Dynamic Pricing and Optimal Control for a Stochastic Inventory System with Non-Instantaneous Deteriorating Items and Partial Backlogging

Abstract

:1. Introduction

2. Notations and Assumptions

- c: the constant purchasing cost per unit, .

- h: the holding cost per unit per unit time, .

- C: the ordering cost per replenishment cycle, which is independent of the order quantity, .

- : the deterioration rate, .

- T: the duration of a replenishment cycle, such as one week, one month, one quarter, .

- : the length of time where items exhibit no deterioration.

- : the initial inventory level, .

- : the inventory level at time t.

- : the selling price per unit at time t.

- : the demand sensitivity to the selling price, .

- b: the fixed term of demand rate determined by the market size, .

- : the increment of standard Brownian process.

- : the volatility of the potential demand, .

- : punishment coefficient when stock-out, .

- S: the maximum inventory level, .

- : the admissible control set.

- : the profit function.

- : the value function.

- : the optimal selling price at time t.

- : the optimal replenishment cycle.

- : the optimal initial inventory level.

- : the optimal expected total profit.

- A single non-instantaneous deteriorating item is assumed.

- The selling price changes over time and needs to be determined by the retailer.

- The lead time is zero and the replenishment rate is infinite.

- The cumulative demand is a stochastic process governed by a diffusion processwhich is dependent on the selling price . The mean market potential b can be understood as the maximum sales when the items are free. The term represents the fluctuation of the demand due to the uncertainty of the environment. Note that the notion of “demand” is in a rather broad sense: Any withdrawal from or addition to the inventory can be regarded as an action of the demand. Therefore, it may cover those processes such as inventory spoilage and sales return, which are in general quite random. Moreover, we always assume that holds, otherwise there is no market for this item.

- The inventory level is influenced by the deterioration rate and demand. If , the items exhibit no deterioration. If , we assume the deterioration rate is a constant and the amount of deteriorating items at time t are .

- Shortages are allowed. We assume that during the period of shortages, the retailer will not lose his customers completely who are not satisfied with the retailer. Besides, when , the backlogging rate depends on the delay between the confirmation of the customer order and the next replenishment. Thus, the demand is partially backlogged according to the fraction .

- Remains are allowed. We assume that when , the retailer should pay the penalties at the end of the replenishment cycle T. It should be noted that the quadratic convex function of surplus cost captures the increasing marginal cost, which is in accord with reported articles (see, e.g., [14,28]). In fact, numerous greengrocers may discard substandard items when the next replenishment cycle arrives. Thus, it is reasonable to assume that the penalties should be paid if there are remains.

- There is no replacement or repair of the deterioration items.

- In real life, the shelf space is limited in many retail outlets. Thus, we impose a maximum inventory level S, that is, , for all .

3. The Model Formulation

- The ordering cost per cycle is represented by C.

- The inventory holding cost is presented by

- The surplus cost is , where .

- The profit on sale is presented by

- During the shortage period , i.e., , the profit is represented byIn this period, the retailer can make orders, but cannot make delivery at once. Since the delivery is delayed, the demand rate iswhich depends on the delay time length .

4. Optimal Control Analysis

- (1)

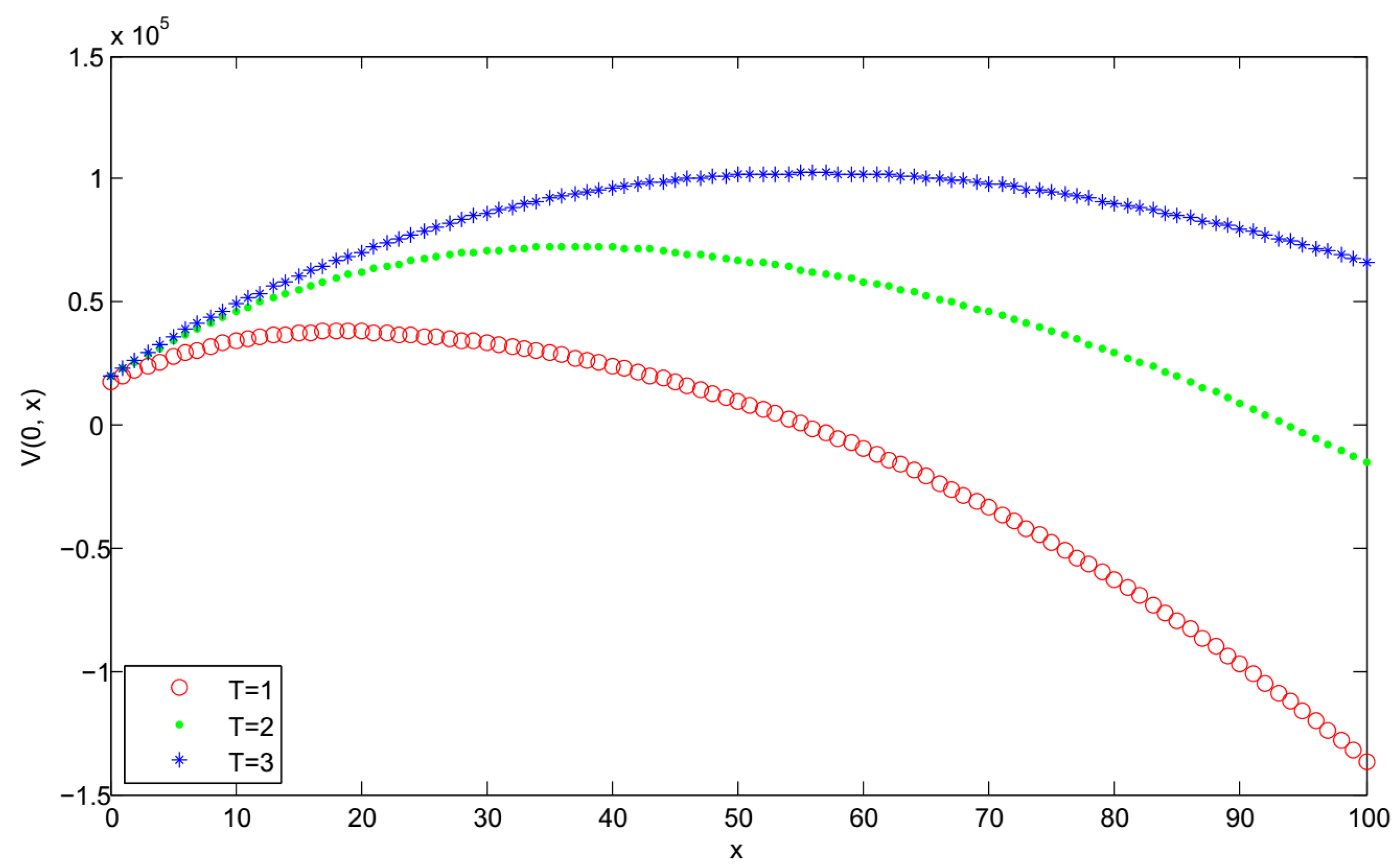

- and are decreasing with respect to t strictly. Moreover, when , and are negative;

- (2)

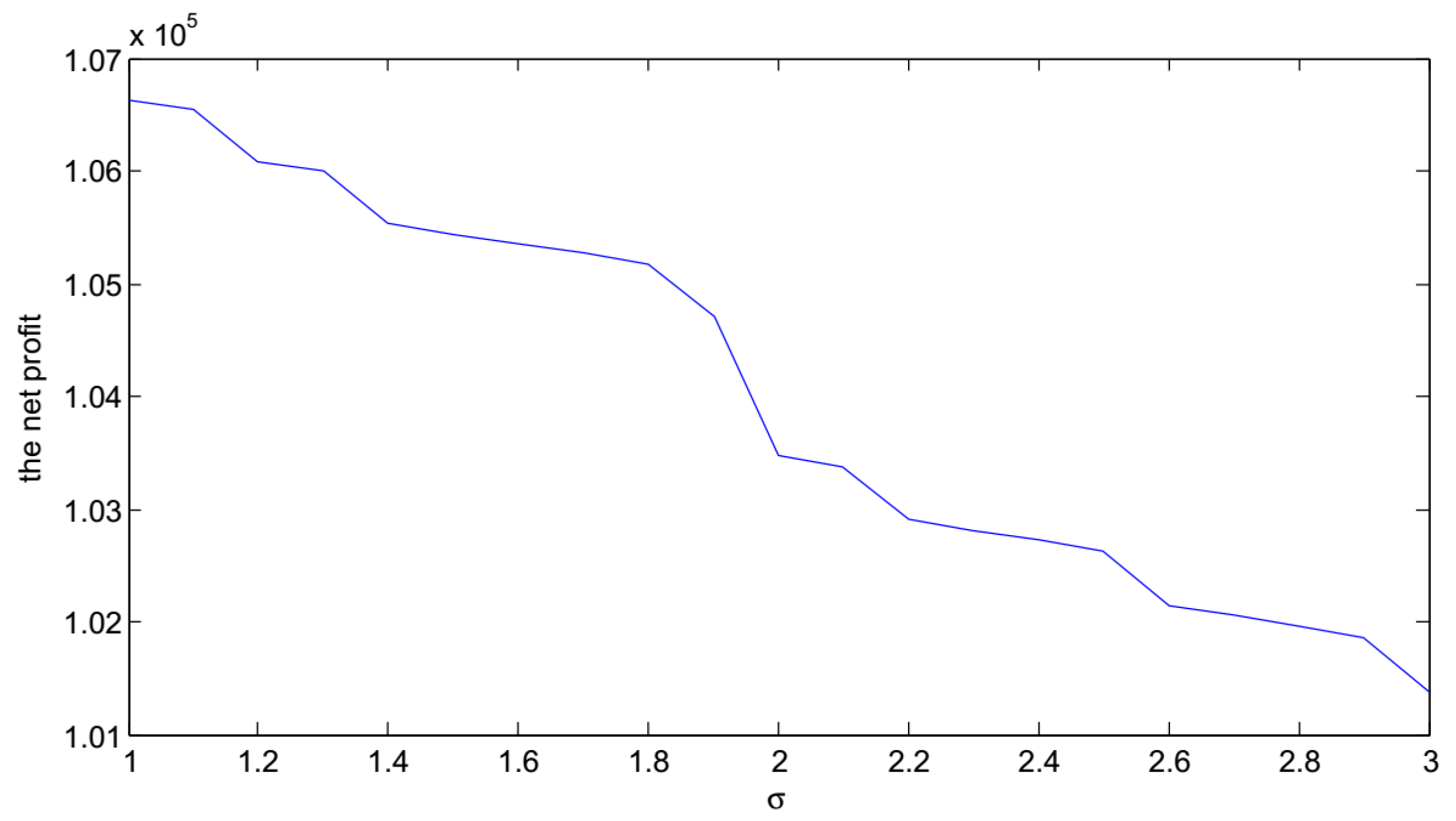

- As the increasing in the volatility of the potential demand σ, V is decreasing.

- (1)

- for , the optimal selling price is presented bywhere , .

- (2)

- for , the optimal selling price is given bywhere .

- (1)

- if , then the optimal selling price is given bywhere , ;

- (2)

- if , then the optimal selling price is given bywhere , .

- (1)

- if , the optimal initial inventory level isand the optimal selling price iswhere , , ,and the optimal replenishment cycle isand the optimal expected total profit is

- (2)

- if , the optimal initial inventory level isand the optimal selling price iswhere , ,and the optimal replenishment cycle isand the optimal expected total profit is

5. Numerical Experiments

5.1. Numerical Examples

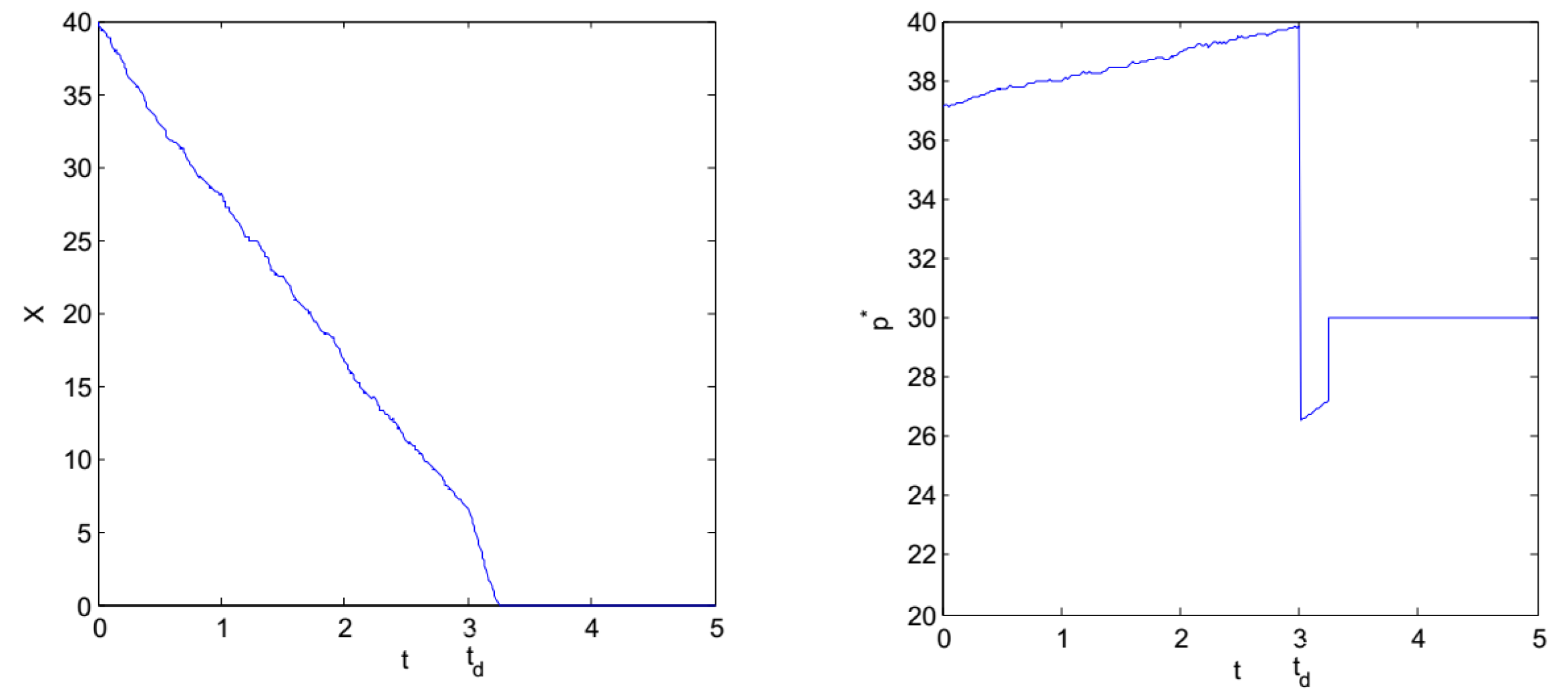

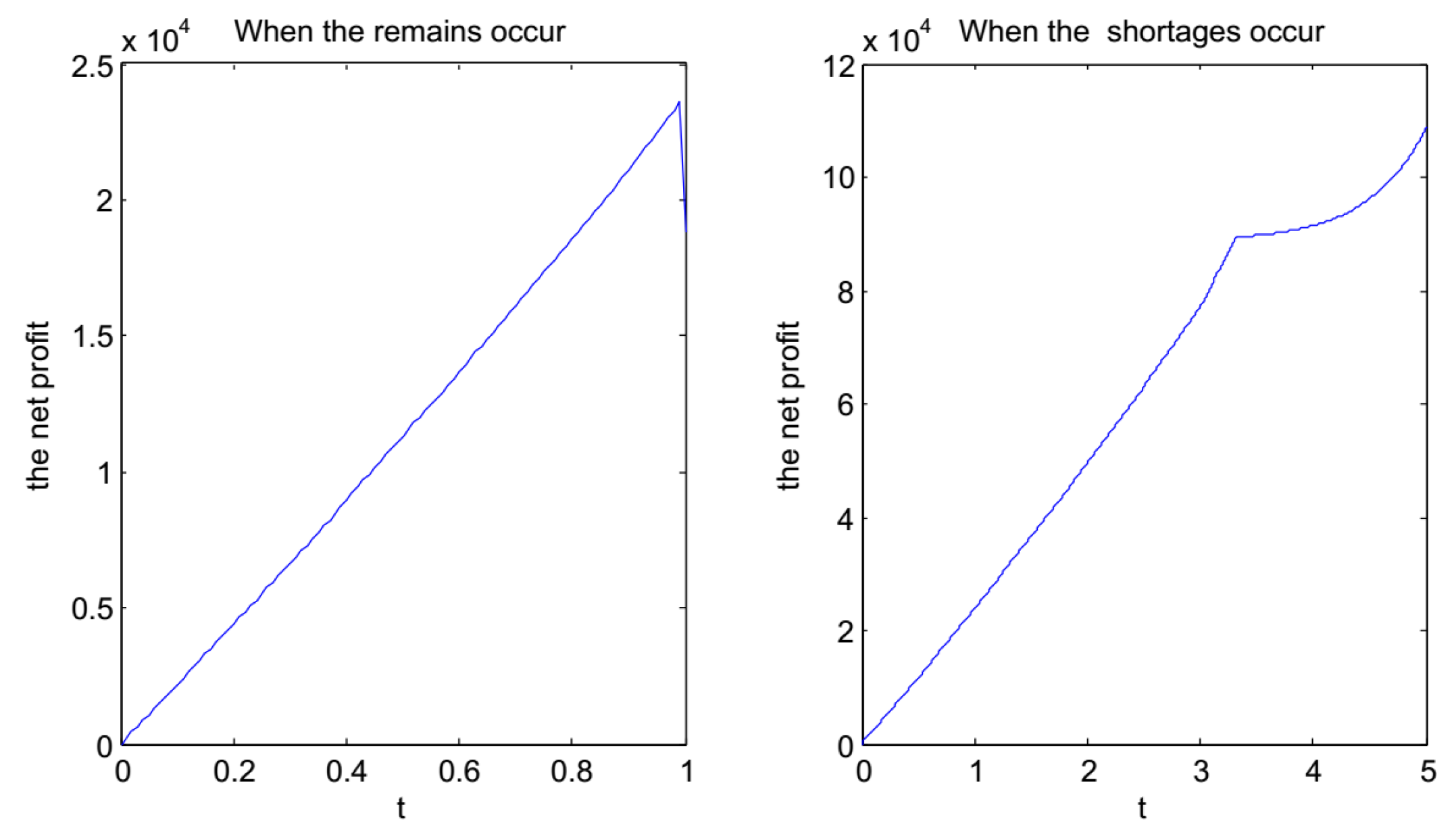

- (1)

- when

- (2)

- when

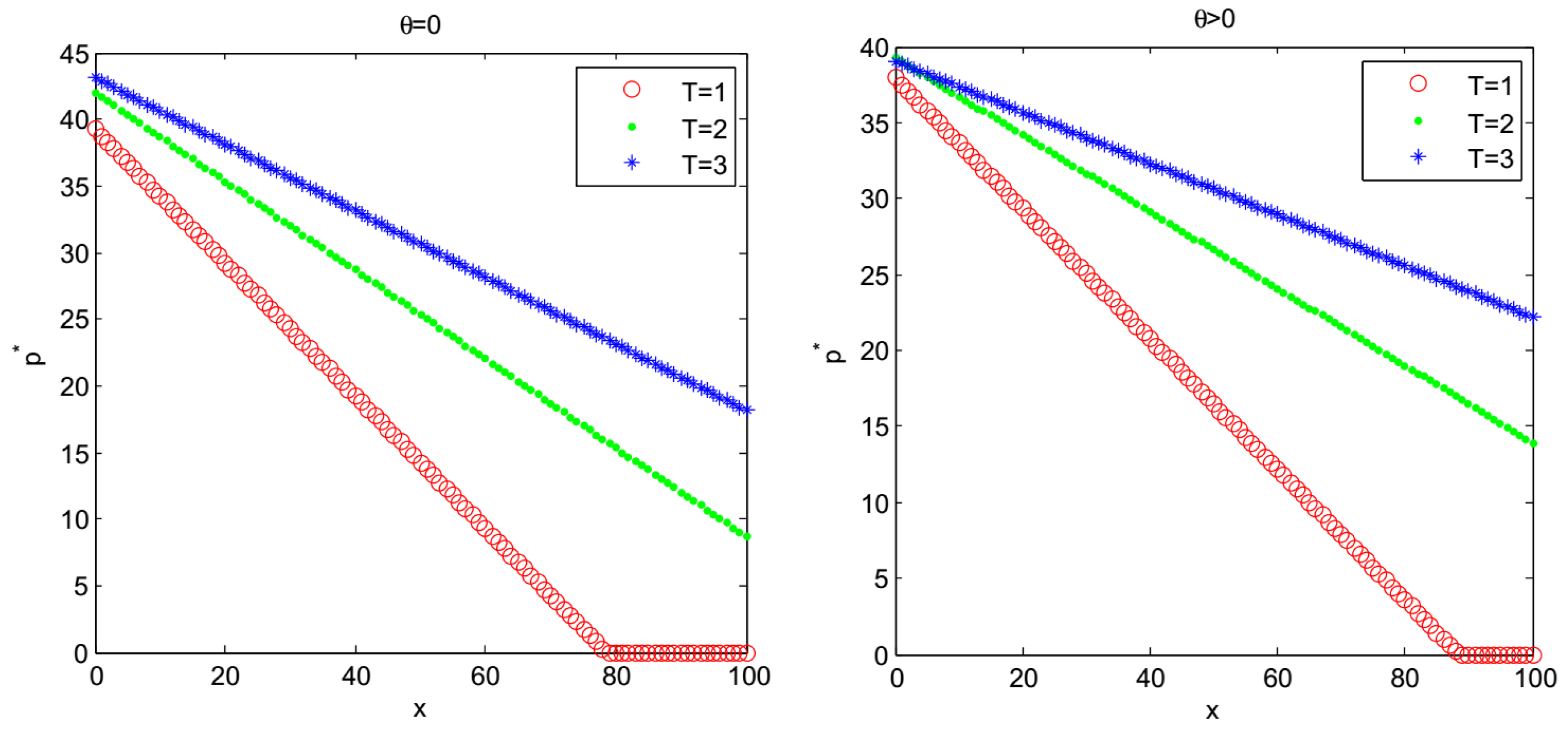

5.2. Sensitivity Analysis

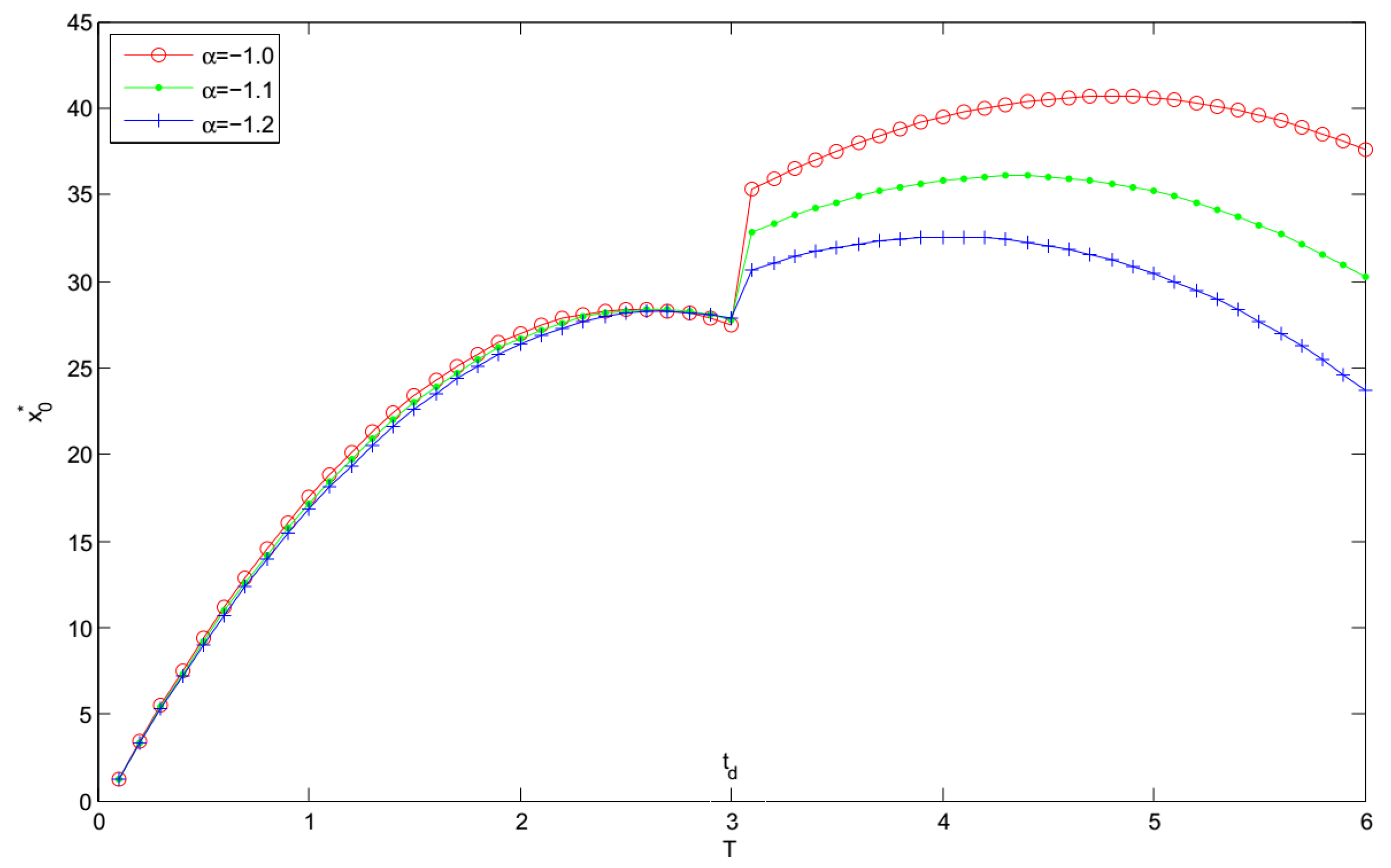

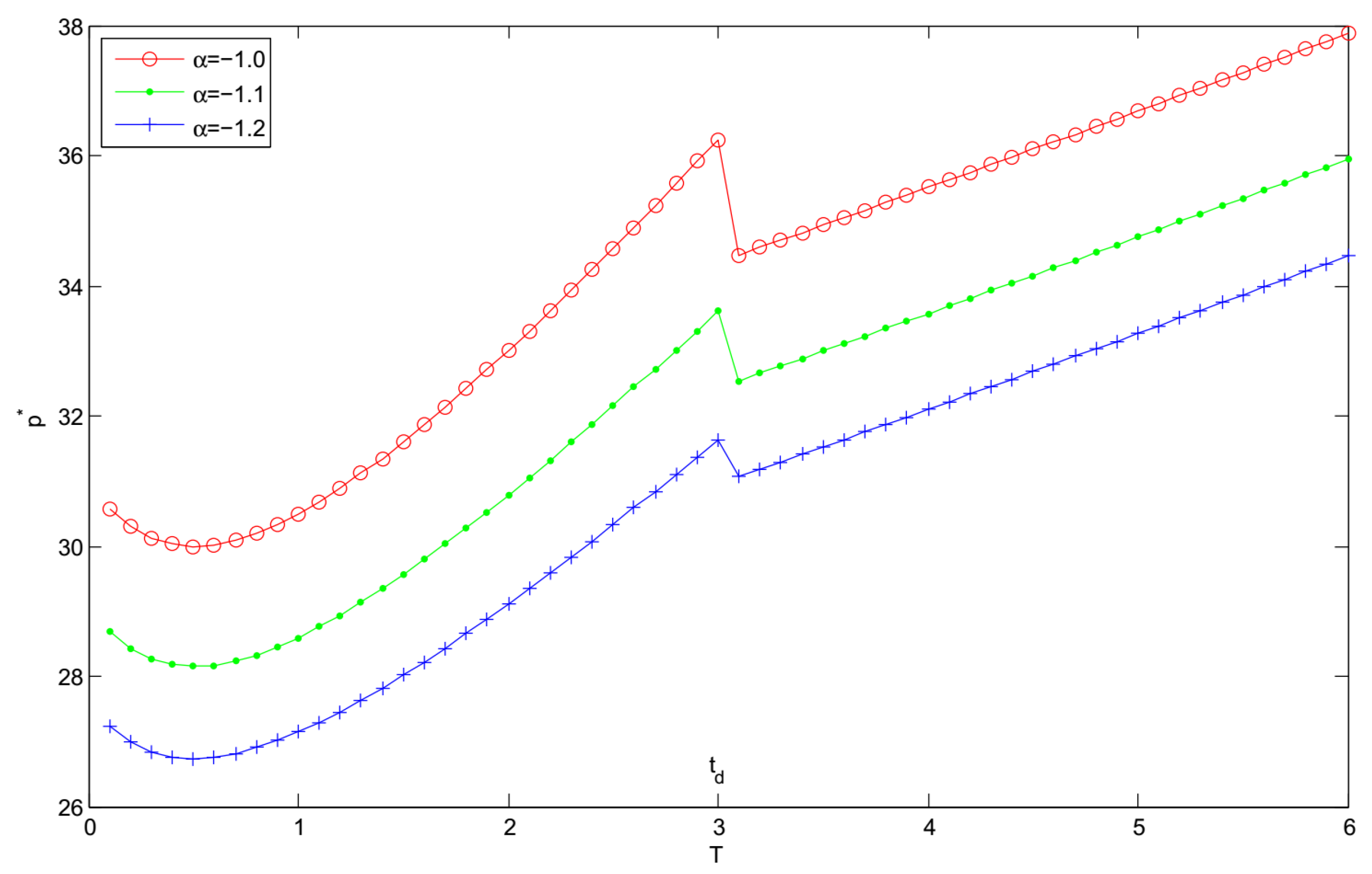

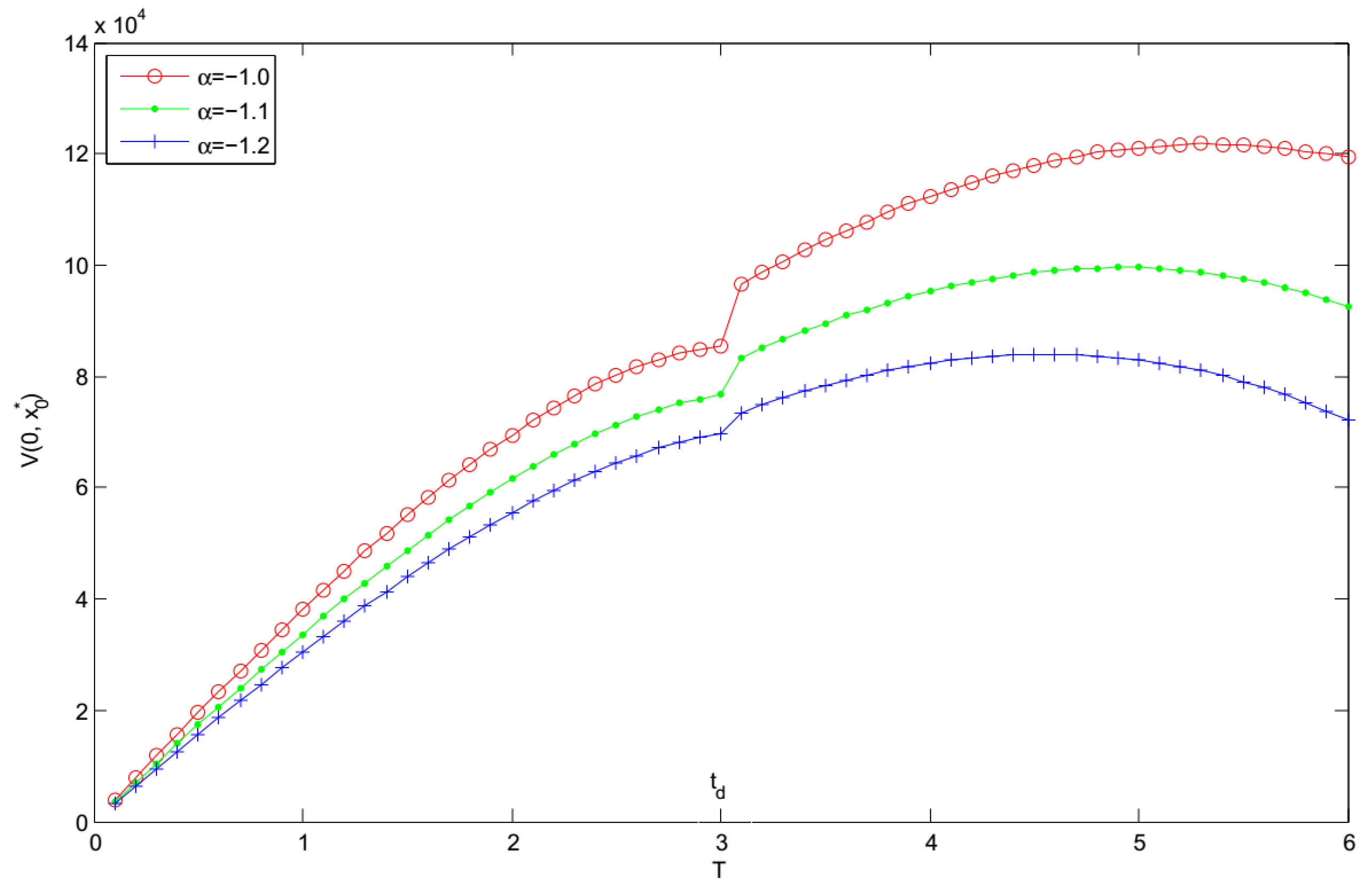

- Figure 7, Figure 8 and Figure 9 show that , and increase with increase in the demand sensitivity to the selling price α for the fixed replenishment cycle length T. It indicates that when the selling price has a less impact on the demand, the retailer should raise selling price to achieve more profit.

- When the deteriorating items occur, the retailer should increase stock and lower the selling price to reduce the impact of the perishable items.

- When , the retailer should keep less stocks, drop the selling price, and reduce the replenishment cycle after items deteriorate to achieve higher profit.

- When , the retailer should keep more stocks, and raise the selling price after items deteriorate to maximize the profit.

- It can be seen that increasing the demand sensitivity to the selling price α will cause the increase of and . Furthermore, the optimal replenishment cycle and the optimal expected total profit are highly sensitive to the changes in the price sensitivity factor to the demand.

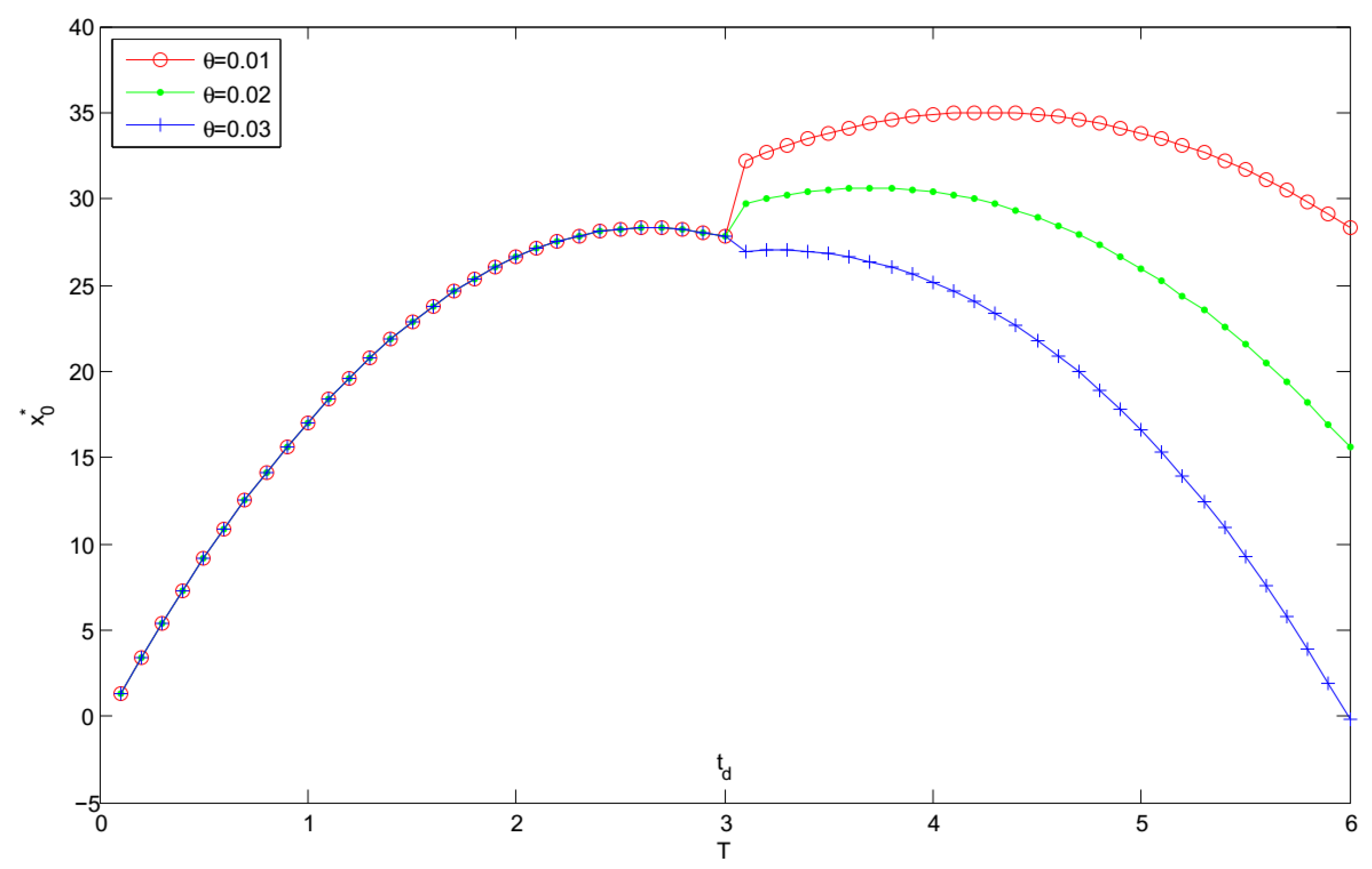

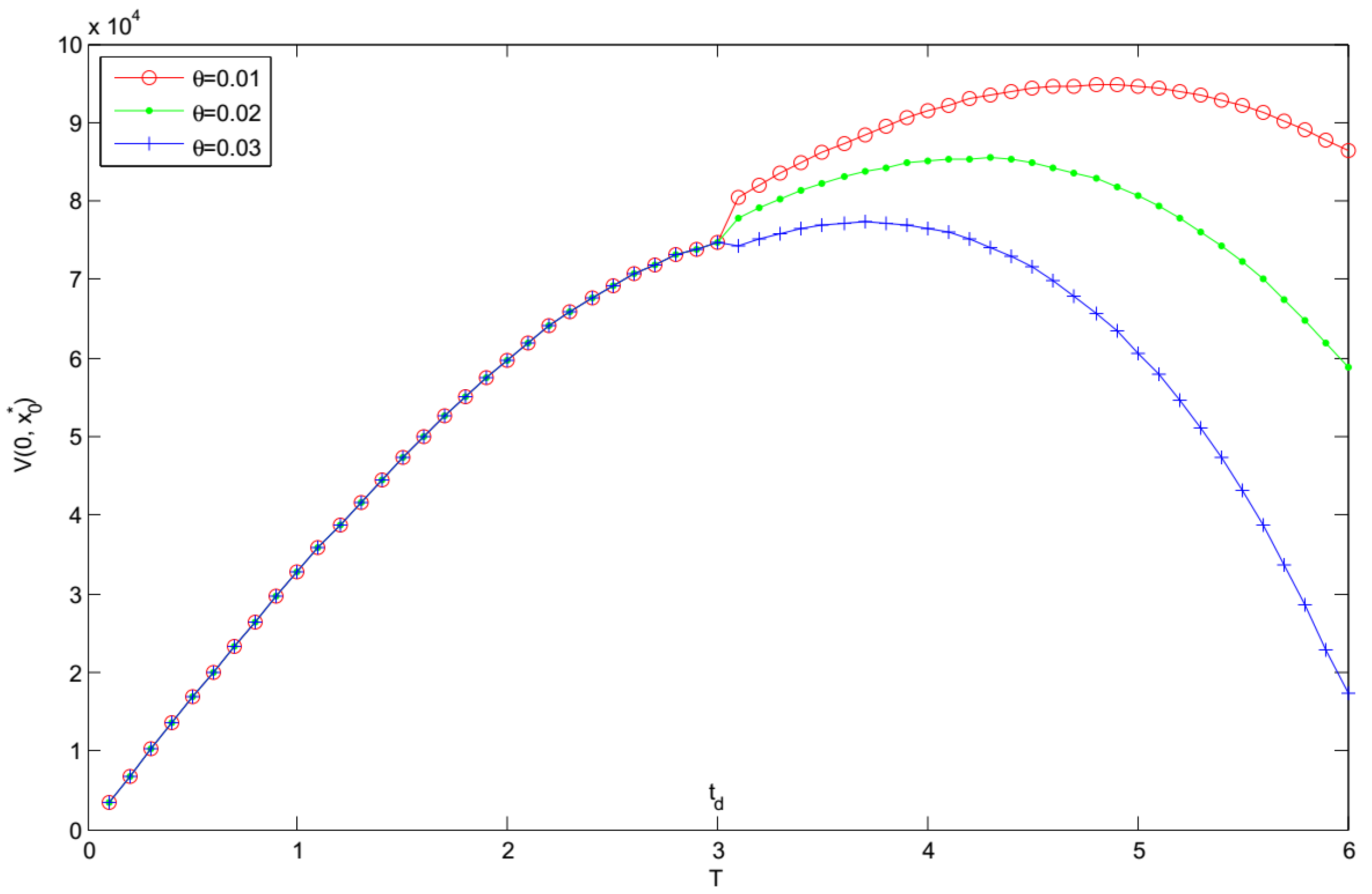

- For a fixed replenishment cycle length T, and increase whereas decreases with the decreasing in the deterioration rate θ. The results show that a higher deterioration rate leads to a higher selling price, and a lower optimal initial inventory level and optimal expected total profit.

- When , the retailer should keep more stocks and knock down selling price to get higher profit.

- When , the retailer should keep less stocks, raise the selling price and reduce the replenishment cycle resulting from a higher deteriorating rate to maximize their profit.

- It can be found that and decrease with the increasing in the deterioration rate θ. Moreover, the optimal replenishment cycle and the optimal expected total profit are highly sensitive to the change in the deterioration rate.

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

Abbreviations

| HJB | Hamilton-Jacobi-Bellman |

| EOQ | Economic Order Quantity |

Appendix A. A Detailed Derivation of A(t)

Appendix B. A Detailed Derivation of B(t)

Appendix C. A Detailed Derivation of A1 (t) and B1 (t)

References

- Ghare, P.M.; Schrader, G.F. A model for exponentially decaying inventory. J. Ind. Eng. 1963, 14, 238–243. [Google Scholar]

- Covert, R.P.; Philip, G.C. An EOQ model for items with weibull distribution deterioration. AIIE Trans. 1973, 5, 323–326. [Google Scholar] [CrossRef]

- Shah, Y.K. An order-level lot-size inventory model for deteriorating items. AIIE Trans. 1977, 9, 108–112. [Google Scholar] [CrossRef]

- Goyal, S.K.; Giri, B.C. Recent trends in modeling of deteriorating inventory. Eur. J. Oper. Res. 2001, 134, 1–16. [Google Scholar] [CrossRef]

- Bakker, M.; Riezebos, J.; Teunter, R.H. Review of inventory systems with deterioration since 2001. Eur. J. Oper. Res. 2012, 221, 275–284. [Google Scholar] [CrossRef]

- Wu, K.S.; Ouyang, L.Y.; Yang, C.T. An optimal replenishment policy for non-instantaneous deteriorating items with stock-dependent demand and partial backlogging. Int. J. Prod. Econ. 2006, 101, 369–384. [Google Scholar] [CrossRef]

- Ouyang, L.Y.; Wu, K.S.; Yang, C.T. A study on an inventory model for non-instantaneous deteriorating items with permissible delay in payments. Comput. Ind. Eng. 2006, 51, 637–651. [Google Scholar] [CrossRef]

- Chang, J.H.; Lin, F.W. A partial backlogging inventory model for non-instantaneous deteriorating items with stock-dependent consumption rate under inflation. Yugosl. J. Oper. Res. 2010, 20, 35–54. [Google Scholar] [CrossRef]

- Whitin, T.M. Inventory Control and Price Theory. Manag. Sci. 1955, 2, 61–68. [Google Scholar] [CrossRef]

- Wee, H.M. A replenishment policy for items with a price-dependent demand and a varying rate of deterioration. Prod. Plan. Control. 1997, 8, 494–499. [Google Scholar] [CrossRef]

- Wu, K.S.; Ouyang, L.Y.; Yang, C.T. Coordinating replenishment and pricing policies for non-instantaneous deteriorating items with price-sensitive demand. Int. J. Syst. Sci. 2009, 40, 1273–1281. [Google Scholar] [CrossRef]

- Soni, H.N.; Patel, K.A. Joint pricing and replenishment policies for non-instantaneous deteriorating items with imprecise deterioration free time and credibility constraint. Comput. Ind. Eng. 2013, 66, 944–951. [Google Scholar] [CrossRef]

- Zhang, J.; Wang, Y.; Lu, L.; Tan, W. Optimal dynamic pricing and replenishment cycle for non-instantaneous deterioration items with inventory-level-dependent demand. Int. J. Prod. Econ. 2015, 170, 136–145. [Google Scholar] [CrossRef]

- Duan, Y.; Cao, Y.; Huo, J. Optimal pricing, production, and inventory for deteriorating items under demand uncertainty: The finite horizon case. Appl. Math. Model. 2018, 58, 331–348. [Google Scholar] [CrossRef]

- Li, Y.; Zhang, S.; Han, J. Dynamic pricing and periodic ordering for a stochastic inventory system with deteriorating items. Automatica 2017, 76, 200–213. [Google Scholar] [CrossRef] [Green Version]

- Geetha, K.V.; Udayakumar, R. Optimal lot sizing policy for non-instantaneous deteriorating items with price and advertisement dependent demand under partial backlogging. Int. J. Appl. Comput. Math. 2016, 2, 171–193. [Google Scholar] [CrossRef] [Green Version]

- Das, S.C.; Zidan, A.M.; Manna, A.K.; Shaikh, A.A.; Bhunia, A.K. An application of preservation technology in inventory control system with price dependent demand and partial backlogging. Alex. Eng. J. 2020. [Google Scholar] [CrossRef]

- Debata, S.; Acharya, M. An inventory control for non-instantaneous deteriorating items with non-zero lead time and partial backlogging under joint price and time dependent demand. Int. J. Appl. Comput. Math. 2017, 3, 1381–1393. [Google Scholar] [CrossRef]

- Agi, M.A.; Soni, H.N. Joint pricing and inventory decisions for perishable products with age-, stock-, and price-dependent demand rate. J. Oper. Res. Soc. 2020, 71, 85–99. [Google Scholar] [CrossRef]

- Chang, H.J.; Dye, C.Y. An EOQ model for deteriorating items with time varying demand and partial backlogging. J. Oper. Res. Soc. 1999, 50, 1176–1182. [Google Scholar] [CrossRef]

- Maihami, R.; Kamalabadi, I.N. Joint pricing and inventory control for non-instantaneous deteriorating items with partial backlogging and time and price dependent demand. Int. J. Prod. Econ. 2012, 136, 116–122. [Google Scholar] [CrossRef]

- Soni, H.; Suthar, D. Pricing and inventory decisions for non-instantaneous deteriorating items with price and promotional effort stochastic demand. J. Control Decis. 2018, 6, 1–25. [Google Scholar] [CrossRef]

- Abad, P.L. Optimal price and order size for a reseller under partial backordering. Comput. Ind. Eng. 2001, 28, 53–65. [Google Scholar] [CrossRef]

- Wang, S.P. An inventory replenishment policy for deteriorating items with shortages and partial backlogging. Comput. Oper. Res. 2002, 29, 2043–2051. [Google Scholar] [CrossRef]

- Dye, C.Y.; Ouyang, L.Y.; Hsieh, T.P. Inventory and pricing strategies for deteriorating items with shortages: A discounted cash flow approach. Comput. Ind. Eng. 2007, 52, 29–40. [Google Scholar] [CrossRef]

- Papachristos, S.; Skouri, K. An inventory model with deteriorating items, quantity discount, pricing and time-dependent partial backlogging. Int. J. Prod. Econ. 2003, 83, 247–256. [Google Scholar] [CrossRef]

- Farughi, H.; Khanlarzade, N.; Yegane, B.Y. Pricing and inventory control policy for non-instantaneous deteriorating items with time- and price-dependent demand and partial backlogging. Decis. Sci. Lett. 2014, 3, 325–334. [Google Scholar] [CrossRef] [Green Version]

- Kogan, K.; Herbon, A. Inventory control over a short time horizon under unknown demand distribution. IEEE Trans. Automat. Contr. 2016, 61, 3058–3063. [Google Scholar] [CrossRef]

- Zwillinger, D. Handbook of Differential Equations; Academic Press: New York, NY, USA, 1989. [Google Scholar]

| −1.0 | 5.3 | 40.1040 | 37.0381 | 1.2247 |

| −1.1 | 5 | 35.1775 | 34.7441 | 0.9956 |

| −1.2 | 4.6 | 31.8401 | 32.7993 | 0.8405 |

| 0.01 | 4.9 | 34.1299 | 34.1856 | 9.4751 |

| 0.02 | 4.3 | 29.6720 | 33.0762 | 8.5439 |

| 0.03 | 3.7 | 26.3545 | 33.7969 | 7.7317 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Luo, X.; Liu, Z.; Wu, J. Dynamic Pricing and Optimal Control for a Stochastic Inventory System with Non-Instantaneous Deteriorating Items and Partial Backlogging. Mathematics 2020, 8, 906. https://doi.org/10.3390/math8060906

Luo X, Liu Z, Wu J. Dynamic Pricing and Optimal Control for a Stochastic Inventory System with Non-Instantaneous Deteriorating Items and Partial Backlogging. Mathematics. 2020; 8(6):906. https://doi.org/10.3390/math8060906

Chicago/Turabian StyleLuo, Xuxiang, Zaiming Liu, and Jinbiao Wu. 2020. "Dynamic Pricing and Optimal Control for a Stochastic Inventory System with Non-Instantaneous Deteriorating Items and Partial Backlogging" Mathematics 8, no. 6: 906. https://doi.org/10.3390/math8060906