Abstract

In the trade environment of a globalized economy, tariffs play a crucial role in transnational supply chains. At the same time, the power structure of the supply chain also plays an important role in the decision making and income distribution of a transnational supply chain. Therefore, we construct game-theoretic models to analyze the impacts of tariffs and power structures on the decision making and revenue distribution of transnational supply chains. First, we consider a bilateral monopoly model consisting of a Chinese manufacturer and a U.S. retailer and analyze the effects of tariffs and power structures on decision making and revenue distributions in this supply chain. Then, we extend the model to a duopoly competition model consisting of two Chinese manufacturers and one American retailer, further analyzing the roles of tariffs and power structures. The results indicate that in the bilateral monopoly model, the impact of tariffs on the manufacturer’s profits is always greater than on the retailer’s profits under a manufacturer-led circumstance. However, in a competitive model, when the market size is large, the impact of tariffs on the manufacturer’s profits exceeds that of the retailer’s profits; conversely, when the market size is smaller, the impact of tariffs on the retailer’s profits is greater than on the manufacturer’s profits. Furthermore, we find that in the duopoly competition model, under the manufacturer-led circumstance, both the manufacturer and the retailer earn the highest profits.

MSC:

90B06

1. Introduction

In the past few decades, offshore outsourcing has become a crucial method for many foreign enterprises to pursue cost efficiency and core competitiveness. By transferring production and manufacturing activities to countries and regions with lower costs, these enterprises can effectively reduce operating costs and enhance market competitiveness [1]. China, with its abundant labor resources, mature supply chain systems, and manufacturing foundation, has become one of the preferred destinations for the outsourcing strategies of American enterprises. For example, all components of Kent International and Element Electronics come from Asia, especially China, for production in China and are then imported to the United States [2]. This model of transnational cooperation not only promotes the development of China’s manufacturing industry but also meets the American market’s demand for diverse and low-cost products.

For a long time, China has been a favored destination for American retailers, becoming an indispensable part of the global supply chain. However, in recent years, offshore outsourcing activities have been challenged by trade protectionism and anti-globalization waves [3]. To protect domestic manufacturing, the U.S. government has imposed high tariffs on products imported from China [4,5]. On 8 March 2018, the U.S. President announced new tariffs on certain types of imported unprocessed steel and aluminum. The new rates are 25% for imported steel and 10% for imported aluminum [6]. On 9 May 2019, the U.S. government announced that, starting from 10 May 2019, the tariff rate on the USD 200 billion list of goods imported from China would increase from 10% to 25% [7]. Discussions regarding the U.S. government’s reduction in tariffs on China have yet to be implemented. Following this, on 13 September 2024, the Trade Representative of the Office of the United States announced that, effective 27 September, the tariff rate on electric vehicles manufactured in China will increase to 100%, and the tariff rate on solar panels will rise to 50%. The world’s largest machinery manufacturer, Caterpillar, headquartered in the United States, reported that due to trade tariffs, the company lost more than USD 100 million in 2018 and expects losses to double in 2019 [8]. Huawei also faced a significant decline in revenue in 2021, with its revenue decreasing by approximately 30%. This illustrates that tariffs are an important factor that cannot be overlooked in multinational supply chains.

In addition to the direct impact of trade tariffs, power structures play a crucial role in transnational supply chains [9,10]. For example, the partnership between Apple Inc. and Foxconn highlights the dominant position of the American retailer in the supply chain [11]. With its strong brand influence and market demand, Apple can impose strict quality control and cost management requirements on its suppliers to ensure the competitiveness of its products [12]. Foxconn, as a contract manufacturer, although it has advantages in production scale and efficiency, remains in a relatively passive position in its collaboration with Apple. On the other hand, some Chinese enterprises possess technological or resource advantages in specific fields, allowing them to dominate in their partnerships with American companies. For instance, CATL’s leading position in the global market of electric vehicle batteries has made it become an important partner for many international automakers, including some American companies. This technological advantage enables CATL to hold a strong bargaining position in collaborations [13]. These cases illustrate that power dynamics within a supply chain have a significant impact on the decisions of all supply chain members. Therefore, analyzing the power structures of upstream and downstream enterprises is essential for understanding supply chain strategies and trade flows in the current trade environment.

Offshore outsourcing is currently the most popular production method in transnational supply chains. In the context of rising trade protectionism, tariffs have become a significant factor that businesses must consider, and the bargaining power of enterprises determines the profit distribution throughout the supply chain. However, most existing research focuses on the production methods of multinational corporations. It remains unclear how tariffs affect the extent of impact on upstream and downstream enterprises, particularly from the perspective of Chinese companies. The current economic situation is bleak with the escalating U.S.–China trade war, especially following the recent U.S. government’s further tariff measures on Chinese goods. Under these major trade frictions, the situation for Chinese enterprises is becoming increasingly challenging. Our research aims to provide Chinese companies with a clearer understanding of their position in multinational supply chains, offering valuable guidance. We aim to provide a better understanding of this topic by answering the following questions. Firstly, what are the impacts of tariffs and power structures on the decisions and profits of transnational supply chain members? Secondly, how does competition affect the relationships among transnational supply chain members under a competitive model? Finally, does the impact of tariffs on supply chain members change under monopoly and competition models, and, if so, what are those changes?

We developed game theory models to study these issues. To further understand the impact of tariffs on the decisions and profits of transnational supply chain members, we consider an American retailer (R) and a Chinese manufacturer (M) in a transnational supply chain. To provide more insightful conclusions, we extend the basic model from a monopoly model to a competitive model, both of which have two Chinese manufacturers and one U.S. retailer. The American retailer obtains products from China, and then, the products are sold to consumers in the United States. Tariffs are generated when U.S. retailers buy products from Chinese manufacturers. To model the interactions between upstream and downstream supply chain members, we use three common game theory models: a manufacturer-led or retailer-led Stackelberg game and one with equal power. These games reflect the relative market power of enterprises: in the manufacturer-led or retailer-led Stackelberg games, the manufacturer or retailer has greater power, whereas with equal power, the manufacturer and retailer have equal power. Differences in power structures can lead to different decision sequences in Stackelberg games. The decision-making process in the supply chain varies based on the relative power dynamics between manufacturers and retailers. When manufacturers hold a dominant position, they initiate the decision-making process, followed by retailers. Conversely, if retailers dominate, they lead the decision making, with manufacturers responding subsequently. In scenarios where power is balanced, both manufacturers and retailers engage in simultaneous decision making.

This paper analyzes the impacts of tariffs and power structures on the decisions and profits of transnational supply chain members under bilateral monopoly and duopoly competitive models, as well as the impact of competition among manufacturers on supply chain members. We found that in a bilateral monopoly model, the supply chain member with greater power gains higher profits. It is important to note that the results indicate that in the bilateral monopoly model, the impact of tariffs on the manufacturer’s profits is always greater than on the retailer’s profits under the manufacturer-led circumstance. When tariffs are raised, the retailer depresses wholesale prices in order to maintain their own margins. This causes the manufacturer to bear the cost of the increased tariff, and the retailer can also transfer the pressure of the tariff to the consumer through the sales price. However, in the duopoly competition model, when the market size is large, the impact of tariffs on the manufacturer’s profits exceeds that of the retailer’s profits; conversely, when the market size is smaller, the impact of tariffs on the retailer’s profits is greater than on the manufacturer’s profits. This is because the size of the market determines how much of the cost pressure caused by tariffs can be passed on to consumers by retailers. Furthermore, we found that in the duopoly competition model, under the manufacturer-led circumstance, both the manufacturer and the retailer earn the highest profits. We also consider another variant: a cost asymmetry among manufacturers. The analysis of asymmetric costs shows that the effect of tariffs on equilibrium outcomes is the same as when it is symmetric, which also proves that the effect of tariffs on the equilibrium outcomes is robust to some extent.

The remainder of this paper is organized as follows. In Section 2, we review the relevant literature. In Section 3, we describe the model settings under the monopoly and competitive models. In Section 4, we present the analysis results under the monopoly and competitive models. In Section 5, we conduct a comparative analysis of the monopoly and competitive models. In Section 6, we extend the competitive model. Finally, we provide a conclusion of our paper. Proofs are provided in Appendix A.

2. Literature Review

This study analyzes the impact of tariff costs arising from offshore outsourcing by U.S. retailers, as well as the influence of power structures within an upstream and downstream supply chain. Research studies related to our study can be divided into two main types: the first type of research focuses on offshore outsourcing, and the second type of research on power structures. In this literature review, we first review the literature on offshore outsourcing strategies, followed by a review of the literature concerning the application of power structures within a supply chain.

2.1. Offshore Outsourcing

Our study is closely related to offshore outsourcing. According to Mihalache and Mihalache [14], offshore outsourcing refers to the transfer of business activities to foreign countries to take advantage of their comparative advantages, thereby supporting the current business operations of domestic companies. In transnational supply chains, offshore outsourcing is one of the most common production methods. A number of papers related to offshore outsourcing study the impact of taxes or tariffs and can be roughly divided into the following categories.

Firstly, some studies focus on the impact of tax differences between countries or regions. For example, based on the North–South theoretical framework, Antràs and Helpman [15] found that higher tariffs in the North reduce the incentives for outsourcing and establishing overseas factories, while higher tariffs in the South have the opposite effect. Subsequent research studies have mostly combined offshore outsourcing with other real-world factors that affect supply chains and more complex environments. For instance, Tim Huh and Park [16] studied multinational companies setting up departments in different countries to decentralize their entire supply chain. By considering an exogenous factor—demand uncertainty—they compared supply chain profits and profit distributions under two tax methods: the cost-plus method and the resale price method. Kim et al. [17], considering the fair regulation of transfer pricing, analyzed the trade-offs in the optimal choice of a supply chain structure for multinational companies: vertical integration (local procurement) or offshore outsourcing. By analyzing these two production methods, they showed that tax factors are worth the attention of managers when designing supply chain structures. In a similar research context, Hsu et al. [18] studied whether multinational companies should sell products to competitors from production bases in low-tax regions, despite having certain competitive relationships with them in their domestic markets. Chen et al. [19] studied the impacts of tariffs and product price premiums on global manufacturers’ decisions to choose between global procurement or local procurement. Interestingly, increasing tariffs does not necessarily promote local procurement, depending on the market size of the domestic market. Although their research context is similar, the focus of the research questions of these studies differs.

Moreover, some studies focus on the low-cost advantage effect of offshore outsourcing. For example, Lu et al. [20] considered the impacts of transportation costs and manufacturing cost differences on centralized and decentralized decision making. Wu and Zhang [1], considering procurement costs, compared efficient procurement and responsive procurement, and their research showed that responsive procurement reduces the competition in terms of cost dimensions. This study mainly focuses on the impact of tariffs on offshore outsourcing. In contrast to the aforementioned studies, our research incorporates a competing manufacturer with a certain degree of substitutability into the basic model, leading to a competition between manufacturers. This approach further enriches the body of research on offshore outsourcing. Current research on transnational supply chains primarily adopts the perspective of foreign multinational corporations, focusing especially on their production strategies—whether to offshore or outsource. For example, Wu et al. [5] explored how multinational companies decide to develop new contract manufacturers to avoid high tariff risks stemming from the U.S.–China trade war amid tariff uncertainties and competitive environments. Xie and Liu et al. [21] investigated the procurement issues faced by automotive manufacturers with brand premiums under the influence of government subsidies and labor cost differences, identifying three procurement methods: in-house production, outsourcing to original equipment manufacturers, or contracting with non-competitive suppliers. This paper differs in two key ways: firstly, it is the first study to investigate the impact of tariffs on profit distributions within multinational supply chains, specifically comparing the effects on manufacturers versus retailers. Secondly, it shifts the focus away from multinational corporations to view Chinese manufacturers and U.S. retailers as two independent entities within the supply chain, particularly emphasizing the role of Chinese manufacturers.

2.2. Power Structures

One type of research relevant to this study is research on power structures. The initial application of a power structure was in supply chain pricing and operational decision making. For example, Pan et al. [22] considered a supply chain structure with two manufacturers and one retailer, where manufacturers could choose between wholesale price contracts or revenue-sharing contracts. They compared whether manufacturers opting for revenue-sharing contracts was beneficial under different channel power structures. Similar to Pan et al.‘s study, Wei et al. [23] also examined a supply chain channel with two manufacturers and one retailer, focusing on the pricing of complementary products. They explored optimal pricing and maximum profits under different market power structures among channel members, providing managerial insights into different dispersion strategies for enterprises. Xue et al. [24] and Wang et al. [25] similarly studied cases where manufacturers or retailers dominate, considering external conditions such as stochastic and price-sensitive demands to further investigate the performance of supply chain partners and changes in the consumer surplus. Additionally, Niu et al. [26] explored supply chain sustainability from a novel perspective, examining the impact on supply chain sustainability and profitability when manufacturers and suppliers, respectively, dominate. Furthermore, the article studied the impact of suppliers’ attitudes towards losses on supply chain sustainability and profitability.

The above articles pertain to power structures in traditional retail channels, though there are also many sales models that differ from traditional channels, such as Chen et al. [27], who focused on a hybrid online-to-offline (O2O) retail service supply chain, thus formulating pricing strategies for both channels. Chai et al. [28] developed three game theory models to analyze how service spillovers and power structures affect the performance of supply chain members in the O2O business model. Interestingly, the transition of power dominance between manufacturers and retailers did not affect retail prices and demands. Of course, there are many other types of research studies on power structures, such as Zhang et al. [29], who studied whether manufacturers decide to introduce direct sales channels under different power structures when retailers are in capital-constrained or capital-sufficient states. Xiao et al. [10] explored how quality differentiation and power structures influence the introduction of store brands by retailers and shape incentives and corporate profitability. Yang et al. [30] investigated how tariffs and production costs affect the reflow mechanism of multinational enterprises under different power structures, showing varying results across different power structures. From the above literature review, it is evident that a power structure significantly influences the profit distribution among supply chain members. However, the literature on power structures within transnational supply chains is scarce, with most studies rarely incorporating power structures into their models. A study akin to ours is that of Yang et al. [30], which examines the effects of tariffs and production costs on the incentives for offshore outsourcing by multinational corporations under varying power structures. In contrast to existing research, our paper explores the influence of tariffs on the profit sensitivity of upstream and downstream firms within multinational supply chains across different power dynamics. Table 1 shows how our paper differs from other papers.

Table 1.

Comparison of the literature.

In summary, this research contributes to the theoretical advancement of transnational supply chains by examining the impact of tariffs on the profits of upstream and downstream members from a unique perspective—specifically, that of Chinese manufactures. Most of the existing literature on transnational supply chains predominantly focuses on the production strategies of multinational corporations, leaving a significant gap in the investigation of tariff effects on these members. Furthermore, the application of power structures within multinational supply chains is a relatively novel area, with limited studies dedicated to exploring this phenomenon. Through our research, we aim to further expand the theoretical boundaries of multinational supply chains by elucidating the extent of tariff impacts on supply chain members under varying power dynamics.

3. Model Description and Construction

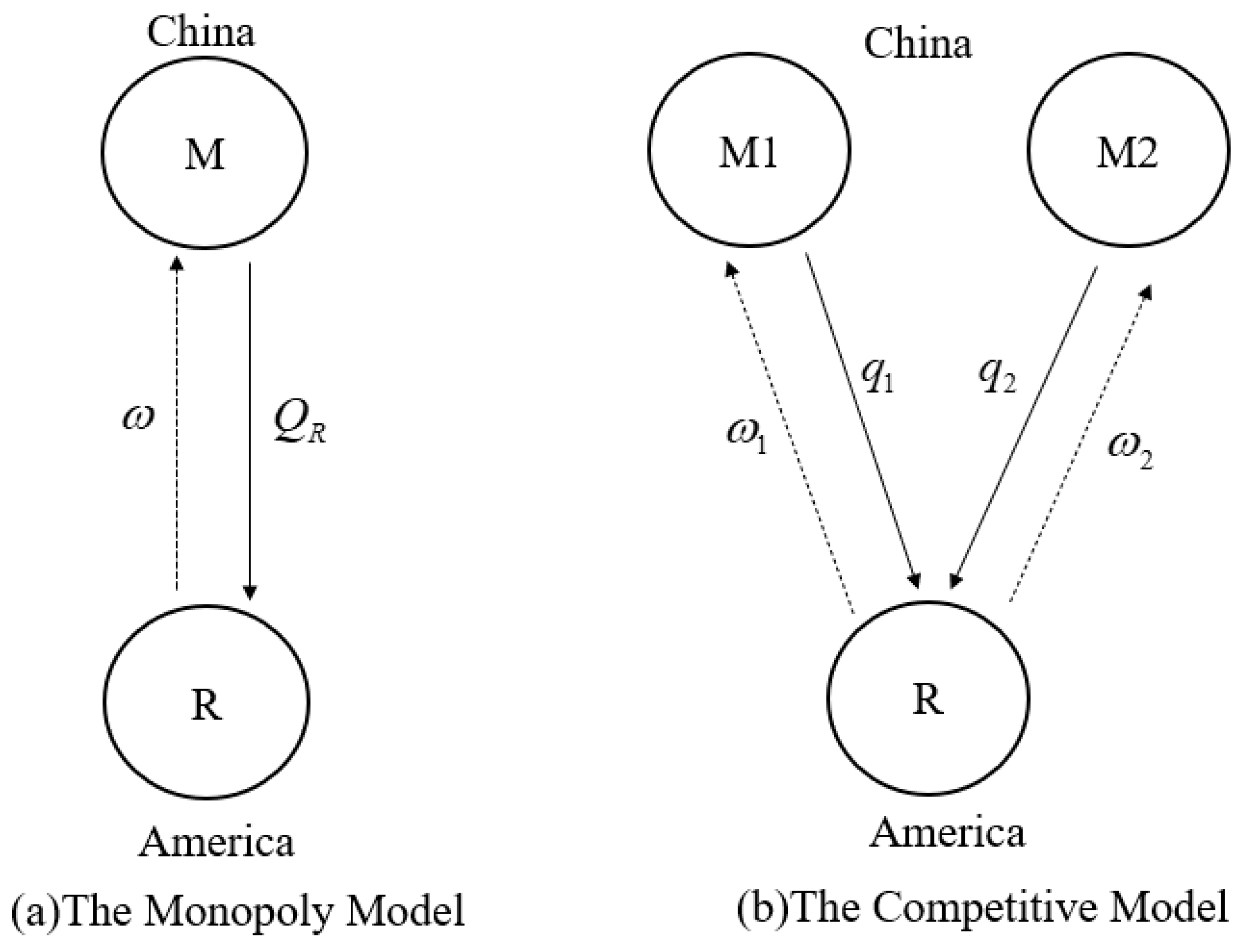

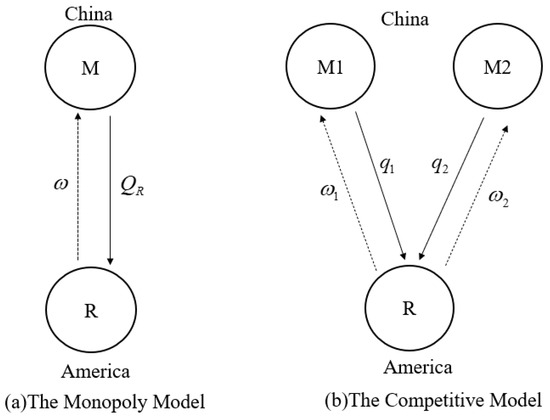

This study first considers the monopoly model: a company manufacturing in China (denoted as M) produces goods to be sold abroad. The Chinese manufacturer sells its products to the U.S. market through an American retailer (denoted as R) to meet the demands of overseas consumers. However, to protect domestic manufacturing industries, the U.S. government imposes tariffs on imported goods [19]. Therefore, the Chinese manufacturer sells its products at a wholesale price to the American retailer, who must bear the cost of the import tariffs. For convenience, we will use M to represent the Chinese manufacturer in a monopoly model and R to represent the American retailer in a monopoly model. This study then extends the monopoly model to a competitive model: both Chinese manufacturer 1 (denoted as M1) and Chinese manufacturer 2 (denoted as M2) supply imported products to the American retailer. However, the products from the two manufacturers are not perfectly substitutable.

The supply chain structures under the bilateral monopoly and duopoly competition models are illustrated in Figure 1, respectively. In the bilateral monopoly model, if the American retailer purchases from the Chinese manufacturer, the Chinese manufacturer sells the products to the American retailer at a wholesale price , thereby meeting the demand in the domestic market. We assume that each final product unit requires one component unit, with the American retailer selecting for the domestic market to maximize profits and reduce losses. To reflect more realistic conditions, we assume that the production cost for the manufacturers is [30,31]. In the duopoly competition model, the American retailer can procure products from both M1 and M2. Consequently, Chinese manufacturer 1 and Chinese manufacturer 2 sell their products at wholesale prices, and , to the American retailer. The American retailer then sells the products at retail prices, and , in the final market. The American retailer selects and to represent the quantities obtained from Chinese manufacturer 1 and 2, respectively, to supply to the U.S. market.

Figure 1.

Supply chain structure.

We assume that the manufacturer in the bilateral monopoly model produces only one product; the two manufacturers in the duopoly competition model each produce one product. To keep the model formulation simple, we assume their manufacturing costs are also the same, denoted by . This paper also assumes that the supply and demand are in equilibrium, that there are no production constraints, and that every unit of product produced is a new product with no discounting.

Referring to the research by Zhong et al. [32] and Singh and Vives [33], if there is only one manufacturer and one retailer in the market, that is, a bilateral monopoly model, then the inverse demand function for the American retailer is expressed as . Under the competitive model, the two manufacturers produce somewhat substitutable products and sell them in the same market. The inverse demand functions for the two products are, respectively, given by the following:

where the parameter represents the market potential, represents the selling price of the product produced by Chinese manufacturer 1, and represents the selling price of the product produced by Chinese manufacturer 2. The parameter measures the degree of product substitutability (the intensity of competition between manufacturers), consistent with the existing literature [34,35]. In this paper, is assumed to belong to the interval (0,1). As increases, the products become more homogeneous. When approaches 0, the products are completely independent; when approaches 1, the products are perfectly substitutable. This paper assumes that the American retailer can achieve market equilibrium in selling products in the local market, with the retailer and manufacturers having complete and symmetric information while pursuing profit maximization.

Under the bilateral monopoly model, is the wholesale price of the wholesale price from the Chinese manufacturer, is the corresponding retail price, and is the profit margin the retailer requires per unit of product sold. So, the retail prices of the product are as follows:

Under the duopoly competition model, are the wholesale prices from the Chinese manufacturers, are the corresponding retail prices, and are the profit margin the retailer requires per unit of products sold. So, the retail prices of the product are as follows:

To model the strategic interactions between manufacturers and retailers, we introduce three common game-theoretic models, as demonstrated by Pan et al. [22]: a Stackelberg game with the manufacturer as the leader (denoted as ML), a Stackelberg game with the retailer as the leader (denoted as RL), and a game with equal power (denoted as E). These models reflect the relative market power of the firms. Therefore, in the structures of ML, RL, and E, the market power of the manufacturers (M) is strong, weak, and moderate, respectively. In terms of the decision sequence discussed in this paper, the manufacturer sets the wholesale price, while the retailer determines the sales quantity. Under ML, the manufacturer first decides its wholesale price, and then the retailer decides his quantity. Under RL, the retailer first decides his quantity, and then the manufacturer decides its wholesale price. Under E conditions, the manufacturer and the retailer simultaneously decide the wholesale price and quantity. This applies to both the monopoly and competitive scenarios.

In order to model the high tariffs between the United States and China, we denote the import tariffs on goods exported to the United States by Chinese manufacturers as . The tariffs imposed by the government on imported products are justified and can be based on ad valorem, specific, or compound rates, as outlined in the latest “Importer’s Guide” published by the U.S. Customs and Border Protection [36]. The most commonly used tariff is the ad valorem rate, which is a percentage of the product’s value, such as an ad valorem rate of 10%. A specific rate refers to a fixed fee per unit of volume or other quantity, such as 8 cents per gallon. A compound rate is a combination of the ad valorem rate and specific rates, for example, 6 cents per pound plus an ad valorem rate of 5%. In this study, we follow Nagurney et al. [37] and assume that the government adopts an ad valorem tariff, with a tariff rate of ().

For reference, we summarized the notation used in Table 2. One thing to note is the functional expression of profits: β represents one of the three power structures (ML means manufacturer-led, RL means retailer-led, and E means equal power), and ω represents wholesale prices. τ represents the tariff rate. M is for monopoly, and C is for competition.

Table 2.

Notation summary.

4. Model Construction and Equilibrium Analysis

In this section, we first analyze the impacts of tariffs and power structures on the retailer and manufacturer under the bilateral monopoly model. Subsequently, we discuss the effects of tariffs, power structures, and product substitutability on members of the transnational supply chain under the duopoly competition model.

4.1. The Bilateral Monopoly Model

To protect domestic manufacturing, the U.S. government imposes tariffs on imported goods, which an American retailer must bear when purchasing wholesale from a Chinese manufacturer. The tariff calculation in this model is based on ad valorem taxation. Without the loss of generality, this study adopts a two-stage Stackelberg game framework. Due to potential variations in power structures, the sequence of gameplay differs: if the manufacturer leads (ML), the manufacturer makes the initial decision, followed by the retailer; if the retailer leads (RL), the retailer decides first, followed by the manufacturer; if the power is equal (E), both the manufacturer and retailer decide simultaneously. Chinese manufacturers determine wholesale prices, and U.S. retailers determine product quantities. In this scenario, the profits of the Chinese manufacturer and American retailer can be expressed by the following formulas:

represents the profits of the Chinese manufacturer in the bilateral monopoly model. represents the profits of the American retailer in the bilateral monopoly model. represents the wholesale price of the product. represents the manufacturing cost of the Chinese manufacturer. represents the quantity of the product.

According to the three described game sequences, retailer leader, manufacturer leader, and equal power between both enterprises, we can employ backward induction to determine the optimal decisions of the firms and their corresponding profits. The equilibrium outcomes are shown in Table 3.

Table 3.

Equilibrium outcomes in the monopoly model.

4.2. The Competitive Model

Under the competition model, consider the case where two manufacturers located in China are supplying to U.S. retailers at the same time, and consider whether the competition between the two manufacturers would make a difference in the results. Although not a complete substitution, competition arises between manufacturers, as both seek to supply an American retailer. Without the loss of generality, the competitive model also considers a two-stage Stackelberg game, accounting for different power structures and gameplay sequences. However, the decision variables and decision makers remain unchanged, as in the monopoly model. The profit functions for the supply chain members are expressed as follows:

represents the profits of the U.S. retailers. represent the profits of manufacturer 1 and manufacturer 2. represent the wholesale prices of manufacturer 1 and manufacturer 2. represent the quantity of manufacturer 1 and manufacturer 2. represent the sales prices from the products produced by manufacturer 1 and manufacturer 2. represents the tariff rate.

This paper primarily employs backward induction to determine the optimal decisions of the firms and their corresponding profits under three game sequences: retailer leader (RL), manufacturer leader (ML), and equal power between both enterprises (E). The equilibrium outcomes are shown in Table 4.

Table 4.

Equilibrium outcomes in a competitive model.

To gain a deeper understanding of the impacts of trade tariffs and power structures on transnational supply chain members’ profits across different models, we first compare equilibrium outcomes under three market power structures in the bilateral monopoly model. Before comparing equilibrium outcomes, it is essential to observe how the equilibrium results vary with tariffs across different power structures.

Corollary 1.

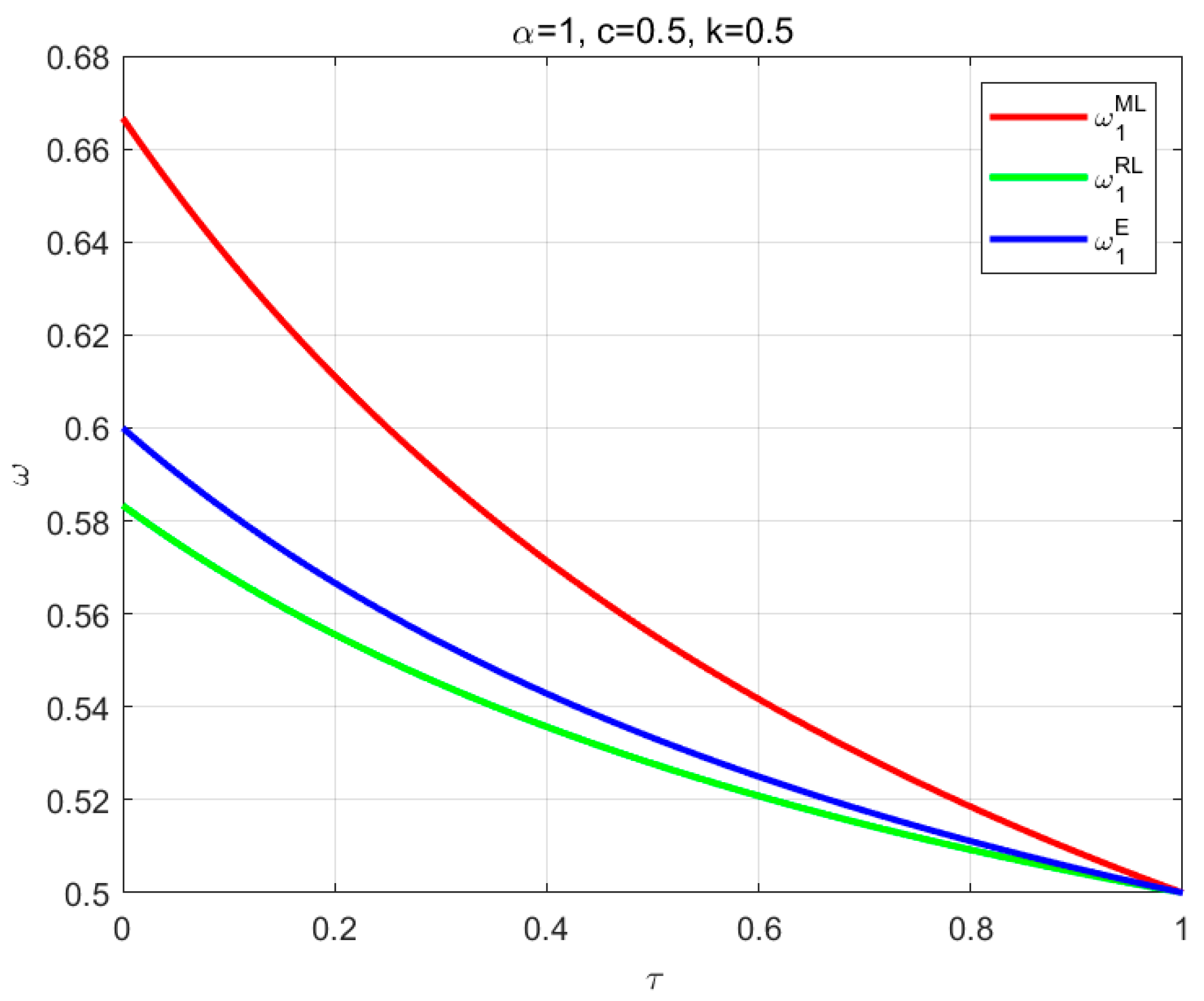

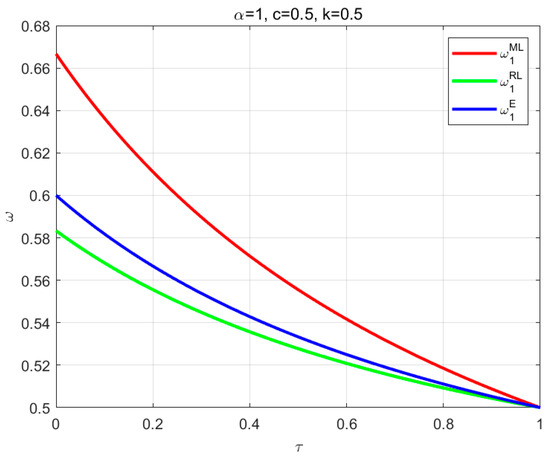

Considering the bilateral monopoly model, the equilibrium outcomes across the three power structures exhibit consistent trends with respect to , as shown below:

Corollary 1 suggests that as the tariff rate increases in the monopoly model, the Chinese manufacturer reduces its wholesale prices to enable the American retailer to continue purchasing the manufacturer’s products, thereby lowering its own profit margin. For the American retailer, an increase in the tariff rate implies higher tariff costs, prompting them to raise product prices further to maintain profitability, which consequently reduces product demands due to inverse demand relationships. With the tariff rate hike, both the wholesale prices and production quantity of the Chinese manufacturer decrease, leading to reduced profits, as indicated by their profit expressions. Similarly, the American retailer experiences decreased marginal profits and a reduced output with increasing tariffs, resulting in an overall decline in its total profit. Corollary 1 and the analysis suggest that higher tariffs diminish profits for both the Chinese manufacturer and the American retailer, resulting in a mutually detrimental outcome—a double loss for both parties.

The above analysis examined the trends in equilibrium outcomes for the three power structures under the monopoly model as tariffs change. Next, we will delve deeper into comparing the equilibrium results and their sensitivity to tariffs across different power structures. The goal is to uncover the impact of various power structures on profit distributions more thoroughly. See Table A1 for the relevant proof.

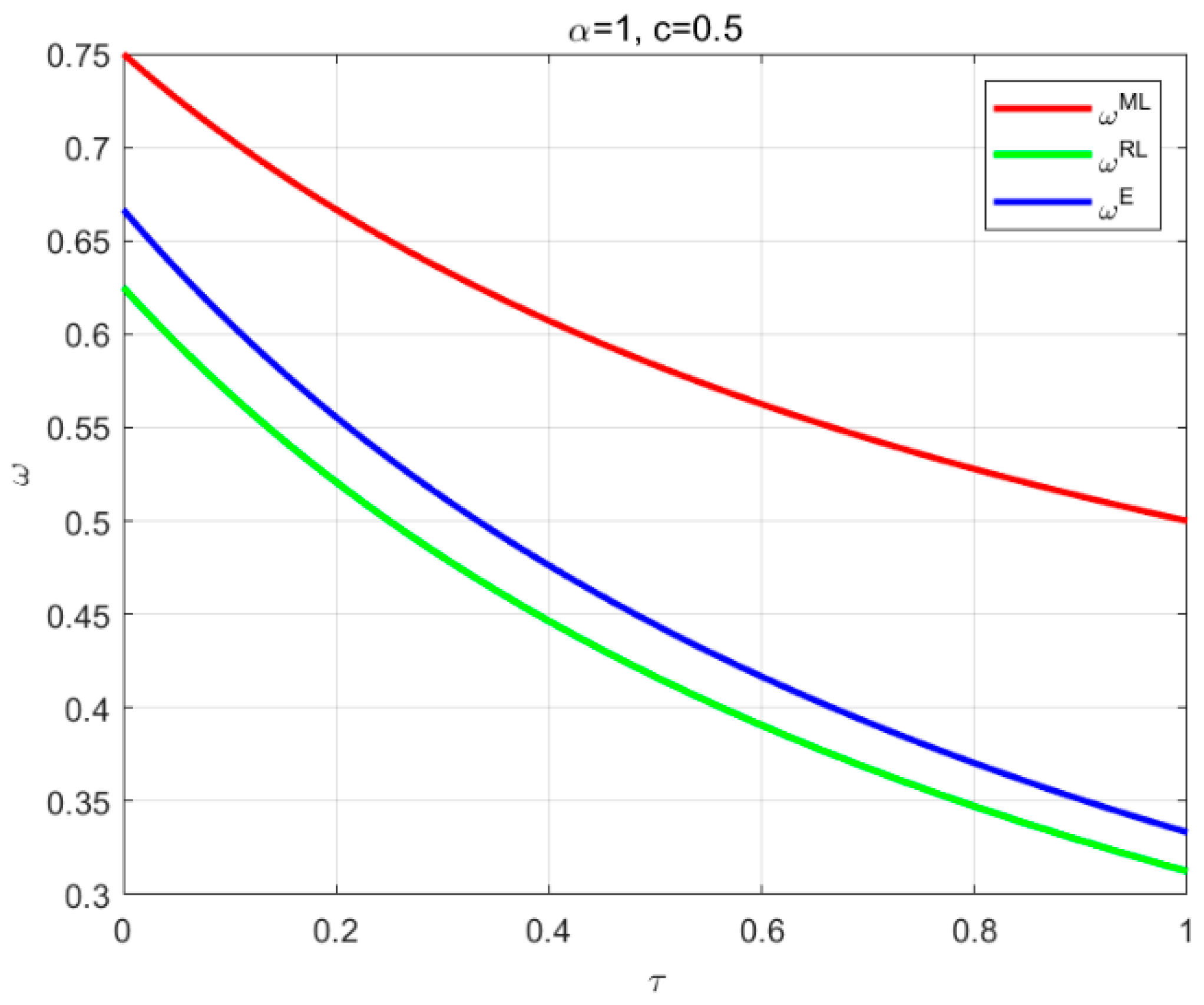

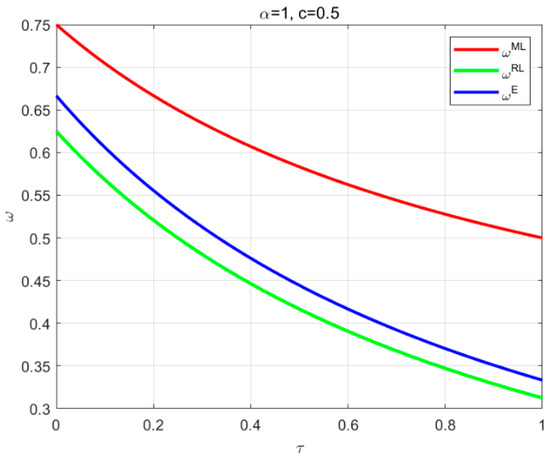

Proposition 1.

Considering the bilateral monopoly model, for different power structures,

, the following exists: , .

Proposition 1 illustrates the relationship of wholesale prices under different power structures, see Figure 2. The wholesale price is determined by the Chinese manufacturer; therefore, when the Chinese manufacturer holds a dominant position, the wholesale price is the highest, as it seeks to maximize its marginal profit. Next, the wholesale price is determined when the manufacturer and retailer have equal power, and finally, it is the lowest when the American retailer holds the dominant position. This result indicates that whoever holds the dominant position gains the initiative to secure a more marginal profit. When the American retailer is in a leading position, the Chinese manufacturer is in a highly passive situation, resulting in a relatively passive wholesale price.

Figure 2.

The effect of tariffs on wholesale prices in the bilateral monopoly model.

It follows from Proposition 1 that it is evident that the impact of tariffs on wholesale prices is the greatest in the ML scenario, followed by E, and finally RL. In the ML scenario, the Chinese manufacturer has a greater ability to pass on cost increases (such as tariffs) to the retailer through the wholesale price. In this situation, the sensitivity of the wholesale price to tariffs is the highest, because the manufacturer is more inclined to raise the wholesale price to compensate for the increased costs due to higher tariffs. In the E scenario, both the American retailer and the Chinese manufacturer have some bargaining power, but both need to compromise to some extent to reach an agreement. Therefore, the impact of tariff changes on the wholesale price is moderate. In the RL scenario, the retailer has greater bargaining power and can effectively minimize the impact of cost increases (such as tariffs) by pushing down the wholesale price paid to the manufacturer to maintain its marginal profit.

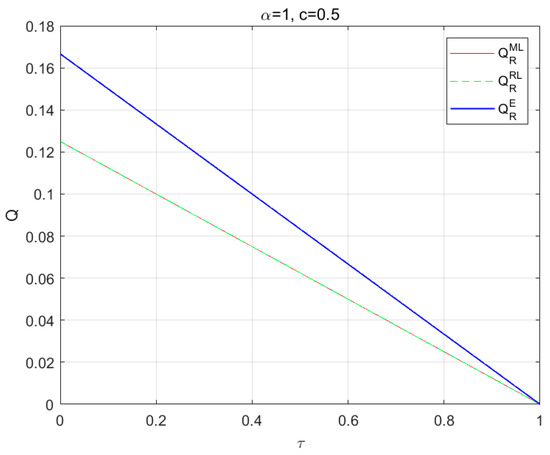

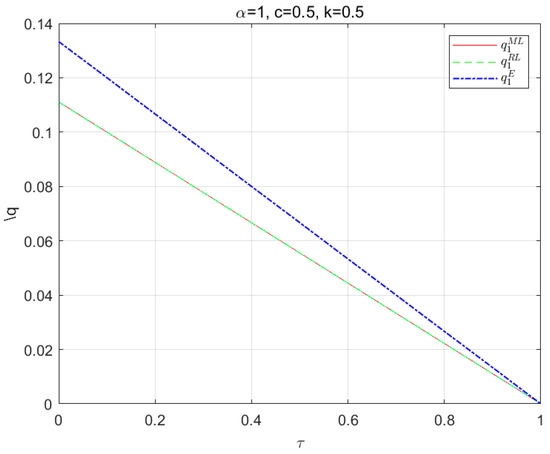

Proposition 2.

Considering the bilateral monopoly model,

(a) for the different power structures, and , the following exists: , ;

(b) the impact of tariffs on them under different power structures is as follows: ,

Proposition 2 indicates that under the power structure E, the product demand for American retailers is the highest, see Figure 3. In contrast, under the scenarios where either the Chinese manufacturer or the American retailer is dominant, the demand is the same but lower than that under the power structure E. This phenomenon demonstrates that the quantity of demands across the three power structures does not correspond to the market power of the enterprises. The reason for this is as follows: When the retailer holds dominance, they increase the product’s selling price to boost their profits, which discourages consumers and reduces their purchasing power, thus lowering product demands. When the manufacturer holds dominance, they increase the wholesale price to enhance their marginal profit. A higher wholesale price increases the procurement cost for the American retailer, who may then raise the selling price to maintain their profit margin. Higher selling prices inevitably lead to a decrease in the quantity sold. Therefore, the quantity under the power structure E is the highest, and the price is the lowest. In scenarios where either the retailer or manufacturer is dominant, the quantity and selling price are the same, reflecting the symmetry in the monopoly model’s power structure. That is, regardless of which enterprise has the upper hand, the impact on the quantity and selling price is identical.

Figure 3.

The effect of tariffs on sales quantity in the bilateral monopoly model.

Proposition 2 also indicates that under the power structure E, the impact of tariffs on both the quantity and selling price is greater compared to other power structures. In the power structure E, both the retailer and the manufacturer have equal bargaining power. This typically leads to both parties striving to optimize the overall supply chain’s efficiency, making them more sensitive to changes in tariffs.

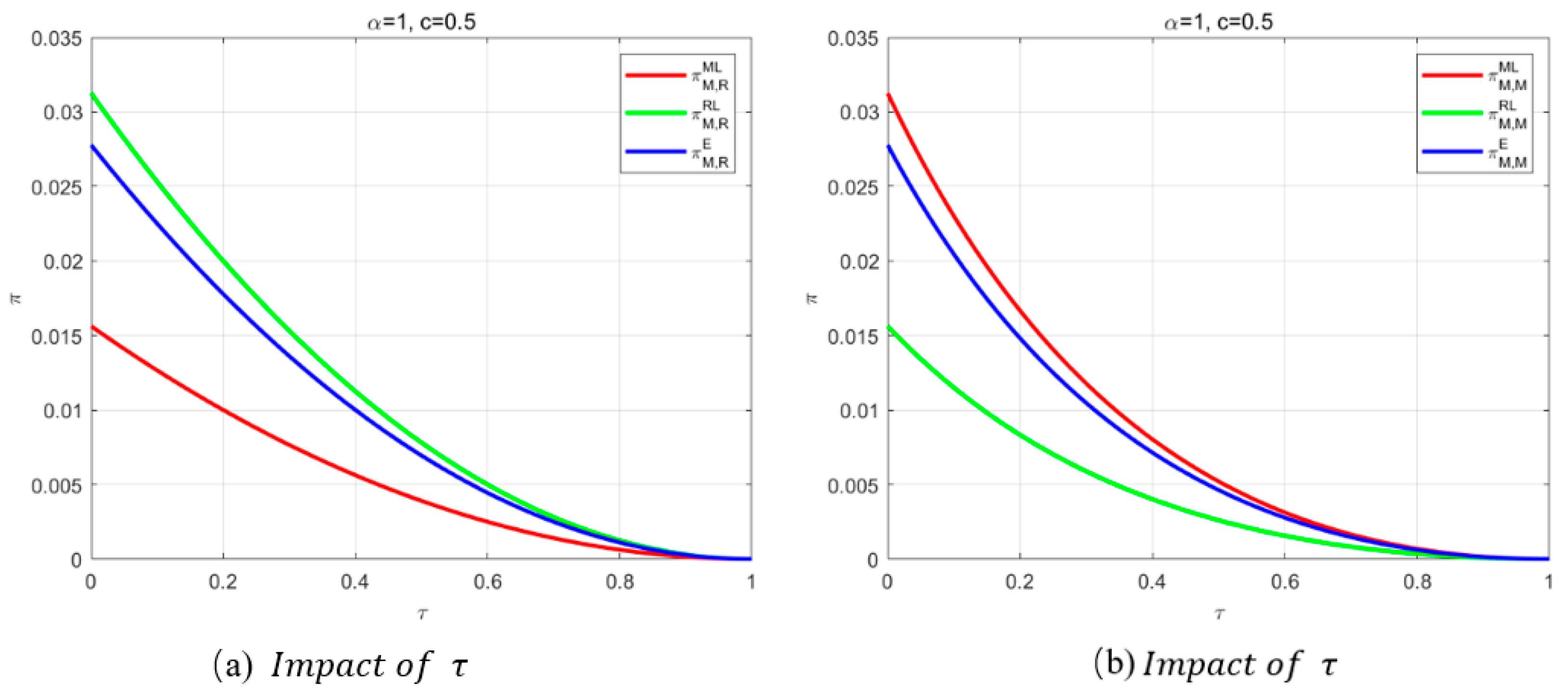

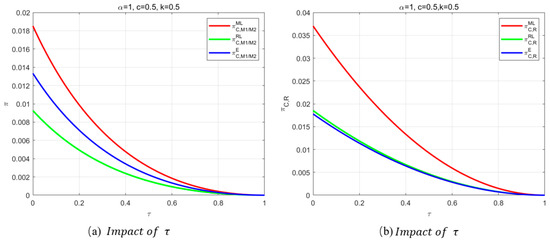

Proposition 3.

In the context of the bilateral monopoly model,

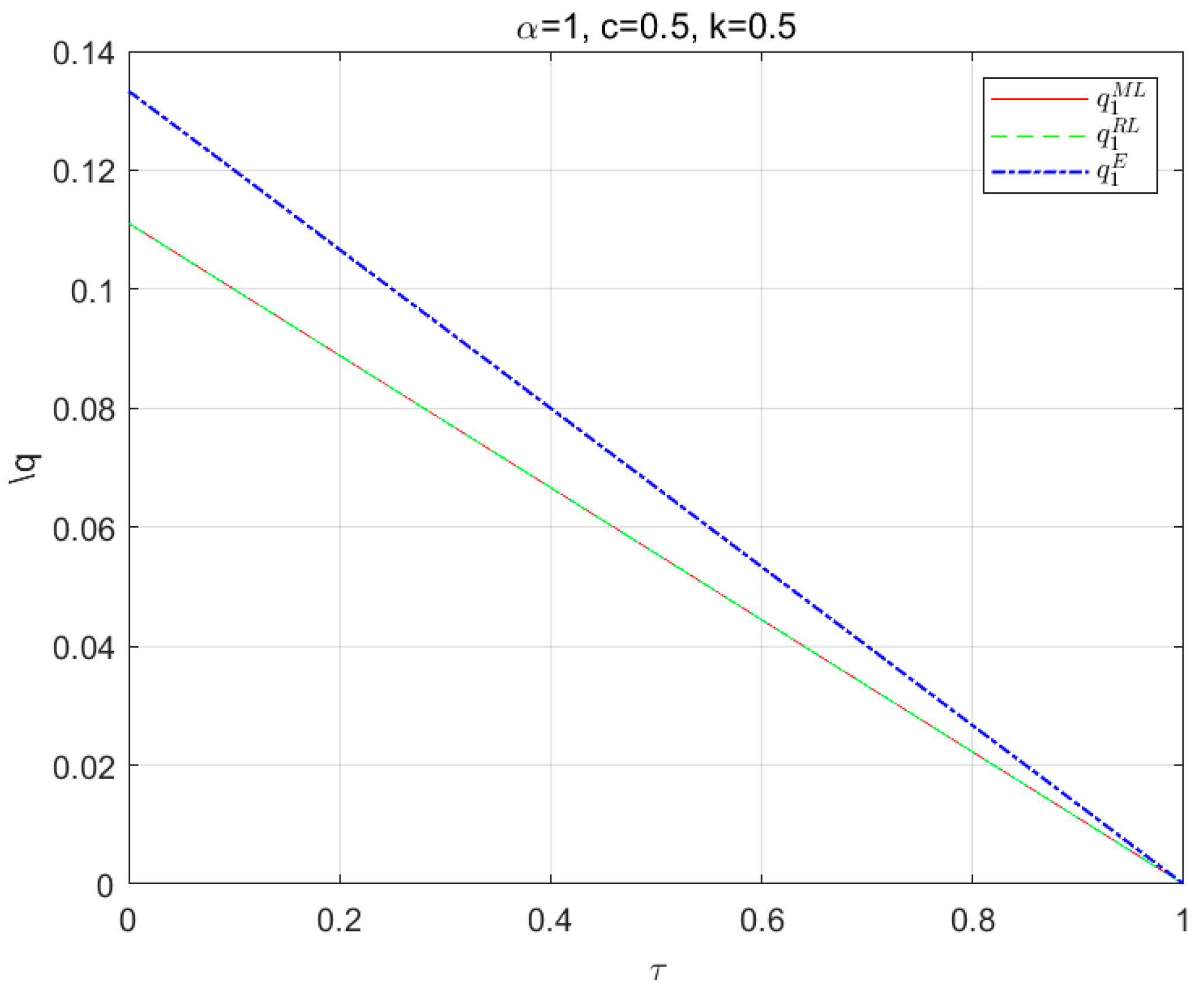

(a) for the profits of multinational supply chain members under the different power structures, and , the following exists: , ;

(b) the impact of tariffs on them under different power structures is as follows: ,

Proposition 3 indicates that for the Chinese manufacturer, the greater their dominant power, the stronger its motivation to increase its marginal profits, ultimately resulting in higher overall profits. For the American retailer, its profits also increased with greater dominance. This demonstrates that under different power structures, the overall profit distribution in the supply chain tends to allocate more to the party with greater power. Overall, the Chinese manufacturer or the American retailer prefers to hold the dominant position, aligning with the traditional intuition that first movers have an advantage [38]. We can see in Figure 4 that as the tariffs grow, the profits of the Chinese manufacturer are largest when the Chinese manufacturer is dominated, and the profits of U.S. retailer are largest when U.S. retailer is dominated by U.S. retailers. For the Chinese manufacturer, the greater their power, the more significant the impact of tariffs on their profits; similarly, for retailers, the greater their power, the more substantial the impact of tariffs on their profits.

Figure 4.

Tariffs on manufacturer’s and retailer’s profits in the bilateral monopoly model.

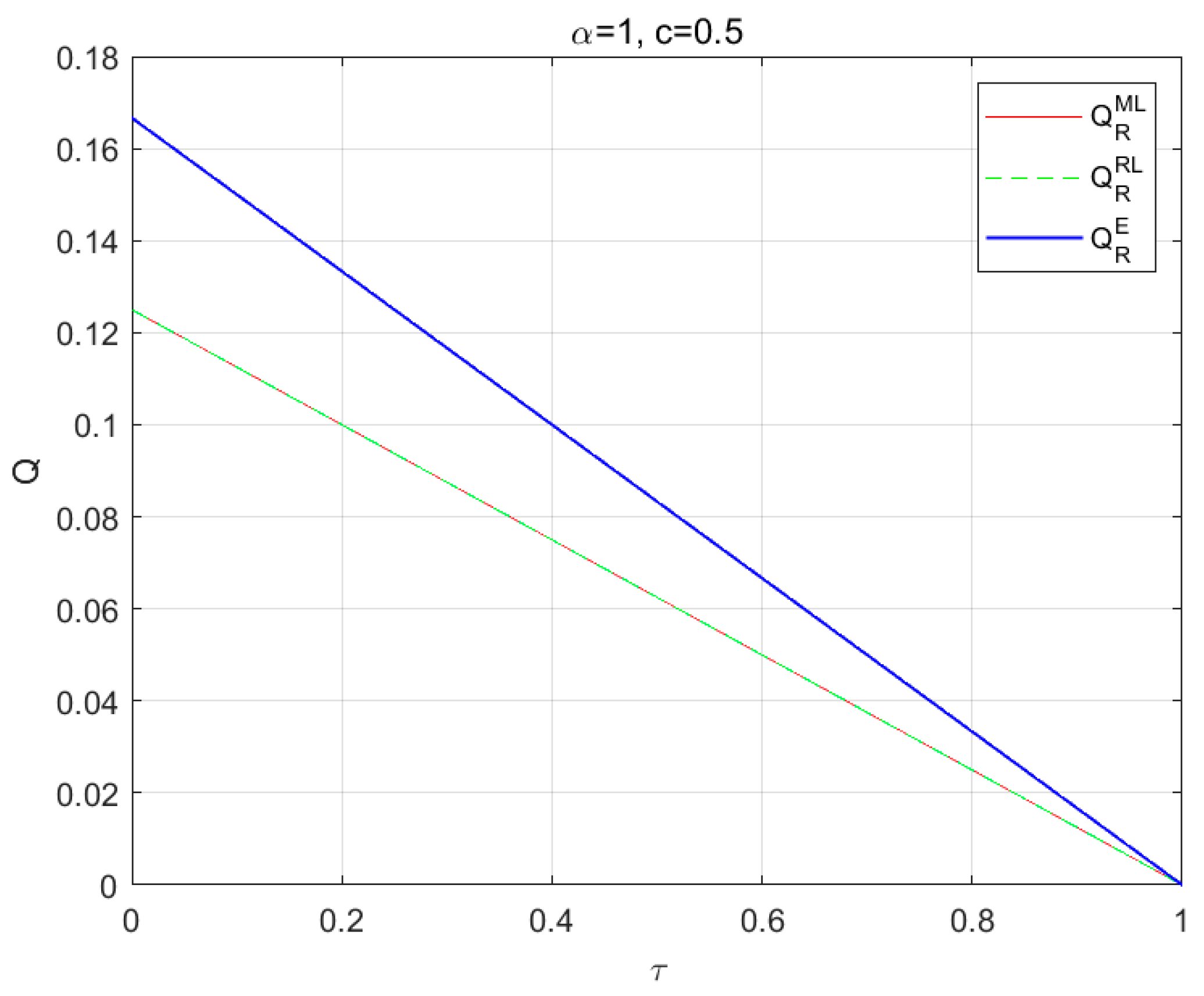

Proposition 4.

Considering the bilateral monopoly model, the relationship between the impact of tariffs on members under the three different power structures is as follows:

(a) Under the ML power structure, a comparison of the impact of tariffs on manufacturers and retailers is as follows: ;

(b) Under the RL power structure, if , then , else , ;

(c) Under E power structure, if , then , else ,

Proposition 4 compares the extent of the impact of tariffs on different members of the supply chain under various power structures. For example, under the manufacturer leadership (ML) model, the impact of tariffs on manufacturers is greater than on retailers; that is, manufacturers consistently incur higher losses due to tariffs compared to retailers. Similar conclusions are drawn under retailer leadership (RL) and equal (E) power structures: when the market size is relatively small, the losses for manufacturers are smaller than those for retailers; when the market size is relatively large, the losses for manufacturers exceed those for retailers. In the case of ML, an increase in tariffs directly raises manufacturers’ production and export costs. As manufacturers need to adjust their pricing strategies to cope with the increased tariff costs, this adjustment typically affects the profit distribution across the entire supply chain. Retailers, on the other hand, have methods to buffer the impact of tariff costs on their profits. They can partially absorb the tariff costs through product mix adjustments, promotional activities, and pricing strategies, thereby maintaining market competitiveness. Therefore, under the ML scenario, tariffs inflict more damage on manufacturers than on retailers.

Under the RL and E scenarios, when the market size is relatively small, the losses due to tariffs are greater for the retailer than for the manufacturer. As mentioned earlier, the retailer can mitigate the impact of tariffs on its profits through pricing strategies, but in a small market, the profits retailers can achieve are significantly lower than the adverse impact of tariffs. Conversely, in a large market, the profits a retailer gains from a larger market substantially outweigh the negative effects of tariffs.

Corollary 2.

When considering the duopoly competition model, the equilibrium results under the three power structures exhibit consistent trends with respect to , as follows:

(a) , , , , , ;

(b) , , , .

Corollary 2 indicates that under the competitive model, the impact of tariffs on the equilibrium results across the three power structures is consistent. When the tariff rates increase, the procurement costs from China rise. To encourage U.S. retailers to continue purchasing Chinese products, Chinese manufacturers are likely to lower their wholesale prices. For U.S. retailers, higher tariffs mean increased costs, which leads them to raise the retail prices of Chinese products to maintain their profit margins. According to the inverse demand relationship, an increase in product prices results in a decrease in demands. Consequently, as the wholesale prices of Chinese products decrease and demands drop, the profits of Chinese manufacturers naturally decline. This phenomenon can be attributed to the fact that higher tariffs elevate the overall cost burden on the supply chain, prompting manufacturers to lower their wholesale prices in an attempt to maintain competitiveness, while the retailer transfers part of the increased cost to consumers, thereby leading to reduced sales quantities and decreased profits for all parties involved. Consequently, U.S. retailers do not benefit from increased tariffs. In summary, the analysis shows that increased tariffs do not improve the profits of Chinese manufacturers or U.S. retailers; in fact, they likely reduce their profits.

The above analysis examined the trends in equilibrium outcomes under three power structures in competitive models as tariffs change. The following section will delve deeper into the sensitivity analysis of equilibrium outcomes to tariffs under different power structures in competitive models, aiming to uncover results that differ from those in monopolistic models. See Table A2 for the relevant proof.

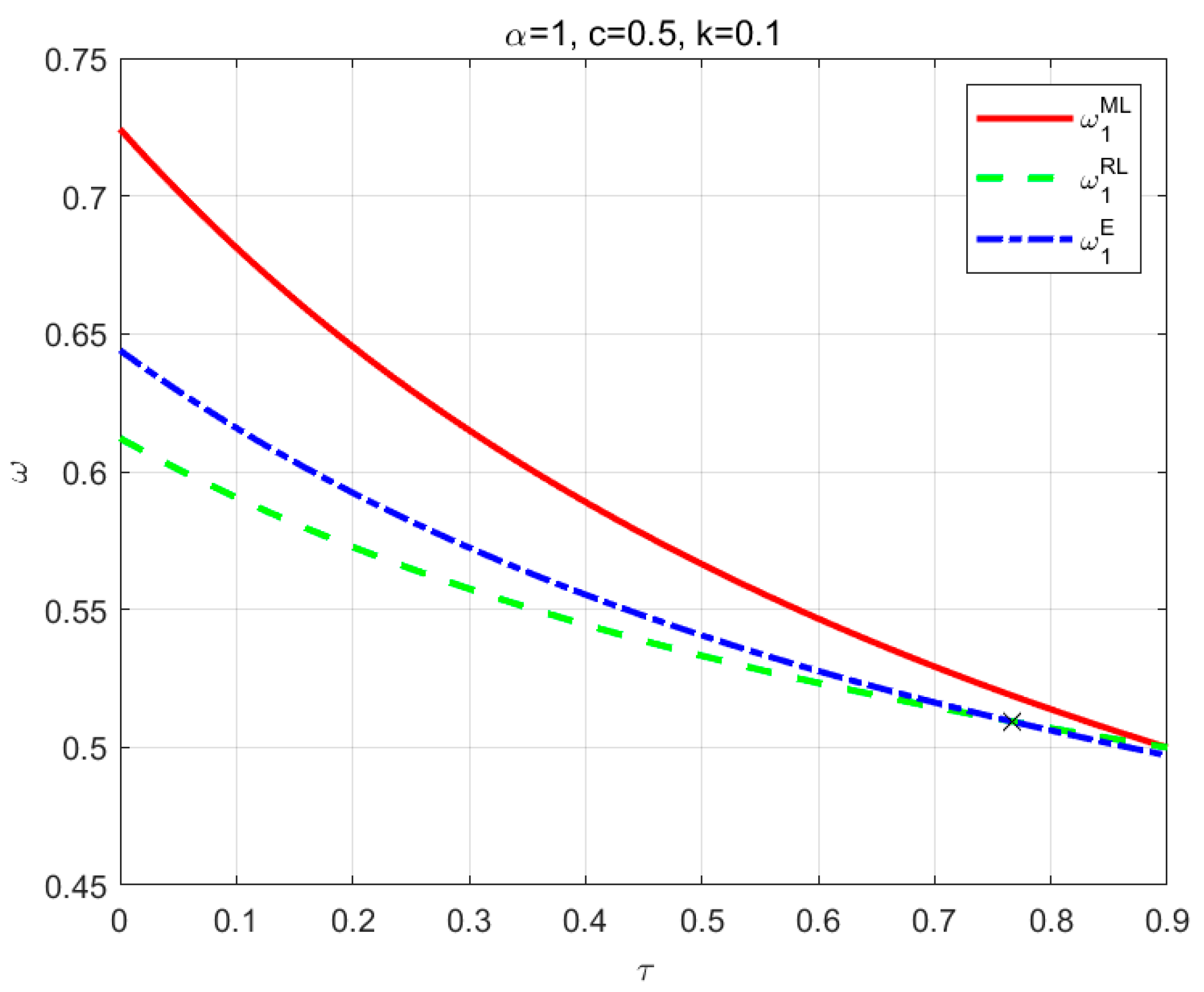

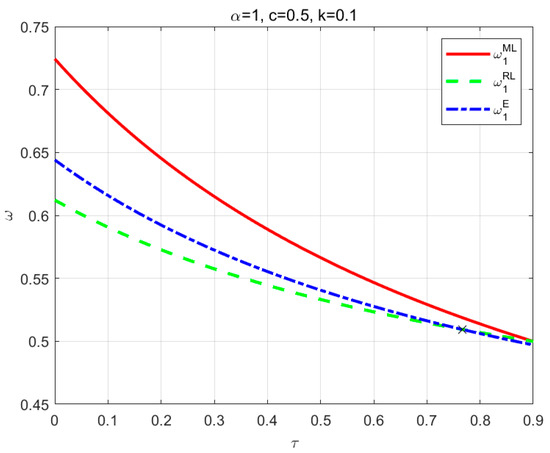

Proposition 5.

In the duopoly competition model, with respect to the wholesale prices and under different power structures,

(a) , ;

(b) , .

Proposition 5 (a) indicates the comparison of the wholesale prices () of two manufacturers under the three different power structures and their sensitivity to tariffs. This proposition shows that under different power structures, the relationships between the wholesale prices and are as follows: , . See Figure 5.

Figure 5.

Impact of tariffs on wholesale prices in the competitive model.

Under a manufacturer-led power structure, manufacturers possess significant pricing power. They can set higher wholesale prices to maximize their profits. Given the weaker bargaining power of retailers, they are compelled to accept these higher wholesale prices. When tariffs increase, manufacturers face higher production and export costs. Due to their considerable pricing power, manufacturers tend to pass these tariff costs onto retailers by raising the wholesale prices to maintain their profit margins. This means that the increase in tariffs will significantly impact the wholesale prices. Under a retailer-led power structure, retailers have strong bargaining power. They can drive down wholesale prices to reduce costs and increase their profits. Manufacturers have to accept lower wholesale prices in order to maintain their market share. When tariffs increase, manufacturers still face higher production and export costs. However, due to the strong bargaining power of retailers, manufacturers cannot fully pass on tariff costs to retailers. As a result, manufacturers may need to absorb some of the tariff costs themselves, thereby reducing the magnitude of the increase in wholesale prices.

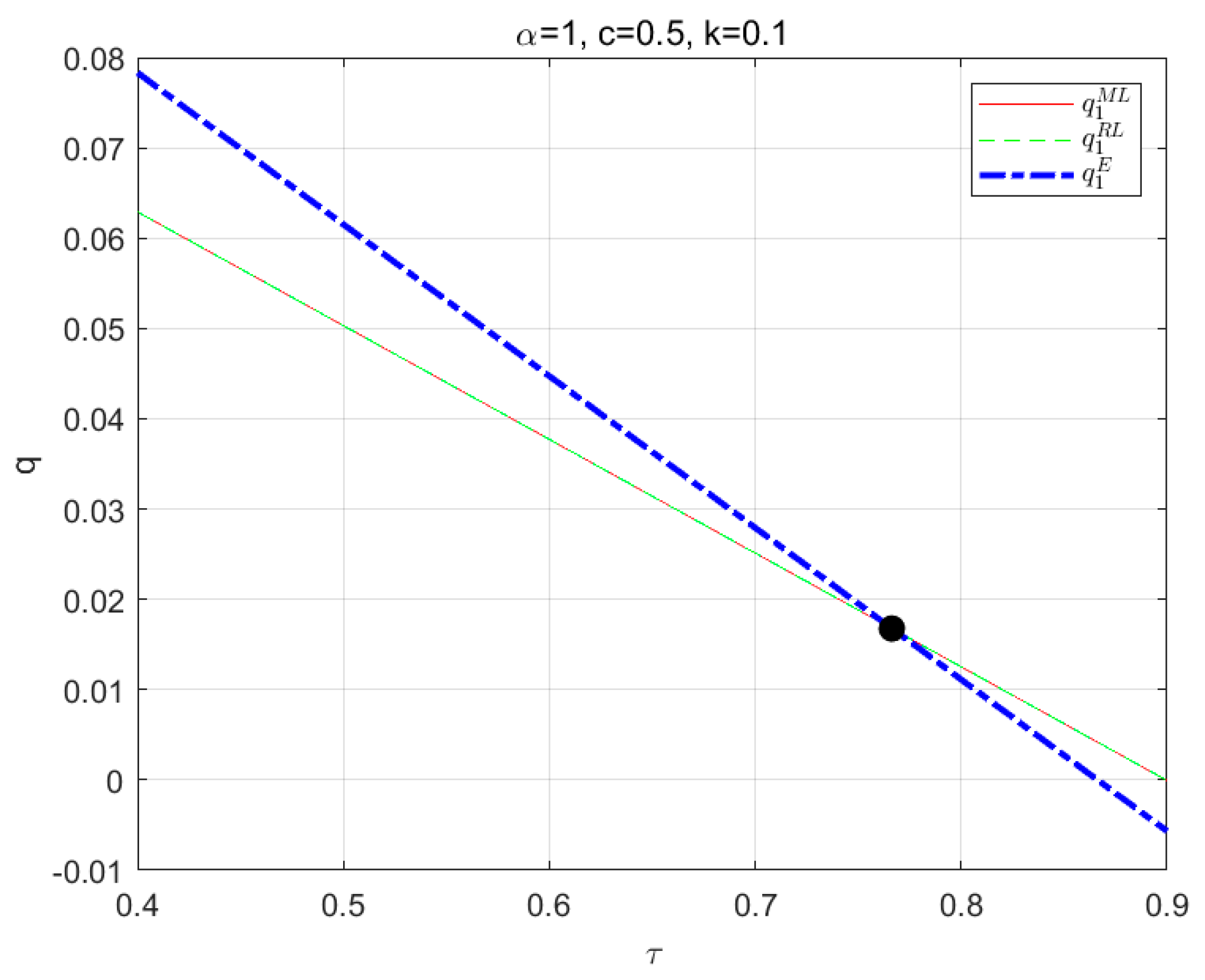

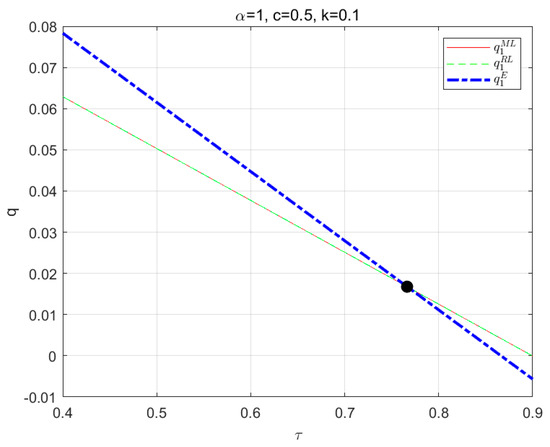

Proposition 6.

Considering the duopoly competition model, for the different power structures and , the following exists:

(a) , ;

(b) ,

According to Proposition 6 (a), the production quantities of Chinese manufacturer 1 (M1) under different power structures are ordered as follows: . See Figure 6. The production quantities of Chinese manufacturer 2 (M2) under different power structures are ordered as follows: . In situations where manufacturers or retailers hold dominant positions, the double marginalization effect is strong, leading to a relatively lower and equal output (, ). In a structure with equal power, cooperation mitigates the double marginalization effect, resulting in the highest output (, ). Under the manufacturer-dominant and retailer-dominant structures, the double marginalization effect within the supply chain is pronounced. Manufacturers and retailers each optimize their profits, but due to the presence of double marginalization, the overall efficiency of the supply chain is low. An increase in tariffs is transmitted to manufacturers through retailers; however, the low efficiency of the supply chain results in a relatively small impact on the output due to the tariff increase. In an equal power structure, manufacturers and retailers collaborate to optimize the supply chain, mitigating the double marginalization effect and enhancing the overall supply chain efficiency. Consequently, as cooperative optimization improves the supply chain efficiency, the impact of tariffs on the output becomes more significant.

Figure 6.

Impact of tariffs on sales quantity under the competitive model.

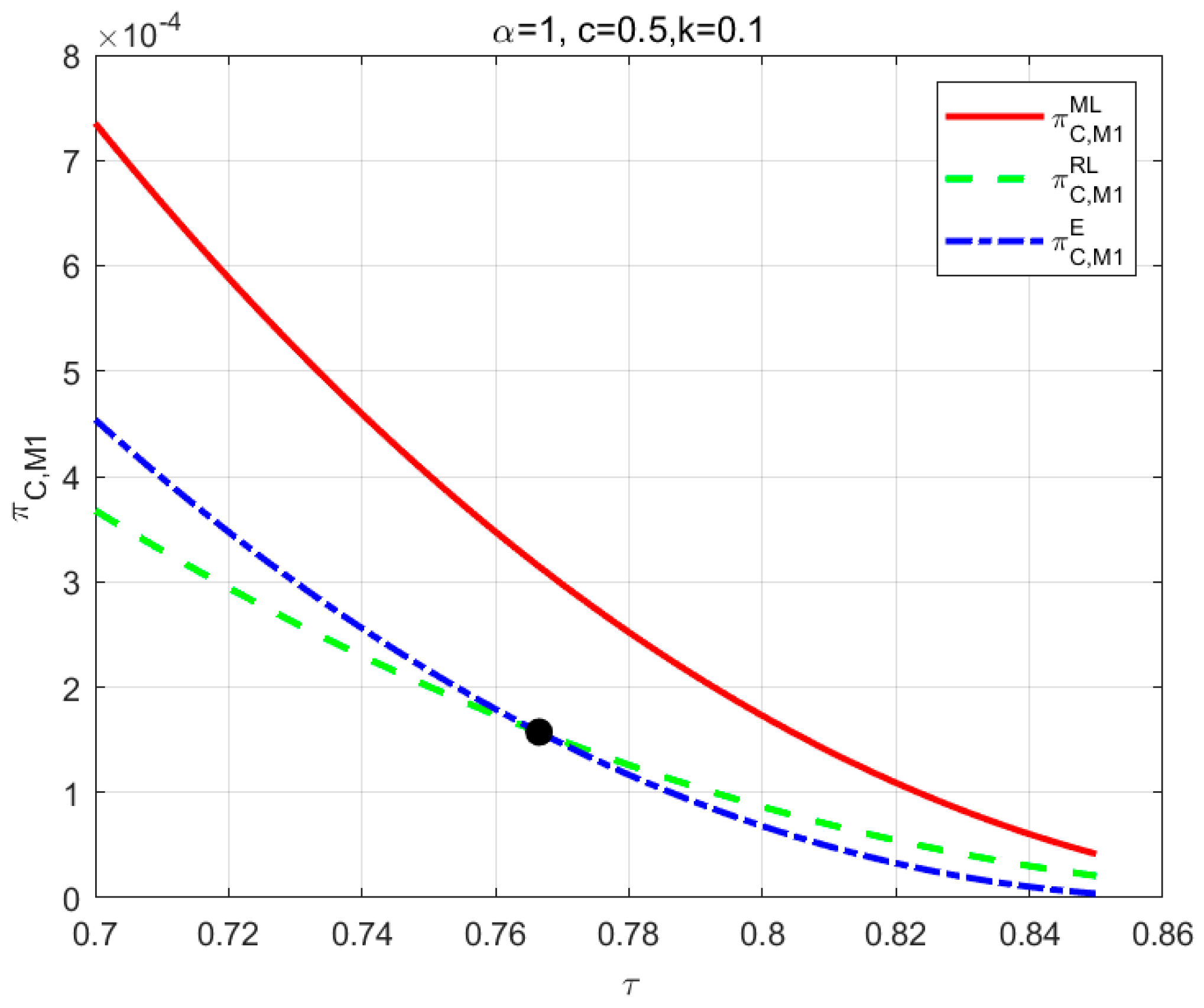

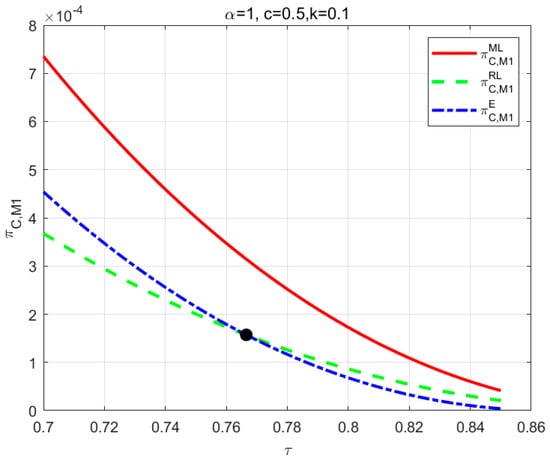

Proposition 7.

In a competitive model, the profits of two manufacturers and one retailer are under different power structures . The relationships are outlined as follows:

(a) ;

(b) , ;

(c) , .

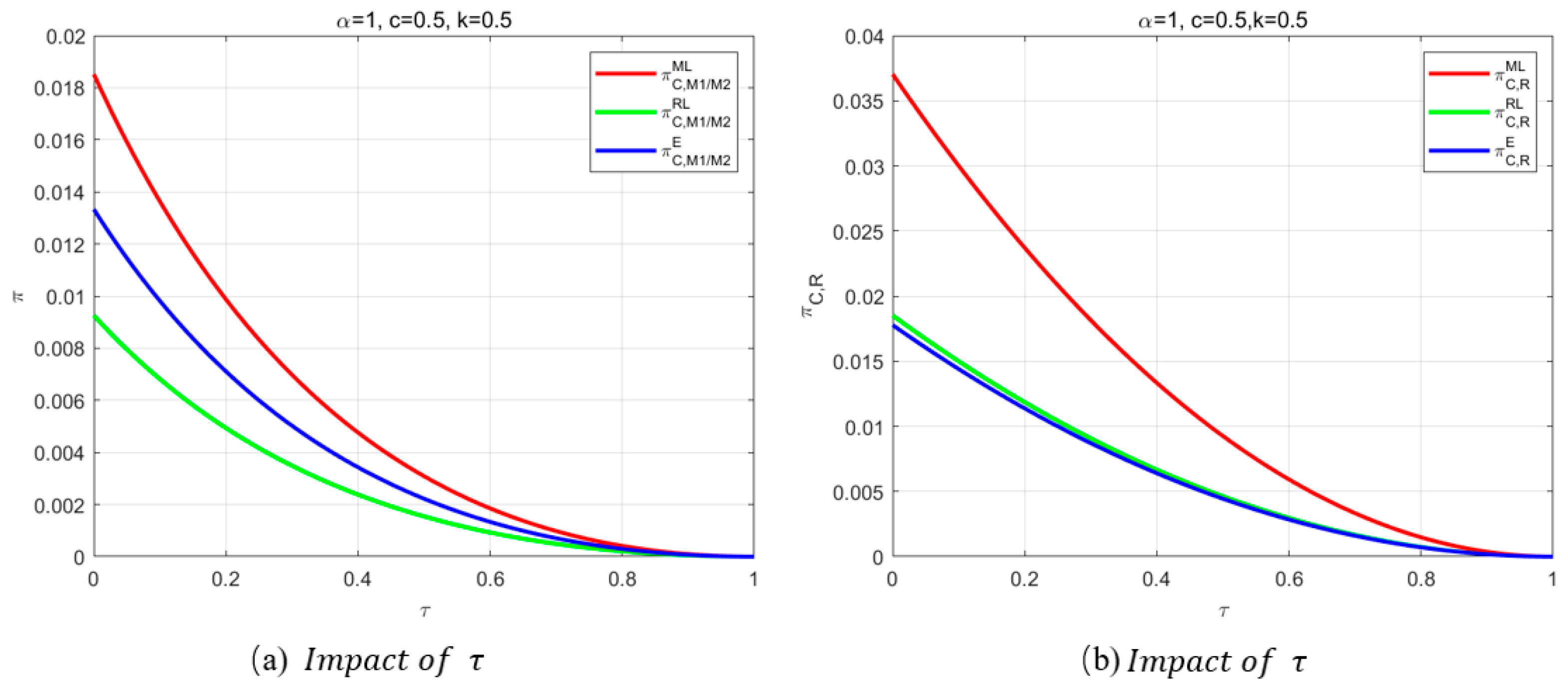

According to Proposition 7, in a manufacturer-led power structure, manufacturers have greater pricing power and market control. Therefore, they can set higher wholesale prices to maximize their profits. This is followed by the equal power structure and finally, under a structure with retailer dominance. The profits of manufacturer 1 under the three power structures vary with changes in tariffs, as illustrated in the Figure 7a.

Figure 7.

Tariffs on two manufacturers’ and one retailer’s profits in the competitive model.

The retailer’s profits are maximized when the manufacturer is dominant, which is very different from the conventional conclusion, and this change is mainly due to the intense competition between the two manufacturers, which ultimately creates a situation where the retailer sits on the sidelines and reaps the benefits. When the retailer is dominant, the retailer takes full advantage of its dominant position to maximize its margins and thus its profits. When the power structure is equal, the manufacturer and the retailer have the same dominant position, and it is difficult for the retailer to take advantage of the manufacturer. From Figure 7b, it can be seen that under the leadership of the manufacturers, the profits of the manufacturers and the retailer are maximized, and the manufacturers and the retailer can achieve a win–win situation.

The sensitivity of retailer profits to tariffs is greatest in a retailer-dominant structure, as retailers face increased cost pressures and find it challenging to fully pass these costs onto consumers, leading to narrower profit margins. In a manufacturer-dominant structure, retailers can partially offset the increased costs by raising retail prices, resulting in a slightly lower sensitivity. In a balanced power structure, both manufacturers and retailers share the burden of tariff-induced cost increases, resulting in the lowest sensitivity of retailer profits to changes in tariffs.

Proposition 8.

Considering the competitive model, the relationship between the impact of tariffs on manufacturers and the impact of tariffs on retailers under three different power structures is as follows:

(a) Under ML, if , then ; if , then ;

(b) Under RL, if , then ; if , then ;

(c) Under E, if , then , .

Based on Proposition 8, regardless of the power structure, tariffs hurt manufacturers more than retailers when the market is relatively large; they hurt retailers more than retailers when the market is relatively small.

When the market size is large, under the conditions of symmetric costs for two manufacturers and considering manufacturer-dominant, retailer-dominant, and equal power structures, the impact of tariffs on manufacturers’ profits is greater than on retailers’ profits. This is because, in a large market, manufacturers have more pricing power and can influence the supply chain significantly. As tariffs increase, manufacturers face higher production and export costs, which directly reduce their profit margins. Even though retailers might also be affected, their ability to pass on these costs to consumers helps mitigate the impact on their profits.

When the market size is small, the impact of tariffs on retailers’ profits is greater than on manufacturers’ profits. In a constrained market, manufacturers are less willing or able to absorb tariff costs by significantly lowering their prices. As a result, more of the tariff burden is transferred to retailers. Retailers, facing higher costs and the limited ability to raise consumer prices due to low market demands, experience a greater compression of their profit margins. Thus, the profit impact of tariffs shifts towards retailers in smaller markets.

5. Comparison between Monopoly and Competitive Models

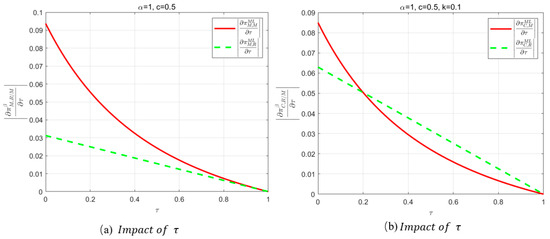

5.1. Comparative Analysis of the Impact of Tariffs

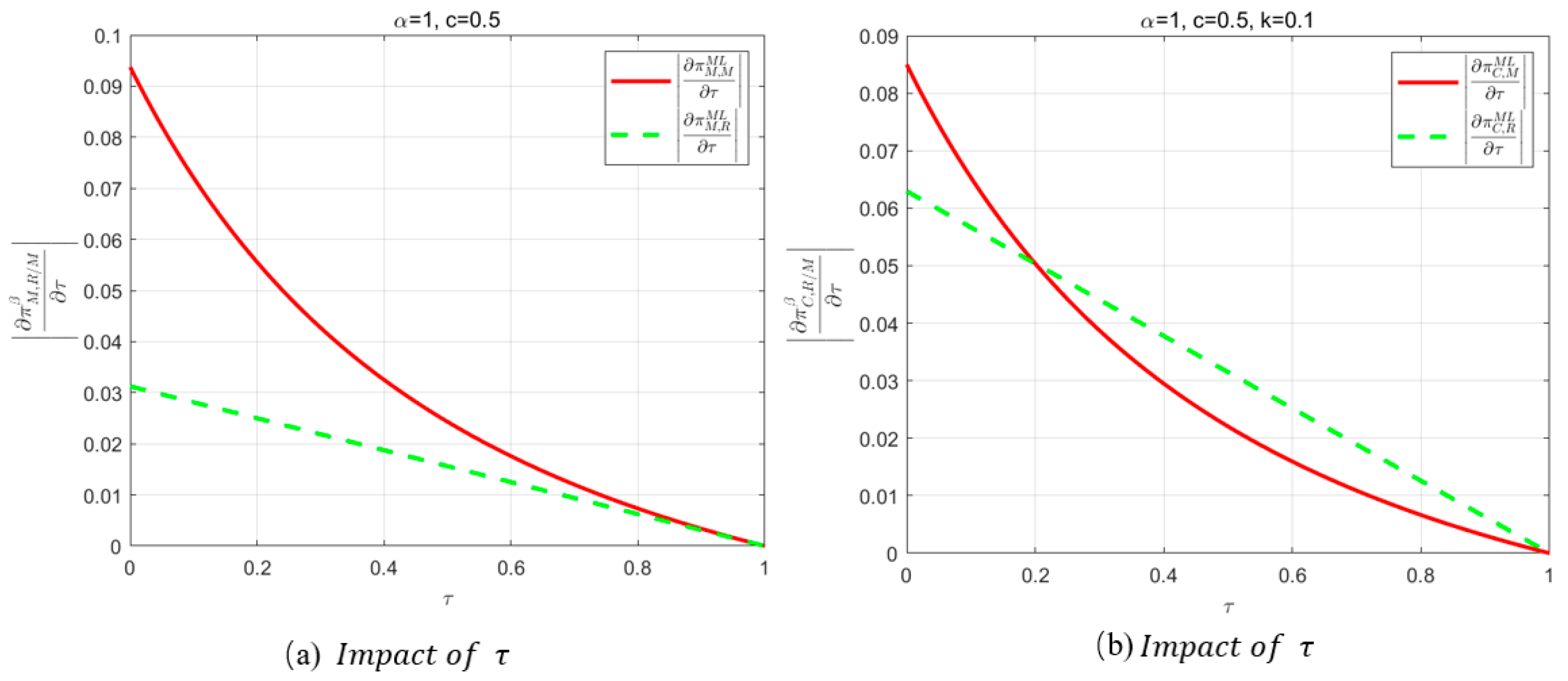

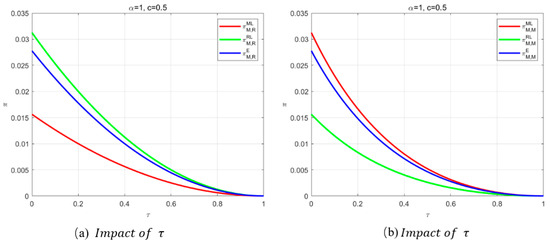

This subsection summarizes the comparative analysis of the impact of tariffs on the Chinese manufacturers and retailers discussed in Chapter 4. In the monopoly model, the effect of tariffs on Chinese manufacturers and retailers varies under different power structures. By plotting three-dimensional graphs of the impacts concerning and , we can determine the relative effects of tariffs on Chinese manufacturers and retailers. The summary of Propositions 5 and 8 is as follows:

Corollary 3.

(a) Under the ML (manufacturer-leader) scenario, in the monopoly model, ; in the competitive model, if , then , and if , then ;

(b) Under the RL (retailer-leader) and E (equal power) scenarios, for both the monopoly and competitive models, when the market is large, and , and when the market is small, and

It is evident that there are inconsistencies between the monopoly and competitive models. Under ML, the monopoly model is as follows: the impact of tariffs on Chinese manufacturers is consistently greater than the impact of tariffs on retailers, as can be seen in Figure 8a. The competition model is as follows: the extent of the impact of tariffs is related to the size of the market among manufacturers, and the impact of tariffs on Chinese manufacturers is consistently greater than the impact of tariffs on retailers when the size of the market is large, and the impact of tariffs on Chinese manufacturers is consistently less than the impact of tariffs on retailers when the size of the market is small, as can be seen in Figure 8b.

Figure 8.

Comparison of manufacturers’ and retailers’ sensitivity to tariffs in two models under ML.

In the monopoly model, under the manufacturer-dominant structure, an increase in tariffs directly raises the production and export costs for the manufacturer. In the competition model, when the market size is large, in the manufacturer-dominant structure (ML), manufacturers compete for orders by potentially lowering prices to attract retailers despite increased tariffs. This behavior reduces the impact of tariffs on retailers. Manufacturers may have to absorb a portion of the tariff costs to remain competitive, affecting their profit margins. It can be said that the impact of this competitive dynamic surpasses the influence of the power structure within the supply chain, regardless of the market size. When the market size is small, manufacturers are less willing to significantly lower prices, so the tariff costs are more likely to be passed on to retailers. With rising tariff costs, retailers may find it difficult to fully pass these costs onto consumers by raising prices, leading to compressed profit margins.

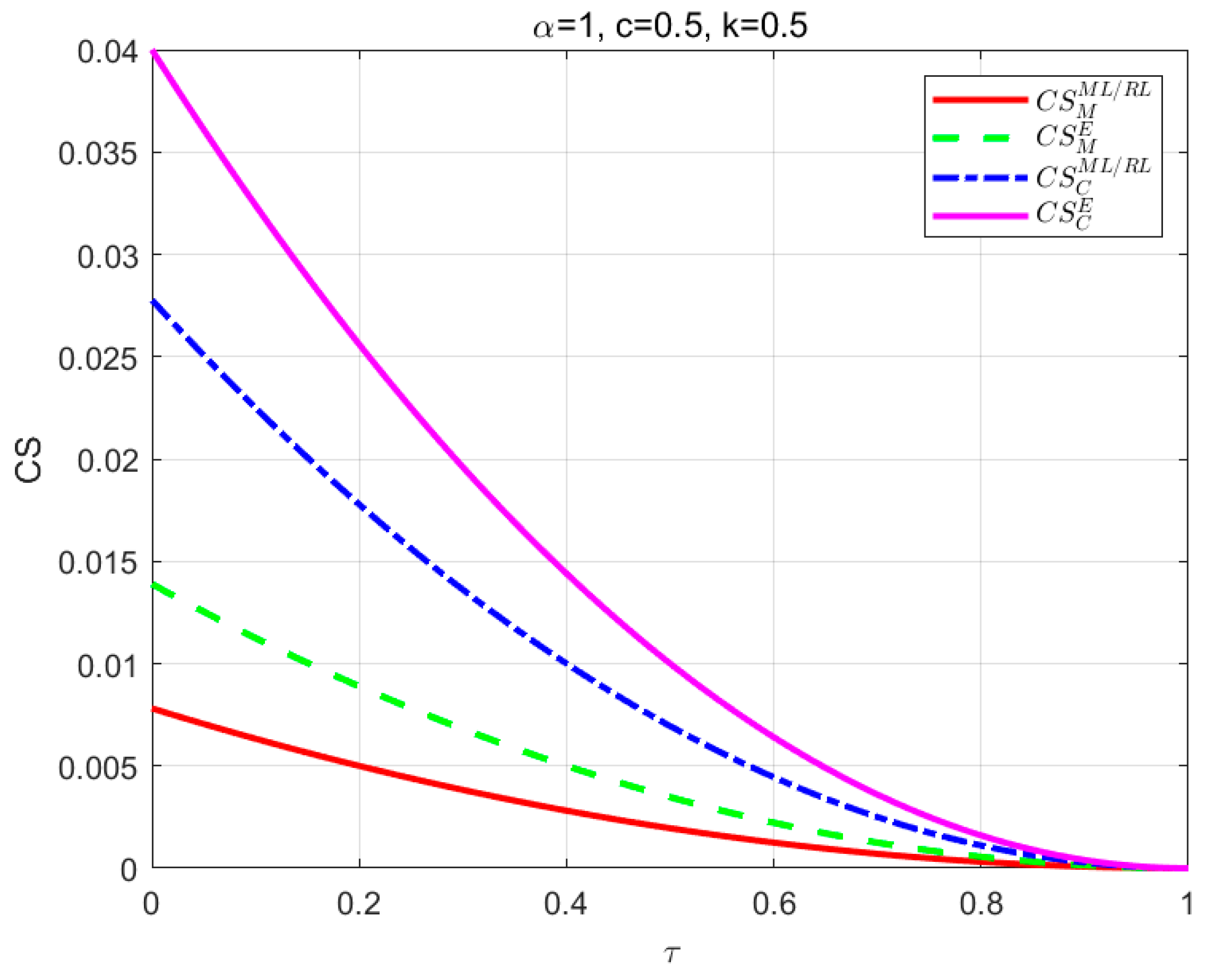

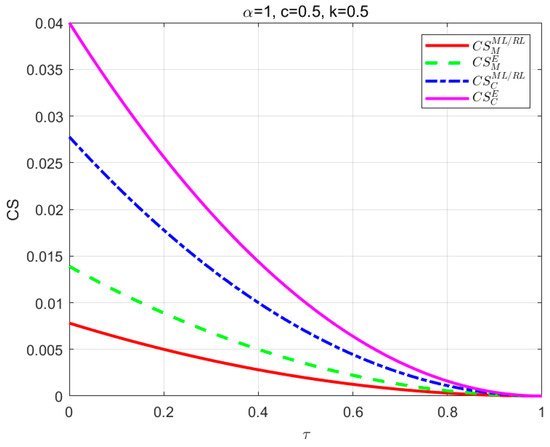

5.2. Consumer Surplus

This section analyzes the consumer surplus, observing how the impact of tariffs changes under the monopoly model and under the competitive model. According to the literature [33,39], the expressions for the consumer surplus in both monopoly and competition models are as follows:

represents the consumer surplus under the monopoly model, and and represent the quantity and sales price under the monopoly model. represents the consumer surplus under the competition model, with representing the output and sales price under the competition model.

Based on the above analysis, it is possible to derive the consumer surplus under the monopoly model and under the competitive model and the effect of tariffs on the consumer surplus. Actually, the consumer surplus under monopoly and competitive models follows the same pattern. Due to the complexity of the results, a numerical analysis is used to study the changes in the consumer surplus before and after platform intrusion. Set . In both models, there are three power structures: ML, RL, and E. The following sequence describes the changes in both models, with ML and RL showing consistent trends in the graphs. Therefore, only one scenario needs to be displayed graphically. In order to better represent the effect of tariffs on the consumer surplus in different scenarios, we represent this in detail in a graph: Figure 9. The horizontal coordinate of Figure 9 is the tariff, and the vertical coordinate is the consumer surplus.

Figure 9.

The effect of tariffs on consumer surplus under different power structures.

The consumer surplus decreases as the tariffs increase, both in the monopoly and competitive models. The increase in tariffs directly raises the cost of imported goods. Manufacturers, in an effort to maintain their profits, typically pass tariff costs onto consumers. This results in higher retail prices. As the prices of goods rise, the consumers’ purchasing power diminishes, leading to a decrease in the quantity purchased. The combination of higher prices and lower quantities purchased leads to a reduction in the consumer surplus. Please refer to Figure 9 for specific details. From Figure 9, it can be seen that the consumer surplus decreases as tariffs increase. The consumer surplus in the competitive model is consistently larger than that of the monopoly model. And the consumer surplus under equal power under either the monopoly or competition model is consistently greater than the consumer surplus under other power structures.

6. Extensions

In the primary model, we assume that the two manufacturers have identical costs. In the extended analysis, we relax this assumption and consider the case of cost asymmetries between manufacturers: assuming manufacturer 1 incurs costs while manufacturer 2 does not. The propositions derived in this section differ slightly from those in the primary model, as detailed in the proposition analysis. The profit function for the supply chain members is shown below.

represents the profits of the U.S. retailers. represent the profits of manufacturer 1 and manufacturer 2. represent the wholesale prices of manufacturer 1 and manufacturer 2. represent the quantity of manufacturer 1 and manufacturer 2. represent the sales prices from the products produced by manufacturer 1 and manufacturer 2. represents the tariff rate. The equalization results can be found in Appendix A (Table A3), and the propositions are analyzed below.

Proposition 9.

Considering cost asymmetries, with respect to the wholesale prices and under different power structures,

(a) if , then ;

if , then .

(b) .

(c) and .

Proposition 9 (a) indicates a comparison of the wholesale prices () of two manufacturers under three different power structures and their sensitivity to tariffs. This proposition shows that under different power structures, the relationships between wholesale prices, , are as follows: if , then , else . See Figure 10 for details.

Figure 10.

The effect of tariffs on wholesale prices under asymmetric costs.

When the market size is large, the wholesale prices, , under the three power structures are determined by the Chinese manufacturer. Specifically, the wholesale price is the highest under manufacturer leadership (ML), followed by the competitive scenario (E), and the lowest wholesale price is under retailer leadership (RL). The greater the manufacturer’s power, the stronger their desire to increase their marginal profits, which in turn increases their motivation to raise wholesale prices. Therefore, when the manufacturer holds the dominant position, the Chinese manufacturer’s wholesale price is the highest; when the retailer holds the dominant position, the Chinese manufacturer’s wholesale price is the lowest; and when the manufacturer and retailer have equal power, the Chinese manufacturer’s wholesale price is intermediate.

When the market size is relatively small, the order of wholesale prices under the three different power structures of Chinese manufacturers changes. remains the highest, but . The reasons for this are as follows: When the market size is small, products from China face intense competition, each trying to capture a larger market share. When the manufacturer holds the dominant position, the influence of the manufacturer’s power outweighs the effect of competition among manufacturers, resulting in the highest wholesale price under manufacturer leadership. In the RL scenario, the competition between Chinese manufacturers is also intense. However, when the power between manufacturers and retailers is balanced, the competition among manufacturers becomes most fierce. Each manufacturer (M1 and M2) engages in a psychological price war, striving to capture as much market share as possible. At this point, the impact of competition among manufacturers on wholesale prices is greater than the effect of the power structure. Consequently, the outcome changes. Specifically, when the retailer holds the leading position, manufacturers are already aware of the retailer’s relevant information and strive to avoid price wars, aiming to maximize their profits or minimize their losses. Therefore, under a smaller market size, the wholesale price in the simultaneous game scenario is even lower than in the retailer-led scenario.

According to Proposition 9 (b), the wholesale price relationship of manufacturer 2 under different power structures is shown to be . Since manufacturer 2 has a no-cost advantage in the competition with manufacturer 1, it is always in an advantageous position in this competition, so manufacturer 2’s wholesale price is only affected by the power structure, which ultimately leads to this relationship. The impact of tariffs on wholesale prices is also influenced by the power structure, with wholesale prices being most sensitive to tariffs under the leadership of the manufacturers and being least sensitive under the leadership of the retailer.

Proposition 10.

Considering cost asymmetries, for the different power structures and , the following exists:

(a) if , then ,

else and .

(b) .

(c) and .

According to Proposition 10 (a), when the market size is relatively large, the production quantities of Chinese manufacturers (M1) under different power structures are ordered as follows: . When the market size is relatively small, the production quantities of Chinese manufacturers (M1) under different power structures are ordered as follows: . See Figure 11 for details. When the market size is large, in situations where manufacturers or retailers hold dominant positions, the double marginalization effect is strong, leading to a relatively lower and equal output (). In a structure with equal power, cooperation mitigates the double marginalization effect, resulting in the highest output (). When the market size is small, in an equal power structure, even with optimized cooperation, insufficient market demands lead to a relatively lower output (). Under manufacturer or retailer leadership, the output is relatively higher and equal (), due to limited market demands and lower marginal tax costs.

Figure 11.

The effect of tariffs on sales quantity under asymmetric costs.

A primary reason for the relationship between the output quantities of manufacturer 2, represented as , is that the costless advantage allows manufacturer 2 to flexibly adjust the output under any power structure, but its production remains limited by market demands and the overall efficiency of the supply chain. In addition, under manufacturer-dominant and retailer-dominant scenarios, double marginalization restricts the overall efficiency and output of the supply chain. In an equal power structure, cooperative optimization mitigates the double marginalization effect, enhancing the overall efficiency and output of the supply chain.

In manufacturer-dominant and retailer-dominant structures, the double marginalization effect within the supply chain is pronounced. Manufacturers and retailers each optimize their profits, but due to the presence of double marginalization, the overall efficiency of the supply chain is low. An increase in tariffs is transmitted to manufacturers through retailers; however, the low efficiency of the supply chain results in a relatively small impact on the output due to the tariff increase. In an equal power structure, manufacturers and retailers collaborate to optimize the supply chain, mitigating the double marginalization effect and enhancing the overall supply chain efficiency. Consequently, as cooperative optimization improves the supply chain efficiency, the impact of tariffs on the output becomes more significant.

Proposition 11.

Considering cost asymmetries, the profits of firms under different power structures are . The specific relationships and impacts on profits are outlined as follows:

(a) If , then ,

else and .

(b) and .

According to Proposition 11, for Chinese manufacturer 1, when they dominate a larger market, their profits are maximized under manufacturer leadership and are minimized under retailer leadership. When the market size is smaller, Chinese manufacturer 1 still achieves maximum profits under manufacturer leadership, but its profits under equal conditions are minimized. When the market size is large, manufacturer 1 possesses significant pricing power under the manufacturer-dominant structure, allowing it to directly set wholesale prices and maximize its profits through high pricing, without being constrained by the retailer. Consequently, manufacturer 1 achieves the highest profits in this scenario. Profits are lower in an equal power structure and are the lowest under the retailer-dominant structure. In the retailer-dominant scenario, the retailer aims to maximize its own profits by minimizing the wholesale price, further squeezing the profit margin of manufacturer 1. See Figure 12 for details.

Figure 12.

The effect of tariffs on manufacturer 1’s profits under asymmetric costs.

When the market size is small, intense competition under the retailer-dominant (RL) structure forces manufacturer 1 to reduce prices to maintain the market share, leading to a decline in profits. In the equal power structure (E), although cooperation improves the supply chain efficiency, the limited profit margins and competition between manufacturer 1 and manufacturer 2 restrict manufacturer 1’s profits. When the market size is small, the overall market demands are low, intensifying the competition between manufacturer 1 and manufacturer 2, which has a more substantial negative impact on manufacturer 1’s profits. The relationship between the profits of manufacturer 2 and the retailer under the three power structures is essentially led by the power relationship, with the greater the power of the manufacturer, the greater its profits, and the greater the power of the retailer, the greater its profits.

7. Conclusions

Based on real-world scenarios, this paper first constructed a two-party game model between a Chinese manufacturer and a U.S. retailer under a monopoly model. Subsequently, a three-party game model was developed under a competitive model involving two Chinese manufacturers and a U.S. retailer. The primary focus was on the impacts of tariffs and power structures on the members of the transnational supply chain, as well as the effect of product substitutability on the equilibrium outcomes of supply chain members in the competitive model. The U.S. retailer offshores its production to Chinese manufacturers, and the products procured from these manufacturers are subject to import taxes when sold to consumers through the U.S. retailer. To analyze the impact of the relative market power (power structure) on upstream and downstream supply chain firms, we considered three commonly used power structures: the manufacturer as the leader (ML), the retailer as the leader (RL), and companies with equal power (E). We examined two models, and based on our analysis, we derived several important managerial implications.

In our monopoly model, we demonstrated that under all three power structures, the equilibrium outcomes exhibit the same trends concerning tariff changes. Specifically, as tariffs increase, the manufacturer’s wholesale price tends to decrease, the production quantity tends to decrease, the sales price tends to increase, and both the retailer’s and the manufacturer’s profits decrease. The impact of tariffs on wholesale prices increases as the power of manufacturers increases, and Chinese manufacturers have a greater ability to pass on cost increases (e.g., tariffs) to retailers through wholesale prices, so the sensitivity of wholesale prices to tariffs increases. In addition, the impact of tariffs on the manufacturers’ profits increases as the manufacturers’ power increases. A similar conclusion was reached for the retailer: tariffs affect the retailers’ profits more and more as retailers’ power increases. And in the manufacturer-led case, tariffs under the competitive model have a greater impact on manufacturers than on retailers only when the market size is relatively large. On the other hand, under the monopoly model, tariffs consistently have a greater impact on manufacturers than tariffs have on the retailer. It is more interesting to note that under the leadership of the manufacturer, the profits of the manufacturers and the retailer are maximized, and the manufacturer and the retailer can achieve a win–win situation. This is not consistent with the conventional conclusion of power structures.

In addition to this, we drew different conclusions for the manufacturers in the expanded scenario, i.e., with cost asymmetries (manufacturer 2 has a cost advantage, and manufacturer 1 has no cost advantage). Wholesale prices are highest under the manufacturer-led structure and are the lowest when power is equally distributed, particularly in smaller markets. This pattern also applies to profits, with this variation being driven by competition among manufacturers and the intersecting effects of power structures. An analysis of asymmetric costs showed that the effect of tariffs on the equilibrium outcome is the same as when it is symmetric, which also proves that the effect of tariffs on the equilibrium outcome is robust to some extent.

Of course, our research has several limitations. First, this study does not consider the uncertainty in the production output of Southeast Asian manufacturers due to factors such as transportation, production technology, or supply chain disruptions. Second, the U.S. retailer in this paper acquires products through offshore outsourcing. In reality, there is another production method, namely, local production. Local production involves considerations of production costs, brand premiums, and other factors. Taking these factors into account would make our research more realistic, and we will discuss their impact in future studies.

Author Contributions

Conceptualization, Z.Z. and Y.L.; methodology, Z.Z., Y.L. and L.C.; software, Z.Z. and Y.L.; validation, Z.Z., Y.L. and L.C.; formal analysis, Z.Z., Y.L. and L.C.; investigation, Z.Z. and Y.L.; resources, Z.Z.; writing—original draft preparation, Z.Z. and Y.L.; writing—review and editing, Z.Z., Y.L. and L.C.; visualization, Y.L.; supervision, Z.Z. and Y.L.; project administration, Z.Z.; funding acquisition, Z.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This research was supported by the Humanities and Social Science Fund of Ministry of Education of China (21YJC630052, 21YJC630186), the Guangdong Basic and Applied Basic Research Foundation (2023A1515030260, 2022A1515012034), and the Philosophy and Social Science Planning Project of Guangdong Province (GD20CGL19).

Data Availability Statement

The original contributions presented in the study are included in the article, further inquiries can be directed to the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A. Proof

Proof of Table 1.

(Model M): The three power structures in the monopoly model imply that the equilibrium outcome is to be solved three times, and this proof takes M dominance as an example, and so on for the other types of power structures. The two-party decision problem is solved using backward induction, and this time, the decision sequence is as follows: M decides on first, and R decides on afterwards. According to the profit function of R, given the parameter , is a concave function with respect to , since the second derivative of with respect to is negative. Taking a single derivative with respect to and making it 0 yields the following optimal response function of the retailer under the monopoly model with manufacturer dominance:

Next, solve for the manufacturer’s decision wholesale price, . Substituting the above result into the manufacturer’s profit function and rewriting the manufacturer’s profit decision problem, given tariffs and the output , since the second derivative of with respect to is and is a concave function with respect to , taking the first derivative of and letting it be 0 yields the following wholesale price, , of the manufacturer in the manufacturer-dominant structure in the monopoly model:

Substituting the above result of , yields the final retailer’s (R) optimal ordering decision as follows:

The equilibrium profits of each member of the supply chain are as follows: , .

In addition, make and , and the joint solution should satisfy the relationship of , in order to ensure that the equilibrium results under the monopoly model under the leadership of the manufacturer always contains a feasible solution. The details of the results of the monopoly model are discussed under the feasible domain part (by solving for the other two power structures under the feasible domain condition, the outcome is ). Table 1 proves this. □

Proof of Table 2.

(Model C): In the competitive model, there are also three power structures, and here, we also take only one of them as an example, the retailer-led case. The decision sequence in the retailer-led case is that R first decides on and simultaneously, after which M1 and M2 simultaneously decide on and , respectively. Before proceeding to the solution, we should solve for the demand function by associating Equations (1) and (2):

Combining (9) and (10), we obtain the following:

The results obtained above are first substituted into the profit functions of the retailer and the manufacturer. In this paper, we mainly use the inverse induction method to find the equilibrium results. Firstly, M1 and M2 decide the wholesale prices and . At the same time, according to the M1 and M2 profit functions, given tariffs, in the product substitutability case, since the second partial derivative of of is , the second partial derivative of of is , so and are concave functions of and , respectively, and the partial derivatives of and occur once and are made 0, which can be obtained as the optimal response function of M1 and M2 in the retailer-led structure under the competitive model of the optimal response function.

Next solve for the retailer’s decision marginal profits, and . Bringing the above results to the retailer’s profit function rewrites the retailer’s decision problem, given tariffs, product substitutability, and product quantity. Since the second derivative of , with respect to both and , is , is a concave function with respect to and . Take the first partial derivative with respect to and , respectively, and let it be 0. The joint solution yields the retailer’s marginal profit decision in the retailer-led case in the competitive model as follows:

The other equilibrium outcomes are as follows:

The profits of the members of the supply chain are as follows:

Let , , , and . The joint solution should satisfy the relationship of , in order to ensure that the competitive model under the RL structure under the equilibrium results always contain feasible solutions. The details of the results of the relevant competition model are in the feasible domain part of the discussion on the feasible domain (the ML feasibility of the domain condition is , and the E feasibility of the domain condition is ). Table 2 is proven. □

Proof of Corollary 1.

From the above table, it can be seen that the equilibrium outcomes under all three power structures in the monopoly model have the same trend regarding tariffs, i.e., , , , , , and .

Table A1.

Sensitivity analysis in the monopoly model.

Table A1.

Sensitivity analysis in the monopoly model.

| ML | RL | E | |

|---|---|---|---|

□

Proof of Proposition 1.

□

Proof of Proposition 2.

□

Proof of Proposition 3.

By analogy, the other proofs of Proposition 4 can be made to differ according to the table given in the proof of Proposition 1, which ultimately leads to the following results:

□

Proof of Proposition 4.

From the results of the table in Corollary 1, this proposition can be obtained by differentiating the first derivatives with respect to the tariff under different power structures. □

Proof of Corollary 2.

Table A2.

Sensitivity analysis in a competitive model.

Table A2.

Sensitivity analysis in a competitive model.

| ML | RL | E | |

|---|---|---|---|

| < 0 | < 0 | < 0 | |

| < 0 | < 0 | < 0 | |

| < 0 | < 0 | < 0 | |

| < 0 | < 0 | < 0 | |

| > 0 | > 0 | > 0 | |

| > 0 | > 0 | > 0 | |

| < 0 | < 0 | ||

| < 0 | < 0 | < 0 | |

| < 0 | < 0 | < 0 |

Note that to make the expression easier, the form sets the following:

It can be shown that the equilibrium results from the competitive model of the above table change with respect to tariffs. The final result of Proposition 5 is finally obtained:

□

Proof of Proposition 5.

Let us first determine the relevant conclusion of .

The same reasoning can be used to obtain the following. Let us first determine the relevant conclusion of . □

Proof of Proposition 6.

Let us first determine the relevant conclusion of .

Let us first determine the relevant conclusion of .

Then, let us first determine the relevant conclusion of and .

From the table in the proof of Corollary 2, it is possible to achieve the equilibrium results based on the trend of the tariffs, as it can basically be calculated simply, and this process will not be described carefully here, but this will lead to the following result:

□

Proof of Proposition 7.

□

Proof of Proposition 8.

□

Proof of Corollary 3.

See Proposition 4 and Proposition 8. □

Proof of Consumer Surplus.

The given formulas for the consumer surplus are used to solve for the consumer surplus. Set . In both models, there are three power structures: ML, RL, and E. The following sequence describes the changes in both models, with ML and RL showing consistent trends in the graphs. Differences are made between the results under the competition model and the results under the monopoly case, and the given parameter values were substituted to draw a two-dimensional diagram. □

Proof of Proposition 9.

The equilibrium results under asymmetric costs can likewise be obtained according to backward induction as follows.

Table A3.

Equilibrium outcomes under cost asymmetries.

Table A3.

Equilibrium outcomes under cost asymmetries.

| ML | RL | |

|---|---|---|

| E | ||

In order for the equilibrium outcome to hold, each power structure has a constraint.

Comparing the situation under different power structures based on the partial derivatives of wholesale prices with respect to tariffs leads to the following.

□

Proof of Proposition 10.

Proof of Proposition 11.

A proof of the conclusion of Proposition 11 along the lines of Propositions 9 and 10 can be finalized. By using the method of making differences directly, the result can be computed, and some of the computational procedures are the same as in Proposition 9 and Proposition 10. □

References

- Wu, X.; Zhang, F. Home or overseas? An analysis of sourcing strategies under competition. Manag. Sci. 2014, 60, 1223–1240. [Google Scholar] [CrossRef]

- Weitzman, H. High hopes for Jobs and “Made in the USA”. Financial Times. (May10). 2012. Available online: https://www.ft.com/content/e9b21ba2-995b-11e1-9a57-00144feabdc0 (accessed on 1 October 2024).

- Su. 2016. Available online: http://ihl.cankaoxiaoxi.com/2016/0927/1319462.shtml (accessed on 1 October 2024).

- Higgins, T.; Pramuk, J. ‘Tariffs Are a Beautiful Thing’—Trump Doubles Down on Trade War Strategy with China after Mexico Deal. 2019. Available online: https://www.cnbc.com/2019/06/10/trump-doubles-down-on-trade-war-tariff-strategy-after-mexico-deal.html (accessed on 1 October 2024).