1. Introduction

Product diversification is a prominent aspect of today’s business environment, which makes it more of a challenge to maintain an adequate supply of materials on hand to satisfy downstream customers. The costs of storing these materials include management, holding, and land costs as well as damage liability and risk, which decrease the profits of a company [

1]. However, insufficient product supply can lead to delays or extended delivery schedules and loss of many customers. When developing a market, effective inventory management strategies are essential to maximize profits.

The most pressing issue on every manager’s mind is determining exactly how much stock to order and when (also known as reorder point and reorder quantity). Although the more traditional economic order quantity (EOQ) model [

2] and the material requirement planning (MRP) method [

3] can be of help when facing these issues, the (

s,

S) policy [

4,

5,

6,

7,

8,

9,

10] and the Markov decision process (MDP) [

11,

12] have also been touted by many scholars as more modern and effective techniques for solving inventory management issues. These methods are all based on set parameters for the purpose of finding the optimal policy that minimizes costs and maximizes profits. The problem is that many scholars have based their analyses on mock data rather than actual data from real businesses [

13,

14,

15,

16,

17], resulting in a great disparity between theoretical results and practical applications of these methods [

18].

The issues of inventory management must be dealt with over a long period of time; [

11] however, the EOQ, MRP, and (

s,

S) policies for simplified optimal solutions are only able to meet short-term goals when faced with unpredictable levels of demand. When we look at the larger picture, we realize that only the MDP is able to adapt to changing circumstances and offer new policy recommendations to satisfy quarterly demands [

19]. This strategy has also been widely used to analyze complicated, long-term strategy issues in many diverse areas, including queuing theory [

20], inventory [

12], maintenance [

21], finance [

22], disease treatment [

23], and water reservoir maintenance [

24].

An analysis of Taiwan Industry Economics Services on April, 2014 [

25]) makes it clear that the overstocking of materials during a period of falling steel prices eroded the company’s profits. Global trends over the last two years have made it essential for the iron and steel industry to solve inventory management issues. Isotupa [

26] studied the critical elements of lead time and safety stock via probability distribution within set parameters by feeding data into the ARENA program and using probability distribution to interpret it. The surprising results revealed that regardless of the data used, the probability distribution (including the common index distributions) and the use of actual company data within set parameters highlights many modern inventory management issues.

We decided to further test this method by utilizing it to develop an optimal inventory policy. We obtained permission from a steel and iron manufacturer to gather inventory data including dates, initial inventory, sales figures, and ending inventory over a period of 216 weeks from January 2010 to February 2014. Numerous production processes and longer manufacturing times in the steel industry mean that orders are usually received up to six months in advance. This makes the sales volume more predictable and relatively stable, although actual delivery times might be affected. After utilizing the MDP to establish an optimal inventory policy, we then compared the results to those obtained via EOQ, MRP, and (s,S) policies.

In

Section 2, we introduce the MDP model and describe all the states, actions, and transition probabilities involved. In

Section 3, we discuss the company case study and outcome of each action. In

Section 4, we present the results of our analysis of the case study. Our conclusions and suggestions for future research are presented in

Section 5.

4. Results and Analysis

This section explains the optimal inventory policy calculated via the MDP-a policy that helps managers to minimize order quantities while still meeting quarterly demands. Results for comparison were calculated using the EOQ, MRP, and (s,S) models. In addition. the ABC analysis is an early simple method in the field of inventory management. It is also called the cycle counting method, which only defines the product classification method and does not specify the calculation of order quantity. On the other hand, this paper uses MDP method for analysis. In the case of most large-scale products (belonging to the A-type products), the company has to find the optimal policy for each period, which already contains the concept of ABC analysis. So, in this comparison of subsequent empirical analysis, the ABC method is not implemented for analyzing this value.

Table 4 shows the data from the steel company that were obtained using the EOQ model. The final optimal order quantity was calculated at

Q * = 7640.86, which would be enough to fill 15 orders.

The material requirement planning (MRP) model, based on the traditional order point system, categorizes materials into bills of material (BOM) according to their structure and demand. It then uses this information to increase the efficiency of the manufacturing process. Put simply, the purpose of the MRP is to implement demand-based ordering of materials.

The (

s,

S) policy model is also commonly used in inventory control investigations for determining reorder points and quantities by defining minimum and maximum inventory quantities.

Table 5 shows the calculations which provided the optimal inventory maximum and minimum limits of

s = 27,271.7 and

S = 28,211.5 in kilograms.

Table 6 shows the optimal policy as calculated using the MDP. The data show that actions 2 and 3 are optimal if inventory levels are similar to state 1; however, action 1 is optimal only if inventory levels are similar to state 10. The other states are best calculated using a combination of actions 1 and 2. The actual data show that inventory levels at week 113 were similar to state 9 and levels at week 165 were most similar to state 4, making this the optimal policy to handle these individual differences.

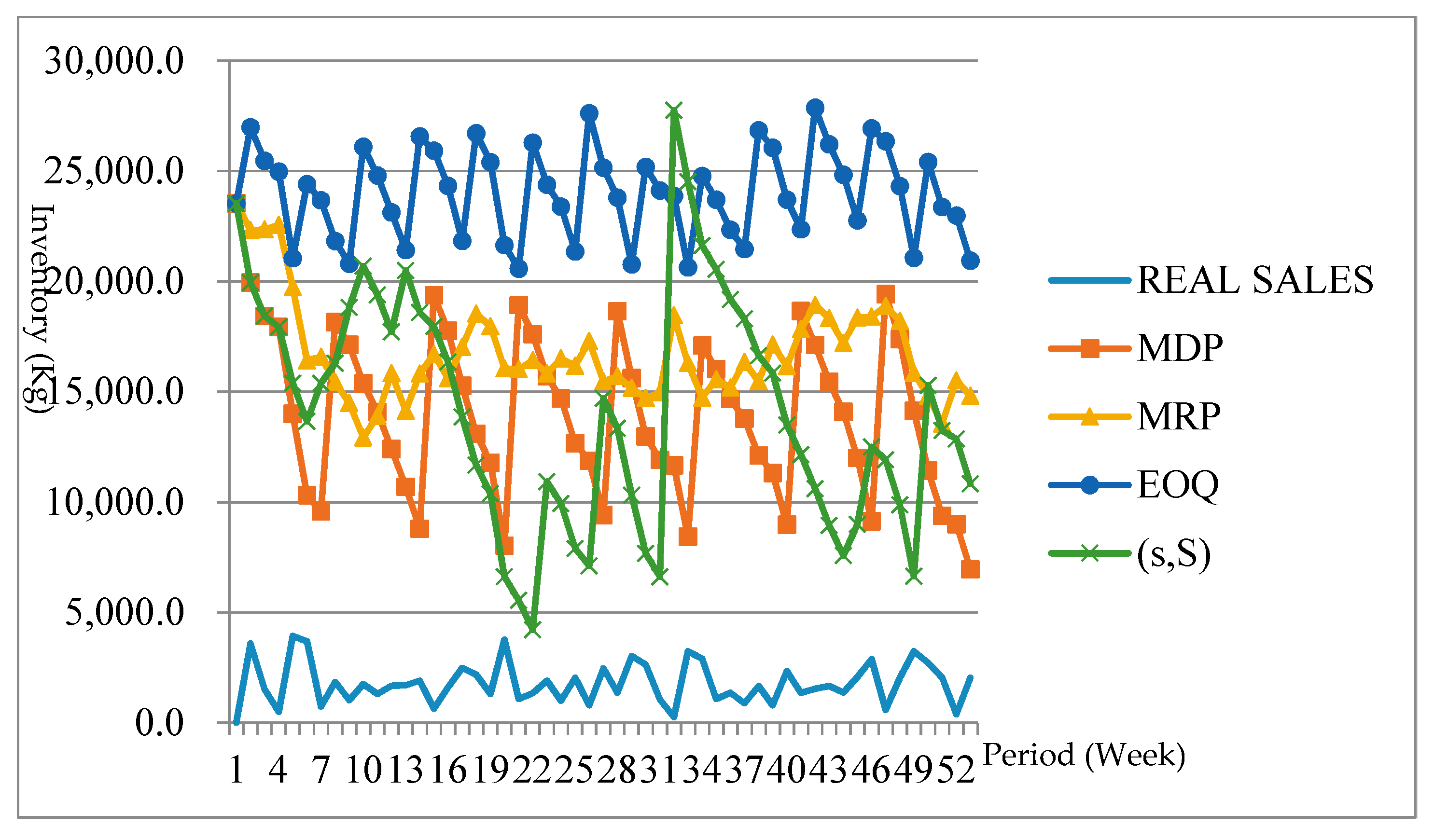

A comparison of each inventory control method using inventory and sales information for weeks 113 through 164 showed that only the (

s,

S) policy and MDP could be used to effectively manage inventory quantities; however, use of the (

s,

S) policy occasionally led to inventory shortages (see

Figure 1). As such, in the face of ever-changing demand this policy proved to be more precise than either the EOQ or MRP. However, it was more effective for short-term intervals because over the course of an entire year, its single minimum and maximum values become inaccurate. This means that the MDP was more effective for creating a flexible policy able to adapt to changes in demand at different times with no inventory shortages.

In order to verify the effectiveness of the results discussed in the previous section, we applied the policy to the 52 weeks of data from week 165 to 216.

Figure 2 shows that all four models were able to effectively reduce inventory levels during this period without shortages. However, the differences between each inventory control method become clear when actual ending inventory figures were removed from the equation (as shown in

Figure 3). Demand was relatively stable throughout the year, resulting in more accurate results across the board for each model; however, even under these optimal circumstances, the (

s,

S) and MDP models produced more useful results than the others. It must be noted that fluctuations were greater with (

s,

S) than MDP, making MDP the better choice for creating an optimal inventory control policy. We believe that more useful results could be obtained if more actions were added to the MDP model for future analyses.

Based on our results, we suggest that inventory managers determine the quantity of materials ordered based on long-term trends from six months to a year ahead. This will be far more effective for long-term success than simply considering the current inventory level over a week or a month. If decisions are made based on the current inventory only, this may cause a decrease in the inventory level, which may cause the company to suffer supply shortages. This may lead to huge compensation claims for late deliveries and irreparable damage to the company’s reputation.

It is also recommended that purchases be made more frequently. Stock inspections should be carried out regularly and orders placed once a week. If the quantity of purchases can be split up, inventory level reduction can be achieved. Multiple orders result in wasted manpower and extra cost. Therefore, the company may coordinate with the supplier to maintain one-time orders that are delivered in batches to avoid everything being delivered at once. The optimum strategy obtained from MDP analysis may serve as a reference for delivery quantities. However, when the results of this study are actually applied, recalculating the settings of MDP such as the transaction probability based on actual situations and values would be necessary, which is also a limitation of this paper.

5. Conclusions

We utilized the Markov decision process to investigate the optimal inventory policy for the iron and steel industry. Actual data from a company were used to analyze three different policy actions with low, medium, and high ordering quantities, with a focus on safety stock. Subsequent tests and simulations were used to validate the effectiveness of the optimal inventory policy and its ability to minimize costs. We found that when a company requires medium-to-low ordering criteria (as seen in actions 1 and 2), it was able to meet quarterly demand without shortages, which effectively reduced inventory quantity and released capital for other uses.

The MDP was able to offer flexible optimal policy options for each inventory state. We found that of all the methods tested, it was the most appropriate for analyzing inventory management issues. In addition, most previous research on the Markov decision-making process involved the use of probability distribution models to test hypotheses [

39,

40]. Several probability distribution models were used to calculate the transition probability matrix and construct an optimum inventory strategy. However, when changes in actual inventory level do not comply with specific probability distributions, the reliability of the strategy is called into question. This study is based on the actual production data of the enterprise. It is the most appropriate to describe the real situation of the case company based on the change of the inventory level in the different periods. Also, in the past, researchers have mostly focused on the retail [

12] or logistics industries [

41], while analyses of the steel industry remain scarce. The main reason for this was the difficulty of acquiring data. At the same time, one must keep in mind that the data characteristics of various industries are not the same.

The use of actual business data in this study made it clear that the inventory management policy can be improved, and further investigation showed that the main responsibility of purchasers is to prevent inventory shortages. Large quantities of material are purchased at one time to increase the flow of operations, while repurchases are made only once the inventory quantity falls below a certain level (determined by experience), as seen in

Figure A1 and

Figure A2.

In conclusion, based on the results of the study, we recommend that the company we studied change its purchasing quantity and frequency from a “large quantity low frequency” model to a “high frequency average quantity” model in order to greatly reduce current inventory levels. Additional data and study will allow for more effective analyses in the future and provide more contemporary and precise policy recommendations, which will allow company executives to better customize policies in response to unstable demand.