Optimizing Electricity Markets Through Game-Theoretical Methods: Strategic and Policy Implications for Power Purchasing and Generation Enterprises

Abstract

:Featured Application

Abstract

1. Introduction

- Comprehensive Review of Electricity Market Structures

- Examination of Electricity as a Unique Commodity

- Analysis of Market Participants and Their Roles

- Application of Game Theory to Electricity Market Dynamics

- Investigation of Transaction Modes

- Examination of Market Reform Policies

- Integration of Renewable Energy Considerations:

- Analysis of Information Asymmetry and Market Power

- Exploration of Risk Management Strategies

- Future Outlook and Recommendations

- (1)

- Integrated Theoretical Framework: Our unique synthesis of EGT, Stackelberg games, Bayesian games, and DRL presents an unprecedented comprehensive framework that not only enhances the understanding of strategic interactions in electricity markets but also provides practical optimization strategies. This integration facilitates the development of adaptive and resilient market participants capable of navigating the complexities of modern energy systems, thereby offering original contributions to both the theoretical and applied aspects of energy economics. Through the integration of EGT, Stackelberg games, Bayesian games, and DRL, our paper presents a comprehensive and multifaceted framework for understanding and optimizing strategic interactions in electricity markets. This holistic approach allows for the modeling of dynamic strategic behaviors, adaptation to market fluctuations, and the optimization of decision-making processes, thereby enhancing the overall efficiency and resilience of electricity markets. By leveraging the synergistic strengths of these methodologies, our framework provides deeper insights into both individual and collective market behaviors, facilitating more informed policy-making and strategic planning. This multifaceted approach allows for the modeling of dynamic strategic behaviors, adaptation to market fluctuations, and the optimization of decision-making processes, thereby enhancing the overall efficiency and resilience of electricity markets.

- (2)

- Dynamic Market Evolution Analysis: Unlike many static analyses, this review introduces a dynamic perspective on market evolution. It traces the transformation of electricity markets from monopolistic structures to competitive environments, offering insights into the transitional stages and their impact on strategic behaviors.

- (3)

- Multi-dimensional Participant Modeling: This study introduces a novel approach to modeling market participants by considering not only their economic motivations but also their adaptability to regulatory changes and technological advancements. This multi-dimensional modeling provides a more accurate representation of real-world decision-making processes.

- (4)

- Contextual Analysis of Market Reforms: This paper innovatively contextualizes game-theoretic analyses within the framework of ongoing market reforms, particularly in China. This approach bridges the gap between theoretical models and practical policy implementation, offering insights into the real-world implications of market design choices.

- (5)

- Integration of Renewable Energy Considerations: This study breaks new ground by incorporating the challenges and opportunities presented by increasing renewable energy penetration into traditional game-theoretic models of electricity markets. This integration provides a forward-looking perspective on market evolution in the context of an energy transition.

- (1)

- Adaptive Market Design: This paper’s analysis suggests the need for more adaptive and flexible market designs that can accommodate rapid technological changes and shifting policy priorities. Future research could focus on developing dynamic market mechanisms that can self-adjust to changing conditions without compromising efficiency or stability.

- (2)

- Information Asymmetry and Market Efficiency: This study’s examination of information asymmetry in electricity markets highlights the critical role of information flow in market efficiency. This insight opens up avenues for research into innovative information-sharing mechanisms and their impact on market outcomes, potentially leveraging blockchain or other distributed ledger technologies.

- (3)

- Behavioral Economics in Electricity Markets: This paper’s consideration of bounded rationality in decision-making processes suggests a fertile area for future research at the intersection of behavioral economics and electricity market design. Studies could explore how cognitive biases and heuristics influence market participant behavior and overall market efficiency.

- (4)

- Resilience in Complex Market Systems: This review’s holistic approach to market analysis underscores the importance of system resilience in the face of external shocks (e.g., extreme weather events, geopolitical crises). This insight encourages future research into the development of robust market structures that can maintain stability and efficiency under various stress scenarios.

- (5)

- Interdisciplinary Approach to Market Modeling: This paper’s integration of game theory with machine learning techniques suggests the potential for further interdisciplinary research. Future studies could explore the application of other fields such as network theory, complexity science, or even quantum computing to enhance our understanding and modeling of electricity market dynamics.

- (6)

- Policy and Regulation in Evolving Markets: This study’s analysis of market evolution in the context of policy reforms highlights the need for adaptive regulatory frameworks. This insight encourages research into innovative regulatory approaches that can keep pace with rapid technological and market changes while ensuring fair competition and consumer protection.

- (7)

- Long-term vs. Short-term Market Mechanisms: This paper’s examination of various transaction modes (long-term contracts vs. spot markets) raises important questions about the optimal balance between market stability and flexibility. Future research could explore hybrid market mechanisms that effectively combine long-term planning with short-term adaptability.

- (8)

- Renewable Integration and Market Design: This study’s consideration of renewable energy integration challenges opens up a critical area for future research. Studies could focus on developing market structures and pricing mechanisms that effectively accommodate the variability and uncertainty associated with high penetrations of renewable energy.

- (9)

- Cross-border and Regional Market Integration: While this paper focuses primarily on national markets, its insights suggest the potential for research into cross-border and regional market integration. Future studies could explore game-theoretic models of international power markets, considering factors such as differing regulatory regimes and transmission constraints.

- (10)

- Equity and Social Welfare in Market Design: This paper’s comprehensive approach to market analysis raises important questions about the distributional impacts of different market structures. This insight encourages future research into market designs that not only maximize efficiency but also ensure equitable outcomes and enhance overall social welfare.

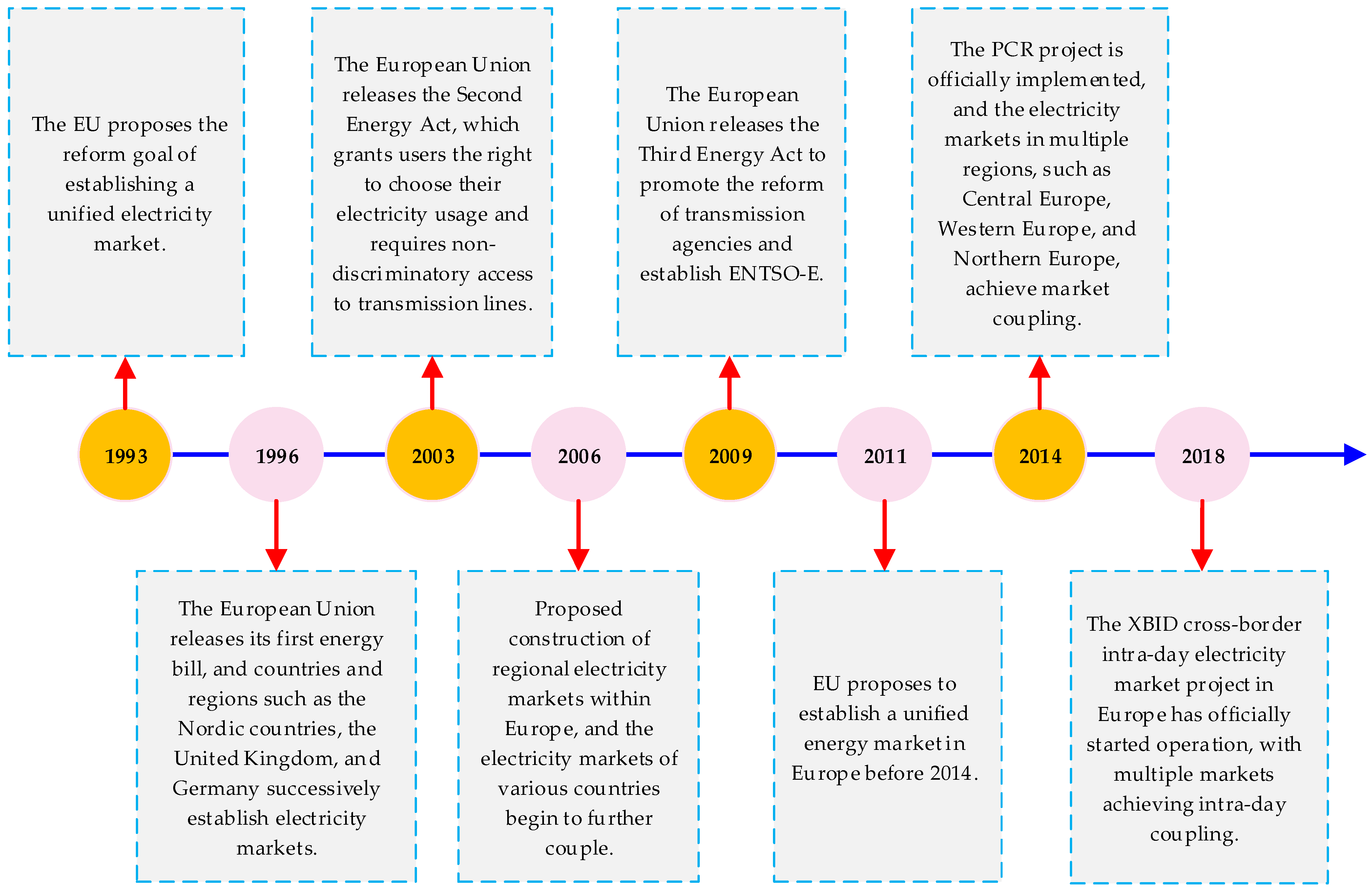

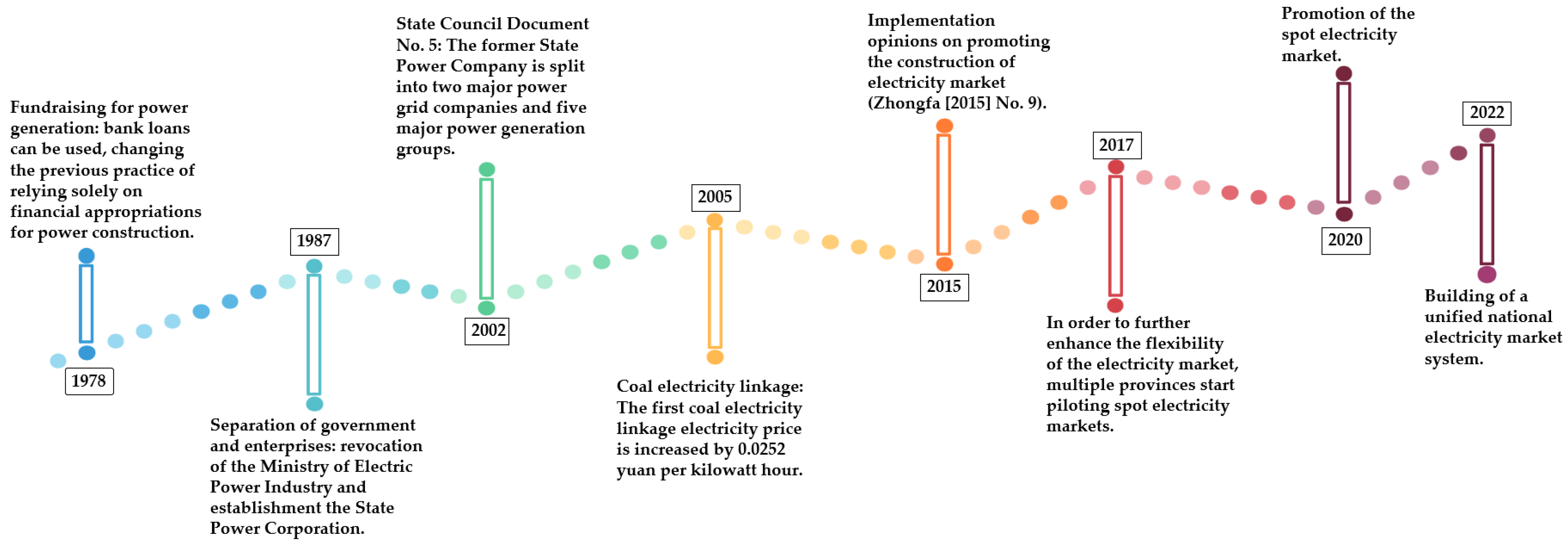

2. Evolution and Comparative Analysis of Global Electricity Market Structures and Game-Theoretical Methodology

2.1. Monopoly Form

- P: the price of electricity per unit (set by the state through regulation).

- Q: the quantity of electricity produced and sold.

- C(Q): the total cost function of the monopoly, which is a function of the quantity produced, reflecting production, transmission, and distribution costs.

- R(Q) = PQ: the total revenue of the monopoly, where P is constant due to price regulation.

- Π(Q): the profit of the monopoly.

2.2. Competitive Form of Power Generation

2.3. Wholesale Competition Form

- Pg represents the generation power output by the generator g;

- Ui(Pi) is the utility function of consumer i, which represents the benefit obtained from consuming power Pi;

- Cj(Pj) is the cost function of generator j, representing the cost incurred for producing power Pj;

- N is the number of consumers in the market;

- M is the number of power generators participating in the market.

- λ is the marginal cost of generation;

- μl is the shadow price associated with transmission constraint on line l;

- fln represents the sensitivity of power flow on transmission line l with respect to the injection at node n.

2.4. Forms of Retail Competition

- Ui(Pi) is the utility function of user i, representing the benefit derived from consuming power Pi;

- Cj(Pj) is the cost function of generator j, representing the cost associated with producing power Pj;

- Pi is the quantity of electricity demanded by user i;

- Pj is the quantity of electricity supplied by generator j;

- N represents the number of consumers, and M the number of competing generators.

- λ0 is the base price reflecting the marginal cost of producing electricity;

- μl represents the shadow price associated with the transmission and distribution constraints on line l;

- fln represents the sensitivity of power flow on line l with respect to the injection or withdrawal of power at node n;

- L denotes the total number of transmission and distribution constraints in the system.

2.4.1. The Universality of Electricity and Bulk Commodities

- (1)

- Tradeability. Electricity can be bought, traded, and transmitted. This suggests that electricity can be bought and sold on the market, and that suppliers and consumers can participate in the market transaction to meet their respective needs.

- (2)

- Impact of supply and demand. The electricity market follows the basic law of the supply and demand relationship. Prices are often influenced by the relative relationship between supply and demand. Prices may fall when supply exceeds demand, and prices may rise when demand exceeds supply.

- (3)

- Price fluctuations. The electricity market is affected by supply and demand, seasonality, weather, and other factors, and prices will also fluctuate. Price fluctuations bring uncertainty to the market and have a significant impact on the decision-making of the market entities [23].

2.4.2. The Particularity of Electric Power Commodities

- (1)

- Do not store electric power goods. Electricity production, delivery, and consumption occur almost simultaneously, much faster than the average commodity. There is no cost-effective way to store large amounts of electricity, so there is no traditional “pay-out” transaction.

- (2)

- Homogeneity of electricity bulk commodities. Electricity does not carry any identification of the producer. Power producers (usually power plants) provide power to the grid, and users of the electricity can only get the required amount of power from the grid. Electricity producers and consumers can trade, but the current in the power system follows the laws of physics and is difficult to control artificially. In essence, there is no complete correspondence between the power generation and consumption processes and the transaction results.

- (3)

- Predictability of electricity bulk commodities. When there is electricity demand in the long term, power demand will fluctuate daily or weekly. This predictability partly suppresses the speculation of market participants but also increases the possibility that market participants will abuse their market power.

- (4)

- The dual attributes of electric power commodities. Electric power is not only a means of production and a means of life; it is related to the national economy but also related to people’s lives. Therefore, the electricity market is not only a means of the production market, but also a means of the living market, or a typical public market without storage [25].

2.5. Game-Theoretical Methodology

- Evolutionary Game Theory (EGT) Framework

- 2.

- DRL Integration

- 3.

- Hybrid Framework Development

- (i)

- Strategy Initialization: Define initial strategies for market participants based on historical data and theoretical considerations. This involves categorizing strategies into distinct types, such as aggressive pricing, cooperative resource sharing, and conservative investment.

- (ii)

- Simulation of Market Interactions: Utilize EGT to model the strategic interactions among enterprises, capturing the competitive and cooperative dynamics inherent in electricity markets. Concurrently, employ DRL to optimize individual strategies by training agents to maximize their utility through trial-and-error learning.

- (iii)

- Replicator Dynamics Implementation: Apply replicator dynamic equations to update the frequency of each strategy within the population based on their relative payoffs. This step ensures that more successful strategies become more prevalent over time, reflecting the natural selection process.

- (iv)

- Policy Evaluation: Assess the effectiveness and cost-efficiency of various control policies under different market scenarios using the hybrid EGT-DRL framework. This involves simulating the impact of policies such as pricing mechanisms, capacity incentives, and renewable integration incentives on market performance and participant behavior.

- 4.

- Data Sources and Validation

- 5.

- Software and Tools

- 6.

- Ethical Considerations

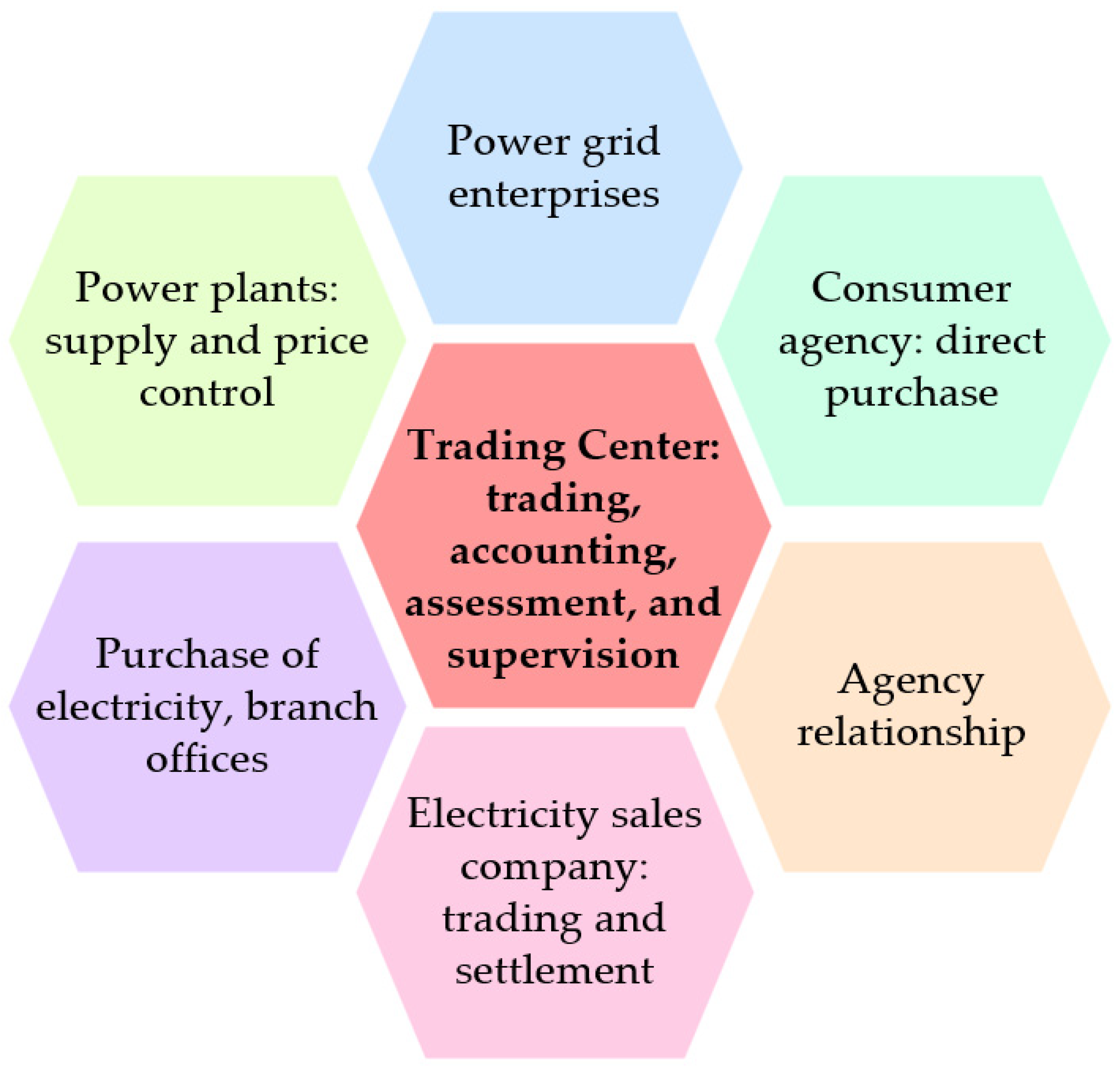

3. Market Segmentation and Stakeholder Dynamics in Modern Electricity Markets

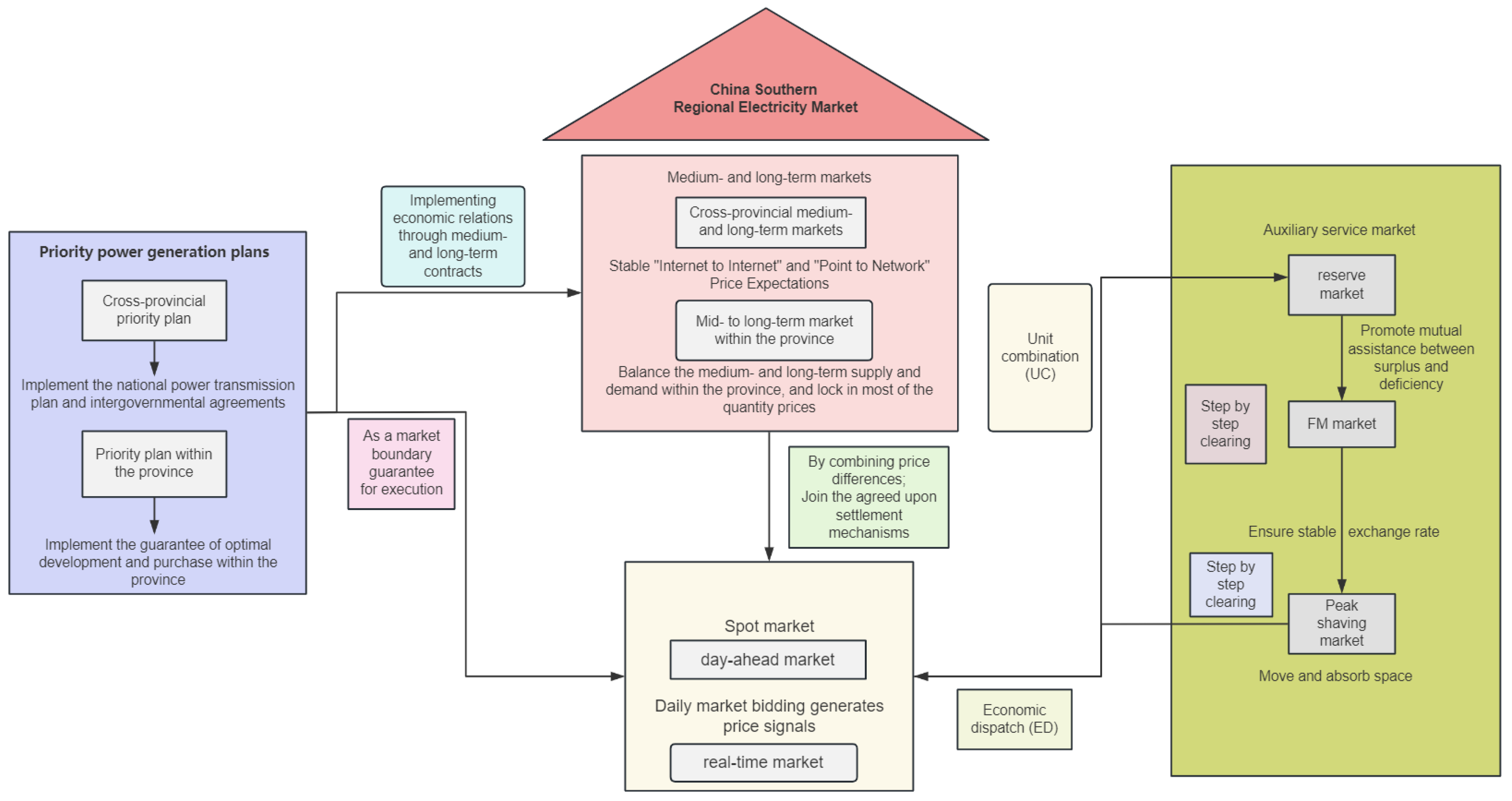

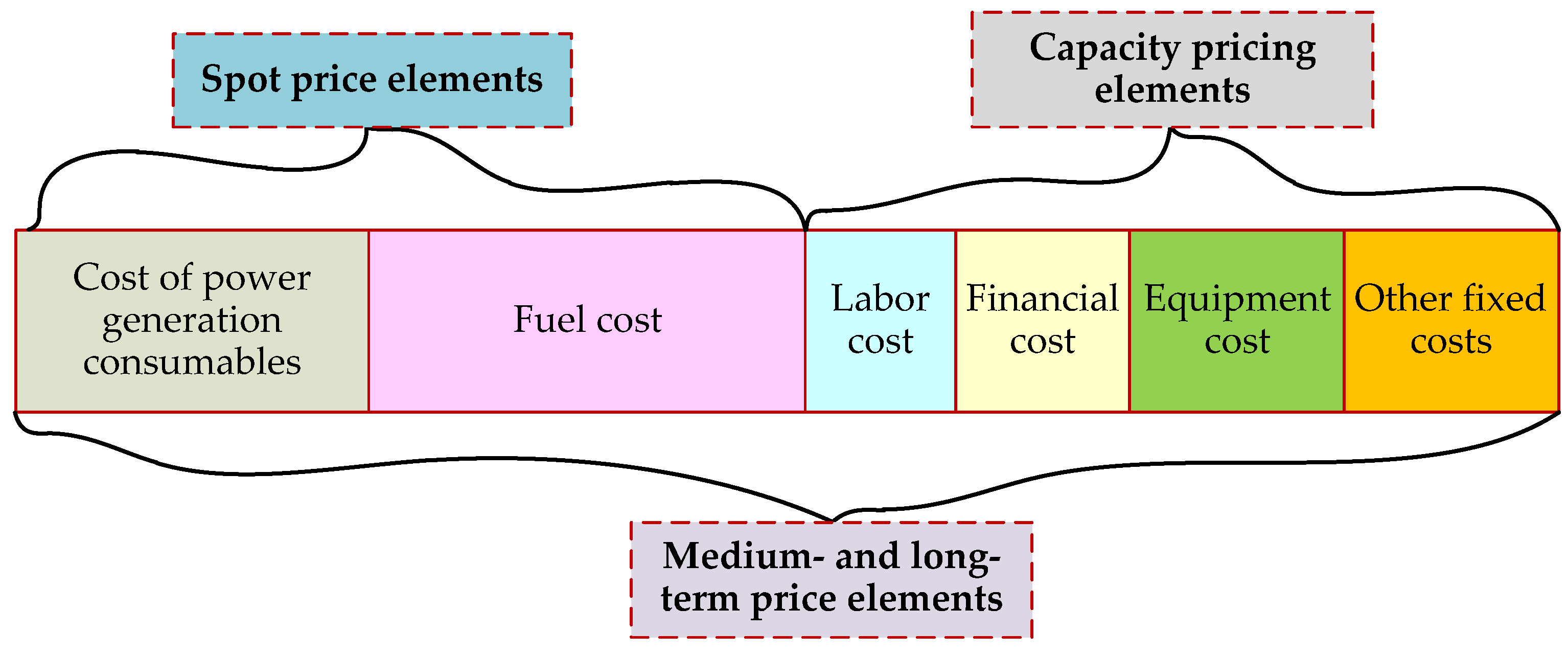

3.1. Medium-Term and Long-Term Power Energy Market

3.2. Spot Electricity Market

3.2.1. Advance Electricity Trading

3.2.2. Real-Time Electricity Trading

- Cg(Pg) is the cost function of generator g, representing the cost incurred to produce Pg units of electricity;

- Pg is the power output of generator g;

- G is the number of generators participating in the real-time market;

- Dt represents the electricity demand at time t;

- and represent the minimum and maximum generation limits of generator g.

- Pg(t) is the power output of generator g at time t;

- Rg represents the maximum ramping capability of generator g, i.e., the rate at which the generator can change its output from one period to the next.

- C0 is the base marginal cost of generation;

- μl is the shadow price associated with the transmission constraint on line l;

- fln represents the sensitivity of the power flow on line l with respect to power injection at location n;

- L is the number of transmission constraints in the system.

3.3. Effectiveness and Cost-Efficiency of Control Policies

- Pricing Mechanisms

- 2.

- Capacity Incentives

- 3.

- Renewable Integration Incentives

- 4.

- Regulatory Measures

4. Application of EGT in Electricity Market Analysis

4.1. Comparative Advantages of EGT

- (i)

- Adaptability to Dynamic Environments: EGT inherently models how strategies evolve over time, allowing for the representation of continuous adaptation and learning among market participants. This is particularly important in electricity markets, which are subject to rapid changes in demand, supply, regulatory policies, and technological advancements.

- (ii)

- Population-Level Insights: EGT focuses on the strategic interactions within populations of players, providing insights into collective behavior patterns and emergent market dynamics that individual-focused models may overlook. This is crucial in electricity markets, where the actions of one enterprise can significantly influence the strategies of others, leading to systemic effects.

- (iii)

- Flexibility in Modeling Complex Interactions: EGT can easily incorporate various factors influencing strategic decisions, including environmental policies, technological innovations, renewable energy integration, and competitive pressures. This flexibility makes it a robust tool for comprehensive market analysis, capable of addressing multifaceted and interdependent variables.

- (iv)

- Empirical and Theoretical Support: Numerous studies have demonstrated the efficacy of EGT in capturing the strategic evolution of market behaviors, particularly in contexts involving long-term interactions and adaptive decision-making [34,43]. These empirical validations, combined with strong theoretical foundations, reinforce the suitability of EGT for our analysis.

- (v)

- Enhanced Predictive Capabilities: EGT provides a dynamic framework that can predict not only equilibrium states but also transitional dynamics, offering a more nuanced understanding of how markets evolve over time. This is particularly advantageous for forecasting the impacts of policy changes and market interventions.

4.2. Comparative Analysis with Other Game-Theoretic Models

- (i)

- Stackelberg Games: Stackelberg models are designed to analyze leader–follower dynamics, where leaders commit to strategies that followers respond to optimally. While effective in hierarchical decision-making scenarios, they are limited in capturing the continuous and adaptive nature of strategy evolution in electricity markets. EGT, on the other hand, accommodates the iterative adaptation of strategies without predefined leadership roles, offering a more flexible and realistic representation of market interactions.

- (ii)

- Bayesian Games: Bayesian games address strategic interactions under incomplete information, allowing players to form beliefs about others’ types or strategies based on available information. However, they primarily focus on static information asymmetry and do not inherently account for the dynamic evolution of strategies over time. EGT surpasses Bayesian models by providing a dynamic framework that continuously evolves strategies based on historical performance and changing market conditions, thereby offering deeper insights into long-term market behavior.

- (iii)

- Simulation Methods: Simulation-based approaches, including agent-based models, offer flexibility in modeling complex systems by simulating interactions among heterogeneous agents. While useful for scenario analysis, they often lack the strategic depth and theoretical rigor of game-theoretic models like EGT. EGT not only models strategic interactions with evolutionary dynamics but also integrates empirical data and theoretical principles to provide a more comprehensive and predictive analysis of market behaviors.

4.3. Practical Implications of Using EGT

- (i)

- Policy Formulation and Evaluation: EGT enables policymakers to simulate and evaluate the long-term impacts of regulatory interventions and policy changes on market behaviors. By modeling how market participants adapt their strategies over time, EGT provides insights into the potential effectiveness and unintended consequences of policies aimed at promoting renewable energy adoption, enhancing market competition, or ensuring grid stability.

- (ii)

- Strategic Planning for Market Participants: Electricity market participants, including power purchasing and generation enterprises, can leverage EGT to develop strategic plans that anticipate and adapt to the evolving strategies of competitors. EGT facilitates the identification of stable and resilient strategies that can withstand market fluctuations and competitive pressures, thereby enhancing the sustainability and profitability of enterprises.

- (iii)

- Market Design and Optimization: EGT contributes to the optimization of market structures by highlighting the conditions under which cooperative behaviors emerge and persist. This understanding aids in designing market mechanisms and incentives that foster collaboration, reduce market inefficiencies, and enhance overall market performance.

- (iv)

- Integration with Advanced Technologies: The integration of EGT with machine learning techniques, such as DRL, as discussed in Section 7.1, further amplifies its practical utility. This combination enables the development of adaptive and intelligent market models that can respond to real-time data and dynamically evolving market conditions, thereby enhancing the robustness and responsiveness of electricity markets.

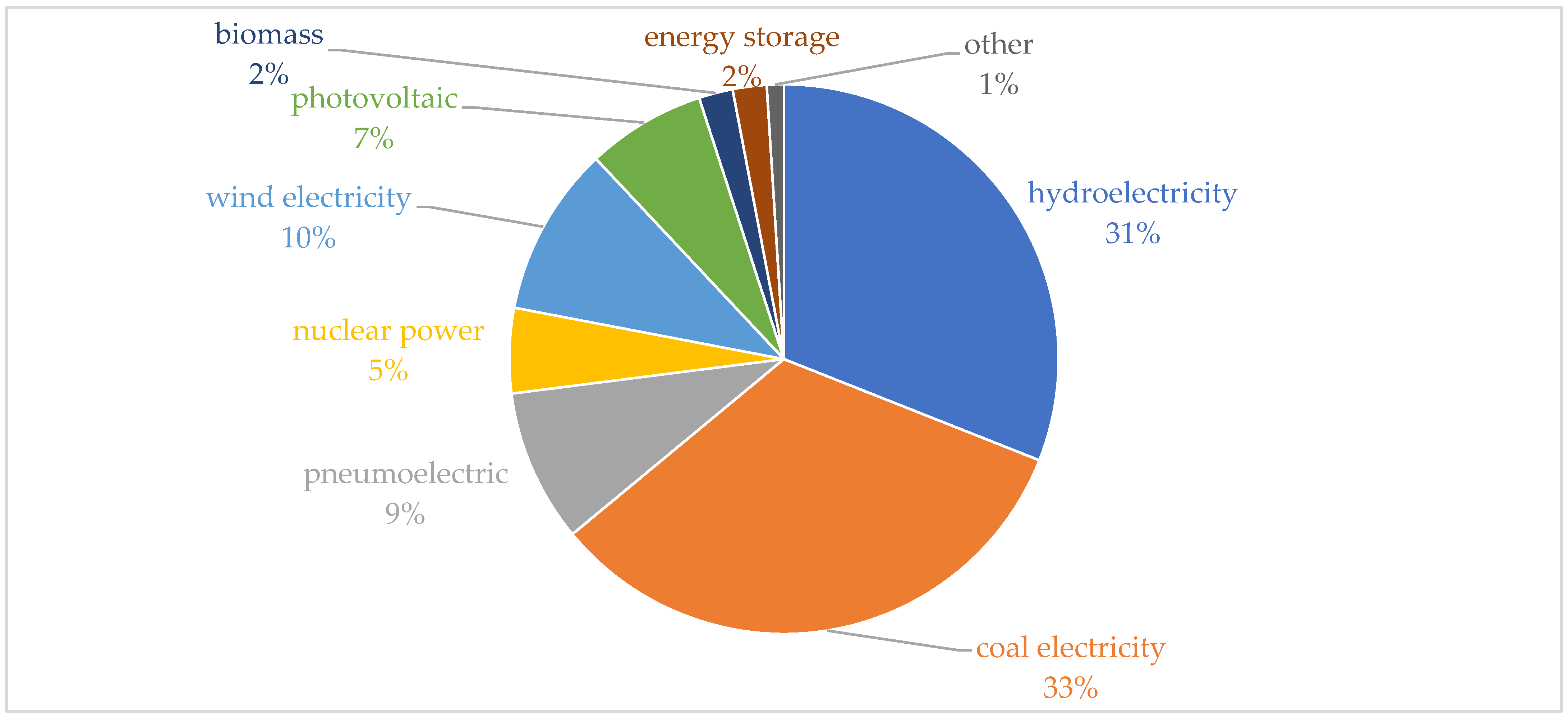

4.4. Power Generation Side

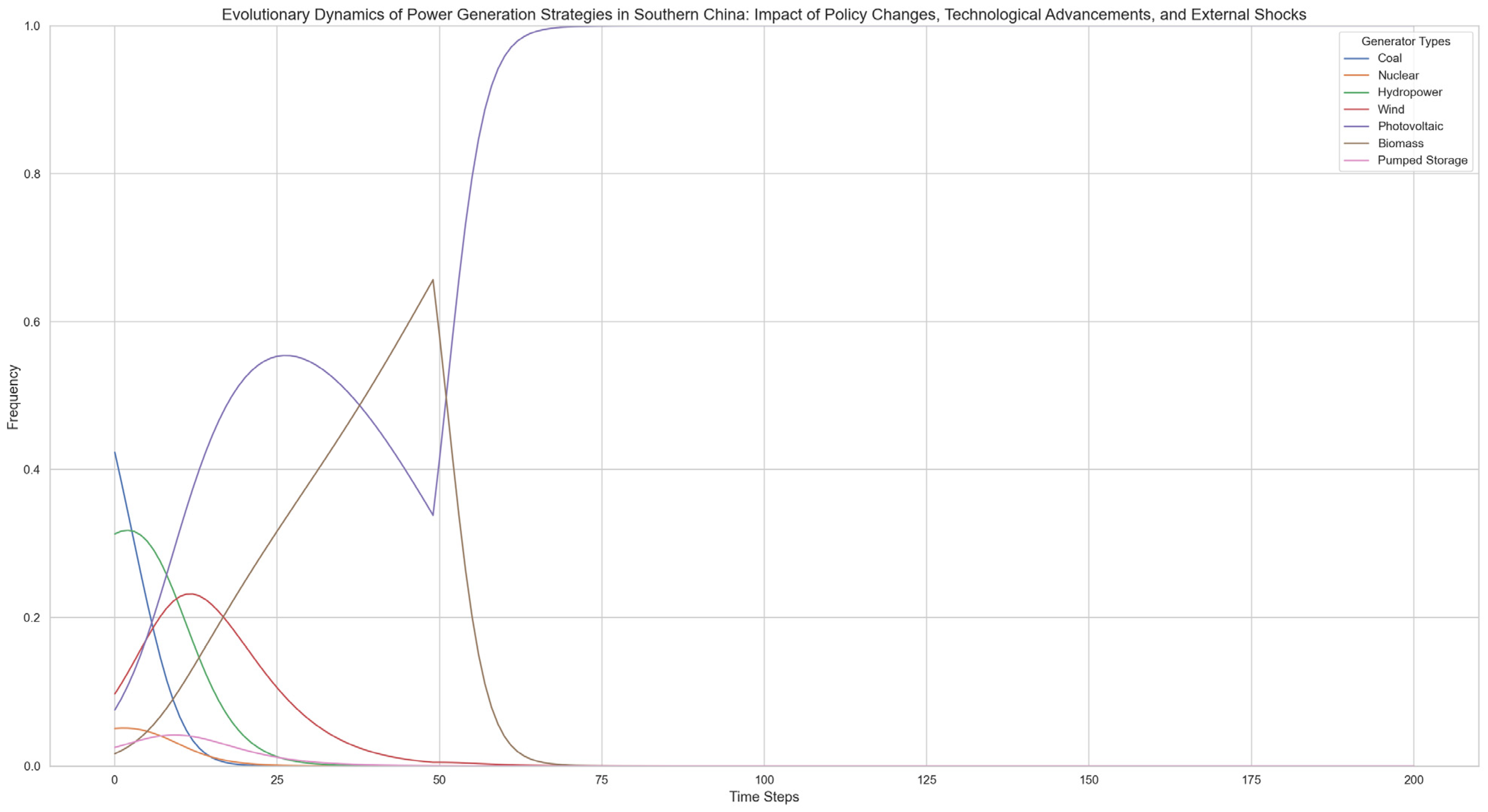

- Initial Dominance of Traditional Power Generators

- 2.

- Impact of Policy Changes

- Time Step 50: the introduction of renewable energy subsidies significantly enhances the payoffs for wind and photovoltaic (PV) power, leading to a rapid increase in their market shares.

- Time Step 150: the implementation of a carbon tax reduces the payoffs for coal and nuclear power, resulting in a marked decline in their market frequencies.

- 3.

- Sustained Impact of Technological Advancements

- 4.

- Temporary Effects of External Shocks

- 5.

- Long-Term Trends and Market Transition

- The sustained increase in the frequencies of wind and PV power over time indicates a clear market transition toward clean energy.

- The gradual decline in the frequencies of coal and nuclear power reflects the relative disadvantages of traditional energy sources in a competitive, policy-driven market.

- The stability of hydropower and pumped storage demonstrates their critical roles in maintaining grid resilience and balancing supply–demand fluctuations.

- The persistently low frequency of biomass energy suggests its limited competitiveness in the current market environment.

4.5. Electricity Sales Company Side

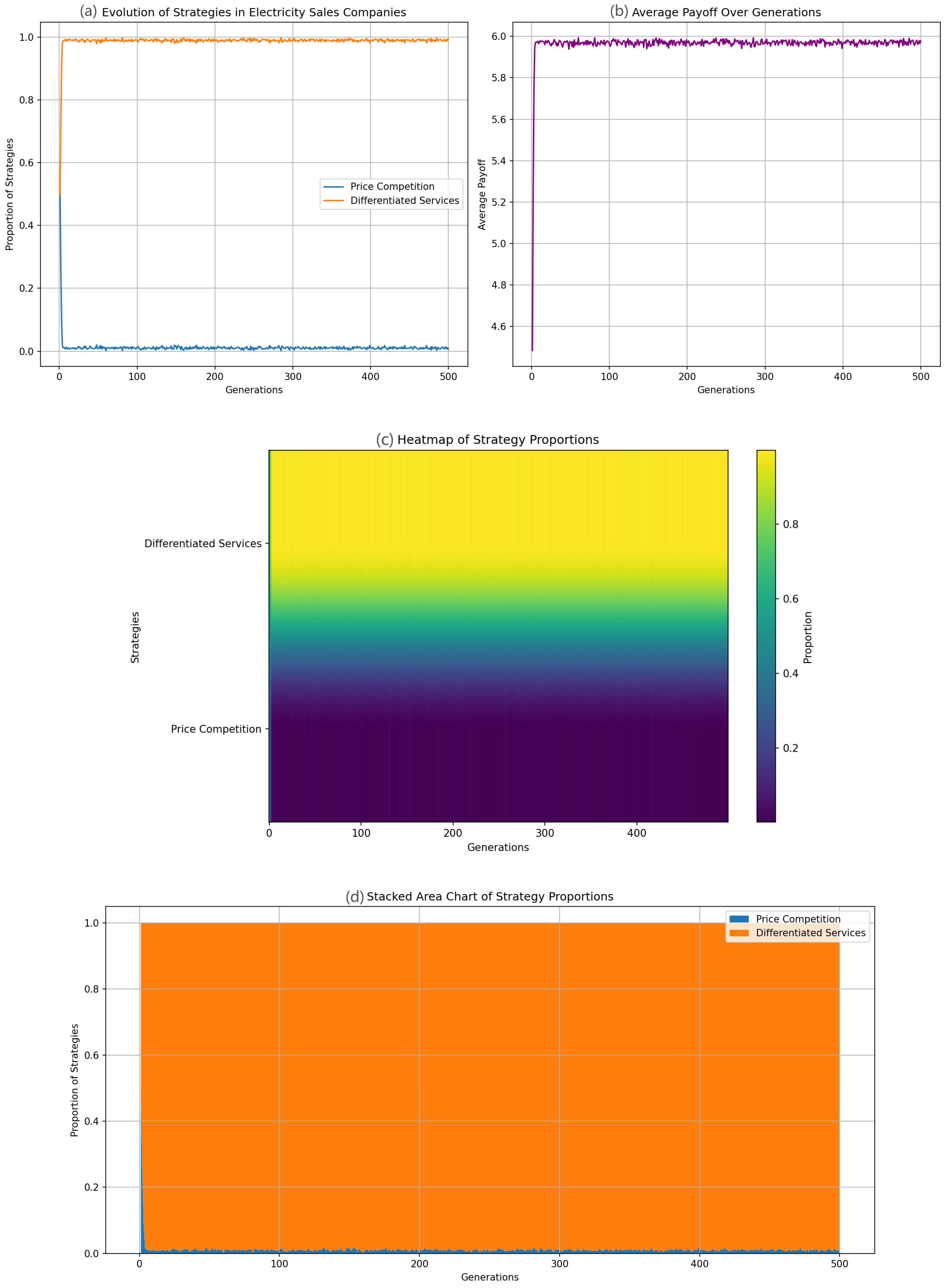

- Figure 8a: Evolution of Strategies in Electricity Sales Companies

- 2.

- Figure 8b: Average Payoff Over Generations

- 3.

- Figure 8c: Heatmap of Strategy Proportions

- 4.

- Figure 8d: Stacked Area Chart of Strategy Proportions

4.6. Power Grid Side

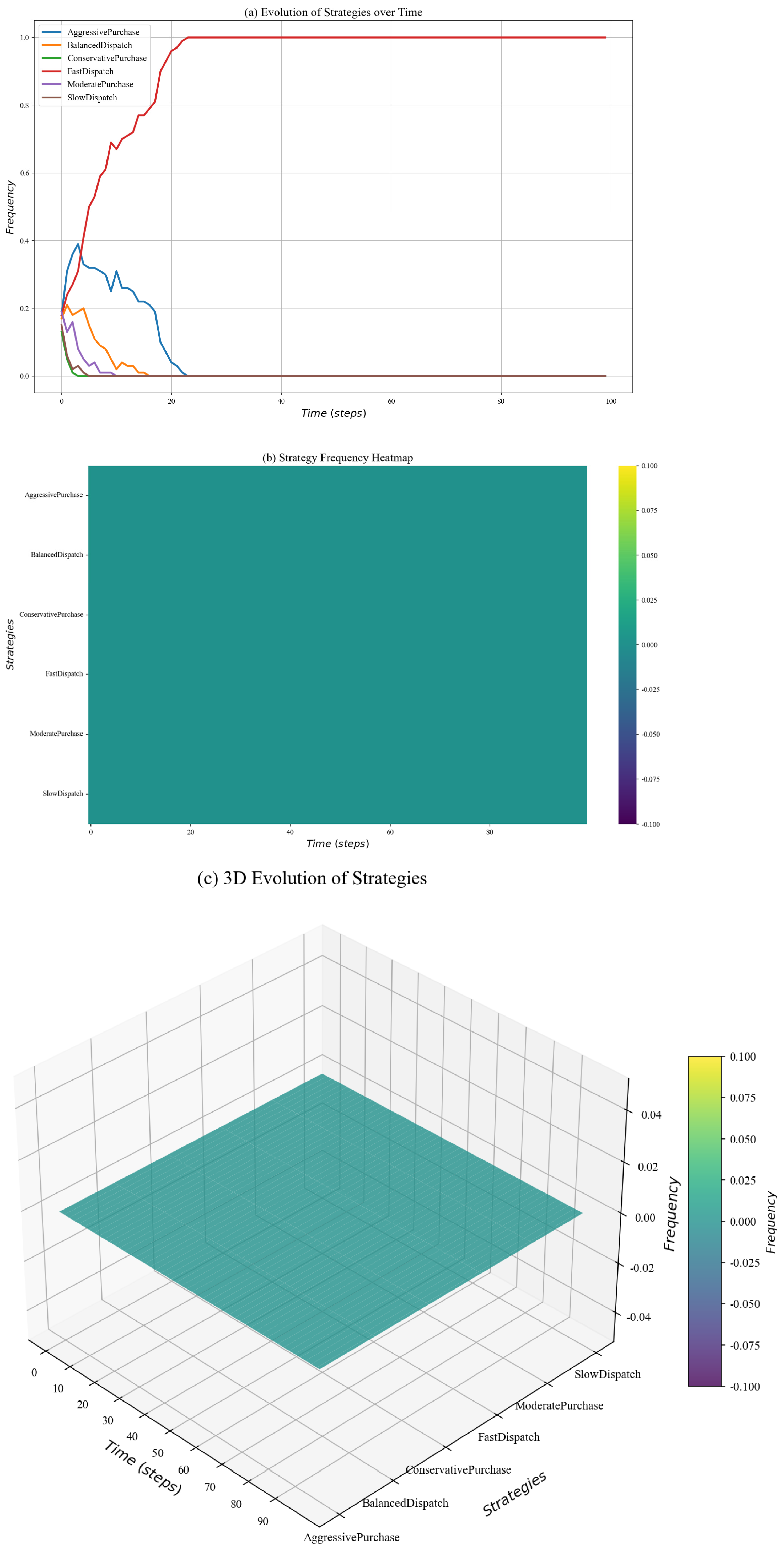

- Figure 9a: Temporal Evolution of Purchasing Strategies among Power Trading Centers

- 2.

- Figure 9b: Strategy Frequency Heatmap of Dispatching Strategies among Power Dispatching Centers

- 3.

- Figure 9c: 3D Evolution of Strategy Frequencies Over Time

5. Modeling Strategic Interactions in Electricity Markets: The Stackelberg Game Approach

5.1. Foundation of Game Theory

5.2. EGT Method

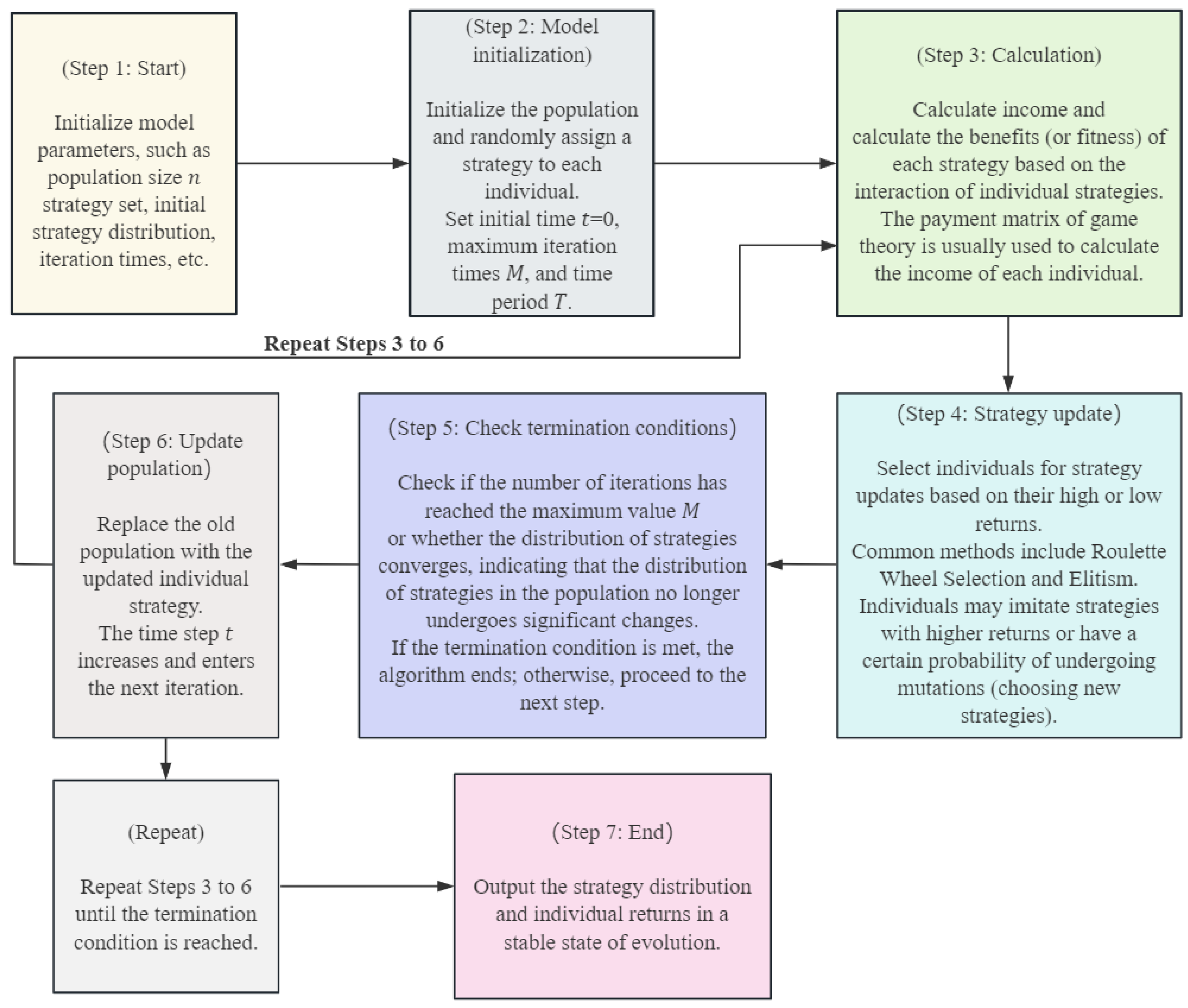

- 1.

- Strategy Initialization:

- Population Setup: The flow chart begins with the establishment of a population of market participants, each adopting an initial strategy. These strategies may vary based on factors such as technological capabilities, regulatory compliance, and market objectives.

- Initial Strategy Distribution: the distribution of strategies within the population is depicted, highlighting the diversity or homogeneity of approaches at the outset.

- 2.

- Interaction and Payoff Calculation:

- Strategic Interactions: participants engage in strategic interactions, where the success of each strategy is evaluated based on its performance against others.

- Payoff Matrix: The outcomes of these interactions are quantified through a payoff matrix, which assigns fitness values to strategies based on their relative success. Higher payoffs indicate more successful strategies that are likely to proliferate.

- 3.

- Replicator Dynamics:

- Frequency Adjustment: The replicator dynamic equations govern the adjustment of strategy frequencies within the population. Strategies that yield higher payoffs relative to the population average increase in prevalence, while less successful strategies diminish.

- Mutation and Inheritance: the flow chart incorporates stochastic elements such as mutations—random strategy alterations—and inheritance mechanisms that transmit successful strategies to subsequent generations.

- 4.

- Adaptation and Evolution:

- Adaptive Learning: Participants continuously adapt their strategies in response to environmental changes, competitor behaviors, and regulatory shifts. This adaptive learning is visualized as iterative loops within the flow chart.

- Emergent Behaviors: over successive iterations, emergent behaviors and patterns arise, reflecting the collective adaptation of the population to the evolving market landscape.

- 5.

- Equilibrium Attainment:

- Evolutionarily Stable Strategy (ESS): The flow chart culminates in the identification of an ESS, a strategy that, once prevalent, resists invasion by alternative strategies. This signifies the stabilization of market dynamics.

- System Resilience: The attainment of ESS contributes to the overall resilience and efficiency of the electricity market, ensuring sustained equilibrium amidst ongoing strategic adaptations.

- (i)

- Holistic Integration of Multi-Layered Adaptations: The flow chart adeptly integrates multi-layered strategic adaptations, illustrating how individual learning processes coexist with population-level evolutionary dynamics. This dual-layered approach captures the complexity of electricity markets, where micro-level decisions aggregate to macro-level market behaviors.

- (ii)

- Dynamic Resilience through Iterative Processes: By emphasizing iterative loops, the flow chart underscores the inherent resilience of electricity markets. Continuous adaptation and strategy evolution enable the market to withstand and recover from disruptions, such as sudden regulatory changes or technological innovations, thereby maintaining stability over time.

- (iii)

- Visual Representation of Complex Interdependencies: The flow chart effectively visualizes the intricate interdependencies between strategies, payoffs, and evolutionary forces. This graphical representation facilitates a deeper understanding of how specific strategies can dominate or recede based on their performance and adaptability within the competitive landscape.

- (iv)

- Implications for Policy and Market Design: The depiction of EGT dynamics in the flow chart provides valuable insights for policymakers and market designers. By recognizing the pathways through which certain strategies become dominant, stakeholders can devise regulatory frameworks that promote desired behaviors, mitigate market power abuses, and enhance overall market efficiency.

- (v)

- Enhancing Predictive Capabilities: The incorporation of replicator dynamics and stochastic elements within the flow chart enhances the predictive capabilities of the EGT model. This enables the forecasting of potential market evolutions and the identification of critical leverage points where interventions can most effectively steer market outcomes towards equilibrium.

5.3. Stakelberg Game Theory Method

5.3.1. Price Bidding for the Electricity Market

5.3.2. The Game Between the Dominant Players and the Competitors in the Power Generation Market

5.3.3. Game in Demand Response Management

5.3.4. Cooperation and Competition Between Power Generation Companies and Grid Operators

5.3.5. The Game Between Renewable Energy Power Generators and Traditional Power Generators

5.3.6. Cybersecurity in Smart Grids

- Integration of Technological Advancements and Market Dynamics

- 2.

- Enhancing Market Resilience and Stability

- 3.

- Strategic Interactions Between Attackers and Defenders

- 4.

- Influence on Market Structure and Resource Allocation

- 5.

- Policy Implications and Regulatory Frameworks

- 6.

- Facilitating Advanced Research and Technological Innovation

6. Decision-Making Under Uncertainty: Bayesian Game Theory in Electricity Markets

6.1. The Bayesian Game Theory

6.2. Market Bidding Mechanism

6.3. Power Generation and Demand Forecasting

6.4. Market Design and Regulation

7. Enhancing Market Behavior Modeling: Integration of DRL with Game Theory and Analysis of Information Asymmetry and Market Power

7.1. Integration of EGT and DRL

7.2. Integration of DRL with Game Theory for Enhancing Market Behavior Modeling

7.3. Analysis of Information Asymmetry and Market Power

8. The Transaction Mode Between Power Purchasing Enterprises and Power Generation Enterprises

- The buyer and the seller shall quote in quantity;

- The transaction can be made when the declared price is not lower than the declared price by the seller;

- The first transaction price of the session is the average of the transaction pair;

- The subsequent transaction price will refer to the transaction price of the previous transaction.

9. Conclusions, Prospects, Policy Implications and Future Directions

9.1. Conclusions

9.2. Prospects for Future Research and Development in Electricity Markets

- (1)

- Advanced Market Mechanisms: Future research should delve into the creation of more sophisticated market mechanisms that seamlessly integrate long-term stability with short-term adaptability. One promising direction is the design of hybrid contracts combining long-term agreements with dynamic spot market pricing to provide both stability and flexibility [93]. Moreover, developing advanced auction frameworks, particularly for the integration of renewable energy and capacity markets, can boost market efficiency and facilitate the energy transition [94].

- (2)

- Integration of Artificial Intelligence and Machine Learning: Future research should explore more advanced AI and ML techniques for market modeling and forecasting. Building on DRL’s integration with game theory, generative adversarial networks (GANs) could be used for scenario generation, while transformer models may be applied to analyze long-term market trends. These sophisticated techniques can significantly enhance the accuracy of market simulations, providing improved decision-making tools for operators and participants [95,96,97,98]. Here, reinforcement learning (RL) is a subset of machine learning where an agent learns to make decisions by performing actions in an environment to achieve maximum cumulative reward [95]. In the power market, DRL—which combines RL with deep neural networks—enhances the agent’s ability to handle complex, high-dimensional data and make sophisticated decisions [95,96,97,98]. The DRL game theory method is widely used in demand response management, load scheduling, price bidding, and other scenarios. For example, power companies can use this method to learn the optimal generation strategy to cope with market price fluctuations, while power purchasing companies can adjust their purchasing behavior according to historical data and market trends.

- (3)

- Blockchain and Decentralized Markets: The potential of blockchain technology in enhancing transparency and efficiency within decentralized energy markets warrants further investigation. Research could explore how smart contracts and decentralized autonomous organizations (DAOs) facilitate peer-to-peer energy trading and grid management, leading to more resilient and democratic market structures. Such innovations would particularly benefit markets with increasing distributed energy resources and renewable energy penetration [99,100,101,102].

- (4)

- Multi-Energy Systems and Sector Coupling: As the energy transition accelerates, the integration of electricity markets with other energy sectors such as gas, heat, and hydrogen is becoming essential for achieving sustainable energy systems. The development of multi-energy systems (MES) allows for more efficient resource utilization, leveraging the synergies between different energy vectors. Future research should focus on creating integrated market models that capture the interdependencies among electricity, gas, and heating sectors, ensuring that these systems work in harmony to maximize energy efficiency and flexibility. For instance, power-to-gas (P2G) technologies, which convert surplus electricity into hydrogen or methane, can enable more flexible energy management, particularly during periods of excess renewable generation [103]. Game-theoretic approaches offer a promising framework for optimizing these multi-commodity markets, providing a structured way to balance supply and demand across sectors [104]. Additionally, technologies such as hydrogen storage and power-to-heat systems can significantly enhance energy flexibility, improving the resilience of energy systems against market fluctuations [105]. The integration of these diverse energy systems into a unified framework not only boosts efficiency but also opens up new opportunities for renewable energy integration [106]. Going forward, the development of robust optimization models that incorporate these energy vectors will be key to creating a low-carbon, reliable energy future [107].

- (5)

- Behavioral Economics in Electricity Markets: As the electricity market evolves, understanding the behavioral economics of market participants becomes increasingly important [92]. Future research should explore how cognitive biases, such as overconfidence or loss aversion, influence the bidding strategies of electricity providers and consumers. Empirical studies on these biases could lead to more accurate agent-based models that reflect real-world decision-making under uncertainty [108]. Furthermore, integrating behavioral insights into market models can help regulators design more effective market rules and bidding strategies [109]. Agent-based models that incorporate bounded rationality and learning dynamics, such as reinforcement learning, have shown promise in simulating market behaviors and outcomes [110]. These models can also examine the role of incomplete information and how it affects strategic bidding, ultimately improving the accuracy of electricity market simulations [111]. Exploring these behavioral factors will enable the development of market structures that better reflect the complexities of human decision-making, leading to more efficient and resilient electricity markets [112].

- (6)

- Climate Change and Extreme Weather Events: The growing impact of climate change on electricity markets, particularly due to the increasing frequency and severity of extreme weather events, requires urgent attention [92]. These events, such as hurricanes, heatwaves, and cold waves, significantly affect grid stability and energy supply. Future research should focus on integrating climate models with market simulations to better predict and mitigate these risks [113]. Additionally, developing new risk management tools for market participants, such as adaptive capacity markets, could help manage the reliability challenges posed by extreme events [114]. Extreme weather events not only disrupt power grids but also reduce the efficiency of power generation, particularly during peak demand [115]. Coupling electricity market models with climate projections can provide better forecasts and improve market resilience. Risk assessment tools that include weather impacts can also be utilized to evaluate potential infrastructure vulnerabilities [116]. By incorporating these measures, the electricity sector can better adapt to the challenges posed by climate change [117].

- (7)

- Energy Justice and Market Design: As electricity markets evolve, promoting energy justice is essential to ensure equitable access and fair market participation, especially for vulnerable communities and developing economies. Future research should focus on how market design can better address social equity by incorporating mechanisms that account for fairness and welfare. For instance, designing new metrics to assess market fairness could help identify disparities in energy access and affordability. Additionally, market structures should be adapted to include considerations of social welfare, allowing for more inclusive participation in energy markets, especially in low-income regions [118]. Empirical studies on energy justice have revealed the importance of empowering marginalized groups and ensuring that clean energy transitions do not disproportionately benefit the wealthy [119]. Integrating energy justice into market governance would also require balancing the needs of vulnerable populations with the operational flexibility required in modern grids [120]. Addressing these concerns through comprehensive market designs can help create more just and resilient energy systems [121].

- (8)

- Cybersecurity and Market Resilience: With the growing digitalization of electricity markets, cybersecurity has emerged as a critical concern. Future research should prioritize developing robust market platforms capable of withstanding cyber-attacks and ensuring the integrity of operations. Cyber-attacks can disrupt market activities, manipulate data, and induce financial losses, thus necessitating advanced security measures [122]. Game theory can be applied to model the behavior of attackers and defenders, helping market operators predict and counter cyber threats more effectively [123]. AI-powered anomaly detection systems could be used to monitor market transactions and detect irregular patterns indicative of cyber-attacks [124]. Furthermore, the integration of cybersecurity strategies into real-time power system operations can enhance the resilience of energy markets [125]. Additionally, game-theoretic frameworks for anomaly detection and dynamic defense offer promising pathways to enhance cyber resilience [126].

- (9)

- Regulatory Frameworks and International Coordination: As electricity markets become increasingly interconnected across national borders, the development of robust regulatory frameworks to facilitate international market coordination is critical. Effective cooperation between countries is essential to managing cross-border electricity flows, congestion, and market integration. Future research should explore various regulatory approaches and game-theoretic models that enable better international cooperation. Comparative studies of existing regulatory practices in different regions could reveal best practices and inform new policy frameworks [127]. Additionally, game-theoretic frameworks can be used to model strategic behavior and coordination among market participants, which can help optimize cross-border congestion management and pricing [128]. Moreover, the integration of distributed energy resources (DER) across borders presents additional challenges, requiring innovative coordination strategies and risk-sharing mechanisms [129]. The use of game theory in these contexts can provide valuable insights into how market participants—such as generators and transmission system operators—can cooperate to achieve stable and efficient electricity flows [130]. Establishing a common regulatory framework that incorporates cross-border market coupling mechanisms will be key to the future of European electricity markets [131].

- (10)

- Long-term Market Evolution and Energy Transitions: As global energy transitions accelerate, understanding how electricity markets evolve over the coming decades becomes essential [92]. Future studies should develop scenario-based modeling approaches that account for technological, economic, and policy uncertainties. These models should incorporate renewable energy integration, energy demand changes, and the impact of market mechanisms to guide policymakers and long-term investors [132]. Scenario analysis, especially Monte Carlo simulations, can aid in capturing the volatility and long-term uncertainties that shape market dynamics [133]. Furthermore, system dynamics modeling provides valuable insights into energy transition pathways, emphasizing feedback loops and learning processes [134]. Models that explore technological transitions in transportation and other sectors should also be integrated to ensure comprehensive planning [135]. Decision-making frameworks, such as real options and robust decision models, are essential for navigating market uncertainties [136], while agent-based models are crucial for exploring decentralized market behaviors [137]. By incorporating these methodologies, future market evolution models will provide valuable strategies for energy policy and investment decisions [138].

9.3. Policy Implications and Future Directions for Energy Governance

9.3.1. Policy Implications

9.3.2. Policy Recommendations

9.3.3. Political Applicability

- (1)

- Guiding Local and National Regulators in Redesigning Energy Auctions.

- (i)

- Multi-Round Auctions: Incorporating multi-round bidding (e.g., descending-clock or iterative sealed-bid formats) enables regulators to capture the evolving cost structures of both conventional and renewable generators. In each round, participants update bids based on previously revealed market information, which improves market price convergence and transparency.

- (ii)

- Forward Contracts and Real-Time Bidding: Pairing forward capacity contracts with real-time spot auctions can stabilize prices over the planning horizon. This approach leverages the security of long-term deals while allowing market participants to respond to short-term fluctuations via spot pricing.

- (iii)

- Risk Mitigation Tools: auctions could also provide optional hedging instruments—such as contracts for differences (CfDs)—to reduce the financial vulnerability of participants to price volatility, thus preventing undue market exit of smaller or renewable-based providers.

- (i)

- Incentive-Compatible Mechanisms: game-theoretic principles can guide the design of auction rules that minimize gaming opportunities and encourage truthful revelation of costs and capacities.

- (ii)

- Support for Emerging Generators: Policymakers could introduce tiered or technology-specific auctions to encourage market entry by renewables or distributed resources. For instance, separate bidding segments for wind or solar generation help align procurement with decarbonization targets.

- (i)

- Real-Time Information Disclosure: regulators can enforce data-sharing protocols that provide timely insights into grid conditions and competitor strategies, thereby preventing market manipulation.

- (ii)

- Smart Monitoring Systems: integrating monitoring tools, potentially enhanced by DRL, can detect anomalous bidding behaviors in real-time, enabling rapid regulatory interventions.

- (2)

- Strengthening the Adaptive Capabilities of Microgrid Operators and Virtual Power Plants (VPPs).

- (i)

- Dynamic Pricing Integration: by leveraging DRL-based optimization, microgrid operators and VPPs can adjust their supply bids and consumption schedules in near-real time, mitigating the financial risks associated with spot market volatility.

- (ii)

- Multi-Agent Learning: evolutionary game models facilitate iterative learning among multiple DER agents (e.g., solar PV, battery storage, demand-response aggregators), enabling these entities to co-evolve strategies that maximize the joint utility (profitability, reliability) of the microgrid ecosystem.

- (i)

- Resilient Infrastructure Planning: combining game theory with stochastic models helps microgrids identify critical nodes and storage resources that minimize supply disruptions during sudden demand spikes or supply deficits.

- (ii)

- Frequency Regulation and Ancillary Services: VPPs can coordinate DERs to provide short-term load balancing, voltage support, and other ancillary services in response to real-time grid needs, ensuring overall system stability.

- (i)

- Local Market Creation: adopting the proposed frameworks can encourage the formation of local trading platforms where microgrids and VPPs trade energy surpluses or deficits among themselves, harnessing price signals from both local and system-wide markets.

- (ii)

- Decentralized Coordination: through consensus-driven strategies (e.g., game-theoretic bargaining), small DERs can negotiate terms that optimize collective welfare without dependence on centralized market operators.

- (3)

- Enhancing Collaboration Among International Bodies and Establishing Cross-Border Balancing Mechanisms.

- (i)

- Common Auction Platforms: internationally coordinated auction rules and cross-border capacity reservation mechanisms can reduce arbitrage opportunities and ensure that grid reliability is maintained at lower aggregate cost.

- (ii)

- Multilateral Contracts and Congestion Management: applying EGT to cross-border congestion management can reveal stable cooperation patterns, e.g., cost-sharing for interconnection projects, thereby facilitating the equitable distribution of infrastructure investments.

- (i)

- Real-Time Balancing Services: expanding existing balancing markets to include near-instantaneous cross-border services promotes the seamless flow of electricity, reduces localized stress on networks, and incentivizes higher renewable penetration.

- (ii)

- Coordination of Reserve Requirements: Common reserve standards and reciprocal balancing agreements can minimize the total reserve margin needed across multiple regions. In times of emergency or abrupt demand spikes, cooperative protocols allow surplus capacity in one region to assist another.

- (i)

- Incentive-Compatible International Agreements: by modeling each country (or region) as a strategic player, global regulators can design frameworks that reward honest reporting of resource availability and penalize free-riding or non-cooperative behavior.

- (ii)

- Institutional Capacity Building: data exchange and harmonized grid codes require continuous dialog among national regulatory bodies, which can be enhanced by multi-agent DRL simulations that test negotiation outcomes under diverse scenarios.

9.3.4. Future Research Directions in Energy Policy

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Nomenclature

| Term/Acronym | Definition/Explanation |

| Adaptive Market Mechanisms | Advanced market designs that balance long-term stability with short-term flexibility, such as hybridized systems that integrate forward contracts and spot trading. These mechanisms dynamically adjust price signals and trading rules to enhance the efficiency and adaptability of power systems. |

| Ancillary Services Market | A market dedicated to services that support secure and stable grid operation, such as reserve capacity, frequency regulation, and ramp-rate control. This market typically runs in parallel with primary energy transactions (e.g., spot or long-term contracts) to ensure overall system reliability. |

| Auction | A transaction model that collects bids from multiple parties, often used in centralized bidding, energy spot markets, or other competitive settings. By gathering and matching buy and sell bids according to predetermined rules, auctions enhance price discovery and promote market competitiveness. |

| Backward Induction | A method used in multi-stage or dynamic games to determine optimal strategies, starting from the last stage and moving backward to earlier stages. This approach identifies subgame-perfect Nash equilibria (SPNE) by examining how each participant’s decision would evolve, assuming rationality at every step. |

| Bayesian Game Theory (BGT) | A class of game-theoretic models that address strategic interactions under incomplete information. Each player has probabilistic beliefs (priors) about the types, cost structures, or payoff functions of other players, and updates these beliefs based on observed actions. Such models are widely applied to settings where information asymmetry shapes strategic behavior. |

| Bayesian Nash Equilibrium (BNE) | An equilibrium concept in incomplete-information games where each player maximizes expected utility based on beliefs about other players’ types or private information. In a BNE, no single player can deviate unilaterally to achieve a higher expected payoff, given the strategies and beliefs of other players. |

| Bilateral Negotiation | A transaction mode in which power generation companies and electricity purchasers (or retailers) establish a contract through direct, one-on-one negotiation. Although it offers flexibility and customization, bilateral negotiation can entail higher information costs and potential opacity in large-scale markets. |

| Capacity Price | A payment or compensation mechanism for generation units to maintain adequate available capacity—often referred to as “standby capacity”—especially for peak-demand periods. Generators receive this payment regardless of actual dispatch, offsetting the costs of keeping equipment online and ensuring reliability. |

| Centralized Competitive Trading | A mechanism in which trades are cleared through a unified exchange or platform. A market operator (or similar authority) collects bids from buyers and sellers, matching them under uniform rules. While such centralized procedures can improve transparency and reduce transaction costs, they may also restrict the scope for customized bilateral agreements. |

| Clean Energy Integration | The systematic incorporation of renewable energy sources (e.g., wind, photovoltaic, or hydrogen-based systems) into the grid, facilitated by policies such as subsidies, renewable energy certificates, and priority dispatch. This process aims to reduce carbon emissions and transition the energy mix toward greater sustainability. |

| Congestion Management | A set of measures or mechanisms (e.g., transmission rights, locational marginal pricing) designed to address bottlenecks in transmission networks. Congestion management ensures reliable operation by redistributing power flows or incentivizing certain units to increase or decrease generation when line constraints are at risk. |

| Cross-border Electricity Trade | Energy transactions occurring across national or regional borders. These trades require harmonization of regulations, transmission standards, and market rules to allow seamless power flow and efficient resource sharing among participating countries or regions. |

| Cybersecurity | The suite of strategies and technologies that protect highly digitized power systems and energy markets against cyberattacks, data breaches, or disruptive events. By employing game-theoretic models of attackers and defenders, operators can design proactive and resilient security measures for energy infrastructures. |

| Day-Ahead Market (DA) | A spot market mechanism where participants place bids for each hour (or designated interval) of the following day. This market provides early price signals and a preliminary schedule for both system dispatch and market operations, thereby enhancing short-term predictability and grid planning. |

| Deep Reinforcement Learning (DRL) | A methodology combining reinforcement learning with deep neural networks, capable of handling high-dimensional data by learning optimal strategies through iterative interactions with the environment. In power markets, DRL can be merged with game-theoretic models for real-time bidding, demand response, and grid scheduling. |

| Demand Response | A set of strategies (e.g., time-of-use pricing, direct load control) that incentivize consumers to shift or reduce electricity usage during peak demand periods. This mechanism helps balance supply and demand, lowers overall system costs, and maintains grid stability. |

| Distributed Energy Resources (DER) | Smaller-scale generation or storage units (e.g., rooftop solar, community-level storage, electric vehicles) are typically located on the consumer side. When aggregated, these resources can provide grid services such as peak shaving or frequency regulation, thereby increasing system flexibility. |

| EGT (Evolutionary Game Theory) | An approach that applies evolutionary concepts such as “survival of the fittest” to economic or social interactions, focusing on how strategies change and spread through repeated interactions. EGT emphasizes dynamic adaptation and examines evolutionarily stable strategies (ESS) in complex systems like electricity markets. |

| Electricity Spot Market | A real-time or near-real-time trading platform in which supply and demand are matched at short intervals (e.g., hourly, 15 min blocks), reflecting marginal costs and system conditions. Spot markets provide essential price signals for adjusting dispatch and ensuring immediate supply–demand balance. |

| ESS (Evolutionarily Stable Strategy) | A central concept in evolutionary game theory. A strategy is evolutionarily stable if, once it is adopted by most players, no small group of “mutant” or alternative strategies can invade and achieve a higher payoff. ESS indicates a stable long-term outcome in an adaptive, repeated interaction setting. |

| Forward Contract | A long-term agreement wherein a power producer and purchaser fix the terms (quantity, price, and delivery schedule) for future electricity delivery. This contract stabilizes prices and mitigates risk from spot-market volatility. |

| Game Theory | A theoretical framework for analyzing decisions made by multiple rational agents in situations where their choices affect one another’s outcomes. Encompasses classical (fully rational) models as well as extended forms accommodating incomplete information, dynamic evolution, or bounded rationality. |

| Hybrid Transaction Models | Transaction frameworks that incorporate both long-term contracts and short-term (spot) market elements. They aim to retain the price stability of long-term agreements while exploiting spot-market flexibility to manage real-time fluctuations and uncertainties, thus optimizing risk–return profiles. |

| Independent Power Producer (IPP) | A non-utility entity that owns generation assets and may sell electricity into wholesale or retail markets through direct contracts (e.g., power purchase agreements). IPPs compete with vertically integrated utilities, increasing market competition and improving resource allocation efficiency. |

| Independent System Operator (ISO) | A neutral, non-profit entity responsible for power system dispatch, market organization, and market oversight within a given region. ISOs typically do not own generation or transmission assets, allowing them to operate impartially to ensure grid reliability and fair competition. |

| Information Asymmetry | A condition where different market participants have unequal access to information (e.g., generation costs, load forecasts, or strategic intentions). Such asymmetry can lead to adverse selection, market manipulation, and inefficient outcomes. Bayesian game models, mandated data disclosure, or robust transparency protocols can partially mitigate these issues. |

| Locational Marginal Price (LMP) | The marginal cost of delivering one additional unit of electricity to a specific node, reflecting generation expenses and transmission congestion costs. LMP-based pricing helps manage congestion in large networks by differentiating prices across network nodes. |

| Long-term Power Purchase Contracts (LTPC) | Contracts of extended duration between power generators and purchasers, stabilizing costs and revenues by locking in prices. Although they mitigate volatility, LTPCs may reduce short-term market liquidity and flexibility. |

| Market Concentration | A measure (often captured by the Herfindahl-Hirschman Index, HHI) indicating the relative dominance of a few major players in generation, transmission, or retail segments. High concentration can suggest reduced competition and increased market power. |

| Market Mechanism | The institutional rules and structures by which goods or services (e.g., electricity, ancillary services) are priced, traded, and settled. Effective market mechanisms minimize transaction costs and resource misallocation, while promoting transparency and fairness. |

| Market Power | The capacity of a player (particularly large generators or retailers) to influence market prices or contractual terms to their advantage, sometimes leading to monopoly or oligopoly behavior. Mechanisms like antitrust policies or capacity market regulations are often employed to curb excessive market power. |

| Market Resilience | The ability of a market to maintain balance and recover swiftly from external shocks (e.g., extreme weather events, unexpected demand surges). Mechanisms such as flexible trading arrangements, diversified energy portfolios, and policy interventions can strengthen resilience. |

| Nash Equilibrium | A foundational concept in classical game theory, describing a strategy profile in which no player has an incentive to deviate unilaterally. Each player’s strategy is optimal given the fixed strategies of all other players. |

| Non-Cooperative Game | A framework in which participants independently maximize their individual payoffs without forming binding agreements or coalitions. Contrasts with cooperative games, where players may negotiate enforceable contracts to share resources or profits. |

| Poolco Model | A centralized market structure wherein a single operator (the “Pool”) manages bidding, dispatch, and settlement for both generators and retailers. All sellers and buyers transact through this centralized entity, which handles unified pricing and clearing. |

| Power Purchase Agreement (PPA) | A contract between a power producer and a buyer (e.g., a retailer, utility, or large end-user) specifying terms of electricity procurement, including price, volume, and liability clauses. PPAs are common in long-term and medium-term transactions. |

| Price Volatility | Short-term fluctuations in electricity prices caused by supply–demand imbalances, fuel cost variability, policy interventions, or speculative trading. Managing volatility often involves financial instruments (e.g., hedging) or operational measures (e.g., demand response). |

| Real-time Market | A short-interval market (e.g., updated every 5–15 min) that continuously reconciles actual demand with available supply, addressing deviations from day-ahead schedules. Real-time markets provide precise price signals and allow immediate adjustments to maintain grid reliability. |

| Renewable Integration Incentives | Policy instruments (e.g., feed-in tariffs, production tax credits) designed to encourage the adoption and market participation of renewable energy. They aim to boost investment in clean generation technologies and accelerate decarbonization. |

| Replicator Dynamics | The core differential equations in evolutionary game theory that describe how strategy frequencies evolve over time. Strategies with payoffs exceeding the population average proliferate, while less successful strategies diminish. |

| Risk Management | Practices undertaken by market participants (e.g., hedging, financial derivatives) to mitigate price volatility, demand uncertainty, and other operational risks. Effective risk management is critical in electricity markets prone to fluctuating conditions and unforeseen shocks. |

| Spot Market | A short-term energy market that uses flexible bidding and settlement to balance supply and demand. Typically subdivided into day-ahead, intra-day, and real-time segments, spot markets provide dynamic pricing that reflects marginal production costs and system conditions. |

| Stackelberg Game | A leader–follower model of strategic interaction in which the “leader” moves first, anticipating the follower’s rational response. This framework is especially useful for analyzing situations with hierarchical decision-making, such as large power companies setting generation or price strategies to which smaller participants must adapt. |

| Stackelberg Equilibrium | An equilibrium solution in a leader–follower game, where the leader optimizes its strategy based on how the follower is expected to react, and the follower’s best response is consistent with that anticipation. |

| Stochastic Evolutionary Game | An extension of evolutionary game theory that incorporates randomness (e.g., mutations, stochastic shocks) to capture more realistic scenarios. Strategies evolve under uncertainty, and the analysis focuses on long-term patterns under probabilistic conditions. |

| Sustainable Market Performance | Market performance metrics that account not only for economic efficiency but also for environmental impact (e.g., carbon footprint) and social equity. Sustainable performance assessments often examine resource utilization, emission reductions, and overall societal benefits. |

| Transmission System Operator (TSO) | An entity responsible for operating, maintaining, and expanding the high-voltage transmission grid. TSOs ensure secure power flows, manage congestion, and provide non-discriminatory access to the transmission network, closely collaborating with market operators and other stakeholders. |

| Virtual Power Plant (VPP) | An aggregated platform that pools the capacity of distributed energy resources (DERs)—such as small-scale renewables, storage systems, and flexible loads—into a unified entity. A VPP can participate in energy and ancillary service markets as if it were a conventional power plant, improving dispatch flexibility and revenue opportunities. |

| Wholesale Competition | A phase in electricity market liberalization wherein independent power generators compete for wholesale contracts, typically under regulated or semi-regulated transmission systems. Large industrial consumers may also purchase directly from generators at wholesale prices, improving overall resource allocation. |

References

- Wind Energy Equipment Branch of China Agricultural Machinery Industry Association. Several Opinions of the CPC Central Committee and The State Council on Further Deepening the Reform of the Electric Power System; Wind Energy Industry (No. 4, 2015); China Agricultural Machinery Industry Association: Beijing, China, 2015; Volume 5. [Google Scholar]

- National Development and Reform Commission. The National Development and Reform Commission has deployed all localities to organize and carry out power purchase work by power grid enterprises. Rural. Electr. 2021, 29, 2. [Google Scholar] [CrossRef]

- Editorial Department of this Journal. The National Development and Reform Commission requires further agency of power purchase by power grid enterprises. Rural. Electr. 2023, 31, 1. [Google Scholar] [CrossRef]

- Li, X.; Zheng, Z.; Luo, B.; Shi, D.; Han, X. The impact of electricity sales side reform on energy technology innovation: An analysis based on SCP paradigm. Energy Econ. 2024, 136, 107763. [Google Scholar] [CrossRef]

- Jingjun, L.; Wei, C.; Jingyao, G.; Liyan, Z.; Tao, L.; Nan, W. Profit Model Analysis of Power Grid Company after Electricity Price Reform. In Proceedings of the 2018 China International Conference on Electricity Distribution (CICED), Tianjin, China, 17–19 September 2018; pp. 377–381. [Google Scholar] [CrossRef]

- Liu, J.; Wang, J.; Cardinal, J. Evolution and reform of UK electricity market. Renew. Sustain. Energy Rev. 2022, 161, 112317. [Google Scholar] [CrossRef]

- Chenghui, T.; Fan, Z. The marketization process of electricity purchase and power generation and its significance in China. IOP Conf. Ser. Earth Environ. Sci. 2019, 358, 032050. [Google Scholar] [CrossRef]

- Ma, Q.; Liu, J.; Chen, Z.; Han, B.; Cai, Z. Similarities and differences between internal European market for electricity and Chinese electricity market. In Proceedings of the 2022 4th Asia Energy and Electrical Engineering Symposium (AEEES), Chengdu, China, 25–28 March 2022; pp. 272–277. [Google Scholar] [CrossRef]

- Jin, L.; Zhou, D.; He, J.; Zhao, W.; Wang, X.; Huang, H. Data Analysis Systems in European and PJM electricity markets and suggestions for Zhejiang. In Proceedings of the 2020 IEEE 3rd Student Conference on Electrical Machines and Systems (SCEMS), Jinan, China, 4–6 December 2020; pp. 375–379. [Google Scholar] [CrossRef]

- Chacon, S.; Feng, D. Market Power Assessment of the central America regional electricity market. In Proceedings of the 2021 Power System and Green Energy Conference (PSGEC), Shanghai, China, 20–22 August 2021; pp. 775–783. [Google Scholar] [CrossRef]

- Cheng, Y.; Chung, M.; Tsang, K. Electricity Market Reforms for Energy Transition: Lessons from China. Energies 2023, 16, 905. [Google Scholar] [CrossRef]

- Ouyang, S.; Huang, J.; Leng, T.; Liu, H.; Zhang, D.; Yu, H. Market participation of virtual power plant with renewable generation and waste treatment under incentive and loss mechanism. In Proceedings of the 2021 IEEE 5th Conference on Energy Internet and Energy System Integration (EI2), Taiyuan, China, 22–24 October 2021; pp. 3965–3969. [Google Scholar] [CrossRef]

- Wang, X.; Liu, W.; Chen, Y.; Bai, Y.; Li, J.; Zhong, J. Electricity Market Design and Operation in Guangdong Power. In Proceedings of the 2018 15th International Conference on the European Energy Market (EEM), Lodz, Poland, 27–29 June 2018; pp. 1–5. [Google Scholar] [CrossRef]

- Oksanen, M.; Karjalainen, R.; Viljainen, S.; Kuleshov, D. Electricity markets in Russia, the US, and Europe. In Proceedings of the 2009 6th International Conference on the European Energy Market (EEM), Leuven, Belgium, 27–29 May 2009; pp. 1–7. [Google Scholar] [CrossRef]

- Cheng, L.; Zhang, M.; Huang, P.; Lu, W. Game-theoretic approaches for power-generation companies’ decision-making in the emerging green certificate market. Sustainability 2025, 17, 71. [Google Scholar] [CrossRef]

- Fan, H.; Yu, K.; Li, Z.; Shahidehpour, M. Optimization of Power Supply Capacity of Distribution Network Considering the Participation of Power Sales Companies in Spot Power Trading. IEEE Access 2019, 7, 99651–99657. [Google Scholar] [CrossRef]

- Wu, Z.; Ni, X.; Wu, G.; Shi, J.; Liu, H.; Hou, Y. Comprehensive Evaluation of Power Supply Quality for Power Sale Companies Considering Customized Service. In Proceedings of the 2018 International Conference on Power System Technology (POWERCON), Guangzhou, China, 6–8 November 2018; pp. 734–739. [Google Scholar] [CrossRef]

- Zhou, N.; He, P.; Ding, W. Research on Settlement Risk Control of electricity Sales Company Base on the integration of Margin System and Business Process. In Proceedings of the 2022 China International Conference on Electricity Distribution (CICED), Changsha, China, 7–8 September 2022; pp. 87–91. [Google Scholar] [CrossRef]

- Ma, Y.; Liu, Y.; Yin, Y.; Lin, Z.; Lei, Y.; Li, H. A customized electricity pricing approach that considering the gaming ability of users and the new power sales company. Energy Rep. 2023, 9, 1244–1258. [Google Scholar] [CrossRef]

- Wang, Z.; Yu, H.; Liu, J.; Hu, B.; Xue, M. Evaluation of electric power sales company’s credit under new power market reformation. In Proceedings of the 2018 Chinese Control And Decision Conference (CCDC), Shenyang, China, 9–11 June 2018; pp. 3202–3207. [Google Scholar] [CrossRef]

- Sun, D.; Zhang, Y.; Wu, G.; Zhao, J.; Liu, H. Integrated Generation-Grid-Load Economic Dispatch Considering Demand Response. In Proceedings of the 2020 IEEE/IAS Industrial and Commercial Power System Asia (I&CPS Asia), Weihai, China, 13–15 July 2020; pp. 375–379. [Google Scholar] [CrossRef]

- Niu, R.; Liu, J.; Zhang, X.; Guo, W.; Pan, B. Research on Risk Analysis Technology of Electricity Stealing Behavior Characteristics in Smart Grid. In Proceedings of the 2022 IEEE International Conference on Electrical Engineering, Big Data and Algorithms (EEBDA), Changchun, China, 25–27 February 2022; pp. 128–131. [Google Scholar] [CrossRef]

- Dai, Y.; Zhang, Y.; Liu, J.; Wu, G.; Zhao, J.; Liu, H. The electricity purchasing optimization model considering the trading space of interruptible load under the integration of electricity purchasing and selling. In Proceedings of the 2017 3rd IEEE International Conference on Computer and Communications (ICCC), Chengdu, China, 13–16 December 2017; pp. 2859–2863. [Google Scholar] [CrossRef]

- Yang, X.; Zhao, J.; Zhang, Y.; Wang, Z.; Liu, J.; Wu, G. Platform Economy Enables Electricity Retail Trading Market: ——Take “Lai Tao Dian” retail trading platform in Yunnan Province as an example. In Proceedings of the 2024 IEEE 7th International Electrical and Energy Conference (CIEEC), Harbin, China, 10–12 May 2024; pp. 294–299. [Google Scholar] [CrossRef]

- Wu, Q. Research on Cost and Economy of Pumped Storage Power Station under the Background of Power Market Reform. In Proceedings of the 2023 6th International Conference on Energy, Electrical and Power Engineering (CEEPE), Guangzhou, China, 12–14 May 2023; pp. 1312–1316. [Google Scholar] [CrossRef]

- Motte-Cortés, A.; Eising, M. Assessment of balancing market designs in the context of European coordination. In Proceedings of the 2019 16th International Conference on the European Energy Market (EEM), Ljubljana, Slovenia, 18–20 September 2019; pp. 1–7. [Google Scholar] [CrossRef]

- Ouriachi, A.; Spataru, C. Integrating regional electricity markets towards a single European market. In Proceedings of the 2015 12th International Conference on the European Energy Market (EEM), Lisbon, Portugal, 19–22 May 2015; pp. 1–5. [Google Scholar] [CrossRef]

- Rasheed, S.; Abhyankar, A.R. Development of Nash Equilibrium for Profit Maximization Equilibrium Problem in Electricity Market. In Proceedings of the 2019 8th International Conference on Power Systems (ICPS), Jaipur, India, 20–22 December 2019; pp. 1–6. [Google Scholar] [CrossRef]

- Jin, M.; Xing, Y.; Sun, T. PJM capacity market and Enlightenment to China’s capacity market design. In Proceedings of the 2023 IEEE 6th International Electrical and Energy Conference (CIEEC), Hefei, China, 12–14 May 2023; pp. 53–58. [Google Scholar] [CrossRef]

- Behrangrad, M. A review of demand side management business models in the electricity market. Renew. Sust. Energ. Rev. 2015, 47, 270–283. [Google Scholar] [CrossRef]

- Li, F.; Zhang, C.; Zhou, X.; Wu, Y.; Yang, D.; Jin, L. Market Power Monitoring Model of Electricity Retailer in Retail Market Under Spot Market Mode. In Proceedings of the 2024 9th Asia Conference on Power and Electrical Engineering (ACPEE), Shanghai, China, 11–13 April 2024; pp. 2414–2419. [Google Scholar] [CrossRef]

- Li, T.; Gao, C.; Chen, T.; Jiang, Y.; Feng, Y. Medium and long-term electricity market trading strategy considering renewable portfolio standard in the transitional period of electricity market reform in Jiangsu, China. Energ Econ. 2022, 107, 105860. [Google Scholar] [CrossRef]

- Zhao, S.; Xia, N.; Kuai, J.; Hui, X.; Liang, Y.; Ding, P. Research on Unbalanced Funds Settlement Mechanism in Liaoning Electricity Spot Market. In Proceedings of the 2023 2nd Asian Conference on Frontiers of Power and Energy (ACFPE), Chengdu, China, 20–22 October 2023; pp. 344–350. [Google Scholar] [CrossRef]

- Gao, H.; Li, J.; Liu, M.; Zhang, L.; Fan, H.; Xu, Z. Interactive trading model among multiple market participants based on hierarchical game frame in distribution network. In Proceedings of the 2021 6th Asia Conference on Power and Electrical Engineering (ACPEE), Chongqing, China, 8–11 April 2021; pp. 611–615. [Google Scholar] [CrossRef]

- Liang, B.; Xie, L.; Li, H.; Dai, S.; Yang, Y.; Chen, G. Analysis and decision-making of excess renewable energy consumption trading between electricity retailers based on evolutionary game. In Proceedings of the 2021 IEEE 5th Conference on Energy Internet and Energy System Integration (EI2), Taiyuan, China, 22–24 October 2021; pp. 3460–3465. [Google Scholar] [CrossRef]

- Wang, D.; Zhang, R.; Zhao, L. Stochastic Evolutionary Game model of bidding behavior for electricity purchase and sale in power market. In Proceedings of the 2022 3rd International Conference on Advanced Electrical and Energy Systems (AEES), Lanzhou, China, 23–25 September 2022; pp. 538–543. [Google Scholar] [CrossRef]

- Cheng, L.; Zhang, J.; Yin, L.; Chen, Y.; Wang, J.; Liu, G.; Wang, X.; Zhang, D. General three-population multi-strategy evolutionary games for long-term on-grid bidding of generation-side electricity market. IEEE Access 2020, 9, 5177–5198. [Google Scholar] [CrossRef]

- Cheng, L.; Yu, T. Nash equilibrium-based asymptotic stability analysis of multi-group asymmetric evolutionary games in typical scenario of electricity market. IEEE Access 2018, 6, 32064–32086. [Google Scholar] [CrossRef]

- Xie, X.; Ying, L.; Cui, X. Price strategy analysis of electricity retailers based on evolutionary game on complex networks. Sustainability 2022, 14, 9487. [Google Scholar] [CrossRef]

- Cheng, L.; Yu, T. Game-theoretic approaches applied to transactions in the open and ever-growing electricity markets from the perspective of power demand response: An overview. IEEE Access 2019, 7, 25727–25762. [Google Scholar] [CrossRef]

- Zeng, K.; Cheng, L.; Liu, J.; Zhao, Y.; Peng, Y.; Wu, H. Two-population asymmetric evolutionary game dynamics-based decision-making behavior analysis for a supply-side electric power bidding market. E3S Web Conf. 2020, 194, 03021. [Google Scholar] [CrossRef]

- Wen, H.; Heng, L. Game theory applications in the electricity market and renewable energy trading: A critical survey. Front. Energy Res. 2022, 10, 1009217. [Google Scholar] [CrossRef]

- Abapour, S.; Nazari-Heris, M.; Mohammadi-Ivatloo, B.; Jadid, S. Game Theory Approaches for the Solution of Power System Problems: A Comprehensive Review. Arch. Comput. Methods Eng. 2020, 27, 81–103. [Google Scholar] [CrossRef]

- Pla, B.; Bares, P.; Aronis, N.A.; Kazanci, O.G. Leveraging battery electric vehicle energy storage potential for home energy saving by model predictive control with backward induction. Appl. Energy 2024, 372, 123800. [Google Scholar] [CrossRef]

- Chen, J.; Hou, H.; Wu, W.; Wu, X. Optimal operation between electric power aggregator and electric vehicle based on Stackelberg game model. Energy Rep. 2023, 9, 699–706. [Google Scholar] [CrossRef]

- Dong, X.; Li, X.; Cheng, S. Energy Management Optimization of Microgrid Cluster Based on Multi-Agent-System and Hierarchical Stackelberg Game Theory. IEEE Access 2020, 8, 206183–206197. [Google Scholar] [CrossRef]

- Shan, X.; Zhuang, J. A game-theoretic approach to modeling attacks and defenses of smart grids at three levels. Reliab. Eng. Syst. Saf. 2020, 195, 106683. [Google Scholar] [CrossRef]

- Lu, Q.; Lü, S.; Leng, Y. A Nash-Stackelberg game approach in regional energy market considering users’ integrated demand response. Energy 2019, 175, 21–33. [Google Scholar] [CrossRef]

- Zhang, Z.; Wang, M.; Song, L.; Peng, Y. A data-driven Stackelberg game approach applied to analysis of strategic bidding for distributed energy resource aggregator in electricity markets. Renew. Energy 2023, 215, 1148–1162. [Google Scholar] [CrossRef]

- Zhang, T.; Wu, Y. Collaborative allocation model and balanced interaction strategy of multi flexible resources in the new power system based on Stackelberg game theory. Renew. Energy 2024, 220, 1234–1248. [Google Scholar] [CrossRef]

- Xie, D.; Liu, M.; Xu, L.; Lu, W. Multiplayer Nash–Stackelberg Game Analysis of Electricity Markets With the Participation of a Distribution Company. IEEE Syst. J. 2023, 17, 3658–3669. [Google Scholar] [CrossRef]

- Bo, S.; Mingzhe, L.; Fan, W.; Wang, Q. An incentive mechanism to promote residential renewable energy consumption in China’s electricity retail market: A two-level Stackelberg game approach. Energy 2023, 269, 126861. [Google Scholar] [CrossRef]

- Ma, X.; Pan, Y.; Zhang, M.; Ma, J.; Yang, W. Impact of carbon emission trading and renewable energy development policy on the sustainability of electricity market: A stackelberg game analysis. Energy Econ. 2024, 129, 104836. [Google Scholar] [CrossRef]

- Li, J.; Ai, Q.; Yin, S.; Hao, R. An aggregator-oriented hierarchical market mechanism for multi-type ancillary service provision based on the two-loop Stackelberg game. Appl. Energy 2022, 323, 119763. [Google Scholar] [CrossRef]

- Özge, E.; Ümmühan, F. A Stackelberg game-based dynamic pricing and robust optimization strategy for microgrid operations. Int. J. Electr. Power Energy Syst. 2024, 155, 109574. [Google Scholar] [CrossRef]

- Huang, J.; Chen, F.; Yang, T.; Sun, Y.; Yang, P.; Liu, G. Optimal Operation of Electricity Sales Company with Multiple VPPs Based on Stackelberg Game. In Proceedings of the 2023 5th International Conference on Power and Energy Technology (ICPET), Tianjin, China, 27–30 July 2023; pp. 1194–1199. [Google Scholar] [CrossRef]

- Zhu, Z.; Chan, K.W.; Bu, S.; Hu, Z.; Xia, S. An Imitation Learning Based Algorithm Enabling Priori Knowledge Transfer in Modern Electricity Markets for Bayesian Nash Equilibrium Estimation. IEEE Trans. Power Syst. 2024, 39, 5465–5478. [Google Scholar] [CrossRef]

- Yu, L.; Wang, P.; Zhang, Y.; Li, N.; Cherkaoui, R. A reinforcement-probability Bayesian approach for strategic bidding and market clearing for renewable energy sources with uncertainty. J. Clean. Prod. 2023, 429, 139403. [Google Scholar] [CrossRef]

- Fang, D.; Wang, X.; Ouyang, F.; Ye, C. Bayesian Nash equilibrium bidding strategies for generation companies. In Proceedings of the 2004 IEEE International Conference on Electric Utility Deregulation, Restructuring and Power Technologies, Hong Kong, China, 5–8 April 2004; Volumes 1 and 2, pp. 692–697. [Google Scholar] [CrossRef]

- Li, T.; Shahidehpour, M. Strategic bidding of transmission-constrained GENCOs with incomplete information. IEEE Trans. Power Syst. 2005, 20, 437–447. [Google Scholar] [CrossRef]

- Xu, J.; Pang, H.; Zhang, B.; Li, Q.; Huang, Y. Optimal Scheduling Method of Multi-Energy Hub Systems Based on Bayesian Game Theory. In Proceedings of the 2021 40th Chinese Control Conference (CCC), Shanghai, China, 26–28 July 2021; pp. 1733–1738. [Google Scholar] [CrossRef]

- Zidan, A.; Gabbar, H.A. Optimal scheduling of energy hubs in interconnected multi-energy systems. In Proceedings of the 2016 IEEE Smart Energy Grid Engineering (SEGE), Oshawa, ON, Canada, 21–24 August 2016; pp. 164–169. [Google Scholar] [CrossRef]

- Verma, P.; Hesamzadeh, M.R.; Baldick, R.; Biggar, D.R.; Swarup, K.S.; Srinivasan, D. Bayesian Nash Equilibrium in Electricity Spot Markets: An Affine-Plane Approximation Approach. IEEE Trans. Control Netw. Syst. 2022, 9, 1421–1434. [Google Scholar] [CrossRef]