1. Introduction

“Econophysics represents the ultimate connection between mathematics, physics, engineering, and economics [

1]”.

There are three fundamental differences between natural sciences and economic ones (with this research mostly analyzing the stock differences).

The first difference is that natural sciences are objective, while economic laws must consider the subjective side, namely, the human factor. The laws of physics, chemistry, or mathematics apply universally, regardless of the will of the observer. In quantum mechanics, it is recognized that some observations influence the results, but not by our will. In economics, and particularly stock markets, participants’ attitudes are decisive for the evolution of quotations. Herd behavior, exuberance, panic, confidence,—or the lack thereof—are drivers, especially in key moments of the stock market development. Moreover, if scientific observations are quantifiable phenomena, social, behavioral, and psychological effects are more difficult to express in equations.

The second difference concerns the experimental aspect. In the natural sciences, it is customary to formulate a hypothesis, which practical experiments then confirm, improve, or reject. There are also exact science situations where experiments cannot be performed as the theoreticians would like, e.g., cosmology, anthropology, and geology. However, the primary theories on which they are based are experimentally verifiable. Science cannot experiment on the stock markets. Namely, it cannot separate the facts to demonstrate precisely that a certain theory is valid. Reverse head and shoulders have no scientific explanation, with the most plausible being that it is self-confirming: when analysts call it, most investors become cautious, which automatically leads to a trend shift. We do not know how to define the expression “there is a 70% chance for the market to grow”. We do not have 100 cases to count the 70 favorable. The psychological approach “up to what odds do you bet on growth?” cannot be applied, because it depends essentially on the amount invested and the attitude of the investor towards risk, much more than on the opinion of market evolution. It cannot be checked whether the positive growth of a portfolio is due to the theory applied in the selection of securities or due to the evolution of the securities (market) itself.

The third difference relates to the basic laws of the theories. In physics, the basics are the conservation laws: energy, impulse, kinetic momentum, electrical charge, symmetry, etc. There is also an exception: the second law of thermodynamics, which states that entropy always increases. In the economy, nothing is constant. In addition to the continuous growth trend in the overall markets (due to technological development, expansion into new geographic areas, etc.), no monetary amount is constant, regardless of the economic area considered. Portfolio values are not constant, and this is the main reason stocks are bought and sold. The only null result is on the futures market, where the loss of a part is wholly found in the win of its counterpart. A lack of conservation laws makes it difficult to formulate theories, including extreme (minimum, maximum) and optimal trajectory issues.

However, the results of the exact sciences are to be found in economics. Statistics are the basic method of modeling economic phenomena. On the stock market, it is noted that many theoretical results start from Gaussian statistics, although statistical data does not confirm this distribution.

The Black–Scholes–Merton (BSM) model for evaluating options is another example of mathematical theory (derived from fluid flow physics) applied in the economy.

It is appreciated that the results obtained by exact sciences such as mathematics, physics, and chemistry can be adapted and applied in the economy, and especially in the stock market.

The main objective of this paper is to tackle the application of econophysics in the stock market area, both on the international level and at the Romanian level. In this study, the most important features that influence the impact of econophysics upon the stock market are the following: the weather phenomenon; the magnitude of earthquakes; the complexity of the poker game; the structure, implication, and application of the Le Chatelier principle; and important features such as random walks and dynamic phenomena.

In this paper, we have explored a wide range of known theories that started from the natural sciences, we have resolved their basic rationale, and verified their application in the stock market. In contrast to the immutable laws of nature, in cases where it is analyzed, social phenomena (especially the financial ones) appear as events related to the human participant’s subjectivity. The article did not explore the psychological aspect but only the application of the objective laws to economic activities. The general conclusion is that although derived from different knowledge areas and using different methods and approaches, natural and stock market phenomena share the same common basis: precision areas and different time correlation, a general legitimacy right in seemingly chaotic environments, and periodicities. The data analyzed in this article refers, in general, to stock quotes. The quotes and their history have been accessed from several public websites. The technical analysis has been conducted by several specialized software that are freely available, especially Windows Excel.

Regarding the methodology, it can be emphasized that each of the exposed phenomena had been presented in correlation to their stock market interpretation. The testing process was an immediate one: at any point, the conditions draw near to those of the examples enriched in this paper in order to determine whether the suggested theory can be verified or not. The investment strategies must be subject to other study materials of a larger scale.

The structure of this paper is as follows:

Section 2 highlights the current

state of the art, presenting the theoretical and empirical background for using econophysics related to stock markets.

Section 3 represents the core of the paper, which tackles some important features related to econophysics applied to the stock market, namely, the weather, earthquakes, poker, Le Chatelier principle, random walks, dynamic phenomena, and financial betting.

Section 4 presents the conclusions and remarks regarding the main findings of the empirical research related to the application of econophysics to stock markets.

2. Literature Review

Fractal theory was the first technique related to the application of econophysics on the stock market. The pioneering work (Peters, 1994) [

2] was continued by Mandelbrot with the development of an approach capable of explaining market deviations from Gaussian statistics and accrediting the fractal character of the markets through Hurst’s exponent. The results are not universally appreciated, although fractal structures can be identified on the charts of titles’ evolution as the results show in

Figure 1. Another highly important work focuses on the application of thermodynamics in the economy (Sergeev, 2008) [

3]. However, the principles of thermodynamics start from the conservation of energy, but the amount of money in the economy (with which energy is assimilated) is not preserved.

McCauley investigated the lack of a real balance in financial markets in 2004 [

4]. It was intended to explain the real market movement, in contradiction of current theories, which starts from the premise of how the market should evolve in order to fill certain mathematical theories. Richmond, Mimkes, and Hutzler (2013) applied more complex mathematical theories in the economy [

5]. A Romanian group of authors made a compendium on econophysics, edited in 2013 under the direction of Gheorghe Săvoiu [

6]. It synthesizes results from various economic and mathematical domains.

Other interesting works in this field include Chakrabarti et al. (2006) [

7], Cockshott et al. (2009) [

8], and Roehner (2002) [

9]. Preiss (2011) [

10] tackles the econophysics phenomenon throughout the analyses between time series and their correlation of a time series. The author concludes that time series over a short time scale are influenced by typical behavioral patterns of the financial market’s participants. Liang et al. (2013) [

11] analyze the Chinese stock markets by the impact of their physical properties and conclude that econophysics has a direct impact upon the Chinese stock market based on a large amount of economic data over a long-run time horizon.

Chakrabarti et al. (2011) [

12] highlight the econophysics domain within the agent-based models, concluding that there are three important models which must be taken into account: an agent-based model of order-driven markets, kinetic theory models, and game theory models. Other interesting studies developed by Vasconcelos (2004) [

13], Choi (2014) [

14], Forte (2017) [

15], and Swingler (2017) [

16] analyze the application of agent-based models within the econophysics framework, suggesting the importance of the impact of this phenomenon upon stock markets.

Bali (2011) [

17], Schafer (2012) [

18], and Kakarot-Handtke (2013) [

19] developed various studies about the importance of econophysics applied to stock markets within several features and characteristics in terms of criticisms and opportunities.

Aamir and Ali Shah (2018) [

20] analyze the period between 2001 and 2005 in relation to the Pakistan and Asian emerging economies co-movements through Phillips–Perron and Dickey–Fuller tests. The authors conclude that there are several important forces of integration between the Asian emerging stock market and Pakistan. Other authors test the sustainability of the stock market using the VIX Index and reveal that the market volatility influence has a great impact among different stock markets through an important feature such as diversification (Ruan, 2018) [

21].

Nasr et al. (2018) [

22] provide a qualitative overview regarding the linkages between BRICS countries and highlight the heterogeneity in stock market returns based on several underlying criteria. Their main conclusion is that BRICS countries react differently regarding the rating changes, depending upon their connections with the global market variables. The usage of mining techniques in measuring the connections between the impact of social media and stock market modeling suggests that features such as public opinions, news articles, and technical analyses can result in significant success (Kollintza-Kyriakoulia et al., 2018) [

23].

Li and Wu (2017) [

24] link the stock market performance in relation to firm manufacturing and the wholesale and retail industry in China, revealing that empirical results are significant in cases where it used the Fama–French factor model. Drezewski et al. (2018) [

25] establish correlations between sustainable development strategies and bio-inspired trading strategies and conclude that using the Forex market optimization algorithms can obtain some important future development strategies. The linkage between forecasting stock prices and neural approaches can be explained by a hybrid modeling approach combining analytical and computing models (Paluch and Jackowska-Strumillo, 2018) [

26].

Nguyen and Yuun (2019) [

27] suggest a different type of approach using transfer learning in order to determine the market prediction based upon short-term stock price and conclude that stock relationship information can be a

panacea regarding the improvement of prediction accuracy. Herzog and Osamah (2019) [

28] use a reverse engineering approach in order to determine option pricing and suggest that their approach is highly significant in establishing important future research directions. The impact of portfolio diversification has an effect on domestic and foreign stocks, suggesting that there is a significant impact of correlation volatilities and risks associated with a diversified portfolio (Nayan, 2019) [

29].

The usage of calendar anomalies upon 11 CEE stock markets reveals that the turn-of-the-month effect affects only market returns. especially in the short periods established at the end of one month and the start of a new month (Arendas and Kotlebova, 2019) [

30]. The significant positive results of stock market analysis by using a Markov chain to improve future air quality suggest that this can be an important tool to help governments insert prevention actions during a difficult weather period (Zakaria et al., 2019) [

31]. The market volatility in the conditions of premiums for sustainable and non-sustainable components highlights that a hedging strategy is needed in order to provide an important shield against future uncertainty (Thu Truong and Kim, 2019) [

32].

Blackledge et al. (2019) [

33] provide interesting and important analyses regarding important features such as econophysics, fractional calculus, fractal market, and future price predictions. In this study, the authors conclude that econophysics can be applied to the stock market by using Einstein’s evolution equation, the fractal market hypothesis, and the fractional Poisson equation. Other authors used a minimum spanning tree and cross-correlation coefficient in order to determine the statistical properties of the foreign exchange market and concluded that the results are not stable in the Asia and Latin America cluster but are stable in the Middle East cluster (Wang et al., 2013) [

34].

The applications of econophysics and bio-medical entropy were revealed by using permutation entropy to understand biomedical systems and the analysis of economic markets (Zanin et al., 2012) [

35]. Fry and Brint (2017) [

36] developed a model to investigate if there are any linkages between bubbles in opinion polls and betting markets before the 23 June 2016 UK vote to remain or not remain in the EU. The authors concluded that their research had a significant impact in explaining the reasons for the UK voting to leave the EU.

Ahmad et al. (2016) [

37] used graphical representation to examine stock behavior in relation to several time series. The authors concluded that a certain causal relationship between stock returns and volatility can be identified in several important Asian stock markets. Moreover, Rudzkis and Valkaviciene (2014) [

38] developed several underlying regression models to help identify the global and key macroeconomic indicators and their impact on stock prices indices. The main findings of this study highlight that in the case of small open economies, the price indices of individual sectors vary upon several macroeconomic regressors. Vveinhardt et al. (2016) [

39] analyze the Mean Reversion Phenomenon and reveal several investment opportunities and stock prices returns, but the results have inconsistencies due to the market’s reactions based on different periods.

Ruxanda and Badea (2014) [

40] predict stock market conditions by using artificial neural networks; this study offers a quid pro quo upon the configuring structure of these networks upon the Romanian BET index. The aftermath of the neural networks reveals that the direction of the DAX-30 stock market index can be predicted by using hybrid fuzzy neural networks (Garcia et al., 2018) [

41]. Ahmed et al. (2018) [

42] examine the relationship between stock returns and volatilities and suggest that the evolution of a developed market differs significantly from emerging markets due to the higher returns of the emerging stock markets. Janda et al. (2014) [

43] enables the construction of a sustainable financial portfolio throughout a microfinance investment funds scheme and conclude that investors can be socially responsible by using financial indicators in microfinance.

Ulusoy et al. (2012) [

44] tackled the problem of hierarchical tree and minimal spanning tree approaches in the period 2006–2010 for top 40 UK companies based on the London Stock Exchange Index. They concluded that financial market dynamics can be successfully predicted by using information theory and statistical physics. In the aftermath, Ulusoy (2017) [

45] reveals the importance of using econophysics in the financial market domain due to the complex natural network function of the stock market.

Garcia and Requena (2019) reviewed some of the newest studies in the economic literature regarding the fractal market hypothesis and proposed an FD4 exponent model that can lead to the improvement of empirical results [

46].

Summarizing, all of this research, as well as numerous articles (especially those published on Cornell’s

arxiv.org (accessed on 20 July 2017) platform, but not limited to them), outline the intense interest of mathematicians and physicists in applying results in the economy. This paper contributes to applying the theories of exact science when selecting stock market strategies.

3. Methodology and Empirical Results

In the empirical study methodology, some examples of theories in the exact sciences and attempts to translate them into stock market strategies are considered. The results are listed below. Although not spectacular, practical results urge us to continue our econophysics approach.

3.1. Weather

The connection between meteorology and the capital market is direct: on the Chicago Mercantile Exchange, betting can be made on climatic derivatives. Climatological values that are involved include temperature, rainfall, and snowfall, with the most important, according to the

cmegroup.com (accessed on 20 July 2017) official site, being Heating Degree Day (HDD) and Cooling Degree Day (CDD) contracts. Various strategies have been analyzed (Jewson and Brix, 2005 [

47]; Alexandridis and Zapranis, 2013 [

48]).

Arbitrage on this market has direct positive effects for hotel managers, tourism companies, agricultural producers, and insurers; in return, speculators can make substantial profits.

Figure 2 presents an example of how to apply arbitrage on weather derivatives. A summer hotel owner (or tourist agency) would like summer to be as sunny as possible. However, if the weather is cool, the hotel owner (or tourist agency) will lose customers and profit will be reduced. Therefore, speculators can be bet that high precipitation will occur, the average temperature will be low, or there will be many windy days, etc. Conversely, a climatologist (or an environmentalist or a meteorologist) who knows the effects of global warming will bet exactly the opposite: drought, heat, or scorching heat. Thus, a situation that does not suit anyone can become a solution where everyone benefits (a win-win situation): the hotelier secures a normal level of earnings (if not from customers, then from financial derivatives) and environmentalists take advantage of their studies on climate change (at least financially, if proposed measures to limit the effects of the greenhouse effect are still to be seen).

Another feature, namely the precision of the results, was pursued in this paper. The next graph is the forecast for a week, i.e., the exact situation of surface pressure, according to

http://www.weatheronline.co.uk (accessed on 12 July 2016). Weather predictions are typically valid for a week. Depression has been established in northern Europe, and its evolution is predicted with acceptable accuracy. However, in surrounding areas, precision is lacking; for example, Iceland is at the limit, and there predictions become inaccurate.

The link to the capital market is direct and the resulting conclusion is simple: when the indicators or the technical oscillators are at a limit, their precision is desirable and the confidence we show must be limited (increased caution).

Figure 3 shows that the RSI oscillator for the BET index of the Bucharest Stock Exchange is generally an excellent signal to confirm the trend, where the arrow represents the upward trend. However, in the maximum area, as it can be seen in the circle part of the figure, it indicates many false sales signals because it is at the upper limit of its relevance. Therefore, just as weather’s predictions are good overall but not plausible at the extremes, the oscillators of the technical analysis work well only in the median range of their variation range. The conclusion is similar to the engineering results valid for any mechanical measuring device: the precision is higher in the middle of the measuring scale and lower towards the extremities.

3.2. Earthquakes

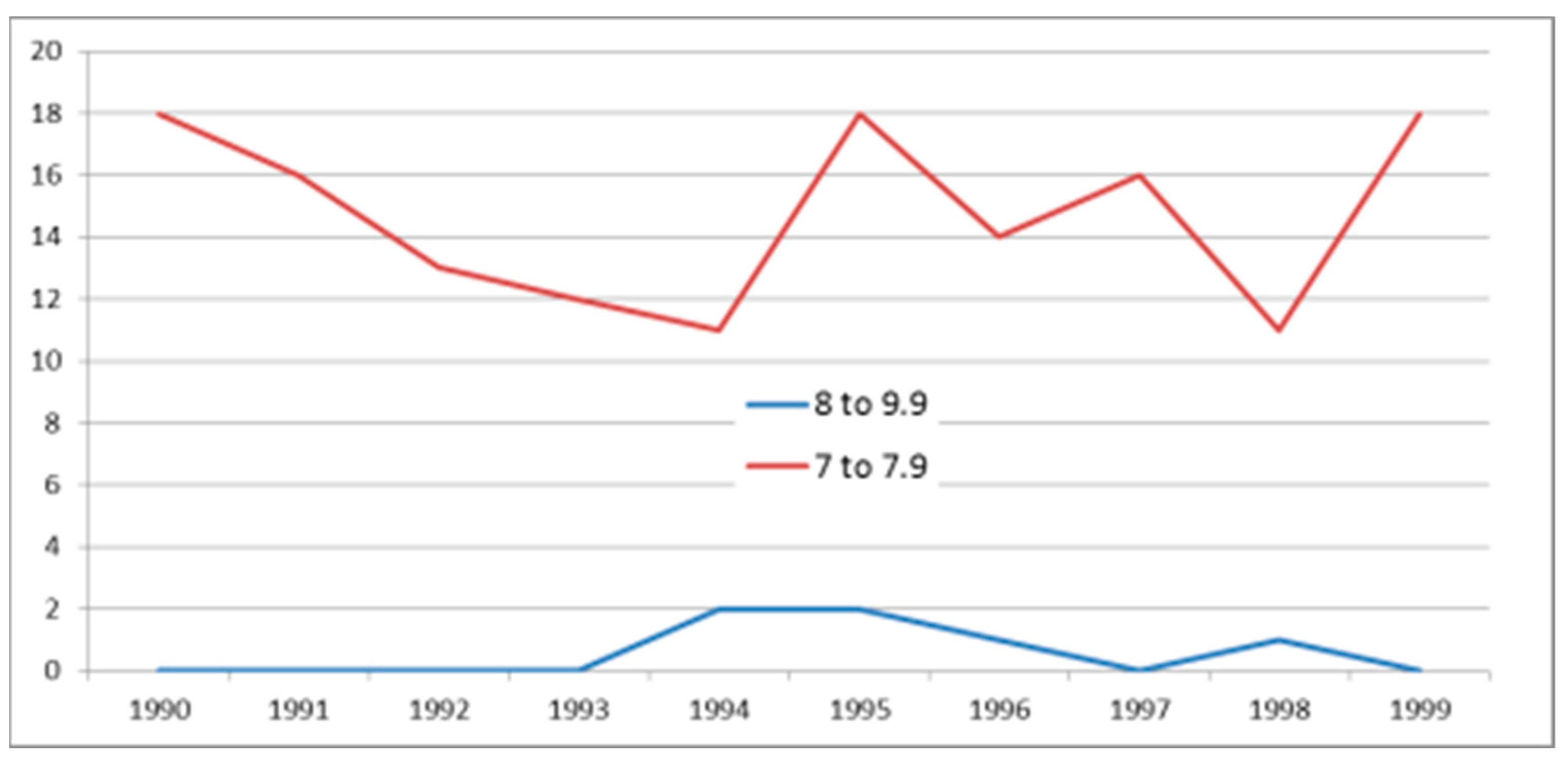

Although they cannot be accurately predicted, earthquakes, especially those in active seismic areas, have a repeatability that allows an estimation of the likelihood of their occurrence as it is highlighted in

Figure 4. Practically, the accumulated tensions tend to unravel even more violently as more time passes between two successive earthquakes. Thus, a good indicator of seismic risk is the period between earthquakes and their frequency. On the stock exchange, this is focused upon the application of the conclusion regarding concerning crises (downward periods highlighted with blue line). Visually, it seems natural to define a crisis, being the portion of the graph on which a more pronounced decrease occurs (some such drops are outlined empirically with black line in

Figure 5).

Mathematically, the loss period is defined in Excel as the area of the chart where downgrading happens marked with the blue line, and the crises where the minima have exceeded a certain threshold set a priori established by the red line. To work directly with relative variations, we considered the logarithmic values in the 10th quote. By plotting the logarithmical quotient of the day

i, the condition that the area of the graph is one of the losses is

and one of the crises is

< p, where

is the maximum value previously reached (historical maximum until k) and p is the discomfort threshold imposed by the investor. Thus, one can check the buy-and-hold stratagem, which for an ascending market (such as the American one) should bring reasonable returns. The results are represented in

Figure 6, with the discomfort threshold set at 0.065 (about 16%).

For an index that experienced a steady growth throughout the analyzed period, the results are not encouraging as most of the time the market has not risen, with quotes below the previous historical highs (the red chart). Moreover, for periods marked with green rectangles, the decrease from the previous maximum exceeded the discomfort threshold predefined by the investor. It means that if the investor bought the maximum, the investor would have to wait for a period equal to the width of the rectangle (quite high, in some cases) for the investment to go into profit. It has been verified for the entire period between 1900 and June 2016 that the definition of the periods of crisis has a more drastic effect on the buy-and-hold strategy (

Figure 7).

One can object that the definition of the crisis is not a standardized one. Some investors buy on a declining market, so those periods of decline and crisis are not defined between the same values for all investors. Nor does the Rolling Windows method, applied in the Matlab program according to Tsinaslanidis and Zapranis, produce better results (2016) [

49] (

Figure 8).

3.3. Poker

Any Texas Hold’em player knows he usually does not play more than 10–15% of his hands. The main reason is not having wrong hands, but the patience to know opponents and to wait for a favorable situation (Purdy, 2005) [

50]. The players (speculators) on the stock exchange seem to forget that although the market has a general trend of growth, not every moment is conducive to investment. A good measure of the reward/risk ratio is RAROC (Risk Adjusted Return on Capital), defined as the ratio between the estimated profit (affected by the associated risk) and the invested capital (Prokopczuk, 2004) [

51].

The strategy adopted to the capital market could be synthesized as follows: a variation limit is set and changes the position only when this limit is reached. Profit is calculated only when the contract is closed because only then is the result (profit or loss) marked. In practice, this would mean that the investor retains his position as long as the opposite variation does not exceed the limit he has a priori imposed. When this limit is reached, the investor closes his position and immediately opens a contrary one. This ensures that the investor will not remain in the wrong position relative to the market more than he initially imposed himself (potential losses are limited).

Applied to DJIA, the strategy would lead to the following results, for a required 9% variation limit (see

Figure 9). Where the DJIA (blue) chart is above the “Entry” (red) chart, the investor’s position is long. Otherwise, it is short. The results are not spectacular at all, but they depend on the required limit, so the correlation between the predefined variation and the realized profit was analyzed. The results presented in

Figure 10 and

Table 1 do not encourage the application of the strategy, being very sensitive to small variations of the arbitrarily imposed limit. The brutal variation of profit, based on relatively minor variations in the stop-loss safety, confirms the nonlinear character of the linkage, similar to chaos theory (Mandelbrot, 2004) [

52].

The key point is that the strategy does NOT yield good returns, even if an investor is cautious and decides that in a contrary variation on the market (reasonable, around 10%) to leave the position and take the opposite position. Therefore, the stop-loss technique is not unbeatable, having previously shown that neither buy-and-hold strategy was. A poker player would conclude that it is not the luck of having good cards but the style of play that is decisive. A stockbroker will conclude that gains cannot be achieved simply by taking a position and expecting it to materialize in a lasting trend. It is recommended that the position be taken (abandoned) whenever the market demands it, without waiting for the opposite movement to reach an arbitrarily imposed limit.

3.4. Le Chatelier Principle

The principle of Le Chatelier is thus: “

If a dynamic equilibrium is disturbed by changing the conditions, the position of equilibrium moves to counteract the change.” In the economy, Samuelson first applied this principle in 1947 to explain the dynamic balance between supply and demand. In the stock market, the best example of this is the placement of large volume orders as is presented in

Figure 11. In the first instance, the market acts to counteract the disturbance, i.e., attempts to absorb the large volume of bid/ask shares. If the investor succeeds, the balance is restored. However, if the perturbation is too strong, the balance can no longer be maintained at the same level of quotations and the market shifts to another price level.

This approach contradicts an essential assertion of the technical analysis, according to which volume confirms the trend (Murphy, 1999) [

53]; that is, the volume should be rising when the trend is bull and descending when the trend is bear. The DJIA graph, drawn with the Incredible Charts Pro program, shows that volume does not oscillate as Murphy predicted. Volume has grown steadily in the 2000s, then increased dramatically with the 2007–2009 crisis, so that with the rebound of markets its fall will be even more pronounced. This evolution can be explained by both the Le Chatelier principle and the herd spirit, which manifests itself mainly in times of crisis and exuberance.

3.5. Random Walk

A photon that leaves the center of the sun reaches us 100,000–1,000,000 years after it hits a lot of nuclei in space. We considered the series of DJIA quotations from 2 January 1900 to 24 June 2016. We logged the series and considered daily variations (returns). Statistically, the mean of the logarithmic differences is 0.00007958 and the standard deviation of the entire population is 0.00483597. With these parameters, we generated a similar number (30,248) of random numbers, using the normal probability distribution, with the same defining parameters (the previously calculated average and dispersion) in Windows Excel (Random Number Generation). These were considered daily variations of hypothetical logarithmic series, called Random, which were then reconstituted and represented on the same graph as the initial DJIA series as is highlithened in

Figure 12.

In

Figure 12, the results highlight that randomly generated series behave similarly to actual quotes, showing more or less steep trends, rises, and decreases. Each generation produces different results, but all have the same characteristics. For securities with a higher volatility history (SIF1) as it is shown in

Figure 13, the situation is different: the randomly generated series exhibits reasonable deviations from the trend, as opposed to the actual quote whose fluctuations are far beyond the limits required by the Gaussian distribution.

3.6. Dynamic Phenomena

The foundations of catastrophe theory were discovered when it was found that the evolution of dynamic (nonlinear) systems mainly depends on the initial conditions: a small deviation could produce results that differ exponentially.

Many areas of physics recognize chaos theory:

The capital market is a dynamic system, so we expect the Butterfly effect (The flap of a butterfly’s wings in Brazil set off a tornado in Texas) to apply in practice. Indeed, the initial conditions accepted for the selection of securities in a portfolio may influence the investment decision.

Suppose an investor decided on the composition of a portfolio formed from three titles: SIF1, BRD, and SNP. Based on an analysis of the period 2001–2017, it is evident that starting from the same point, SIF1 keeps on top of all the other titles, being the most attractive. If the analyzed period is restricted to 2005–2017, BRD is the best title, and if we started in 2008, SNP has the best evolution. In the analysis based on the latest period (since 2013), SNP should have been avoided altogether.

The contradiction reached is a paradox, not an error of reasoning. In all analyses presented in

Figure 14, namely (a–d), the graphs started from the same starting point, but the result and the evolution were different. Thus, the conclusions, all of which are correct, of four analysts can differ radically, only because the analyzed period is different. No one is wrong, but no one has the absolute truth either. Nevertheless, this is also the charm of technical analysis, which is the combination of exact mathematical results and the art of interpreting them, the analyst’s reasoning, and experience.

3.7. Size Matters

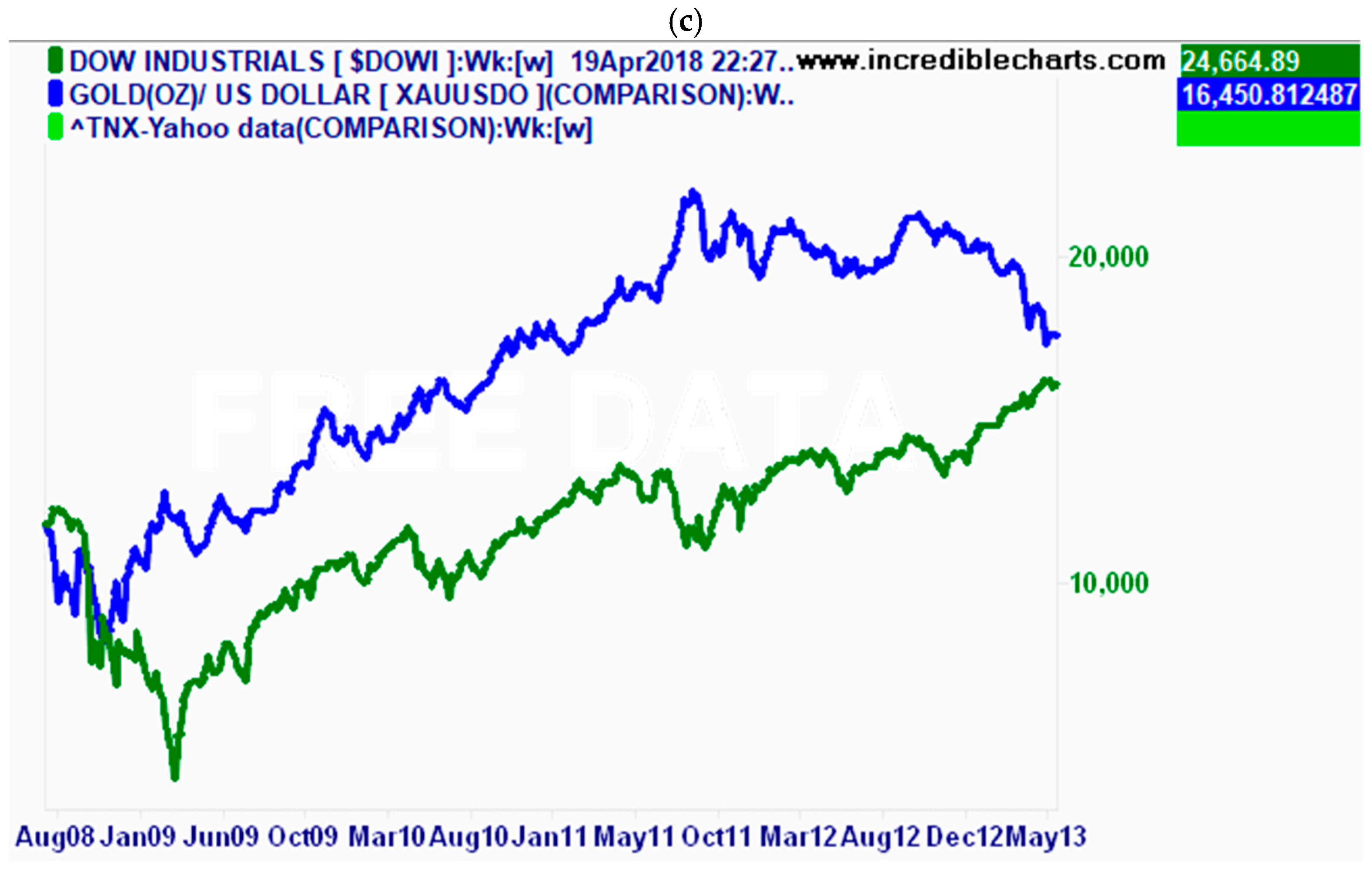

Different behavior produces a physical reality within different scales. Thereby, at the minimum scale dimensions (on a subatomic scale), strong forces are prevailing (the connection between quarks). At the atomic level, electromagnetic forces are occurring which govern the connection of atoms. At the cosmic level, the gravitational force becomes the most crucial feature, determining the galaxies and solar systems’ evolutions. A similar conclusion is observed throughout the analysis of the different types of graphical correlation. In the next example, the Dow Jones index and the gold quotation on the American market were analyzed according to the Intermarket theory (Murphy). Thus, these two features must be inversely correlated.

The conclusions differ according to the analyzed period. In

Figure 15a, it can be observed that the two titles are uncorrelated. Beyond a relative increase of both titles, there are periods in which both graphs have similar variation and other periods in which the titles vary in opposition, but also other sections in which one is on bearing and the other has a trend. In this case, the conclusion is that the two titles are uncorrelated. In

Figure 15b (drawn on different periods), the graphics are inversely correlated: when one is decreasing, the other is increasing and vice versa. Finally, in

Figure 15c, the graphics are positively correlated, with both titles simultaneously having the same evolution variation.

In this situation, the results represent a shortcoming of the technical analysis. Depending on the historical period selection, a technical analyst can graphically demonstrate the direct correlation, the inverse correlation, or the absence nexus for the two selected titles. The explanations have both economic and behavioral foundations. Gold is a limited natural resource. The DJIA stocks are conventional entities theoretically unlimited, as much as the global production has an increasing trend. Gold cannot infinitely increase; the stocks are not unlimited, either as number or value. Therefore, in the long run, the two titles cannot be correlated.

In the short run, if the stock market keeps good time, investors will prefer stocks. In a case where there are crises signals, investors will flee from gold (which is a defensive action). According to this view, it can be explained by the inverse correlation. In the medium run, if the economy registers a soundtrack and there are no danger signs, investors can diversify their portfolio and will invest in both stock and in gold, especially if government securities cannot offer an attractive interest rate. Thereby, in periods of moderate economic growth and economic calm, the two titles can register a direct correlation.

3.8. Financial Betting

Even if it seems attractive, there are no financial bets similar to the ones mentioned. At most, there is financial betting which proposes odds below 50%, if the quotation will increase or decrease in the next period as is presented in

Figure 16.

Hedging (arbitrage) is the main barrier to revealing realistic forecasts regarding the evolution of prices. Hedging supposes the sale (at a higher price) and the purchase (at a lower price), simultaneously, on two markets, of one and the same title (or a derivative, directly connected with the basic one). Because the two courses will be mathematically equal at maturity, the speculator wins the difference regardless of the closing price. Therefore, whatever the experts’ forecasts regarding the market evolution, the spot course and futures course may not differ too much (at most with the risk-free interest and the costs of the operations, or due to the current variations as a consequence of the inertia of the markets).

The advantage of the financial bets is that the opportunity of hedging does not exist, therefore, the quotations can be as realistic as possible.

However, the following problem arises: what happens if the real probability, p’

i, known by the gamblers is different to the one calculated by the bookmaker, p

i? In a simple case in which we have two betting options (1 and 2) presented in

Figure 16, an elementary algebraic calculation shows that the maximum potential gain is reached if the available amount is played in full on the bet that has a higher chance of realization than those listed (p’i-pi = max).

However, according to

Table 2, it can be noted that the potential loss of the gambler also increases (if the bet does not succeed, the entire invested amount will be lost), but the probability of failure is smaller.

A little more complicated is the situation in which more variants of betting exist and the gamblers appreciate quotations differently than the brokers as is revealed by

Table 3 and

Table 4. As in the case with two betting variants, the entire investment must be allocated where the actual probabilities are greater than the reversed quotations. An algebraic calculation reveals, in the case of two increases in the gambler’s probabilities compared to those of the broker, p’

1 > p

1 and p’

2 > p

2, that the entire amount should be invested when the ratio between growth and the broker’s quotation,

, is a maximum.

The result may be easily verified/established numerically using the Solver utility in Windows Excel.

Table 5 shows that it is important and necessary to harmonize the quotations between betting houses so that the gamblers cannot hedge between themselves. If each broker bet independently of all others, there is the possibility that the gamblers find variants for winning regardless of the result.

However, if the quotations are referring to financial bets with alternating variation intervals, even if the quotations are different, it is possible that opportunities for hedging between betting houses may not be found. The explanation is that an optimal investment cannot be selected for each interval, taking into account that these are not distinct.

Table 5 suggests that because the titles are correlated, it is not possible to accept multiple bets. Multiple bets allow the accumulation of several options on a single ticket, with the final quotation being obtained by multiplying the individual quotations, assuming that the bets are independent. However, if the bets are not independent, then the gambler’s chances are higher than those quoted by the broker.

According to

Table 6, the solution found by betting houses is to either not multiply the odds or not allow multiple bets. However, this means that these quotations are not useful for selecting portfolios.

4. Discussion and Recommendations

This article intended to apply a series of mathematical results from physics and chemistry on the capital market, in the form of investment strategies. The article thus contributes to the effort that we increasingly see, to explain economic phenomena through theories of the exact sciences, an approach generically known as econophysics.

The results are translated into practical conclusions for investors.

The most important conclusion is the importance of the moment of entry, not only of the exit from the stock exchange. Whoever invested on 23 February 2000 in Dow Jones recovered his money only on 3 October 2006. However, this loss is difficult to accept even for investment funds, even if the investment horizon is for decades.

Besides, the analyzed period is significant for concluding the evolution of titles. Selecting different periods (not necessarily related to crises or spikes), or even different timeframes, can have significant consequences on the conclusions. More importantly, it results from the proposed strategies that do not universally work on their own. Any strategy is suitable for some time, namely for a specific evolution on the stock market. The investor should continually analyze the applicability of the theory and the market trend, to decide when to apply a specific strategy and when to leave the market.

From a theoretical point of view, in this study, it has been worthwhile trying to apply mathematical (physical) theories, with a large number of participants, diversity of concepts, and multitude of factors of influence often causing the market to behave as a complex physical system. The main issues are the adequacy of theory to market reality (for example, Gaussian statistics are not appropriate, so most statistical conclusions—including VaR—do not apply in practice), the absence of conservation laws (as a basis for mathematical physics), and the difficulty of quantifying the influence of the human factor.

The study directions opened by econophysics are broad; practically, any theory in the exact sciences can have a correspondent in the economy, with the art being in adapting them to reflect the realities of the market. This article also proposes a practical side: the establishment of strategies based on mathematical theories. Although the conclusion is that the application is not direct and purely objective, the subjective side of the investment process can be greatly reduced and improved.

Regarding recommendations for future research, the following suggestions should be emphasized. In the first place, on what should be focused the forecast of future quotations and related probabilities? On technical analysis, of course. The fact that the market is moving in (Murphy, 1999) [

53] is a truth that has been repeatedly demonstrated. Nor should the fundamental analysis be omitted, given that the issuers tend to have quotations that bring indicators to the values close to those of the market (Rossi and Forte, 2016) [

54]. For those who use automated trading or a computerized selection of titles, statistical analysis and game theory are essential. Taking into account that there are millions of sites and even books (Pesavento, 2015) [

55] that recommend esoteric methods, behavioral analysis should not be neglected.

However, the approaches using different reasoning can lead to different results. An eloquent example presented in

Figure 17 is represented by a series of bets which, although they refer to the same final result (0–0), because they start from different premises, lead to unequal probabilities.

The question is whether it is a big mistake if it is determined that the probabilities for investment decisions do not strictly respect the principles of No Dutch Book. Does it seem to be wrong to quote 50% long chances and 51% short chances (probabilities coming from different reasoning)? However, these probabilities are not meant for betting, but only for your own investment decision. In addition, these situations are not totally wrong: after all, the mathematical probability is defined as , where n is the number of favorable cases divided by the total number of cases N. Mathematically, the condition of complementarity must be respected only at infinity. It is as equally likely that the next roll of a coin will be Heads or Tails. However, it is very likely that after six rolls, consecutive series of similar results appear. To what probability should it be given priority?

It can be noticed that even more interesting is the fact that the stock exchange is being manipulated. It runs large investors, large arbitrators, speculators, brokerage houses, high-speed automated trading systems, ordinary citizens persuaded by telephone to “invest”, etc. Consciously or not, hostile or not, every transaction is a manipulation of the price. The buyer wants to acquire a price as low as possible, to the detriment of the seller. In addition, the buyer does this to then sell more expensively when he thinks the price will decrease. It is not illegal, immoral, or unfair. Simply, the market is made up of actors who try to use randomness in their favor.

This observation could change the basic perspective of probabilities. The ideal toss of a coin or the perfect throw of a dice has been scientifically studied. However, what if the producer confessed to cheating the coin? Unfortunately, the person died before specifying in which way and how large the asymmetry is. Specific devices that make a non-destructive analysis and lead us to a deterministic result cannot be identified. However, if the records of the last 100 throws exist, can the probability of the 101st throw be estimated? In theory, it is 50–50%, although it is known that this is not right, but it is not known how wrong it is. Or 52–48% in favor of the first throws, although it is known that 100 throws are not statistically relevant (they do not meet the Law of Large Numbers or the central limit theorem)?

Applied on the stock exchange, the observation gives rise to further reasoning. It cannot be precisely determined if the coin is ideal or fake. It can be identified that there are 55–45 H–T cases after 100 throws. In what hypothesis can be established the probability of 101 attempts? If one number is drawn more frequently than another in the lottery, is it reasonable to assume that the balls were not manufactured perfectly equal? Returning to the subject of the problem: if it is noticed that a certain phenomenon related to an issuer, can it be believed (is there an associated logic?) or not? Do fractals have a say here?

Another problem would be the adjustment, via the application of Bayesian models to re-evaluate the probabilities based on events that have already occurred (Grover, 2013) [

56]. Here, however, a problem can already be identified (Tijms, 2019) [

57]: an initial intuited probability of 20% (prior probability) leads to a deduced probability (posterior probability) of 52.2%, while an initial probability of 50% leads to a final one of 81.4%, with a chance factor (likelihood factor) of 35/8. In this example, the psychological (subjective) effect of mistrust is amplified if a practical result is negative, which is neither logical nor beneficial.

5. Conclusions

The main conclusion of the article is that all possible knowledge from other areas (mathematics, physics, chemistry, sociology, and psychology) should be used to shape the capital market. Current economic assumptions are:

Investors act rationally;

Profit must be maximized (the worst strategy is to try and sell at the highest and buy at the lowest price);

Rational report between economy and consumption;

Static equilibrium theories;

They are not applicable to financial markets.

It is likely that financial markets are the most complex scientific phenomenon possible, because of acts that are objective, natural laws (statistical laws, economic and financial realities, and automated trading programs), and random opinions and impulsive actions from a multitude of investors and speculators, with the most diverse professional qualifications, perceptions, styles, and possible conceptions.

Comments were received during the presentation of the paper at different conferences that neural networks and cyberlearning systems are the solution to market success. Undeniably, they have practical applicability, as long as automated systems make most of the transactions, with the majority of them working in the feedback loop (learning). Their deficiency is that they use past situations to make decisions; this is where the tsunami example came in.

Another example is added to this study. The creators of the AlphaGo (Netflix Reportage: AlphaGo) program succeeded in defeating the Go world champion, Lee Sodol, 4–1. Go is a game that is suitable for modern cyber systems because the analysis of 50 moves forward gives a clear advantage to the computer. Furthermore, the algorithm is the learning one: thousands of games were introduced into the memory of the computer and it was programmed to conclude its preparatory games. In this sense, it is not a thought process but a data processing one. In the only game he won, Lee Sedol made an unexpected move. It is not known whether it was a good or bad one, but the computer was confused and lost lamentably, making incredible mistakes. Is it still necessary to compare the crisis when people simply lose their heads?

The conclusions of this study reveal that the best evidence that the stock market mechanism had been understood would come if a bookmaker would open quotas for an average period: not one day, because it would be a lottery; not one year, because it has to react to market movements. Do not let speculators bet these odds because it would only be another venue for derivatives. Odds should be established by the professional house, which has sufficient interest to be fair: without excessive regulations and supervision, with only the usual precautions in the industry, and with slight chances of arbitrage.

Based on what will the bookmaker act?

On probabilities, of course. Nevertheless, they are limited: they operate on a subatomic level (quantum mechanics) or molecular (gas theory), where an astronomical number of physical events need to be processed statistically. On the capital market, the best evidence of non-adaptation is that VaR did not work in crisis: simply, the decreases exceeded the statistical threshold.

On the technical analysis, obviously. Strong trends beat everything, so they cannot be overlooked. However, this is again limited. When trying to obtain results only from the study of graphs, my colleagues received an unpleasant surprise.

Financial (fundamental) analyses are mandatory. Quotations shall take account of the results of issuers, but in a manner that is neither linear nor immediate and sometimes irrelevant.

On other considerations, yes. Market sentiment (measured by established indices: SWFX, Sentix, SSI, ISE), macroeconomic trends, and the behavioral study of the relevant market can all provide valuable information, even if they are very hard to quantify numerically.

Would corrections be necessary? Of course: feedback loops, machine learning, and Bayes.

Besides, it is considered that the market stage can be determinant (it cannot be accepted that periods of soars, stagnation, or collapse can be integrated into a single strategy).

Fractal principles also apply to the capital market. Elliott’s waves are an elegant example: each wave consists of subwaves, in the same structure. There are five movements in the direction of the trend and three in the opposite direction.

As with the technique (the accuracy of the measuring devices is superior in the middle of the scale), on the major part of strong trends, the results of the technical analysis are applied much better than at the ends (at the beginning or finish of the trend).

Although the market is on an upward secular trend, crises, declines, or even periods of marasmus (trading) exist and are unpredictable in duration and intensity. Like earthquakes, it is known for sure that they will happen, but not when and with what strength.

The comparison with poker is almost trivial. There are also people in the markets who have different strategies, who try to manipulate the market, and who enter or exit the investments in an unpredictable way compared to other participants.

Obviously, each individual transaction is part of a random walk of the fight between bid and ask. However, just as obvious is that, overall, the market is moving in waves, according to the Dow theory. The physical laws of the Brownian movement are known; those of the capital markets remain to be determined.

There are no good or bad stocks; there are only appropriate entry/exit times in/from the market. At different times, different stocks perform well or poorly; investors turn their eyes from those that have already performed excellently to those that are lagging behind. Over different periods, things happen similarly: some stocks rise thanks to speculators; others grow more slowly, thanks to investors who capitalize them.

Financial bets are prohibited or restricted and cannot be “marketed” similarly to sports betting. However, similar mathematical reasoning may be beneficial in estimating future developments, provided that a system is found for assigning probabilities for future quotations and performances. Moreover, the system is compatible with evaluation theories, which recommend mediating the results of scenarios weighted with their probability.

The extension of the approach for studying the applicability of the laws of physics, chemistry, biology, etc. (not only mathematics) on the capital market is limited only by the knowledge in the field and by interdisciplinary collaboration, which is increasingly used in the contemporary sciences.

The methodology enriched in this paper deals with several themes and subjects which had been treated into general shape, without entering into the minor details. It can be noted that technical analyses also treat hundreds of graphical formations, indicators, and oscillators, each with its own mentality and, in most cases, without any interconnection between them. These features have not solely any yield but are correlated and can lead to investment strategies and tactics of real success.

The article methodology proposes to review, evaluate, and assess a wide range of ideas regarding the econophysics phenomenon which have not been explored in similar academic papers. Any of these ideas can be extended and investigated in detail and/or adapted. The presentation is general in nature in order to convey to the reader the basic ideas for possible stock market theories that they may be interested in investigating in detail. Some of these ideas, plus similar ones, will be developed further by the authors in future papers. The scope of this paper is to encourage researchers to bend down upon mathematical, physical, and engineering dedicated theories that can also be applied in economics, especially on the stock market.

In conclusion, econophysics is the first step towards diversifying research directions. The way we see the possibility of adopting new theories is the collaboration between specialists from various fields of science and capital market practitioners. Take any scientific field and you will find similarities with the stock exchange; you may even find appropriate strategies.