Deterioration Control Decision Support System for the Retailer during Availability of Trade Credit and Shortages

Abstract

:1. Introduction

1.1. Aim of This Study

- What is the need for controlling deterioration rate using fresh quality technology and effort according to a cost factor?

- Why does the deterioration rate always consider the ideal rate if the deterioration rate is between 0 and 1?

- Why must the optimal rate of deterioration and preservation factor be in the interval ?

- How does a strategy of trade credit affect a retailer’s productivity and profitability?

- When should a retailer have to place a back order to escape stock-outs?

- If this model were implemented in reality, what would the managerial implications be?

1.2. Contribution

- This study develops a perishable inventory system in which deterioration rate is considered as a decision parameter and investigates its impact on perishable quality control parameters.

- The rate of deterioration is controlled using the fresh quality technique and effort as a cost factor.

- The demand depends on the deterioration and quality of the perishable product.

- Quality is defined as the time integration of the original and deteriorating quality. For illustration, a farming product with a reduced deterioration rate, which appears fresh and has much more available stock, will generate higher demand.

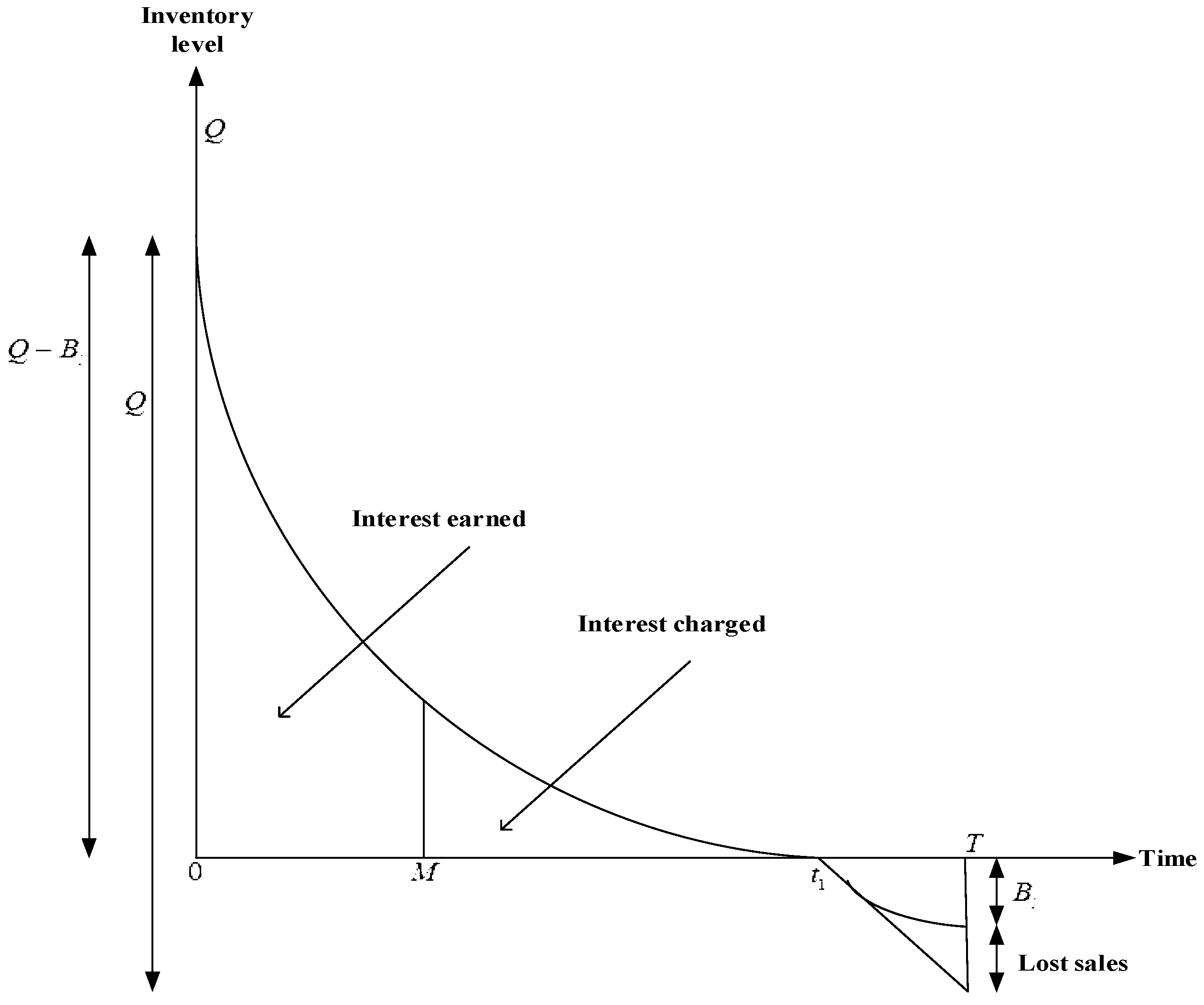

- Trade credit policy and its impact on the overall cost of the retailer.

- Partially backlogged shortages are permitted.

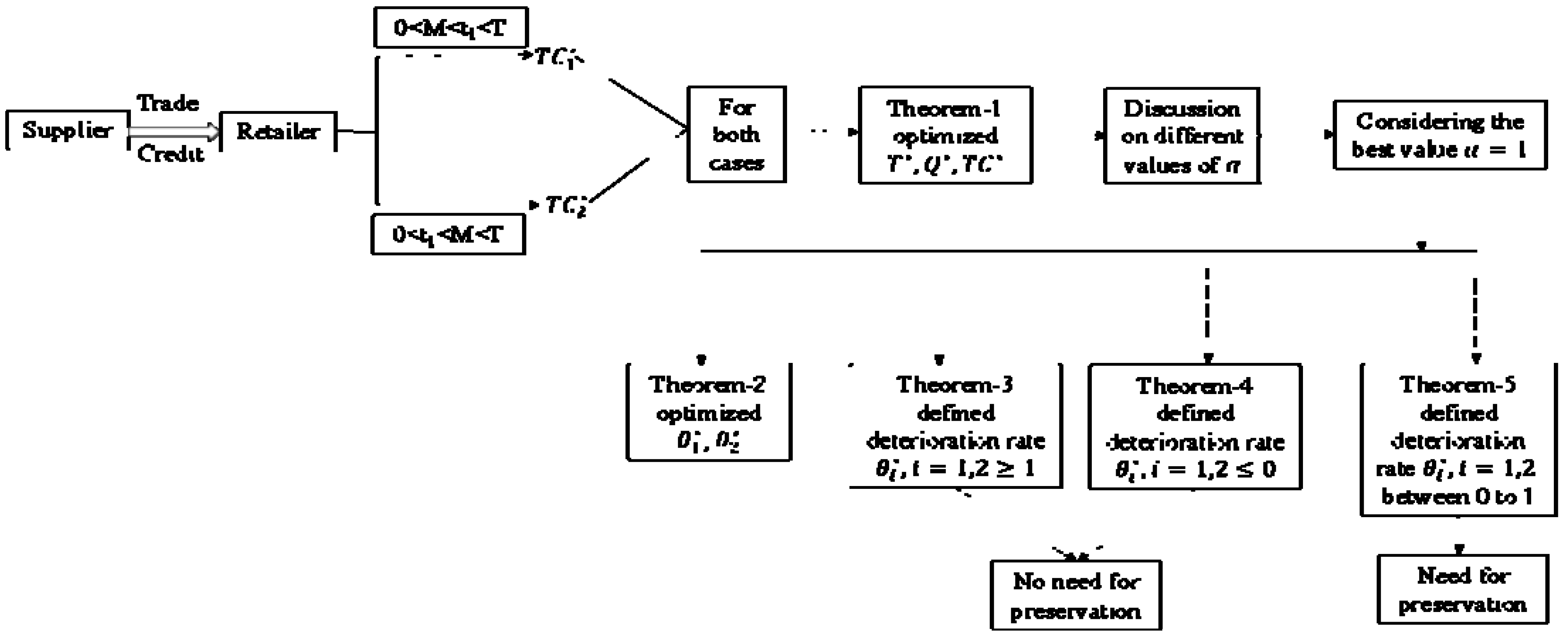

1.3. Flow of the Paper

2. Literature Review

2.1. Literature Review on Inventory Models under Various Types of Demand

2.2. Literature Review on Inventory Models under Deteriorating Inventories

2.3. Literature Review on Inventory Models under Trade Credit Policy

2.4. Gap Identification

3. Notation and Assumptions

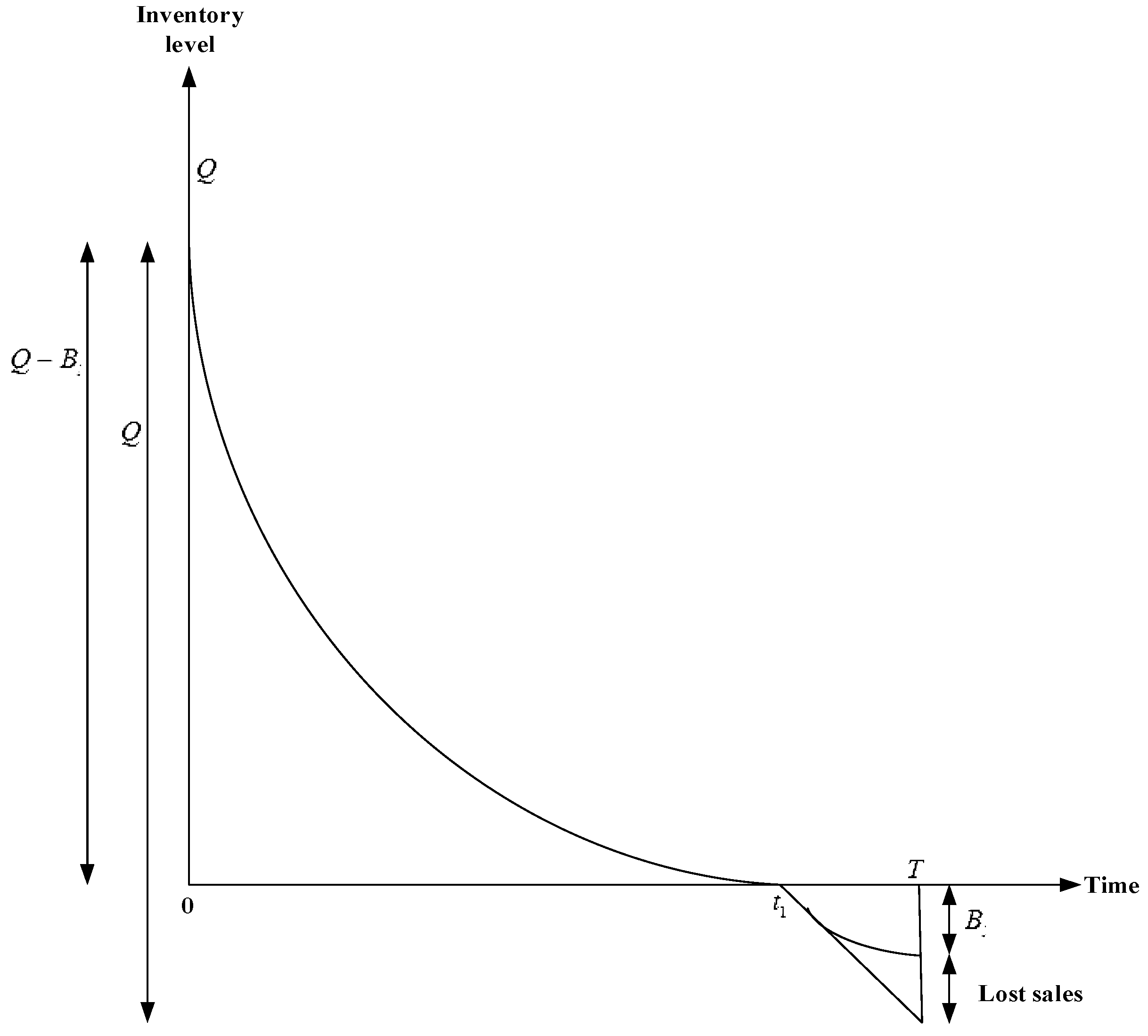

Assumptions

4. Mathematical Model

- Cost of ordering per order:

- Cost of holding per unit per unit time:

- Cost of deterioration per cycle time :

- Cost of backlogging per unit:

- Cost of lost sales per cycle time :

Discussion on the Different Values

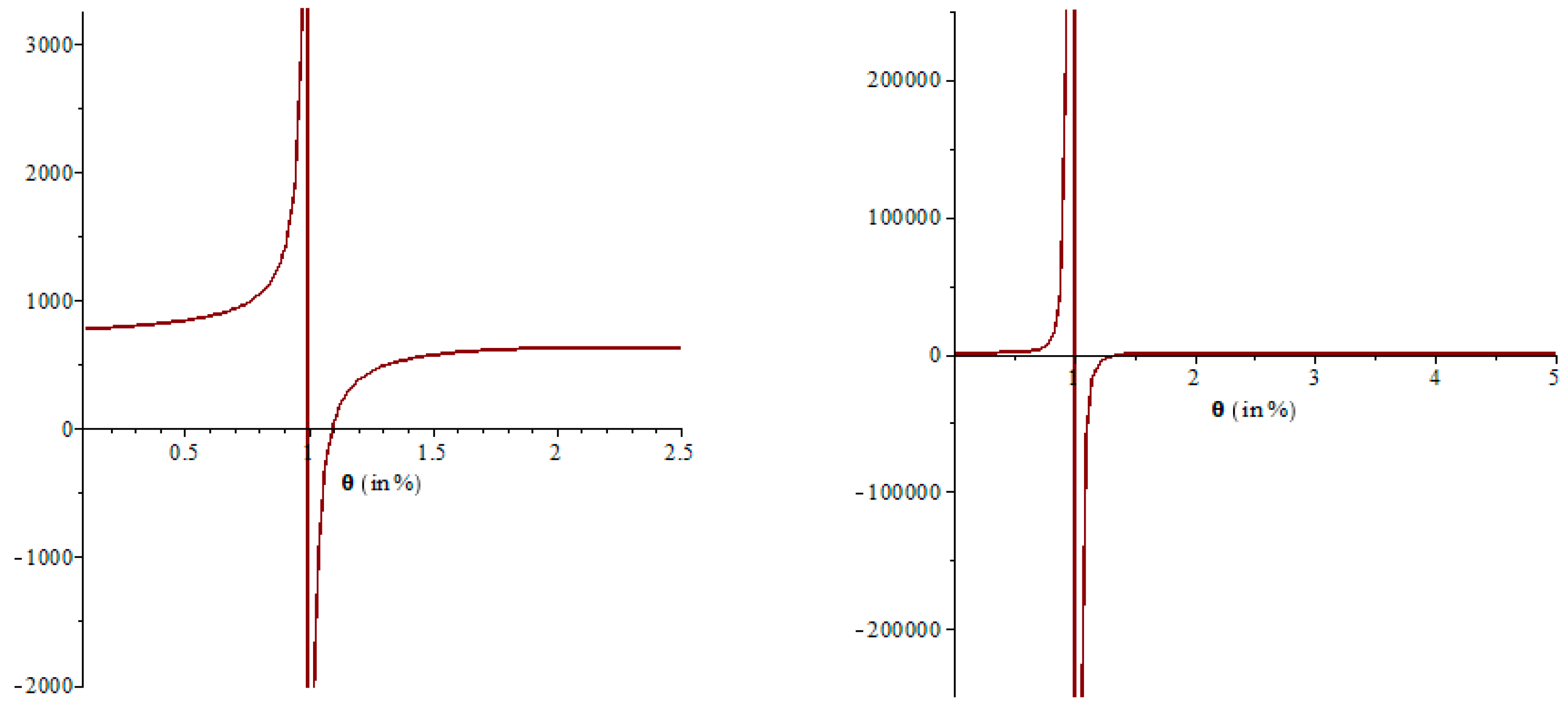

- When then becomes infinite which is not possible and the equation is not solvable. Therefore, is not conceivable.

- When , then from Figure 4 it is observed that is not in the optimal range. Therefore, is also not considered.

- When , it is noticed that deterioration rates for various items vary even when they are kept at the same freshness level. For various goods, the relationship coefficient between and takes on different values. For illustration, with the same FQT and preservation cost, the rate of deterioration is different for oranges and grapes. Table 2 shows this, where is as in Equation (1) and the FQT indicator is set to 0.4.

- 4.

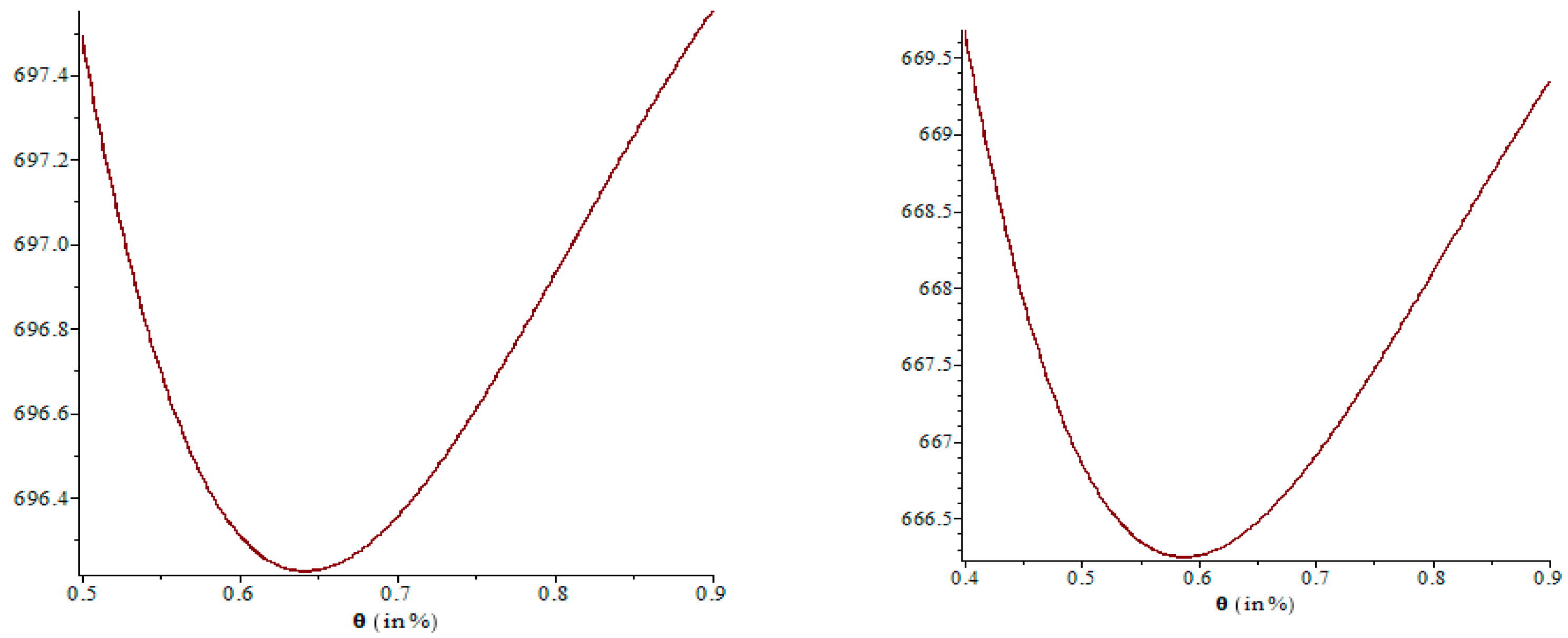

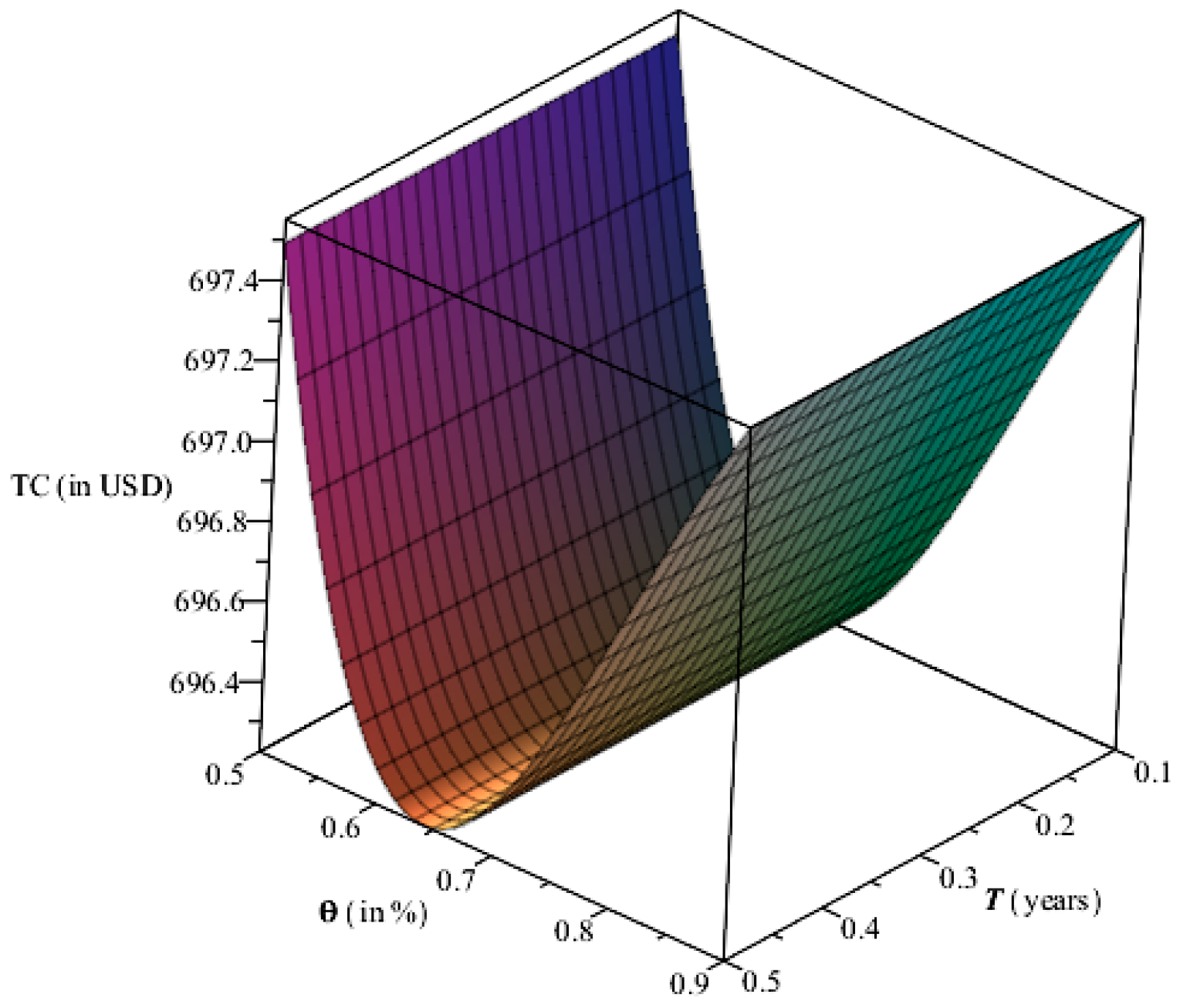

- When : from Figure 5 it is observed that the conceivable value is greater or equal to 1. To verify that Equation (1) and other equations based on Equation (1) are reliable against changes in values, the range might be restricted to . Therefore, in this model, the optimal rate of deterioration is discussed only for and . Furthermore, this portion concludes some managerial outcomes.

𝛼 = 1: Steps to make a decision

- and are not the global optimal solutions, where is and the value of is at .

- or

- and are not the global optimal solutions, where is the value of at .

- or

5. Numerical Study and Sensitivity Analysis

5.1. Numerical Study

5.2. Sensitivity Analysis

- When the rate of deterioration preservation factor increases, the FQT indicator , cycle time , quantity of order , and the time considered for inventory level to drop to zero increase slowly while the deterioration rate decreases slowly. However, total cost decreases gradually.

- There is a negative effect of fixed demand rate on total cost and FQT indicator . They all are increased rapidly. Further, order quantity increases slowly, and cycle time , deterioration rate , and time considered for inventory level to drop to zero decrease slowly.

- If ordering cost increases, the deterioration rate decreases slowly while order quantity and time considered for inventory level to drop to zero increase slowly. However, total cost , FQT indicator , and cycle time increase rapidly.

- Change in the parameter’s sales price and interest earned , total cost , the time considered for inventory level to drop to zero , cycle time , order quantity , and FQT indicator decrease slowly. However, there are no changes in the rate of deterioration .

- As the demand-on-quantity variable changes, cycle time , total cost , order quantity , and the time considered for inventory level to drop to zero decrease slowly, whereas the FQT indicator decreases rapidly and the deterioration rate increases rapidly.

- The FQT indicator increases slowly and total cost decreases rapidly. Further, cycle time , order quantity , the time considered for inventory level to drop to zero , and deterioration rate decrease slowly whenever the upstream trade credit period changes.

- As the holding parameter increases, quantity of order decreases slowly and total cost decreases rapidly. On the other hand, cycle time , the time considered for the stock level to drop to zero , and FQT indicator decrease rapidly and the rate of deterioration increases slowly.

- As the cost of procurement varies, the deterioration rate increases slowly, while cycle time , order quantity , and time considered for inventory level to drop to zero decrease slowly. Furthermore, total cost increases rapidly and the FQT indicator increases slowly; after that, it increases rapidly.

- The cycle time and time considered for level of inventory to drop to zero decrease slowly, the total cost increases rapidly, and then both become constant. However, order quantity decreases slowly, the deterioration rate increases slowly, and FQT indicator decreases rapidly when the maximum cost of holding parameter fluctuates.

5.3. Managerial Implications

- A retailer should take a long credit period from the supplier to receive more benefits since the credit period significantly reduces the total cost per cycle time rapidly while the cycle time drops slowly.

- Based on Theorem 3, a retailer should not invest in the preservation factor because the rate of deterioration is which implies that the product fully deteriorates. So, there is no need to preserve and increase the total cost. For example, if all of the tomatoes, lemons, bread, flowers, and other perishable items fully deteriorate then the retailer should not invest to sustain that kind of product.

- According to Theorem 4, if then the retailer should not invest in preservation because the product is non-deteriorating. For example, if dry inventory, coffee powder, tea powder, etc., have zero deterioration rate then the retailer should not invest in the preservation factor to raise the cost.

- According to Theorem 5, if the range of deterioration is then the retailer should invest in the preservation factor to preserve the perishable product and fulfill the demand of consumers. Dairy products, cooked leftovers, vegetables, fruits, and so on need a preservation and temperature environment according to their freshness. So, if the product is not fully deteriorated or non-deteriorating then the retailer should invest in the preservation factor because the demand is quality-dependent on the perishable product.

- As Table 4 shows, the retailer should decrease the cost of holding parameter, reduce the ordering cost, focus on the quality of the perishable product, and adjust the sales price to generate more revenue and less expenditure.

- If the rate of deterioration is low and demand is high, the retailer should buy additional inventory before the shortages occur. If the flowers are fresh, retailers will buy them, and demand will rise gradually. Therefore, before all of the flowers are sold, the retailer should order more flowers.

- To achieve the optimal rate of deterioration, the value of the rate of the deterioration preservation factor must be restricted . If the value of the rate of the deterioration preservation factor is less than 1, the optimal deterioration rate increases, implying a rise in the overall cost of a retailer. (See Table 2).

6. Conclusions

- This model discussed the relation between the fresh quality technology (FQT) indicator and controllable rate of deterioration. However, preservation technology was not applied to reduce the rate of deterioration. Additionally, the fluctuating rate of deterioration and the functional relationship between the rate of deterioration and the quality indicator are not considered in this model.

- This study allows for a one-layered trade credit policy and partially backlogged shortages. In spite of this, one can consider a two-layered trade credit policy and fully backlogged shortages as shown in [45].

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Nomenclature

| Parameters | |

| Ordering cost; (in USD/order) | |

| Purchasing cost; (in USD/unit) | |

| Holding cost; (in USD/unit/unit time) | |

| The maximum cost of holding including preservation; (in USD/unit/unit time) | |

| The controllable marginal cost of holding including preservation; | |

| Indicator of fresh quality technology; | |

| Rate of deterioration with the factor of preservation; | |

| Fixed rate of demand | |

| The factor of quality-related variation in demand; | |

| Total demand; (in years) | |

| Upstream trade credit; (in years) | |

| Earned interest of a retailer; (in %/year) | |

| Charged interest of a retailer; (in %/year) | |

| Backlogging factor; | |

| The total volume of backlog based on demand; (in units) | |

| Retailer’s quantity of order per cycle time; (in units) | |

| Procurement cost; (in USD/unit) | |

| Backlogging cost; (in USD/unit time) | |

| Cost of unit opportunity due to lost sale; (in USD/unit time) | |

| The product’s sales price; (in USD/unit) | |

| Decision variables | |

| Cycle time; (in years) | |

| Deterioration rate; | |

| Functions | |

| ; time considered for a stock level to drop to zero, where (in years) | |

| The on-hand stock level at a time ; (units) | |

| Backlogged level of stock at a time ; (units) | |

| Lost sales number at a time ; (units) | |

| The function of total profit per unit time for ; (in USD) | |

Appendix A. Proof of Theorem 1

Appendix B. Proof of Theorem 2

Appendix C. Proof of Theorem 3

Appendix D. Proof of Theorem 4

Appendix E. Proof of Theorem 5

References

- Cai, X.; Chen, J.; Xiao, Y.; Xu, X. Optimization and coordination of fresh product supply chains with freshness-keeping effort. Prod. Oper. Manag. 2010, 19, 261–278. [Google Scholar] [CrossRef]

- Yang, Y.; Chi, H.; Zhou, W.; Fan, T.; Piramuthu, S. Deterioration control decision support for perishable inventory management. Decis. Support Syst. 2020, 134, 113308. [Google Scholar] [CrossRef]

- Xu, G.; Wu, H.; Liu, Y.; Wu, C.-H.; Tsai, S.-B. A Research on Fresh-Keeping Strategies for Fresh Agricultural Products from the Perspective of Green Transportation. Discret. Dyn. Nat. Soc. 2020, 2020, 1307170. [Google Scholar] [CrossRef]

- Tu, Y.J.; Zhou, W.; Piramuthu, S. A novel means to address RFID tag/item separation in supply chains. Decis. Support Syst. 2018, 115, 13–23. [Google Scholar] [CrossRef]

- Bakker, M.; Riezebos, J.; Teunter, R.H. Review of inventory systems with deterioration since 2001. Eur. J. Oper. Res. 2012, 221, 275–284. [Google Scholar] [CrossRef]

- Cárdenas-Barrón, L.E.; Shaikh, A.A.; Tiwari, S.; Treviño-Garza, G. An EOQ inventory model with nonlinear stock dependent holding cost, nonlinear stock dependent demand and trade credit. Comput. Ind. Eng. 2018, 139, 105557. [Google Scholar] [CrossRef]

- Shaikh, A.A.; Das, S.C.; Bhunia, A.K.; Sarkar, B. Decision support system for customers during availability of trade credit financing with different pricing situations. RAIRO-Oper. Res. 2021, 55, 1043–1061. [Google Scholar] [CrossRef]

- Shaikh, A.A. A two-warehouse inventory model for deteriorating items with variable demand under alternative trade credit policy. Int. J. Logist. Syst. Manag. 2017, 27, 40–61. [Google Scholar] [CrossRef]

- Jaggi, C.K.; Gautam, P.; Khanna, A. Quality, Inventory decisions for imperfect quality deteriorating items with exponential declining demand under trade credit and partially backlogged shortages. In Quality, IT and Business Operations, Springer Proceedings in Business and Economics; Kapur, P., Kumar, U., Verma, A., Eds.; Springer: Berlin/Heidelberg, Germany, 2018; Chapter 18; pp. 213–229. [Google Scholar] [CrossRef]

- Tripathi, R.P. Innovation of economic order quantity (EOQ) model for deteriorating items with time-linked quadratic demand under non-decreasing shortages. Int. J. Appl. Comput. Math. 2019, 5, 123. [Google Scholar] [CrossRef]

- Namdeo, A.; Khedlekar, U.K.; Singh, P. Discount pricing policy for deteriorating items under preservation technology cost and shortages. J. Manag. Anal. 2020, 7, 1–23. [Google Scholar] [CrossRef]

- Shaikh, A.A.; Panda, G.C.; Khan, M.A.A.; Mashud, A.H.M.; Biswas, A. An inventory model for deteriorating items with preservation facility of ramp type demand and trade credit. Int. J. Math. Oper. Res. 2020, 17, 514–551. [Google Scholar] [CrossRef]

- Handa, N.; Singh, S.R.; Punetha, N.; Shah, N.H.; Mittal, M.; Cárdenas-Barrón, L.E. (Eds.) Decision Making in Inventory Management, Impact of inflation on production inventory model with variable demand and shortages. In Inventory Optimization; Springer: Singapore, 2021; pp. 37–48. [Google Scholar] [CrossRef]

- Khan, M.A.A.; Shaikh, A.A.; Cárdenas-Barrón, L.E.; Mashud, A.H.M.; Treviño-Garza, G.; Céspedes-Mota, A. An Inventory Model for Non-Instantaneously Deteriorating Items with Nonlinear Stock-Dependent Demand, Hybrid Payment Scheme and Partially Backlogged Shortages. Mathematics 2022, 10, 434. [Google Scholar] [CrossRef]

- Shah, B.J.; Shroff, A. Inventory model for sustainable operations of fixed-life products: Role of trapezoidal demand and two-level trade credit financing. J. Clean. Prod. 2022, 380, 135093. [Google Scholar] [CrossRef]

- Shah, N.H.; Chaudhari, U.; Jani, M.Y. Optimum inventory control for an imperfect quality item with maximum life-time under quadratic demand and preservation technology investment. Int. J. Appl. Eng. Res. 2018, 13, 12475–12485. [Google Scholar]

- Shaikh, A.A.; Panda, G.C.; Sahu, S.; Das, A.K. Economic order quantity model for deteriorating item with preservation technology in time-dependent demand with partial backlogging and trade credit. Int. J. Logist. Syst. Manag. 2019, 32, 1–24. [Google Scholar] [CrossRef]

- Ghandehari, M.; Dezhtaherian, M. An EOQ model for deteriorating items with partial backlogging and financial considerations. Int. J. Serv. Oper. Manag. 2019, 32, 269–284. [Google Scholar] [CrossRef]

- Rezagholifam, M.; Sadjadi, S.J.; Heydari, M.; Karimi, M. Optimal pricing and ordering strategy for non-instantaneous deteriorating items with price and stock sensitive demand and capacity constraint. Int. J. Syst. Sci. Oper. Logist. 2020, 9, 121–132. [Google Scholar] [CrossRef]

- Chaudhari, U.; Shah, N.H.; Jani, M.Y. Inventory modelling of deteriorating item and preservation technology with advance payment scheme under quadratic demand. In Optimization and Inventory Management; Shah, N.H., Mittal, M., Eds.; Springer: Singapore, 2020; pp. 69–79. [Google Scholar] [CrossRef]

- Jani, M.Y.; Shah, N.H.; Chaudhari, U. Inventory control policies for time-dependent deteriorating item with variable demand and two-level order linked trade credit. In Optimization and Inventory Management, Asset Analytics; Shah, N.H., Mittal, M., Eds.; Springer: Singapore, 2020; pp. 55–67. [Google Scholar] [CrossRef]

- Priyamvada; Rini; Khanna, A.; Jaggi, C.K. An inventory model under price and stock dependent demand for controllable deterioration rate with shortages and preservation technology investment: Revisited. OPSEARCH 2021, 58, 102–181. [Google Scholar] [CrossRef]

- Mishra, U.; Mashud, A.H.M.; Tseng, M.-L.; Wu, J.-Z. Optimizing a Sustainable Supply Chain Inventory Model for Controllable Deterioration and Emission Rates in a Greenhouse Farm. Mathematics 2021, 9, 495. [Google Scholar] [CrossRef]

- Shekhawat, S.; Rathore, H.; Sharma, K. Economic production quantity model for deteriorating items with Weibull deterioration rate over the finite time horizon. Int. J. Appl. Comput. Math. 2021, 7, 56. [Google Scholar] [CrossRef]

- Abdul Hakim, M.; Hezam, I.M.; Alrasheedi, A.F.; Gwak, J. Pricing Policy in an Inventory Model with Green Level Dependent Demand for a Deteriorating Item. Sustainability 2022, 14, 4646. [Google Scholar] [CrossRef]

- Shah, N.H.; Rabari, K.; Patel, E. Greening efforts and deteriorating inventory policies for price-sensitive stock-dependent demand. Int. J. Syst. Sci. Oper. Logist. 2022, 1, 1–7. [Google Scholar] [CrossRef]

- Manna, A.K.; Dey, J.K.; Mondal, S.K. Effect of inspection errors on imperfect production inventory model with warranty and price discount dependent demand rate. RAIRO-Oper. Res. 2020, 54, 1189–1213. [Google Scholar] [CrossRef] [Green Version]

- Bhunia, A.K.; Shaikh, A.A. An application of PSO in a two-warehouse inventory model for deteriorating item under permissible delay in payment with different inventory policies. Appl. Math. Comput. 2015, 256, 831–850. [Google Scholar] [CrossRef]

- Taleizadeh, A.A.; Pentico, D.W.; Jabalameli, M.S.; Aryanezhad, M. An economic order quantity model with multiple partial prepayments and partial backordering. Math. Comput. Model. 2013, 57, 311–323. [Google Scholar] [CrossRef]

- Tiwari, S.; Cárdenas-Barrón, L.E.; Khanna, A.; Jaggi, C.K. Impact of trade credit and inflation on retailer’s ordering policies for non-instantaneous deteriorating items in a two-warehouse environment. Int. J. Prod. Econ. 2016, 176, 154–169. [Google Scholar] [CrossRef]

- Mahata, P.; Mahata, G.C.; De, S.K. An economic order quantity model under two-level partial trade credit for time-varying deteriorating items. Int. J. Syst. Sci. Oper. Logist. 2018, 7, 1–17. [Google Scholar] [CrossRef]

- Vandana; Singh, S.R.; Yadav, D.; Sarkar, B.; Sarkar, M. Impact of Energy and Carbon Emission of a Supply Chain Management with Two-Level Trade-Credit Policy. Energies 2021, 14, 1569. [Google Scholar] [CrossRef]

- Sarkar, B.; Ahmed, W.; Choi, S.B.; Tayyab, M. Sustainable Inventory Management for Environmental Impact through Partial Backordering and Multi-Trade-Credit-Period. Sustainability 2018, 10, 4761. [Google Scholar] [CrossRef] [Green Version]

- Rapolu, C.N.; Kandpal, D.H. Joint pricing, advertisement, preservation technology investment and inventory policies for non-instantaneous deteriorating items under trade credit. OPSEARCH 2020, 57, 274–300. [Google Scholar] [CrossRef]

- Mahato, C.; Mahata, G.C. Optimal inventory policies for deteriorating items with expiration date and dynamic demand under two-level trade credit. OPSEARCH 2021, 58, 994–1017. [Google Scholar] [CrossRef]

- Jani, M.Y.; Soni, V.M.; Betheja, M.R. Impact of customer returns and trade credit for deteriorating items with preservation technology investment under price-sensitive demand. Investig. Oper. 2021, 42, 540–550. [Google Scholar]

- Fu, K.; Wang, C.; Xu, J. The impact of trade credit on information sharing in a supply chain. Omega 2022, 110, 102633. [Google Scholar] [CrossRef]

- Tiwari, S.; Cárdenas-Barrón, L.E.; Malik, A.I.; Jaggi, C.K. Retailer’s credit and inventory decisions for imperfect quality and deteriorating items under two-level trade credit. Comput. Oper. Res. 2022, 138, 105617. [Google Scholar] [CrossRef]

- Jani, M.Y.; Rajtiya, N.J.; Betheja, M.R. Effects of future price increase and trade credit on optimal ordering policies for perishable items under quadratic demand. Investig. Oper. 2022, 43, 63–79. [Google Scholar]

- Mahato, C.; Mahata, G.C. Decaying items inventory models with partial linked-to-order upstream trade credit and downstream full trade credit. J. Manag. Anal. 2022, 9, 137–168. [Google Scholar] [CrossRef]

- Ma, X.; Wang, J.; Bai, Q.; Wang, S. Optimization of a three-echelon cold chain considering freshness-keeping efforts under cap-and-trade regulation in Industry 4.0. Int. J. Prod. Econ. 2019, 220, 107457. [Google Scholar] [CrossRef]

- Jani, M.Y.; Betheja, M.R.; Chaudhari, U.; Sarkar, B. Optimal investment in preservation technology for variable demand under trade-credit and shortages. Mathematics 2021, 9, 1301. [Google Scholar] [CrossRef]

- Sarkar, B.; Biswas, A. Linguistic einstein aggregation operator-based TOPSIS for multicriteria group decision making in linguistic pythagorean fuzzy environment. Int. J. Intell. Syst. 2021, 36, 2825–2864. [Google Scholar] [CrossRef]

- Cai, X.; Chen, J.; Xiao, Y.; Xu, X.; Yu, G. Fresh-product supply chain management with logistics outsourcing. Omega 2013, 41, 752–765. [Google Scholar] [CrossRef]

- Jani, M.Y.; Shah, N.H.; Chaudhari, U. An inventory policy for maximum fixed life-time item with back ordering and variable demand under two levels order linked Trade credits. In Decision Making in inventory Management, Inventory Optimization; Shah, N.H., Mittal, M., Cárdenas-Barrón, L.E., Eds.; Springer: Singapore, 2021. [Google Scholar] [CrossRef]

| Source | Demand | Deterioration | Shortages | Trade Credit |

|---|---|---|---|---|

| [12] | Ramp type | Constant | Yes | Yes |

| [31] | Constant | No | Yes | Yes |

| [35] | Constant | Constant | Yes | Yes |

| [2] | Deterioration-dependent | Controllable deterioration | No | No |

| [22] | Price- and stock-dependent | Controllable deterioration | Yes | No |

| [24] | Constant | Weibull deterioration | Yes | No |

| … | 1 | 2 | 3 | … | |||

|---|---|---|---|---|---|---|---|

| … | 0.963 | 0.84 | 0.6 | 0.367 | 0.263 | … |

| Parameters | Values | ||||||

|---|---|---|---|---|---|---|---|

| 3.2 | 0.220 | 0.70 | 25.16 | 0.176 | 667.84 | 0.021 | |

| 3.6 | 0.222 | 0.64 | 25.57 | 0.178 | 667.05 | 0.026 | |

| 4.4 | 0.226 | 0.55 | 26.23 | 0.181 | 665.45 | 0.031 | |

| 4.8 | 0.228 | 0.51 | 26.49 | 0.182 | 664.68 | 0.033 | |

| 80 | 0.236 | 0.66 | 23.94 | 0.189 | 606.97 | 0.011 | |

| 90 | 0.236 | 0.66 | 24.14 | 0.189 | 611.95 | 0.014 | |

| 110 | 0.214 | 0.55 | 27.45 | 0.171 | 719.16 | 0.041 | |

| 120 | 0.205 | 0.52 | 28.84 | 0.164 | 771.01 | 0.051 | |

| 32 | 0.166 | 0.65 | 22.73 | 0.159 | 628.49 | 0.015 | |

| 36 | 0.212 | 0.61 | 24.39 | 0.170 | 647.94 | 0.023 | |

| 44 | 0.236 | 0.57 | 27.36 | 0.189 | 683.61 | 0.034 | |

| 48 | 0.247 | 0.56 | 28.73 | 0.198 | 700.17 | 0.039 | |

| 12 | 0.225 | 0.49 | 26.61 | 0.180 | 674.78 | 0.066 | |

| 13.5 | 0.225 | 0.53 | 26.33 | 0.180 | 670.71 | 0.048 | |

| 16.5 | 0.222 | 0.69 | 25.15 | 0.178 | 661.14 | 0.009 | |

| 18 | 4.847 | 4.42 | 9.24 | 3.877 | 41019.31 | 136.543 | |

| 8 | 0.216 | 1.21 | 23.64 | 0.172 | 584.01 | 0.002 | |

| 9 | 0.210 | 1.24 | 22.89 | 0.162 | 618.44 | 0.003 | |

| 11 | 0.196 | 1.34 | 21.00 | 0.157 | 712.13 | 0.013 | |

| 12 | 0.190 | 1.38 | 20.22 | 0.152 | 754.20 | 0.020 | |

| 8 | 0.240 | 0.55 | 27.85 | 0.192 | 645.88 | 0.043 | |

| 9 | 0.232 | 0.57 | 26.85 | 0.185 | 656.24 | 0.036 | |

| 11 | 0.222 | 0.60 | 25.66 | 0.178 | 669.17 | 0.026 | |

| 12 | 0.212 | 0.65 | 24.24 | 0.169 | 685.23 | 0.016 | |

| 6.4 | 0.226 | 0.55 | 26.21 | 0.181 | 665.69 | 0.043 | |

| 7.2 | 0.226 | 0.57 | 26.01 | 0.180 | 666.06 | 0.033 | |

| 8.8 | 0.206 | 1.14 | 22.61 | 0.164 | 669.83 | 0.0005 | |

| 9.6 | 0.206 | 1.15 | 22.59 | 0.164 | 669.83 | 0.0005 | |

| 0.16 | 0.224 | 0.60 | 25.84 | 0.179 | 677.14 | 0.025 | |

| 0.18 | 0.224 | 0.60 | 25.88 | 0.179 | 671.70 | 0.027 | |

| 0.22 | 0.225 | 0.58 | 25.96 | 0.180 | 660.79 | 0.031 | |

| 0.24 | 0.225 | 0.57 | 26.00 | 0.180 | 655.33 | 0.033 | |

| 0.08 | 0.227 | 0.59 | 26.21 | 0.182 | 673.20 | 0.028 | |

| 0.09 | 0.226 | 0.59 | 26.06 | 0.181 | 669.73 | 0.028 | |

| 0.11 | 0.223 | 0.59 | 25.79 | 0.179 | 662.75 | 0.030 | |

| 0.12 | 0.222 | 0.59 | 25.69 | 0.178 | 660.30 | 0.030 | |

| 24 | 0.227 | 0.59 | 26.21 | 0.182 | 673.20 | 0.028 | |

| 27 | 0.226 | 0.59 | 26.06 | 0.181 | 669.73 | 0.028 | |

| 33 | 0.223 | 0.59 | 25.79 | 0.179 | 662.75 | 0.030 | |

| 36 | 0.222 | 0.59 | 25.69 | 0.178 | 660.30 | 0.030 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jani, M.Y.; Patel, H.A.; Bhadoriya, A.; Chaudhari, U.; Abbas, M.; Alqahtani, M.S. Deterioration Control Decision Support System for the Retailer during Availability of Trade Credit and Shortages. Mathematics 2023, 11, 580. https://doi.org/10.3390/math11030580

Jani MY, Patel HA, Bhadoriya A, Chaudhari U, Abbas M, Alqahtani MS. Deterioration Control Decision Support System for the Retailer during Availability of Trade Credit and Shortages. Mathematics. 2023; 11(3):580. https://doi.org/10.3390/math11030580

Chicago/Turabian StyleJani, Mrudul Y., Heta A. Patel, Amrita Bhadoriya, Urmila Chaudhari, Mohamed Abbas, and Malak S. Alqahtani. 2023. "Deterioration Control Decision Support System for the Retailer during Availability of Trade Credit and Shortages" Mathematics 11, no. 3: 580. https://doi.org/10.3390/math11030580

APA StyleJani, M. Y., Patel, H. A., Bhadoriya, A., Chaudhari, U., Abbas, M., & Alqahtani, M. S. (2023). Deterioration Control Decision Support System for the Retailer during Availability of Trade Credit and Shortages. Mathematics, 11(3), 580. https://doi.org/10.3390/math11030580