Prediction of Lithium Carbonate Prices in China Applying a VMD–SSA–LSTM Combined Model

Abstract

1. Introduction

2. Single Model Construction

2.1. VMD Algorithm

2.2. Sparrow Search Algorithm

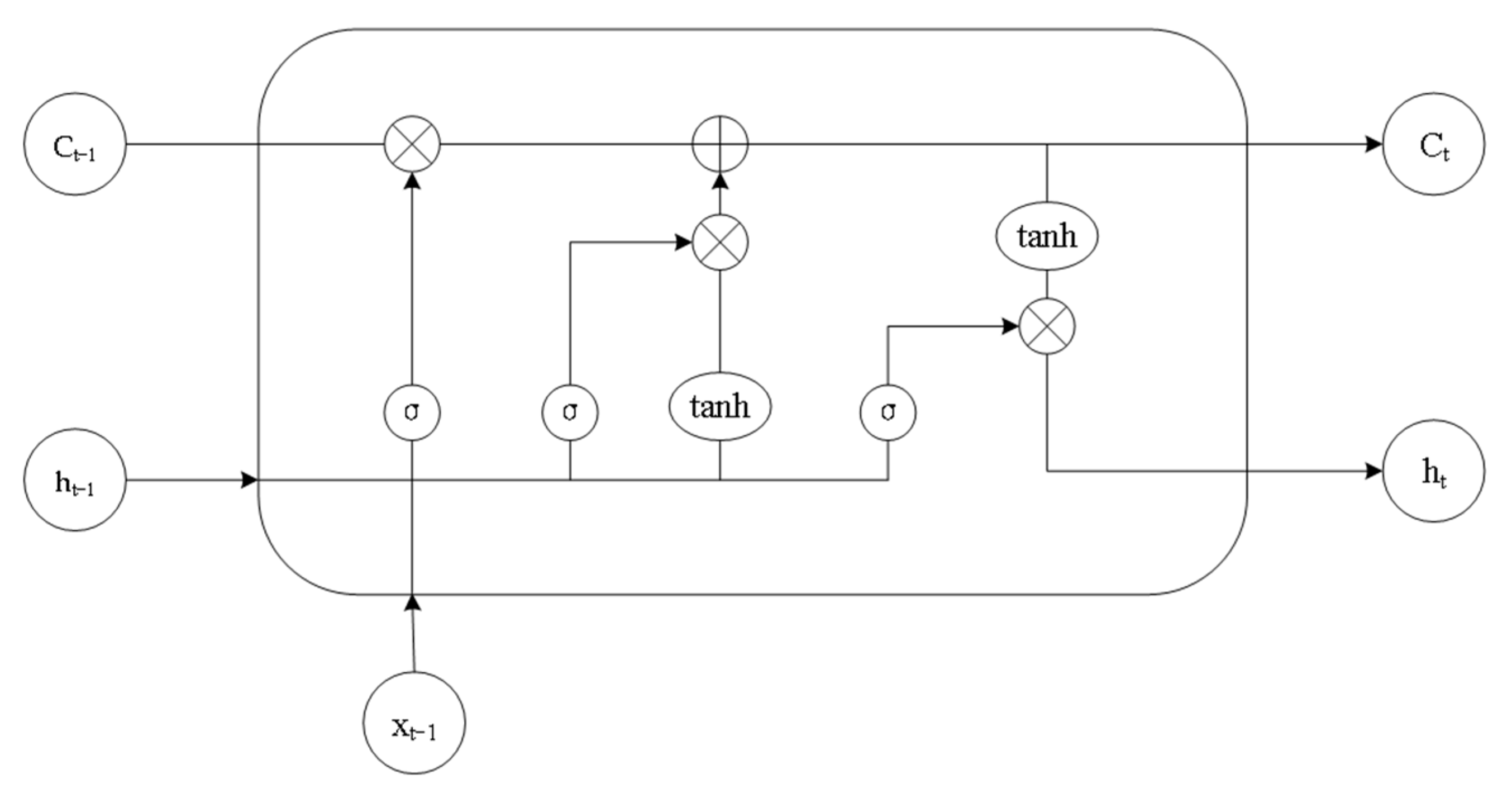

2.3. Long Short-Term Memory Network

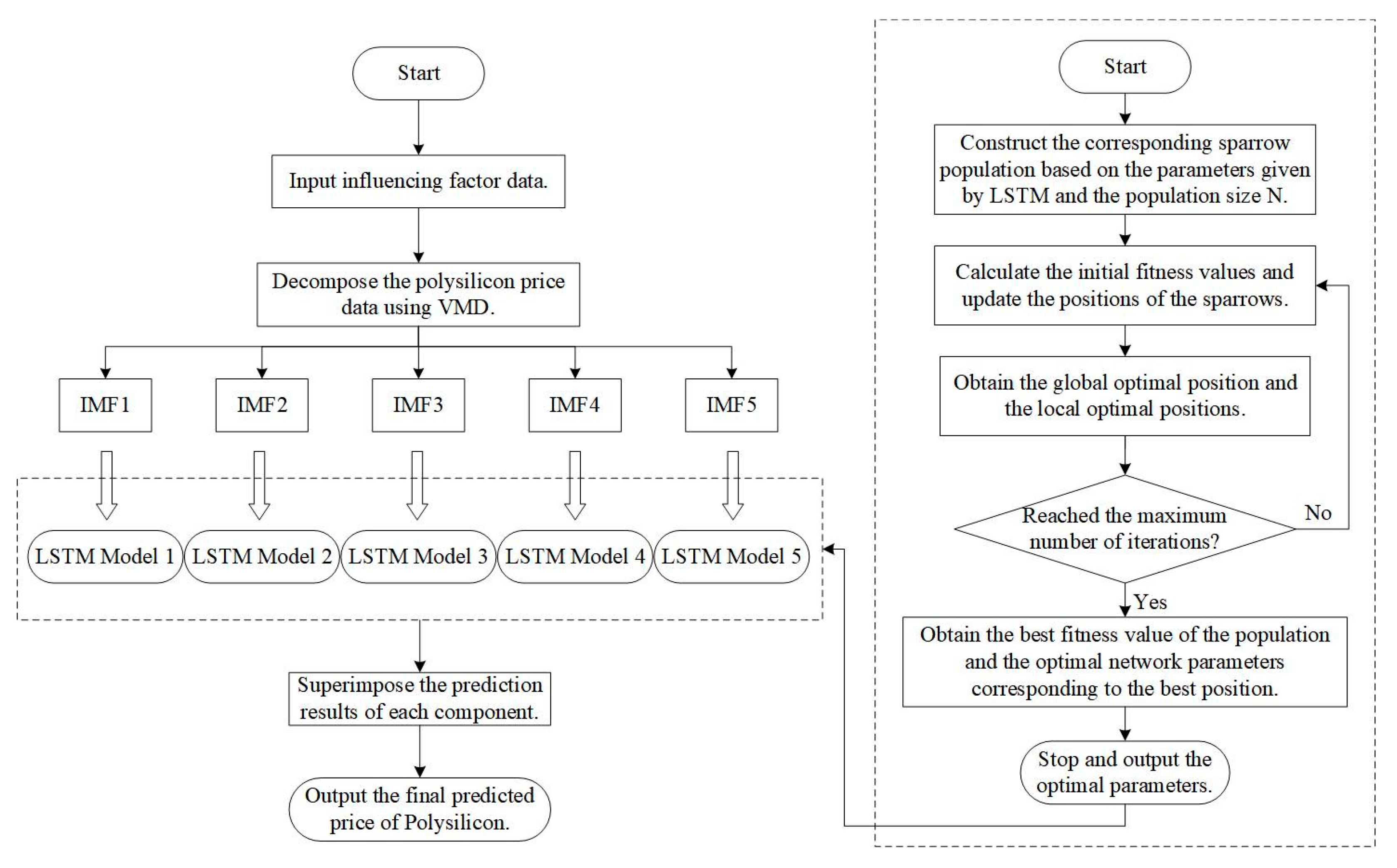

3. VMD–SSA–LSTM Combination Model

3.1. Data Sources and Indicators

- (1)

- Lithium hydroxide and lithium carbonate have certain correlations in terms of preparation processes and uses. The price connection mechanism between the two indicates that fluctuations in the price of lithium hydroxide may have an impact on the supply and demand relationship in the lithium carbonate market. In addition, as a part of the lithium battery materials, the price trend of lithium hydroxide reflects the overall cost changes in the entire lithium battery industry chain.

- (2)

- Lithium iron phosphate is a key cathode material for lithium batteries, and its demand has a direct impact on lithium carbonate prices. With the rapid growth of the new energy vehicle sector, demand for lithium iron phosphate has skyrocketed, driving up the price of lithium carbonate. However, fluctuations in the price of lithium iron phosphate may have an indirect impact on the lithium carbonate market. For example, if the price of lithium iron phosphate falls, this may lead to a decrease in demand for lithium carbonate, which affects its price.

- (3)

- As another cathode material for lithium batteries, changes in demand for lithium manganate will have an impact on market demand for lithium carbonate. The supply and demand situation, as well as the price trend of lithium manganate, can be used as an important reference indicator of the lithium carbonate market, particularly in the context of the diversified development of lithium battery materials. Due to its low cost, lithium manganate is primarily used in low-end markets such as power tools and electric bicycles; if demand in these areas surges, the price of lithium carbonate will be lowered.

- (4)

- Lithium hexafluorophosphate is an important component of lithium battery electrolytes, and supply and demand fluctuations have a direct impact on lithium battery production costs. The rising price of lithium hexafluorophosphate will put more pricing pressure on lithium battery producers, perhaps increasing demand for lithium carbonate. In contrast, a drop in the price of lithium hexafluorophosphate may relieve cost pressure on lithium battery makers, hence inhibiting the lithium carbonate market.

- (5)

- The stock market’s performance regularly reflects investors’ forecasts for future economy and industry. The movements of the CSI 300 Index and the Shanghai Composite Index can be utilized to assess macroeconomic conditions and market confidence, which can have an indirect impact on lithium carbonate prices. When the macro-environment is performing well, investors may be more willing to invest in lithium battery-related industries, thus pushing up the demand for and price of lithium carbonate.

3.2. The Process of Combination Model

- (1)

- The model considers seven influencing factors, including lithium hydroxide price, lithium iron phosphate price, lithium manganese oxide price, lithium hexafluorophosphate price, CSI 300 Index, Shanghai Composite Index, and historical lithium carbonate prices. The output variable is the predicted lithium carbonate price. Before modeling, the dataset is divided into training (70%) and validation (30%) sets, and all data are normalized to ensure consistency.

- (2)

- Since lithium carbonate prices exhibit high volatility and non-stationarity, VMD (Variational Mode Decomposition) is applied only to lithium carbonate price data to decompose them into multiple Intrinsic Mode Functions (IMFs), which helps to extract key frequency components and reduce noise.

- (3)

- The input value of LSTM stores the data of the first lithium carbonate prices and the first (m + 1) influencing factors, while the output value outputs the predicted value of the lithium carbonate price at the (m − 1)-th moment.

- (4)

- Optimization parameters, such as the number of sparrows in the population and the boundary constraints for the circumstances to be improved, are set in the LSTM. Using the information given from the LSTM, the SSA constructs a matching sparrow population and calculates its ideal fitness value and position.

- (5)

- The parameter data from the SSA are used to determine the three optimal parameters for the LSTM model. The LSTM prediction model is reconstructed according to these optimal parameters. Next, the projected lithium carbonate prices are renormalized to generate the prediction curve.

3.3. Evaluation Index of Combination Model

4. Analysis of Lithium Carbonate Price Prediction in China

4.1. Descriptive Statistical Analysis

4.2. Variational Mode Decomposition

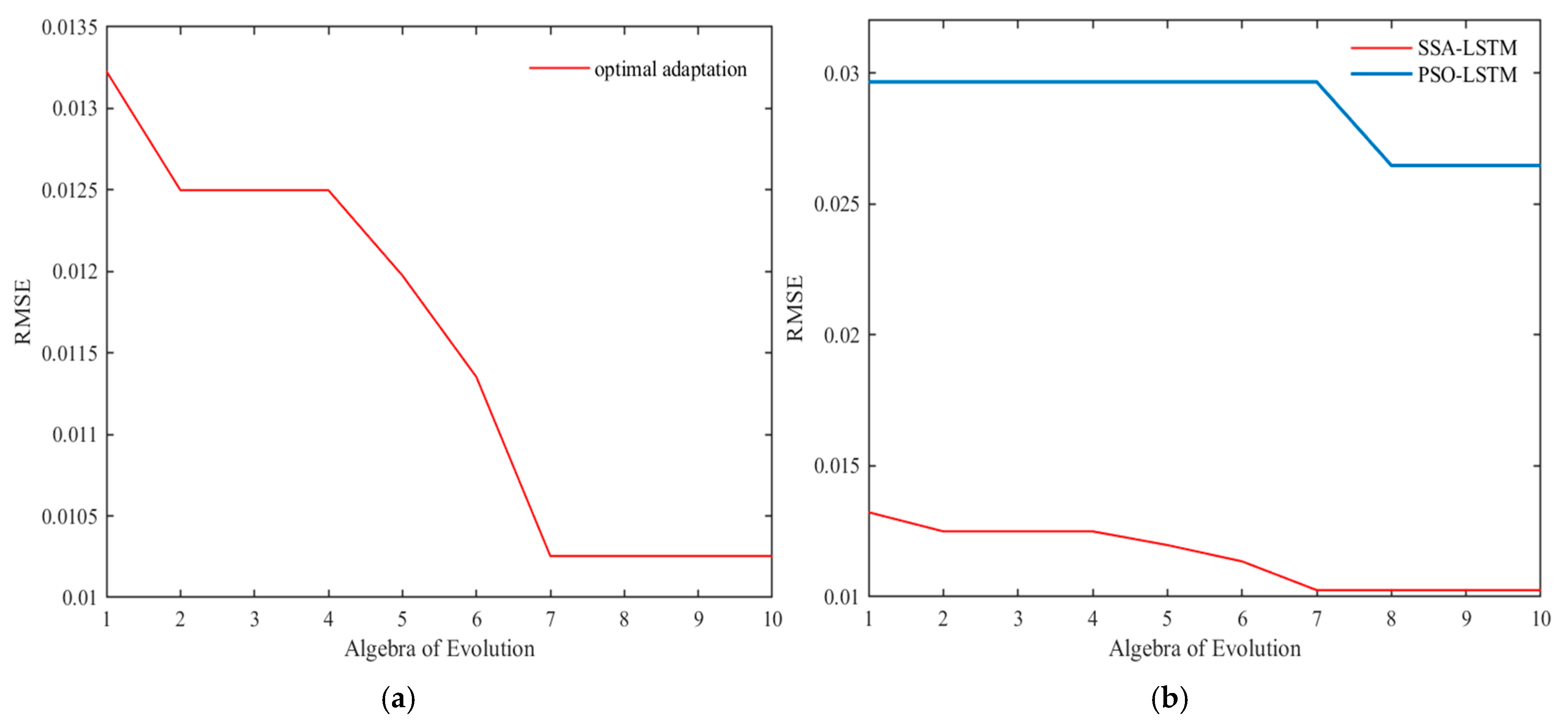

4.3. Parameter Optimization of LSTM

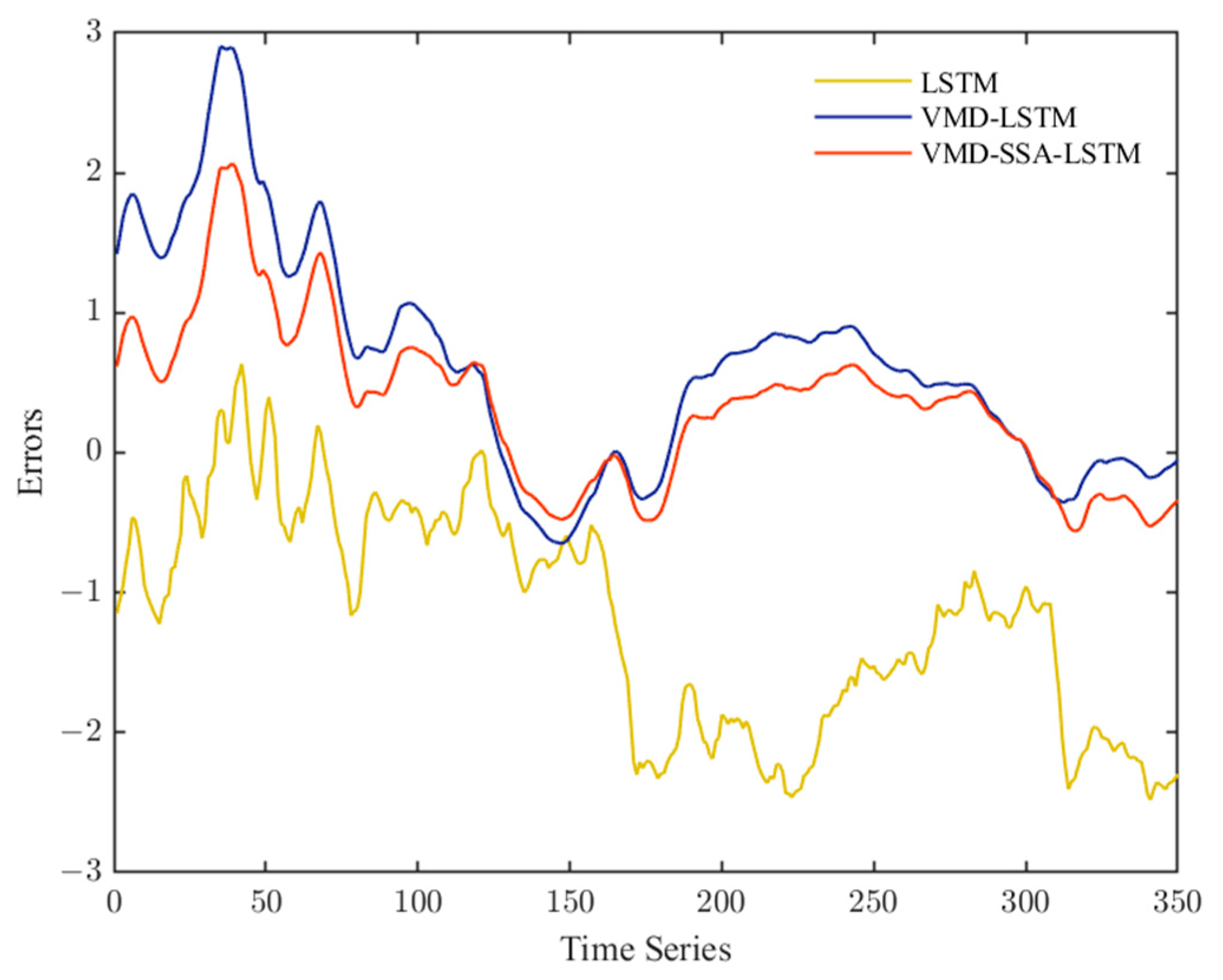

4.4. Further Analysis

- (1)

- Use the supply of lithium resources to further predict the price of lithium carbonate in 2025. The above analysis verified the advantages of this paper’s model in predicting the price of lithium carbonate. This paper predicts the trends in lithium carbonate price changes based on the above model and, combined with the current supply of lithium resources in the world, the situation can be further analyzed and the following information can be obtained: First, the world’s lithium resource reserves and supply is sufficient. In 2024, the world’s total supply of lithium resources is expected to be 1.33 million tonnes, the world’s total demand is expected to be 1.15 million tonnes; the world’s supply of lithium resources exceeds the demand for 180,000 tonnes. This will inevitably lead to a further decline in the price of lithium carbonate raw materials in 2025, which, in turn, will trigger a sustained decline in the price of lithium carbonate. Secondly, China’s lithium resources supply chain is complete. China is currently the world’s largest new energy vehicle market, and also has built a complete lithium resources supply chain system. This will effectively guarantee the effective supply of lithium resources and protect it against the impact of the external uncertainty environment. This further supports the idea that the price of lithium carbonate will generally be lower in 2025. These analyses also further illustrate the robustness of the forecast model presented above.

- (2)

- The price of lithium carbonate in 2025 can be further predicted based on cognitive biases under the effect of information asymmetry. In the process of constructing the above prediction model, it was found that the fluctuations in lithium carbonate prices are not only the result of the internal and external environment, but also a comprehensive reflection of the cognitive biases of different market participants. This indicates that the accurate prediction of lithium carbonate prices needs to be further analyzed in combination with the cognitive biases of different market participants. A specific analysis can be made of the information asymmetry caused by different market participants’ cognitive biases. Due to the development trend of the lithium carbonate industry and the fluctuations in the trading price, there is a large amount of information asymmetry. On the one hand, the industry’s market participants that make investment decisions, being misled by the past benefits of the rich historical market information that is available, may choose to continue to increase their investment, leading to the release of excessive production capacity. On the other hand, when the lithium carbonate industry suffers short-term losses, market participants’ decisions will also be based on their inherent empirical judgment; they may insist that the losses are short-lived adjustments, and that there will still be better investment returns later on. This would lead to a high lithium carbonate production capacity, resulting in the entire lithium carbonate industry being caught in a capacity trap from which it cannot extricate itself. This further indicates that the price of lithium carbonate in 2025 will not only show an overall low trend, but also may face more frequent fluctuations in the adjustment period.

- (3)

- The theory of herd behavior can be used to further predict the price of lithium carbonate in 2025. At present, although the lithium carbonate industry has been in a booming stage of development, investors outside the industry are still affected by herd behavior and blindly enter the lithium carbonate industry. Specific analysis shows that first, investors outside the lithium carbonate industry look at the development of new energy industry and believe it will bring huge dividends, choosing a swarm into this industry. This behavior is typical herd behavior. This suggests that investors outside the lithium carbonate industry not only lack the ability to think independently but also rely excessively on the decisions of others. Secondly, under the influence of information asymmetry, these investors ignore in-depth studies of the market and investment targets and, furthermore, ignore their own core business and risk control measures. This leads to a lack of scientific and rational investment decisions by investors outside the lithium carbonate industry, who instead blindly enter the lithium carbonate industry. As a result, due to the effects of herd behavior, the price of lithium carbonate in 2025 will be excessively volatile, further deviating from its true value and increasing the risk and uncertainty of the market. More seriously, under the continuous aggregation of herd behavior, there will be over-investment and investment mistakes in lithium carbonate enterprises, which will bring severe investment risks and financial difficulties.

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Peng, Z.; Yin, T.; Zhu, X.; Lu, X.; Li, X. Hybrid price prediction method combining TCN-BiGRU and attention mechanism for battery-grade lithium carbonate. Kybernetes 2024. [Google Scholar] [CrossRef]

- Pan, Z.; Guo, J. External Uncertainty and Raw Material Price in Energy Transition: Implications for Green. Renew. Energy 2025, 241, 122354. [Google Scholar] [CrossRef]

- Zhao, Z.; Zhang, W.; Cui, K.; Jin, S.; Liu, K.; Yang, S.; Lai, Y.; Chang, X. Multistage gradient crystallization study towards lithium carbonate crystal growth. Sep. Purif. Technol. 2025, 360, 130955. [Google Scholar] [CrossRef]

- Ebensperger, A.; Maxwell, P.; Moscoso, C. The lithium industry: Its recent evolution and future prospects. Resour. Policy 2005, 30, 218–231. [Google Scholar] [CrossRef]

- Ambrose, H.; Kendall, A. Understanding the future of lithium: Part 1, resource model. J. Ind. Ecol. 2020, 24, 80–89. [Google Scholar] [CrossRef]

- Bajolle, H.; Lagadic, M.; Louvet, N. The future of lithium-ion batteries: Exploring expert conceptions, market trends, and price scenarios. Energy Res. Soc. Sci. 2022, 93, 102850. [Google Scholar] [CrossRef]

- Zhang, X.; Chang, H.L.; Su, C.W.; Qin, M.; Umar, M. Exploring the dynamic interaction between geopolitical risks and lithium prices: A time-varying analysis. Resour. Policy 2024, 90, 104840. [Google Scholar] [CrossRef]

- Su, X.; Zhao, Y. Risk spillovers between Chinese new energy futures and carbon-intensive assets: Asymmetric effect, time–frequency dynamics, and portfolio strategies. North Am. J. Econ. Financ. 2025, 75, 102275. [Google Scholar] [CrossRef]

- Li, X.; Sengupta, T.; Mohammed, K.S.; Jamaani, F. Forecasting the lithium mineral resources prices in China: Evidence with Facebook Prophet (Fb-P) and Artificial Neural Networks (ANN) methods. Resour. Policy 2023, 82, 103580. [Google Scholar] [CrossRef]

- Sai, W.; Pan, Z.; Liu, S.; Jiao, Z.; Zhong, Z.; Miao, B.; Chan, S.H. Event-driven forecasting of wholesale electricity price and frequency regulation price using machine learning algorithms. Appl. Energy 2023, 352, 121989. [Google Scholar] [CrossRef]

- Ding, G.; Qin, L. Study on the prediction of stock price based on the associated network model of LSTM. Int. J. Mach. Learn. Cybern. 2020, 11, 1307–1317. [Google Scholar] [CrossRef]

- Jailani, N.L.M.; Dhanasegaran, J.K.; Alkawsi, G.; Alkahtani, A.A.; Phing, C.C.; Baashar, Y.; Capretz, L.F.; Al-Shetwi, A.Q.; Tiong, S.K. Investigating the power of LSTM-based models in solar energy forecasting. Processes 2023, 11, 1382. [Google Scholar] [CrossRef]

- Guo, F.; Deng, S.; Zheng, W.; Wen, A.; Du, J.; Huang, G.; Wang, R. Short-Term Electricity Price Forecasting Based on the Two-Layer VMD Decomposition Technique and SSA-LSTM. Energies 2022, 15, 8445. [Google Scholar] [CrossRef]

- Han, M.; Zhong, J.; Sang, P.; Liao, H.; Tan, A. A combined model incorporating improved SSA and LSTM algorithms for short-term load forecasting. Electronics 2022, 11, 1835. [Google Scholar] [CrossRef]

- Wang, K.; Fan, X.; Yang, X.; Zhou, Z. An AQI decomposition ensemble model based on SSA-LSTM using improved AMSSA-VMD decomposition reconstruction technique. Environ. Res. 2023, 232, 116365. [Google Scholar] [CrossRef]

- Wang, J.; Jiang, L.; Wang, L. Prediction of China’s Polysilicon Prices: A Combination Model Based on Variational Mode Decomposition, Sparrow Search Algorithm and Long Short-Term Memory. Mathematics 2024, 12, 3690. [Google Scholar] [CrossRef]

- Wang, J.; Zhang, D.; Huang, Q.; Cui, Z. Multiple-step accurate prediction of wave energy: A hybrid model based on quadratic decomposition, SSA and LSTM. Int. J. Green Energy 2025, 22, 100–123. [Google Scholar] [CrossRef]

- Dragomiretskiy, K.; Zosso, D. Variational mode decomposition. IEEE Trans. Signal Process. 2013, 62, 531–544. [Google Scholar] [CrossRef]

- Wu, J.; Hu, Y.; Wu, D.; Yang, Z. An aquatic product price forecast model using VMD-IBES-LSTM hybrid approach. Agriculture 2022, 12, 1185. [Google Scholar] [CrossRef]

- Liu, T.; Ma, X.; Li, S.; Zhang, C. A stock price prediction method based on meta-learning and variational mode decomposition. Knowl. Based Syst. 2022, 252, 109324. [Google Scholar] [CrossRef]

- Xue, J.; Shen, B. A novel swarm intelligence optimization approach: Sparrow search algorithm. Syst. Sci. Control Eng. 2020, 8, 22–34. [Google Scholar] [CrossRef]

- Awadallah, M.A.; Al-Betar, M.A.; Doush, I.A.; Makhadmeh, S.N.; Al-Naymat, G. Recent versions and applications of sparrow search algorithm. Arch. Comput. Methods Eng. 2023, 30, 2831–2858. [Google Scholar] [CrossRef] [PubMed]

- Hochreiter, S. Long Short-term Memory. In Neural Computation; MIT-Press: Cambridge, MA, USA, 1997. [Google Scholar]

- Bhandari, H.N.; Rimal, B.; Pokhrel, N.R.; Rimal, R.; Dahal, K.R.; Khatri, R.K. Predicting stock market index using LSTM. Mach. Learn. Appl. 2022, 9, 100320. [Google Scholar] [CrossRef]

- Wu, H.; Chen, S.; Ding, Y. Comparison of ARIMA and LSTM for Stock Price Prediction. Financ. Eng. Risk Manag. 2023, 6, 1–7. [Google Scholar]

- Mu, G.; Gao, N.; Wang, Y.; Dai, L. A stock price prediction model based on investor sentiment and optimized deep learning. IEEE Access 2023, 11, 51353–51367. [Google Scholar] [CrossRef]

- Liu, H.; Li, D.; Yuan, Y.; Zhang, S.; Zhao, H.; Deng, W. Fault diagnosis for a bearing rolling element using improved VMD and HT. Appl. Sci. 2019, 9, 1439. [Google Scholar] [CrossRef]

| Indicator | Variables | Data Sources |

|---|---|---|

| Related Product Prices | Lithium Hydroxide Price | Wind |

| Lithium Iron Phosphate Price | Wind | |

| Lithium Manganese Oxide Price | Wind | |

| Lithium Hexafluorophosphate Price | Wind | |

| Macroeconomic Indicators | CSI 300 Index | Shanghai Stock Exchange |

| Shanghai Composite Index | Shanghai Stock Exchange |

| VarName | Obs | Mean | SD | Min | Max | Skewness | Kurtosis |

|---|---|---|---|---|---|---|---|

| Lithium Hydroxide Price | 1182 | 19.90 | 16.97 | 4.80 | 56.02 | 0.92 | 2.27 |

| Lithium Iron Phosphate Price | 1182 | 7.82 | 4.84 | 3.25 | 17.70 | 0.86 | 2.15 |

| Lithium Manganese Oxide Price | 1182 | 3.63 | 2.19 | 1.18 | 8.58 | 0.99 | 2.93 |

| Lithium Hexafluorophosphate Price | 1182 | 19.97 | 15.77 | 5.42 | 59.00 | 1.15 | 3.18 |

| CSI 300 Index | 1182 | 4215.84 | 605.93 | 3159.25 | 5807.72 | 0.38 | 2.07 |

| Shanghai Composite Index | 1182 | 3224.03 | 236.23 | 2660.17 | 3715.37 | −0.06 | 2.14 |

| Lithium Carbonate Price | 1182 | 20.23 | 17.10 | 4.00 | 56.76 | 0.88 | 2.24 |

| Training Set | Testing Set | |||||||

|---|---|---|---|---|---|---|---|---|

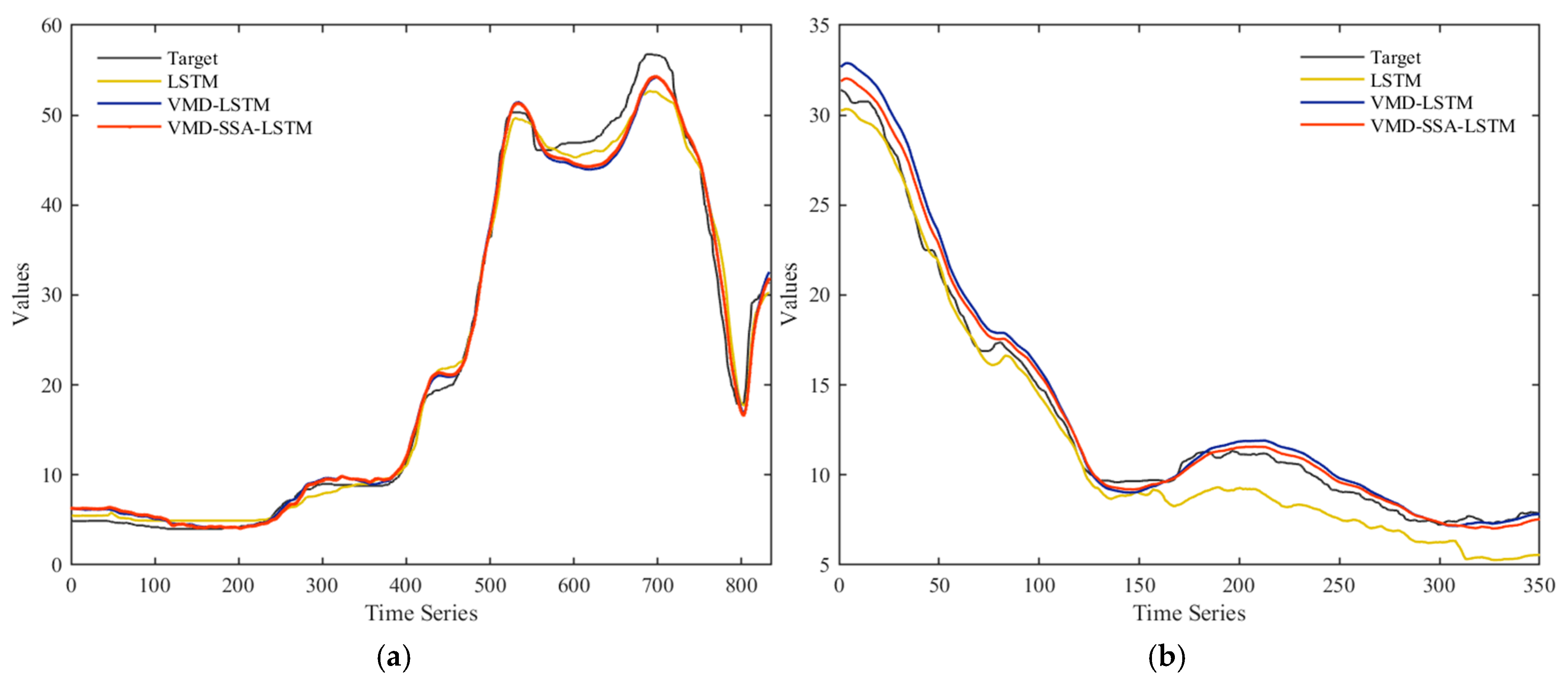

| Model | MAE | RMSE | MAPE% | R2 | MAE | RMSE | MAPE% | R2 |

| LSTM | 1.3467 | 1.8501 | 4.6514 | 0.9906 | 1.1976 | 1.4556 | 5.7504 | 0.9532 |

| VMD–LSTM | 1.3219 | 1.8305 | 4.9193 | 0.9908 | 0.6014 | 0.7657 | 4.5882 | 0.9870 |

| VMD–SSA–LSTM | 1.1527 | 1.5252 | 4.1266 | 0.9936 | 0.5614 | 0.7359 | 4.3568 | 0.9880 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, W.; Liu, H.; Jiang, L.; Wang, L. Prediction of Lithium Carbonate Prices in China Applying a VMD–SSA–LSTM Combined Model. Mathematics 2025, 13, 613. https://doi.org/10.3390/math13040613

Wang W, Liu H, Jiang L, Wang L. Prediction of Lithium Carbonate Prices in China Applying a VMD–SSA–LSTM Combined Model. Mathematics. 2025; 13(4):613. https://doi.org/10.3390/math13040613

Chicago/Turabian StyleWang, Wenyi, Haifei Liu, Lin Jiang, and Lei Wang. 2025. "Prediction of Lithium Carbonate Prices in China Applying a VMD–SSA–LSTM Combined Model" Mathematics 13, no. 4: 613. https://doi.org/10.3390/math13040613

APA StyleWang, W., Liu, H., Jiang, L., & Wang, L. (2025). Prediction of Lithium Carbonate Prices in China Applying a VMD–SSA–LSTM Combined Model. Mathematics, 13(4), 613. https://doi.org/10.3390/math13040613