Novel Numerical Investigation of Reaction Diffusion Equation Arising in Oil Price Modeling

Abstract

1. Introduction

- Finding the exact (analytical) solution to the reduced problem for given and ;

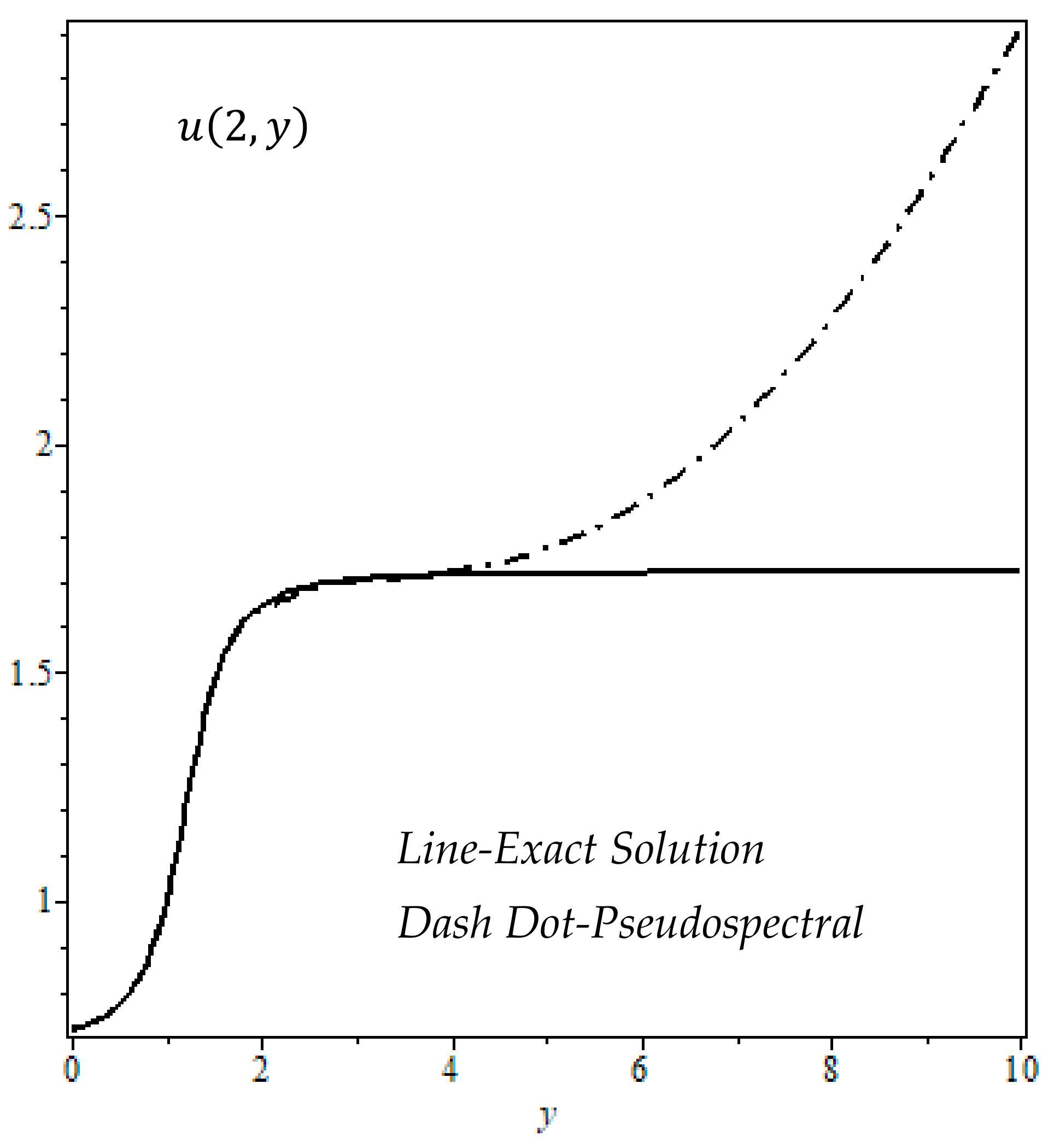

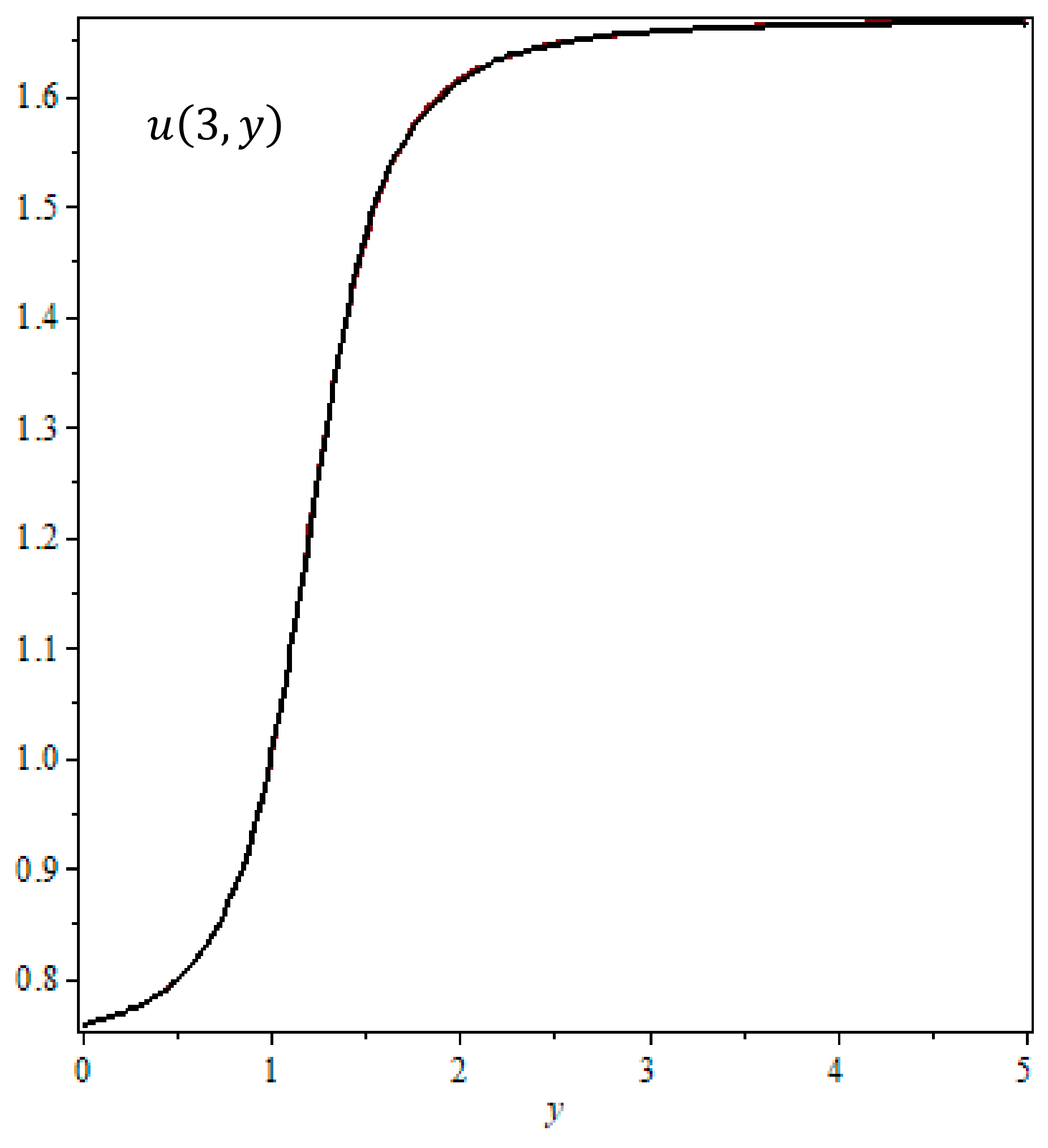

- Constructing a scheme based on both the Chebyshev pseudospectral method and the superconsistent Chebyshev collocation method in time and space directions for the solution to the reduced problem of Equation (7) and RDFBP Equation (7) on the graded interval and compare with an analytic (exact) solution;

- The theory of error estimate and convergence analysis for a fully discrete solution is derived for the Chebyshev pseudospectral method;

- We also discuss the convergence rates for the pseudospectral solutions.

2. Analytic Exact Solution to Reduced Problem of Equation (7)

- 1.

- , Equation (9) can be rewritten as follows:

- 2.

- For , Equation (7) yields the following:

- 3.

- For , using the method of characteristic provides the following:

- 4.

- For or or , in this case, for example ;

3. Time–Space Chebyshev Pseudospectral Method

4. Error Analysis

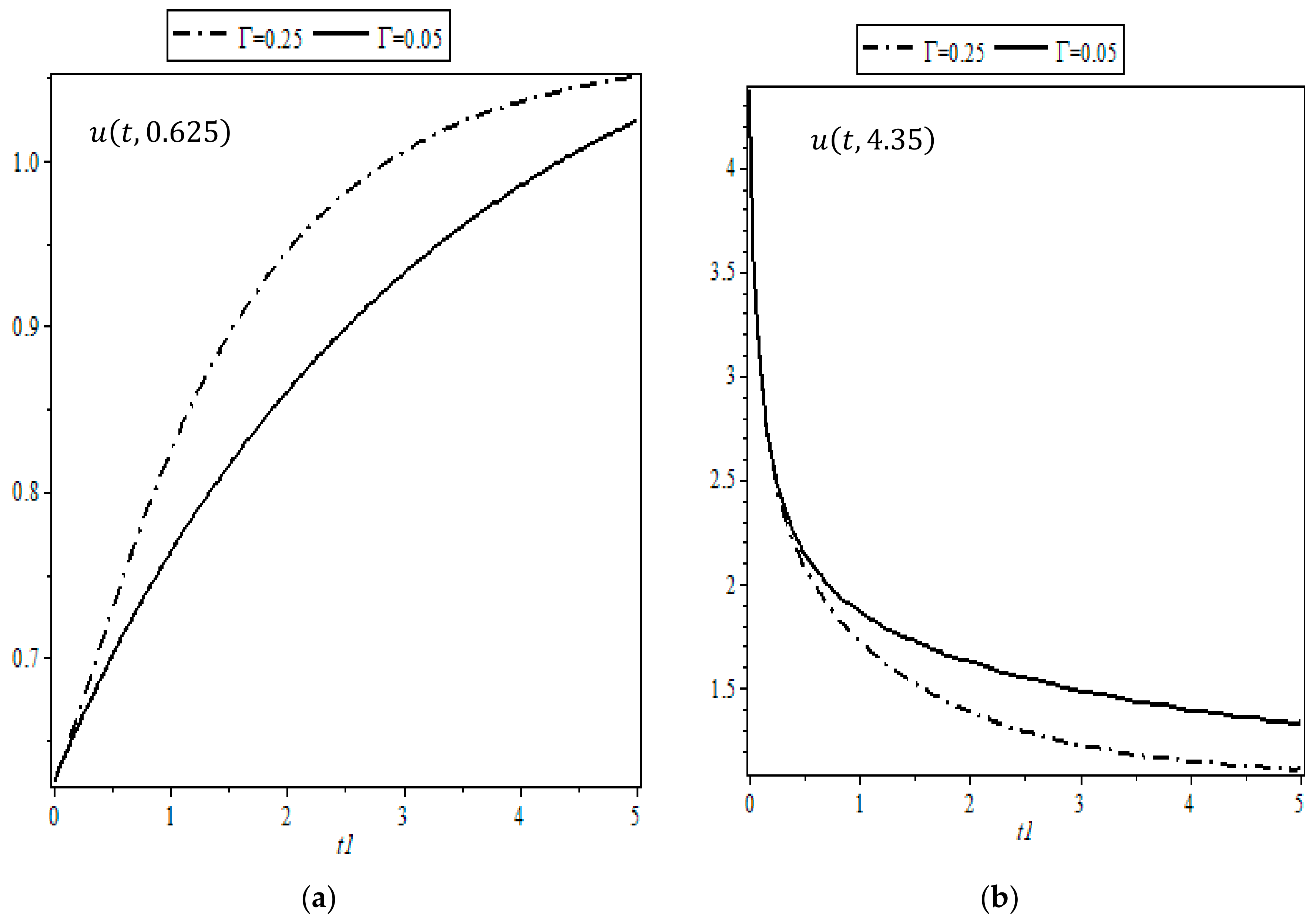

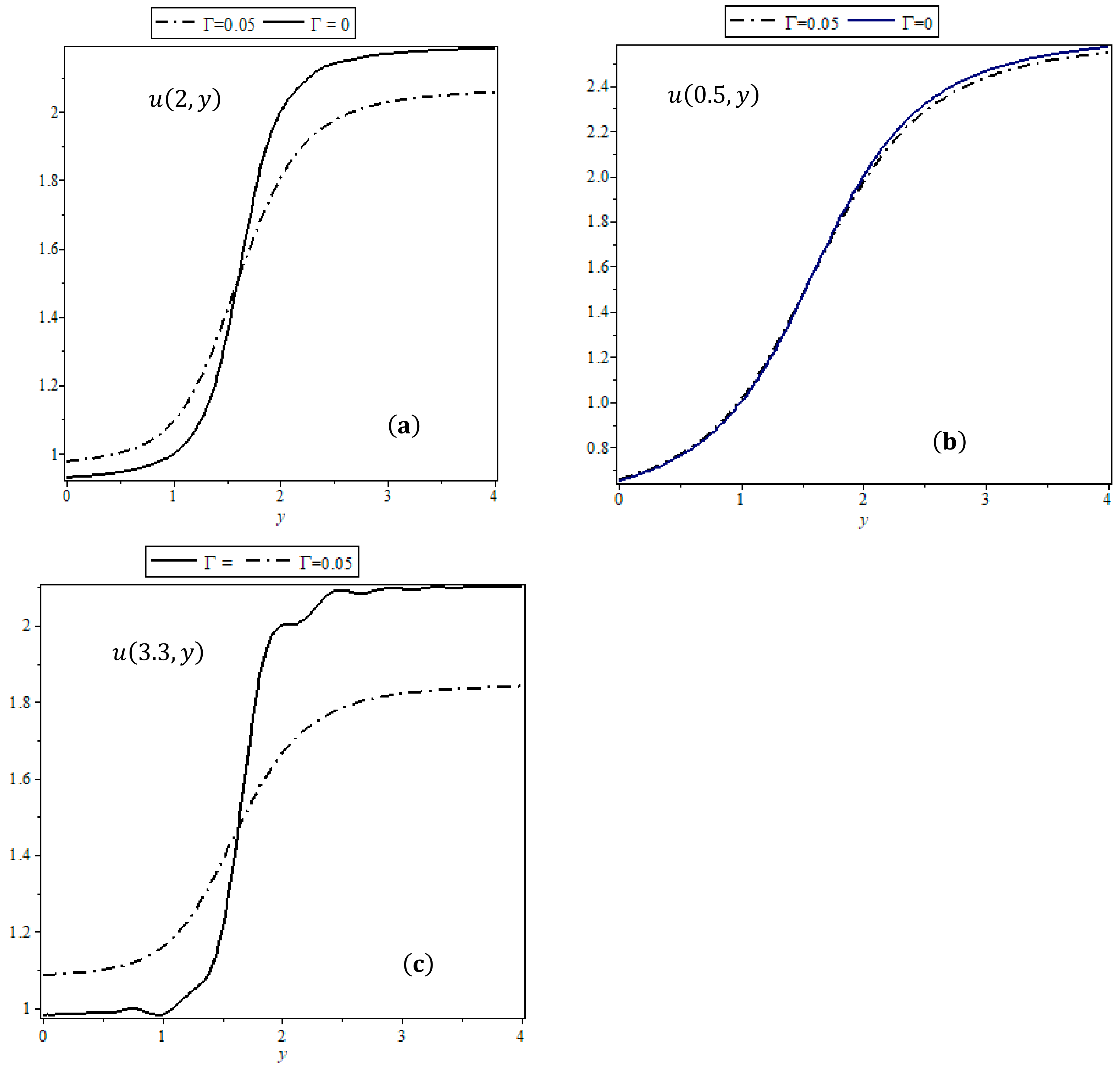

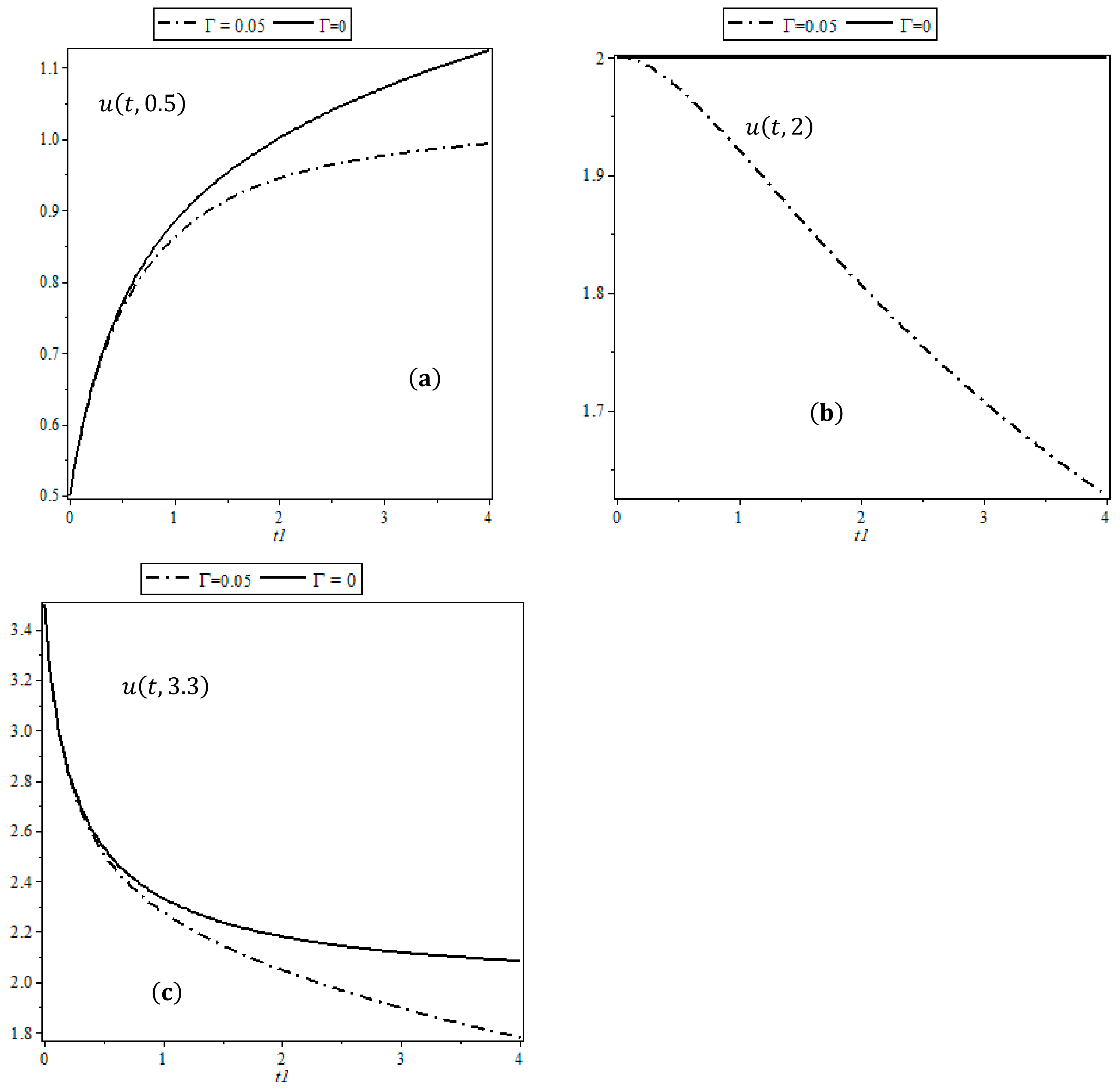

5. Numerical Results and Discussion

6. Conclusions

- For the (i.e., first-order hyperbolic equation or reduced equation) case, we obtained the exact (analytical) solution for a variety of parameters involved in modeling;

- We used the pseudospectral Chebyshev collocation method to obtain the approximate analytical solution to the reduced problem on the graded interval and spectral convergence of the method observed for the solution;

Funding

Data Availability Statement

Conflicts of Interest

References

- Wang, Q.; Li, S.; Zhang, M.; Li, R. Impact of COVID-19 pandemic on oil consumption in the United States: A new estimation approach. Energy 2022, 239, 122280. [Google Scholar] [CrossRef] [PubMed]

- Limakrisna, N.; Setiawan, E.B.; Agusinta, L.; Firdianyah, R.; Ricardianto, P.; Indupurnahayu, I.; Suryawan, R.F.; Sari, M.; Mulyono, S.; Sakti, R.F.J. Changes in demand and supply of the crude oil market during the COVID-19 pandemic and its effects on the natural gas market. Int. J. Energy Econ. Policy. 2021, 11, 1–6. [Google Scholar] [CrossRef]

- Goard, J.; AbaOud, M.A. Bimodal Model for Oil Prices. Mathematics 2023, 11, 2222. [Google Scholar] [CrossRef]

- Ross, S.M. Introduction to Probability Models; Academic Press: Cambridge, MA, USA, 2014. [Google Scholar]

- Brennan, M.; Schwartz, E. Evaluating Natural Resource Investments. J. Bus. 1985, 58, 135–157. [Google Scholar] [CrossRef]

- Gabillon, J. The Term Structures of Oil Futures Prices; Oxford Institute for Energy Studies: Oxford, UK, 1991. [Google Scholar]

- Bjerksund, P.; Ekern, S. Contingent claims evaluation of mean-reverting cash flows in shipping. In Real Options in Capital Investment: Models, Strategies, and Applications; Greenwood Publishing Group: Westport, CT, USA, 1995; pp. 207–219. [Google Scholar]

- Schwartz, E. The stochastic behaviour of commodity prices: Implications for valuation and hedging. J. Financ. 1997, 3, 923–973. [Google Scholar] [CrossRef]

- AbaOud, M.; Goard, J. Stochastic Models for Oil Prices and the Pricing of Futures on Oil. Appl. Math. Financ. 2015, 22, 189–206. [Google Scholar] [CrossRef]

- Gibson, R.; Schwartz, E. Stochastic Conveience Yield And The Pricing of Oil Continget Claims. J. Financ. 1999, 3, 959–976. [Google Scholar]

- Pilipovic, D. Energy Risk: Valuing and Managing Energy Derivatives; McGraw Hill: New York, NY, USA, 1997. [Google Scholar]

- Schwartz, E.; Smith, J. Short-Term Variation And Long-Trem Dyanamics in Commodity Prices. Manag. Sci. 2000, 46, 893–911. [Google Scholar] [CrossRef]

- Cortazar, G.; Schwartz, E. Implementing a Stochastic Model For Oil Futures Prices. Energy Econ. 2003, 25, 215–238. [Google Scholar] [CrossRef]

- Wilmott, P. Derivatives: The Theory and Practice of Financial Engineering; John Wiley & Sons: Chichester, UK, 1998. [Google Scholar]

- Funaro, D. A new scheme for the approximation of advection-diffusion equations by collocation. SIAM J. Numer. Anal. 1993, 30, 1664–1676. [Google Scholar] [CrossRef]

- Funaro, D. Some remarks about the collocation method on a modified Legendre grid. Comput. Math. Appl. 1997, 33, 95–103. [Google Scholar] [CrossRef]

- Funaro, D. A superconsistent Chebyshev collocation method for second-order differential operators. Numer. Algorithms 2001, 28, 151–157. [Google Scholar] [CrossRef]

- Pinelli, A.; Couzy, W.; Deville, M.O.; Benocci, C. An efficient iterative solution method for the Chebyshev collocation of advection-dominated transport problems. SIAM J. Sci. Comput. 1996, 17, 647–657. [Google Scholar] [CrossRef][Green Version]

- De l’Isle, F.; Owens, R.G. A superconsistent collocation method for high Reynolds number flows. Comput. Fluids 2023, 259, 105897. [Google Scholar] [CrossRef]

- Mittal, A.K. A space-time pseudospectral method for solving multi-dimensional quasi-linear parabolic partial differential (Burgers’) equations. Appl. Numer. Math. 2024, 195, 39–53. [Google Scholar] [CrossRef]

- Canuto, C.; Hussaini, M.Y.; Quarteroni, A.; Zang, T.A. Spectral Methods: Fundamentals in Single Domains; Springer Science & Business Media: Berlin, Germany, 2007. [Google Scholar]

- Canuto, C.; Hussaini, M.Y.; Quarteroni, A.; Zang, T.A. Spectral Methods: Evolution to Complex Geometries and Applications to Fluid Dynamics; Springer Science & Business Media: Berlin, Germany, 2007. [Google Scholar]

- Fornberg, B. A Practical Guide to Pseudospectral Methods; Cambridge University Press: Cambridge, UK, 1998. [Google Scholar]

- Mittal, A.K. Two-dimensional Jacobi pseudospectral quadrature solutions of two-dimensional fractional Volterra integral equations. Calcolo 2023, 60, 50. [Google Scholar] [CrossRef]

- Balyan, L.K.; Mittal, A.K.; Kumar, M.; Choube, M. Stability analysis and highly accurate numerical approximation of Fisher’s equations using pseudospectral method. Math. Comput. Simul. 2020, 177, 86–104. [Google Scholar] [CrossRef]

- Mittal, A.K.; Balyan, L.K. A highly accurate time–space pseudospectral approximation and stability analysis of two dimensional brusselator model for chemical systems. Int. J. Appl. Comput. Math. 2019, 5, 140. [Google Scholar] [CrossRef]

- Boyd, J.P. Chebyshev and Fourier Spectral Methods; Courier Corporation: Chelmsford, MA, USA, 2001. [Google Scholar]

- Friedman, A. Partial Differential Equations of Parabolic Type; Courier Dover Publications: Mineola, NY, USA, 2008. [Google Scholar]

- Baker, M.D.; Süli, E.; Ware, A.F. Stability and convergence of the spectral Lagrange-Galerkin method for mixed periodic/non-periodic convection-dominated diffusion problems. IMA J. Numer. Anal. 1999, 19, 637–663. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Alshammari, F.S. Novel Numerical Investigation of Reaction Diffusion Equation Arising in Oil Price Modeling. Mathematics 2024, 12, 1142. https://doi.org/10.3390/math12081142

Alshammari FS. Novel Numerical Investigation of Reaction Diffusion Equation Arising in Oil Price Modeling. Mathematics. 2024; 12(8):1142. https://doi.org/10.3390/math12081142

Chicago/Turabian StyleAlshammari, Fehaid Salem. 2024. "Novel Numerical Investigation of Reaction Diffusion Equation Arising in Oil Price Modeling" Mathematics 12, no. 8: 1142. https://doi.org/10.3390/math12081142

APA StyleAlshammari, F. S. (2024). Novel Numerical Investigation of Reaction Diffusion Equation Arising in Oil Price Modeling. Mathematics, 12(8), 1142. https://doi.org/10.3390/math12081142