Optimal Investment Strategy for DC Pension Plan with Stochastic Income and Inflation Risk under the Ornstein–Uhlenbeck Model

Abstract

:1. Introduction

2. Model Hypothesis

2.1. Financial Market

2.2. Stochastic Income

2.3. Inflation Risk

3. Model Formulation

3.1. Wealth Process

3.2. The HJB Equation

4. Verification Theorem

- for any initial data and control process π, where

- If for any initial data , there exists satisfying:then , where the operator is defined by:

5. Model Solution

5.1. Legendre Transform

5.2. The Solution under the Logarithm Utility Function

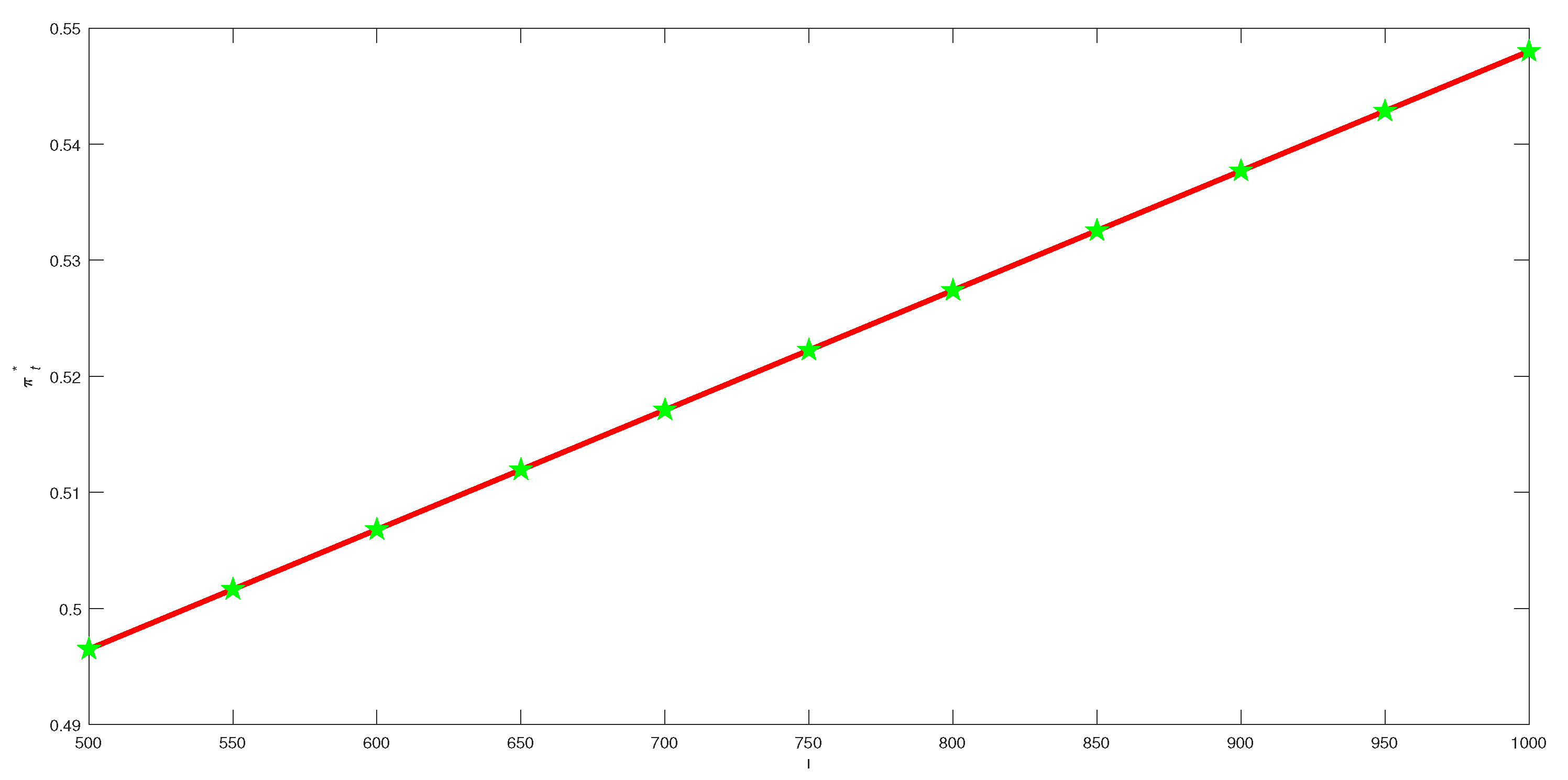

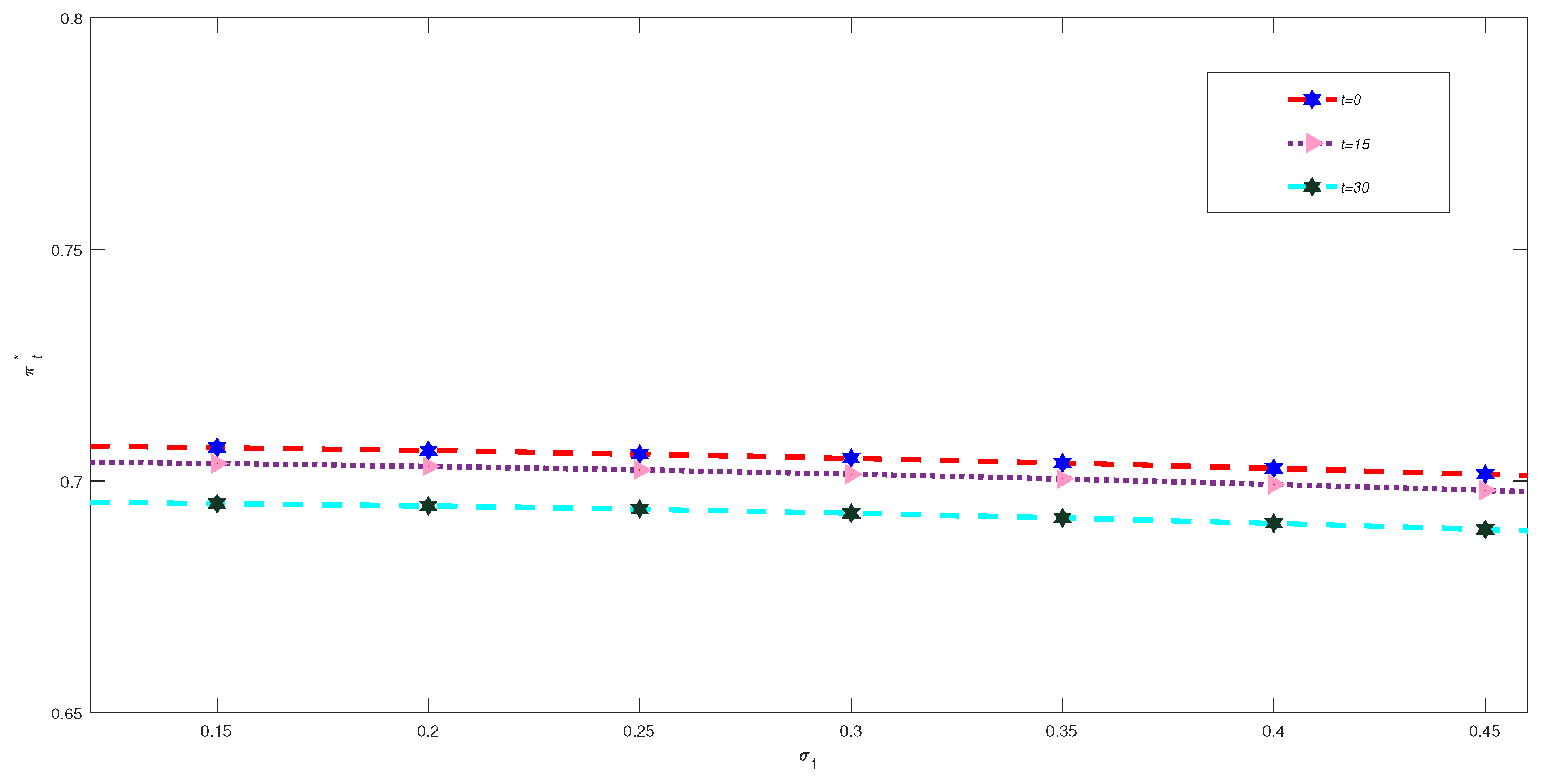

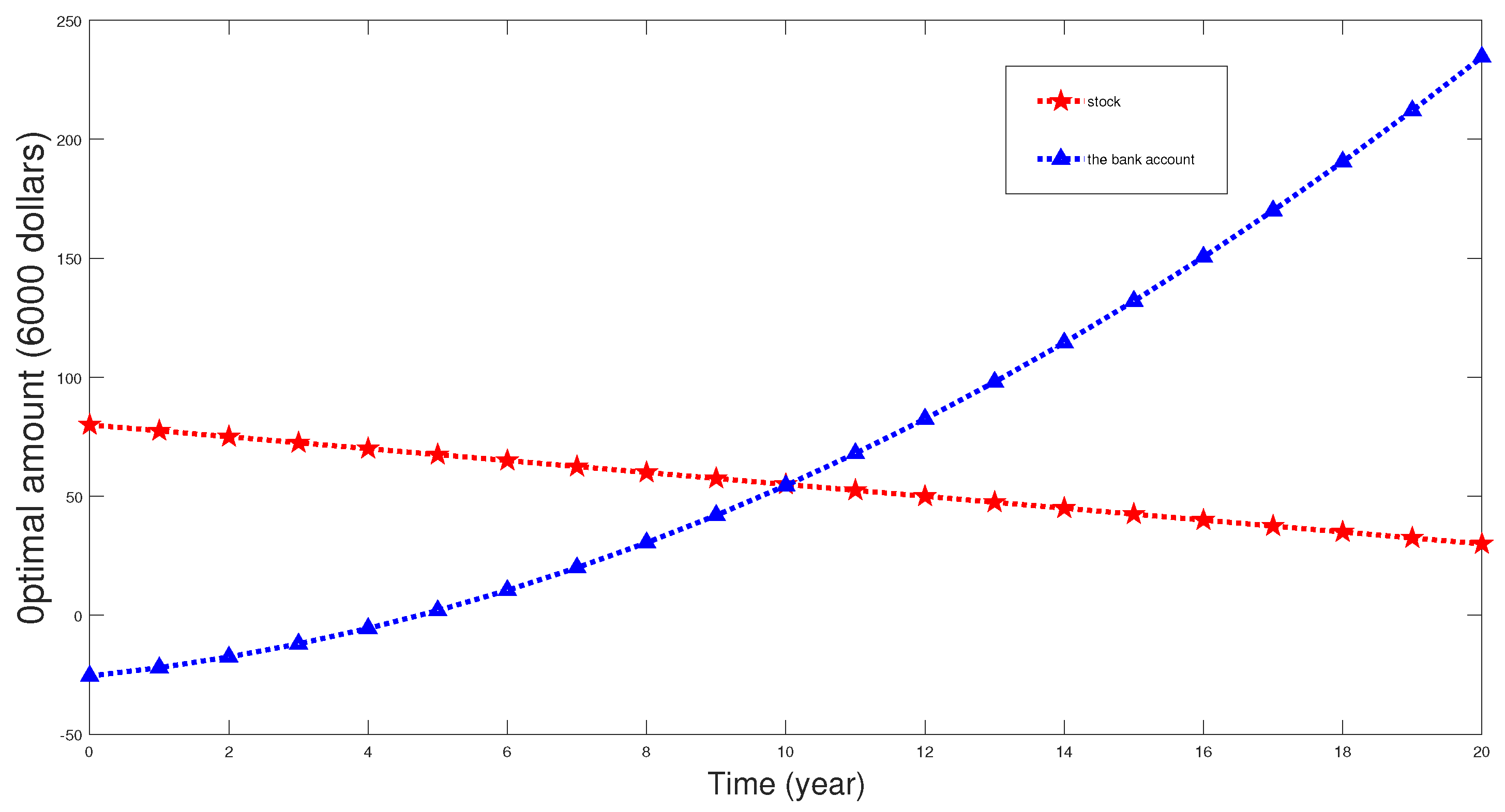

6. Numerical Analysis

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Vigna, E.; Haberman, S. Optimal investment strategy for defined contribution pension schemes. Insur. Math. Econ. 2001, 28, 233–262. [Google Scholar] [CrossRef]

- Thomson, R.J. The use of utility functions for investment channel choice in defined contribution retirement fund, I: Defence. Br. Actuar. J. 2003, 9, 653–709. [Google Scholar] [CrossRef]

- Devolder, P.; Princep, M.B.; Fabian, I.D. Stochastic optimal control of annuity contracts. Insur. Math. Econ. 2003, 33, 227–238. [Google Scholar] [CrossRef]

- Deelstra, G.; Grasselli, M.; Koehl, P.F. Optimal investment strategies in the presence of a minimum guarantee. Insur. Math. Econ. 2003, 33, 189–207. [Google Scholar] [CrossRef] [Green Version]

- Gerrard, R.; Haberman, S.; Vigna, E. Optimal investment choices post-retirement in a defined contribution pension scheme. Insur. Math. Econ. 2004, 35, 321–342. [Google Scholar] [CrossRef] [Green Version]

- French, K.R.; Schwert, G.W.; Stambaugh, R.F. Expected stock returns and volatility. J. Financ. Econ. 1987, 19, 3–29. [Google Scholar] [CrossRef] [Green Version]

- Pagan, A.R.; Schwert, G.W. Alternative models for conditional stock volatility. J. Econom. 1990, 45, 267–290. [Google Scholar] [CrossRef] [Green Version]

- Hobson, D.G.; Rogers, L.C.G. Complete models with stochastic volatility. Math. Financ. 1998, 8, 27–48. [Google Scholar] [CrossRef]

- Xiao, J.W.; Zhai, H.; Qin, C.L. The constant elasticity of variance (CEV) model and the legendre transform-dual solution for annuity constracts. Insur. Math. Econ. 2006, 40, 302–310. [Google Scholar] [CrossRef]

- Gao, J.W. Optimal portfolios for DC pension plans under a CEV mode. Insur. Math. Econ. 2009, 44, 479–490. [Google Scholar] [CrossRef]

- Zhang, C.B.; Rong, X.M.; Chang, H. Optimal Investment for DC Pension with stochastic salary under a CEV model. Chin. J. Eng. Math. 2013, 30, 1–9. [Google Scholar]

- Li, D.; Rong, X.; Zhao, H.; Yi, B. Equilibrium investment strategy for DC pension plan with default risk and return of premiums clauses under CEV model. Insur. Math. Econ. 2017, 72, 6–20. [Google Scholar] [CrossRef]

- Yong, X.; Sun, X.; Gao, J. Symmetry-based optimal portfolio for a DC pension plan under a CEV model with power utility. Nonlinear Dyn. 2021, 103, 1775–1783. [Google Scholar] [CrossRef]

- Cairns, A.J.; Blake, D.; Dowd, K. Stochastic lifestyling: Optimal dynamic asset allocation for defined contribution pension plans. J. Econ. Dyn. Control 2005, 30, 843–877. [Google Scholar] [CrossRef] [Green Version]

- Battocchio, P.; Menoncin, F. Optimal pension management in a stochastic framework. Insur. Math. Econ. 2004, 34, 79–95. [Google Scholar] [CrossRef]

- Wu, H.L.; Dong, H.B. Multi-period mean-variance defined contribution pension management with inflation and stochastic income. Syst. Eng. Theory Pract. 2016, 36, 545–558. [Google Scholar]

- Chen, Z.; Li, Z.F.; Zeng, Y. Asset allocation under loss aversion and minimum performance constraint in a DC pension plan with inflation risk. Insur. Math. Econ. 2017, 75, 137–150. [Google Scholar] [CrossRef]

- Wang, C.Y.; Fu, C.Y.; Sheng, G.X. Optimal investment of DC Pension under the inflation and minimum guarantee. Oper. Res. Manag. Sci. 2018, 27, 193–199. [Google Scholar]

- Song, A.; Chen, P. Relative performance concern on DC pension plan under Heston model with inflation risk. Math. Probl. Eng. 2020, 2020, 5180286. [Google Scholar]

- Wang, P.; Li, Z.; Sun, J. Robust portfolio choice for a DC pension plan with inflation risk and mean-reverting risk premium under ambiguity. Optimization 2021, 70, 191–224. [Google Scholar] [CrossRef]

- Maenhout, P.J. Robust portfolio rules and detection-error probabilities for a mean-reverting risk premium. J. Econ. Theory 2006, 128, 136–163. [Google Scholar] [CrossRef]

- Gu, A.; Li, Z.; Zeng, Y. Optimal investment strategy under Ornstein–Uhlenbeck mode for a DC pension plan. Acta Math. Appl. Sin. 2013, 36, 715–726. [Google Scholar]

- Guan, G.; Liang, Z. Mean-variance efficiency of the DC pension plan under stochastic interest rate and mean-reverting returns. Insur. Math. Econ. 2015, 61, 99–109. [Google Scholar] [CrossRef]

- Soner, H.M. Controlled Markov processes, viscosity solutions and applications to mathematical finance. In Viscosity Solutions and Applications; Dolcetta, I.C., Lions, P.L., Eds.; Springer: Berlin, Germany, 1997; Volume 1660, pp. 134–185. [Google Scholar]

- Jonsson, M.; Sircar, R. Optimal investment problems and volatility homogenization approximations. In Modern Methods in Scientific Computing and Applications; Bourlioux, A., Gander, M.l., Eds.; Springer: Dordrecht, The Netherlands, 2002; pp. 255–281. [Google Scholar]

- Irgens, C.; Paulsen, J. Optimal control of risk exposure, reinsurance and investments for insurance portfolios. Insur. Math. Econ. 2004, 35, 21–51. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, Y.; Xu, X.; Zhang, J. Optimal Investment Strategy for DC Pension Plan with Stochastic Income and Inflation Risk under the Ornstein–Uhlenbeck Model. Mathematics 2021, 9, 1756. https://doi.org/10.3390/math9151756

Wang Y, Xu X, Zhang J. Optimal Investment Strategy for DC Pension Plan with Stochastic Income and Inflation Risk under the Ornstein–Uhlenbeck Model. Mathematics. 2021; 9(15):1756. https://doi.org/10.3390/math9151756

Chicago/Turabian StyleWang, Yang, Xiao Xu, and Jizhou Zhang. 2021. "Optimal Investment Strategy for DC Pension Plan with Stochastic Income and Inflation Risk under the Ornstein–Uhlenbeck Model" Mathematics 9, no. 15: 1756. https://doi.org/10.3390/math9151756

APA StyleWang, Y., Xu, X., & Zhang, J. (2021). Optimal Investment Strategy for DC Pension Plan with Stochastic Income and Inflation Risk under the Ornstein–Uhlenbeck Model. Mathematics, 9(15), 1756. https://doi.org/10.3390/math9151756