A Dynamic Competition Analysis of Stochastic Fractional Differential Equation Arising in Finance via Pseudospectral Method

Abstract

1. Introduction

2. Model Formulation and Method Description

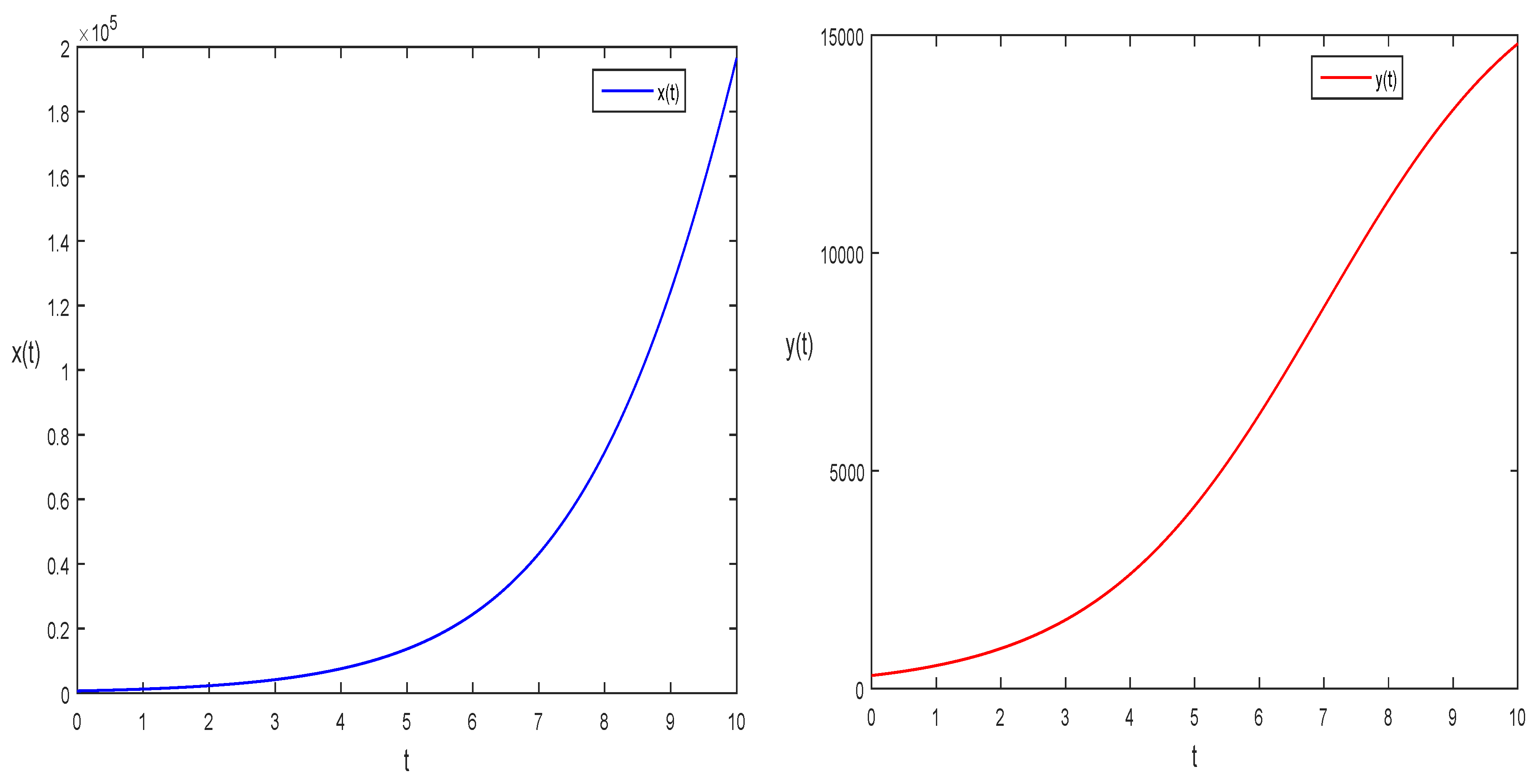

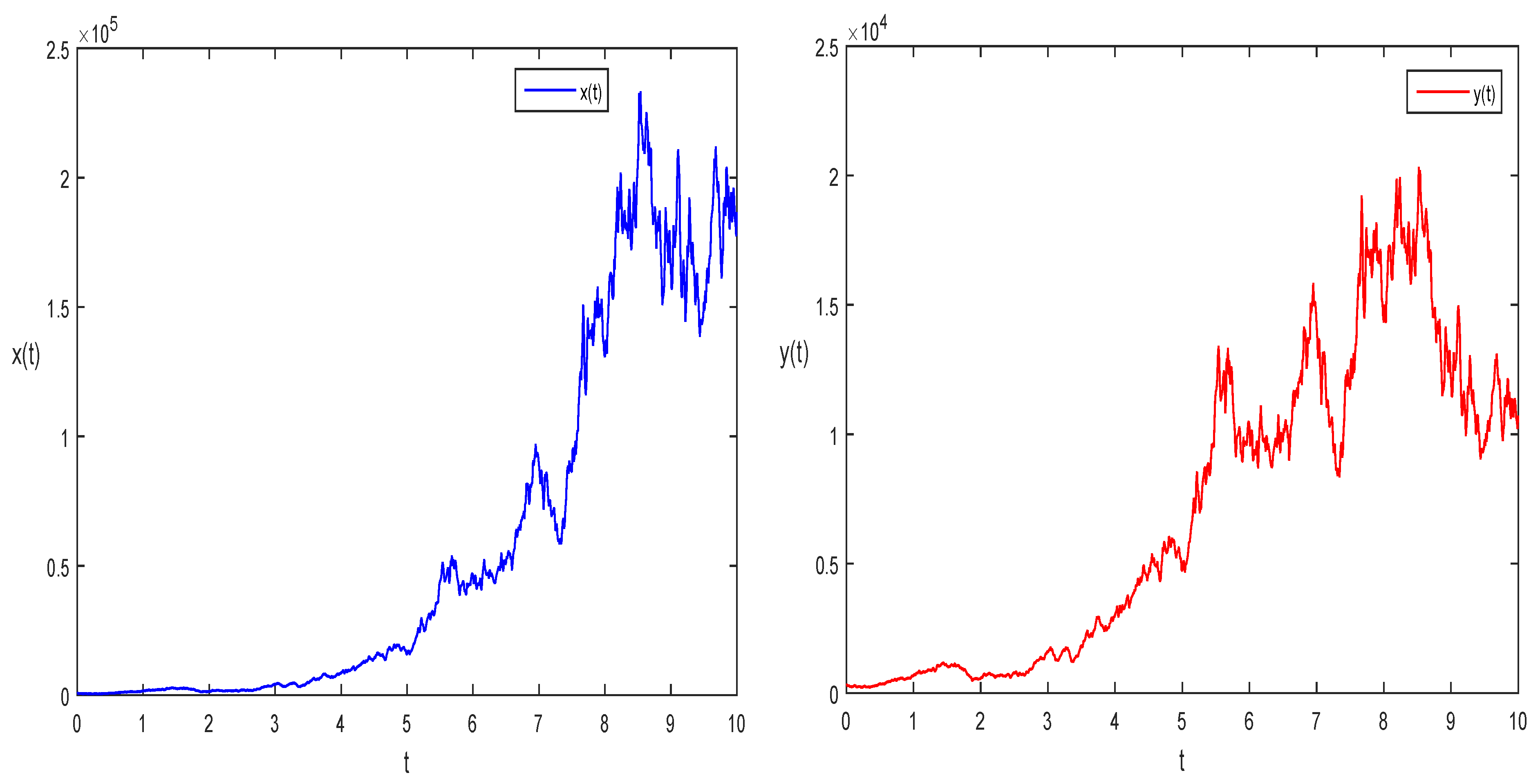

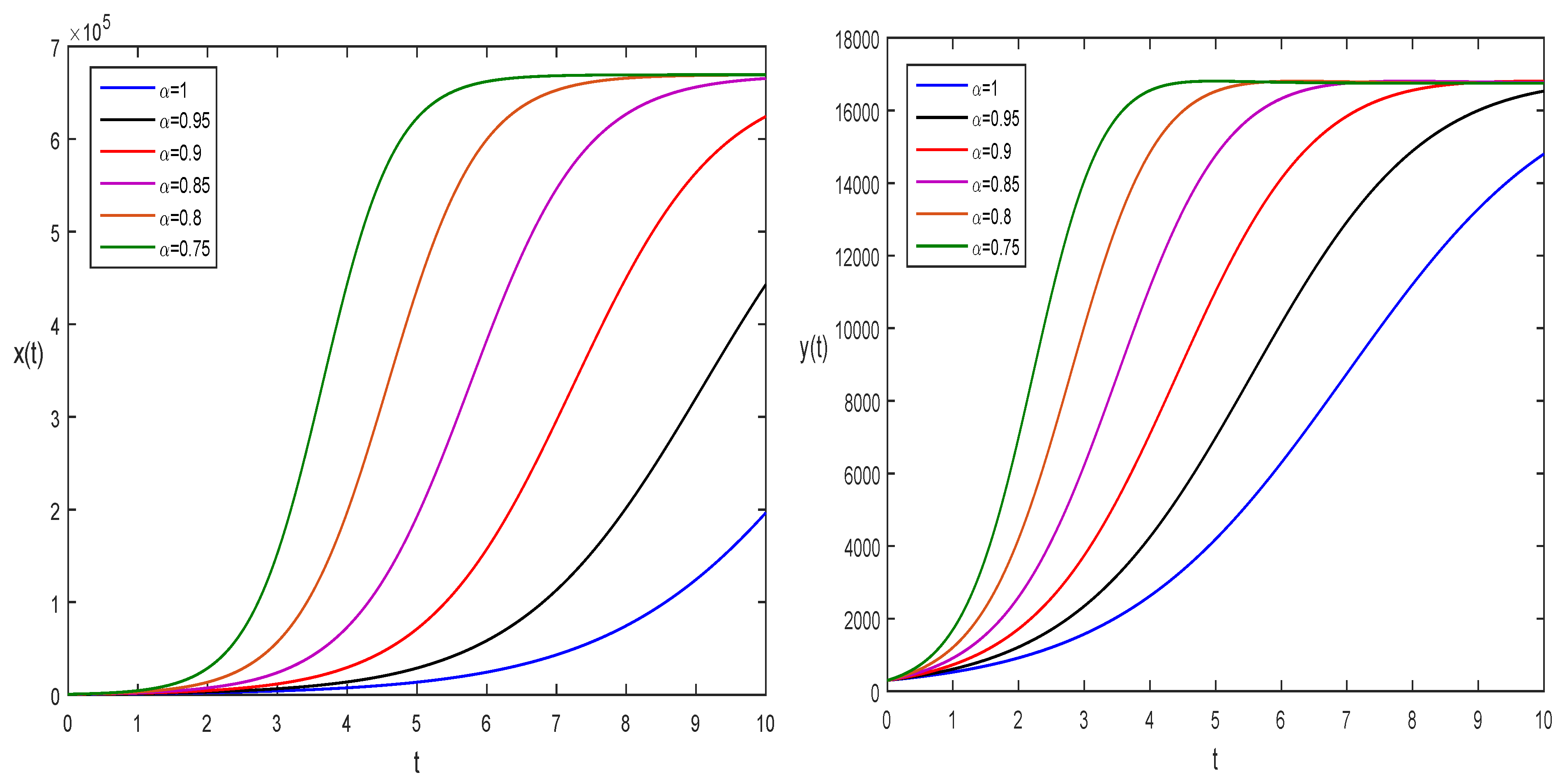

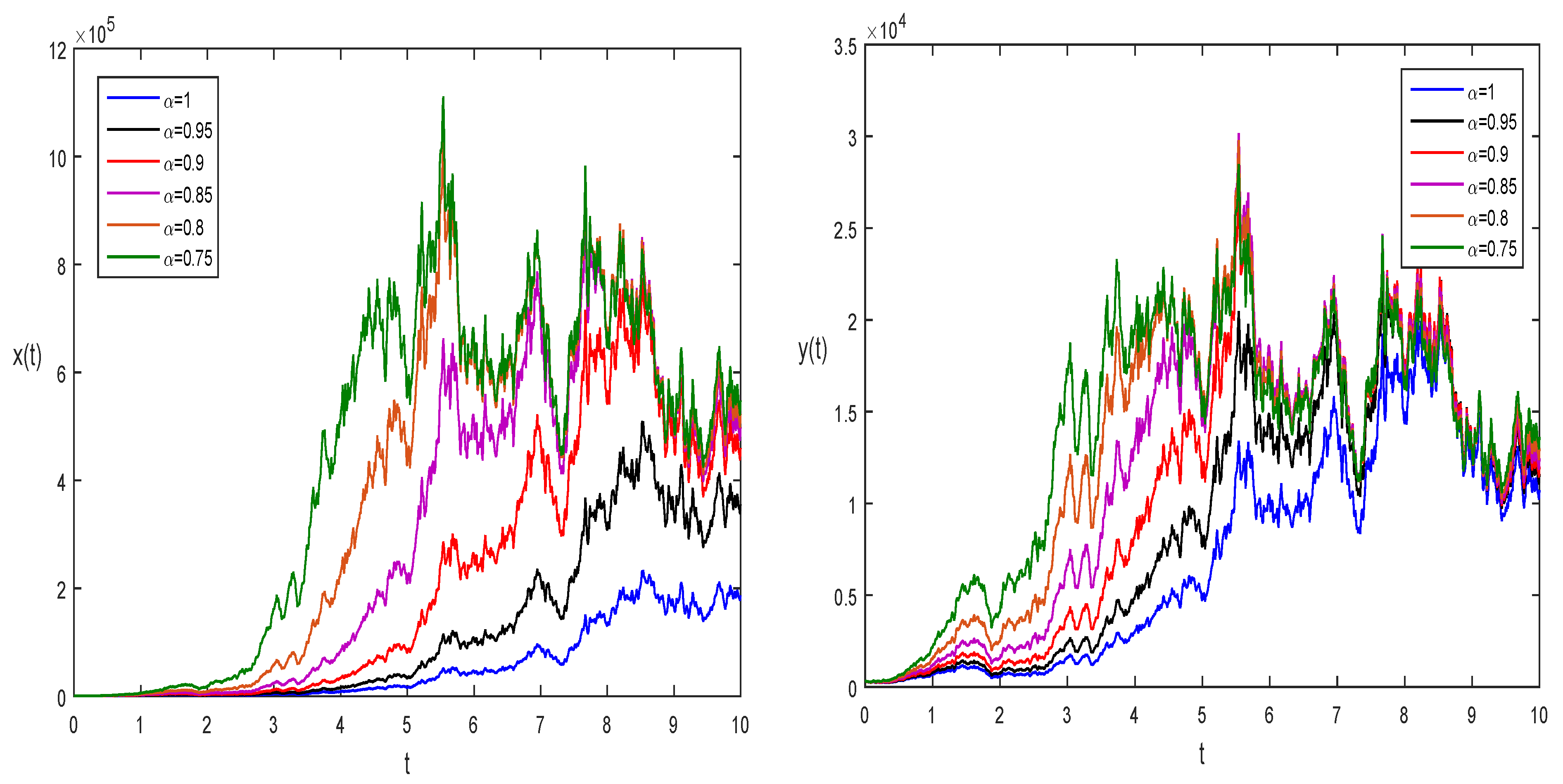

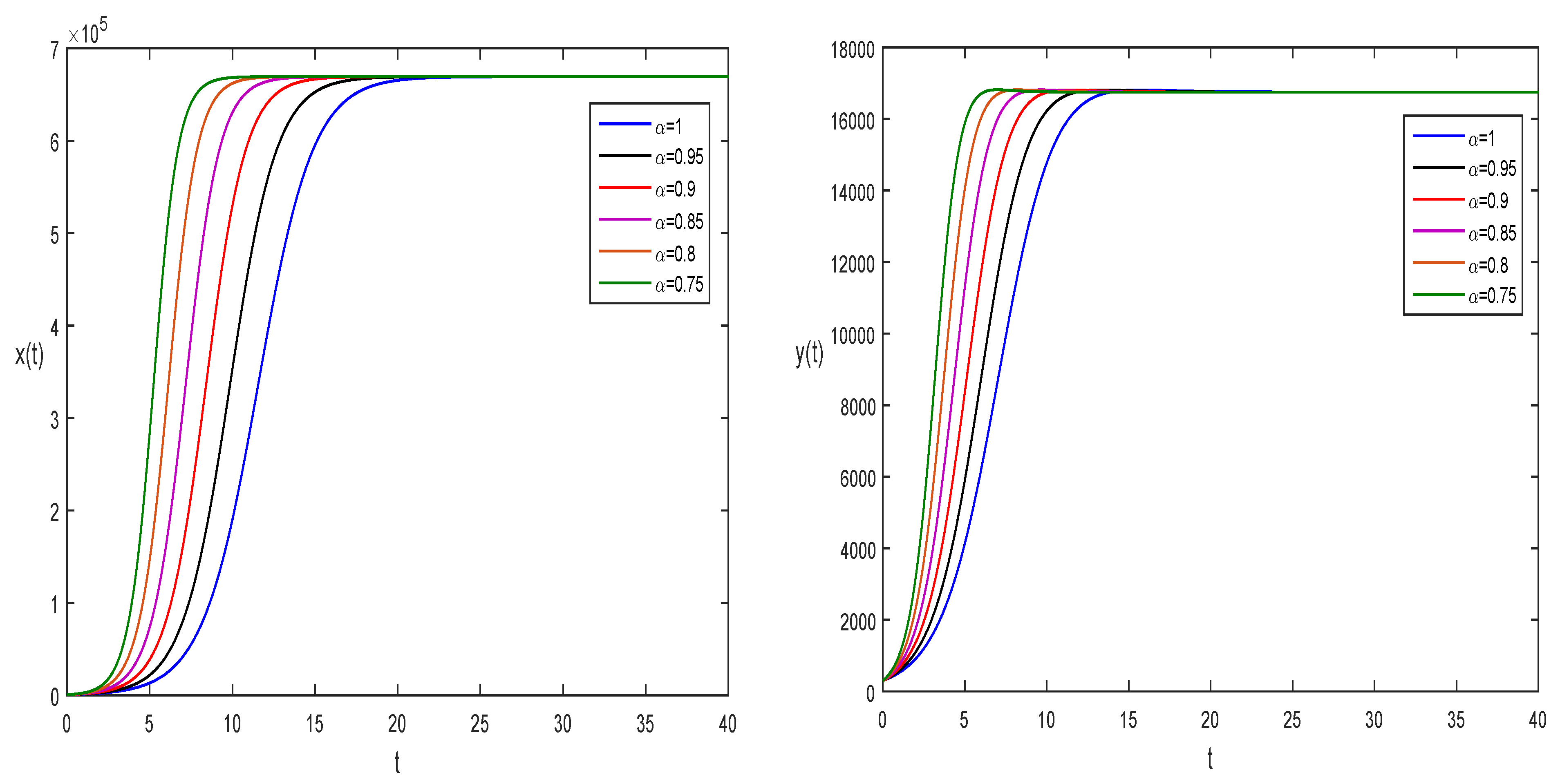

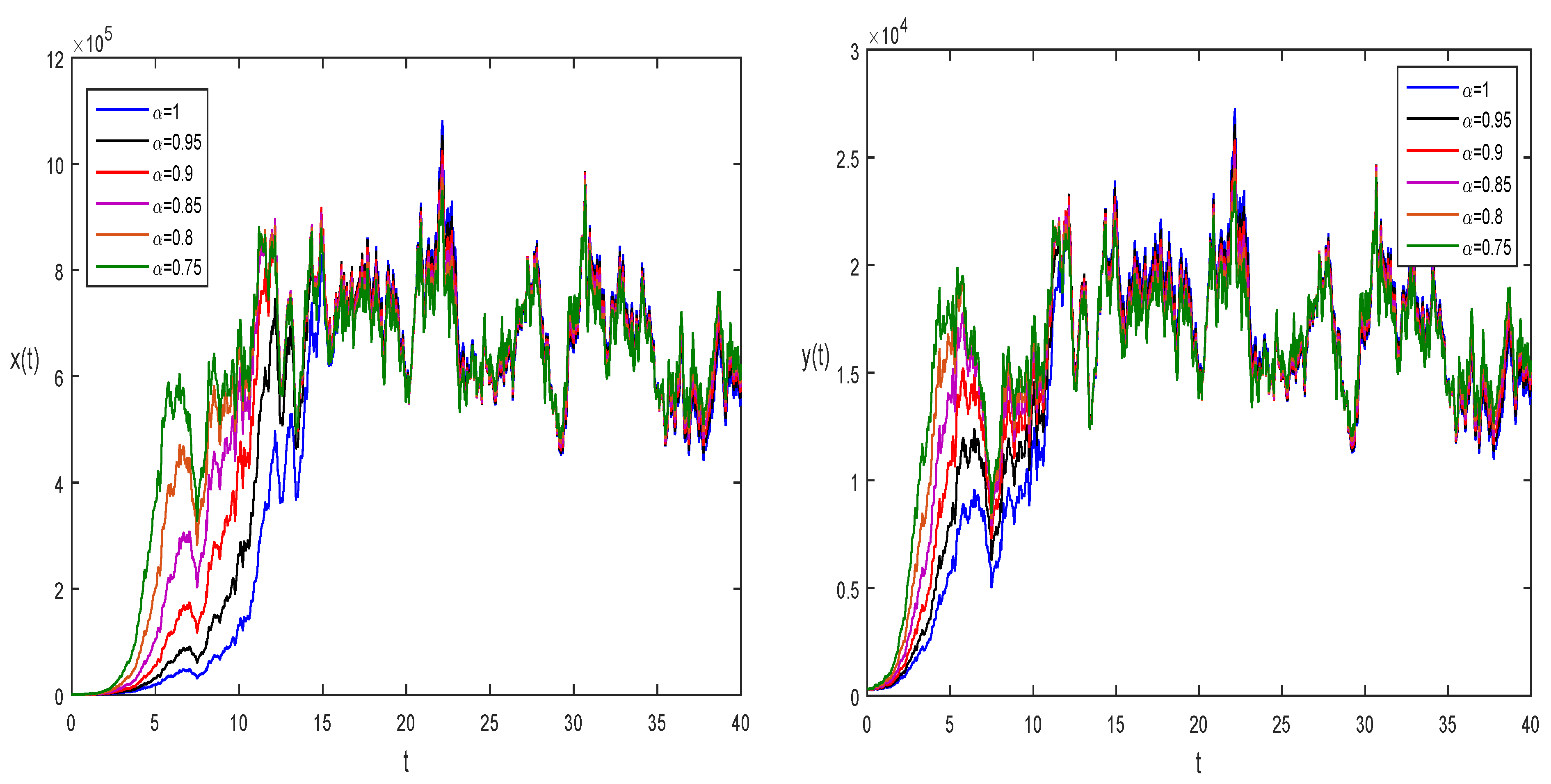

- ⋆

- It was anticipated that the increase in the number of banks could be accommodated logistically.

- ⋆

- There is not much difference between the commercial and rural banking sectors in terms of yearly profit.

3. Basics of Fractional Calculus

3.1. Atangana–Baleanu Fractional Model

3.2. Equilibria and Their Stability

3.3. Numerical Solution with Atangana–Baleanu Derivative

3.4. A Stochastic Competition Model

4. Numerical Results

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Hastings, A. (Ed.) Population Biology: Concepts and Models; Springer Science and Business Media: Berlin/Heidelberg, Germany, 2013. [Google Scholar]

- Ojk, Statistik Perbankan Indonesia 2004–2014. Available online: http://www.ojk.go.id/datastatistikperbankan-indonesia (accessed on 16 May 2015).

- Kim, J.; Lee, D.J.; Ahn, J. A dynamic competition analysis on the Korean mobile phone market using competitive diffusion model. Comput. Ind. Eng. 2006, 51, 174–182. [Google Scholar] [CrossRef]

- Michalakelis, C.; Christodoulos, C.; Varoutas, D.; Sphicopoulos, T. Dynamic estimation of markets exhibiting a preypredator behavior. Expert. Appl. 2012, 39, 7690–7700. [Google Scholar] [CrossRef]

- Lakka, S.; Michalakelis, C.; Varoutas, D.; Martakos, D. Competitive dynamics in the operating systems market: Modeling and policy implications. Technol Forecast Social Change. Comput. Math. Methods Med. 2013, 80, 88–105. [Google Scholar]

- Comes, C.A. Banking system: Three level Lotka-Volterra model. Procedia Econ. Financ. 2012, 3, 251–255. [Google Scholar] [CrossRef]

- Khan, M.A.; Azizah, M.; Ullah, S. A fractional model for the dynamics of competition between commercial and rural banks in Indonesia. Chaos Solitons Fractals 2019, 122, 32–46. [Google Scholar]

- Cai, G.Q.; Lin, Y.K. Stochastic analysis of the Lotka-Volterra model for ecosystems. Phys. Rev. E Stat. Nonlinear Soft Matter Phys. 2004, 70 Pt 1, 041910. [Google Scholar] [CrossRef]

- Ramanda, H.; Handari, B.D.; Aldila, D. Numerical simulation of stochastic model for deposit and loan volume based on the Lotka-Volterra model. Aip Conf. Proc. 2023, 2018, 020216. [Google Scholar]

- Arbi, S. Lembaga: Perbankan, Keuangan dan Pembiayaan; BPFE: Yogyakarta, Indonesia, 2013. [Google Scholar]

- Iskandar, S. Bank Dan Lembaga Keuangan Lainnya; Penerbit in Media: Jakarta, Indonesia, 2013. [Google Scholar]

- Owolabi, K.M.; Atangana, A. Mathematical analysis and computational experiments for an epidemic system with nonlocal and nonsingular derivative. Chaos Solitons Fractals 2019, 126, 41–49. [Google Scholar] [CrossRef]

- Atangana, A.; Khan, M.A. Validity of fractal derivative to capturing chaotic attractors. Chaos Solitons Fractals 2019, 126, 50–59. [Google Scholar] [CrossRef]

- Qureshi, S.; Atangana, A. Mathematical analysis of dengue fever outbreak by novel fractional operators with field data. Phys. A Stat. Mech. Its Appl. 2019, 526, 121127. [Google Scholar] [CrossRef]

- Mesgarani, H.; Rashidinia, J.; Aghdam, Y.E.; Nikan, O. Numerical treatment of the space fractional advection–dispersion model arising in groundwater hydrology. Comp. Appl. Math. 2021, 40, 22. [Google Scholar] [CrossRef]

- Oderinu, R.A.; Owolabi, J.A.; Taiwo, M. Approximate solutions of linear time-fractional differential equations. J. Math. Comput. Sci. 2023, 29, 60–72. [Google Scholar] [CrossRef]

- AlAhmad, R.; AlAhmad, Q.; Abdelhadi, A. Solution of fractional autonomous ordinary differential equations. J. Math. Comput. Sci. 2022, 27, 59–64. [Google Scholar] [CrossRef]

- Akram, T.; Abbas, M.; Ali, A. A numerical study on time fractional Fisher equation using an extended cubic B-spline approximation. J. Math. Comput. Sci. 2021, 22, 85–96. [Google Scholar] [CrossRef]

- Kilbas, A.A.; Srivastava, H.M.; Trujillo, J.J. Theory and Applications of Fractional Differential Equations, Volume 204 of North-Holland Mathematics Studies; Elsevier Science Inc.: New York, NY, USA, 2006. [Google Scholar]

- Podlubny, I. Fractional Differential Equations; Academic Press: New York, NY, USA, 1999. [Google Scholar]

- Wang, W.; Khan, M.A.; Fatmawati; Kumam, P.; Thounthong, P. A comparison study of bank data in fractional calculus. Chaos Solitons Fractals 2019, 126, 369–384. [Google Scholar] [CrossRef]

- Qureshi, S.; Yusuf, A. Fractional derivatives applied to MSEIR problems: Comparative study with real world data. Eur. J. Plus 2019, 134, 1–13. [Google Scholar] [CrossRef]

- Yusuf, A.; Qureshi, S.; Inc, M.; Aliyu, A.I.; Baleanu, D.; Shaikh, A.A. Two-strain epidemic model involving fractional derivative with Mittag-Leffler kernel. Chaos Interdiscip. Nonlinear Sci. 2018, 28, 123121. [Google Scholar] [CrossRef]

- Butt, A.I.K.; Imran, M.; Chamaleen, D.B.D.; Batool, S. Optimal control strategies for the reliable and competitive mathematical analysis of Covid-19 pandemic model. Math. Methods Appl. Sci. 2023, 46, 1528–1555. [Google Scholar] [CrossRef]

- Afzal, M.; Ismaeel, T.; Butt, A.I.K.; Farooq, Z.; Ahmad, R.; Khan, I. On the reducibility of a class of almost-periodic linear Hamiltonian systems and its application in Schr–dinger equation. AIMS Math. 2023, 8, 7471–7489. [Google Scholar] [CrossRef]

- Butt, A.I.K.; Ahmad, W.; Rafiq, M.; Baleanu, D. Numerical analysis of Atangana-Baleanu fractional model to understand the propagation of a novel corona virus pandemic. Alex. Eng. J. 2022, 61, 7007–7027. [Google Scholar] [CrossRef]

- Butt, A.I.K.; Imran, M.; Batool, S.; Nuwairan, M.A. Theoretical Analysis of a COVID-19 CF-Fractional Model to Optimally Control the Spread of Pandemic. Symmetry 2023, 15, 380. [Google Scholar] [CrossRef]

- Ali, A.; Khan, S.U.; Ali, I.; Khan, F.U. On dynamics of stochastic avian influenza model with asymptomatic carrier using spectral method. Math. Methods Appl. Sci. 2022, 45, 8230–8246. [Google Scholar] [CrossRef]

- Gul, N.; Khan, S.U.; Ali, I.; Khan, F.U. Transmission dynamic of stochastic hepatitis C model by spectral collocation method. Comput. Methods Biomech. Biomed. Eng. 2022, 25, 578–592. [Google Scholar] [CrossRef] [PubMed]

- Algehyne, E.A.; Khan, F.U.; Khan, S.U.; Jamshed, W.; Tag El Din, E.S.M. Dynamics of Stochastic Zika Virus with Treatment Class in Human Population via Spectral Method. Symmetry 2022, 14, 2137. [Google Scholar] [CrossRef]

- Khan, S.U.; Ali, I. Application of Legendre spectral-collocation method to delay differential and stochastic delay differential equation. AIP Adv. 2018, 8, 035301. [Google Scholar] [CrossRef]

- Khan, S.U.; Ali, I. Convergence and error analysis of a spectral collocation method for solving system of nonlinear Fredholm integral equations of second kind. Comput. Appl. Math. 2019, 38, 125. [Google Scholar] [CrossRef]

- Khan, S.U.; Ali, I. Applications of Legendre spectral collocation method for solving system of time delay differential equations. Adv. Mech. Eng. 2020, 12, 1–13. [Google Scholar] [CrossRef]

- Ali, I. Convergence analysis of spectral methods for integro-differential equations with vanishing proportional delays. J. Comput. Math. 2011, 29, 49–60. [Google Scholar] [CrossRef]

- Khan, S.U.; Ali, I. Numerical analysis of stochastic SIR model by Legendre spectral collocation method. Adv. Mech. Eng. 2019, 11, 1687814019862918. [Google Scholar] [CrossRef]

- Ali, I.; Khan, S.U. Analysis of stochastic delayed SIRS model with exponential birth and saturated incidence rate. Chaos Solitons Fractals 2020, 138, 110008. [Google Scholar] [CrossRef]

- Ali, I.; Khan, S.U. Threshold of stochastic SIRS epidemic model from infectious to susceptible class with saturated incidence rate using spectral method. Symmetry 2022, 14, 1838. [Google Scholar] [CrossRef]

- Ali, I.; Khan, S.U. Asymptotic Behavior of Three Connected Stochastic Delay Neoclassical Growth Systems Using Spectral Technique. Mathematics 2022, 10, 3639. [Google Scholar] [CrossRef]

- Ali, I.; Saleem, M.T. Applications of Orthogonal Polynomials in Simulations of Mass Transfer Diffusion Equation Arising in Food Engineering. Symmetry 2023, 15, 527. [Google Scholar] [CrossRef]

- Muhammad Altaf, K.; Atangana, A. Dynamics of Ebola Disease in the Framework of Different Fractional Derivatives. Entropy 2019, 21, 303. [Google Scholar] [CrossRef] [PubMed]

- Atangana, A.; Baleanu, D. New fractional derivatives with nonlocal and non-singular kernel: Theory and application to heat transfer model. Therm. Sci. 2016, 20, 763–769. [Google Scholar] [CrossRef]

- Zada, A.; Yar, M.; Li, T. Existence and stability analysis of nonlinear sequential coupled system of Caputo fractional differential equations with integral boundary conditions. Ann. Univ. Paedagog. Cracoviensis Stud. 2019, 17, 103–125. [Google Scholar] [CrossRef]

- Das, S.; Gupta, P.K. A mathematical model on fractional Lotka-Volterra equations. J. Theor. Biol. 2011, 277, 1–6. [Google Scholar] [CrossRef]

- Toufik, M.; Atangana, A. New numerical approximation of fractional derivative with non-local and non-singular kernel: Application to chaotic models. Eur. Phys. J. Plus 2017, 132, 444. [Google Scholar] [CrossRef]

- Morales-Delgado, V.F.; Gómez-Aguilar, J.F.; Saad, K.; Escobar Jiménez, R.F. Application of the Caputo-Fabrizio and Atangana-Baleanu fractional derivatives to mathematical model of cancer chemotherapy effect. Math. Methods Appl. Sci. 2019, 42, 1167–1193. [Google Scholar] [CrossRef]

- Owolabi, K.M. Numerical approach to fractional blow-up equations with Atangana-Baleanu derivative in Riemann-Liouville sense. Math. Model. Nat. Phenom. 2018, 13, 7. [Google Scholar] [CrossRef]

- Alb Lupaş, A.; Cătaş, A. Applications of the Atangana–Baleanu Fractional Integral Operator. Symmetry 2022, 14, 630. [Google Scholar] [CrossRef]

- Angstmann, C.N.; Jacobs, B.A.; Henry, B.I.; Xu, Z. Intrinsic Discontinuities in Solutions of Evolution Equations Involving Fractional Caputo–Fabrizio and Atangana–Baleanu Operators. Mathematics 2020, 8, 2023. [Google Scholar] [CrossRef]

- Sabatier, J.; Farges, C.; Tartaglione, V. Some Alternative Solutions to Fractional Models for Modelling Power Law Type Long Memory Behaviours. Mathematics 2020, 8, 196. [Google Scholar] [CrossRef]

- Baleanu, D.; Fernandez, A. On Fractional Operators and Their Classifications. Mathematics 2019, 7, 830. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ali, I.; Khan, S.U. A Dynamic Competition Analysis of Stochastic Fractional Differential Equation Arising in Finance via Pseudospectral Method. Mathematics 2023, 11, 1328. https://doi.org/10.3390/math11061328

Ali I, Khan SU. A Dynamic Competition Analysis of Stochastic Fractional Differential Equation Arising in Finance via Pseudospectral Method. Mathematics. 2023; 11(6):1328. https://doi.org/10.3390/math11061328

Chicago/Turabian StyleAli, Ishtiaq, and Sami Ullah Khan. 2023. "A Dynamic Competition Analysis of Stochastic Fractional Differential Equation Arising in Finance via Pseudospectral Method" Mathematics 11, no. 6: 1328. https://doi.org/10.3390/math11061328

APA StyleAli, I., & Khan, S. U. (2023). A Dynamic Competition Analysis of Stochastic Fractional Differential Equation Arising in Finance via Pseudospectral Method. Mathematics, 11(6), 1328. https://doi.org/10.3390/math11061328