Three-Echelon Supply Chain Management with Deteriorated Products under the Effect of Inflation

Abstract

:1. Introduction

- A three-echelon supply chain model is considered with single-producer and multi-buyers, and each buyer deals with a separate group of multi-sellers. Each supply chain player has an individual cycle time.

- Products deteriorate at each supply chain player with different deterioration rates. The aim of each supply chain player is to sell the product to the customer at the right time and in good quality.

- Inflation has a very important effect on any global business. The product’s price and other costs vary with inflation. In this study, the effect of inflation on supply chain management is discussed elaborately.

2. Literature Review

2.1. Classical IM with Deteriorating Items

2.2. Inventory Management in Supply Chain

2.3. Inflation in Supply Chain Management

2.4. Deterioration during Transportation

3. Mathematical Model

3.1. Assumptions

- A supply chain has been used to develop this model in which three members have been kept in the main roles, which are producer, supplier, and buyer, in which the producer is a company that manufactures the inventory and delivers it to each buyer; after that, the buyer delivers the items to the suppliers, which may vary in number for each buyer.

- Some inventory may become imperfect while being transported. Additionally, the total rate of this imperfect quality inventory is considered as the deteriorating items.

3.2. Notation

- production rate for the producer

- demand rate for the producer

- deterioration rate for the producer

- selling price for the producer for the αth buyers = 1, 2, 3 … m

- setup cost of producer per setup

- holding cost for the producer

- deterioration cost for the producer

- fixed transport cost for the producer

- variable transportation cost in transporting inventory from the producer to the αth buyer

- demand rate for the αth buyer

- deteriorating rate for each buyer

- total number of shipments to the buyer from the producer

- total number of shipments to the supplier from the buyer

- selling price for the αth buyer to the suppliers

- holding cost for the αth buyer

- deterioration cost of the αth buyer

- ordering cost of the αth buyer

- fixed transportation cost charged in carrying inventory from the αth buyer to the supplier.

- variable transportation cost charged in carrying inventory from the αth buyer to the supplier’s group

- demand rate of the αth group of the suppliers

- deteriorating rate for each supplier.

- supplier’s holding cost of the αth group

- supplier’s deterioration cost of the αth group

- supplier’s ordering cost of the αth group

- selling price for the αth group of suppliers

3.3. Model Formulation

3.3.1. Model for Producer

3.3.2. Model for Buyers

3.3.3. Model for Suppliers

4. Solution Methodology

4.1. Algorithm

4.2. Numerical Examples

4.3. Comparison with Existing Studies

- Instead of supply chain and transportation costs, if one considers only the inventory system for deteriorating products, the present study converges with Alamri et al. [36].

- Considering the delay in payments for the inventory system and ignoring transportation costs and inflation, the present study will merge with Khan et al. [49].

- Considering a single retailer and a single supplier instead of multi-retailers and multi-suppliers and ignoring variable transportation costs, the current study converges with the Sebatjane and Adetunji [23] model.

- Suppose one ignores the concept of a three-echelon supply chain, transportation cost, and inflation and considers multi-buyers and multi-suppliers. In that case, the present study converges with Shah and Naik [51].

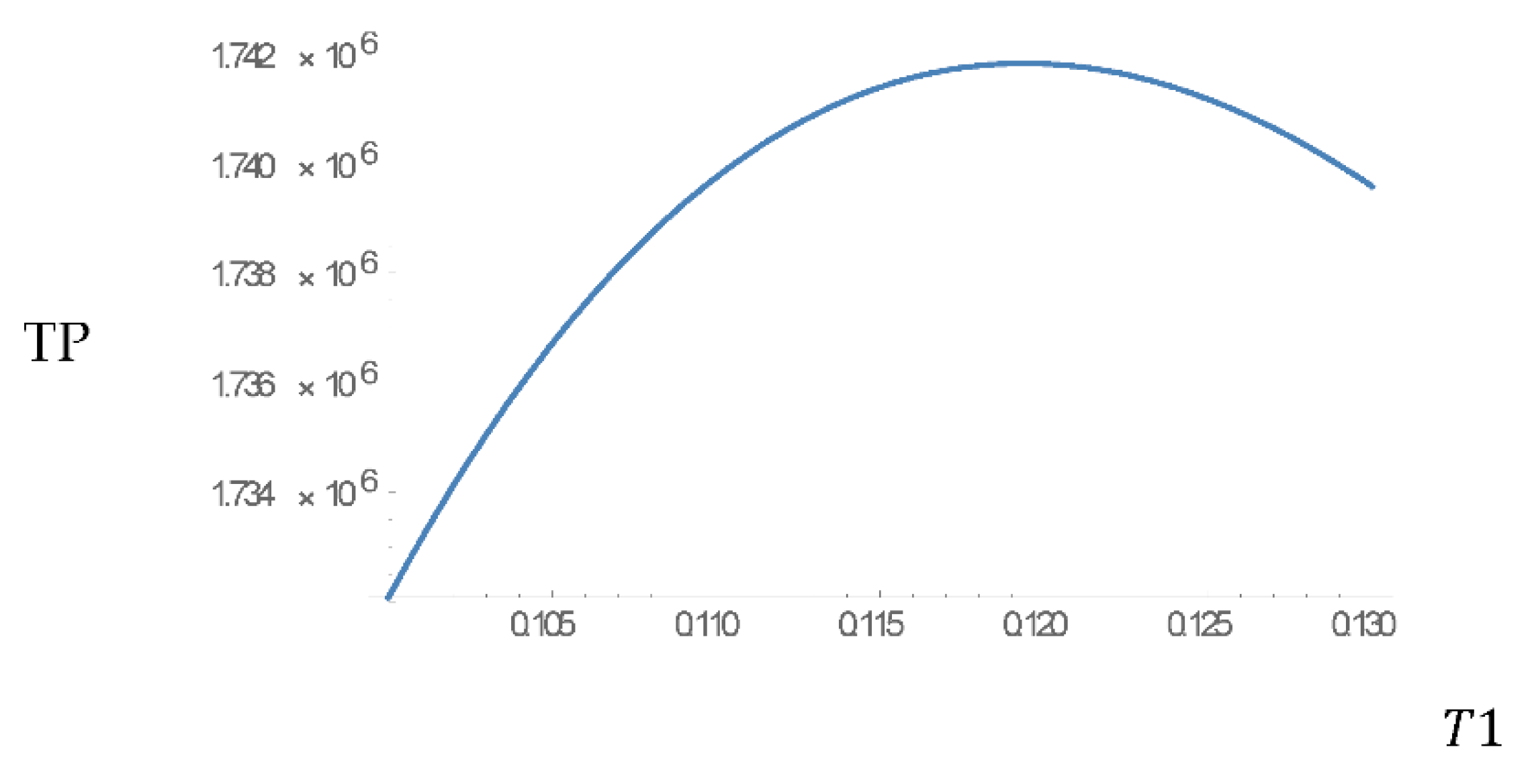

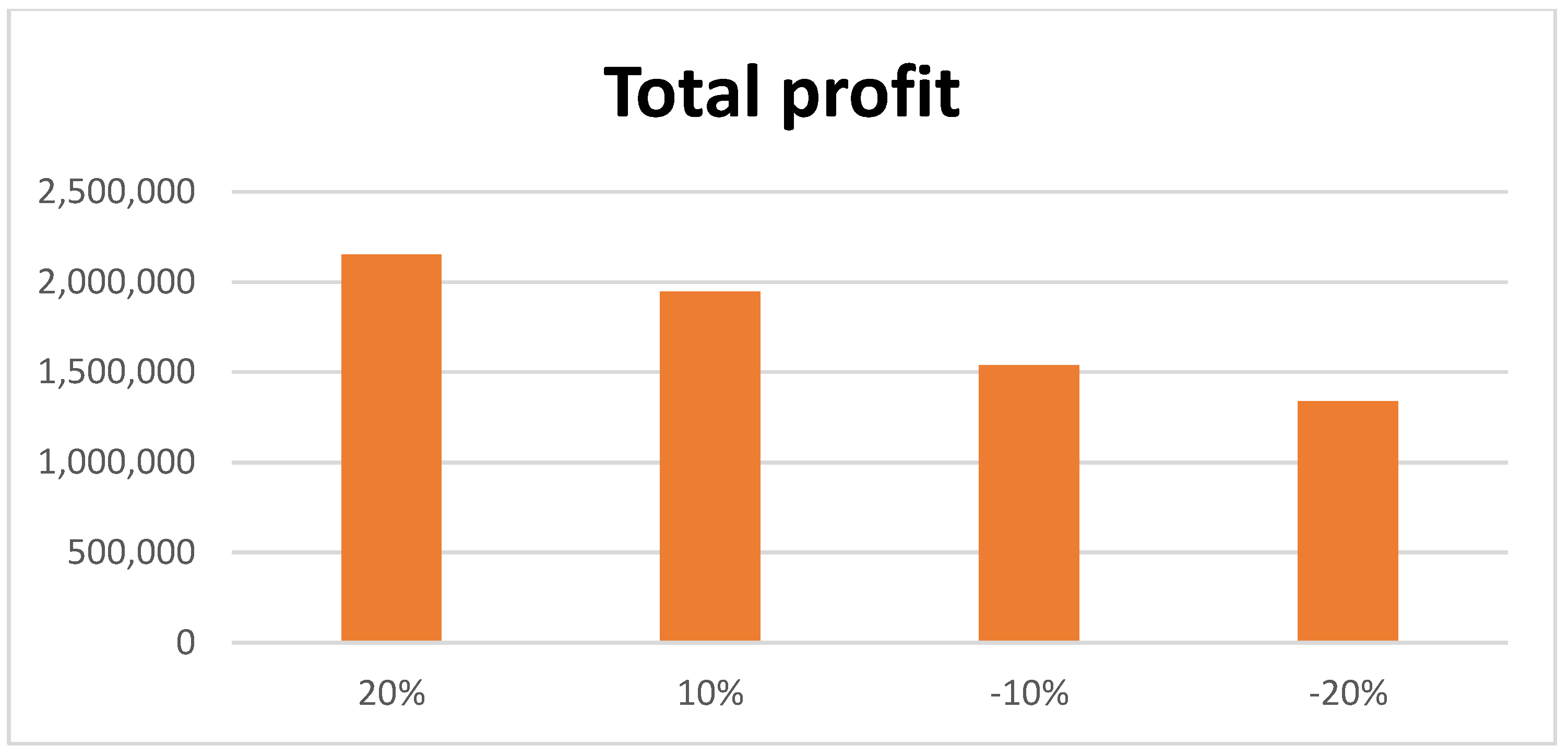

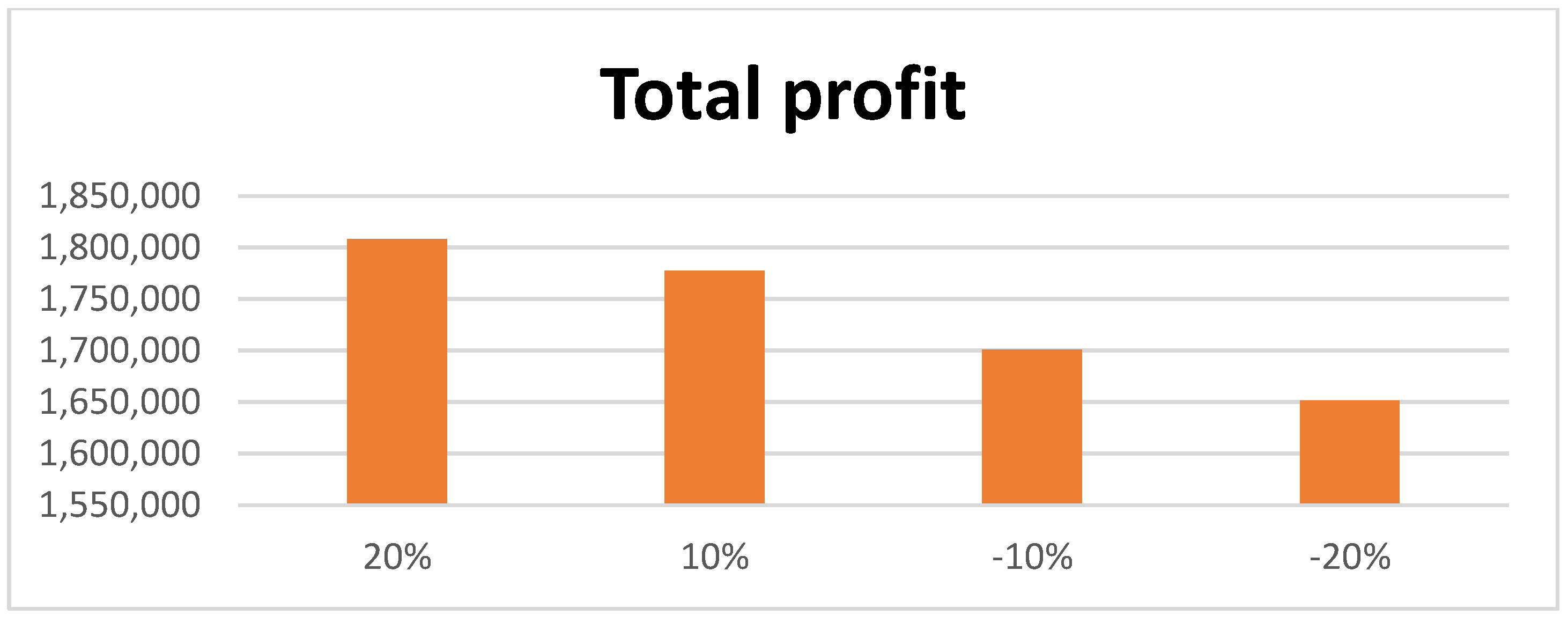

5. Sensitivity Analysis and Managerial Insights

5.1. Sensitivity Analysis

5.2. Managerial Insights

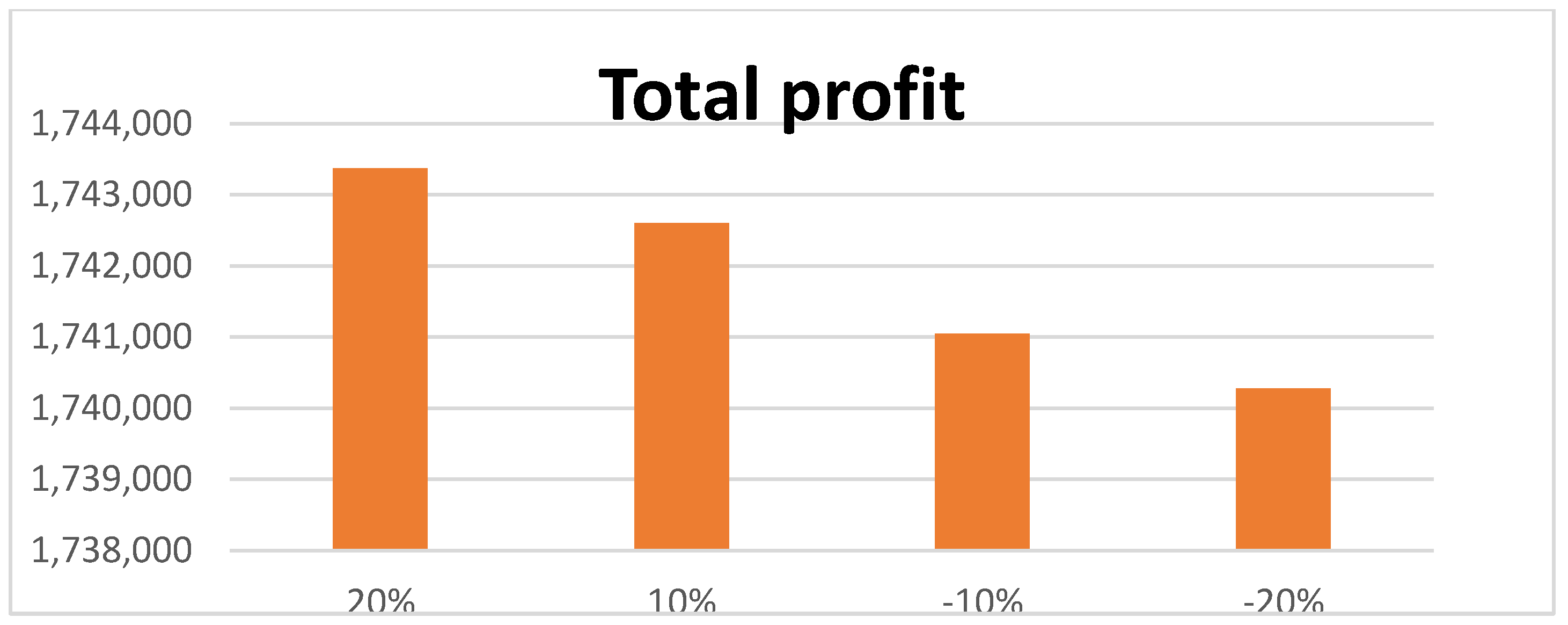

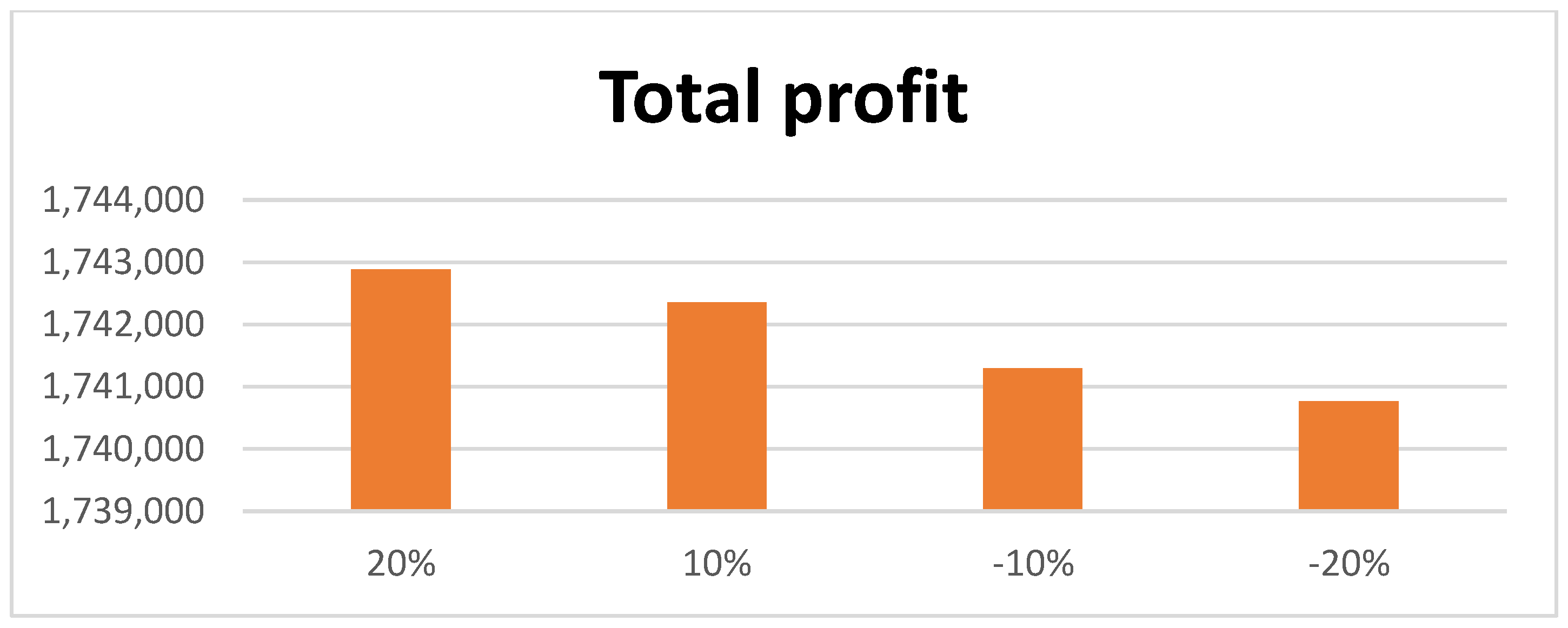

- In this model, only one company produces inventory and then supplies it to multiple buyers. Here, each buyer has a separate organization with a different number of possible suppliers. It was found through sensitivity analysis that, for the first supplier of the first group of buyers, if the value of the selling price is increased to a maximum of 20 percent, the production time is reduced. Additionally, the maximum profit of USD 233 is obtained by reducing the delivery time given to the buyer and the supplier. Conversely, by reducing the value of the selling price, all types of time periods increase, and a small amount of profit also increases.

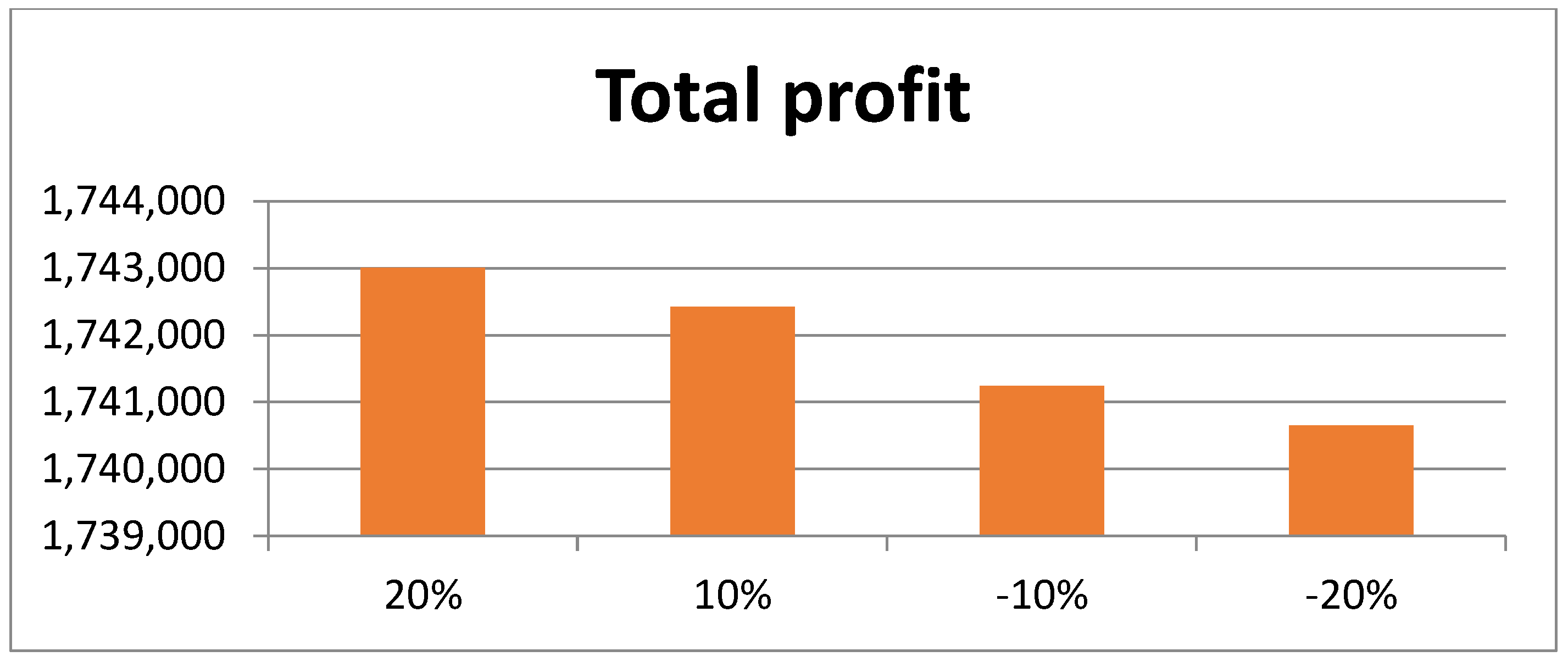

- If the value of the selling price for the second supplier of the first group is increased slightly by about 20 percent, then it is observed that the total profit increases by USD 210 with a decline in the production time. Conversely, if the value of the selling price declines by about 20 percent, then the total profit is reduced by USD 210, increasing the production time to 16 days.

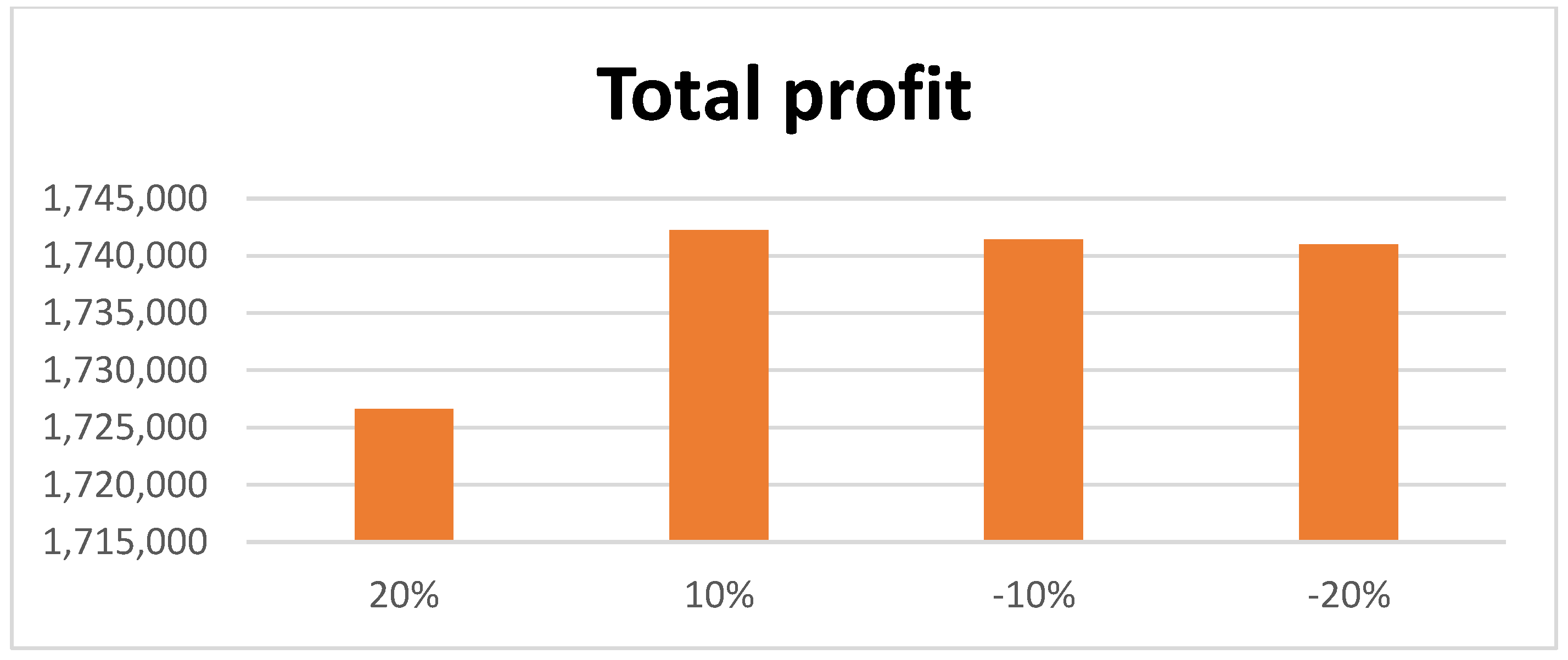

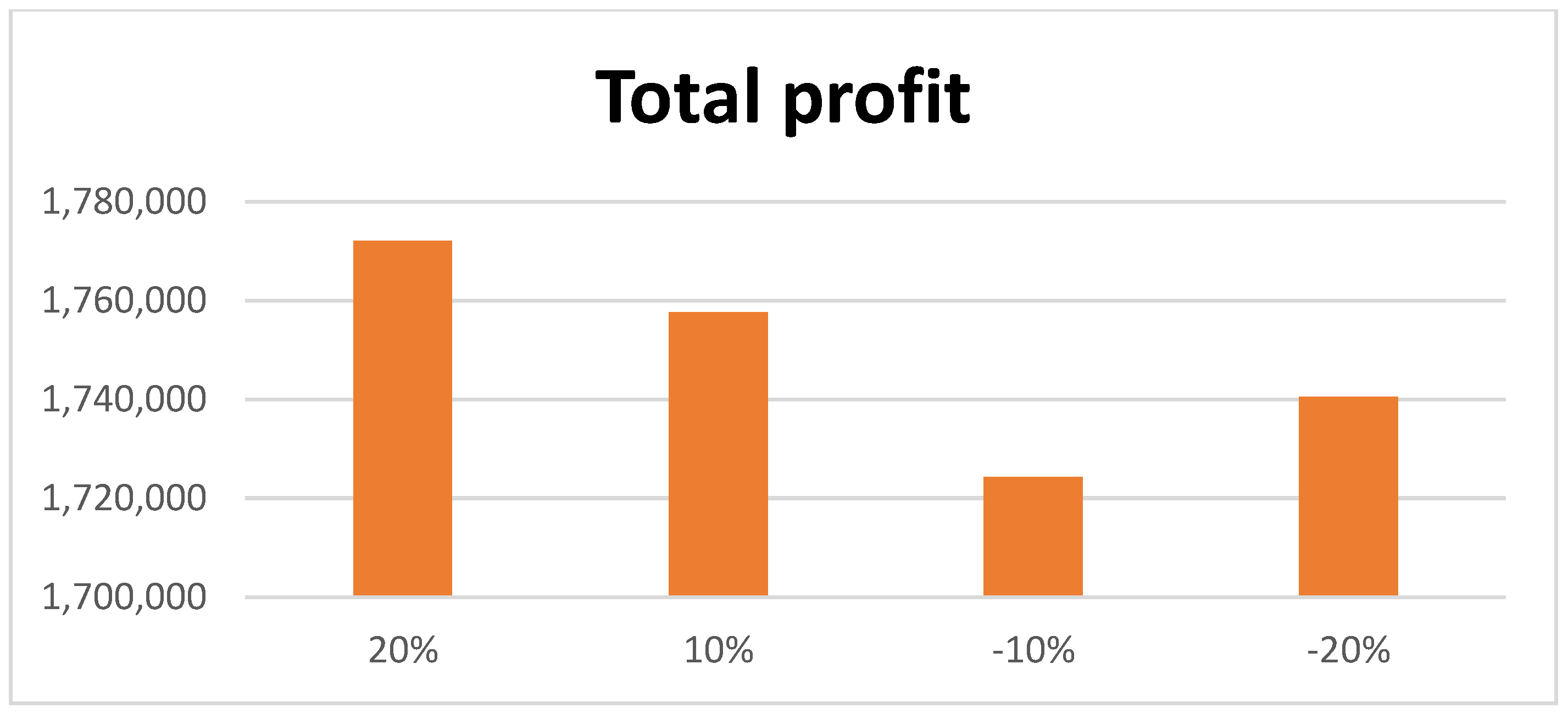

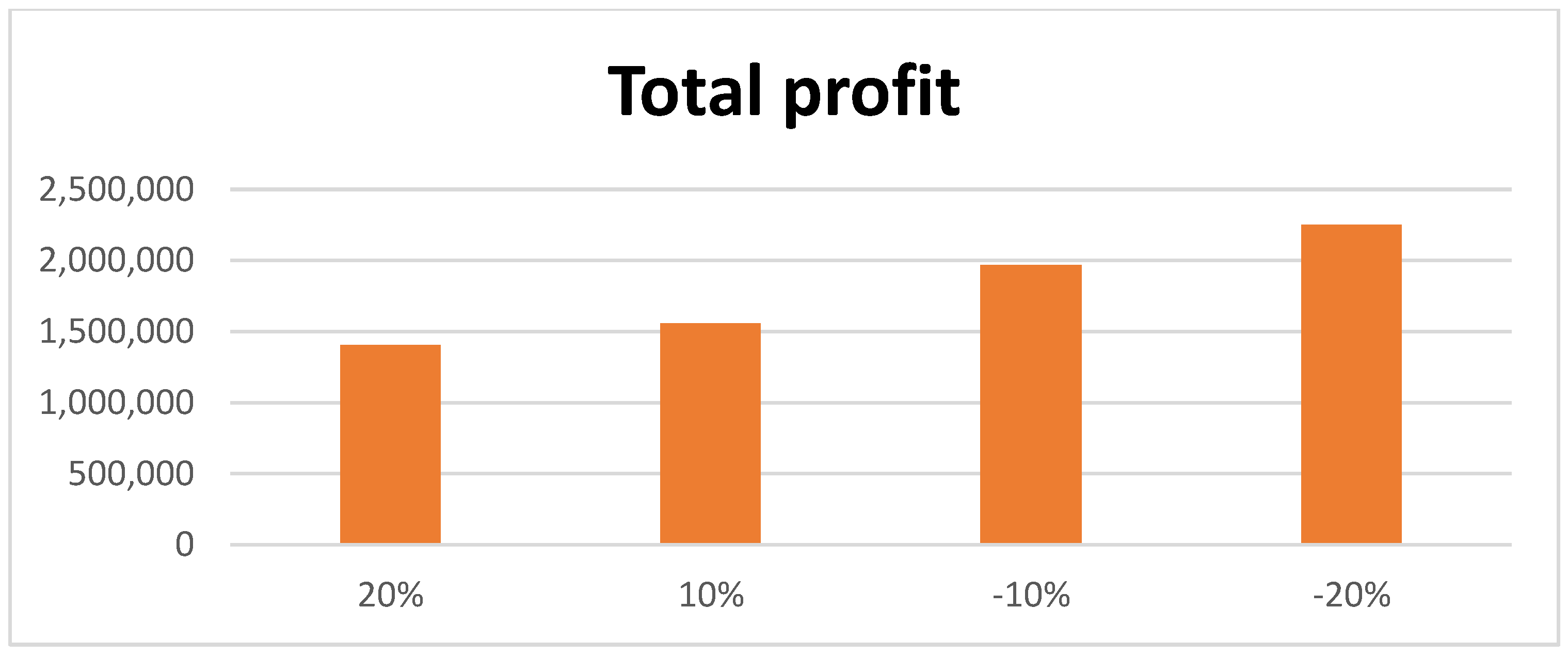

- A total reduction of 31 days in the production time upon increasing the selling price of the first supplier from the second group of suppliers and a decrease of 16 days in the first delivery time from producer to buyer, plus a USD 466 increase in total profit, were found. In addition, the increase in the selling price for another supplier in the second group resulted in an increase of 83 days in production time and an increase in total profit by USD 541. In contrast, for all suppliers in the other group, the selling price is reduced by about 20 percent; total profit also increases, along with an increase in working hours for all supply chain members, indicating lower profit.

- When vaccines are manufactured and supplied to all the buyers from the production house, the job of the buyer is to deliver the vaccine to the supplier very quickly. This requires taking into account the total number of shipments delivered from the buyer to the supplier, and if the total number of shipments is increased to a maximum of 20 percent, then it is found that the production period is 93 days, with a deficiency of USD 131 in total profit. In addition, if the number of shipments is reduced by 20 percent, a profit of USD 164 is observed. It is concluded that if the total number of shipments in delivering the vaccine to the supplier is minimized, the maximum profit is obtained.

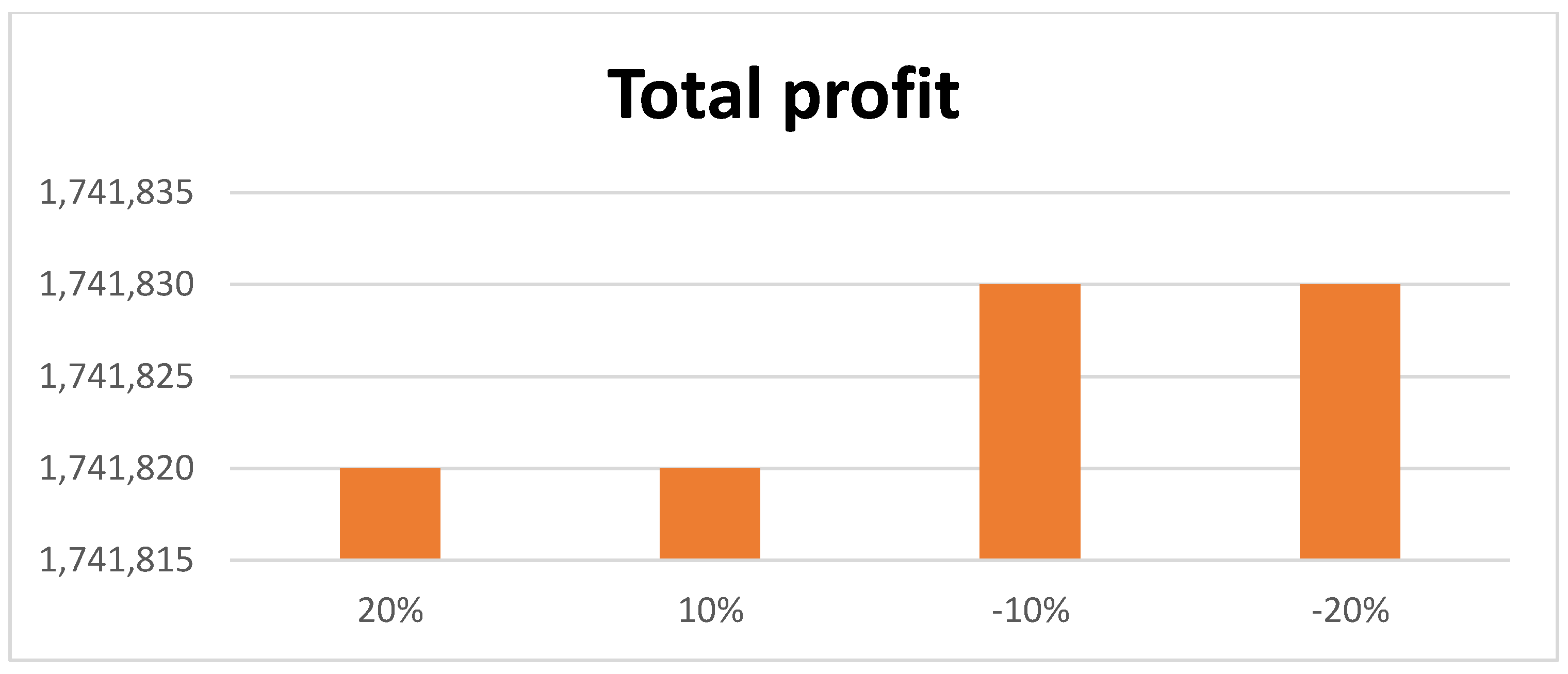

- When the vaccine is manufactured, special attention is given to the production plant to ensure that the minimum quantity of inventory becomes spoiled. In that case, it becomes the producer’s responsibility to maintain the inventory. To ensure that the lost quantity is minimized, he sees a slight variation in his holding cost in holding the inventory. If the holding cost is increased by 20 percent, then there is a very small difference in total profit, but if the holding cost is reduced by 20 percent, then there is a slight increase in total profit.

- Additionally, an examination of the sensitivity of the deteriorating rate of inventory for each member of the supply chain found that if the supplier’s deterioration rate increased by 20 percent, the overall profit declined. Conversely, increasing the deterioration rate of the buyer and supplier by 20 percent will see an increase of USD 65 and USD 114 in total profit.

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Asghar, I.; Kim, J.S. An automated smart EPQ based inventory model for technology dependent product under stochastic failure and repair rate. Symmetry 2020, 12, 388. [Google Scholar] [CrossRef] [Green Version]

- Mallick, R.K.; Patra, K.; Mondal, S.K. Mixture inventory model of lost sale and back order with stochastic lead time demand on permissible delay in payments. Ann. Oper. Res. 2020, 292, 341–369. [Google Scholar] [CrossRef]

- Mashud, A.H.; Roy, D.; Daryanto, Y.; Ali, M.H. A sustainable inventory model with imperfect products, deterioration, and controllable emissions. Mathematics 2020, 8, 2049. [Google Scholar] [CrossRef]

- Bachar, R.K.; Bhuniya, S.; Ghosh, S.K.; Sarkar, B. Controllable energy consumption in a sustainable smart manufacturing model considering superior service, flexible demand, and partial outsourcing. Mathematics 2022, 10, 4517. [Google Scholar] [CrossRef]

- Sarkar, B.; Kar, S.; Basu, K.; Guchhait, R. A sustainable managerial decision-making problem for a substitutable product in a dual-channel under carbon tax policy. Comput. Ind. Eng. 2022, 172, 108635. [Google Scholar] [CrossRef]

- Rau, H.; Wu, M.Y.; Wee, H.M. Integrated inventory model for deteriorating items under a multi-echelon supply chain environment. Int. J. Prod. Econ. 2003, 86, 155–168. [Google Scholar] [CrossRef]

- Rani, S.; Ali, R.; Agarwal, A. Inventory model for deteriorating items in green supply chain with credit period dependent demand. Int. J. Appl. Eng. Res. 2020, 15, 157–172. [Google Scholar]

- Shaikh, A.K.; Panda, G.C.; Khan, M.A.; Mashud, A.H.; Biswas, A. An inventory model for deteriorating items with preservation facility of ramp type demand and trade credit. Int. J. Oper. Res. 2020, 17, 514–551. [Google Scholar] [CrossRef]

- Gupta, M.; Tiwari, S.; Jaggi, C.K. Retailer’s ordering policies for time varying deteriorating items with partial backlogging and permissible delay in payments in a two warehouse environment. Ann. Oper. Res. 2020, 295, 139–161. [Google Scholar] [CrossRef]

- Padiyar, S.V.S.; Kuraie, V.; Bhagat, N.; Singh, S.R.; Dem, H. Green integrated model for imperfect production process under reliability. J. Math. Control Sci. Appl. 2022, 8, 1–13. [Google Scholar]

- Hasan, K.W. A production inventory model for the deteriorating goods under COVID-19 disruption risk. World J. Adv. Res. Rev. 2022, 13, 355–368. [Google Scholar] [CrossRef]

- Kumar, N.; Dahiya, S.; Kumar, S. An Inventory Model deteriorating items with Demand Dependent Production Rate under Permissible Delay Payment. Turk. J. Comput. Math. Educ. (TURCOMAT) 2022, 13, 226–253. [Google Scholar]

- Chou, T.H. Integrated Two-Stage Inventory Model for Deteriorating Items. Master’s Thesis, Chung Yuan Christian University, Taoyuan City, Taiwan.

- Rani, M.; Kishan, H. A multi echelon supply chain inventory model with variable demand rate for deteriorating items. Pure Appl. Math. Sci. 2011, LXXIV, 31–44. [Google Scholar]

- Habib, M.S.; Omair, M.; Ramzan, M.B.; Chaudhary, T.N.; Farooq, M.; Sarkar, B. A robust possibilistic flexible programming approach toward a resilient and cost-efficient biodiesel supply chain. J. Clean Prod. 2022, 366, 132752. [Google Scholar] [CrossRef]

- Jaggi, C.K.; Pareek, S.; Sharma, N.; Nidhi. Fuzzy inventory model for deteriorating items with time varying demand and shortage. Am. J. Oper. Res. 2012, 2, 81–92. [Google Scholar] [CrossRef]

- Barman, H.; Parvin, M.; Roy, S.K.; Weber, G.W. Back-ordered inventory model with inflation in a cloudy-fuzzy environment. J. Ind. Manag. Optim. 2021, 17, 1913–1941. [Google Scholar] [CrossRef] [Green Version]

- Rana, R.S.; Kumar, D.; Prasad, K. Two warehouse dispatching policies for perishable items with freshness efforts, inflationary conditions and partial backlogging. Oper. Manag. Res. 2022, 15, 28–45. [Google Scholar] [CrossRef]

- Sarkar, B.; Joo, J.; Kim, Y.; Park, H.; Sarkar, M. Controlling defective items in a complex multi-phase manufacturing system. Rairo-Oper. Res. 2022, 56, 871–889. [Google Scholar] [CrossRef]

- Maihami, R.; Govindan, K.; Fattahi, M. The inventory and pricing decisions in a three-echelon supply chain of deteriorating items under probabilistic environment. Transp. Res. Part E Logist. Transp. Rev. 2019, 131, 118–138. [Google Scholar] [CrossRef]

- Sarkar, B.; Dey, B.K.; Sarkar, M.; Kim, S.J. A smart production system with an autonomation technology and dual channel retailing. Comput. Ind. Eng. 2022, 173, 108607. [Google Scholar] [CrossRef]

- Jiang, Y.; Zhao, Y.; Dong, M.; Han, S. Sustainable supply chain network design with carbon footprint consideration: A case study in China. Math. Probl. Eng. 2019, 2019, 3162471. [Google Scholar] [CrossRef]

- Sebatjane, M.; Adetunji, O. A three echelon supply chain for economic growing quantity model with Price and freshness dependent demand: Pricing, ordering, and shipment decisions. Oper. Res. Perspect. 2020, 7, 100153. [Google Scholar] [CrossRef]

- Sana, S.S. A structural mathematical model on two echelon supply chain system. Ann. Oper. Res. 2021, 315, 1997–2025. [Google Scholar] [CrossRef]

- Lu, C.J.; Lee, T.S.; Gu, M.; Yang, C.T. A multistage sustainable production inventory model with carbon emission reduction and Price dependent demand under Stackelberg game. Appl. Sci. 2020, 10, 4878. [Google Scholar] [CrossRef]

- Jauhari, W.M.; Adam, N.A.F.P.; Rosyidi, C.N.; Pujawan, N.; Shah, N.H. A closed loop supply chain model with rework, waste disposal, and carbon emissions. Oper. Res. Perspect. 2020, 7, 100155. [Google Scholar] [CrossRef]

- Padiyar, S.V.S.; Singh, S.R.; Punetha, N. Inventory system with price dependent consumption for deteriorating items with shortages under fuzzy environment. Int. J. Sustain. Manag. Inform. 2021, 7, 218–231. [Google Scholar] [CrossRef]

- Karimi, M.; Sadjadi, S.J. Optimization of a multi-item inventory model for deteriorating items with capacity constraint using dynamic programming. J. Ind. Manag. Optim. 2022, 18, 1145. [Google Scholar] [CrossRef]

- Tiwari, S.; Cárdenas-Barrón, L.E.; Khanna, A.; Jaggi, C.K. Impact of trade credit and inflation on retailer’s ordering policies for non-instantaneous deteriorating items in a two-warehouse environment. Int. J. Prod. Econ. 2016, 176, 154–169. [Google Scholar] [CrossRef]

- Mukherjee, T.; Sangal, I.; Sarkar, B.; Alkadash, T.M. Mathematical estimation for maximum flow of goods within a cross-dock to reduce inventory. Math. Biosci. Eng. 2022, 19, 13710–13731. [Google Scholar] [CrossRef]

- Mahapatra, A.S.; Dasgupta, A.; Shaw, A.K.; Sarkar, B. An inventory model with uncertain demand under preservation strategy for deteriorating items. Rairo-Oper. Res. 2022; in press. [Google Scholar] [CrossRef]

- Palanivel, M.; Uthayakumar, R. Two-warehouse inventory model for non–instantaneous deteriorating items with optimal credit period and partial backlogging under inflation. J. Control Decis. 2016, 3, 132–150. [Google Scholar] [CrossRef]

- Singh, S.; Sharma, S.; Pundir, S.R. Two-warehouse inventory model for deteriorating items with time dependent demand and partial backlogging under inflation. Int. J. Math. Model. Comput. 2018, 08, 73–88. [Google Scholar]

- Agarwal, A.; Sangal, I.; Singh, S.R.; Rani, S. Two warehouse inventory model for lifetime deterioration and inflation with exponential demand and partial lost sales. Int. J. Pure Appl. Math. 2018, 118, 1253–1265. [Google Scholar]

- Singh, S.R.; Rana, K. Effect of inflation and variable holding cost on life time inventory model with multi variable demand and lost sales. Int. J. Recent Technol. Eng. 2020, 8, 5513–5519. [Google Scholar] [CrossRef]

- Alamri, O.A.; Jayaswal, M.K.; Khan, F.A.; Mittal, M. An EOQ Model with Carbon Emissions and Inflation for Deteriorating Imperfect Quality Items under Learning Effect. Sustainability 2022, 14, 1365. [Google Scholar] [CrossRef]

- Alfares, H.K.; Attia, A.M. A supply chain model with vendor-managed inventory, consignment, and quality inspection errors. Int. J. Prod. Res. 2017, 55, 5706–5727. [Google Scholar] [CrossRef]

- Jaggi, C.K.; Aggarwal, K.K.; Goel, S.K. Optimal order policy for deteriorating items with inflation induced demand. Int. J. Prod. Econ. 2006, 103, 707–714. [Google Scholar] [CrossRef]

- Padiyar, S.V.S.; Kuraie, V.C.; Rajput, N.; Padiyar, N.B.; Joshi, D.; Adhikari, M. Production inventory model with limited storage problem for perishable items under learning and inspection with fuzzy parameters. Des. Eng. 2021, 9, 12821–12839. [Google Scholar]

- Aghighi, A.; Goli, A.; Malmir, B.; Trikolaee, E.B. The stochastic location-routing-inventory problem of perishable products with reneging and balking. J. Ambient Intell. Hum. Comput. 2021, in press. [CrossRef]

- Goli, A.; Ala, A.; Mirjalili, S. A robust possibilistic programming framework for designing an organ transplant supply chain under uncertainty. Ann. Oper. Res. 2022, in press. [CrossRef]

- Tirkolaee, E.B.; Aydin, N.S. Integrated design of sustainable supply chain and transportation network using a fuzzy bi-level decision support system for perishable products. Expert Syst. Appl. 2022, 195, 116628. [Google Scholar] [CrossRef]

- Tirkolaee, E.B.; Goli, A.; Mardani, A. A novel two-echelon hierarchical location-allocation-routing optimization for green energy-efficient logistics systems. Ann. Oper Res. 2021, in press. [CrossRef]

- Alinezhad, M.; Mahdavi, I.; Hematian, M.; Trikolaee, E.B. A fuzzy multi-objective optimization model for sustainable closed-loop supply chain network design in food industries. Environ. Dev. Sustain. 2022, 24, 8779–8806. [Google Scholar] [CrossRef]

- Sarkar, B.; Ganguly, B.; Pareek, S.; Cárdenas-Barrón, L.E. A three-echelon green supply chain management for biodegradable products with three transportation modes. Comput. Ind. Eng. 2022, 174, 108727. [Google Scholar] [CrossRef]

- Padiyar, S.V.S.; Vandana, V.; Bhagat, N.; Singh, S.R.; Sarkar, B. Joint replenishment strategy for deteriorating multi-item through multi-echelon supply chain model with imperfect production under imprecise and inflationary environment. Rairo-Oper. Res. 2022, 56, 3071–3096. [Google Scholar] [CrossRef]

- Mahapatra, A.S.; Mahapatra, M.S.; Sarkar, B.; Majumder, S.K. Benefit of preservation technology with promotion and time-dependent deterioration under fuzzy learning. Expert Syst. Appl. 2022, 201, 117169. [Google Scholar] [CrossRef]

- Fallah, M.; Nozari, H. Neutrosophic mathematical programming for optimization of multi-objective sustainable biomass supply chain network design. CMES-Comp. Model. Eng. Sci. 2021, 129, 927–951. [Google Scholar] [CrossRef]

- Sundararajan, S.; Vaithyasubramanian, S.; Rajinikannan, M. Price determination of a non-instantaneous deteriorating EOQ model with shortage and inflation under delay in payment. Int. J. Syst. Sci.-Oper. Logist. 2022, 9, 384–404. [Google Scholar] [CrossRef]

- Gupta, S.; Vijaygargy, L.; Sarkar, B. A bi-objective integrated transportation and inventory management under a supply chain network considering multiple distribution networks. Rairo-Oper. Res. 2022, 56, 3991–4022. [Google Scholar] [CrossRef]

- Khan, M.A.A.; Shaikh, A.A.; Cárdenas-Barrón, L.E.; Mashud, A.H.M.; Treviño-Garza, G.; Céspedes-Mota, A. An Inventory Model for Non-Instantaneously Deteriorating Items with Nonlinear Stock-Dependent Demand, Hybrid Payment Scheme and Partially Backlogged Shortages. Mathematics 2022, 10, 434. [Google Scholar] [CrossRef]

- Dey, B.K.; Yilmaz, I.; Seok, H. A sustainable supply chain integrated with autonomated inspection, flexible eco-production, and smart transportation. Processes 2022, 10, 1775. [Google Scholar] [CrossRef]

- Chakraborty, D.; Jana, D.K.; Roy, T.K. Multi-warehouse partial backlogging inventory system with inflation for non-instantaneous deteriorating multi-item under imprecise environment. Soft Comput. 2020, 24, 14471–14490. [Google Scholar] [CrossRef]

- Khan, M.A.A.; Halim, M.A.; AlArjani, A.; Shaikh, A.A.; Uddin, M.S. Advance and delay in payments with the price-discount inventory model for deteriorating items under capacity constraint and partially backlogged shortages. Alex. Eng. J. 2022, 61, 1735–1745. [Google Scholar]

- Duary, A.; Das, S.; Arif, M.G.; Abualnaja, K.M.; Khan, M.A.A.; Zakarya, M.; Shaikh, A.A. Inventory management with hybrid cash-advance payment for time-dependent demand, time-varying holding cost and non-instantaneous deterioration under backordering and non-terminating situations. Alex. Eng. J. 2022, 61, 8469–8486. [Google Scholar]

- Shah, N.H.; Naik, M.K. Inventory policies for deteriorating items with time-price backlog dependent demand. Int. J. Syst. Sci.-Oper. Logist. 2020, 7, 76–89. [Google Scholar] [CrossRef]

| Authors | Model Type | Transportation Cost | Deterioration | Inflation |

|---|---|---|---|---|

| Karimi and Sadjadi [28] | Inventory | NC | Considered | NC |

| Alamri et al. [36] | Inventory | NC | Considered | Considered |

| Sarkar et al. [45] | SCM | Variable | NC | NC |

| Padiyar et al. [46] | SCM | NC | Considered | Considered |

| Mahapatra et al. [47] | Inventory | NC | Considered | Considered |

| Fallah and Nozari [48] | SCM | Considered | NC | NC |

| Sundararajan et al. [49] | Inventory | NC | Considered | Considered |

| Gupta et al. [50] | SCM | Variable | NC | NC |

| Khan et al. [51] | Inventory | NC | Considered | NC |

| Dey et al. [52] | SCM | Variable | NC | NC |

| Chakraborty et al. [53] | Inventory | Considered | Considered | Considered |

| Khan et al. [54] | Inventory | NC | Considered | NC |

| Duary et al. [55] | Inventory | Considered | Considered | NC |

| Shah and Naik [56] | Inventory | NC | Considered | NC |

| This study | SCM | Fixed and Variable | Considered | Considered |

| 0.00095 | 1,848,520 | |

| 0.00098 | 1,783,150 | |

| 0.001 | 1,741,830 | |

| 0.0012 | 1,406,880 | |

| 0.0015 | 1,077,440 |

| Parameters | % Change | T | TP | |||

|---|---|---|---|---|---|---|

| 20 | 0.0994734 | 0.059683 | 0.0298415 | 0.119366 | ||

| 10 | 0.0994769 | 0.059685 | 0.0298427 | 0.119371 | ||

| −10 | 0.0994862 | 0.059691 | 0.0298455 | 0.119382 | ||

| −20 | 0.994907 | 0.059694 | 0.029847 | 0.119388 | ||

| 20 | 0.0994748 | 0.0596845 | 0.02984225 | 0.119369 | ||

| 10 | 0.0994780 | 0.0596865 | 0.02984325 | 0.119373 | ||

| −10 | 0.0994852 | 0.0596905 | 0.02984525 | 0.119381 | ||

| −20 | 0.0994886 | 0.0596925 | 0.02984625 | 0.119385 | ||

| 20 | 0.0994762 | 0.0596855 | 0.02984275 | 0.119371 | ||

| 10 | 0.0994804 | 0.059687 | 0.0298435 | 0.119374 | ||

| −10 | 0.0994841 | 0.05969 | 0.029845 | 0.11938 | ||

| −20 | 0.0994866 | 0.0596915 | 0.02984575 | 0.119383 | ||

| 20 | 0.0994755 | 0.0598195 | 0.02990975 | 0.1193 | ||

| 10 | 0.0994784 | 0.0596865 | 0.02984325 | 0.119374 | ||

| −10 | 0.0994848 | 0.0596905 | 0.02984525 | 0.119381 | ||

| −20 | 0.0994879 | 0.059692 | 0.029846 | 0.119384 | ||

| 20 | 0.0933605 | 0.056016 | 0.028008 | 0.112032 | ||

| 10 | 0.0963868 | 0.0577715 | 0.02888575 | 0.115543 | ||

| −10 | 0.10299 | 0.061793 | 0.0308965 | 0.123586 | ||

| −20 | 0.106866 | 0.0641185 | 0.03205925 | 0.128237 | ||

| 20 | 0.0994808 | 0.059688 | 0.029844 | 0.119376 | ||

| 10 | 0.0994814 | 0.059688 | 0.029844 | 0.119376 | ||

| −10 | 0.0994822 | 0.0596885 | 0.02984425 | 0.119377 | ||

| −20 | 0.0994826 | 0.059689 | 0.0298445 | 0.119378 | ||

| 20 | 0.108817 | 0.0652895 | 0.03264475 | 0.130579 | ||

| 10 | 0.104262 | 0.062556 | 0.031278 | 0.125112 | ||

| −10 | 0.0944438 | 0.0472219 | 0.02361095 | 0.0944438 | ||

| −20 | 0.0891039 | 0.053462 | 0.026731 | 0.106924 | ||

| 20 | 0.0912151 | 0.054729 | 0.0273645 | 0.109458 | ||

| 10 | 0.0950794 | 0.057047 | 0.0285235 | 0.114094 | ||

| −10 | 0.104554 | 0.0627315 | 0.03136575 | 0.125463 | ||

| −20 | 0.110471 | 0.066282 | 0.033141 | 0.132564 | ||

| 20 | 0.085553 | 0.0531325 | 0.02656625 | 0.106265 | ||

| 10 | 0.0936292 | 0.0561765 | 0.02808825 | 0.112353 | ||

| −10 | 0.106323 | 0.063793 | 0.0318965 | 0.127586 | ||

| −20 | 0.11447 | 0.0686675 | 0.0343375 | 0.137335 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Padiyar, S.V.S.; Vandana; Singh, S.R.; Singh, D.; Sarkar, M.; Dey, B.K.; Sarkar, B. Three-Echelon Supply Chain Management with Deteriorated Products under the Effect of Inflation. Mathematics 2023, 11, 104. https://doi.org/10.3390/math11010104

Padiyar SVS, Vandana, Singh SR, Singh D, Sarkar M, Dey BK, Sarkar B. Three-Echelon Supply Chain Management with Deteriorated Products under the Effect of Inflation. Mathematics. 2023; 11(1):104. https://doi.org/10.3390/math11010104

Chicago/Turabian StylePadiyar, Surendra Vikram Singh, Vandana, Shiv Raj Singh, Dipti Singh, Mitali Sarkar, Bikash Koli Dey, and Biswajit Sarkar. 2023. "Three-Echelon Supply Chain Management with Deteriorated Products under the Effect of Inflation" Mathematics 11, no. 1: 104. https://doi.org/10.3390/math11010104

APA StylePadiyar, S. V. S., Vandana, Singh, S. R., Singh, D., Sarkar, M., Dey, B. K., & Sarkar, B. (2023). Three-Echelon Supply Chain Management with Deteriorated Products under the Effect of Inflation. Mathematics, 11(1), 104. https://doi.org/10.3390/math11010104