Portfolio Selection Based on Modified CoVaR in Gaussian Framework

Abstract

:1. Introduction

“The higher the value of X, the better”.

2. Notation

2.1. CoVaR in Copula Setting

2.2. Portfolio Selection

3. The Mean-CoVaR Model

- The symmetric matrix is positively defined, i.e., is a matrix of a scalar product on ;

- The vectors and are linearly independent (i.e., not parallel);

- E is any real number.

4. Proofs and Auxiliary Results

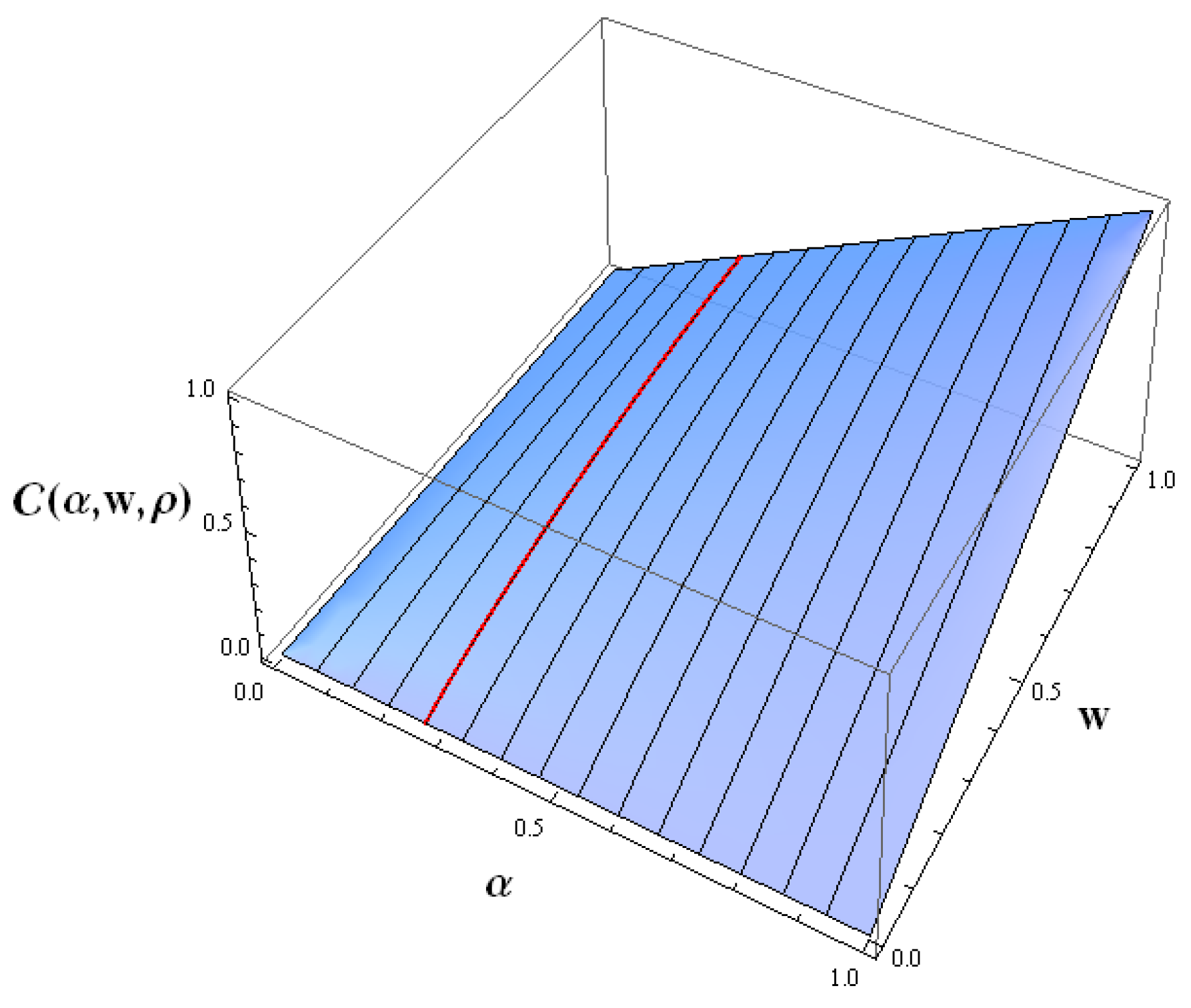

4.1. Gaussian Copulas

- 1.

- ;

- 2.

- ;

- 3.

- .

4.2. The Optimization Problems

4.2.1. The Basic Problem

4.2.2. The Markowitz Problem

4.2.3. Critical Plane

4.2.4. Auxiliary Optimization Problem

4.2.5. Proof of Theorem 2

4.2.6. Proof of Theorem 3

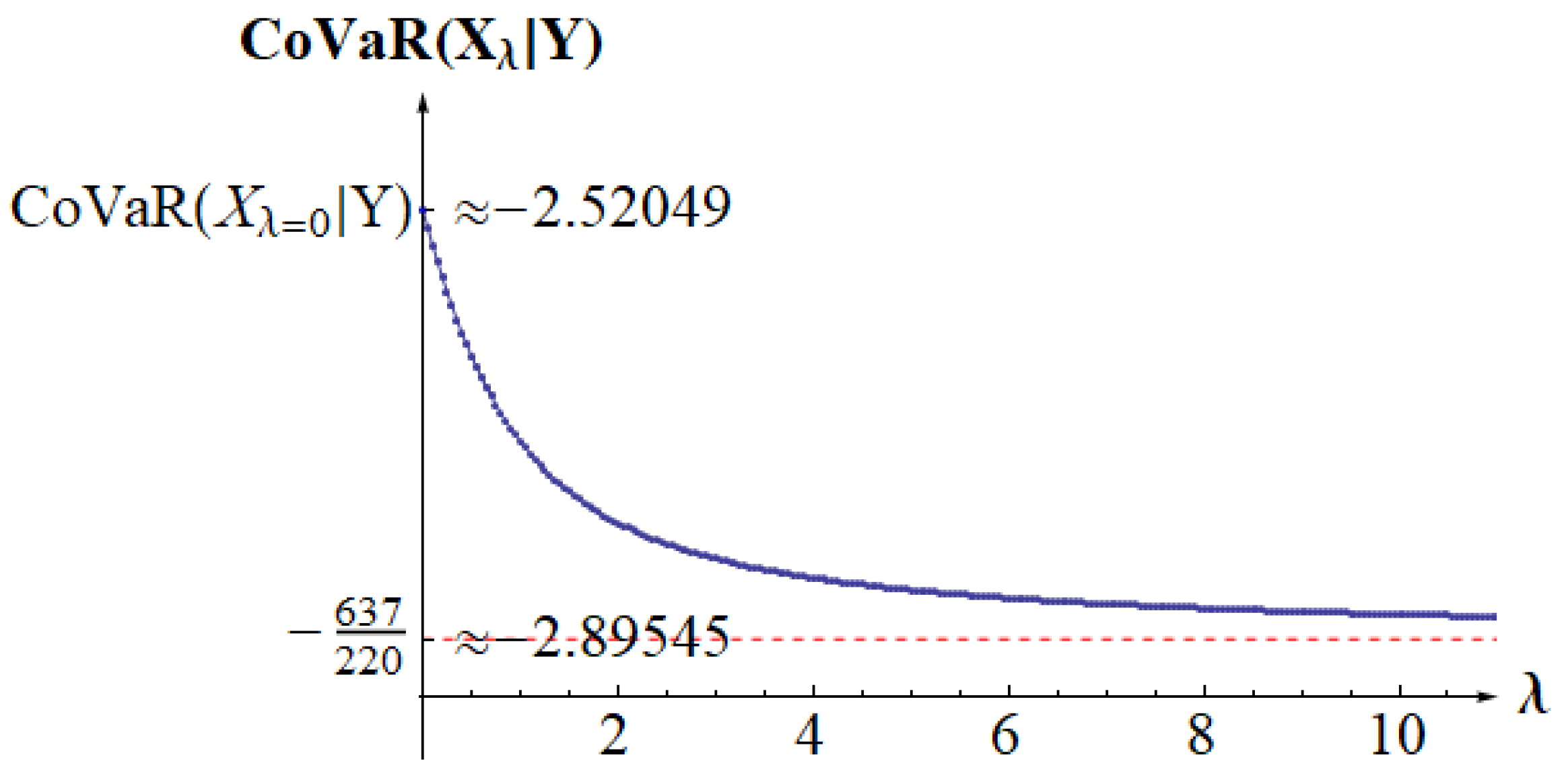

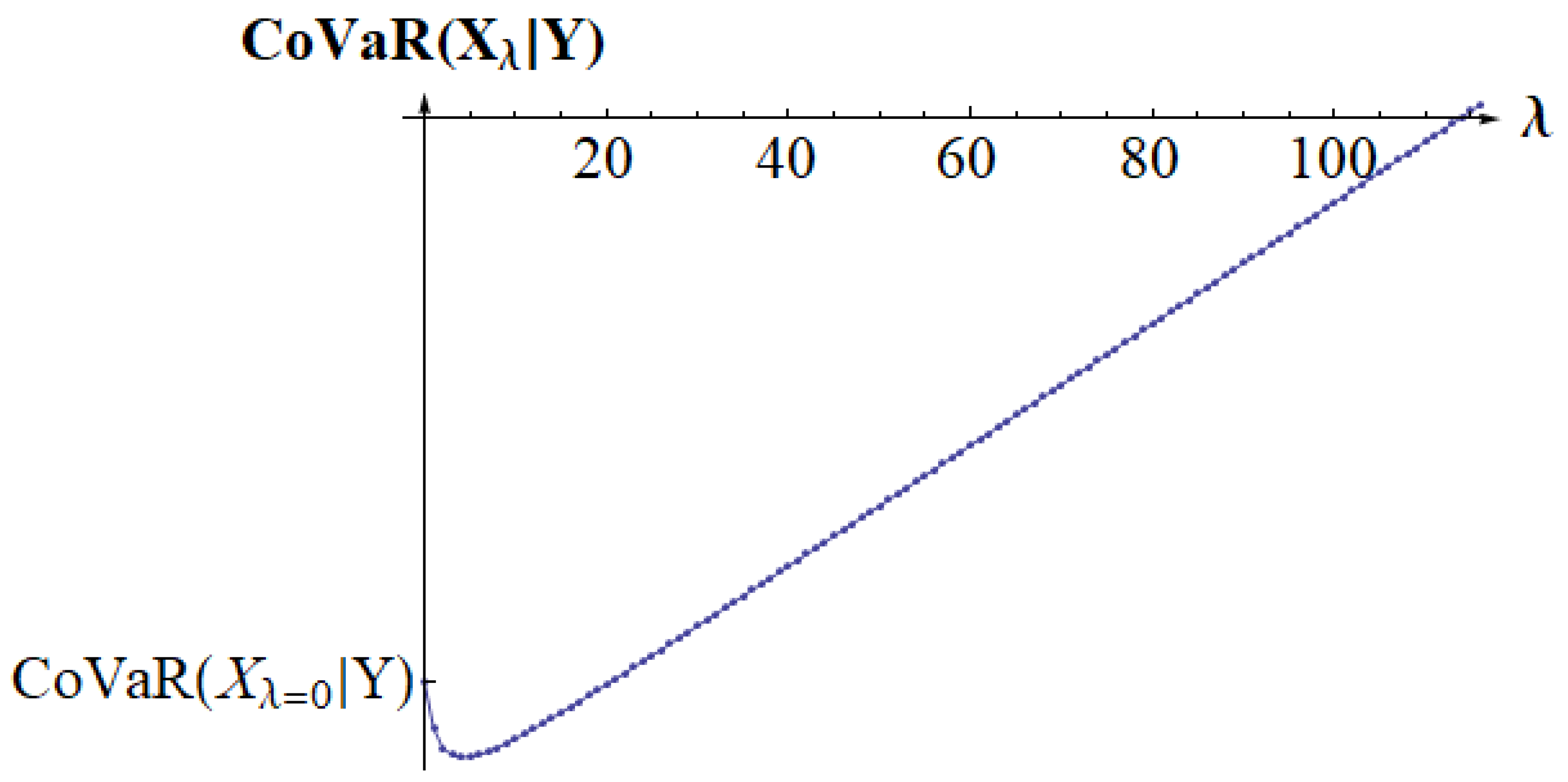

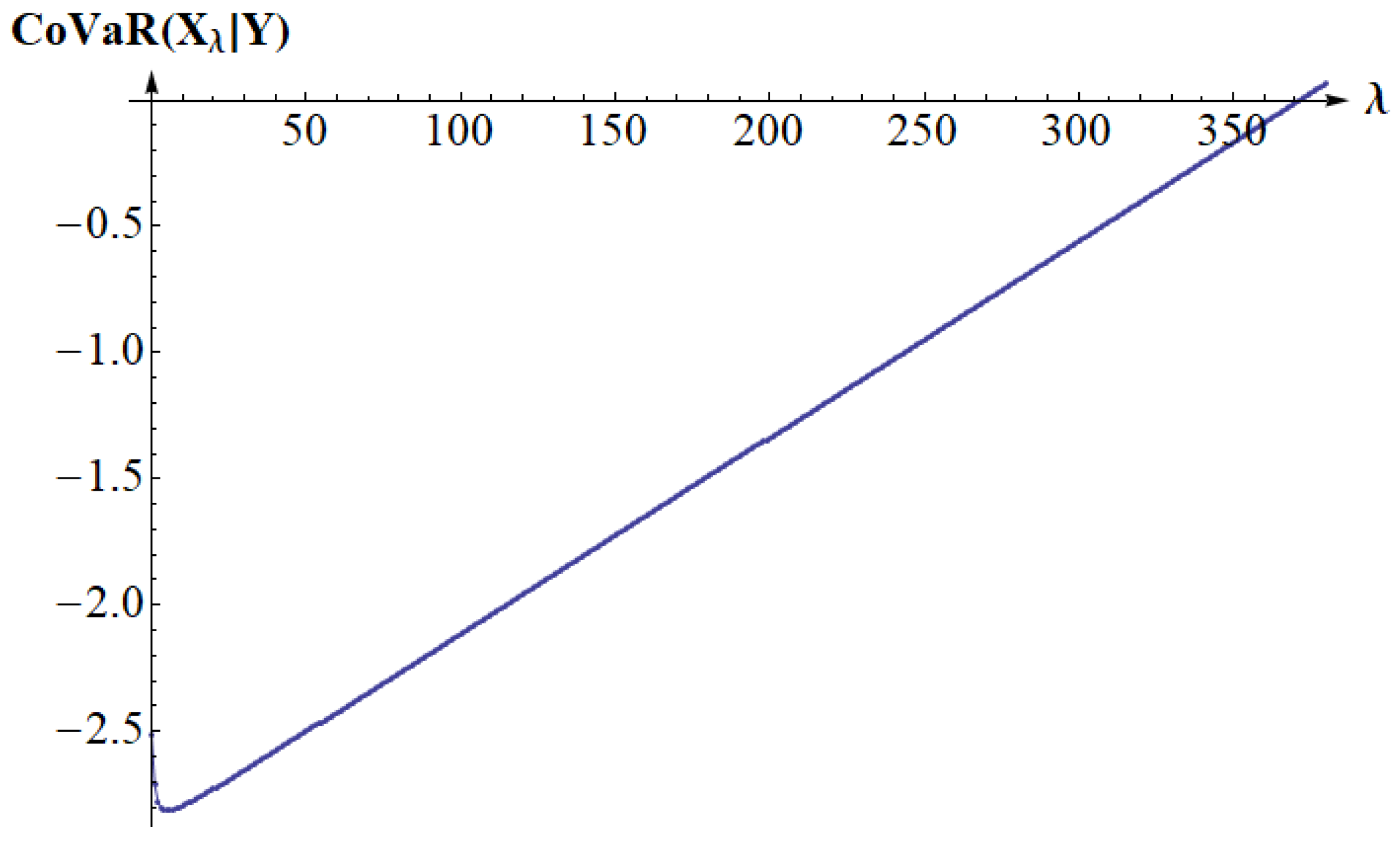

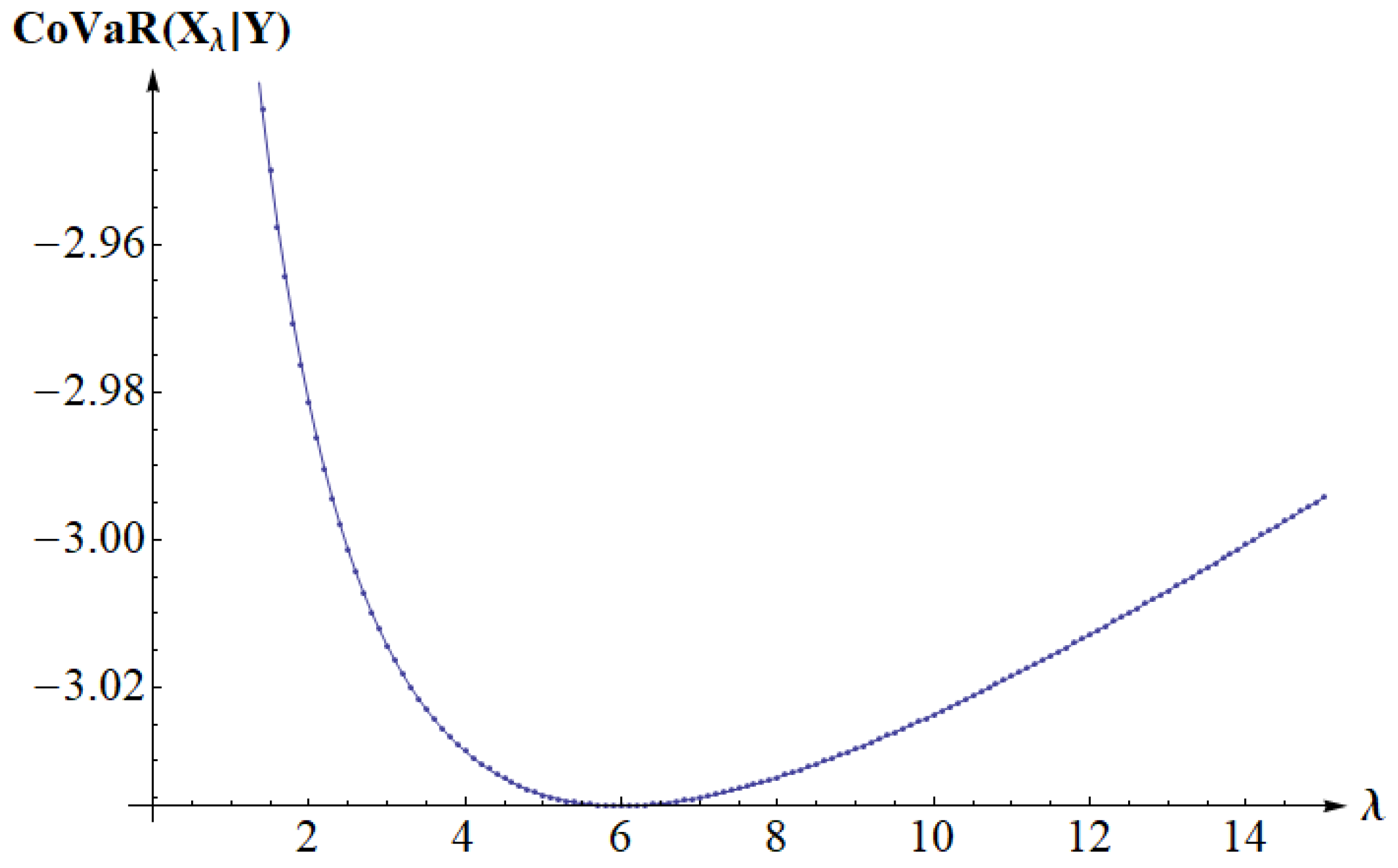

5. Examples

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Alexander, G.J.; Francis, J.C. Portfolio Analysis, 3rd ed.; Prentice-Hall: New Jersey, NJ, USA, 1986. [Google Scholar]

- Black, F. Capital market equilibrium with restricted borrowing. J. Bus. 1972, 45, 444–455. [Google Scholar] [CrossRef]

- Tobin, J. Liquidity preference as behavior towards risk. Rev. Econ. Stud. 1958, 25, 65–86. [Google Scholar] [CrossRef]

- Frost, P.A.; Savarino, J.E. An Empirical Bayes Approach to Efficient Portfolio Selection. J. Financ. Quant. Anal. 1986, 3, 293–305. [Google Scholar] [CrossRef]

- Frost, P.A.; Savarino, J.E. For better performance: Constrain portfolio weights. J. Portf. Manag. 1988, 15, 29. [Google Scholar] [CrossRef]

- Petukhina, A.; Klochkov, Y.; Härdle, W.K.; Zhivotovskiy, N. Robustifying Markowitz. J. Econom. 2024, 239, 105387. [Google Scholar] [CrossRef]

- Black, F.; Litterman, R. Global Portfolio Optimization. Financ. Anal. J. 1922, 48, 28–43. [Google Scholar] [CrossRef]

- Idzorek, T. A step-by-step guide to the Black-Litterman model: Incorporating user-specified confidence levels. In Forecasting Expected Returns in the Financial Markets; Elsevier: Amsterdam, The Netherlands, 2007; pp. 17–38. [Google Scholar]

- Palczewski, A.; Palczewski, J. Black–Litterman model for continuous distributions. Eur. J. Oper. Res. 2019, 273, 708–720. [Google Scholar] [CrossRef]

- Jagannathan, R.; Tongshu, M. Risk reduction in large portfolios: Why imposing the wrong constraints helps. J. Financ. 2003, 58, 1651–1683. [Google Scholar] [CrossRef]

- Adrian, T.; Brunnermeier, M.K. CoVaR (Working Paper 17454); National Bureau of Economic Research Working Paper Series; National Bureau of Economic Research: Cambridge, MA, USA, 2011. [Google Scholar]

- Adrian, T.; Brunnermeier, M.K. CoVaR. Am. Econ. Rev. 2016, 106, 1705–1741. [Google Scholar] [CrossRef]

- Bernardi, M.; Durante, F.; Jaworski, P. Covar of families of copulas. Stat. Probab. Lett. 2017, 120, 8–17. [Google Scholar] [CrossRef]

- Föllmer, H.; Schied, A. Stochastic Finance. An Introduction in Discrete Time, 2nd ed.; de Gruyter: Berlin, Germany, 2004. [Google Scholar]

- Jaworski, P. On the Conditional Value at Risk (CoVaR) for tail-dependent copulas. Depend. Model. 2017, 5, 1–15. [Google Scholar] [CrossRef]

- Jaworski, P. On the Conditional Value-at-Risk (CoVaR) in copula setting. In Copulas and Dependence Models with Applications; Úbeda Flores, M., de Amo Artero, E., Durante, F., Fernández-Sánchez, J., Eds.; Springer: Cham, Switzerland, 2017; pp. 95–117. [Google Scholar]

- Zalewska, A. On peculiarities of covar-based portfolio selection. Appl. Math. 2018, 45, 181–197. [Google Scholar]

- Bernardi, M.; Durante, F.; Jaworski, P.; Petrella, L.; Salvadori, G. Conditional Risk based on multivariate Hazard Scenarios. Stoch. Environ. Res. Risk Assess. 2018, 32, 203–211. [Google Scholar] [CrossRef]

- Hakwa, B.; Jäger-Ambrozewicz, M.; Rüdiger, B. Analysing systemic risk contribution using a closed formula for conditional Value at Risk through copula. Commun. Stoch. Anal. 2015, 9, 131–158. [Google Scholar] [CrossRef]

- Mainik, G.; Schaanning, E. On dependence consistency of CoVaR and some other systemic risk measures. Stat. Risk Model. 2014, 31, 49–77. [Google Scholar] [CrossRef]

- Girardi, G.; Ergün, T.A. Systemic risk measurement: Multivariate GARCH estimation of CoVar. J. Bank. Financ. 2013, 37, 3169–3180. [Google Scholar] [CrossRef]

- Nelsen, R.B. An Introduction to Copulas, 2nd ed.; Springer Series in Statistics; Springer: New York, NY, USA, 2006. [Google Scholar]

- Cherubini, U.; Luciano, E.; Vecchiato, W. Copula Methods in Finance; John Wiley & Sons Ltd.: Hoboken, NJ, USA, 2004. [Google Scholar]

- Durante, F.; Sempi, C. Principles of Copula Theory; CRC Press: Boca Raton, FL, USA, 2016. [Google Scholar]

- Embrechts, P. Copulas: A personal view. J. Risk Insur. 2009, 76, 639–650. [Google Scholar] [CrossRef]

- Joe, H. Dependence Modeling with Copulas; Chapman & Hall/CRC: London, UK, 2014. [Google Scholar]

- McNeil, A.J.; Frey, R.; Embrechts, P. Quantitative Risk Management. Concepts, Techniques and Tools; Princeton Series in Finance; Princeton University Press: Princeton, NJ, USA, 2005. [Google Scholar]

- Mai, J.; Scherer, M. Simulating Copulas: Stochastic Models, Sampling Algorithms, and Applications; Series in Quantitative Finance; Imperial College Press: London, UK, 2012. [Google Scholar]

- Meyer, C. The bivariate normal copula. Commun. Stat. Theory Methods 2013, 42, 2402–2422. [Google Scholar] [CrossRef]

- Sheppard, W.F. On the calculation of the double integral expressing normal correlation. Trans. Camb. Phil. Soc. 1900, 19, 23–68. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jaworski, P.; Zalewska, A. Portfolio Selection Based on Modified CoVaR in Gaussian Framework. Mathematics 2024, 12, 3766. https://doi.org/10.3390/math12233766

Jaworski P, Zalewska A. Portfolio Selection Based on Modified CoVaR in Gaussian Framework. Mathematics. 2024; 12(23):3766. https://doi.org/10.3390/math12233766

Chicago/Turabian StyleJaworski, Piotr, and Anna Zalewska. 2024. "Portfolio Selection Based on Modified CoVaR in Gaussian Framework" Mathematics 12, no. 23: 3766. https://doi.org/10.3390/math12233766

APA StyleJaworski, P., & Zalewska, A. (2024). Portfolio Selection Based on Modified CoVaR in Gaussian Framework. Mathematics, 12(23), 3766. https://doi.org/10.3390/math12233766