Impact of Capital Position and Financing Strategies on Encroachment in Supply Chain Dynamics

Abstract

1. Introduction

2. Literature Review

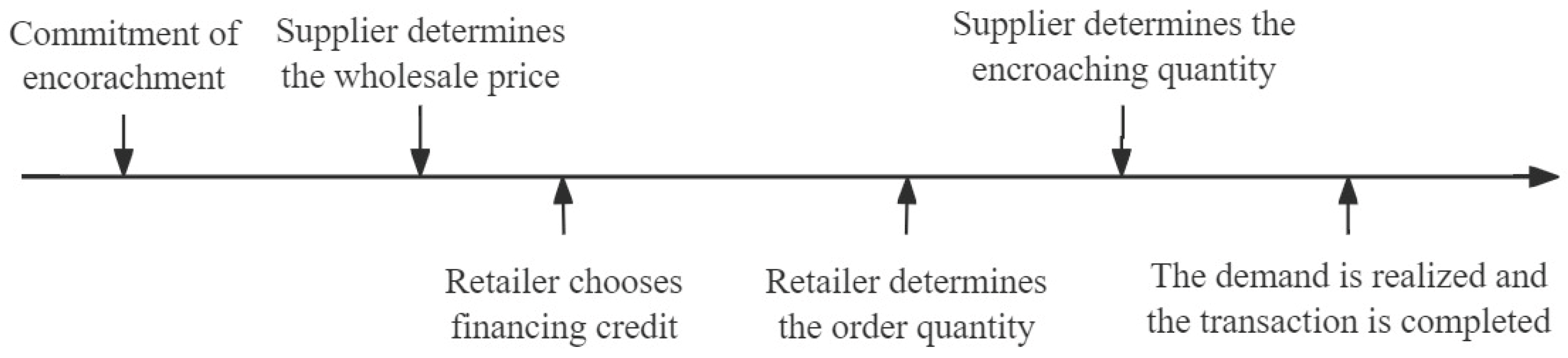

3. Assumptions and Basic Model

3.1. Model Assumptions

3.2. Benchmark Analysis: The Retailer without Financing Options

- (1)

- when the entry cost is high, i.e., , the supplier’s best choice is non-encroachment;

- (2)

- when the entry cost is medium, i.e., , if , the supplier encroaches; if , the supplier never encroach;

- (3)

- when the entry cost is low, i.e., , the supplier’s best choice is encroachment.

- (1)

- ;

- (2)

- when , ; when , ; when , ;

- (3)

- when , ; when , .

4. Equilibrium When Considering Retailer’s Financing Options

4.1. Equilibria under Trade Credit

4.2. Equilibria under Bank Credit

5. Impacts of Financing Strategies and Encroachment

5.1. The Effects of Financing Strategies

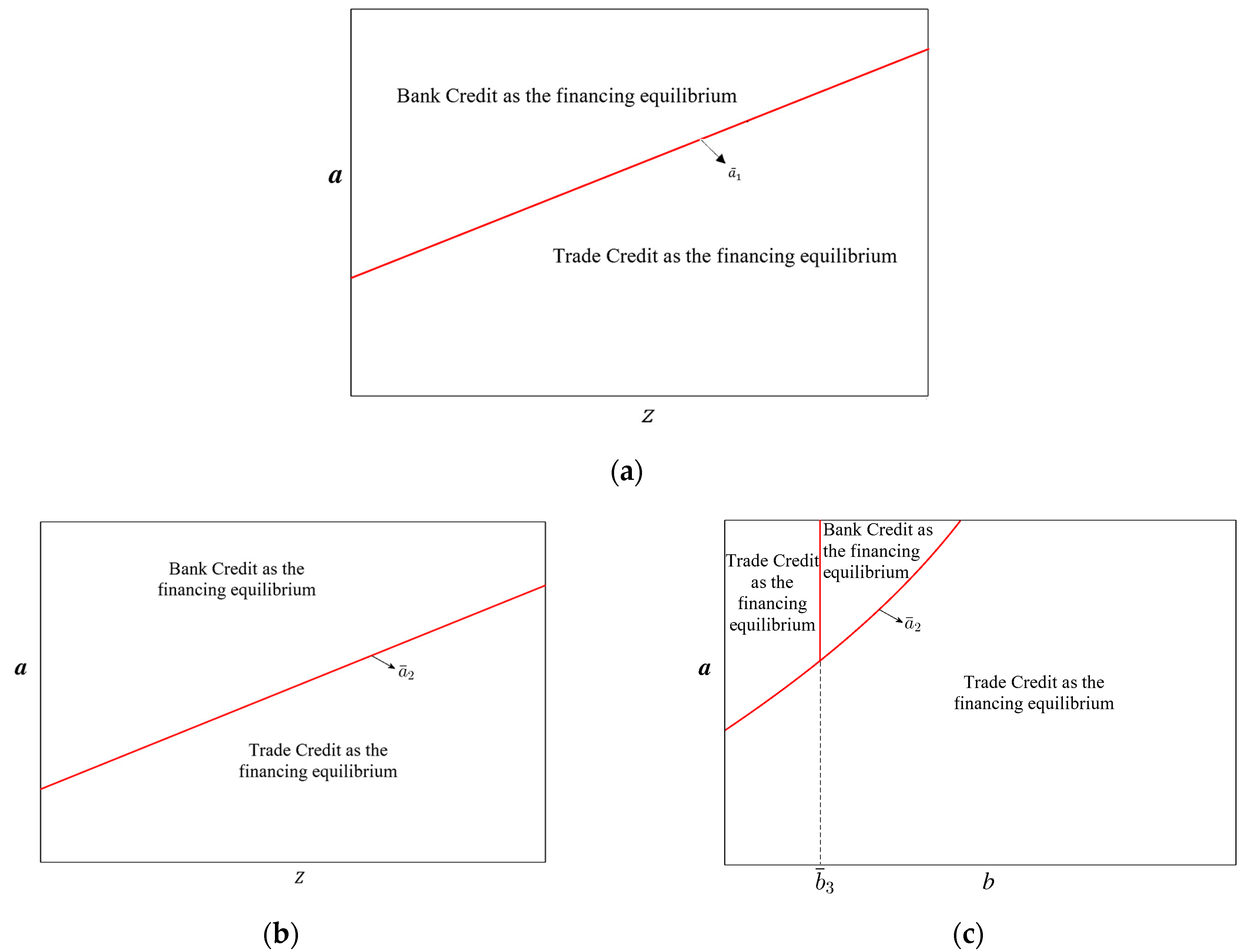

- (1)

- Without encroachment, when , the retailer always chooses trade credit; when , the retailer chooses bank credit;

- (2)

- With encroachment, the retailer’s financing decision is jointly determined by the demand volatility rate and the channel substitution rate . When , the retailer always chooses trade credit financing. When , the retailer chooses trade credit financing if b is low and otherwise the retailer chooses bank credit financing.

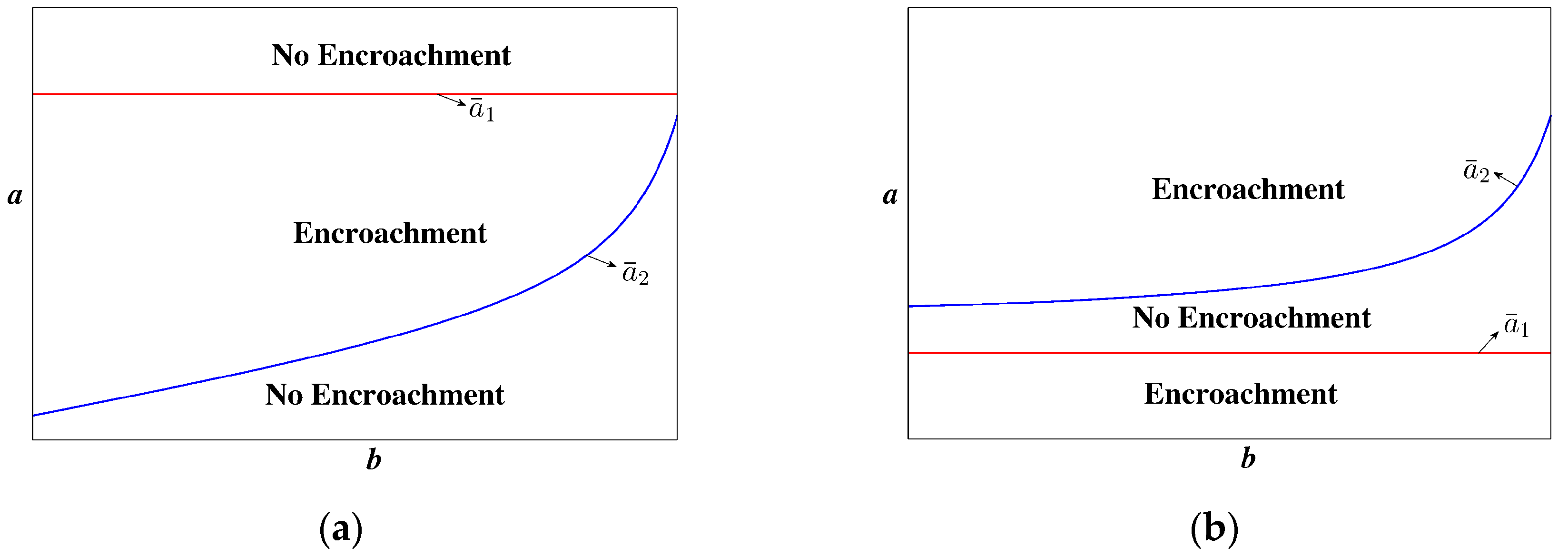

5.2. The Effects of Supplier Encroachment

- (1)

- the wholesale price under supplier encroachment is smaller than that under no encroachment;

- (2)

- when , , , the retailer’s order quantity under supplier encroachment is smaller than that under no encroachment; otherwise, the retailer’s order quantity under supplier encroachment is higher than that under no encroachment.

6. Conclusions

- (1)

- When the supplier does not compete in the retail market, the retailer opts for trade credit financing when the demand volatility is low. The threshold is determined by the retailer’s initial capital and the production cost. When the supplier encroaches, the rate of product substitution becomes a crucial factor in determining the retailer’s choice of credit financing. If the demand volatility and product substitution rates are high, the retailer will opt for bank credit financing. Otherwise, they will choose trade credit financing. The supplier always benefits from the choice of trade credit financing when both financing options are available, whether they are utilized or not;

- (2)

- The supplier’s wholesale price under supplier encroachment is lower than that under no encroachment. The retailer’s order quantity under supplier encroachment is also lower than that under no encroachment, except when the retailer’s initial capital and the product substitution rate are small, and the demand volatility rate is medium;

- (3)

- The supplier’s decision to encroach is primarily determined by the entry cost when the retailer has no access to credit. The supplier encroaches on the retail market when the entry cost is low but otherwise refrains from doing so. When both financing options are available, the supplier’s decision to encroach is jointly determined by the entry cost, the demand volatility rate, and the retailer’s initial working capital. The supplier never enters the market when the entry cost is too high; however, they always enter the market when the entry cost is very low. When the entry cost is moderate, the supplier’s decision on encroachment varies from no encroachment to encroachment, or from no encroachment to encroachment, and then to encroachment again, with the increase in demand volatility, and depending on the retailer’s initial working capital.

- (1)

- The retailer should consider the level of demand volatility and the presence of product substitution when making financing decisions. When the supplier does not compete in the retail market, trade credit financing may be preferable under low demand volatility. However, if the supplier encroaches and demand volatility is high, it might be more beneficial to opt for bank credit financing. The retailer should carefully assess these factors when choosing the financing strategy;

- (2)

- The supplier needs to carefully consider the impact of encroachment on wholesale pricing and order quantity. Under supplier encroachment, the wholesale price tends to decrease, and the retailer may order smaller quantities, particularly when initial capital and product substitution rates are low, and demand volatility is medium. The supplier should evaluate these factors to adjust his pricing and inventory strategy accordingly;

- (3)

- The supplier should evaluate the entry cost, demand volatility, and the retailer’s working capital when considering entering the retail market. When the retailer has no access to credit, the decision to encroach is primarily influenced by the entry cost; however, if both financing options are available, then the supplier should consider more factors. The supplier should also assess these factors to determine the optimal timing and conditions for entering the retail market.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

- (1)

- when , we have ;

- (2)

- when , if or ; if .

- (1)

- when , we have and ;

- (2)

- when , we have and if or ; we have and if .

- (1)

- if or , substitute and into the supplier’s expected profit function, where . Then, increases with in , and decreases in . When , , so the optimal results are , , . When , decreases with , so the optimal results are , , . Then, the retailer’s minimum initial working capital is , and we define .

- (2)

- If , substitute and into the supplier’s profit function, where . Because increases with in , the optimal results are , and .

- (1)

- when , we have , , ;

- (2)

- when , we have , , . □

- (1)

- when , , , , ;

- (2)

- when , , , , . □

- (1)

- when , , , , , =;

- (2)

- when , , , , , =. □

- (1)

- When , three scenarios are discussed as follows:

- (2)

- When , three scenarios are discussed as follows:

- (1)

- When the entry cost is high, i.e., , the supplier experiences economic damage from the encroachment;

- (2)

- When , if , the supplier experiences economic damage from the encroachment; if , the supplier’s encroachment decision varies from encroachment to no encroachment, and then to encroachment with the increase in ;

- (3)

- When , the supplier benefits from encroachment when is high and does not otherwise encroach;

- (4)

- When , if , the supplier’s encroachment decision varies from encroachment to no encroachment, and then to encroachment with the increase in ; if , the supplier always benefits from encroachment;

- (5)

- When the entry cost is low, i.e., , the supplier always benefits from encroachment. □

References

- Arya, A.; Mittendorf, B.; Sappington, D.E. The bright side of supplier encroachment. Market.Sci. 2007, 26, 651–659. [Google Scholar] [CrossRef]

- Guan, H.; Gurnani, H.; Geng, X.; Luo, Y. Strategic inventory and supplier encroachment. Manuf. Serv. Oper. Manag. 2019, 21, 536–555. [Google Scholar] [CrossRef]

- Emtehani, F.; Nahavandi, N.; Rafiei, F.M. Trade credit financing for supply chain coordination under financial challenges: A multi-leader–follower game approach. Financ. Innov. 2023, 9, 6. [Google Scholar] [CrossRef]

- Li, Y.; Wu, D.; Dolgui, A. Optimal trade credit coordination policy in dual-channel supply chain with consumer transfer. Int. J. Prod. Res. 2022, 60, 4641–4653. [Google Scholar] [CrossRef]

- Zhang, L.-H.; Zhang, C.; Yang, J. Impacts of power structure and financing choice on manufacturer’s encroachment in a supply chain. Ann. Oper. Res. 2023, 322, 273–319. [Google Scholar] [CrossRef]

- An, S.; Li, B.; Song, D.; Chen, X. Green credit financing versus trade credit financing in a supply chain with carbon emission limits. Eur. J. Oper. Res. 2021, 292, 125–142. [Google Scholar] [CrossRef]

- Yan, N.; He, X.; Liu, Y. Financing the capital-constrained supply chain with loss aversion: Supplier finance vs. supplier investment. Omega 2019, 88, 162–178. [Google Scholar] [CrossRef]

- Yuan, X.; Bi, G.; Fei, Y.; Liu, L. Supply chain with random yield and financing. Omega 2021, 102, 102334. [Google Scholar] [CrossRef]

- Deng, S.; Fu, K.; Xu, J.; Zhu, K. The supply chain effects of trade credit under uncertain demands. Omega 2021, 98, 102113. [Google Scholar] [CrossRef]

- Zhang, B.; Wu, D.D.; Liang, L. Trade credit model with customer balking and asymmetric market information. Transp. Res. Part E Logist. Transp. Rev. 2018, 110, 31–46. [Google Scholar] [CrossRef]

- Cai, G.; Chen, X.; Xiao, Z. The roles of bank and trade credits: Theoretical analysis and empirical evidence. Prod. Oper. Manag. 2014, 23, 583–598. [Google Scholar] [CrossRef]

- Jing, B.; Chen, X.; Cai, G. Equilibrium financing in a distribution channel with capital constraint. Prod. Oper. Manag. 2012, 21, 1090–1101. [Google Scholar] [CrossRef]

- Kouvelis, P.; Zhao, W. Financing the newsvendor: Supplier vs. bank, and the structure of optimal trade credit contracts. Oper. Res. 2012, 60, 566–580. [Google Scholar] [CrossRef]

- Hou, R.; Li, W.; Lin, X.; Zhao, Y. Impact of quality decisions on information sharing with supplier encroachment. RAIRO-Oper. Res. 2022, 56, 145–164. [Google Scholar] [CrossRef]

- Guan, X.; Liu, B.; Chen, Y.J.; Wang, H. Inducing supply chain transparency through supplier encroachment. Prod. Oper. Manag. 2020, 29, 725–749. [Google Scholar] [CrossRef]

- Mittendorf, B.; Shin, J.; Yoon, D.-H. Manufacturer marketing initiatives and retailer information sharing. Quant. Mark. Econ. 2013, 11, 263–287. [Google Scholar] [CrossRef]

- Tang, Y.; Sethi, S.P.; Wang, Y. Games of supplier encroachment channel selection and e-tailer’s information sharing. Prod. Oper. Manag. 2023, 32, 3650–3664. [Google Scholar] [CrossRef]

- Xu, J.; Zhou, X.; Zhang, J.; Long, D.Z. The optimal channel structure with retail costs in a dual-channel supply chain. Int. J. Prod. Res. 2021, 59, 47–75. [Google Scholar] [CrossRef]

- Hotkar, P.; Gilbert, S.M. Supplier encroachment in a nonexclusive reselling channel. Manag. Sci. 2021, 67, 5821–5837. [Google Scholar] [CrossRef]

- Huang, S.; Guan, X.; Chen, Y.J. Retailer information sharing with supplier encroachment. Prod. Oper. Manag. 2018, 27, 1133–1147. [Google Scholar] [CrossRef]

- Ha, A.; Long, X.; Nasiry, J. Quality in supply chain encroachment. Manuf. Serv. Oper. Manag. 2016, 18, 280–298. [Google Scholar] [CrossRef]

- Cao, E.; Qin, L. Supplier encroachment deterrence through a target-oriented retailer. Comput. Ind. Eng. 2024, 188, 109884. [Google Scholar] [CrossRef]

- Liang, L.; Chen, J.; Yao, D.Q. Switching to profitable outside options under supplier encroachment. Prod. Oper. Manag. 2023, 32, 2788–2804. [Google Scholar] [CrossRef]

- Elahi, H.; Pun, H.; Ghamat, S. The impact of capacity information on supplier encroachment. Omega 2023, 117, 102818. [Google Scholar] [CrossRef]

- Ghosh, S.K.; Seikh, M.R.; Chakrabortty, M. Coordination and strategic decision making in a stochastic dual-channel supply chain based on customers’ channel preferences. Int. J. Syst. Assur. Eng. 2024, 15, 1–23. [Google Scholar] [CrossRef]

- Bhunia, S.; Das, S.K.; Jablonsky, J.; Roy, S.K. Evaluating carbon cap and trade policy effects on a multi-period bi-objective closed-loop supply chain in retail management under mixed uncertainty: Towards greener horizons. Expert. Syst. Appl. 2024, 250, 123889. [Google Scholar] [CrossRef]

- Maruthasalam, A.P.P.; Balasubramanian, G. Supplier encroachment in the presence of asymmetric retail competition. Int. J. Prod. Econ. 2023, 264, 108961. [Google Scholar] [CrossRef]

- Zhang, J.; Li, S.; Zhang, S.; Dai, R. Manufacturer encroachment with quality decision under asymmetric demand information. Eur. J. Oper. Res. 2019, 273, 217–236. [Google Scholar] [CrossRef]

- Zhang, S.; Zhang, J.; Zhu, G. Retail service investing: An anti-encroachment strategy in a retailer-led supply chain. Omega 2019, 84, 212–231. [Google Scholar] [CrossRef]

- Yao, Y.; Zhang, J.; Fan, X. Strategic pricing: An anti-encroachment policy of retailer with uncertainty in retail service. Eur. J. Oper. Res. 2022, 302, 144–157. [Google Scholar] [CrossRef]

- Chod, J.; Lyandres, E.; Yang, S.A. Trade credit and supplier competition. J. Financ. Econ. 2019, 131, 484–505. [Google Scholar] [CrossRef]

- Wu, D.; Zhang, B.; Baron, O. A trade credit model with asymmetric competing retailers. Prod. Oper. Manag. 2019, 28, 206–231. [Google Scholar] [CrossRef]

- Yang, S.A.; Birge, J.R. Trade credit, risk sharing, and inventory financing portfolios. Manag. Sci. 2018, 64, 3667–3689. [Google Scholar] [CrossRef]

- Chen, X.; Qi, L.; Shen, Z.-J.M.; Xu, Y. The value of trade credit under risk controls. Int. J. Prod. Res. 2021, 59, 2498–2521. [Google Scholar] [CrossRef]

- Tang, C.S.; Yang, S.A.; Wu, J. Sourcing from suppliers with financial constraints and performance risk. Manuf. Serv. Oper. Manag. 2018, 20, 70–84. [Google Scholar] [CrossRef]

- Alan, Y.; Gaur, V. Operational investment and capital structure under asset-based lending. Manuf. Serv. Oper. Manag. 2018, 20, 637–654. [Google Scholar] [CrossRef]

- Phan, D.A.; Vo, T.L.H.; Lai, A.N. Supply chain coordination under trade credit and retailer effort. Int. J. Prod. Res. 2019, 57, 2642–2655. [Google Scholar] [CrossRef]

- Wang, Z.; Zhao, L.; Shao, Y.; Wen, X. Reputation compensation for incentive alignment in a supply chain with trade credit under information asymmetry. Ann. Oper. Res. 2023, 331, 581–604. [Google Scholar] [CrossRef]

- Hasan, M.M.; Alam, N. Asset redeployability and trade credit. Int. Rev. Financ. Anal. 2022, 80, 102024. [Google Scholar] [CrossRef]

- Peura, H.; Yang, S.A.; Lai, G. Trade credit in competition: A horizontal benefit. Manuf. Serv. Oper. Manag. 2017, 19, 263–289. [Google Scholar] [CrossRef]

- Lee, H.-H.; Zhou, J.; Wang, J. Trade credit financing under competition and its impact on firm performance in supply chains. Manuf. Serv. Oper. Manag. 2018, 20, 36–52. [Google Scholar] [CrossRef]

- Sun, S.; Hua, S.; Liu, Z. Navigating default risk in supply chain finance: Guidelines based on trade credit and equity vendor financing. Transport. Res. E-log. 2024, 182, 103410. [Google Scholar] [CrossRef]

- Jani, M.Y.; Betheja, M.R.; Chaudhari, U.; Sarkar, B. Effect of future price increase for products with expiry dates and price-sensitive demand under different payment policies. Mathematics 2023, 11, 263. [Google Scholar] [CrossRef]

- Ruan, P.; Huang, Y.-F.; Weng, M.-W. Impact of COVID-19 on Supply Chains: A Hybrid Trade Credit Policy. Mathematics 2022, 10, 1209. [Google Scholar] [CrossRef]

- Zhang, L.-H.; Zhang, C. Manufacturer encroachment with capital-constrained competitive retailers. Eur. J. Oper. Res. 2022, 296, 1067–1083. [Google Scholar] [CrossRef]

- Xu, L.; Luo, Y.; Shi, J.; Liu, L. Credit financing and channel encroachment: Analysis of distribution choice in a dual-channel supply chain. Oper. Res-Ger. 2022, 22, 3925–3944. [Google Scholar] [CrossRef]

- Hsiao, L.; Chen, Y.-J.; Xiong, H.; Liu, H. Incentives for disclosing the store brand supplier. Omega 2022, 109, 102590. [Google Scholar] [CrossRef]

- Li, Q.-X.; Ji, H.-M.; Huang, Y.-M. The information leakage strategies of the supply chain under the block chain technology introduction. Omega 2022, 110, 102616. [Google Scholar] [CrossRef]

- Shamir, N.; Shin, H. Public forecast information sharing in a market with competing supply chains. Manag. Sci. 2016, 62, 2994–3022. [Google Scholar] [CrossRef]

| Author(s) | Supply Encroachment | Trade Credit | Bank Credit | Initial Working Capital |

|---|---|---|---|---|

| Arya et al. (2007) [1] | √ | X | X | X |

| Zhang et al. (2023) [5] | √ | √ | √ | X |

| Yuan et al. (2021) [8] | X | √ | X | √ |

| Kouvelis and Zhao (2012) [13] | X | √ | √ | √ |

| Jing et al. (2012) [12] | X | √ | √ | √ |

| Deng et al. (2021) [9] | X | √ | √ | X |

| Phan, et al. (2019) [37] | X | √ | X | X |

| Guan et al. (2020) [15] | √ | X | X | X |

| Lee et al. (2018) [41] | X | √ | X | X |

| Huang et al. (2018) [20] | √ | X | X | X |

| Hotkar et al. (2021) [19] | √ | X | X | X |

| Maruthasalam and Balasubramanian (2023) [27] | √ | X | X | X |

| Xu et al. (2022) [46] | √ | √ | √ | X |

| Zhang and Zhang (2022) [45] | √ | √ | √ | X |

| Our study | √ | √ | √ | √ |

| Notation | Explanation |

|---|---|

| Supplier | |

| Retailer | |

| Retailer’s initial working capital | |

| Market state, denotes low market demand, denotes high market demand | |

| ’s retail price, | |

| ’s sales or order quantity, | |

| Channel substitution rate | |

| is the measure of demand volatility | |

| Supplier’s fixed costs in establishing a direct sales channel | |

| Wholesale price | |

| ’s profit with financing unde strategy, where donates without financing, donates bank credit financing, donates trade credit financing; where donates non-encroachment, donates encroachment |

| Case NN | Case NE | |||

|---|---|---|---|---|

| 0.1 | 0.15 | 0.499 | 0.226 | 0.051 | ||||||

| 0.2 | 0.25 | 0.498 | 0.205 | 0.479 | 0.041 | |||||

| 0.3 | 0.35 | 0.496 | 0.185 | 0.472 | ||||||

| 0.4 | 0.45 | 0.493 | 0.166 | 0.466 |

| Case TN | Case TE | |||

|---|---|---|---|---|

| 0.1 | 0.1 | 0.1 | 0.499 | 0.226 | 0.062 | ||||||

| 0.2 | 0.3 | 0.4 | 0.498 | 0.205 | 0.479 | 0.059 | |||||

| 0.3 | 0.5 | 0.7 | 0.496 | 0.185 | 0.472 | ||||||

| 0.4 | 0.7 | 1 | 0.493 | 0.167 | 0.467 |

| Case BN | Case BE | |

|---|---|---|

| 0.2 | 0.498 | 0.205 | 0.059 | ||||||

| 0.4 | 0.493 | 0.167 | 0.467 | 0.050 | |||||

| 0.6 | 0.488 | 0.129 | 0.461 | ||||||

| 0.8 | 0.486 | 0.083 | 0.467 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhu, Q.; Wang, C.; Zhang, B. Impact of Capital Position and Financing Strategies on Encroachment in Supply Chain Dynamics. Mathematics 2024, 12, 1830. https://doi.org/10.3390/math12121830

Zhu Q, Wang C, Zhang B. Impact of Capital Position and Financing Strategies on Encroachment in Supply Chain Dynamics. Mathematics. 2024; 12(12):1830. https://doi.org/10.3390/math12121830

Chicago/Turabian StyleZhu, Qiuying, Ce Wang, and Bin Zhang. 2024. "Impact of Capital Position and Financing Strategies on Encroachment in Supply Chain Dynamics" Mathematics 12, no. 12: 1830. https://doi.org/10.3390/math12121830

APA StyleZhu, Q., Wang, C., & Zhang, B. (2024). Impact of Capital Position and Financing Strategies on Encroachment in Supply Chain Dynamics. Mathematics, 12(12), 1830. https://doi.org/10.3390/math12121830