Default Probabilities and the Credit Spread of Mexican Companies: The Modified Merton Model

Abstract

:1. Introduction

2. Literature Review

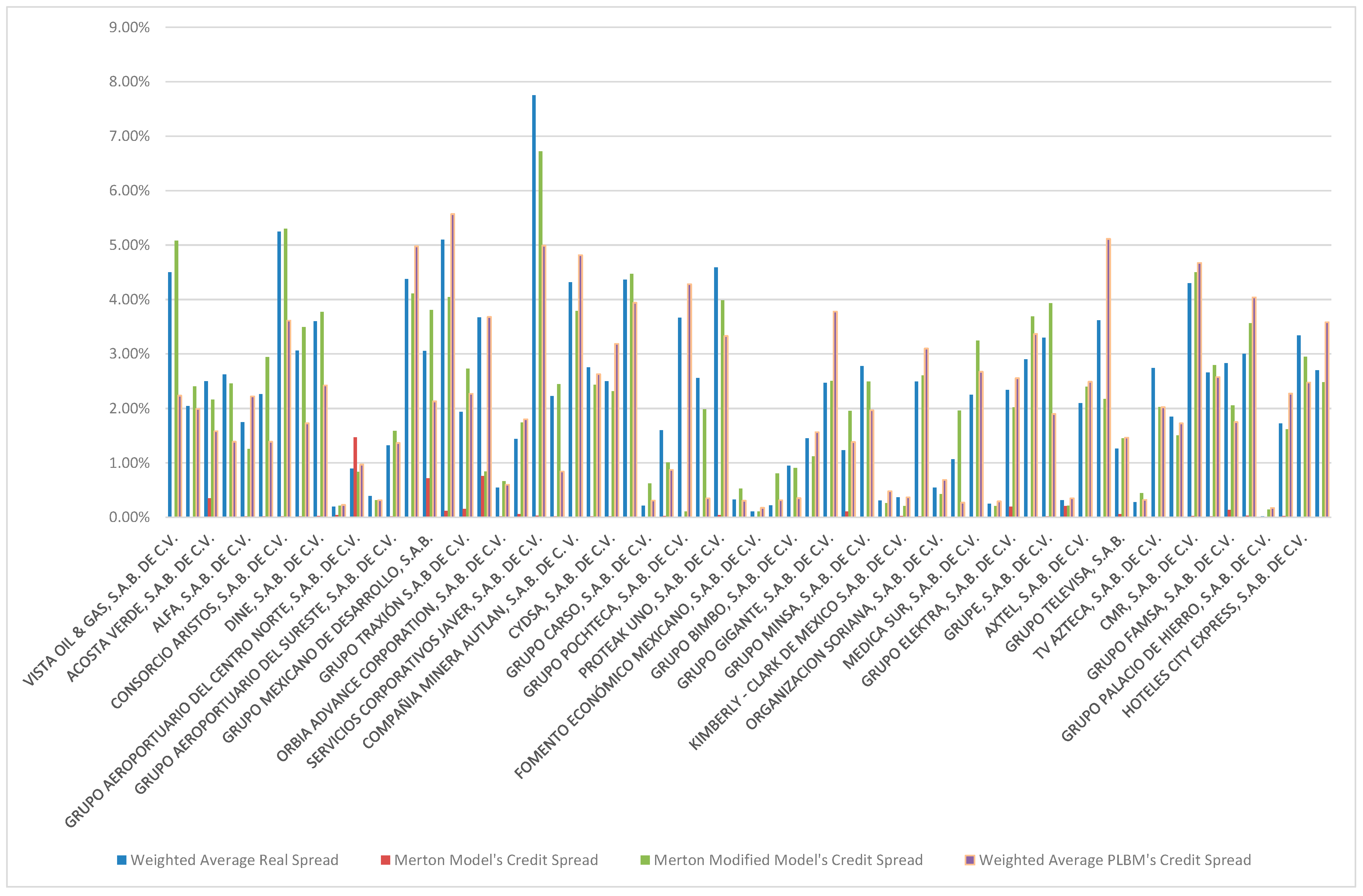

3. Methods

3.1. Merton’s Model, Vasicek, and Kealhofer

3.2. Brownian Motion (BM) and Power Law Brownian Motion Models

3.2.1. An Introduction at Brownian Model

3.2.2. Brownian Motion (BM) Model

3.2.3. Power Law Brownian Motion (PLBM) Model

3.3. The Bloomberg Corporate Default Risk Model (DRSK) for Public Firms

3.4. Modified Merton Model

3.4.1. Fractional and Conformable Derivatives

- , linearity;

- = , product rule;

- , chain rule.

3.4.2. Proposed Model

Solving the Black, Scholes, and Merton Equation by Conformable Derivatives

3.4.3. Test Parameter

4. Empirical Results

Data Collection

- In an analogy to the standard deviation, taking the square root of the MSE yields the root mean square error or root mean square deviation (RMSE or RMSD, respectively), which has the same units as the square of the quantity being estimated; for an unbiased estimator, the RMSE is the square root of the variance, known as the standard deviation.

- In statistics, the mean absolute error (MAE) is a measure of errors between paired observations expressing the same phenomenon. For example, Y versus X include comparisons of predicted versus observed. The MAE is calculated as the sum of absolute errors ( divided by the sample size:

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Sánchez, A.; López-Herrera, F. Tasa de política monetaria en México ante los efectos del COVID-19. Rev. Mex. Econ. Finanz. 2020, 15, 295–311. [Google Scholar]

- Ozili, P.; Arun, T. Spillover of COVID-19 impact on the Global Economy. In Managing Inflation and Supply Chain Disruption in the Global Economy; IGI Global: Hershey, PA, USA, 2023; pp. 41–61. [Google Scholar]

- Nicola, M.; Alsafi, Z.; Sohrabi, C.; Kerman, A.; Al-Jabir, A.; Iosifidis, C.; Agha, R. The socio-economic implications of the coronavirus pandemic (COVID-19): A review. Int. J. Surg. 2020, 75, 185–193. [Google Scholar] [CrossRef]

- Gopinath, G. Limiting the Economic Fallout of the Coronavirus with Large Targeted Policies; Centre for Economic Policy Research: London, UK, 2020. [Google Scholar]

- Schmitt-Grohé, S.; Uribe, M. How Important are Terms of Trade Shocks. Int. Econ. Rev. 2018, 59, 85–111. [Google Scholar] [CrossRef]

- Furman, J.; Summers, L. A Reconsideration of Fiscal Policy in the Era of the Low Interest Rates; Unpublished Manuscript; Harvard University: Cambridge, MA, USA; Peterson Institute for International Economics: Washington, DC, USA, 2020. [Google Scholar]

- Odendahl, C.; Springford, J. 16 Bold Policies Needed to Counter the Coronavirus Recession1; Centre for Economic Policy Research: London, UK, 2020. [Google Scholar]

- Galí, J. Helicopter Money. The Time Is Now; Centre for Economic Policy Research: London, UK, 2020. [Google Scholar]

- Mexican Credit Institutions Law. Available online: https://www.diputados.gob.mx/LeyesBiblio/pdf/LIC.pdf (accessed on 2 October 2023).

- Xin, B.; Jiang, K. Economic uncertainty, central bank digital currency, and negative interest rate policy. J. Manag. Sci. Eng. 2023, 8, 430–452. [Google Scholar] [CrossRef]

- Hu, G.; Liu, S. Economic policy uncertainty (EPU) and China’s export fluctuation in the post-pandemic era: An empirical analysis based on the TVP-SV-VAR model. Front. Public Health 2021, 9, 788171. [Google Scholar] [CrossRef] [PubMed]

- Ulate, M. Going negative at zero lower bound: The effects of negative nominal interest rates. Am. Econ. Rev. 2021, 111, 1–40. [Google Scholar] [CrossRef]

- Merton, R. On Pricing of Corporate Debt: The Risk Structure of Interest Rates. J. Financ. 1974, 29, 449–469. [Google Scholar]

- Denzler, S.; Dacoronga, M.; Müller, U.; McNeil, A. From Default Probabilities to Credit Spreads: Credit Risk Models Do Explain Market Prices. Financ. Res. Lett. 2005, 3, 79–95. [Google Scholar] [CrossRef]

- Ballester, L.; González-Urteaga, A.; Martínez, B. The role of internal corporate governance mechanisms on default risk: A systematic review for different institutional settings. Res. Int. Bus. Financ. 2020, 54, 101293. [Google Scholar] [CrossRef]

- Switzer, L.N.; Wang, J.; Zhang, Y. Effect of corporate governance om default risk in financial versus nonfinancial firms: Canadian evidence. Can. J. Adm. Sci. 2018, 35, 313–328. [Google Scholar] [CrossRef]

- Daily, C.; Dalton, D.R. Bankruptcy and Corporate Governance: The impact of Board Composition and Structure. Acad. Manag. J. 1994, 6, 1603–1617. [Google Scholar] [CrossRef]

- Asbaugh-Skaife, H.; Collins, D.; LaFond, R. The effects of corporate governance on firms’ credit ratings. J. Account. Econ. 2006, 42, 203–243. [Google Scholar] [CrossRef]

- Manzaneque, M.; Priego, A.; Merino, E. Corporate governance effect on financial distress likelihood: Evidence from Spain. Rev. Contab. Span. Account. Rev. 2016, 19, 111–121. [Google Scholar] [CrossRef]

- Esparza, J.; Dalton, D. El gobierno corporativo y el riesgo de insolvencia en las empresas familiares mexicanas. Contaduría Adm. 2019, 64, 140. [Google Scholar] [CrossRef]

- Kealhofer, S.; Vasicek, O. Quantifying Credit Risk I: Default Prediction. Financ. Anal. J. 2003, 59, 30–44. [Google Scholar] [CrossRef]

- Nagy, M.; Lazaroiu, G. Computer vision algorithms, remote sensing data fusion techniques, and mapping and navigatio in the Industry 4.0-based Slovak automotive sector. Mathematics 2022, 10, 3543. [Google Scholar] [CrossRef]

- Pavlicko, M.; Durica, M.; Mazanec, J. Ensemble Model of the Financial Distress Prediction in Visegrad Group Contries. Mathematics 2021, 9, 1886. [Google Scholar] [CrossRef]

- Stefko, R.; Horvathova, J.; Mokrisova, M. The application of graphic methods and the DEA in predicting the risk of bankruptcy. J. Risk Financ. Manag. 2021, 14, 220. [Google Scholar] [CrossRef]

- Jumbe, G.; Gor, R. Credit Risk Modeling Using Default Models: A Review. J. Econ. Financ. 2022, 13, 28–39. [Google Scholar]

- Eberhart, A. A comparison of Merton’s option pricing model of corporate debt valuation to use of book values. J. Corp. Financ. 2003, 11, 401–426. [Google Scholar] [CrossRef]

- Leland, H. Corporate Debt Value, Bonds Covenants, and Optimal Capital Structure. J. Financ. 1994, 49, 1213–1252. [Google Scholar] [CrossRef]

- Anderson, R.; Sundaresan, S. A comparative study of structural models of corporate bond yields: An exploratory investigation. J. Bank. Financ. 2000, 24, 255–269. [Google Scholar] [CrossRef]

- Ericsson, J.; Reneby, J. The Valuation of Corporate Liabilities: Theory and Tests; SSE/EFI Working Paper Series in Economics and Finance, Barcelona, España. 2001. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=275841 (accessed on 10 March 2023).

- Eom, Y.; Helwege, J.; Huang, J. Structural Models of Corporate Bonds Pricing: An Empirical Analysis. Rev. Financ. Stud. 2008, 17, 499–544. [Google Scholar] [CrossRef]

- Geske, R. The Valuation of Corporate Liabilities as Compound Options. J. Financ. Quant. Anal. 1977, 12, 541–552. [Google Scholar] [CrossRef]

- Longstaff, F.; Schwartz, E. A Simple Approach to Valuing Risky Fixed and Floating Rate Debt. J. Finan. 1995, 50, 789–819. [Google Scholar] [CrossRef]

- Leland, H.; Toft, K. Optimal Capital Structure, Endogenous Bankruptcy, and the Term Structure of Credit Spreads. J. Financ. 2001, 51, 987–1019. [Google Scholar] [CrossRef]

- Collin-Dufresne, P.; Goldstein, R. Do Credit Spread Reflect Stationary Leverage Ratios? J. Financ. 2001, 56, 1929–1957. [Google Scholar] [CrossRef]

- Teixeira, J. An Empirical Analysis of Structural Models of Corporate Debt Pricing. Appl. Financ. Econ. 2007, 17, 1141–1165. [Google Scholar] [CrossRef]

- Heynderickx, W.; Carboni, J.; Schoutens, W.; Smits, B. The relationship between risk-neutral and actual default probabilities: The credit risk premium. Appl. Econ. 2016, 48, 4066–4081. [Google Scholar] [CrossRef]

- Coval, J.; Jores, J.; Stafford, E. The economics of structured finance. J. Econ. Perspect. 2009, 23, 3–25. [Google Scholar] [CrossRef]

- Leduc, S.; Liu, Z. Uncertainty shocks are aggregate demand shocks. J. Monet. Econ. 2016, 82, 20–35. [Google Scholar] [CrossRef]

- Haque, Q.; Magnusson, l. Uncertainty shocks and inflation dynamics in the US. Econ. Lett. 2021, 202, 109825. [Google Scholar] [CrossRef]

- Crosbie, P.; Bohn, J. Modeling Default Risk-Modeling Methodology; Moody’s K.M.V. Co. LLC.: Chicago, IL, USA, 2003; pp. 6–31. [Google Scholar]

- Black, F.; Scholes, M. The Pricing of Options and Corporate Liabilities. J. Political Econ. 1973, 81, 637–659. [Google Scholar] [CrossRef]

- Freeman, R.E.; Dmytriyev, S.D.; Phillips, R.A. Stkeholder theory and the resources-based view of the firm. J. Manag. 2021, 47, 1757–1770. [Google Scholar]

- Katagumpola, U.N. A new fractional derivate with classical properties. arXiv 2014, arXiv:1410.6335. [Google Scholar]

- Hull, J. Options, Futures and Other Derivates; Pearson Prentice Hall: Upper Saddle River, NJ, USA, 2008. [Google Scholar]

- Altman, E.; Kishore, V. Almost Everything You Wanted to Know About Recoveries of Default Bonds. Financ. Anal. J. 1996, 52, 57–64. [Google Scholar] [CrossRef]

- Acharya, V.V.; Bharath, S.T.; Srinivasan, A. Understanding the Recovery Rates of Indebtedness Securities; C.E.P.R. Working Paper; London Business School: London, UK; University of Michigan: Ann Arbor, MI, USA; University of Georgia: Athens, GA, USA, 2004. [Google Scholar]

- Hamilton, D.T.; Varma, P.; Ou, S.; Cantor, R. Special Comment. Default and Recovery Rates of Corporate Bond Issuers, 1920–2004; Moody’s Investors Service Global Credit Research: New York, NY, USA, 2005; pp. 2–40. [Google Scholar]

- Karatzas, I.; Shreve, S. Brownian Motion and Stochastic Calculus; Springer: New York, NY, USA, 1988. [Google Scholar]

- Harrison, J. Brownian Motion and Stochastic Flow Systems; John Wiley & Sons, Inc.: London, UK, 1985. [Google Scholar]

- Janeblack, M.; Rutkowski, M. Molding the Default Risk. An Overview. In Mathematical Finance: Theory and Practice; Modern Mathematics Series; Fudan University: Shanghai, China, 2000; pp. 1–14. [Google Scholar]

- Bondoli, M.; Goldberg, M.; Hu, N.; Li, C.; Maalaoui, O.; Stein, H. The Bloomberg Corporate Default Risk Model (DRSK) for Public Firms; Bloomberg L.P.: New York, NY, USA, 2021; pp. 2–31. [Google Scholar]

- Kahlil, R.; Al Horani, M.; Yousef, A.; Sababheh, M. A new definition of factional derivate. J. Comput. Appl. Math. 2014, 264, 65–70. [Google Scholar] [CrossRef]

- Nelson, C.; Siegel, A. Parsimonious Modeling of Yield Curves. J. Bus. 1987, 60, 473–489. [Google Scholar] [CrossRef]

- Anderson, R.; Camrud, E.; Ulness, D. On Nature of the Conformable Derivate and its Applications to Physics. J. Fract. Calc. Appl. 2019, 10, 92–135. [Google Scholar]

- Morales-Bañuelos, P.; Muriel, N.; Fernández-Anaya, G. A Modified Black-Scholes-Merton Model for Option Pricing. Mathematics 2022, 10, 1492. [Google Scholar] [CrossRef]

- Bloomberg Anywhere Platform. Available online: https://bba.bloomberg.net/ (accessed on 20 March 2023).

- Risk Analytics, K.M.V. Moody’s Platform. Available online: https://www.moodysanalytics.com/ (accessed on 3 April 2023).

- Salas-Porras, A. Globalización y proceso corporativo de los grandes grupos económicos en México. Rev. Mex. Sociol. 1992, 54, 133–162. [Google Scholar] [CrossRef]

- Athari, S.; Kondoz, M.; Kirikkaleli, D. Dependency between sovereign credit ratings and economic risk: Insight from Balkan countries. J. Econ. Bus. 2021, 116, 105984. [Google Scholar] [CrossRef]

| Company | Sector | Total Amount of Debt | Weighted Average Duration | Number of Liabilities | Base Rate | Weighted Average Credit Spread | |

|---|---|---|---|---|---|---|---|

| Vista Oil & Gas, S.A.B. de C.V. | Energy | 374 | 1.56 | 1 | 1.29% | plus | 4.50% |

| Accel, S.A.B. de C.V. | Industrial | 779 | 5.66 | 3 | 1.29% | plus | 2.04% |

| Acosta Verde, S.A.B. de C.V. | Industrial | 3056 | 7.34 | 17 | 4.63% | plus | 2.50% |

| Aleatica, S.A.B. de C.V. | Industrial | 6318 | 5.57 | 1 | 1.29% | plus | 2.62% |

| Alfa, S.A.B. de C.V. | Industrial | 50 | 2.36 | 1 | 4.63% | plus | 1.75% |

| Consorcio Ara, S.A.B. de C.V. | Industrial | 507 | 5.49 | 7 | 4.63% | plus | 2.26% |

| Consorcio Aristos, S.A.B. de C.V. | Industrial | 62 | 4.89 | 7 | 4.63% | plus | 5.25% |

| Corpovael S.A.B. de C.V. | Industrial | 3092 | 1.59 | 22 | 4.63% | plus | 3.06% |

| Dine, S.A.B. de C.V. | Industrial | 210 | 2.08 | 1 | 4.63% | plus | 3.60% |

| Gméxico Transportes, S.A.B. de C.V. | Industrial | 64 | 0.76 | 3 | 4.63% | plus | 0.20% |

| Grupo Aeroportuario Del Centro Norte, S.A.B. de C.V. | Industrial | 2700 | 1.91 | 3 | 4.63% | plus | 0.89% |

| Grupo Aeroportuario Del Pacifico, S.A.B.de C.V. | Industrial | 13,800 | 2.88 | 6 | 4.63% | plus | 0.39% |

| Grupo Aeroportuario Del Sureste, S.A.B. de C.V. | Industrial | 5 | 4.57 | 2 | 4.63% | plus | 1.32% |

| Grupo Gicsa, S.A.B. de C.V. | Industrial | 4429 | 4.7 | 6 | 4.63% | plus | 4.37% |

| Grupo Mexicano de Desarrollo, S.A.B. | Industrial | 65,974 | 1.46 | 5 | 4.63% | plus | 3.05% |

| Grupo TMM, S.A. | Industrial | 80 | 0.53 | 5 | 4.63% | plus | 5.10% |

| Grupo Traxión S.A.B de C.V. | Industrial | 3781 | 0.51 | 8 | 4.63% | plus | 1.94% |

| Impulsora Del Desarrollo Y El Empleo En America Latina, S.A.B. de C.V. | Industrial | 12,794 | 8.94 | 7 | 4.63% | plus | 3.67% |

| Orbia Advance Corporation, S.A.B. de C.V. | Industrial | 986 | 0.5 | 1 | 4.63% | plus | 0.55% |

| Promotora Ambiental, S.A.B. de C.V. | Industrial | 2255 | 0.48 | 4 | 4.63% | plus | 1.44% |

| Servicios Corporativos Javer, S.A.B. de C.V. | Industrial | 2521 | 2.49 | 1 | 4.63% | plus | 7.75% |

| Cemex, S.A.B. de C.V. | Materials | 1481 | 3.76 | 4 | 4.63% | plus | 2.23% |

| Compañia Minera Autlan, S.A.B. de C. V. | Materials | 3 | 5.29 | 4 | 4.63% | plus | 4.32% |

| Convertidora Industrial, S.A.B. de C.V. | Materials | 365 | 1.7 | 16 | 4.63% | plus | 2.75% |

| Cydsa, S.A.B. de C.V. | Materials | 2751 | 10.19 | 1 | 4.66% | plus | 2.50% |

| G Collado, S.A.B. de C.V. | Materials | 174 | 0.11 | 1 | 4.63% | plus | 4.36% |

| Grupo Carso, S.A.B. de C.V. | Materials | 3500 | 2.25 | 1 | 4.63% | plus | 0.22% |

| Grupo Kuo, S.A.B. de C.V. | Materials | 711 | 1.59 | 2 | 4.66% | plus | 1.60% |

| Grupo Pochteca, S.A.B. de C.V. | Materials | 1975 | 2.46 | 2 | 4.63% | plus | 3.67% |

| Minera Frisco, S.A.B. de C.V. | Materials | 7350 | 2.81 | 1 | 4.66% | plus | 2.56% |

| Proteak Uno, S.A.B. de C.V. | Materials | 775 | 1.39 | 3 | 1.29% | plus | 4.59% |

| Arca Continental | Products Of Frequent Consumption | 12 | 3.23 | 9 | 4.65% | plus | 0.32% |

| Fomento Económico Mexicano, S.A.B. de C.V. | Products Of Frequent Consumption | 5662 | 3.47 | 3 | 4.63% | plus | 0.11% |

| Gruma, S.A.B. de C.V. | Products Of Frequent Consumption | 1050 | 0.54 | 2 | 4.63% | plus | 0.22% |

| Grupo Bimbo, S.A.B. de C.V. | Products Of Frequent Consumption | 35,500 | 3.04 | 2 | 4.63% | plus | 0.95% |

| Grupo Comercial Chedraui, S.A.B. de C.V. | Products Of Frequent Consumption | 17,568 | 3.25 | 6 | 4.63% | plus | 1.46% |

| Grupo Gigante, S.A.B. de C.V. | Products Of Frequent Consumption | 9 | 4.86 | 6 | 4.63% | plus | 2.47% |

| Grupo Herdez, S.A.B. de C.V. | Products Of Frequent Consumption | 3500 | 0.54 | 7 | 4.66% | plus | 1.23% |

| Grupo Minsa, S.A.B. de C.V. | Products Of Frequent Consumption | 100 | 2.15 | 7 | 4.63% | plus | 2.77% |

| Industrias Bachoco, S.A.B. de C.V. | Products Of Frequent Consumption | 1500 | 3.44 | 1 | 4.63% | plus | 0.31% |

| Kimberly-Clark De Mexico S.A.B. de C.V. | Products Of Frequent Consumption | 6000 | 3.2 | 2 | 4.63% | plus | 0.37% |

| Organización Cultiba, S.A.B. de Cv | Products Of Frequent Consumption | 752 | 2.95 | 6 | 4.63% | plus | 2.49% |

| Organizacion Soriana, S.A.B. de C.V. | Products Of Frequent Consumption | 8538 | 1.82 | 4 | 4.63% | plus | 0.55% |

| Genomma Lab Internacional, S.A.B. de C.V. | Health | 97,790 | 2.01 | 20 | 4.63% | plus | 1.06% |

| Medica Sur, S.A.B. de C.V. | Health | 1200 | 1.6 | 2 | 4.63% | plus | 2.25% |

| El Puerto de Liverpool, S.A.B. de C.V. | Non-Commodity Goods and Services | 1500 | 0.67 | 1 | 4.63% | plus | 0.25% |

| Grupo Elektra, S.A.B. de C.V. | Non-Commodity Goods and Services | 13,080 | 0.75 | 10 | 4.63% | plus | 2.34% |

| Grupo Vasconia S.A.B. | Non-Commodity Goods and Services | 145 | 1.3 | 1 | 4.63% | plus | 2.90% |

| Grupe, S.A.B. de C.V. | Non-Commodity Goods and Services | 1365 | 7.32 | 3 | 4.63% | plus | 3.30% |

| America Movil, S.A.B. de C.V. | Telecommunications Services | 34,080 | 0.51 | 10 | 4.93% | plus | 0.32% |

| Axtel, S.A.B. de C.V. | Telecommunications Services | 3205 | 5.5 | 2 | 4.63% | plus | 2.10% |

| Grupo Radio Centro, S.A.B. de C.V. | Telecommunications Services | 711 | 5.45 | 6 | 4.63% | plus | 3.62% |

| Grupo Televisa, S.A.B. | Telecommunications Services | 17,935 | 0.47 | 4 | 4.63% | plus | 1.26% |

| Megacable Holdings, S.A.B. de C.V. | Telecommunications Services | 6823 | 0.58 | 4 | 4.63% | plus | 0.28% |

| Tv Azteca, S.A.B. de C.V. | Telecommunications Services | 5708 | 3.22 | 4 | 4.63% | plus | 2.74% |

| Alsea, S.A.B. de C.V. | Non-Commodity Goods and Services | 565 | 1.95 | 2 | 4.63% | plus | 1.85% |

| CMR S.A.B. de C.V. | Non-Commodity Goods and Services | 1141 | 3.33 | 1 | 4.63% | plus | 4.30% |

| Corporacion Interamericana de Entretenimiento, S.A.B. De C.V. | Non-Commodity Goods and Services | 850 | 0.31 | 4 | 4.63% | plus | 2.66% |

| Grupo Famsa, S.A.B. De C.V. | Non-Commodity Goods and Services | 4529 | 0.66 | 7 | 4.63% | plus | 2.83% |

| Grupo Hotelero Santa Fe, S.A.B. De C.V. | Non-Commodity Goods and Services | 343 | 2.95 | 2 | 4.63% | plus | 3.00% |

| Grupo Palacio de Hierro, S.A.B. De C.V. | Non-Commodity Goods and Services | 1 | 0.86 | 2 | 4.63% | plus | 0.02% |

| Grupo Sports World, S.A.B. De C.V. | Non-Commodity Goods and Services | 2 | 0.76 | 2 | 4.63% | plus | 1.72% |

| Hoteles City Express, S.A.B. De C.V. | Non-Commodity Goods and Services | 5101 | 3.42 | 18 | 4.63% | plus | 3.34% |

| Nemak, S.A.B. De C.V. | Non-Commodity Goods and Services | 3788 | 7.1 | 1 | 4.63% | plus | 2.70% |

| Company | DRSK 1 Year | DRSK 2 Years | Bloomberg Credit Spread | EDF 1 Year | KMV Moody’s |

|---|---|---|---|---|---|

| Vista Oil & Gas, S.A.B. e C.V. | 0.22% | 0.97% | 2.46% | 3.02% | B1 |

| Accel, S.A.B. de C.V. | 0.00% | 0.00% | 0.92% | 3.02% | B1 |

| Acosta Verde, S.A.B. de C.V. | 0.52% | 1.40% | 2.75% | 1.98% | Ba3 |

| Aleatica, S.A.B. de C.V. | 0.48% | 2.11% | 2.82% | 1.67% | Ba |

| Alfa, S.A.B. de C.V. | 0.27% | 0.99% | 2.67% | 2.02% | Baa3 |

| Consorcio Ara, S.A.B. de C.V. | 0.03% | 0.26% | 2.24% | 1.67% | Ba2 |

| Consorcio Aristos, S.A.B. de C.V. | 1.55% | 3.38% | 3.15% | 35.00% | Caa-C |

| Corpovael S.A.B. de C.V. | 1.66% | 4.55% | 3.27% | 7.58% | B3 |

| Dine, S.A.B. de C.V. | 0.00% | 0.00% | 0.71% | 3.02% | B1 |

| Gméxico Transportes, S.A.B. de C.V. | 0.79% | 2.33% | 2.76% | 3.02% | B1 |

| Grupo Aeroportuario Del Centro Norte, S.A.B. de C.V. | 0.00% | 0.05% | 1.47% | 6.71% | B3 |

| Grupo Aeroportuario Del Pacifico, S.A.B. de C.V. | 0.01% | 0.17% | 1.83% | 0.37% | Baa1 |

| Grupo Aeroportuario Del Sureste, S.A.B. de C.V. | 0.00% | 0.04% | 1.56% | 6.71% | B3 |

| Grupo Gicsa, S.A.B. de C.V. | 3.71% | 5.93% | 3.31% | 1.67% | Ba2 |

| Grupo Mexicano de Desarrollo, S.A.B. | 0.35% | 1.16% | 2.55% | 3.02% | B2 |

| Grupo TMM, S.A. | 0.58% | 1.90% | 2.56% | 6.71% | B3 |

| Grupo Traxión S.A.B De C.V. | 0.30% | 1.18% | 2.38% | 3.02% | B1 |

| Impulsora Del Desarrollo y el Empleo en America Latina, S.A.B. de C.V. | 0.00% | 0.12% | 1.66% | 4.35% | B2 |

| Orbia Advance Corporation, S.A.B. de C.V. | 0.21% | 0.87% | 2.39% | 0.98% | Ba1 |

| Promotora Ambiental, S.A.B. de C.V. | 0.00% | 0.03% | 1.37% | 1.67% | Ba2 |

| Servicios Corporativos Javer, S.A.B. de C.V. | 0.00% | 0.00% | 0.39% | 35.00% | Caa-C |

| Cemex, S.A.B. de C.V. | 0.53% | 1.75% | 2.71% | 0.93% | Ba1 |

| Compañia Minera Autlan, S.A.B. de C. V. | 0.01% | 0.10% | 1.87% | 6.71% | B3 |

| Convertidora Industrial, S.A.B. de C.V. | 0.00% | 0.00% | 0.74% | 0.37% | Baa1 |

| Cydsa, S.A.B. de C.V. | 0.01% | 0.19% | 2.17% | 3.52% | Ba2 |

| G Collado, S.A.B. de C.V. | 0.04% | 0.34% | 2.33% | 6.71% | B3 |

| Grupo Carso, S.A.B. de C.V. | 0.03% | 0.35% | 2.20% | 0.37% | Baa1 |

| Grupo Kuo, S.A.B. de C.V. | 0.00% | 0.01% | 1.41% | 0.98% | Ba1 |

| Grupo Pochteca, S.A.B. de C.V. | 0.01% | 0.19% | 1.79% | 3.02% | B3 |

| Minera Frisco, S.A.B. de C.V. | 0.31% | 1.13% | 2.48% | 0.37% | Baa1 |

| Proteak Uno, S.A.B. de C.V. | 0.98% | 2.79% | 2.69% | 6.71% | B3 |

| Arca Continental | 0.00% | 0.03% | 1.66% | 0.37% | Baa1 |

| Fomento Económico Mexicano, S.A.B. de C.V. | 0.00% | 0.01% | 1.42% | 0.37% | Baa1 |

| Gruma, S.A.B. de C.V. | 0.03% | 0.35% | 2.39% | 0.37% | Baa1 |

| Grupo Bimbo, S.A.B. de C.V. | 0.03% | 0.29% | 2.34% | 0.38% | Baa2 |

| Grupo Comercial Chedraui, S.A.B. de C.V. | 0.01% | 0.18% | 2.18% | 6.71% | B3 |

| Grupo Gigante, S.A.B. de C.V. | 0.00% | 0.05% | 1.60% | 3.02% | B1 |

| Grupo Herdez, S.A.B. de C.V. | 0.14% | 0.76% | 2.71% | 4.35% | B2 |

| Grupo Minsa, S.A.B. de C.V. | 0.00% | 0.04% | 1.57% | 1.98% | Ba3 |

| Industrias Bachoco, S.A.B. de C.V. | 0.00% | 0.01% | 1.42% | 0.37% | Baa1 |

| Kimberly-Clark de Mexico S.A.B. de C.V. | 0.00% | 0.00% | 1.08% | 0.37% | Baa1 |

| Organización Cultiba, S.A.B. de C.V. | 0.00% | 0.07% | 1.62% | 0.37% | Baa1 |

| Organizacion Soriana, S.A.B. de C.V. | 0.00% | 0.08% | 1.86% | 0.98% | Ba1 |

| Genomma Lab Internacional, S.A.B. de C.V. | 0.04% | 0.37% | 2.23% | 3.02% | B1 |

| Medica Sur, S.A.B. de C.V. | 0.43% | 1.71% | 2.78% | 4.35% | B2 |

| El Puerto de Liverpool, S.A.B. de C.V. | 0.00% | 0.00% | 1.06% | 0.37% | Baa1 |

| Grupo Elektra, S.A.B. de C.V. | 0.00% | 0.13% | 1.50% | 3.02% | B1 |

| Grupo Vasconia S.A.B. | 2.41% | 4.43% | 3.21% | 3.02% | B1 |

| Grupe, S.A.B. de C.V. | 0.00% | 0.00% | 0.42% | 1.98% | Ba3 |

| America Movil, S.A.B. de C.V. | 0.01% | 0.18% | 1.49% | 0.48% | Baa2 |

| Axtel, S.A.B. de C.V. | 3.73% | 6.51% | 2.50% | 4.35% | B2 |

| Grupo Radio Centro, S.A.B. de C.V. | 0.00% | 0.00% | 0.28% | 6.71% | B3 |

| Grupo Televisa, S.A.B. | 0.65% | 2.29% | 1.99% | 1.98% | Ba3 |

| Megacable Holdings, S.A.B. de C.V. | 0.01% | 0.13% | 1.32% | 0.37% | Baa1 |

| Tv Azteca, S.A.B. de C.V. | 4.08% | 5.76% | 2.50% | 35.00% | Caa-C |

| Alsea, S.A.B. de C.V. | 0.20% | 0.86% | 2.70% | 3.02% | B1 |

| CMR, S.A.B. de C.V. | 1.80% | 3.06% | 3.13% | 2.02% | Baa3 |

| Corporacion Interamericana de Entretenimiento, S.A.B. de C.V. | 0.00% | 0.00% | 0.91% | 3.02% | Baa3 |

| Grupo Famsa, S.A.B. de C.V. | 14.30% | 16.07% | 4.10% | 35.00% | Caa-C |

| Grupo Hotelero Santa Fe, S.A.B. de C.V. | 0.04% | 0.34% | 2.23% | 3.02% | B1 |

| Grupo Palacio de Hierro, S.A.B. de C.V. | 0.00% | 0.00% | 0.38% | 0.37% | Baa1 |

| Grupo Sports World, S.A.B. de C.V. | 7.53% | 10.55% | 3.57% | 3.20% | B1 |

| Hoteles City Express, S.A.B. de C.V. | 0.58% | 2.12% | 2.89% | 6.71% | B3 |

| Nemak, S.A.B. de C.V. | 0.30% | 1.00% | 2.68% | 3.20% | B1 |

| Max Bloomberg y Moody’s (Famsa) | 14.30% | 16.07% | 4.10% | 35.00% | |

| Min Bloomberg y Moody’s (Palacio de Hierro) | 0.00% | 0.00% | 0.28% | 0.37% | |

| Average | 0.77% | 1.43% | 2.05% | 4.78% | |

| Correlation Between DRSK 1 year vs. EDF I Year | 51% | ||||

| Correlation Between EDF1 year and Debt Cost calculated by Bloomberg | 55% | ||||

| Correlation Between DRSK 1 year and Debt Cost calculated by Bloomberg | 20% |

| Merton | BM | PLBM | Modified | ||

|---|---|---|---|---|---|

| Bloomberg | Merton | ||||

| G Value | −0.17 | −2.16 | −13.105 | 0.50 | 0.77 |

| Market Value of Equity Multiplied by the Proportion of Debts Referenced to a Base Rate | Merton’s Modified Model Value of Firm | Traditional Merton’s Model Value of Firm | |

|---|---|---|---|

| Vista Oil & Gas, S.A.B. de C.V. | 3204 | 4094 | 4108 |

| Accel, S.A.B. de C.V. | 71 | 1515 | 1511 |

| Acosta Verde, S.A.B. de C.V. | 4174 | 5360 | 5391 |

| Aleatica, S.A.B. de C.V. | 4413 | 19,198 | 18,777 |

| Alfa, S.A.B. de C.V. | 17 | 83 | 76 |

| Consorcio Ara, S.A.B. de C.V. | 377 | 1216 | 1464 |

| Consorcio Aristos, S.A.B. de C.V. | 336 | 648 | 565 |

| Corpovael S.A.B. de C.V. | 5622 | 10,211 | 10,025 |

| Dine, S.A.B. de C.V. | 367 | 681 | 685 |

| Gméxico Transportes, S.A.B. de C.V. | 10 | 87 | 86 |

| Grupo Aeroportuario Del Centro Norte, S.A.B. de C.V. | 1084 | 4714 | 4680 |

| Grupo Aeroportuario Del Pacifico, S.A.B. de C.V. | 52,297 | 91,120 | 90,885 |

| Grupo Aeroportuario Del Sureste, S.A.B. de C.V. | 27 | 51 | 51 |

| Grupo Gicsa, S.A.B. de C.V. | 2308 | 14,837 | 14,591 |

| Grupo Mexicano de Desarrollo, S.A.B. | 660 | 85,512 | 79,305 |

| Grupo TMM, S.A. | 12 | 149 | 119 |

| Grupo Traxión S.A.B de C.V. | 6750 | 16,585 | 12,409 |

| Impulsora Del Desarrollo y e Empleo en America Latina, S.A.B. De C.V. | 74,219 | 210,948 | 202,277 |

| Orbia Advance Corporation, S.A.B. de C.V. | 13,675 | 15,381 | 15,392 |

| Promotora Ambiental, S.A.B. de C.V. | 1012 | 3884 | 3664 |

| Servicios Corporativos Javer, S.A.B. de C.V. | 1664 | 5510 | 5572 |

| Cemex, S.A.B. de C.V. | 9573 | 17,441 | 17,413 |

| Compañia Minera Autlan, S.A.B. de C. V. | 194 | 16,021 | 333 |

| Convertidora Industrial, S.A.B. de C.V. | 90 | 511 | 512 |

| Cydsa, S.A.B. de C.V. | 1262 | 12,891 | 12,522 |

| G Collado, S.A.B. de C.V. | 994 | 1179 | 1179 |

| Grupo Carso, S.A.B. de C.V. | 7265 | 16,021 | 16,021 |

| Grupo Kuo, S.A.B. de C.V. | 211 | 1364 | 1218 |

| Grupo Pochteca, S.A.B. de C.V. | 145 | 19,002 | 2778 |

| Minera Frisco, S.A.B. de C.V. | 5218 | 17,726 | 17,425 |

| Proteak Uno, S.A.B. de C.V. | 1630 | 3081 | 2977 |

| Arca Continental | 26 | 54 | 53 |

| Fomento Económico Mexicano, S.A.B. de C.V. | 4845 | 14,962 | 14,695 |

| Gruma, S.A.B. de C.V. | 36,744 | 39,699 | 39,707 |

| Grupo Bimbo, S.A.B. de C.V. | 41,978 | 106,305 | 102,355 |

| Grupo Comercial Chedraui, S.A.B. de C.V. | 6614 | 34,077 | 34,134 |

| Grupo Gigante, S.A.B. de C.V. | 10 | 30 | 31 |

| Grupo Herdez, S.A.B. de C.V. | 5977 | 12,087 | 10,723 |

| Grupo Minsa, S.A.B. de C.V. | 173 | 329 | 322 |

| Industrias Bachoco, S.A.B. de C.V. | 3695 | 7326 | 7349 |

| Kimberly-Clark De Mexico S.A.B. de C.V. | 13,287 | 36,864 | 28,911 |

| Organización Cultiba, S.A.B. de C.V. | 389 | 1576 | 1563 |

| Organizacion Soriana, S.A.B. de C.V. | 1554 | 12,284 | 11,843 |

| Genomma Lab Internacional, S.A.B. de C.V. | 11,526 | 21,166 | 20,834 |

| Medica Sur, S.A.B. de C.V. | 3135 | 4943 | 4874 |

| El Puerto De Liverpool, S.A.B. de C.V. | 1751 | 3497 | 3498 |

| Grupo Elektra, S.A.B. de C.V. | 14,130 | 28,042 | 28,060 |

| Grupo Vasconia S.A.B. | 120 | 307 | 304 |

| Grupe, S.A.B. de C.V. | 875 | 4192 | 3827 |

| Axtel, S.A.B. de C.V. | 2605 | 12,247 | 12,107 |

| Grupo Radio Centro, S.A.B. de C.V. | 303 | 2224 | 1982 |

| Grupo Televisa, S.A.B. | 9937 | 29,043 | 30,865 |

| Megacable Holdings, S.A.B. de C.V. | 43,799 | 53,770 | 53,756 |

| Tv Azteca, S.A.B. de C.V. | 2 | 7854 | 7865 |

| Alsea, S.A.B. de C.V. | 236 | 909 | 966 |

| CMR S.A.B. de C.V. | 343 | 1899 | 1784 |

| Corporacion Interamericana de Entretenimiento, S.A.B. de C.V. | 730 | 1629 | 1629 |

| Grupo Famsa, S.A.B. de C.V. | 137 | 9160 | 6937 |

| Grupo Hotelero Santa Fe, S.A.B. de C.V. | 210 | 1117 | 919 |

| Grupo Palacio de Hierro, S.A.B. de C.V. | 1 | 3 | 3 |

| Grupo Sports World, S.A.B. de C.V. | 10 | 14 | 13 |

| Hoteles City Express, S.A.B. de C.V. | 1383 | 10,006 | 9696 |

| Nemak, S.A.B. de C.V. | 1068 | 7028 | 8061 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Morales-Bañuelos, P.; Fernández-Anaya, G. Default Probabilities and the Credit Spread of Mexican Companies: The Modified Merton Model. Mathematics 2023, 11, 4397. https://doi.org/10.3390/math11204397

Morales-Bañuelos P, Fernández-Anaya G. Default Probabilities and the Credit Spread of Mexican Companies: The Modified Merton Model. Mathematics. 2023; 11(20):4397. https://doi.org/10.3390/math11204397

Chicago/Turabian StyleMorales-Bañuelos, Paula, and Guillermo Fernández-Anaya. 2023. "Default Probabilities and the Credit Spread of Mexican Companies: The Modified Merton Model" Mathematics 11, no. 20: 4397. https://doi.org/10.3390/math11204397

APA StyleMorales-Bañuelos, P., & Fernández-Anaya, G. (2023). Default Probabilities and the Credit Spread of Mexican Companies: The Modified Merton Model. Mathematics, 11(20), 4397. https://doi.org/10.3390/math11204397