Insurance Contracts for Hedging Wind Power Uncertainty

Abstract

:1. Introduction

2. The Stochastic Models

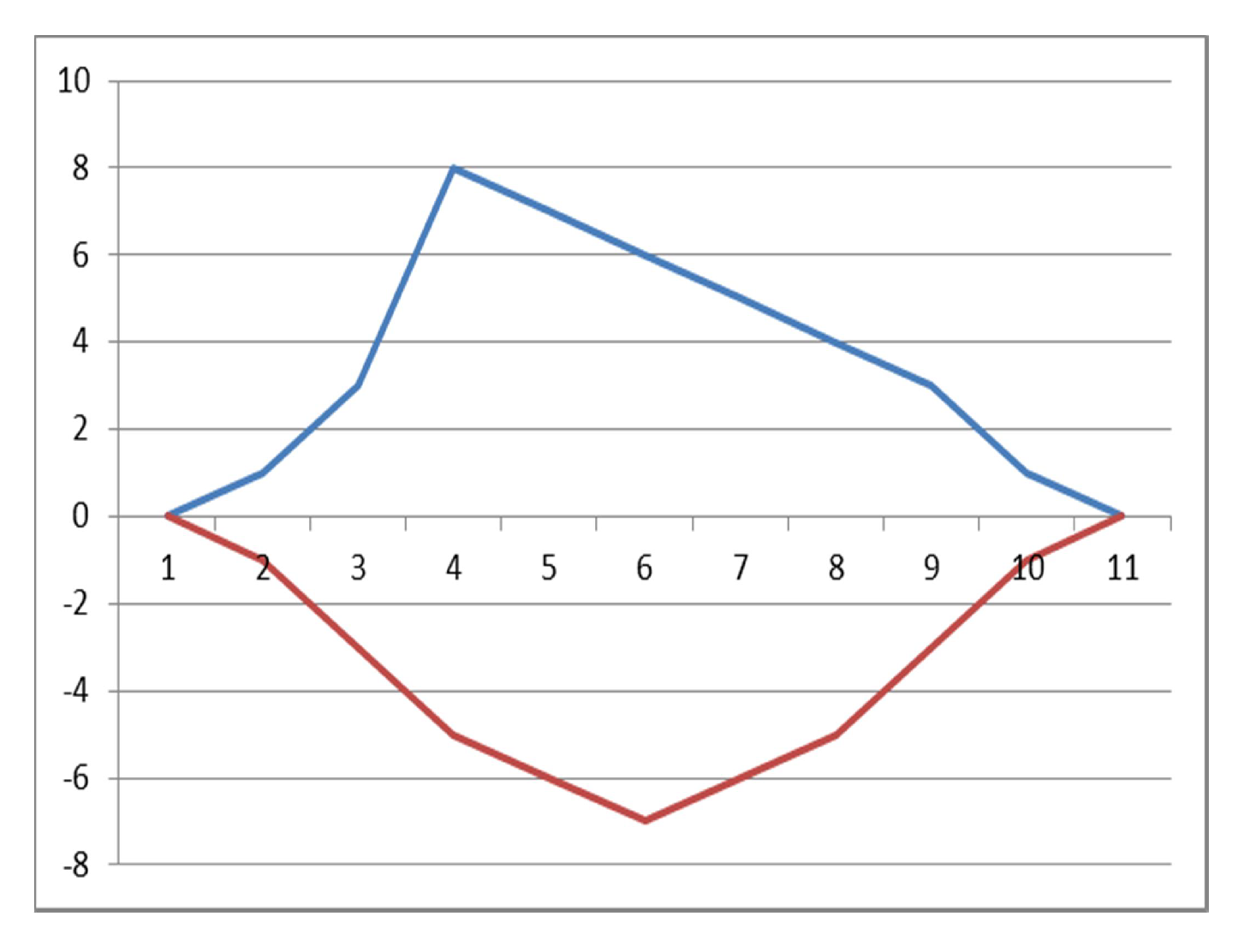

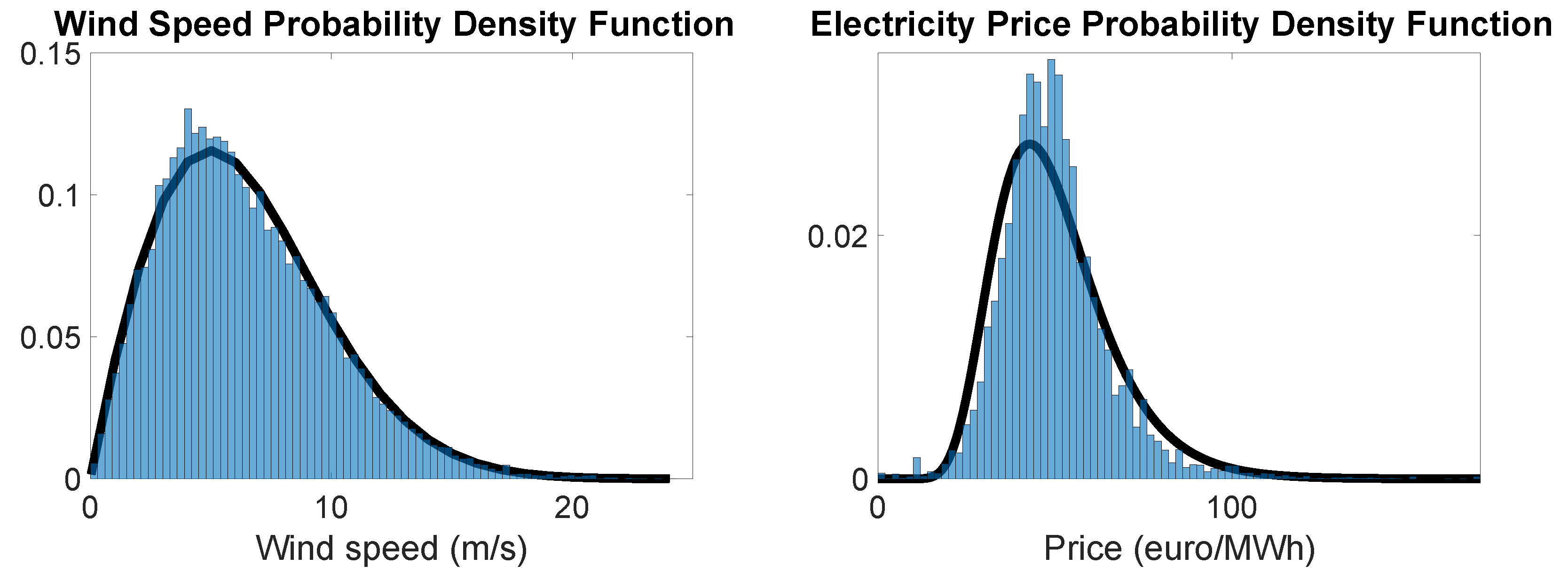

2.1. The WISMC Model of Wind Power Production

2.2. Joint Model of Electricity Price and Wind Power Production

3. The Insurance Problem

- if , he/she gets from the insurer the benefit ;

- if , no money transfer from the insurer to the WPP occurs;

- at any time during the validity period of the contract, he/she pays a fixed premium to the insurer equal to .

- money amounts are discounted with fixed discount factor v; accordingly, denotes the discount factor for s periods of time.

4. Materials and Methods

- -

- geographical coordinates: 39.5 N (latitude) and 8.75 E (longitude);

- -

- hub height of the turbine: 95 m;

- -

- rated power of the turbine: 2 MW;

- -

- cut-in wind speed: 4 m/s;

- -

- rated wind speed: 13 m/s;

- -

- cut-out wind speed: 25 m/s.

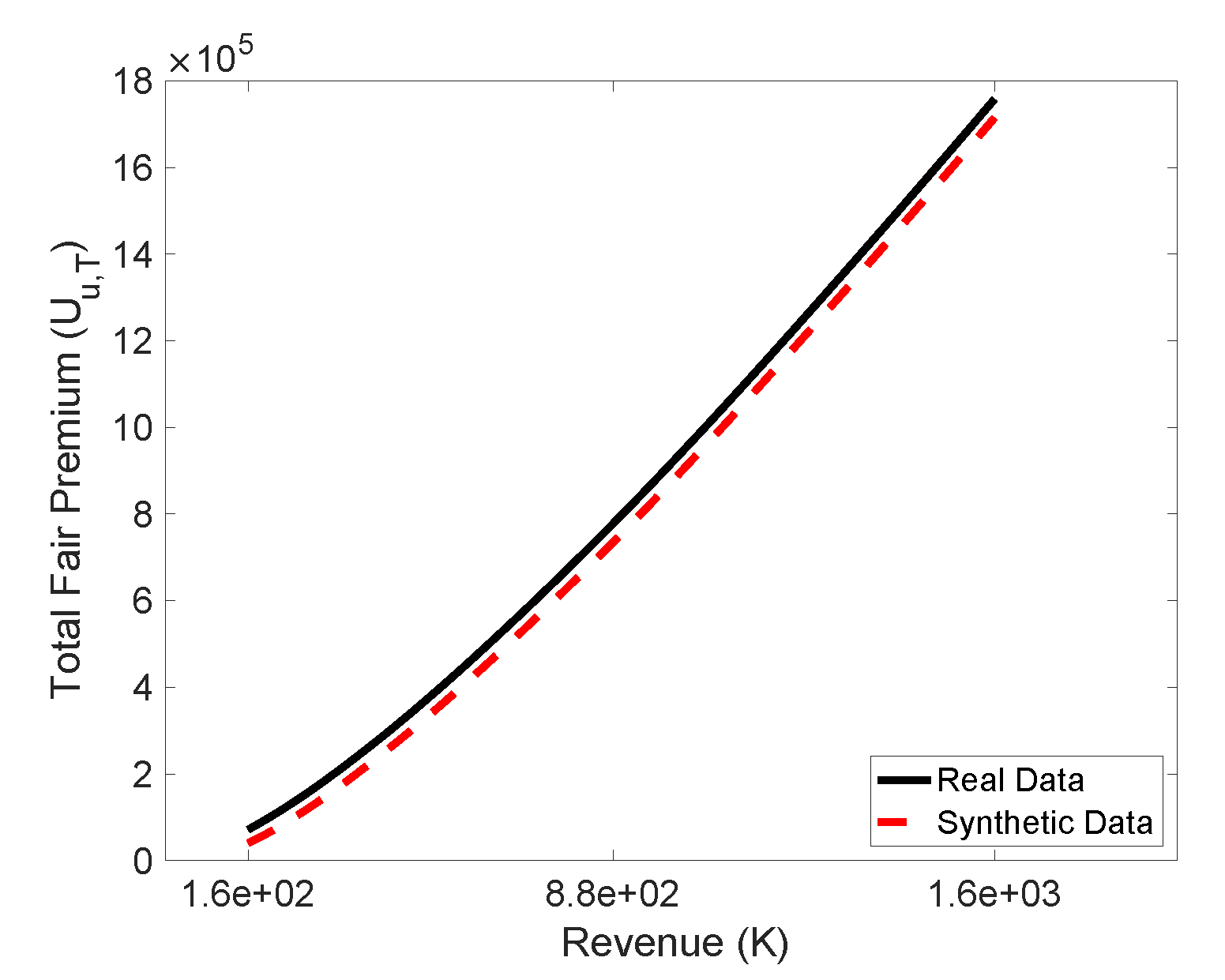

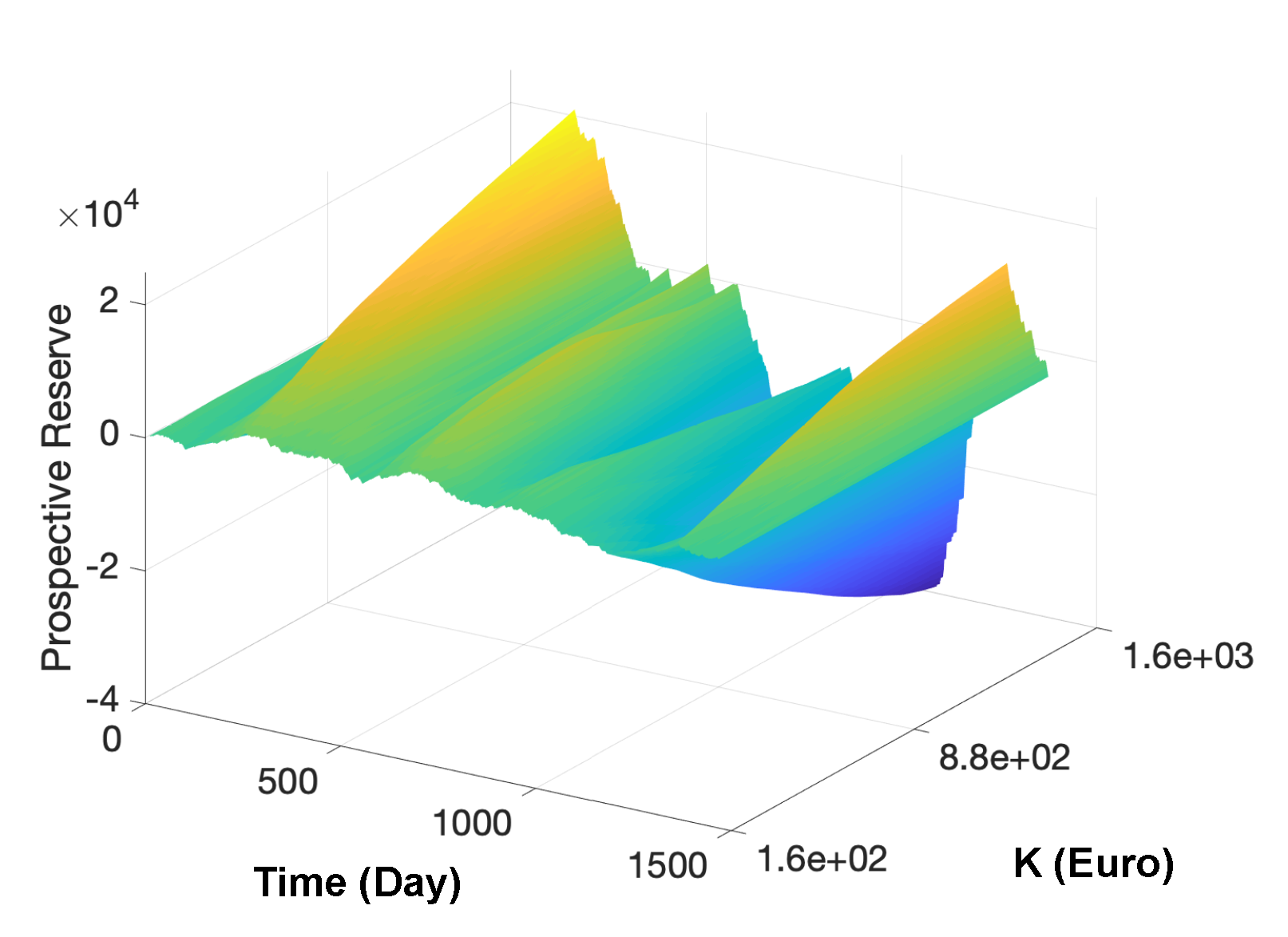

5. Results on the Insurance Problem

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- IEA. Renewable Energy Market Update. 2020. Available online: https://www.iea.org/reports/renewable-energy-market-update (accessed on 15 May 2020).

- Beenstock, M. The stochastic economics of windpower. Energy Econ. 1995, 17, 27–37. [Google Scholar] [CrossRef]

- Barton, J.P.; Infield, D.G. Energy storage and its use with intermittent renewable energy. IEEE Trans. Energy Convers. 2004, 19, 441–448. [Google Scholar] [CrossRef]

- Sufyan, M.; Rahim, N.A.; Aman, M.M.; Tan, C.K.; Raihan, S.R.S. Sizing and applications of battery energy storage technologies in smart grid system: A review. J. Renew. Sustain. Energy 2019, 11, 014105. [Google Scholar] [CrossRef]

- Wang, X.; Vilathgamuwa, D.M.; Choi, S.S. Determination of battery storage capacity in energy buffer for wind farm. IEEE Trans. Energy Convers. 2008, 23, 868–878. [Google Scholar] [CrossRef]

- Pinson, P.; Papaefthymiou, G.; Klockl, B.; Verboomen, J. Dynamic sizing of energy storage for hedging wind power forecast uncertainty. In Proceedings of the 2009 IEEE Power & Energy Society General Meeting, Calgary, AB, Canada, 26–30 July 2009; pp. 1–8. [Google Scholar]

- D’Amico, G.; Petroni, F.; Sobolewski, R.A. Optimal Control of a Dispatchable Energy Source for Wind Energy Management. Stochastics Qual. Control 2019, 34, 19–34. [Google Scholar] [CrossRef]

- Hedman, K.W.; Sheblé, G.B. Comparing hedging methods for wind power: Using pumped storage hydro units vs. options purchasing. In Proceedings of the 2006 International Conference on Probabilistic Methods Applied to Power Systems, Stockholm, Sweden, 11–15 June 2006; pp. 1–6. [Google Scholar]

- Xiao, Y.; Wang, X.; Wang, X.; Wu, Z. Trading wind power with barrier option. Appl. Energy 2016, 182, 232–242. [Google Scholar] [CrossRef]

- D’Amico, G.; Petroni, F.; Prattico, F. Insuring wind energy production. Phys. A Stat. Mech. Appl. 2017, 467, 542–553. [Google Scholar] [CrossRef]

- D’Amico, G.; Petroni, F.; Prattico, F. Wind speed modeled as an indexed semi-Markov process. Environmetrics 2013, 24, 367–376. [Google Scholar] [CrossRef] [Green Version]

- D’Amico, G.; Petroni, F.; Prattico, F. Wind speed and energy forecasting at different time scales: A nonparametric approach. Phys. A Stat. Mech. Appl. 2014, 406, 59–66. [Google Scholar] [CrossRef] [Green Version]

- D’Amico, G.; Petroni, F.; Prattico, F. Economic performance indicators of wind energy based on wind speed stochastic modeling. Appl. Energy 2015, 154, 290–297. [Google Scholar] [CrossRef]

- D’Amico, G.; Petroni, F.; Prattico, F. Reliability measures for indexed semi-Markov chains applied to wind energy production. Reliab. Eng. Syst. Saf. 2015, 144, 170–177. [Google Scholar] [CrossRef] [Green Version]

- Limnios, N.; Oprisan, G. Semi-Markov Process and Reliability. 2001. Available online: file:///C:/Users/MDPI/Downloads/bok3A978-1-4612-0161-8.pdf (accessed on 15 May 2020).

- Barbu, V.S.; Limnios, N. Semi-Markov Chains and Hidden Semi-Markov Models toward Applications: Their Use in Reliability and DNA Analysis; Springer Science & Business Media: Berlin/Heidelberg, Germany, 2009; Volume 191. [Google Scholar]

- Swishchuk, A.; Hofmeister, T.; Cera, K.; Schmidt, J. General semi-Markov model for limit order books. Int. J. Theor. Appl. Financ. 2017, 20, 1750019. [Google Scholar] [CrossRef]

- Weron, R. Electricity price forecasting: A review of the state-of-the-art with a look into the future. Int. J. Forecast. 2014, 30, 1030–1081. [Google Scholar] [CrossRef] [Green Version]

- Mari, C. Hedging electricity price volatility using nuclear power. Appl. Energy 2014, 113, 615–621. [Google Scholar] [CrossRef]

- Casula, L.; D’Amico, G.; Masala, G.; Petroni, F. Performance estimation of a wind farm with a dependence structure between electricity price and wind speed. World Econ. 2020. [Google Scholar] [CrossRef]

- Norberg, R. A Time-Continuous Markov Chain Interest Model with Applications to Insurance. Appl. Stoch. Model. Data Anal. 1995, 11, 245–256. [Google Scholar] [CrossRef]

- Milbrodt, H. Hattendorff’s theorem for non-smooth continuous-time Markov models I: Theory. Insur. Math. Econ. 1999, 25, 181–195. [Google Scholar] [CrossRef]

- Henriksen, L.F.B.; Nielsen, J.W.; Steffensen, M.; Svensson, C. Markov chain modeling of policyholder behavior in life insurance and pension. Eur. Actuar. J. 2014, 4, 1–29. [Google Scholar] [CrossRef]

- Janssen, J. Application des processus semi-Markoviens à un probléme d’invalidité. Bulletin de l’Association Royale des Actuaries Belges 1966, 63, 35–52. [Google Scholar]

- Hoem, J.M. Inhomogeneous Semi-Markov Processes, Select Actuarial Tables, and Duration-dependence in Demography. In Population Dynamics; Elsevier: Amsterdam, The Netherlands, 1972; pp. 251–296. [Google Scholar]

- Janssen, J.; De Dominicis, R. Finite non-homogeneous semi-Markov processes: Theoretical and computational aspects. Insur. Math. Econ. 1984, 3, 157–165. [Google Scholar] [CrossRef]

- Janssen, J.; Manca, R. A realistic non-homogeneous stochastic pension fund model on scenario basis. Scand. Actuar. J. 1997, 1997, 113–137. [Google Scholar] [CrossRef]

- Stenberg, F.; Manca, R.; Silvestrov, D. Semi-Markov Reward Models for Disability Insurance. 2006. Available online: http://dspace.nbuv.gov.ua/bitstream/handle/123456789/4468/2006_12_3-4_17.pdf (accessed on 15 May 2020).

- Stenberg, F.; Manca, R.; Silvestrov, D. An algorithmic approach to discrete time non-homogeneous backward semi-Markov reward processes with an application to disability insurance. Methodol. Comput. Appl. Probab. 2007, 9, 497–519. [Google Scholar] [CrossRef]

- D’Amico, G.; Guillen, M.; Manca, R. Full backward non-homogeneous semi-Markov processes for disability insurance models: A Catalunya real data application. Insur. Math. Econ. 2009, 45, 173–179. [Google Scholar] [CrossRef]

- Ji, M.; Hardy, M.; Li, J.S.H. A semi-Markov multiple state model for reverse mortgage terminations. Ann. Actuar. Sci. 2012, 6, 235–257. [Google Scholar] [CrossRef]

- Maegebier, A. Valuation and risk assessment of disability insurance using a discrete time trivariate Markov renewal reward process. Insur. Math. Econ. 2013, 53, 802–811. [Google Scholar] [CrossRef]

- Buchardt, K.; Møller, T.; Schmidt, K.B. Cash flows and policyholder behaviour in the semi-Markov life insurance setup. Scand. Actuar. J. 2015, 2015, 660–688. [Google Scholar] [CrossRef]

- D’Amico, G.; Petroni, F. Multivariate high-frequency financial data via semi-Markov processes. Markov Process. Relat. Fields. 2014, 20, 415–434. [Google Scholar]

- D’Amico, G.; Petroni, F. A micro-to-macro approach to returns, volumes and waiting times. arXiv 2020, arXiv:2007.06262. [Google Scholar]

- Onken, A.; Panzeri, S. Mixed Vine Copulas as Joint Models of Spike Counts and Local Field Potentials. In Advances in Neural Information Processing Systems; Mit Press: Cambridge, MA, USA, 2016; pp. 1325–1333. [Google Scholar]

- D’Amico, G.; Petroni, F. Copula based multivariate semi-Markov models with applications in high-frequency finance. Eur. J. Oper. Res. 2018, 267, 765–777. [Google Scholar] [CrossRef]

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

D’Amico, G.; Gismondi, F.; Petroni, F. Insurance Contracts for Hedging Wind Power Uncertainty. Mathematics 2020, 8, 1376. https://doi.org/10.3390/math8081376

D’Amico G, Gismondi F, Petroni F. Insurance Contracts for Hedging Wind Power Uncertainty. Mathematics. 2020; 8(8):1376. https://doi.org/10.3390/math8081376

Chicago/Turabian StyleD’Amico, Guglielmo, Fulvio Gismondi, and Filippo Petroni. 2020. "Insurance Contracts for Hedging Wind Power Uncertainty" Mathematics 8, no. 8: 1376. https://doi.org/10.3390/math8081376

APA StyleD’Amico, G., Gismondi, F., & Petroni, F. (2020). Insurance Contracts for Hedging Wind Power Uncertainty. Mathematics, 8(8), 1376. https://doi.org/10.3390/math8081376