Research Analysis on Emerging Technologies in Corporate Accounting

Abstract

:1. Introduction

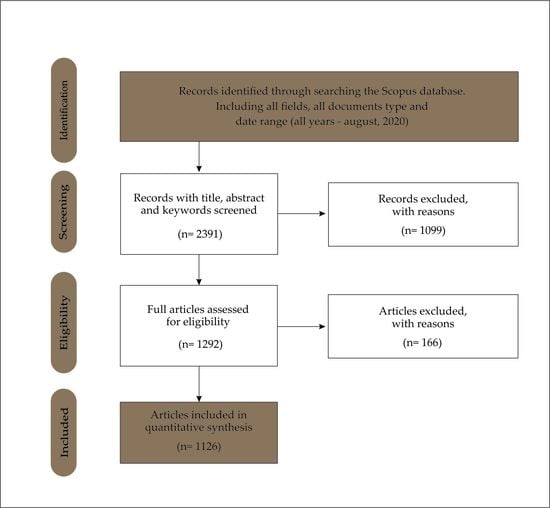

2. Framework

3. Materials and Methods

3.1. Bibliometric Method and Data Gathering

3.2. Data Processing

3.3. Concepts for Keyword Analysis

- Determine the relationship of the publications: from a set of articles the relationship of each pair in this set is determined, to produce hierarchical classification systems. Each article belongs to a single research area at the lowest level of a ranking system, each research area at the lowest level in turn belongs to a unique research area at the second lowest level, and so on.

- Group the articles to build the basic structure of a classification system: the articles are grouped into research areas and the research areas are organized in a hierarchical structure. The grouping technique is based on modularity. VOSviewer’s clustering algorithm allows communities to be detected in a network, which considers modularity, that is, a measure that assesses the quality of community structures. Therefore, VOSViewer’s modularity-based clustering provides networks where nodes are densely connected internally within groups, but without external connection between different groups. In this manner, it unifies the mapping and grouping approaches, in addition to dividing the research carried out in documents [87].

- Labeling research areas: to complete the construction of the classification system, labels are assigned to research areas. These labels are obtained by extracting appropriate terms from the titles and summaries of the articles that belong to a research area.

4. Results and Discussion

4.1. Evolution of Scientific Production

4.2. Subject Areas and Scientific Journals

4.3. Productivity by Research Institutions and Countries

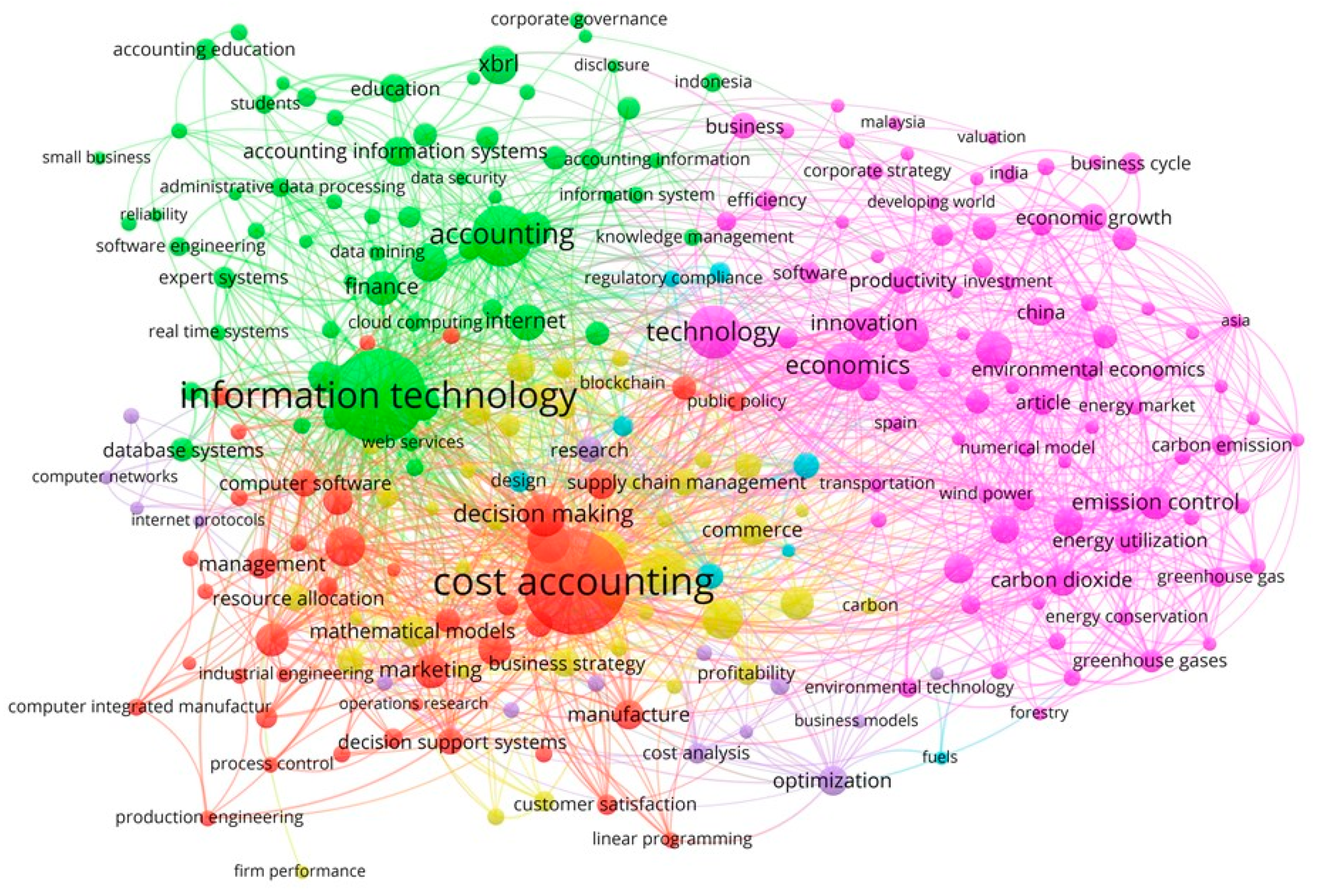

4.4. Keyword Analysis

4.4.1. Current Lines of Research

- Technology: The publications during this period have analyzed the technologies related to accounting, both as improvements in speed, which only affect quantitative aspects, and in the changes in the design of information systems that cause changes in the way companies work [17]. During these decades, the actors have dedicated their efforts to verify the new technologies, which they have incorporated more speed, interconnectivity, data processing capacity, and self-learning capacity, and it has not always been perceived as a positive aspect because it is a discipline very anchored to tradition [106].

- Information Technology: During this period, the linkage of information technologies as an engine of change that leads to a new post-industrial era has been studied and that, during this period, has been making obsolete all business structures that have failed to adapt [16]. Thereby, this line associated with information technology has been developed as an application of telecommunication equipment to store, retrieve, transmit, and manipulate data, in the context of business or other companies [107,108].

- Cost Accounting: This school of thought has examined the study of cost accounting as an information system for recording, determining, distributing, accumulating, analyzing, interpreting, controlling, and reporting the costs of production, distribution, administration, and financing [109].

- Investments: During this period, research in this line has sought to identify investments in research and development activities as a measure that will reduce capital requirements, operating costs, and the generation of innovative products in accordance with market requirements. This line has examined improving productivity, to help companies to be more efficient and economically viable by increasing the productive apparatus of the countries [110].

- Optimization: Since the beginning of the analyzed period, research in this line has studied inefficiency in internal accounting processes that have a negative impact on business flow. So, this line has contributed to the analysis of the management of the processes as a continuous activity of the financial inputs and outputs in the company that guarantees a correct operation. Accounting and financial reporting continue to play a leading and regulatory role among models and information on economic phenomena that help understand how companies produce value [111].

4.4.2. Evolution of Keywords

4.4.3. Future Directions of Research

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Balboni, B.; Bortoluzzi, G.; Pugliese, R.; Tracogna, A. Business model evolution, contextual ambidexterity and the growth performance of high-tech start-ups. J. Bus. Res. 2019, 99, 115–124. [Google Scholar] [CrossRef]

- Evseeva, M. Comparative effectiveness of high-tech and medium-tech business models: Key indicators and value sustainability. Upravlenets 2020, 11, 59–71. [Google Scholar] [CrossRef]

- Zubkova, A.B.; Rusanova, L.D. International business management: Agility journey for high-tech companies. Bus. Inf. 2019, 12, 370–383. [Google Scholar] [CrossRef]

- Baber, W.W.; Ojala, A.; Martinez, R. Effectuation logic in digital business model transformation. J. Small Bus. Enterp. Dev. 2019, 26, 811–830. [Google Scholar] [CrossRef] [Green Version]

- Wilkins, M. Business groups in the west: Origins, evolution, and resilience. Bus. Hist. Rev. 2019, 93, 599–609. [Google Scholar] [CrossRef]

- Burns, J.; Jollands, S. Acting in the public interest: Accounting for the vulnerable. Account. Bus. Res. 2020, 50, 507–534. [Google Scholar] [CrossRef]

- Lai, A.; Leoni, G.; Stacchezzini, R. Accounting and governance in diverse settings—An introduction. Account. Hist. 2019, 24, 325–337. [Google Scholar] [CrossRef] [Green Version]

- Lehenchuk, S.; Zhyhlei, I.; Syvak, O. Understanding accounting as a social and institutional practice: Possible exit of accounting science from crisis. Account. Financ. Control 2020, 3, 11–22. [Google Scholar] [CrossRef]

- Taylor, G.; Brasel, K.R.; Dawkins, M.C.; Dugan, M.T. Keeping pace: The conditional probability of accounting academics to continue publishing in elite accounting journals. Adv. Account. 2018, 41, 97–113. [Google Scholar] [CrossRef]

- Outa, E.R.; Ozili, P.K.; Eisenberg, P. IFRS convergence and revisions: Value relevance of accounting information from East Africa. J. Account. Emerg. Econ. 2017, 7, 352–368. [Google Scholar] [CrossRef]

- Zhong, Y.; Li, W. Accounting conservatism: A literature review. Aust. Account. Rev. 2016, 27, 195–213. [Google Scholar] [CrossRef]

- Miller, T. Explanation in artificial intelligence: Insights from the social sciences. Artif. Intell. 2019, 267, 1–38. [Google Scholar] [CrossRef]

- Feeney, O. Editing the gene editing debate: Reassessing the normative discussions on emerging genetic technologies. NanoEthics 2019, 13, 233–243. [Google Scholar] [CrossRef]

- Khalil, M.; Ozkanc, A.; Yildiz, Y. Foreign institutional ownership and demand for accounting conservatism: Evidence from an emerging market. Rev. Quant. Financ. Account. 2019, 55, 1–27. [Google Scholar] [CrossRef] [Green Version]

- Demirkan, S.; Demirkan, I.; McKee, A. Blockchain technology in the future of business cyber security and accounting. J. Manag. Anal. 2020, 7, 189–208. [Google Scholar] [CrossRef]

- Kalantonis, P.; Schoina, S.; Missiakoulis, S.; Zopounidis, C. The impact of the disclosed R & D expenditure on the value relevance of the accounting information: Evidence from Greek listed firms. Mathematics 2020, 8, 730. [Google Scholar] [CrossRef]

- Kokina, J.; Blanchette, S. Early evidence of digital labor in accounting: Innovation with robotic process automation. Int. J. Account. Inf. Syst. 2019, 35, 100431. [Google Scholar] [CrossRef]

- Liu, M.; Wu, K.; Xu, J.J. How will blockchain technology impact auditing and accounting: Permissionless versus permissioned blockchain. Curr. Issues Audit. 2019, 13, A19–A29. [Google Scholar] [CrossRef] [Green Version]

- Lehner, O.M.; Leitner-Hanetseder, S.; Eisl, C. The whatness of digital accounting: Status quo and ways to move forward. ACRN J. Finance Risk Perspect. 2019, 8, I–IX. [Google Scholar] [CrossRef]

- Elliot, V.H.; Paananen, M.; Staron, M. Artificial intelligence for decision-makers. J. Emerg. Technol. Account. 2019, 17, 51–55. [Google Scholar] [CrossRef]

- Sutton, S.G.; Arnold, V.; Holt, M. How much automation is too much? Keeping the human relevant in knowledge work. J. Emerg. Technol. Account. 2018, 15, 15–25. [Google Scholar] [CrossRef]

- Locke, J.; Rowbottom, N.; Troshani, I. Sites of translation in digital reporting. Account. Audit. Account. J. 2018, 31, 2006–2030. [Google Scholar] [CrossRef] [Green Version]

- Janvrin, D.J.; Watson, M.W. “Big data”: A new twist to accounting. J. Account. Educ. 2017, 38, 3–8. [Google Scholar] [CrossRef]

- Prasad, A.; Green, P.F. Governing cloud computing services: Reconsideration of IT governance structures. Int. J. Account. Inf. Syst. 2015, 19, 45–58. [Google Scholar] [CrossRef] [Green Version]

- Elbashir, M.Z.; Collier, P.A.; Sutton, S.G. The Role of organizational absorptive capacity in strategic use of business intelligence to support integrated management control systems. Account. Rev. 2011, 86, 155–184. [Google Scholar] [CrossRef]

- Smith, L.M. Acceptance of emerging technologies for corporate accounting and business tasks: An international comparison. Adv. Account. 2008, 24, 250–261. [Google Scholar] [CrossRef]

- Murthy, U.S.; Groomer, S. A continuous auditing web services model for XML-based accounting systems. Int. J. Account. Inf. Syst. 2004, 5, 139–163. [Google Scholar] [CrossRef]

- Rezaee, Z.; Elam, R.; Sharbatoghlie, A. Continuous auditing: The audit of the future. Manag. Audit. J. 2001, 16, 150–158. [Google Scholar] [CrossRef]

- Limmack, R. Advanced accounting. Br. Account. Rev. 1989, 21, 196–197. [Google Scholar] [CrossRef]

- Ong, T.; Djajadikerta, H.G. Adoption of emerging technology to incorporate business research skills in teaching accounting theory. J. Educ. Bus. 2019, 94, 480–489. [Google Scholar] [CrossRef]

- Braña, F.-J. A fourth industrial revolution? Digital transformation, labor and work organization: A view from Spain. J. Ind. Bus. Econ. 2019, 46, 415–430. [Google Scholar] [CrossRef]

- Bican, P.M.; Brem, A. Digital business model, digital transformation, digital entrepreneurship: Is there a sustainable “digital”? Sustainability 2020, 12, 5239. [Google Scholar] [CrossRef]

- Dronyuk, I.; Fedevych, O.; Kryvinska, N. Constructing of digital watermark based on generalized fourier transform. Electronics 2020, 9, 1108. [Google Scholar] [CrossRef]

- Otrebski, R.; Pospisil, D.; Engelhardt-Nowitzki, C.; Kryvinska, N.; Aburaia, M. Flexibility enhancements in digital manufacturing by means of ontological data modeling. Procedia Comput. Sci. 2019, 155, 296–302. [Google Scholar] [CrossRef]

- Pawlak, M.; Poniszewska-Maranda, A.; Kryvinska, N. Towards the intelligent agents for blockchain e-voting system. Procedia Comput. Sci. 2018, 141, 239–246. [Google Scholar] [CrossRef]

- Zelenay, J.; Balco, P.; Greguš, M. Cloud technologies—Solution for secure communication and collaboration. Procedia Comput. Sci. 2019, 151, 567–574. [Google Scholar] [CrossRef]

- Ebert, I. The tech company dilemma. Ethical managerial practice in dealing with government data requests. Z. für Wirtsch. Und Unternehm. 2019, 20, 264–275. [Google Scholar] [CrossRef]

- Melnykova, N.; Shakhovska, N.; Gregus, M.; Melnykov, V.; Zakharchuk, M.; Vovk, O. Data-driven analytics for personalized medical decision making. Mathematics 2020, 8, 1211. [Google Scholar] [CrossRef]

- Cooper, L.A.; Holderness, D.K.; Sorensen, T.L.; Wood, D.A. Robotic process automation in public accounting. Account. Horiz. 2019, 33, 15–35. [Google Scholar] [CrossRef]

- Dillard, J.; Vinnari, E. Critical dialogical accountability: From accounting-based accountability to accountability-based accounting. Crit. Perspect. Account. 2019, 62, 16–38. [Google Scholar] [CrossRef] [Green Version]

- Lourenço, S.M. Field experiments in managerial accounting research. Found. Trends Account. 2019, 14, 1–72. [Google Scholar] [CrossRef] [Green Version]

- Morais, A.I.A.P.D.C. Are changes in international accounting standards making them more complex? Account. Forum 2019, 44, 35–63. [Google Scholar] [CrossRef]

- Killian, S.; O’Regan, P. Accounting, the public interest and the common good. Crit. Perspect. Account. 2020, 67–68, 102144. [Google Scholar] [CrossRef]

- Chen, A.; Gong, J.J. Accounting comparability, financial reporting quality, and the pricing of accruals. Adv. Account. 2019, 45, 100415. [Google Scholar] [CrossRef]

- Muda, I.; Afrina, A. Influence of human resources to the effect of system quality and information quality on the user satisfaction of accrual-based accounting system. Contaduría Adm. 2018, 64, 100. [Google Scholar] [CrossRef]

- La Fors, K.; Custers, B.; Keymolen, E. Reassessing values for emerging big data technologies: Integrating design-based and application-based approaches. Ethic Inf. Technol. 2019, 21, 209–226. [Google Scholar] [CrossRef] [Green Version]

- Andiola, L.M.; Masters, E.; Norman, C. Integrating technology and data analytic skills into the accounting curriculum: Accounting department leaders’ experiences and insights. J. Account. Educ. 2020, 50, 100655. [Google Scholar] [CrossRef]

- Byrnes, P.E. Automated clustering for data analytics. J. Emerg. Technol. Account. 2019, 16, 43–58. [Google Scholar] [CrossRef]

- Flasher, R. Sunshine to government—Opportunities for engagement with government data. J. Emerg. Technol. Account. 2019, 17, 57–62. [Google Scholar] [CrossRef]

- Shawver, T.J. An experimental study of cooperative learning in advanced financial accounting courses. Account. Educ. 2020, 29, 247–262. [Google Scholar] [CrossRef]

- Bailey, W.J.; Sawers, K.M. Moving toward a principle-based approach to U.S. accounting standard setting: A demand for procedural justice and accounting reform. Adv. Account. 2018, 43, 1–13. [Google Scholar] [CrossRef]

- Hall, M.; O’Dwyer, B. Accounting, non-governmental organizations and civil society: The importance of nonprofit organizations to understanding accounting, organizations and society. Account. Organ. Soc. 2017, 63, 1–5. [Google Scholar] [CrossRef] [Green Version]

- Blackburn, D.W.; Cakici, N. Tangible and intangible information in emerging markets. Rev. Quant. Financ. Account. 2019, 54, 1509–1527. [Google Scholar] [CrossRef]

- Rîndașu, S.-M. Emerging information technologies in accounting and related security risks—What is the impact on the Romanian accounting profession. J. Account. Manag. Inf. Syst. 2017, 16, 581–609. [Google Scholar] [CrossRef]

- Lin, C.; Kunnathur, A.S.; Li, L. Conceptualizing big data practices. Int. J. Account. Inf. Manag. 2020, 28, 205–222. [Google Scholar] [CrossRef]

- Gao, L. Exploring the data processing practices of cloud ERP—A case study. J. Emerg. Technol. Account. 2019, 17, 63–70. [Google Scholar] [CrossRef]

- Marshall, T.E.; Lambert, S.L. Cloud-based intelligent accounting applications: Accounting task automation using IBM watson cognitive computing. J. Emerg. Technol. Account. 2018, 15, 199–215. [Google Scholar] [CrossRef]

- Channuntapipat, C.; Samsonova, A.; Turley, S. Variation in sustainability assurance practice: An analysis of accounting versus non-accounting providers. Br. Account. Rev. 2020, 52, 100843. [Google Scholar] [CrossRef]

- Polulekh, M.V. Normative production accounting in the digital economy: Issues and solutions. Account. Anal. Audit. 2018, 5, 82–93. [Google Scholar] [CrossRef]

- Aburous, D. IFRS and institutional work in the accounting domain. Crit. Perspect. Account. 2019, 62, 1–15. [Google Scholar] [CrossRef]

- Prathap, G. Eugene garfield: From the metrics of science to the science of metrics. Science 2017, 114, 637–650. [Google Scholar] [CrossRef]

- Nicolaisen, J.; Frandsen, T.F. Bibliometric evolution: Is the journal of the association for information science and technology transforming into a specialty journal? J. Assoc. Inf. Sci. Technol. 2014, 66, 1082–1085. [Google Scholar] [CrossRef] [Green Version]

- Aksu, G.; Üniversitesi, A.M.; Güzeller, C.O.; Üniversitesi, A. Analysis of scientific studies on item response theory by bibliometric analysis method. Int. J. Progress. Educ. 2019, 15, 44–64. [Google Scholar] [CrossRef]

- Prathap, G. Quantity, quality, and consistency as bibliometric indicators. J. Assoc. Inf. Sci. Technol. 2013, 65, 214. [Google Scholar] [CrossRef]

- Besselaar, P.V.D.; Sandström, U. Measuring researcher independence using bibliometric data: A proposal for a new performance indicator. PLoS ONE 2019, 14, e0202712. [Google Scholar] [CrossRef] [Green Version]

- Abad-Segura, E.; González-Zamar, M.-D. Global research trends in financial transactions. Mathematics 2020, 8, 614. [Google Scholar] [CrossRef]

- González-Zamar, M.-D.; Abad-Segura, E.; Vázquez-Cano, E.; López-Meneses, E. IoT technology applications-based smart cities: Research analysis. Electronics 2020, 9, 1246. [Google Scholar] [CrossRef]

- Efremenkova, V.M.; Gonnova, S.M. A comparison of Scopus and WoS database subject classifiers in mathematical disciplines. Sci. Tech. Inf. Process. 2016, 43, 115–122. [Google Scholar] [CrossRef]

- Franceschini, F.; Maisano, D.; Mastrogiacomo, L. Do Scopus and WoS correct “old” omitted citations? Science 2016, 107, 321–335. [Google Scholar] [CrossRef]

- Liberati, A.; Altman, D.G.; Tetzlaff, J.; Mulrow, C.; Gøtzsche, P.C.; Ioannidis, J.P.A.; Clarke, M.; Devereaux, P.J.; Kleijnen, J.; Moher, D. The PRISMA statement for reporting systematic reviews and meta-analyses of studies that evaluate health care interventions: Explanation and elaboration. PLoS Med. 2009, 6, e1000100. [Google Scholar] [CrossRef]

- Abad-Segura, E.; González-Zamar, M.-D.; López-Meneses, E.; Vázquez-Cano, E. Financial technology: Review of trends, approaches and management. Mathematics 2020, 8, 951. [Google Scholar] [CrossRef]

- López-Meneses, E.; Vázquez-Cano, E.; González-Zamar, M.-D.; Abad-Segura, E. Socioeconomic effects in cyberbullying: Global research trends in the educational context. Int. J. Environ. Res. Public Health 2020, 17, 4369. [Google Scholar] [CrossRef]

- Belmonte-Ureña, L.J.; Garrido-Cardenas, J.A.; Camacho-Ferre, F. Analysis of world research on grafting in horticultural plants. HortScience 2020, 55, 112–120. [Google Scholar] [CrossRef]

- González-Zamar, M.-D.; Jiménez, L.O.; Ayala, A.S.; Abad-Segura, E. The impact of the university classroom on managing the socio-educational well-being: A global study. Int. J. Environ. Res. Public Health 2020, 17, 931. [Google Scholar] [CrossRef] [Green Version]

- Bar-Ilan, J. Which h-index?—A comparison of WoS, Scopus and google scholar. Science 2007, 74, 257–271. [Google Scholar] [CrossRef]

- Prichina, O.S. Developing and testing the forecasting algorithm for the technological revolution theme through the analysis of the scimago JR scientific journal database. J. Adv. Res. Dyn. Control. Syst. 2020, 12, 712–724. [Google Scholar] [CrossRef]

- Al-Hoorie, A.H.; Vitta, J.P. The seven sins of L2 research: A review of 30 journals’ statistical quality and their CiteScore, SJR, SNIP, JCR impact factors. Lang. Teach. Res. 2018, 23, 727–744. [Google Scholar] [CrossRef]

- Cugmas, M.; Ferligoj, A.; Kronegger, L. The stability of co-authorship structures. Science 2015, 106, 163–186. [Google Scholar] [CrossRef] [Green Version]

- Durda, K.; Buchanan, L.; Caron, R.J. Grounding co-occurrence: Identifying features in a lexical co-occurrence model of semantic memory. Behav. Res. Methods 2009, 41, 1210–1223. [Google Scholar] [CrossRef]

- Brodić, D.; Milivojević, Z.N.; Maluckov, C.A. Recognition of the script in serbian documents using frequency occurrence and co-occurrence analysis. Sci. World J. 2013, 2013, 1–14. [Google Scholar] [CrossRef]

- Kimbrough, D.E.; Parekh, P. Occurrence and co-occurrence of perchlorate and nitrate in California drinking water sources. J. Am. Water Work. Assoc. 2007, 99, 126–132. [Google Scholar] [CrossRef]

- Ravikumar, S.; Agrahari, A.; Singh, S.N. Mapping the intellectual structure of scientometrics: A co-word analysis of the journal Scientometrics (2005–2010). Science 2014, 102, 929–955. [Google Scholar] [CrossRef]

- Shen, B.; Li, Y. Analysis of co-occurrence networks with clique occurrence information. Int. J. Mod. Phys. C 2014, 25, 1440015. [Google Scholar] [CrossRef]

- Van Eck, N.J.; Waltman, L. Citation-based clustering of publications using CitNetExplorer and VOSviewer. Science 2017, 111, 1053–1070. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Lee, C.I.; Felps, W.; Baruch, Y. Mapping career studies: A bibliometric analysis. Acad. Manag. Proc. 2014, 2014, 14214. [Google Scholar] [CrossRef]

- Waltman, L.; Van Eck, N.J. A new methodology for constructing a publication-level classification system of science. J. Am. Soc. Inf. Sci. Technol. 2012, 63, 2378–2392. [Google Scholar] [CrossRef] [Green Version]

- Van Eck, N.J.; Waltman, L. Software survey: VOSviewer, a computer program for bibliometric mapping. Scientometrics 2009, 84, 523–538. [Google Scholar] [CrossRef] [Green Version]

- Boyack, K.W.; Glänzel, W.; Gläser, J.; Havemann, F.; Scharnhorst, A.; Thijs, B.; Van Eck, N.J.; Velden, T.; Waltmann, L. Topic identification challenge. Science 2017, 111, 1223–1224. [Google Scholar] [CrossRef]

- Van Eck, N.J.; Waltman, L.; Noyons, E.; Buter, R.K. Automatic term identification for bibliometric mapping. Science 2010, 82, 581–596. [Google Scholar] [CrossRef] [Green Version]

- Bennett, W.S. A digital storage language’’ for engineering and production information. IRE Trans. Ind. Electron. 1961, IE-8, 36–42. [Google Scholar] [CrossRef]

- Thorelli, H.B. Networks: Between markets and hierarchies. Strat. Manag. J. 1986, 7, 37–51. [Google Scholar] [CrossRef]

- Pan, G.; Seow, P.-S.M. Preparing accounting graduates for digital revolution: A critical review of information technology competencies and skills development. J. Educ. Bus. 2016, 91, 166–175. [Google Scholar] [CrossRef]

- Albarillo, F. Language in social science databases: English versus non-english articles in JSTOR and Scopus. Behav. Soc. Sci. Libr. 2014, 33, 77–90. [Google Scholar] [CrossRef]

- Mesa, W.B. Accounting students’ learning processes in analytics: A sensemaking perspective. J. Account. Educ. 2019, 48, 50–68. [Google Scholar] [CrossRef]

- Bujaki, M.; Lento, C.; Sayed, N. Utilizing professional accounting concepts to understand and respond to academic dishonesty in accounting programs. J. Account. Educ. 2019, 47, 28–47. [Google Scholar] [CrossRef]

- Gifford, L. “You can’t value what you can’t measure”: A critical look at forest carbon accounting. Clim. Chang. 2020, 161, 291–306. [Google Scholar] [CrossRef]

- Perdana, A.; Robb, A.; Rohde, F. Textual and contextual analysis of professionals’ discourses on XBRL data and information quality. Int. J. Account. Inf. Manag. 2019, 27, 492–511. [Google Scholar] [CrossRef]

- Pei, D.; Vasarhelyi, M.A. Big data and algorithmic trading against periodic and tangible asset reporting: The need for U-XBRL. Int. J. Account. Inf. Syst. 2020, 37, 100453. [Google Scholar] [CrossRef]

- Bhuyian, N.M.; Kalyanapu, A.J. Accounting digital elevation uncertainty for flood consequence assessment. J. Flood Risk Manag. 2017, 11, S1051–S1062. [Google Scholar] [CrossRef]

- Bonyuet, D. Overview and impact of blockchain on auditing. Int. J. Digit. Account. Res. 2020, 31–43. [Google Scholar] [CrossRef]

- Varshney, L.R. Mathematical limit theorems for computational creativity. IBM J. Res. Dev. 2019, 63, 2:1–2:12. [Google Scholar] [CrossRef]

- Walker, L. IBM business transformation enabled by service-oriented architecture. IBM Syst. J. 2007, 46, 651–667. [Google Scholar] [CrossRef]

- Olaniyi, E.O.; Prause, G. Seca regulatory impact assessment: Administrative burden costs in the baltic sea region. Transp. Telecommun. J. 2019, 20, 62–73. [Google Scholar] [CrossRef] [Green Version]

- Badua, F. Lies, sex, and suicide: Teaching fundamental accounting concepts with sordid tales from the seamier side of accounting history. Account. Hist. J. 2019, 46, 79–85. [Google Scholar] [CrossRef]

- Lin, P.; Smith, L.M. Using a Web-based accounting system for teaching accounting system design and implementation. J. Inf. Syst. 2006, 20, 65–79. [Google Scholar] [CrossRef]

- Zhang, C. (Abigail) Intelligent process automation in audit. J. Emerg. Technol. Account. 2019, 16, 69–88. [Google Scholar] [CrossRef]

- Ali, S.; Green, P.F.; Robb, A. Information technology investment governance: What is it and does it matter? Int. J. Account. Inf. Syst. 2015, 18, 1–25. [Google Scholar] [CrossRef] [Green Version]

- Liew, A. Enhancing and enabling management control systems through information technology: The essential roles of internal transparency and global transparency. Int. J. Account. Inf. Syst. 2019, 33, 16–31. [Google Scholar] [CrossRef]

- Dierkes, S.; Siepelmeyer, D. Production and cost theory-based material flow cost accounting. J. Clean. Prod. 2019, 235, 483–492. [Google Scholar] [CrossRef]

- Han, S.; Rezaee, Z.; Xue, L.; Zhang, J.H. The association between information technology investments and audit risk. J. Inf. Syst. 2015, 30, 93–116. [Google Scholar] [CrossRef] [Green Version]

- Huang, W.; Viti, F.; Tampère, C.M. Repeated anticipatory network traffic control using iterative optimization accounting for model bias correction. Transp. Res. Part C Emerg. Technol. 2016, 67, 243–265. [Google Scholar] [CrossRef]

- Wilton, R.; Evans, J. Accounting for context: Social enterprises and meaningful employment for people with mental illness. Work 2019, 61, 561–574. [Google Scholar] [CrossRef] [PubMed]

- Shastri, N.M.; Kumar, S.; Shaw, V. Role of big data in accounting & auditing. Manag. Account. J. 2019, 54, 33. [Google Scholar] [CrossRef]

- Baev, A.A.; Levina, V.S.; Reut, A.V.; Svidler, A.A.; Kharitonov, I.A.; Григoрьев, B.B. Blockchain technology in accounting and auditing. Account. Anal. Audit. 2020, 7, 69–79. [Google Scholar] [CrossRef]

- Perdana, A.; Robb, A.; Rohde, F. XBRL diffusion in social media: Discourses and community learning. J. Inf. Syst. 2014, 29, 71–106. [Google Scholar] [CrossRef]

- Arnaboldi, M.; Busco, C.; Cuganesan, S. Accounting, accountability, social media and big data: Revolution or hype? Account. Audit. Account. J. 2017, 30, 762–776. [Google Scholar] [CrossRef] [Green Version]

- Petkov, R. Artificial intelligence (AI) and the accounting function—A revisit and a new perspective for developing framework. J. Emerg. Technol. Account. 2019, 17, 99–105. [Google Scholar] [CrossRef]

- Hou, X. Application of blockchain technology in the field of accounting supervision. Probe Account. Audit. Tax. 2020, 2, 34–38. [Google Scholar] [CrossRef]

- Salim, A.; Khan, S. The effects of factors on making investment decisions among Omani working women. Accounting 2020, 6, 657–664. [Google Scholar] [CrossRef]

- Fossung, M.F.; Ntoung, L.A.T.; De Oliveira, H.M.S.; Pereira, C.M.F.; Bastos, S.A.M.C.; Pimentel, L.M. Transition to the revised OHADA law on accounting and financial reporting: Corporate perceptions of costs and benefits. J. Risk Financ. Manag. 2020, 13, 172. [Google Scholar] [CrossRef]

- Shuremov, E.L. Whether it is worth being fond of big data? Account. Anal. Audit. 2020, 7, 17–29. [Google Scholar] [CrossRef]

- Marthandan, G.; Joshi, P.L. Continuous internal auditing: Can big data analytics help. Int. J. Account. Audit. Perform. Eval. 2020, 16, 25. [Google Scholar] [CrossRef] [Green Version]

- Xu, D. Accounting information revolution based on cloud computing technology. In Proceedings of the IOP Conference Series: Materials Science and Engineering, Shenyang, China, 27–29 December 2019; IOP Publishing: Bristol, UK, 2020; Volume 750, p. 012201. [Google Scholar]

- Doshi, H.A.K.; Balasingam, S.; Arumugam, D. Artificial intelligence as a paradoxical digital disruptor in the accounting profession: An empirical study amongst accountants. Int. J. Psychosoc. Rehabil. 2020, 24, 873–885. [Google Scholar] [CrossRef]

- Huang, F.; Vasarhelyi, M.A. Applying robotic process automation (RPA) in auditing: A framework. Int. J. Account. Inf. Syst. 2019, 35, 100433. [Google Scholar] [CrossRef]

- Trigueiros, D. Improving the effectiveness of predictors in accounting-based models. J. Appl. Account. Res. 2019, 20, 207–226. [Google Scholar] [CrossRef] [Green Version]

- Irsyadillah, I. The ideological character of accounting textbooks. J. Account. Emerg. Econ. 2019, 9, 542–566. [Google Scholar] [CrossRef]

- Ucoglu, D. Effects of artificial intelligence technology on accounting profession and education. Pressacademia 2020, 11, 16–21. [Google Scholar] [CrossRef]

| Ref. | Year | Article Title | Author(s) | Journal | Subject Area |

|---|---|---|---|---|---|

| [15] | 2020 | Blockchain technology in the future of business cyber security and accounting | Demirkan, S.; Demirkan, I.; McKee, A. | Journal of Management Analytics | BMA—M |

| [16] | 2020 | The Impact of the Disclosed R & D Expenditure on the Value Relevance of the Accounting Information: Evidence from Greek Listed Firms | Kalantonis, P.; Schoina, S.; Missiakoulis, S.; Zopounidis, C. | Mathematics | M |

| [17] | 2019 | Early evidence of digital labor in accounting: Innovation with Robotic Process Automation | Kokina, J.; Blanchette, S. | International Journal of Accounting Information Systems | EEF—BMA—DS |

| [18] | 2019 | How Will Blockchain Technology Impact Auditing and Accounting: Permission less versus Permissioned Blockchain | Liu, M.; Wu, K.; Xu, J. J. | Current Issues in Auditing | BMA |

| [19] | 2019 | The Whatness of Digital Accounting: Status Quo and Ways to move forward | Lehner, O.; Leitner-Hanetseder, S.; Eisl, C. | ACRN Journal of Finance and Risk Perspectives | BMA—DS |

| [20] | 2019 | Artificial Intelligence for Decision-Makers | Elliot, V. H.; Paananen, M.; Staron, M. | Journal of Emerging Technologies in Accounting | BMA—CS |

| [21] | 2018 | How Much Automation Is Too Much? Keeping the Human Relevant in Knowledge Work | Sutton, S. G.; Arnold, V.; Holt, M. | Journal of Emerging Technologies in Accounting | BMA—CS |

| [22] | 2018 | Sites of translation in digital reporting | Locke, J.; Rowbottom, N.; Troshani, I. | Accounting, Auditing & Accountability Journal | EEF—BMA |

| [23] | 2017 | “Big Data”: A new twist to accounting | Janvrin, D. J.; Weidenmier Watson, M. | Journal of Accounting Education | SS—BMA |

| [24] | 2015 | Governing cloud computing services: Reconsideration of IT governance structures | Prasad, A.; Green, P. | International Journal of Accounting Information Systems | EEF—BMA |

| [25] | 2011 | The Role of Organizational Absorptive Capacity in Strategic Use of Business Intelligence to Support Integrated Management Control Systems | Elbashir, M. Z.; Collier, P. A.; Sutton, S. G. | The Accounting Review | EEF—BMA |

| [26] | 2008 | Acceptance of emerging technologies for corporate accounting and business tasks: An international comparison | Smith, L. M. | Advances in Accounting | EEF—BMA |

| [27] | 2004 | A continuous auditing web services model for XML-based accounting systems | Murthy, U. S.; Groomer, S. M. | International Journal of Accounting Information Systems | EEF—BMA |

| [28] | 2001 | Continuous auditing: the audit of the future | Rezaee, Z.; Elam, R.; Sharbatoghlie, A. | Managerial Auditing Journal | EEF—BMA |

| [29] | 1989 | Advanced accounting | Limmack, R. | The British Accounting Review | BMA |

| Journal | C | A * | H * | 1A * | LA * | SJR * | CS * | SNIP * | KW1 | KW2 | KW3 | Subject Area |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| International Journal of Accounting Information Systems | UK | 18 | 11 | 2004 | 2019 | 0.619 | 4.4 | 1.496 | Digital Reporting | Technology Acceptance | XBRL | BMA-DS-EEF |

| Journal of Information Systems | USA | 16 | 7 | 2011 | 2019 | 0.780 | 4.0 | 1.671 | IT Governance | Accounting Information Systems | Business Value of IT | BMA-CS-DS |

| Journal of Accounting Education | UK | 15 | 7 | 1998 | 2019 | 0.481 | 3.2 | 1.592 | Accounting Education | Higher Education | Technology | BMA-SS |

| Accounting Education | UK | 12 | 8 | 1995 | 2019 | 0.520 | 2.8 | 1.238 | Information Technology | Teaching | Accountancy | BMA-SS |

| Journal of Emerging Technologies in Accounting | USA | 11 | 5 | 2009 | 2019 | 0.490 | 2.3 | 0.879 | Technology Adoption | Artificial Intelligence | Continuous Monitoring | BMA-CS |

| Journal of Productivity Analysis | NL | 11 | 5 | 2006 | 2017 | 0.888 | 3.2 | 1.429 | Efficiency | Productivity | Accounting | BMA-EEF-SS |

| Managerial Auditing Journal | UK | 10 | 7 | 1997 | 2019 | 0.468 | 2.7 | 1.271 | Information Technology | Accounting | Auditing | BMA-EEF |

| Turkish Online Journal of Educational Technology | TU | 10 | 1 | 2015 | 2017 | 0.126 | 0.4 | 0.263 | Accounting | Simulation | Academic Achievement | SS |

| Accounting Auditing and Accountability Journal | UK | 9 | 4 | 2005 | 2019 | 1.459 | 4.9 | 1.879 | Accounting | Accounting Standards | Alienation | BMA-EEF |

| Australasian Accounting Business and Finance Journal | AU | 9 | 4 | 2014 | 2019 | 0.309 | 2.6 | 1.368 | Behavior | Business Strategy | CSR Disclosure Index | BMA-EEF |

| Critical Perspectives on Accounting | USA | 9 | 7 | 1996 | 2019 | 1.823 | 5.1 | 1.936 | Accountability | Accounting | Accounting Firms | BMA-DS-EEF-SS |

| International Journal of Scientific and Technology Research | IN | 9 | 1 | 2018 | 2019 | 0.123 | 0.2 | 0.091 | Accounting | Accounting Events | Accounting Information Systems | BMA-E-SS |

| Climatic Change | NL | 8 | 7 | 2007 | 2017 | 1.908 | 8.3 | 1.504 | Uncertainty Analysis | Economic Analysis | Emission Control | EPS-ES |

| Issues in Accounting Education | USA | 8 | 5 | 2010 | 2016 | 0.410 | 1.8 | 0.811 | XBRL | Accounting Principles | Audience Response Systems (ARS) | BMA-SS |

| Journal of Intellectual Capital | UK | 8 | 5 | 2002 | 2019 | 1.184 | 8.6 | 2.290 | Intellectual Capital | Business Performance | Management Accounting | BMA-SS |

| Research Institution | Country | A | SA | h | 1A | LA | KW1 | KW2 | KW3 |

|---|---|---|---|---|---|---|---|---|---|

| The University of Sydney | Australia | 11 | BMA-SS-CS | 6 | 2009 | 2019 | Accounting | Intellectual Capital | Accounting History |

| University of Melbourne | Australia | 9 | BMA-SS-EEF | 5 | 2007 | 2019 | Absorptive Capacity | Accounting History | Administration |

| RMIT University | Australia | 8 | BMA-EEF-SS | 6 | 1988 | 2019 | Digital Reporting | XBRL | Administrative Burden |

| Southeast Missouri State University | USA | 8 | BMA-SS-CS | 0 | 2011 | 2015 | Acquisition Cycle | Control | Convergence |

| Monash University | Australia | 8 | SS-BMA-EEF | 5 | 1996 | 2019 | Access | Accounting Education | Agricultural Policy |

| University of Birmingham | UK | 8 | BMA-SS-EEF | 5 | 1995 | 2018 | Digital Reporting | XBRL | Abstractions |

| International Business Machines (IBM) | USA | 8 | CS-M-DS | 4 | 1977 | 2014 | Cost Accounting | Accounting Information Systems (AIS) | Administrative Data Processing |

| The University of Queensland | USA | 8 | BMA-EEF-CS | 4 | 2011 | 2019 | Extensible Business Reporting Language | XBRL | Business Reporting |

| University of Southern California | USA | 7 | BMA-CS-EEF | 3 | 1999 | 2018 | Enterprise Resource Planning Systems | AIS Research | Adoption Curve |

| Universiti Utara Malaysia | Malaysia | 6 | EEF-BMA-E | 3 | 2014 | 2019 | Internet Reporting | Accountants | Accounting Information System |

| Country | A | % | SA | h | 1A | LA | KW1 | KW2 | KW3 |

|---|---|---|---|---|---|---|---|---|---|

| USA | 348 | 30.91 | BMA-SS-CS | 42 | 1961 | 2019 | Information Technology | Cost Accounting | Technology |

| UK | 104 | 9.24 | BMA-SS-EEF | 20 | 1970 | 2019 | Information Technology | Cost Accounting | Investments |

| Australia | 87 | 7.73 | BMA-SS-EEF | 20 | 1988 | 2019 | XBRL | Accounting | Economics |

| China | 53 | 4.71 | CS-E-BMA | 12 | 2004 | 2019 | Cost Accounting | Accounting Information System | Emission Control |

| Germany | 38 | 3.37 | BMA-EEF-E | 12 | 1998 | 2019 | Cost Accounting | Cost Benefit Analysis | Information Technology |

| Russia | 37 | 3.29 | EEF-E-BMA | 6 | 2000 | 2019 | Digital Economy | Innovation | Standardization |

| Canada | 36 | 3.20 | BMA-CS-EEF | 14 | 1996 | 2019 | Information Technology | Cost Accounting | Mathematical Models |

| India | 30 | 2.66 | BMA-EEF-SS | 6 | 1996 | 2019 | Information Technology | Cost Accounting | Industry |

| Spain | 27 | 2.40 | BMA-SS-E | 9 | 1997 | 2019 | Costs | Economics | Cost Accounting |

| Malaysia | 23 | 2.04 | EEF-BMA-SS | 6 | 2010 | 2019 | Accounting Information System | ICT | Information Technology |

| Cluster Number | Cluster Color (See in Figure 5) | % | Keyword | O | L | TLS |

|---|---|---|---|---|---|---|

| 1 | Pink | 34.00% | Technology (*) | 44 | 112 | 183 |

| Economics | 38 | 121 | 228 | |||

| Sustainable Development | 23 | 74 | 104 | |||

| Emission Control | 21 | 57 | 75 | |||

| 2 | Green | 24.40% | Information Technology (*) | 112 | 163 | 450 |

| Accounting | 54 | 80 | 122 | |||

| XBRL | 26 | 18 | 21 | |||

| Information Systems | 23 | 47 | 76 | |||

| 3 | Red | 16.40% | Cost Accounting (*) | 131 | 179 | 625 |

| Decision Making | 30 | 100 | 175 | |||

| Industrial Economics | 29 | 74 | 132 | |||

| Strategic Planning | 27 | 75 | 145 | |||

| 4 | Yellow | 16.00% | Investments (*) | 33 | 102 | 191 |

| Cost Benefit Analysis | 28 | 96 | 183 | |||

| Industry | 25 | 88 | 141 | |||

| Economic Analysis | 20 | 88 | 135 | |||

| 5 | Violet | 6.00% | Optimization (*) | 16 | 53 | 84 |

| Cost Analysis | 9 | 33 | 56 | |||

| E-Commerce | 8 | 21 | 26 | |||

| Standardization | 8 | 18 | 21 | |||

| 6 | Blue | 3.20% | Employment (*) | 13 | 48 | 73 |

| Laws and Legislation | 9 | 37 | 47 | |||

| Standards | 9 | 36 | 47 | |||

| Regulatory Compliance | 7 | 27 | 31 |

| Future Direction of Research | Score Relevance | Main Associated Terms | Description |

|---|---|---|---|

| Blockchain Ontology | 19.631 |

| This line will examine Blockchain as the technology that unites the philosophy of technology and the ethics of information. This will allow companies the decentralization, transparency, and privacy that the current internet has lost, building a quasi-metaphysical system where everything would be noted, linked, and individualized by cryptographically perfect hashing processes and ensured by ethical managers [118]. |

| Involuntary Unemployment | 19.279 |

| Analysis of the disadvantages and advantages of how emerging technologies in the accounting field increase involuntary unemployment. This direction should examine how to take advantage of technological change to improve corporate performance through workers, customers, technology, and innovation [119]. |

| Cybersecurity Risk | 16.642 |

| Cybersecurity risk management is key to safeguarding the confidentiality, availability, and integrity of information assets, critical infrastructure, and personal data in cyberspace. To successfully manage risk, you must follow the reference framework for the study, identification, and mitigation of cybersecurity risks of standards such as ISO 31000: 2018 or ISO/IEC 27005: 2001. Its importance lies in protecting a company’s most valuable assets and its reputation [15,120]. |

| Big Data Technology | 11.945 |

| Analysis of the multiple options that big data offers to reorganize data structures, to allow the entry of different data sources, and a single transformation of data and homogenization of results. This line will examine how data analysis enables data manipulation and provides tools to create reports and data sets for financial and risk management purposes. In addition, the implementation of big data solutions will be assessed in relation to the challenges (implement new principles of data governance and transform data quality processes) and benefits (improved operational risk mitigation by reducing human intervention) [121,122]. |

| Cloud Accounting | 11.807 |

| Examine how cloud accounting can be the most efficient way to maintain a business’s accounting records, offering greater flexibility and security. The information is kept in large data centers with more redundant and backup systems than the company’s own installation. The digital transformation, in this sense, will allow one to structure all the available information. Moreover, this line should study if the ontology engineering methods work in the development of the regulatory function established by the required International Financial Information Standards [123]. |

| AI exposure | 10.684 |

| Analysis of the combination of artificial intelligence and automation in relation to the ability to take on tasks in the accounting area of an organization based on transactions, with little or no human participation. This direction will have to analyze the challenge of the economic survival of a company that consists of capitalizing on the changes in the way of developing the accounting functions [124]. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Abad-Segura, E.; González-Zamar, M.-D. Research Analysis on Emerging Technologies in Corporate Accounting. Mathematics 2020, 8, 1589. https://doi.org/10.3390/math8091589

Abad-Segura E, González-Zamar M-D. Research Analysis on Emerging Technologies in Corporate Accounting. Mathematics. 2020; 8(9):1589. https://doi.org/10.3390/math8091589

Chicago/Turabian StyleAbad-Segura, Emilio, and Mariana-Daniela González-Zamar. 2020. "Research Analysis on Emerging Technologies in Corporate Accounting" Mathematics 8, no. 9: 1589. https://doi.org/10.3390/math8091589

APA StyleAbad-Segura, E., & González-Zamar, M.-D. (2020). Research Analysis on Emerging Technologies in Corporate Accounting. Mathematics, 8(9), 1589. https://doi.org/10.3390/math8091589