Abstract

With the advent of big data, the swift advancement of diverse algorithmic technologies has enhanced the transaction efficiency of the e-commerce business. Nevertheless, it is crucial to acknowledge that e-commerce platforms might employ algorithmic technology to enforce differential pricing for various consumers with the aim of maximizing profits, thus infringing upon the lawful rights and interests of consumers. This paper focuses on the algorithmic price discrimination commonly observed on e-commerce platforms. To effectively regulate this behavior, the paper utilizes evolutionary game theory (EGT) to analyze the strategies employed by e-commerce platforms, consumers, and market regulators to achieve stability. This research employs a real-life situation and utilizes parametric simulation to visualize and analyze the process and outcomes of the three-party evolutionary game. The results demonstrate the credibility and feasibility of the article’s findings. Based on our research, we have reached the following findings: During the process of evolution, the strategic decisions made by the game participants from the three parties will mutually impact each other, and various elements exert varying degrees of influence on the strategic choices made by the game participants from each party. Collaborative governance can enable consumers and market regulators to regulate the discriminatory pricing behavior of e-commerce platforms effectively. This article offers valuable insights into the governance of violations in the e-commerce sector based on robust data and model research.

Keywords:

algorithmic price discrimination; evolutionary game theory; e-commerce platform; consumer; market regulator MSC:

91-10

1. Introduction

Within the realm of big data, e-commerce platforms employ algorithms to scrutinize consumer activity and comprehend their interests and preferences to attain customized recommendations [1]. Nevertheless, these platforms utilize big data and computational technology to carry out price discrimination against consumers [2]. A 2022 poll conducted by the Beijing Consumers’ Association revealed that over 86.91% of consumers encounter “discrimination” from e-commerce platforms due to algorithmic pricing. These platforms utilize their advantages to gather personal information and records of customer usage, employing algorithmic pricing to take the remaining value from consumers unlawfully [3].

Insufficient regulation of algorithmic price discrimination on e-commerce platforms will lead to a monopolistic scenario where one entity dominates the market. Consumers are increasingly questioning the fairness of product prices in e-commerce, which is having a lasting detrimental effect on platform operations and the market economy [4,5]. It passively impacts consumer interests, displaces competitors, and disrupts the structure of market competition [6]. Various nations have implemented diverse strategies to combat algorithmic price discrimination by e-commerce platforms. China enhances surveillance and enforcement through legislation and administrative oversight; the United States relies on current consumer protection and antitrust laws overseen by the Federal Trade Commission; and the European Union guarantees transparency and equity in data handling through the General Data Protection Regulation (GDPR). Every nation strives to guarantee equitable competition in the marketplace and safeguard consumer rights through legislative and administrative regulations, as well as measures for data protection and consumer protection.

The research on algorithmic price discrimination on e-commerce platforms can be broadly categorized into two areas: legal regulation and regulatory mechanisms. Nevertheless, the current body of research mostly concentrates on the legal systems [7,8,9], with comparatively less emphasis on the development of regulatory systems. As algorithmic technology has progressed, platform price discrimination has become more hidden, which has made the issue more noticeable [10]. Dependence entirely on external legal governance needs to be improved for successful regulation [11]. Consequently, researchers are redirecting their attention from legal systems to mechanism design to regulate algorithmic price discrimination on e-commerce platforms.

Evolutionary game theory integrates principles from both game theory and evolutionary biology to elucidate the process by which individual behavioral strategies undergo adaptation in response to environmental conditions and interactions within a group. The framework has been extensively utilized in various domains like logistics [12], environmental protection [13], food safety [14], supply chain regulation [15], blockchain governance [16], transportation risk avoidance [17], and others. Evolutionary game theory suggests that game participants are limited in their rationality but can assess aspects that influence decision-making effectively. They also can learn and improve their strategies continuously [18,19]. As a result, they gradually move towards a state of equilibrium [20]. The regulation of algorithmic price discrimination for e-commerce platforms is an ongoing and complex process influenced by multiple factors [21]. Hence, evolutionary game theory can aid in comprehending the dynamic interplay among e-commerce platforms, customers, and market regulators. By simulating changes under various settings, it can forecast the behavioral strategies of each party. Market regulators can utilize the outcomes of game models to create dynamic regulatory mechanisms that can effectively address algorithmic price discrimination. This can lead to improved efficiency in policy implementation and enhanced consumer protection. Additionally, these tools can simplify the complaint process and facilitate consumer education. These findings may also incentivize platforms to develop self-monitoring tools and collaborate across platforms to improve the comprehensiveness and efficacy of regulation.

Presently, certain academics have investigated the control of algorithmic price discrimination through the use of evolutionary game theory. This includes the examination of the evolutionary game dynamics between users and platforms [22], as well as between governments and platforms [23]. In addition, some scientists have developed an evolutionary game model that explores the joint regulation between the government and consumers [24]. Given the intricate nature of real-world games, it seems improbable that the regulation of platform algorithmic price discrimination is merely limited to two-party games. There is a higher probability that many parties are involved.

Consequently, some researchers have introduced a third-party game element into the two-by-two evolutionary game. Bin Wu et al. (2020) and Li Jianjun et al. (2023) developed a three-party evolutionary game model including platforms, customers, and the government. The study examined the impact of government regulatory expenses, fines, and consumers’ cost to protect rights on the regulation of platform algorithmic price discrimination [25,26]. Chen et al. (2023) examined the practice of industry-specific platform algorithmic price discrimination in the online hotel booking sector. Their research contributed to the existing body of knowledge on evolutionary games in this domain [27]. Furthermore, Wu Zhiyan et al. (2022) discovered that when consumers are highly sensitive to prices, it hinders the practice of big data price discrimination [28]. The deficiencies in current research encompass the restricted range of individuals involved, the focus on only one aspect or approach, the absence of factual evidence, and the inadequate implementation of policies. This study aims to fill these deficiencies by incorporating a larger number of participants and dynamic characteristics. It also seeks to improve the adaptability and practicality of the model by integrating many sources of data and using empirical cases. This research additionally includes consumers’ price sensitivity as a novel variable for analysis, offering precise policy recommendations to enhance regulatory measures.

The next sections are structured as follows: Section 2 explains the research problem, assumptions, and parameter settings for the subjects involved in the game. Section 3 develops two distinct two-party evolutionary game models to investigate the influence of unilateral regulation by consumers or market regulators on the management of algorithmic price discrimination on e-commerce platforms. Section 4 presents a three-party evolutionary game model of the “e-commerce platform-consumer-market regulator” and examines the strategic stability and evolutionary stable state of the game participants. Section 5 examines the evolutionary stable points identified in Section 4 using numerical simulations and parameter sensitivity analysis, which are based on real cases. Section 6 outlines the conclusions that have been drawn and offers suggestions for consumers and market regulators.

2. Construction and Analysis of Evolutionary Game Models

2.1. Description of the Problem

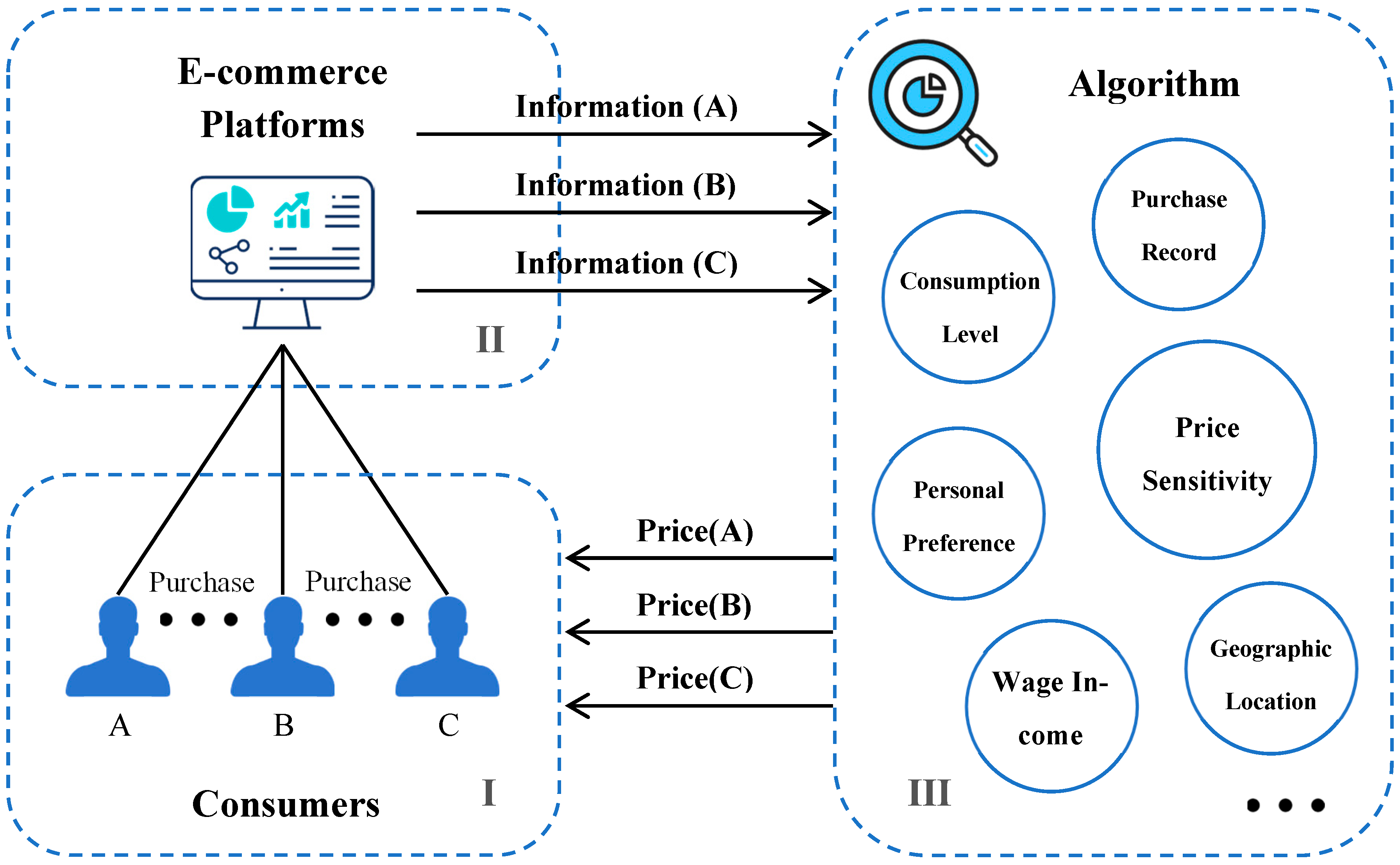

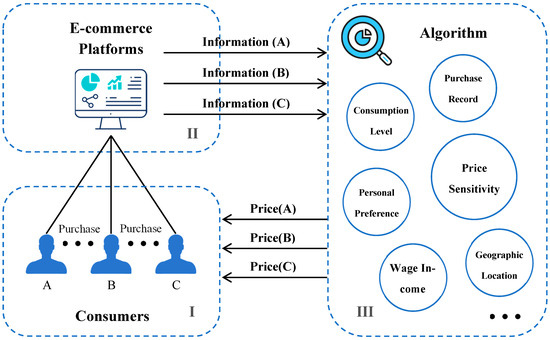

Algorithmic price discrimination refers to the practice of using algorithms and big data analysis to display varying prices to various consumers. This is achieved by examining factors such as their purchase history, browsing habits, geographic location, and other relevant information. Companies gather individuals’ data through big data and employ algorithms to analyze it, enabling them to forecast consumers’ inclination to pay and determine pricing limits. Ultimately, platforms will establish varying rates for individual consumers or certain consumer segments, relying on the outcomes of the investigation. The outcome of implementing algorithmic price discrimination is depicted in Figure 1.

Figure 1.

Implementation path of algorithmic price discrimination on e-commerce platforms.

Secondary or tertiary pricing discrimination, when applied moderately, can improve social welfare and result in reciprocal gains for all parties involved [29]. Nevertheless, the emergence of technology like big data and algorithms has led platforms to increasingly depend on them for devising their pricing plans [30]. Many experts and scholars argue that the algorithmic price discrimination employed by e-commerce platforms closely resembles first-degree price discrimination. This allows for the dynamic implementation of “price discrimination” [31], enabling the platforms to offer thousands of different prices to individual consumers [32]. By doing so, they can effectively exploit consumer surplus and maximize their profits [33]. Algorithmic price discrimination closely resembles first-degree price discrimination. Hence, algorithmic price discrimination has amplified the profits of businesses and stimulated market growth. However, it has also engendered issues such as infringement of consumer rights, distortion of market competition, social and ethical concerns, and regulatory hurdles.

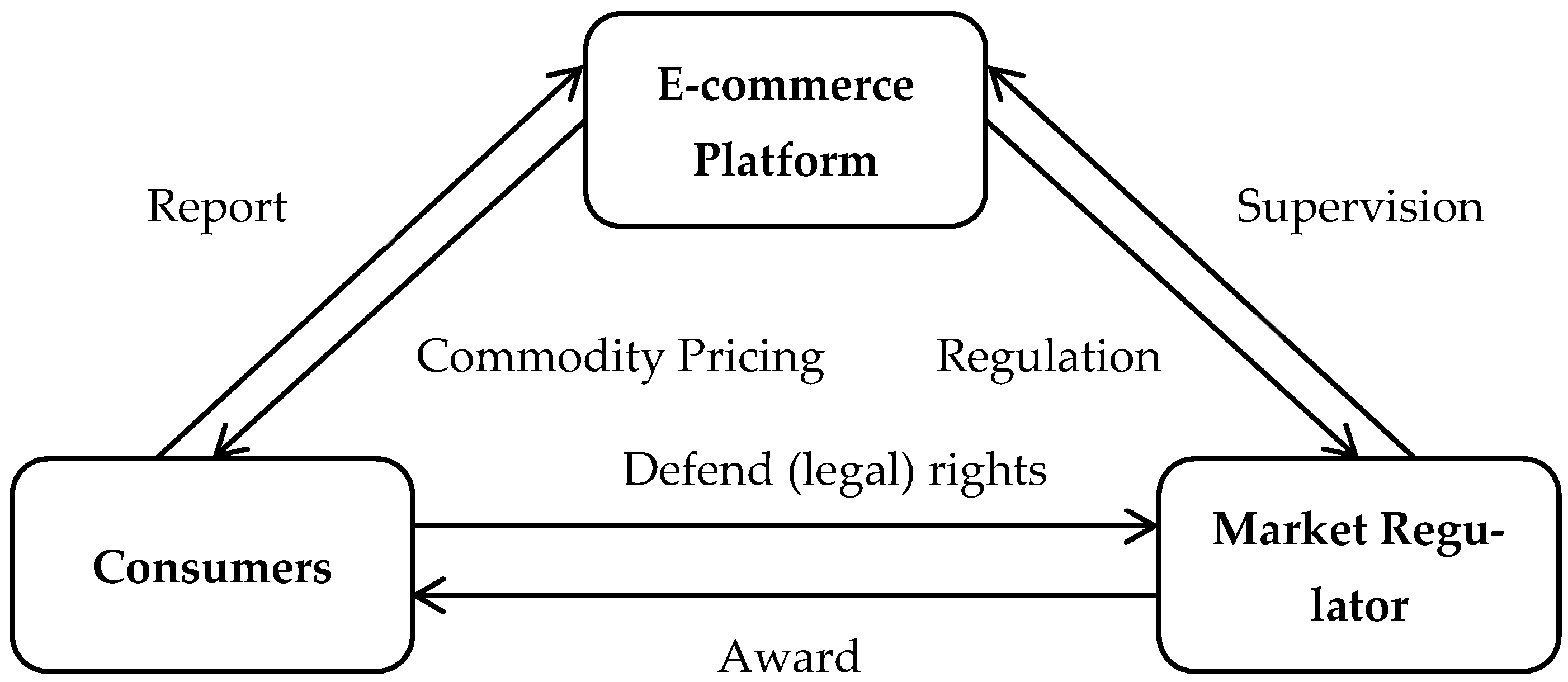

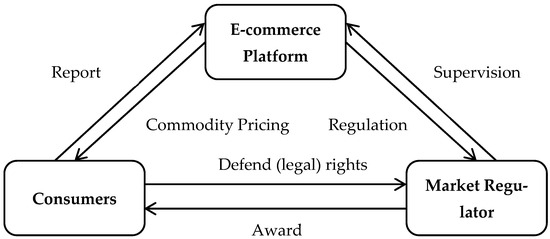

Within the e-commerce sector, an intricate interplay exists among the three primary entities: e-commerce platforms, consumers, and market regulators. E-commerce platforms have the option to either use normal pricing or discriminatory pricing techniques. When confronted with discriminatory pricing, consumers have the option to assert their rights by reporting the issue or to endure and accept it. Market regulators have the option to implement either active or passive regulation. Active supervision entails rigorous oversight of algorithmic price discrimination by e-commerce platforms and providing incentives to consumers who report it; passive supervision involves opting to disregard such conduct. The conduct of e-commerce platforms and the fairness of the market are influenced by the decisions of consumers and the attitudes of market authorities. Enforcing regulations and empowering customers to protect their rights actively will effectively restrain the discriminatory pricing practices of e-commerce platforms, thereby ensuring a fair market environment.

Meanwhile, the platform sets prices for goods sold to consumers and is subject to regulation by the market supervision department. If a consumer discovers that they are being subjected to algorithmic price discrimination, they can report this to the platform and seek assistance from the market supervision department to protect their rights. Upon receiving a consumer’s rights report, the market supervision department will investigate the behavior of the e-commerce platform. If algorithmic price discrimination is found to be occurring, the platform will be fined, and consumers may receive rewards to compensate for their rights infringement. This process is illustrated in Figure 2, which depicts the relationship between the three parties involved.

Figure 2.

Action relationships of the three-party game subjects.

2.2. Underlying Assumptions

2.2.1. Strategy Space Hypothesis

The game model proposed in this study consists of three entities: e-commerce platforms, consumers, and market regulators. Each entity possesses two strategies and chooses them based on the goal of maximizing their interests. It is assumed that all game participants have limited rationality and act to maximize their interests.

Let represent the strategy of the party game subject, where and . Hence, the e-commerce platform’s decision to regulate pricing can be denoted as , and the consumer’s decision to report can be denoted as . The market regulator’s decision to actively regulate can be denoted as . Similarly, one can derive the formulas for various strategic options.

2.2.2. E-Commerce Platform-Related Assumptions

- (1)

- The normal pricing for the e-commerce platform is denoted as C1, whereas the cost of adopting algorithmic price discrimination is denoted as C2. Implementing algorithmic price discrimination incurs additional technology expenses such as system development, maintenance, and updates. Consequently, the cost for the e-commerce platform to adopt algorithmic discriminatory pricing exceeds the cost of its normal pricing, denoted as C2 > C1.

- (2)

- The e-commerce platform has a normal pricing called P1, but the deployment of algorithmic price discrimination has a different pricing called P2. Due to the additional cost expenditure, the e-commerce platform implementing algorithmic discrimination sets its pricing higher than the normal pricing. In other words, the platform adopts a pricing (P2) that is greater than its normal pricing (P1).

- (3)

- E-commerce platforms prefer algorithmic discriminatory pricing over prescriptive pricing due to the advantages of the former compared to the latter, resulting in C2-P1 > C1-P1.

- (4)

- The reputation of a platform is passively affected when the platform engages in algorithmic price discrimination and a consumer files a complaint, denoted as LP.

- (5)

- The government imposes a fine of F2 on platforms that practice algorithmic price discrimination.

2.2.3. Consumer-Related Assumptions

- (1)

- When a consumer experiences algorithmic price discrimination from an e-commerce platform, the cost of defending and reporting this discrimination is denoted as C4. The consumer’s willingness to accept that they do not have to expend much time and effort to file a complaint and recover the price difference is almost zero and, therefore, insignificant.

- (2)

- The estimated value that a customer assigns to goods or services provided by an e-commerce platform is denoted as VE. A consumer will only purchase such goods or services if its estimated value is greater than its pricing, whether it is normal pricing or discriminatory pricing. In other words, VE must be greater than P1 and P2.

- (3)

- The psychological advantage of consumers comparing prices and discovering that the e-commerce platform does not engage in algorithmic price discrimination is referred to as RC1. The incentive provided by the government when the platform engages in algorithmic price discrimination, and consumers exercise their reporting it is known as RC2. The potential advantage for the e-commerce platform resulting from an increase in consumer trust is referred to as RP.

- (4)

- The probability that a consumer, upon realizing that they have experienced algorithmic price discrimination by a platform, will report the price discrepancy to assert their rights is represented by the variable β.

2.2.4. Market Regulators-Related Assumptions

- (1)

- The cost associated with active supervision by the market regulator is C3. In contrast, passive supervision, which does not involve significant time and effort, has a cost that is near zero and can be considered inconsequential.

- (2)

- Algorithmic price discrimination on e-commerce platforms can result in negative consequences for social credibility when the government regulates it unfavorably (LG), highlighting the potential risks. Conversely, positive government regulation can lead to potential benefits such as increased social credibility and rewards from higher authorities (RG). However, if e-commerce platforms implement algorithmic price discrimination and face negative regulation from market regulators, they may incur penalties from higher authorities (F2).

- (3)

- The government’s ability to discover e-commerce platforms engaging in algorithmic price discrimination is significantly enhanced when it actively controls, underscoring the importance of such measures (α).

- (4)

- From the perspective of maximizing the market regulator’s self-interest, the fines imposed on e-commerce platforms by the regulator must exceed the bonuses provided to customers for reporting their rights to ensure a positive return. Therefore, F1 > RC2.

- (5)

- Market regulators are motivated to implement this technique only if the advantages they gain from independently identifying infractions are greater than the costs associated with implementing stricter regulations, so αF1 > C3.

2.2.5. Probabilistic Assumption

The game model presented in this work consists of three parties, each having two strategies. If one of the parties selects the first strategy with a probability denoted as P (0 ≤ P ≤ 1), then the probability of selecting the second strategy is 1 − P. This paper assumes that an e-commerce platform has a probability of x of choosing the “normal pricing” strategy and a probability of 1 − x of choosing the “discriminatory pricing” strategy. Similarly, it assumes that a consumer has a probability of y of choosing the “reporting” strategy and a probability of 1 − y of choosing the “acceptance” strategy. Lastly, it assumes that the market regulator has a probability of z of choosing the “active supervision” strategy and a probability of 1 − z of choosing the “passive supervision” strategy.

2.3. Model Parameter Setting

This paper examines the parametric models developed by researchers from Nanjing University of Technology (2020) [25] and Li Jianjun et al., (2023) [26] in the context of a three-party evolutionary game. Building upon these models, the paper introduces a new variable, namely “the punishment imposed by superior leaders in response to price discrimination by platform algorithms and negative government regulations”. This variable has the potential to influence the outcome of the evolutionary game. Furthermore, Wu Zhiyan’s (2022) research indicates that consumer price sensitivity hinders big data price discrimination [28]. Consequently, this study incorporates consumer price sensitivity as a covariate in the evolutionary game analysis.

To enhance comprehension of each parameter and its significance, the assumption symbols and their corresponding meanings pertaining to e-commerce platforms, consumers, and market regulators in Section 2.2 have been condensed. Additionally, the assumptions regarding strategy space and probability have been consolidated and presented in Table 1.

Table 1.

Parameter symbols and their meanings.

3. Analysis of the Two-Party Evolutionary Game

3.1. The “E-Commerce Platform-Consumer” Two-Party Game

After determining the strategy sets and action relations of the two parties’ game subjects, and according to the parameters in the basic assumptions of Section 2.2, the two-party benefit matrix is constructed and shown in Table 2.

Table 2.

Matrix of the “e-commerce platform-consumer” game.

According to the benefit matrix, the expected benefit functions of the e-commerce platforms that choose normal pricing and discriminatory pricing are and , respectively, and the average benefit of both parties is .

Assuming that is the replication dynamics equation for the e-commerce platform that chooses the “normal pricing” strategy, then

is the replication dynamics equation for the platform that chooses the “normal pricing” strategy.

Making yields three possible equilibrium solutions:

Similarly, the expected benefit functions for consumer market consumers who choose to report on their rights and those who tolerate acceptance are and , respectively, and the average benefit for both parties is .

Assuming that is the replicated dynamic equation for a consumer who chooses a “reporting” strategy, then

is the replicated dynamic equation for a consumer who chooses a “reporting” strategy.

Making yields three possible equilibrium solutions:

This shows that there are five possible stabilization strategies for both sides of the game: , , , , and .

According to the method proposed by Friedman (1991) [18], in this paper, we use the values and traces of the Jacobi matrix to discriminate whether the equilibrium point is an evolutionary stable strategy or not, where , . An equilibrium point is an evolutionary stable strategy if and when it satisfies and . In addition, since of is 0, the point is not discussed.

The replicated dynamic equations for the e-commerce platforms and market regulators and are partialized with respect to and , respectively, to obtain the Jacobi matrix as:

Among them:

Find and for the four equilibrium points , , , and , respectively. The results are shown in Table 3.

Table 3.

Values and traces of the Jacobi matrix of equilibrium points (1).

Since the positive and negative cases of and are unknown for each equilibrium point, a categorization discussion must be conducted to determine whether they are stable points or not. In general, the gains from implementing algorithmic price discrimination on e-commerce platforms will be greater than the gains from normal pricing, i.e., .

- (1)

- When , the equilibrium point of is greater than 0 and is less than 0, so is a stable point. In this case, due to the implementation of algorithmic price discrimination in the e-commerce platform when the revenue is greater than its standardized operation of the revenue, the e-commerce platform will tend to choose “discriminatory pricing” strategy. At the same time, due to the rights of consumers to report the recovery of the difference in the price , cannot be compensated for their rights to report the cost, so the consumer will ultimately tend to choose the “acceptance” strategy. Thus both sides will eventually take the stabilization of the “discriminatory pricing, acceptance” strategy.

- (2)

- When and , the equilibrium point of is greater than 0 and is less than 0, so is a stable point. In this case, since the price difference recovered by consumers when they report their rights to defend is larger than the cost of reporting, consumers will eventually choose the strategy of “reporting”; however, since the revenue of the e-commerce platform from implementing algorithmic price discrimination can make up for its loss from being reported by consumers, even if the e-commerce platform is reported by consumers for defending their rights, it still tends to choose the strategy of “discriminatory pricing” in the end, and thus both parties will eventually adopt the stabilization strategy of “discriminatory pricing, reporting”.

- (3)

- The equilibrium point of and cannot be established at the same time, i.e., the stabilization conditions are in conflict, so is not a stabilization point.

- (4)

- The equilibrium point of and cannot be established at the same time, i.e., the stabilization conditions are in conflict, so is not a stabilization point.

In general, no matter what strategies consumers adopt, the stabilization strategies of e-commerce platforms will eventually evolve towards “discriminatory pricing”, i.e., the equilibrium points and . This is because e-commerce platforms and consumers are always in a state of information asymmetry, and e-commerce platforms can adjust their strategies according to the specific state of consumers, so that consumers are always on the passive side. At the same time, this result also shows that only relying on consumers’ right reporting cannot effectively regulate the behavior of e-commerce platforms to implement algorithmic price discrimination, and thus requires the government to participate in the governance as a third-party subject.

3.2. “E-Commerce Platform-Market Regulators” Two-Party Game

Once the strategy sets and action relationships of the two-game subjects have been determined, the two-party benefit matrix is produced based on the parameters in the basic assumptions of Section 2.2. This matrix is displayed in Table 4.

Table 4.

“E-commerce platform-market regulator” game matrix.

According to the benefit matrix, the expected benefit functions of the e-commerce platforms that choose normal pricing and discriminatory pricing are and , respectively, and the average benefit of both parties is .

Assuming that is the replication dynamics equation for the e-commerce platform that chooses the “normal pricing” strategy, then

is the replication dynamics equation for the platform that chooses the “normal pricing” strategy.

Making yields three possible equilibrium solutions:

Similarly, the expected benefit functions of the market regulators who choose active and passive supervision are and , respectively, and the average benefit for both sides is .

Assuming that is the equation for the replication dynamics of a market regulator that chooses an “active supervision” strategy, then

is the equation for the replication dynamics of a market regulator that chooses an “active supervision” strategy.

Making yields three possible equilibrium solutions:

This shows that there are five possible stabilization strategies for both sides of the game: , , , , and .

According to the method proposed by Friedman (1991) [18], in this paper, we use the values and traces of the Jacobi matrix to discriminate whether the equilibrium point is an evolutionary stable strategy or not, where , . An equilibrium point is an evolutionary stable strategy if and when it satisfies and . In addition, since of is 0, the point is not discussed.

The replicated dynamic equations for the e-commerce platforms and market regulators and can be derived by partial derivation of and respectively, and according to the Jacobi matrix formula in Equation (9):

Find and for the four equilibrium points , , and , respectively. The results are shown in Table 5.

Table 5.

Values and traces of the Jacobi matrix of equilibrium points (2).

Since the positive and negative cases of and are unknown for each equilibrium point, a categorization discussion must be conducted to determine whether they are stable points or not. In general, the gains from implementing algorithmic price discrimination on e-commerce platforms will be greater than the gains from normal pricing, i.e., .

- (1)

- When , the equilibrium point of is greater than 0 and is less than 0, so is the stabilization point. In this case, the illegal gains from the implementation of algorithmic price discrimination by the e-commerce platform are greater than the legal gains from its regulated operation, and the various revenues and expenditures gained by the market regulator are not enough to compensate for the cost of its active supervision, so both sides will ultimately adopt the stabilizing strategy of “discriminatory pricing, passive supervision”.

- (2)

- When and , the equilibrium point of is greater than 0 and is less than 0, so is a stable point. In this case, the illegal income of the e-commerce platform implementing algorithmic price discrimination can compensate for the fine imposed by the market regulator, so even if the market regulator adopts the strategy of “active supervision”, it still cannot change the e-commerce platform’s behavior of implementing algorithmic price discrimination. Both parties will therefore eventually adopt the stabilization strategy of “discrimination pricing, active supervision”.

- (3)

- The equilibrium point of and cannot be established at the same time, i.e., the stabilization conditions are in conflict, so is not a stabilization point.

- (4)

- When and , the equilibrium point of is greater than 0 and is less than 0, so is the stabilization point. In this case, the illegal proceeds from the implementation of algorithmic price discrimination by the e-commerce platform cannot compensate for the fines imposed by the market regulator, so the stabilization strategy that both parties will ultimately adopt is “normal pricing, active supervision”.

In general, if the market regulator does not adopt the strategy of “active supervision”, then the e-commerce platforms will implement algorithmic price discrimination. Moreover, even if the market regulator adopts the strategy of “active supervision”, if it does not increase the corresponding fines and enforcement acumen , then after a long period of gaming, e-commerce platforms will still choose the strategy of “discriminatory pricing” in the end. Therefore, higher authorities should increase the incentives for market regulators to enforce the law to improve their motivation to regulate. At the same time, market regulators should also improve their own law enforcement acumen and increase the penalties for illegal behaviors of e-commerce platforms to increase the cost of violation of the law of e-commerce platforms, and motivate them to choose the strategy of “normal pricing”.

4. Analysis of the Three-Party Evolutionary Game

4.1. Game Matrix Construction

Once the strategy set and action relationship of each game subject have been determined, the three-party benefit matrix is produced and displayed in Table 6, based on the model parameters provided in Section 2.3.

Table 6.

“E-commerce platform-consumer-market regulator” game matrix.

4.2. Strategic Stability Analysis of Three-Party Game Subjects

4.2.1. E-Commerce Platform Strategy Stability Analysis

The expected benefit of the e-commerce platform choosing the “normal pricing” strategy is , the expected benefit of choosing the “discriminatory pricing” strategy is and the average of the two is , respectively:

As a result, the replication dynamic equation for the e-commerce platform choosing the “normal pricing” strategy is:

The derivation of with respect to shows that .

According to the stability principle of the differential equation, when and , the e-commerce platform chooses the “normal pricing” strategy as a stable state.

- (1)

- Let ,then .

Also, because , then , therefore is an increasing function with respect to .

Conclusion 1.

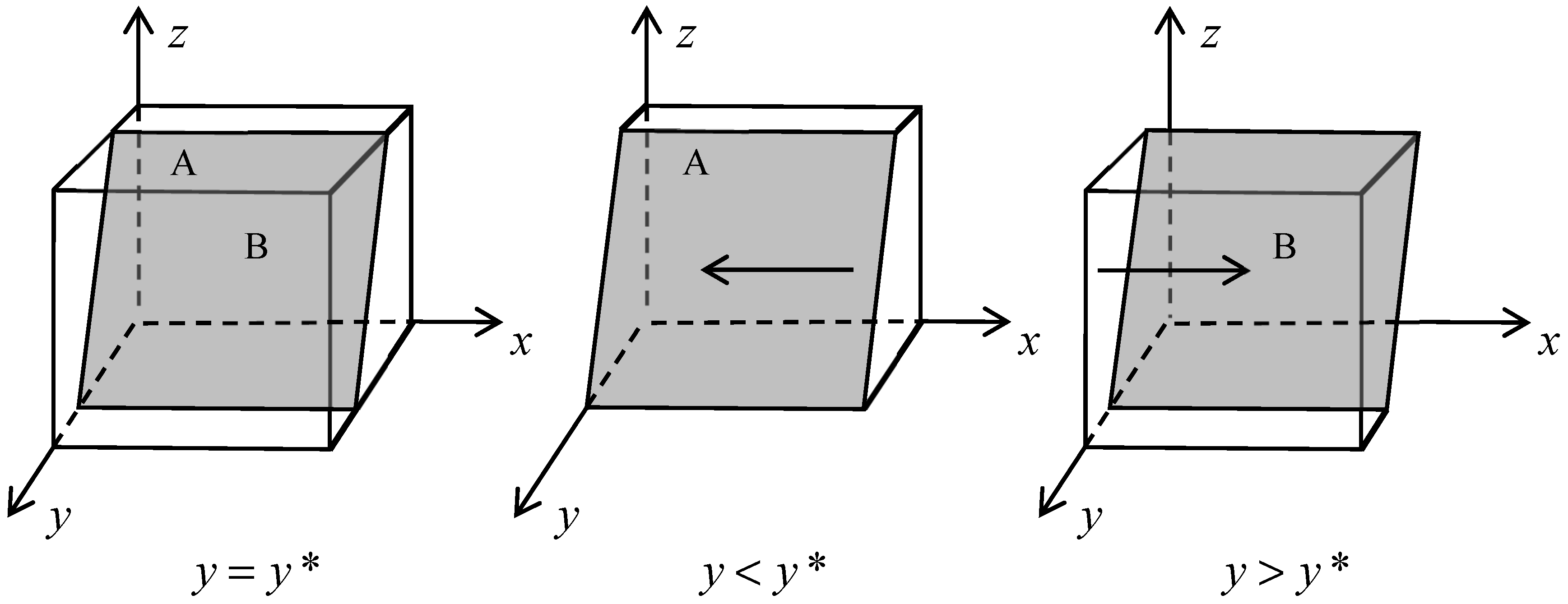

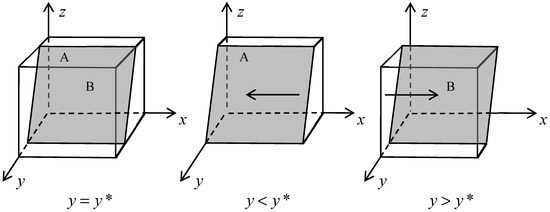

When , , and , all are evolutionary stable strategies; when , , at this time , at this time is an evolutionary stable strategy for e-commerce platforms, i.e., e-commerce platforms will choose discriminatory pricing. On the contrary, when, , at this time , at this time is an evolutionary stable strategy for e-commerce platforms, i.e., e-commerce platforms will choose normal pricing.

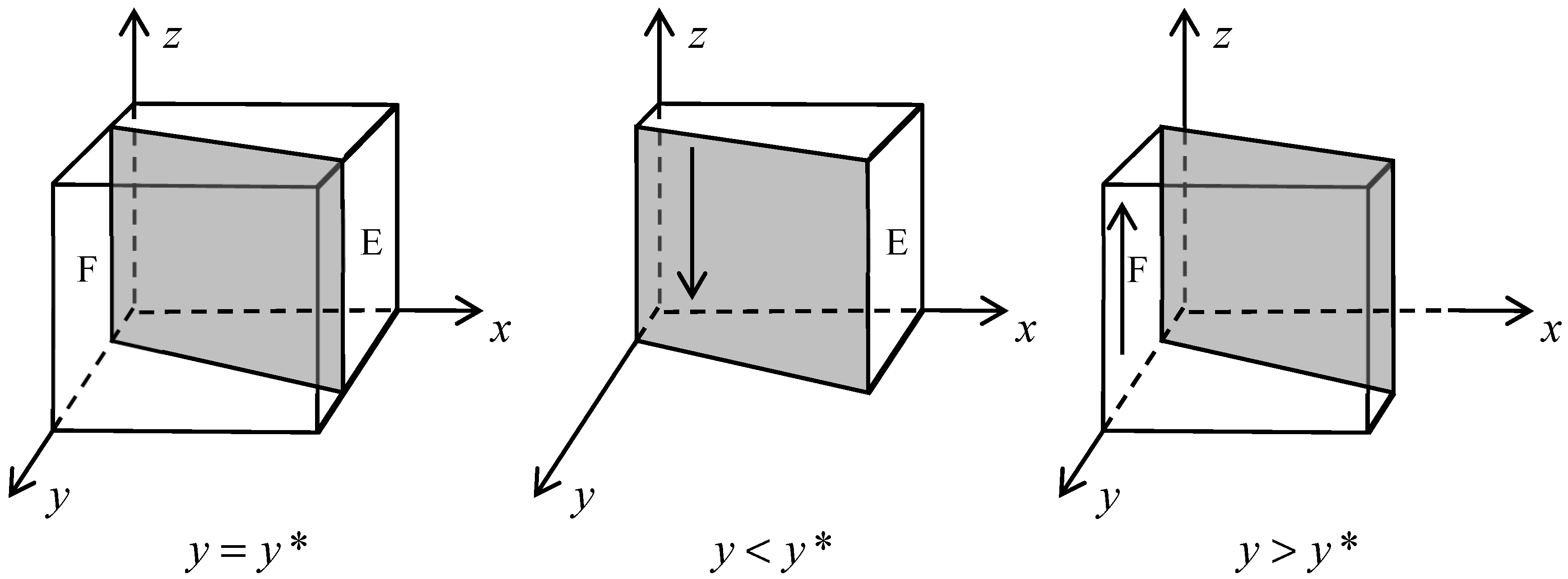

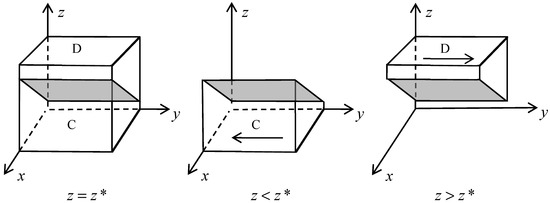

Conclusion 1 demonstrates that when the likelihood of consumers reporting violations of their rights increases, e-commerce platforms adapt their approach from “discriminatory pricing” to “normal pricing” to maintain stability and survival. Conversely, when the likelihood of consumers accepting a product increases, e-commerce platforms change their strategy from using “normal pricing” to employing “discriminatory pricing” as a means of evolutionary stabilization. Hence, e-commerce platforms will determine their adoption of “discriminatory pricing” by considering users’ inclinations toward algorithmic price discrimination. Figure 3 displays the evolutionary phase diagram of the strategy decision for the e-commerce platform.

Figure 3.

Evolutionary phase diagram of e-commerce platform strategy selection.

4.2.2. Consumer Strategy Stability Analysis

The expected benefits of choosing the “reporting” strategy are , the expected benefits of choosing the “acceptance” strategy are , and the average of the two is , respectively:

Thus, the replication dynamics of the consumer’s choice of the strategy of “reporting” is given in the following equation:

The derivation of with respect to shows that .

According to the principle of stability of differential equations: when and , consumers’ stable state is to opt for “report” strategy.

Let .

Then ;

so is an increasing function with respect to .

Conclusion 2.

When , , at this time and , at this time all are evolutionary stable strategy; when , , at this time , at this time is the evolutionary stable strategy of consumers, that is, consumers will choose to tolerate acceptance; on the contrary, when , , at this time , at this time is the evolutionary stable strategy of consumers, that is, consumers will choose to defend the reporting.

Conclusion 2 demonstrates that when the market regulator becomes more involved, consumers’ adaptive stabilizing approach transitions from “acceptance” to “reporting”. Conversely, when the motive of the market regulator declines, customers’ adaptive stabilizing approach transitions from “reporting” to “acceptance”. Thus, consumers will determine their adoption of the “reporting” strategy based on the level of assertiveness exhibited by the market regulator. Figure 4 displays the evolutionary phase diagram of consumers’ approach choices.

Figure 4.

Evolutionary phase diagram of consumer strategy choice.

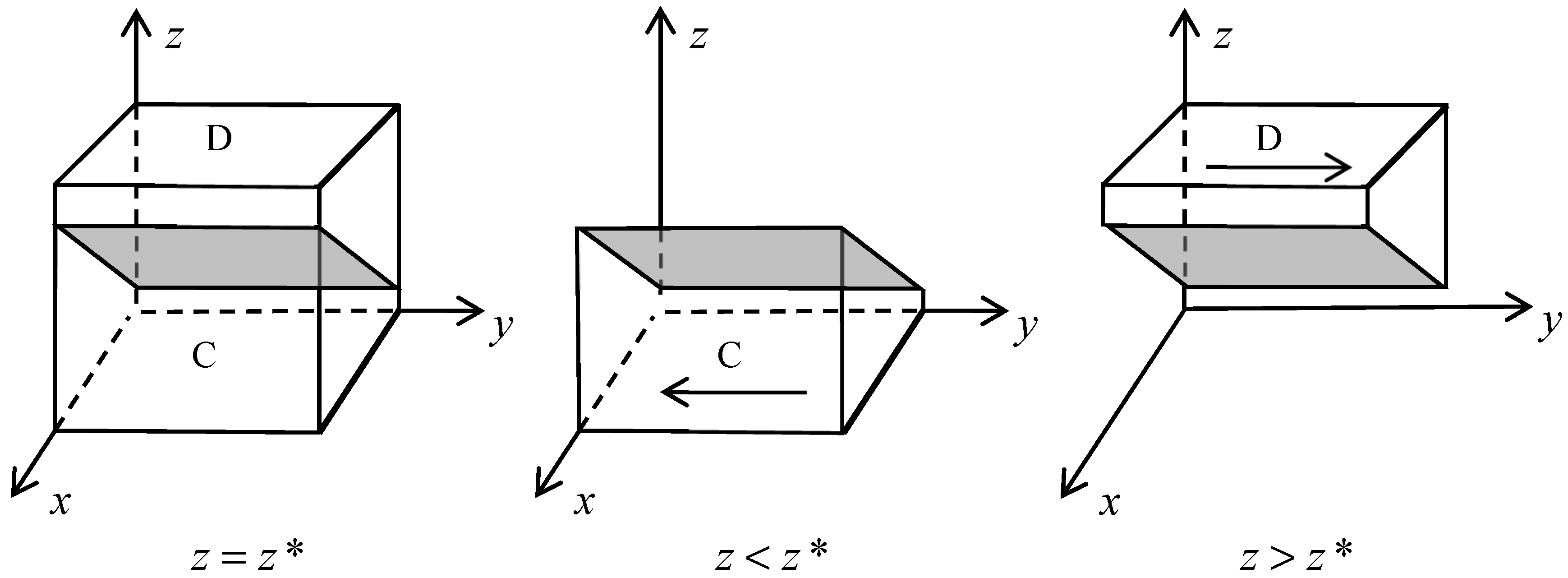

4.2.3. Analysis of Strategic Stability in the Market Regulation Sector

The expected benefits of the market regulator choosing the “active supervision” strategy are , the expected benefits of the “passive supervision” strategy are and the average of the two are :

As a result, the replication dynamics of the market regulator’s choice of “active supervision” strategy is given by:

The derivation of with respect to shows that .

According to the stability principle of the differential equation, when and , the government chooses the “active supervision” strategy as a steady state.

Let .

Then .

Thus is an increasing function with respect to .

Conclusion 3.

When , , at this time and , all are evolutionary stabilization strategies; when , , at this time , at this time is the government’s evolutionary stabilization strategy, i.e., the government will choose to regulate passively. On the contrary, when , , at this time , at this time is the government’s evolutionary stabilization strategy, i.e., the government will choose to regulate positively.

Conclusion 3 indicates that when consumer advocacy becomes more probable, the market regulator’s strategy of maintaining stability in the market changes from “passive supervision” to “active supervision”. In contrast, when the probability of consumer advocacy falls, the market regulator’s evolutionary stabilizing technique transitions from “active supervision” to “passive supervision”. The market regulator’s decision to implement an “active supervision” policy is motivated by the expectation that consumers will assert their rights by filing reports. Figure 5 illustrates the evolutionary phase diagram of the market regulator’s strategy decision.

Figure 5.

Evolutionary phase diagram of strategic choices of market regulators.

4.3. ESS Analysis of the Subjects of the Three-Way Game

Based on the results of solving the game matrix in Section 4.2, the replicated dynamic equations for the e-commerce platforms, consumers and market regulators are obtained at , and , respectively.

The replicated dynamic equations for , and can be obtained by associating them:

According to the theorem of differential equation, the eight equilibrium points and their meanings can be obtained by ordering , and , respectively, as shown in Table 7.

Table 7.

Equilibrium points and their meaning.

Lyapunov’s theory (1992) proposes that the stability of an equilibrium point can be assessed by discerning the positive and negative characteristics of the eigenroots. If all three eigenvalues , and of the Jacobi matrix are negative, then the equilibrium point is considered to be a stable point in the evolutionary game. The Jacobi matrix of the three-party evolutionary game model, including e-commerce platforms, consumers, and market regulators, can be produced through calculation.

The three eigenvalues , , and of the Jacobi matrix are calculated as follows:

The above three eigenvalues , , and are calculated by substituting them into different equilibrium points, as shown in Table 8.

Table 8.

Eigenvalues of equilibrium points.

The positivity and negativity of the eigenvalues are discriminated according to the basic assumptions in Section 2.2 such as , and to identify whether they are evolutionary steady states or not, as shown in Table 9.

Table 9.

Positivity and negativity of eigenvalues of equilibrium points.

Therefore, the equilibrium points , , and are not steady state points, because their eigenvalues are greater than 0. Meanwhile, the remaining equilibria are all unknown and will be further analyzed in the next section.

If the real component of all eigenvalues is negative, it indicates that the perturbation will exhibit exponential decay over time, returning to the steady state point. Consequently, even the slightest deviation will progressively diminish, leading the system to ultimately revert to its stable condition.

Thus, the equilibrium points , and are not evolutionary steady points due to their eigenvalues being greater than 0. However, the remaining equilibria are currently unidentified and will undergo more analysis in the subsequent section.

5. Numerical Simulation Analysis and Parametric Sensitivity Analysis

5.1. Case Description

Based on the game results of e-commerce platforms, this study identifies five distinct evolutionary stable states: , , , , and , as observed among consumers and market regulators in Section 4.3. This section will utilize the MatlabR2023a program to perform numerical simulation analysis to determine the conditions that will cause the e-commerce platform to select the evolutionary stable strategy of “normal pricing”.

Due to the limited number of previous instances and data regarding algorithmic price discrimination on e-commerce platforms, this paper establishes the initial values of certain parameters by incorporating a thesis case and utilizing existing relevant data. The remaining parameter values are determined based on the findings of other pertinent research papers, aiming to maximize the availability and dependability of the simulation data.

Ms. Hu, a Ctrip “Diamond VIP” customer, made a reservation at the Zhoushan Hilton Hotel on 18 July 2020, using the Ctrip App. The total amount paid for the stay was 2889 RMB. Upon checkout, the hotel front desk provided an invoice indicating that the room fee was 1377.63 CNY, which was nearly twice the amount stated previously [34]. Ms. Hu alleged that Ctrip had utilized her data for the purpose of implementing “discriminatory pricing” and subsequently filed a lawsuit against Ctrip in the Keqiao District Court, seeking reparation for her financial damages. The court determined that Ctrip, acting as an intermediary platform, did not accurately disclose the value to consumers, did not meet its commitment to provide preferential treatment to consumers, and participated in deceptive practices. These actions were considered false advertising and pricing fraud, and the court supported the plaintiff’s claim. Hence, in this scenario, the normal pricing and discriminatory pricing of the e-commerce platform amount to CNY 1377.63 and RMB 2889, respectively. According to the terms of the Measures for Payment of Litigation Costs, if the lawsuit’s subject matter is less than 10,000 CNY, a payment of 50 CNY will be made for each case.

Additionally, attorney’s fees (typically 3% to 10% of the subject matter of the lawsuit), deposition fees, and other expenses (such as transportation and lodging) will be added. Consequently, the total cost of the lawsuit will range from approximately 340 yuan to 1150 yuan. For this article, we will consider the median cost, which amounts to 745 yuan, as the value for the consumer’s rights to report C4 in this case.

This paper refers to the research conducted by Nanjing University of Technology [25] and Li Jianjun [26] to support its argument. It focuses on the difficulty of quantifying and evaluating data related to reputation and potential effects. The paper is based on the principle of establishing inequality, specifically the condition where Case 1 leads to an evolutionary steady state. It discusses the loss of platform reputation when algorithmic price discrimination occurs, and consumers report it. It also examines the loss of social credibility when the government passively regulates algorithmic price discrimination. Additionally, the paper explores the potential benefits of positive government regulation, such as an increase in social credibility and rewards from higher authorities. The psychological benefits experienced by consumers when they compare prices and discover that the platform RC1 does not engage in algorithmic price discrimination, as well as the potential benefits to the e-commerce platform resulting from an increase in consumer trust (RP), were assigned values of 8, 5, 12, 3, and 3, respectively.

In this instance, Ctrip is obligated to provide Ms. Hu, the customer, with the exact amount she originally paid. This is because Ctrip has been held responsible for the compensation and must also cover the lawsuit expenses, which will be included in the penalty F2, along with other fees. Thus, the market regulator has levied a penalty of 10 on the platform, and in addition, Ms. Hu, the customer, will receive a return of services from Ctrip and compensation RC2, which is set at 5. Additionally, the e-commerce platform incurs supplementary technical costs, operational costs, and costs associated with reputational risk when implementing algorithmic price discrimination. These costs, in addition to the platform’s regular operational expenses, result in a significant overhead compared to the original cost of normal operation. However, when considering the goal of maximizing individual interests, the added cost will be, at most, the difference in profit before and after implementing discriminatory pricing. Therefore, based on the principle of establishing inequality, this paper sets C1 as 5 and C2 as twice that amount, which is 10.

Furthermore, the cost to the government when it implements active supervision is the expenses incurred by court personnel who actively carry out hearings, trials, and verdicts. A civil action that is actively performed is usually concluded within a timeframe of 1 to 2 days. A judgment requires a minimum of one presiding judge to oversee the proceedings, along with one to two court recorders to document the events and one to two security personnel to ensure courtroom decorum. According to CEIC Data and Salarylnsights, judges receive an average monthly pay ranging from RMB 15,000 to RMB 21,000. Clerks earn an average monthly income ranging from RMB 4000 to RMB 8000, while guards earn an average monthly salary of approximately RMB 6000. In addition, considering the different locations and equipment required to establish a courtroom, this document establishes C3 as 8. For the determination of the values of α and β, this study cites Zhou Kui et al. [35] and initializes them to 0.2. This permits the later inclusion of debugging for comparison purposes.

In this Section 4.3, this study determines the evolutionary stability point of “Case 1” based on the basic assumptions in Section 2.2 and considering the specific conditions of the instance above. The initial values of each parameter are presented in Table 10.

Table 10.

Initial values of the game model parameter settings.

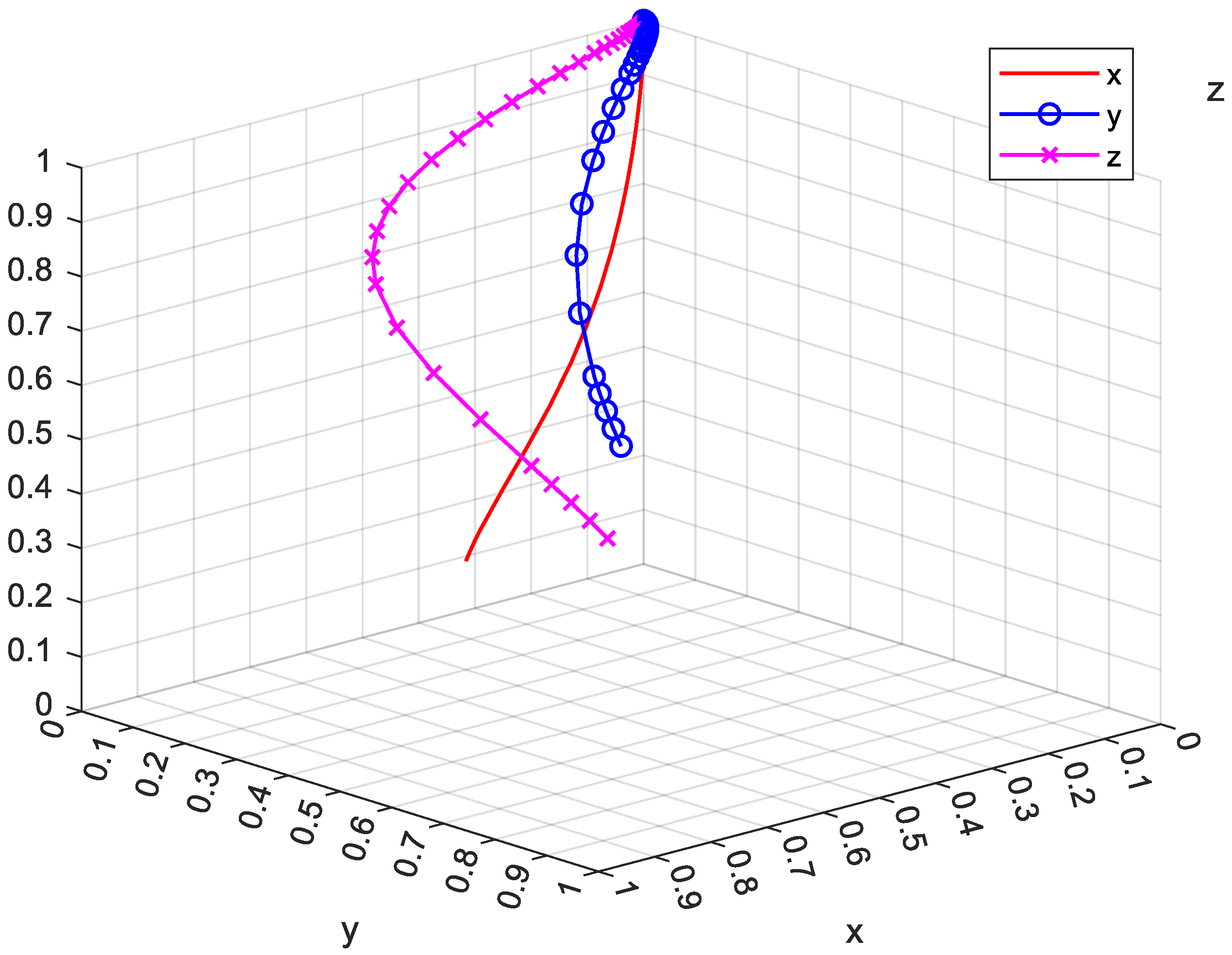

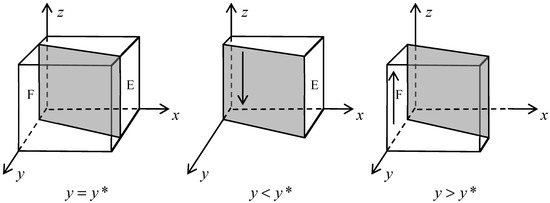

Substitute the values in Table 10 into , , and , refer to the method of Jianjun Li [26], set the initial willingness of the three-party subjects (, , and ) all uniformly to 0.5, and carry out 50 evolutionary games. The results are shown in Figure 6.

Figure 6.

Initial steady state of the evolutionary game of the three subjects.

The eventual evolutionary steady state of the three parties , the consumer, the market regulator, and the e-commerce platform, under the identical initial will is depicted in Figure 6. Table 10 shows that consumer stabilization strategies will eventually move toward “acceptance”, e-commerce platform stabilization strategies will eventually move toward “discriminatory pricing”, and market regulator stabilization strategies will eventually move toward “active supervision”.

Despite the market regulator’s adoption of the “active supervision” approach, it is still powerless to influence e-commerce platforms’ use of algorithmic price discrimination. Over time, e-commerce platforms will likely gravitate toward the stable strategy of “discriminatory pricing” because, on the one hand, the benefits of implementing algorithmic price discrimination can offset the costs of engaging in illegal behavior. On the other hand, market regulators have not adequately punished e-commerce platforms for engaging in illegal behavior. The reward brought about by consumers’ “reporting” strategy, however, is unable to make up for the cost of their reporting owing to the high cost of that right and the government’s inadequate incentives for it. As a result, after weighing the pros and cons, consumers will eventually tend towards “acceptance” of the strategy’s evolution toward stability.

5.2. Analysis of the Impact of Changes in Relevant Parameters

5.2.1. The Effect of Initial Willingness on the Outcome of Evolutionary Games

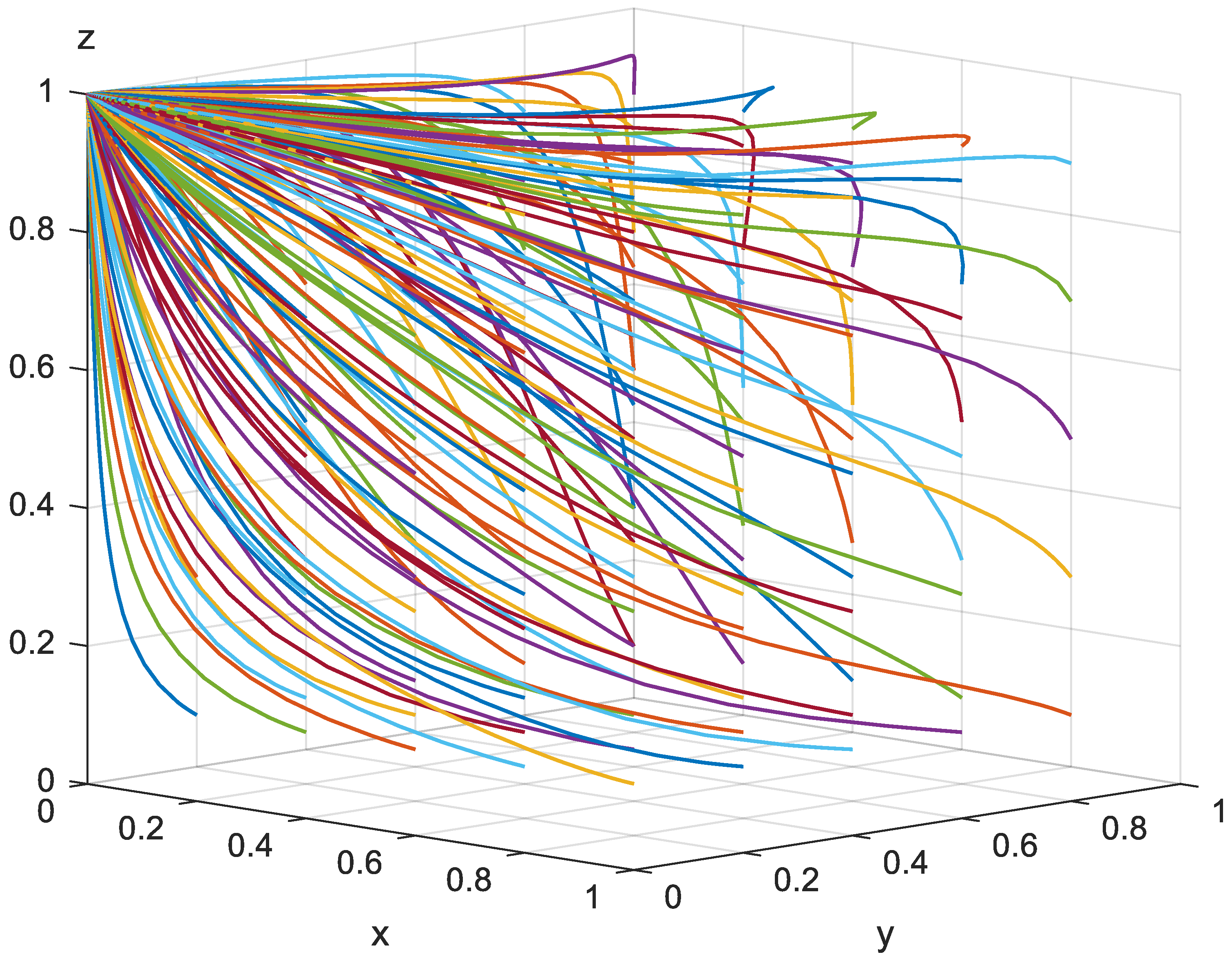

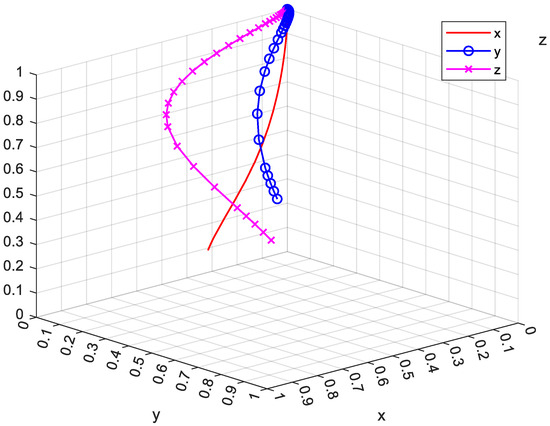

The starting values of , , and are set to 0.1, 0.3, 0.5, 0.7, and 0.9, respectively, leaving other parameters untouched. The evolutionary stabilizing tactics of customers, market regulators, and e-commerce platforms with varying initial values are depicted in Figure 7, along with their final state and trend.

Figure 7.

Evolutionary steady state of the three-party subjects under different initial levels of willingness. The various colored lines represent the stable state that the e-commerce platforms, consumers, and market regulators will ultimately reach after 50 evolutionary games with varying beginning levels of willingness (x, y, and z).

The results depicted in Figure 6 align with those presented in Figure 7, indicating that irrespective of the initial value assigned, the evolutionary game will maintain a consistent trend and outcome. Alternatively, e-commerce platforms will choose the “discriminatory pricing” approach, customers will adopt the “acceptance” approach, and market regulators will implement the “active supervision” approach. Nevertheless, the adoption of “discriminatory pricing” and “acceptance” techniques by e-commerce platforms and customers tends to progress at a slower pace. When comparing the three parties, the market regulator tends to adopt the “active supervision” technique more quickly as their initial willingness increases. Therefore, the government must demonstrate a greater willingness to engage in active supervision initially. It could also shape the final stable state of e-commerce platforms and clients by implementing various initiatives to enhance their initial inclination.

5.2.2. The Effect of Platform Penalties on the Outcome of Evolutionary Games

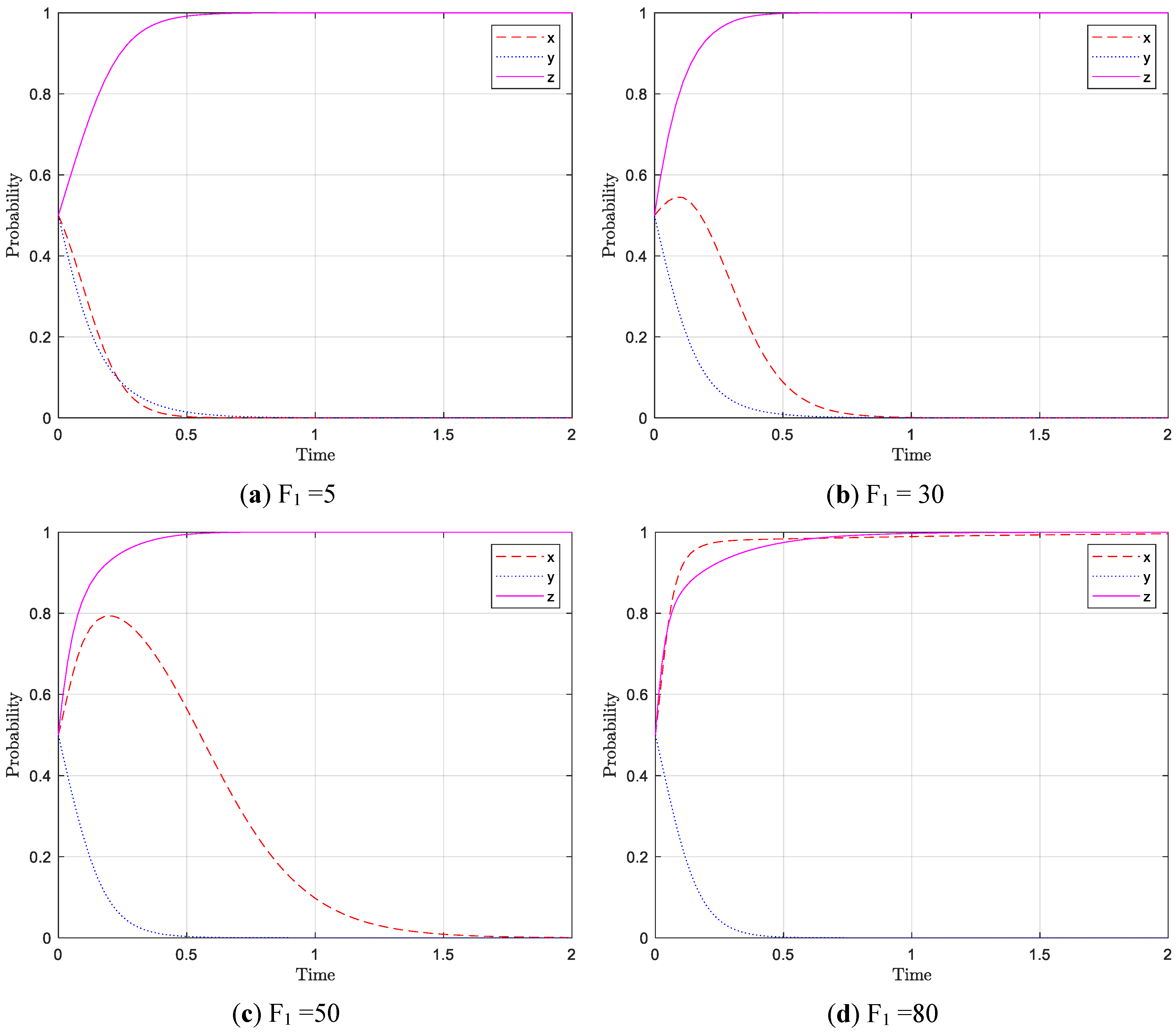

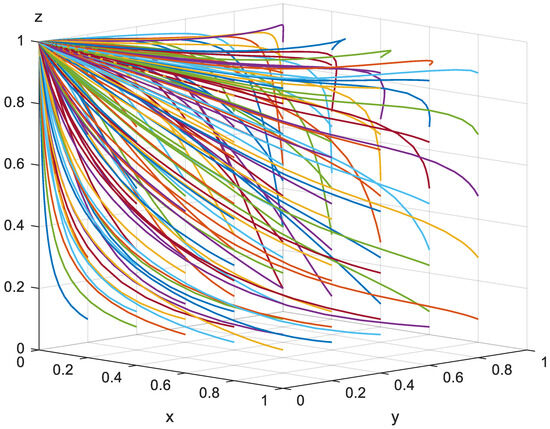

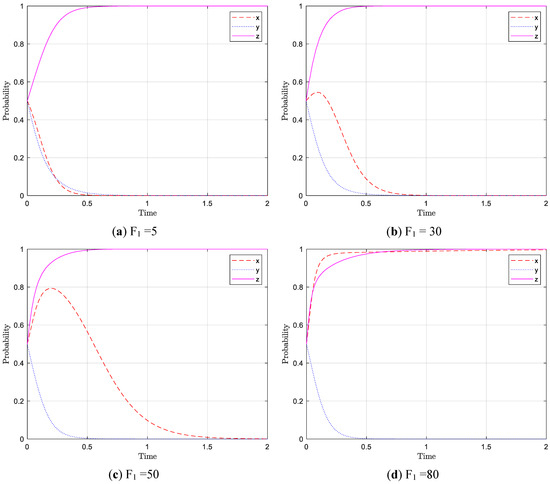

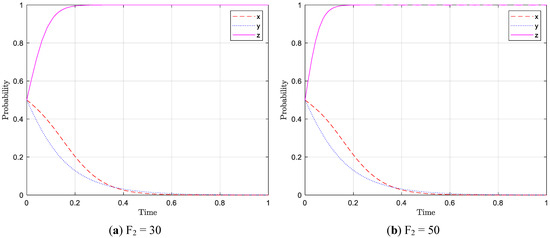

The F1 numbers, which represent the penalties imposed by the market regulator on e-commerce platforms, are fixed at 5, 30, 50, and 80 while keeping the other criteria unchanged. The Figure 8a–d illustrate the ultimate states and changing patterns of the evolutionary stabilizing procedures used by the three parties’ subjects across different penalty strengths.

Figure 8.

Evolutionary steady state of the three-party game subjects under different platform fines.

The data presented in Figure 8 clearly demonstrates that e-commerce platforms tend to engage in price discrimination when the penalty is modest (F1 = 5). Consumers, on the other hand, are generally willing to accept this practice, while market regulators are inclined to enforce strict regulations. E-commerce platforms will ultimately embrace a “discriminatory pricing” approach as they achieve greater profit margins from clients, which will compensate for the substantial penalties levied by the market regulator. This strategy undergoes development at lower levels (F1 = 5), and clients are inclined to accept it. E-commerce platforms typically adjust their pricing in response to increasing penalties imposed by the market regulator, with penalties ranging from F1 = 30 to F1 = 50. Over time, e-commerce platforms will increasingly adopt the “discriminatory pricing” strategy to offset the substantial fines imposed by the market regulator (F1 = 80), thanks to the growing customer profit surplus. In due course, they will transition to the “normal pricing” approach. Customers’ motivation to defend their rights stays consistent due to the government’s growing platform fines, which offer minimal incentives and result in hefty expenses for customers. Instead, they regularly choose the tactic of “acceptance”.

Market regulators have a crucial role in the e-commerce industry, particularly in the regulation of pricing. Their active involvement is more pronounced when there is a system of consequences in place to justify their actions. This is evident when fines for e-commerce platforms are increased, leading to a rise in the funds collected by regulators through enforcement actions. These funds enable them to cover the costs associated with their active regulating efforts. Despite customers’ consistent tolerance towards platform fine increases, the market regulator is the sole entity actively engaged in illegal governance, resulting in increased government spending. To reduce these costs and encourage e-commerce platforms to regulate prices, the market regulator must provide customers with appropriate incentives to protect their rights and enhance their ability to report any violations, thereby improving the regulatory process.

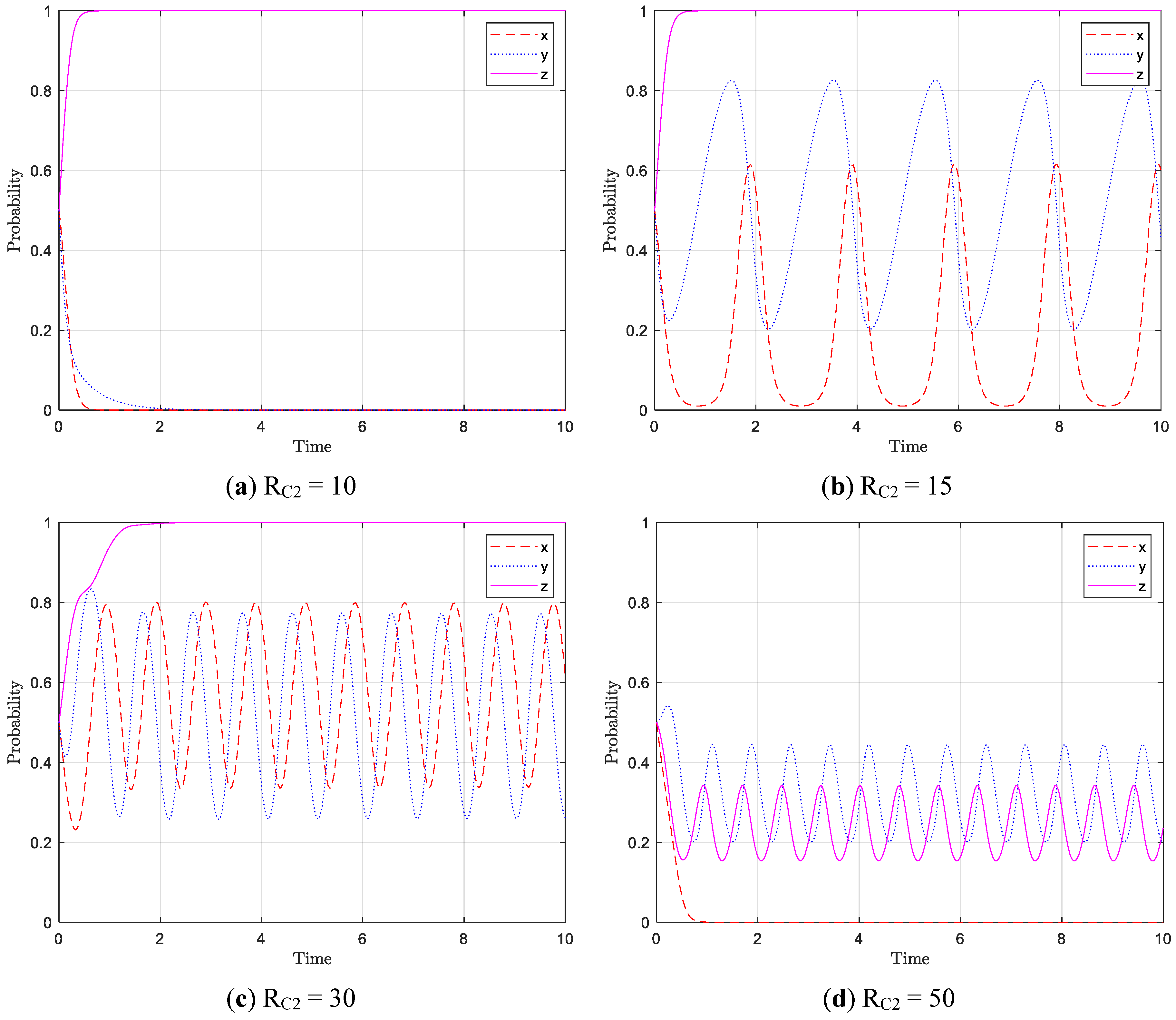

5.2.3. The Effect of Consumer Advocacy Incentives on the Outcome of an Evolutionary Game

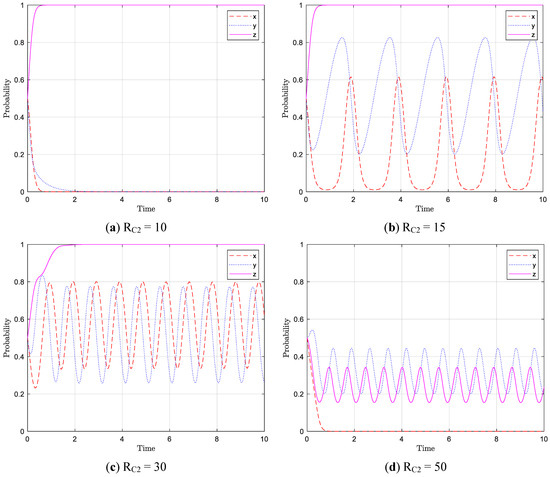

The reward value RC2 for consumer advocacy reports was adjusted to 10, 15, 30, and 50 while keeping all other parameters unchanged. The Figure 9a–d illustrate the ultimate states and changing patterns of the three participants’ evolutionary stabilizing strategies in response to different rewards for consumer reporting.

Figure 9.

Evolutionary steady state of the three-party game players under different consumer rights incentives.

According to Figure 9, when the reward for consumers’ reporting is relatively low (RC2 = 10), e-commerce platforms adopt a strategy of “discriminatory pricing” to stabilize their evolution, consumers adopt a strategy of “acceptance”, and market regulators adopt a strategy of “active supervision”. As the rewards gradually increase (RC2 = 15 and RC2 = 30), the market regulator’s motivation to regulate fluctuates but remains generally positive. This is because as consumers become more motivated to protect their rights and report any violations, they can work together with the market regulator to regulate e-commerce platforms. Additionally, the market regulator can be incentivized by the increase in consumers’ motivation to report any violations. Consumers can reimburse the market regulator for the expenses incurred in rewarding those who report violations of consumer rights. This action indirectly leads to an increase in the funds obtained through enforcement. Increasing the reward amount for consumers enhances their motivation to defend their rights and report issues. However, over time, this motivation fluctuates, and there needs to be a definitive stable strategy. This is because consumers’ psychological expectations (RC1) and evaluation value (VE) influence their behavior, and simply increasing the reward amount does not guarantee that they will always choose the strategy of “reporting”. Choosing the incentive for e-commerce platforms will pose a greater challenge. The probability of e-commerce platforms selecting “normal pricing” is contingent upon the probability of consumers opting to select “reporting”. When consumers are highly motivated to report, e-commerce platforms will implement the “normal pricing” strategy. When consumers are strongly inclined to safeguard their rights, e-commerce platforms will implement the “normal pricing” strategy, albeit with a certain delay between the two strategies. However, if the rewards are significantly amplified (RC2 = 50), the motivation of market regulators to enforce regulations will diminish. This is because excessively generous rewards for consumers to protect and report their rights would impose an exorbitant cost on regulators, thereby reducing their willingness to regulate e-commerce platforms. Simultaneously, as the motive of the market regulator diminishes, its inclination to incentivize customers to report will also diminish, leading to a drop in consumers’ readiness to report any misconduct. Consequently, e-commerce platforms will employ algorithmic price discrimination against consumers when both parties are less inclined to enforce regulations. This is known as the “discriminatory pricing” method, which serves as an evolutionary stabilizing approach for e-commerce platforms.

Based on this, the level of government incentives for consumers should be moderate. If the rewards are higher, consumers may be motivated enough to report violations of their rights, which would undermine the effectiveness of active supervision. On the other hand, if the rewards are too high, it could result in a significant increase in regulatory costs for the government, which should be avoided. Therefore, it is crucial to maintain a reasonable balance in setting the amount of government rewards for consumers.

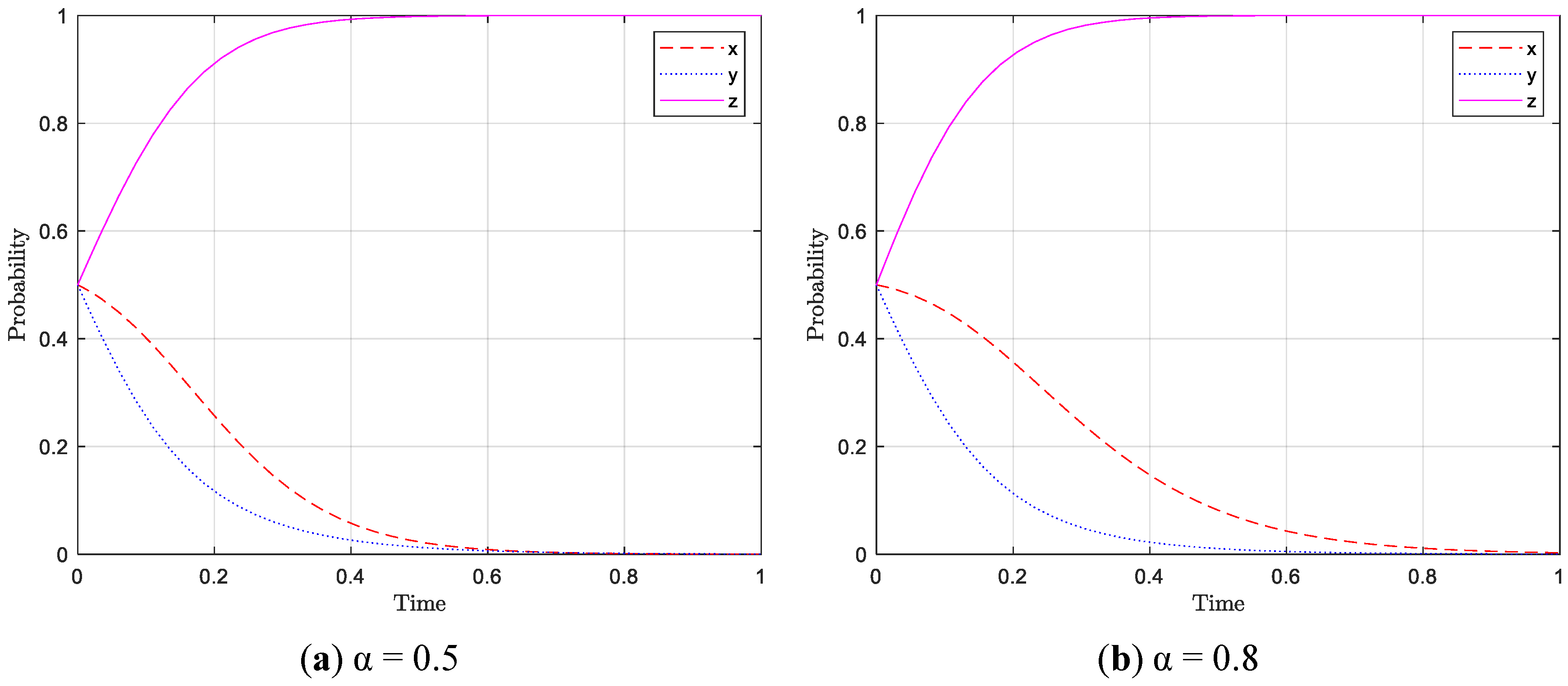

5.2.4. The Impact of Market Regulators’ Enforcement Acumen on Evolutionary Game Outcomes

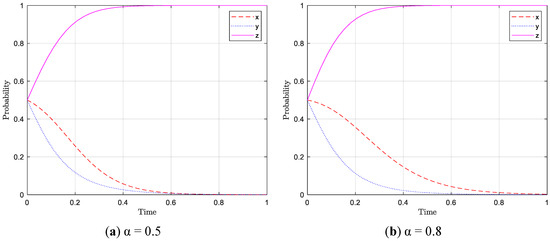

Assuming all other factors remain the same, the market regulator’s enforcement acuity values are adjusted to 0.5 and 0.8, respectively. When α = 0.2, you can consult Figure 6 for reference. The Figure 10a,b represent the evolving trends and outcomes of the tripartite subjects’ stabilizing methods in response to varying levels of enforcement expertise from different market regulators.

Figure 10.

Evolutionary steady state of the three-party game players under different market regulators’ enforcement acumen.

According to Figure 10, an increase in the market regulator’s enforcement acumen leads to a decrease in the rate at which e-commerce platforms adopt the “discriminatory pricing” strategy and consumers adopt the “acceptance” strategy. However, both parties still tend to ultimately choose the evolutionary stabilization strategy of “discriminatory pricing” and “acceptance”. Nevertheless, they continue to opt for the evolutionary stabilizing technique of “discriminatory pricing” and “acceptance”. The market regulator’s enhanced enforcement expertise results in a more rapid implementation of the “active supervision” approach, ultimately leading to stabilization.

Increasing the market regulator’s enforcement acumen alone will not alter the final evolutionary stabilization strategy of the three parties. Therefore, it is essential to proportionally increase the fine F1 to raise the value of αF1 significantly. This will incentivize the e-commerce platform to adopt the “normal pricing” stabilization strategy.

5.2.5. The Impact of Consumer Autonomy Likelihood on Evolutionary Game Outcomes

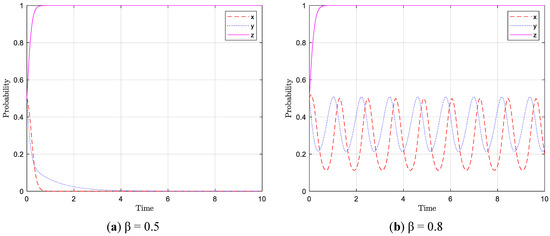

Assuming all other factors remain the same, the likelihood of consumer autonomy is assigned values of 0.5 and 0.8, respectively. This is applicable when β is equal to 0.2, as shown in Figure 6. The Figure 11a,b represent the evolutionary stabilizing methods of the three subjects under varied levels of consumer autonomy. Figure 11a shows the trajectory of these strategies, while Figure 11b shows their final state.

Figure 11.

Evolutionary steady state of the tripartite game players under different possibilities of consumer autonomy in defending their rights.

According to Figure 11, when consumers have a moderate level of ability to defend their rights (β = 0.2 and β = 0.5), the e-commerce platform is more likely to engage in discriminatory pricing, consumers are more likely to tolerate it, and the market regulator is more likely to regulate actively. Consumers who are less inclined to protect their rights independently will have reduced motivation to regulate e-commerce platforms. As a result, the e-commerce platform will be more likely to choose a “discriminatory pricing” strategy, leading to a smaller price difference recovered from the platform. Conversely, when consumers are more likely to defend their rights independently (β = 0.8), they will recover a larger price difference from the e-commerce platform. This will compel the platform to adopt a “normal pricing” strategy.

Nevertheless, the data from subplot (b) in Figure 11 indicates that an increase in consumers’ willingness to report their rights leads to a corresponding increase in e-commerce platforms’ willingness to regulate pricing. However, it is important to note that consumer reporting alone is insufficient to consistently motivate e-commerce platforms to adopt the strategy of “normal pricing”. To achieve this, collaborative participation from the government is necessary. Consequently, the strategy of “normal pricing” lacks evolutionary stability for both e-commerce platforms and consumers.

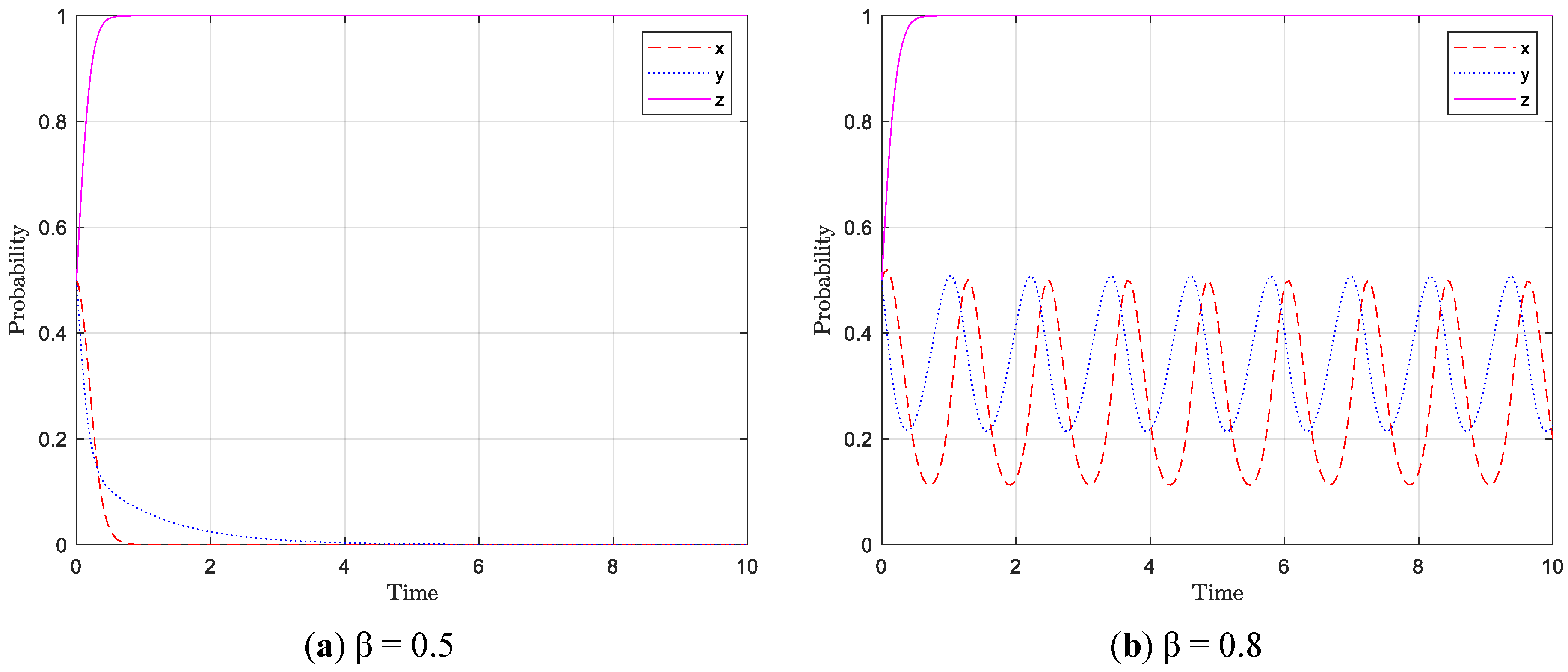

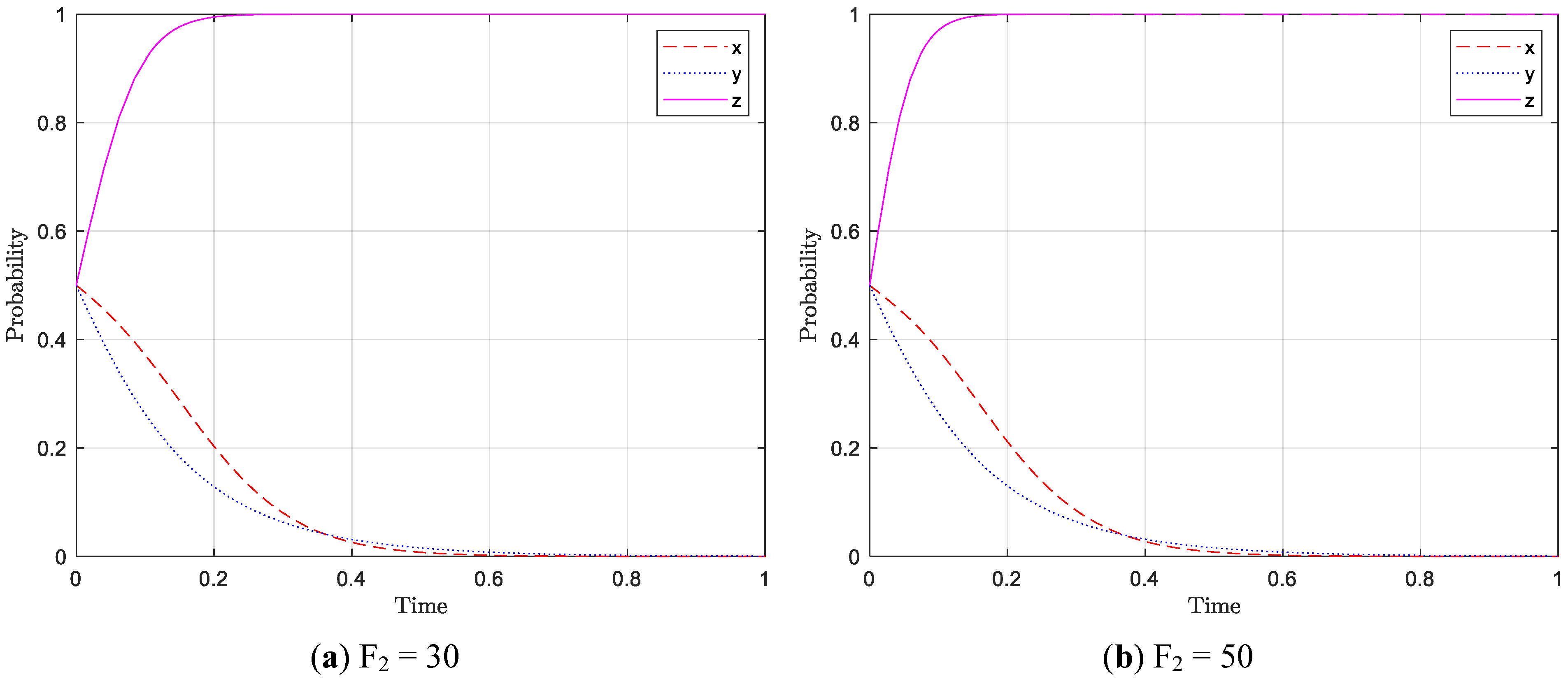

5.2.6. The Effect of Punishment of Government by Superiors on the Outcome of the Evolutionary Game

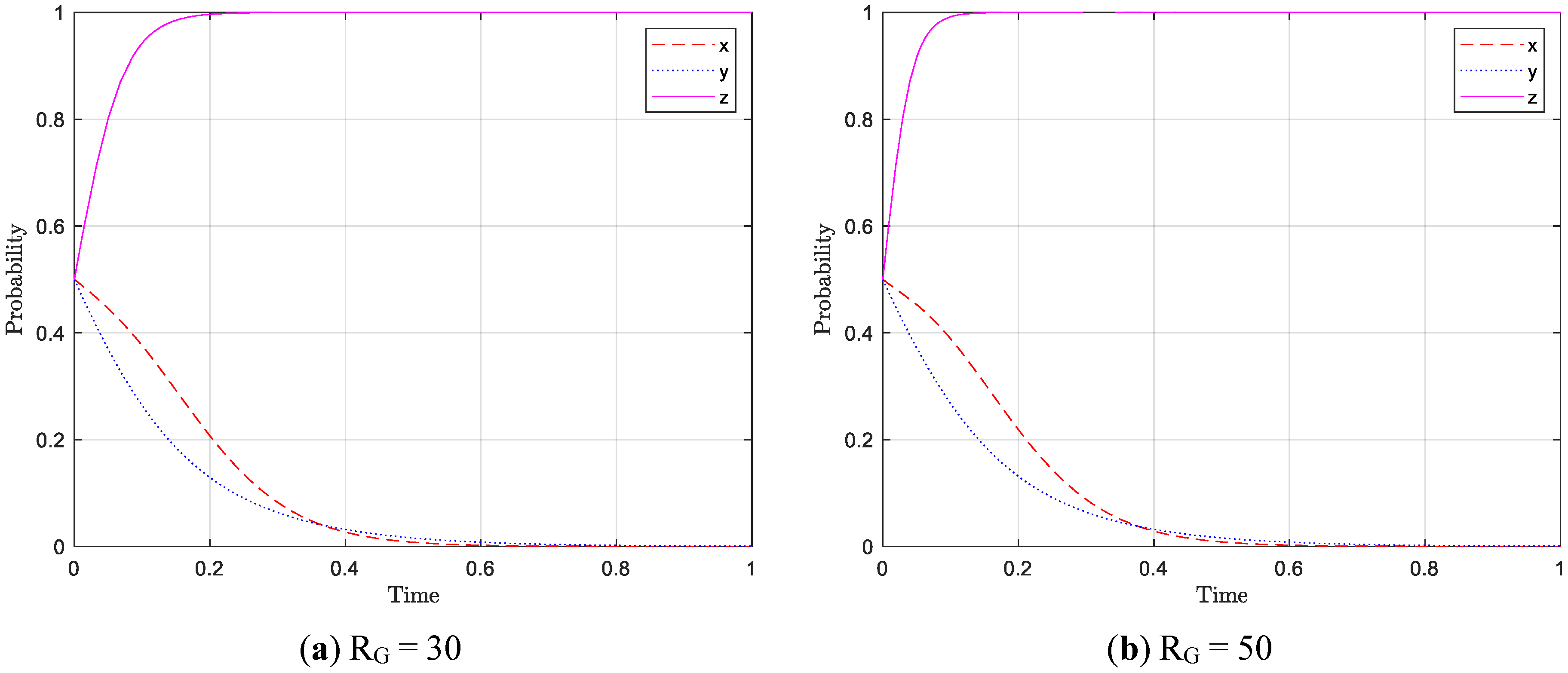

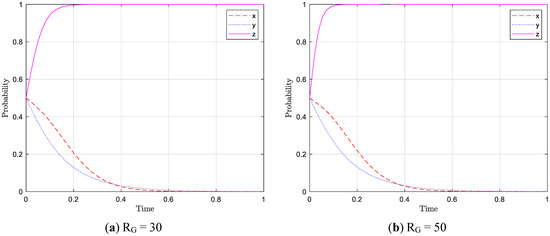

By maintaining the other parameters at a constant level and assigning penalty values of 30 and 50 to the government’s higher authority, the Figure 12a,b represent the evolving trends and outcomes of the e-commerce platforms, consumers, and market regulators’ strategies for stabilizing the system. These strategies are influenced by the varying degrees of punishment imposed by the government’s superior leaders.

Figure 12.

Evolutionary steady state of the tripartite game subjects under different levels of punishment from higher-ups.

According to Figure 12, it is evident that when the higher authority penalizes the government with F2 values of 30 and 50, the e-commerce platform tends to engage in discriminatory pricing, consumers are more likely to accept it, and the market regulator becomes more aggressive in its regulation. This contrasts with the situation when F2 = 5, as shown in Figure 6, where the evolutionary stabilization strategy remains consistent. This indicates that the severity of punishment imposed by higher authorities on the government has minimal impact on the selection of the ultimate evolutionary stabilizing technique among the three subjects. Nevertheless, it is worth noting that when the severity of punishment imposed by higher authorities increases, the market regulator promptly adopts the “active supervision” approach to prevent being fined for “passive supervision”.

5.2.7. The Potential Benefits of Active Supervision by Market Regulators on the Outcome of Evolutionary Games

Assuming all other factors remain unchanged and assigning the values of the potential benefits of active supervision by the market regulator as 30 and 50, the Figure 13a,b represent the evolutionary stabilization strategies of the three subjects. These strategies are influenced by varying potential benefits provided by the government.

Figure 13.

Evolutionary steady state of tripartite game players under different potential benefits of active supervision.

According to Figure 13, when the market regulator’s potential benefit from active supervision increases (RG = 30 and RG = 50), the e-commerce platform’s evolutionary stabilizing strategy is “discriminatory pricing”, the consumer’s evolutionary stabilizing strategy is “acceptance”, and the market regulator’s evolutionary stabilizing strategy is “active supervision”. This is consistent with the findings when RG = 5, as shown in Figure 6. This indicates that the prospective government advantages have minimal impact on the ultimate selection of the evolutionary stabilization approach by the three parties.

Nevertheless, it is worth noting that when the potential advantages of proactive oversight by market regulators rise, market regulators will opt for an “active supervision” approach more promptly, as it has the potential to provide higher returns.

6. Conclusions and Discussion

6.1. Conclusions

This paper takes the current widespread algorithmic price discrimination behavior of the e-commerce platform as the research object and carries out research from different aspects of multiple subjects by setting parameters, establishing models, conducting analysis, and adjusting the values of parameters. The main conclusions are as follows:

1. Algorithmic price discrimination by e-commerce platforms cannot be properly regulated solely by customers or market regulators exercising unilateral governance. Despite initially showing a strong inclination towards adopting “normal pricing”, e-commerce platforms ultimately tend to opt for the tactic of “discriminatory pricing”.

2. The strategic decisions made by e-commerce platforms are influenced by factors such as the cost of implementing algorithmic price discrimination C2 and the penalties imposed by the market regulator for engaging in discriminatory practices F1. On the other hand, consumers’ strategic decisions are influenced by factors such as the psychological benefits they experience when comparing prices and discovering that they have not been subjected to algorithmic discrimination by the platforms RC1, as well as the incentives provided by the market regulator for reporting any violations of their rights RC2. Lastly, the strategic decisions made by the market regulator are influenced by the potential loss of social credibility and penalties imposed by higher authorities for passive supervision LG, as well as the punishment imposed by higher authorities F2.

3. Various elements exert varying degrees and patterns of influence on the strategic decisions made by the players of the game. The initial willingness of the game players (x, y, and z), the enforcement ability of the market regulator α, the punishment by the government F2, and the potential benefits of active supervision by the market regulator RG do not significantly affect the final stable state of evolution. However, the fine imposed by the market regulator on e-commerce platforms for discriminatory pricing F1 is positively associated with the e-commerce platforms’ willingness to regulate pricing. However, if the penalty (referred to as F1) is low, e-commerce platforms may initially regulate their pricing, but it will not ultimately deter them from choosing the “discriminatory pricing” strategy. The adoption of consumer rights protection incentives RC2 has influenced the preference of e-commerce platforms in implementing “normal pricing” strategies, which in turn depends on consumers’ inclination towards “reporting” strategies. However, due to the excessive expenditure of the market supervision department, it tends to adopt a “passive supervision” approach. Consequently, the three-party game transforms into a two-party game between e-commerce platforms and consumers. In this scenario, e-commerce platforms are still likely to opt for “discriminatory pricing” strategies. Moreover, as the likelihood of consumers independently safeguarding their rights β increases, the cost for e-commerce platforms to violate the law also rises. As consumer empowerment grows, the consequences of breaking the law become more expensive, leading to an increased inclination to regulate prices. This inclination is driven by customers’ determination to safeguard their rights and denounce any violations.

Compared to the two-party evolutionary game discussed in Section 3, the three-party evolutionary game model involving the “e-commerce platform-consumer-market regulator” can more effectively explore ways to regulate algorithmic price discrimination on e-commerce platforms. This is achieved through the combined efforts of consumers and market regulators, resulting in a synergistic effect.

6.2. Suggestion

6.2.1. Consumers

1. Enhance the fervor for asserting one’s rights through self-defense. Suppose you encounter algorithmic price discrimination by an e-commerce platform. In that case, it is advisable to promptly report the incident and assert your rights to the appropriate authorities rather than passively enduring and acquiescing to it.

2. Heighten the focus on e-commerce platforms and their conduct. As consumers and the general public become increasingly aware of e-commerce platforms and their actions, these platforms may be concerned that their pricing practices could passively impact their brand reputation and long-term success. Consequently, e-commerce platforms are now placing greater emphasis on their brand reputation and word-of-mouth, ultimately leading them to adopt the strategy of “normal pricing”.

3. Enhance the oversight of market regulators. As consumers and the general public become more vigilant in monitoring market regulators, any negative oversight by market regulators regarding algorithmic price discrimination by e-commerce platforms will greatly undermine their credibility. This will compel market regulators to place greater emphasis on their credibility, leading them to enhance their control over e-commerce platforms and consequently reducing the occurrence of algorithmic price discrimination.

6.2.2. Market Regulator

1. Enhance the penalties for algorithmic price discrimination implemented by e-commerce platforms. The stringent enforcement measures implemented by market authorities have a favorable and substantial influence on the behavioral inclination of e-commerce platforms. Raising the penalties for discriminatory pricing practices on e-commerce platforms reduces the profitability of these illegal actions and encourages the platforms to adopt standardized operations.

2. Expand the platform for exercising rights and decrease the expenses associated with reporting consumer rights violations. Market supervision departments aim to expand consumer rights, decrease the cost of exercising these rights, enhance consumer engagement in reporting rights violations, and minimize the cost of market monitoring for the departments themselves.

3. The upper echelons of leadership enhance the incentives and penalties for the operational efficiency of market regulatory agencies. To successfully enhance the motivation of market supervision departments and regulate the algorithmic pricing discriminatory behavior of e-commerce platforms, it is necessary to reinforce the incentives and penalties associated with the effectiveness of these departments.

4. Adequately enhance the incentives for reporting violations of consumer rights. Market regulatory agencies should provide or enhance incentives for consumers to actively protect their rights, thereby increasing their motivation to report violations. However, the rewards for consumers reporting violations should be reasonable and within the compensatory range of fines imposed. Excessive rewards may diminish their regulatory initiative and undermine the effectiveness of governance.

6.3. Limitations

The primary constraints and deficiencies of this research mostly lie in the selection of the game subject and the simulation of parameters. This paper focuses on analyzing the game involving the e-commerce platform, consumers, and market regulators. However, in reality there may be additional game subjects, such as consumer associations and te-commerce platform merchants participating in the game. Therefore, the choice of game subjects in this paper needs to be more comprehensive. This research examines the parameter settings of previous studies and incorporates personal insights in the context of parameter simulation. However, it is important to note that real-life situations are more intricate, and so the parameters proposed in this paper may only encompass some aspects. Simultaneously, there currently needs to be a definitive and widely accepted approach for the numerical simulation aspect. This requires independent mastery and may deviate from the actual circumstances, resulting in the numerical simulation findings potentially needing to reflect the real scenario accurately.

Author Contributions

Y.G. and J.L. collaborated to produce the initial version. Y.G. guided the drafting and editing of the paper, while J.L. analyzed the simulation data. Ultimately, W.Z. thoroughly examined and verified the entire manuscript. All authors have read and agreed to the published version of the manuscript.

Funding

National Social Science Foundation of China: Research on B2B Data Ownership Definition and Transaction Incentive Mechanism Design for Industry Chain Collaboration (grant number 22BGL007).

Data Availability Statement

This paper contains all the data needed to support the results of this study.

Acknowledgments

The authors express their gratitude to the anonymous reviewers for their invaluable feedback, which significantly enhanced the quality of this research. Furthermore, the authors express their gratitude to Yan Guo for his invaluable mentorship throughout this study.

Conflicts of Interest

The authors confirm that there are no conflicts of interest or personal relationships that could have influenced the work reported in this paper.

References

- Islek, I.; Oguducu, S.G. A hierarchical recommendation system for E-commerce using online user reviews. Electron. Commer. Res. Appl. 2022, 52, 101131. [Google Scholar] [CrossRef]

- Gonçalves, M.J.A.; Pereira, R.H.; Coelho, M.A.G.M. User Reputation on E-Commerce: Blockchain-Based Approaches. J. Cybersecur. Priv. 2022, 2, 907–923. [Google Scholar] [CrossRef]

- Abrardi, L.; Cambini, C.; Rondi, L. Artificial intelligence, firms and consumer behavior: A survey. J. Econ. Surv. 2022, 36, 969–991. [Google Scholar] [CrossRef]

- Keller, A.; Vogelsang, M.; Totzek, D. How displaying price discounts can mitigate negative customer reactions to dynamic pricing. J. Bus. Res. 2022, 148, 277–291. [Google Scholar] [CrossRef]

- Wang, J.; Shu, T.; Zhao, W.; Zhou, J. Research on Chinese Consumers’ Attitudes Analysis of Big-Data Driven Price Discrimination Based on Machine Learning. Front. Psychol. 2022, 12, 803212. [Google Scholar] [CrossRef]

- Zhu, Z. Legal Regulation of Algorithmic Discrimination. Adv. Soc. Behav. Res. 2021, 1, 65–72. [Google Scholar] [CrossRef]

- Wang, F. China’s Regulatory Framework for Dynamic and Personalized Pricing in the Digital Economy. Int. J. Soc. Sci. Stud. 2022, 10, 1–10. [Google Scholar] [CrossRef]

- Zhao, Q. Exploration on the protection of consumer rights and interests in big data price discrimination. Int. J. Front. Sociol. 2024, 6, 060403. [Google Scholar]

- Li, Y. The Anti-nonopoly Law Regulation of Big Data Killing in the Background of Digital Economy. J. Econ. Law 2024, 1, 214–222. [Google Scholar] [CrossRef]

- Hu, Z. Liability Rules for Algorithmic Discrimination. Sci. Law J. 2023, 2, 020902. [Google Scholar]

- Wang, Y. Price Discrimination in the Era of Big Data; Atlantis Press: Amsterdam, The Netherlands, 2022; 664p. [Google Scholar]

- Yang, X.; Dai, X.; Bin, H. The Dynamics of Rewards and Penalties: Governmental Impact on Green Packaging Adoption in Logistics. Sustainability 2024, 16, 4835. [Google Scholar] [CrossRef]

- Hu, Z.; Wang, Y.; Zhang, H.; Liao, W.; Tao, T. An evolutionary game study on the collaborative governance of environmental pollution: From the perspective of regulatory capture. Front. Public Health 2024, 11, 1320072. [Google Scholar] [CrossRef] [PubMed]

- Luo, E.; Xiang, S.; Yang, Y.; Sethi, N. A stochastic and time-delay evolutionary game of food safety regulation under central government A stochastic and time-delay evolutionary game of food safety regulation under central government punishment mechanism. Heliyon 2024, 10, e30126. [Google Scholar]

- Liu, Z.; Zhao, L.; Wu, C. Supervision Timing Simulation Analysis of Community E-commerce Platform Supply Chain Based on Tripartite Game Model. Teh. Vjesn. 2022, 29, 2008–2017. [Google Scholar]

- Liu, X.; Huang, Z.; Wang, Q.; Wan, B. An Evolutionary Game Theory-Based Method to Mitigate Block Withholding Attack in Blockchain System. Electronics 2023, 12, 2808. [Google Scholar] [CrossRef]

- Pan, K.; Wang, L.; Zhang, L. A Study on Enhancing the Information Security of Urban Traffic Control Systems Using Evolutionary Game Theory. Electronics 2023, 12, 4856. [Google Scholar] [CrossRef]

- Friedman, D. On economic applications of evolutionary game theory. J. Evol. Econ. 1998, 8, 15–43. [Google Scholar] [CrossRef]

- Luo, J.; Huang, M.; Bai, Y. Promoting green development of agriculture based on low-carbon policies and green preferences: An evolutionary game analysis. Environ. Dev. Sustain. 2023, 26, 6443–6470. [Google Scholar] [CrossRef]

- Bai, S.; Liu, Z.; Lv, Y. Evolutionary Game Analysis of Consumer Complaint Handling in E-Commerce. Discret. Dyn. Nat. Soc. 2022, 2022, 3792080. [Google Scholar] [CrossRef]

- Zha, Y.; Wang, Y.; Li, Q.; Yao, W. Credit offering strategy and dynamic pricing in the presence of consumer strategic behavior. Eur. J. Oper. Res. 2022, 303, 753–766. [Google Scholar] [CrossRef]

- Yu, D.; Li, X. Dynamic evolutionary game research of big data-based price discrimination between consumers and merchants. Price Theory Pract. 2019, 11, 129–132. [Google Scholar]

- Xing, G.; Lu, F.; Luo, D. An Evolutionary Simulation Analysis of E-Commerce Big Data-Based Price Discrimination under Government Supervision. J. Hunan Univ. Technol. 2021, 35, 65–72. [Google Scholar]

- Qiu, Z.; Yin, Y.; Yuan, Y.; Chen, Y. Research on Credit Regulation Mechanism of E-commerce Platform Based on Evolutionary Game Theory. J. Syst. Sci. Syst. Eng. 2024, 33, 330–359. [Google Scholar] [CrossRef]

- Statistical Mechanics; Data on Statistical Mechanics Reported by Researchers at Nanjing Tech University (Tripartite Evolutionary Game Analysis for “deceive Acquaintances” Behavior of E-commerce Platforms in Cooperative Supervision). J. Phys. Res. 2020.

- Li, J.; Xu, X.; Yang, Y. Research on the Regulation of Algorithmic Price Discrimination Behaviour of E-Commerce Platform Based on Tripartite Evolutionary Game. Sustainability 2023, 15, 8294. [Google Scholar] [CrossRef]

- Chen, Y.-F.; Pang, T.-T.; Kuslina, B.H. The Effect of Price Discrimination on Fairness Perception and Online Hotel Reservation Intention. J. Theor. Appl. Electron. Commer. Res. 2023, 18, 1320–1337. [Google Scholar] [CrossRef]

- Wu, Z.; Yang, Y.; Zhao, J.; Wu, Y. The Impact of Algorithmic Price Discrimination on Consumers’ Perceived Betrayal. Front. Psychol. 2022, 13, 825420. [Google Scholar] [CrossRef] [PubMed]

- Hu, L.; Zhang, Y.; Chung, S.-H.; Wang, L. Two-tier price membership mechanism design based on user profiles. Electron. Commer. Res. Appl. 2022, 52, 101130. [Google Scholar] [CrossRef]

- Peiseler, F.; Rasch, A.; Shekhar, S. Imperfect information, algorithmic price discrimination, and collusion. Scand. J. Econ. 2022, 124, 516–549. [Google Scholar] [CrossRef]

- Liu, W.; Long, S.; Xie, D.; Liang, Y.; Wang, J. How to govern the big data discriminatory pricing behavior in the platform service supply chain? An examination with a three-party evolutionary game model. Int. J. Prod. Econ. 2020, 231, 107910. [Google Scholar] [CrossRef]

- Aparicio, D.; Misra, K. Artificial Intelligence and Pricing; Emerald Publishing Limited: Bradford, UK, 2023; Volume 20, pp. 103–124. [Google Scholar]

- van der Rest, J.-P.; Sears, A.M.; Kuokkanen, H.; Heidary, K. Algorithmic pricing in hospitality and tourism: Call for research on ethics, consumer backlash and CSR. J. Hosp. Tour. Insights 2022, 5, 771–781. [Google Scholar] [CrossRef]

- Deng, C.; Zhu, H. On the Legal Status of OTA Network Platform: Taking the “Ctrip Price Discrimination” Case as an Example. J. Hunan Univ. Technol. (Soc. Sci. Ed.) 2023, 28, 60–71. [Google Scholar]

- Zhou, K.; Wang, Q.; Tang, J. Evolutionary game and simulation analysis of enterprise’s green technology innovation under green credit policy: Evidence from China. Technol. Anal. Strateg. Manag. 2024, 36, 1551–1570. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).