Bitcoin and Fiat Currency Interactions: Surprising Results from Asian Giants

Abstract

1. Introduction

2. Literature Review

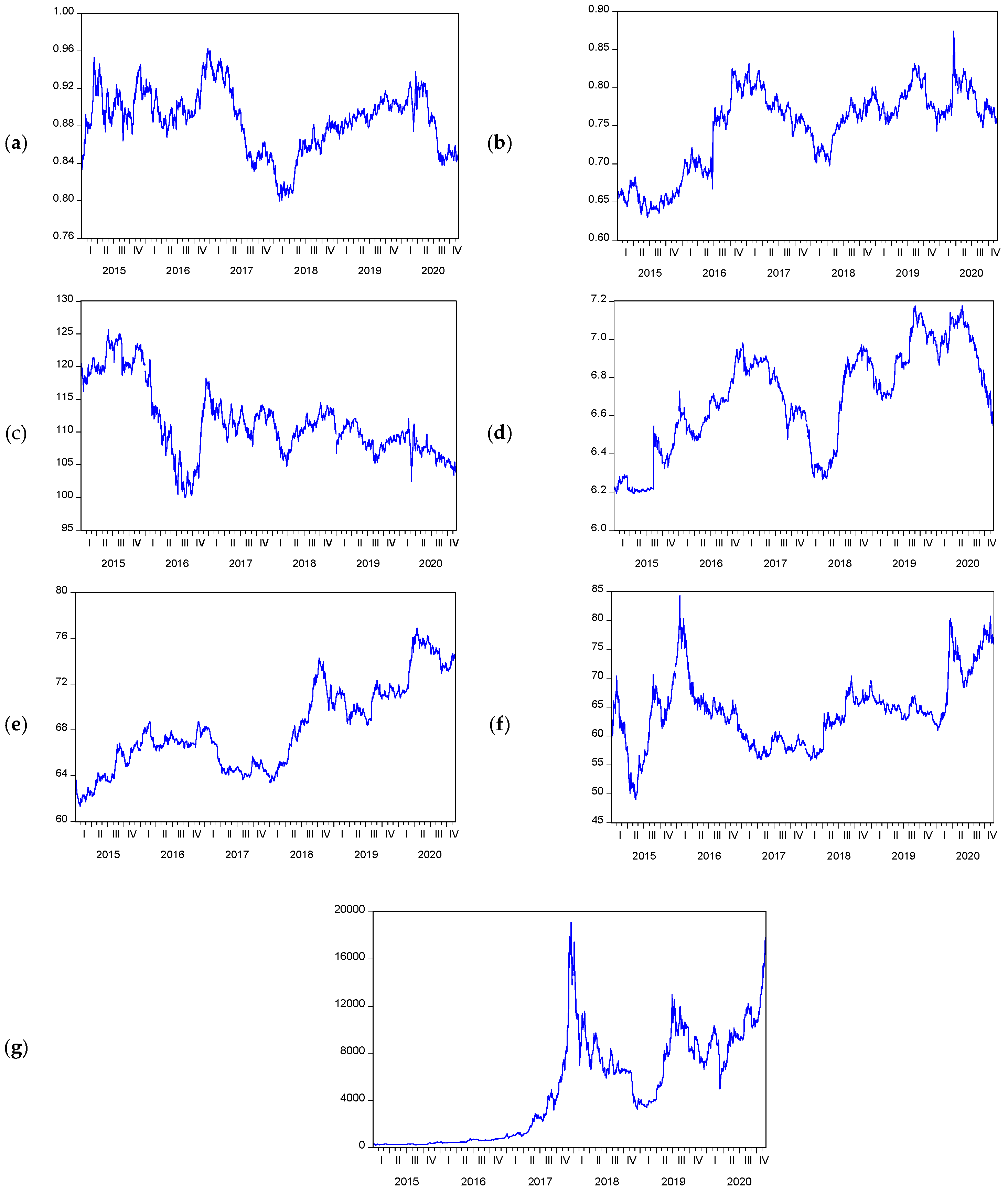

3. Methodology

3.1. Symmetric and Asymmetric Causality Analysis

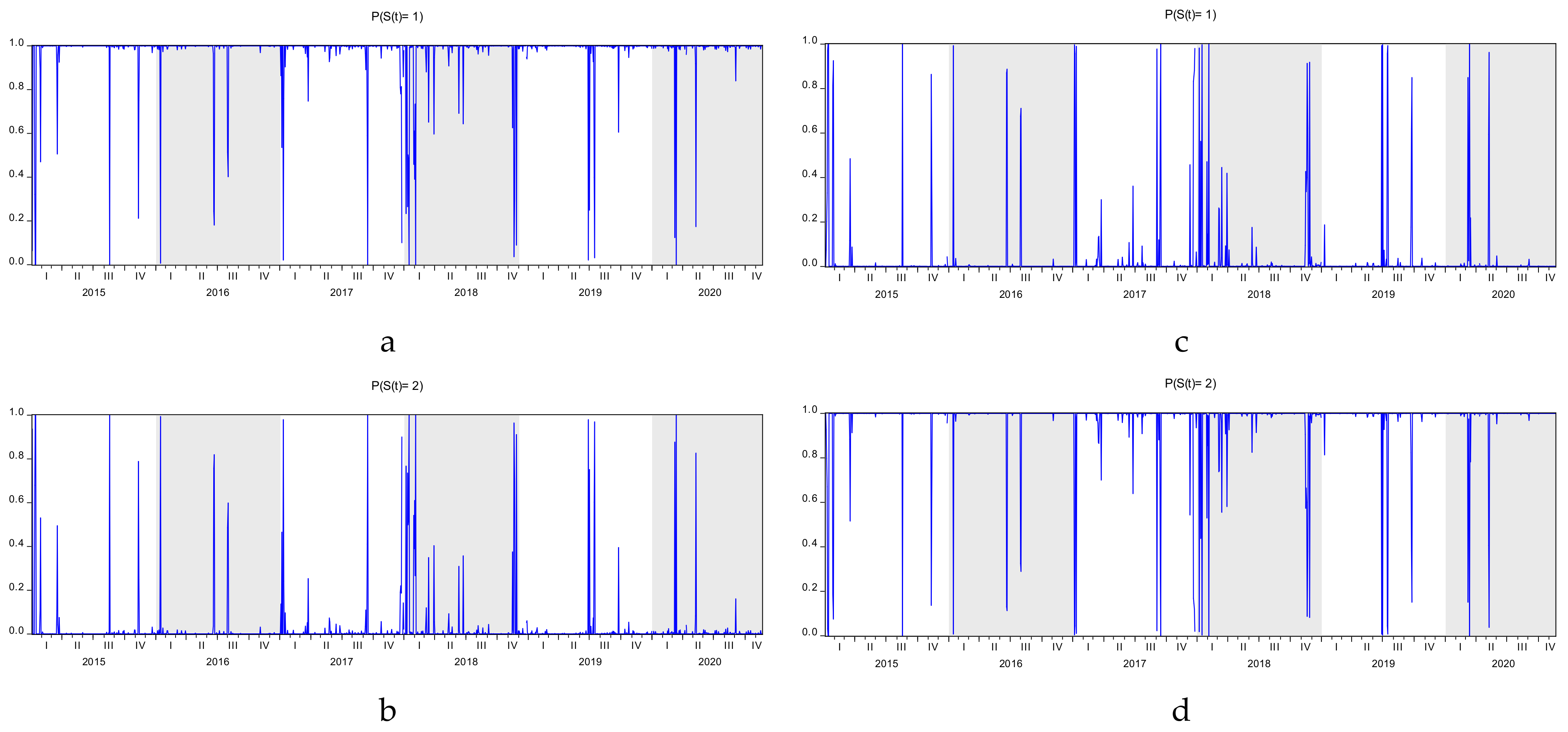

3.2. Markov Regime-Switching Regression Analysis

4. Empirical Analysis

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| USDBTC USDEUR | ||||||

| Lag | LogL | LR | FPE | AIC | SC | HQ |

| 0 | 2881.112 | NA | 0.000077 | −3.800808 | −3.793781 | −3.798192 |

| 1 | 10,929.14 | 16,064.19 * | 0.000000 * | −14.41999 * | −14.39891 * | −14.41214 * |

| 2 | 10,929.65 | 1.014806 | 0.000000 | −14.41538 | −14.38025 | −14.40230 |

| 3 | 10,930.44 | 1.571077 | 0.000000 | −14.41115 | −14.36196 | −14.39283 |

| 4 | 10,932.46 | 4.009429 | 0.000000 | −14.40853 | −14.34528 | −14.38498 |

| 5 | 10934.16 | 3.370010 | 0.000000 | −14.40549 | −14.32819 | −14.37671 |

| 6 | 10,935.39 | 2.450304 | 0.000000 | −14.40184 | −14.31048 | −14.36782 |

| 7 | 10,937.80 | 4.761609 | 0.000000 | −14.39973 | −14.29432 | −14.36048 |

| 8 | 10,940.81 | 5.951279 | 0.000000 | −14.39843 | −14.27896 | −14.35394 |

| * indicates lag order selected by the criterion, LR: sequential modified LR test statistic, FPE: Final prediction error, AIC: Akaike information criterion, SC: Schwarz information criterion, HQ: Hannan-Quinn information criterion. Each test at 5% level. | ||||||

| USDBTC USDGBP | ||||||

| Lag | LogL | LR | FPE | AIC | SC | HQ |

| 0 | 2097.359 | NA | 0.000216 | −2.766151 | −2.759124 | −2.763534 |

| 1 | 10,579.65 | 16,931.00 * | 0.000000 * | −13.95862 * | −13.93754 * | −13.95077 * |

| 2 | 10,582.06 | 4.807086 | 0.000000 | −13.95652 | −13.92138 | −13.94344 |

| 3 | 10,583.92 | 3.692400 | 0.000000 | −13.95369 | −13.90450 | −13.93537 |

| 4 | 10,587.54 | 7.196135 | 0.000000 | −13.95319 | −13.88994 | −13.92964 |

| 5 | 10,591.14 | 7.158725 | 0.000000 | −13.95267 | −13.87537 | −13.92388 |

| 6 | 10,593.97 | 5.604220 | 0.000000 | −13.95112 | −13.85976 | −13.91710 |

| 7 | 10,595.35 | 2.734897 | 0.000000 | −13.94766 | −13.84225 | −13.90841 |

| 8 | 10,596.38 | 2.023126 | 0.000000 | −13.94373 | −13.82427 | −13.89925 |

| * indicates lag order selected by the criterion, LR: sequential modified LR test statistic, FPE: Final prediction error, AIC: Akaike information criterion, SC: Schwarz information criterion, HQ: Hannan-Quinn information criterion. Each test at 5% level. | ||||||

| USDBTC USDJPY | ||||||

| Lag | LogL | LR | FPE | AIC | SC | HQ |

| 0 | 2595.231 | NA | 0.000112 | −3.423408 | −3.416380 | −3.420791 |

| 1 | 10,822.31 | 16,421.57 * | 0.000000 * | −14.27895 * | −14.25787 * | −14.27110 * |

| 2 | 10,823.13 | 1.644358 | 0.000000 | −14.27476 | −14.23962 | −14.26168 |

| 3 | 10,825.00 | 3.729162 | 0.000000 | −14.27195 | −14.22276 | −14.25364 |

| 4 | 10,825.78 | 1.550677 | 0.000000 | −14.26770 | −14.20446 | −14.24415 |

| 5 | 10,827.91 | 4.223469 | 0.000000 | −14.26523 | −14.18793 | −14.23645 |

| 6 | 10,832.33 | 8.770173 | 0.000000 | −14.26579 | −14.17443 | −14.23177 |

| 7 | 10,834.17 | 3.638410 | 0.000000 | −14.26293 | −14.15752 | −14.22368 |

| 8 | 10,837.06 | 5.709984 | 0.000000 | −14.26146 | −14.14200 | −14.21698 |

| * indicates lag order selected by the criterion, LR: sequential modified LR test statistic, FPE: Final prediction error, AIC: Akaike information criterion, SC: Schwarz information criterion, HQ: Hannan-Quinn information criterion. Each test at 5% level. | ||||||

| USDBTC USDCNY | ||||||

| Lag | LogL | LR | FPE | AIC | SC | HQ |

| 0 | 2849.837 | NA | 0.000080 | −3.759521 | −3.752493 | −3.756904 |

| 1 | 11,836.90 | 17,938.53 * | 0.000000 | −15.61835 | −15.59727 * | −15.61050 * |

| 2 | 11,841.41 | 8.984658 | 0.000000 * | −15.61902 * | −15.58388 | −15.60594 |

| 3 | 11,842.03 | 1.250872 | 0.000000 | −15.61457 | −15.56538 | −15.59625 |

| 4 | 11,844.00 | 3.905036 | 0.000000 | −15.61188 | −15.54863 | −15.58833 |

| 5 | 11,845.79 | 3.554996 | 0.000000 | −15.60896 | −15.53166 | −15.58018 |

| 6 | 11,848.76 | 5.897740 | 0.000000 | −15.60761 | −15.51625 | −15.57359 |

| 7 | 11,849.98 | 2.412930 | 0.000000 | −15.60394 | −15.49853 | −15.56469 |

| 8 | 11,851.97 | 3.932251 | 0.000000 | −15.60128 | −15.48182 | −15.55680 |

| * indicates lag order selected by the criterion, LR: sequential modified LR test statistic, FPE: Final prediction error, AIC: Akaike information criterion, SC: Schwarz information criterion, HQ: Hannan-Quinn information criterion. Each test at 5% level. | ||||||

| USDBTC USDINR | ||||||

| Lag | LogL | LR | FPE | AIC | SC | HQ |

| 0 | 2435.975 | NA | 0.000138 | −3.213168 | −3.206141 | −3.210552 |

| 1 | 11,645.42 | 18,382.41 * | 0.000000 * | −15.36557 * | −15.34449 * | −15.35772 * |

| 2 | 11,648.69 | 6.518171 | 0.000000 | −15.36461 | −15.32947 | −15.35152 |

| 3 | 11,649.82 | 2.255323 | 0.000000 | −15.36082 | −15.31163 | −15.34250 |

| 4 | 11,650.48 | 1.304369 | 0.000000 | −15.35641 | −15.29316 | −15.33286 |

| 5 | 11,653.28 | 5.558456 | 0.000000 | −15.35482 | −15.27752 | −15.32604 |

| 6 | 11,655.13 | 3.666487 | 0.000000 | −15.35198 | −15.26063 | −15.31797 |

| 7 | 11,658.02 | 5.739961 | 0.000000 | −15.35053 | −15.24512 | −15.31128 |

| 8 | 11,660.94 | 5.757218 | 0.000000 | −15.34909 | −15.22963 | −15.30461 |

| * indicates lag order selected by the criterion, LR: sequential modified LR test statistic, FPE: Final prediction error, AIC: Akaike information criterion, SC: Schwarz information criterion, HQ: Hannan-Quinn information criterion. Each test at 5% level. | ||||||

| USDBTC USDRUB | ||||||

| Lag | LogL | LR | FPE | AIC | SC | HQ |

| 0 | 1309.580 | NA | 0.000610 | −1.726178 | −1.719151 | −1.723561 |

| 1 | 9902.139 | 17,151.09 | 0.000000 * | −13.06421 * | −13.04313 * | −13.05636 * |

| 2 | 9902.816 | 1.350777 | 0.000000 | −13.05982 | −13.02469 | −13.04674 |

| 3 | 9905.789 | 5.917453 | 0.000000 | −13.05847 | −13.00928 | −13.04015 |

| 4 | 9909.513 | 7.404516 | 0.000000 | −13.05810 | −12.99486 | −13.03455 |

| 5 | 9915.051 | 10.99546 * | 0.000000 | −13.06013 | −12.98283 | −13.03135 |

| 6 | 9915.408 | 0.708395 | 0.000000 | −13.05532 | −12.96397 | −13.02131 |

| 7 | 9916.920 | 2.994092 | 0.000000 | −13.05204 | −12.94663 | −13.01279 |

| 8 | 9918.703 | 3.526030 | 0.000000 | −13.04911 | −12.92965 | −13.00463 |

| * indicates lag order selected by the criterion, LR: sequential modified LR test statistic, FPE: Final prediction error, AIC: Akaike information criterion, SC: Schwarz information criterion, HQ: Hannan-Quinn information criterion. Each test at 5% level. | ||||||

References

- Conlon, T.; McGee, R. Safe Haven or Risky Hazard? Bitcoin during the COVID-19 Bear Market. Financ. Res. Lett. 2020, 35, 101607. [Google Scholar] [CrossRef]

- Corbet, S.; Larkin, C.; Lucey, B. The Contagion Effects of the COVID-19 Pandemic: Evidence from Gold and Cryptocurrencies. Financ. Res. Lett. 2020, 35, 101554. [Google Scholar] [CrossRef]

- Malik, V.; Bandyopadhyay, S. Crypto-Currency: A Bubble Waiting for a Burst? Econ. Polity Environ. Int. Peer Rev. J. Soc. Stud. 2021, 3, 44–56. [Google Scholar]

- Scharnowski, S. Understanding Bitcoin Liquidity. Financ. Res. Lett. 2021, 38, 101477. [Google Scholar] [CrossRef]

- Cavalli, S.; Amoretti, M. CNN-Based Multivariate Data Analysis for Bitcoin Trend Prediction. Appl. Soft Comput. 2021, 101, 107065. [Google Scholar] [CrossRef]

- Li, Y.; Wang, Z.; Wang, H.; Wu, M.; Xie, L. Identifying Price Bubble Periods in the Bitcoin Market-Based on GSADF Model. Qual. Quant. 2021. [Google Scholar] [CrossRef]

- Yao, C.-Z.; Li, H.-Y. A Study on the Bursting Point of Bitcoin Based on the BSADF and LPPLS Methods. N. Am. J. Econ. Financ. 2021, 55, 101280. [Google Scholar] [CrossRef]

- Peng, Y.; Albuquerque, P.H.M.; de Sá, J.M.C.; Padula, A.J.A.; Montenegro, M.R. The Best of Two Worlds: Forecasting High Frequency Volatility for Cryptocurrencies and Traditional Currencies with Support Vector Regression. Expert Syst. Appl. 2018, 97, 177–192. [Google Scholar] [CrossRef]

- Shahzad, S.J.H.; Balli, F.; Naeem, M.A.; Hasan, M.; Arif, M. Do Conventional Currencies Hedge Cryptocurrencies? Q. Rev. Econ. Financ. 2021. [Google Scholar] [CrossRef]

- Carrick, J. Bitcoin as a Complement to Emerging Market Currencies. Emerg. Mark. Financ. Trade 2016, 52, 2321–2334. [Google Scholar] [CrossRef]

- Matkovskyy, R. Centralized and Decentralized Bitcoin Markets: Euro vs USD vs GBP. Q. Rev. Econ. Financ. 2019, 71, 270–279. [Google Scholar] [CrossRef]

- Nadeem, M.A.; Liu, Z.; Pitafi, A.H.; Younis, A.; Xu, Y. Investigating the Adoption Factors of Cryptocurrencies—A Case of Bitcoin: Empirical Evidence From China. SAGE Open 2021, 11, 2158244021998704. [Google Scholar] [CrossRef]

- Shahzad, F.; Xiu, G.; Wang, J.; Shahbaz, M. An Empirical Investigation on the Adoption of Cryptocurrencies among the People of Mainland China. Technol. Soc. 2018, 55, 33–40. [Google Scholar] [CrossRef]

- Kaiser, B.; Jurado, M.; Ledger, A. The Looming Threat of China: An Analysis of Chinese Influence on Bitcoin. arXiv 2018, arXiv:1810.02466. [Google Scholar]

- Helms, K. 33,000 Companies Register Blockchain Business in China—Regulation Bitcoin News. Bitcoin News, 6 January 2020. [Google Scholar]

- Zhang, S.; Gregoriou, A. The Price and Liquidity Impact of China Forbidding Initial Coin Offerings on the Cryptocurrency Market. Appl. Econ. Lett. 2020, 27, 1695–1698. [Google Scholar] [CrossRef]

- Pilarowski, G.; Yue, L. China Bans Initial Coin Offerings and Cryptocurrency Trading Platforms. 2017. Available online: http://www.pillarlegalpc.com/en/news/wp (accessed on 21 February 2021).

- Okorie, D.I.; Lin, B. Did China’s ICO Ban Alter the Bitcoin Market? Int. Rev. Econ. Financ. 2020, 69, 977–993. [Google Scholar] [CrossRef]

- Leising, M. Crypto Assets of $50 Billion Moved From China in the Past Year. Bloomberg.com, 20 August 2020. [Google Scholar]

- Nguyen, T.V.H.; Nguyen, B.T.; Nguyen, K.S.; Pham, H. Asymmetric Monetary Policy Effects on Cryptocurrency Markets. Res. Int. Bus. Financ. 2019, 48, 335–339. [Google Scholar] [CrossRef]

- Kukreja, G. FinTech Adoption in China: Challenges, Regulations, and Opportunities. 2021. Available online: www.igi-global.com/chapter/fintech-adoption-in-china/260369 (accessed on 25 April 2021).

- Miglietti, C.; Kubosova, Z.; Skulanova, N. Bitcoin, Litecoin, and the Euro: An Annualized Volatility Analysis. Stud. Econ. Financ. 2019, 37, 229–242. [Google Scholar] [CrossRef]

- Katsiampa, P.; Corbet, S.; Lucey, B. High Frequency Volatility Co-Movements in Cryptocurrency Markets. J. Int. Financ. Mark. Inst. Money 2019, 62, 35–52. [Google Scholar] [CrossRef]

- Kasper, D.J. Evolution of Bitcoin—Volatility Comparisons with Least Developed Countries’ Currencies; Social Science Research Network: Rochester, NY, USA, 2017. [Google Scholar]

- Cermak, V. Can Bitcoin Become a Viable Alternative to Fiat Currencies? An Empirical Analysis of Bitcoin’s Volatility Based on a GARCH Model; Social Science Research Network: Rochester, NY, USA, 2017. [Google Scholar]

- Gunay, S. Comparing COVID-19 with the GFC: A Shockwave Analysis of Currency Markets. Res. Int. Bus. Financ. 2021, 56, 101377. [Google Scholar] [CrossRef]

- MSCI. MSCI Country Classification Standard. Available online: https://www.msci.com/market-classification (accessed on 7 June 2021).

- BIS. Triennial Central Bank Survey; Monetary and Economic Department, Bank for International Settlements: Basel, Switzerland, 2019. [Google Scholar]

- Baur, D.G.; Dimpfl, T.; Kuck, K. Bitcoin, Gold and the US Dollar—A Replication and Extension. Financ. Res. Lett. 2018, 25, 103–110. [Google Scholar] [CrossRef]

- Dyhrberg, A.H. Bitcoin, Gold and the Dollar—A GARCH Volatility Analysis. Financ. Res. Lett. 2016, 16, 85–92. [Google Scholar] [CrossRef]

- Aysan, A.F.; Demir, E.; Gozgor, G.; Lau, C.K.M. Effects of the Geopolitical Risks on Bitcoin Returns and Volatility. Res. Int. Bus. Financ. 2019, 47, 511–518. [Google Scholar] [CrossRef]

- Hall, S.G.; Kenjegaliev, A.; Swamy, P.; Tavlas, G.S. Measuring Currency Pressures: The Cases of the Japanese Yen, the Chinese Yuan, and the UK Pound. J. Jpn. Int. Econ. 2013, 29, 1–20. [Google Scholar] [CrossRef][Green Version]

- Chen, H.; Peng, W. The potential of the renminbi as an international currency. In Currency Internationalization: Global Experiences and Implications for the Renminbi; Palgrave Macmillan: London, UK, 2010; pp. 115–138. [Google Scholar]

- Mallaby, S.; Wethington, O. The Future of the Yuan: China’s Struggle to Internationalize Its Currency. Foreign Aff. 2012, 91, 135–146. [Google Scholar]

- Dobson, W.; Masson, P.R. Will the Renminbi Become a World Currency? China Econ. Rev. 2009, 20, 124–135. [Google Scholar] [CrossRef]

- Zhang, J.; Fung, H.-G. Winners and Losers: Assessing the Impact of Chinese Yuan Appreciation. J. Policy Model. 2006, 28, 995–1009. [Google Scholar] [CrossRef]

- Inagaki, K. Testing for Volatility Spillover between the British Pound and the Euro. Res. Int. Bus. Financ. 2007, 21, 161–174. [Google Scholar] [CrossRef]

- Baba, N.; Packer, F.; Nagano, T. The Spillover of Money Market Turbulence to FX Swap and Cross-Currency Swap Markets. BIS Q. Rev. 2008. [Google Scholar]

- Antonakakis, N.; Kizys, R. Dynamic Spillovers between Commodity and Currency Markets. Int. Rev. Financ. Anal. 2015, 41, 303–319. [Google Scholar] [CrossRef]

- Nikkinen, J.; Sahlström, P.; Vähämaa, S. Implied Volatility Linkages among Major European Currencies. J. Int. Financ. Mark. Inst. Money 2006, 16, 87–103. [Google Scholar] [CrossRef]

- Cairns, J.; Ho, C.; McCauley, R.N. Exchange Rates and Global Volatility: Implications for Asia-Pacific Currencies. BIS Q. Rev. 2007. [Google Scholar]

- Guesmi, K.; Saadi, S.; Abid, I.; Ftiti, Z. Portfolio Diversification with Virtual Currency: Evidence from Bitcoin. Int. Rev. Financ. Anal. 2019, 63, 431–437. [Google Scholar] [CrossRef]

- Katsiampa, P. Volatility Estimation for Bitcoin: A Comparison of GARCH Models. Econ. Lett. 2017, 158, 3–6. [Google Scholar] [CrossRef]

- Katsiampa, P. Volatility Co-Movement between Bitcoin and Ether. Financ. Res. Lett. 2019, 30, 221–227. [Google Scholar] [CrossRef]

- Katsiampa, P.; Corbet, S.; Lucey, B. Volatility Spillover Effects in Leading Cryptocurrencies: A BEKK-MGARCH Analysis. Financ. Res. Lett. 2019, 29, 68–74. [Google Scholar] [CrossRef]

- Fry, J.; Cheah, E.-T. Negative Bubbles and Shocks in Cryptocurrency Markets. Int. Rev. Financ. Anal. 2016, 47, 343–352. [Google Scholar] [CrossRef]

- Li, Z.; Dong, H.; Huang, Z.; Failler, P. Asymmetric Effects on Risks of Virtual Financial Assets (VFAs) in Different Regimes: A Case of Bitcoin. Quant. Financ. Econ. 2018, 2, 860–883. [Google Scholar] [CrossRef]

- Klein, T.; Thu, H.P.; Walther, T. Bitcoin Is Not the New Gold–A Comparison of Volatility, Correlation, and Portfolio Performance. Int. Rev. Financ. Anal. 2018, 59, 105–116. [Google Scholar] [CrossRef]

- Ji, Q.; Bouri, E.; Lau, C.K.M.; Roubaud, D. Dynamic Connectedness and Integration in Cryptocurrency Markets. Int. Rev. Financ. Anal. 2019, 63, 257–272. [Google Scholar] [CrossRef]

- Ji, Q.; Bouri, E.; Roubaud, D.; Kristoufek, L. Information Interdependence among Energy, Cryptocurrency and Major Commodity Markets. Energy Econ. 2019, 81, 1042–1055. [Google Scholar] [CrossRef]

- Bouri, E.; Das, M.; Gupta, R.; Roubaud, D. Spillovers between Bitcoin and Other Assets during Bear and Bull Markets. Appl. Econ. 2018, 50, 5935–5949. [Google Scholar] [CrossRef]

- Ferreira, P.; Kristoufek, L.; de Area LeãoPereira, E.J. DCCA and DMCA Correlations of Cryptocurrency Markets. Phys. A Stat. Mech. Its Appl. 2020, 545, 123803. [Google Scholar] [CrossRef]

- Corbet, S.; Larkin, C.; Lucey, B.; Meegan, A.; Yarovaya, L. Cryptocurrency Reaction to FOMC Announcements: Evidence of Heterogeneity Based on Blockchain Stack Position. J. Financ. Stab. 2020, 46, 100706. [Google Scholar] [CrossRef]

- Giudici, P.; Pagnottoni, P. High Frequency Price Change Spillovers in Bitcoin Markets. Risks 2019, 7, 111. [Google Scholar] [CrossRef]

- Diebold, F.X.; Yilmaz, K. Better to Give than to Receive: Predictive Directional Measurement of Volatility Spillovers. Int. J. Forecast. 2012, 28, 57–66. [Google Scholar] [CrossRef]

- Luu Duc Huynh, T. Spillover Risks on Cryptocurrency Markets: A Look from VAR-SVAR Granger Causality and Student’s-t Copulas. J. Risk Financ. Manag. 2019, 12, 52. [Google Scholar] [CrossRef]

- Kim, J.-M.; Kim, S.-T.; Kim, S. On the Relationship of Cryptocurrency Price with US Stock and Gold Price Using Copula Models. Mathematics 2020, 8, 1859. [Google Scholar] [CrossRef]

- Bohte, R.; Rossini, L. Comparing the Forecasting of Cryptocurrencies by Bayesian Time-Varying Volatility Models. J. Risk Financ. Manag. 2019, 12, 150. [Google Scholar] [CrossRef]

- Catania, L.; Grassi, S.; Ravazzolo, F. Forecasting Cryptocurrencies under Model and Parameter Instability. Int. J. Forecast. 2019, 35, 485–501. [Google Scholar] [CrossRef]

- Bianchi, D.; Rossini, L.; Iacopini, M. Stablecoins and Cryptocurrency Returns: Evidence From Large Bayesian VARs; Social Science Research Network: Rochester, NY, USA, 2020. [Google Scholar]

- Toda, H.Y.; Yamamoto, T. Statistical Inference in Vector Autoregressions with Possibly Integrated Processes. J. Econom. 1995, 66, 225–250. [Google Scholar] [CrossRef]

- Hacker, R.S.; Hatemi-J, A. Tests for Causality between Integrated Variables Using Asymptotic and Bootstrap Distributions: Theory and Application. Appl. Econ. 2006, 38, 1489–1500. [Google Scholar] [CrossRef]

- Hatemi-J, A. Asymmetric Causality Tests with an Application. Empir. Econ. 2012, 43, 447–456. [Google Scholar] [CrossRef]

- Hamilton, J.D. A New Approach to the Economic Analysis of Nonstationary Time Series and the Business Cycle. Econometrica 1989, 57, 357–384. [Google Scholar] [CrossRef]

- Kim, C.-J.; Piger, J.; Startz, R. Estimation of Markov Regime-Switching Regression Models with Endogenous Switching. J. Econom. 2008, 143, 263–273. [Google Scholar] [CrossRef]

- Pippenger, M.K.; Goering, G.E. Additional Results on the Power of Unit Root and Cointegration Tests under Threshold Processes. Appl. Econ. Lett. 2000, 7, 641–644. [Google Scholar] [CrossRef]

- Kapetanios, G.; Shin, Y.; Snell, A. Testing for a Unit Root in the Nonlinear STAR Framework. J. Econom. 2003, 112, 359–379. [Google Scholar] [CrossRef]

- Habimana, O.; Månsson, K.; Sjölander, P. Testing for Nonlinear Unit Roots in the Presence of a Structural Break with an Application to the Qualified PPP during the 1997 Asian Financial Crisis. Int. J. Financ. Econ. 2018, 23, 221–232. [Google Scholar] [CrossRef]

- Bec, F.; Ben Salem, M.; Carrasco, M. Detecting Mean Reversion in Real Exchange Rates from a Multiple Regime STAR Model. Ann. Econ. Stat. 2010, 395–427. [Google Scholar] [CrossRef][Green Version]

- Tong, H. Non-Linear Time Series: A Dynamical System Approach; Oxford University Press: Oxford, UK, 1990; ISBN 978-0-19-852224-9. [Google Scholar]

- Stern, D.I. A Multivariate Cointegration Analysis of the Role of Energy in the US Macroeconomy. Energy Econ. 2000, 22, 267–283. [Google Scholar] [CrossRef]

- Cont, R. Empirical Properties of Asset Returns: Stylized Facts and Statistical Issues. Quant. Financ. 2001, 1, 223–236. [Google Scholar] [CrossRef]

- Black, F. Studies of Stock Market Volatility Changes. In Proceedings of the 1976 Meeting of the Business and Economic Statistics Section, American Statistical Association, Washington, DC, USA, 1976; pp. 177–181. [Google Scholar]

- French, K.R.; Schwert, G.W.; Stambaugh, R.F. Expected Stock Returns and Volatility. J. Financ. Econ. 1987, 19, 3–29. [Google Scholar] [CrossRef]

- Campbell, J.Y.; Hentschel, L. No News Is Good News: An Asymmetric Model of Changing Volatility in Stock Returns. J. Financ. Econ. 1992, 31, 281–318. [Google Scholar] [CrossRef]

- Yılancı, V.; Bozoklu, Ş. Analysis of Symmetric and Asymmetric Nonlinear Causal Relationship between Stock Prices and Exchange Rates for Selected Emerging Market Economies [Seçilmiş gelişmekte olan ülkeler için hisse senedi fiyatları ve döviz kurları arasındaki doğrusal olmayan simetrik ve asimetrik nedensellik ilişkisinin analizi]. Doğuş Üniversitesi Derg. 2015, 16, 155–164. [Google Scholar]

- Flood, R.; Marion, N. Perspectives on the Recent Currency Crisis Literature. Int. J. Financ. Econ. 1999, 4, 1–26. [Google Scholar] [CrossRef]

- Hmamouche, Y. NlinTS: An R Package For Causality Detection in Time Series. R J. 2020, 12, 21–31. [Google Scholar] [CrossRef]

- Hileman, G.; Rauchs, M. Global Cryptocurrency Benchmarking Study. 2017. Available online: https://blossom.informatik.uni-rostock.de/14/ (accessed on 6 March 2021).

| USD/BTC | USD/EUR | USD/GBP | USD/JPY | USD/CNY | USD/INR | USD/RUB | ||

|---|---|---|---|---|---|---|---|---|

| Log Returns | Mean | 0.0027 | 0.0000 | 0.0001 | −0.0001 | 0.0000 | 0.0001 | 0.0002 |

| Std. Dev. | 0.0454 | 0.0051 | 0.0064 | 0.0055 | 0.0028 | 0.0032 | 0.0102 | |

| Skewness | −0.8387 | 0.0429 | 2.1105 | −0.5534 | 0.9179 | 0.2181 | 0.0615 | |

| Kurtosis | 14.373 | 5.7030 | 36.255 | 9.1740 | 16.335 | 4.9660 | 7.9010 | |

| Jarque-Bera | 8.3810 * | 464.00 * | 7.1263 * | 2.4950 * | 1.1490 * | 257.00 * | 1.5240 * | |

| Log Prices | Mean | 3.3685 | −0.0528 | −0.1275 | 2.0467 | 0.8253 | 1.8327 | 1.8056 |

| Std. Dev. | 0.6238 | 0.0162 | 0.0317 | 0.0210 | 0.0175 | 0.0235 | 0.0403 | |

| Skewness | −0.3959 | −0.4139 | −0.7637 | 0.5029 | −0.3551 | 0.3431 | 0.1645 | |

| Kurtosis | 1.5410 | 2.8792 | 2.4356 | 2.7817 | 2.0737 | 2.1782 | 3.1190 | |

| Jarque-Bera | 175.00 * | 44.000 * | 168.00 * | 67.000 * | 86.000 * | 73.000 * | 8.0000 * |

| Method | USD/BTC | USD/EUR | USD/GBP | USD/JPY | USD/CNY | USD/INR | USD/RUB | |

|---|---|---|---|---|---|---|---|---|

| Log Returns | ADF | −39.48 *** | −38.63 *** | −37.87 *** | −39.98 *** | −38.65 *** | −38.98 *** | −38.31 *** |

| PP | −39.49 *** | −38.72 *** | −37.92 *** | −39.98 *** | −38.65 *** | −39.01 *** | −38.31 *** | |

| BBC test | 622.15 *** | 415.74 *** | 467.60 *** | 520.95 *** | 553.18 *** | 513.94 *** | 548.15 *** | |

| Log Prices | ADF | −0.5945 | −2.7557 * | −2.2008 | −2.2711 | −1.9063 | −0.9629 | −1.7825 |

| PP | −0.6177 | −2.7177 * | −2.1566 | −2.2668 | −1.9032 | −1.0205 | −1.7777 | |

| BBC test | 10.39 | 22.75 ** | 15.67 | 15.97 | 7.64 | 7.18 | 20.66 ** |

| Causality Directions | Lag | Selection Criteria | MWALD Test Statistic | CV | ||

|---|---|---|---|---|---|---|

| BTCUSD | → | USDEUR | 1 | [LR, FPE, AIC, SC, HQ] | 0.139 | [7.458] [3.758] [2.552] |

| USDEUR | → | BTCUSD | 1 | [LR, FPE, AIC, SC, HQ] | 0.595 | [6.758] [3.725] [2.634] |

| BTCUSD | → | USDGBP | 1 | [LR, FPE, AIC, SC, HQ] | 0.247 | [6.746] [3.893] [2.752] |

| USDGBP | → | BTCUSD | 1 | [LR, FPE, AIC, SC, HQ] | 3.562 | [7.376] [4.125] [2.898] |

| BTCUSD | → | USDJPY | 1 | [LR, FPE, AIC, SC, HQ] | 0.594 | [7.197] [3.661] [2.748] |

| USDJPY | → | BTCUSD | 1 | [LR, FPE, AIC, SC, HQ] | 0.001 | [6.310] [3.893] [2.748] |

| BTCUSD | → | USDCNY | 1 | [LR, SC, HQ] | 0.000 | [6.816] [3.901] [2.766] |

| USDCNY | → | BTCUSD | 1 | [LR, SC, HQ] | 9.606 *** | [7.443] [4.129] [2.862] |

| BTCUSD | → | USDINR | 1 | [LR, FPE, AIC, SC, HQ] | 2.723 | [5.856] [3.597] [2.590] |

| USDINR | → | BTCUSD | 1 | [LR, FPE, AIC, SC, HQ] | 4.325 ** | [7.525] [3.958] [2.661] |

| BTCUSD | → | USDRUB | 1 | [FPE, AIC, SC, HQ] | 0.405 | [7.520] [4.400] [3.045] |

| USDRUB | → | BTCUSD | 1 | [FPE, AIC, SC, HQ] | 0.124 | [6.286] [3.678] [2.798] |

| Causality Directions | Lag | Selection Criteria | MWALD Test Statistic | CV | ||

|---|---|---|---|---|---|---|

| +BTCUSD | → | +USDCNY | 1 | [FPE, AIC, SC, HQ] | 0.072 | [7.354] [3.523] [2.477] |

| +USDCNY | → | +BTCUSD | 1 | [FPE, AIC, SC, HQ] | 1.243 | [7.106] [3.616] [2.586] |

| −BTCUSD | → | −USDCNY | 1 | [FPE, AIC, SC, HQ] | 1.546 | [7.678] [3.918] [2.719] |

| −USDCNY | → | −BTCUSD | 1 | [FPE, AIC, SC, HQ] | 8.021 *** | [6.784] [3.602] [2.565] |

| +BTCUSD | → | −USDCNY | 1 | [FPE, AIC, SC, HQ] | 0.095 | [7.609] [3.731] [2.565] |

| −USDCNY | → | +BTCUSD | 1 | [FPE, AIC, SC, HQ] | 6.549 ** | [7.790] [3.988] [2.884] |

| −BTCUSD | → | +USDCNY | 1 | [FPE, AIC, SC, HQ] | 0.844 | [6.721] [3.706] [2.624] |

| +USDCNY | → | −BTCUSD | 1 | [FPE, AIC, SC, HQ] | 1.627 | [8.398] [3.656] [2.504] |

| +BTCUSD | → | +USDINR | 1 | [LR, FPE, AIC, SC, HQ] | 1.396 | [6.903] [4.071] [2.868] |

| +USDINR | → | +BTCUSD | 1 | [LR, FPE, AIC, SC, HQ] | 0.012 | [6.909] [4.175] [2.757] |

| −BTCUSD | → | −USDINR | 1 | [LR, FPE, AIC, SC, HQ] | 0.663 | [6.665] [3.925] [2.830] |

| −USDINR | → | −BTCUSD | 1 | [LR, FPE, AIC, SC, HQ] | 8.044 *** | [6.579] [3.681] [2.493] |

| +BTCUSD | → | −USDINR | 1 | [LR, FPE, AIC, SC, HQ] | 5.809 ** | [6.951] [3.594] [2.565] |

| −USDINR | → | +BTCUSD | 1 | [LR, FPE, AIC, SC, HQ] | 2.560 | [6.752] [4.163] [2.939] |

| −BTCUSD | → | +USDINR | 1 | [LR, FPE, AIC, SC, HQ] | 0.149 | [6.508] [3.558] [2.463] |

| +USDINR | → | −BTCUSD | 1 | [LR, FPE, AIC, SC, HQ] | 1.533 | [7.898] [3.943] [2.701] |

| Causality Directions | Lag | Selection Criteria | F Test Statistic | ||

|---|---|---|---|---|---|

| BTCUSD | → | USDCNY | 1 | [FPE, AIC, SC, HQ] | 58.7563 *** |

| USDCNY | → | BTCUSD | 1 | [FPE, AIC, SC, HQ] | 3.1501 *** |

| BTCUSD | → | USDINR | 1 | [LR, FPE, AIC, SC, HQ] | 1.3667 |

| USDINR | → | BTCUSD | 1 | [LR, FPE, AIC, SC, HQ] | 2.0684 ** |

| Yuan/Const | Yuan/TV | Rupee/Const | Rupee/TV | ||

|---|---|---|---|---|---|

| Regime 1 | c | 0.0058 0.0011 | 0.0037 (0.0011) | −0.1303 *** (0.0084) | −0.1236 *** (0.0074) |

| Fiat currency | 0.4432 (0.3730) | 0.6582 ** (0.3872) | −15.3414 *** (2.5000) | −16.5784 *** (2.2457) | |

| Regime 2 | c | −0.1399 *** (0.0101) | −0.0742 *** (0.0111) | 0.0063 *** (0.0011) | 0.0065 *** (0.0011) |

| Fiat currency | −25.3499 *** (3.3208) | −60.7281 *** (4.3024) | 0.3157 (0.3228) | 0.3050 (0.3228) | |

| AIC | −3.4692 | −3.4369 | −3.4741 | −3.4780 | |

| SC | −3.4447 | −3.4054 | −3.4496 | −3.4465 | |

| HQ | −3.4601 | −3.4252 | −3.4650 | −3.4662 |

| Yuan/Const | Yuan/TV | Rupee/Const | Rupee/TV | |||||

|---|---|---|---|---|---|---|---|---|

| R1 | R2 | R1 | R2 | R1 | R2 | R1 | R2 | |

| R1 | 0.9813 | 0.0187 | TV | TV | 0.1652 | 0.8348 | TV | TV |

| R2 | 0.7546 | 0.2454 | TV | TV | 0.0234 | 0.9766 | TV | TV |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gunay, S.; Kaskaloglu, K.; Muhammed, S. Bitcoin and Fiat Currency Interactions: Surprising Results from Asian Giants. Mathematics 2021, 9, 1395. https://doi.org/10.3390/math9121395

Gunay S, Kaskaloglu K, Muhammed S. Bitcoin and Fiat Currency Interactions: Surprising Results from Asian Giants. Mathematics. 2021; 9(12):1395. https://doi.org/10.3390/math9121395

Chicago/Turabian StyleGunay, Samet, Kerem Kaskaloglu, and Shahnawaz Muhammed. 2021. "Bitcoin and Fiat Currency Interactions: Surprising Results from Asian Giants" Mathematics 9, no. 12: 1395. https://doi.org/10.3390/math9121395

APA StyleGunay, S., Kaskaloglu, K., & Muhammed, S. (2021). Bitcoin and Fiat Currency Interactions: Surprising Results from Asian Giants. Mathematics, 9(12), 1395. https://doi.org/10.3390/math9121395