The Effect of O2O Retail Service Quality in Supply Chain Management

Abstract

1. Introduction

Gaps in the Literature

2. Literature Review

2.1. O2O Retail Supply Chain System

2.2. Quality- and Price-Dependent Demand

2.3. Unreliable Supply Chain

2.4. Lead Time Reduction

2.5. Service Level Improvement

3. Problem Definition, Notation, and Assumptions

3.1. Problem Definition

3.2. Notation

| Index | |

| x | minimum duration lead time component |

| y | normal duration lead time component |

| Decision Variables | |

| volume of each shipment (unit) | |

| safety factor ($/week) | |

| lead time (weeks) | |

| product selling-price ($/unit) | |

| back-order price discount per item offered by vendor ($/unit) | |

| quality upgradation variable | |

| probability to go to the out-of-control state | |

| ordering cost for the buyer ($/unit) | |

| s | service level |

| Parameters | |

| m | number of product shipments per lot (a positive integer) |

| lot size (units) | |

| demand quantity, (units) | |

| demand rate of buyer, (units) | |

| production rate of vendor, (units/time) | |

| cycle time, (time) | |

| inventory holding cost per unit per unit time ($/unit/unit time) | |

| vendor’s unit production cost per unit ($/unit) | |

| buyer’s unit purchase cost per unit ($/unit purchased) | |

| unit shortage cost per unit ($/unit shortage) | |

| quality improvement cost ($/unit) | |

| setup cost () reduction investment ($) | |

| initial setup cost per production run ($/setup) | |

| setup cost, which is necessarily a decreasing function of , | |

| with , where r is a parameter ($/unit) | |

| minimum quality for the acceptance of the finished product | |

| product quality of the perfect product | |

| q | quality ordered by buyer |

| cost to make a product with quality q ($/unit) | |

| standard normal probability density function | |

| annual fractional cost for the capital investment ($/investment) | |

| service level constant | |

| price elasticity parameter | |

| back-order ratio, | |

| upper bound of the back-order ratio | |

| deterioration rate, which follows a certain distribution | |

| standard normal cumulative distribution function | |

| M | maximum available service (unit) |

| constant related to service level | |

| parameter for improving the quality of the product | |

| collection rate of imperfect products in per cycle | |

| total number of consumers under lead time L | |

| total amount purchased by time L | |

| total crashing cost is related to the lead time ($/week) | |

| component of lead time, with as minimum duration (days) | |

| component of lead time, with as normal duration (days) | |

| fixed carbon emission cost of consumer ($/shipment) | |

| variable carbon emission cost of consumer ($/unit) | |

| fixed carbon emission cost of vendor ($/shipment) | |

| variable carbon emission cost of vendor ($/unit) | |

| fixed transportation cost ($/shipment) | |

| variable transportation cost ($/unit) | |

| total cost component of buyer ($/cycle) | |

| total cost component of vendor ($/cycle) |

3.3. Assumptions

- This paper deals with a single-buyer single-vendor supply chain model in the presence of an O2O environment with a single type of item, where service is upgraded through O2O channeling.

- The total number of consumers, , follows a Poisson distribution during the lead time with mean . The are independent and normally distributed with mean and standard deviation , while is a compound Poisson process (Huang et al. [33]).

- Most researchers consider a constant setup cost to formulate their production or supply chain models; however, using a continuous investment in setup can reduced the total setup cost, which can also improve the service that is provided by the companies to their customers (see, e.g., Sarkar and Moon [35]). It is not necessary to invest continuously to reduce the total setup cost for each step, though, which is why discrete investment is sometimes more beneficial to reduce the setup cost and improve the quality of service provided to customers. Thus, a discrete function is utilized to reduce the setup cost and improve the service of the total supply chain (see, e.g., Huang et al. [33]); specifically, where and

- Reduction of lead time is another component leading to service improvements. Different crashing costs associated with reducing the lead time for different mutually independent components are considered in this model. Let be the normal duration of the component and be the minimum duration, where the crashing costs per unit time satisfy Suppose that is the length of the lead time for which components crash to their minimum duration and let . Then, and the crashing cost can be written as for [38].

- The backorder ratio is considered as a variable which is proportional to the back-order price discount offered by the supplier. As is the back-order rate and a price discount is considered on the back-order, it is assumed that , , and , where is the price discount during the maximum of back-order and is the marginal profit per unit. The supplier makes decisions in order to obtain profits. Therefore, if the back-order price discount is greater than the marginal profit , the vendor may decide against offering the price discount (see, e.g., Pan et al. [51] and Lin [52]).

- The buyer’s demand for a particular product is , with minimum quality q, and the vendor has committed to deliver all demanded products with quality q, which the vendor has charged the buyer for; however, the vendor produces an item with quality , where . At the time of delivery of the product, the vendor delivers a lesser quality product but the charge was the same as that which was charged for the product of quality q.

- A single-setup multi-delivery (SSMD) policy is adopted for transportation in this model. The vendor produces the products in a single lot and transports them in a multi-delivery process. The main reason for adopting the SSMD policy is that this policy makes the supply chain model more in line with an O2O environment. As multiple delivery was used, this increases the number of deliveries as well as the transportation cost. Thus, there is a trade-off between the buyer’s holding cost and the increased transportation cost. For transportation, variable and fixed transportation costs, as well as carbon emission costs, are considered, in order to make the model more sustainable.

- The safety stock and the sum of the expected demand during the lead time measures the re-order point (i.e., ). To make the model more sustainable, demand is considered to be dependent on quality as well as the selling price of products and service of the vendor; more specifically, .

- To order something, the buyer incurs a cost which is known as the ordering cost. Continuous investment can reduce the ordering cost and increase the total profit of the system. When a production system goes through a long-run process, due to different issues, it may move from an “in-control” to “out-of-control” state and may produce defective items. Thus, an improvement in process quality is required, which is incorporated into the model along with reduced ordering cost, which improves the service provided to the customers.

- Fully back-ordered shortages are permitted.

4. Mathematical Model

4.1. Buyer’s Profit

4.2. Vendor’s Profit

5. Solution Methodology

6. Numerical Experiment

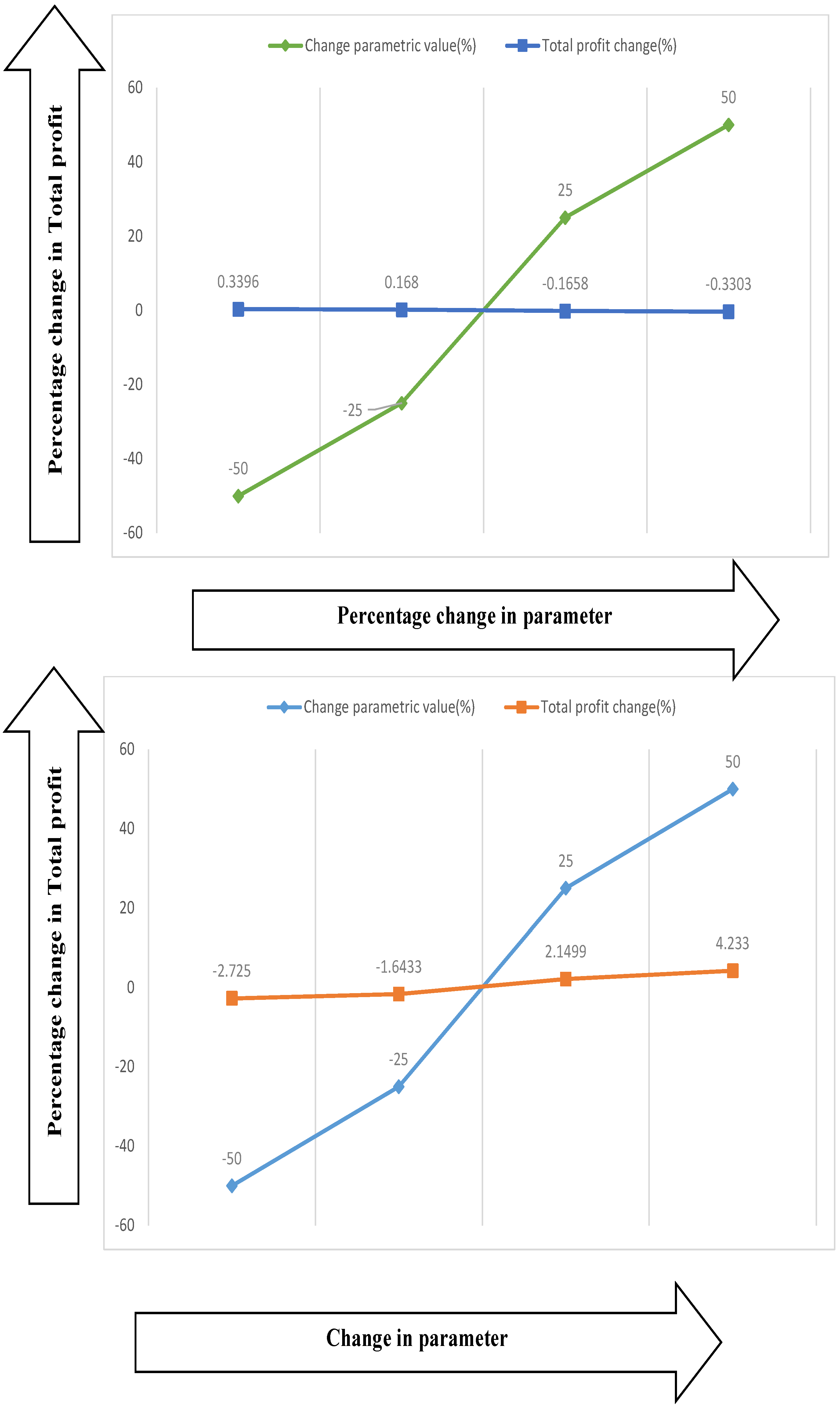

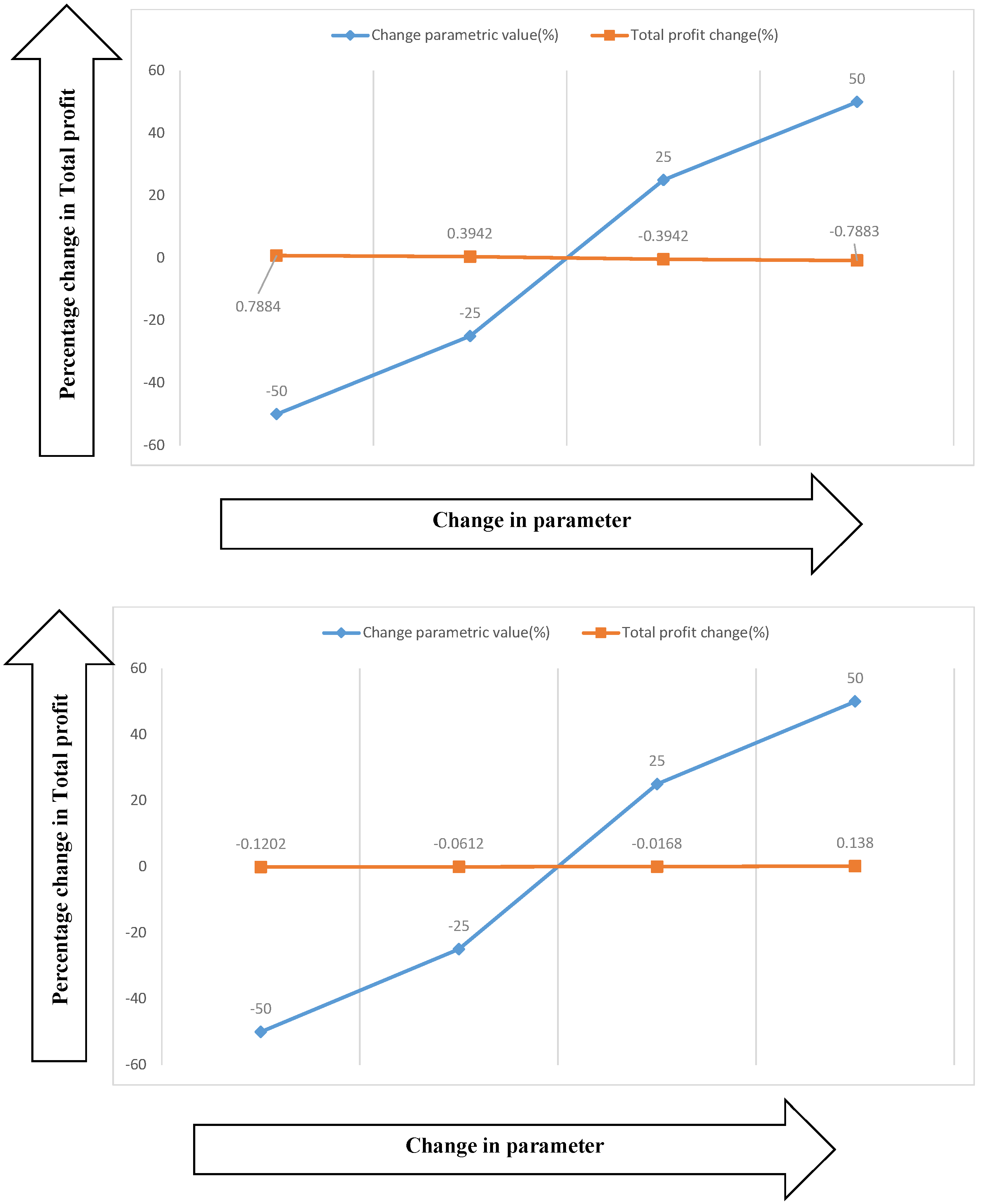

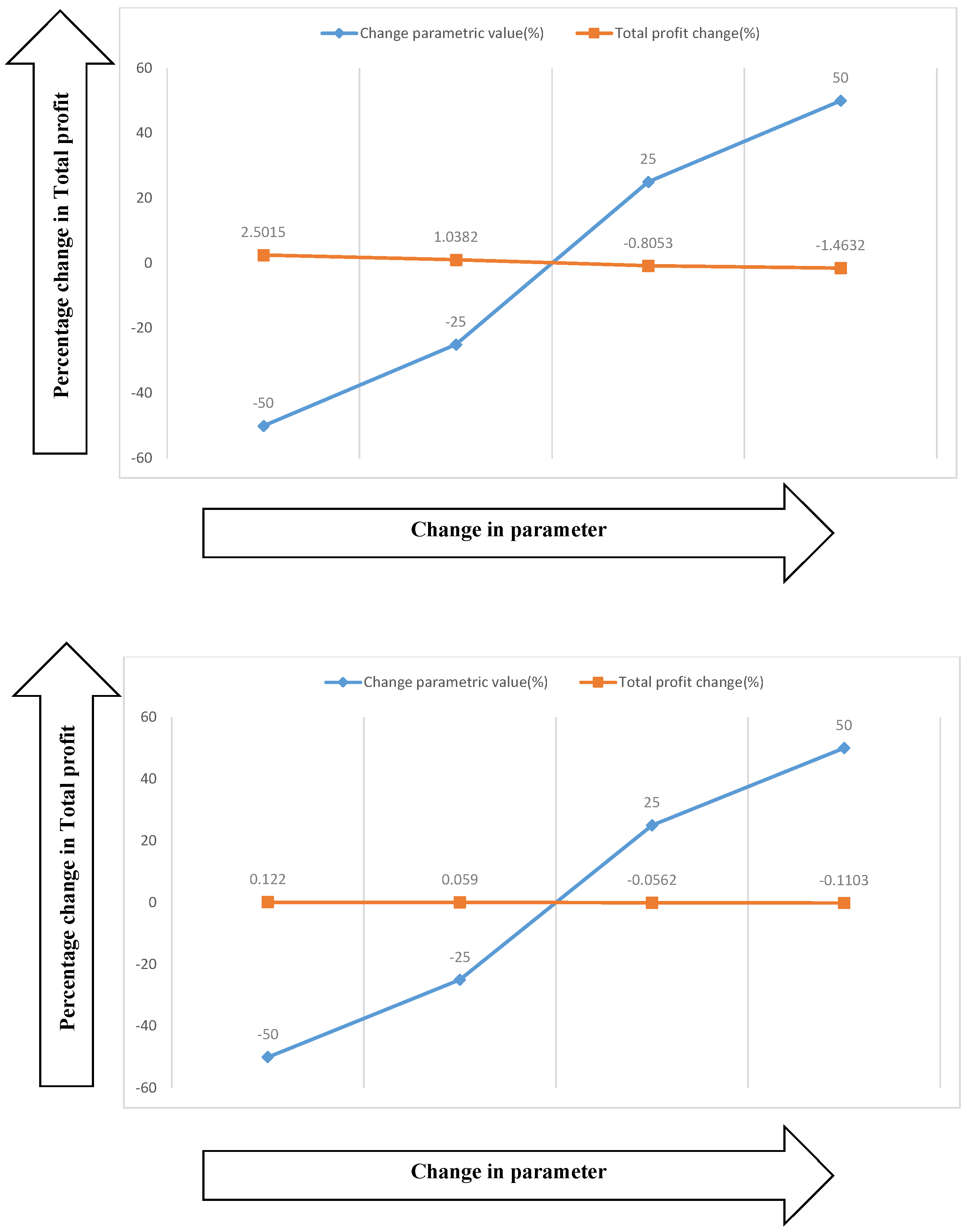

7. Sensitivity Analysis

- (i)

- The initial ordering cost and service are more sensitive in this supply chain model (i.e., in the presence of an O2O environment). It is quite natural that the best service always provides more profit, which can be seen in the sensitivity table.

- (ii)

- When providing good service, holding and production costs are less sensitive in this supply chain model.

- (iii)

- Considering the environmental issue, fixed and variable carbon emissions costs also have an effect on the total profit.

- (iv)

- The quality ordered by the buyer also has an effect on the total profit.

- (v)

- The effect of the vendor production rate is almost negligible.

- (vi)

- All other parameters only have a small effect on the total system profit.

8. Managerial Insights

- (i)

- We consider SCM in the presence of an unreliable vendor and O2O environment, where joint total profit of the supply chain is optimized along with the optimized values of service, quality of the products, shipment size, lead time period, backorder price discount, safety factor, selling price, ordering cost for the buyer, and probability to transfer the production process from an “in-control” to “out-of-control” state.

- (ii)

- We developed this supply chain model in the presence of an unreliable vendor, where unreliability occurs in quality of the product. Furthermore, the online-to-offline concept is adopted and the best service is provided to the customers.

- (iii)

- This is a integrated supply chain model, in which the effect of carbon emissions is also considered. Thus, the proposed model is much more effective for the modern, earth-conscious business environment; further, customers obtain upgraded service from the vendor.

- (iv)

- The ordering and setup costs of the supply chain system can be reduced through continuous investment, which improves the service of the total SCM and also makes this model more sustainable. The process quality is also improved by investment, which has a great impact on the total joint expected profit of the supply chain, as well as on the service provided by the vendor.

- (v)

- The quality of any product plays a major role in increasing demand for the product. To maintain the brand image of the company and optimize the total profit, quality upgrading is considered in this study. Better service is provided to the customers along with a better quality product. This concept should be gladly accepted by any industry, in order to optimize their profit.

- (vi)

- Service for any particular item cannot be infinite. Any company has a maximum capability to provide services to their customers. The result of this model were more appropriate, due to consideration of a service constraint, which should be considered a very effective concept in any industry.

- (vii)

- Lead time and shortages create a bad image for any company, as well as affecting the service provided by the company to its customers. In the proposed model, the lead time period and safety factor are optimized along with various other decision variables, thus providing better service and making the model more sustainable. Moreover, the lead time was shown to be reduced, which is beneficial for any industry.

9. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

References

- Visser, J.; Nemoto, T.; Browne, M. Home Delivery and the Impacts on Urban Freight Transport: A Review. Procedia-Soc. Behav. Sci. 2014, 125, 15–27. [Google Scholar] [CrossRef]

- Xiao, S.; Dong, M. Hidden semi-Markov model-based reputation management system for online to offline (O2O) e-commerce markets. Decis. Support Syst. 2015, 77, 87–99. [Google Scholar] [CrossRef]

- He, Z.; Cheng, T.E.C.; Dong, J.; Wang, S. Evolutionary location and pricing strategies for service merchants in competitive O2O markets. Eur. J. Oper. Res. 2016, 254, 595–609. [Google Scholar] [CrossRef]

- Li, X.; Li, Y.; Cao, W. Cooperative advertising models in O2O supply chains. Int. J. Prod. Econ. 2019, 215, 144–152. [Google Scholar] [CrossRef]

- Choi, T.M.; Chen, Y.; Chung, S.H. Online-offline fashion franchising supply chains without channel conflicts: Choices on postponement and contracts. Int. J. Prod. Econ. 2019, 215, 174–184. [Google Scholar] [CrossRef]

- Yan, R.; Pei, Z. Return policies and O2O coordination in the e-tailing age. J. Retail. Consum. Serv. 2019, 50, 314–321. [Google Scholar] [CrossRef]

- Yan, R.; Pei, Z.; Ghose, S. Reward points, profit sharing, and valuable coordination mechanism in the O2O era. Int. J. Prod. Econ. 2019, 215, 34–47. [Google Scholar] [CrossRef]

- Yuchen, P.; Desheng, W.; Luo, C.; Alexandre, D. User activity measurement in rating-based online-to-offline (O2O) service recommendation. Inf. Sci. 2019, 479, 180–196. [Google Scholar] [CrossRef]

- Zand, F.; Yaghoubi, S.; Sadjadi, S.J. Impacts of government direct limitation on pricing, greening activities and recycling management in an online to offline closed loop supply chain. J. Clean. Prod. 2019, 215, 1327–1340. [Google Scholar] [CrossRef]

- Vareda, J. Access regulation and the incumbent investment in quality-upgrades and in cost-reduction. Telecommun. Policy 2010, 34, 697–710. [Google Scholar] [CrossRef]

- Dhargalkar, K.; Shinde, K.; Arora, Y. A universal new product development and upgradation framework. J. Innov. Entrep. 2016, 5, 1–16. [Google Scholar] [CrossRef]

- Aziz, N.A.; Wahab, D.A.; Ramil, R.; Azhari, C.H. Modelling and optimisation of upgradability in the design of multiple life cycle products: A critical review. J. Clean. Prod. 2016, 112, 282–290. [Google Scholar] [CrossRef]

- Sarkar, B.; Majumder, A.; Sarkar, M.; Dey, B.K.; Roy, G. Two-echelon supply chain model with manufacturing quality improvement and setup cost reduction. J. Ind. Manag. Optim. 2017, 13, 1085–1104. [Google Scholar] [CrossRef]

- Sarkar, B.; Ullah, M.; Kim, N. Environmental and economic assessment of closed-loop supply chain with remanufacturing and returnable transport items. Comput. Ind. Eng. 2017, 111, 148–163. [Google Scholar] [CrossRef]

- Dey, B.K.; Pareek, S.; Tayyab, M.; Sarkar, B. Autonomation policy to control work-inprocess inventory in a smart production system. Int. J. Prod. Res. 2020, in press. [Google Scholar] [CrossRef]

- Chiou, J.S.; Wu, L.Y.; Chuang, M.C. Antecedents of retailer loyalty: Simultaneously investigating channel push and consumer pull effects. J. Bus. Res. 2010, 63, 431–438. [Google Scholar] [CrossRef]

- Li, J.; Wang, S.; Cheng, T.C.E. Competition and cooperation in a single-retailer two-supplier supply chain with supply disruption. Int. J. Prod. Econ. 2010, 124, 137–150. [Google Scholar] [CrossRef]

- Wu, Y.; Dong, M.; Fan, T.; Liu, S. Performance evaluation of supply chain networks with assembly structure under system disruptions. Comput. Oper. Res. 2012, 39, 3229–3243. [Google Scholar] [CrossRef]

- Pal, B.; Sana, S.S.; Chaudhuri, K. Joint pricing and ordering policy for two echelon imperfect production inventory model with two cycles. Int. J. Prod. Econ. 2014, 155, 229–238. [Google Scholar] [CrossRef]

- Hlioui, R.; Gharbi, A.; Hajji, A. Joint supplier selection, production and replenishment of an unreliable manufacturing-oriented supply chain. Int. J. Prod. Econ. 2017, 187, 53–67. [Google Scholar] [CrossRef]

- Sarkar, B. A production-inventory model with probabilistic deterioration in two-echelon supply chain management. Appl. Math. Model. 2013, 37, 3138–3151. [Google Scholar] [CrossRef]

- Goyal, S.K. An integrated inventory model for a single supplier-single customer problem. Int. J. Prod. Res. 1977, 15, 107–111. [Google Scholar] [CrossRef]

- Banarjee, A. A joint economic-lot-size model for purchaser and vendor. Decis. Sci. 1986, 17, 29–311. [Google Scholar] [CrossRef]

- Goyal, S.K. A joint economic-lot-size model for purchaser and vendor: A comment. Decis. Sci. 1988, 19, 223–241. [Google Scholar] [CrossRef]

- Ha, D.; Kim, S.L. Implementation of JIT purchasing: An integrated approach. Prod. Plan. Control 1997, 8, 152–157. [Google Scholar] [CrossRef]

- Cárdenas-Barrón, L.E.; Sana, S.S. A production-inventory model for a two-echelon supply chain when demand is dependent on sales teams’ initiatives. Int. J. Prod. Econ. 2014, 155, 249–258. [Google Scholar] [CrossRef]

- Liao, C.J.; Shyu, C.H. An Analytical Determination of Lead Time with Normal Demand. Int. J. Oper. Prod. Manag. 1991, 11, 72–78. [Google Scholar] [CrossRef]

- Ben-Daya, M.; Raouf, A. Inventory Models Involving Lead Time as a Decision Variable. J. Oper. Res. Soc. 1994, 45, 579–582. [Google Scholar] [CrossRef]

- Ouyang, L.Y.; Yeh, N.C.; Wu, K.S. Mixture inventory model with backorders and lost sales for variable lead time. J. Oper. Res. Soc. 1996, 47, 829–832. [Google Scholar] [CrossRef]

- Ouyang, L.Y.; Chen, C.K.; Chang, H.C. Quality improvement, setup cost and lead-time reductions in lot size reorder point models with an imperfect production process. Comput. Oper. Res. 2002, 29, 1701–1717. [Google Scholar] [CrossRef]

- Chang, C.T.; Lo, T.Y. On the inventory model with continuous and discrete lead time, backorders and lost sales. Appl. Math. Mod. 2009, 33, 2196–2206. [Google Scholar] [CrossRef]

- Annadurai, K.; Uthayakumar, R. Reducing lost-sales rate in (T, R, L) inventory model with controllable lead time. Appl. Math. Model. 2010, 34, 3465–3477. [Google Scholar] [CrossRef]

- Huang, C.K.; Cheng, T.L.; Kao, T.C.; Goyal, S.K. An integrated inventory model involving manufacturing setup cost reduction in compound poisson process. Int. J. Prod. Res. 2010, 49, 1219–1228. [Google Scholar] [CrossRef]

- Sarkar, B.; Majumder, A. Integrated vendor–buyer supply chain model with vendor’s setup cost reduction. Appl. Math. Comput. 2013, 224, 362–371. [Google Scholar] [CrossRef]

- Sarkar, B.; Moon, I. Improved quality, setup cost reduction, and variable backorder costs in an imperfect production process. Int. J. Prod. Econ. 2014, 155, 204–213. [Google Scholar] [CrossRef]

- Majumder, A.; Jaggi, C.K.; Sarkar, B. A multi-retailer supply chain model with backorder and variable production cost. RAIOR-Oper. Res. 2018, 52, 943–954. [Google Scholar] [CrossRef]

- Majumder, A.; Guchhait, R.; Sarkar, B. Manufacturing quality improvement and setup cost reduction in a vendor-buyer supply chain model. Eur. J. Ind. Eng. 2017, 11, 588–612. [Google Scholar] [CrossRef]

- Dey, B.K.; Sarkar, B.; Sarkar, M.; Pareek, S. An integrated inventory model involving discrete setup cost reduction, variable safety factor, selling-price dependent demand, and investment. RAIRO-Oper. Res. 2019, 53, 39–57. [Google Scholar] [CrossRef]

- Chen, F.Y.; Krass, D. Inventory models with minimal service level constraints. Eur. J. Oper. Res. 2001, 134, 120–140. [Google Scholar] [CrossRef]

- Hwang, H.S. Design of supply-chain logistics system considering service level. Comput. Ind. Eng. 2002, 43, 283–297. [Google Scholar] [CrossRef]

- Chiu, S.W.; Ting, C.K.; Chiu, Y.S.P. Optimal production lot sizing with rework, scrap rate, and service level constraint. Math. Comput. Model. 2007, 46, 535–549. [Google Scholar] [CrossRef]

- Jodlbauer, H.; Reitner, S. Optimizing service-level and relevant cost for a stochastic multi-item cyclic production system. Int. J. Prod. Econ. 2012, 136, 306–317. [Google Scholar] [CrossRef]

- Moon, I.; Shin, E.; Sarkar, B. Min–max distribution free continuous-review model with a service level constraint and variable lead time. Appl. Math. Comput. 2014, 229, 310–315. [Google Scholar] [CrossRef]

- Sarkar, B.; Ganguly, B.; Sarkar, M.; Pareek, S. Effect of variable transportation and carbon emission in a three-echelon supply chain model. Transp. Res. Part e-Logist. Transp. Rev. 2016, 91, 112–128. [Google Scholar] [CrossRef]

- Sarkar, B.; Saren, S.; Sarkar, M.; Seo, Y.W. A Stackelberg Game Approach in an Integrated Inventory Model with Carbon-Emission and Setup Cost Reduction. Sustainability 2016, 8, 1244. [Google Scholar] [CrossRef]

- Tayyab, M.; Sarkar, B. Optimal batch quantity in a cleaner multi-stage lean production system with random defective rate. J. Clean. Prod. 2016, 139, 922–934. [Google Scholar] [CrossRef]

- Kim, M.S.; Sarkar, B. Multi-stage cleaner production process with quality improvement and lead time dependent ordering cost. J. Clean. Prod. 2017, 144, 572–590. [Google Scholar] [CrossRef]

- Omair, M.; Sarkar, B.; Cárdenas-Barrón, L.E. Minimum Quantity Lubrication and Carbon Footprint: A Step towards Sustainability. Sustainability 2017, 9, 714. [Google Scholar] [CrossRef]

- Sarkar, B.; Ahmed, W.; Kim, N. Joint effects of variable carbon emission cost and multi-delay-in-payments under single-setup-multiple-delivery policy in a global sustainable supply chain. J. Clean. Prod. 2018, 185, 421–445. [Google Scholar] [CrossRef]

- Ahmed, W.; Sarkar, B. Impact of carbon emissions in a sustainable supply chain management for a second generation biofuel. J. Clean. Prod. 2018, 186, 807–820. [Google Scholar] [CrossRef]

- Pan, J.; Lo, M.C.; Hsiao, Y.C. Optimal reorder point inventory models withvariable lead time and backorder discount considerations. Eur. J. Oper. Res. 2004, 158, 488–505. [Google Scholar] [CrossRef]

- Lin, Y.J. Minimax distribution free procedure with backorder price discount. Int. J. Prod. Econ. 2008, 111, 118–128. [Google Scholar] [CrossRef]

- Ullah, M.; Sarkar, B. Recovery-channel selection in a hybrid manufacturing-remanufacturing production model with RFID and product quality. Int. J. Prod. Econ. 2020, 219, 360–374. [Google Scholar] [CrossRef]

- Sarkar, M.; Pan, L.; Dey, B.K.; Sarkar, B. Does the autonomation policy really help in a smart production system for controlling defective production? Mathematics 2020, 8, 1142. [Google Scholar] [CrossRef]

- Sarkar, B.; Dey, B.K.; Sarkar, M.; Hur, S.; Mandal, B.; Dhaka, V. Optimal replenishment decision for retailer with variable demand for deteriorating products under trade-credit policy. RAIRO-Oper. Res. 2020, in press. [Google Scholar] [CrossRef]

- Sarkar, B.; Sarkar, M.; Ganguly, B.; Cárdenas-Barrón, L.E. Combined effects of carbon emission and production quality improvement for fixed lifetime products in a sustainable supply chain management. Int. J. Prod. Econ. 2021, 231, 107867. [Google Scholar] [CrossRef]

- Liu, G.; Yang, H.; Dai, R. Which contract is more effective in improving product greenness under different power structures: Revenue sharing or cost sharing? Comput. Ind. Eng. 2020, 148, 107867. [Google Scholar] [CrossRef]

| Author(s) | Quality Upgradation | Ordering Cost Reduction | Variable Safety Factor | Service | Setup Cost Reduction |

|---|---|---|---|---|---|

| Ben-Daya and Raouf [28] | √ | ||||

| Chang and Lo [31] | |||||

| Dey et al. [38] | √ | √ | |||

| Dhargalkar et al. [11] | √ | ||||

| Huang et al. [33] | √ | √ | |||

| Majumder et al. [37] | √ | √ | |||

| Ouyang et al. [30] | √ | ||||

| Sarkar and Moon [35] | √ | ||||

| Vareda [10] | √ | √ | |||

| Dey et al. [15] | √ | √ | |||

| This model | √ | √ | √ | √ | √ |

| Investment | Setup Cost |

|---|---|

| 0 | 1000 |

| 50 | 606 |

| 100 | 368 |

| 200 | 135 |

| Uniform Distribution | Triangular Distribution | Beta Distribution | |

|---|---|---|---|

| (units) | |||

| ($/unit) | |||

| (weeks) | 4 | 4 | 4 |

| ($) |

| Uniform Distribution | Triangular Distribution | Beta Distribution | |

|---|---|---|---|

| (units) | |||

| ($/unit) | |||

| (weeks) | 4 | 4 | 4 |

| ($) |

| Uniform Distribution | Triangular Distribution | Beta Distribution | |

|---|---|---|---|

| (units) | |||

| ($/unit) | |||

| (weeks) | 4 | 4 | 4 |

| ($) |

| Uniform Distribution | Triangular Distribution | Beta Distribution | |

|---|---|---|---|

| (units) | |||

| ($/unit) | |||

| (weeks) | 4 | 4 | 4 |

| ($) |

| Dey et al. [38] | Dey et al. [15] | This Model | |

|---|---|---|---|

| Total Profit ($/cycle) | 1802 | 6860 | 9780 |

| Parameters | Changes (in%) | (in%) | Parameters | Changes (in%) | (in%) |

|---|---|---|---|---|---|

| −50 | |||||

| q | |||||

| M | |||||

| V | |||||

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sett, B.K.; Dey, B.K.; Sarkar, B. The Effect of O2O Retail Service Quality in Supply Chain Management. Mathematics 2020, 8, 1743. https://doi.org/10.3390/math8101743

Sett BK, Dey BK, Sarkar B. The Effect of O2O Retail Service Quality in Supply Chain Management. Mathematics. 2020; 8(10):1743. https://doi.org/10.3390/math8101743

Chicago/Turabian StyleSett, Bimal Kumar, Bikash Koli Dey, and Biswajit Sarkar. 2020. "The Effect of O2O Retail Service Quality in Supply Chain Management" Mathematics 8, no. 10: 1743. https://doi.org/10.3390/math8101743

APA StyleSett, B. K., Dey, B. K., & Sarkar, B. (2020). The Effect of O2O Retail Service Quality in Supply Chain Management. Mathematics, 8(10), 1743. https://doi.org/10.3390/math8101743