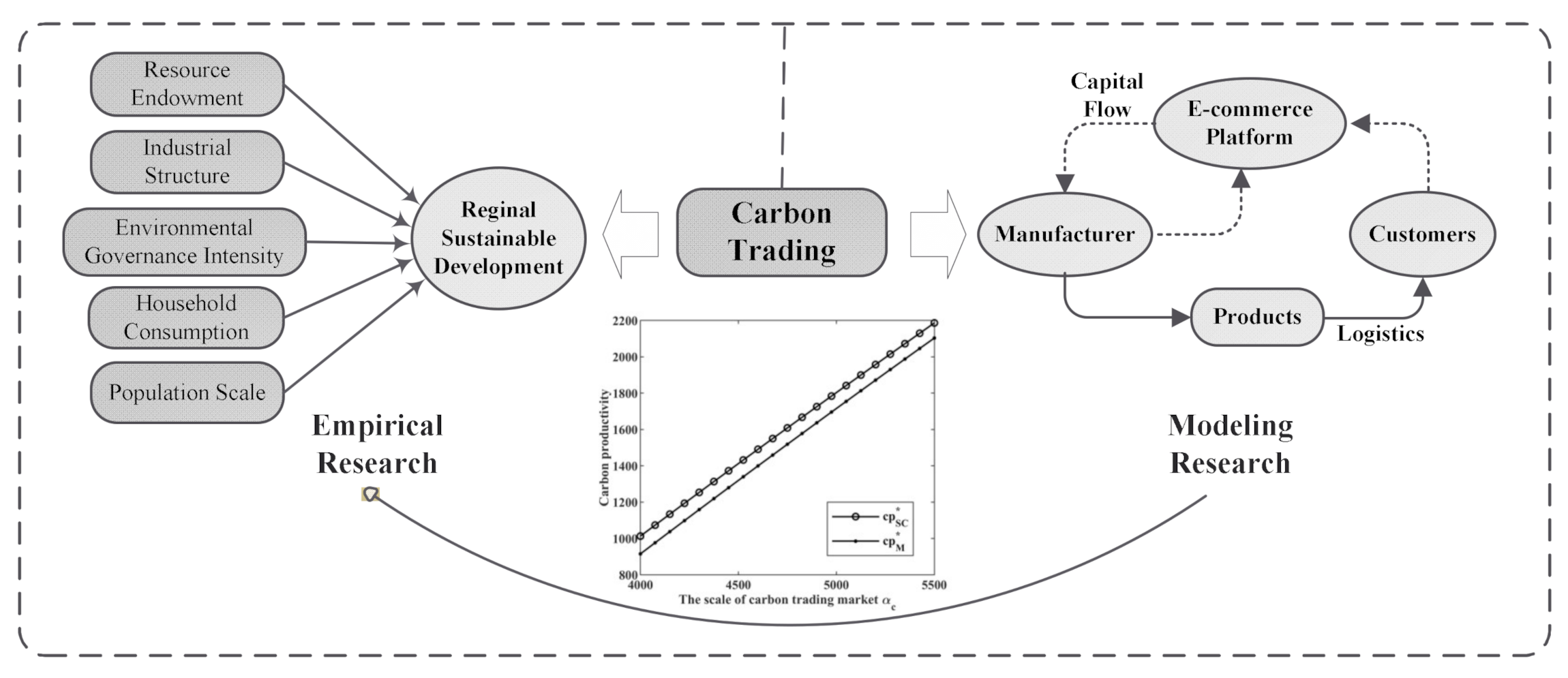

Carbon Trading Mechanism, Low-Carbon E-Commerce Supply Chain and Sustainable Development

Abstract

:1. Introduction

2. Literature Review

2.1. Decision-Making of LCE-SC

2.2. Influence of Carbon Trading on Decisions of Low-Carbon Supply Chains

2.3. Influence of Carbon Trading on Regional Sustainable Development

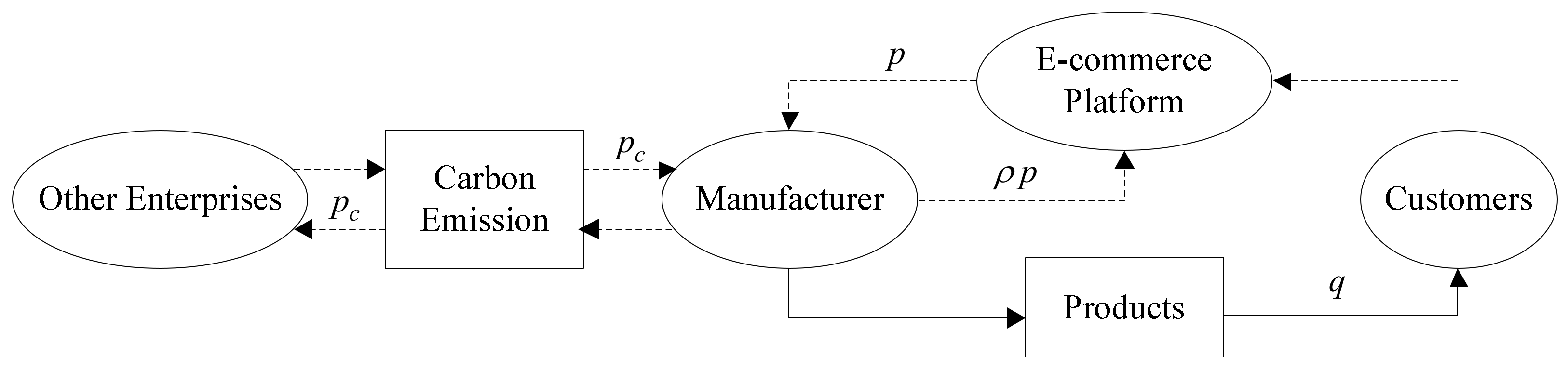

3. Problem Description and Assumptions

4. Optimal Decisions of LCE-SC and the Influence Mechanism of Carbon Trading

4.1. Optimal Decisions

4.2. Analysis of LCE-SC Model

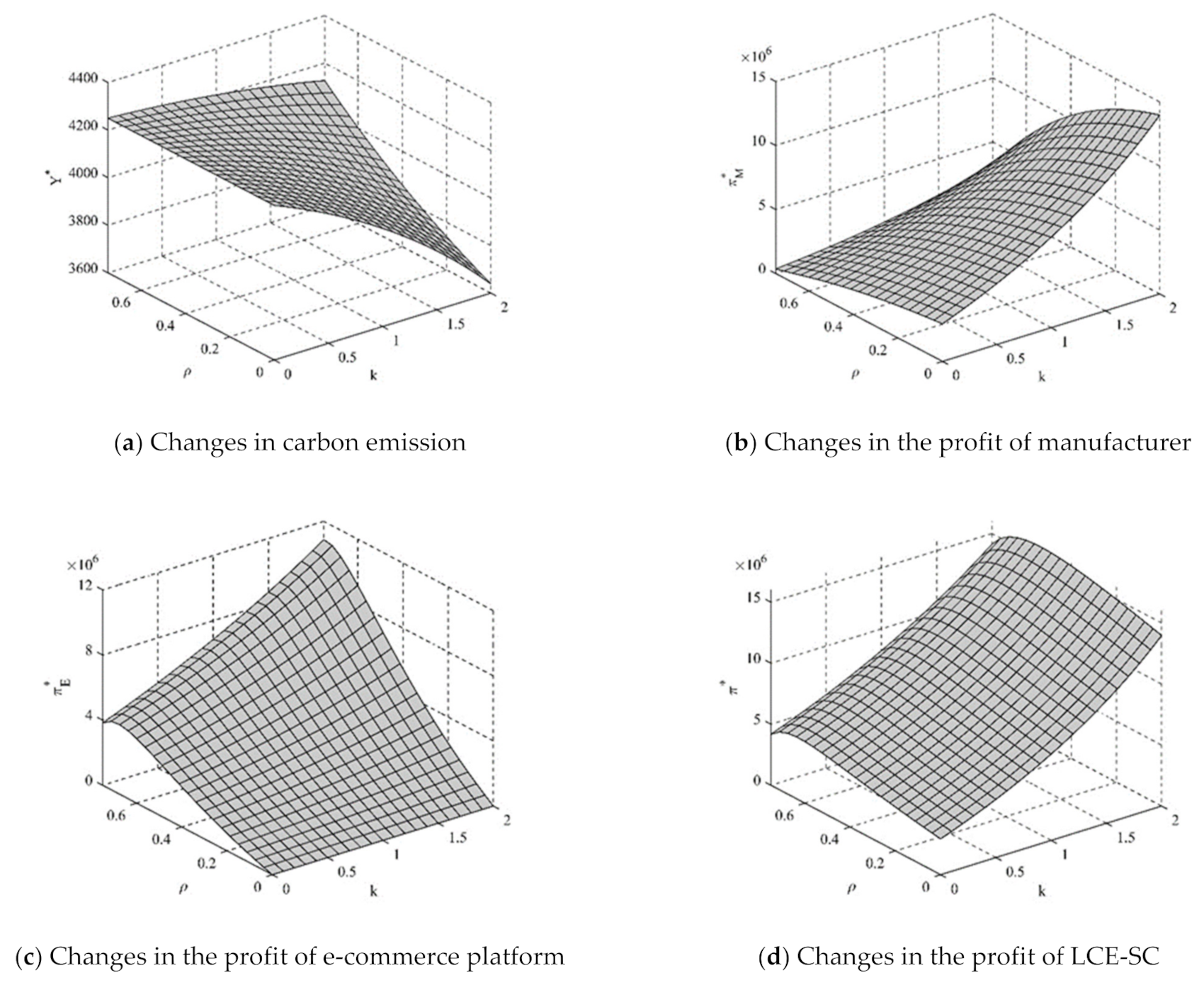

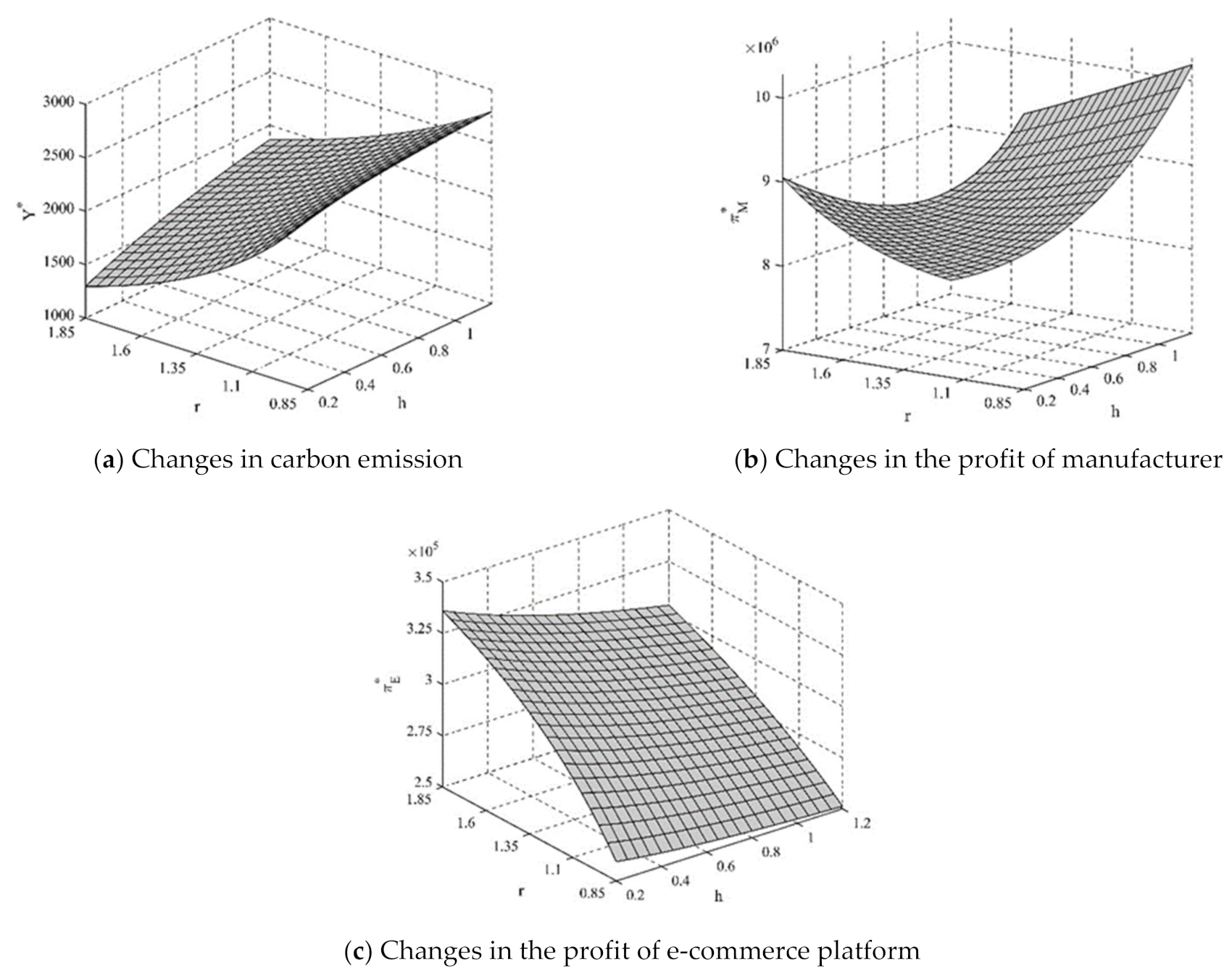

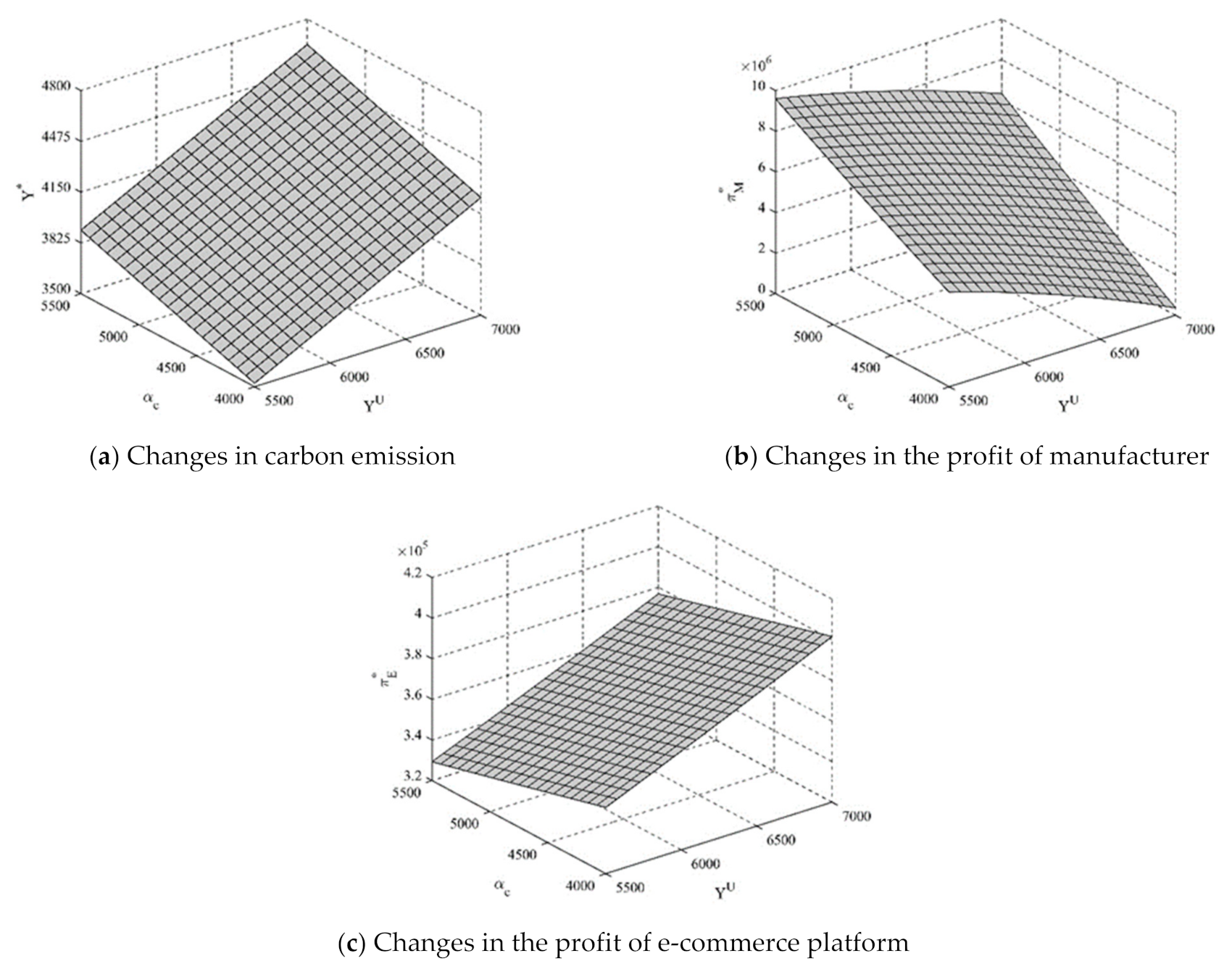

4.3. Numerical Analysis

5. An Empirical Analysis of the Influence of Carbon Trading on Regional Enterprises’ Sustainable Development

5.1. The Method of Empirical Analysis

5.2. Variable Selection and Data Sources

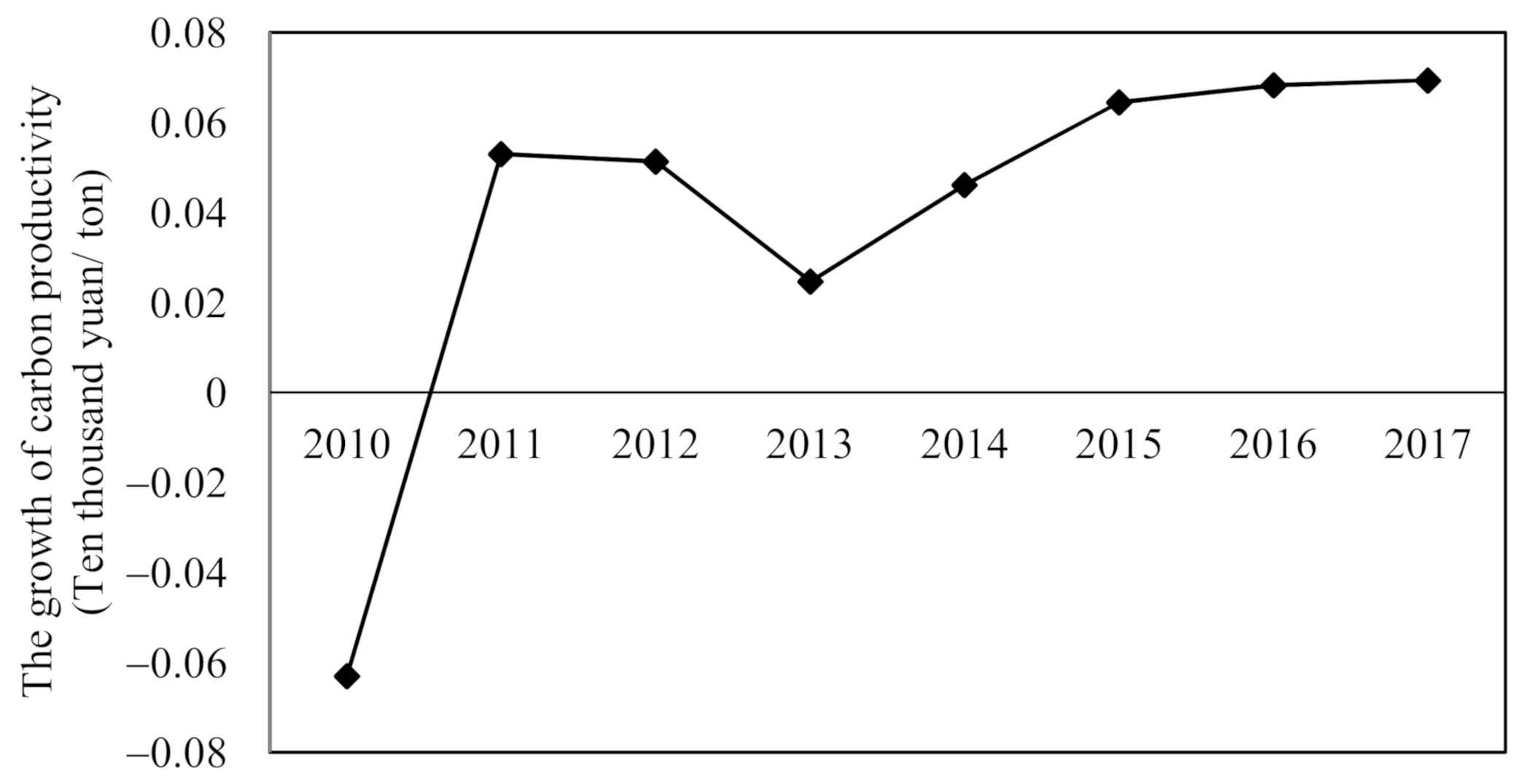

5.2.1. Carbon Productivity

5.2.2. Control Variables

5.2.3. Data Sources and Descriptive Statistics

5.3. Model Construction

5.4. Analysis of Regressive Results

5.4.1. Preliminary DID Analysis

5.4.2. Analysis of PSM Results

5.4.3. PSM-DID Regression Analysis

5.4.4. Placebo Test

6. Results and Discussion

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

Appendix B

References

- Zhang, L.; Zhou, H.; Liu, Y.; Lu, R. The optimal carbon emission reduction and prices with cap and trade mechanism and competition. Int. J. Environ. Res. Public Health 2018, 15, 2570. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Ding, H.; Huang, H.; Tang, O. Sustainable supply chain collaboration with outsourcing pollutant-reduction service in power industry. J. Clean. Prod. 2018, 186, 215–228. [Google Scholar] [CrossRef]

- Coase, R.H. The Problem of Social Cost. Econ. Anal. Law Sel. Read. 2007, 1–13. [Google Scholar] [CrossRef]

- Stern, N. The Economics of Climate Change. Am. Econ. Rev. Pap. Proc. 2008, 98, 1–37. [Google Scholar] [CrossRef] [Green Version]

- Yang, L.; Zheng, C.; Xu, M. Comparisons of low carbon policies in supply chain coordination. J. Syst. Sci. Syst. Eng. 2014, 23, 342–361. [Google Scholar] [CrossRef]

- Zhou, K.; Li, Y. Influencing factors and fluctuation characteristics of China’s carbon emission trading price. Phys. A Stat. Mech. Its Appl. 2019, 524, 459–474. [Google Scholar] [CrossRef]

- Qiyan, Z.; Weibin, C.; Xiang, W. The Effect and Influence of Carbon-Emission Trading on the Concept and Action of Energy Conservation and Emission Reduction of Enterprises. Available online: http://www.cncete.com/magazine/show-525.html (accessed on 15 October 2016).

- Zhang, K.; Yao, Y.; Liang, Q.; Saren, G. How should China prioritize the deregulation of electricity prices in the context of carbon pricing? A computable general equilibrium analysis. Energy Econ. 2021, 96, 105187. [Google Scholar] [CrossRef]

- Pagès-Bernaus, A.; Ramalhinho, H.; Juan, A.A.; Calvet, L. Designing e-commerce supply chains: A stochastic facility–location approach. Int. Trans. Oper. Res. 2019, 26, 507–528. [Google Scholar] [CrossRef]

- Cao, K.; Xu, X.; Wu, Q.; Zhang, Q. Optimal production and carbon emission reduction level under cap-and-trade and low carbon subsidy policies. J. Clean. Prod. 2017, 167, 505–513. [Google Scholar] [CrossRef]

- Fan, Y.; Wang, M.; Zhao, L. Production-inventory and emission reduction investment decision under carbon cap-and-trade policy. RAIRO Oper. Res. 2018, 52, 1043–1067. [Google Scholar] [CrossRef] [Green Version]

- Jiang, W.; Yuan, L.; Wu, L.; Guo, S. Carbon emission reduction and profit distribution mechanism of construction supply chain with fairness concern and capand-trade. PLoS ONE 2019, 14, e0224153. [Google Scholar] [CrossRef]

- Dumrongsiri, A.; Fan, M.; Jain, A.; Moinzadeh, K. A supply chain model with direct and retail channels. Eur. J. Oper. Res. 2008, 187, 691–718. [Google Scholar] [CrossRef]

- Yan, N.; Liu, Y.; Xu, X.; He, X. Strategic dual-channel pricing games with e-retailer finance. Eur. J. Oper. Res. 2020, 283, 138–151. [Google Scholar] [CrossRef]

- Jia, S.; Zhou, C.; Qin, C. No difference in effect of high-speed rail on regional economic growth based on match effect perspective? Transp. Res. Part A Policy Pract. 2017, 106, 144–157. [Google Scholar] [CrossRef]

- Liu, Y.; Wang, A.; Wu, Y. Environmental regulation and green innovation: Evidence from China’s new environmental protection law. J. Clean. Prod. 2021, 297, 126698. [Google Scholar] [CrossRef]

- Yang, L.; Wang, G.; Ke, C. Remanufacturing and promotion in dual-channel supply chains under cap-and-trade regulation. J. Clean. Prod. 2018, 204, 939–957. [Google Scholar] [CrossRef]

- Kang, K.; Zhao, Y.; Zhang, J.; Qiang, C. Evolutionary game theoretic analysis on low-carbon strategy for supply chain enterprises. J. Clean. Prod. 2019, 230, 981–994. [Google Scholar] [CrossRef]

- Mishra, M.; Hota, S.K.; Ghosh, S.K.; Sarkar, B. Controlling waste and carbon emission for a sustainable closed-loop supply chain management under a cap-and-trade strategy. Mathematics 2020, 8, 466. [Google Scholar] [CrossRef] [Green Version]

- Han, Q.; Wang, Y. Decision and coordination in a low-carbon E-supply chain considering the manufacturer’s carbon emission reduction behavior. Sustainability 2018, 10, 1686. [Google Scholar] [CrossRef] [Green Version]

- Ji, S.; Sun, Q. Low-carbon planning and design in B & R logistics service: A case study of an E-commerce big data platform in China. Sustainability 2017, 9, 2052. [Google Scholar] [CrossRef] [Green Version]

- Wang, J.; Huang, X. The optimal carbon reduction and return strategies under carbon tax policy. Sustainability 2018, 10, 2471. [Google Scholar] [CrossRef] [Green Version]

- Wang, Y.; Fan, R.; Shen, L.; Miller, W. Recycling decisions of low-carbon e-commerce closed-loop supply chain under government subsidy mechanism and altruistic preference. J. Clean. Prod. 2020, 259, 120883. [Google Scholar] [CrossRef]

- Benjaafar, S.; Li, Y.; Daskin, M. Carbon footprint and the management of supply chains: Insights from simple models. IEEE Trans. Autom. Sci. Eng. 2013, 10, 99–116. [Google Scholar] [CrossRef]

- Barbosa-Póvoa, A.P.; da Silva, C.; Carvalho, A. Opportunities and challenges in sustainable supply chain: An operations research perspective. Eur. J. Oper. Res. 2018, 268, 399–431. [Google Scholar] [CrossRef]

- Chai, Q.; Xiao, Z.; Lai, K.H.; Zhou, G. Can carbon cap and trade mechanism be beneficial for remanufacturing? Int. J. Prod. Econ. 2018, 203, 311–321. [Google Scholar] [CrossRef]

- Dong, C.; Shen, B.; Chow, P.S.; Yang, L.; Ng, C.T. Sustainability investment under cap-and-trade regulation. Ann. Oper. Res. 2016, 240, 509–531. [Google Scholar] [CrossRef]

- Du, S.; Ma, F.; Fu, Z.; Zhu, L.; Zhang, J. Game-theoretic analysis for an emission-dependent supply chain in a ‘cap-and-trade’ system. Ann. Oper. Res. 2015, 228, 135–149. [Google Scholar] [CrossRef]

- Xu, X.; He, P.; Xu, H.; Zhang, Q. Supply Chain Coordination with Green Technology under Cap-and-Trade Regulation. Int. J. Prod. Econ. 2017, 183 Pt B, 433–442. [Google Scholar] [CrossRef]

- Xu, X.; Zhang, W.; He, P.; Xu, X. Production and pricing problems in make-to-order supply chain with cap-and-trade regulation. Omega (UK) 2017, 66, 248–257. [Google Scholar] [CrossRef]

- Wang, M.; Zhao, L.; Herty, M. Joint replenishment and carbon trading in fresh food supply chains. Eur. J. Oper. Res. 2019, 277, 561–573. [Google Scholar] [CrossRef]

- Smith, S.; Swierzbinski, J. Assessing the performance of the UK Emissions Trading Scheme. Environ. Resour. Econ. 2007, 37, 131–158. [Google Scholar] [CrossRef]

- Wang, P.; Dai, H.C.; Ren, S.-Y.; Zhao, D.-Q.; Masui, T. Achieving Copenhagen target through carbon emission trading: Economic impacts assessment in Guangdong Province of China. Energy 2015, 79, 212–227. [Google Scholar] [CrossRef]

- Zhao, X.; Zhang, Y.; Liang, J.; Li, Y.; Jia, R.; Wang, L. The sustainable development of the economic-energy-environment (3E) system under the carbon trading (CT) mechanism: A Chinese case. Sustainability 2018, 10, 98. [Google Scholar] [CrossRef] [Green Version]

- Zhou, B.; Zhang, C.; Song, H.; Wang, Q. How does emission trading reduce China’s carbon intensity? An exploration using a decomposition and difference-in-differences approach. Sci. Total Environ. 2019, 676, 514–523. [Google Scholar] [CrossRef] [PubMed]

- Zhang, W.; Zhang, N.; Yu, Y. Carbon mitigation effects and potential cost savings from carbon emissions trading in China’s regional industry. Technol. Forecast. Soc. Chang. 2019, 141, 1–11. [Google Scholar] [CrossRef]

- Hamzah, T.A.A.T.; Zainuddin, Z.; Yusoff, M.M.; Osman, S.; Abdullah, A.; Saini, K.M.; Sisun, A. The conundrum of carbon trading projects towards sustainable development: A review from the palm oil industry in Malaysia. Energies 2019, 12, 3530. [Google Scholar] [CrossRef] [Green Version]

- Zhang, H.; Zhang, R.; Li, G.; Li, W.; Choi, Y. Sustainable feasibility of carbon trading policy on heterogenetic economic and industrial development. Sustainability 2019, 11, 6869. [Google Scholar] [CrossRef] [Green Version]

- Zheng, J.; Yang, M.; Ma, G.; Xu, Q.; He, Y. Multi-agents-based modeling and simulation for carbon permits trading in China: A regional development perspective. Int. J. Environ. Res. Public Health 2020, 17, 301. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Xu, L.; Wang, C.; Miao, Z.; Chen, J. Governmental subsidy policies and supply chain decisions with carbon emission limit and consumer’s environmental awareness. RAIRO Oper. Res. 2019, 53, 1675–1689. [Google Scholar] [CrossRef] [Green Version]

- Ma, X.; Wang, J.; Bai, Q.; Wang, S. Optimization of a three-echelon cold chain considering freshness-keeping efforts under cap-and-trade regulation in Industry 4.0. Int. J. Prod. Econ. 2020, 220. [Google Scholar] [CrossRef]

- Xia, X.; Li, C.; Zhu, Q. Game analysis for the impact of carbon trading on low-carbon supply chain. J. Clean. Prod. 2020, 276, 123220. [Google Scholar] [CrossRef]

- Liu, X.; Du, W.; Sun, Y. Green supply chain decisions under different power structures: Wholesale price vs. revenue sharing contract. Int. J. Environ. Res. Public Health 2020, 17, 7737. [Google Scholar] [CrossRef]

- Zhang, J.; Cao, Q.; He, X. Contract and product quality in platform selling. Eur. J. Oper. Res. 2019, 272, 928–944. [Google Scholar] [CrossRef]

- Tan, Y.R.; Carrillo, J.E. Strategic Analysis of the Agency Model for Digital Goods. Prod. Oper. Manag. 2017, 26, 724–741. [Google Scholar] [CrossRef]

- Adida, E.; Ratisoontorn, N. Consignment contracts with retail competition. Eur. J. Oper. Res. 2011, 215, 136–148. [Google Scholar] [CrossRef]

- Nair, A.; Narasimhan, R. Dynamics of competing with quality- and advertising-based goodwill. Eur. J. Oper. Res. 2006, 175, 462–474. [Google Scholar] [CrossRef]

- Xia, L.; Hao, W.; Qin, J.; Ji, F.; Yue, X. Carbon emission reduction and promotion policies considering social preferences and consumers’ low-carbon awareness in the cap-and-trade system. J. Clean. Prod. 2018, 195, 1105–1124. [Google Scholar] [CrossRef]

- Xing, E.; Shi, C.; Zhang, J.; Cheng, S.; Lin, J.; Ni, S. Double third-party recycling closed-loop supply chain decision under the perspective of carbon trading. J. Clean. Prod. 2020, 259. [Google Scholar] [CrossRef]

- Wang, W.; Zhou, C.; Li, X. Carbon reduction in a supply chain via dynamic carbon emission quotas. J. Clean. Prod. 2019, 240, 118244. [Google Scholar] [CrossRef]

- Shen, L.; Wang, Y. Supervision mechanism for pollution behavior of Chinese enterprises based on haze governance. J. Clean. Prod. 2018, 197, 571–582. [Google Scholar] [CrossRef]

- Zhang, J.; Jiang, H.; Liu, G.; Zeng, W. A study on the contribution of industrial restructuring to reduction of carbon emissions in China during the five Five-Year Plan periods. J. Clean. Prod. 2018, 176, 629–635. [Google Scholar] [CrossRef]

- Li, X.; Luo, Q.; Hai, B.; Li, L. Progress in the micro-perspective studies of economic geography in China since 1980s. J. Geogr. Sci. 2016, 26, 1041–1056. [Google Scholar] [CrossRef]

- Zhang, K.; Xu, D.; Li, S.; Zhou, N.; Xiong, J. Has China’s pilot emissions trading scheme influenced the carbon intensity of output? Int. J. Environ. Res. Public Health 2019, 16, 1854. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Wang, L.; Watanabe, T. Effects of environmental policy on public risk perceptions of haze in Tianjin City: A difference-in-differences analysis. Renew. Sustain. Energy Rev. 2019, 109, 199–212. [Google Scholar] [CrossRef]

- Li, J.; Lin, B. Environmental impact of electricity relocation: A quasi-natural experiment from interregional electricity transmission. Environ. Impact Assess. Rev. 2017, 66, 151–161. [Google Scholar] [CrossRef]

- Wing, C.; Simon, K.; Bello-Gomez, R.A. Designing Difference in Difference Studies: Best Practices for Public Health Policy Research. Annu. Rev. Public Health 2018, 39, 453–469. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Dong, F.; Dai, Y.; Zhang, S.; Zhang, X.; Long, R. Can a carbon emission trading scheme generate the Porter effect? Evidence from pilot areas in China. Sci. Total Environ. 2019, 653, 565–577. [Google Scholar] [CrossRef]

- Zhu, B.; Zhang, M.; Huang, L.; Wang, P.; Su, B.; Wei, Y.M. Exploring the effect of carbon trading mechanism on China’s green development efficiency: A novel integrated approach. Energy Econ. 2020, 85, 104601. [Google Scholar] [CrossRef]

- Austin, P.C. Some methods of propensity-score matching had superior performance to others: Results of an empirical investigation and monte carlo simulations. Biom. J. 2009, 51, 171–184. [Google Scholar] [CrossRef]

- Rosenbaum, P.R.; Rubin, D.B. The central role of the propensity score in observational studies for causal effects. Matched Sampl. Causal Eff. 2006, 170–184. [Google Scholar] [CrossRef] [Green Version]

- Zhang, C.; Wang, Q.; Shi, D.; Li, P.; Cai, W. Scenario-based potential effects of carbon trading in China: An integrated approach. Appl. Energy 2016, 182, 177–190. [Google Scholar] [CrossRef]

- Wang, H.; Chen, Z.; Wu, X.; Nie, X. Can a carbon trading system promote the transformation of a low-carbon economy under the framework of the porter hypothesis?—Empirical analysis based on the PSM-DID method. Energy Policy 2019, 129, 930–938. [Google Scholar] [CrossRef]

- Yan, D.; Kong, Y.; Ren, X.; Shi, Y.; Chiang, S.W. The determinants of urban sustainability in Chinese resource-based cities: A panel quantile regression approach. Sci. Total Environ. 2019, 686, 1210–1219. [Google Scholar] [CrossRef] [PubMed]

- Hu, Y.; Ren, S.; Wang, Y.; Chen, X. Can carbon emission trading scheme achieve energy conservation and emission reduction? Evidence from the industrial sector in China. Energy Econ. 2020, 85, 104590. [Google Scholar] [CrossRef]

- Xu, S.C.; He, Z.X.; Long, R.Y. Factors that influence carbon emissions due to energy consumption in China: Decomposition analysis using LMDI. Appl. Energy 2014, 127, 182–193. [Google Scholar] [CrossRef]

- Chang, X.; Xia, H.; Zhu, H.; Fan, T.; Zhao, H. Production decisions in a hybrid manufacturing-remanufacturing system with carbon cap and trade mechanism. Int. J. Prod. Econ. 2015, 162, 160–173. [Google Scholar] [CrossRef]

- Halat, K.; Hafezalkotob, A. Modeling carbon regulation policies in inventory decisions of a multi-stage green supply chain: A game theory approach. Comput. Ind. Eng. 2019, 128, 807–830. [Google Scholar] [CrossRef]

- Xiong, S.; Feng, Y.; Huang, K. Optimal MTS and MTO hybrid production system for a single product under the cap-and-trade environment. Sustainability 2020, 12, 2426. [Google Scholar] [CrossRef] [Green Version]

- Konstantaras, I.; Skouri, K.; Benkherouf, L. Optimizing inventory decisions for a closed–loop supply chain model under a carbon tax regulatory mechanism. Int. J. Prod. Econ. 2021, 239, 108185. [Google Scholar] [CrossRef]

- Kong, D.; Xia, Q.; Xue, Y.; Zhao, X. Effects of multi policies on electric vehicle diffusion under subsidy policy abolishment in China: A multi-actor perspective. Appl. Energy 2020, 266, 114887. [Google Scholar] [CrossRef]

- Wang, L.; Cui, L.; Weng, S.; Liu, C. Promoting industrial structure advancement through an emission trading scheme: Lessons from China’s pilot practice. Comput. Ind. Eng. 2021, 157, 107339. [Google Scholar] [CrossRef]

| Author(s) | Supply Chain System | Policy | Research Method | Customers’ Environmental Awareness | Emission Reduction Investment | Variable Carbon Price |

|---|---|---|---|---|---|---|

| Xu et al. [29] | A manufacturer and a retailer | Carbon trading | Modeling and numerical simulation | Yes | Yes | No |

| Fan et al. [11] | A manufacturer and a retailer | Carbon trading | Modeling and numerical simulation | No | Yes | No |

| Xu et al. [40] | A manufacturer and a retailer | Governmental subsidy | Modeling and numerical simulation | Yes | Yes | No |

| Ma et al. [41] | A supplier, a third-party logistics service provider, and a retailer | Carbon trading and carbon tax | Modeling and numerical simulation | No | No | No |

| Wang et al. [31] | A supplier and multiple retailers | Carbon trading | Modeling and numerical simulation | No | No | No |

| Xia et al. [42] | A manufacturer; an ordinary manufacturer and a low-carbon manufacturer | Carbon trading | Modeling and numerical simulation | Yes | No | No |

| Liu et al. [43] | A manufacturer and a retailer | Power control structure | Modeling and numerical simulation | Yes | Yes | - |

| This paper | A manufacturer and an e-commerce platform | Carbon trading | Modeling, numerical simulation, and empirical analysis | Yes | Yes | Yes |

| Variable | Measurement Method | Symbol |

|---|---|---|

| Resource Endowment | Proportion of investment in fixed assets of the mining industry (excluding rural households) to the total investment in fixed assets | |

| Industrial Structure | Proportion of secondary industry to regional GDP | |

| Environmental Governance Intensity | Proportion of investment completed in the treatment of industrial pollution to regional GDP | |

| Household Consumption | Household consumption in the total consumption of energy | |

| Population Scale | Population at year-end |

| Variables | |||||||

|---|---|---|---|---|---|---|---|

| 2009 | Mean | 7.76602 | 0.04620 | 0.47461 | 0.00159 | 6.86159 | 8.16080 |

| Std. Dev. | 0.52569 | 0.04531 | 0.07627 | 0.00116 | 0.69372 | 0.76387 | |

| 2010 | Mean | 7.82837 | 0.04374 | 0.49071 | 0.00113 | 6.95988 | 8.17059 |

| Std. Dev. | 0.52532 | 0.04516 | 0.07586 | 0.00089 | 0.70520 | 0.75837 | |

| 2011 | Mean | 7.91161 | 0.04554 | 0.49565 | 0.00107 | 7.04084 | 8.17772 |

| Std. Dev. | 0.54293 | 0.04507 | 0.08064 | 0.00067 | 0.70480 | 0.75428 | |

| 2012 | Mean | 7.96974 | 0.04119 | 0.48648 | 0.00110 | 7.11616 | 8.18518 |

| Std. Dev. | 0.55357 | 0.03921 | 0.07903 | 0.00085 | 0.69778 | 0.75045 | |

| 2013 | Mean | 8.01021 | 0.03832 | 0.46781 | 0.00172 | 7.12947 | 8.19240 |

| Std. Dev. | 0.60977 | 0.03522 | 0.07952 | 0.00131 | 0.67814 | 0.74697 | |

| 2014 | Mean | 8.06601 | 0.03313 | 0.45984 | 0.00189 | 7.15885 | 8.19891 |

| Std. Dev. | 0.61777 | 0.03036 | 0.07815 | 0.00180 | 0.66334 | 0.74442 | |

| 2015 | Mean | 8.11762 | 0.02778 | 0.43255 | 0.00122 | 7.23768 | 8.20539 |

| Std. Dev. | 0.62495 | 0.02502 | 0.07790 | 0.00073 | 0.66524 | 0.74327 | |

| 2016 | Mean | 8.18463 | 0.01971 | 0.41553 | 0.00133 | 7.29991 | 8.21142 |

| Std. Dev. | 0.67653 | 0.01824 | 0.07769 | 0.00142 | 0.66808 | 0.74330 | |

| 2017 | Mean | 8.21442 | 0.01861 | 0.40707 | 0.00090 | 7.35082 | 8.21709 |

| Std. Dev. | 0.67278 | 0.01852 | 0.07578 | 0.00074 | 0.67553 | 0.74345 | |

| Mean | 8.00763 | 0.03491 | 0.45892 | 0.00133 | 7.12836 | 8.19106 | |

| 0.122 * (2.53) | |

| 0.396 *** (5.55) | |

| 0.233 ** (2.67) | |

| −6.122 *** (−8.93) | |

| −0.881 ** (−3.36) | |

| −143.706 *** (−7.18) | |

| −0.229 *** (−4.18) | |

| 0.283 *** (5.12) | |

| 7.934 *** (33.35) | |

| 270 | |

| 0.7598 |

| 0.457 * (2.09) | |

| 0.514 * (2.35) | |

| 0.608 ** (2.78) | |

| 0.692 ** (3.17) | |

| 0.796 *** (3.64) | |

| 0.863 *** (3.95) | |

| 0.929 *** (4.25) | |

| 1.097 *** (5.02) | |

| 1.093 *** (5.00) | |

| 7.825 *** (76.63) | |

| 270 | |

| 0.3551 |

| Variable | Mean Control | Mean Treated | Reduct |bias| | t Value | p Value |

|---|---|---|---|---|---|

| 0.01424 | 0.01408 | 99.5 | −0.05 | 0.958 | |

| 0.47500 | 0.45169 | 41.7 | −1.52 | 0.132 | |

| 0.00094 | 0.00090 | 94.4 | −0.36 | 0.723 | |

| 7.28740 | 7.28770 | 99.8 | 0.00 | 0.998 | |

| 8.27600 | 8.23570 | 55.6 | −0.26 | 0.797 |

| Model 1 | Model 2 | |

|---|---|---|

| 0.174 * (2.55) | 0.160 ** (3.27) | |

| 0.420 *** (4.00) | 0.363 *** (5.24) | |

| 0.287 * (2.11) | 0.202 * (2.35) | |

| −8.478 *** (−6.22) | ||

| −0.933 ** (−3.16) | ||

| −163.073 *** (−5.81) | ||

| −0.255 *** (−4.31) | ||

| 0.297 *** (4.42) | ||

| 7.890 *** (146.95) | 8.101 *** (31.84) | |

| 206 | 206 | |

| 0.3179 | 0.7350 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Shen, L.; Wang, X.; Liu, Q.; Wang, Y.; Lv, L.; Tang, R. Carbon Trading Mechanism, Low-Carbon E-Commerce Supply Chain and Sustainable Development. Mathematics 2021, 9, 1717. https://doi.org/10.3390/math9151717

Shen L, Wang X, Liu Q, Wang Y, Lv L, Tang R. Carbon Trading Mechanism, Low-Carbon E-Commerce Supply Chain and Sustainable Development. Mathematics. 2021; 9(15):1717. https://doi.org/10.3390/math9151717

Chicago/Turabian StyleShen, Liang, Xiaodi Wang, Qinqin Liu, Yuyan Wang, Lingxue Lv, and Rongyun Tang. 2021. "Carbon Trading Mechanism, Low-Carbon E-Commerce Supply Chain and Sustainable Development" Mathematics 9, no. 15: 1717. https://doi.org/10.3390/math9151717