Reserve Fund Optimization Model for Digital Banking Transaction Risk with Extreme Value-at-Risk Constraints

Abstract

:1. Introduction

2. Literature Overview

2.1. Digital Banking Transaction Risk

2.2. Digital Banking Reserve Fund

3. Materials and Methods

3.1. Materials

3.2. Methods

3.2.1. Threshold Selection

3.2.2. Generalized Pareto Distribution (GPD)

3.2.3. Extreme Value-at-Risk (EVaR)

3.2.4. Linear Programming Optimization Modeling

- (a).

- Determination of Decision VariablesIn an optimization problem, it must first be stated what variables are to be determined as the result of optimization. For example, if there is a decision of n measurable variables, then can be formed as a decision variables. The value of the decision variable will be determined based on the optimization result.

- (b).

- Determination of Objective FunctionOptimization problems require an objective function as the optimum result in the form of maximization or minimization. The formulation of the objective function is based on the size of the cost coefficient of the decision variable corresponding to the problem to be solved (for example, as ). The objective function in linear programming can be written in standard form as follows:

- (c).

- Determination of Constraint FunctionOptimization problems must have limitations that affect the decision variables. The limitations of the decision variables need to be formed in a constraint function. The formulation of the constraint function is based on the technology coefficient (for example, as for and ) and right-hand-side constraints (for example as for ). In addition, in optimization problems, there are non-negativity constraints which indicate that all decision variables must have values equal to or greater than zero. Therefore, the constraint function in linear programming can be written in standard form in Equations (5) and (6).

4. Results

4.1. Reserve Fund Using EVaR

- (a).

- Ensuring that the value reserved based on potential digital banking system risk losses should not be less than the estimated digital banking losses ();

- (b).

- Ensuring that the value reserved based on potential digital banking operational risk losses should not be less than the estimated digital banking losses ();

- (c).

- Guaranteeing that the total value reserved based on potential digital banking loss must not exceed the average profit value of the digital banking itself;

- (d).

- Ensuring that the reserve based on the estimated loss of digital banking risk must not be less than the 20% () weight of the capital () for the implementation of digital banking. The weight coefficient has been set at 20% based on Article 71 paragraph 1 of the Company Law.

4.2. Reserve Fund Optimization Model Using Constraint of EvaR

4.3. Computational Solution of Reserve Fund Optimization Model

4.3.1. Profit and Capital Data on the Implementation of E-Banking Services

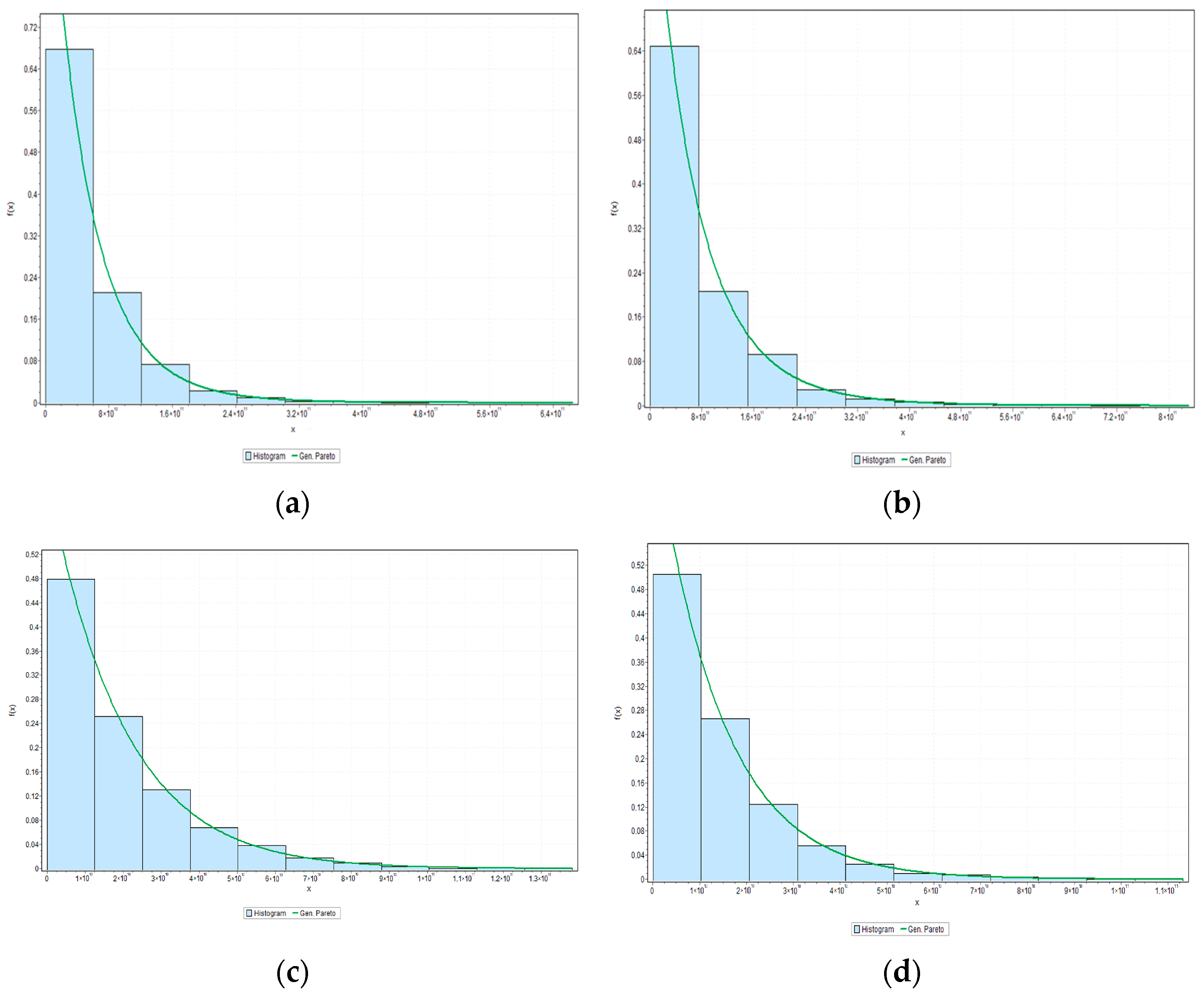

4.3.2. Data Simulation for Digital Banking Risk

4.3.3. Solution of Reserve Fund Optimization

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- El-Chaarani, H.; El-Abiad, Z. The Impact of Technological Innovation on Bank Performance. J. Internet Bank. Commer. 2018, 23, 1–33. [Google Scholar]

- Aguayo, F.; Lusarczyk, B. Risks of Banking Services’ Digitalization: The Practice of Diversification and Sustainable Development Goals. Sustainability 2020, 12, 4040. [Google Scholar] [CrossRef]

- Mishra, M. Evolution of the Invisible Bank: How Partnerships with FinTechs are Driving Digital Innovation. J. Digit. Bank. 2020, 5, 36–40. [Google Scholar]

- Institute of International Finance. The Future of Risk Management in the Digital Era; McKinsey & Company Report; Institute of International Finance: Washington, DC, USA, 2017. [Google Scholar]

- Casaló, L.V.; Carlos, F.; Miguel, G. The Role of Security, Privacy, Usability and Reputation in the Development of Online Banking. Online Inf. Rev. 2007, 31, 583–603. [Google Scholar] [CrossRef]

- Mulya, N.B.; Pradnyani, K.D.N.; Wangi, L.A.; Nugraha, A.A.; Rimadhani, T.D. Analysis of Increasing the Number of Cyber Attack Cases in Indonesia during The COVID-19 Pandemic. Proceeding SITASI 2021, 1, 241–247. [Google Scholar]

- CNN Indonesia. Bank Indonesia Data Leak Unfinished, Rises to 74GB; CNN Indonesia: Jakarta, Indonesia, 2022; Available online: https://www.cnnindonesia.com/teknologi/20220124163634-185-750569/kebocoran-data-bank-indonesia-belum-selesai-naik-jadi-74gb (accessed on 12 January 2023).

- Alexander, L.; Constantinos, A.; Joseph, G.N. Payment System Innovations and Financial Intermediation: The Case of Indonesia; Working Paper Series 984; ADBI (Asian Development Bank Institute): Tokyo, Japan, 2019. [Google Scholar]

- Otoritas Jasa Keuangan (OJK) Indonesia. Circular Letter of The Financial Services Authority Number 6/SEOJK.03/2020; OJK: Jakarta, Indonesia, 2020; Available online: https://peraturan.bpk.go.id/Home/Download/134836/SE%20OJK%20Nomor%206%20Tahun%202020.pdf (accessed on 2 January 2023).

- Saputra, M.P.A.; Sukono Chaerani, D. Estimation of Maximum Potential Losses for Digital Banking Transaction Risks Using the Extreme Value-at-Risks Method. Risks 2022, 10, 10. [Google Scholar] [CrossRef]

- Schalkwyk, G.J.; Witbooi, P.J. A Model for Bank Reserves Versus Treasuries under Basel III. Appl. Stoch. Models Bus. Ind. 2017, 33, 237–247. [Google Scholar]

- Esterhuysen, J.; Styger, P.; Vuuren, G. Calculating Operational Value-at-Risk (OPVaR) in a Retail Bank. S. Afr. J. Econ. Manag. Sci. 2008, 11, 1–16. [Google Scholar] [CrossRef] [Green Version]

- Baran, J.; Witzany, J. A Comparison of EVT and Standard VaR Estimations. Econom. Appl. Econom. Model. eJ. 2011. [Google Scholar] [CrossRef]

- Yao, F.; Wen, H.; Luan, J. CVaR Measurement and Operational Risk Management in Commercial Banks According to The Peak Value Method of Extreme Value Theory. Math. Comput. Model. 2013, 58, 15–27. [Google Scholar] [CrossRef]

- Tran, M.H.; Tran, N.M. Value-at-risk and the global financial crisis. J. Risk Model Valid. 2023, 17, 41–83. [Google Scholar] [CrossRef]

- Kyoud, A.; El Msiyah, C.; Madkour, J. Modelling Systemic Risk in Morocco’s Banking System. Int. J. Financ. Stud. 2023, 11, 70. [Google Scholar] [CrossRef]

- Chikobvu, D.; Ndlovu, T. The Generalised Extreme Value Distribution Approach to Comparing the Riskiness of BitCoin/US Dollar and South African Rand/US Dollar Returns. J. Risk Financ. Manag. 2023, 16, 253. [Google Scholar] [CrossRef]

- Gilli, M.; Këllezi, E. An Application of Extreme Value Theory for Measuring Financial Risk. Soc. Comput. Econ. 2006, 27, 207–228. [Google Scholar] [CrossRef] [Green Version]

- Ojeniyi, J.; Edward, E.; Abdulhamid, S. Security Risk Analysis in Online Banking Transactions: Using Diamond Bank as a Case Study. Int. J. Educ. Manag. Eng. 2019, 9, 1–14. [Google Scholar] [CrossRef]

- Sarma, G.; Singh, P.K. Internet Banking: Risk Analysis and Applicability of Biometric Technology for Authentication. Int. J. Pure Appl. Sci. Technol. 2010, 1, 67–78. [Google Scholar]

- Belás, J.; Korauš, M.; Kombo, F.; Korauš, A. Electronic Banking Security and Customer Satisfaction Incommercial Banks. J. Sustain. Secur. 2016, 5, 411–422. [Google Scholar]

- Tănase, R.D.; Serbu, R. Operational Risk and E-Banking. Bull. Transylvania Univ. Braşov: Econ. Sci. 2010, 3, 52. [Google Scholar]

- Mappanyuki, R.; Anfusina, M.S.; Alam, S. The Impact of Media Reputation, Customer Satisfaction, Digital Banking, and Risk Management Moderation on ROA. Stud. Media Commun. 2023, 11, 78. [Google Scholar] [CrossRef]

- Keister, T.; McAndrews, J. Why Are Banks Holding So Many Excess Reserves? Staff Reports No. 380; Federal Reserve Bank of New York: New York, NY, USA, 2009. [Google Scholar]

- Fabiani, A.; Piñeros, M.L.; Peydró, J.L.; Soto, P.E. Capital controls, domestic macroprudential policy and the bank lending channel of monetary policy. J. Int. Econ. 2022, 139, 103677. [Google Scholar] [CrossRef]

- Churchill, C.; Liber, D.; McCord, M.; Roth, J. Making Insurance Work: For Microfinance Institutions: A Technical Guide to Develop and to Deliver Microinsurance; International Labor Organization: Geneva, Switzerland, 2003. [Google Scholar]

- Hubbert, S. Essential Mathematics for Market Risk Management; John Wiley & Sons: Hoboken, NJ, USA, 2012. [Google Scholar]

- Rydman, M. Application of the Peaks-Over-Threshold Method on Insurance Data. UUDM Project Report; Uppsala Universitet: Uppsala, Sweden, 2018; pp. 1–32. [Google Scholar]

- Zhao, X.; Zhongxian, Z.; Weihu, C.; Pengyue, Z. A New Parameter Estimator for the Generalized Pareto Distribution under the Peaks over Threshold Framework. Mathematics 2019, 7, 406. [Google Scholar] [CrossRef] [Green Version]

- Schulze, M. Linear Programming for Optimization; Perceptive Scientific Instruments, Inc.: League City, Texas, USA, 1998. [Google Scholar]

- Bazaraa, M.S.; Sherali, H.D.; Shetty, C.M. Nonlinear Programming: Theory and Algorithms, Nonlinear Programming: Theory and Algorithms; John Wiley & Sons: Hoboken, NJ, USA, 2005. [Google Scholar]

- Bazaraa, M.S.; Jarvis, J.J.; Sherali, H.D. Linear Programming and Network Flows; John Wiley & Sons: Hoboken, NJ, USA, 2008. [Google Scholar]

- Government of Indonesia. Law of The Republic of Indonesia Number 40 of 2007 Concerning Limited Liability Companies; President of The Republic of Indonesia: Jakarta, Indonesia, 2007; Available online: https://www.ojk.go.id/sustainable-finance/id/peraturan/undang-undang/Documents/5.%20UU-40-2007%20PERSEROAN%20TERBATAS.pdf (accessed on 17 January 2023).

- Abraham, R.; El Samad, M.; Bakhach, A.M.; El-Chaarani, H.; Sardouk, A.; El Nemar, S.; Jaber, D. Forecasting a Stock Trend Using Genetic Algorithm and Random Forest. J. Risk Financ. Manag. 2022, 15, 188. [Google Scholar] [CrossRef]

| Authors | Variables | Method | Use of Value-at-Risk | Use of EVT Approach | Determination of Optimum Reserve Fund |

|---|---|---|---|---|---|

| Gilli and Kellezi, 2006 [18] | Market risk, and daily returns of some portfolios. | VaR, EVT, and expected shortfall. | - | Yes | - |

| Esterhuysen et al., 2008 [12] | Operational losses, net interest income, and gross income. | OpVaR, SA, and AMA. | Yes | - | - |

| Yao et al., 2013 [14] | Operational risks of commercial bank. | CVaR, EVT, and peak value method. | Yes | Yes | - |

| Schalkwyk and Witbooi, 2017 [11] | Cumulative cost, net cash flows, and deposit risk. | Portfolio, stochastic optimal control | Yes | - | - |

| Saputra et al., 2022 [10] | Digital Banking Transaction Operational Risk | Extreme Value-at-Risk | Yes | Yes | - |

| Tran and Tran, 2023 [15] | Risks of global financial crisis | Value-at-Risks, GARCH | Yes | - | - |

| Kyoud et al., 2023 [16] | Systemic risks of banking company | CVaR, Extreme approach | Yes | Yes | - |

| Chikobvu and Ndlovu, 2023 [17] | Exchange rates risks (ZAR/USD and BTC/USD) | VaR, GEVD | Yes | Yes | - |

| This Research | Digital Banking Transaction Risk | Extreme Value-at-Risk, Linear Programming Optimization | Yes | Yes | Yes |

| Digital Banking Services | Profit of 2020 | Profit of 2021 | Profit of 2022 |

|---|---|---|---|

| Internet Banking | 2,467,284 | 4,360,382 | 5,059,046 |

| Mobile Banking | 2,800,607 | 2,552,457 | 2,616,315 |

| Total of Profit per Year | 5,267,891 | 6,912,839 | 7,711,361 |

| Digital Banking Services | Average Profit |

|---|---|

| Internet Banking | 3,962,237.33 |

| Mobile Banking | 2,656,459.67 |

| Total of Average Profit | 5,618,697 |

| Digital Banking Services | Capital |

|---|---|

| Internet Banking | 4,437,864.10 |

| Mobile Banking | 3,569,658.65 |

| Total of Capital | 8,007,522.75 |

| Digital Banking Risk | Risk Type | Lots of Data after Simulation | Lots of Data above Threshold (Extreme Data) | Threshold | Parameter Estimated Value | |

|---|---|---|---|---|---|---|

| System Risks | Timeout System | 2000 | 300 | 56,769,000,000 | 0.05963 | |

| Downtime System | 2000 | 300 | 146,258,625,357 | 73,777,000,000 | 0.09501 | |

| Operational Risks | External Failure | 2000 | 300 | 35,954,062,029 | 18,913,000,000 | −0.09309 |

| User Failure | 2000 | 300 | 20,768,602,154 | 7,546,800,000 | −0.14352 | |

| Digital Banking Risk | Risk Type | EVaR |

|---|---|---|

| System Risks | Timeout System | IDR 269,082,483,221.22 |

| Downtime System | IDR 374,106,598,772.46 | |

| Operational Risks | External Failure | IDR 81,225,609,878 |

| User Failure | IDR 37,702,356,747 |

| Digital Banking Risk | Risk Type | Potential Loss | Reserves |

|---|---|---|---|

| System Risks | Timeout System | IDR | IDR |

| Downtime System | IDR | ||

| Operational Risks | External Failure | IDR | IDR |

| User Failure | IDR | ||

| Average Proportion of Profit Reserved | IDR | ||

| Total of Optimum Reserve Fund for E-Banking Risk | IDR | ||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Saputra, M.P.A.; Chaerani, D.; Sukono; Md. Yusuf, M. Reserve Fund Optimization Model for Digital Banking Transaction Risk with Extreme Value-at-Risk Constraints. Mathematics 2023, 11, 3507. https://doi.org/10.3390/math11163507

Saputra MPA, Chaerani D, Sukono, Md. Yusuf M. Reserve Fund Optimization Model for Digital Banking Transaction Risk with Extreme Value-at-Risk Constraints. Mathematics. 2023; 11(16):3507. https://doi.org/10.3390/math11163507

Chicago/Turabian StyleSaputra, Moch Panji Agung, Diah Chaerani, Sukono, and Mazlynda Md. Yusuf. 2023. "Reserve Fund Optimization Model for Digital Banking Transaction Risk with Extreme Value-at-Risk Constraints" Mathematics 11, no. 16: 3507. https://doi.org/10.3390/math11163507