Dynamic Model of Enterprise Revenue Management Based on the SFA Model

Abstract

1. Introduction

- Fulmer’s model—a nine-factor model for assessing bankruptcy risk [8];

- Taffler’s four-factor bankruptcy model [11];

- Saifullin–Kadykov’s model of enterprises bankruptcy is a medium-term rating model for predicting bankruptcy risk, developed by Russian scientists, which can be applied to any industry and enterprises of various sizes [12,13]; it should be noted that these models’ bankruptcy forecasting differs between countries, sectors of the economy, enterprise size or age;

2. Materials and Methods: Model

3. Accounting for Enterprise Efficiency

4. Solution Algorithm

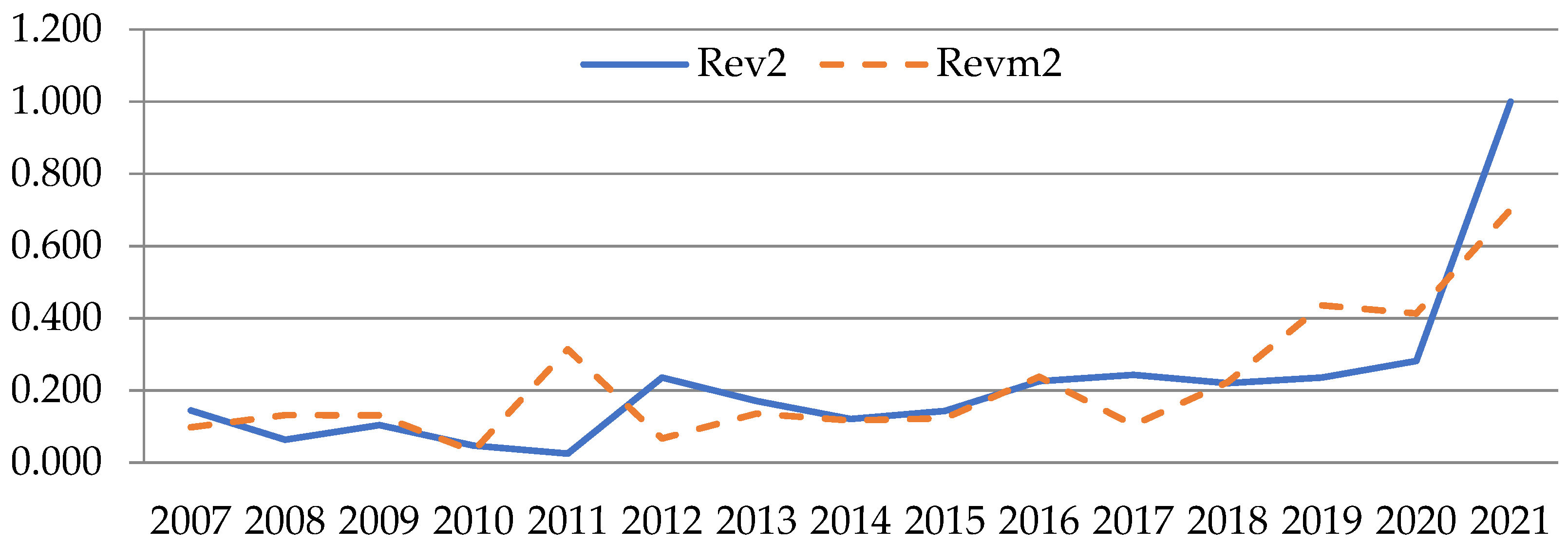

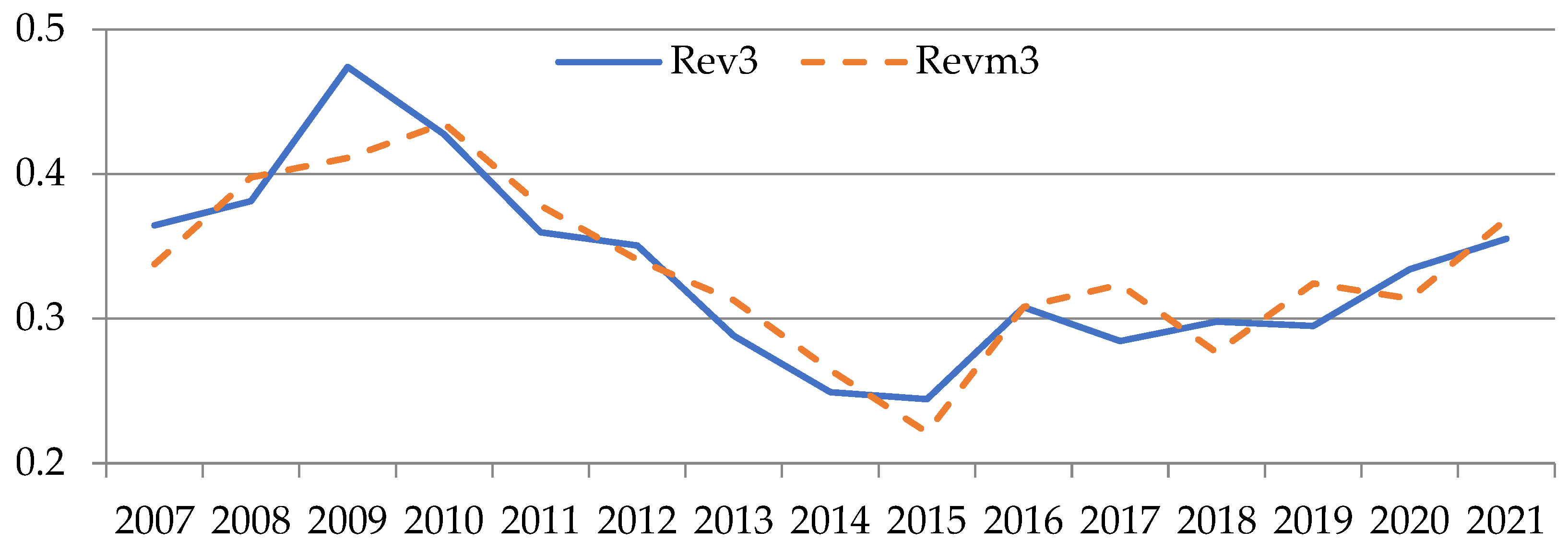

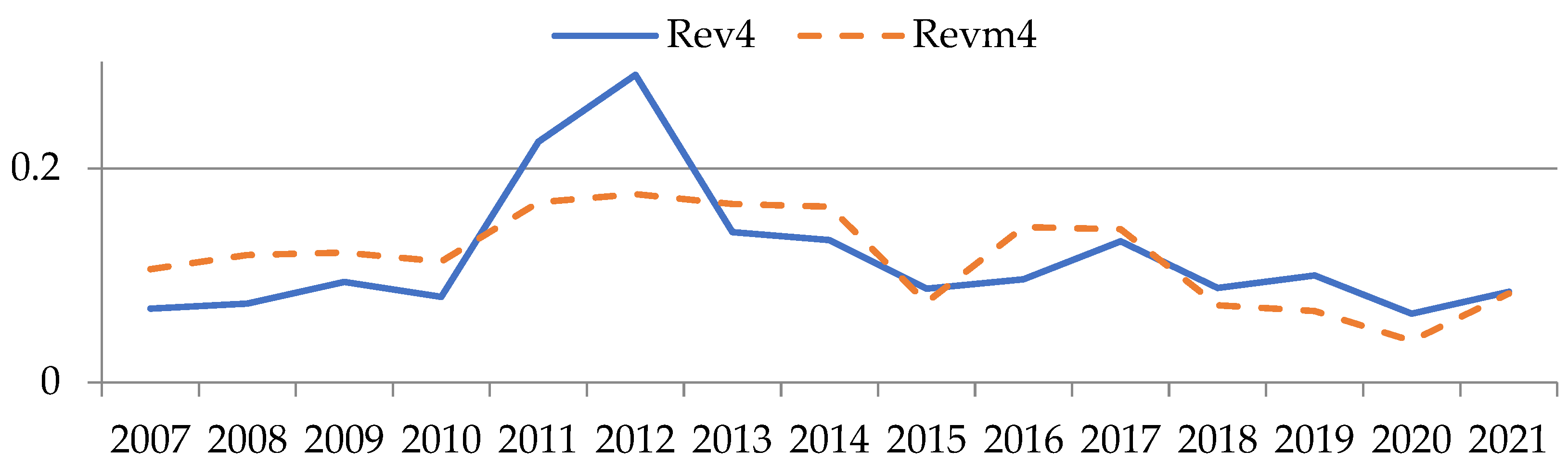

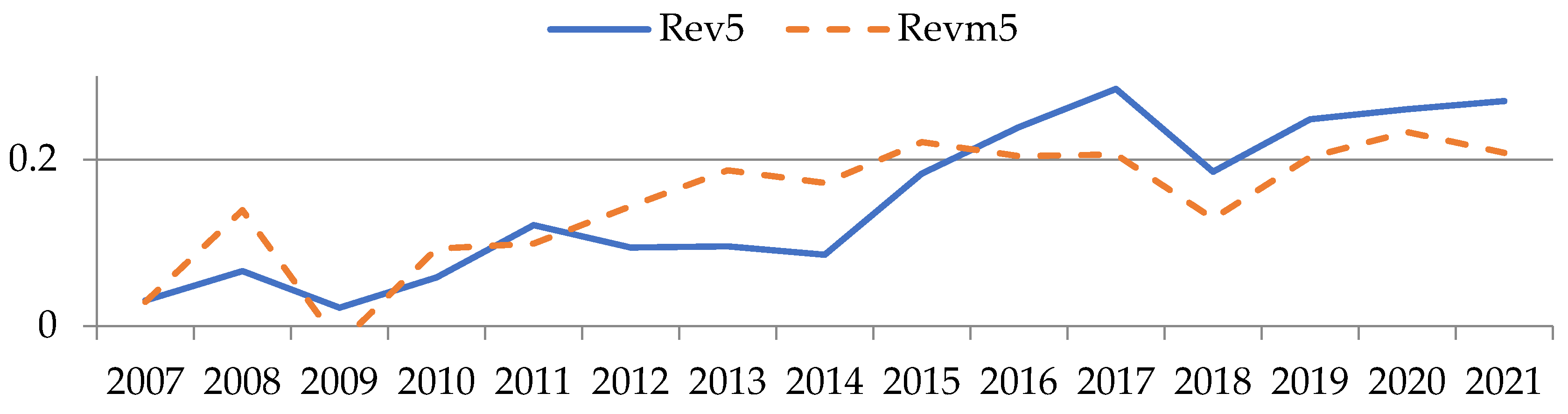

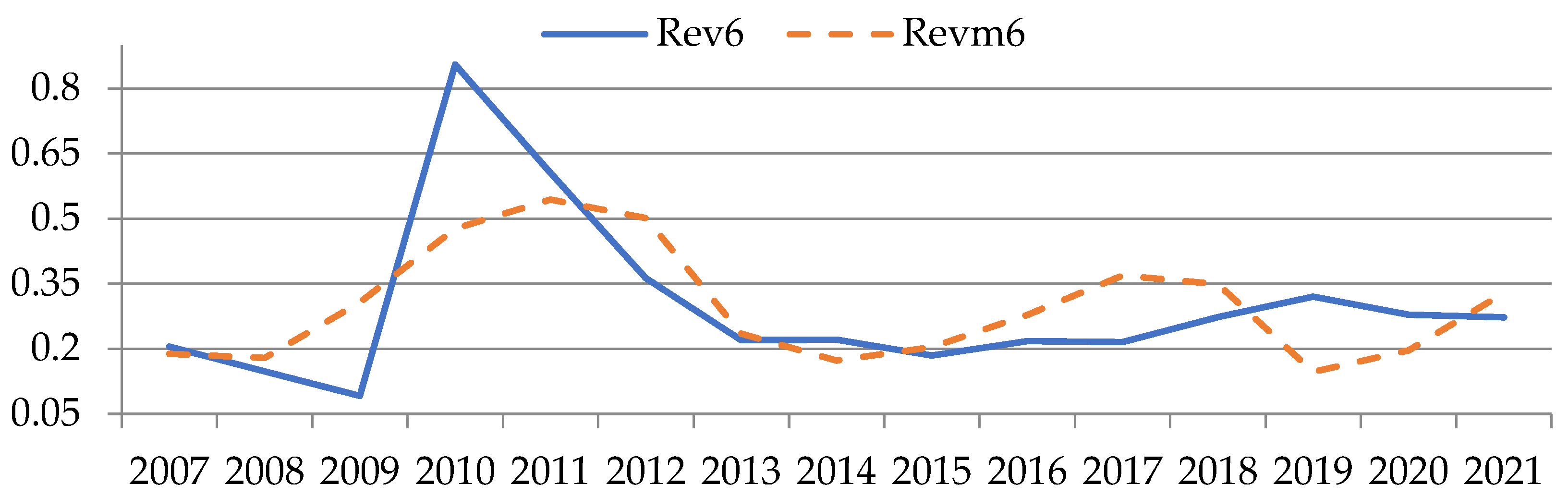

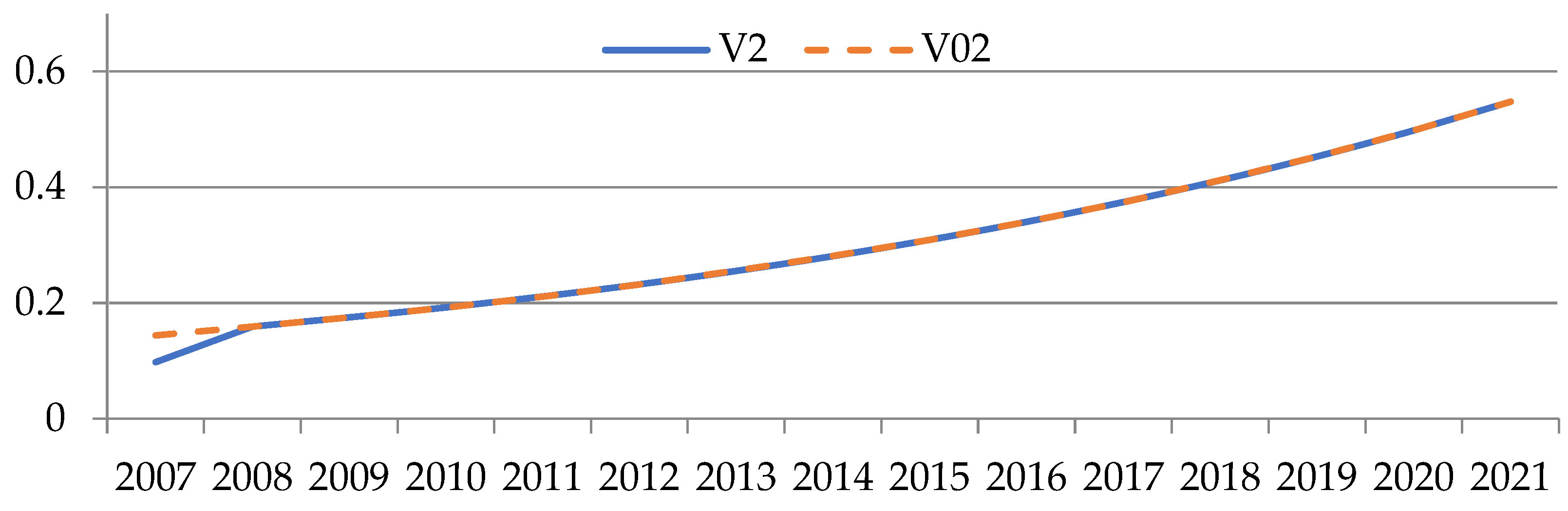

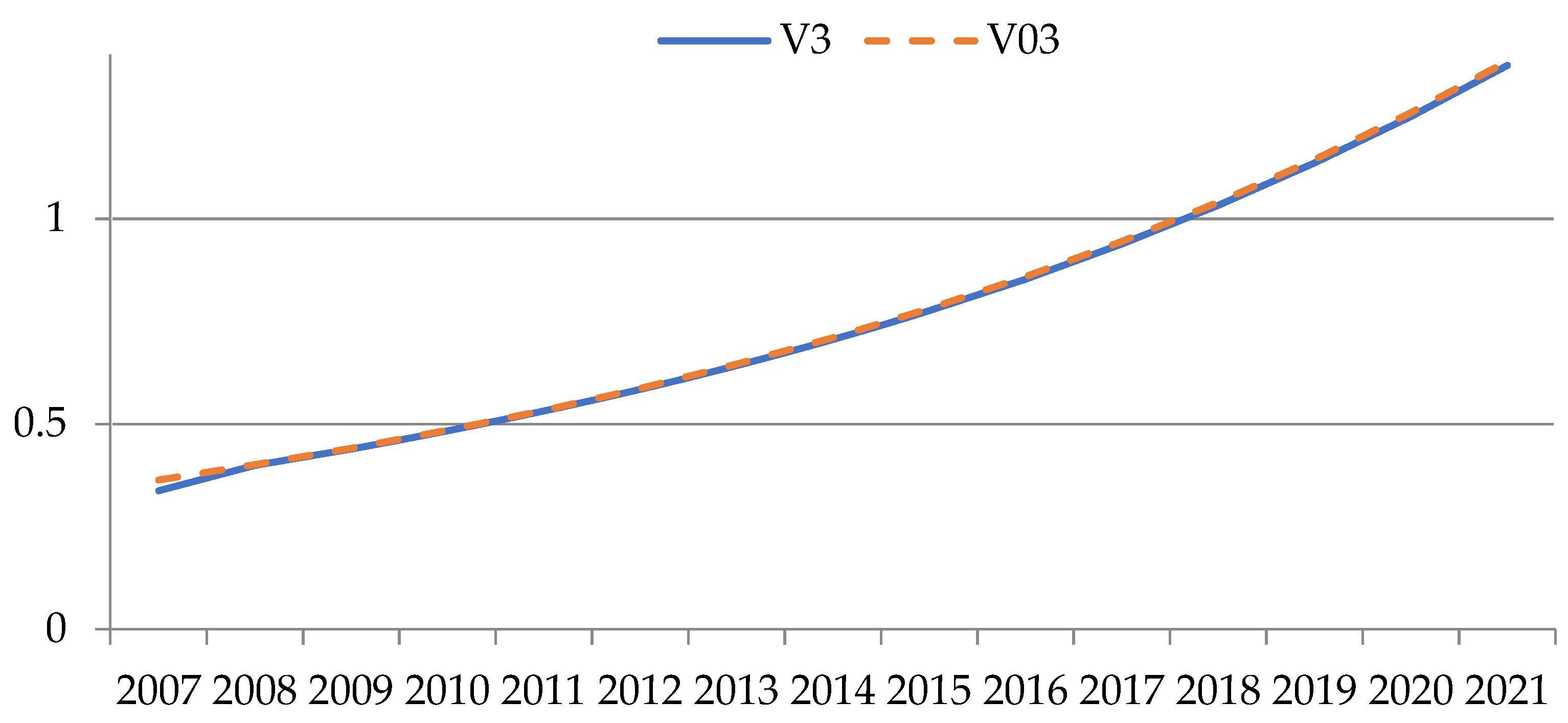

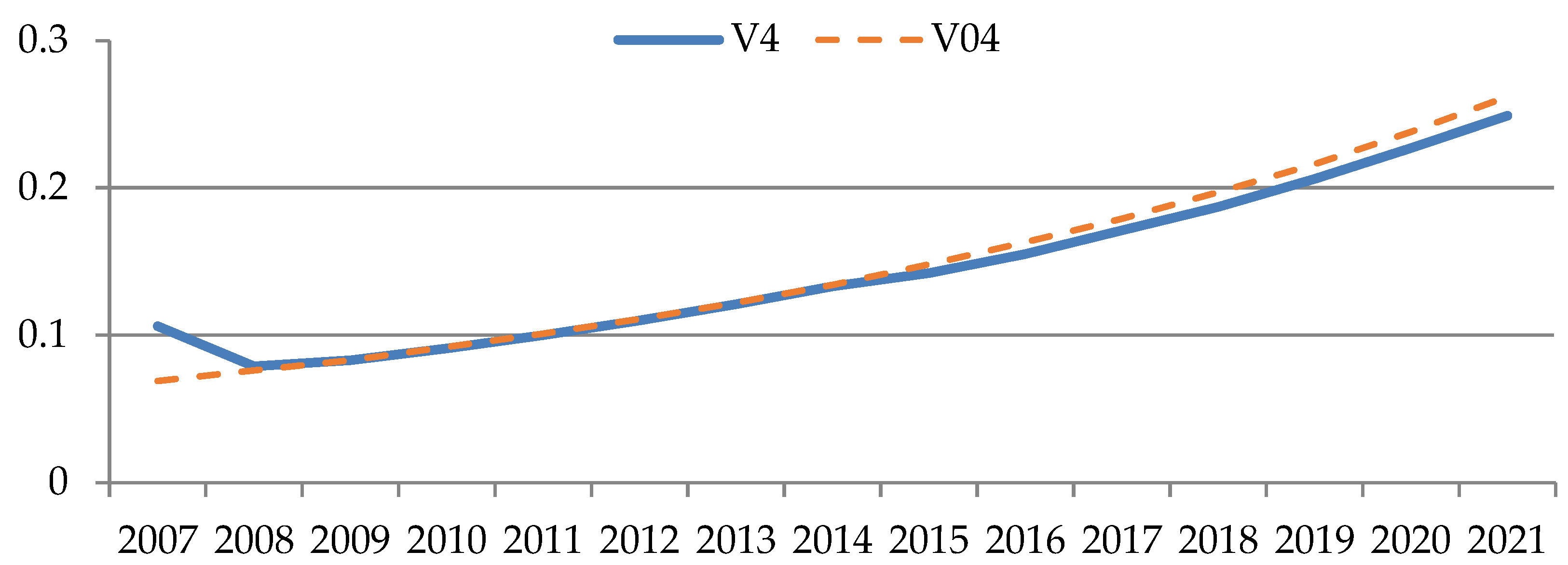

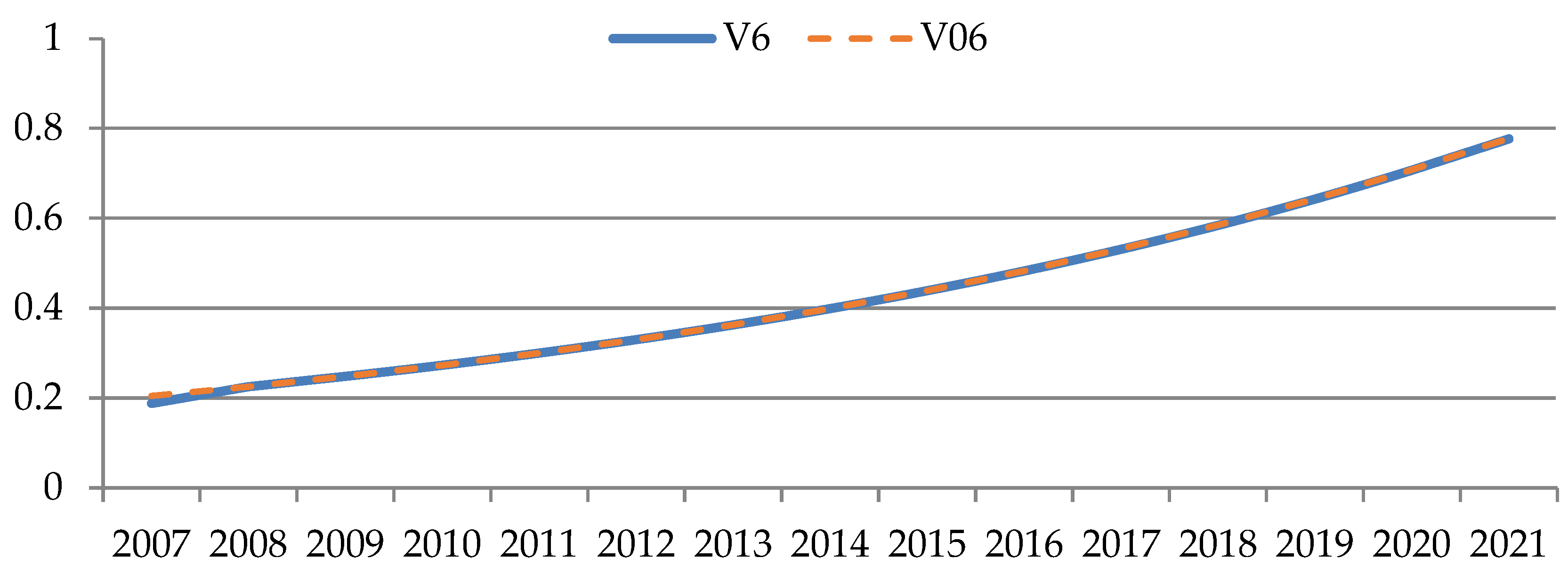

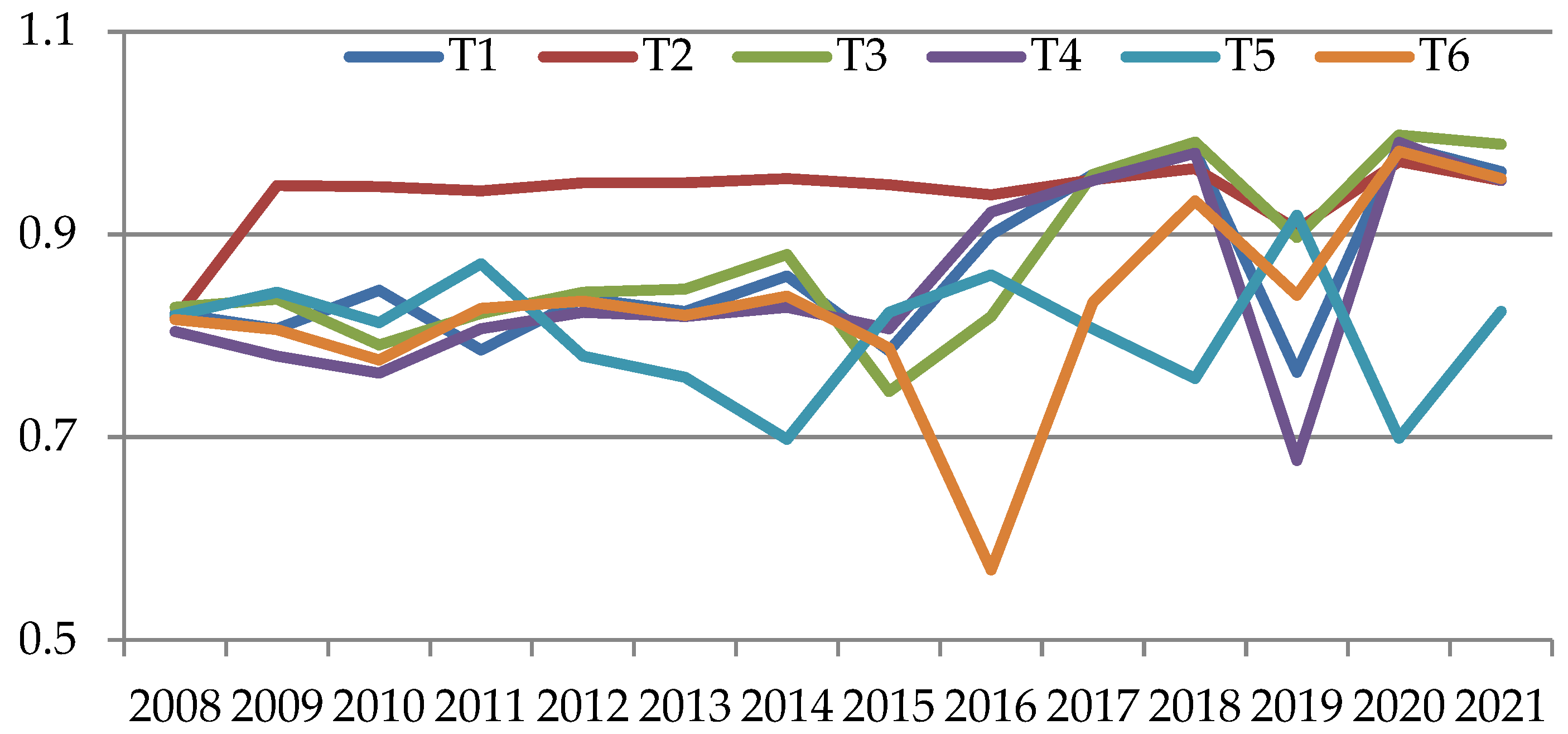

5. Simulation Results

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Telipenko, E.V.; Zakharova, A.A. Bankruptcy risk management of a machine builder. Appl. Mech. Mater. 2014, 682, 17–622. [Google Scholar] [CrossRef]

- Modeli Bankrotstva (Diagnostika i Otsenka Veroiatnosti Bankrotstva). Available online: http://finance-m.info/bankruptcy_models.html (accessed on 20 September 2022). (In Russian).

- Altman, E.I. Corporate Financial Distress; Wiley: New York, NY, USA, 1983; 368p. [Google Scholar]

- Altman, E.I.; Haldeman, R.G.; Narayanan, P. ZETA analysis: A new model to identify bankruptcy risk of corporations. J. Bank. Financ. 1977, 1, 29–54. [Google Scholar] [CrossRef]

- Altman, E.I. Financial Rations. Discriminate analysis, and the prediction of corporate bankruptcy. J. Financ. 1968, 23, 589–609. [Google Scholar] [CrossRef]

- Chetyrekhfaktornaia Model’ R. Lisa Otsenki Riska Bankrotstva. Available online: http://www.beintrend.ru/2011-12-05-17-20-28 (accessed on 20 September 2022). (In Russian).

- Mitsel, A.A.; Soboleva, M.A. Analysis of financial sustainability of Russian cellular communication enterprises. J. Financ. Anal. Sci. Exp. 2015, 8, 24–31. [Google Scholar]

- Fulmer, J.G.; Moon, J.; Gavin, T.A.; Erwin, M.J. A bankruptcy classification model for small firms. J. Commer. Bank Lend. 1984, 66, 25–37. [Google Scholar]

- Prognoznaia Model’ Platezhesposobnosti Springeitava. Available online: http://afdanalyse.ru/publ/finansovyj_analiz/1/prognoznaja_model_platezhesposobnosti_springejta/13-1-0-39 (accessed on 21 September 2022). (In Russian).

- Model’ Prognozirovaniia Bankrotstva Predpriiatiia Springeita. Available online: http://beintrend.ru/springate (accessed on 20 September 2022). (In Russian).

- Taffler, R.J.; Tisshaw, H. Going, going, gone—Four factors which predict. Accountancy 1977, 88, 50–54. [Google Scholar]

- Model’ Bankrotstva Predpriiatii Saifullina-Kadykova. Available online: http://www.beintrend.ru/2011-06-20-17-05-06 (accessed on 21 September 2022). (In Russian).

- Sheremet, A.D.; Saifulin, R.S. Metodika Finansovogo Analiza Predpriiatiia [Methodology of Financial Analysis of the Enterprise]; Business: Moscow, Russia, 1998; 320p. [Google Scholar]

- Davydova, G.V.; Belikov, A.I. Metodika kolichestvennoi otsenki riska bankrotstva predpriiatii [Methodology of quantitative assessment of the risk of bankruptcy of enterprises]. Risk Manag. 1999, 3, 13–20. [Google Scholar]

- Zaitseva, O.P. Antikrizisnyi Menedzhment v Rossiiskoi Firme [Anti -Crisis Management in the Russian Company]. Sib. Financ. Sch. 1998, 11–12, 66–73. [Google Scholar]

- Makareva, V.I.; Andreeva, L.V. Analiz Finansovo-Khoziaistvennoi Deiatel’nosti Predpriiatiia [Analysis of the Financial and Economic Activities of the Enterprise]; Finance and Statistics: Moscow, Russia, 2004; 264p. [Google Scholar]

- Telipenko, E.V.; Zakharova, A.A. Problemy prognozirovaniia riska bankrotstva predpriiatii mashinostroitel’nogo kompleksa [Problems of predicting the risk of bankruptcy of enterprises of the engineering complex]. In Innovative Technologies and Economics in Mechanical Engineering: A Collection of Works of the VI International Scientific and Practical Conference; Tomsk Polytechnic University: Tomsk, Russia, 2015; pp. 262–266. [Google Scholar]

- Mitsel, A.A.; Kabalin, A.A. Modeli riska i prognozirovaniia bankrotstva predpriiatiia [Models of risk and prediction of bankruptcy of the enterprise]. Risk Manag. 2013, 1, 44–52. [Google Scholar]

- Vazhdaev, A.N.; Mitsel, A.A. One-Factor Dynamic Model to Manage Small Businesses in a Single-Industry City. J. Econ. Anal. Theory Pract. 2018, 17, 950–966. [Google Scholar] [CrossRef]

- Coelli, T.; Prasada Rao, D.S.; Battese, G.E. An Introduction to Efficiency and Productivity Analysis; Springer: New York, NY, USA, 1998; 276p. [Google Scholar]

- Battese, G.E.; Coelli, T.J. Prediction of firm-level technical efficiencies with a generalized frontier production function and panel data. J. Econom. 1988, 38, 387–399. [Google Scholar] [CrossRef]

- Jondrow, J.; Lovell, C.A.K.; Materov, I.S.; Schmidt, P. On the estimation of technical inefficiency in stochastic frontier production function model. J. Econom. 1982, 19, 233–239. [Google Scholar] [CrossRef]

- Malakhov, D.I.; Pilnik, N.P. Methods of estimating of the efficiency in stochastic frontier models. Ekon. Zhurnal VSE 2013, 4, 660–686. [Google Scholar]

- Wheelock, D.C.; Wilson, P.W. Explaining bank failures: Deposit insurance, regulation, and efficiency. Rev. Econ. Stat. 1995, 4, 689–700. [Google Scholar] [CrossRef]

- Dimara, E.; Skuras, D.; Tsekouras, K.; Tzelepis, D. Productive efficiency and firm exit in the food sector. Food Policy 2008, 33, 185–196. [Google Scholar] [CrossRef]

- Barr, R.S.; Siems, T.F. Bank Failure Prediction Using Dea to Measure Management Quality. In Interfaces in Computer Science and Operations Research; Barr, R.S., Helgason, R.V., Kennington, J.L., Eds.; Operations Research/Computer Science In-terfaces Series; Springer: Boston, MA, USA, 1997; Volume 7, pp. 341–365. [Google Scholar] [CrossRef]

- González, J.S.; Restrepo-Tobón, D.; Hassan, A.R. Inefficiency and bank failure: A joint Bayesian estimation method of stochastic frontier and hazards models. Econ. Model. 2021, 95, 344–360. [Google Scholar] [CrossRef]

- Sun, K.; Salim, R. A semiparametric stochastic input distance frontier model with application to the Indonesian banking in-dustry. J. Product. Anal. 2020, 54, 139–156. [Google Scholar] [CrossRef]

- Hwang, R.-C.; Siao, J.-S.; Huimin, C.; Chu, C.K. Assessing bankruptcy prediction models via information content of technical inefficiency. J. Product. Anal. 2011, 36, 263–273. [Google Scholar] [CrossRef][Green Version]

- Merton, R.C. On the pricing of corporate debt: The risk structure of interest rates. J. Financ. 1974, 29, 449–470. [Google Scholar]

- Shumway, T. Forecasting bankruptcy more accurately: A simple hazard model. J. Bus. 2001, 74, 101–124. [Google Scholar] [CrossRef]

- Mogilat, A.; Ipatova, I. Technical efficiency as a factor of Russian industrial companies’ risks of financial distress. J. Appl. Econoimetr. 2016, 42, 5–29. [Google Scholar]

- Van Nguyen, Q.; Pascoe, S.; Coglan, L.; Nghiem, S. The sensitivity of efficiency scores to input and other choices in stochastic frontier analysis: An empirical investigation. J. Product. Anal. 2021, 55, 31–40. [Google Scholar] [CrossRef]

- Despic, D.R.; Bojovic, N.J.; Kilibarda, M.J.; Kapetanovic, M.V. Assessment of efficiency of military transport units using the DEA and SFA methods. Vojnoteh. Glas. 2019, 67, 68–92. [Google Scholar] [CrossRef]

- André, C.; Pareliussen, J.; Hwang, H. Swedish School Results, Student Background, Competition and Efficiency. Educ. Stud. Mosc. 2020, 3, 8–36. [Google Scholar]

- Ponkina, E.V.; Kurochkin, D.V. Technical Efficiency in Crop Production: Measurement Based on Econometric Methods of Data Envelopment Analysis and Stochastic Frontier Analysis. Izv. Altai State Univ. 2014, 1, 170–178. [Google Scholar] [CrossRef]

- Aivazian, S.A.; Afanasiev, M.Y.; Rudenko, V.A. Efficiency estimation of the russian regions based on the productive potential model including the characteristics of readiness to innovate. Econ. Math. Methods 2014, 50, 34–70. [Google Scholar]

- Vasanthi, R.; Sivasankari, B.; Gitanjali, J. A stochastic frontier and corrected ordinary least square models of determining technical efficiency of canal irrigated paddy farms in Tamil Nadu. J. Appl. Nat. Sci. 2017, 2, 658–662. [Google Scholar] [CrossRef]

- Riabchenko, A.V. Otsenka effektivnosti strakhovykh kompanii. SFA-podkhod [Assessment of the effectiveness of insurance companies. SFA approach]. Bull. Khabarovsk State Acad. Econ. Law 2012, 1, 97–106. [Google Scholar]

- Papadopoulos, A.; Parmeter, C.F. Quantile Methods for Stochastic Frontier Analysis. Found. Trends Econom. 2022, 12, 1–120. [Google Scholar] [CrossRef]

- Vazhdaev, A.N.; Mitsel, A.A. Technology of preliminary data preparation by city indicators and microindicators of small business for investigation of their dependencies (on the example of the single-industry town of Yurga). In Proceedings of the International Scientific and Practical Conference “New Technologies in Science, Education, Production”, Ryazan, Russia, 10–13 November 2017; pp. 34–45. [Google Scholar]

- Vazhdaev, A.N. Technology of downloading data of accounting reporting of small business enterprises from the service of contract inspection (on the example of the single-industry town of Yurga). Fundam. Res. 2017, 5, 31–35. [Google Scholar]

| Sector Number | Sector Name |

|---|---|

| 1 | Manufacturing industries |

| 2 | Construction |

| 3 | Wholesale and retail trade, repair of motor vehicles and motorcycles, household and personal items |

| 4 | Activities of hotels and restaurants |

| 5 | Transport and communications |

| 6 | Operations with real estate, rent and provision services |

| Sector Number | Sector Name | Number of Surveyed Companies in the Sector |

|---|---|---|

| 1 | Manufacturing industries | 108 |

| 2 | Construction | 64 |

| 3 | Wholesale and retail trade, repair of motor vehicles and motorcycles, household and personal items | 162 |

| 4 | Activities of hotels and restaurants | 31 |

| 5 | Transport and communications | 48 |

| 6 | Operations with real estate, rent, and provision services | 101 |

| Sectors of Economy 1 | Sectors of Economy 2 | Sectors of Economy 3 | Sectors of Economy 4 | Sectors of Economy 5 | Sectors of Economy 6 | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Rev, rub. | Revn | Rev, rub. | Revn | Rev, rub. | Revn | Rev, rub. | Revn | Rev, rub. | Revn | Rev, rub. | Revn | |

| 2007 | 35,089.333 | 0.507 | 9990.000 | 0.144 | 25,222.125 | 0.364 | 4772.000 | 0.069 | 2125.500 | 0.031 | 14,186.167 | 0.205 |

| 2008 | 43,020.750 | 0.622 | 4399.667 | 0.064 | 26,385.476 | 0.381 | 5094.500 | 0.074 | 4564.000 | 0.066 | 10,250.500 | 0.148 |

| 2009 | 50,432.250 | 0.729 | 7197.333 | 0.104 | 32,815.609 | 0.474 | 6495.500 | 0.094 | 1528.000 | 0.022 | 6344.000 | 0.092 |

| 2010 | 36,807.000 | 0.532 | 3260.000 | 0.047 | 29,575.517 | 0.427 | 5537.667 | 0.080 | 4050.200 | 0.059 | 59,215.667 | 0.855 |

| 2011 | 42,645.800 | 0.616 | 1738.500 | 0.025 | 24,895.818 | 0.360 | 15,569.667 | 0.225 | 8388.000 | 0.121 | 41,892.200 | 0.605 |

| 2012 | 28,348.800 | 0.410 | 16,326.000 | 0.236 | 24,267.028 | 0.351 | 19,913.333 | 0.288 | 6526.900 | 0.094 | 25,113.200 | 0.363 |

| 2013 | 13,489.104 | 0.195 | 11,837.167 | 0.171 | 19,946.515 | 0.288 | 9720.000 | 0.140 | 6618.556 | 0.096 | 15,222.116 | 0.220 |

| 2014 | 10,726.058 | 0.155 | 8361.741 | 0.121 | 17,242.640 | 0.249 | 9202.714 | 0.133 | 5929.263 | 0.086 | 15,283.431 | 0.221 |

| 2015 | 11,079.438 | 0.160 | 9933.313 | 0.144 | 16,912.392 | 0.244 | 6055.846 | 0.087 | 12,666.136 | 0.183 | 12,749.232 | 0.184 |

| 2016 | 9695.729 | 0.140 | 15,611.971 | 0.226 | 21,315.682 | 0.308 | 6672.467 | 0.096 | 16,544.957 | 0.239 | 15,066.220 | 0.218 |

| 2017 | 10,793.446 | 0.156 | 16,859.167 | 0.244 | 19,688.458 | 0.284 | 9130.364 | 0.132 | 19,722.333 | 0.285 | 14,898.471 | 0.215 |

| 2018 | 14,147.340 | 0.204 | 15,256.120 | 0.220 | 20,619.793 | 0.298 | 6105.167 | 0.088 | 12,834.950 | 0.185 | 18,898.216 | 0.273 |

| 2019 | 14,325.078 | 0.207 | 16,324.476 | 0.236 | 20,414.429 | 0.295 | 6912.818 | 0.100 | 17,188.000 | 0.248 | 22,160.821 | 0.320 |

| 2020 | 14,035.792 | 0.203 | 19,480.650 | 0.281 | 23,126.980 | 0.334 | 4449.500 | 0.064 | 18,024.800 | 0.260 | 19,277.875 | 0.279 |

| 2021 | 20,172.917 | 0.291 | 9990.000 | 1.000 | 24,584.538 | 0.355 | 5852.556 | 0.085 | 18,699.850 | 0.270 | 18,871.951 | 0.273 |

| Sector | X1 | X2 | X3 | X4 | X5 |

|---|---|---|---|---|---|

| No. 1 | −0.56256 | −0.94231 | 2.813319 | 1.234472 | 16.37489 |

| No. 2 | −0.74012 | −1.8269 | 12.72102 | −1.95656 | 15.23503 |

| No. 3 | 0.677137 | 0.309009 | 1.462181 | −0.86176 | −1.51321 |

| No. 4 | −0.07224 | 0.196955 | 0.564035 | 0.036146 | −1.18152 |

| No. 5 | 1.057226 | 1.133884 | −7.83356 | −0.92589 | −5.76095 |

| No. 6 | −0.2081 | 0.044338 | −1.0011 | 2.904171 | 2.577806 |

| Sector | μj(t) | ||||

|---|---|---|---|---|---|

| No. 1 | 0.196386 | 0.616996 | 0.008233 | 0.014397 | 0.00311 |

| No. 2 | 0.067032 | 0.820458 | 0.00479 | 0.000556 | 0.006921 |

| No. 3 | 0.076643 | 0.735129 | 0.010589 | 0.00299 | 0.020087 |

| No. 4 | 0.239288 | 0.58449 | 0.007383 | 0.213352 | 0.001686 |

| No. 5 | 0.527567 | 0.350937 | 0.004393 | 0.057926 | 0.005339 |

| No. 6 | 0.146914 | 0.690977 | 0.004453 | 0.000587 | 0.018444 |

| Sector | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

| No. 1 | 0.227 | 0.822 | 0.807 | 0.845 | 0.786 | 0.837 | 0.824 | 0.859 | 0.785 | 0.9 | 0.959 | 0.982 | 0.764 | 0.988 | 0.962 |

| No. 2 | 0.22 | 0.817 | 0.948 | 0.947 | 0.943 | 0.951 | 0.951 | 0.955 | 0.949 | 0.939 | 0.954 | 0.965 | 0.905 | 0.972 | 0.953 |

| No. 3 | 0.22 | 0.828 | 0.836 | 0.791 | 0.822 | 0.843 | 0.846 | 0.88 | 0.745 | 0.819 | 0.959 | 0.991 | 0.897 | 0.998 | 0.989 |

| No. 4 | 0.213 | 0.804 | 0.78 | 0.763 | 0.807 | 0.823 | 0.819 | 0.828 | 0.807 | 0.922 | 0.953 | 0.98 | 0.677 | 0.991 | 0.953 |

| No. 5 | 0.216 | 0.82 | 0.843 | 0.813 | 0.871 | 0.78 | 0.759 | 0.698 | 0.823 | 0.86 | 0.807 | 0.758 | 0.919 | 0.699 | 0.824 |

| No. 6 | 0.223 | 0.816 | 0.806 | 0.776 | 0.827 | 0.834 | 0.82 | 0.839 | 0.788 | 0.569 | 0.833 | 0.933 | 0.84 | 0.982 | 0.955 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Alimhanova, A.; Vazhdaev, A.; Mitsel, A.; Sidorov, A. Dynamic Model of Enterprise Revenue Management Based on the SFA Model. Mathematics 2023, 11, 211. https://doi.org/10.3390/math11010211

Alimhanova A, Vazhdaev A, Mitsel A, Sidorov A. Dynamic Model of Enterprise Revenue Management Based on the SFA Model. Mathematics. 2023; 11(1):211. https://doi.org/10.3390/math11010211

Chicago/Turabian StyleAlimhanova, Aliya, Andrey Vazhdaev, Artur Mitsel, and Anatoly Sidorov. 2023. "Dynamic Model of Enterprise Revenue Management Based on the SFA Model" Mathematics 11, no. 1: 211. https://doi.org/10.3390/math11010211

APA StyleAlimhanova, A., Vazhdaev, A., Mitsel, A., & Sidorov, A. (2023). Dynamic Model of Enterprise Revenue Management Based on the SFA Model. Mathematics, 11(1), 211. https://doi.org/10.3390/math11010211