Abstract

We present and prove a triple sum series formula for the European call option price in a market model where the underlying asset price is driven by a Variance Gamma process. In order to obtain this formula, we present some concepts and properties of multidimensional complex analysis, with particular emphasis on the multidimensional Jordan Lemma and the application of residue calculus to a Mellin–Barnes integral representation in , for the call option price. Moreover, we derive triple sum series formulas for some of the Greeks associated to the call option and we discuss the numerical accuracy and convergence of the main pricing formula.

1. Introduction

The pricing of financial derivatives, such as options, is one of the pivotal tasks of mathematical finance, yet it can be an arduous task to develop a model that is consistent with the empirical evidence, soluble, and where its numerical estimation is neither erroneous nor time consuming. One of the first attempts to solve this quandary was the Gaussian model that was first introduced by Fischer Black and Myron Scholes in [1] and later expanded by Robert Merton in [2], aptly named the Black–Scholes model, where the stochastic process driving the underlying asset price is modeled by a geometric Brownian motion. Its simplicity and the admission of a close formula for the option price are the main reasons why, to this day, it remains the most frequently used model by market practitioners. Still, the model fails to account for sudden price drops or increases that can be expressed as discontinuous price jumps; moreover, it assumes the volatility to remain constant for changes in relation to the strike price and time to maturity, contrary to the evidence derived from empirical data and, furthermore, the distributions of asset returns have been shown to be negatively skewed and exhibit fat-tails that are not captured by the symmetric Gaussian model.

The Black–Scholes model has been generalized in many ways. Let us mention two of the most important classes of models used in these generalizations: stochastic volatility models and jump models (see [3]). The model that we consider in this paper is a particular jump model, which assumes that the underlying asset price dynamics are described by a Lévy Process, namely the Variance Gamma process, which was first proposed by Dilip Madan and Eugene Seneta in [4]. The descriptive power of models that are based on Lévy processes for accurately portraying financial markets (not displaying the aforementioned problems that are present in the Black–Scholes model) has been known since the works of Benoît Mandelbrot [5] and Eugene Fama [3], and they have been gaining traction in recent decades with the advent of technology and computer development. Yet, the Black–Scholes model remains mostly ubiquitous. The main reason for this state of affairs is that pricing models that are based on Lévy processes admit, at best, a closed pricing formula for some particular cases, but, in general, prices must be computed by numerical simulation.

Several authors have studied the problem of option pricing under the Variance Gamma model. Let us highlight some important contributions. In [6], the authors obtain a closed form formula for the price of a European call option. This formula involves the evaluation of a modified Bessel function and a degenerate Hypergeometric function. A numerical method for option pricing based on Fourier Transform and Fast Fourier Transform was proposed in [7] and a method based on the Fourier-cosine series was proposed in [8]. An alternative numerical approach to the problem is based on the development of finite difference schemes for obtaining the solution of the partial integro-differential equation (PIDE) for the option pricing function (see, for instance, [9]). A multinomial method for option pricing of European and American options under the Variance Gamma model was also proposed and discussed in [10].

In recent years, a different approach has been undertaken directed at -stable Lévy processes (see [11]), which include: the discovery of the conditions for guaranteeing the existence of a martingale measure, which was carried out by Peter Carr and Liuren Wu in [12]; the representation of the Green function (the fundamental solution to the space–time fractional diffusion equation) by a Mellin–Barnes integral of a Gamma fraction, which was done by Rudolf Gorenflo and Francesco Mainardi, among others (see [13,14,15,16] for more details); and, the discovery that, under certain conditions, Residue Calculus can be applied to a Mellin–Barnes integral of a Gamma fraction, converting it into a multiple sum series, by Mikael Passare, August Tsikh, and Oleg Zhadanov in [17,18,19]. Let us briefly describe why the Mellin–Barnes integral is important when studying the space–time fractional diffusion equation (which generalizes the standard diffusion equation by replacing the usual derivatives with fractional derivatives). The fundamental solution or Green function of the fractional diffusion equation can be represented as a spatial density probability function that is time dependent. After applying the Mellin transform to this Green function, one obtains a Mellin–Barnes integral of Gamma functions in the complex plane. This Mellin–Barnes integral can be evaluated using the residues theorem and represented by a convergent series (for more details, see [13]). Finally, Jean-Phillipe Aguilar, Cyril Coste, and Jan Korbel used the Green function to express the price of a European option as a Mellin–Barnes integral in their works [20,21,22], and they were able to arrive at a double series representation for the European call option price by applying the previously mentioned results that were developed by Passare et al.

The main novelty and major contribution of the present study is that we obtain and prove a Mellin–Barnes integral representation and the associated triple residue sum formulas for European option prices and Greek functions, by using three-dimensional complex analysis in and considering the Variance Gamma model for the dynamics of the underlying risky asset. We also confirmed the viability and accuracy of the formula obtained by using numerical tests on real option data. Note that, in [20,21,22], a similar approach was applied to the time-fractional diffusion and the particular case of the finite moment Lévy stable model. However, in these papers, only two-dimensional complex analysis in was required and a double residue sum formula was obtained. Let us also note that, in [4], the authors introduce the Variance Gamma model for option pricing, but they use a very different approach for the calculation of the option price: the traditional risk neutral valuation formula and numerical integration techniques, when considering the probability density function of the Variance Gamma distribution.

The organization of the paper follows below. In Section 2, we will introduce preliminary concepts, such as the multidimensional Residue Theory and Mellin–Barnes integral, and discuss some of their properties. In Section 3, we present the option pricing problem and prove the representation of the triple Mellin–Barnes Integral for the option price. In Section 4, we present the main results of the paper. By applying residue calculus, we derive the triple series representation for the European call option price under the Variance Gamma model and the subsequent Greek functions. In Section 5, taking advantage of the data presented in [23], we test the accuracy of the Variance Gamma formula and its Greeks. The last section is dedicated to some concluding remarks.

2. Preliminary Theory

2.1. Multidimensional Residue Calculus

We start by enumerating, without proving, some of the definitions and results of multidimensional complex analysis. A more in-depth theoretical introduction to multidimensional complex analysis can be found in the textbooks [24,25].

Definition 1

(Grothendieck Residue). Let h and , for any index , be functions in , where h is holomorphic. Consider the meromorphic differential n-form

which has the singularities , such that the intersection is discrete. The Grothendieck residue on a singularity is defined as

where is a cycle in a small neighborhood of the singularity a with the orientation .

Before proceeding we will formalize the concept of a multidimensional polyhedron in . The two following definitions will underpin most of the theorems from Section 2 and Section 3.

Definition 2

(Polyhedron). Consider a proper (the inverse images of a compact set are compact) holomorphic map where is a domain (connected open subset of a finite-dimensional vector space) where, for each , is a domain with piecewise smooth boundary. We define a polyhedron Π as the inverse image

and for a multi-index we define the polyhedron’s faces as

Definition 3

(Compatible divisors). Consider the polyhedron Π and the family of divisors , they are said to be compatible if for any we get

Analogously to the one dimensional integral on the real axis, we may want to compute an integral where is the meromorphic form (1) and is the boundary of a polyhedron . For an unbounded polyhedron we need the integrand to vanish as it goes to infinity. To achieve this goal let us introduce the auxiliary functions

where . Using the functions (6) we define the differential -forms as

where , for , is a multi-index, is the position of j in set J and . We now define the multidimensional condition analogous to .

Definition 4

(Jordan condition). Consider the sphere , where is the boundary of the polyhedron Π. A differential form satisfies the Jordan condition on face , with , if exists a sequence of positive real numbers that goes to infinity, such that

Note that, for , there exists only one form and thus the condition (8) corresponds to the unidimensional condition . For the multidimensional case, consider the set . Thus, we have the following theorem, which allows us to compute the integral of the meromorphic form (1) on the boundary of the polyhedron as a sum of residues, and it is the main theoretical tool used in the proof of Theorem 2.

Theorem 1

(The Jordan Lemma). Let ω be a meromorphic form with the polar divisors compatible with polyhedron Π. If, for every multi-index J, the differential form satisfies the Jordan condition on , then we get

The Jordan’s Lemma proof can be found in [17].

2.2. One-Dimensional Mellin–Barnes Integral

We will start by presenting, without proof, some basic concepts and properties for the one-dimensional Mellin–Barnes integral. For a more in depth look at Fourier, Laplace, and Mellin Transforms, as well as their corresponding properties, we recommend the book [26].

Definition 5

(Mellin–Barnes Integral). The Mellin–Barnes Integral is given by a ratio of products of Gamma functions of linear arguments

where its characteristic quantity, Δ, is defined by

Before proceeding, let us state the Stirling’s approximation of the gamma function (see [27])

Equipped with this expression, one can easily see how governs the behavior of the ratio of Gammas as , and, therefore, which residues, of the singularities to the left or right of the strip, one will sum to compute the integral (10):

For example, one can express an exponential term as the Mellin–Barnes integral

where .

2.3. Three-Dimensional Mellin–Barnes Integral

In this subsection, similarly to what we did previously for the unidimensional case, we will present the triple Mellin–Barnes integral and deduce its formula as a sum of residues, which will be crucial when proving the main result of this paper. In order to achieve this, let us first consider its integral form

Henceforth, for brevity, we will denote the three-form integrand of (15) by . Its zeroes will be the complex planes , for any and , which represent each singularity given by the gamma functions present in the numerator of the form . We will also denote the vectors , and, most importantly, define the characteristic vector as

Suppose that is a non-zero vector. In this case, we can define the plane where its real part intersects the point and has as its normal vector, i.e., , and thereupon we can define the admissible-polyhedra, , as the real volume “below” , i.e., .

Taking all of these previous demarcations into account, we can construct an admissible polyhedron , which will be uniquely defined by the linear function , where and

with the image , i.e the first octant. From (17), we can ascertain that its only vertex is and that , , and are the normal vectors of the faces , , and of the polyhedron:

If the polyhedron was providently constructed, then we can balkanize the singularities, , into three distinct sets, such that they are compatible with the polyhedron, i.e.:

Theorem 2

(Residue formula for the Triple Mellin–Barnes integral). Let ω be the three-form integrand of (15) with the characteristic vector and divisors , , and , as defined in (21), being compatible with the admissible polyhedron . Subsequently, the sum formula holds:

where the series on the right-hand side converges absolutely for any , for U, defined as,

and α is a constant that is given by,

where is the unit sphere in .

For a proof of Theorem 2, please see Appendix A.

3. Option Pricing Driven by a Variance Gamma Process

Equipped with the results of the previous section, we will now center our attention on deducing the main result of this paper, the formula for the price of a European call option under the Variance Gamma model. Similar to the derivation presented in [20], we will arrive at this result in two steps. First, we will derive the Mellin–Barnes representation for the aforementioned call option price and, secondly, we will use residue calculus to derive the triple sum series formula.

3.1. Mellin–Barnes Representation for a Call Option

Before introducing the call option price, let us recall that we can define the Variance Gamma process as the difference between two independent gamma processes (see [6]),

where is the time variable, and with parameters , , and . The probability density function of a gamma process is given by

Under these definitions, one can, by direct computation, easily arrive at the characteristic function for the variance gamma process ,

where is the main variable of the characteristic function and is the time variable.

Let us now briefly discuss the standard problem of option pricing. For more details about this problem, we refer to [28]. Consider that we have an underlying risky asset with price process denoted by the stochastic process , where T denotes the maturity of the European option that we want to evaluate. In our market model, we assume that the continuously compounded risk-free interest rate is denoted by the parameter r and q represents the dividend yield. In the standard Black–Scholes model, it is well known that the market is arbitrage-free and complete. Moreover, we know from the fundamental theorems of asset pricing that an equivalent martingale measure or risk-neutral measure exists if and only if the market is arbitrage-free, and the measure is unique if and only if the market is complete. Therefore, under the standard Black–Scholes model, the equivalent martingale measure exists and it is unique. The measure is equivalent to the real (physical) probability measure and the process is a martingale under . The underlying risky asset price at time T, under the measure , is given by

where and is a standard Brownian motion under measure .

When considering Lévy Processes (like the Variance Gamma process), the market is, in general, incomplete and many equivalent martingale measures exist. Using the mean correcting martingale measure is one standard way to choose just one equivalent martingale measure. Under this particular measure, in the market model that is driven by the Variance Gamma process, we have that the risky asset price at time T is given by

where is the mean correcting parameter. For more details on the mean correcting martingale measure and the mean correcting parameter, see Chapter 6 of [23]. Let us recall that a European call option with maturity T and strike price is a contract that gives the buyer of the contract the right, but not the obligation, to buy the underlying risky asset at time T by the price K. The payoff of the call option is given by . Using the well-known risk-neutral valuation formula for option pricing, we can write the price at time t of a European call option with maturity T and strike price as the discounted expected value

where the variables are the underlying risky asset price at time t (denoted by ), the strike price of the option K, the risk-free interest rate r, the dividend yield q, and the time until maturity .

Using the notation introduced in the previous paragraphs, we can now state and derive the Mellin–Barnes integral representation in for the European call option price under the Variance Gamma model.

Proposition 1

(The Mellin–Barnes representation for a Call Option under Variance Gamma). Let us denote , where . Consider the polyhedra , which is defined by

Subsequently, the price of a European call option that is driven by the Variance Gamma process is given by the formula

where, for any and , we define and by

Proof.

For the mean correcting martingale measure , the price of a European Call Option under the Variance Gamma process (25) is given by (see (30))

By definition, and ; hence, from (26), their probability density functions are given, respectively, by and . Thus,

In order for the term to be different from zero, we must have . Additionally, notice that, by definition, both x and y are non-negative; hence, the values for which the integrand in (37) is not zero are given by the set , with the removal of the values in the set for the cases where . Thus, can be expressed as the sum

where and are given by

By the Mellin–Barnes representation of the exponential that is given by Equation (14), for where , we can represent both terms and as the integrals and , respectively. Implementing these new representations on the integral of Equation (39) results in

The Mellin–Barnes exponential representation for is given by the integral , where . This substitution of terms in (42) will yield

where was extended to the third dimension, i.e., . For the integral in (43), consider the variable change . This change of variables will result in the expression

Similarly, for the integral in (45), consider the variable change . This exchange will result in

By replacing (46) on the integral (45) and subsequntly inserting the resulting term on the original expression (39), we finally obtain Formula (34). This integral converges if all of the arguments of the Gamma functions in the numerator are positive. This happens when , , , and , i.e., .

Conversely, we can charter the same steps for the integral (40) of that we did for (39) of ; apply the Mellin–Barnes representation of the exponential term to both and . Subsequently, use integration by parts over the variable y, and again apply the Mellin–Barnes representation of , and finally apply the change of variables , in order to obtain

3.2. Residue Summation Formula for a Call Option

Now, we will state and prove the main result of this paper: the triple representation formula for the European call option under the Variance Gamma model.

Theorem 3

(European Call Option Price under the Variance Gamma Process). The price for the European Call-Option under the Variance Gamma process is given by the formula

where , and are defined by

Proof.

The Formula (34) for can be written as

where is a three-dimensional point and is a complex differential three-form that is defined by

By (16), we can compute the characteristic vector of as , and then use it to constrict the values of to the space where convergence is obtained, i.e., . Thus, the admissible half-space is the space that is located under this plane,

Given the half-space that is defined by (55), we will now construct an admissible polyhedron , as in the case (17), where G is the first octant, which will be uniquely defined by the linear function

Under the linear function (56), the polyhedron will be admissible, which is,

and its faces , , and and vertex will be

Finally, we can group (where we used the notation ) into three families

that are compatible with the polyhedron , i.e., , , and , thus verifying all of the conditions needed to apply Theorem 2. Note that this theorem is a version of the Jordan Lemma (Theorem 1) that allows us to represent the integral (53), which is an integral that appears in the formula for the call option price (33), as a sum of residues of the complex differential three-form in (54).

Before applying the residue summation, notice that the form can be considered as having two sets of discontinuity points under the polyhedron ; the first set is defined as , which represents the singularity points that are given by the functions , , and , and the second set is defined as , which represents the discontinuity points that are given by the functions , and .

Given this delineated partition, we can now express equation (53) as

where we define the terms and , respectively, by

The computation of the residues for the first set present in the first series of (66) is straightforward

Embedding the result (67) on the first equation of (66) will produce the sum Formula (50). On the other hand, for the computation of the residues of the set presented in the second series of (66), let us consider the variable change , , and . If we apply these variables changes to the expression (54), the form will be written as

Subsequently, the residues of the second series in (66) are given by

Analogously to what we did for , the expression (35) of can be written as

where is a three-dimensional point and is a complex differential three-form defined by

Just like in the previous case, we use (16) to compute the characteristic vector of as , and then use it to determine the set for where convergence is achieved, i.e., . Thus, we conclude that the admissible half-space is located under this plane,

Similarly to what we did for , given the expression (72) for , we will now construct an admissible polyhedron , as in the case (17), where G is the first octant and is the linear function

where I is the identity matrix. Under the linear function prescribed in (73), the polyhedron will be admissible,

and its faces , , and and vertex will be

Finally, we will group the divisors of into three sets:

that are compatible with polyhedron , i.e., , , and , thus satisfying all of the conditions needed to apply Theorem 2.

Unlike the case, the form under the polyhedron has only one set of residues that result from the functions , , and . Therefore, Equation (35) can be expressed as

The computation of the residues of set in the series of (82) is straightforward:

The price formula for the European call option that is given by the expression (49) entails an easily derivable price for the European put option through the use of Put–Call parity:

3.3. The Greeks

Given the simple formula for the European call option deduced previously, one may inquire about the availability of an equally simple measure for risk exposure. The Greeks quantify the sensibility of the option price to changes in the model parameters. In this section, we will show the existence of a series of formulas for the , , , and functions, which will be obtained by a differentiation of (49) on the appropriate parameter.

Theorem 4

(The Greeks). The delta, gamma, rho, and theta functions for a European option under the Variance Gamma process are given by:

- Deltais defined as , hence:where , , and are defined by

4. Numerical Results

The formulas of the previous section can be heuristically observed to be sound. In order to do this, we start by comparing the results that were obtained by Formula (49) with both a Monte Carlo simulation for the European call option (under the Variance Gamma process) and the actual values that were observed on the market. We will also verify that it is well behaved, which is, its price for any initial stock value and its implied volatility smile are similar to the expected behavior observed in any stock. We also take these results to observe the speed of convergence of the new method. To conclude, we will study the behavior of the Greek functions (85), (89), (93), and (94), which were derived in the previous section, and then compare them to the ones in the Black–Scholes model.

We compare the option prices that were obtained from Formula (49) with the prices obtained from the Black–Scholes model and the Monte Carlo simulation of the Variance Gamma model. Our goal with this comparison is to test the viability and accuracy of Formula (49) against these well-known benchmark models and standard approaches to option pricing. We could also compare the option prices that were obtained from our formula with the ones obtained under the Variance Gamma model with other numerical techniques, such as the closed form formula in [6], the Fast Fourier Transform method of [7], the Fourier-cosine series proposed in [8], the finite differences method in [9], or the multinomial method of [10]. However, such a comparison of the numerical results from our formula with the results that were obtained from all of these numerical methods is out of the scope of this paper and would require much more numerical analysis and computational work.

4.1. Variance Gamma Formula Values and Behavior

For the aforementioned comparison, we will use the values of European call options with the S&P500 as the underlying asset, bought at the close of the market on 18 April 2002. According to [23], at the close of the market on 18 April 2002, we had a risk-free rate of return , a dividend rate of , and the stock price closed at , with a volatility parameter, for the Black–Scholes model, of and risk neutral parameters , , and for the Variance Gamma model.

We will take advantage of 75 actual recorded values that are presented in Table 1, and make an error estimation for each model, by calculating their respective root mean square error, which is given by the formula . Under this metric, Table 2 presents the deviations from the observed results.

Table 1.

Table containing the values for the Variance Gamma Formula (49) for , , and , denoted by “F”, the Monte Carlo method with 10000 simulated trajectories, denoted by “MC”, and the observed market values are denoted by “Real”.

Table 2.

Root Mean Square Error.

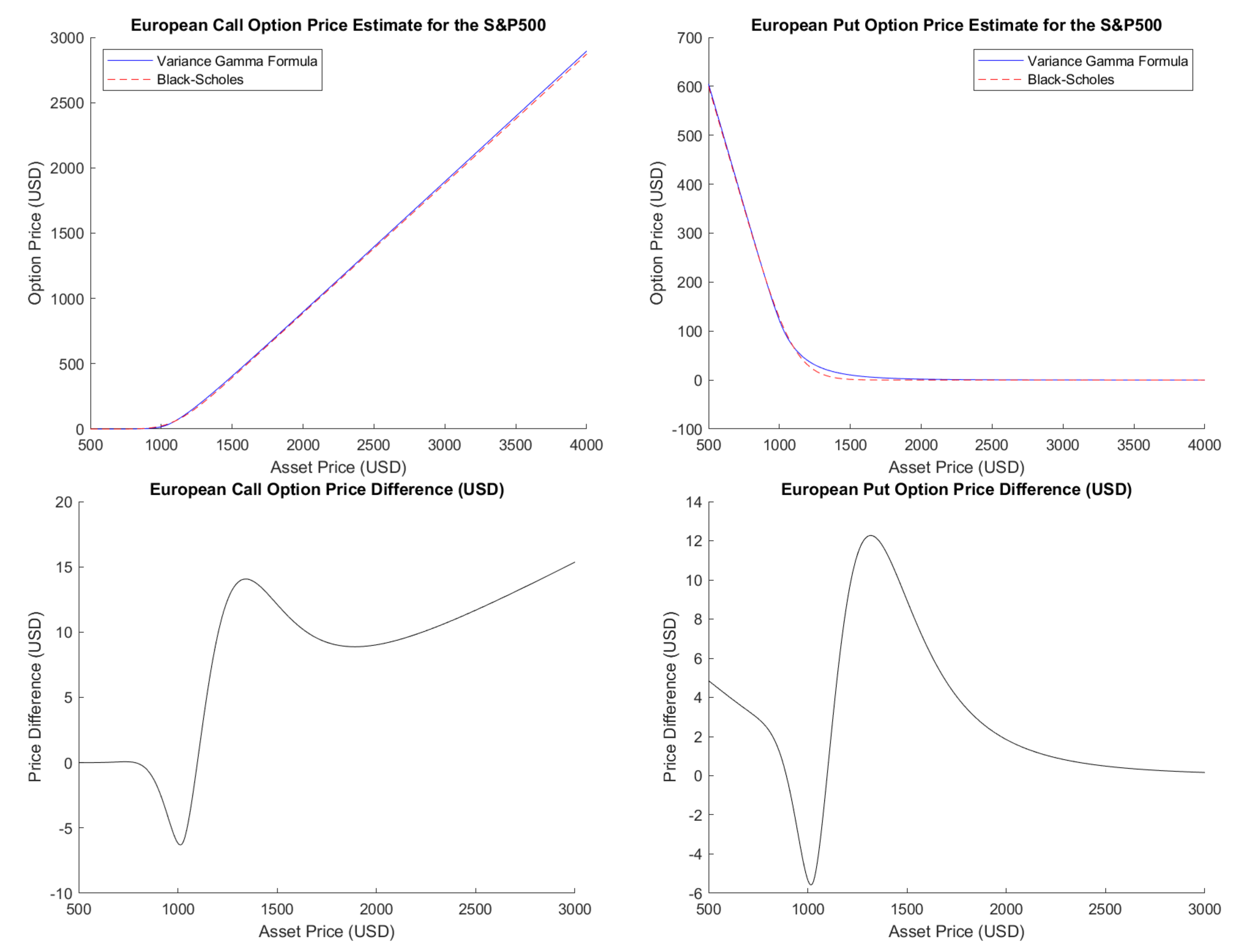

Therefore, not only is the Formula (49) more expedient due to much lower computational time, but it also outperforms the Monte-Carlo method (and, consequently, the Black–Scholes by a wide margin). From Figure 1, one can also observe that the formulas for the European options under the Variance Gamma (49) and (84) present typical behavior. For example, a change in the initial asset price influences the price formula as one would expect, yet with some substantial differences from the Black–Scholes model.

Figure 1.

European Options prices under the Black–Scholes and Variance Gamma models and their differences, for , and different values of .

Let us note that, in [23], the author estimates the model parameters and calculates the option prices for the same option data and the same Variance Gamma model while using the Fast Fourier transform method of [7], and it obtains a RMSE value of , which is a little smaller than the one we obtained. We have also calculated the RMSE by the same numerical method and we obtained a RMSE of . These small discrepancies are perhaps a result of small differences in the precise computation of the maturities of some options.

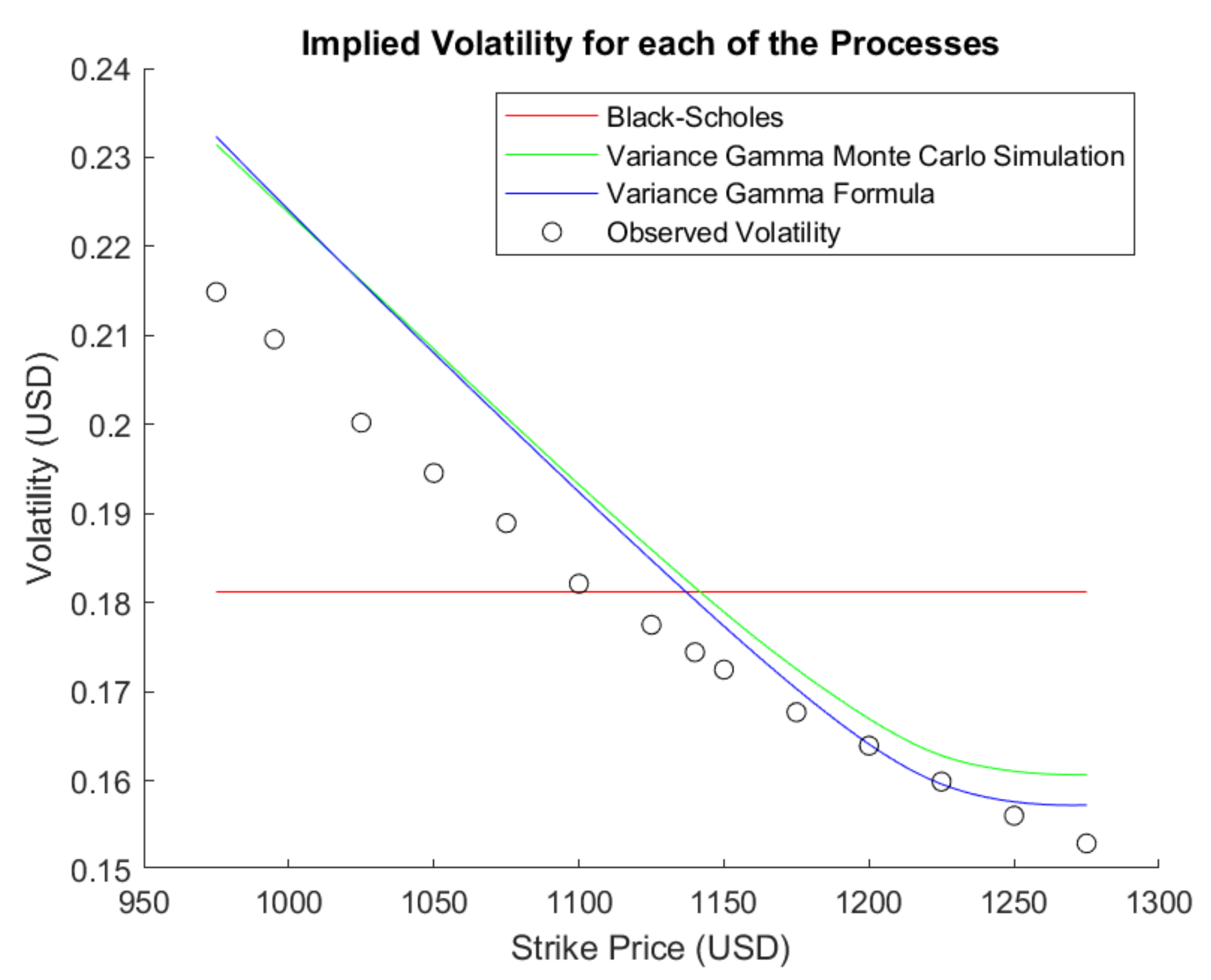

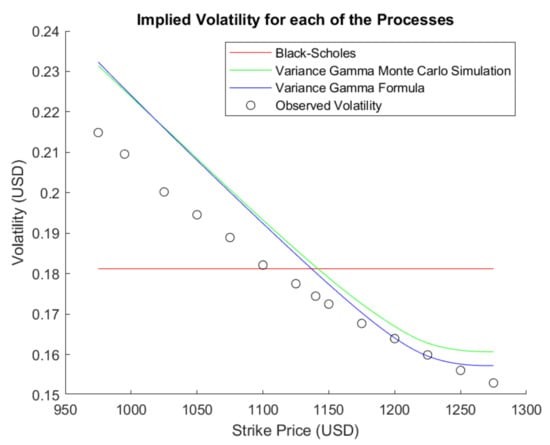

More importantly the Formula (49) also displays the volatility smile typically present in most assets, with values relatively close to the empirical observed on present asset, as can be seen from Figure 2.

Figure 2.

Implied Volatility for the empirical data and Black–Scholes and Variance Gamma models, where , , and .

4.2. Convergence of the Variance Gamma Formula

In order to study the numerical convergence and precision of the new formula, we must first realize that observing the value of each isolated term in the triple sum (49) is fallacious, since an unit increase of, for instance, parameter n will lead to the sum of an extra terms, which may lead to an error of substantially higher magnitude than each individual term. Let us denote each term of the sum (49) by . Given this notation, we can write . To determine the values , , and , for which the sum converges, for all values K and of Table 1, we will apply the Euclidean norm to the 189 resulting values from the three possible double sum series: the series computed by summing the terms of for a fixed n and , i.e., , the series computed by summing the terms of for a fixed m and , i.e., , and the series computed by summing the terms of for a fixed k and , i.e., .

From the values shown in Table 3, for any K and of Table 1, we can assure convergence with a two-decimal precision, when the sum of the three double sum series has a result lower than 0.005, for instance, , , and .

Table 3.

Convergence of the three double series.

Let us note that, in [20,22], the authors studied the convergence of their double series for the option price with a precision, while considering the price of a single European call option (with fixed maturity and strike) under the fractional diffusion process and the finite moment Lévy stable process. They have concluded that is enough to sum the terms in the series up to and . The results are quite different, because, in their models the call option price is given by a double series (not a triple series), the convergence was estimated for a single option (we calculate the convergence for options of all maturities and strikes in our data set), and their underlying model is not the Variance Gamma model.

4.3. The Greek Formulas Behavior

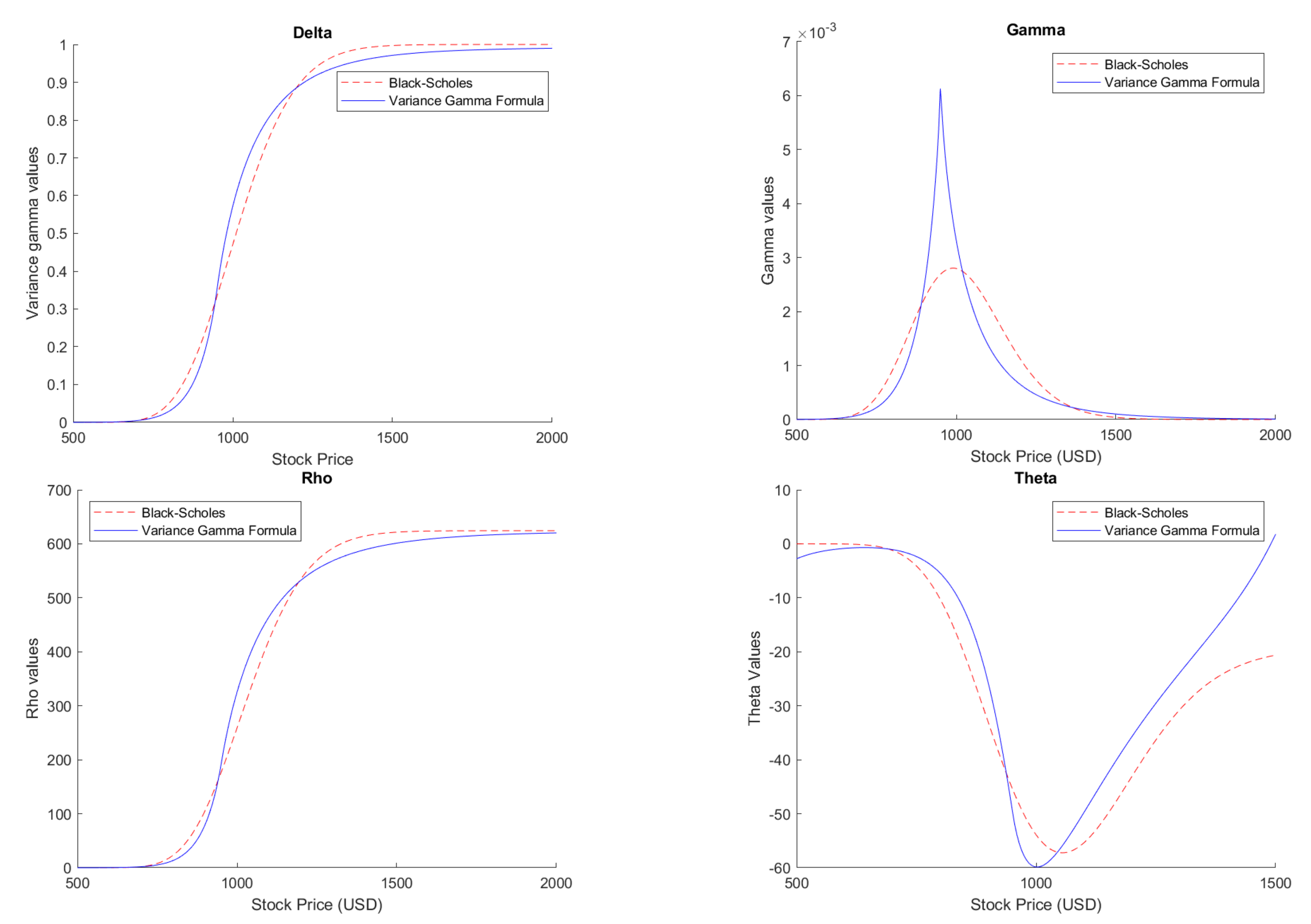

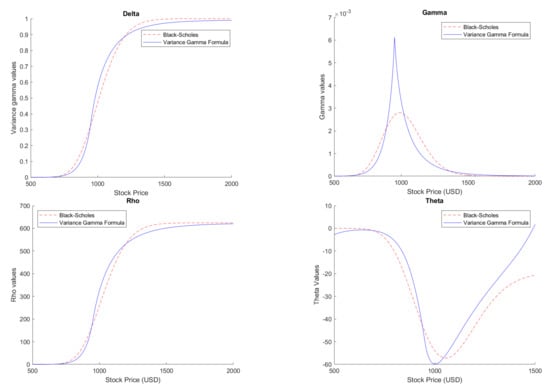

We terminate this section by visualizing and contrasting the behavior of Greek functions under the two models. The Greek functions for the Variance Gamma model seem similar enough to the ones of the Black–Scholes model, yet they exhibit enough discrepancies to be worthy of note, primarily in the behavior of the Gamma and Theta functions, as can be seen in Figure 3. These discrepancies can have important consequences in establishing hedging strategies and the associated expected profit and loss. We refer to [22] for a detailed discussion of this subject in the case of the finite moment log-stable model.

Figure 3.

Greek functions under the Black–Scholes and Variance Gamma models, for and .

5. Conclusions

We have derived a triple Mellin–Barnes integral representation for the price of a European call option in a market model where a Variance Gamma process drives the price of the underlying asset. Subsequently, we applied the multidimensional residue calculus to the aforementioned integral and computed a triple sum series for the European call option price (49). Triple sum series for the delta, gamma, rho, and theta Greeks were also found by direct differentiation. When numerically tested, Formula (49) exhibited the behavior that was typically observed in the market for European options, and it outperformed the Monte-Carlo simulation method in both accuracy and computational time. The Greeks also displayed their usual behavior.

For practical applications, the simplicity of the aforementioned formulas (such as the lack of necessity of simulations for pricing European options, or of complex numerical schemes to compute the Greeks), coupled with their higher rates of precision and much lower computation time, makes them ideal for financial practitioners. For example, Formulas (85) and (89) can be used directly to generate a portfolio with optimal delta and gamma hedge strategies.

In terms of future research, the most obvious course of action would be to compare the performance of Formula (49), in terms of accuracy and computational time, to other semi-closed formulas such as the Bessel functions representation formula or the Fast Fourier Transform method for the price of a European call option under the Variance Gamma model (as discussed in [6,7]).

In terms of generalization of the theoretical results, the more pressing question will be the ability to use a similar reasoning to that presented in Section 3 to arrive at a sum series for the more general CGMY process and Generalized Tempered Stable process, even if this necessitates a higher dimensional Mellin–Barnes integral. One also might inquire further into the pricing of more complex financial instruments, like American or Barrier options, and especially instruments like Asian options, where the integral that is involved in their definition seems to make them a prime candidate for residue calculus.

Author Contributions

Conceptualization, P.F. and J.G.; methodology, P.F. and J.G.; software, P.F.; validation, P.F. and J.G.; formal analysis, P.F.; investigation, P.F. and J.G.; writing—original draft preparation, P.F.; writing—review and editing, J.G.; visualization, P.F.; supervision, J.G. Both authors have read and agreed to the published version of the manuscript.

Funding

This research has been partially funded by the project CEMAPRE/REM UIDB/05069/2020—financed by FCT/MCTES through national funds.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A. Proof of Theorem 2

Proof.

In the first part of the proof, we will show that the Mellin–Barnes integral in (15) converges in the set U that is defined by (23). Let us start by noting that, for any , we have the inequality

for some constant , as well as the inequality

The last inequality (A2) is verified if and only if the inequality is valid. Inasmuch as we can write , where and , the inequality can be written as , which holds for any and . If z does not intersect the set , then, as , we can apply the Stirling Formula (12) and, from the expressions (A1) and (A2), we know there exist constants and , such that

On the other hand, if we constrict the real value, x, to a compact set , x will be bounded and the gamma function will be continuous in the domain . Thus, we can denote its supremum as and infimum as . Under this notation, we have and , additionally as we have . Applying these properties to (A3) results in the inequalities

for some constants and . Taking advantage of the inequalities (A4), we can bound the integrand of expression (15) by

for some constant C. If, for all and , the inequality

is satisfied, then the integrand in (15) decreases exponentially as , which makes the integral converge absolutely. Taking into account (24), the inequality (A6) will hold if

By the Cauchy–Schwartz inequality, we have

and, since we are working in U, , which concludes the first part of our proof.

In the second part of the proof, we will extrapolate the proof that is presented in [19] to the three-dimensional case. We begin by separating the gammas in the numerator of the form into three groups , , and , such that, for the singularities in (17), the zeroes of do not intersect , the ones of , , and the ones of , . Similarly, we also denote the multiple gammas in the denominator of by . Taking this new notation into account, we can write the form in the standard form (1), i.e.,

where , , , and h are defined by

The proof of the theorem follows once we are able to validate the compatibility and Jordan conditions, i.e., (8), under the polyhedron . By definition, the zeroes , , and are compatible with the polyhedron . We can, without a loss of generality, apply the linear change of variables , the inverse of the linear transformation (17), which will result in the real part of being the first octant, the real part of , , and the -plane, -plane and the -plane, respectively, the real part of , and the z-axis, y-axis and the x-axis, respectively, and . Under this new change of variables, it will suffice for us to prove the Jordan lemma for the differential forms

on the corresponding half-spaces

where, , , and are defined by

and , , , , , and are subsequently defined by , , , , , and .

Further, the computation of the integral over will be analogous to over and over , as will the computation of over be analogous to over and over . Thus, it will suffice to examine just three cases.

Let us consider the sequence of sets , where as . Define the surface and let be one of the seven integrands of (A11)–(A13) defined on its corresponding of (A14) or (A15). It is a well-known property of Lebesgue integrals that there exists a constant , such that:

where Z is a set with zero Lebesgue measure. We will prove that, as , at an exponential rate, which results in the integral in (A19), and, consequently, all (A41), (A45), and (A46) being zero. In order to achieve this, we will divide into two sets

Depending on the that we are working with, this separation will yield different results. For instance, for , we have and , for we have and and for we have and .

As a final tool for our proof, consider the set , which removes a neighborhood in around the singularities that are present in the numerator of the ratio of products of gamma functions in . Hence, we can write the left most term of (A19) as

Our proof will consist of three steps: firstly, to estimate the value of ; secondly, to estimate the value of ; and thirdly, to extend the two previous results to the value of the integral to the set of neighborhoods (in the proof of Lemmas A1, A2, and A3).

Step 1:

Recall that, for any , we have , also for any point in the three-dimensional space, , there exist and , such that , hence the real part of for is given by . Having fixed and , and given that we are working in the space , we will choose the radii , such that will not intersect the singularities of the form , (the latter case will be dealt in the lemmas). Thus, the numerator of the form can be segregated into two terms, the ones where , which we will order as , and the ones where , which we will order as . Analogously, we can sort the denominator of , where , for , and , for . In this case, as , we have and for and , respectively, and and for and , respectively. Therefore, if we use the relation and then apply the Stirling Formula (12), we get

where is an undetermined constant independent of either k or y values.

Because all of the linear equations and are on the set , we have and . Given this parametrization, the modulus of the functions , , , and are bounded below by and above by for some constants . Now, if we take note that and for and , respectively, and and for and , respectively, we conclude that

where , , , and are constants that we can define without any recourse to the angles and , making the upper bound (A23) hold for every .

Observe that, since we are working in , there does not exist a sequence , such that goes to zero; otherwise, inasmuch as sin and are continuous, we would have , which is a contradiction, hence and . On the other hand, for the sin’s in the denominator of , there exists a constant c, such that

Similarly, by applying the Cauchy–Schwartz inequality to the modulus of , we have:

Therefore, all of the terms of not present in (A22) grow, at most, exponentially as . If we combine the results from (A23), (A24), and (A25), we get

where and is a function independent from k and y. Because , from (A26) as , the first integral of (A21) vanishes.

Step 2:

Before tacking the second integral in (A21), note that, in , we have and . Similarly to step 1, for big enough, the modulus of the functions , , , and is bounded below by and above by , for some constants . When combining these restrictions with the inequality (A3), we obtain

Just like we did in step one, we will fix and , i.e., fix , and use the above estimates and the fact that and , we can bound the value of by

where A, B and C and E are constants and and are the functions

From the proof of Theorem 2 in paper [19], is negative for all . Therefore, because , as , goes to zero at an exponential rate. If increases as increases, we can just use the arguments from step 1 to show that goes to zero, hence must be bounded. Because increases, at most, at a polynomial rate, our last requirement is to show that increases, at most, at a slower rate than decreases.

The first thing to note is that, by the construction of (A32), A is negative and B is positive. Secondly, by definition, for any , we have ; hence, since , we have . Consider the function , has a maximum . Therefore, even if we choose , the term will increase at a rate lower than decreases. We conclude that, as , the second integral of (A21) vanishes.

Step 3:

We will now undertake the third integral of (A21) where the singularities of the form are present. Let us define and as the open sets that contain the discontinuity that is given by the values in . If we fix the angles , , , , for the aforementioned discontinuity, we can restate the previous equations as and .

For the case where , we have , and the real part of the singularities will be given by the one dimensional segments . Hence, we can chose the radii ’s, such that, for each point belonging the two dimensional segment of , when we increase the radius from to , the points with the same angles and , but now with the higher length , i.e., , will not intersect , for any and , and will intersect the remaining at most one time, for any , and . We can construct the radii ’s in order for this event to occur, because the set containing all of the two dimensional segments is countable. In fact, we can define its (surjective) enumerating function as:

where represents the radii , represents the Gamma function, and the zero in the Gamma function. This entails that, as , the upper bound (A23) deduced in step 1 will still hold for any angles and .

The case where is slightly more complicated. Let us consider , the multi-index set of the gammas that do not have a singularity under , and , the multi-index set of the gammas that have a singularity under .

Because we are dealing with a case where , where K is compact, by the inequalities (A4), the estimate upper bound for the modulus of is given by

Consider , as defined in (24). For each in the domain U that is defined in (23), we have . If we apply the Cauchy–Schwartz inequality, we obtain:

Consider the parametrization that is given by , of the plane , where ( and are points and and are vectors). The neighborhood around can be defined as the intersection of the parallel planes with , where and are in the neighborhood of and . If we take into account that vanishes on , we have

where the and are the bounded constants. Hence, for any , the following inequality will hold

In other words, decreases exponentially as increases.

What remains to be shown is that the forms , , and (the proofs for the remaining forms are identical) decrease as increases, whether or not they are in or its complement. We will have to show that the forms are bounded at any point where the Gamma functions are discontinuous. In the following, we present three lemmas with these results and prove the first one. The remaining two proofs are similar and the same techniques can be used. As a consequence of these three lemmas, the proof of our main theorem concludes. □

Lemma A1.

There exists a sequence of radii , such that and for which

Proof.

For the form , recall that , which can be written as

where , , , and are products of a subset of Gamma functions present in the numerator and denominator of defined at the beginning of the proof of Theorem 8. Knowing this, the following inequality for the norm of will hold true for any :

The first factor of the inequality (A43) is bounded by 1 and the second factor, as we deduced previously, decreases exponentially as increases.

On the other hand, the complementary set, , will include the complex planes of , and . Recall that, from (21), we have , , and , which implies that . Because we are working in , we will only consider the planes in . We will represent as the product , where is the product of the functions in without singularities on and is the product of the functions in with singularities on , where we will denote, by s, the number of factors in . Taking this notation into account, the following inequality for the norm of will hold true for any :

The first factor has a zero of order , the second factor has a pole of order s, and the third factor decreases exponentially as increases. Therefore, the product of the first and second factors has a zero of order s. This, in conjunction with the previous deductions, completes the proof of Lemma A1. □

Lemma A2.

There exists a sequence of radii , such that , and for which

Lemma A3.

There exists a sequence of radii , such that , and for which

References

- Black, F.; Scholes, M. The pricing of options and Corporate Liabilities. J. Political Econ. 1973, 81, 637–654. [Google Scholar] [CrossRef]

- Merton, R.C. The Theory of Rational Option Pricing. Bell J. Econ. Manag. Sci. 1973, 4, 141–183. [Google Scholar] [CrossRef]

- Fama, E.F. The Behavior of Stock-Market Prices. J. Bus. 1965, 38, 34–105. [Google Scholar] [CrossRef]

- Madan, D.B.; Seneta, E. The Variance Gamma (V.G.) Model for Share Market Returns. J. Bus. 1990, 63, 511–524. [Google Scholar] [CrossRef]

- Mandelbrot, B. The Variation of Certain Speculative Prices. J. Bus. 1963, 36, 394–419. [Google Scholar] [CrossRef]

- Madan, D.B.; Carr, P.P.; Chang, E.C. The Variance Gamma Process and Option Pricing. Rev. Financ. 1998, 2, 79–105. [Google Scholar] [CrossRef]

- Carr, P.; Madan, D.B.; Stanley, M. Option valuation using the Fast Fourier Transform. J. Comput. Financ. 1999, 2, 61–73. [Google Scholar] [CrossRef]

- Fang, F.; Oosterlee, C.W. A Novel Pricing Method for European Options Based on Fourier-Cosine Series Expansions. SIAM J. Sci. Comput. 2008, 31, 826–848. [Google Scholar] [CrossRef]

- Cont, R.; Voltchkova, E. A Finite Difference Scheme for Option Pricing in Jump Diffusion and Exponential Lévy Models. SIAM J. Numer. Anal. 2005, 43, 1596–1626. [Google Scholar] [CrossRef]

- Cantarutti, N.; Guerra, J. Multinomial method for option pricing under Variance Gamma. Int. J. Comput. Math. 2019, 96, 1087–1106. [Google Scholar] [CrossRef]

- Sato, K.I. Lévy Processes and Infinitely Divisible Distributions; Cambridge University Press: Cambridge, UK, 1999. [Google Scholar]

- Carr, P.; Wu, L. The finite moment log stable process and option pricing. J. Financ. 2003, 58, 753–777. [Google Scholar] [CrossRef]

- Mainardi, F.; Luchko, Y.; Pagnini, G. The Fundamental Solution of the Space-Time Fractional Diffusion Equation. 2007. Available online: https://arxiv.org/abs/cond-mat/0702419 (accessed on 25 March 2021).

- Gorenflo, R.; Luchko, Y.; Mainardi, F. Analytical Properties and Applications of the Wright Function. 2007. Available online: https://arxiv.org/abs/math-ph/0701069v1 (accessed on 25 March 2021).

- Mainardi, F. Fractional Calculus: Some Basic Problems in Continuum and Statistical Mechanics. In Fractals and Fractional Calculus in Continuum Mechanics; International Centre for Mechanical Sciences (Courses and Lectures); Carpinteri, A., Mainardi, F., Eds.; Springer: Vienna, Austria, 1997; pp. 291–348. [Google Scholar] [CrossRef]

- Gorenflo, R.; Mainardi, F.; Raberto, M.; Scalas, E. Fractional diffusion in finance: Basic theory. In Proceedings of the MDEF2000-Workshop ‘Modelli Dinamici in Economia e Finanza’, Urbino, Italy, 28–30 September 2000. [Google Scholar]

- Passare, M.; Tsikh, A.; Zhdanov, O. A multidimensional Jordan residue lemma with an application to Mellin-Barnes integrals. In Contributions to Complex Analysis and Analytic Geometry; Skoda, H., Trépreau, J.M., Eds.; Vieweg+Teubner Verlag: Wiesbaden, Germany, 1994. [Google Scholar]

- Passare, M.; Tsikh, A.; Cheshel, A. Multiple Mellin-Barnes integrals as periods of Calabi-Yau manifolds with several moduli. Theor. Math. Phys. 1996, 109, 1544–1555. [Google Scholar] [CrossRef]

- Zhdanov, O.; Tsikh, A. Studying the multiple Mellin-Barnes integrals by means of multidimensional residues. Sib. Math. J. 1998, 39, 245–260. [Google Scholar] [CrossRef]

- Aguilar, J.P.; Coste, C.; Korbel, J. Series representation of the pricing formula for the European option driven by space-time fractional diffusion. Fract. Calc. Appl. Anal. 2018, 21, 981–1004. [Google Scholar] [CrossRef]

- Aguilar, J.P.; Korbel, J. Option pricing models driven by the space-time fractional diffusion: Series representation and applications. Fractal Fract. 2018, 2, 15. [Google Scholar] [CrossRef]

- Aguilar, J.P.; Korbel, J. Simple formulas for pricing and hedging European options in the finite moment log-stable model. Risks 2019, 7, 36. [Google Scholar] [CrossRef]

- Schoutens, W. Lévy Processes in Finance: Pricing Financial Derivatives; Wiley: Hoboken, NJ, USA, 2003. [Google Scholar] [CrossRef]

- Griffiths, P.; Harris, J. Principles of Algebraic Geometry; Wiley Online Library: Hoboken, NJ, USA, 1978. [Google Scholar] [CrossRef]

- Begehr, H.G.; Dzhuraev, A.; Begher, H. An Introduction to Several Complex Variables and Partial Differential Equations; Addison-Wesley Longman: Harlow, UK, 1997. [Google Scholar]

- Titchmarsh, E.C. Introduction to the Theory of Fourier Integrals; The Clarendon Press: Oxford, UK, 1937. [Google Scholar]

- Abramowitz, M.; Stegun, I.A. Handbook of Mathematical Functions with Formulas, Graphs, and Mathematical Tables, 9th dover printing, 10th gpo printing ed.; Dover: New York, NY, USA, 1964. [Google Scholar]

- Cont, R.; Tankov, P. Financial Modelling with Jump Processes; Chapman and Hall/CRC Financial Mathematics Series; CRC Press: Boca Raton, FL, USA, 2003. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).