.0037 | |||

| (0.0480) | (0.1760) | (0.4700) | (0.0860) | (0.0660) | (0.0760) | (0.0070) | ||||

| Durable Goods | 0.0049 ** | 0.0011 | 0.0024 | −0.0029 | 0.0047 ** | −0.0044 | −0.0034 ** | |||

| (0.1790) | (0.0220) | (0.0230) | (0.0180) | (0.2890) | (0.0680) | (0.3340) | ||||

| Durable Goods and Real Estate | 0.0188 | −0.0169 * | 0.0265 | 0.0627 ** | −0.014 | 0.0084 | 0.0025 | |||

| (0.0750) | (0.1450) | (0.0830) | (0.2480) | (0.0720) | (0.0070) | (0.0050) | ||||

| Durable Goods and Mortgage | 0.0547 ** | 0.0112 | 0.0108 | −0.062 | 0.0569 *** | −0.0403 | −0.0400 *** | |||

| (0.2290) | (0.0230) | (0.0050) | (0.0870) | (0.4310) | (0.0580) | (0.4910) |

| Traditional CCAPM | Durable Goods | Real Estate | Mortgage | |

|---|---|---|---|---|

| Portfolios formed on Size and Book-to-market | 0.1247 | 0.1584 | 0.1429 | 0.1708 |

| Portfolios formed on Size and Short-term Reversal | 0.0880 | 0.1270 | 0.1119 | 0.1482 |

| Traditional CCAPM | Durable Goods | Durable Goods and Real Estate | Durable Goods and Mortgage | |

|---|---|---|---|---|

| coefficient | −714.977 | 4458.363 * | 397.4273 | −2532.897 |

| T-value | −0.83 | 2.01 | 0.54 | −1.28 |

| Traditional CCAPM | Durable Goods | Durable Goods and Real Estate | Durable Goods and Mortgage | |

|---|---|---|---|---|

| coefficient | −3971.675 | 8823.567 * | 1141.787 | −5967.786 *** |

| T-value | −1.00 | 1.95 | 1.20 | −3.95 |

| Traditional CCAPM | Durable Goods | Durable Goods and Real Estate | Durable Goods and Mortgage | |

|---|---|---|---|---|

| coefficient | −593.4991 | 5346.244 * | −9.76455 | −2054.592 |

| T-value | −0.5 | 1.76 | −0.01 | −0.76 |

| Traditional CCAPM | Durable Goods | Durable Goods and Real Estate | Durable Goods and Mortgage | |

|---|---|---|---|---|

| coefficient | −1405.042 | 6512.049 * | 752.2156 | −3574.18 |

| T-value | −0.94 | 1.70 | 0.59 | −1.04 |

| Traditional CCAPM | Durable Goods | Durable Goods and Real Estate | Durable Goods and Mortgage | |

|---|---|---|---|---|

| coefficient | 110.9902 | −1671.528 | 985.8642 | −2153.467 |

| T-value | 0.05 | −0.29 | 0.52 | −0.42 |

| Traditional CCAPM | Durable Goods | Durable Goods and Real Estate | Durable Goods and Mortgage | |

|---|---|---|---|---|

| coefficient | −5908.321 | 12403.9 ** | 1172.098 | −7658.789 *** |

| T-value | −1.10 | 2.03 | 0.91 | −3.74 |

| Traditional CCAPM | Durable Goods | Durable Goods and Real Estate | Durable Goods and Mortgage | |

|---|---|---|---|---|

| coefficient | −1871.832 | 6163.453 | 962.619 | −4248.296 |

| T-value | −0.27 | 0.77 | 0.57 | −1.59 |

| Traditional CCAPM | Durable Goods | Durable Goods and Real Estate | Durable Goods and Mortgage | |

|---|---|---|---|---|

| coefficient | −1880.036 | 2861.979 | 1359.852 | −3946.002 |

| T-value | −0.18 | 0.25 | 0.55 | −1.01 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zheng, D.; Ding, S.; Cui, T.; Jin, H. Real Economy Effects on Consumption-Based CAPM. Mathematics 2022, 10, 360. https://doi.org/10.3390/math10030360

Zheng D, Ding S, Cui T, Jin H. Real Economy Effects on Consumption-Based CAPM. Mathematics. 2022; 10(3):360. https://doi.org/10.3390/math10030360

Chicago/Turabian StyleZheng, Dandan, Shusheng Ding, Tianxiang Cui, and Huan Jin. 2022. "Real Economy Effects on Consumption-Based CAPM" Mathematics 10, no. 3: 360. https://doi.org/10.3390/math10030360