Assessing Mutual Fund Performance in China: A Sector Weight-Based Approach

Abstract

1. Introduction

2. Literature Review and Hypotheses

2.1. New Measures of Stock-Picking and Market-Timing Skill

2.2. Learning Stock Picking and Market Timing Skills

2.3. Stock-Picking and Market-Timing Skill and Job Security

3. Data and Methodology

3.1. Data

3.2. Methodology

3.2.1. Skill and Fund Performance

3.2.2. Learning

3.2.3. Stock-Picking and Market-Timing Skills and Job Security

4. Results

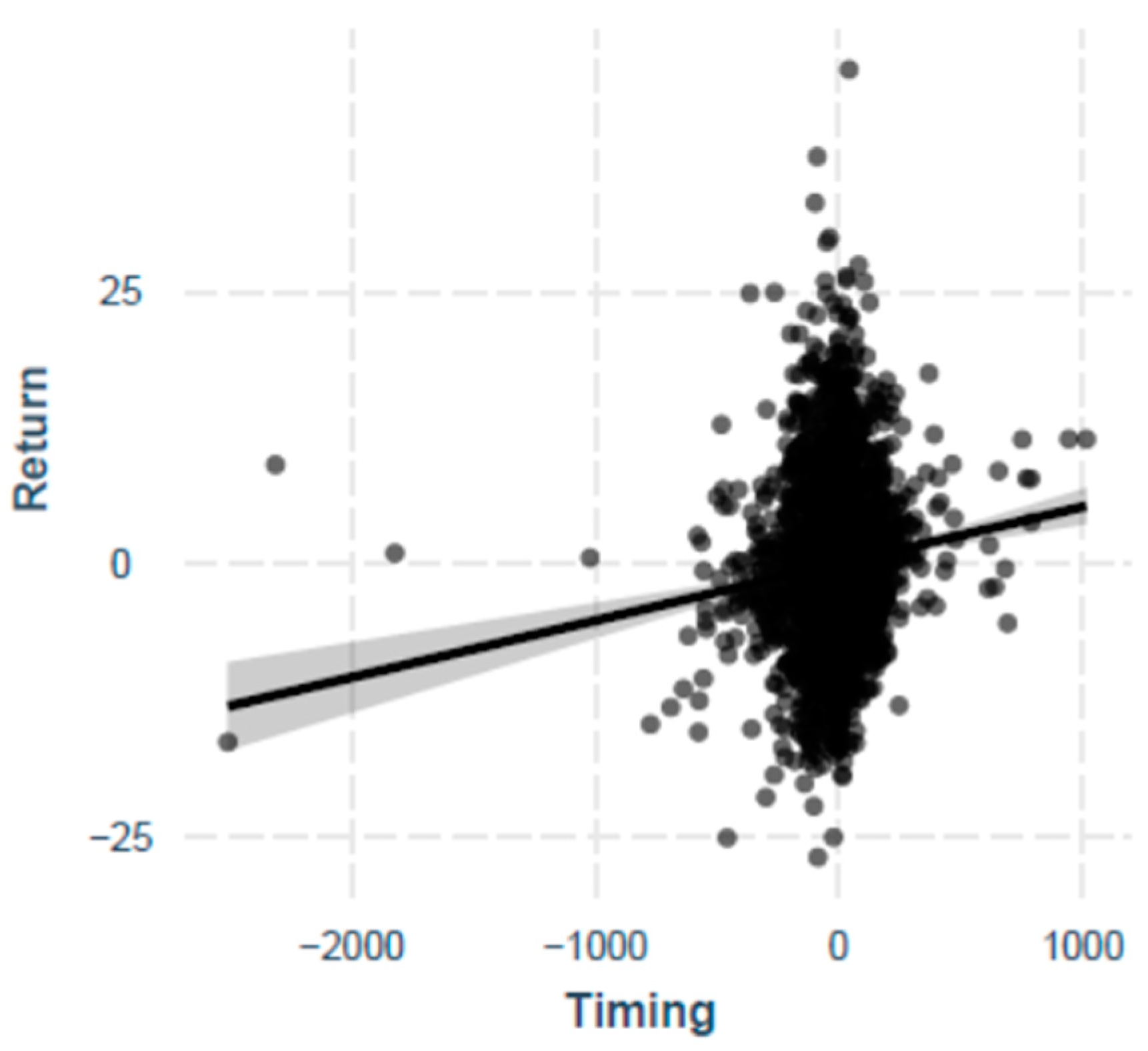

4.1. Manager Skill and Fund Performance

4.2. Learning

4.3. Manager Skill and Job Security

4.4. Summary of Findings

5. Conclusions and Directions for Future Research

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Dimov, D.; Shepherd, D.A.; Sutcliffe, K.M. Requisite expertise, firm reputation, and status in venture capital investment allocation decisions. J. Bus. Ventur. 2007, 22, 481–502. [Google Scholar] [CrossRef]

- Šindelář, J. Can active investment managers beat the market? A study from the US large cap equity segment. Financ. Res. Lett. 2022, 50, 103204. [Google Scholar] [CrossRef]

- Dong, F.; Doukas, J.A. Managerial ability premium factor and fund performance. J. Int. Money Financ. 2021, 113, 102353. [Google Scholar] [CrossRef]

- Feng, X.; Johansson, A.C. Can mutual funds pick stocks in China? Evidence from the IPO market. J. Bank. Financ. 2015, 55, 170–186. [Google Scholar] [CrossRef]

- Ünal, G.; Tan, Ö.F. Selectivity and market timing ability of polish fund managers analysis of selected equity funds. Procedia-Soc. Behav. Sci. 2015, 213, 411–416. [Google Scholar] [CrossRef]

- Oueslati, A.; Hammami, Y.; Jilani, F. The timing ability and global performance of Tunisian mutual fund managers: A multivariate GARCH approach. Res. Int. Bus. Financ. 2014, 31, 57–73. [Google Scholar] [CrossRef]

- Aggarwal, R.; Boyson, N.M. The performance of female hedge fund managers. Rev. Financ. Econ. 2016, 29, 23–36. [Google Scholar] [CrossRef]

- Song, Z.; Gong, X.; Zhang, C.; Yu, C. Investor sentiment based on scaled PCA method: A powerful predictor of realized volatility in the Chinese stock market. Int. Rev. Econ. Financ. 2023, 83, 528–545. [Google Scholar] [CrossRef]

- Huang, J.; Wei, K.D.; Yan, H. Investor learning and mutual fund flows. Financ. Manag. 2022, 51, 739–765. [Google Scholar] [CrossRef]

- Huij, J.; Verbeek, M. Cross-sectional learning and short-run persistence in mutual fund performance. J. Bank. Financ. 2007, 31, 973–997. [Google Scholar] [CrossRef]

- Matallín-Sáez, J.C.; Soler-Dominguez, A.; Tortosa-Ausina, E. On the robustness of persistence in mutual fund performance. N. Am. J. Econ. Financ. 2016, 36, 192–231. [Google Scholar] [CrossRef]

- Cagnazzo, A. Market-timing performance of mutual fund investors in Emerging Markets. Int. Rev. Econ. Financ. 2022, 77, 378–394. [Google Scholar] [CrossRef]

- Rao, Z.U.R.; Ahsan, T.; Tauni, M.Z.; Umar, M. Performance and persistence in performance of actively managed Chinese equity funds. J. Quant. Econ. 2018, 16, 727–747. [Google Scholar] [CrossRef]

- Feng, X.; Zhou, M.; Chan, K.C. Smart money or dumb money? A study on the selection ability of mutual fund investors in China. N. Am. J. Econ. Financ. 2014, 30, 154–170. [Google Scholar] [CrossRef]

- Iqbal, A.; Tauni, M.Z. Performance persistence in institutional investment management: The case of Chinese equity funds. Borsa Istanb. Rev. 2016, 16, 146–156. [Google Scholar] [CrossRef]

- Gao, J.; O’Sullivan, N.; Sherman, M. Performance persistence in Chinese securities investment funds. Res. Int. Bus. Financ. 2017, 42, 1467–1477. [Google Scholar] [CrossRef]

- Jun, X.; Li, M.; Yan, W.; Zhang, R. Flow-performance relationship and star effect: New evidence from Chinese mutual funds. Emerg. Mark. Financ. Trade 2014, 50, 81–101. [Google Scholar] [CrossRef]

- Jun, X.; Li, M.; Shi, J. Volatile market condition and investor clientele effects on mutual fund flow performance relationship. Pac.-Basin Financ. J. 2014, 29, 310–334. [Google Scholar] [CrossRef]

- Carhart, M.M. On persistence in mutual fund performance. J. Financ. 1997, 52, 57–82. [Google Scholar] [CrossRef]

- Bollen, N.P.; Busse, J.A. On the timing ability of mutual fund managers. J. Financ. 2001, 56, 1075–1094. [Google Scholar] [CrossRef]

- Fulkerson, J.A.; Riley, T.B. Portfolio concentration and mutual fund performance. J. Empir. Financ. 2019, 51, 1–16. [Google Scholar] [CrossRef]

- Chen, X.; Lai, Y.J. On the concentration of mutual fund portfolio holdings: Evidence from Taiwan. Res. Int. Bus. Financ. 2015, 33, 268–286. [Google Scholar] [CrossRef]

- Cuthbertson, K.; Nitzsche, D.; O’Sullivan, N. Mutual fund performance persistence: Factor models and portfolio size. Int. Rev. Financ. Anal. 2022, 81, 102133. [Google Scholar] [CrossRef]

- Pollet, J.M.; Wilson, M. How does size affect mutual fund behavior? J. Financ. 2008, 63, 2941–2969. [Google Scholar] [CrossRef]

- Fan, Y. Position adjusted turnover ratio and mutual fund performance. Stud. Econ. Financ. 2018, 35, 65–80. [Google Scholar] [CrossRef]

- Malhotra, D.K.; McLeod, R.W. An empirical analysis of mutual fund expenses. J. Financ. Res. 1997, 20, 175–190. [Google Scholar] [CrossRef]

- Cashman, G.D.; Deli, D.N.; Nardari, F.; Villupuram, S. Investors do respond to poor mutual fund performance: Evidence from inflows and outflows. Financ. Rev. 2012, 47, 719–739. [Google Scholar] [CrossRef]

- Berk, J.B.; Van Binsbergen, J.H. Measuring skill in the mutual fund industry. J. Financ. Econ. 2015, 118, 1–20. [Google Scholar] [CrossRef]

- Dellva, W.L.; Olson, G.T. The relationship between mutual fund fees and expenses and their effects on performance. Financ. Rev. 1998, 33, 85–104. [Google Scholar] [CrossRef]

- Ivković, Z.; Weisbenner, S. Individual investor mutual fund flows. J. Financ. Econ. 2009, 92, 223–237. [Google Scholar] [CrossRef]

- Ding, J.; Jiang, L.; Liu, X.; Peng, L. Nonparametric tests for market timing ability using daily mutual fund returns. J. Econ. Dyn. Control 2023, 150, 104635. [Google Scholar] [CrossRef]

- Kim, S.; Sohn, P. Market timing performance in the Korean Fund Market: Evidence from portfolio holdings. Procedia Econ. Financ. 2013, 5, 443–452. [Google Scholar] [CrossRef][Green Version]

- Andreu, L.; Matallín-Sáez, J.C.; Sarto, J.L. Mutual fund performance attribution and market timing using portfolio holdings. Int. Rev. Econ. Financ. 2018, 57, 353–370. [Google Scholar] [CrossRef]

- Jiang, G.J.; Zaynutdinova, G.R.; Zhang, H. Stock-selection timing. J. Bank. Financ. 2021, 125, 106089. [Google Scholar] [CrossRef]

- Muñoz, F.; Vargas, M.; Vicente, R. Fund flow bias in market timing skill. Evidence of the clientele effect. Int. Rev. Econ. Financ. 2014, 33, 257–269. [Google Scholar] [CrossRef]

- Glassman, D.A.; Riddick, L.A. Market timing by global fund managers. J. Int. Money Financ. 2006, 25, 1029–1050. [Google Scholar] [CrossRef]

- Zheng, Y.; Osmer, E.; Zheng, L. Can mutual fund managers time commonality in stock market misvaluation? J. Econ. Bus. 2021, 117, 106018. [Google Scholar] [CrossRef]

- Wattanatorn, W.; Padungsaksawasdi, C.; Chunhachinda, P.; Nathaphan, S. Mutual fund liquidity timing ability in the higher moment framework. Res. Int. Bus. Financ. 2020, 51, 101105. [Google Scholar] [CrossRef]

- Jenkinson, T.; Morkoetter, S.; Schori, T.; Wetzer, T. Buy low, sell high? Do private equity fund managers have market timing abilities? J. Bank. Financ. 2022, 138, 106424. [Google Scholar] [CrossRef]

- Zhang, W.; Li, Y. Do visiting monks give better sermons? An analysis of the foreign experience of Chinese fund managers. J. Int. Financ. Mark. Inst. Money 2021, 75, 101352. [Google Scholar] [CrossRef]

- Chen, Y.; Liu, Y.; Li, M. Do funds selected by managers’ skills perform better? Res. Int. Bus. Financ. 2021, 56, 101368. [Google Scholar] [CrossRef]

- Stein, R. Are mutual fund managers good gamblers? J. Financ. Mark. 2022, 64, 100787. [Google Scholar] [CrossRef]

- Nain, A.; Yao, T. Mutual fund skill and the performance of corporate acquirers. J. Financ. Econ. 2013, 110, 437–456. [Google Scholar] [CrossRef]

- Yu, B.; Shen, Y.; Jin, X.; Xu, Q. Does prospect theory explain mutual fund performance? Evidence from China. Pac.-Basin Financ. J. 2022, 73, 101766. [Google Scholar] [CrossRef]

- Jitmaneeroj, B. Time-Varying Fund Manager Skills of Socially Responsible Investing (SRI) Funds in Developed and Emerging Markets. Res. Int. Bus. Financ. 2023, 64, 101877. [Google Scholar] [CrossRef]

- Jordan, B.D.; Li, A.; Liu, M.H. Mutual fund preference for pure-play firms. J. Financ. Mark. 2022, 61, 100719. [Google Scholar] [CrossRef]

- Chen, J.; Lasfer, M.; Song, W.; Zhou, S. Recession managers and mutual fund performance. J. Corp. Financ. 2021, 69, 102010. [Google Scholar] [CrossRef]

- Kacperczyk, M.; Nieuwerburgh, S.V.; Veldkamp, L. Time-varying fund manager skill. J. Financ. 2014, 69, 1455–1484. [Google Scholar] [CrossRef]

- Majeed, M.A.; Yan, C. Financial statement comparability and stock liquidity: Evidence from China. Appl. Econ. 2022, 54, 5497–5514. [Google Scholar] [CrossRef]

- Xiang, E.; Tian, G.Y.; Yang, F.; Liu, Z. Do mutual funds have information advantage? Evidence from seasoned equity offerings in China. Int. Rev. Financ. Anal. 2014, 31, 70–79. [Google Scholar] [CrossRef]

- Hu, M.; Tuilautala, M.; Yang, J.; Zhong, Q. Asymmetric information and inside management trading in the Chinese market. N. Am. J. Econ. Financ. 2022, 62, 101756. [Google Scholar] [CrossRef]

- Barberis, N.; Shleifer, A.; Vishny, R. A model of investor sentiment. J. Financ. Econ. 1998, 49, 307–343. [Google Scholar] [CrossRef]

- Wu, C.H.; Wu, C.S.; Liu, V.W. The conservatism bias in an emerging stock market: Evidence from Taiwan. Pac.-Basin Financ. J. 2009, 17, 494–505. [Google Scholar] [CrossRef]

- Clatworthy, M.; Jones, M.J. Overseas equity analysis by UK analysts and fund managers. Br. Account. Rev. 2008, 40, 337–355. [Google Scholar] [CrossRef]

- Gupta-Mukherjee, S. When active fund managers deviate from their peers: Implications for fund performance. J. Bank. Financ. 2013, 37, 1286–1305. [Google Scholar] [CrossRef]

- Fang, J.; Kempf, A.; Trapp, M. Fund manager allocation. J. Financ. Econ. 2014, 111, 661–674. [Google Scholar] [CrossRef]

- Porter, G.E.; Trifts, J.W. The career paths of mutual fund managers: The role of merit. Financ. Anal. J. 2014, 70, 55–71. [Google Scholar] [CrossRef]

- Chevalier, J.; Ellison, G. Are some mutual fund managers better than others? Cross-sectional patterns in behavior and performance. J. Financ. 1999, 54, 875–899. [Google Scholar] [CrossRef]

- Fang, Y.; Wang, H. Fund manager characteristics and performance. Invest. Anal. J. 2015, 44, 102–116. [Google Scholar] [CrossRef]

- Khorana, A. Top management turnover an empirical investigation of mutual fund managers. J. Financ. Econ. 1996, 40, 403–427. [Google Scholar] [CrossRef]

- Wang, Y.; Ko, K. Implications of fund manager turnover in China. Int. Rev. Econ. Financ. 2017, 51, 99–106. [Google Scholar] [CrossRef]

- Ghalke, A.; Kulkarni, S. Mutual fund manager turnover: An empirical investigation of performance. Int. J. Manag. Financ. 2022, 18, 869–887. [Google Scholar] [CrossRef]

- Andreu, L.; Sarto, J.L.; Serrano, M. Implications of manager replacement: Evidence from the Spanish mutual fund industry. Appl. Econ. 2015, 47, 1366–1387. [Google Scholar] [CrossRef]

- Kostovetsky, L.; Warner, J.B. You’re fired! New evidence on portfolio manager turnover and performance. J. Financ. Quant. Anal. 2015, 50, 729–755. [Google Scholar] [CrossRef]

- Berk, J.B.; Stanton, R. Managerial Ability, Compensation, and the Closed-End Fund Discount. J. Financ. 2007, 62, 529–556. [Google Scholar] [CrossRef]

- Hendricks, D.; Patel, J.; Zeckhauser, R. Hot hands in mutual funds: Short-run persistence of performance. J. Financ. 1993, 48, 65–91. [Google Scholar] [CrossRef]

- Goetzmann, W.N.; Ibbotson, R.G. Do winners repeat? J. Portf. Manag. 1994, 20, 9–18. [Google Scholar] [CrossRef]

- Brown, S.J.; Goetzmann, W.N. Performance persistence. J. Financ. 1995, 50, 679–698. [Google Scholar] [CrossRef]

- Grinblatt, M.; Titman, S. The persistence of mutual fund performance. J. Financ. 1992, 47, 1977–1984. [Google Scholar] [CrossRef]

- Busse, J.A.; Irvine, P.J. Bayesian alphas and mutual fund persistence. J. Financ. 2006, 61, 2251–2288. [Google Scholar] [CrossRef]

- Jagannathan, R.; Malakhov, A.; Novikov, D. Do hot hands exist among hedge fund managers? An empirical evaluation. J. Financ. 2010, 65, 217–255. [Google Scholar] [CrossRef]

- Kacperczyk, M.; Seru, A. Fund manager use of public information: New evidence on managerial skills. J. Financ. 2007, 62, 485–528. [Google Scholar] [CrossRef]

- Chen, C.D.; Kutan, A.M. Information transmission through rumors in stock markets: A new evidence. J. Behav. Financ. 2016, 17, 365–381. [Google Scholar] [CrossRef]

- Li, Q.; Wang, J.; Bao, L. Do institutions trade ahead of false news? Evidence from an emerging market. J. Financ. Stab. 2018, 36, 98–113. [Google Scholar] [CrossRef]

- Herrmann, U.; Rohleder, M.; Scholz, H. Does style-shifting activity predict performance? Evidence from equity mutual funds. Q. Rev. Econ. Financ. 2016, 59, 112–130. [Google Scholar] [CrossRef]

- Dyakov, T.; Jiang, H.; Verbeek, M. Trade less and exit overcrowded markets: Lessons from international mutual funds. Rev. Financ. 2020, 24, 677–731. [Google Scholar] [CrossRef]

- Chen, R.; Gao, Z.; Zhang, X.; Zhu, M. Mutual fund managers’ prior work experience and their investment skill. Financ. Manag. 2018, 47, 3–24. [Google Scholar] [CrossRef]

- Liang, Q.; Liao, J.; Ling, L. Social interactions and mutual fund portfolios: The role of alumni networks in China. China Financ. Rev. Int. 2022, 12, 433–450. [Google Scholar] [CrossRef]

- Yin, X.N.; Li, J.P.; Su, C.W. How does ESG performance affect stock returns? Empirical evidence from listed companies in China. Heliyon 2023, 9, e16320. [Google Scholar] [CrossRef]

- Wang, H.; Shen, H.; Li, S. ESG performance and stock price fragility. Financ. Res. Lett. 2023, 56, 104101. [Google Scholar] [CrossRef]

- Dubois, M.S.; Veraart, L.A. Optimal diversification in the presence of parameter uncertainty for a risk averse investor. SIAM J. Financ. Math. 2015, 6, 201–241. [Google Scholar] [CrossRef]

- Otuteye, E.; Siddiquee, M. Underperformance of actively managed portfolios: Some behavioral insights. J. Behav. Financ. 2020, 21, 284–300. [Google Scholar] [CrossRef]

- Kacperczyk, M.; Van Nieuwerburgh, S.; Veldkamp, L. A rational theory of mutual funds’ attention allocation. Econometrica 2016, 84, 571–626. [Google Scholar] [CrossRef]

| Statistic | N | Mean | St. Dev. | Min | Pctl (25) | Pctl (75) | Max |

|---|---|---|---|---|---|---|---|

| Fund Manager Skill | |||||||

| Picking | 3762 | −5.535 | 130.881 | −2508.84 | −39.484 | 36.335 | 1016.76 |

| Timing | 3762 | 17.574 | 234.871 | −1434.72 | −105.817 | 142.489 | 1839.60 |

| Fund Manager Learning | |||||||

| Learning_Picking | 3564 | 0.503 | 0.5 | 0 | 0 | 1 | 1 |

| Learning_Timing | 3564 | 0.468 | 0.499 | 0 | 0 | 1 | 1 |

| Learning | 3564 | 0.21 | 0.407 | 0 | 0 | 0 | 1 |

| Fund Outcomes | |||||||

| Return | 3762 | 0 | 6.644 | −26.907 | −4.04 | 3.624 | 45.396 |

| Replacement | 3762 | 0.058 | 0.234 | 0 | 0 | 0 | 1 |

| Fund Characteristics | |||||||

| Size | 3762 | 6.112 | 1.532 | 0.165 | 5.204 | 7.147 | 10.455 |

| Expenses | 3762 | 1.376 | 0.282 | 0.5 | 1.5 | 1.5 | 1.5 |

| Turnover | 3726 | 280.803 | 209.150 | 18.644 | 125.029 | 383.358 | 1338.154 |

| Flow | 3762 | −0.011 | 0.186 | −1.940 | −0.044 | 0.007 | 3.306 |

| Load | 3762 | 1.449 | 0.139 | 0.6 | 1.5 | 1.5 | 1.5 |

| Momentum | 3762 | 0.64 | 1.109 | −2.066 | −0.178 | 1.545 | 2.658 |

| Dependent Variable | ||||

|---|---|---|---|---|

| Relative Return | ||||

| (1) | (2) | (3) | (4) | |

| Stock-Picking Skill | 0.012 *** | 0.012 *** | ||

| (0.0004) | (0.0004) | |||

| Market-Timing Skill | 0.005 *** | 0.005 *** | ||

| (0.001) | (0.001) | |||

| Size | −0.207 *** | −0.162 ** | ||

| (0.070) | (0.077) | |||

| Expenses | 1.974 *** | 2.676 *** | ||

| (0.575) | (0.633) | |||

| Turnover | −0.001 | −0.001 * | ||

| (0.0005) | (0.001) | |||

| Flow | 0.142 | −0.225 | ||

| (0.521) | (0.574) | |||

| Load | 1.629 | 1.593 | ||

| (1.163) | (1.281) | |||

| Momentum | 0.350 *** | 0.294 *** | ||

| (0.089) | (0.099) | |||

| Constant | −0.213 ** | 0.027 | −4.020 *** | −4.878 *** |

| (0.098) | (0.108) | (1.192) | (1.312) | |

| Observations | 3762 | 3762 | 3726 | 3726 |

| R2 | 0.183 | 0.010 | 0.199 | 0.028 |

| Adjusted R2 | 0.183 | 0.009 | 0.198 | 0.026 |

| Residual Std. Error | 6.007 (df = 3760) | 6.613 (df = 3760) | 5.934 (df = 3718) | 6.537 (df = 3718) |

| F Statistic | 841.304 *** (df = 1; 3760) | 36.308 *** (df = 1; 3760) | 132.014 *** (df = 7; 3718) | 15.405 *** (df = 7; 3718) |

| Top | G2 | G3 | G4 | G5 | G6 | G7 | G8 | G9 | Bottom |

|---|---|---|---|---|---|---|---|---|---|

| 5.651 | 3.410 | 2.083 | 1.343 | 0.626 | −0.239 | −1.249 | −2.366 | −3.378 | −5.316 |

| Top–Bottom sample mean difference | Standard error | G2–G9 sample mean difference | Standard error | Top–G2 sample mean difference | Standard error | ||||

| 10.968 *** | 1.096 | 6.789 *** | 0.742 | 2.241 ** | 1.028 | ||||

| Top | G2 | G3 | G4 | G5 | G6 | G7 | G8 | G9 | Bottom |

|---|---|---|---|---|---|---|---|---|---|

| 1.424 | 1.064 | 0.884 | 0.631 | 0.313 | −0.114 | −1.230 | −0.484 | −0.784 | −1.562 |

| Top–Bottom sample mean difference | Standard error | G2–G9 sample mean difference | Standard error | Top–G7 sample mean difference | Standard error | ||||

| 2.988 ** | 1.232 | 1.849 ** | 0.740 | 2.656 *** | 0.986 | ||||

| Dependent Variable | ||||||

|---|---|---|---|---|---|---|

| Learning_Picking Improved Stock-Picking Skill | Learning_Timing Improved Market-Timing Skill | Learning Improved Stock-Picking and Market-Timing Skill | ||||

| (1) | (2) | (3) | (4) | (5) | (6) | |

| Stock-Picking Skill | −0.010 *** | −0.010 *** | −0.006 *** | −0.006 *** | ||

| (0.0004) | (0.0004) | (0.0003) | (0.0003) | |||

| Market-Timing Skill | −0.031 *** | −0.031 *** | −0.008 *** | −0.008 *** | ||

| (0.001) | (0.001) | (0.001) | (0.001) | |||

| Size | 0.044 | 0.073 ** | 0.007 | −0.010 | 0.007 | 0.015 |

| (0.031) | (0.031) | (0.033) | (0.033) | (0.034) | (0.035) | |

| Expenses | 0.266 | 0.217 | 0.142 | 0.134 | 0.270 | 0.266 |

| (0.235) | (0.237) | (0.260) | (0.260) | (0.283) | (0.283) | |

| Turnover | 0.0001 | 0.00001 | −0.0003 | −0.0003 | −0.00001 | −0.00002 |

| (0.0002) | (0.0002) | (0.0002) | (0.0002) | (0.0002) | (0.0002) | |

| Flow | −0.160 | −0.049 | 0.415 * | 0.396 | −0.320 | −0.307 |

| (0.251) | (0.258) | (0.246) | (0.247) | (0.275) | (0.276) | |

| Load | 0.263 | 0.417 | −0.531 | −0.574 | −0.070 | −0.028 |

| (0.497) | (0.503) | (0.510) | (0.510) | (0.576) | (0.578) | |

| Momentum | −0.306 *** | 0.124 *** | −0.062 | |||

| (0.040) | (0.039) | (0.044) | ||||

| Constant | −0.859 | −0.995 * | 0.416 | 0.519 | −1.998 *** | −2.058 *** |

| (0.538) | (0.545) | (0.520) | (0.521) | (0.598) | (0.601) | |

| Observations | 3528 | 3528 | 3528 | 3528 | 3528 | 3528 |

| AME1 | AME2 | AME3 | AME4 | AME5 | AME6 | |

|---|---|---|---|---|---|---|

| Stock-Picking Skill | −0.0024 *** | −0.0025 *** | −0.0007 *** | −0.0007 *** | ||

| (0.0001) | (0.0001) | (0.0000) | (0.0000) | |||

| Market-Timing Skill | −0.0078 *** | −0.0077 *** | −0.001 *** | −0.001 *** | ||

| (0.0003) | (0.0003) | (0.0001) | (0.0001) | |||

| Size | 0.011 | 0.0182 ** | 0.0017 | −0.0026 | 0.0009 | 0.0019 |

| (0.0076) | (0.0078) | (0.0082) | (0.0083) | (0.0043) | (0.0044) | |

| Expenses | 0.0664 | 0.0543 | 0.0356 | 0.0334 | 0.0341 | 0.0336 |

| (0.0586) | (0.0593) | (0.0651) | (0.065) | (0.0358) | (0.0357) | |

| Turnover | 0.0000 | 0.0000 | −0.0001 | −0.0001 | 0.0000 | 0.0000 |

| (0.0001) | (0.0001) | (0.0001) | (0.0001) | (0.0000) | (0.0000) | |

| Flow | −0.0401 | −0.0123 | 0.1037 * | 0.099 | −0.0404 | −0.0388 |

| (0.0627) | (0.0645) | (0.0614) | (0.0617) | (0.0348) | (0.0348) | |

| Load | 0.0658 | 0.1041 | −0.1327 | −0.1434 | −0.0089 | −0.0036 |

| (0.0586) | (0.1257) | (0.1274) | (0.1274) | (0.0728) | (0.0729) | |

| Momentum | −0.0765 *** | 0.0309 ** | −0.0078 | |||

| (0.0099) | (0.0097) | (0.0056) |

| Dependent Variable | ||

|---|---|---|

| Replacement | ||

| (1) | (2) | |

| Stock-Picking Skill | −0.035 | |

| (0.031) | ||

| Market-Timing Skill | −0.101 ** | |

| (0.046) | ||

| Size | −0.124 ** | −0.117 ** |

| (0.049) | (0.050) | |

| Expenses | −1.191 *** | −1.216 *** |

| (0.324) | (0.324) | |

| Turnover | 0.001 ** | 0.001 ** |

| (0.0003) | (0.0003) | |

| Flow | −1.171 ** | −1.121 ** |

| (0.461) | (0.456) | |

| Load | 2.352 *** | 2.324 *** |

| (0.777) | (0.775) | |

| Momentum | −0.079 | −0.092 |

| (0.063) | (0.064) | |

| Constant | −4.028 *** | −4.009 *** |

| (0.887) | (0.885) | |

| Observations | 3726 | 3726 |

| AME | AME | |

|---|---|---|

| Stock-Picking Skill | −0.0018 | |

| (0.0016) | ||

| Market-Timing Skill | −0.0052 ** | |

| (0.0023) | ||

| Size | −0.0063 | −0.0059 ** |

| (0.0025) | (0.0179) | |

| Expenses | −0.0607 *** | −0.0618 *** |

| (0.0164) | (0.0163) | |

| Turnover | 0.0000 | 0.0000 ** |

| (0.0000) | (0.0000) | |

| Flow | −0.0597 * | −0.057 ** |

| (0.0231) | (0.0228) | |

| Load | 0.1199 ** | 0.1182 *** |

| (0.0393) | (0.0391) | |

| Momentum | −0.004 | −0.0047 |

| (0.0032) | (0.0032) |

| Dependent Variable | |||

|---|---|---|---|

| Relative Return | |||

| (1) | (2) | (3) | |

| Fund Manager Replacement | −0.020 | 0.109 | 0.449 |

| (0.463) | (0.462) | (0.510) | |

| Size | −0.143 * | −0.148 * | |

| (0.077) | (0.077) | ||

| Expenses | 2.676 *** | 2.656 *** | |

| (0.637) | (0.637) | ||

| Turnover | −0.001 * | −0.001 * | |

| (0.001) | (0.001) | ||

| Flow | −0.204 | −0.230 | |

| (0.577) | (0.577) | ||

| Load | 1.525 | 1.562 | |

| (1.288) | (1.288) | ||

| Momentum | 0.227 ** | 0.264 *** | |

| (0.099) | (0.102) | ||

| Fund Manager Replacement × Sharpe | −0.661 | ||

| (0.423) | |||

| Constant | 0.001 | −4.866 *** | −4.888 *** |

| (0.112) | (1.318) | (1.317) | |

| Observations | 3762 | 3726 | 3726 |

| R2 | 0.00000 | 0.020 | 0.021 |

| Adjusted R2 | −0.0003 | 0.018 | 0.018 |

| Residual Std. Error | 6.645 (df = 3760) | 6.564 (df = 3718) | 6.563 (df = 3717) |

| F Statistic | 0.002 (df = 1; 3760) | 10.817 *** (df = 7; 3718) | 9.774 *** (df = 8; 3717) |

| Hypotheses | Validation | Discussion |

|---|---|---|

| H1: Fund managers with higher stock-picking or market-timing skill ability outperform their peers in both absolute and risk-adjusted relative returns. | Supported | Fund managers with higher stock-picking and market-timing skill earn statistically significantly higher fund returns relative to other funds. |

| H2: Fund managers with poor stock-picking or market-timing skills are more likely to learn those skills and improve their skills in the following period. | Supported | Fund managers with lower stock-picking and market-timing skill are more likely to learn and improve their skills in the following period. |

| H3a: Fund managers with high stock-picking or market-timing ability are less likely to be replaced, thereby enjoying greater job security. | Partly Supported | Fund managers with higher market-timing skills enjoy more job security, but stock-picking ability does not statistically significantly impact job security. |

| H3b: Replacement of a fund manager or adding a new fund manager in addition to the current manager leads to an improvement in fund performance. | Rejected | Replacement of a fund manager does not lead to statistically significantly higher fund returns relative to other funds. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sheng, D.; Montgomery, H.A. Assessing Mutual Fund Performance in China: A Sector Weight-Based Approach. Mathematics 2024, 12, 2449. https://doi.org/10.3390/math12162449

Sheng D, Montgomery HA. Assessing Mutual Fund Performance in China: A Sector Weight-Based Approach. Mathematics. 2024; 12(16):2449. https://doi.org/10.3390/math12162449

Chicago/Turabian StyleSheng, Dachen, and Heather A. Montgomery. 2024. "Assessing Mutual Fund Performance in China: A Sector Weight-Based Approach" Mathematics 12, no. 16: 2449. https://doi.org/10.3390/math12162449

APA StyleSheng, D., & Montgomery, H. A. (2024). Assessing Mutual Fund Performance in China: A Sector Weight-Based Approach. Mathematics, 12(16), 2449. https://doi.org/10.3390/math12162449